Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ILLINOIS TOOL WORKS INC | itw8k3q14.htm |

| EX-99.1 - EXHIBIT 99.1 - ILLINOIS TOOL WORKS INC | ex991pressrel3q14.htm |

| 8-K - 8-K - ILLINOIS TOOL WORKS INC | itw8k3q14.pdf |

| EX-99.1 - EXHIBIT 99.1 - ILLINOIS TOOL WORKS INC | ex991pressrel3q14.pdf |

| EX-99.2 - EXHIBIT 99.2 - ILLINOIS TOOL WORKS INC | ex992confercall3q14.pdf |

FORWARD LOOKING STATEMENTS Safe Harbor Statement This conference call contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, without limitation, statements regarding the expected impact and timing of strategic initiatives and related benefits, future financial performance, operating performance, growth in free operating cash flow, organic and total revenue growth, operating margin growth, growth in diluted income per share from continuing operations, restructuring expenses and related benefits, tax rates, exchange rates, timing and amount of share repurchases, end market economic conditions, and the Company’s related 2014 guidance. These statements are subject to certain risks, uncertainties, and other factors which could cause actual results to differ materially from those anticipated. Important risks that could cause actual results to differ materially from the Company’s expectations include those that are detailed in ITW’s Form 10-Q for the second quarter of 2014. Non-GAAP Measures The Company uses certain non-GAAP measures in discussing the Company’s performance. The reconciliation of those measures to the most comparable GAAP measures are detailed in ITW’s press release for the third quarter of 2014, which is available at www.itw.com, together with this presentation. Third Quarter 2014 Conference Call E. Scott Santi, President & CEO Michael M. Larsen, Senior Vice President & CFO John Brooklier, Vice President, Investor Relations Aaron Hoffman, Vice President, Investor Relations October 21, 2014

2 $3.7B $3.6B Q3’13 Q3’14 Total Revenue $1.28 $0.90 EPS Operating Margin EPS +42% Q3 2014 Financial Summary Enterprise initiatives and organic revenue growth drive strong results 20.9% 19.0% +190 bps ROIC* 20.1% 17.6% +250 bps * See ITW’s third quarter 2014 press release for the reconciliation from GAAP to non-GAAP measurements. Q3 2014 Actuals Highlights ● Enterprise initiatives contribute 120 bps of margin expansion ● All time record … $772M quarterly operating income ● Total and organic revenue up 3.5% … -1% drag from product line simplification ● 128% Free Operating Cash Flow conversion* ● Repurchased ~$500M shares

3 4% 3% 5% 1% 3% North America Inter- national South America Asia Pacific EMEA Q3 2014 Organic Revenue Growth Organic revenue growth across all major geographies Organic revenue +3.5% Growth by Geography Highlights ● North America up 4% – Welding +10%, Automotive OEM +8%, Test & Measurement and Electronics +6% and Food Equipment +6% ● International up 3% – Europe up 3% driven by Automotive OEM +9% and Food Equipment +6% – Asia Pacific up 5% driven by Automotive OEM +9%, Test & Measurement and Electronics +9% and Construction Products +6%

4 Q3 Enterprise Initiatives +120 bps Volume +80 Price/Cost +10 Other (20) Margin Expansion +190 bps Operating Margins Q3‘14 20.9% Q3‘13 19.0% Key Drivers OM% V bps Automotive OEM 23.4% +230 T&M and Electronics 18.7 +240 Food Equipment 23.1 +320 Polymers & Fluids 20.2 +210 Welding 26.2 +80 Construction Products 18.9 +270 Specialty Products 21.3 +20 Q3 2014 Operating Margins Margin expansion across all segments … 5 segments improved 200+ bps

5 Total Revenue Operating Income Q3'14 VPY% Q3‘14 VPY% Automotive OEM $631 7% $148 19% T&M and Electronics 586 6% 110 21% Food Equipment 575 6% 133 23% Polymers & Fluids 490 -3% 99 8% Welding 459 5% 120 8% Construction Products 445 1% 84 18% Specialty Products 513 1% 109 1% Intersegment / Unallocated (7) - (31) - Total Company $3,692 4% $772 14% By Segment Automotive OEM Organic +8% Total +7% +230 bps $589 $631 Q3‘13 Q3‘14 Total Revenue 23.4% Operating Margin Q3 2014 Segment Results Dynamics ● Organic revenue growth of 8% vs. WW auto build of 2% due to ongoing innovation/product penetration ● Organic revenue vs. geographic auto builds: – Europe: +9% vs. -1% – N.A.: +8% vs. +8% – China: +12% vs. +8% 21.1% ($’s in millions) Q3‘13 Q3‘14

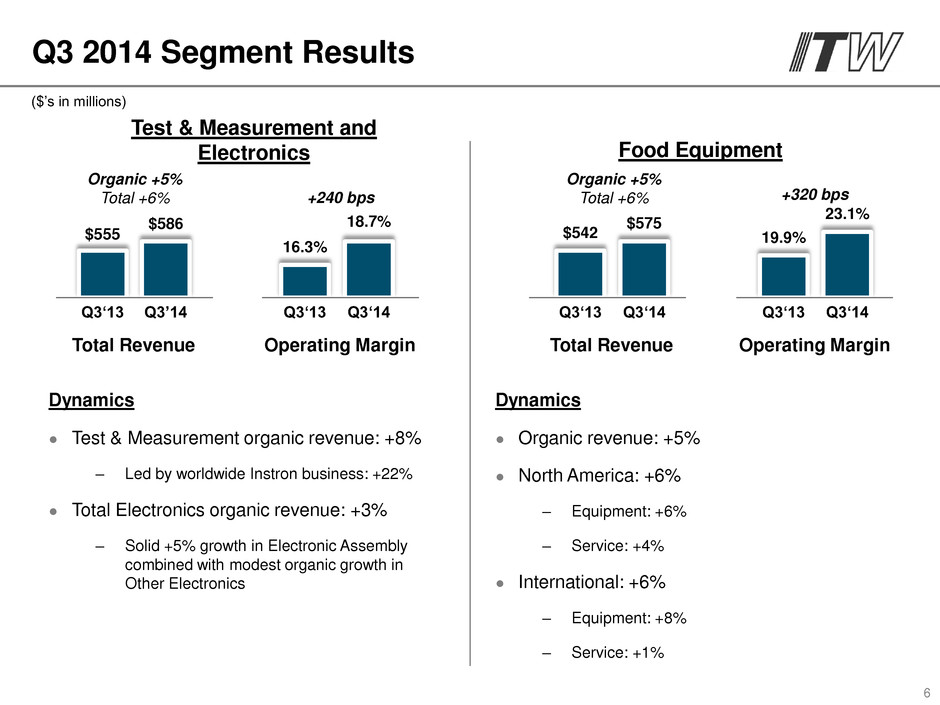

6 Food Equipment Q3 2014 Segment Results Dynamics ● Test & Measurement organic revenue: +8% – Led by worldwide Instron business: +22% ● Total Electronics organic revenue: +3% – Solid +5% growth in Electronic Assembly combined with modest organic growth in Other Electronics Dynamics ● Organic revenue: +5% ● North America: +6% – Equipment: +6% – Service: +4% ● International: +6% – Equipment: +8% – Service: +1% Test & Measurement and Electronics $555 $586 16.3% 18.7% Organic +5% Total +6% +240 bps $542 $575 19.9% 23.1% Organic +5% Total +6% +320 bps Total Revenue Operating Margin Q3‘13 Q3’14 Total Revenue Operating Margin Q3‘13 Q3‘13 Q3‘13 Q3‘14 Q3‘14 Q3‘14 ($’s in millions)

7 Dynamics ● Organic revenue of -2% driven by ongoing product line simplification activity ● Auto Aftermarket organic revenue: -4% ● Polymers organic revenue: -1% ● Fluids & Hygiene organic revenue: -1% Dynamics ● Organic revenue: +5% ● N.A.: +10% driven by strength in equipment sales to industrial and commercial customers ● International: -7% – China/Middle East: Delays in onshore pipeline projects – Germany: Ongoing product line simplification activity Polymers & Fluids $504 18.1% 20.2% Organic -2% Total -3% +210 bps $459 $438 25.4% 26.2% Organic +5% Total +5% +80 bps $490 Welding Total Revenue Operating Margin Total Revenue Operating Margin Q3‘13 Q3‘13 Q3‘14 Q3‘14 Q3‘14 Q3‘14 Q3‘13 Q3‘13 Q3 2014 Segment Results ($’s in millions)

8 Dynamics ● Organic revenue: +2% driven by product line simplification ● Organic revenue by geography: – Asia Pacific: +6% as Australia/New Zealand had growth across all sectors – N.A.: Mixed at +2% with residential and renovation up and commercial down – Europe: -1% largely due to product line simplification activity in France; U.K. continues to be strong Dynamics ● Consumer Packaging: Flat ● Appliance: Flat ● Ground Support: +2% $440 $445 16.2% 18.9% Organic +2% Total +1% +270 bps Construction Products $510 $513 21.1% 21.3% Organic Flat Total +1% +20 bps Specialty Products Total Revenue Operating Margin Total Revenue Operating Margin Q3‘13 Q3‘13 Q3‘14 Q3‘14 Q3‘14 Q3‘14 Q3‘13 Q3‘13 Q3 2014 Segment Results ($’s in millions)

9 $3.6B Total Revenue $1.07 - $1.15 $0.92 EPS EPS $3.63 $14.1B 2013 2014F 2014 Guidance Q4 2014 Guidance $4.57 - $4.65 EPS +21% at mid-point EPS +27% at mid-point Q4’14F Q4’13 Total Revenue 2014 Financial Guidance Good progress in year 2 of ITW’s 5 year enterprise strategy ● Initiatives contribute ~100 bps of margin expansion ● Expect to repurchase at least $500M of shares ● Operating margin ~20% … +200 bps margin expansion ● ROIC 18-19% … +200 bps improvement Organic: 2-3% Total: ~Flat Organic: 2-3% Total: 2-3%

10 Appendix

11 Total Revenue Automotive OEM T&M and Electronics Food Equipment Polymers & Fluids Welding Construction Products Specialty Products Organic 7.6% 5.2% 5.3% (2.0%) 5.0% 2.1% - Divestitures (0.1%) - - - - (1.4%) - Translation (0.4%) 0.4% 0.7% (0.8%) (0.3%) 0.4% 0.5% Total Revenue 7.1% 5.6% 6.0% (2.8%) 4.7% 1.1% 0.5% Change in Operating Margin Automotive OEM T&M and Electronics Food Equipment Polymers & Fluids Welding Construction Products Specialty Products Operating Leverage 110 bps 140 bps 120 bps (50 bps) 80 bps 60 bps - Changes in Variable Margin & OH Costs 80 bps 60 bps 150 bps 280 bps - 270 bps 90 bps Total Organic 190 bps 200 bps 270 bps 230 bps 80 bps 330 bps 90 bps Restructuring 40 bps 20 bps 40 bps - - (60 bps) (80 bps) Impairment - 10 bps - (20 bps) - - - Translation - 10 bps 10 bps - - - 10 bps Total Operating Margin Change 230 bps 240 bps 320 bps 210 bps 80 bps 270 bps 20 bps Total Operating Margin % 23.4% 18.7% 23.1% 20.2% 26.2% 18.9% 21.3% Segment Results Q3 2014 vs. Q3 2013 Favorable / (Unfavorable)