Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Bio-En Holdings Corp. | v391099_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - Bio-En Holdings Corp. | v391099_ex99-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Amendment No. 1

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 10, 2014

| BIO-EN HOLDINGS CORP. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 333-186629 | 990369776 | ||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

56 Main Street

Monsey, New York 10952

| (Address of principal executive offices) (Zip Code) |

Registrant’s telephone number, including area code: (845)364-7151

| N/A |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c) |

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This Current Report on form 8-K (this “Report”) contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “seeks,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” below. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Such statements may include, but are not limited to, information related to: anticipated operating results; relationships with our customers; consumer demand; financial resources and condition; changes in revenues; cost of sales; selling, general and administrative expenses; interest expense; legal proceedings and claims.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this Report. You should read this Report and the documents that we reference and filed as exhibits to this Report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

| Item 1.01 | Entry Into A Material Definitive Agreement |

Merger Agreement

On September 10, 2014 (the “Closing Date”), Bio-En Holdings Corp. (the “Company” or “BHC”) closed on a merger and share exchange agreement, dated August 21, 2014, (the “Merger Agreement”) by and among (i) the Company, (ii) Bio-En Corp., a Delaware corporation, (“Bio-En”), and (iii) Serena B. Potash, an officer and director of BHC and the majority shareholder of BHC. Pursuant to the terms of the Merger Agreement, Bio-En shall be merged with and into BHC, with BHC to continue as the surviving corporation (the “Surviving Corporation”) in the Merger, and BHC succeeding to and assuming all the rights, assets, liabilities, debts, and obligations of Bio-En (the “Merger”).

The foregoing descriptions of the terms of the Merger Agreement are qualified in their entirety by reference to the provisions of the Merger Agreement filed as Exhibit 2.1 to this Report, which is incorporated by reference herein.

Cancellation Agreement

In connection with the Merger, BHC entered into a cancellation agreement with Ms. Potash (the “Cancellation Agreement”) whereby Ms. Potash, owning an aggregate of 7,894,625 shares of the BHC’s common stock cancelled 6,024,625 of her BHC shares.

The foregoing descriptions of the terms of the Cancellation Agreement are qualified in its entirety by reference to the provisions of the Cancellation Agreement filed as Exhibit 10.1 to this Report, which is incorporated by reference herein.

Increase in Authorized Shares and Preferred Shares

On August 5, 2014, the Company filed a Certificate of Amendment to its Certificate of Incorporation, pursuant to which: (1) the Company increased its authorized capital stock from 200,000,000 to 300,000,000; and (2) created 50,000,000 shares of blank check preferred stock, par value $0.0001 per share, with such preferred shares to be issued in one or more classes or series with such designations, powers, preferences and relative participation, optional and other special rights, if any, of each such class or series, and qualifications, limitations and restrictions thereof, to be stated by a resolution adopted by the Board. As a result, the Company’s capital stock is comprised of comprised of 250,000,000 shares of common stock, par value of $0.0001 per share (“Common Stock”), and 50,000,000 shares of preferred stock, par value $0.0001 per share (“Preferred Stock”).

Amended and Restated By-Laws

On April 20, 2014, prior to the Merger, the Board of Directors and majority shareholders of BHC adopted Amended and Restated By-Laws of the Company. The Amended and Restated Bylaws are filed as Exhibit 3.4 to this Report, which is incorporated by reference herein.

| Item 2.01 | Completion Of Acquisition Or Disposition Of Assets |

Reference is made to the disclosure set forth under Item 1.01 of this Report, which disclosure is incorporated herein by reference.

On September 10, 2014, we acquired Bio-En Corp. upon closing of the Merger. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

FORM 10 DISCLOSURE

As disclosed elsewhere in this Report, on September 10, 2014, the Company acquired Bio-En in a merger transaction. Item 2.01(f) of Form 8-K provides that if the registrant was a shell company, other than a business combination related shell company, as those terms are defined in Rule 12b-2 under the Exchange Act, immediately before the reverse acquisition transaction, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10 under the Exchange Act reflecting all classes of the registrant’s securities subject to the reporting requirements of Section 13 of the such Exchange Act upon consummation of the transaction.

Since we were a shell company immediately before the reverse acquisition transaction disclosed under Item 2.01, we are providing below the information that we would be required to disclose on Form 10 under the Exchange Act if we were to file such form. Please note that the information provided below relates to the combined enterprises after the acquisition of Bio-En, except that information relating to periods prior to the date of the reverse acquisition only relate to Bio-En unless otherwise specifically indicated.

Information in response to this Item 2.01 below is keyed to the items numbers of Form 10.

| Item 1. | Description Of Business |

Business Overview

The Company intends to enter into an agreement with Applied Biofuels (Malta) Limited whereby all assets of Applied Biofuels (Malta) Limited shall be transferred to a new subsidiary (“Newco”), to be incorporated in Malta, which will be a wholly owned subsidiary of the Company. As of the date of this Report, no such formal agreement has been finalized. The Company is a project and plant development company in the business of producing and selling ethanol and butanol made from municipal solid waste and other cellulosic fiber. Bio-En and BHC are referred to in this section collectively as “we,” “us” and the “Company” unless the context indicates otherwise, in which case such terms refer just to Bio-En or BHC.

We have planned, designed, engineered and prepared agreements to build and operate a facility using Gravity Pressure Vessel Technology in Weak Acid Hydrolysis to convert Biomass to Ethanol (the “Facility”). As of the date of this Report, no such formal agreements have been finalized. The Facility will be built on the Island of Malta and is anticipated to be fully operational by the end of the 4th quarter of 2016.

The Facility will combine technologies from the waste management industry and integrate the recycling of waste, control of carbon dioxide and other emissions, with the profitable production of fuel grade Ethanol.

Our Corporate History and Background

Bio-En Corp. was incorporated under the laws of the State of Delaware on January 6, 2014. The Company, through its merger with Bio-En, is in the development stage and is devoting substantially all of its efforts to the development of its business plan. The Company intends to be a world leader of setting the standard for waste to bio-fuel technologies. The Company intends to plan, design, and execute agreements to build, operate and maintain a bio-mass to energy facility on the island of Malta, which is contingent on sufficient capital funding. The Company’s fiscal year-end is March 31.

Industry

The Company is a renewable energy company which intends to offer profitable solutions to environmental problems by the integration and application of proven technologies and methods that deal with waste materials and the processing of biomass to fuel grade ethanol or other biofuels. The Company is focused on the up-to-date use of established process engineering principles joined with specific patented technology available to it through a license agreement entered into on March 23, 2014 between Bio-En Corp. and GeneSyst International, Inc. a Delaware corporation.

The Company has received correspondence from Malta Enterprise, the governing body in Malta overseeing projects for the government indicating the Company has been given a green light to design, build and operate a facility to convert municipal solid waste and other forms of cellulosic biomass to ethanol subject to requirements established by Malta Enterprises and the government of Malta. The Malta Facility should be fully operational within 18/24 months of full funding.

The planned Facility is designed to be a major GREEN project. The Facility will combine technologies from the waste management industry which will be integrated into the Facility’s overall waste recycling program, control of carbon dioxide and other emissions and the profitable production of fuel grade ethanol and other Biofuels.

The Company plans to derive its revenue from gate fees for MSW (as defined below) brought to the plant, the sale of ethanol or other biofuels, sale of carbon dioxide and sale of excess electricity to Malta. No off-take contracts have been entered into as of this time.

In addition to these traditional sources of revenue, the Company expects to derive additional revenue from biofuels production subsidies. The European Union (“EU”) recognizes that producing Biofuel food crops on crop land has considerable cost implications since they are staple foods and need significant subsidies to be converted to biofuels. The price and demand for fuel has contributed to escalating food price inflation over recent years causing serious hardship for poorer populations. The EU is expected to implement a major overhaul of biofuels production subsidies that favor the Company.

Green Business Opportunity and Cellulosic Feedstock

The past decade has seen soaring oil prices, Middle East turmoil, government Biofuel incentives, clean-tech venture investments and maturing technologies, all these factors contributing to the critical mass necessary to launch the Biofuel market in a meaningful way.

Ethanol is a significant source of liquid fuel and its production from food grains is widespread. However, the use of the food grains in the production of ethanol along with the cost for fuel is causing widespread increases in food prices and governments are now seeking alternative feedstock and fuel sources to accommodate the increasing demand for clean fuels from sustainable sources other than food grains or fossil fuels.

The global market for ethanol will be open to enormous opportunities and transitional challenges over the next ten years. A few issues hold the key to these growth opportunities. If the promises of competitive, large-scale cellulosic ethanol production is realized, and if national import/export policies for Biofuels are further liberalized, then the possibilities for ethanol to replace 20% of gasoline consumption in the USA, Europe, China and India may be actualized by the year 2020.

Business Strategy

The Green Business Opportunity is not about green sentiment, anymore. It is about building national energy security and being part of a huge emerging market of a kind that may come once in a century. Global Biofuel production is estimated to reach 1,900 million barrels in 2020, at a compound annual growth rate (CAGR) of 10% over the forecast period 2015 – 2020.

The Company intends to take advantage of the worldwide burgeoning demand for Biofuels thus adding value to the Company and high returns for the Company’s investors by integrating world-class technology matched to a project for the conversion of solid waste feedstock (“MSW”) and other cellulosic feedstock into fuel grade ethanol and other Biofuel.

The Company’s use of patented Gravity Pressure Vessel (“GPV”) technology will demonstrate its leadership in setting the standard for best practicable waste conversion to fungible Ethanol and other Biofuels for the world market in an environmentally friendly manner.

The Company believes that its Malta project will be the future standard that will be used to measure all projects of this type and will lead to additional projects across the EU, Asia and the Middle East.

Intellectual Property

Bio-En, as a first step in achieving its business plan has entered into a license agreement (the “License Agreement”) with GeneSyst International, Inc., the exclusive licensing agent for a portfolio of patents including the Gravity Pressure Vessels and supporting appurtenances. The license and patents are issued by political boundary, with exclusive rights defined by the physical location of the Facility. There are no restrictions on source of materials or marketing of products. Pursuant to the Merger, the Company has assumed the rights and responsibilities under the License Agreement.

The License Agreement calls for a fee of 3% of income, but not less than $330,000 per year. After the initial payment, alternate one-time payment plans are available. Supporting services are available by separate arrangement coincident with the License Agreement. As new patents are developed they are automatically added to the patent portfolio without additional charge.

The License Agreement runs for the life of the most recently issued patent - which is twenty years from the original filing date. Quality control matters are built into the License Agreement.

A list of granted patents pertaining to the Company’s business is included in the License Agreement. The most applicable and flexible patent being US 8496754 which patent has been approved in the EU awaiting publishing. Another which has several advantages has been disclosed to the patent attorneys and in the application process. For further patent detail please see United States Patent No. US 8,496,754 B2 Titmas Date of Patent: Jul.30, 2013

The foregoing descriptions of the terms of the License Agreement are qualified in their entirety by reference to the provisions of the License Agreement filed as Exhibit 10.2 to this Report, which is incorporated by reference herein.

Patent Technical Field and Description

The present invention is generally directed toward a process whereby woody cellulosic material is converted to ethanol via acid hydrolysis of cellulosic material to sugars that are subsequently fermented. The acid hydrolysis takes place in a gravity pressure vessel. In particular, the present invention is directed to apparatus and methods for impregnating woody cellulosic material with an alkali to make it more amiable to treatment in the gravity pressure vessel. In more particular embodiments, this invention is also directed toward employing ultrasound in a gravity pressure vessel to aid in the processing of woody cellulosic material.

Production and Facility

The Company plans to produce 88.5 million liters (23.3 million gallons) of fuel grade Ethanol each year which it would sell under contract to offshore users and spot purchasers. The production volume can be adjusted to accommodate short-term increases in overall capacity.

The Company plans to build a Biofuels and Ethanol production facility that will have an initial capacity to take in a mixture of raw materials amounting to 370,000 wet metric tons of Biomass per year. In addition, the Company has reached a preliminary understanding with the Maltese Government to take into the planned Malta facility a major portion of the MSW that is generated by Malta and Gozo. The gross annual amount is approximately 250,000 metric tons and the Company will become the only Government contractor employed to receive this MSW supply for processing and treatment. The plant is designed to meet the requirements for Zero Waste Back to Landfill.

The planned facility anticipates using MSW and various forms of Biomass as the raw feedstock in the production process. The GenySyst process is a wet-based procedure and requires a supply of water to initiate the operation of the process. This water supply can come from any non-salt water source, direct potable water, rain water, final effluent from a sewage works, or from recovered process water from businesses or from sewage sludge. Once initiated, the internal process water is continuously recycled. This water supply will be supplemented with make-up water contained within new supplies of Biomass and sources of non-potable water.

All residual products and excess water produced from the plant will be treated in a small waste water treatment processing plant located on or adjacent to the site. The waste water treatment plant will be designed to produce water that is suitable for discharge into inland watercourses or for irrigation purposes, as well as make-up water or used in the production of electricity from the Combined Heat and Power (“CHP”) plant. Excess power not used at the facility will be sold to the Malta grid.

An Electrical Generation set will be installed on site as part of the Facility. This will allow the facility to operate independently of the Malta Electrical Grid. The Facility may use residual heat and by-products, such as Methane and a CHP (Combined Heat and Power) plant to provide the power needed for the plant to operate. The facility will be a net producer of heat energy that can be converted to electricity and sold to local users.

All the Biomass contained within the process facility, or any further materials produced during the production process would be non-toxic, and can be reused or incorporated into construction materials and pavement foundations for roads.

Production

The quantity of Bio-fuel or Ethanol produced will vary according to the type and source of Biomass. The estimated range is from 550 liters per dry metric ton from pure cotton, 400 to 450 liters per dry metric ton of recovered paper and wood, 300 to 350 liters per dry metric ton from green waste in parks & gardens and food waste, to around 200 to 250 liters per metric ton from MSW.

The sources of Biomass proposed for the facility include recovered paper, green waste from parks and gardens, MSW, as well as coastal sea weed and shore debris.

There appears to be ample supply of various sources of Biomass obtained within Malta or imported from the EU or to meet the feedstock needs of the facility. The company plans to develop its first facility based on MSW and recovered paper, augmenting the feedstock with a blend of additional raw materials to increase bottom line revenues. Malta prohibits the importation of raw trash and garbage, but does allow pre-processed materials.

Integration of Technologies for Mitigation and Production

The Bio-En facility is designed to integrate existing proven technologies with GeneSyst’s GPV technology to convert the cellulose content in Biomass into fuel grade Ethanol, Biofuel and other byproducts that can be sold in the open market.

Proven Technologies and Key Components

The key components of a Mild Acid Hydrolysis Facility needed to convert municipal and agricultural wastes to Ethanol and Biofuel have been in use and functioning for many years. Two decades ago a breakthrough occurred in the creation of a “continuous pressure cooker” that operated with extremely high thermal and mechanical efficiency coupled with industry setting records for on-line availability, which is now known as the GPV.

The key element in this technology is how the GPV accepts and processes solid wastes in water. When the GPV technology was coupled with wastewater treatment technology, the joining of these technologies supported a process that achieved rapid, high volume processing of waste products and various other environmentally unfriendly raw materials into environmentally safe Biofuel at a low sustainable cost.

The incorporation of municipal waste and other waste streams into the process economics results in a negative cost for feedstock. Bio-En’s robust returns are a result of the low cost of its feedstock, which in fact is not a cost (liability) but a source of revenue (asset), since Malta pays a tipping fee to get rid of its MSW. The use of MSW and other waste feedstock ensures economically viable operations with or without tax incentives and meets the sustainability requirements which have been written into EU laws pertaining to the sustainability of Biofuel production. The use of grains and other foodstuffs to make Biofuel has caused widespread increases in the cost of food in Europe and is affecting the economics of everyday life.

Extrapolation of Known Procedures

Throughout this business summary predictions have been made based upon generally accepted engineering procedures to predict performance of the facility as well as the economic expectations to be derived from these practices. In order to be successful, it is necessary to build a facility that is more efficient and more effective than previous technologies employed by others. To accomplish this with minimal risk, certain protocols have been established by the Company’s engineers to insure that the plant to be designed and built will meet all requisite standards discussed throughout the body of this plan. The Company’s engineers believe these extrapolations are limited, conservative and reasonable in nature so as to result in a financially viable facility. However, some actual results may differ from projections due to unforeseen developments.

Basis of the Technology

The process of turning Biomass (Celluloses) to the Saccharides by Weak Acid Hydrolysis prior to making Ethanol has been used in the United States in the Pulp and Paper industry for over 30 years, using small scale plants with heating under pressure in multiple batch tanks above ground. The GPV has been used for twenty years to oxidize wet waste materials. During this time GPVs were also used for the conversion of waste streams to commercial commodities, thus proving their viability and profitability.

Drivers Promoting Processing MSW to Ethanol

| a. | Need for a clean, non-polluting process for the manufacture of fuel grade Ethanol | |

| b. | The absolute amount of waste produced is rising | |

| c. | Unchecked emission of greenhouse gases may lead to a rise in global temperature | |

| d. | In less developed countries, waste production per capita is rising, probably at an even faster rate than the EU, as per-capita GNP and living standards increase | |

| e. | Developed countries are banning/limiting landfill and dumping of waste leading to an increased demand for waste processing and waste mitigation | |

| f. | Less developed countries have acknowledged the need for waste management | |

| g. | Release of toxic materials into water and air is prohibited in many countries | |

| h. | More countries are banning or limiting landfill and dumping of waste to protect the environment | |

| i. | Governments are increasingly enacting environmental taxation | |

| j. | Recycling of materials is fundamental in modern waste treatment and disposal | |

| k. | Oil, electricity and other energy prices are all rising | |

| l. | Population is rising and land is getting increasingly expensive particularly land used for growing feedstock for fuel | |

| m. | Transportation costs are increasing - reflecting rising oil, land and labor prices | |

| n. | Increasing demand for waste treatment in urban areas, coupled with ongoing health concerns requires innovative application of proven technologies/methods to treat waste economically | |

| o. | The cost of food grain is rising due to their diversion to Biofuel production thus causing higher food prices and starvation | |

| p. | Liquid energy in the form of Ethanol may have higher market value than other forms of energy conversion |

Background of the GPV Technology

The GPV was invented and developed by James Titmas a professional engineer with 54 years of experience in water and waste treatment and the founder of GeneSyst International Inc.

The process of using the GPV in Weak Acid Hydrolysis to convert celluloses to saccharides was discovered in the 1820’s and used by Henry Ford in the 1920-30’s to provide the feed stock for producing fuel grade Ethanol.

The use of a GPV increases the efficiency of converting celluloses to high value saccharides, and thus increases the resulting yield of Ethanol from Biomass and waste materials.

The GeneSyst system updates this conversion process by using a shallow commercial water well chamber modified to be a sealed vacuum chamber in which hangs the GPV. After receipt and initial shredding of cellulosic materials, the Biomass is mixed with water and impregnated with a mild alkali solution. The processed Biomass then enters the outer annulus of the GPV passing downwards, pre-heating and accumulating pressure. In the reaction chamber at the bottom of the GPV, Oxygen is used to destroy tramp organics that inhibit fermentation followed by the introduction of a catalyst (dilute carbonic acid) to instigate the disassociation of the celluloses to saccharides (sugars). This oxidation step is exothermic and after pre-heating, the temperature is trimmed to 455ºF (235o Celsius). With a small portion of un-reacted nitrogen and thermal expansion, the density of the mixture is lowered to allow natural convection to move the fluids through the GPV without pumping. The mixture, which is now sugar based, rises up the inner pipe after neutralization of its acid in the reaction chambers. The mixture continues to rise driven upwards past the downward flowing colder feed mix, and as it does, it allows its heat to pass through the wall of the inner heat exchanging pipe to the descending raw materials in the outer annulus of the GPV. At the surface the sugar mixture is then cleaned using conventional water processing equipment and forwarded for conversion to Ethanol or Biofuel ready for sale. All tanks and processing vessels are enclosed. The system is completely sealed to prevent loss of product, odors and environmental contamination. Ethanol produced from Biomass waste eliminates the production of new Green House Gases (GHG) arising from the waste. Ethanol is used up to an 85% concentration as a substitute for the refined fossil fuels as an additive to gasoline. It offers a further reduction in the emission of GHG giving additional benefits to the environment. The GHG emissions of landfill gasses are also dramatically reduced.

The Process Advantage

The process to extract the saccharides from cellulosic material uses a combination of higher temperatures with acid conditions. The higher the temperature, the lesser the amount of acid needed. This hydrolysis reaction process is nearly instantaneous and must be arrested before the acids decompose the saccharides created from de-polymerization of the cellulosic materials. In the case of the GPV the acidic conditions are neutralized to arrest the reaction and the heat energy is recovered.

The process described above is the specific advantage made available by using a continuous plug flow GPV reaction chamber, combined with the advantages of no moving parts, a tolerance for large size pieces and use of many types of raw materials, the internal recycling of pressure and heat energy all combine to create high availability.

The process is continuous and not batching which leads to increased productivity at lower costs.

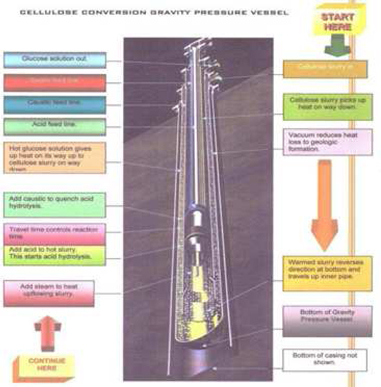

Gravity Pressure Vessel © (GPV) Visual

Recap of the Gravity Pressure Vessel and How It Works

| a. | The GPV hangs freely in a 700 meter deep shaft | |

| b. | The containment shaft consists of a steel tube fixed in a grout jacket | |

| c. | The shaft is brought under vacuum pressure, like a vacuum flask | |

| d. | The GPV is a closed outer tube with an open inner tube | |

| e. | Celluloses waste in water is pumped through the outer pipe down and through the inner pipe up |

| f. | At the bottom of the pipe, celluloses converts to sugars in a low pH environment | |

| g. | The acid is neutralized with alkaline to retain the sugars | |

| h. | The up going stream heats the down going stream | |

| i. | It is an energy efficient sterile chemical flow process without moving parts and gas emissions | |

| j. | After the celluloses are cracked in the “reactor” chamber, the sugar dissolves and rises through the inner pipe to the closed sedimentation tanks on ground level | |

| k. | Here the remaining inorganic dense and lightweight particles are removed for beneficial reuse. | |

| l. | The Saccharides are then stripped of other valuable organic byproducts and passed forward for fermentation to ethanol |

GeneSyst Schematic for Conversion of Biomass to Ethanol

Project Description

The Malta Facility is intended to be a Finance, Design, Construct and Operate Facility and will cost approximately $150 million to complete and to put into full operation.

This facility will be located on designated land allocated by the Government of Malta at the eastern end of the Hal Far Industrial Area. The site has an area of 55,000 square meters (13.25 acres) and is fully accessible being bounded on three sides by major roads suitable for HGV Class III vehicles. The site is in the south east of the island of Malta within 6 kilometers of Malta’s main airport (Luqa) and more importantly 3 kilometers of the Malta Free Port.

The Bio-En Malta Biomass to Ethanol Facilities targeted to make upwards of 88 Million liters per year of the Bio-Ethanol. The source material to make this will be 270,000 dry metric tons equivalent per year of the Raw Material Biomass. It is anticipated that 80% of the feedstock come from sources on Malta and Gozo. The target date to begin commercial production of ethanol is estimated to be the last quarter of 2016.

The ethanol produced at the facility will be made using the process known as Dilute-Acid Hydrolysis in conjunction with GeneSyst’s patented Gravity Pressure Vessel ™ along with remainder of plant engineering and design obtained from the waste water (sewage) treatment industry and traditional fermentation and distillation plant technology used in the Ethanol Industry.

The issue of using non-invasive enzymes or GMO (genetically-modified-organisms) in the conversion process was a major point of discussion with the Advisory Board of Assessors and Engineers for the Government of Malta. Once it was proven that the plant did not pose a risk to humans, animals and the flora and fauna on the Island, the project was given an immediate go-ahead by the Malta Authorities.

The Company has been in discussions with an Engineering, Procurement, Construction (“EPC”) contractor to design, construct and operate the facility and to oversee local sub-contractors such as the civil engineering construction company Attard Construction supported by Panta Lesco who specializes in mechanical, electrical and ICA/SCADA (Instrumentation Control and Automation/System Collection and Data Acquisition). Both of these local sub-contractors have worked on projects in the Water and Waste Water (Sewage) Treatment and the Food and Chemical Process Industry. EPC is a prominent form of contracting agreement in the construction industry. The engineering and construction contractor will carry out the detailed engineering design of the project, procure all the equipment and materials necessary, and then construct to deliver a functioning facility or asset to their clients. Companies that deliver EPC Projects are commonly referred to as EPC Contractors.

As soon as the project financing is in place, the Company’s in house engineers along with the EPC contractor and the sub-contractors will finalize the various protocols and strategies for the design and construction for the facility, and establish the parameters for the facility to be completed. During this period, the target dates for overall completion of the project will be set along with the purchase of Owners Protective Professional Indemnity Insurance to cover any risks concerning the design and operations of the project.

The Company anticipates starting delivery of Ethanol or Biofuel as soon as the first phase of the plant is completed. The Company’s business implementation strategy has been to assemble a first class team to design and construct and operate the plant at the earliest possible time. Bio-En will be using the appropriate FIDIC (Fédération International Des Ingénieurs-Conseils) Conditions of Contract to ensure that any issues are normalized under traditional working practices as used in the EU.

This Biomass to Ethanol Facility will be developed according to a Design and Construct contract where a portion of the design may not be fully developed until construction is about to start. However as soon as the financing is in place and mobilization of the designers and construction companies has occurred, this process will be started. This whole procedure will be nurtured through a VM/VE (Value Management/Value Engineering) audit trail which will be under constant review by the in-house staff and consultants for the Company.

All the confirmatory site investigations and the residual planning assays with MEPA (Malta Environment and Planning Authority) need to be finalized before the actual construction begins. These investigations may be carried out simultaneously with the need to assess and confirm the supply of the raw materials used to make the Biofuels and should be confirmed by the necessary laboratory testing which will be carried out in the local testing centers and University. At the same time, pre-orders should be lodged with the longest lead time items including that for the drilling company that will be needed to drill the bore-holes for the installation of the three gravity pressure vessels. All boreholes should be drilled to the common depth of 610 meters (2000 feet) needed for the process. The drilling of these boreholes and the installation of the steel-work will take approximately 6 weeks. Two major drilling companies have been asked for quotes for this part of the operation and early indications suggest that one will be the most acceptable in terms of practice, record and price for this part of the work. Again the lead time to obtain the fermentation and concentration plant for the production of the Ethanol will also be required to be ordered early on and this should be organized at the same time.

As soon as the first gravity pressure vessel is installed and operational, the sections making up the overall plant needed for full commercial operation, complete with its pre-treatment settlement tanks needed to prepare the Biomass, and its subsequent post gravity pressure vessel cleaning mechanical elements for cleaning the saccharides/sugars and treatment plant items may be put on-line making the plant ready for full service and for training personnel in operations and maintenance.

This first train (unit) will also include the final waste water (or residual effluent) treatment process plant, the anaerobic digestion facility, its CHP (Combined Heat and Power) plant for creating electrical generation capacity and the residual water treatment component for discharging water for irrigation purposes.

At the same time as this first unit is being installed, the construction and fitting out of the additional gravity pressure vessels that form the main service units of the overall plant will be carried to completion. Simultaneously with the development of the service units, the facilities for the processing and preparation of the Biomass will be ongoing along with the facilities for post gravity pressure vessel cleaning of the saccharides/sugars) and treatment items for fermentation and concentration of Biofuels and/or Ethanol.

Once the Ethanol has been prepared it can be moved to its own on-site storage tanks so the Malta and the EU Customs and Excise Authority can inspect and confirm the amount and specifications of the fuel prior to its release and collection by Bio-En Holdings, Inc.’s own transportation fleet of HGV Class III articulated tankers to ship the fuel to the storage depot in the Malta Free Port for export. Within the Malta Free Port an additional storage tank for the Ethanol can be built to accommodate this need.

Overall, the Malta Biomass to Ethanol Facility should take around 22 months to construct but because of the phased nature of construction and commissioning it will start delivering Ethanol well within this period – at around 12 to 15 months. It is anticipated that upon establishment of the full operating protocols the facility may become fully operational within 22 months of commissioning.

Key Contractors

Currently, the Company is in discussions with the following contractors:

Design and Engineering

| a. | David Xuereb & Associates is anticipated to be the local firm of Architects and Engineers. The Maltese authorities approved the employment of David Xuereb & Associates at an early stage in negotiations and the firm will be the single point of contact for the full design and all attendant issues of the facility. The design role should include the direct design input from GeneSyst International Incorporated - as part of the licensing arrangements with GeneSyst. |

| b. | Kevin H Ramsey Consulting may provide additional design work relating to the Civil and Process Engineering, which includes Chemical, Hydraulics, Thermodynamics etc. with Mechanical and Electrical, HV/LV and Power, and ICA/SCADA works. |

| c. | The Malta College of Arts Science and Technology and the University of Malta, together with Queen's University in Belfast and the Carbolea Institute at the University of Limerick may also be providing services to assist in verifying the input materials through testing and analytical work. |

Operations and Maintenance Contractor

| a. | The Facility Operations and Maintenance (O & M) is currently integrated into the operating expense budget projections. However, it is envisioned that the O & M function will be organized as a separate Company Contractor under a separate contract expected with an EPC contractor. |

| b. | The Biomass to Ethanol Facility is not a complex type of plant and uses traditional and standard equipment that is generally used across a wide selection of water, waste water, chemical and food process industries. The O &M Contractor personnel will be trained people with experience from Malta based chemical and waste water and process industries. |

| c. | Selected personnel will be trained on site and through coordinated courses at the Malta College of Arts Science and Technology. |

Plant Performance

The estimated quantity of Ethanol produced from different sources of Biomass ranges from 132 liters of Ethanol per metric ton, to over 340liters per metric ton from raw materials rich in fiber such as wood, low lignin pulp and sugar beet residues. It is estimated, over 40 different kinds of fiber sources may be available from population centers, many associated with negative cost sourcing, all of which are usable in GPV processing. Negative cost sourcing refers to buyer cost factors. Buyer cost factors are response adjustments that occur when dealing with a particular supplier. Buyer cost factors account for negative (and positive) aspects inherent in dealing with a particular supplier. Such aspects could include the risk involved in dealing with a particular supplier because of supplier location, or possible supplier past performance. For example, a new and untried supplier (or new manufacturing or shipping location for an incumbent supplier) exposes the buying organization to a higher risk of supply disruption simply because the buying organization has no experience of buying from the new supplier or location. Buyer cost factors are used in transformational bidding/quoting.

The overall process has the potential to use a majority of the total volume of organic wastes from human activity. The process is believed to meet and exceed all public mandates to recycle. The conversion process has no air emissions. The separation, fermentation and distillation processes are well known and widely used.

Feedstock Compatible with the GeneSyst Technology

A blending of the waste streams in the processing would allow for significant efficiencies along with administrative, environmental and social advantages.

| Food Waste | Sewer Screenings |

| Septic Tank Waste | Restaurant waste |

| Magazine Paper | Dilute WWTP Sludge |

| Crop Processing | Garden Waste |

| Pulp and Paper Waste | Office paper |

| News Print | Cardboard |

| Crop Chaff | Scrap Wood |

| Landscaping Debris | Road Sweepings |

| Hospital Waste | Cotton Cloth |

| Tree clearing waste | Biofuel MFG waste |

| Feed lot Manure | Expired food and Drink |

Project and Plant Strengths

| a. | Dedicated municipal solid waste supply from Government of Malta | |

| b. | Agreement with Malta on building site (No competition) | |

| c. | Gate fee for selected waste materials already established with Malta | |

| d. | The plant system is a closed loop and emits no harmful gases or odors | |

| e. | Ethanol produced from will create a significant reduction in greenhouse gases |

| f. | The Facility will be self-sufficient by generating its own power and surplus of clean water | |

| g. | Carbon Credits and Emissions Trading Credits for each metric ton of waste used and for each liter of Ethanol produced | |

| h. | Generates excess energy that can be sold into the Malta market | |

| i. | Continuous production rather than batching leading to lower production costs | |

| j. | Production residue can be sold to construction industry as filler material and road paving material |

Competing Technologies

Gasification: The GPV or “Titmas Process” grew out of the need to meet the inherent failures of incineration and gasification processes. The problems arose from complications in recovery of first stage combustion energy (complex heat exchanger failures) incidence of toxic emissions from chlorinated and toxic inclusions in the feed stocks, char and clinker interference with continuance ash extraction, low “on line availability (less than 75%) failure to meet permit standards during start up and shut down protocols and an overall failure to “scale up” beyond weekly batch operations larger than 100 tons per day. Despite the known technical failings of gasification, promoters continue to garner investment of significant funds which will fail on observing the traditional problems have not been resolved. Examples of these failures include Brightstar, Thermoselect, Siemens-Fürth, Range Fuel and others to name just a few. The losses to investors ranged from $200 million to $500 million US.

Mechanical Heat and Pressure: The generic family of processing materials, known as the “pump and tank” mechanical means of inducing higher temperatures in fluids via pumping and heat exchangers includes: wet oxidation (Zimproet. Al.) pyrolysis, acid hydrolysis (both concentrated and dilute). All have in common the use of heat to crack, decompose or make digestible complex organic debris – basically similar to cooking foods for the same reasons. The most common practitioner of these arts was the Zimpro process which built over 200 commercial plants between 1960 and 1990. Of these only 5 are still in operation by virtue of cannibalization of parts from other units. Again, the problems revolve around “on line availability,” mechanical complexity, moving parts, operator challenges and low yields. Attempts at strong acid hydrolysis in lieu of wet oxidation had the added complication of acid destruction of containment vessels. Yields in all cases were low due to the time period to manipulate the combination of the cellulose to sugar reaction (the combination of higher temperatures and acidic conditions) and complex mixtures of thick cellulosic semi-solid pastes obligated by the costs of pumping and containment. The longer the reaction, the more sugars were destroyed before extraction.

Enzymatic Conversions: Rather than solve the problems of acid hydrolysis researchers moved to the more academic fields of enzyme enhancements which to date have turned out to require the use of expendable proteins for the saccharides conversion. Enzymes also held the promise of continuous academic study which also had a peculiar advantage in the research fields. Lignin remains problematic and some attempts are at hand to separate cellulose, hemi cellulose and lignin prior to further processing. Most of these are pursuing agricultural raw materials. The same problems of the processing of incoming MSW remain the same, noting that many components of agri-wastes and MSW share many characteristics and processing challenges in common. The real shortfall occurs from the seasonality of agricultural cellulose sources and the costs to collect and transport adequate quantities of agricultural chaff.

Customers

At the present time the Company has not sought out any customers because the Facility has yet to be built. Prior to the completion of the first phase of plant construction the Company intends to make its first entry onto the Biofuel Marketplace seeking a long-term contract for 80% of its production. The Company plans to sell 20% of its total production on the spot market or under short term contracts to take advantage of what it believes to be a rising market demand and subsequent increase in ethanol prices.

Government Regulation

European Union: The EU maintains two complementary pieces of legislation relating to renewable fuels: the Renewable Energy Directive (RED) and the Fuel Quality Directive (FQD). Together, these directives establish targets for the adoption of renewable fuels in EU member states by 2020. Transportation fuels are one category of fuels covered by these directives, and the targeted goals cover all renewable fuels – that is, they are not limited to ethanol. The FQD is relevant to the present discussion in that it establishes a limit of 10% for ethanol blending within EU member states, which are obligated to adopt national laws in conformance with the requirements of the directive.

The European Commission’s Renewable Energy Directive (RED) requires that by 2020 all transportation fuels in the EU must contain 10% Biofuel. Individual EU states are free to incrementally build up to this target as they see fit, meaning that current mandated levels vary. Nevertheless, the fines incurred by fuel producers for not meeting local requirements offer some measure of demand stability. Of course, given that the mandates are dictated as percentages, declines in the consumption of the primary fuel for example, gasoline or diesel – will also affect Biofuel demand.

The mandated requirements apply to Biofuels across the board, but there are numerous other legislative changes that are set to affect specific products in different ways. Biofuels produced from a raw material that is not part of the food chain, known as second-generation Biofuels, are set to count double when tallying up the bio-content of a fuel blend. This will include Biodiesel, which is made from used cooking oil and Ethanol produced from crude glycerin, which is itself a by-product of Biodiesel production. These changes add up to a positive future for the product, which has yet to enjoy widespread usage.

Marketing Strategy and Sources of Revenue

The Company’s business model is based on management’s belief that there is a significant market demand for fuel grade Ethanol and other Biofuels derived from sources other than agricultural feedstock and which are fully sustainable without impacting the food supply chain. The Company believes that its revenue model has the capability to provide substantial and predictable recurring revenue because it uses waste materials, MSW and agricultural waste at no feedstock costs to the enterprise. In addition to the negative feedstock costs, the Company will be receiving substantial gate fees for taking in the waste as well as other environmental cash credits from the EU. The Company has developed a multi-faceted revenue model that is expected, over time, to provide recurring revenue from the following sources:

| a. | Sales of Ethanol and other Biofuels | |

| b. | Sales of byproducts | |

| c. | Gate fees | |

| d. | EU Environmental subsidies |

Markets

Biofuels have seen a spurt in the United States and the EU, with the latter planning to increase its annual production to about 10% of its liquid fuels by 2020. The United States has set up an ambitious target to produce about 8 billion gallons annually by 2012 and about 40 billion gallons by 2022. Though the energy companies are widening their portfolios to include Biofuels, the move is fraught by significant challenges such as types of fuels to be used, regulations and regulatory approvals, increased usage of land for cultivating Biofuel crops and diversion of food crops for fuel production which is resulting in the increase of food prices.

The global market for Biofuels is projected to grow by a CAGR of 12.9% during the period 2006-2015 to reach US$ 61.5 billion by 2015. Focusing on the key challenges that still impede the realization of the billion-metric ton renewable fuels vision, this Memorandum integrates technological development and business development rationales to highlight the key technological developments that are necessary to industrialize Biofuels on a global scale. Technological issues addressed in this work include fermentation and downstream processing technologies, as compared to current industrial practice and process economics. Business issues that provide the lens through which the technological review is performed span the entire Biofuel value chain, from financial mechanisms to fund biotechnology start-ups in the Biofuel arena up to large green field manufacturing projects, to raw material farming, collection and transport to the bioconversion plant, manufacturing, product recovery, storage, and transport to the point of sale. Green Field manufacturing is form of foreign direct investment where a parent company starts a new venture in a foreign country by constructing new operational facilities from the ground up. In addition to building new facilities, most parent companies also create new long-term jobs in the foreign country by hiring new employees. Emphasis has been placed throughout the book on providing a global view that takes into account the intrinsic characteristics of various Biofuels markets from Brazil, the EU, the US, or Japan, to emerging economies as agricultural development and Biofuel development appear undissociably linked. Biofuels have emerged as a widely used renewable source of energy in the recent years. However, the rising demand for Biofuels in developed as well as developing countries has put a lot of pressure on - such as corn, sorghum, and soy, which are food crops. To ease off this pressure on food crops, scientists around the world are working on methods to convert lignocelluloses from plant waste material into Biofuels, instead of utilizing more food crops.

Any types of Biomass derived from plant such as cellulose, hemicellulose, and lignin are known as lingo-cellulosic Biomass. It is possible to categorize lignocellulosic Biomass into four categories: energy crops, wood residues, agricultural residues and municipal paper waste.

Lignocellulosic Biofuels have the potential to provide a large portion of cheap fuel for transportation especially if the available conversion processes are made cost effective. If technological hurdles are overcome, then a wide variety of lingocellulosic Biomass can be converted into Biofuels.

Global cellulosic ethanol is expected to increase from 14.25m gallons in 2012 to 412.25m gallons in 2020, with commercial production anticipated to take off on a large scale in late 2013 and 2014, thanks to major players adding substantial production capacity and new companies joining the market. The US is expected to retain its market dominance until 2020.

Ethanol is the most widely acclaimed alternative or additive for gasoline used for running vehicles, and the US ranked as number one producer of this biofuel using natural waste feedstock, states new analysis.

According to the latest report “Cellulosic Ethanol - Global Production, Major Trends, Regulations, and Key Country Analysis to 2020 the US is the global leader in cellulosic ethanol production, manufacturing 5.42m gallons in 2012 –

http://www.reportsnreports.com/reports/232712-cellulosic-ethanol-global-production-major-trends-regulations-and-key-country-analysis-to-2020.html”

Some EU countries such as France and Italy have cellulosic ethanol production infrastructure, but a limited supply of biomass feedstock. Growth of commercial production in these countries may fuel the need to import feedstock from nearby countries or expand production to other countries with ample feedstock availability. A few producers with upcoming commercial scale plants in the US have already started signing agreements to procure agricultural residue and other kinds of cellulosic feedstock.

Employees

As of the date of this Report, the Company has no employees.

| Item 1a. | Risk Factors |

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this Report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our shares of common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Special Note Regarding Forward Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this Report.

Risks Related to Our Company and the Biofuel Industry

We have no trading history and may never achieve profitability and the failure to raise additional capital could place our continued viability in question.

In particular we must raise additional capital from external sources to carry out our business plan, develop the Malta facility and develop markets for the sale of our products. If we are unable to generate the required additional capital, our ability to meet our financial obligations and to implement our business plan may be adversely affected. We currently have no commitments to obtain additional capital, and there can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all. If we are not successful in raising additional working capital to support our operations and implement our business plan, we may be forced to curtail our operations, take additional measures to reduce costs, modify our business plan, and consider strategic alternatives that could include a sale of our business or filing for bankruptcy protection.

We are a development stage green field company with a limited history and a small employee base, which makes an investment in us highly speculative.

Our business plan for the production and marketing of fuel grade ethanol, carbon dioxide, electricity and other associated products is primarily based upon the construction and operation of a future facility in Malta. We have not produced or sold any products to date. Accordingly, we have a limited operating history from which you can evaluate our business and prospects. In addition, our prospects must be considered in light of the inherent risks, expenses and difficulties encountered by companies in the early stages of development, particularly companies in rapidly evolving markets, such as the bioenergy market, where supply and demand may change significantly in a short amount of time. Some of these risks relate to our potential inability to:

| • | Effectively manage our business and operations; |

| • | Recruit and retain key personnel; |

| • | Manage rapid growth in personnel and operations; |

| • | Raise capital to implement our business plan or address unforeseen capital requirements; |

| • | Overcome competitive disadvantages against larger and more established companies; and |

| • | Successfully address the other risks described throughout this prospectus. |

If we cannot successfully address these risks, our business and our results of operations and financial position would suffer.

We may not be able to secure additional necessary funding on favorable terms, or at all, in order to sustain our current operations, execute on our business plan and market our products.

We must seek additional capital to support our ongoing operations and complete construction of our Malta facility. We may raise these additional funds from public and private debt or equity offerings, borrowings under bank or lease lines of credit, or other sources. Any additional financing may not be available on a timely basis, on terms acceptable to us, or at all. Such financing may be dilutive to shareholders or may require us to grant a lender a security interest in our assets, which could be detrimental to our shareholders if we are unable to repay our obligations. The amount of money we will need may depend on many factors, including:

| • | An increase in the cost of constructing or commencing operation at our Malta facility; |

| • | A material increase in the cost of the biomass and other materials we need for our operations; |

| • | A decrease in the price we receive as gate fees for the intake of waste materials; |

| • | A decrease in the price we receive for our fuel grade ethanol and other products, which would reduce our revenues; and |

| • | An increase in the cost of operating our Malta facility. |

If adequate funds are not available, we may incur further delays in completing our Malta facility or be required to curtail or cease our operations altogether. Any of these results would materially harm our business, financial condition and results of operations.

Additional delays due to, among other things, labor or material shortages, permitting or zoning issues, or opposition from local groups may hinder our ability to commence operations at the Malta facility, which would harm our business, financial condition and results of operations.

We may experience delays in the construction of the Malta facility for any number of reasons, including compliance with permitting and zoning requirements, opposition from local groups, shortages of labor or material, defects in materials or workmanship, changes in interest rates or the credit market, or policy changes at the Malta Government or European Community level. There can be no assurance that we will be able to raise the additional required capital, complete construction and operate the Malta facility at full design capacity. If our timetable for construction and the commencement of operations at the Malta facility is delayed, this will impact our ability to generate revenue and achieve profitability, which would have an adverse material effect on our business, our financial condition and our results of operations.

Significant increases in the cost of constructing the Malta facility may further delay or cause us to abandon construction of the Malta facility, which would materially impact our ability to achieve profitability and the value of your shares.

There can be no assurance that the final cost of constructing the Malta facility and commencing operations will not be significantly higher than budgeted. Many events and conditions, including economic factors, site conditions, design modifications and set-up delays or overruns, could also lead to significant increases in project costs. Furthermore, we need to obtain and comply with a number of permitting requirements, many of which can be costly and time consuming. As a condition to granting necessary permits, regulators may make additional demands that increase the costs of constructing and operating the plant. If any of these events occurs, we could be forced to seek additional debt or equity financing beyond what we currently expect to need, which may not be immediately available, may not be available on favorable terms, or may not be available at all. If additional capital is required, we may experience additional significant construction delays, or fail to achieve profitability, any of which would have a material adverse effect on our business, our financial condition and our results of operations, and significantly diminish or eliminate the value of your shares.

We may materially modify our business plan for any number of reasons, which may cause us to incur additional costs or further delay the expansion of our production capacity, which would harm our business, financial condition and results of operations.

We may modify our business plan in any number of ways, including decreasing the design capacity of the Malta facility or abandoning the Hal Far Estate site for an alternative location. Any material modification to our business plan may result in higher than anticipated construction and start-up costs at the Malta facility, require us to abandon the Malta facility with or without the ability to recoup acquisition, design and construction costs incurred to date; may cause significant delays before we are able to increase our current production capacity, cause our planned production to be significantly below our current estimates, or result in higher than anticipated operating costs, any of which could have an adverse material effect on our business, our financial condition and our results of operations.

We operate in an intensely competitive industry and we may not be able to compete effectively.

The market for the manufacture, marketing and sale of alternative fuels is highly competitive. Competition could be intense and result in increases in the costs of raw materials, plant construction and operating expenses, as well as make it more difficult to attract and retain qualified engineers, chemists and other employees whose services could be key to our operations as they develop. Larger companies that are already engaged in this business may have access to greater financial and other resources, making it difficult to compete with them in recruiting and retaining qualified employees, in acquiring attractive locations for the construction and operation of future production facilities, and selling our products at competitive prices.

New plants under construction or decreases in the demand for biofuels may result in excess production capacity in our industry.

We expect that the number of biofuel producers and the amount of biofuels produced will likely continue to increase in the near future, which may lead to excess biofuel production capacity. In a manufacturing industry with excess capacity, producers have an incentive to manufacture additional products for so long as the price exceeds the marginal cost of production (i.e., the cost of producing only the next unit, without regard for interest, overhead or fixed costs). This incentive can result in the reduction of the market price of biofuel to a level that is inadequate to generate sufficient cash flow to cover costs. Excess capacity may also result from decreases in the demand for biofuel, which could result from a number of factors, including increased governmental regulation, the elimination or modification of governmental incentives, the development of other technologies or products that compete with biofuel, or reduced fuel consumption generally. Excess capacity in the biofuel industry or the reduction of the market price for biofuel could have an adverse effect on our results of operations, cash flows and financial position.

The production of biofuel requires that we purchase significant amounts of raw materials, such as biomass waste, paper waste and other materials that we may be unable to procure.

Our biofuel production requires significant amounts of biomass waste. We will be required to purchase purchase significant amounts of raw materials, such as biomass waste, paper waste and other materials. Such raw materials may be unavailable which could significantly reduce our ability to produce biofuels.

Our business is highly sensitive to the gate fees we receive and the prices we pay for biomass waste, and any future price adjustments could increase our operating costs and may adversely affect our operating results.

Negative consumer perceptions of biofuel may impair or prevent the acceptance of biofuel in the marketplace, which could harm our business.

The biofuel industry is relatively new and general public acceptance of biofuel is uncertain. Public acceptance of biofuel as a reliable, high-quality alternative transport fuel may be limited or slower than anticipated. Even if our production processes consistently produce biofuel that complies with applicable standards, actual or perceived problems with quality control in the industry generally may lead to a lack of consumer confidence in biofuel and harm our ability to successfully market biofuel. Quality control issues in biofuel that is produced by other industry participants could result in a decrease in demand or mandates for biofuel, with a resulting decrease in our revenue. Furthermore, any negative media reports, whether substantiated or not, may adversely affect the demand for our biofuel, which in turn could decrease our sales, harm our business and adversely affect our financial condition.

Deterioration in European, United States and global credit and financial markets may have a material adverse impact on our liquidity, financial position and ability to operate our business.

The recent unprecedented deterioration in the European, United States and global credit and financial markets could negatively impact our ability to obtain financing to construct and operate our Malta facility.

We may be adversely affected by environmental, health and safety laws, regulations and liabilities.

Our Malta facility production business is subject to various environmental laws and regulations, including those relating to the discharge of materials into the air, water and ground, the generation, storage, handling, use, transportation and disposal of hazardous materials, and the health and safety of our employees. In addition, some of these laws and regulations require our facilities to operate under permits that are subject to renewal or modification. These laws, regulations and permits can often require expensive pollution control equipment or operational changes to limit actual or potential impacts to the environment. A violation of these laws and regulations or permit conditions can result in substantial fines, natural resource damages, criminal sanctions, permit revocations and/or facility shutdowns. In addition, we have made, and expect to make, significant capital expenditures on an ongoing basis to comply with increasingly stringent environmental laws, regulations and permits.

In addition, new laws, new interpretations of existing laws, increased governmental enforcement of environmental laws or other developments could require us to make additional significant expenditures. Continued government and public emphasis on environmental issues can be expected to result in increased future investments for environmental controls at our production facilities. Present and future environmental laws and regulations (and interpretations thereof) applicable to our operations, more vigorous enforcement policies and discovery of currently unknown conditions may require substantial expenditures that could have a material adverse effect on our results of operations and financial position.

European biofuel industries are highly dependent upon a myriad of legislation and regulation and any changes in legislation or regulation could materially and adversely affect our results of operations and financial position.

There are a number of European and Maltese laws, regulations and programs that have led to an increase in the supply and demand for biofuels, some of which provide significant economic incentives to biofuel producers and users. These laws, regulations and programs are constantly changing. The passage of new European and Maltese energy legislation, or the revocation or amendment of existing laws, regulations or programs related to biofuel and renewable fuels, could have a significant adverse effect on the biofuel industry in general and our business specifically. We cannot assure you that any of the laws, regulations or programs from which our business benefits will continue in the future or that these laws, regulations or programs will benefit us or benefit us more than our competitors. The elimination or reduction of government subsidies and tax incentives could cause the cost of biofuel to increase to the point where it is not feasible to economically produce and market biofuel, which could require us to abandon our business plan and cease operations.

Our competitive position, financial position and results of operations may be adversely affected by technological advances.

The development and implementation of new technologies could result in the processes and procedures that we intend to use at our Malta facility becoming less efficient or obsolete, allow our competitors to produce biofuel at a lower cost than us, or cause the biofuel we produce to be of a lesser quality than the biofuel produced by our competitors. Also, any advance in biofuel process technology could make our Malta facility less competitive, less efficient or obsolete, any of which could lower the revenue we would otherwise earn from our product sales. We do not predict when new technologies may become available, the rate of acceptance of new technologies by our competitors or the costs associated with new technologies. In addition, advances in the development of alternatives to biofuel could significantly reduce demand or eliminate the need for biofuel. Any advances in technology which require significant capital expenditures to remain competitive or which reduce demand or prices for biofuel would have a material adverse effect on our results of operations and financial position.

Defects in the construction or performance of the Malta facility could result in a reduction in our revenues and profitability and in the value of your shares.

Although we intend to engage third party companies to construct our Malta facility, we do not believe we will receive any warranties with respect to materials and workmanship or assurances that the project will be capable of operating at its full design capacity. Defects in the construction or performance of the plant could occur and there is no assurance that we, our sub-contractors or anyone else that we contract with to construct the project would be able to correct all problems that arise. If defects delay the construction or hinder the continued operation of the Malta facility, our business, financial condition and results of operations could be adversely affected.

Our directors and officers have limited experience in the construction and operation of a waste biomass to biofuel facility.

Our directors and officers have limited experience in raising large amounts of project finance related equity and debt capital, or building and operating the proposed Malta waste biomass to biofuel facility. Although we expect to hire additional personnel and enter into agreements with contractors and consultants to assist us in constructing and operating the facility, there is no assurance that we will be able to hire employees or sign agreements satisfactory to us. If our directors and officers are unable or find it difficult to manage our development and operations successfully, our ability to succeed as a business and the value of your shares will be adversely affected.

Our management will be subject to greater demands and we will incur increased costs as a result of being a public company, which could affect our profitability and operating results. Our accounting, internal audit and other management systems and resources may not be adequately prepared for these demands.

We have not been responsible for the corporate governance and financial reporting practices and policies required of a public company. Following the effectiveness of the registration statement of which this prospectus is a part, we will be a public reporting company in the United States subject to the information and reporting requirements of the Securities Exchange Act of 1934 and the compliance obligations of the Sarbanes-Oxley Act of 2002. As a public reporting company, we will incur significant legal, accounting, investor relations and other expenses. These significant expenses could affect our profitability and our results of operations.

Section 404 of the Sarbanes-Oxley Act requires annual management assessment of the effectiveness of our internal controls over financial reporting and a report by our independent auditors addressing these assessments. These reporting and other obligations will place significant demands on our management, administrative, operational, internal audit and accounting resources. We anticipate that we will need to upgrade our systems; implement additional financial and management controls, reporting systems and procedures; implement an internal audit function; and hire additional accounting, internal audit and finance staff. If we are unable to accomplish these objectives in a timely and effective fashion, our ability to comply with our financial reporting requirements and other rules that apply to reporting companies could be impaired. Any failure to maintain effective internal controls could have a material adverse effect on our business, operating results and stock price.

We are dependent upon our officers for management and direction, and the loss of any of these persons could adversely affect our operations and results.

We are dependent upon our officers for the successful management of our operations and execution of our business plan. We do not have employment agreements with our officers or other key personnel. The loss of any of our officers could delay or prevent the achievement of our business objectives, which could have a material adverse effect upon our results of operations and financial position.

Competition for qualified personnel in the biofuel industry is intense and we may be unable to hire and retain qualified managers and other key personnel.

Prior to commencement of commercial operations at our Malta facility, we will need to hire additional employees to manage and operate the plant. Competition to attract and retain qualified employees is intense in the biofuel industry, and we expect that competition will continue or increase as a result of significant growth in the number of companies producing biofuel and other alternative fuels. If we are unable to attract and retain key personnel, we may be unable to successfully execute our business plan and our financial condition and results of operation may be adversely affected.

It may be more difficult for us to retain or attract officers and directors due to the Sarbanes-Oxley Act of 2002.