Attached files

| file | filename |

|---|---|

| 8-K - 3RD QTR 2014 EARNINGS SLIDES - FIRST MERCHANTS CORP | a8k3rdqtr2014earningscalls.htm |

First Merchants Corporation NASDAQ: FRME Michael C. Rechin Mark K. Hardwick John J. Martin President Executive Vice President Executive Vice President Chief Executive Officer Chief Financial Officer Chief Credit Officer ® THE STRENGTH OF BIG. THE SERVICE OF SMALL. 3rd QUARTER 2014 EARNINGS CALL October 23, 2014 Filed by First Merchants Corporation Pursuant to Rule 425 under the Securities Act of 1933 Subject Company: Community Bancshares, Inc. SEC Registration Statement No: 333-198661

Forward-Looking Statement THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com www.firstmerchants.com ® 2 This presentation contains forward-looking statements made pursuant to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements can often, but not always, be identified by the use of words like “believe”, “continue”, “pattern”, “estimate”, “project”, “intend”, “anticipate”, “expect” and similar expressions or future or conditional verbs such as “will”, would”, “should”, “could”, “might”, “can”, “may”, or similar expressions. These forward-looking statements include, but are not limited to, any indications regarding the financial services industry, the economy and future growth of the balance sheet or income statement, statements relating to the expected timing and benefits of the proposed merger (the “Merger”) between First Merchants Corporation (“First Merchants”) and Community Bancshares, Inc. (“Community Bancshares”), including future financial and operating results, cost savings, enhanced revenues, and accretion/dilution to reported earnings that may be realized from the Merger, as well as other statements of expectations regarding the Merger, and other statements of First Merchants’ goals, intentions and expectations; statements regarding the First Merchants’ business plan and growth strategies; statements regarding the asset quality of First Merchants’ loan and investment portfolios; and estimates of First Merchants’ risks and future costs and benefits, whether with respect to the Merger or otherwise. These forward-looking statements are subject to significant risks, assumptions and uncertainties that may cause results to differ materially from those set forth in forward-looking statements, including, among other things: the risk that the businesses of the First Merchants and Community Bancshares will not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected; expected revenue synergies and cost savings from the Merger may not be fully realized or realized within the expected time frame; revenues following the Merger may be lower than expected; customer and employee relationships and business operations may be disrupted by the Merger; the ability to obtain required governmental and shareholder approvals, and the ability to complete the Merger on the expected timeframe; possible changes in economic and business conditions; the existence or exacerbation of general geopolitical instability and uncertainty; the ability of First Merchants to integrate recent acquisitions and attract new customers; possible changes in monetary and fiscal policies, and laws and regulations; the effects of easing restrictions on participants in the financial services industry; the cost and other effects of legal and administrative cases; possible changes in the credit worthiness of customers and the possible impairment of collectability of loans; fluctuations in market rates of interest; competitive factors in the banking industry; changes in the banking legislation or regulatory requirements of federal and state agencies applicable to bank holding companies and banks like First Merchants’ affiliate bank; continued availability of earnings and excess capital sufficient for the lawful and prudent declaration of dividends; changes in market, economic, operational, liquidity, credit and interest rate risks associated with the First Merchants’ business; and other risks and factors identified in First Merchants’ filings with the Securities and Exchange Commission. First Merchants does not undertake any obligation to update any forward-looking statement, whether written or oral, relating to the matters discussed in this presentation. In addition, First Merchants’ and Community Bancshares’ past results of operations do not necessarily indicate either of their anticipated future results, whether the Merger is effectuated or not. THE STRENGTH OF BIG. THE SERVICE OF SMALL.

Additional Information THE STRENGTH OF BIG. THE SERVICE OF SMALL. www.firstmerchants.com www.firstmerchants.com ® 3 This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any proxy vote or approval. The proposed merger will be submitted to Community Bancshares’ shareholders for their consideration. In connection with the proposed merger, First Merchants Corporation (“First Merchants”) has filed with the Securities and Exchange Commission (“SEC”) a Registration Statement on Form S-4 (Registration No. 333-198661) that includes a Proxy Statement for Community Bancshares, Inc. (“Community Bancshares”) and a Prospectus of First Merchants, as well as other relevant documents concerning the proposed transaction. The SEC declared the Form S-4 Registration Statement effective on October 2, 2014. A definitive Proxy Statement and Prospectus was mailed to Community Bancshares shareholders on or about October 2, 2014. COMMUNITY BANCSHARES SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE CORRESPONDING PROXY STATEMENT AND PROSPECTUS REGARDING THE MERGER, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, TOGETHER WITH ALL AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, AS THEY WILL CONTAIN IMPORTANT INFORMATION. A free copy of the Proxy Statement and Prospectus, as well as other filings containing information about First Merchants, may be obtained at the SEC’s Web Site (http://www.sec.gov). You may also obtain these documents, free of charge, by accessing First Merchants’ Web site http://www.firstmerchants.com) under the tab Investors, then under the heading Financial Information, and finally under the link to SEC Filings. Community Bancshares and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Community Bancshares in connection with the proposed Merger. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement and Prospectus regarding the proposed merger when they become available. Free copies of this document may be obtained as described in the preceding paragraph. Non-GAAP Financial Measures These slides contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant’s historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, First Merchants Corporation has provided reconciliations within the slides, as necessary, of the non-GAAP financial measure to the most directly comparable GAAP financial measure. THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com 3rd Quarter 2014 Highlights 4 Earnings • Earnings Per Share of $.45, a 29% Increase over 3rd Quarter of 2013 • Net Income of $16.1 Million • Return on Average Assets of 1.16% • Return on Tangible Equity of 13.64% • Efficiency Ratio 58.52% Balance Sheet • Organic Loan Growth Y-O-Y of $250M, or 8.50% • Tangible Book Value of $13.53, a 17% Increase over 3rd Quarter of 2013 Net Interest Margin • Strong Net Interest Margin at 3.98% • 3.71% without FMV Accretion ® THE STRENGTH OF BIG. THE SERVICE OF SMALL.

Executive Vice President and Chief Financial Officer www.firstmerchants.com ® 5 THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com Total Assets 2012 2013 Q1-’14 Q2-’14 Q3-’14 1. Investments $ 874 $1,096 $1,150 $1,214 $1,190 2. Loans Held for Sale 22 5 7 7 6 3. Loans 2,902 3,633 3,617 3,723 3,773 4. Allowance (69) (68) (70) (68) (66) 5. CD&I & Goodwill 150 203 202 202 201 6. BOLI 125 165 165 166 165 7. Other 301 403 382 371 322 8. Total Assets $4,305 $5,437 $5,453 $5,615 $5,591 ($ in Millions) 6 ® THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com Commercial & Industrial 23.8% Commercial Real Estate Owner-Occupied 13.0% Commercial Real Estate Non-Owner Occupied 25.2%Construction, Land & Land Development 4.7% Agricultural Land 4.2% Agricultural Production 2.6% Other Non-Consumer 0.7% Residential Mortgage 16.7% Home Equity 7.1% Other Consumer 2.0% Loan and Yield Detail (as of 9/30/2014) QTD Yield = 4.62% YTD Yield = 4.62% Total Loans = $3.8 Billion 7 ® THE STRENGTH OF BIG. THE SERVICE OF SMALL.

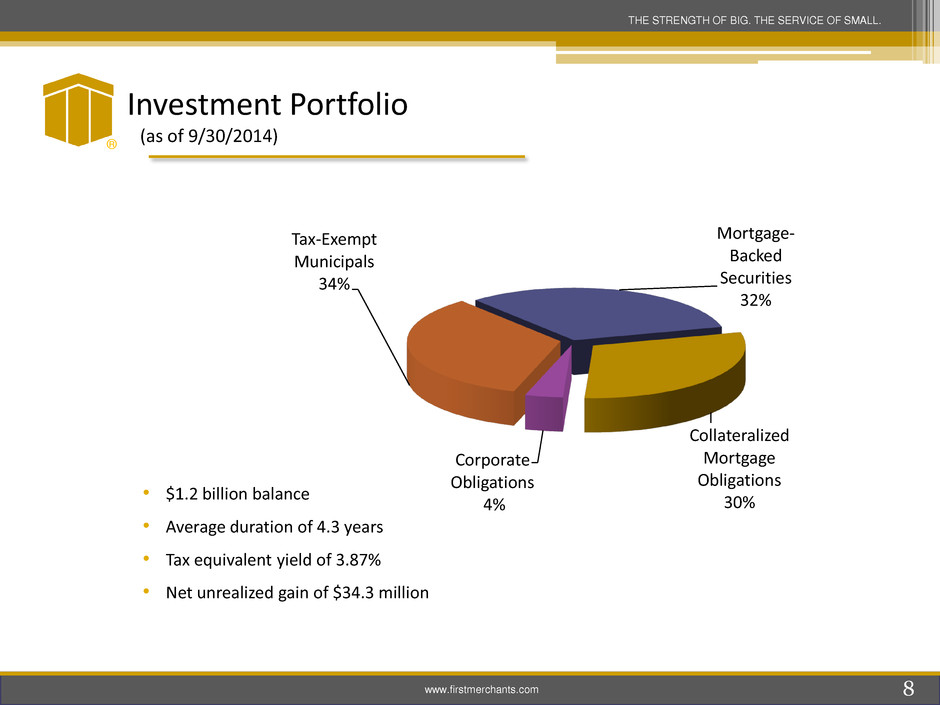

www.firstmerchants.com • $1.2 billion balance • Average duration of 4.3 years • Tax equivalent yield of 3.87% • Net unrealized gain of $34.3 million Investment Portfolio (as of 9/30/2014) 8 Mortgage- Backed Securities 32% Collateralized Mortgage Obligations 30% Corporate Obligations 4% Tax-Exempt Municipals 34% ® THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com 2012 2013 Q1-’14 Q2-’14 Q3-’14 1. Customer Non-Maturity Deposits $2,479 $3,276 $3,249 $3,292 $3,229 2. Customer Time Deposits 739 868 834 786 744 3. Brokered Deposits 128 87 200 251 337 4. Borrowings 260 401 362 459 440 5. Other Liabilities 39 48 34 34 34 6. Hybrid Capital 107 122 122 122 122 7. Preferred Stock (SBLF) 91 8. Common Equity 462 635 652 671 685 9. Total Liabilities and Capital $4,305 $5,437 $5,453 $5,615 $5,591 10. Tangible Book Value Per Share $10.95 $12.17 $12.63 $13.14 $13.53 Total Liabilities and Capital ($ in Millions) 9 ® THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com Deposits and Cost of Funds Detail (as of 09/30/2014) 10 ® Demand Deposits 45% Savings Deposits 30% Certificates & Time Deposits of >$100,000 5% Certificates & Time Deposits of <$100,000 12% Brokered Deposits 8% QTD Cost = .34% YTD Cost = .33% Total Deposits = $4.3 Billion THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com Capital Ratios 9.71% 9.62% 10.20% 10.13% 10.42% 10.37% 10.86% 11.00% 11.16% 7.51% 7.55% 7.88% 7.74% 7.97% 8.34% 8.65% 8.74% 9.05% 16.62% 16.34% 15.91% 15.69% 14.96% 14.54% 15.04% 15.11% 15.21% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% 13.00% 14.00% 15.00% 16.00% 17.00% 18.00% 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 Total Risk-Based Capital Ratio (Target = 14.50%) Tier 1 Common Risk-Based Capital Ratio (Target = 10.00%) Tangible Common Equity/Tangible Assets (TCE) (Target = 8.00%) (Target) (Target) (Target) 11 ® THE STRENGTH OF BIG. THE SERVICE OF SMALL.

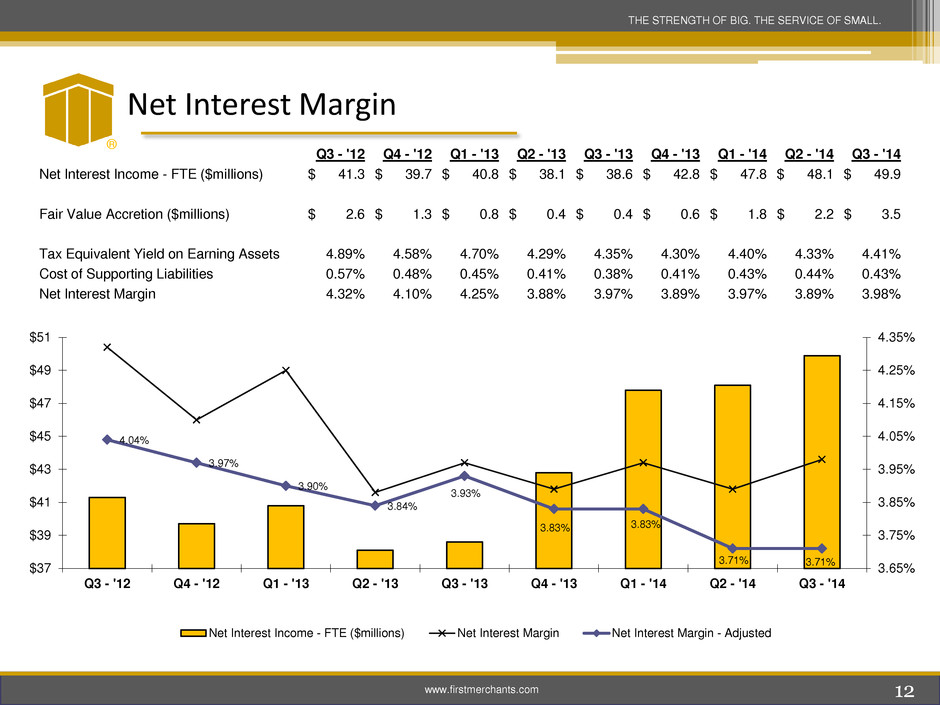

www.firstmerchants.com Net Interest Margin 12 ® Q3 - '12 Q4 - '12 Q1 - '13 Q2 - '13 Q3 - '13 Q4 - '13 Q1 - '14 Q2 - '14 Q3 - '14 Net Interest Income - FTE ($millions) $ 41.3 $ 39.7 $ 40.8 $ 38.1 $ 38.6 $ 42.8 $ 47.8 $ 48.1 $ 49.9 Fair Value Accretion ($millions) $ 2.6 $ 1.3 $ 0.8 $ 0.4 $ 0.4 $ 0.6 $ 1.8 $ 2.2 $ 3.5 Tax Equivalent Yield on Earning Assets 4.89% 4.58% 4.70% 4.29% 4.35% 4.30% 4.40% 4.33% 4.41% Cost of Supporting Liabilities 0.57% 0.48% 0.45% 0.41% 0.38% 0.41% 0.43% 0.44% 0.43% Net Interest Margin 4.32% 4.10% 4.25% 3.88% 3.97% 3.89% 3.97% 3.89% 3.98% 4.04% 3.97% 3.90% 3.84% 3.93% 3.83% 3.83% 3.71% 3.71% 3.65% 3.75% 3.85% 3.95% 4.05% 4.15% 4.25% 4.35% $37 $39 $41 $43 $45 $47 $49 $51 Q3 - '12 Q4 - '12 Q1 - '13 Q2 - '13 Q3 - '13 Q4 - '13 Q1 - '14 Q2 - '14 Q3 - '14 Net Interest Income - FTE ($millions) Net Interest Margin Net Interest Margin - Adjusted THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com 2012 2013 Q1-’14 Q2-’14 Q3-’14 1. Service Charges on Deposit Accounts $11.6 $12.4 $ 3.6 $ 4.1 $ 4.1 2. Trust Fees 7.9 8.6 2.2 2.4 2.2 3. Insurance Commission Income 6.2 7.1 2.3 1.9 1.7 4. Electronic Card Fees 7.3 7.5 2.3 2.5 2.4 5. Cash Surrender Value of Life Ins 3.4 2.6 0.7 0.7 1.5 6. Gains on Sales Mortgage Loans 10.6 7.5 0.7 1.2 1.5 7. Securities Gains/Losses 2.4 0.5 0.6 0.8 0.9 8. Gain on FDIC Transaction 9.1 – – – – 9. Other 5.8 8.6 2.8 2.3 4.0 10. Total $64.3 $54.8 $15.2 $15.9 $18.3 11. Adjusted Non-Interest Income1 $52.8 $54.3 $14.6 $15.1 $17.4 ($ in Millions) Non-Interest Income 1Adjusted for Bond Gains & Losses and Gain on FDIC-Modified Whole-Bank Transaction 13 ® THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com Non-Interest Expense 2012 2013 Q1-’14 Q2-’14 Q3-’14 1. Salary & Benefits $ 79.4 $ 85.4 $ 25.3 $23.4 $24.2 2. Premises & Equipment 17.4 18.0 6.6 5.3 5.6 3. Core Deposit Intangible 1.9 1.6 0.6 0.6 0.6 4. Professional & Other Outside Services 6.2 8.3 1.4 1.5 1.6 5. OREO/Credit-Related Expense 8.2 6.7 1.8 2.6 2.6 6. FDIC Expense 3.5 2.9 1.1 0.9 0.9 7. Outside Data Processing 5.7 5.6 1.8 2.0 1.9 8. Marketing 2.2 2.2 0.8 0.8 1.1 9. Other 12.6 12.5 3.7 4.1 4.1 10. Non-Interest Expense $137.1 $143.2 $ 43.1 $ 41.2 $42.6 ($ in Millions) 14 ® THE STRENGTH OF BIG. THE SERVICE OF SMALL.

2012 2013 Q1-’14 Q2-’14 Q3-’14 1. Net Interest Income $152.3 $154.3 $ 45.9 $ 46.1 $ 47.9 2. Provision for Loan Losses (18.5) (6.6) – – (1.6) 3. Net Interest Income after Provision 133.8 147.7 45.9 46.1 46.3 4. Non-Interest Income 64.3 54.8 15.2 15.9 18.3 5. Non-Interest Expense (137.1) (143.2) (43.1) (41.2) (42.6) 6. Income before Income Taxes 61.0 59.3 18.0 20.8 22.0 7. Income Tax Expense (15.9) (14.7) (4.4) (5.6) (5.9) 8. Preferred Stock Dividend (4.5) (2.4) – – – 9. Net Income Avail. for Distribution $ 40.6 $ 42.2 $13.6 $15.2 $16.1 10. EPS $ 1.41 $ 1.41 $0.38 $0.41 $0.45 www.firstmerchants.com Earnings ($ in Millions) ® 15 THE STRENGTH OF BIG. THE SERVICE OF SMALL.

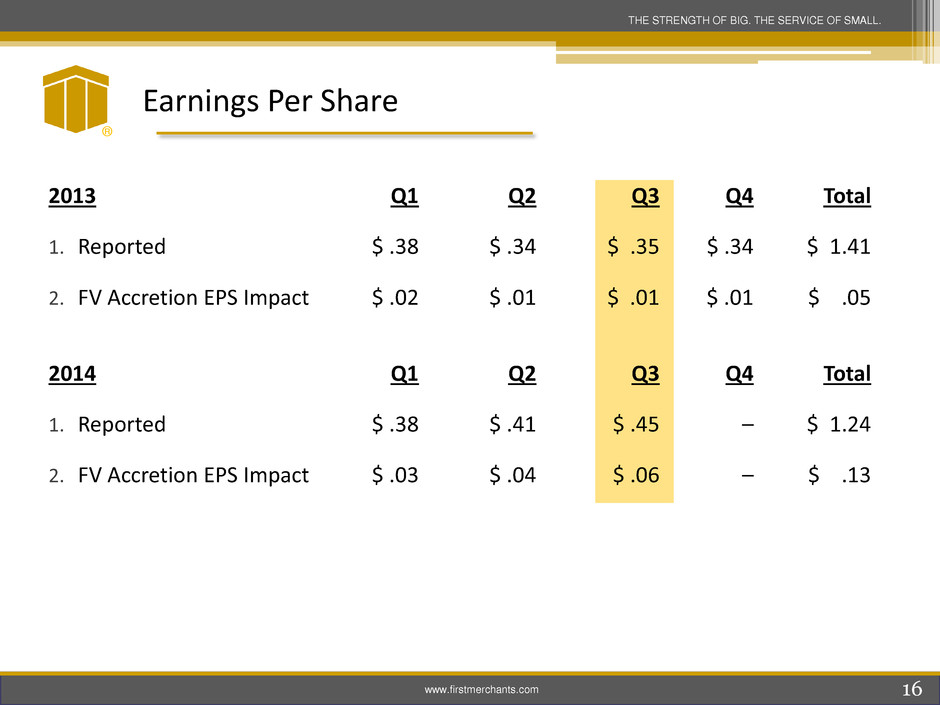

www.firstmerchants.com Earnings Per Share 2013 Q1 Q2 Q3 Q4 Total 1. Reported $ .38 $ .34 $ .35 $ .34 $ 1.41 2. FV Accretion EPS Impact $ .02 $ .01 $ .01 $ .01 $ .05 2014 Q1 Q2 Q3 Q4 Total 1. Reported $ .38 $ .41 $ .45 – $ 1.24 2. FV Accretion EPS Impact $ .03 $ .04 $ .06 – $ .13 ® 16 THE STRENGTH OF BIG. THE SERVICE OF SMALL.

Executive Vice President and Chief Credit Officer www.firstmerchants.com ® 17 THE STRENGTH OF BIG. THE SERVICE OF SMALL.

® www.firstmerchants.com 18 Loan Portfolio Trends ($ in Millions) Change 2012 2013 Q1-'14 Q2-'14 Q3-'14 $ % 149.9 1. Commercial & Industrial 622.6$ 761.7$ 787.4$ 857.8$ 901.0$ 43.2$ 5.0% 2. Construction, Land and Land Development 98.6 177.1 155.1 165.4 178.2 12.8 7.7% 3. CRE Non-Owner Occupied 706.3 963.4 954.9 963.8 953.2 (10.6) (1.1%) 4. CRE Owner Occupied 434.2 501.1 503.0 504.0 492.9 (11.1) (2.2%) 5. Agricultural Production 112.5 114.3 99.2 102.3 99.7 (2.6) (2.5%) 6. Agricultural Land 126.2 147.3 148.9 153.6 157.6 4.0 2.6% 7. Residential Mortgage 473.5 616.4 626.2 629.2 625.6 (3.6) (0.6%) 8. Home Equity 203.5 255.2 256.8 261.8 270.0 8.2 3.1% 9. Other Non-Consumer 46.5 26.1 23.4 23.3 27.5 4.2 18.0% 10. Other Consumer 78.3 69.8 61.7 61.5 66.8 5.3 8.6% 11. Loans 2,902.2$ 3,632.4$ 3,616.6$ 3,722.7$ 3,772.5$ 49.8$ 1.3% Linked Quarter THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com Asset Quality Summary ® 19 ($ in Millions) 2012 2013 Q1-'14 Q2-'14 Q3-'14 $ % 1. Non-Accrual Loans 53.4$ 56.4$ 55.7$ 51.3$ 49.1$ (2.2)$ (4.3%) 2. Other Real Estate 13.3$ 22.2$ 21.1$ 18.6$ 14.5$ (4.1)$ (22.0%) 3. Renegotiated Loans 12.7$ 3.0$ 0.4$ 1.4$ 1.2$ (0.2)$ (14.3%) 4. 90+ Days Delinquent Loans 2.0$ 1.4$ 1.7$ 1.1$ 0.8$ (0.3)$ (27.3%) 5. NPAs/Loans and ORE 2.7% 2.2% 2.1% 1.9% 1.7% 6. Classified Assets 184.4$ 191.9$ 217.0$ 204.4$ 193.4$ (11.0)$ (5.4%) 7. Criticized Assets (includes Classified) 250.2$ 263.5$ 281.4$ 269.5$ 255.3$ (14.2)$ (5.3%) 8. Specific Reserves 4.2$ 1.6$ 1.8$ 1.7$ 3.4$ 1.7$ 100.0% 9. Allowance for Loan and Lease Losses 69.4$ 67.9$ 69.6$ 68.4$ 65.6$ (2.8)$ (4.1%) 10. ALLL/Non-Accrual Loans 129.9% 120.4% 125.0% 133.3% 133.6% Linked Quarter Change THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com Non-Performing Asset Reconciliation ® 20 ($ in Millions) Q4-'13 Q1-'14 Q2-'14 Q3-'14 1. Beginning Balance NPA's & 90+ Days Delinquent 51.2$ 83.0$ 78.9$ 72.4$ Non-Accrual 2. Add: New Non-Accruals 4.2 9.1 8.3 18.3 3. Add: Citizens Non-Accruals 22.7 4. Less: To Accrual/Payoff/Renegotiated (3.6) (6.9) (8.5) (11.3) 5. Less: To OREO (1.0) (1.0) (1.8) (1.1) 6. Less: Charge-offs (0.9) (1.9) (2.4) (8.1) 7. Increase / (Decrease): Non-Accrual Loans 21.4 (0.7) (4.4) (2.2) Other Real Estate Owned (ORE) 8. Add: New ORE Properties 1.0 1.0 1.8 1.1 9. Add: Citizens ORE Properties 12.9 10. Less: ORE Sold (3.1) (1.5) (2.7) (3.7) 11. Less: ORE Losses (write-downs) (0.6) (0.6) (1.6) (1.5) 12. Increase / (Decrease): ORE 10.2 (1.1) (2.5) (4.1) 13. Increase / (Decrease): 90+ Days Delinquent 0.4 0.4 (0.6) (0.3) 14. Increase / (Decrease): Restructured Loans (0.2) (2.7) 1.0 (0.2) 15. Total NPA Change 31.8 (4.1) (6.5) (6.8) 16. Ending Balance NPA's & 90+ Days Delinquent 83.0$ 78.9$ 72.4$ 65.6$ THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com Net Charge-Offs, Provision & Allowance ® 21 ($ in Millions) THE STRENGTH OF BIG. THE SERVICE OF SMALL.

® www.firstmerchants.com 22 ALLL and Fair Value Summary (as of 09/30/2014) ($ in Millions) FMB 1 SCB CFS Total 1. Allowance for Loan Losses (ALLL) 65.1$ 0.1$ 0.4$ 65.6$ 2. Fair Value Adjustment 6.8 28.7 35.5 3. Total ALLL plus FV Adjustments 65.1$ 6.9$ 29.1$ 101.1$ 4. Gross Loan Balances 3,218.1$ 48.1$ 548.2$ 3,814.4$ 5. Net Loan Balances 3,218.1$ 41.3$ 519.5$ 3,778.9$ 6. ALLL/Loans 1.74% 7. ALLL & FV Adj/Gross Loan Balances 3 2.02% 14.35% 5.31% 2.65% 1 Loans originated by FMB 2 ALLL represents an impairment reserve. 3 Management uses this Non-GAAP measure to demonstrate coverage and credit risk 22 THE STRENGTH OF BIG. THE SERVICE OF SMALL.

President and Chief Executive Officer www.firstmerchants.com ® 23 THE STRENGTH OF BIG. THE SERVICE OF SMALL.

www.firstmerchants.com Strategy and Tactics Overview ® 24 Assess Acquisition Opportunities in Our Marketplace • Received regulatory approvals for the Community Bank acquisition • Targeting a 4th quarter close of the transaction Intensify Revenue-Generating Activities • Achieve organic growth throughout the franchise • Additionally invest in First Merchants’ brand in new “Lakeshore Region” • Develop and retain outstanding talent • Leverage our Centers of Influence and Regional Board relationships Improve Efficiency • Attain normalized expense levels • Actively review mortgage volumes and related expenses • Optimize branch system Focus on the Customer Experience • Continue to advance our loan process for speed and accuracy • Evaluate and enhance our technology platforms • Invest in mobile banking THE STRENGTH OF BIG. THE SERVICE OF SMALL.

First Merchants Corporation common stock is traded on the NASDAQ Global Select Market under the symbol FRME Additional information can be found at www.firstmerchants.com Investor inquiries: David L. Ortega Investor Relations Telephone: 765.378.8937 dortega@firstmerchants.com FIRST MERCHANTS and the Shield Logo are registered trademarks of First Merchants Corporation Contact Information ® 25 www.firstmerchants.com THE STRENGTH OF BIG. THE SERVICE OF SMALL.