Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AMTECH SYSTEMS INC | d809426d8k.htm |

| EX-99.4 - EX-99.4 - AMTECH SYSTEMS INC | d809426dex994.htm |

| EX-99.1 - EX-99.1 - AMTECH SYSTEMS INC | d809426dex991.htm |

| EX-99.5 - EX-99.5 - AMTECH SYSTEMS INC | d809426dex995.htm |

| EX-2.1 - EX-2.1 - AMTECH SYSTEMS INC | d809426dex21.htm |

| EX-99.6 - EX-99.6 - AMTECH SYSTEMS INC | d809426dex996.htm |

| EX-99.2 - EX-99.2 - AMTECH SYSTEMS INC | d809426dex992.htm |

Exhibit 99.3

|

|

AMTECH SYSTEMS TO ACQUIRE BTU INTERNATIONAL

October 22, 2014

|

|

Safe Harbor Statement

This Presentation may contain certain statements or information that constitute “forward-looking statements” (as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended). In some but not all cases, forward-looking statements can be identified by terminology such as, for example, “may,” “will,” “should,” “would,” “expects,” “plans,” “anticipates,” “intends,” “believes,” “estimates,” “predicts,” “potential,” “continue,” or the negative of these terms or other comparable terminology. Examples of forward-looking statements include statements regarding Amtech Systems, Inc.’s (“Amtech”) or BTU International, Inc.’s (“BTU”) future financial results, operating results, business strategies, projected costs, products under development, competitive positions and plans and objectives of each company and its management for future operations. Such forward-looking statements may also include, but are not limited to, statements about the proposed benefits of the merger involving Amtech and BTU, including future financial and operating results, Amtech’s or BTU’s plans, objectives, expectations, and intentions, the expected timing of the completion of the merger, and other statements that are not historical facts. Such forward-looking statements and information are provided by each company based on current expectations of such company and reflect various assumptions of management concerning the future performance of such company, and are subject to significant business, economic and competitive risks, uncertainties and contingencies, many of which are beyond the control of such company. Accordingly, there can be no guarantee that such forward-looking statements or information will be realized. Actual results may vary from any anticipated results included in such forward-looking statements and information and such variations may be material. No representations or warranties are made as to the accuracy or reasonableness of any expectations or assumptions or the forward-looking statements or information based thereon. Only those representations and warranties that are made in a definitive written agreement relating to a transaction, when and if executed, and subject to any limitations and restrictions as may be specified in such definitive agreement, shall have any effect, legal or otherwise. Each recipient of forward-looking statements should make an independent assessment of the merits of and should consult its own professional advisors. Except as required by law, we undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events, or otherwise.

2

|

|

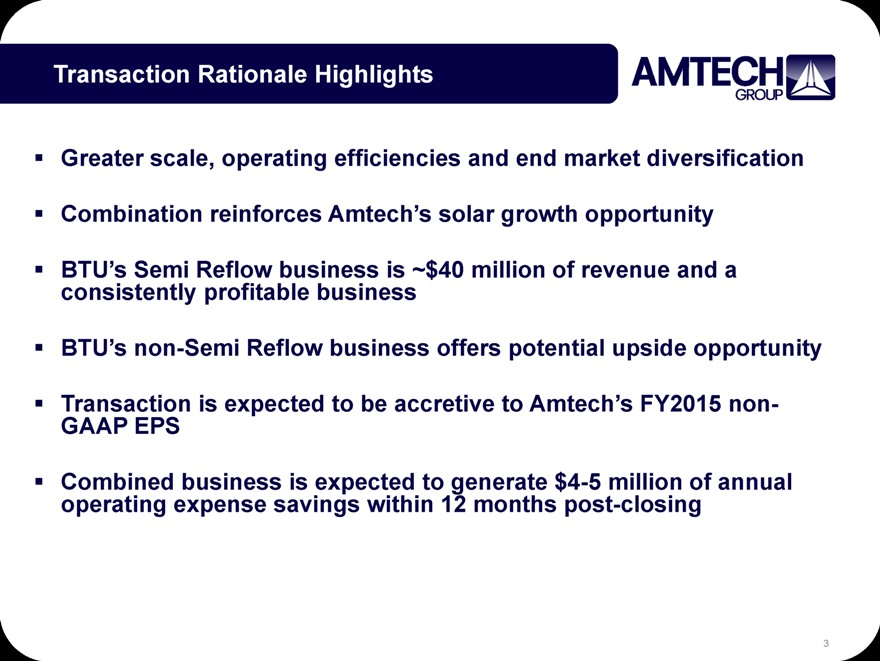

Transaction Rationale Highlights

Greater scale, operating efficiencies and end market diversification

Combination reinforces Amtech’s solar growth opportunity

BTU’s Semi Reflow business is ~$40 million of revenue and a consistently profitable business

BTU’s non-Semi Reflow business offers potential upside opportunity

Transaction is expected to be accretive to Amtech’s FY2015 non-GAAP EPS

Combined business is expected to generate $4-5 million of annual operating expense savings within 12 months post-closing

3

|

|

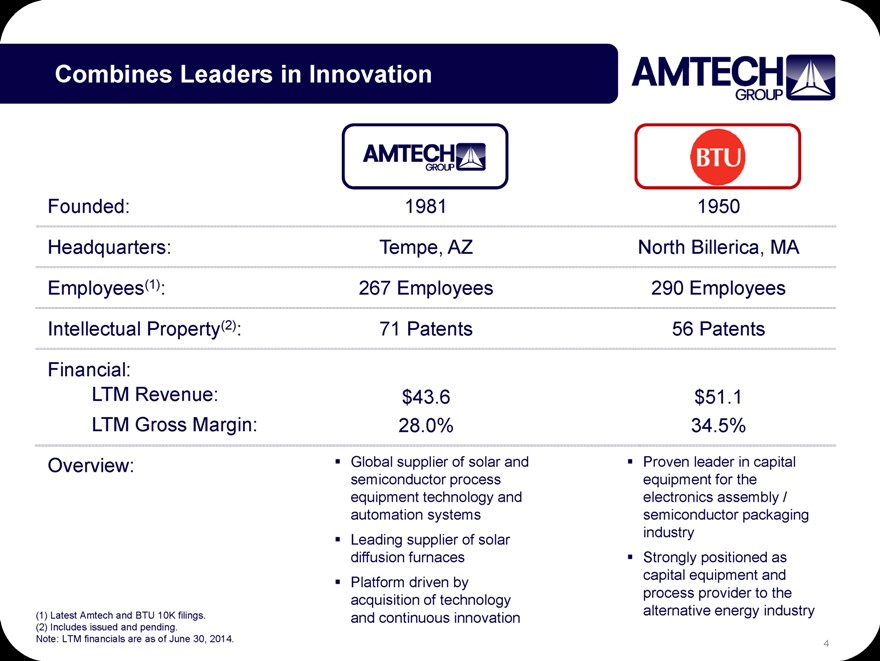

Combines Leaders in Innovation

Founded: 1981 1950

Headquarters: Tempe, AZ North Billerica, MA

Employees(1): 267 Employees 290 Employees

Intellectual Property(2): 71 Patents 56 Patents

Financial:

LTM Revenue: $43.6 $51.1

LTM Gross Margin: 28.0% 34.5%

Overview:

Global supplier of solar and semiconductor process equipment technology and automation systems

Leading supplier of solar diffusion furnaces

Platform driven by acquisition of technology and continuous innovation

Proven leader in capital equipment for the electronics assembly / semiconductor packaging industry

Strongly positioned as capital equipment and process provider to the alternative energy industry

(1) Latest Amtech and BTU 10K filings. and continuous innovation alternative energy industry

(2) Includes issued and pending.

Note: LTM financials are as of June 30, 2014. 4

|

|

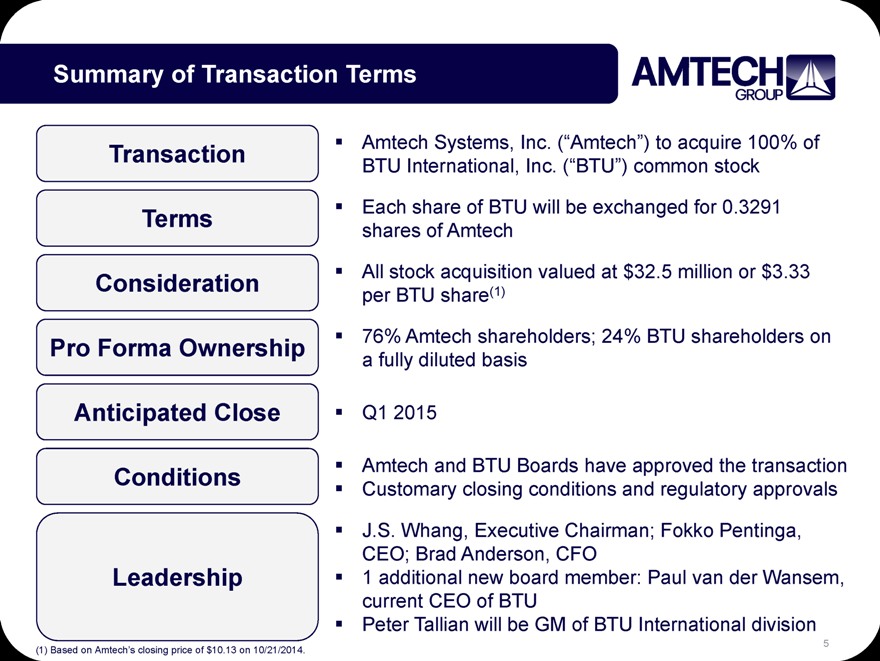

Summary of Transaction Terms

Transaction Amtech Systems, Inc. (“Amtech”) to acquire 100% of

BTU International, Inc. (“BTU”) common stock

Terms Each share of BTU will be exchanged for 0.3291

shares of Amtech

All stock acquisition valued at $32.5 million or $3.33

Consideration per BTU share(1)

Pro Forma Ownership 76% Amtech shareholders; 24% BTU shareholders on

a fully diluted basis

Anticipated Close Q1 2015

Conditions Amtech and BTU Boards have approved the transaction

Customary closing conditions and regulatory approvals

Leadership

J.S. Whang, Executive Chairman; Fokko Pentinga, CEO; Brad Anderson, CFO

1 additional new board member: Paul van der Wansem, current CEO of BTU

Peter Tallian will be GM of BTU International division

(1) Based on Amtech’s closing price of $10.13 on 10/21/2014. 5

|

|

Transaction Rationale Detail

Combination brings together two leaders in thermal processing equipment Consistent with Amtech’s strategy of pursuing strategic acquisitions that complement the existing platform Broader product portfolio

Semi Reflow products critical to the electronics assembly and semi packaging market Portfolio of solar and other complementary thermal-based products

Expands Amtech’s served available markets

Stronger footprint in China

Expected to be immediately accretive to gross and operating margins with significant operational synergies Accretive to Amtech’s FY2015 non-GAAP EPS

6

|

|

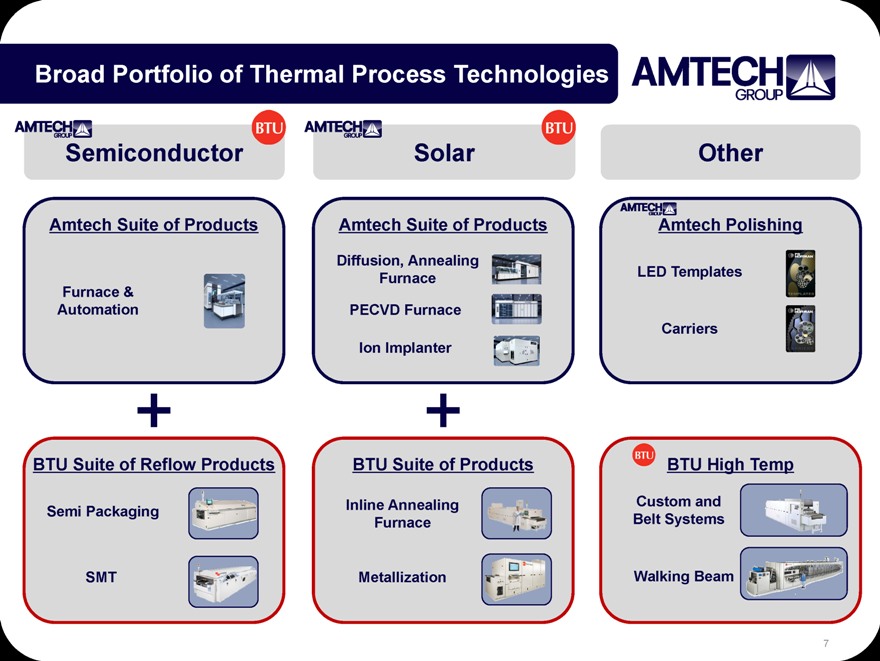

Broad Portfolio of Thermal Process Technologies

Semiconductor Solar Other

Amtech Suite of Products Amtech Suite of Products Amtech Polishing

Diffusion, Annealing

Furnace LED Templates

Furnace &

Automation PECVD Furnace

Carriers

Ion Implanter

BTU Suite of Reflow Products BTU Suite of Products BTU High Temp

Semi Packaging Inline Annealing Custom and

Furnace Belt Systems

SMT Metallization Walking Beam

7

|

|

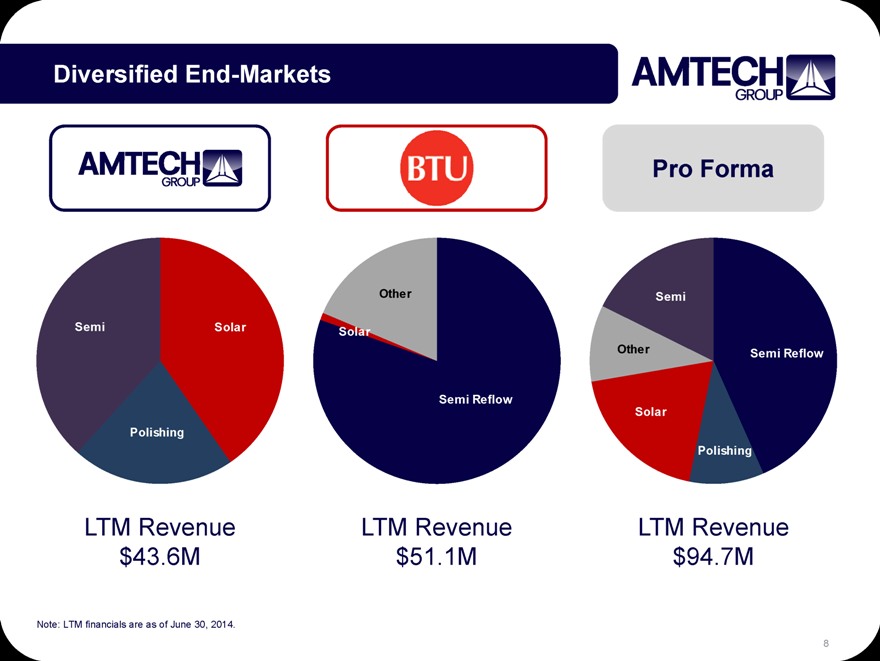

Diversified End-Markets

Other Semi

Semi Solar Solar

Other Semi Reflow

Semi Reflow

Solar

Polishing

Polishing

LTM Revenue LTM Revenue LTM Revenue

$43.6M $51.1M $94.7M

Note: LTM financials are as of June 30, 2014.

8

|

|

Key Takeaways

Larger, stronger global platform to support solar growth

Combination of leaders in thermal processing equipment with histories of innovation

Consistent with Amtech’s acquisition strategy

Broader product portfolio

Expands served available market

Stronger China footprint

Immediately accretive to gross and operating margins

Accretive to Amtech’s FY2015 non-GAAP EPS

9

|

|

Important Information For Investors and Shareholders

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger, Amtech Systems, Inc. (“Amtech”) and BTU International, Inc. (“BTU”) intend to file a registration statement on Form S-4 with the Securities and Exchange Commission (the “SEC”), containing a joint proxy statement/prospectus, relating to the proposed merger. Amtech and BTU also intend to file other relevant documents relating to the proposed merger with the SEC. The proposals for the proposed merger will be made solely through the joint proxy statement/prospectus. BTU AND AMTECH URGE INVESTORS AND SHAREHOLDERS TO READ THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ANY AMENDMENTS AND SUPPLEMENTS THERETO) WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED BY EITHER PARTY WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AMTECH, BTU AND THE PROPOSED MERGER.

Investors and shareholders of Amtech and BTU will be able to obtain the joint proxy statement/prospectus and other documents filed with the SEC free of charge at the website maintained by the SEC at www.sec.gov. In addition, documents filed with the SEC by BTU will be available free of charge on the investor relations portion of the Company’s website at www.btu.com. Documents filed with the SEC by Amtech will be available free of charge on the investor relations portion of the Amtech website at www.amtechsystems.com.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any security holder of BTU or Amtech. BTU and its directors and executive officers, and Amtech and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of BTU and Amtech common stock in respect of the proposed merger and the transactions contemplated thereby. Information about the directors and executive officers of BTU is set forth in the proxy statement for BTU’s 2014 annual meeting of stockholders, which was filed with the SEC on April 14, 2014. Information about the directors and executive officers of Amtech is set forth in the proxy statement for Amtech’s 2014 annual meeting of stockholders, which was filed with the SEC on March 28, 2014. Investors and shareholders can obtain more detailed information regarding the direct and indirect interests of BTU’s and Amtech’s directors and executive officers in the proposed merger by reading the joint proxy statement/prospectus and any other relevant documents filed with the SEC when they become available.

10