Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRST NIAGARA FINANCIAL GROUP INC | a8-k102414q3earningsreleas.htm |

Gary M. Crosby President & Chief Executive Officer Gregory W. Norwood Chief Financial Officer Third Quarter 2014 Earnings Highlights October 24, 2014

2 Any statements contained in this presentation regarding the outlook for FNFG’s business and markets, such as projections of future earnings performance, statements of FNFG’s plans and objectives, forecasts or market trends and other matters, are forward-looking statements based on FNFG’s assumptions and beliefs. Such statements may be identified by such words or phrases as “will likely result,” “are expected to,” “will continue,” “outlook,” “will benefit,” “is anticipated,” “estimate,” “project,” “management believes” or similar expressions. These forward- looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those discussed in such statements and no assurance can be given that the results in any forward-looking statement will be achieved. For these statements, FNFG claims the protection of the safe harbor for forward- looking statements contained in the Private Securities Litigation Reform Act of 1995. Any forward-looking statement speaks only as of the date on which it is made, and we disclaim any obligation to subsequently revise any forward-looking statement to reflect events or circumstances after such date or to reflect the occurrence of anticipated or unanticipated events. Certain factors could cause FNFG’s future results to differ materially from those expressed or implied in any forward-looking statements contained in this presentation. These factors include the factors discussed in Part I, Item 1A of FNFG’s 2013 Annual Report on Form 10-K under the heading “Risk Factors” and any other cautionary statements, written or oral, which may be made or referred to in connection with any such forward-looking statements. Since it is not possible to foresee all such factors, these factors should not be considered as complete or exhaustive. Safe Harbor Statement

3 3Q14 Earnings Reconciliation ▪ Reported GAAP loss of $1.90 per share includes: ◦ Non-cash goodwill impairment of $800 million ▪ No negative impact to regulatory and tangible capital ratios ◦ $45 million in reserves to address a process issue on certain customer deposit accounts ◦ Recent branch staffing realignment and an executive departure resulted in $2 million in pre-tax restructuring charges ▪ QOQ increase in 3Q operating expenses was driven by $7.5M, or $0.01 per share, in above-normal expenses related to: ◦ Single property ORE write-down expense ($3.5M) ◦ State Franchise taxes ($2.3M) ◦ Home Depot Card breach expense ($1.8M) ($ in millions, except per share data) Pre-tax After-tax* EPS Reported GAAP Income $(769.4) $(664.8) -$1.90 Add: Goodwill Impairment† 800.0 697.3 1.99 Add: Deposit Account Remediation 45.0 29.3 0.08 Add: Restructuring Charges 2.4 1.6 0.00 Operating Earnings $78.0 $63.3 $0.18 * Denotes net income available to common shareholders, assumes 13% tax rate for goodwill impairment and 35% tax rate for all other items † The amount of the non-cash pre-tax goodwill impairment charge was $800 million

4 ▪ Average loans increased 9% annualized QOQ ◦ Average commercial loans increased 6% annualized QOQ ◦ Average consumer loans increased 13% annualized QOQ ◦ Continued growth in indirect auto business ▪ Net revenues declined 1% QOQ ◦ 4% increase in average earning assets, CLO accretion income and extra day in the quarter partially offset margin compression that reflects ongoing loan pricing pressures ◦ Fee income declined 7% QOQ ▪ Noninterest expense* of $249M increased $5M QOQ ◦ Approximately $7M of elevated expenses due to an ORE write- down, elevated levels of state franchise tax, and expenses associated with the Home Depot card breach ◦ Excluding elevated expenses, core expenses were down QOQ ▪ Credit metrics stable ◦ Originated NCOs of 0.27%, down 3 bps QOQ ◦ Allowance to originated loans stable at 1.20% ◦ Early stage DQs decline ▪ Effective tax rate of 9% reflects benefits of previously announced tax strategies * Excludes $2.4M impact of restructuring charges, $800M of goodwill impairment, and $45M of deposit account remediation for 3Q14; operating results represent non-GAAP measures. Refer to Noninterest Expense slide for further detail † The amount of the non-cash pre-tax goodwill impairment charge was $800 million 3Q14 Financial Results Income Statement ($ in millions, except per share data) 2Q14 3Q14 Net Interest Income $ 271.8 $ 273.3 Noninterest Income 80.9 75.4 Net Revenues 352.7 348.7 Noninterest Expense* 244.1 249.5 Pre-tax, Pre-provision Income 108.6 99.2 Provision for Loan Losses 22.8 21.2 Pre-tax Income 85.8 78.0 Income Taxes 12.0 7.1 Net Operating Income $ 73.8 $ 70.9 Preferred stock dividend 7.5 7.5 Net Income Available to Common Stockholders $ 66.2 $ 63.3 Operating Earnings per Diluted Share $ 0.19 $ 0.18 Less: Goodwill Impairment, net of taxes† — (1.99) Less: Deposit Account Remediation, net of taxes — (0.08) Less: Restructuring Charges, net of taxes — (0.00) GAAP Earnings per Diluted Share $ 0.19 $ (1.90) Key Ratios Net Interest Margin 3.26% 3.21% Return on Average Tangible Assets* 0.83% 0.78% Pre-tax, pre-provision ROA* 1.14% 1.02% Return on Average Tangible Common Equity* 12.10% 11.19% Efficiency Ratio* 69.2% 71.5% Effective Tax Rate 14.0% 9.1% Tier 1 Common Ratio (B1) 7.92% 7.89%

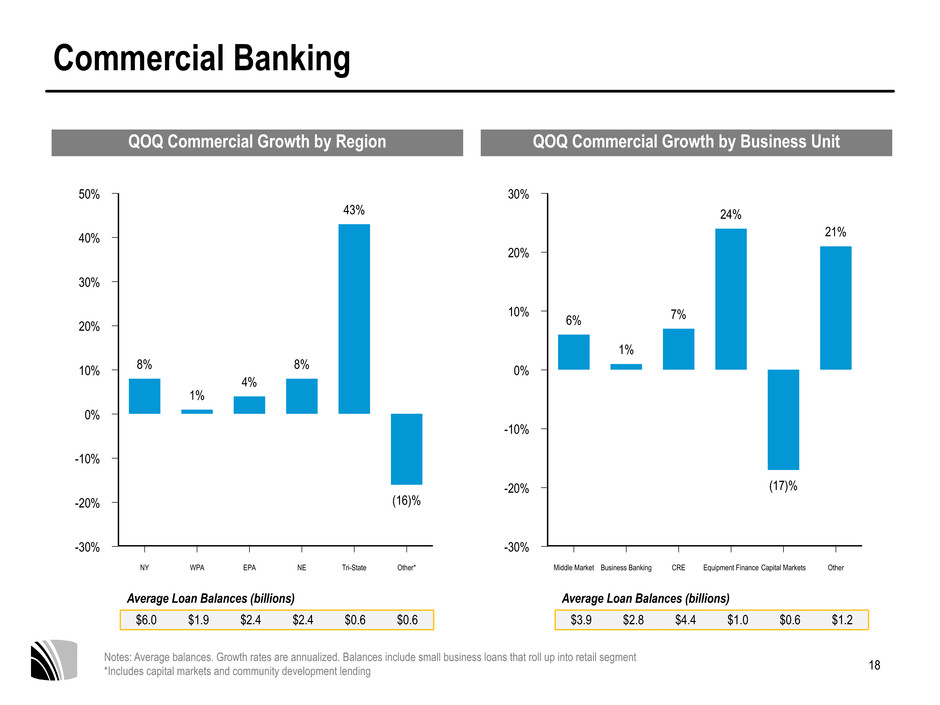

5 ▪ Commercial growth was strongest in our Tri-State (43% annualized), New England (8% annualized), and New York (8% annualized) markets ◦ Growth in Tri-State is strong across all business lines as a result of the recent addition of large-bank talent within the region ▪ Commercial Real Estate growth driven by construction lending and investor real estate properties ▪ Middle market / Healthcare segments continue to deliver strongest growth (6% QOQ) ▪ The commercial pipeline remains consistent with seasonal strength ▪ HELOC balances increased for the 6th consecutive quarter ▪ Average Indirect auto loans increased $228M in 3Q ◦ $376M in new originations at 2.84% yield, net of dealer reserve, with an average FICO score of 768 Consumer Balance Growth Residential Real Estate Home Equity Indirect Auto Credit Cards Other Consumer Total Consumer 60% 30% 0% -30% 1Q14 2Q14 3Q14 (7)% (6)% (1)% 4% 6% 8% 45% 34% 52% 1% (8)% 6% (9)% (12)% (6)% 6% 5% 13% Balance Sheet Summary | Loans ($ in millions) 3Q14 QOQ YOY Business 5,694 9% 10% Real Estate 7,985 4% 6% Total Commercial Loans 13,679 6% 8% Residential Real Estate 3,351 (1)% (5)% Home Equity 2,857 8% 6% Indirect Auto 1,978 52% 64% Credit Cards 313 6% 1% Other Consumer 287 (5)% (8)% Total Consumer Loans 8,786 13% 9% Total Average Loans 22,465 9% 8% Business Real Estate Total Commercial 15% 12% 9% 6% 3% 0% 1Q14 2Q14 3Q14 12% 11% 9% 7% 5% 4% 9% 8% 6% Commercial Balance Growth Note: Growth rates are annualized

6 QOQ Deposit Balance Growth Interest-Bearing Checking Savings & MMDA Non Interest Deposits Total Deposits 25% 20% 15% 10% 5% 0% -5% -10% -15% 1Q14 2Q14 3Q14 1% 7% —% (2)% 3% (6)% (1)% 18% 14% (2)% 11% —% Noninterest-bearing Interest-bearing % of Total Deposits $12 $10 $8 $6 $4 $2 $0 60% 50% 40% 30% 20% 10% 0% 3Q13 4Q13 1Q14 2Q14 3Q14 $4.79 $4.88 $4.86 $5.08 $5.26 $4.48 $4.73 $4.73 $4.82 $4.82 35% 36% 36% 36% 37% ▪ Average transactional deposit balance growth of 7% QOQ annualized driven by seasonal increase in commercial balances and new account acquisitions ◦ Transactional deposits were 37% of total deposits in Q3 (35% in 3Q13) ◦ Deposit balance growth was strongest in our Eastern PA (+$78M) and Western PA (+$46M) markets ▪ Cost of interest-bearing deposits remained unchanged at 0.24% ▪ Savings and MMDA balances declined at annualized rates of 11% and 4%, respectively, as a result of typical seasonality in municipal money market balances Balance Sheet Summary | Deposits ($ in millions) 3Q14 QOQ YOY Interest-Bearing Checking 4,821 —% 8% Savings Accounts 3,552 (11)% (6)% Money Market Deposits 9,882 (4)% (1)% CDs 3,969 —% 4% Interest-bearing Deposits 22,225 (3)% 1% Non Interest-bearing Deposits 5,260 14% 10% Total Deposits 27,484 —% 2% Note: Growth rates are annualized Average Transaction Deposits ($B) $9.3 $9.6 $9.6 $9.9 $10.1

7 ▪ 3Q14 net interest income increased $1.5M QOQ; net interest margin declined 5 bps QOQ to 3.21% ▪ Net interest income included a net $4.4M of benefits from certain unusual items ◦ $2M higher NII from 1 more day in the third quarter ◦ Favorable discount accretion of $5.4M from CLO portfolio, compared to $2.5M last quarter ◦ Favorable credit mark accretion of $0.7M from early payments of an acquired loan in 3Q ▪ 4% annualized increase in average earning assets QOQ generally offset yield declines ◦ Average commercial loans grew by $216M QOQ (6%), while consumer loans grew $276M (13%) ◦ Investment securities decreased $40M QOQ (-1%) ▪ Loan yields down 9 bps QOQ to 3.80% as new origination yields continue to trend lower than those rolling off ◦ Commercial spreads continue to remain in line with expectations and consistent with prior quarter ◦ Indirect origination yields declined a modest 4 bps QOQ due to higher FICO borrowers and greater new car mix ▪ Interest-bearing deposit costs remained flat at 0.24% Net Interest Income (T/E) Net Interest Margin ($ in millions) 1Q14 2Q14 3Q14 1Q14 2Q14 3Q14 3Q14 Notes Quarter As Reported $275.5 $276.6 $278.2 3.33% 3.26% 3.21% Less: CLO pay-off discount recognition (1.5) (2.5) ($5.4) (0.02%) (0.03%) (0.06%) Earlier than expected pay-offs of CLOs purchased at a discount Add: CMO Amort & Retro (1.1) - $0.9 (0.01)% - 0.01% RMBS premium amortization expense was $6M, up $1M QOQ Add: CRE prepayment penalties - 0.6 $0.8 - 0.01% 0.01% Lower than normal fees due to slower CRE prepayment activity Less: PAA-Early Payoffs - - ($0.7) - - (0.01%) Credit mark accretion on acquired loan pay-off Add: Other items 1.1 - - 0.02% - - SUB-TOTAL ($1.5) ($1.9) ($4.4) (0.01%) (0.02%) (0.05%) Quarter Normalized $274.0 $274.7 $273.8 3.32% 3.24% 3.16% Net Interest Income & Margin Overview

8 Credit Quality - Originated Portfolio Note: Originated loans represent loans excluding acquired loans (i.e., loans originated under First Niagara ownership) 1. Loans classified as special mention, substandard or doubtful 2. Loans classified as substandard or doubtful ▪ Net charge-offs of 27 bps in Q3; down 3 bps from Q2 and down 6 bps YOY ▪ Reserve build continued as provision expense of $19.6M was well in excess of $12.5M in NCOs ◦ $0.6 billion in originated loan growth ◦ Coverage ratio of originated allowance consistent with prior quarters ◦ Reserve build reduced EPS by ~$0.02 in Q3 ▪ Originated NPLs increased 9% QOQ due primarily to the impact of consumer bankruptcies ◦ Originated NPLs increased 5 bps to 91 bps of originated loan balances; up 2 bps YOY • Criticized loans increased 17% annualized QOQ and 30% YOY to $822M due primarily to commercial portfolio migration as well as consumer non-accruals • Classified loans increased 5% annualized QOQ and 19% YOY to $470M; as a percent of originated loans, classified loans relatively flat • ORE balances declined $4M reflecting the write- down of a commercial property ($ in millions) 3Q13 2Q14 3Q14 Net Charge-offs $12.9 $13.2 $12.5 Provision for loan losses $25.4 $22.1 $19.6 NCOs / Average Loans 0.33% 0.30% 0.27% Nonperforming Originated Loans $145 $157 $171 NPLs / Loans - Originated 0.89% 0.86% 0.91% Total Originated Loans $16,212 $18,196 $18,842 Allowance - Originated $195.0 $219.7 $226.7 Allowance / Loans - Originated 1.20% 1.21% 1.20% Criticized1 $634.2 $788.3 $822.1 Criticized as a % of Total Originated Loans 3.9% 4.3% 4.4% Classified2 $395.9 $464.0 $469.6 Classified as a % of Total Originated Loans 2.4% 2.6% 2.5%

9 Credit Quality - Acquired Portfolio ▪ Provision on acquired loans increased $0.9M in Q3 ▪ Credit mark of $100M equals 2.5% of remaining $4.0B acquired book Note: Acquired loans before associated credit discount. Refer to the end balance sheet in our Q3 2014 press release tables for a reconciliation to total loans and leases ($ in millions) NCC HNBC NAL HSBC Acquired NCC HNBC NAL HSBC Acquired Provision for loan losses $ — $ 0.3 $ — $ — $ 0.3 $ — $ 0.8 $ 0.4 $ — $ 1.2 Net charge-offs — 0.7 — — 0.7 — 0.5 — — 0.5 NCOs / avg loans 0.06% 0.05% Nonperforming loans 2.0 12.6 11.3 6.7 32.5 1.6 9.8 10.4 6.7 28.6 Total loans 236 874 2,308 836 4,255 229 814 2,171 814 4,028 Allowance — 3.8 — — 3.8 — 4.2 0.4 — 4.6 Credit discount on Acq loans $ 4.5 $ 21.4 $ 59.7 $ 19.6 $ 105.2 $ 4.4 $ 19.5 $ 57.5 $ 18.7 $ 100.1 Credit discount / Acq loans 1.9% 2.4% 2.6% 2.3% 2.5% 1.9% 2.4% 2.6% 2.3% 2.5% Criticized $ 29.8 $ 76.9 $ 144.8 $ 32.3 $ 283.8 $ 25.4 $ 64.3 $ 150.0 $ 28.0 $ 267.7 Classified 19.4 67.4 85.5 25.0 197.7 17.7 58.1 80.1 23.8 179.8 Accruing 90+ days delinquent $ 9.6 $ 34.1 $ 53.8 $ 11.7 $ 109.1 $ 9.8 $ 32.1 $ 53.1 $ 11.2 $ 106.2 2Q14 3Q14

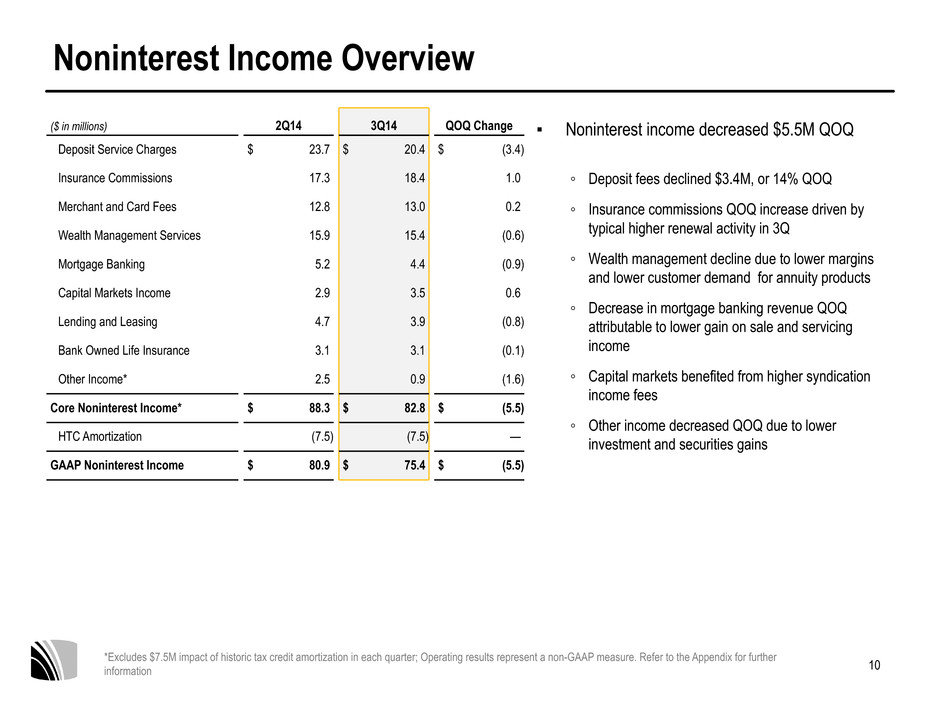

10 ▪ Noninterest income decreased $5.5M QOQ ◦ Deposit fees declined $3.4M, or 14% QOQ ◦ Insurance commissions QOQ increase driven by typical higher renewal activity in 3Q ◦ Wealth management decline due to lower margins and lower customer demand for annuity products ◦ Decrease in mortgage banking revenue QOQ attributable to lower gain on sale and servicing income ◦ Capital markets benefited from higher syndication income fees ◦ Other income decreased QOQ due to lower investment and securities gains Noninterest Income Overview ($ in millions) 2Q14 3Q14 QOQ Change Deposit Service Charges $ 23.7 $ 20.4 $ (3.4) Insurance Commissions 17.3 18.4 1.0 Merchant and Card Fees 12.8 13.0 0.2 Wealth Management Services 15.9 15.4 (0.6) Mortgage Banking 5.2 4.4 (0.9) Capital Markets Income 2.9 3.5 0.6 Lending and Leasing 4.7 3.9 (0.8) Bank Owned Life Insurance 3.1 3.1 (0.1) Other Income* 2.5 0.9 (1.6) Core Noninterest Income* $ 88.3 $ 82.8 $ (5.5) HTC Amortization (7.5) (7.5) — GAAP Noninterest Income $ 80.9 $ 75.4 $ (5.5) *Excludes $7.5M impact of historic tax credit amortization in each quarter; Operating results represent a non-GAAP measure. Refer to the Appendix for further information

11 ▪ Reported GAAP noninterest expense of $1.1B ◦ Goodwill impairment charge recorded at $800 million ◦ Reserve for process issue on certain deposit accounts of $45M ◦ Restructuring charges of $2.4M ▪ 3Q operating expenses* increased $5M from prior quarter; excluding elevated expenses of $7.5M, expenses were down $2M ◦ $3.5M in higher ORE write-down on one single property ◦ $1.8M related to losses incurred and new card expense related to Home Depot data breach ◦ $2.3M due to higher State Franchise taxes ◦ $1.1M in lower occupancy and equipment expense as leasehold depreciation expense normalized from elevated 2Q ◦ $1.5M in lower compensation expenses due to payroll taxes and incentive compensation expense Noninterest Expense ($ in millions) 2Q14 3Q14 QOQ Change Salaries and Employee Benefits $ 117.7 $ 116.2 $ (1.5) Occupancy and Equipment 28.6 27.5 (1.1) Technology and Communication 31.1 31.5 0.3 Marketing 8.4 7.7 (0.7) Professional Services 13.0 14.0 1.0 Amortization of Intangibles 6.8 6.5 (0.3) FDIC Premiums 9.8 9.6 (0.2) Other Expense 28.7 36.5 7.8 Operating Expense $ 244.1 $ 249.5 $ 5.4 Goodwill Impairment — 800.0 800.0 Deposit Account Remediation — 45.0 45.0 Restructuring Charges — 2.4 2.4 GAAP Noninterest Expense $ 244.1 $ 1,096.8 $ 852.7

12 4Q14 Outlook (as of October 24, 2014) Based on the computed median of all 17 analyst models where available and SNL Financial; 4Q14 expectations as of October 24, 2014 * Operating expenses to exclude branch and other restructuring expenses Metric Street Median1 Management Commentary on Street Expectations Net Interest Margin (T/E) 3.19% Modest downward bias to Street 4Q expectations Average Earning Assets $34.9B Consistent with Street 4Q expectations Noninterest Income (excluding HTC amort) $84M Seasonality in certain fee income categories to drive low- single digit decline QOQ Operating Expenses * $247M Consistent with Street 4Q expectations Loan loss provision $27M NCOs: consistent with 3Q levels; excess provisionconsistent with originated loan growth Tax rate - GAAP - 14-16% including HTC tax credit Operating EPS $0.18 Modest downward bias to Street 4Q expectations

Appendix

14 Investment Security Mix (Book Value $11.5B) RMBS: 57.9% CMBS: 13.5% CLO: 9.0% ABS: 5.9% Corporates: 7.2% Muni: 4.2% US Gov't: 1.9% Other: 0.2% UST: 0.2% Investment Securities1 (as of September 30, 2014) Commercial Assets2 to Total Deposits 1. Excludes Federal Home Loan Bank and Federal Reserve Bank stock 2. Commercial assets include C&I and CRE loans plus CLO, CMBS, corporates and commercial ABS at amortized cost Traditional Portfolio $7.4B; 64% Credit Securities $4.1B; 36% Portfolio Stats 2Q14 3Q14 Market Value $11.5B $11.5B Yield 3.01% 2.96% Average Rating AA AA Remaining RMBS Purchase Premium $77M $82M Remaining Premium as a % of RMBS Portfolio 1.3% 1.3% Total Portfolio Duration 3.7 years 3.7 years AFS Portfolio Duration 2.9 years 2.9 years QOQ Change in after-tax AOCI $14M ($30M) Quarterly Purchases 2Q14 3Q14 Total $574M $743M Yield 2.7% 2.5% Average Rating AA+ AA+ Risk Profile Consistent with Peers FNFG Peer Median 80% 75% 70% 65% 60% 55% 50% 45% 40% 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 52% 55% 58% 61% 62% 63% 64% 63% 63% 63%

15 Strong Asset Quality Originated NPL to Loans by Loan Category1 Originated NCO to Loans by Loan Category1 CRE C&I RRE Home Equity Total Other Consumer 2.00% 1.50% 1.00% 0.50% 0.00% 3Q13 4Q13 1Q14 2Q14 3Q14 0.83% 0.83% 0.61% 0.68% 1.74% 1.78% 1.14% 1.31% 0.60% 0.64% 1. Excludes acquired loans that are marked to market at acquisition CRE C&I RRE Home Equity Total Other Consumer 1.40% 1.20% 1.00% 0.80% 0.60% 0.40% 0.20% 0.00% -0.20% -0.40% 3Q13 4Q13 1Q14 2Q14 3Q14 0.29% 0.13% 0.14% 0.24% 0.07% 0.02% 0.16% 0.17% 0.95% 0.98%

16 ($ in billions)($ in billions) Strong Asset Quality Commercial Loan Count1 Originated Criticized & Classified Loans to Total Loans2 Criticized Classified 5.00% 4.00% 3.00% 2.00% 1.00% 0.00% 3Q13 4Q13 1Q14 2Q14 3Q14 3.91% 4.00% 4.40% 4.33% 4.36% 2.44% 2.67% 2.66% 2.55% 2.49% 4Q12 4Q13 2Q14 3Q14 2,500 2,000 1,500 1,000 500 0 $1M to $5M $5M to $10M $10M to $20M > $20M 1. Multiple loans to one borrower have not been aggregated for purposes of this chart 2. Excludes acquired loans that are marked to market at acquisition 3333 33 25 2,035 2,045 1,953 1,841 187 180 166 150 387 379 35 0 315

17 Continued Momentum in Loan Growth Average Commercial Loans Average Consumer Loans C&I CRE $15 $12 $9 $6 $3 $0 4Q13 1Q14 2Q14 3Q14 $5.3 $5.4 $5.6 $5.7 $7.7 $7.8 $7.9 $8.0 ▪ 9% annualized increase in average loans QOQ ▪ Double-digit growth in Consumer lending ▪ Continued momentum in indirect auto lending platform Notes: Growth rates are annualized 6% Residential RE Home Equity Other Consumer Credit Card Indirect Auto $10 $8 $6 $4 $2 $0 4Q13 1Q14 2Q14 3Q14 $3.5 $3.4 $3.4 $3.4 $2.7 $2.8 $2.8 $2.9 $0.3 $0.3 $0.3 $0.3$0.3 $0.3 $0.3 $0.3 $1.5 $1.6 $1.8 $2.0 13% $8.3 $8.4 $8.5 $8.8 $12.9 $13.2 $13.5 $13.7

18 Commercial Banking QOQ Commercial Growth by Region QOQ Commercial Growth by Business Unit 50% 40% 30% 20% 10% 0% -10% -20% -30% NY WPA EPA NE Tri-State Other* 8% 1% 4% 8% 43% (16)% $6.0 $1.9 $2.4 $2.4 $0.6 $0.6 $3.9 $2.8 $4.4 $1.0 $0.6 $1.2 Average Loan Balances (billions) Average Loan Balances (billions) Notes: Average balances. Growth rates are annualized. Balances include small business loans that roll up into retail segment *Includes capital markets and community development lending 30% 20% 10% 0% -10% -20% -30% Middle Market Business Banking CRE Equipment Finance Capital Markets Other 6% 1% 7% 24% (17)% 21%

19 ▪ Indirect Auto ◦ Net origination yield of 2.84%, 4 bps below Q2 due to higher FICO scores and a higher percentage of new car loans ◦ $376 million in originations in 3Q14, up from 2Q14 ▪ Average FICO of 768 on new originations during the quarter; improvement over prior quarter (763) ▪ 56% of originations are for used vehicles at new car dealers, compared to 60% for 2Q14 ▪ Credit cards ◦ Purchase volume up modestly QOQ ◦ Continued focus in building the balance sheet through origination, activation, and usage campaigns ◦ Apple Pay agreement signed with MasterCard in October ▪ Residential Lending ◦ Application volumes down 10% QOQ due to seasonality, but up 21% YOY ◦ Closed volumes increased 30% QOQ on seasonally strong 2Q application volumes ◦ Purchase volumes accounted for 76% of total production in quarter; purchase volume up 43% QOQ ◦ HELOC: 6th consecutive quarter of growth driven by targeted promotional campaigns Consumer Finance ($ in millions) 2Q14 3Q14 QOQ Change Period end balance $1,872 $2,073 11% Origination Volume $368 $376 2% Origination Yield 2.88% 2.84% (4bps) # of dealers 1,218 1,182 (3)% % units used 60% 56% (4)% Period end loan balance $312 $313 —% Purchase Volume $251 $253 1% Interchange fee income $4.8 $4.8 —% Total active accounts (units) 155,081 158,542 2% Total Origination Volume $274 $356 30% Retail Origination Volume $221 $284 29% Purchase Volume $189 $270 43% HFS Lock Volume $187 $179 (4)% Application Volume $562 $504 (10)% Residential Mortgag e Credit Car ds Indirect Aut o

20 Non-GAAP Measures Non-GAAP Measures – This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (GAAP). The Company believes that these non-GAAP financial measures provide a meaningful comparison of the underlying operational performance of the Company, and facilitate investors’ assessments of business and performance trends in comparison to others in the financial services industry. In addition, the Company believes the exclusion of these non-operating items enables management to perform a more effective evaluation and comparison of the Company’s results and to assess performance in relation to the Company’s ongoing operations. These disclosures should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Where non-GAAP disclosures are used in this presentation, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in this Appendix.

21 GAAP to non-GAAP Measures