Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - BALLY TECHNOLOGIES, INC. | a2221830zex-31_2.htm |

| EX-10.1 - EX-10.1 - BALLY TECHNOLOGIES, INC. | a2221830zex-10_1.htm |

| EX-32.1 - EX-32.1 - BALLY TECHNOLOGIES, INC. | a2221830zex-32_1.htm |

| EX-10.2 - EX-10.2 - BALLY TECHNOLOGIES, INC. | a2221830zex-10_2.htm |

| EX-10.4 - EX-10.4 - BALLY TECHNOLOGIES, INC. | a2221830zex-10_4.htm |

| EX-31.1 - EX-31.1 - BALLY TECHNOLOGIES, INC. | a2221830zex-31_1.htm |

| EX-10.3 - EX-10.3 - BALLY TECHNOLOGIES, INC. | a2221830zex-10_3.htm |

| EX-32.2 - EX-32.2 - BALLY TECHNOLOGIES, INC. | a2221830zex-32_2.htm |

QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended June 30, 2014 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to

Commission File Number 001-31558

BALLY TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| NEVADA (State or other jurisdiction of incorporation or organization) |

88-0104066 (I.R.S. Employer Identification No.) |

6601 S. Bermuda Rd. Las Vegas, Nevada 89119

(Address of principal executive offices)

(702) 584-7700

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each Exchange on which registered | |

|---|---|---|

| Common Stock, $0.10 par value per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ý Yes o No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes ý No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ý Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act). (Check one):

| ý Large accelerated filer | o Accelerated filer | o Non-accelerated filer | o Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes ý No

The aggregate market value of the common stock, $0.10 par value, held by non-affiliates of the registrant, computed based on the closing sale price as of December 31, 2013 of $78.45 per share as reported by the New York Stock Exchange, was approximately $3,004,000,000.

According to the records of the registrant's registrar and transfer agent, the number of shares of the registrant's common stock outstanding as of October 16, 2014 was 38,355,000, which does not include 27,800,000 shares held in treasury.

Documents Incorporated by Reference: None.

Unless the context indicates otherwise, all references to "Bally," "we," "our," and the "Company" refer to Bally Technologies, Inc. and its consolidated entities.

This Amendment No. 1 on Form 10-K/A (the "Amendment No. 1") to our Annual Report on Form 10-K for the year ended June 30, 2014, filed with the Securities and Exchange Commission ("SEC") on August 29, 2014 (the "Annual Report"), is being filed solely to amend Part III, Item 10 through 14.

As required by the rules of the SEC, this Amendment No. 1 sets forth amended Part III, Item 10 through 14, in its entirety and includes new certifications of our Chief Executive Officer and Chief Financial Officer (Exhibits 31.1, 31.2, 32.1 and 32.2).

Except as set forth above, no changes have been made to the Annual Report, and this Amendment No. 1 does not amend, modify or update in any way any of the financial statements of the Company or other information contained in the Annual Report. This Amendment No. 1 does not reflect events that may have occurred subsequent to the filing date of the Annual Report. Accordingly, this Amendment No. 1 should be read in conjunction with the Annual Report and the Company's filings with the SEC subsequent to the filing of the Annual Report.

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

A. Identification of Directors

The Board of Directors of Bally (the "Board") is comprised of six directors (each a "Director" and collectively, the "Directors"). The Directors are divided into three classes, Class I, Class II, and Class III, each of which currently consists of two Directors. The term of each Director in each respective Class expires in the year noted below when the Director's successor is duly elected and qualified.

On May 15, 2014, the Board announced the appointment of Richard M. Haddrill as Chief Executive Officer of the Company, effective May 23, 2014. Prior to his appointment as Chief Executive Officer, Mr. Haddrill was the non-executive Chairman of the Board. David Robbins, who had been serving as the Board's Lead Independent Director, was appointed Chairman of the Board, effective May 23, 2014. On that date, Ramesh Srinivasan ceased to be a member of the Board and the Board appointed Michael A. Klayko to fill Mr. Srinivasan's Board seat, effective July 1, 2014.

Set forth below is biographical and other information about the Directors, including information concerning the particular experience, qualifications, attributes and skills that led the Nominating and Corporate Governance Committee and the Board to determine that each should serve as a Director.

Class I Directors serving until 2016:

Richard M. Haddrill. Mr. Haddrill, age 61, became a director in April 2003 and Chief Executive Officer on May 23, 2014. Mr. Haddrill served as the non-executive Chairman of the Board from December 2012 until his appointment as the Chief Executive Officer in May 2014. Mr. Haddrill had previously served as the Company's Chief Executive Officer from October 1, 2004 to December 14, 2012. Prior to becoming the Company's Chief Executive Officer in 2004, Mr. Haddrill most recently served as Chief Executive Officer and as a member of the Board of Directors of Manhattan Associates, Inc., a global leader in software solutions to the supply chain industry. He continued to serve as Vice Chairman of the Board of Manhattan Associates until May 2006. Mr. Haddrill also served

1

as President and Chief Executive Officer and as a member of the Board of Directors of Powerhouse Technologies, Inc., a technology and gaming company, from September 1996 to June 1999, when Powerhouse was acquired by Anchor Gaming. Mr. Haddrill previously served as an Area Managing Partner for Ernst & Young ("E&Y"). In June 2012, Mr. Haddrill joined the Board of Directors of Corrective Education Company, a company involved in providing training and education alternatives to judicial prosecution, and became Chairman of the Board in December 2012. Mr. Haddrill previously served on the Boards of Directors of True Demand Software, Inc., a supply chain solutions company, Danka Business Systems, Ltd., a provider of digital imaging systems and services, Outlooksoft, a provider of corporate performance management software based solutions, and JDA Software Group Inc., a leading provider of innovative supply chain management, merchandising and pricing excellence solutions worldwide. Mr. Haddrill serves on the Board of Directors of the American Gaming Association and previously served as the Chairman of the Board from 2011 to 2013. Mr. Haddrill is on the Board of Directors of the Smith Center for the Performing Arts and the Advisory Board of the Las Vegas Area Council of Boy Scouts of America. As the Chief Executive Officer of the Company, Mr. Haddrill brings a deep understanding of Bally's business, operations and strategic planning to the Board. He also brings expansive knowledge of both the gaming and technology industries from his current and prior management and director positions at other gaming and technology companies and from his service as Chairman of the American Gaming Association.

Josephine Linden. Mrs. Linden, age 62, became a director in April 2011 and is the Chair of the Compensation Committee and a member of the Audit Committee. In 2008, Mrs. Linden retired from Goldman Sachs as a Partner and Managing Director after being with the firm for more than 25 years, where she held a variety of roles, including Managing Director and Regional Manager of the New York office for Private Wealth Management, and head of Global Equities Compliance, and acted as an Advisor to GSJBWere, Australia. Mrs. Linden is also a principal of Linden Global Strategies, a wealth management advisory firm that is a registered investment advisory group, founded in 2011. In March 2014, Mrs. Linden joined the Board of Directors of Lands' End, Inc. and is the Chair of the Compensation Committee and a member of the Audit Committee. In October 2014, Mrs. Linden became Chairman of the Board of Lands' End, Inc. In October 2012, Mrs. Linden joined the Board of Directors of Sears Hometown and Outlet Stores, Inc., a national retailer of home appliances, hardware, tools and lawn and garden equipment, and is the Chair of the Nominating and Governance Committee and a member of the Audit Committee. Mrs. Linden was an Adjunct Professor in the Finance department of Columbia Business School from 2010 to 2012. Mrs. Linden brings extensive knowledge of capital markets and other financial matters to the Board from her 25-year career with Goldman Sachs. She also brings important experience in international businesses matters, a topic relevant to the Company's international expansion, developed while at Goldman Sachs and through her current service for various foundations.

Class II Directors serving until 2014:

Robert Guido. Mr. Guido, age 68, became a director in December 2006 and is the Chair of the Audit Committee and a member of the Nominating and Corporate Governance Committee and was a member of the Compensation Committee until August 19, 2014. Mr. Guido retired from E&Y in June 2006 where he was Vice Chair and Chief Executive Officer of E&Y's Assurance and Advisory Practice. In these roles, he was responsible for overall business strategy and had significant dealings with both the SEC and the Public Company Accounting Oversight Board ("PCAOB") on behalf of the firm. During his 38-year career at E&Y, Mr. Guido also co-chaired the firm's Global Client Steering Committee and served as a senior advisory or engagement partner to numerous global companies. Since April 2007, Mr. Guido has served as a member of the Board of Directors and presently chairs the Audit Committee of Commercial Metals Company, a manufacturer, recycler, and distributor of steel and metal products. Since May 2007, Mr. Guido has also been a member of the Board of Trustees and Chair of the Audit Committee of Siena College, a liberal arts college near Albany, NY. Since

2

October 2011, Mr. Guido has served as a member of the Board of Directors and currently chairs the Audit/Finance Committee of North Highland, a private global consulting company in Atlanta, GA. In January, 2012, Mr. Guido was appointed to serve a three-year term to the PCAOB's Standing Advisory Committee in Washington, D.C. and was recently appointed to the National Association of Corporate Directors Risk Oversight Advisory Council. Mr. Guido brings a significant level of financial and accounting expertise to the Board that he developed throughout his 38-year career at E&Y. His service as a senior advisory and engagement partner to numerous global companies also provides him with an in-depth understanding of the range of issues facing global companies. He brings important knowledge of and experience with the SEC and PCAOB from both his current position and his prior dealings with those agencies while working as a public accountant. He also has a valuable background in corporate governance and enterprise risk management based on his experience as a guest lecturer and author on corporate governance and enterprise risk management best practices.

Michael A. Klayko. Mr. Klayko, age 60, became a director in July 2014 and is a member of the Audit Committee and Compensation Committee. Mr. Klayko currently serves as the Chairman of the Board of Directors and as a member of the Compensation Committee of Allscripts Healthcare Solutions, Inc. Mr. Klayko also currently serves as a member of the Board of Directors and as a member of the Compensation Committee of PMC-Sierra, Inc. Mr. Klayko is the Chief Executive Officer of MKA Capital, LLC, an investment company focused on technology investments. He previously served as Chief Executive Officer of Brocade Communications Systems, Inc. from 2005 until 2013. Additionally, Mr. Klayko has held executive positions at Rhapsody Networks (including as its Chief Executive Officer), McDATA, EMC Corporation, Hewlett-Packard Company, and International Business Machines Corporation. Mr. Klayko brings 35 years of experience in the storage, computer and telecommunications industries.

Class III Directors serving until 2015:

W. Andrew McKenna. Mr. McKenna, age 68, became a director in April 2011 and is the Chair of the Nominating and Corporate Governance Committee and a member of the Audit Committee. Mr. McKenna currently serves as a member of the Board of Directors and as Audit Committee Chair of AutoZone, Inc., a retailer and distributor of automotive replacement parts and accessories. From March 2010 until September 2011, he was the Chairman of the Supervisory Board of Georgia BioMass, LLC, a wholly-owned subsidiary of RWE Innogy, a company that plans, builds and operates facilities generating power from renewable energies. He previously served as Lead Director and Audit Committee Chair for Danka Business Systems, Ltd., a provider of digital imaging systems and services, and President and member of the Board of Directors of SciQuest.com Inc., a provider of on-demand procurement and supplier management solutions. Prior to that, Mr. McKenna held various positions with The Home Depot Inc. from 1990 to 1999, including Senior Vice President of Strategic Business Development, Division President, and Chief Information Officer. Mr. McKenna also spent 16 years as a management consultant with Touche Ross & Co (a predecessor firm of Deloitte Consulting) including 10 years as a partner ending in 1990. Mr. McKenna brings a significant level of financial and accounting expertise to the Board developed during his tenure with Touche/Deloitte and his service on audit committees of other public companies. This experience also brings important knowledge of and experience with the requirements and guidelines of the SEC and PCAOB. Mr. McKenna's prior service as a public company executive officer provides further insight of management's day-to-day actions and responsibilities. Mr. McKenna's service on other boards of directors also adds a depth of knowledge to the Board regarding best practices in corporate governance.

David Robbins. Mr. Robbins, age 54, became the Chairman of the Board on May 23, 2014 and is a member of the Compensation Committee, Audit Committee, and Nominating and Corporate Governance Committee. Mr. Robbins served as a director of the Company from July 1994 to September 1997 (and as Chairman of the Board from February 1997 through September 1997) and

3

then rejoined Bally as a director (and Chairman) in December 1997, serving as Chairman through December 2010. From October 2013 to May 2014, Mr. Robbins served as the Lead Independent Director and presided over executive sessions of non-employee directors. From 1984 to 2004, Mr. Robbins practiced corporate, securities and real estate law at Cahill Gordon & Reindel LLP and Kramer Levin Naftalis & Frankel LLP, and then at other mid-sized law firms in New York City. Mr. Robbins was also a licensed CPA (inactive status) in the state of New York. Since January 2003, Mr. Robbins has co-managed investment funds, with an emphasis in the healthcare field, and in 2005 he was one of the co-founders of Trevi Health Capital, which manages private investments in the healthcare field. He serves on the boards of directors of various private companies in which the Trevi Health Capital funds have invested, and as a trustee or member of a steering committee of various not-for-profit entities, including the McCarton Foundation and the NYU Langone Medical Center Comprehensive Epilepsy Center. Mr. Robbins brings experience in corporate and securities law to the Board from his 20-year career as an attorney, as well as expertise in the management and allocation of investment capital from his 10+ years of managing investment funds. He also brings other directorship experience through his management and allocation of investment capital and service on various private company boards. Finally, Mr. Robbins serves as a valuable resource of institutional knowledge as he has served on the Company's Board for 20 years.

B. Identification of Executive Officers

The following sets forth information about the Company's executive officers and their business experience and other pertinent information, except for Mr. Haddrill, whose biography is listed above in Board of Directors.

Neil Davidson. Mr. Davidson, age 42, joined Bally in February 2006 as Vice President of Corporate Accounting and was appointed Chief Accounting Officer in May 2008. On August 12, 2010, Mr. Davidson was promoted to Senior Vice President, Chief Financial Officer, Secretary and Treasurer. On January 2, 2014, Mr. Davidson was appointed Secretary. From 2002 to 2006, Mr. Davidson was the Vice President of Finance for Multimedia Games, Inc., a gaming equipment and systems company. Mr. Davidson began his career with KPMG in the Houston office, holding several positions during his tenure, the last of which was Audit Manager. Mr. Davidson is a certified public accountant.

Kathryn S. Lever. Ms. Lever, age 45, joined Bally in 2014 as the Senior Vice President and General Counsel. Prior to joining Bally, Ms. Lever was the Executive Vice President and General Counsel of SHFL entertainment, Inc. ("SHFL") since 2011. Prior to that she was General Counsel and Executive Vice President of Global Cash Access, the gaming industry's largest cash access provider, since 2005, and prior to that was a Partner with the Las Vegas law firm Schreck Brignone (now Brownstein Hyatt Farber Schreck). Before joining Schreck Brignone, Ms. Lever practiced law in Canada representing high-tech and bio-tech companies in private and public equity transactions.

Derik Mooberry. Mr. Mooberry, age 41, joined Bally in November 2001 and is currently the Senior Vice President of Games, Table-Game Products, and Interactive Research & Development. Mr. Mooberry has held several other senior positions at Bally including Vice President of Systems Operations, Vice President of Strategic Planning, Vice President of System Sales—Western North America, Vice President of North America Game Sales, and Vice President of Sales—Americas. Mr. Mooberry joined Bally as a result of the Casino Marketplace Development Corporation acquisition. Mr. Mooberry also spent six years working at Arthur Andersen in various audit and business consulting roles. Mr. Mooberry is a certified public accountant.

John Connelly. Mr. Connelly, age 44, initially joined Bally in 2004 as Vice President of Governmental Markets, and was promoted to Vice President International in 2005, which included overseeing Gaming

4

Operations from 2008 to 2009. Mr. Connelly left Bally as an employee in 2010 and served as a consultant to the Company until he rejoined Bally in 2011 as Vice President of Business Development and is currently the Senior Vice President of Business Development and Interactive. Mr. Connelly has more than 20 years of experience in the global gaming industry, at one time serving as Senior Vice President of Sales for Oberthur Gaming Technologies Corporation, as Vice President of Sales and Marketing for Automated Wagering International, Inc., and as an Account Executive for GTECH Corporation, and in other times as a consultant.

C. Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company's directors and executive officers, and persons who own more than 10% of a registered class of the Company's equity securities, to file with the SEC and the NYSE initial reports of ownership and reports of changes in ownership of the Company's common stock and other equity securities. To the Company's knowledge, all Section 16(a) filing requirements applicable to the Company's directors, executive officers, and greater than 10% beneficial owners were complied with on a timely basis during the fiscal year ended June 30, 2014.

D. Code of Ethics

The Board of Directors has adopted a Code of Ethics and Business Conduct (the "Code of Ethics") applicable to all of the Company's directors, officers and employees. The Code of Ethics, along with the Corporate Governance Guidelines, serves as the foundation for the Company's system of corporate governance. Among other things, the Code of Ethics:

- •

- provides guidance for maintaining ethical behavior;

- •

- requires that directors, officers and employees comply with applicable laws and regulations;

- •

- addresses how individuals should handle Company assets and opportunities;

- •

- prohibits conflicts of interest; and

- •

- provides mechanisms for reporting violations of the Company's policies and procedures.

In the event the Company makes any amendment to, or grants any waiver from, a provision of the Code of Ethics that applies to the Company's principal executive officer, principal financial officer, or principal accounting officer that requires disclosure under applicable SEC rules, the Company intends to disclose the amendment or waiver and the reasons therefor on its website www.ballytech.com. The full text of the Code of Ethics is available on the Company's website www.ballytech.com, by following links to "Investor Relations" and "Governance" or upon written request to the Company, at Bally Technologies, Inc., 6650 El Camino Road, Las Vegas, Nevada 89118, Attention: Investor Relations.

E. Director Nominees

There have been no material changes to the procedures by which security holders may recommend nominees to the Board of Directors.

F. Audit Committee

The Audit Committee of the Board of Directors is comprised of Messrs. Guido (Chair), McKenna, Robbins and Klayko and Mrs. Linden. The Audit Committee, among other things:

- •

- reviews and engages an independent registered public accounting firm to audit the Company's financial statements;

- •

- reviews the policies and procedures of the Company and management in maintaining the Company's books and records and furnishing information necessary to the independent auditors;

5

- •

- reviews and discusses the adequacy and implementation of the Company's internal controls, including the internal audit

function and the adequacy and competency of the relevant personnel;

- •

- considers financial risk, including internal controls and discusses the Company's risk profile with the Company's

independent registered public accounting firm;

- •

- reviews potential violations of the Company's Code of Ethics and related corporate policies; and

- •

- reviews and determines such other matters relating to the Company's financial affairs and accounts as the Audit Committee may in its discretion deem desirable.

The Board has affirmatively determined that Messrs. Guido, McKenna, Robbins and Klayko and Mrs. Linden are financially literate, as required by Section 303A.07(a) of the NYSE Listed Company Manual, as such qualification is interpreted by the Company's Board in its business judgment. In addition, the Board has determined that Messrs. Guido, McKenna, and Robbins are audit committee financial experts, as defined in Item 407(d)(5) of SEC Regulation S-K. The Board made these determinations based on Messrs. Guido's, McKenna's and Robbins's respective qualifications and business experience, as described above under "Identification of Directors."

G. Corporate Governance

The Company monitors developments in the area of corporate governance and routinely reviews its processes and procedures in light of such developments. Accordingly, the Company reviews federal laws affecting corporate governance such as the Sarbanes Oxley Act of 2002 and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, as well as various rules promulgated by the SEC and the NYSE. The Company believes that it has procedures and practices in place that are designed to enhance and protect the interests of its stockholders.

The full text of the Corporate Governance Guidelines is available on the Company's website www.ballytech.com by following links to "Investor Relations" and "Governance," or upon written request to the Company, at Bally Technologies, Inc., 6650 El Camino Road, Las Vegas, Nevada 89118, Attention: Investor Relations.

H. Communication with the Board of Directors

Stockholders and other interested parties may communicate directly with individual directors, the Board as a group, or with non-employee directors as a group, by writing to Board of Directors, Bally Technologies, Inc., 6601 South Bermuda Road, Las Vegas, Nevada 89119, or by email to boardofdirectors@ballytech.com, indicating to whose attention the communication should be directed. All communications will be received and processed by the Company's legal department unless indicated otherwise. Communications about accounting, internal controls and audits will be referred to the Audit Committee, and other communications will be referred to the Chairman of the Board of Directors. You may communicate anonymously if you wish.

Individuals may submit at any time a good faith complaint regarding any questionable accounting, internal controls or auditing matters concerning the Company without fear of dismissal or retaliation of any kind. Anonymous reports may be made confidentially:

- 1.

- By

Company employees pursuant to the Company's Corporate Integrity hotline procedures; or

- 2.

- By all other individuals by either (i) writing to Chair of the Audit Committee, Bally Technologies, Inc., 6601 South Bermuda Road, Las Vegas, Nevada 89119, in an envelope marked confidential; or (ii) sending an email to boardofdirectors@ballytech.com with a reference to "confidential accounting related matters" in the subject line.

6

ITEM 11. EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

INTRODUCTION

This Compensation Discussion and Analysis provides a detailed description of the Company's executive compensation philosophy and programs, the compensation decisions made by the Compensation Committee (the "Committee") for the fiscal year ending June 30, 2014, and the considerations for such decisions. Our executive compensation programs are designed to attract, reward and retain our executive officers, yet do so cost effectively so the long-term interests of the Company and our stockholders are well balanced. This Compensation Discussion and Analysis focuses on the compensation of our Named Executive Officers for the fiscal year ending June 30, 2014, who were:

Name

|

Title | |

|---|---|---|

| Richard M. Haddrill(1) | Chief Executive Officer | |

Neil Davidson |

Senior Vice President, Chief Financial Officer, Secretary and Treasurer |

|

Kathryn S. Lever |

Senior Vice President and General Counsel |

|

Derik Mooberry |

Senior Vice President of Games, Table-Game Products, and Interactive Research & Development |

|

John Connelly |

Senior Vice President of Business Development and Interactive |

|

Ramesh Srinivasan |

Former Chief Executive Officer and President |

- (1)

- Effective May 23, 2014, Mr. Haddrill became the Chief Executive Officer of the Company.

EXECUTIVE SUMMARY

Overview of Executive Compensation

The Compensation Committee monitors the results of the annual advisory "Say-on-Pay" vote and incorporates such results as one of many factors considered in connection with the discharge of its responsibilities. At the Company's 2013 Annual Meeting of Stockholders held on December 5, 2013, the stockholders were presented an opportunity to vote on an advisory basis with respect to the compensation of the Company's Chief Executive Officer and the other Named Executive Officers. Approximately 80% of votes cast voted in favor of the advisory vote proposal. When establishing the 2014 executive compensation program, the Compensation Committee considered, among other things, the 2013 vote results.

Additionally, the Compensation Committee obtained feedback, advice and recommendations on compensation best practices from its external compensation consultants, Steven Hall & Partners ("SH&P") and Frederic W. Cook & Co. ("Frederic Cook"). The Compensation Committee also reviewed the Company's performance, the compensation practices of its peers with respect to the Chief Executive Officer's and Chief Financial Officer's compensation and compensation surveys and other materials regarding the compensation of the other Named Executive Officers and the other matters discussed below under "How We Make Compensation Decisions—Competitive Marketplace

7

Assessment." In addition, the Compensation Committee also considered competitive pressures in the technology space, market conditions for talent with gaming, international and technology experience, and a balance between providing long-term incentives aligned with market pressures and stockholder interests versus the overall cost of these programs to the Company.

Overall, the Compensation Committee has substantially maintained its executive compensation policies and reaffirmed the philosophy of aligning pay with the interests of stockholders and linking pay and performance. The Compensation Committee believes that the executive compensation policies and philosophy currently in effect have supported our strong Fiscal Year 2014 financial performance.

How Pay Ties to Company Performance

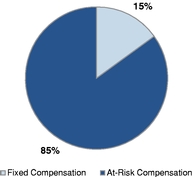

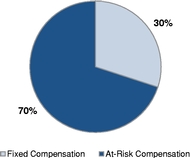

Our executive compensation program is designed to align executive compensation with the interests of our stockholders through the achievement of the Company's business objectives and individual executive contributions towards those objectives. The majority of compensation for our Named Executive Officers is at-risk compensation, which consists of annual incentive payments and long-term equity-based compensation. In Fiscal Year 2014, at-risk compensation averaged 85% of total compensation for our Chief Executive Officer, Mr. Haddrill and our former Chief Executive Officer and President, Mr. Srinivasan, and 70% for the other Named Executive Officers, who were employees of the Company as of the fiscal year end.

| CEO 2014 Fixed vs. At-Risk Compensation |

Other Named Executive Officers 2014 Fixed vs. At-Risk Compensation (Average) |

|

|---|---|---|

|

|

Fiscal Year 2014 Business Highlights

In Fiscal Year 2014, the Company accomplished the following:

- •

- Completed the acquisition of SHFL for $1.38 billion;

- •

- Increased total revenues in Fiscal Year 2014 by $218 million, or 22%, as compared to Fiscal Year 2013;

- •

- Increased Electronic Gaming Machine ("EGM") revenues by $42 million, or 12%, in Fiscal Year 2014 over 2013;

- •

- Increased Systems revenues by $76 million, or 30%, in Fiscal Year 2014 over 2013;

- •

- Generated Table Products revenues of $100 million resulting from the acquisition of SHFL; and

- •

- Increased cash flows provided by operating activities by $17 million in Fiscal Year 2014 over 2013 to $222 million from $205 million, respectively.

Consistent with our strong performance and pay for performance philosophy, annual incentive payments for Fiscal Year 2014 were earned at 116% of target, on average. For more information about the Company's financial performance and measures, see the Company's Annual Report.

8

Executive Compensation Program Highlights

The Company's executive compensation program is designed to drive performance and promote good corporate governance and we have highlighted some of these practices below. We have also highlighted the practices that we have intentionally not implemented as we do not believe that such practices would serve our stockholders' long-term interests.

- ü

- Majority of Pay is Variable. The majority of the

total compensation opportunity for our Named Executive Officers is not fixed. It is based upon the achievement of corporate and individual performance objectives designed to enhance stockholder value

or to promote continued service with the Company, which we believe is also in the best long-term interests of our stockholders.

- ü

- Stock Ownership Guidelines. We have stock ownership

guidelines for our Named Executive Officers. Our Chief Executive Officer has a guideline equal to three times his base salary.

- ü

- Annual Risk Assessment. In Fiscal Year 2014, as in

previous years, the Compensation Committee reviewed and analyzed the Company's comprehensive compensation policies and practices concluding that our executive compensation programs do not encourage

behaviors that would create risks reasonably likely to have a material adverse effect on the Company.

- ü

- Double-Trigger Severance. In the event of a

change-in-control, post termination benefits for each Named Executive Officer who is currently an executive officer would not be payable unless such Named Executive Officer is terminated within one

year of the change-in-control, i.e., a so-called "double trigger."

- ü

- Reasonable Change in Control Severance

Provisions. We believe we have reasonable post-employment and change in control cash severance provisions for our Named Executive Officers that do not exceed three

times base salary plus bonus.

- ü

- Minimal Perquisites. We provide our Named Executive

Officers with minimal perquisites.

- ü

- Minimum Vesting Periods. In accordance with the

terms of the Amended and Restated Bally Technologies, Inc. 2010 Long Term Incentive Plan (the "2010 LTIP"), grants of restricted stock and restricted stock units ("RSUs"), including RSUs that

vest based upon the achievement of specified performance metrics, to our Named Executive Officers are subject to minimum vesting periods of not less than twelve months for awards subject to

performance conditions and three years for awards based only upon continued employment.

- ü

- Independent Compensation Consulting Firm. In Fiscal

Year 2014, the Compensation Committee reviewed and analyzed a number of factors, including those pursuant to Item 407(e)(3)(iii) of SEC Regulation S-K, and concluded that SH&P and

Frederic Cook, its compensation consulting firms, were independent and there were no conflicts of interest raised as a result of any work performed by SH&P and Frederic Cook, directly or indirectly,

for the Committee during Fiscal Year 2014.

- ü

- Assessment of Compensation Advisor Independence. Prior to considering such advice before the Committee, the Compensation Committee assesses the independence of any person or entity providing compensation advice to the Committee (i.e., outside legal counsel, accountants, any Compensation Consultants), regardless of whether such adviser is retained directly by the Committee.

What We Do:

9

- ü

- No-Hedging Policy. Our directors and officers,

including our Named Executive Officers, are prohibited from hedging their ownership of the Company's stock, including trading in options, puts, calls or other derivative instruments related to Company

stock or debt.

- ü

- No-Pledged Securities. Our Insider Trading policy

cautions directors and officers, including our Named Executive Officers, against pledging shares of the Company. In Fiscal Year 2014, no director or Named Executive Officer pledged any shares of the

Company's common stock.

- ü

- No Tax Gross-Ups. We do not provide tax gross-ups

on any severance or change-in-control payments.

- ü

- No Repricing of Awards. Repricing of underwater

stock options and other awards is expressly prohibited under the 2010 LTIP without stockholder approval. The Company does not have a history of repricing equity incentive awards for executive

officers.

- ü

- No Above Market Returns. We do not offer

preferential or above market returns on deferred compensation.

- ü

- No Underpriced Stock Options. We do not grant stock options with exercise prices that are below the fair market value of the Company's common stock on the date of grant.

What We Don't Do:

OUR COMPENSATION PHILOSOPHY AND OBJECTIVES

Philosophy

Our executive compensation philosophy, which has been adopted by the Compensation Committee, is designed to align executive compensation with the achievement of the Company's business objectives and with individual performance towards obtaining those objectives. The Compensation Committee believes executive compensation should be weighted towards at-risk pay. This emphasis on at-risk pay is consistent with the philosophy of paying for performance. In considering the elements of the compensation program, the Compensation Committee emphasizes pay for performance on both an annual and long-term basis and consideration of marketplace best practices.

Objectives

The compensation program for our executive officers is designed to achieve the following objectives:

- •

- attract and retain key executives critical to the Company's long-term vision and success;

- •

- motivate executives to enhance long-term stockholder value by focusing on performance metrics such as growth,

productivity, profitability and operating margins;

- •

- provide an appropriate mix between fixed and at-risk compensation;

- •

- maintain cost effective programs that are prudent for our industry, Company size and growth expectations;

- •

- provide competitive compensation opportunities; and

- •

- enhance stockholder value by linking a large portion of Named Executive Officer compensation to the Company's overall performance, as reflected in the value of the Company's common stock.

The gaming industry is highly competitive and has a limited pool of executive officer candidates with the desired level of industry expertise. The Compensation Committee considers information from a variety of sources when assessing the competitiveness of the Company's current and future compensation levels. These sources include, but are not limited to, management, other members of the

10

Board, publicly available compensation data regarding executive officers both within and outside the industry, the Company's understanding of compensation arrangements at other gaming companies, and advice from the Compensation Committee's consultants. In addition, the Compensation Committee reviewed compensation analyses prepared by SH&P and Frederic Cook detailing compensation arrangements for named executive officers at companies that are considered to be competing for the same key executive officer candidates, and the other matters discussed below under "How We Made Compensation Decisions—Competitive Marketplace Assessment."

Elements of Executive Compensation

In designing our executive compensation program, the Compensation Committee takes into account how each element motivates performance, aligns with stockholder interests and promotes retention. Although the final structure may vary from year to year and executive to executive, the Compensation Committee utilizes three main components designed to help achieve the objectives of our compensation philosophy:

- •

- base salary;

- •

- annual incentive; and

- •

- long-term incentives.

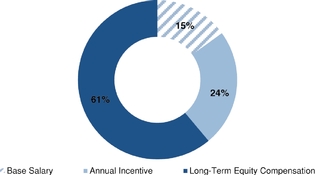

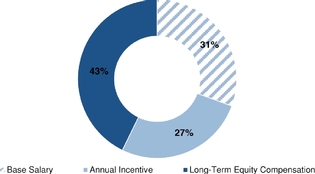

In addition, each Named Executive Officer is also eligible to receive certain benefits, which are generally provided to all other eligible employees, and certain minimal perquisites as described below. The following charts show the average percentage by component of Mr. Haddrill's, our Chief Executive Officer, and Mr. Srinivasan's, our former Chief Executive Officer and President, combined compensation, and the other Named Executive Officers' compensation, excluding any benefits or perquisites:

| CEO 2014 Total Compensation |

Other Named Executive Officers 2014 Total Compensation (Average) |

|

|---|---|---|

|

|

Base Salary

General. Base salary provides the executive officer with a measure of security regarding the minimum level of compensation he or she will receive for meeting day to day responsibilities, while the annual and long-term incentive components motivate the executive officer to focus on business metrics that will produce a high level of Company performance over the short- and long-term. The Compensation Committee believes this approach not only leads to increases in stockholder value and long term wealth creation for the executive, but also promotes retention.

The Compensation Committee annually reviews the base salary of each Named Executive Officer. These reviews include consideration of, among other things, factors such as:

- •

- the review and recommendation to the Board of the Company's compensation philosophy;

11

- •

- the Company's overall performance;

- •

- new duties and responsibilities assumed by the executive;

- •

- the overall performance of the executive's area of responsibility;

- •

- any previously negotiated agreement between the Company and the executive regarding base salary;

- •

- comparison to industry peers;

- •

- the executive's impact on strategic goals; and

- •

- the executive's length of service with the Company.

There is no specific weighting applied to any one factor in setting the level of base salary; the process ultimately relies on the Compensation Committee's judgment.

Increases in 2014. During Fiscal Year 2014, the Compensation Committee assessed each Named Executive Officer's current base salary levels in light of the factors listed above as well as the Compensation Committee's understanding of the competitive marketplace and the executive's experience and compensation levels prior to joining Bally. Base salary may also be adjusted to recognize a promotion or change in the individual's role; however, increases are not guaranteed upon such events.

The base salary increases awarded during Fiscal Year 2014 for the Named Executive Officers, if any, were as follows:

Executive

|

2014 Base Salary |

2014 vs. 2013 |

Date of Most Recent Adjustment |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Richard M. Haddrill(1) |

$ | 1,000,000 | — | — | ||||||

Neil Davidson(2) |

400,000 | 8 | % | 12/04/2013 | ||||||

Kathryn S. Lever(1) |

315,000 | — | — | |||||||

Derik Mooberry(3) |

330,000 | 10 | % | 12/04/2013 | ||||||

John Connelly(4) |

275,000 | 17 | % | 12/04/2013 | ||||||

Ramesh Srinivasan(5) |

825,000 | — | — | |||||||

- (1)

- On

May 23, 2014, Mr. Haddrill became Chief Executive Officer and on January 1, 2014, Kathryn S. Lever became Senior Vice President and

General Counsel. The compensation paid to Mr. Haddrill in his capacity as Chief Executive Officer and Ms. Lever in her capacity as Senior Vice President and General Counsel is described

in greater detail below in the Summary Compensation Table and under "Executive Compensation—Narrative to the Summary Compensation Table and Grants of Plan Based Awards

Table—Employment and Other Agreements with Named Executive Officers."

- (2)

- On

December 4, 2013, Mr. Davidson's base salary was increased primarily based on the results of a competitive study discussed below under "How

We Make Compensation Decisions—Competitive Marketplace Assessment—Chief Financial Officer Compensation Considered at Peer Companies" in which it was concluded that increases in

base salary, target annual bonus percentage and long-term incentives were warranted.

- (3)

- On

December 4, 2013, Mr. Mooberry's base salary was increased based on performance as recommended by the Chief Executive Officer.

- (4)

- On

December 4, 2013, Mr. Connelly's base salary was increased based on performance as recommended by the Chief Executive Officer.

- (5)

- On May 23, 2014, Ramesh Srinivasan's employment with the Company ended.

12

Annual Incentives

General. The Company believes that annual incentives tied to company-wide performance metrics are an effective means of motivating and rewarding executives, including the Named Executive Officers, to enhance short- and long-term stockholder value. The Compensation Committee establishes the target incentive opportunities, the range of possible incentive awards, the applicable performance measures and the level of performance that will correspond to a particular incentive payment. The target opportunity is expressed as a percentage of the Named Executive Officer's base salary in effect at the time the target is established.

For each Named Executive Officer participating in the Company's Management Incentive Plan (the "MIP"), annual performance bonuses are tied to the Company's overall performance, as well as to both the performance of each individual executive and the performance of his or her area of responsibility. Annual awards under the MIP are payable in cash; however, the Compensation Committee may elect to distribute any award in the form of restricted stock. The Committee may also modify, amend or eliminate the MIP at any time, and has complete discretion to use business judgment to decide the effect on target awards if the MIP is cancelled part way through a performance period.

Several Named Executive Officers also participate in incentive plans other than the MIP, as described in greater detail below.

Each of the Named Executive Officers currently serving as an executive officer is eligible to participate in the MIP.

Performance Metrics for Fiscal Year 2014. In Fiscal Year 2014, the actual payouts to the Named Executive Officers under the MIP were allocated between Company and individual performance, assuming both Company performance and individual goals were achieved at the target level. For the Named Executive Officers, participating in the MIP, except Messrs. Haddrill and Davidson, the allocation was: (i) 70% of each award was tied to the Company's financial performance and (ii) 30% of each award was tied to individual goals, as determined by the Compensation Committee. For Mr. Haddrill, 100% of the award was tied to Company performance as determined by the Compensation Committee. For Mr. Davidson, the allocation was: (i) 85% of the award was tied to the Company's financial performance and (ii) 15% of the award was tied to individual goals, as determined by the Compensation Committee. The Committee consulted with the current and prior Chief Executive Officers with respect to each other Named Executive Officer's achievement of his or her individual goals.

Company Performance Metric for Fiscal Year 2014. The Compensation Committee sets and approves the Company performance metrics (financial and operational), which are used to assess achievement with respect to 70% of the MIP award (or 85% and 100% in the case of Mr. Davidson and Mr. Haddrill, respectively). The threshold performance level of such Company metrics must be met to receive a payout under the Company performance portion of the MIP. For Fiscal Year 2014, Diluted EPS, as adjusted (if necessary) for non-recurring expenses ("Diluted EPS"), was chosen as the financial performance measure because the Company and the Compensation Committee believed that Diluted EPS is a good indicator of the Company's achievement with respect to its overall business objectives and a significant driver of stock price performance. As a result of the acquisition of SHFL on November 25, 2013, the initial Diluted EPS performance metrics were updated to take into account the newly combined Company.

13

The Compensation Committee established the updated Company performance metric as follows:

| |

Threshold | Target | Maximum | Actual | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Diluted EPS |

$ | 4.01 | $ | 4.28 | $ | 4.66 | $ | 4.34 | (1) | ||||

- (1)

- Actual Diluted EPS was adjusted for one-time items including amortization of purchased intangibles, restructuring and acquisition-related costs, loss on extinguishment of debt, foreign currency losses, net of tax, and certain income tax items.

Individual Performance Metrics for Fiscal Year 2014. The individual performance component of the bonus is based on the Chief Executive Officer's subjective evaluation of the overall performance of each of the Named Executive Officers. At the start of Fiscal Year 2014, Mr. Srinivasan, the then current Chief Executive Officer, set the individual performance targets for the other Named Executive Officers and in January 2014, when Ms. Lever became the Senior Vice President and General Counsel, Mr. Srinivasan set her individual performance targets.

In reaching its determinations, the Compensation Committee reviews the executive's individual accomplishments and efforts during the year as well as recommendations of the Chief Executive Officer with respect to the other Named Executive Officers. The recommendations of the Chief Executive Officer are based on his assessment of each executive's performance against individual goals set by the Chief Executive Officer and the executive. The following briefly outlines the individual goals established for each of the Named Executive Officers eligible to participate in the MIP for Fiscal Year 2014.

- •

- Neil Davidson. Mr. Davidson's individual

performance goals for Fiscal Year 2014 included: (i) support Enterprise Resource Planning ("ERP") implementation; (ii) continue to drive efficient capital structure; (iii) support

business development efforts; and (iv) cultivate relationships with customers and investors.

- •

- Kathryn S. Lever. Ms. Lever's individual

performance goals for Fiscal Year 2014 included: (i) integrate and manage Bally/SHFL legal department; (ii) manage and develop global legal department budget; (iii) effectively

and efficiently protect intellectual property; and (iv) create legal experts to integrate into operational business units.

- •

- Derik Mooberry. Mr. Mooberry's individual

performance goals for Fiscal Year 2014 included: (i) improve game performance; (ii) launch Pro Wave cabinet; (iii) grow wide area

progressive installed base; (iv) improve international game sales; and (v) launch a multi-game platform into the market.

- •

- John Connelly. Mr. Connelly's individual performance goals for Fiscal Year 2014 included: (i) achieve Illinois Video Game Terminal ("VGT") targets; (ii) identify potential acquisitions for Company growth; (iii) identify potential acquisition for an online social casino company; and (iv) go live with online wagering in New Jersey.

During Fiscal Year 2014, with respect to the percentage of MIP opportunity tied to individual performance, the Compensation Committee approved the awards based upon the Committee's qualitative review of individual performance against the goals described above and the recommendation of Mr. Haddrill, the Chief Executive Officer, at 100% of target for each of the Named Executive Officers who had individual performance metrics.

MIP Opportunity and Actual Payout for Fiscal Year 2014. As discussed above, the target opportunity for each Named Executive Officer is expressed as a percentage of the Named Executive Officer's base salary in effect at fiscal year end. The target opportunities for each Named Executive Officer, as reflected in the table below, is set primarily based upon the Compensation Committee's understanding of the marketplace, and, to a lesser degree for Fiscal Year 2014, based upon the compensation analyses

14

prepared by SH&P. Historically, the Compensation Committee typically sets target opportunities for senior executives that report to the Chief Executive Officer at or near 60% of base salary based on its understanding of the marketplace. This was the case for Messrs. Mooberry and Connelly and Ms. Lever in Fiscal Year 2014. For Messrs. Srinivasan and Davidson, the Compensation Committee also considered the compensation analysis prepared by SH&P, and set the target opportunities for Messrs. Srinivasan and Davidson at 100% of base salary, and for Mr. Haddrill, the Compensation Committee also considered the compensation analysis prepared by Frederic Cook, and set his target opportunity at 150% of base salary, which targets were appropriate for their respective positions and responsibilities. In addition, Messrs. Mooberry and Connelly earn incentive compensation from other sales-driven programs discussed in greater detail below.

| |

2014 MIP Opportunity as a Percentage of Base Salary(1) Based Upon Achievement of Company and Individual Performance |

||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Threshold | Target | Maximum | Actual Payout | Actual Payout | ||||||||||||||||||||||||||

| |

As a % of Target |

As a % of Base |

As a % of Target |

As a % of Target |

In U.S. Dollars |

||||||||||||||||||||||||||

Executive

|

Company | Individual | Company | Individual | Company | Individual | Company | Individual | Company | Individual | |||||||||||||||||||||

Mr. Haddrill (2) |

100% | N/A | 150% | N/A | 200% | N/A | 100% | N/A | $ | 218,910 | N/A | ||||||||||||||||||||

Mr. Davidson(3) |

30% | 100% | 85% | 15 | % | 200% | 100% | 116% | 100% | $ | 393,720 | $ | 60,000 | ||||||||||||||||||

Ms. Lever |

30% | 100% | 28% | 12 | % | 200% | 100% | 116% | 100% | $ | 106,207 | $ | 33,729 | ||||||||||||||||||

Mr. Mooberry |

30% | 100% | 42% | 18 | % | 200% | 100% | 116% | 100% | $ | 160,499 | $ | 59,400 | ||||||||||||||||||

Mr. Connelly |

30% | 100% | 42% | 18 | % | 200% | 100% | 116% | 100% | $ | 169,636 | $ | 13,613 | ||||||||||||||||||

Mr. Srinivasan(4) |

30% | 100% | 100% | N/A | 200% | N/A | 116% | N/A | $ | 875,254 | N/A | ||||||||||||||||||||

- (1)

- For

Company performance results between the threshold and target, or between the target and the maximum, the bonus amount is determined by straight line

interpolation.

- (2)

- The

Haddrill Agreement provides for participation in the MIP with the target performance bonus equal to 150% of his base salary, the maximum performance

bonus up to 200% of target performance bonus, and the threshold performance bonus equal to 60% of his target performance bonus. For Fiscal Year 2014, the MIP was prorated and 100% based on Company

performance as determined by the Compensation Committee and for Fiscal Year 2015, the performance objectives will be based on the Company's earnings per share performance.

- (3)

- Based

on the results of the competitive study discussed below under "—How We Make Compensation Decisions—Competitive Marketplace

Assessment—Peer Chief Financial Officer Compensation," the Committee set Mr. Davidson's Fiscal Year 2014 MIP target at 100% of base salary with 85% tied to Company performance and

15% tied to individual objectives.

- (4)

- On May 23, 2014, Mr. Srinivasan ceased as the Chief Executive Officer and President of the Company. As a result, Mr. Srinivasan received a pro-rata amount of the target bonus under the MIP for Fiscal Year 2014 based on his employment agreement.

Operating Income Bonus Plan, Quarterly Objective Bonuses and Sales Commission Program. Mr. Mooberry is the only Named Executive Officer whose annual incentive compensation includes, in addition to the MIP, sales commissions and an Operating Income Bonus Plan. For Fiscal Year 2014, the Operating Income Bonus Plan was based on .07% on global annual operating income of $315 million within a selected number of departments. In Fiscal Year 2014, Mr. Mooberry earned $64,718 in sales commissions including those based on Latin America and Mexico Operating Income and $224,743 in compensation from the Operating Income Bonus Plan.

Mr. Connelly is the only Named Executive Officer whose annual incentive compensation includes, in addition to MIP, sales commissions and a Quarterly Objective Bonus based on achievement of business development activities. Mr. Connelly's total bonus was targeted at $300,000 for Fiscal Year 2014. In Fiscal Year 2014, Mr. Connelly earned $293,958 in sales commissions and $56,250 in compensation from his Quarterly Objective Bonus based upon the achievement of certain business development activities, as determined by Mr. Haddrill or Mr. Srinivasan, as applicable, in his supervision of Mr. Connelly throughout the period.

Long-Term Incentives

General. The Compensation Committee believes that a significant portion of certain Named Executive Officers' target compensation should be in the form of long-term incentives, which motivates leaders

15

and key employees through the use of awards tied to the long-term performance of the Company. These awards are intended to reward performance over a multi-year period, align the interests of executives with those of stockholders, instill an ownership culture, enhance the personal stake of executive officers in the growth and success of the Company and provide an incentive for continued service at the Company. Long-term incentive awards are generally granted under the 2010 LTIP. See "Executive Compensation—Narrative to the Summary Compensation Table and Grants of Plan Based Awards Table—Long-Term Incentive Awards Under the 2010 LTIP" for further description of certain general terms of awards granted under the 2010 LTIP.

In determining whether to award long-term incentives to executives, the Compensation Committee performs an annual review process which includes consideration of factors such as the Company's overall performance, duties and responsibilities assumed by the executive, the overall performance of the executive's area of responsibility, the executive's impact on strategic goals, prior levels of total compensation, the number and mix of each executive's outstanding equity-based awards and the desired emphasis on retention and motivation. However, there is no specific weighting applied to any one factor in determining the level of equity-based awards or the mix between stock options, restricted stock, and RSUs (with or without performance criteria). Instead, the process ultimately relies on a holistic and qualitative assessment of the facts and the exercise of the Compensation Committee's judgment. This mix of long-term incentive awards is designed to motivate, reward and retain our executives.

Fiscal Year 2014 Grants. During Fiscal Year 2014, based on the recommendation of the Chief Executive Officer at the applicable time and the determination of the Compensation Committee, the Company granted restricted stock awards and restricted stock units with performance criteria to certain Named Executive Officers.

The award level for each Named Executive Officer, as reflected in the table below, is set primarily based upon the Compensation Committee's understanding of the marketplace, and with respect to Mr. Haddrill, partially based upon the compensation analyses prepared by Frederic Cook and, with respect to Mr. Davidson, based upon the compensation analyses prepared by SH&P. The Compensation Committee also considered the following factors, with no particular goals or weightings assigned to such factors, when determining award levels: retention, current equity holdings, the allocation of the executive's pay between fixed and variable compensation and historical individual performance. The awards granted in Fiscal Year 2014 were generally subject to the following terms:

- •

- Restricted Stock Awards Granted in Fiscal Year 2014. Vest

over three or four years in equal installments beginning on the first anniversary of the date of grant.

- •

- Restricted Stock Units Granted in Fiscal Year 2014 (with or without performance criteria). Vest either (i) annually in three equal installments beginning on the first anniversary of the date of

16

grant or (ii) in totality at the end of the three year term, in an aggregate number of up to 150% or 200% of the RSUs granted.

| |

Number of Shares | |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Executive

|

RSUs (Performance- Based) |

RSUs | Restricted Stock |

Vesting Terms and Notes | |||||||

Richard M. Haddrill |

30,896 | 23,885 | — | Time-Based Grant: On June 4, 2014, in connection with his appointment as Chief Executive Officer, Mr. Haddrill received a grant of 23,885 RSUs, which vest, subject to continued employment, one-third on the first anniversary of the date of grant and thereafter, in equal semi-annual installments for the next 2 years. | |||||||

|

Performance-Based Restricted Stock Unit Grant: On June 4, 2014, in connection with his appointment as Chief Executive Officer, Mr. Haddrill received a target grant of 30,896 RSUs, which vest, subject to continued employment, annually in three installments subject to the achievement of certain relative total shareholder return targets for the performance period. The performance period is the thirty month period commencing on June 4, 2014. |

||||||||||

Neil Davidson |

7,097 |

— |

8,074 |

Time-Based Grant: On December 4, 2013, Mr. Davidson received a grant of 8,074 restricted stock shares, which vests annually, subject to continued employment, in four equal installments beginning on the first anniversary of the grant date. |

|||||||

|

Performance-Based Restricted Stock Unit Grant: On March 7, 2014, Mr. Davidson received a target grant of 3,549 RSUs, which vest, subject to continued employment, annually in three installments subject to the achievement of certain earning per share targets for the performance periods. The performance periods are July 1, 2014 to June 30, 2015, July 1, 2015 to June 30, 2016, and July 1, 2016 to June 30, 2017. |

||||||||||

|

Performance-Based Restricted Stock Unit Grant: On March 7, 2014, Mr. Davidson received a target grant of 3,548 RSUs, which vest, subject to continued employment, annually in three installments on March 6th subject to the achievement of certain relative total shareholder return targets for each respective fiscal year. |

||||||||||

Kathryn S. Lever |

— |

— |

6,922 |

Time-Based Grant: On November 25, 2013, Ms. Lever received a grant of 6,922 restricted stock shares, which vest annually, subject to continued employment, in four equal installments beginning on the first anniversary of the grant date. |

|||||||

17

| |

Number of Shares | |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Executive

|

RSUs (Performance- Based) |

RSUs | Restricted Stock |

Vesting Terms and Notes | |||||||

Derik Mooberry |

— | — | 4,709 | Time-Based Grant: On December 4, 2013, Mr. Mooberry received a grant of 4,709 restricted stock shares, which vest annually, subject to continued employment, in four equal installments beginning on the first anniversary of the grant date. |

|||||||

John Connelly |

— |

— |

4,037 |

Time-Based Grant: On December 4, 2013, Mr. Connelly received a grant of 4,037 restricted stock shares, which vest annually, subject to continued employment, in four equal installments beginning on the first anniversary of the grant date. |

|||||||

ADDITIONAL COMPENSATION ELEMENTS

Benefits

The Named Executive Officers are entitled to the same employee benefits generally available to all full-time employees, subject to certain conditions such as fulfilling minimum service periods. These benefits include, among other things, vacation, health and welfare benefits, and participation in the 2008 Employee Stock Purchase Plan (the "2008 ESPP") and the Company's 401(k) Savings Plan. Certain other perquisites are also made available to executives, including the Named Executive Officers.

These benefits are intended to provide an overall level of benefits that are competitive with those offered by similarly situated companies in the markets in which the Company operates. The Committee believes that these particular plans and programs provide a valuable recruiting and retention mechanism for its executives and enable the Company to compete more successfully for qualified executive talent. Additional information regarding the specific amounts of these types of benefits paid to the Named Executive Officers is included in the "All Other Compensation" column and the accompanying footnotes in the "Summary Compensation Table" below.

Equity Grants

Executives receive long-term equity awards pursuant to the terms of the 2010 LTIP, which was approved by the Company's stockholders. Awards may also be granted outside of the 2010 LTIP to the extent those grants are permitted by the rules of the NYSE. The Board and, by delegation, the Compensation Committee, administers the 2010 LTIP and establishes the rules for all awards granted under the plan, including grant guidelines, vesting schedules and other provisions. The Board or the Compensation Committee reviews these rules periodically and considers, among other things, the interests of our stockholders, market conditions, information provided by independent advisers, performance objectives and recommendations made by the Chief Executive Officer.

18

The Board or the Compensation Committee reviews awards for all employees. For annual awards, the Compensation Committee reviews the recommendations of the Chief Executive Officer for executives and other employees, modifies the proposed grants in certain circumstances and approves the awards effective as of the date of its approval. Pursuant to the terms of the 2010 LTIP, the Board has delegated certain limited authority to the Chair of the Compensation Committee and the Chief Executive Officer to make equity grants in accordance with the rules established by the Board. The Chief Executive Officer has been delegated limited authority to make equity grants to non-direct reports of the Chief Executive Officer throughout the year. The Chair of the Compensation Committee has been delegated limited authority to make equity grants to all employees.

The exercise price of stock option grants are set at 100% of the closing market price of a share of Company common stock on the date the Board or Compensation Committee approves the grants, or such later date as established by the Board or Compensation Committee at the time of grant, or upon the date such approval is made by the Chair of the Compensation Committee or Chief Executive Officer under the limited delegated authority referenced above, to be reported to the Board or Compensation Committee at its next regularly scheduled meeting. The exercise price of new hire awards and relocation or retention grants is determined as set forth above, except that the exercise price is set on the date of hire or effective date of the underlying agreement providing for such grant rather than the date of the approval thereof (which precedes the date of hire or the underlying agreement).

Employment Agreements and Letters and Post-Termination Payments

The Company has entered into employment agreements or letters with each of the Named Executive Officers. The Compensation Committee determined that the compensation packages provided under these agreements and letters were fair and reasonable on the basis of its assessment of comparable compensation opportunities available to the individuals, including the compensation arrangements of the Named Executive Officer at his or her prior place of employment, in the case of new hires. The specifics of these arrangements are described in detail below under "Executive Compensation—Narrative to the Summary Compensation Table and Grants of Plan Based Awards Table—Employment Agreements and Letters with Named Executive Officers."

Payments Due Upon Termination or a Change in Control. Under the terms of our equity-based compensation plans and their respective employment agreements or letters, the Chief Executive Officer and the other Named Executive Officers are entitled to payments and benefits upon the occurrence of specified events, including termination of employment and upon a change in control of the Company. The specific terms of these arrangements, as well as an estimate of the compensation that would have been payable had they been triggered as of fiscal year-end, are described in detail below under "Executive Compensation—Potential Payments upon Termination or Change in Control at Fiscal Year-End 2014."

In the case of each employment agreement or letter, the terms of these arrangements were set through the course of arms-length negotiations with the Named Executive Officer. As part of these negotiations, the Compensation Committee considered, among other factors, the terms of arrangements for comparable executives employed by companies in the gaming and leisure industries.

At the time of entering into these arrangements, the Compensation Committee considered the aggregate potential obligations of the Company in the context of the desirability of hiring or retaining the individual. The Compensation Committee believes that these arrangements can play a significant role in attracting and retaining key executive officers by providing security to the executive and leadership continuity to the Company.

The 2010 LTIP currently provides for the accelerated vesting of equity awards in the event of a Merger Event (as defined in the 2010 LTIP) in which all of the outstanding shares of Company common stock

19

is exchanged for any lawful consideration and subsequent termination of employment without Cause or for Good Reason (each as defined in the 2010 LTIP), within twelve months after the Merger Event. In addition, certain employment agreements and letters as well as certain forms of equity agreements provide for accelerated vesting of equity-based awards upon either a change in control or a change in control followed by certain terminations of employment.

The Compensation Committee believes that for senior executives, including the Named Executive Officers, accelerated vesting of equity-based awards in the event of a change in control is generally appropriate because in some change in control situations equity of the target company is cancelled making immediate acceleration necessary in order to preserve the value of the award. In addition, the Company relies primarily on long-term incentive awards to provide the Named Executive Officers with the opportunity to accumulate substantial resources to fund their retirement income, and the Compensation Committee believes that a change in control event is an appropriate liquidation point for awards designed for such purpose.

HOW WE MAKE COMPENSATION DECISIONS

The Role of Our Compensation Committee

The Compensation Committee, which is comprised of three independent members of the Company's Board, is responsible for, among other things:

- •

- recommending to the Board the corporate goals and objectives relevant to the Chief Executive Officer's compensation,

evaluating the Chief Executive Officer's performance in light of the corporate goals and objectives adopted by the independent members of the Board and determining and approving the Chief Executive

Officer's compensation level based on this evaluation;

- •

- subject to consultation with the Chief Executive Officer, approving executive compensation arrangements and agreements

(other than the Chief Executive Officer's compensation arrangements), including that of the Company's and its subsidiaries' executives and senior management;

- •

- reviewing and recommending to the Board the criteria by which bonuses to the Company's executives and senior management

are determined, including under the MIP;

- •

- administering, within the authority delegated by the Board, the Company's various long-term incentive plans and such

other stock option or equity participation plans as may be adopted by the Board from time to time;

- •

- reviewing the Company's compensation practices and policies to determine whether they encourage excessive risk taking;

- •

- retaining or obtaining the advice of a compensation consultant, independent legal counsel or other adviser, and the

appointment, compensation and oversight of the work of any compensation consultant, independent legal counsel or other adviser retained by the Compensation Committee; and

- •

- selecting or receiving advice from a compensation consultant, legal counsel or other adviser to the Compensation Committee only after taking into consideration, all factors relevant to that person's independence from management, as required by Section 303A.05(b)(iii) of the NYSE Listed Company Manual.

The Compensation Committee, in consultation with SH&P and Frederic Cook, the independent compensation consultants it has retained, also analyzes the reasonableness of the Company's overall executive compensation program.

20

The Role of Our Management

While the Chief Executive Officer and other senior executive officers may attend meetings of the Compensation Committee, the ultimate decisions regarding executive officer compensation are made solely by the Compensation Committee, subject to Board approval, as applicable. These decisions are based not only on the Compensation Committee's deliberations of executive performance, but also on input requested from outside advisors, including its independent compensation consultants, with respect to, among other things, market data analyses. The final decisions relating to the Chief Executive Officer's compensation are made in executive session of the Compensation Committee without the presence of management. Decisions regarding other executive officers and senior management are typically made by the Compensation Committee after deliberations that include the consideration of recommendations from the Chief Executive Officer.

The Role of the Compensation Committee's Independent Compensation Consultant

The Compensation Committee has historically engaged the services of an independent compensation consulting firm to advise it in connection with executive compensation determinations. The Chair of the Compensation Committee defines the scope of any consultant's engagement. The responsibilities may include, among other things, advising on issues of executive or Board compensation, employment agreements, equity compensation structure and assisting in the preparation of compensation disclosure for inclusion in the Company's SEC filings.

The Compensation Committee retained the services of SH&P and Frederic Cook for Fiscal Year 2014. The Compensation Committee retained SH&P directly and SH&P performed no services for the Company or management during Fiscal Year 2014. In fulfilling its responsibilities, SH&P interacted with management or the Company's other outside advisors when deemed necessary and appropriate. Based on a review of various considerations and a report from SH&P regarding its independence, the Committee determined that the firm is independent from the Company and has no conflicts of interest in its role as compensation consultant to the Committee. In May 2014, the Compensation Committee retained Frederic Cook directly and Frederic Cook performed no services for the Company or management during Fiscal Year 2014. In fulfilling its responsibilities, Frederic Cook interacted with management or the Company's other outside advisors when deemed necessary and appropriate. Based on a review of various considerations and a report from Frederic Cook regarding its independence, the Committee determined that Frederic Cook is independent from the Company and has no conflicts of interest in its role as compensation consultant to the Committee.

Competitive Marketplace Assessment