Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ELAH Holdings, Inc. | sggh-8k_20141021.htm |

Exhibit 99.1

Signature Group Holdings Inc. Acquiring the Largest Independent Aluminum Recycler in the World Signature Reaches Agreement for the Acquisition of Aleris GRSA October 21, 2014

This presentation does not constitute an offer of any securities for sale. Certain debt and equity securities referenced herein will be offered only by private placement and will not be and have not been registered under the Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. Further, no offer to buy any common stock of Signature Group Holdings, Inc. (the “Company” or “Signature”), including pursuant to any primary equity or stapled rights offering, can be accepted, and no part of the purchase price can be received, until the registration statement applicable to such shares has become effective, and any such offer may be withdrawn or revoked, without obligation or commitment of any kind, at any time by the Company prior to notice of its acceptance given after the effective date. This presentation contains forward-looking statements, which are based on the Company’s current expectations, estimates, and projections about the Company's and Aleris Corporation’s Global Recycling and Specification Alloys businesses and prospects, as well as management's beliefs and certain assumptions made by management. Words such as "anticipates," "expects," "intends," "plans," "believes," "seeks," "estimates," "may," "should," "will," “positioned,” “outlook,” and variations of these words are intended to identify forward-looking statements. These statements include, but are not limited to, statements about the Company's and GRSA's expansion and business strategies; the Company's ability to satisfy the conditions to the acquisition of GRSA and the related financings, and to ultimately consummate the GRSA acquisition; anticipated growth opportunities; the amount of capital-raising necessary to achieve those strategies, as well as future performance, growth, operating results, financial condition and prospects. Such statements are not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict. Accordingly, actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors. Important factors that may cause such a difference include, but are not limited to the Company's ability to successfully identify, consummate and integrate the acquisitions of GRSA and/or other businesses; changes in business or other market conditions; the difficulty of keeping expense growth at modest levels while increasing revenues; the Company's ability to successfully defend against current and new litigation matters as well as demands by investment banks for defense, indemnity, and contribution claims; obtaining the expected benefits of the reincorporation; the Company's ability to access and realize value from its federal net operating loss tax carryforwards; and other risks detailed from time to time in the Company's SEC filings, including but not limited to the most recently filed Annual Report on Form 10-K and subsequent reports filed on Forms 10-Q and 8-K. The statements contained herein speak only as of the date of this presentation and are subject to change. The Company undertakes no obligation to revise or update publicly any forward-looking statements for any reason. The industry and market data and other statistical information used in this presentation are based on independent industry publications, government publications, reports by market research firms or other published independent sources. Some data is also based on the Company’s good faith estimates. Although the Company believes these sources are reliable, the Company has not independently verified the information and cannot guarantee its accuracy and completeness. 2 Cautionary Statements

CRAIG BOUCHARD - Chairman of the Board and Chief Executive Officer of Signature - Founder of Shale-Inland, the nation's leading master distributor of pipes, valves and fittings to the energy sector; co-founder of Esmark, Inc., which became the 4th largest American steel company; former President and Chief Executive Officer of NumeriX (risk management software); former Senior Vice President and Global Head of Derivative Trading at the First National Bank of Chicago. Craig is a New York Times Best Selling Author. KYLE ROSS - Executive Vice President and Chief Financial Officer of Signature - Co-founder of Signature Capital Partners (special situations investment company) 3 Management Participants

TRANSACTION - Acquiring GRSA for $525 million - 6.5x LTM 9/30/14 Adjusted EBITDA(1) - Immediately accretive to earnings - Funded via combination of cash, equity, preferred stock, and debt - Plan to raise at least $125 million equity via primary offering and stapled rights offering - Anticipated closing prior to January 31, 2015 - Conditional on customary regulatory filings and approvals - Transaction structured as a stock purchase with a 338(h)(10) deemed asset sale tax election FINANCING CONDITIONS/TIMING TAX BENEFIT 4 Transaction Highlights (1) Signature estimated GRSA standalone LTM 9/30/14 Adj. EBITDA using Aleris Corporation public filings. Multiple is based on the midpoint of the LTM 9/30/14 Adj. EBITDA range estimated by Signature. (2) Total uses of funds includes $525 million purchase price plus customary transaction fees and expenses.

- Global leader in third-party aluminum recycling - 24 facilities in North America and Europe - 300+ customers worldwide - 1,600 employees - Shipped 1.2 million tons in 2013 - 55% tolling, 45% buy/sell - LTM 9/30/14 revenues of $1.5 billion and Adj. EBITDA of $79–82 million Business at a Glance Note: Signature estimated LTM 9/30/14 revenues and Adj. EBITDA using Aleris Corporation public filings. 5

Key Metrics Note: Signature estimated LTM 9/30/14 metrics using Aleris Corporation public filings. 6

G L O B A L L E A D E R I N A L U M I N U M R E C Y C L I N G - #1 position in global third-party aluminum recycling - 24 facilities across North America and Europe - End use sectors forecast robust growth through 2022 - Demand for secondary aluminum increasing vs. primary - North America automotive body-in-white (“BiW”) transition - Capabilities cover processing, melting, milling, and disposal - Pre-processing ability provides operational flexibility - 40% of volume delivered in molten form providing significant savings for customers - Average 10+ years with Top 10 customers; consistently renews 95%+ of contracts with top customers - Facilities with close proximity to customers provides cost advantages and strong barrier to entry - Near term organic growth opportunities with existing customers - Longer term growth opportunities into other regions - Acquisition opportunities will be considered S T R O N G I N D U S T R Y D Y N A M I C S & O U T L O O K B L U E C H I P C U S T O M E R B A S E W I T H S T R O N G R E L A T I O N S H I P S G R O W T H O P P O R T U N I T I E S Investment Highlights B R O A D O P E R A T I O N A L C A P A B I L I T I E S 7

Global Footprint 8 PROXIMITY TO CUSTOMERS PROVIDES DISTINCT COST ADVANTAGES

- Secondary (i.e. recycled) production requires less energy than that required to manufacture primary - Can be recycled repeatedly without loss of quality - ~10%(1) cost savings in producing alloyed aluminum from recycled aluminum (vs. primary) due to existing alloying agents in scrap - Increasing environmental awareness raising recycling rates - Strong recycling trends in automative, can, and construction to increase scrap availability Increased Focus on Recycled Products 1 (1) Up to 10% cost savings on average, using company assumptions. Source: Freedonia Group, October 2013 9 SECONDARY ALUMINUM PRODUCTION PROJECTED TO GROW FASTER AND INCREASE SHARE

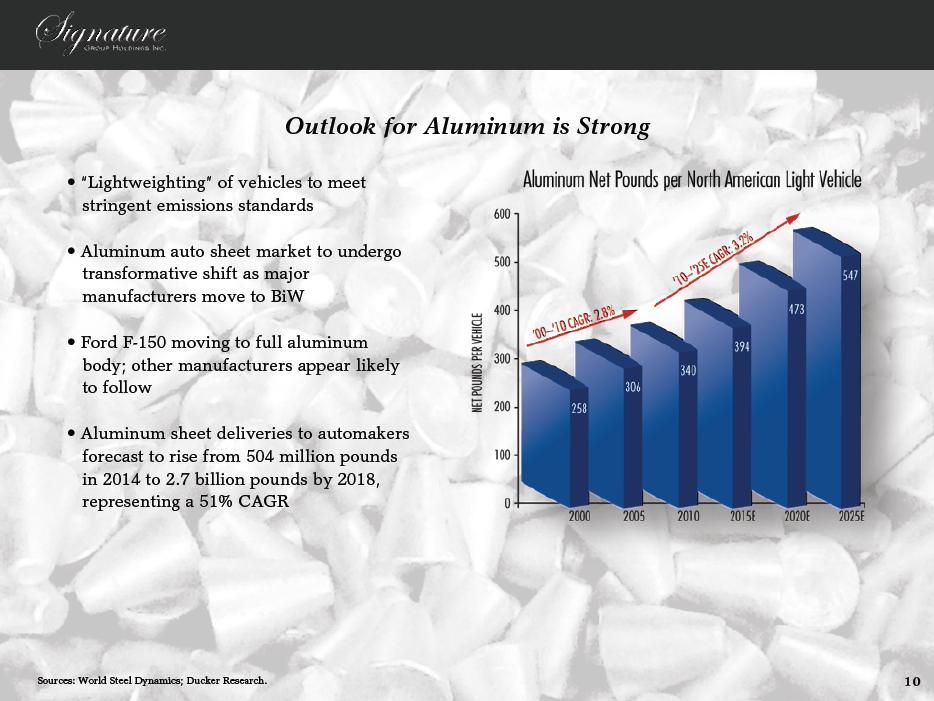

- “Lightweighting” of vehicles to meet stringent emissions standards - Aluminum auto sheet market to undergo transformative shift as major manufacturers move to BiW - Ford F-150 moving to full aluminum body; other manufacturers appear likely to follow - Aluminum sheet deliveries to automakers forecast to rise from 504 million pounds in 2014 to 2.7 billion pounds by 2018, representing a 51% CAGR Outlook for Aluminum is Strong 10 Sources: World Steel Dynamics; Ducker Research.

- CEO of Signature well-versed in metals sector; augments GRSA management team with collective 190+ years industry experience - Entire management team intends to stay with the business - Transition Services Agreement with Aleris through 2015 - Deleverage - Creates larger platform to grow through further acquisitions - Pro forma business results anticipated to use Signature’s existing Federal NOLs Combined Company Positioned for Success 11

Appendix 12

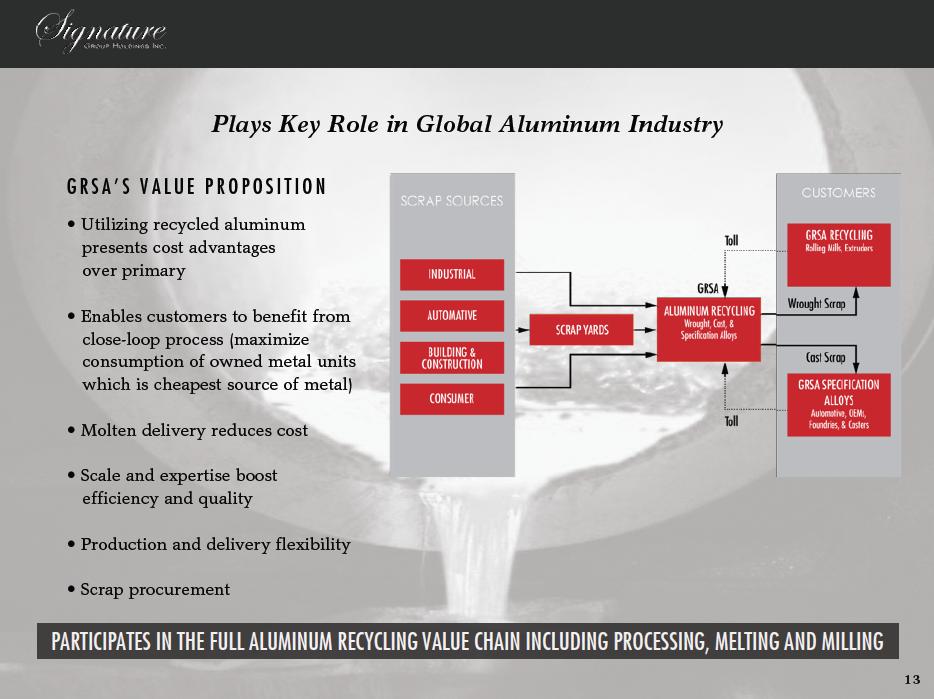

GRSA’S VALUE PROPOSITION - Utilizing recycled aluminum presents cost advantages over primary - Enables customers to benefit from close-loop process (maximize consumption of owned metal units which is cheapest source of metal) - Molten delivery reduces cost - Scale and expertise boost efficiency and quality - Production and delivery flexibility - Scrap procurement Plays Key Role in Global Aluminum Industry 13 PARTICIPATES IN THE FULL ALUMINUM RECYCLING VALUE CHAIN INCLUDING PROCESSING, MELTING AND MILLING

Attractive End Markets 14 A U T O M O T I V E - Growth driven by increases in volume and aluminum content - North America market has upside - ~12% of global aluminum consumption - Used extensively for packaging of food, beverages and pharmaceuticals - Solid order book and strong build rates driving growth - ~22% of global aluminum consumption - Used in wide range of materials such as windows, doors and facades, roofs and walls P A C K A G I N G B U I L D I N G & C O N S T R U C T I O N A E R O S P A C E % GRSA Volume Long-Term Global CAGR 61% 7% 22% 5% 4% 8% 4% 6% (2012–2020E) (2012–2022E) (2012–2017E) (2012–2022E) Sources: Freedonia Report 2013; Ducker Research, HIS Automotive 2014, Airline Monitor, Wall Street Research.

Adjusted EBITDA Reconciliation 15 The following table presents the reconciliation of net income attributable to GRSA standalone to EBITDA and Adjusted EBITDA for the periods below: NOTE ON RECONCILIATION OF NON-GAAP FINANCIAL MEASURES: A non-GAAP financial measure is a numerical measure of historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the balance sheets, statements of operations, or statements of cash flows; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measures so calculated and presented. EBITDA and Adjusted EBITDA are not financial measures recognized under GAAP. EBITDA and Adjusted EBITDA are presented and discussed because management believes they enhance the understanding of the financial performance of Signature's and GRSA's operations by investors and lenders. As a complement to financial measures recognized under GAAP, management believes that EBITDA and Adjusted EBITDA assist investors who follow the practice of some investment analysts who adjust GAAP financial measures to exclude items that may obscure underlying performance and distort comparability. Because EBITDA and Adjusted EBITDA are not measures recognized under GAAP, they are not intended to be presented herein as a substitute for net earnings as an indicator of operating performance. EBITDA and Adjusted EBITDA are primarily performance measurements the Company's senior management and Board expect to use to evaluate certain operating results. Signature calculates EBITDA and Adjusted EBITDA as earnings before interest, taxes, depreciation and amortization, or EBITDA, which is then adjusted to remove or add back certain items, or Adjusted EBITDA. These items are identified below in the reconciliation of GRSA's net earnings to EBITDA and Adjusted EBITDA. Net earnings is the GAAP measure most directly comparable to EBITDA and Adjusted EBITDA. Signature’s calculation of EBITDA and Adjusted EBITDA may be different from the calculation used by other companies for non-GAAP financial measures having the same or similar names; therefore, they may not be comparable to other companies. Twelve Months Ended (Dollars in millions) June 30, 2014 2013 2012 2011 Net income attributable to GRSA $ 23.0 $ 19.0 $ 26.4 $ 68.7 Interest -- -- -- -- Taxes 5.5 4.3 11.9 14.6 Depreciation and amortization 22.4 21.6 15.7 10.9 EBITDA 50.9 44.9 54.0 94.2 Allocated corporate SG&A 18.3 18.4 19.3 17.6 Other, net 5.7 2.1 (4.4) (6.4) Adjusted EBITDA $ 74.7 $ 65.4 $ 68.9 $ 105.4 Year Ended December 31,

Signature Group Holdings Inc.