Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRST HORIZON CORP | d804264d8k.htm |

Exhibit 99.1

THIRD QUARTER 2014

FINANCIAL SUPPLEMENT

If you need further information, please contact:

Aarti Bowman, Investor Relations

901-523-4017

aagoorha@firsthorizon.com

| FHN TABLE OF CONTENTS

|

| |||

| Page | ||||

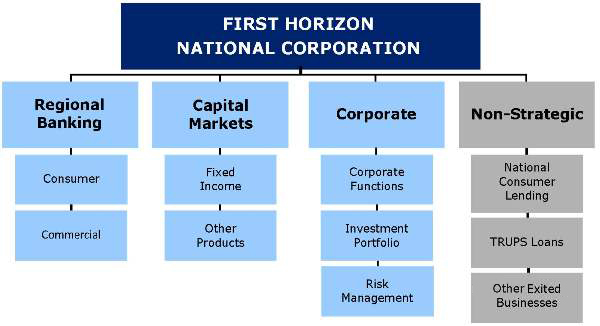

| First Horizon National Corporation Segment Structure |

3 | |||

| Performance Highlights |

4 | |||

| Consolidated Results |

||||

| Income Statement |

||||

| Income Statement |

6 | |||

| Other Income and Other Expense |

7 | |||

| Balance Sheet |

||||

| Period End Balance Sheet |

8 | |||

| Average Balance Sheet |

9 | |||

| Net Interest Income |

10 | |||

| Average Balance Sheet: Yields and Rates |

11 | |||

| Capital Highlights |

12 | |||

| Business Segment Detail |

||||

| Segment Highlights |

13 | |||

| Regional Banking |

14 | |||

| Capital Markets and Corporate |

15 | |||

| Non-Strategic |

16 | |||

| Asset Quality |

||||

| Asset Quality: Consolidated |

17 | |||

| Asset Quality: Regional Banking and Corporate |

19 | |||

| Asset Quality: Non-Strategic |

20 | |||

| Portfolio Metrics |

21 | |||

| Non-GAAP to GAAP Reconciliation |

22 | |||

| Glossary of Terms |

23 | |||

Other Information

This financial supplement contains forward-looking statements involving significant risks and uncertainties. A number of important factors could cause actual results to differ materially from those in the forward-looking information. Those factors include general economic and financial market conditions, including expectations of and actual timing and amount of interest rate movements including the slope of the yield curve, competition, customer and investor responses to these conditions, ability to execute business plans, geopolitical developments, recent and future legislative and regulatory developments, natural disasters, and items mentioned in this financial supplement and in First Horizon National Corporation’s (“FHN”) most recent press release, as well as critical accounting estimates and other factors described in FHN’s recent filings with the SEC. FHN disclaims any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements included herein or therein to reflect future events or developments.

Use of Non-GAAP Measures

Certain ratios are included in this financial supplement that are non-GAAP, meaning they are not presented in accordance with generally accepted accounting principles (“GAAP”) in the U.S. FHN’s management believes such ratios are relevant to understanding the capital position and results of the Company. The non-GAAP ratios presented in this financial supplement are tangible common equity (“TCE”) to tangible assets (“TA”), tangible book value per common share, tier 1 common to risk weighted assets (“RWA”), adjusted tangible common equity to risk weighted assets and pre-tax pre-provision net revenue (“PPNR”). These ratios are reported to FHN’s management and Board of Directors through various internal reports. Additionally, disclosure of non-GAAP capital ratios provides a meaningful base for comparability to other financial institutions as demonstrated by their use by the various banking regulators in reviewing the capital adequacy of financial institutions. Non-GAAP measures are not formally defined by GAAP or codified in currently effective federal banking regulations, and other entities may use calculation methods that differ from those used by FHN. Tier 1 capital is a regulatory term and is generally defined as the sum of core capital (including common equity and instruments that can not be redeemed at the option of the holder) adjusted for certain items under risk based capital regulations. Also a regulatory term, risk weighted assets includes total assets adjusted for credit risk and is used to determine regulatory capital ratios. Refer to the tabular reconciliation of non-GAAP to GAAP measures and presentation of the most comparable GAAP items on page 22 of this financial supplement.

| FIRST HORIZON NATIONAL CORPORATION SEGMENT STRUCTURE |

|

3

FHN PERFORMANCE HIGHLIGHTS

| Summary of Third Quarter 2014 Notable Items

| ||||||||

|

Segment |

Item | Income Statement | Amount | Comments | ||||

|

• Non-Strategic |

Gain on sales of held-for-sale loans | Mortgage banking | $39.7 million | Pre-tax gain on the sales of held-for-sale (“HFS”) mortgage loans | ||||

| • Non-Strategic |

Litigation expense | Litigation and regulatory matters | $(50.0) million | Pre-tax loss accruals related to legal matters | ||||

| Insurance proceeds | Litigation and regulatory matters | $15.0 million | Pre-tax recoveries related to agreements reached with insurance companies for expenses FHN previously incurred associated with litigation | |||||

|

|

||||||||

| $(35.0) million | Net pre-tax loss accrual related to legal matters | |||||||

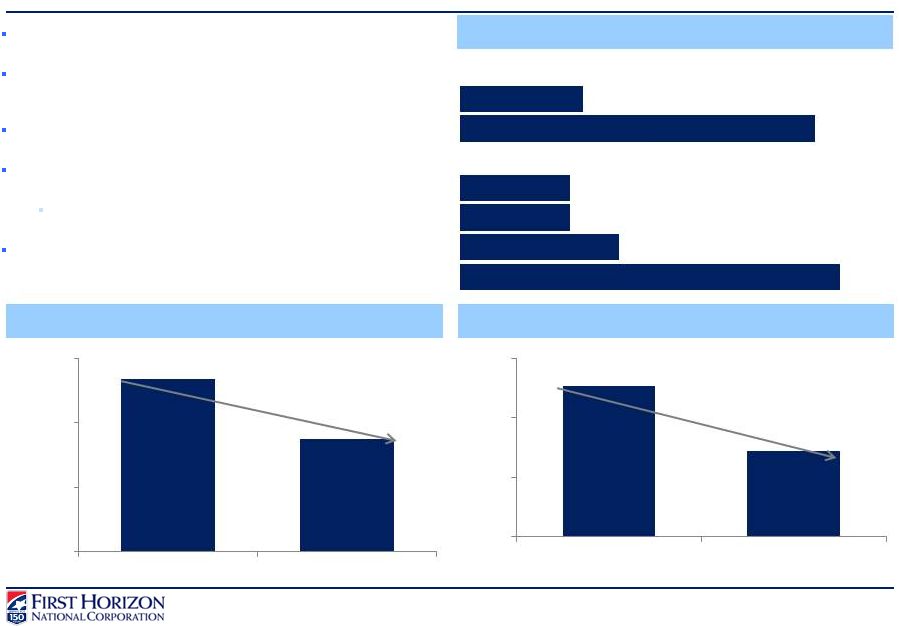

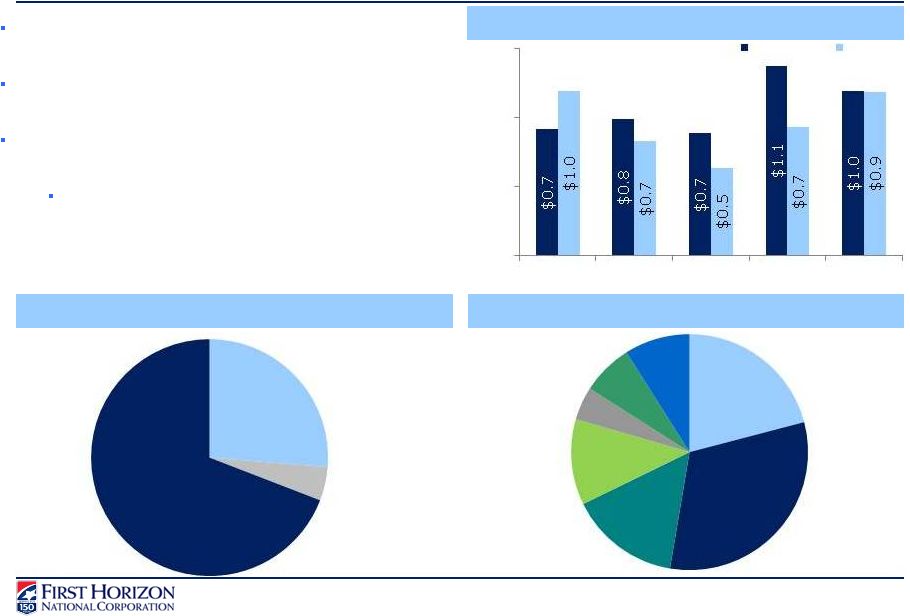

Third Quarter 2014 vs. Second Quarter 2014

Consolidated

| • | Net income available to common shareholders was $45.3 million, or $.19 per diluted share in third quarter, compared to $76.8 million, or $.32 per diluted share in prior quarter |

| • | Net interest income (“NII”) increased to $159.5 million in third quarter from $156.8 million in second quarter; Net interest margin (“NIM”) was flat at 2.97 percent |

| • | The increase in NII was affected by a number of factors including improved deposit pricing, one more day in third quarter compared to second quarter, and higher loan balances |

| • | Noninterest income (including securities gains) increased $30.9 million to $157.8 million in third quarter |

| • | The increase in noninterest income was largely the result of gains associated with the sales of HFS mortgage loans in third quarter |

| • | Noninterest expense was $246.2 million in third quarter compared to $165.3 million in second quarter primarily due to an increase in litigation loss accruals, partially offset by an expense reversal related to agreements with insurance companies for the recovery of prior litigation losses |

| • | Second quarter includes a $47.1 million expense reversal related to a recovery associated with the 2011 settlement of the Sentinel litigation matter and related legal expenses |

| • | Average loans grew to $15.8 billion in third quarter from $15.4 billion in second quarter; period-end loans were $15.8 billion in third and second quarters |

Regional Banking

| • | Pre-tax income increased to $79.6 million in third quarter from $72.9 million in second quarter; PPNR was $81.8 million and $81.3 million in third and second quarters, respectively |

| • | Average loans increased 4 percent, or $513.1 million to $12.9 billion in third quarter primarily driven by higher balances of loans to mortgage companies and other commercial loans; period-end loans increased 1 percent to $13.0 billion |

| • | Average core deposits were $14.6 billion in third quarter compared to $14.8 billion in second quarter; period-end core deposits decreased 2 percent to $14.7 billion |

| • | NII improved to $153.9 million in third quarter from $148.7 million in second quarter |

| • | The increase in NII is primarily attributable to lower deposit rates, higher average balances of loans to mortgage companies, and the impact of day variance relative to second quarter |

| • | Provision for loan losses dropped to $2.2 million in third quarter from $8.4 million in second quarter |

| • | Provision levels reflect continued favorable trends in the commercial portfolio including favorable grade migration, lower delinquencies, and historically low net charge-off levels; consumer asset quality trends remain relatively stable |

| • | Noninterest income was $64.2 million in third quarter compared to $66.2 million in second quarter |

| • | Second quarter includes $2.8 million of Visa volume incentives |

| • | Noninterest expense was $136.3 million in third quarter compared to $133.6 million in second quarter |

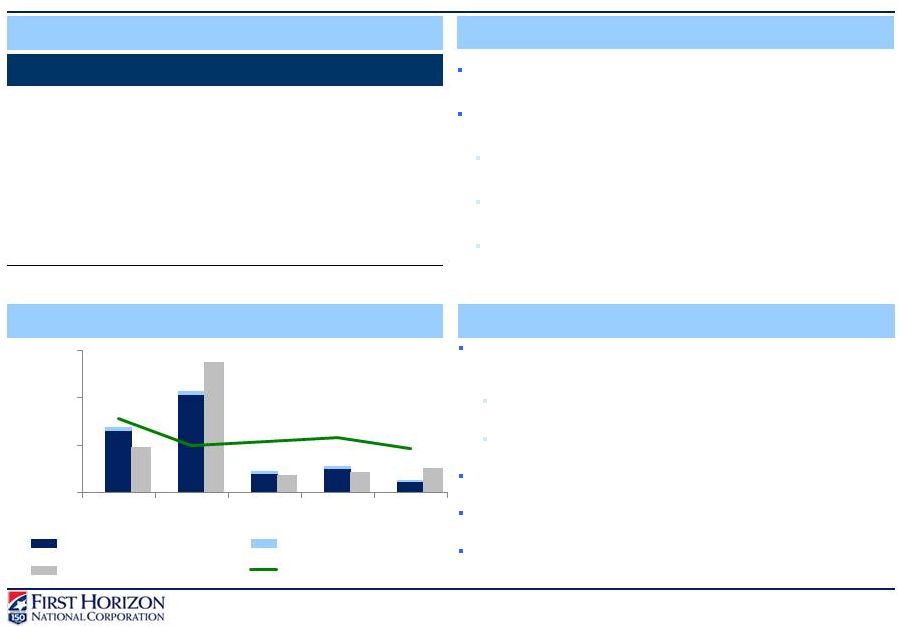

Capital Markets

| • | Fixed income revenue increased to $41.2 million in third quarter from $40.5 million in second quarter |

| • | Fixed income average daily revenue (“ADR”) was $644 thousand and $642 thousand in third and second quarters, respectively |

| • | Noninterest expense was $47.9 million in third quarter compared to $.1 million in the prior quarter |

| • | Second quarter included a $47.1 million expense reversal recognized as a result of agreements with insurance companies for the recovery of expenses incurred in the Sentinel litigation matter which was settled in 2011 |

Corporate

| • | NII was negative $12.5 million in third quarter compared to negative $10.5 million in the prior quarter |

| • | Estimated effective duration of the securities portfolio was 3.4 years in third quarter compared to 3.3 years in second quarter |

| • | Estimated modified duration of the securities portfolio was 3.9 years in third and second quarters |

| • | Noninterest income was $4.1 million in third quarter compared to $5.2 million in second quarter |

| • | Decrease primarily relates to lower deferred compensation driven by market conditions; changes in deferred compensation income are mirrored by changes in deferred compensation expense |

| • | Noninterest expense was $18.8 million in third quarter compared to $15.8 million in the prior quarter |

| • | Increase primarily related to a $3.2 million negative valuation adjustment associated with derivatives related to prior sales of Visa Class B shares |

4

FHN PERFORMANCE HIGHLIGHTS (continued)

Third Quarter 2014 vs. Second Quarter 2014

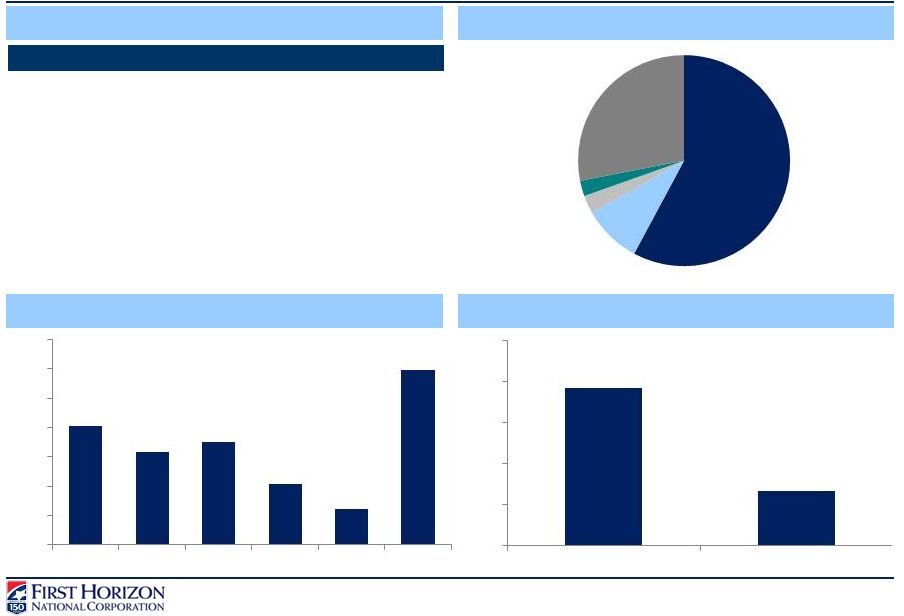

Non-Strategic

| • | Pre-tax income was $7.8 million in third quarter compared to $11.5 million in second quarter |

| • | The provision for loan losses was $3.8 million in third quarter compared to a provision credit of $3.4 million in second quarter |

| • | The third quarter provision reflects an increase in allowance associated with an Insurance TRUP that elected interest deferral and an uptick in consumer delinquencies |

| • | Noninterest income increased to $39.6 million in third quarter from $7.9 million in the prior quarter |

| • | Increase primarily driven by the gain on the sales of mortgage loans HFS in third quarter |

| • | Noninterest expense was $43.2 million in third quarter compared to $15.9 million in second quarter |

| • | Third quarter increase was driven primarily by a net increase in litigation loss accruals related to legal matters |

| • | This increase was partially offset by a $4.3 million reversal of repurchase and foreclosure provision as a result of a settlement of certain repurchase claims and a decline in legal fees |

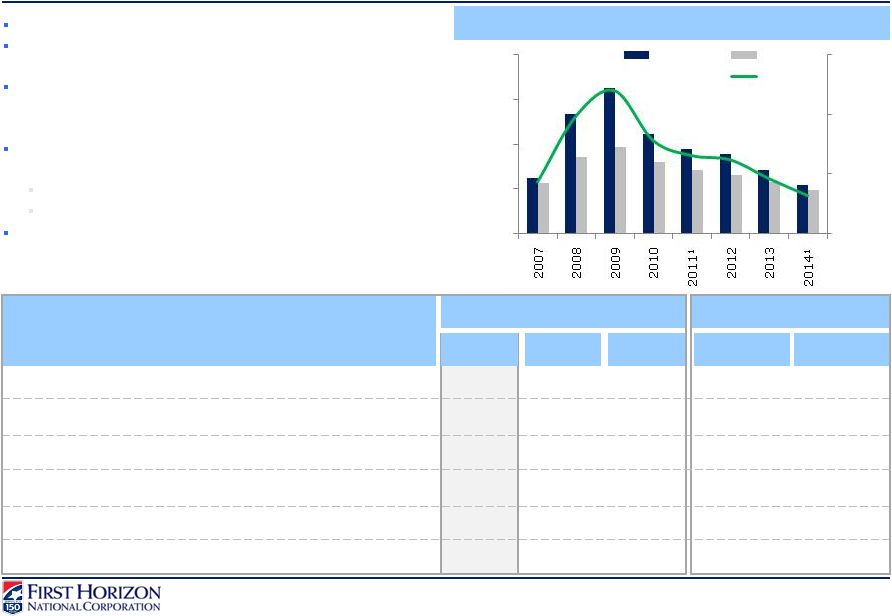

Asset Quality

| • | Allowance for loan losses declined to $238.6 million in third quarter from $243.6 million in second quarter; the allowance to loans ratio was 151 basis points in third quarter compared to 154 basis points in second quarter |

| • | The decline in the allowance was driven by a $5.9 million consumer reserve release; the allowance associated with the C&I portfolio increased as a result of an insurance TRUP loan that moved to interest deferral during third quarter |

| • | Net charge-offs (“NCOs”) were $11.0 million in third quarter compared to $8.6 million in prior quarter; annualized net charge-offs increased to 28 basis points of average loans in third quarter from 22 basis points in prior quarter |

| • | Net charge-offs within the consumer real estate portfolio increased $5.3 million from prior quarter which more than offset a $2.9 million decline in commercial net charge-offs |

| • | Commercial net charge-offs were $0 for third quarter |

| • | Nonperforming loans (“NPLs”) in the portfolio declined to $213.7 million from $231.6 million in second quarter |

| • | Both commercial and consumer NPLs declined from last quarter; commercial due to return to accrual and consumer due to decline in nonaccruing junior liens |

| • | Nonperforming C&I loans within the non-strategic segment increased by $9.4 million as a result of an insurance TRUP electing interest deferral in third quarter |

| • | Nonperforming assets (“NPAs”), including loans held-for-sale, decreased to $256.9 million in third quarter from $339.6 million in prior quarter |

| • | $61.3 million of the decline was related to the sale of mortgage loans held-for-sale |

| • | Total 30+ delinquencies improved to $86.3 million in third quarter compared to $92.8 million in prior quarter |

| • | Commercial delinquencies declined by $16.8 million as a result of payoffs and loans that returned to accrual status in third quarter |

| • | Consumer delinquencies increased by $10.3 million driven by higher delinquencies within the non-strategic consumer real estate and permanent mortgage portfolios |

| • | Troubled debt restructurings (“TDRs”) declined to $429.1 million in third quarter from $490.4 million in prior quarter |

| • | The decline was mainly due to the sale of mortgage loans held-for-sale |

Taxes

| • | The effective tax rate for third quarter and second quarter were 23.66 percent and 28.37 percent, respectively, and reflect forecasted taxable income for the year and the favorable effect on the tax rate from permanent benefits |

| • | Permanent differences primarily consist of: tax credit investments, life insurance, tax-exempt interest, and a decrease in the capital loss deferred tax valuation allowance |

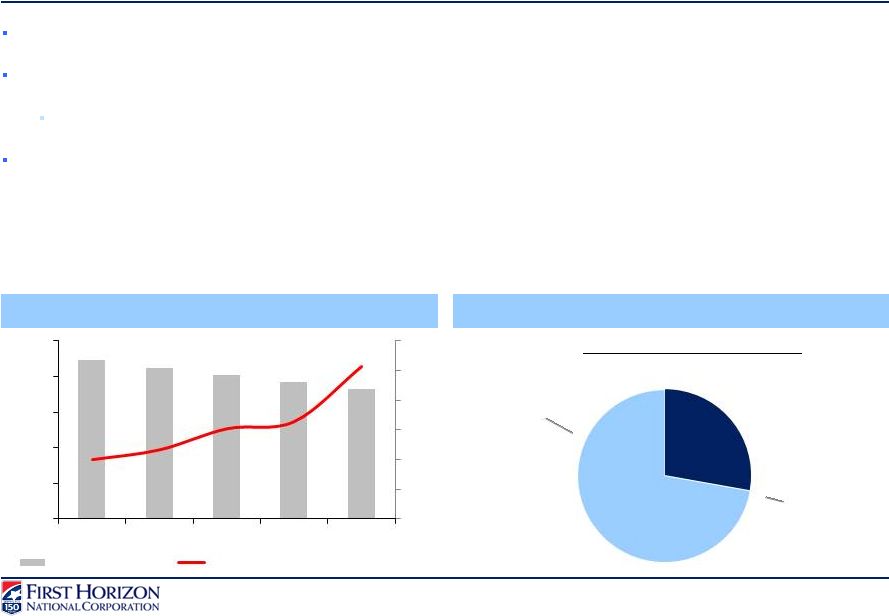

Capital and Liquidity

| • | Paid $0.05 per common share dividend on October 1, 2014 |

| • | Paid preferred quarterly dividend of $1.6 million on October 10, 2014 |

| • | Repurchased shares costing $24.0 million in third quarter under the $100 million share repurchase program announced in January 2014 |

| • | Cumulative shares repurchased since the program’s inception are $24.0 million with a volume weighted average price of $12.02 per share (before $.02 per share broker commission) |

| • | Capital ratios (regulatory capital ratios estimated based on period-end balances) |

| • | 8.69 percent for tangible common equity to tangible assets |

| • | 14.37 percent for Tier 1 |

| • | 16.12 percent for Total Capital |

| • | 11.31 percent for Tier 1 Common |

| • | 11.71 percent for Leverage |

5

FHN CONSOLIDATED INCOME STATEMENT

Quarterly, Unaudited

| 3Q14 Changes vs. | ||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) |

3Q14 | 2Q14 | 1Q14 | 4Q13 | 3Q13 | 2Q14 | 3Q13 | |||||||||||||||||||||

| Interest income |

$ | 178,858 | $ | 177,359 | $ | 173,584 | $ | 179,053 | $ | 182,610 | 1 | % | (2 | )% | ||||||||||||||

| Less: interest expense |

19,317 | 20,591 | 21,225 | 21,918 | 23,772 | (6 | )% | (19 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net interest income |

159,541 | 156,768 | 152,359 | 157,135 | 158,838 | 2 | % | * | ||||||||||||||||||||

| Provision for loan losses |

6,000 | 5,000 | 10,000 | 15,000 | 10,000 | 20 | % | (40 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net interest income after provision for loan losses |

153,541 | 151,768 | 142,359 | 142,135 | 148,838 | 1 | % | 3 | % | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Noninterest income: |

||||||||||||||||||||||||||||

| Capital markets |

47,589 | 47,680 | 56,840 | 59,653 | 64,283 | * | (26 | )% | ||||||||||||||||||||

| Deposit transactions and cash management |

28,546 | 27,911 | 26,456 | 29,194 | 29,279 | 2 | % | (3 | )% | |||||||||||||||||||

| Brokerage, management fees and commissions |

12,333 | 12,843 | 12,276 | 11,505 | 10,868 | (4 | )% | 13 | % | |||||||||||||||||||

| Mortgage banking (a) |

41,559 | 8,861 | 19,029 | 3,853 | 14,460 | NM | NM | |||||||||||||||||||||

| Trust services and investment management |

6,779 | 7,309 | 6,744 | 6,596 | 6,649 | (7 | )% | 2 | % | |||||||||||||||||||

| Bankcard income (b) |

5,521 | 7,919 | 4,520 | 4,998 | 5,303 | (30 | )% | 4 | % | |||||||||||||||||||

| Bank-owned life insurance (c) |

3,547 | 3,312 | 6,032 | 3,636 | 3,560 | 7 | % | * | ||||||||||||||||||||

| Other service charges |

3,064 | 3,143 | 2,845 | 3,144 | 3,707 | (3 | )% | (17 | )% | |||||||||||||||||||

| Insurance commissions |

593 | 611 | 437 | 960 | 733 | (3 | )% | (19 | )% | |||||||||||||||||||

| Securities gains/(losses), net (d) |

(862 | ) | (1,923 | ) | 5,657 | 2,183 | (96 | ) | 55 | % | NM | |||||||||||||||||

| Gain/(loss) on divestitures |

— | — | — | (4 | ) | 115 | NM | NM | ||||||||||||||||||||

| Other (e) |

9,146 | 9,235 | 4,894 | 9,325 | 11,614 | (1 | )% | (21 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total noninterest income |

157,815 | 126,901 | 145,730 | 135,043 | 150,475 | 24 | % | 5 | % | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Adjusted gross income after provision for loan losses |

311,356 | 278,669 | 288,089 | 277,178 | 299,313 | 12 | % | 4 | % | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Noninterest expense: |

||||||||||||||||||||||||||||

| Employee compensation, incentives, and benefits |

120,742 | 119,659 | 119,229 | 127,144 | 132,213 | 1 | % | (9 | )% | |||||||||||||||||||

| Repurchase and foreclosure provision (f) |

(4,300 | ) | — | — | (30,000 | ) | 200,000 | NM | NM | |||||||||||||||||||

| Legal and professional fees (g) |

10,463 | 6,151 | 15,039 | 15,419 | 12,704 | 70 | % | (18 | )% | |||||||||||||||||||

| Occupancy (h) |

12,405 | 11,944 | 17,592 | 12,811 | 13,147 | 4 | % | (6 | )% | |||||||||||||||||||

| Computer software |

10,614 | 11,087 | 10,656 | 10,197 | 10,446 | (4 | )% | 2 | % | |||||||||||||||||||

| Contract employment and outsourcing (i) |

5,199 | 5,318 | 4,325 | 9,059 | 9,241 | (2 | )% | (44 | )% | |||||||||||||||||||

| Operations services |

9,044 | 8,804 | 8,982 | 9,104 | 9,199 | 3 | % | (2 | )% | |||||||||||||||||||

| Equipment rentals, depreciation, and maintenance |

7,150 | 7,442 | 7,849 | 8,431 | 7,890 | (4 | )% | (9 | )% | |||||||||||||||||||

| FDIC premium expense (j) |

3,456 | 1,136 | 3,991 | 4,477 | 4,631 | NM | (25 | )% | ||||||||||||||||||||

| Advertising and public relations |

4,386 | 4,312 | 5,908 | 4,685 | 5,486 | 2 | % | (20 | )% | |||||||||||||||||||

| Communications and courier |

3,628 | 3,948 | 4,224 | 4,473 | 4,517 | (8 | )% | (20 | )% | |||||||||||||||||||

| Foreclosed real estate |

788 | 439 | 784 | 1,050 | 523 | 79 | % | 51 | % | |||||||||||||||||||

| Amortization of intangible assets |

982 | 981 | 982 | 1,128 | 928 | * | 6 | % | ||||||||||||||||||||

| Other (e) |

61,629 | (15,889 | ) | 20,653 | 79,119 | 22,631 | NM | NM | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total noninterest expense |

246,186 | 165,332 | 220,214 | 257,097 | 433,556 | 49 | % | (43 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income/(loss) before income taxes |

65,170 | 113,337 | 67,875 | 20,081 | (134,243 | ) | (42 | )% | NM | |||||||||||||||||||

| Provision/(benefit) for income taxes |

15,421 | 32,157 | 18,645 | (33,813 | ) | (31,094 | ) | (52 | )% | NM | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income/(loss) from continuing operations |

49,749 | 81,180 | 49,230 | 53,894 | (103,149 | ) | (39 | )% | NM | |||||||||||||||||||

| Income/(loss) from discontinued operations, net of tax |

— | — | — | (6 | ) | 123 | NM | NM | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income/(loss) |

49,749 | 81,180 | 49,230 | 53,888 | (103,026 | ) | (39 | )% | NM | |||||||||||||||||||

| Net income attributable to noncontrolling interest |

2,875 | 2,859 | 2,813 | 2,934 | 2,875 | 1 | % | * | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income/(loss) attributable to controlling interest |

46,874 | 78,321 | 46,417 | 50,954 | (105,901 | ) | (40 | )% | NM | |||||||||||||||||||

| Preferred stock dividends |

1,550 | 1,550 | 1,550 | 1,550 | 1,550 | * | * | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income/(loss) available to common shareholders |

$ | 45,324 | $ | 76,771 | $ | 44,867 | $ | 49,404 | $ | (107,451 | ) | (41 | )% | NM | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Common Stock Data |

||||||||||||||||||||||||||||

| Diluted EPS |

$ | 0.19 | $ | 0.32 | $ | 0.19 | $ | 0.21 | $ | (0.45 | ) | (41 | )% | NM | ||||||||||||||

| Diluted shares (thousands) |

236,862 | 237,250 | 237,401 | 236,753 | 236,895 | * | * | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Key Ratios & Other |

||||||||||||||||||||||||||||

| Return on average assets (annualized) (k) |

0.83 | % | 1.38 | % | 0.83 | % | 0.90 | % | (1.69 | )% | ||||||||||||||||||

| Return on average common equity (annualized) (k) |

7.99 | % | 14.14 | % | 8.48 | % | 9.42 | % | (20.39 | )% | ||||||||||||||||||

| Fee income to total revenue (k) |

49.86 | % | 45.11 | % | 47.90 | % | 45.81 | % | 48.66 | % | ||||||||||||||||||

| Efficiency ratio (k) |

77.36 | % | 57.89 | % | 75.30 | % | 88.66 | % | NM | |||||||||||||||||||

| Full time equivalent employees |

4,193 | 4,216 | 4,251 | 4,309 | 4,338 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

NM - Not meaningful

| * | Amount is less than one percent. |

| (a) | 3Q14 includes a $39.7 million gain on the sales of mortgage loans HFS; 2Q14 includes an $8.2 million positive fair value adjustment to the held-for-sale portfolio; 1Q14 increase reflects the receipt of previously unrecognized servicing fees in conjunction with transfers of servicing in 1Q14; 4Q13 decline due to transfers of servicing. |

| (b) | 2Q14 includes $2.8 million of Visa volume incentives. |

| (c) | 1Q14 increase driven by $2.8 million of policy benefits received. |

| (d) | 3Q14 includes a $1.0 million loss on the sale of an investment; 2Q14 includes a $2.0 million negative fair value adjustment of an investment. |

| (e) | Refer to the Other Income and Other Expense table on page 7 for additional information. |

| (f) | 3Q14 expense reversal associated with the settlement of certain repurchase claims. |

| (g) | 2Q14 includes an $8.5 million expense reversal related to agreements with insurance companies for the recovery of Sentinel legal expenses. |

| (h) | 1Q14 includes $4.6 million of lease abandonment expense. |

| (i) | 1Q14 decline due to lower subservicing costs associated with the sales of servicing. |

| (j) | 2Q14 includes the effect of $3.3 million of FDIC premium refunds. |

| (k) | See Glossary of Terms for definitions of Key Ratios. |

6

FHN OTHER INCOME AND OTHER EXPENSE

Quarterly, Unaudited

| 3Q14 Changes vs. | ||||||||||||||||||||||||||||

| (Thousands) |

3Q14 | 2Q14 | 1Q14 | 4Q13 | 3Q13 | 2Q14 | 3Q13 | |||||||||||||||||||||

| Other Income |

||||||||||||||||||||||||||||

| ATM and interchange fees |

$ | 2,739 | $ | 2,746 | $ | 2,497 | $ | 2,721 | $ | 2,680 | * | 2 | % | |||||||||||||||

| Electronic banking fees |

1,560 | 1,535 | 1,534 | 1,535 | 1,607 | 2 | % | (3 | )% | |||||||||||||||||||

| Letter of credit fees |

917 | 1,173 | 1,663 | 1,215 | 1,171 | (22 | )% | (22 | )% | |||||||||||||||||||

| Deferred compensation (a) |

(41 | ) | 1,184 | 657 | 1,210 | 2,160 | NM | NM | ||||||||||||||||||||

| Gain /(loss) on extinguishment of debt (b) |

— | — | (4,350 | ) | — | — | NM | NM | ||||||||||||||||||||

| Other |

3,971 | 2,597 | 2,893 | 2,644 | 3,996 | 53 | % | (1 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

$ | 9,146 | $ | 9,235 | $ | 4,894 | $ | 9,325 | $ | 11,614 | (1 | )% | (21 | )% | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Other Expense |

||||||||||||||||||||||||||||

| Litigation and regulatory matters (c) |

$ | 35,390 | $ | (38,200 | ) | $ | 90 | $ | 57,355 | $ | 229 | NM | NM | |||||||||||||||

| Other insurance and taxes |

3,909 | 3,209 | 3,060 | 3,261 | 3,215 | 22 | % | 22 | % | |||||||||||||||||||

| Tax credit investments |

2,481 | 3,032 | 2,495 | 3,063 | 3,079 | (18 | )% | (19 | )% | |||||||||||||||||||

| Travel and entertainment |

2,164 | 2,645 | 1,824 | 2,339 | 2,400 | (18 | )% | (10 | )% | |||||||||||||||||||

| Employee training and dues |

1,194 | 1,200 | 866 | 1,327 | 1,244 | (1 | )% | (4 | )% | |||||||||||||||||||

| Customer relations |

1,406 | 1,680 | 1,243 | 1,179 | 1,204 | (16 | )% | 17 | % | |||||||||||||||||||

| Miscellaneous loan costs |

597 | 839 | 714 | 701 | 1,349 | (29 | )% | (56 | )% | |||||||||||||||||||

| Supplies |

779 | 804 | 1,116 | 1,090 | 950 | (3 | )% | (18 | )% | |||||||||||||||||||

| Other (d) |

13,709 | 8,902 | 9,245 | 8,804 | 8,961 | 54 | % | 53 | % | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

$ | 61,629 | (15,889 | ) | $ | 20,653 | $ | 79,119 | $ | 22,631 | NM | NM | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

NM - Not meaningful

| * | Amount is less than one percent. |

| (a) | Amounts driven by market conditions and are mirrored by changes in deferred compensation expense which is included in employee compensation expense. |

| (b) | 1Q14 loss associated with the collapse of two HELOC securitization trusts. |

| (c) | 3Q14 includes $50.0 million of loss accruals related to legal matters, partially offset by $15.0 million of expense reversals associated with agreements with insurance companies for the recovery of expenses FHN incurred related to litigation losses in previous periods; 2Q14 includes $38.6 million related to the recovery of expenses related to the Sentinel litigation matter which was settled in 2011; 4Q13 includes $57.0 million of net loss accruals related to legal matters. |

| (d) | 3Q14 and 1Q14 include $3.2 million and $2.3 million, respectively, of negative valuation adjustments associated with derivatives related to prior sales of Visa Class B shares. |

7

FHN CONSOLIDATED PERIOD-END BALANCE SHEET

Quarterly, Unaudited

| 3Q14 Changes vs. | ||||||||||||||||||||||||||||

| (Thousands) |

3Q14 | 2Q14 | 1Q14 | 4Q13 | 3Q13 | 2Q14 | 3Q13 | |||||||||||||||||||||

| Assets: |

||||||||||||||||||||||||||||

| Investment securities |

$ | 3,538,957 | $ | 3,580,821 | $ | 3,575,453 | $ | 3,398,457 | $ | 3,186,943 | (1 | )% | 11 | % | ||||||||||||||

| Loans held-for-sale (a) |

151,915 | 358,945 | 361,359 | 370,152 | 371,640 | (58 | )% | (59 | )% | |||||||||||||||||||

| Loans, net of unearned income (Restricted - $.1 billion) (b) |

15,812,017 | 15,795,709 | 15,119,461 | 15,389,074 | 15,408,556 | * | 3 | % | ||||||||||||||||||||

| Federal funds sold |

55,242 | 51,537 | 16,555 | 66,079 | 52,830 | 7 | % | 5 | % | |||||||||||||||||||

| Securities purchased under agreements to resell |

561,802 | 624,477 | 605,276 | 412,614 | 576,355 | (10 | )% | (3 | )% | |||||||||||||||||||

| Interest-bearing cash (c) |

275,485 | 255,920 | 685,540 | 730,297 | 184,179 | 8 | % | 50 | % | |||||||||||||||||||

| Trading securities |

1,338,022 | 1,150,280 | 1,194,749 | 801,718 | 1,343,134 | 16 | % | * | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total earning assets |

21,733,440 | 21,817,689 | 21,558,393 | 21,168,391 | 21,123,637 | * | 3 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Cash and due from banks (Restricted - $.3 million) (b) |

292,687 | 417,108 | 450,270 | 349,216 | 395,631 | (30 | )% | (26 | )% | |||||||||||||||||||

| Capital markets receivables (d) |

197,507 | 174,224 | 51,082 | 45,255 | 83,154 | 13 | % | NM | ||||||||||||||||||||

| Mortgage servicing rights, net (e) |

2,880 | 3,197 | 4,687 | 72,793 | 116,686 | (10 | )% | (98 | )% | |||||||||||||||||||

| Goodwill |

141,943 | 141,943 | 141,943 | 141,943 | 140,479 | * | 1 | % | ||||||||||||||||||||

| Other intangible assets, net |

19,044 | 20,025 | 21,007 | 21,988 | 22,216 | (5 | )% | (14 | )% | |||||||||||||||||||

| Premises and equipment, net |

295,833 | 300,533 | 299,183 | 305,244 | 308,779 | (2 | )% | (4 | )% | |||||||||||||||||||

| Real estate acquired by foreclosure (f) |

47,996 | 57,552 | 66,035 | 71,562 | 71,626 | (17 | )% | (33 | )% | |||||||||||||||||||

| Allowance for loan losses (Restricted - $.8 million) (b) |

(238,641 | ) | (243,628 | ) | (247,246 | ) | (253,809 | ) | (255,710 | ) | (2 | )% | (7 | )% | ||||||||||||||

| Derivative assets |

137,742 | 162,067 | 166,465 | 181,866 | 215,116 | (15 | )% | (36 | )% | |||||||||||||||||||

| Other assets (Restricted - $.4 million) (b) |

1,356,356 | 1,372,040 | 1,430,170 | 1,685,384 | 1,637,139 | (1 | )% | (17 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total assets (Restricted - $.1 billion) (b) |

$ | 23,986,787 | $ | 24,222,750 | $ | 23,941,989 | $ | 23,789,833 | $ | 23,858,753 | (1 | )% | 1 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Liabilities and Equity: |

||||||||||||||||||||||||||||

| Deposits: |

||||||||||||||||||||||||||||

| Savings |

$ | 6,371,156 | $ | 6,317,197 | $ | 6,630,142 | $ | 6,732,326 | $ | 6,781,522 | 1 | % | (6 | )% | ||||||||||||||

| Other interest-bearing deposits |

3,955,152 | 4,014,071 | 4,071,699 | 3,859,079 | 3,494,236 | (1 | )% | 13 | % | |||||||||||||||||||

| Time deposits |

767,699 | 808,822 | 898,223 | 951,755 | 997,726 | (5 | )% | (23 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total interest-bearing core deposits |

11,094,007 | 11,140,090 | 11,600,064 | 11,543,160 | 11,273,484 | * | (2 | )% | ||||||||||||||||||||

| Noninterest-bearing deposits |

4,603,826 | 4,513,800 | 4,534,245 | 4,637,839 | 4,434,746 | 2 | % | 4 | % | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total core deposits (g) |

15,697,833 | 15,653,890 | 16,134,309 | 16,180,999 | 15,708,230 | * | * | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Certificates of deposit $100,000 and more |

446,938 | 503,597 | 538,434 | 553,957 | 575,679 | (11 | )% | (22 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total deposits |

16,144,771 | 16,157,487 | 16,672,743 | 16,734,956 | 16,283,909 | * | (1 | )% | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Federal funds purchased |

928,159 | 947,946 | 1,135,665 | 1,042,633 | 1,062,901 | (2 | )% | (13 | )% | |||||||||||||||||||

| Securities sold under agreements to repurchase |

479,384 | 475,530 | 411,795 | 442,789 | 427,232 | 1 | % | 12 | % | |||||||||||||||||||

| Trading liabilities |

532,234 | 706,119 | 667,257 | 368,348 | 585,969 | (25 | )% | (9 | )% | |||||||||||||||||||

| Other short-term borrowings (h) |

790,080 | 1,073,250 | 204,023 | 181,146 | 303,686 | (26 | )% | NM | ||||||||||||||||||||

| Term borrowings (Restricted - $.1 billion) (b) (i) |

1,491,138 | 1,501,209 | 1,507,048 | 1,739,859 | 1,771,288 | (1 | )% | (16 | )% | |||||||||||||||||||

| Capital markets payables (d) |

329,960 | 95,299 | 39,510 | 21,173 | 53,784 | NM | NM | |||||||||||||||||||||

| Derivative liabilities |

123,442 | 138,336 | 137,863 | 154,280 | 165,918 | (11 | )% | (26 | )% | |||||||||||||||||||

| Other liabilities |

545,678 | 501,423 | 621,948 | 603,898 | 770,773 | 9 | % | (29 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total liabilities (Restricted - $.1 billion) (b) |

21,364,846 | 21,596,599 | 21,397,852 | 21,289,082 | 21,425,460 | (1 | )% | * | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Equity: |

||||||||||||||||||||||||||||

| Common stock |

147,030 | 148,217 | 147,866 | 147,731 | 147,705 | (1 | )% | * | ||||||||||||||||||||

| Capital surplus (j) |

1,390,081 | 1,416,012 | 1,417,170 | 1,416,767 | 1,413,248 | (2 | )% | (2 | )% | |||||||||||||||||||

| Undivided profits |

826,610 | 792,978 | 728,165 | 695,207 | 657,676 | 4 | % | 26 | % | |||||||||||||||||||

| Accumulated other comprehensive loss, net |

(132,835 | ) | (122,111 | ) | (140,119 | ) | (150,009 | ) | (176,391 | ) | 9 | % | (25 | )% | ||||||||||||||

| Preferred stock |

95,624 | 95,624 | 95,624 | 95,624 | 95,624 | * | * | |||||||||||||||||||||

| Noncontrolling interest (k) |

295,431 | 295,431 | 295,431 | 295,431 | 295,431 | * | * | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total equity |

2,621,941 | 2,626,151 | 2,544,137 | 2,500,751 | 2,433,293 | * | 8 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total liabilities and equity ( Restricted - $.1 billion) (b) |

$ | 23,986,787 | $ | 24,222,750 | $ | 23,941,989 | $ | 23,789,833 | $ | 23,858,753 | (1 | )% | 1 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

NM - Not meaningful

| * | Amount is less than one percent. |

| (a) | 3Q14 decrease related to the sale of mortgage loans HFS. |

| (b) | Restricted balances parenthetically presented are as of September 30, 2014. |

| (c) | Includes excess balances held at Fed. |

| (d) | Period-end balances fluctuate based on the level of pending unsettled trades. |

| (e) | Decreases beginning in 4Q13 reflect transfers associated with an agreement to sell mortgage servicing rights entered into in 3Q13. |

| (f) | 3Q14 includes $12.7 million of foreclosed assets related to government insured mortgages. |

| (g) | 3Q14 average core deposits were $15.4 billion. |

| (h) | 3Q14 and 2Q14 include increased FHLB borrowings as a result of loan growth and deposit fluctuations. |

| (i) | In 1Q14 FHN resolved the collateralized borrowings for three previously on-balance sheet consumer loan securitizations. |

| (j) | 3Q14 decrease relates to shares purchased under the share repurchase program. |

| (k) | Consists of preferred stock of subsidiaries. |

8

FHN CONSOLIDATED AVERAGE BALANCE SHEET

Quarterly, Unaudited

| 3Q14 Changes vs. | ||||||||||||||||||||||||||||

| (Thousands) |

3Q14 | 2Q14 | 1Q14 | 4Q13 | 3Q13 | 2Q14 | 3Q13 | |||||||||||||||||||||

| Assets: |

||||||||||||||||||||||||||||

| Earning assets: |

||||||||||||||||||||||||||||

| Loans, net of unearned income: |

||||||||||||||||||||||||||||

| Commercial, financial, and industrial (C&I) |

$ | 8,395,553 | $ | 7,994,788 | $ | 7,639,584 | $ | 7,694,029 | $ | 7,888,297 | 5 | % | 6 | % | ||||||||||||||

| Commercial real estate |

1,260,715 | 1,203,631 | 1,139,749 | 1,164,748 | 1,215,586 | 5 | % | 4 | % | |||||||||||||||||||

| Consumer real estate |

5,173,088 | 5,230,107 | 5,305,596 | 5,400,751 | 5,502,825 | (1 | )% | (6 | )% | |||||||||||||||||||

| Permanent mortgage |

581,876 | 607,296 | 637,642 | 678,938 | 721,554 | (4 | )% | (19 | )% | |||||||||||||||||||

| Credit card and other |

352,133 | 345,748 | 336,454 | 334,887 | 323,551 | 2 | % | 9 | % | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total loans, net of unearned income (Restricted - $.1 billion) (a) (b) |

15,763,365 | 15,381,570 | 15,059,025 | 15,273,353 | 15,651,813 | 2 | % | 1 | % | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Loans held-for-sale |

318,743 | 355,822 | 367,899 | 368,373 | 378,263 | (10 | )% | (16 | )% | |||||||||||||||||||

| Investment securities: |

||||||||||||||||||||||||||||

| U.S. treasuries |

26,764 | 39,995 | 41,828 | 39,994 | 41,303 | (33 | )% | (35 | )% | |||||||||||||||||||

| U.S. government agencies |

3,345,739 | 3,330,598 | 3,222,642 | 2,959,355 | 2,900,838 | * | 15 | % | ||||||||||||||||||||

| States and municipalities |

17,458 | 19,430 | 19,425 | 15,155 | 15,246 | (10 | )% | 15 | % | |||||||||||||||||||

| Other |

184,934 | 189,449 | 211,891 | 229,728 | 224,213 | (2 | )% | (18 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total investment securities |

3,574,895 | 3,579,472 | 3,495,786 | 3,244,232 | 3,181,600 | * | 12 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Trading securities |

1,060,123 | 1,118,425 | 1,108,747 | 1,172,282 | 1,171,820 | (5 | )% | (10 | )% | |||||||||||||||||||

| Other earning assets: |

||||||||||||||||||||||||||||

| Federal funds sold |

37,274 | 29,490 | 21,615 | 19,471 | 28,498 | 26 | % | 31 | % | |||||||||||||||||||

| Securities purchased under agreements to resell |

644,022 | 664,194 | 622,466 | 581,798 | 593,978 | (3 | )% | 8 | % | |||||||||||||||||||

| Interest-bearing cash (c) |

288,192 | 363,674 | 972,537 | 614,628 | 537,631 | (21 | )% | (46 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total other earning assets |

969,488 | 1,057,358 | 1,616,618 | 1,215,897 | 1,160,107 | (8 | )% | (16 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total earning assets (Restricted - $.1 billion) (a) |

21,686,614 | 21,492,647 | 21,648,075 | 21,274,137 | 21,543,603 | 1 | % | 1 | % | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Allowance for loan losses (Restricted - $.8 million) (a) |

(240,433 | ) | (246,779 | ) | (249,733 | ) | (250,074 | ) | (256,789 | ) | (3 | )% | (6 | )% | ||||||||||||||

| Cash and due from banks (Restricted - $.6 million) (a) |

321,427 | 308,890 | 336,543 | 341,066 | 351,972 | 4 | % | (9 | )% | |||||||||||||||||||

| Capital markets receivables |

55,937 | 46,864 | 54,654 | 45,179 | 82,289 | 19 | % | (32 | )% | |||||||||||||||||||

| Premises and equipment, net |

297,636 | 299,899 | 301,065 | 307,285 | 308,199 | (1 | )% | (3 | )% | |||||||||||||||||||

| Derivative assets |

154,988 | 165,684 | 181,586 | 201,609 | 209,878 | (6 | )% | (26 | )% | |||||||||||||||||||

| Other assets (Restricted - $.4 million) (a) |

1,528,788 | 1,584,747 | 1,643,879 | 1,926,109 | 1,942,481 | (4 | )% | (21 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total assets (Restricted - $.1 billion) (a) |

$ | 23,804,957 | $ | 23,651,952 | $ | 23,916,069 | $ | 23,845,311 | $ | 24,181,633 | 1 | % | (2 | )% | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Liabilities and equity: |

||||||||||||||||||||||||||||

| Interest-bearing liabilities: |

||||||||||||||||||||||||||||

| Interest-bearing deposits: |

||||||||||||||||||||||||||||

| Savings |

$ | 6,327,556 | $ | 6,427,265 | $ | 6,683,749 | $ | 6,642,159 | $ | 6,957,875 | (2 | )% | (9 | )% | ||||||||||||||

| Other interest-bearing deposits |

3,697,854 | 3,779,293 | 3,830,839 | 3,520,348 | 3,494,211 | (2 | )% | 6 | % | |||||||||||||||||||

| Time deposits |

785,154 | 859,551 | 924,025 | 977,107 | 1,025,788 | (9 | )% | (23 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total interest-bearing core deposits |

10,810,564 | 11,066,109 | 11,438,613 | 11,139,614 | 11,477,874 | (2 | )% | (6 | )% | |||||||||||||||||||

| Certificates of deposit $100,000 and more |

464,792 | 512,527 | 545,845 | 580,760 | 594,536 | (9 | )% | (22 | )% | |||||||||||||||||||

| Federal funds purchased |

1,028,852 | 1,080,347 | 1,161,594 | 1,236,763 | 1,119,273 | (5 | )% | (8 | )% | |||||||||||||||||||

| Securities sold under agreements to repurchase |

406,219 | 458,608 | 454,937 | 446,894 | 452,940 | (11 | )% | (10 | )% | |||||||||||||||||||

| Capital markets trading liabilities |

621,880 | 671,930 | 607,114 | 567,531 | 598,195 | (7 | )% | 4 | % | |||||||||||||||||||

| Other short-term borrowings (d) |

1,093,014 | 540,389 | 184,721 | 219,593 | 243,195 | NM | NM | |||||||||||||||||||||

| Term borrowings (Restricted - $.1 billion) (a) (e) |

1,499,959 | 1,505,860 | 1,702,107 | 1,764,476 | 1,792,250 | * | (16 | )% | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total interest-bearing liabilities |

15,925,280 | 15,835,770 | 16,094,931 | 15,955,631 | 16,278,263 | 1 | % | (2 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Noninterest-bearing deposits |

4,602,292 | 4,547,838 | 4,536,080 | 4,559,023 | 4,542,127 | 1 | % | 1 | % | |||||||||||||||||||

| Capital markets payables |

36,762 | 34,293 | 33,144 | 32,896 | 57,275 | 7 | % | (36 | )% | |||||||||||||||||||

| Derivative liabilities |

130,997 | 138,282 | 152,596 | 159,575 | 161,611 | (5 | )% | (19 | )% | |||||||||||||||||||

| Other liabilities |

467,406 | 526,581 | 563,045 | 666,312 | 660,458 | (11 | )% | (29 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total liabilities (Restricted - $.1 billion) (a) |

21,162,737 | 21,082,764 | 21,379,796 | 21,373,437 | 21,699,734 | * | (2 | )% | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Equity: |

||||||||||||||||||||||||||||

| Common stock |

147,820 | 148,085 | 147,751 | 147,724 | 149,000 | * | (1 | )% | ||||||||||||||||||||

| Capital surplus (f) |

1,408,682 | 1,416,811 | 1,417,642 | 1,414,810 | 1,418,259 | (1 | )% | (1 | )% | |||||||||||||||||||

| Undivided profits |

820,543 | 744,221 | 714,988 | 691,958 | 715,451 | 10 | % | 15 | % | |||||||||||||||||||

| Accumulated other comprehensive loss, net |

(125,880 | ) | (130,984 | ) | (135,163 | ) | (173,673 | ) | (191,866 | ) | (4 | )% | (34 | )% | ||||||||||||||

| Preferred stock |

95,624 | 95,624 | 95,624 | 95,624 | 95,624 | * | * | |||||||||||||||||||||

| Noncontrolling interest |

295,431 | 295,431 | 295,431 | 295,431 | 295,431 | * | * | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total equity |

2,642,220 | 2,569,188 | 2,536,273 | 2,471,874 | 2,481,899 | 3 | % | 6 | % | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total liabilities and equity ( Restricted - $.1 billion) (a) |

$ | 23,804,957 | $ | 23,651,952 | $ | 23,916,069 | $ | 23,845,311 | $ | 24,181,633 | 1 | % | (2 | )% | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Certain previously reported amounts have been reclassified to agree with current presentation.

NM - Not meaningful

| * | Amount is less than one percent. |

| (a) | Restricted balances parenthetically presented are quarterly averages for third quarter 2014. |

| (b) | Includes loans on nonaccrual status. |

| (c) | Includes excess balances held at Fed. |

| (d) | 3Q14 and 2Q14 include increased FHLB borrowings as a result of loan growth and deposit fluctuations. |

| (e) | In 1Q14 FHN resolved the collateralized borrowings for three previously on-balance sheet consumer loan securitizations. |

| (f) | 3Q14 decrease relates to shares repurchased under the share repurchase program. |

9

FHN CONSOLIDATED NET INTEREST INCOME (a)

Quarterly, Unaudited

| 3Q14 Changes vs. | ||||||||||||||||||||||||||||

| (Thousands) |

3Q14 | 2Q14 | 1Q14 | 4Q13 | 3Q13 | 2Q14 | 3Q13 | |||||||||||||||||||||

| Interest Income: |

||||||||||||||||||||||||||||

| Loans, net of unearned income (b) |

$ | 146,931 | $ | 144,975 | $ | 140,487 | $ | 147,322 | $ | 151,504 | 1 | % | (3 | )% | ||||||||||||||

| Loans held-for-sale |

3,263 | 3,209 | 3,215 | 3,253 | 3,058 | 2 | % | 7 | % | |||||||||||||||||||

| Investment securities: |

||||||||||||||||||||||||||||

| U.S. treasuries |

5 | 7 | 5 | 4 | 10 | (29 | )% | (50 | )% | |||||||||||||||||||

| U.S. government agencies |

21,376 | 21,530 | 20,837 | 19,020 | 18,537 | (1 | )% | 15 | % | |||||||||||||||||||

| States and municipalities |

109 | 97 | 117 | 21 | 21 | 12 | % | NM | ||||||||||||||||||||

| Other |

1,866 | 2,103 | 2,281 | 2,307 | 2,355 | (11 | )% | (21 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total investment securities |

23,356 | 23,737 | 23,240 | 21,352 | 20,923 | (2 | )% | 12 | % | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Trading securities |

7,944 | 7,839 | 8,222 | 8,878 | 8,828 | 1 | % | (10 | )% | |||||||||||||||||||

| Other earning assets: |

||||||||||||||||||||||||||||

| Federal funds sold |

92 | 73 | 53 | 48 | 73 | 26 | % | 26 | % | |||||||||||||||||||

| Securities purchased under agreements to resell (c) |

(363 | ) | (218 | ) | (192 | ) | (99 | ) | (171 | ) | (67 | )% | NM | |||||||||||||||

| Interest-bearing cash |

134 | 182 | 546 | 343 | 289 | (26 | )% | (54 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total other earning assets |

(137 | ) | 37 | 407 | 292 | 191 | NM | NM | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Interest income |

$ | 181,357 | $ | 179,797 | $ | 175,571 | $ | 181,097 | $ | 184,504 | 1 | % | (2 | )% | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Interest Expense: |

||||||||||||||||||||||||||||

| Interest-bearing deposits: |

||||||||||||||||||||||||||||

| Savings |

$ | 2,600 | $ | 2,792 | $ | 3,083 | $ | 3,205 | $ | 3,471 | (7 | )% | (25 | )% | ||||||||||||||

| Other interest-bearing deposits |

754 | 746 | 818 | 772 | 817 | 1 | % | (8 | )% | |||||||||||||||||||

| Time deposits |

1,786 | 2,486 | 3,062 | 3,585 | 4,013 | (28 | )% | (55 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total interest-bearing core deposits |

5,140 | 6,024 | 6,963 | 7,562 | 8,301 | (15 | )% | (38 | )% | |||||||||||||||||||

| Certificates of deposit $100,000 and more (d) |

685 | 869 | 1,023 | 873 | 1,658 | (21 | )% | (59 | )% | |||||||||||||||||||

| Federal funds purchased |

654 | 683 | 726 | 791 | 716 | (4 | )% | (9 | )% | |||||||||||||||||||

| Securities sold under agreements to repurchase |

63 | 109 | 118 | 126 | 148 | (42 | )% | (57 | )% | |||||||||||||||||||

| Capital markets trading liabilities |

3,782 | 4,087 | 3,571 | 3,442 | 3,632 | (7 | )% | 4 | % | |||||||||||||||||||

| Other short-term borrowings |

548 | 403 | 261 | 222 | 239 | 36 | % | NM | ||||||||||||||||||||

| Term borrowings |

8,445 | 8,416 | 8,563 | 8,902 | 9,078 | * | (7 | )% | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Interest expense |

19,317 | 20,591 | 21,225 | 21,918 | 23,772 | (6 | )% | (19 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net interest income - tax equivalent basis |

162,040 | 159,206 | 154,346 | 159,179 | 160,732 | 2 | % | 1 | % | |||||||||||||||||||

| Fully taxable equivalent adjustment |

(2,499 | ) | (2,438 | ) | (1,987 | ) | (2,044 | ) | (1,894 | ) | 3 | % | 32 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net interest income |

$ | 159,541 | $ | 156,768 | $ | 152,359 | $ | 157,135 | $ | 158,838 | 2 | % | * | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Certain previously reported amounts have been been reclassified to agree with current presentation.

NM - Not meaningful

| * | Amount is less than one percent. |

| (a) | Net interest income adjusted to a fully taxable equivalent (“FTE”) basis assuming a statutory federal income tax of 35 percent and, where applicable, state income taxes. |

| (b) | Includes interest on loans in nonaccrual status. |

| (c) | Driven by negative market rates on reverse repurchase agreements. |

| (d) | Beginning in 4Q13, includes the effect of amortizing the valuation adjustment for acquired time deposits related to the MNB acquisition. |

10

FHN CONSOLIDATED AVERAGE BALANCE SHEET: YIELDS AND RATES

Quarterly, Unaudited

| 3Q14 | 2Q14 | 1Q14 | 4Q13 | 3Q13 | ||||||||||||||||

| Assets: |

||||||||||||||||||||

| Earning assets (a): |

||||||||||||||||||||

| Loans, net of unearned income: |

||||||||||||||||||||

| Commercial loans |

3.51 | % | 3.59 | % | 3.60 | % | 3.66 | % | 3.69 | % | ||||||||||

| Retail loans |

4.01 | 4.06 | 4.01 | 4.07 | 4.06 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans, net of unearned income (b) |

3.70 | 3.78 | 3.77 | 3.83 | 3.85 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loans held-for-sale |

4.09 | 3.61 | 3.50 | 3.53 | 3.23 | |||||||||||||||

| Investment securities: |

||||||||||||||||||||

| U.S. treasuries |

0.07 | 0.07 | 0.05 | 0.04 | 0.09 | |||||||||||||||

| U.S. government agencies |

2.56 | 2.59 | 2.59 | 2.57 | 2.56 | |||||||||||||||

| States and municipalities (c) |

2.50 | 1.99 | 2.41 | 0.56 | 0.55 | |||||||||||||||

| Other |

4.04 | 4.44 | 4.31 | 4.02 | 4.20 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total investment securities |

2.61 | 2.65 | 2.66 | 2.63 | 2.63 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Trading securities |

3.00 | 2.80 | 2.97 | 3.03 | 3.01 | |||||||||||||||

| Other earning assets: |

||||||||||||||||||||

| Federal funds sold |

0.98 | 1.00 | 0.99 | 0.98 | 1.01 | |||||||||||||||

| Securities purchased under agreements to resell (d) |

(0.22 | ) | (0.13 | ) | (0.13 | ) | (0.07 | ) | (0.11 | ) | ||||||||||

| Interest-bearing cash |

0.19 | 0.20 | 0.23 | 0.22 | 0.21 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total other earning assets |

(0.06 | ) | 0.01 | 0.10 | 0.10 | 0.07 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Interest income/total earning assets |

3.33 | % | 3.35 | % | 3.27 | % | 3.39 | % | 3.41 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Liabilities: |

||||||||||||||||||||

| Interest-bearing liabilities: |

||||||||||||||||||||

| Interest-bearing deposits: |

||||||||||||||||||||

| Savings |

0.16 | % | 0.17 | % | 0.19 | % | 0.19 | % | 0.20 | % | ||||||||||

| Other interest-bearing deposits |

0.08 | 0.08 | 0.09 | 0.09 | 0.09 | |||||||||||||||

| Time deposits |

0.90 | 1.16 | 1.34 | 1.46 | 1.55 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total interest-bearing core deposits |

0.19 | 0.22 | 0.25 | 0.27 | 0.29 | |||||||||||||||

| Certificates of deposit $100,000 and more (e) |

0.59 | 0.68 | 0.76 | 0.60 | 1.11 | |||||||||||||||

| Federal funds purchased |

0.25 | 0.25 | 0.25 | 0.25 | 0.25 | |||||||||||||||

| Securities sold under agreements to repurchase |

0.06 | 0.10 | 0.11 | 0.11 | 0.13 | |||||||||||||||

| Capital markets trading liabilities |

2.41 | 2.44 | 2.39 | 2.41 | 2.41 | |||||||||||||||

| Other short-term borrowings |

0.20 | 0.30 | 0.57 | 0.40 | 0.39 | |||||||||||||||

| Term borrowings (f) |

2.25 | 2.24 | 2.01 | 2.02 | 2.03 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Interest expense/total interest-bearing liabilities |

0.48 | 0.52 | 0.53 | 0.55 | 0.58 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest spread |

2.85 | % | 2.83 | % | 2.74 | % | 2.84 | % | 2.83 | % | ||||||||||

| Effect of interest-free sources used to fund earning assets |

0.12 | 0.14 | 0.14 | 0.14 | 0.14 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest margin |

2.97 | % | 2.97 | % | 2.88 | % | 2.98 | % | 2.97 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Yields are adjusted to a FTE basis assuming a statutory federal income tax rate of 35 percent and, where applicable, state income taxes.

| (a) | Earning assets yields are expressed net of unearned income. |

| (b) | Includes loans on nonaccrual status. |

| (c) | Increase beginning in 1Q14 driven by the yield on an HTM municipal bond. |

| (d) | Driven by negative market rates on reverse repurchase agreements. |

| (e) | Beginning in 4Q13 rate includes the effect of amortizing the valuation adjustment for acquired time deposits related to the MNB acquisition. |

| (f) | Rates are expressed net of unamortized debenture cost for term borrowings. |

11

FHN CAPITAL HIGHLIGHTS

Quarterly, Unaudited

| 3Q14 Changes vs. | ||||||||||||||||||||||||||||

| (Dollars and shares in thousands) |

3Q14 | 2Q14 | 1Q14 | 4Q13 | 3Q13 | 2Q14 | 3Q13 | |||||||||||||||||||||

| Tier 1 capital (a) (b) |

$ | 2,780,367 | $ | 2,751,933 | $ | 2,666,486 | $ | 2,618,976 | $ | 2,555,141 | 1 | % | 9 | % | ||||||||||||||

| Tier 2 capital (a) |

338,569 | 340,279 | 381,619 | 444,655 | 449,100 | (1 | )% | (25 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total capital (a) (b) |

$ | 3,118,936 | $ | 3,092,212 | $ | 3,048,105 | $ | 3,063,631 | $ | 3,004,241 | 1 | % | 4 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Risk-weighted assets (“RWA”) (a) |

$ | 19,354,200 | $ | 19,400,096 | $ | 18,694,719 | $ | 18,878,594 | $ | 19,236,794 | * | 1 | % | |||||||||||||||

| Tier 1 ratio (a) |

14.37 | % | 14.19 | % | 14.26 | % | 13.87 | % | 13.28 | % | ||||||||||||||||||

| Tier 2 ratio (a) |

1.75 | % | 1.75 | % | 2.04 | % | 2.36 | % | 2.34 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total capital ratio (a) |

16.12 | % | 15.94 | % | 16.30 | % | 16.23 | % | 15.62 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Tier 1 common to risk-weighted assets (a) (c) |

11.31 | % | 11.14 | % | 11.10 | % | 10.75 | % | 10.21 | % | ||||||||||||||||||

| Leverage ratio (a) |

11.71 | % | 11.67 | % | 11.19 | % | 11.04 | % | 10.60 | % | ||||||||||||||||||

| Total equity to total assets |

10.93 | % | 10.84 | % | 10.63 | % | 10.51 | % | 10.20 | % | ||||||||||||||||||

| Adjusted tangible common equity to risk-weighted assets (“TCE/RWA”) (a) (c) (d) |

10.67 | % | 10.61 | % | 10.65 | % | 10.37 | % | 9.71 | % | ||||||||||||||||||

| Tangible common equity/tangible assets |

||||||||||||||||||||||||||||

| (“TCE/TA”) (c) (e) |

8.69 | % | 8.62 | % | 8.37 | % | 8.24 | % | 7.93 | % | ||||||||||||||||||

| Period-end shares outstanding (f) |

235,249 | 237,147 | 236,586 | 236,370 | 236,328 | (1 | )% | * | ||||||||||||||||||||

| Cash dividends declared per common share |

$ | 0.05 | $ | 0.05 | $ | 0.05 | $ | 0.05 | $ | 0.05 | * | * | ||||||||||||||||

| Book value per common share |

$ | 9.48 | $ | 9.42 | $ | 9.10 | $ | 8.93 | $ | 8.64 | ||||||||||||||||||

| Tangible book value per common share (c) |

$ | 8.80 | $ | 8.74 | $ | 8.41 | $ | 8.23 | $ | 7.95 | ||||||||||||||||||

| Market capitalization (millions) |

$ | 2,888.9 | $ | 2,812.6 | $ | 2,919.5 | $ | 2,753.7 | $ | 2,597.2 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Certain previously reported amounts have been reclassified to agree with current presentation.

| * | Amount is less than one percent. |

| (a) | Current quarter is an estimate. |

| (b) | All quarters presented include $200 million of tier 1 qualifying trust preferred securities. Beginning in 1Q15 a portion of these will begin phasing out. |

| (c) | Refer to the Non-GAAP to GAAP Reconciliation on page 22 of this financial supplement. |

| (d) | See Glossary of Terms for definition of ratio. |

| (e) | Calculated using period-end balances. |

| (f) | 3Q14 decrease relates to shares purchased under the share repurchase program. |

12

FHN BUSINESS SEGMENT HIGHLIGHTS

Quarterly, Unaudited

| 3Q14 Changes vs. | ||||||||||||||||||||||||||||

| (Thousands) |

3Q14 | 2Q14 | 1Q14 | 4Q13 | 3Q13 | 2Q14 | 3Q13 | |||||||||||||||||||||

| Regional Banking |

||||||||||||||||||||||||||||

| Net interest income |

$ | 153,855 | $ | 148,654 | $ | 142,010 | $ | 146,427 | $ | 149,541 | 3 | % | 3 | % | ||||||||||||||

| Noninterest income |

64,159 | 66,226 | 59,992 | 62,806 | 63,883 | (3 | )% | * | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total revenues |

218,014 | 214,880 | 202,002 | 209,233 | 213,424 | 1 | % | 2 | % | |||||||||||||||||||

| Provision for loan losses |

2,204 | 8,425 | 12,990 | 2,585 | 5,159 | (74 | )% | (57 | )% | |||||||||||||||||||

| Noninterest expense |

136,253 | 133,564 | 133,050 | 139,186 | 131,961 | 2 | % | 3 | % | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income before income taxes |

79,557 | 72,891 | 55,962 | 67,462 | 76,304 | 9 | % | 4 | % | |||||||||||||||||||

| Provision for income taxes |

28,422 | 25,843 | 19,880 | 24,049 | 27,554 | 10 | % | 3 | % | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income |

$ | 51,135 | $ | 47,048 | $ | 36,082 | $ | 43,413 | $ | 48,750 | 9 | % | 5 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Capital Markets |

||||||||||||||||||||||||||||

| Net interest income |

$ | 2,952 | $ | 2,590 | $ | 3,478 | $ | 4,301 | $ | 3,811 | 14 | % | (23 | )% | ||||||||||||||

| Noninterest income |

49,895 | 47,564 | 56,758 | 59,509 | 64,115 | 5 | % | (22 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total revenues |

52,847 | 50,154 | 60,236 | 63,810 | 67,926 | 5 | % | (22 | )% | |||||||||||||||||||

| Noninterest expense (a) |

47,910 | 111 | 52,594 | 53,130 | 57,930 | NM | (17 | )% | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income before income taxes |

4,937 | 50,043 | 7,642 | 10,680 | 9,996 | (90 | )% | (51 | )% | |||||||||||||||||||

| Provision for income taxes |

1,697 | 19,146 | 2,845 | 3,981 | 3,765 | (91 | )% | (55 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income |

$ | 3,240 | $ | 30,897 | $ | 4,797 | $ | 6,699 | $ | 6,231 | (90 | )% | (48 | )% | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Corporate |

||||||||||||||||||||||||||||

| Net interest income/(expense) |

$ | (12,523 | ) | $ | (10,522 | ) | $ | (9,113 | ) | $ | (10,413 | ) | $ | (11,654 | ) | (19 | )% | (7 | )% | |||||||||

| Noninterest income |

4,139 | 5,214 | 13,215 | 7,831 | 6,558 | (21 | )% | (37 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total revenues |

(8,384 | ) | (5,308 | ) | 4,102 | (2,582 | ) | (5,096 | ) | (58 | )% | (65 | )% | |||||||||||||||

| Noninterest expense |

18,783 | 15,798 | 19,578 | 18,770 | 21,739 | 19 | % | (14 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Loss before income taxes |

(27,167 | ) | (21,106 | ) | (15,476 | ) | (21,352 | ) | (26,835 | ) | (29 | )% | (1 | )% | ||||||||||||||

| Benefit for income taxes |

(17,723 | ) | (17,270 | ) | (11,766 | ) | (19,004 | ) | (16,593 | ) | (3 | )% | (7 | )% | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net loss |

$ | (9,444 | ) | $ | (3,836 | ) | $ | (3,710 | ) | $ | (2,348 | ) | $ | (10,242 | ) | NM | 8 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Non-Strategic |

||||||||||||||||||||||||||||

| Net interest income |

$ | 15,257 | $ | 16,046 | $ | 15,984 | $ | 16,820 | $ | 17,140 | (5 | )% | (11 | )% | ||||||||||||||

| Noninterest income (b) |

39,622 | 7,897 | 15,765 | 4,897 | 15,919 | NM | NM | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total revenues |

54,879 | 23,943 | 31,749 | 21,717 | 33,059 | NM | 66 | % | ||||||||||||||||||||

| Provision/(provision credit) for loan losses |

3,796 | (3,425 | ) | (2,990 | ) | 12,415 | 4,841 | NM | (22 | )% | ||||||||||||||||||

| Noninterest expense (c) |

43,240 | 15,859 | 14,992 | 46,011 | 221,926 | NM | (81 | )% | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income/(loss) before income taxes |

7,843 | 11,509 | 19,747 | (36,709 | ) | (193,708 | ) | (32 | )% | NM | ||||||||||||||||||

| Provision/(benefit) for income taxes |

3,025 | 4,438 | 7,686 | (42,839 | ) | (45,820 | ) | (32 | )% | NM | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income/(loss) from continuing operations |

4,818 | 7,071 | 12,061 | 6,130 | (147,888 | ) | (32 | )% | NM | |||||||||||||||||||

| Income/(loss) from discontinued operations, net of tax |

— | — | — | (6 | ) | 123 | NM | NM | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income/(loss) |

$ | 4,818 | $ | 7,071 | $ | 12,061 | $ | 6,124 | $ | (147,765 | ) | (32 | )% | NM | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total Consolidated |

||||||||||||||||||||||||||||

| Net interest income |

$ | 159,541 | $ | 156,768 | $ | 152,359 | $ | 157,135 | $ | 158,838 | 2 | % | * | |||||||||||||||

| Noninterest income |

157,815 | 126,901 | 145,730 | 135,043 | 150,475 | 24 | % | 5 | % | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total revenues |

317,356 | 283,669 | 298,089 | 292,178 | 309,313 | 12 | % | 3 | % | |||||||||||||||||||

| Provision for loan losses |

6,000 | 5,000 | 10,000 | 15,000 | 10,000 | 20 | % | (40 | )% | |||||||||||||||||||

| Noninterest expense |

246,186 | 165,332 | 220,214 | 257,097 | 433,556 | 49 | % | (43 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income/(loss) before income taxes |

65,170 | 113,337 | 67,875 | 20,081 | (134,243 | ) | (42 | )% | NM | |||||||||||||||||||

| Provision/(benefit) for income taxes |

15,421 | 32,157 | 18,645 | (33,813 | ) | (31,094 | ) | (52 | )% | NM | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income/(loss) from continuing operations |

49,749 | 81,180 | 49,230 | 53,894 | (103,149 | ) | (39 | )% | NM | |||||||||||||||||||

| Income/(loss) from discontinued operations, net of tax |

— | — | — | (6 | ) | 123 | NM | NM | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income/(loss) |

$ | 49,749 | $ | 81,180 | $ | 49,230 | $ | 53,888 | $ | (103,026 | ) | (39 | )% | NM | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

NM - Not meaningful

| * | Amount is less than one percent. |

| (a) | 2Q14 includes $47.1 million related to agreements with insurance companies for the recovery of expenses FHN incurred in connection with the Sentinel litigation matter which was settled in 2011. |

| (b) | 3Q14 includes $39.7 million of gains on the sales of HFS mortgage loans. |

| (c) | 3Q14 includes $50.0 million of loss accruals related to legal matters, partially offset by $15.0 million of expense reversals related to agreements with insurance companies for the recovery of expenses FHN incurred related to litigation losses in previous periods; 4Q13 includes $57.0 million of net loss accruals related to legal matters, partially offset by a $30.0 million expense reversal related to the resolution of certain legacy and representation and warranty mortgage loan repurchase obligations to a government sponsored entity; 3Q13 includes a $200.0 million expense stemming from the resolution of certain legacy representation and warranty mortgage loan repurchase obligations to a government sponsored entity. |

13

FHN REGIONAL BANKING

Quarterly, Unaudited

| 3Q14 Changes vs. | ||||||||||||||||||||||||||||

| 3Q14 | 2Q14 | 1Q14 | 4Q13 | 3Q13 | 2Q14 | 3Q13 | ||||||||||||||||||||||

| Income Statement (thousands) |

||||||||||||||||||||||||||||

| Net interest income |

$ | 153,855 | $ | 148,654 | $ | 142,010 | $ | 146,427 | $ | 149,541 | 3 | % | 3 | % | ||||||||||||||

| Provision for loan losses |

2,204 | 8,425 | 12,990 | 2,585 | 5,159 | (74 | )% | (57 | )% | |||||||||||||||||||

| Noninterest income: |

||||||||||||||||||||||||||||

| NSF / Overdraft fees (a) |

11,425 | 10,636 | 9,156 | 11,411 | 11,660 | 7 | % | (2 | )% | |||||||||||||||||||

| Cash management fees |

8,522 | 8,537 | 8,916 | 9,063 | 8,760 | * | (3 | )% | ||||||||||||||||||||

| Debit card income |

2,945 | 2,934 | 2,655 | 2,739 | 2,782 | * | 6 | % | ||||||||||||||||||||

| Other |

4,705 | 4,850 | 4,864 | 5,112 | 5,126 | (3 | )% | (8 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total deposit transactions and cash management |

27,597 | 26,957 | 25,591 | 28,325 | 28,328 | 2 | % | (3 | )% | |||||||||||||||||||

| Brokerage, management fees and commissions |

12,333 | 12,844 | 12,276 | 11,505 | 10,868 | (4 | )% | 13 | % | |||||||||||||||||||

| Trust services and investment management |

6,794 | 7,325 | 6,760 | 6,612 | 6,665 | (7 | )% | 2 | % | |||||||||||||||||||

| Bankcard income (b) |

5,346 | 7,740 | 4,365 | 4,815 | 5,089 | (31 | )% | 5 | % | |||||||||||||||||||

| Other service charges |

2,802 | 2,848 | 2,559 | 2,873 | 3,451 | (2 | )% | (19 | )% | |||||||||||||||||||

| Miscellaneous revenue |

9,287 | 8,512 | 8,441 | 8,676 | 9,482 | 9 | % | (2 | )% | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total noninterest income |

64,159 | 66,226 | 59,992 | 62,806 | 63,883 | (3 | )% | * | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Noninterest expense: |

||||||||||||||||||||||||||||

| Employee compensation, incentives, and benefits |

51,991 | 51,870 | 50,318 | 50,921 | 51,656 | * | 1 | % | ||||||||||||||||||||

| Other |

84,262 | 81,694 | 82,732 | 88,265 | 80,305 | 3 | % | 5 | % | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total noninterest expense |

136,253 | 133,564 | 133,050 | 139,186 | 131,961 | 2 | % | 3 | % | |||||||||||||||||||

|

|

|

|

|

|