As filed with the Securities and Exchange Commission on October 20, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

Under The Securities Act of 1933

CollabRx, Inc.

(Exact name of Registrant as specified in its Charter)

|

Delaware

|

|

68-0370244

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

|

(I.R.S. Employer Identification No.)

|

| |

|

|

|

44 Montgomery Street, Suite 800

|

|

|

|

San Francisco, California

|

|

94104

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

| |

|

|

|

Primary Standard Classification Code Number:

|

|

7374

|

Registrant’s telephone number, including area code: (415) 248-5350

Thomas R. Mika

President and Chief Executive Officer

44 Montgomery Street, Suite 800

San Francisco, CA 94104

(415) 248-5350

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

William Davison, Esq.

Goodwin Procter LLP

135 Commonwealth Drive

Menlo Park, California 94025

Tel: (650) 752-3114

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o (Do not check if a smaller reporting company)

|

Smaller reporting company þ

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Proposed Maximum Aggregate Offering Price (1) (2)

|

|

|

Amount of Registration Fee

|

|

|

Common Stock, par value $0.01 per share

|

|

$

|

4,000,000.00

|

|

|

$

|

464.80

|

|

| Common Stock Purchase Warrants |

|

$ |

[ ] |

|

|

$ |

[ ] |

|

|

Shares of Common Stock unifying

Common Stock Purchase Warrants

|

|

$ |

[ ] |

|

|

$ |

[ ] |

|

| Total |

|

$ |

[ ] |

|

|

$ |

[ ] |

|

(1) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

(2) Includes the aggregate offering price of additional shares that the underwriters have the option to purchase.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

This input page from CollabRx’ Lung Cancer Therapy Finder prompts physicians to enter the relevant data regarding their patient’s tumor. Included are those molecular tests that CollabRx’ Lung Cancer Advisory Board believes are the most relevant (based on clinical evidence) and which, when combined with other information about stage, histopathology, metastatic sites and in some cases prior treatments, should be considered in guiding treatment planning. The output of this interactive app is a description of the importance of each relevant test result, along with fully annotated lists of drugs, clinical trials and citations to the published evidence that supports the relationship of the biomarkers to these therapies.

|

|

CancerRx™ - an IOS application designed to help oncologists and pathologists navigate the complex landscape of oncology therapeutic options. CancerRx was formally introduced to physicians at the 2014 American Society of Clinical Oncology (ASCO) Annual Meeting that took place May 30-June 3, 2014 in Chicago.

Highlights of the ASCO launch include:

● More than 9,600 downloads (5/30-6/11)

● Averaging 1,677 weekly unique users

● Target users include oncologists and other health care practitioners involved in cancer care (approximately 40,000 potential users)

● A 5-star rating on the Apple App Store

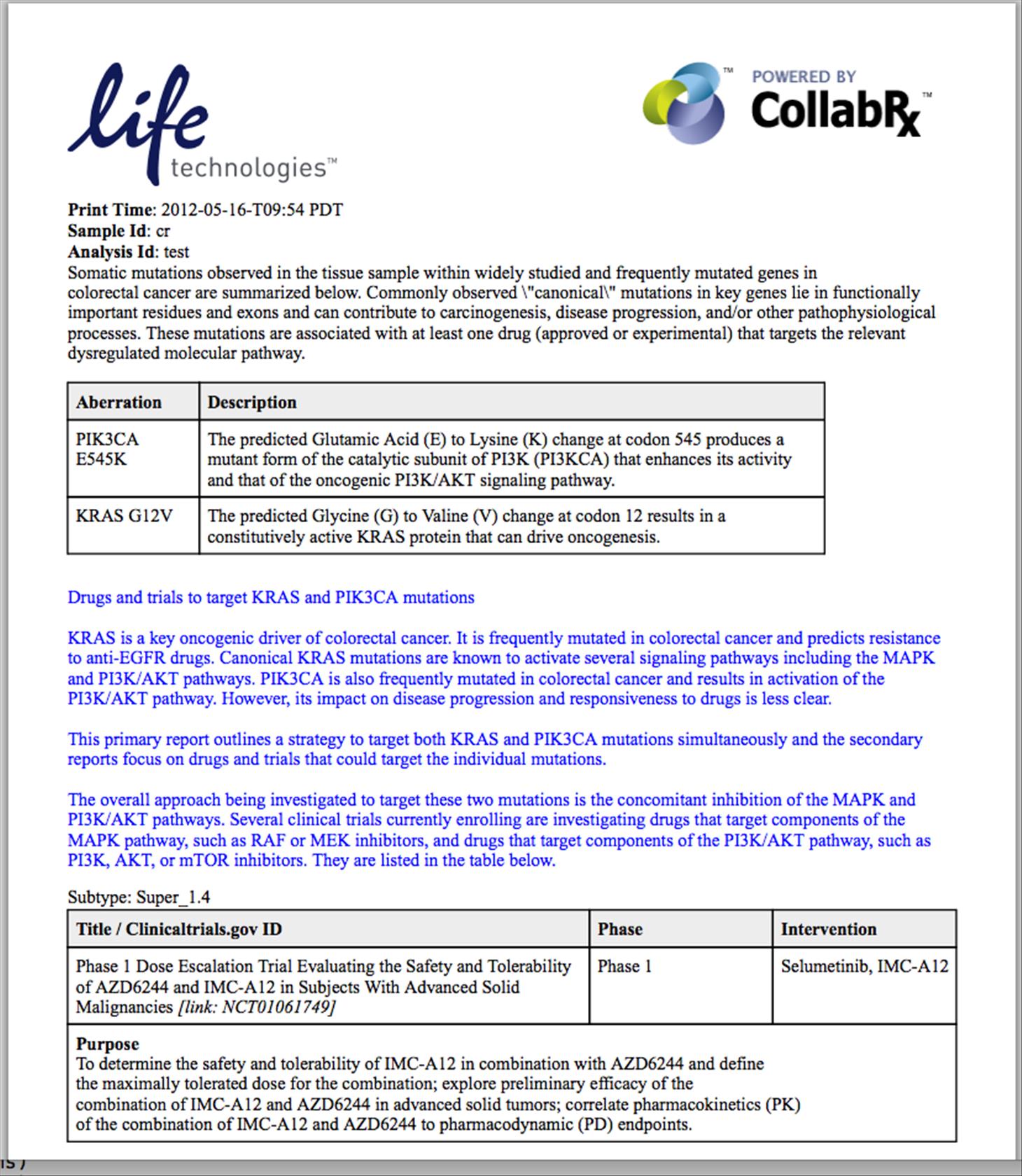

CollabRx’s Genetic Variant Annotation™ Service (GVA™) supports clinical diagnostic laboratories that perform tumor genomic testing on cancer tumors to uncover genetic alterations that may lead to novel therapeutic approaches for some cancer patients. Offered as Software-as-a-Service (SAAS), diagnostic labs provide the digital output of DNA sequencing and other analytical devices to CollabRx for the identification of “actionable” biomarkers. The GVA provides information back to the laboratory regarding what is known about the actionable biomarker and, as relevant, additional information about related drugs and clinical trials – all in a fully automated system.

|

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion. Dated October 17, 2014.

Shares

Common Stock

Warrants to Purchase Shares of Common Stock

------------------------------------

This is a public offering of shares of common stock and warrants to purchase shares of common stock of CollabRx, Inc. We are offering _____________________ shares to be sold in this offering and warrants to purchase up to an aggregate of shares of common stock. The warrants will have a per share exercise price of $[___]. The warrants are exercisable [immediately] and will expire [__] years from the date of issuance.

Our common stock is listed on The NASDAQ Global Market under the symbol “CLRX.” The last reported sale price of our common stock on The NASDAQ Global Market on October 16, 2014 was $0.88 per share. There is no established public trading market for the warrants, and we do not expect a market to develop. In addition, we do not intend to apply for a listing of the warrants on any national securities exchange.

Investing in our common stock involves a high degree of risk. See “Risk Factors” on page 14 to read about factors you should consider before buying shares of our common stock.

--------------------------------------------

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| |

|

Per Share

|

|

|

Per Warrant |

|

|

Total

|

|

|

Public Offering Price

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Underwriting Discounts and Commissions(1)

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Proceeds to us, before expenses

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

(1) We refer you to “Underwriting” beginning on page 82 for additional information regarding total underwriting compensation.

We have granted the underwriters an option to purchase up to an additional _________ shares of common stock and/or warrants from us at the public offering price less the underwriting discount. The underwriters expect to deliver the shares against payment in _____________, New York, New York on _______________________, 2014.

Prospectus dated _______________________, 2014

| |

|

Page

|

| |

|

6

|

| |

|

14

|

| |

|

25

|

| |

|

26

|

| |

|

26

|

| |

|

26

|

| |

|

27

|

| |

|

28

|

| |

|

30

|

| |

|

33

|

| |

|

50

|

| |

|

62

|

| |

|

66

|

| |

|

73

|

| |

|

74

|

| |

|

75

|

| |

|

77

|

| |

|

79

|

| |

|

83

|

| |

|

86

|

| |

|

86

|

| |

|

86

|

| |

|

87

|

We have not authorized anyone to provide you with any information or to make any representation, other than those contained in this prospectus or any free writing prospectus we have prepared. We take no responsibility for, and provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only in circumstances and in jurisdictions where it is lawful to so do. The information contained in this prospectus is accurate only as of its date, regardless of the time of delivery of this prospectus or of any sale of our common stock.

Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourself about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes included elsewhere in this prospectus. You should also consider, among other things, the matters described under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in each case appearing elsewhere in this prospectus. Unless otherwise stated, all references to “us,” “our,” “CollabRx,” “we,” the “Company” and similar designations refer to CollabRx, Inc.

Overview

CollabRx, Inc. develops and markets medical information and clinical decision support products and services intended to set a standard for the clinical interpretation of genomics-based, precision medicine. Building on a comprehensive and specialized knowledge base, software systems that facilitate dynamic updating and automated reporting, and a unique network of over 75 independent expert clinical advisors, we have developed a suite of unique and differentiated information products and services. These products include a scalable system for providing high-value information on biomarkers and related therapies for inclusion in reports prepared by diagnostic labs reporting on the results from their multi-biomarker genomic-based tests. In addition, we have developed decision-support tools for physicians and patients to assist with treatment planning for advanced cancer, offered over the Internet in both web-based and mobile apps. We believe that both product sets are highly synergistic, and allow opportunities for enhancement, cross-fertilization and adoption that go beyond what each would offer individually.

Our overall vision is that we are at the dawn of an era of explosive growth of data and information generated at the molecular level that must be interpreted and contextualized into knowledge before it can be used effectively by either physicians or patients. We regard this knowledge as being the most valuable portion of the molecular diagnostic process and we believe that all sectors of the healthcare industry, including providers, insurers, drug developers and patients, are potential users of this knowledge. We aim to deliver our proprietary interpretive content as quickly as possible and in as many usable forms as possible via the Internet.

We are a development stage company just entering our commercialization phase. The systems and approach that we have developed can be applied to many disease states, but we have chosen to focus initially on cancer, an area of tremendous need and potential. We believe that our approach is unique, disruptive in the market and well timed, offering the potential for high growth, profitability and above average returns for investors.

Products and Services

We support oncologists and pathologists in their efforts to plan treatment approaches for their advanced cancer patients. We do so through three major information products, all of which are based on a proprietary knowledgebase that is informed by external data sources, our in-house experts, and a large network of independent clinical advisors. We attempt to gather together much of the data and evidence that is relevant to different therapeutic approaches in the context of the presence of specific genetic biomarkers, relating those to the relevant drugs and clinical trials that may help a physician plan a treatment approach for a patient. Similar to an electronic library, we focus on keeping the information comprehensive, accurate, current and easy to access. Currently, our information products include the following:

|

Product

|

Users

|

Description

|

Business Model

|

|

Genetic Variant Annotation Service™ (GVA™)

|

Pathologists and Laboratory Medical Directors via cloud-based servers

|

Automated clinical interpretation of tumor genetic alterations (mutation and copy number variation)

|

Laboratories pay $75-$150 per test event or purchase annual subscription

|

|

Therapy Finders™ for Melanoma, Colorectal and Lung Cancer and Metastatic Breast Cancer

|

Oncology professionals at the point-of-care

|

Web-based expert systems for clinical decision support

|

Advertising and sponsorship sharing with on-line media partner MedPage Today

|

|

CancerRx

|

Oncology professionals at the point-of care

|

Mobile app with reference tools, social media, and expert systems

|

Advertising and sponsorship sharing with media partner MedPage Today

|

Since launching our Genetic Variant Annotation Service (GVA) in August 2013, several prominent diagnostic laboratories, comprehensive cancer centers and life science companies have become customers of and/or partners in this product, including: Life Technologies, Inc. (now Thermo-Fisher, Inc., Carlsbad, California), Affymetrix, Inc. (Santa Clara, California), OncoDNA, SA (Brussels, Belgium), Sengenics, Pte., Ltd. (Singapore), Cynvenio Biosystems, Inc. (Westlake Village, California), Quest Diagnostics, Inc. (Madison, New Jersey), CellNetix Pathology and Laboratories (Seattle, Washington), Genoptix (a Novartis company, Carlsbad, California), The Jackson Laboratory for Genomic Medicine (Bar Harbor, Maine), The University of Chicago Medical (Chicago, Illinois), Stanford Hospital Molecular Laboratory (Palo Alto, CA) and The Ohio State University Medical Center (Columbus, Ohio).

Our Therapy Finders™ and CancerRx are made available free to physicians and patients via our on-line media partner, MedPage Today, the professional property of Everyday Health, Inc.

The Cancer Market and Genomic Testing

Cancer is a worldwide health concern. In 2002, cancer eclipsed heart disease as the number one cause of death in the U.S. for individuals under the age of 85, according to the National Cancer Institute. In the U.S., nearly 12 million individuals are living with a cancer diagnosis, approximately 7 million individuals are being treated for cancer, approximately 1.5 million new cases are diagnosed each year, over 600,000 people die from cancer each year (6 million deaths worldwide), and nearly 1 in 3 females and 1 in 2 males will be diagnosed with cancer in their lifetime, according to the American Cancer Society. Age is the number one risk factor for the development of cancer. Nearly 80% of cancers are diagnosed in individuals age 55 years and older, which is the fastest growing segment of the U.S. population. JPMorgan recently estimated that the total market opportunity for testing in cancer is estimated at $10B in 2014 in the U.S. alone, growing to $25B by 2018, but this opportunity has only been partially tapped.

Cancer treatment and research has been experiencing an unprecedented explosion of knowledge in the past 5-10 years. There are over 500 new cancer therapies in pre-clinical development, thousands of diagnostic labs (private and hospital based), more than 10,000 cancer-related clinical trials are currently ongoing, and over 100,000 cancer-related papers are published in the scientific literature annually, according to PubMed and ClinicalTrials.gov. The knowledge explosion is associated with two interrelated key drivers: (i) cancer is fundamentally a disease of the genome, (i.e., genetic mutations cause cancer), and (ii) the costs and time to sequence genes (and discover mutations that can be targeted for therapy) have been falling at an increasing rate, driven principally by new sequencing technologies commonly referred to as “Next Generation Sequencing” or “NGS”. The concept of a “$1,000 genome” has broad psychological implications since it represents the price point at which leading experts believe that every cancer genome will be sequenced.

Large-scale genetic sequencing studies in tumors are rapidly uncovering mutations in genes that can be selectively targeted by pharmaceutical and biotechnology companies. There were fewer than 10 cancer genes in 2008 in which genetic aberrations were strongly associated with treatment implications. By comparison, there is broad consensus that there are currently approximately 50 such genes based on recent studies, a number that is expected to double in the next year even as additional mutations are being discovered in genes already associated with cancer. Currently there are approximately over 95 biomarkers representing thousands of mutations in aggregate that are associated with at least some level of clinical actionability. This number is expected to increase rapidly as new discoveries are made.

Competitive Strengths

CollabRx is differentiated and unique as an information company. We are not a diagnostic lab offering a particular test or series of tests in cancer diagnostics. Instead, we have focused exclusively on the information, analysis and interpretation-based steps in the diagnostic workflow, developing and refining the increasingly complex task of delineating the relationship between known or studied biomarkers in cancer with the therapeutic strategies that the published evidence supports. With our web-based and mobile apps, we provide a means for physicians to access our knowledgebase easily at the point-of-care. For laboratories, we provide a credible, third party resource for the dynamic information and analysis that is needed to interpret the results of genetic tests.

Our conviction is that the interpretation and reporting of genomic-based test results will become the key differentiator in the market, as opposed to the design and performance of the test itself, given the rapid commoditization of NGS data generation and inherent lack of intellectual property in the sequencing steps. Ultimately, physicians will judge the quality of a diagnostic test based on the quality of the report, and how well it supports the treatment decision process. We are platform agnostic, independent, adaptable and unregulated. We believe that diagnostic companies, medical centers, hospital labs and other community-based labs interested in developing a genomics testing capability will confront the challenges associated with developing and maintaining a clinically-oriented, evidence-based biomarker reference database, and increasingly will realize that it is better to “buy” than to “build.”

In addition, we believe that it is important to address physician needs for information directly, rather than solely via diagnostic laboratories. For this reason we have continued the development of our web-based and mobile applications, addressing oncologists and pathologists at work and at home, providing a resource for both education and for decision-support.

Our ability to compete in these markets and our ability to serve the needs of physicians treating advanced cancer patients rests on a set of principles and ideas that are potentially very disruptive to the markets that we serve and which offer an opportunity for extraordinary growth and profitability. We believe that the following attributes of CollabRx provide a sustainable competitive advantage:

|

· |

Our proprietary knowledgebase is focused on actionable information for physicians – CollabRx medical and scientific content is organized in a knowledgebase that expresses the relationship between genetic profiles, other aspects of the medical record (e.g., stage, prior treatments), and therapy considerations including molecular diagnostics, medical tests, clinical trials, drugs, biologics, and other information relevant for treatment planning. Our focus is, and always has been on providing actionable information that physicians can use to plan treatment strategies for their advanced cancer patients and identifying the evidence in the public domain that justifies the therapy options presented. |

|

· |

Our automated software platform is scalable and capable of handling high test volumes and fast turn-around times – The CollabRx “Semantic Integration Platform” or SIP brings together methods track important changes in molecular oncology from numerous sources, including the published literature and many of the centralized publicly available databases utilized by biomedical and translational clinician/scientists. Our SIP provides CollabRx with a scalable, interactive service that can handle large test volumes and still maintain fast turn-around times for our customers. It this respect it is unmatched in our field. |

|

· |

Our large network of independent expert clinical advisors – Over 75 independent, uncompensated expert advisors, organized by both tissue-specific editorial boards and pan-cancer or biomarker-centric boards, provides a unique, unbiased mechanism to inform and prioritize treatment strategies based on evidence. |

|

· |

Our first-mover advantage and independence - We believe that CollabRx is the first company to have focused exclusively on the information-based, value-added steps of the diagnostic testing workflow in the context of providing clinical grade interpretation of multi-gene testing in cancer, separate from the processing of tissue samples in a laboratory environment.. |

Growth Strategy

Our strategic vision is to become a leading source of high value, independently reviewed, actionable information on molecular medicine that supports decision-making by physicians and patients, embodied in tools and services whose performance or use allow us to accumulate data that is valuable to paying segments of the health care ecosystem. We intend to build our information franchise first in oncology, and then expand to other genomics-based disease areas that are amenable to our approach of automated, scalable, and expert-vetted content creation and distribution.

Our growth strategy includes the following key elements:

|

· |

Marketing of our Genetic Variant Annotation™ Service into additional segments within the clinical diagnostic laboratory market. |

|

· |

Forming strategic partnerships with life science companies to expand GVA biomarker coverage and utility and to engage with them in cooperative marketing efforts. |

|

· |

Forming partnerships with companies in the diagnostic testing workflow to enhance the GVA and to expand our customer base. |

|

· |

Supporting the advertising and sponsorship sales activities of Everyday Health, Inc. in connection with the current and future Therapy Finders and CancerRx mobile apps. |

Risks Associated with Our Business

An investment in our common stock involves a high degree of risk. Any of the factors set forth under “Risk Factors” may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth under “Risk Factors” in deciding whether to invest in our common stock. Some of the principal risks we face are:

|

· |

we may not be able to successfully implement our growth on a timely basis or at all; |

|

· |

we may not be able to generate sufficient cash flow or raise capital on acceptable terms to meet our needs; |

|

· |

we may lose key members of our senior management team; |

|

· |

our products may be alleged to be faulty or fail to comply with government regulation; |

|

· |

we may lose a significant customer; and |

|

· |

our business development and marketing programs may prove insufficient or ineffective. |

Company Background

CollabRx (f/k/a Tegal) was formed in December 1989 to acquire the operations of the former Tegal Corporation, or Tegal, a division of Motorola, Inc. Until recently, we designed, manufactured, marketed and serviced specialized systems used primarily in the production of semiconductors and micro-electrical mechanical devices, including integrated circuits, memory devices, sensors, accelerometers and power devices. Beginning in late 2009, we experienced a sharp decline in revenues resulting from the collapse of the semiconductor capital equipment market and the global financial crisis. In a series of transactions from 2010 to 2012, we sold the majority of our operating assets and intellectual property portfolio. During the same time period, our board of directors evaluated a number of strategic alternatives, which included our continued operation as a stand-alone business with a different business plan, a merger with or into another company, a sale of our remaining assets, and our liquidation or dissolution. We investigated opportunities within and outside the semiconductor capital equipment industry and evaluated a number of transactions involving other diversified technology-based companies. Throughout this process, we developed and refined our criteria for a business combination, with an eventual focus on the healthcare industry, and specifically information technology and services within the healthcare industry.

Company and Other Information

We were formed in December 1989 to acquire the operations of the former Tegal Corporation, a division of Motorola, Inc. Our predecessor company was founded in 1972 and acquired by Motorola in 1978. We completed our initial public offering in October 1995. On July 12, 2012, we completed the acquisition of a private company called CollabRx, Inc., herein referred to as the Merger, pursuant to an Agreement and Plan of Merger dated as of June 29, 2012. As a result of the Merger, CollabRx, Inc. became a wholly-owned subsidiary of ours. In consideration for 100% of the stock of CollabRx, Inc., we issued an aggregate of 236,433 shares of common stock, representing approximately 14% of our total shares outstanding prior to the closing, to former CollabRx, Inc. stockholders. We subsequently changed our name to CollabRx, Inc.

Our principal executive office is located at 44 Montgomery Street, Suite 800, San Francisco, CA 94104, and our telephone number is (415) 248-5350. Our website address is www.collabrx.com. We do not incorporate the information on or accessible through our website into this prospectus, and you should not consider any information on, or that can be accessed through, our website as part of this prospectus.

We own two U.S. federal trademark registrations and applications, and unregistered trademarks and servicemarks, including CollabRx, Inc.™, and Therapy Finders™. All other trademarks or trade names referred to in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

THE OFFERING

|

Securities offered by us:

|

_______________________ shares of common stock and warrants to purchase up to an aggregate of _____ shares of common stock

|

| |

|

|

Common stock to be outstanding after this offering:

|

Shares ( if the warrants are exercised in full). If the underwriters exercise their option to purchase additional shares in full, the total number of shares of common stock outstanding immediately after this offering would be shares ( shares if the warrants are exercised in full).

|

|

Underwriters’ option to purchase additional shares:

|

______________________ shares and __________ warrants

|

| Description of warrants |

The warrants will have a per share exercise price equal to $[ ]. The warrants are exercisable [immediately] and expire [ _____ ] years from the date of issuance. |

|

Use of proceeds by us:

|

We estimate that we will receive net proceeds from this offering of approximately $______ million based upon an assumed public offering price of $0.88 per share, which is the last reported sale price of our common stock on the NASDAQ Capital Market on October 16, 2014 (or approximately $__________ million if the underwriters’ option to purchase additional shares and/or warrants in this offering is exercised in full), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We expect to use the net proceeds from this offering to fund the expansion of our commercial and laboratory operations, ongoing and new clinical trials, continue building our technology infrastructure and capabilities, as well as for working capital and other general corporate purposes, including funding the costs of operating as a public company. See “Use of Proceeds” for additional information.

|

|

Risk factors:

|

You should carefully read “Risk Factors” in this prospectus for a discussion of factors that you should consider before deciding to invest in our common stock.

|

|

Existing NASDAQ Capital Market trading symbol:

|

“CLRX”

|

The number of shares of our common stock to be outstanding after this offering is based on 2,925,788 shares of our common stock outstanding as of June 30, 2014, including shares of common stock subject to repurchase by us, and excludes:

|

· |

383,427 shares of common stock issuable upon the exercise of stock options outstanding as of June 30, 2014 at a weighted-average exercise price of $12.04 per share; |

|

· |

91,800 shares of common stock issuable upon the vesting of restricted stock units with a weighted average fair value at grant date of $2.96; |

|

· |

92,888 shares of common stock issuable upon the exercise of a warrant to purchase common stock that was outstanding as of June 30, 2014, with an exercise price of $3.15 per share; |

|

· |

60,831 restricted stock unit awards whose distribution has been deferred; |

|

· |

27,405 shares of common stock issuable upon the exercise of a warrant to purchase common stock that was outstanding as of June 30, 2014, with an exercise price of $2.50 per share; |

|

· |

274,963 shares available for future issuance, as of June 30, 2014 under our 2007 Stock Incentive Plan, or the “2007 Plan”; and |

|

· |

3,705 shares of common stock reserved for future issuance under our Employee Stock Purchase Plan, which expired on July 22, 2014. |

Unless otherwise indicated, all information in this prospectus reflects or assumes the following:

|

· |

no exercise of outstanding options to purchase common stock or warrants to purchase common stock since June 30, 2014; |

|

· |

no vesting of restricted stock units since June 30, 2014; and |

|

· |

no exercise by the underwriters of their option to purchase up to an additional [_____________________________] shares of common stock in this offering. |

SUMMARY FINANCIAL DATA

The following summary financial data for the years ended March 31, 2014 and 2013 are derived from our audited financial statements included elsewhere in this prospectus. The summary financial data for the three months ended June 30, 2014 and 2013 have been derived from our unaudited financial statements included elsewhere in this prospectus. These unaudited financial statements have been prepared on a basis consistent with our audited financial statements and, in our opinion, contain all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of such financial data. You should read this data together with our audited financial statements and related notes included elsewhere in this prospectus and the information under the captions “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our historical results are not necessarily indicative of our future results, and our operating results for the three-month period ended June 30, 2014 are not necessarily indicative of the results that may be expected for the fiscal year ending March 31, 2015 or any other interim periods or any future year or period.

Income Statement Data

| |

|

Year Ended March 31,

|

|

|

Three Months Ended

June 30,

|

|

| |

|

2014* |

|

|

2013* |

|

|

2014** |

|

|

2013** |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

658

|

|

|

$

|

300

|

|

|

$

|

64

|

|

|

$

|

270

|

|

|

Revenue - related party

|

|

|

--

|

|

|

|

100

|

|

|

|

-

|

|

|

|

-

|

|

|

Total revenue

|

|

|

658

|

|

|

|

400

|

|

|

|

64

|

|

|

|

270

|

|

|

Cost of revenue

|

|

|

158

|

|

|

|

56

|

|

|

|

18

|

|

|

|

18

|

|

|

Gross profit

|

|

|

500

|

|

|

|

344

|

|

|

|

46

|

|

|

|

252

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Engineering

|

|

|

1,714

|

|

|

|

667

|

|

|

|

542

|

|

|

|

232

|

|

|

Research and development

|

|

|

284

|

|

|

|

536

|

|

|

|

50

|

|

|

|

174

|

|

|

Sales and marketing

|

|

|

271

|

|

|

|

257

|

|

|

|

80

|

|

|

|

67

|

|

|

General and administrative

|

|

|

1,819

|

|

|

|

2,979

|

|

|

|

644

|

|

|

|

488

|

|

|

Total operating expenses

|

|

|

4,088

|

|

|

|

4,439

|

|

|

|

1,316

|

|

|

|

961

|

|

|

Operating loss

|

|

|

(3,588

|

)

|

|

|

(4,095

|

)

|

|

|

(1,270

|

)

|

|

|

(709

|

)

|

|

Other income, net

|

|

|

40

|

|

|

|

39

|

|

|

|

7

|

|

|

|

10

|

|

|

Loss before income tax benefit

|

|

|

(3,548

|

)

|

|

|

(4,056

|

)

|

|

|

(1,263

|

)

|

|

|

(699

|

)

|

|

Income tax benefit

|

|

|

(79

|

)

|

|

|

(83

|

)

|

|

|

(15

|

)

|

|

|

(20

|

)

|

|

Loss from continuing operations

|

|

|

(3,469

|

)

|

|

|

(3,973

|

)

|

|

|

(1,248

|

)

|

|

|

(679

|

)

|

|

Gain on sale of discontinued operations, net of taxes

|

|

|

267

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

(Loss) income from discontinued operations, net of taxes

|

|

|

(112

|

)

|

|

|

45

|

|

|

|

--

|

|

|

|

(118

|

)

|

|

Net income from discontinued operations, net of taxes

|

|

|

155

|

|

|

|

45

|

|

|

|

--

|

|

|

|

(118

|

)

|

|

Net loss

|

|

$

|

(3,314

|

)

|

|

$

|

(3,928

|

)

|

|

$

|

(1,248

|

)

|

|

$

|

(797

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share from continuing operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

$

|

(1.77

|

)

|

|

$

|

(2.14

|

)

|

|

$

|

(0.61

|

)

|

|

$

|

(0.35

|

)

|

|

Net income (loss) per share from discontinued operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

$

|

0.08

|

|

|

$

|

0.02

|

|

|

$

|

0.00

|

|

|

$

|

(0.06

|

)

|

|

Net loss per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

$

|

(1.69

|

)

|

|

$

|

(2.12

|

)

|

|

$

|

(0.61

|

)

|

|

$

|

(0.41

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares used in per share computation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

1,965

|

|

|

|

1,856

|

|

|

|

2,032

|

|

|

|

1,953

|

|

* Derived from the Company’s audited financial statements

** Unaudited

Balance Sheet Data:

| |

|

As of June 30, 2014

|

|

| |

|

Actual

|

|

|

As Adjusted

|

|

| |

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

2,068

|

|

|

$

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

Working Capital

|

|

|

2,192

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

Promissory note

|

|

|

511

|

|

|

|

-

|

|

|

Stockholders’ (deficit) equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value; 5,000,000 shares authorized; none issued and outstanding

|

|

|

-

|

|

|

|

-

|

|

|

Common stock, $0.01 par value; 50,000,000 shares authorized; 2,925,788 shares issued and outstanding actual, ________ number of shares issued and outstanding pro forma

|

|

|

29

|

|

|

|

-

|

|

|

Additional paid-in capital

|

|

|

132,463

|

|

|

|

-

|

|

|

Accumulated other comprehensive loss

|

|

|

-

|

|

|

|

-

|

|

|

Accumulated deficit

|

|

|

(129,337

|

)

|

|

|

(129,337

|

)

|

|

Total stockholders’ (deficit) equity

|

|

|

3,155

|

|

|

|

|

|

|

Total Capitalization

|

|

$

|

3,666

|

|

|

$

|

-

|

|

(1) The pro forma column in the balance sheet data table above gives effect to the sale and issuance by us of [_____] shares of common stock in this offering based upon an assumed public offering price of $0.88 per share, which is the last reported sale price of our common stock on the NASDAQ Capital Market on October 16, 2014, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

* Derived from the Company’s unaudited financial statements

You should carefully consider the risks described below, together with all of the other information in this prospectus, before making an investment decision. The risks described below are not the only ones we face. Additional risks we are not presently aware of or that we currently believe are immaterial may also impair our business operations. Our business could be harmed by any of these risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

Risks Related to Our Business

Our future growth is dependent on the successful development and introduction of new products and enhancements. There can be no assurance that we will be successful in developing and marketing, on a timely basis, new products or product enhancements, or that our new products will adequately address the changing needs of the health care marketplace.

A significant portion of our operating expense is relatively fixed and planned expenditures are based in part on expectations regarding future revenues. As a result, we are generally unable to mitigate the negative impact on margins in the short term. Accordingly, unexpected revenue shortfalls may significantly decrease our operating results from quarter to quarter. As a result, in future quarters our operating results could fall below the expectations of securities analysts or investors, in which event our stock price would likely decrease.

We have a history of losses, expect to incur substantial further losses and may not achieve or maintain profitability in the future, which in turn could further materially decrease the price of our common stock.

We had net losses of ($1,248), ($3,314) and ($3,928) for the three months ended June 30, 2014 and the fiscal years ended March 31, 2014 and 2013, respectively. We used cash flows from operations of ($733), ($2,593) and ($3,838) in these respective periods. We expect to continue to sustain losses for the foreseeable future, which may decrease the price of our common stock. As of June 30, 2014, we had cash and cash equivalents of $2,068.

We believe that our existing cash balances will be adequate to fund operations through the third quarter of fiscal year 2015. We cannot assure you that we will be successful in pursuing any of the strategic alternatives described in this prospectus. We intend that our most recent acquisition of CollabRx, Inc. will form the core of our operations going forward.

If our efforts do not succeed, we may need to raise additional capital which may include capital raises through the issuance of debt or equity securities. If additional funds are raised through the issuance of preferred stock or debt, these securities could have rights, privileges or preferences senior to those of our common stock, and debt covenants could impose restrictions on our operations. Moreover, such financing may not be available to us on acceptable terms, if at all. Failure to raise any needed funds would materially adversely affect us. In consideration of these circumstances, the Company may be forced to consider a merger with or into another company or the liquidation or dissolution of the company, including through a bankruptcy proceeding.

Our quarterly operating results may continue to fluctuate.

Our revenue and operating results have fluctuated and are likely to continue to fluctuate significantly from quarter to quarter, and we cannot assure you that we will achieve profitability in the future.

Factors that could affect our quarterly operating results include:

| |

·

|

operating results of CollabRx;

|

| |

·

|

operating results of any companies that we may acquire in the future;

|

| |

·

|

fluctuations in demand for our products, and the timing of agreements with strategic partners in the health care marketplace;

|

| |

·

|

the timing of new products and product enhancements;

|

| |

·

|

changes in the growth rate of the health care marketplace;

|

| |

·

|

our ability to control costs, including operations expenses;

|

| |

·

|

our ability to develop, induce and gain market acceptance for new products and product enhancements;

|

| |

·

|

changes in the competitive environment, including the entry of new competitors and related discounting of products;

|

| |

·

|

adverse changes in the level of economic activity in the United States or other major economies in which we do business;

|

| |

·

|

renewal rates and our ability to up-sell additional products;

|

| |

·

|

the timing of customer acquisitions;

|

| |

·

|

the timing of revenue recognition for our sales; and

|

| |

·

|

future accounting pronouncements or changes in our accounting policies.

|

Our future success depends on our ability to retain our key personnel and to successfully integrate them into our management team.

We are dependent on the services of our executive officers, our technical experts and other members of our senior management team, particularly Thomas Mika, our President and Chief Executive Officer. The loss of one or more of these key officers or any other member of our senior management team could have a material adverse effect on us. We may not be able to retain or replace these key personnel, and we may not have adequate succession plans in place. Mr. Mika is subject to employment conditions or arrangements that contain post-employment non-competition provisions. However, these arrangements permit Mr. Mika to terminate his employment with us upon little or no notice and the enforceability of the non-competition provisions is uncertain.

If we are unable to hire, retain and motivate qualified personnel, our business would suffer.

Our future success depends, in part, on our ability to continue to attract and retain highly skilled personnel. The loss of the services of any of our key personnel, the inability to attract or retain qualified personnel or delays in hiring required personnel, particularly in software and biotechnology, may seriously harm our business, financial condition and operating results. Our ability to continue to attract and retain highly skilled personnel will be critical to our future success. Competition for highly skilled personnel is frequently intense, especially in the San Francisco Bay Area. We intend to issue stock options as a key component of our overall compensation and employee attraction and retention efforts. In addition, we are required under U.S. generally accepted accounting principles, or GAAP, to recognize compensation expense in our operating results for employee stock-based compensation under our equity grant programs, which may negatively impact our operating results and may increase the pressure to limit share-based compensation. We may not be successful in attracting, assimilating or retaining qualified personnel to fulfill our current or future needs. Also, to the extent we hire personnel from competitors, we may be subject to allegations that they have been improperly solicited or divulged proprietary or other confidential information.

The personalized healthcare market is rapidly evolving and difficult to predict. If the personalized healthcare market does not evolve as we anticipate or if healthcare market participants do not perceive value in our products, our sales will not grow as quickly as anticipated and our stock price could decline.

We are in a new, rapidly evolving category within the healthcare industry that focuses on using information technology to inform personalized cancer treatment planning. As such, it is difficult to predict important market trends, including how large the personalized healthcare market will be or when and what products customers will adopt. If the market does not evolve in the way we anticipate, if organizations do not recognize the benefit that our products offer, or if we are unable to sell our products to customers, then our revenue may not grow as expected or may decline, and our stock price could decline.

New or existing technologies that are perceived to address personalized cancer treatment planning in different ways could gain wide adoption and supplant our products, thereby weakening our sales and our financial results.

The introduction of products and services embodying new technologies could render our existing products obsolete or less attractive to customers. Other technologies exist or could be developed in the future, and our business could be materially negatively affected if such technologies are widely adopted. We may not be able to successfully anticipate or adapt to changing technology or customer requirements on a timely basis, or at all. If we fail to keep up with technological changes or to convince our customers and potential customers of the value of our products even in light of new technologies, our business, operating results and financial condition could be materially and adversely affected.

We are dependent on a family of products that informs genomic-based medicine.

Our current product offering is limited to a family of products that informs genomic-based medicine using a unique approach of experts and expert systems. We expect to derive a substantial portion of our revenue from this approach and the family of products based on this approach for the foreseeable future. A decline in the price of these products, whether due to competition or otherwise, or our inability to increase sales of these products, would harm our business and operating results. We expect that this concentration of revenue from a single product family comprised of a limited number of products will continue for the foreseeable future. As a result, our future growth and financial performance will depend heavily on our ability to develop and sell enhanced versions of our products. If we fail to deliver product enhancements, new releases or new products that customers want, it will be more difficult for us to succeed.

If we are unable to introduce new products successfully and to make enhancements to existing products, our growth rates would likely decline and our business, operating results and competitive position could suffer.

Our continued success depends on our ability to identify and develop new products and to enhance and improve our existing products, and the acceptance of those products by our existing and target customers. Our growth would likely be adversely affected if:

| |

·

|

we fail to introduce these new products or enhancements;

|

| |

·

|

we fail to successfully manage the transition to new products from the products they are replacing;

|

| |

·

|

we do not invest our development efforts in appropriate products or enhancements for markets in which we now compete and expect to compete;

|

| |

·

|

we fail to predict the demand for new products following their introduction to market; or

|

| |

·

|

these new products or enhancements do not attain market acceptance.

|

Any or all of the above problems could materially harm our business and operating results.

Our cash flow is highly variable and may not be sufficient to meet all of our objectives and there is uncertainty about our ability to continue as a going concern.

Our cash and cash equivalents were $2.1 million at June 30, 2014, compared to $3.4 million at June 30, 2013. We have used cash from operations of $2.6 million and $3.8 million for the years ended March 31, 2014 and 2013, respectively. Our existing cash and cash equivalents and expected cash flow from operations may not provide sufficient liquidity to fund our operations and capital expenditures for the next 12 months. Our independent registered public accounting firm concluded that there was substantial doubt about our ability to continue as a going concern as of June 30, 2014. Accordingly, it included an explanatory paragraph to that effect in its report on our June 30, 2014 financial statements.

Until the Company can generate sufficient levels of cash from its operations, we may need to sell equity or debt securities to raise additional funds to continue to operate as a going concern beyond the third quarter of fiscal year 2015. In addition, the perception that we may not be able to continue as a going concern may cause others to choose not to deal with us due to concerns about our ability to meet our contractual obligations and may adversely affect our ability to raise additional capital.

The Company expects to continue to finance future cash needs primarily through proceeds from equity financings and collaborative agreements with strategic partners or through a business combination with a company that has such financing in order to be able to sustain its operations until the Company can achieve profitability and positive cash flows.

Our ability to meet our liquidity needs depends on our ability to achieve revenue targets of between $4 and $5 million annually as well as to reduce expenses. We may have insufficient cash to satisfy our liquidity needs, which could force us to obtain additional debt or equity financing from other sources, to further reduce expenses, or to sell assets. Reducing our expenses could adversely affect our operations. We cannot assure you that we will be able to secure additional debt or equity financing or sell assets on acceptable terms, if at all, and failure to do so could cause us to cease operations. In addition, raising additional equity financing could result in substantial dilution of our current equity holders and in the net tangible book value per share of such holdings.

If we are unable to increase market awareness of our company and our products, our revenue may not continue to grow, or may decline.

The personalized healthcare market is nascent, and we have not yet established broad market awareness of our products and services. Market awareness of our value proposition and products will be essential to our continued growth and our success, particularly for the advanced stage treatment segment of the personalized cancer treatment market. If our marketing efforts are unsuccessful in creating market awareness of our company and our products, then our business, financial condition and operating results will be adversely affected, and we will not be able to achieve sustained growth.

We compete in highly competitive markets, and competitive pressures from existing and new companies may adversely impact our business and operating results.

The markets in which we compete are highly competitive. We expect competition to intensify in the future as existing competitors bundle new and more competitive offerings with their existing products and services, and as new market entrants introduce new products into our markets. This competition could result in increased pricing pressure, reduced profit margins, increased sales and marketing expenses and our failure to increase, or the loss of, market share, any of which would likely seriously harm our business, operating results and financial condition. If we do not keep pace with product and technology advances and otherwise keep our product offerings competitive, there could be a material and adverse effect on our competitive position, revenue and prospects for growth.

We compete either directly or indirectly with other medical database solution companies. The principal competitive factors in our markets include, key strategic customer relationships, expert technical personnel, marketplace acceptance of our product, among others.

Many of our current and potential competitors are substantially larger and have greater financial, technical, research and development, sales and marketing, manufacturing, distribution and other resources and greater name recognition. We could also face competition from new market entrants, including our joint-development partners or other current technology partners. In addition, many of our existing and potential competitors enjoy substantial competitive advantages, such as:

| |

·

|

longer operating histories;

|

| |

·

|

the capacity to leverage their sales efforts and marketing expenditures across a broader portfolio of products;

|

| |

·

|

broader distribution and established relationships with partners;

|

| |

·

|

access to larger customer bases;

|

| |

·

|

greater customer support;

|

| |

·

|

greater resources to make acquisitions;

|

| |

·

|

larger intellectual property portfolios; and

|

| |

·

|

the ability to bundle competitive offerings with other products and services.

|

As a result, increased competition could result in loss of existing or new customers, price reductions, reduced operating margins and loss of market share. Our competitors also may be able to provide customers with capabilities or benefits different from or greater than those we can provide in areas such as technical qualifications or geographic presence, or to provide end-user customers a broader range of products, services and prices. In addition, some of our larger potential competitors have substantially broader product offerings and could leverage their relationships based on other products or incorporate functionality into existing products to gain business in a manner that discourages users from purchasing our products, including through selling at zero or negative margins, product bundling or closed technology platforms. These larger potential competitors may also have more extensive relationships within existing and potential customers that provide them with an advantage in competing for business with those customers. Our ability to compete will depend upon our ability to provide a better product than our competitors at a competitive price. We may be required to make substantial investments in research, development, marketing and sales in order to respond to competition, and there is no assurance that these investments will achieve any returns for us or that we will be able to compete successfully in the future.

Our limited operating history in the health care market makes it difficult for you to evaluate our current business and future prospects, and may increase the risk of your investment.

Our Company was formed in December 1989 to acquire the operations of the former Tegal Corporation, a division of Motorola, Inc. Until recently, our Company designed, manufactured, marketed and serviced specialized plasma etch systems used primarily in the production of micro-electrical mechanical systems devices, such as sensors, accelerometers and power devices. We exited the semiconductor industry through a series of divestitures in 2010 to 2012. In July 2012, we acquired CollabRx and entered the personalized healthcare market. CollabRx was founded in 2008 to use information technology to inform personalized medicine. Our current management has only been working together with our employee base for a short period of time. This limited operating history in the healthcare market makes financial forecasting and evaluation of our business difficult. Furthermore, because we depend in part on the market’s acceptance of our products, it is difficult to evaluate trends that may affect our business. We have encountered and will continue to encounter risks and difficulties frequently experienced by growing companies in rapidly changing industries. If we do not address these risks successfully, our business and operating results would be adversely affected, and our stock will be adversely affected.

We do not sell our products directly to users and rely instead on contractual relationships with key market participants who derive a benefit from offering our products to their users. Our business development cycles can be long and unpredictable, and our business development efforts require considerable time and expense.

We do not sell our products directly to users. Instead, we form strategic relationships with existing market participants who derive a benefit from offering our products to their users. Our business development efforts involve educating our potential business partners about the use and benefits of our products. Such potential business partners are typically large, well-established companies with long evaluation cycles. We spend substantial time and resources on our business development efforts without any assurance that our efforts will produce any sales. In addition, partnerships are frequently subject to budget constraints, multiple approvals and unplanned administrative, processing and other delays. These factors, among others, could result in long and unpredictable sales cycles. The length of our products’ business development cycles typically range from six to twelve months based on our limited experience, but may be longer as we expand our business development efforts to other segments of the healthcare market. As a result of these lengthy business development time-lines and the uncertain benefit that our partners may derive from offering our products, it is difficult for us to predict when our partners may purchase products from us and as a result, our operating results may vary significantly and may be adversely affected.

Our customers are concentrated and therefore the loss of a significant customer may harm our business.

We generate revenues from a small number of customers. The loss of any of these customers would significantly impact our operating results in future periods. For the three months ended June 30, 2014, Quest Diagnostics, CellNetix and Everyday Health accounted for 26%, 23% and 20%, respectively, of the Company’s revenue. For the three months ended June 30, 2013, Life Technologies and Everyday Health accounted for 93% and 7%, respectively, of the Company’s revenue. For the twelve months ended March 31, 2014, one customer, Life Technologies, accounted for 76% of the Company’s revenue. In fiscal year 2014 five customers accounted for 96% of the Company’s revenue.In fiscal year 2013, three customers accounted for 100% of our revenues. Specifically, Life Technologies and Everyday Health, Inc. accounted for 62.5% and 12.5%, respectively of the Company’s revenues. Our management contract with Sequel Power, a related party, accounted for 25% of our revenues.

We are exposed to risks associated with contract termination or delay

The software products for which we receive revenue are distributed through third-parties under license or contract, with varying terms. Generally, our agreements with third-parties are subject to termination with notice and/or discretionary termination if certain revenue targets are not achieved. In addition, our agreements generally do not contain revenue or performance guarantees, so our achieved revenues may vary from targets because of changes in strategic direction of our customers, contract termination, or from delays in projected launch dates, over which we have no influence or control. The loss or delay of revenues associated with such contracts may harm our business and cause us to suffer further operating losses.

If our security is breached, our business could be disrupted, our operating results could be harmed, and customers could be deterred from using our products and services.

Our business relies on the secure electronic transmission, storage and hosting of information, including published data and proprietary databases. We face the risk of a deliberate or unintentional incident involving unauthorized access to our computer systems that could result in misappropriation or loss of assets or information, data corruption, or other disruption of business operations. Although we have devoted significant resources to protecting and maintaining the confidentiality of our information, including implementing security and privacy programs and controls, training our workforce, and implementing new technology, we have no guarantee that these programs and controls will be adequate to prevent all possible security threats. We believe that any compromise of our electronic systems, including the unauthorized access, use, or disclosure of information or a significant disruption of our computing assets and networks, would adversely affect our reputation and our ability to fulfill contractual obligations, and would require us to devote significant financial and other resources to mitigate such problems, and could increase our future cyber security costs.

Defects or errors in our software could harm our reputation, result in significant cost to us and impair our ability to market our products.

The software applications underlying our hosted products and services are inherently complex and may contain defects or errors, some of which may be material. Errors may result from our own technology or from the interface of our software with legacy systems and data, which we did not develop. The risk of errors is particularly significant when a new product is first introduced or when new versions or enhancements of existing products are released. The likelihood of errors is increased as a result of our commitment to frequent release of new products and enhancements of existing products.

Material defects in our software could result in a reduction in sales and/or delay in market acceptance of our products. In addition, such defects may lead to the loss of existing customers, difficulty in attracting new customers, diversion of development resources or harm to our reputation. Correction of defects or errors could prove to be impossible or impractical. The costs incurred in correcting any defects or errors or in responding to resulting claims or liability may be substantial and could adversely affect our operating results.

If we experience any failure or interruption in the delivery of our services over the Internet, customer satisfaction and our reputation could be harmed and customer contracts may be terminated.

If we experience any failure or interruption in the delivery of our services over the Internet, customer satisfaction and our reputation could be harmed and lead to reduced revenues and increased expenses.

We may expand our business through new acquisitions in the future. Any such acquisitions could disrupt our business, harm our financial condition and dilute current stockholders’ ownership interests in our company.

We may pursue potential acquisitions of, and investments in, businesses, technologies or products complementary to our business and periodically engage in discussions regarding such possible acquisitions. Acquisitions involve numerous risks, including some or all of the following:

| |

·

|

difficulties in identifying and acquiring complementary products, technologies or businesses; substantial cash expenditures;

|

| |

·

|

incurrence of debt and contingent liabilities, some of which we may not identify at the time of acquisition;

|

| |

·

|

difficulties in assimilating the operations and personnel of the acquired companies;

|

| |

·

|

diversion of management’s attention away from other business concerns;

|

| |

·

|

risk associated with entering markets in which we have limited or no direct experience;

|

| |

·

|

potential loss of key employees, customers and strategic alliances from either our current business or the target company’s business; and

|

| |

·

|

delays in customer purchases due to uncertainty and the inability to maintain relationships with customers of the acquired businesses.

|

If we fail to properly evaluate acquisitions or investments, we may not achieve the anticipated benefits of such acquisitions, we may incur costs in excess of what we anticipate, and management resources and attention may be diverted from other necessary or valuable activities. An acquisition may not result in short-term or long-term benefits to us. The failure to evaluate and execute acquisitions or investments successfully or otherwise adequately address these risks could materially harm our business and financial results. We may incorrectly judge the value or worth of an acquired company or business. In addition, our future success will depend in part on our ability to manage the growth anticipated with these acquisitions.

Furthermore, the development or expansion of our business or any acquired business or companies may require a substantial capital investment by us. We may not have these necessary funds or they might not be available to us on acceptable terms or at all. We may also seek to raise funds for an acquisition by issuing equity securities or convertible debt, as a result of which our existing stockholders may be diluted or the market price of our stock may be adversely affected.

We may be subject to claims that we or our technologies infringe upon the intellectual property or other proprietary rights of a third party. Any such claims may require us to incur significant costs, to enter into royalty or licensing agreements or to develop or license substitute technology.

We cannot assure you that our software solutions and the technologies used in our product offerings do not infringe patents held by others or that they will not in the future. Any future claim of infringement could cause us to incur substantial costs defending against the claim, even if the claim is without merit, and could distract our management from our business. Moreover, any settlement or adverse judgment resulting from the claim could require us to pay substantial amounts or obtain a license to continue to use the technology that is the subject of the claim, or otherwise restrict or prohibit our use of the technology. Any required licenses may not be available to us on acceptable terms, if at all. If we do not obtain any required licenses, we could encounter delays in product introductions if we attempt to design around the technology at issue or attempt to find another provider of suitable alternative technology to permit us to continue offering the applicable software solution. In addition, we generally provide in our customer agreements that we will indemnify our customers against third-party infringement claims relating to our technology provided to the customer, which could obligate us to fund significant amounts. Infringement claims asserted against us or against our customers or other third parties that we are required or otherwise agree to indemnify may have a material adverse effect on our business, results of operations or financial condition.

We may be unable to adequately enforce or defend our ownership and use of our intellectual property and other proprietary rights.

Our success is heavily dependent upon our intellectual property and other proprietary rights. We rely upon a combination of trademark, trade secret, copyright, patent and unfair competition laws, as well as license and access agreements and other contractual provisions, to protect our intellectual property and other proprietary rights. In addition, we attempt to protect our intellectual property and proprietary information by requiring certain of our employees and consultants to enter into confidentiality, non-competition and assignment of inventions agreements. The steps we take to protect these rights may not be adequate to prevent misappropriation of our technology by third parties or may not be adequate under the laws of some foreign countries, which may not protect our intellectual property rights to the same extent as do the laws of the United States.