Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Bank of New York Mellon Corp | a3q2014earnings8-kxxoct9.htm |

| EX-99.3 - KEY FACTS - Bank of New York Mellon Corp | ex993_keyfacts3q14.htm |

| EX-99.2 - QUARTERLY TRENDS - Bank of New York Mellon Corp | ex992_quarterlytrends3q14.htm |

| EX-99.1 - EARNINGS RELEASE - Bank of New York Mellon Corp | ex991_earningsrelease3q14.htm |

BNY Mellon Third Quarter 2014 Financial Highlights October 17, 2014

2 Third Quarter 2014 – Financial Highlights Cautionary Statement A number of statements in our presentations, the accompanying slides and the responses to your questions are “forward-looking statements.” These statements relate to, among other things, The Bank of New York Mellon Corporation’s (the “Corporation”) expectations regarding: our estimated capital ratios and expectations regarding those ratios; preliminary business metrics; our plans relating to the securities portfolio and impact on net interest revenue; and statements regarding the Corporation's aspirations, as well as the Corporation’s overall plans, strategies, goals, objectives, expectations, estimates, intentions, targets, opportunities and initiatives. These forward-looking statements are based on assumptions that involve risks and uncertainties and that are subject to change based on various important factors (some of which are beyond the Corporation’s control). Actual results may differ materially from those expressed or implied as a result of the factors described under “Forward Looking Statements” and “Risk Factors” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2013 (the “2013 Annual Report”), and in other filings of the Corporation with the Securities and Exchange Commission (the “SEC”). Such forward-looking statements speak only as of October 17, 2014, and the Corporation undertakes no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events. Non-GAAP Measures: In this presentation we may discuss some non-GAAP adjusted measures in detailing the Corporation’s performance. We believe these measures are useful to the investment community in analyzing the financial results and trends of ongoing operations. We believe they facilitate comparisons with prior periods and reflect the principal basis on which our management monitors financial performance. Additional disclosures relating to non-GAAP adjusted measures are contained in the Corporation’s reports filed with the SEC, including the 2013 Annual Report, our Quarterly Report on Form 10-Q for the quarter ended June 30, 2014 and the Corporation's Earnings Release for the quarter ended September 30, 2014, included as an exhibit to our Current Report on Form 8-K filed on October 17, 2014 (the “Earnings Release”), available at www.bnymellon.com/investorrelations.

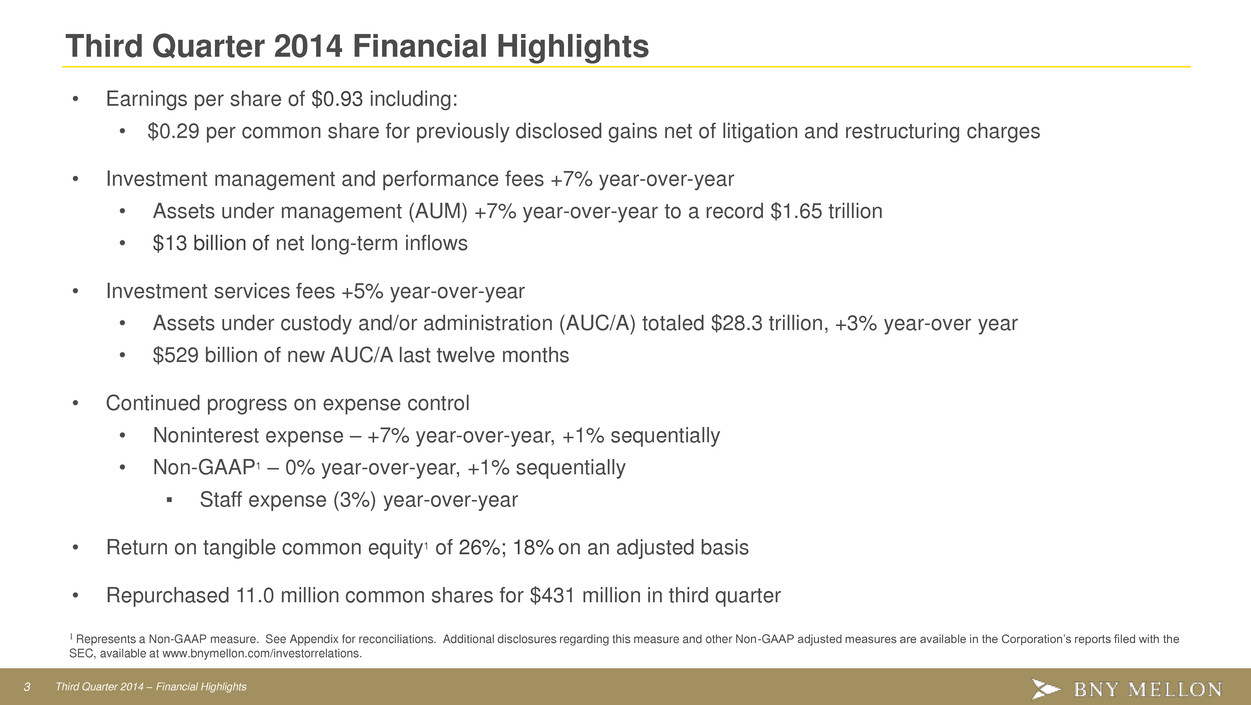

3 Third Quarter 2014 – Financial Highlights Third Quarter 2014 Financial Highlights • Earnings per share of $0.93 including: • $0.29 per common share for previously disclosed gains net of litigation and restructuring charges • Investment management and performance fees +7% year-over-year • Assets under management (AUM) +7% year-over-year to a record $1.65 trillion • $13 billion of net long-term inflows • Investment services fees +5% year-over-year • Assets under custody and/or administration (AUC/A) totaled $28.3 trillion, +3% year-over year • $529 billion of new AUC/A last twelve months • Continued progress on expense control • Noninterest expense – +7% year-over-year, +1% sequentially • Non-GAAP1 – 0% year-over-year, +1% sequentially ▪ Staff expense (3%) year-over-year • Return on tangible common equity1 of 26%; 18% on an adjusted basis • Repurchased 11.0 million common shares for $431 million in third quarter 1 Represents a Non-GAAP measure. See Appendix for reconciliations. Additional disclosures regarding this measure and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations.

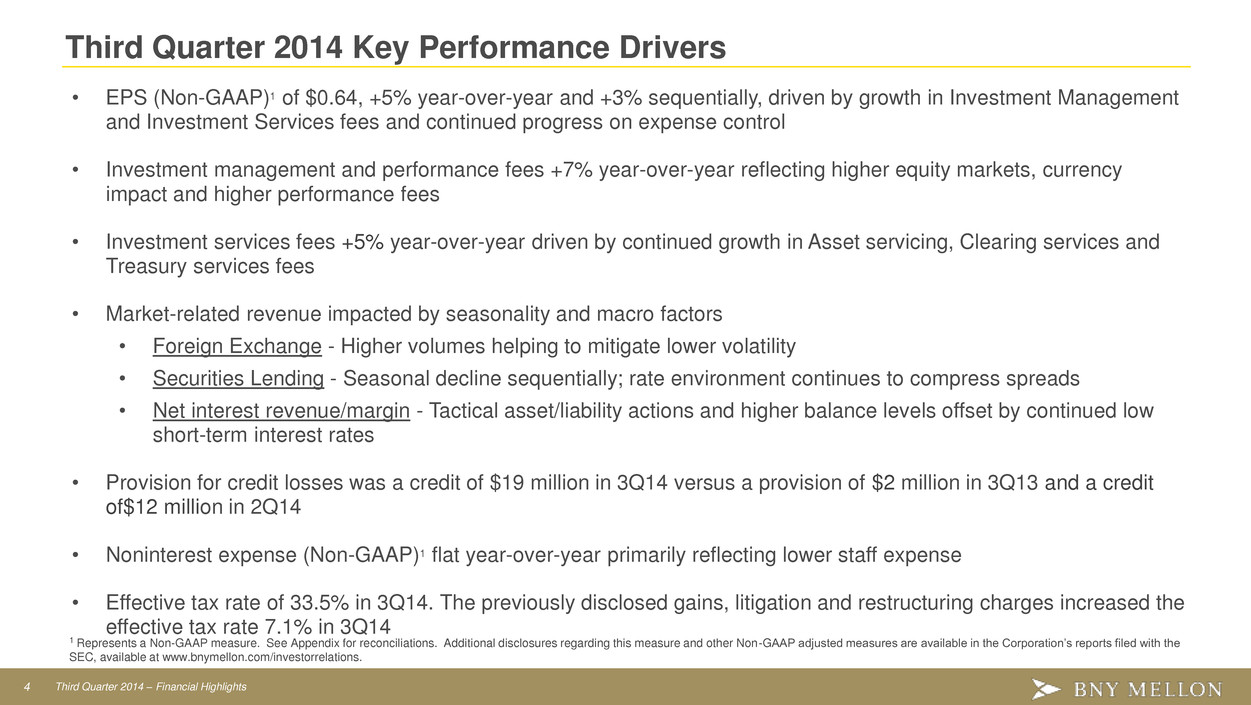

4 Third Quarter 2014 – Financial Highlights Third Quarter 2014 Key Performance Drivers • EPS (Non-GAAP)1 of $0.64, +5% year-over-year and +3% sequentially, driven by growth in Investment Management and Investment Services fees and continued progress on expense control • Investment management and performance fees +7% year-over-year reflecting higher equity markets, currency impact and higher performance fees • Investment services fees +5% year-over-year driven by continued growth in Asset servicing, Clearing services and Treasury services fees • Market-related revenue impacted by seasonality and macro factors • Foreign Exchange - Higher volumes helping to mitigate lower volatility • Securities Lending - Seasonal decline sequentially; rate environment continues to compress spreads • Net interest revenue/margin - Tactical asset/liability actions and higher balance levels offset by continued low short-term interest rates • Provision for credit losses was a credit of $19 million in 3Q14 versus a provision of $2 million in 3Q13 and a credit of$12 million in 2Q14 • Noninterest expense (Non-GAAP)1 flat year-over-year primarily reflecting lower staff expense • Effective tax rate of 33.5% in 3Q14. The previously disclosed gains, litigation and restructuring charges increased the effective tax rate 7.1% in 3Q14 1 Represents a Non-GAAP measure. See Appendix for reconciliations. Additional disclosures regarding this measure and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations.

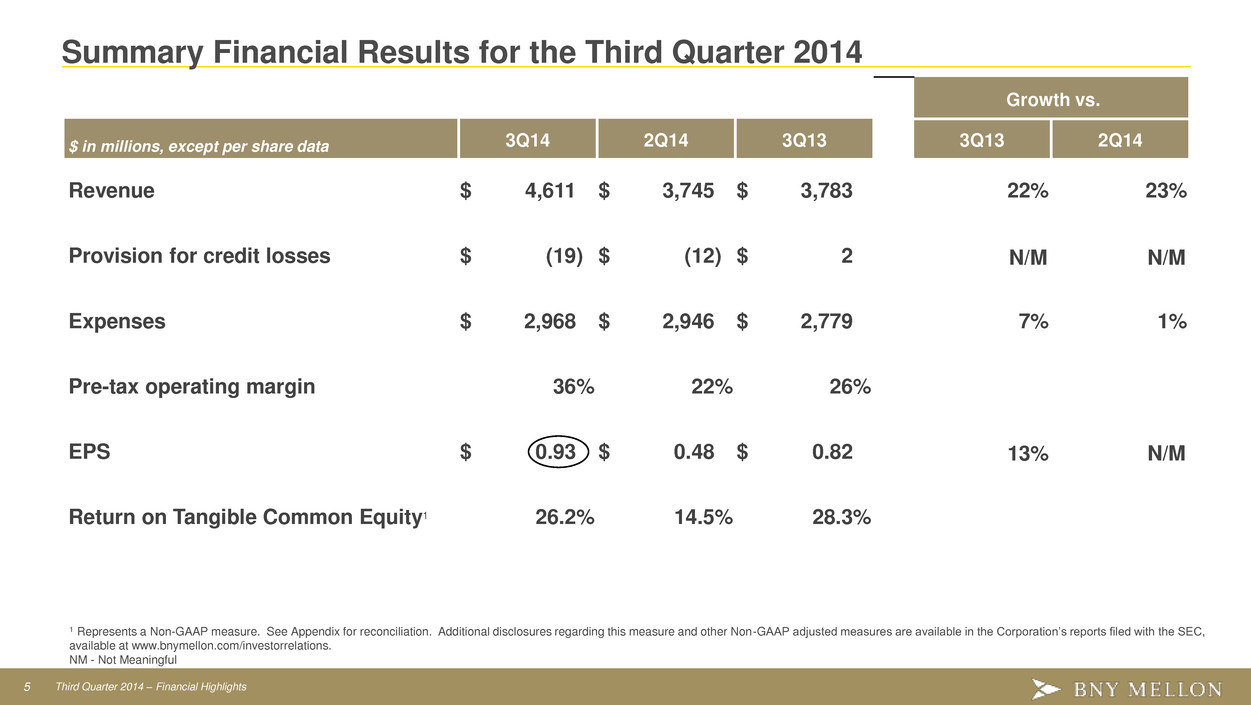

5 Third Quarter 2014 – Financial Highlights Summary Financial Results for the Third Quarter 2014 Growth vs. $ in millions, except per share data 3Q14 2Q14 3Q13 3Q13 2Q14 Revenue $ 4,611 $ 3,745 $ 3,783 22 % 23 % Provision for credit losses $ (19 ) $ (12 ) $ 2 N/M N/M Expenses $ 2,968 $ 2,946 $ 2,779 7 % 1 % Pre-tax operating margin 36 % 22 % 26 % EPS $ 0.93 $ 0.48 $ 0.82 13 % N/M Return on Tangible Common Equity1 26.2 % 14.5 % 28.3 % 1 Represents a Non-GAAP measure. See Appendix for reconciliation. Additional disclosures regarding this measure and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. NM - Not Meaningful

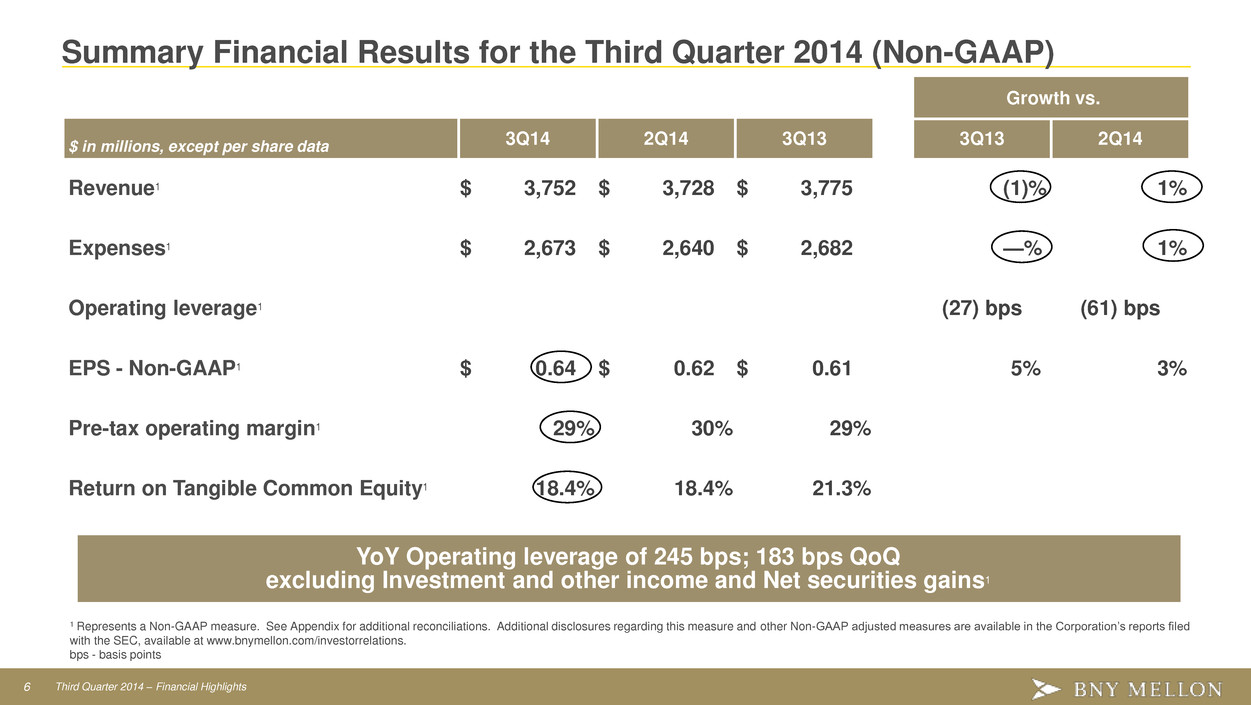

6 Third Quarter 2014 – Financial Highlights Summary Financial Results for the Third Quarter 2014 (Non-GAAP) Growth vs. $ in millions, except per share data 3Q14 2Q14 3Q13 3Q13 2Q14 Revenue1 $ 3,752 $ 3,728 $ 3,775 (1)% 1 % Expenses1 $ 2,673 $ 2,640 $ 2,682 —% 1 % Operating leverage1 (27) bps (61) bps EPS - Non-GAAP1 $ 0.64 $ 0.62 $ 0.61 5% 3 % Pre-tax operating margin1 29 % 30 % 29 % Return on Tangible Common Equity1 18.4 % 18.4 % 21.3 % 1 Represents a Non-GAAP measure. See Appendix for additional reconciliations. Additional disclosures regarding this measure and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. bps - basis points YoY Operating leverage of 245 bps; 183 bps QoQ excluding Investment and other income and Net securities gains1

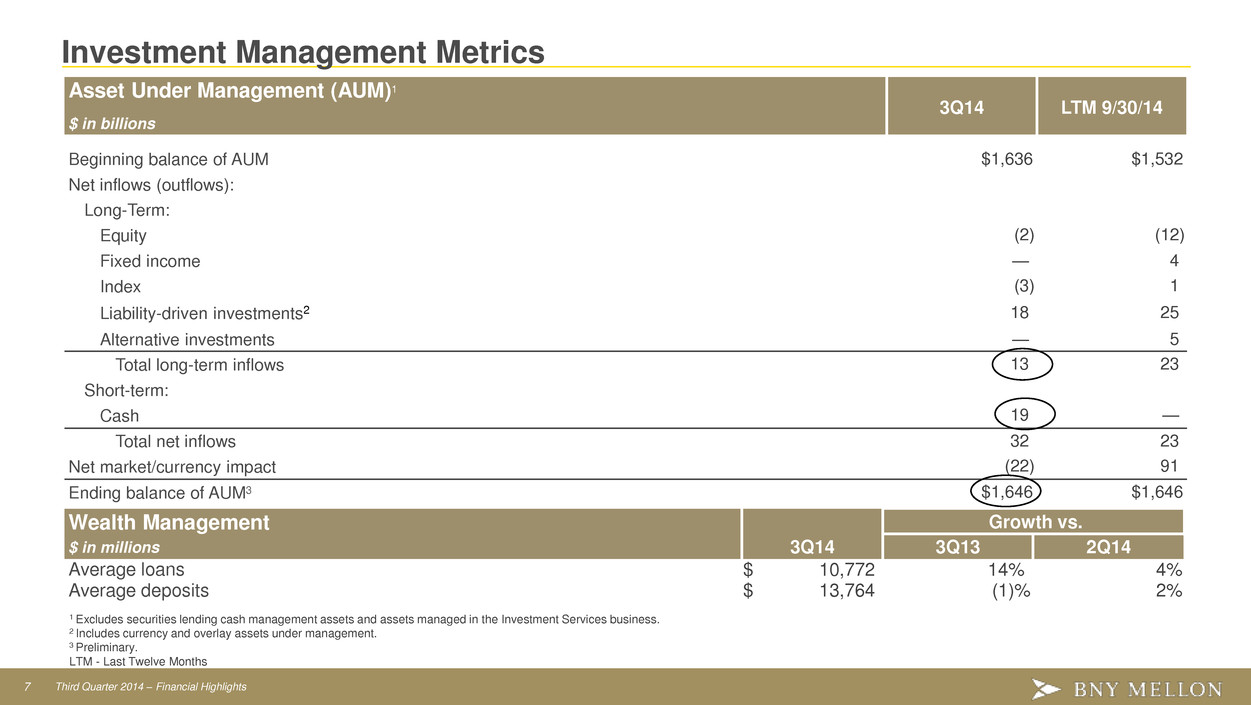

7 Third Quarter 2014 – Financial Highlights Investment Management Metrics Asset Under Management (AUM)1 $ in billions 3Q14 LTM 9/30/14 Beginning balance of AUM $1,636 $1,532 Net inflows (outflows): Long-Term: Equity (2 ) (12 ) Fixed income — 4 Index (3 ) 1 Liability-driven investments2 18 25 Alternative investments — 5 Total long-term inflows 13 23 Short-term: Cash 19 — Total net inflows 32 23 Net market/currency impact (22 ) 91 Ending balance of AUM3 $1,646 $1,646 Wealth Management Growth vs. $ in millions 3Q14 3Q13 2Q14 Average loans $ 10,772 14 % 4 % Average deposits $ 13,764 (1 )% 2 % 1 Excludes securities lending cash management assets and assets managed in the Investment Services business. 2 Includes currency and overlay assets under management. 3 Preliminary. LTM - Last Twelve Months

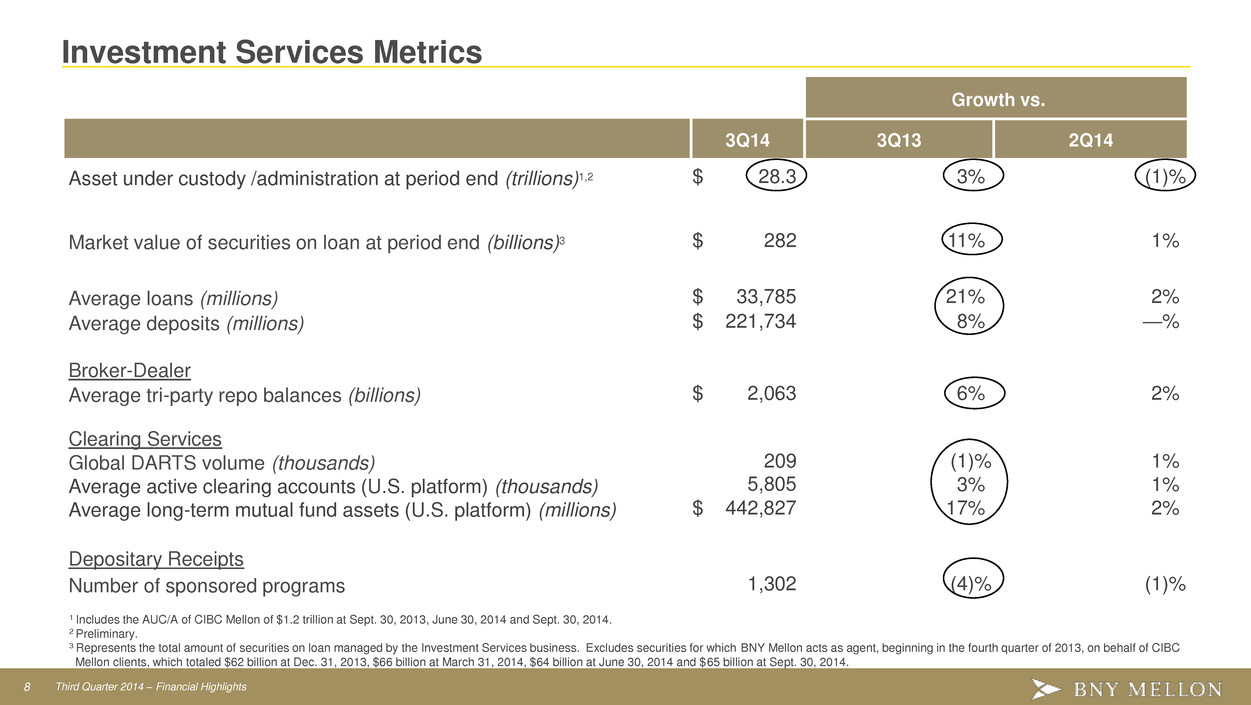

8 Third Quarter 2014 – Financial Highlights Investment Services Metrics Growth vs. 3Q14 3Q13 2Q14 Asset under custody /administration at period end (trillions)1,2 $ 28.3 3 % (1 )% Market value of securities on loan at period end (billions)3 $ 282 11 % 1 % Average loans (millions) $ 33,785 21 % 2 % Average deposits (millions) $ 221,734 8 % — % Broker-Dealer Average tri-party repo balances (billions) $ 2,063 6 % 2 % Clearing Services Global DARTS volume (thousands) 209 (1 )% 1 % Average active clearing accounts (U.S. platform) (thousands) 5,805 3 % 1 % Average long-term mutual fund assets (U.S. platform) (millions) $ 442,827 17 % 2 % Depositary Receipts Number of sponsored programs 1,302 (4 )% (1 )% 1 Includes the AUC/A of CIBC Mellon of $1.2 trillion at Sept. 30, 2013, June 30, 2014 and Sept. 30, 2014. 2 Preliminary. 3 Represents the total amount of securities on loan managed by the Investment Services business. Excludes securities for which BNY Mellon acts as agent, beginning in the fourth quarter of 2013, on behalf of CIBC Mellon clients, which totaled $62 billion at Dec. 31, 2013, $66 billion at March 31, 2014, $64 billion at June 30, 2014 and $65 billion at Sept. 30, 2014.

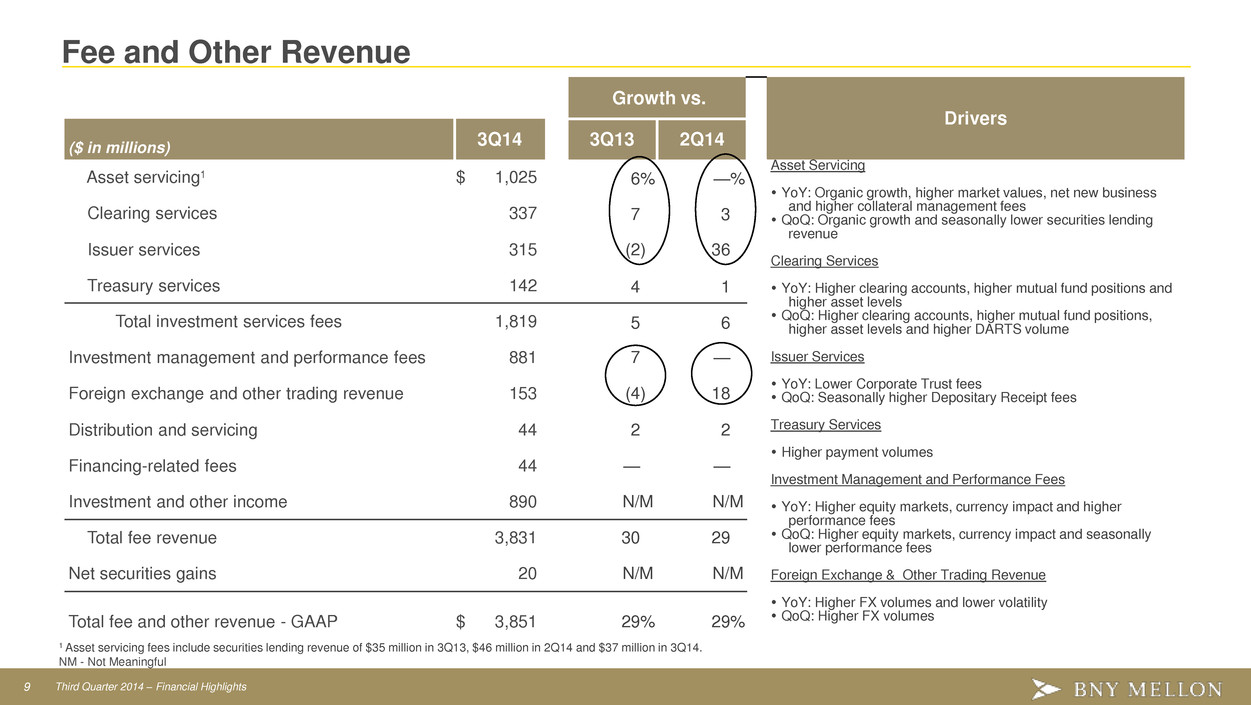

9 Third Quarter 2014 – Financial Highlights Fee and Other Revenue Growth vs. Drivers ($ in millions) 3Q14 3Q13 2Q14 Asset servicing1 $ 1,025 6 % — % Asset Servicing YoY: Organic growth, higher market values, net new business and higher collateral management fees QoQ: Organic growth and seasonally lower securities lending revenue Clearing Services YoY: Higher clearing accounts, higher mutual fund positions and higher asset levels QoQ: Higher clearing accounts, higher mutual fund positions, higher asset levels and higher DARTS volume Issuer Services YoY: Lower Corporate Trust fees QoQ: Seasonally higher Depositary Receipt fees Treasury Services Higher payment volumes Investment Management and Performance Fees YoY: Higher equity markets, currency impact and higher performance fees QoQ: Higher equity markets, currency impact and seasonally lower performance fees Foreign Exchange & Other Trading Revenue YoY: Higher FX volumes and lower volatility QoQ: Higher FX volumes Clearing services 337 7 3 Issuer services 315 (2 ) 36 Treasury services 142 4 1 Total investment services fees 1,819 5 6 Investment management and performance fees 881 7 — Foreign exchange and other trading revenue 153 (4 ) 18 Distribution and servicing 44 2 2 Financing-related fees 44 — — Investment and other income 890 N/M N/M Total fee revenue 3,831 30 29 Net securities gains 20 N/M N/M Total fee and other revenue - GAAP $ 3,851 29 % 29 % 1 Asset servicing fees include securities lending revenue of $35 million in 3Q13, $46 million in 2Q14 and $37 million in 3Q14. NM - Not Meaningful

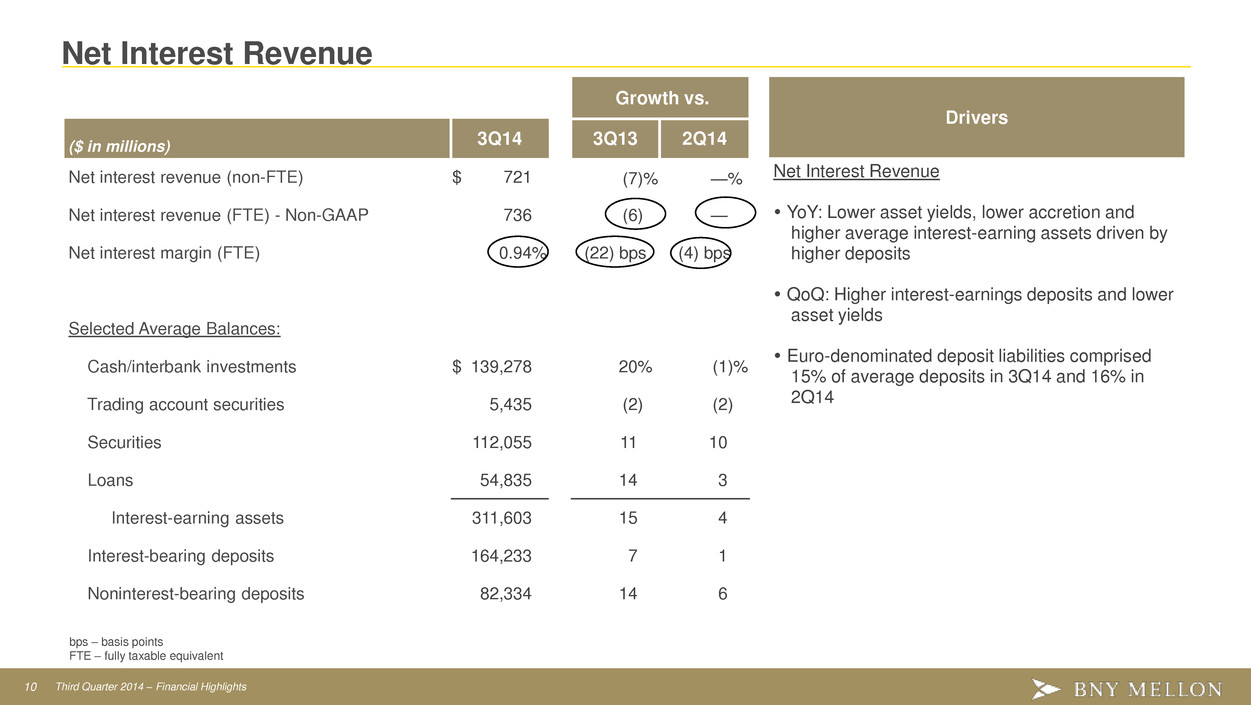

10 Third Quarter 2014 – Financial Highlights Net Interest Revenue Growth vs. Drivers ($ in millions) 3Q14 3Q13 2Q14 Net interest revenue (non-FTE) $ 721 (7 )% — % Net Interest Revenue YoY: Lower asset yields, lower accretion and higher average interest-earning assets driven by higher deposits QoQ: Higher interest-earnings deposits and lower asset yields Euro-denominated deposit liabilities comprised 15% of average deposits in 3Q14 and 16% in 2Q14 Net interest revenue (FTE) - Non-GAAP 736 (6 ) — Net interest margin (FTE) 0.94 % (22) bps (4) bps Selected Average Balances: Cash/interbank investments $ 139,278 20 % (1 )% Trading account securities 5,435 (2 ) (2 ) Securities 112,055 11 10 Loans 54,835 14 3 Interest-earning assets 311,603 15 4 Interest-bearing deposits 164,233 7 1 Noninterest-bearing deposits 82,334 14 6 bps – basis points FTE – fully taxable equivalent

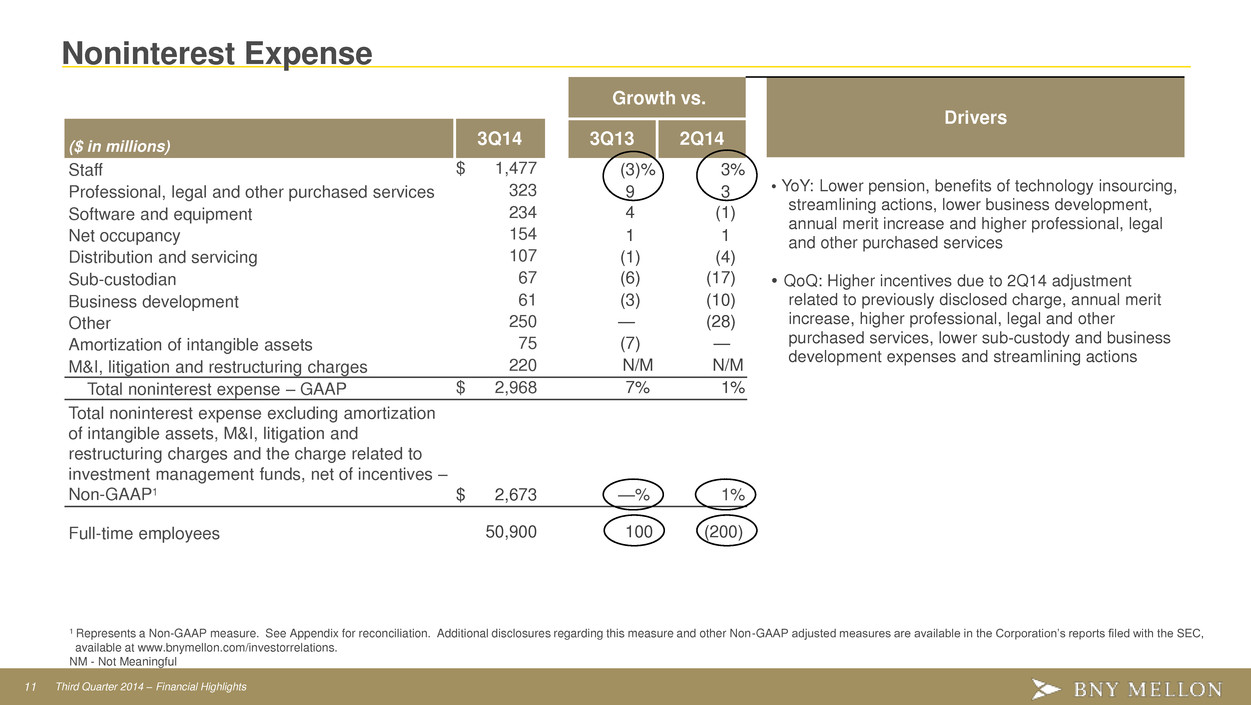

11 Third Quarter 2014 – Financial Highlights Noninterest Expense Growth vs. Drivers ($ in millions) 3Q14 3Q13 2Q14 Staff $ 1,477 (3 )% 3 % YoY: Lower pension, benefits of technology insourcing, streamlining actions, lower business development, annual merit increase and higher professional, legal and other purchased services QoQ: Higher incentives due to 2Q14 adjustment related to previously disclosed charge, annual merit increase, higher professional, legal and other purchased services, lower sub-custody and business development expenses and streamlining actions Professional, legal and other purchased services 323 9 3 Software and equipment 234 4 (1 ) Net occupancy 154 1 1 Distribution and servicing 107 (1 ) (4 ) Sub-custodian 67 (6 ) (17 ) Business development 61 (3 ) (10 ) Other 250 — (28 ) Amortization of intangible assets 75 (7 ) — M&I, litigation and restructuring charges 220 N/M N/M Total noninterest expense – GAAP $ 2,968 7 % 1 % Total noninterest expense excluding amortization of intangible assets, M&I, litigation and restructuring charges and the charge related to investment management funds, net of incentives – Non-GAAP1 $ 2,673 — % 1 % Full-time employees 50,900 100 (200) 1 Represents a Non-GAAP measure. See Appendix for reconciliation. Additional disclosures regarding this measure and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. NM - Not Meaningful

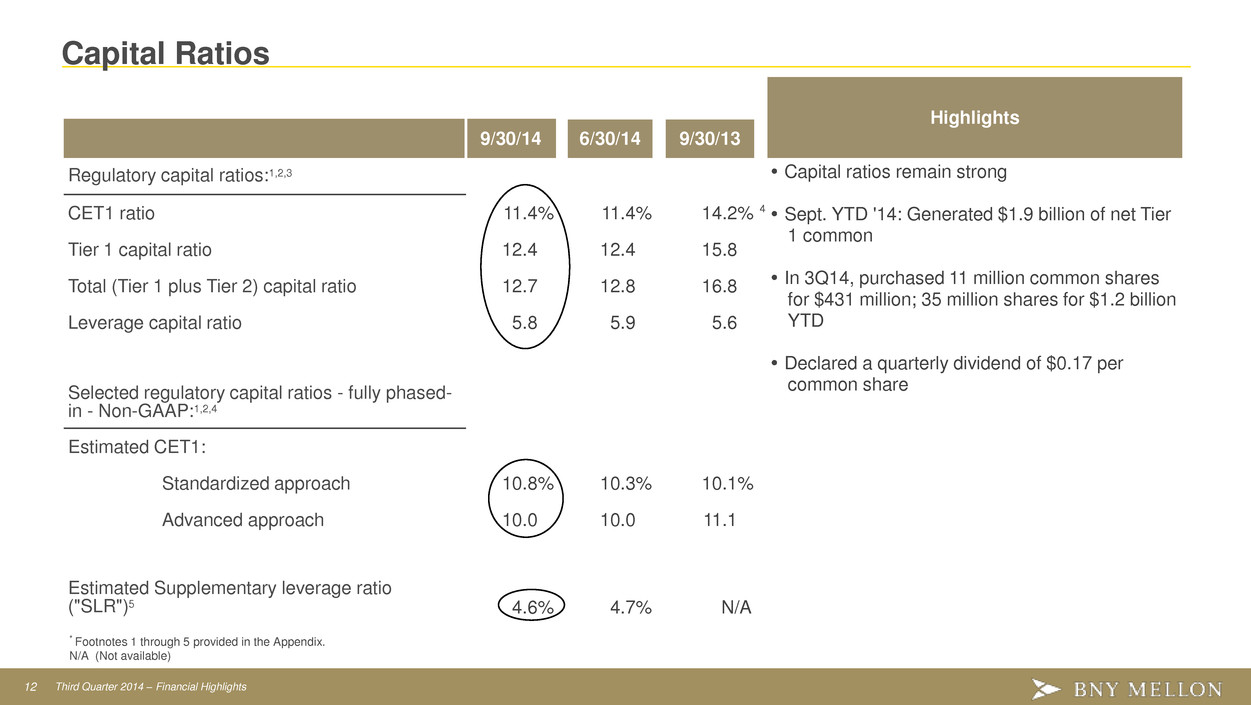

12 Third Quarter 2014 – Financial Highlights Capital Ratios Highlights 9/30/14 6/30/14 9/30/13 Regulatory capital ratios:1,2,3 Capital ratios remain strong Sept. YTD '14: Generated $1.9 billion of net Tier 1 common In 3Q14, purchased 11 million common shares for $431 million; 35 million shares for $1.2 billion YTD Declared a quarterly dividend of $0.17 per common share CET1 ratio 11.4 % 11.4 % 14.2 % 4 Tier 1 capital ratio 12.4 12.4 15.8 Total (Tier 1 plus Tier 2) capital ratio 12.7 12.8 16.8 Leverage capital ratio 5.8 5.9 5.6 Selected regulatory capital ratios - fully phased- in - Non-GAAP:1,2,4 Estimated CET1: Standardized approach 10.8 % 10.3 % 10.1 % Advanced approach 10.0 10.0 11.1 Estimated Supplementary leverage ratio ("SLR")5 4.6 % 4.7 % N/A * Footnotes 1 through 5 provided in the Appendix.e Append N/A (Not available)

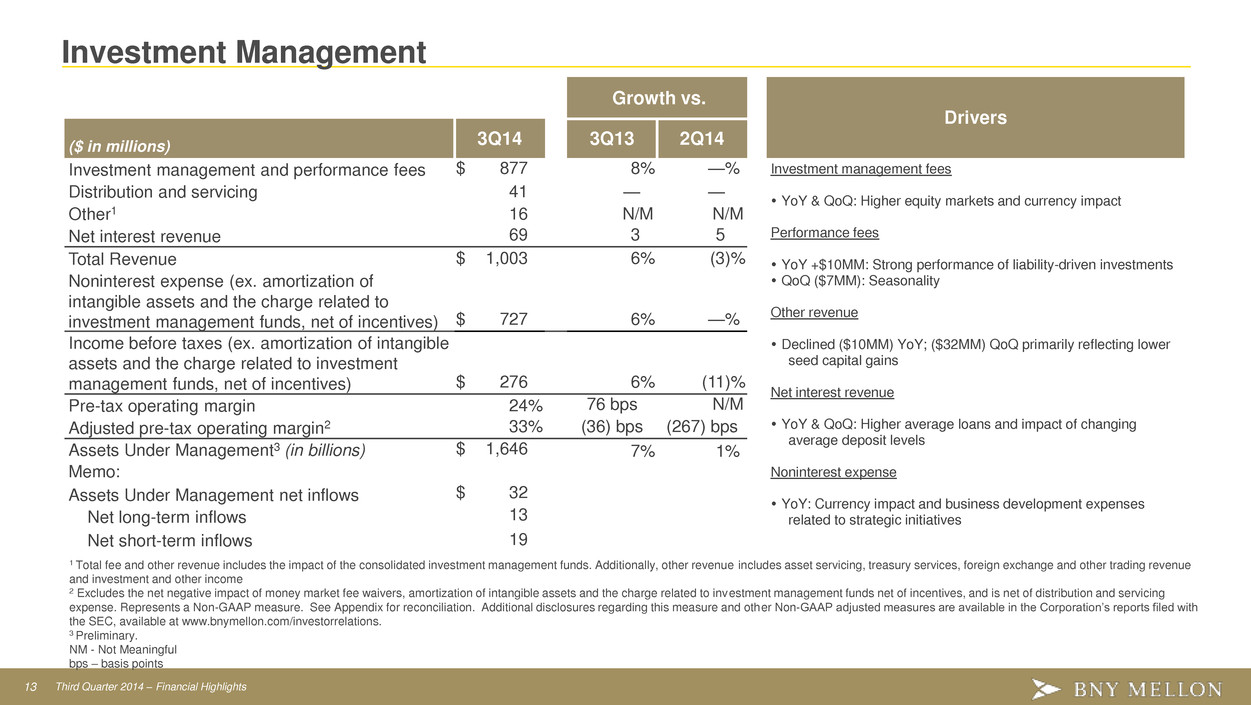

13 Third Quarter 2014 – Financial Highlights Investment Management . Growth vs. Drivers ($ in millions) 3Q14 3Q13 2Q14 Investment management and performance fees $ 877 8 % — % Investment management fees YoY & QoQ: Higher equity markets and currency impact Performance fees YoY +$10MM: Strong performance of liability-driven investments QoQ ($7MM): Seasonality Other revenue Declined ($10MM) YoY; ($32MM) QoQ primarily reflecting lower seed capital gains Net interest revenue YoY & QoQ: Higher average loans and impact of changing average deposit levels Noninterest expense YoY: Currency impact and business development expenses related to strategic initiatives Distribution and servicing 41 — — Other1 16 N/M N/M Net interest revenue 69 3 5 Total Revenue $ 1,003 6 % (3 )% Noninterest expense (ex. amortization of intangible assets and the charge related to investment management funds, net of incentives) $ 727 6 % — % Income before taxes (ex. amortization of intangible assets and the charge related to investment management funds, net of incentives) $ 276 6 % (11 )% Pre-tax operating margin 24 % 76 bps N/M Adjusted pre-tax operating margin2 33 % (36) bps (267) bps Assets Under Management3 (in billions) $ 1,646 7 % 1 % Memo: Assets Under Management net inflows $ 32 Net long-term inflows 13 Net short-term inflows 19 1 Total fee and other revenue includes the impact of the consolidated investment management funds. Additionally, other revenue includes asset servicing, treasury services, foreign exchange and other trading revenue and investment and other income 2 Excludes the net negative impact of money market fee waivers, amortization of intangible assets and the charge related to investment management funds net of incentives, and is net of distribution and servicing expense. Represents a Non-GAAP measure. See Appendix for reconciliation. Additional disclosures regarding this measure and other Non-GAAP adjusted measures are available in the Corporation’s reports filed with the SEC, available at www.bnymellon.com/investorrelations. 3 Preliminary. NM - Not Meaningful bps – basis points

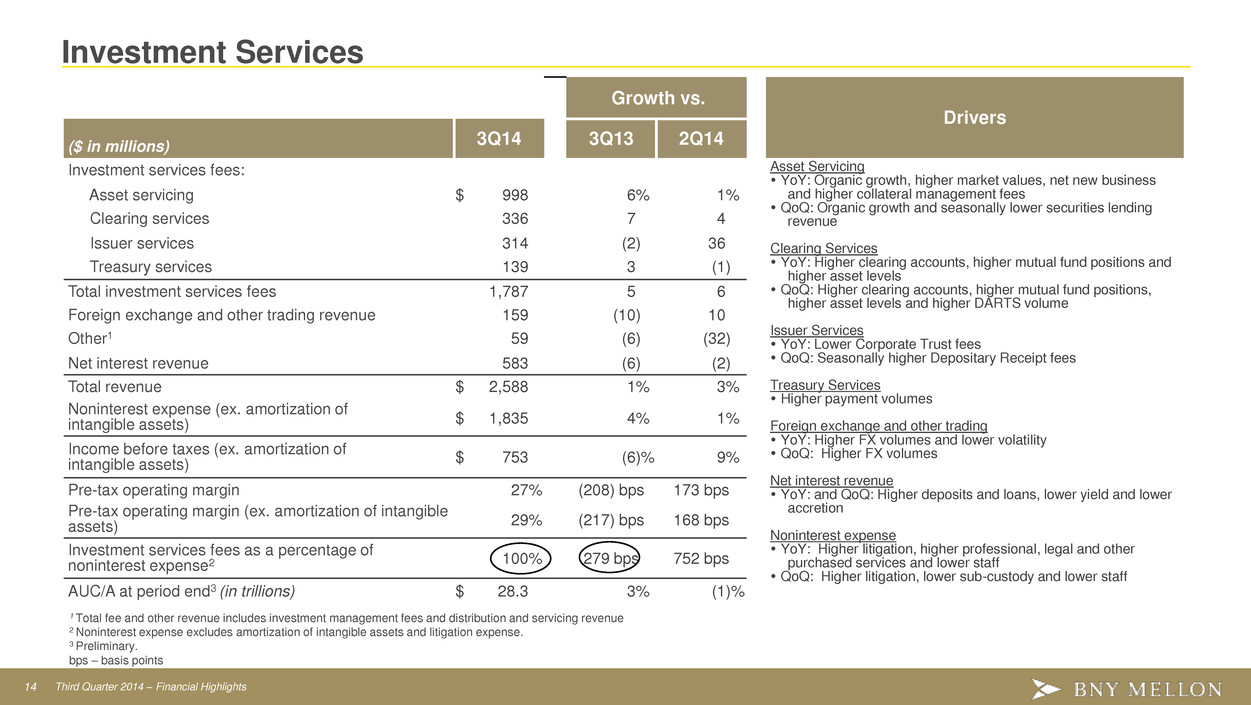

14 Third Quarter 2014 – Financial Highlights Investment Services Growth vs. Drivers ($ in millions) 3Q14 3Q13 2Q14 Investment services fees: Asset Servicing YoY: Organic growth, higher market values, net new business and higher collateral management fees QoQ: Organic growth and seasonally lower securities lending revenue Clearing Services YoY: Higher clearing accounts, higher mutual fund positions and higher asset levels QoQ: Higher clearing accounts, higher mutual fund positions, higher asset levels and higher DARTS volume Issuer Services YoY: Lower Corporate Trust fees QoQ: Seasonally higher Depositary Receipt fees Treasury Services Higher payment volumes Foreign exchange and other trading YoY: Higher FX volumes and lower volatility QoQ: Higher FX volumes Net interest revenue YoY: and QoQ: Higher deposits and loans, lower yield and lower accretion Noninterest expense YoY: Higher litigation, higher professional, legal and other purchased services and lower staff QoQ: Higher litigation, lower sub-custody and lower staff Asset servicing $ 998 6 % 1 % Clearing services 336 7 4 Issuer services 314 (2 ) 36 Treasury services 139 3 (1 ) Total investment services fees 1,787 5 6 Foreign exchange and other trading revenue 159 (10 ) 10 Other1 59 (6 ) (32 ) Net interest revenue 583 (6 ) (2 ) Total revenue $ 2,588 1 % 3 % Noninterest expense (ex. amortization of intangible assets) $ 1,835 4 % 1 % Income before taxes (ex. amortization of intangible assets) $ 753 (6 )% 9 % Pre-tax operating margin 27 % (208) bps 173 bps Pre-tax operating margin (ex. amortization of intangible assets) 29 % (217) bps 168 bps Investment services fees as a percentage of noninterest expense2 100 % 279 bps 752 bps AUC/A at period end3 (in trillions) $ 28.3 3 % (1 )% 1 Total fee and other revenue includes investment management fees and distribution and servicing revenue 2 Noninterest expense excludes amortization of intangible assets and litigation expense. 3 Preliminary. bps – basis points

APPENDIX

16 Third Quarter 2014 – Financial Highlights Expense & Pre-Tax Operating Margin - Non-GAAP Reconciliation 3Q14 2Q14 3Q13 ($ in millions) Total revenue – GAAP $ 4,611 $ 3,745 $ 3,783 Less: Net income attributable to noncontrolling interests of consolidated investment management funds 23 17 8 Gain on the sale of investment in Wing Hang 490 — — Gain on the sale of One Wall Street building 346 — — Total revenue, as adjusted – Non-GAAP $ 3,752 $ 3,728 $ 3,775 Total noninterest expense – GAAP $ 2,968 $ 2,946 $ 2,779 Less: Amortization of intangible assets 75 75 81 M&I, litigation and restructuring charges 220 122 16 Charge related to investment management funds, net of incentives — 109 — Total noninterest expense excluding amortization of intangible assets, M&I, litigation and restructuring charges and the charge related to investment management funds, net of incentives – Non-GAAP2 $ 2,673 $ 2,640 $ 2,682 Provision for credit losses (19 ) (12 ) 2 Income before income taxes, as adjusted – Non-GAAP2 $ 1,098 $ 1,100 $ 1,091 Pre-tax operating margin – Non-GAAP1,2 29 % 30 % 29 % 1 Income before taxes divided by total revenue. 2 Non-GAAP excludes M&I, litigation and restructuring charges, the gain on the sale of our investment in Wing Hang, the gain on the sale of the One Wall Street building, a charge related to investment management funds, net of incentives and net income attributable to noncontrolling interests of consolidated investment management funds, if applicable. .

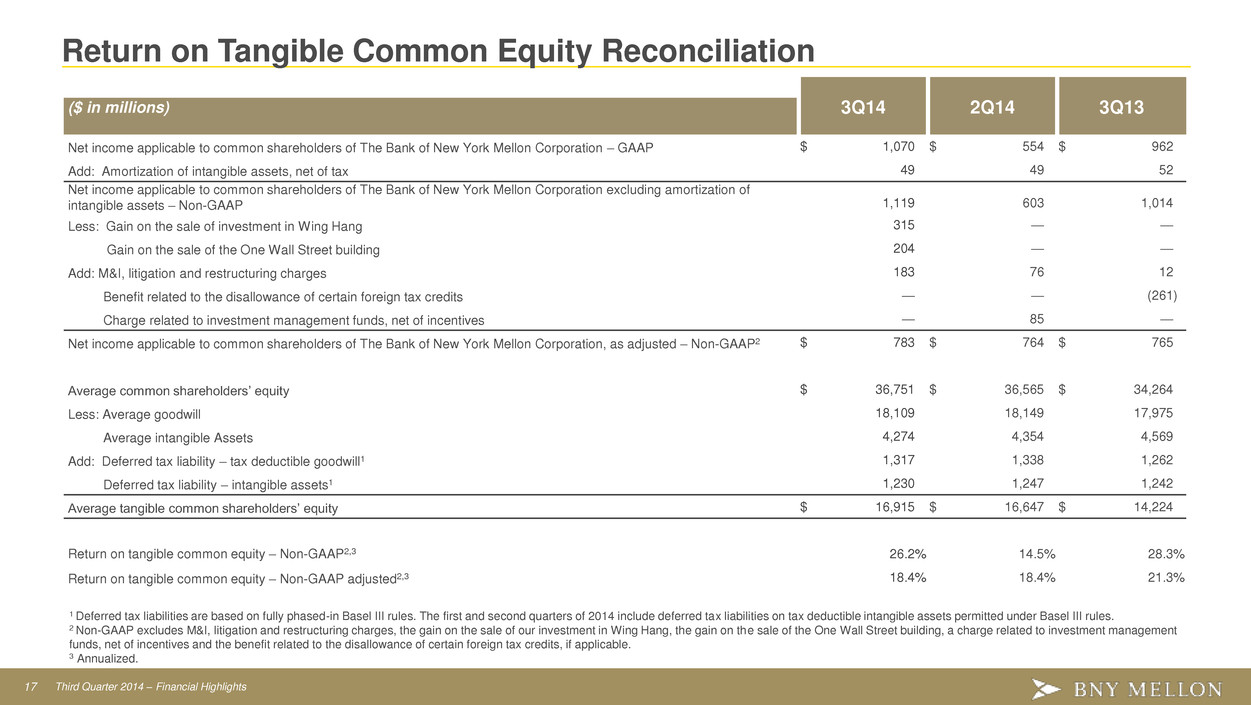

17 Third Quarter 2014 – Financial Highlights Return on Tangible Common Equity Reconciliation 3Q14 2Q14 3Q13 ($ in millions) Net income applicable to common shareholders of The Bank of New York Mellon Corporation – GAAP $ 1,070 $ 554 $ 962 Add: Amortization of intangible assets, net of tax 49 49 52 Net income applicable to common shareholders of The Bank of New York Mellon Corporation excluding amortization of intangible assets – Non-GAAP 1,119 603 1,014 Less: Gain on the sale of investment in Wing Hang 315 — — Gain on the sale of the One Wall Street building 204 — — Add: M&I, litigation and restructuring charges 183 76 12 Benefit related to the disallowance of certain foreign tax credits — — (261 ) Charge related to investment management funds, net of incentives — 85 — Net income applicable to common shareholders of The Bank of New York Mellon Corporation, as adjusted – Non-GAAP2 $ 783 $ 764 $ 765 Average common shareholders’ equity $ 36,751 $ 36,565 $ 34,264 Less: Average goodwill 18,109 18,149 17,975 Average intangible Assets 4,274 4,354 4,569 Add: Deferred tax liability – tax deductible goodwill1 1,317 1,338 1,262 Deferred tax liability – intangible assets1 1,230 1,247 1,242 Average tangible common shareholders’ equity $ 16,915 $ 16,647 $ 14,224 Return on tangible common equity – Non-GAAP2,3 26.2 % 14.5 % 28.3 % Return on tangible common equity – Non-GAAP adjusted2,3 18.4 % 18.4 % 21.3 % 1 Deferred tax liabilities are based on fully phased-in Basel III rules. The first and second quarters of 2014 include deferred tax liabilities on tax deductible intangible assets permitted under Basel III rules. 2 Non-GAAP excludes M&I, litigation and restructuring charges, the gain on the sale of our investment in Wing Hang, the gain on the sale of the One Wall Street building, a charge related to investment management funds, net of incentives and the benefit related to the disallowance of certain foreign tax credits, if applicable. 3 Annualized. .

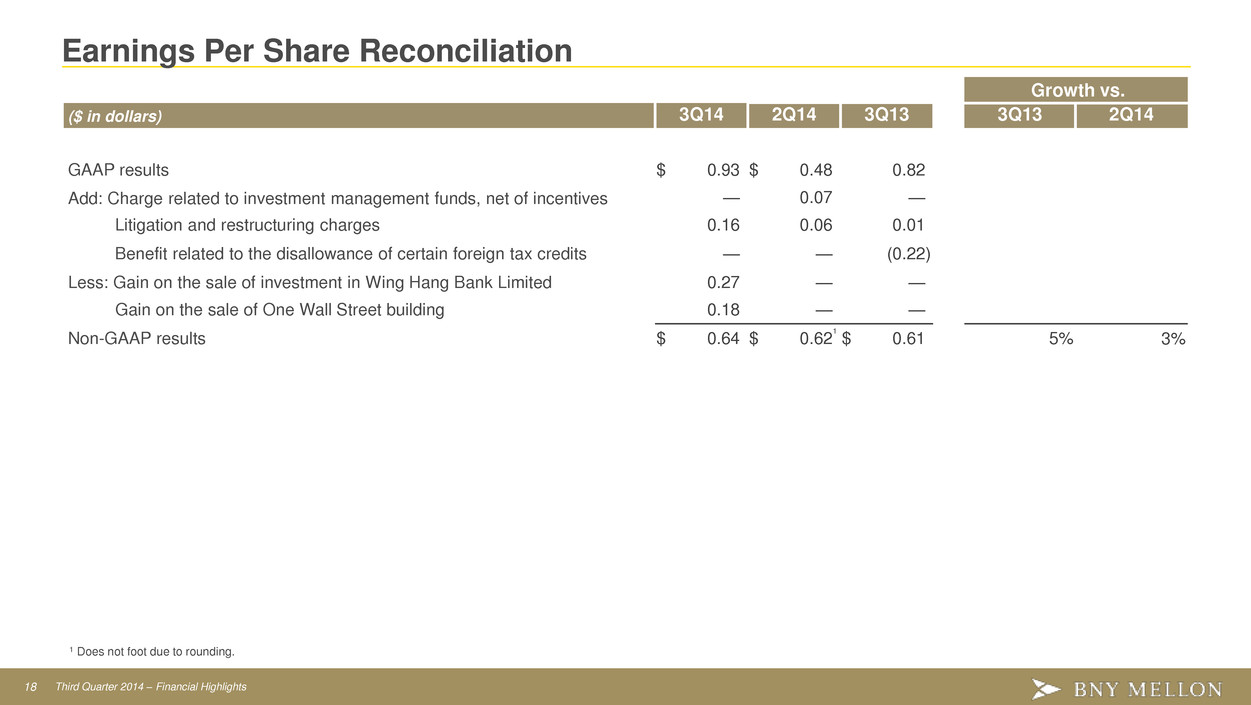

18 Third Quarter 2014 – Financial Highlights Earnings Per Share Reconciliation Growth vs. ($ in dollars) 3Q14 2Q14 3Q13 3Q13 2Q14 GAAP results $ 0.93 $ 0.48 0.82 Add: Charge related to investment management funds, net of incentives — 0.07 — Litigation and restructuring charges 0.16 0.06 0.01 Benefit related to the disallowance of certain foreign tax credits — — (0.22 ) Less: Gain on the sale of investment in Wing Hang Bank Limited 0.27 — — Gain on the sale of One Wall Street building 0.18 — — Non-GAAP results $ 0.64 $ 0.62 $ 0.61 5 % 3 % 1 Does not foot due to rounding. 1

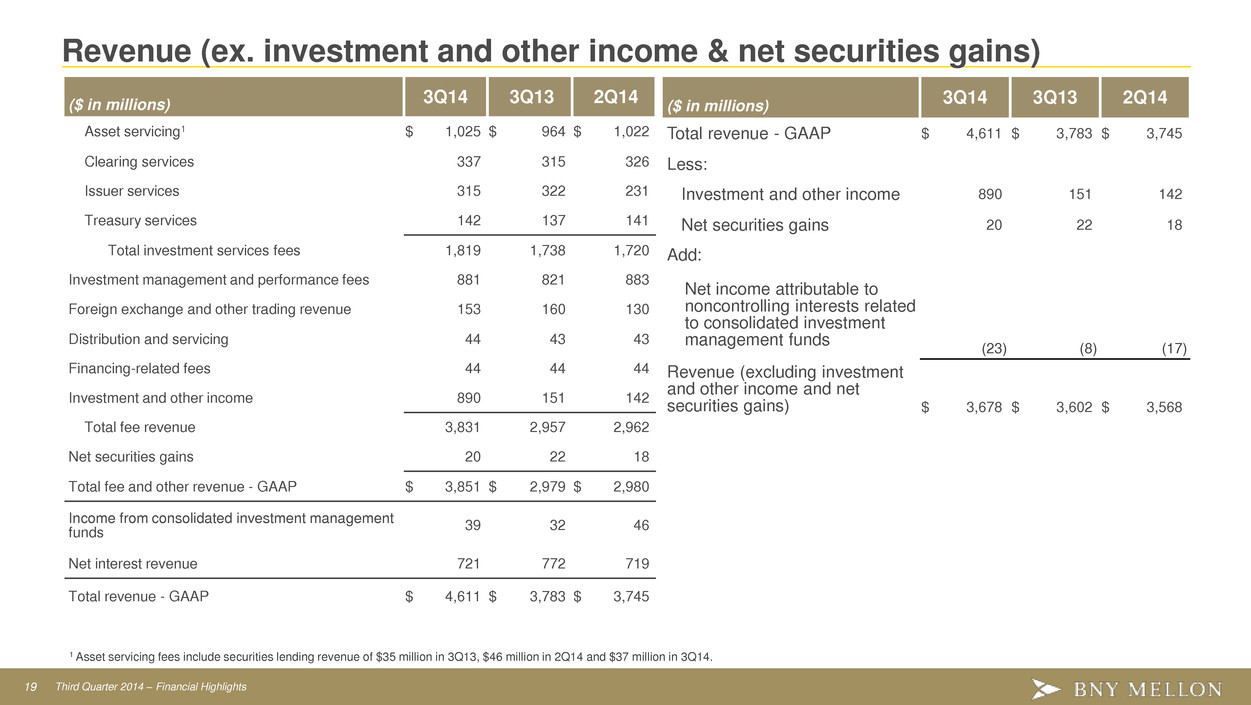

19 Third Quarter 2014 – Financial Highlights ($ in millions) 3Q14 3Q13 2Q14 Asset servicing1 $ 1,025 $ 964 $ 1,022 Clearing services 337 315 326 Issuer services 315 322 231 Treasury services 142 137 141 Total investment services fees 1,819 1,738 1,720 Investment management and performance fees 881 821 883 Foreign exchange and other trading revenue 153 160 130 Distribution and servicing 44 43 43 Financing-related fees 44 44 44 Investment and other income 890 151 142 Total fee revenue 3,831 2,957 2,962 Net securities gains 20 22 18 Total fee and other revenue - GAAP $ 3,851 $ 2,979 $ 2,980 Income from consolidated investment management funds 39 32 46 Net interest revenue 721 772 719 Total revenue - GAAP $ 4,611 $ 3,783 $ 3,745 ($ in millions) 3Q14 3Q13 2Q14 Total revenue - GAAP $ 4,611 $ 3,783 $ 3,745 Less: Investment and other income 890 151 142 Net securities gains 20 22 18 Add: Net income attributable to noncontrolling interests related to consolidated investment management funds (23 ) (8 ) (17 ) Revenue (excluding investment and other income and net securities gains) $ 3,678 $ 3,602 $ 3,568 Revenue (ex. investment and other income & net securities gains) 1 Asset servicing fees include securities lending revenue of $35 million in 3Q13, $46 million in 2Q14 and $37 million in 3Q14.

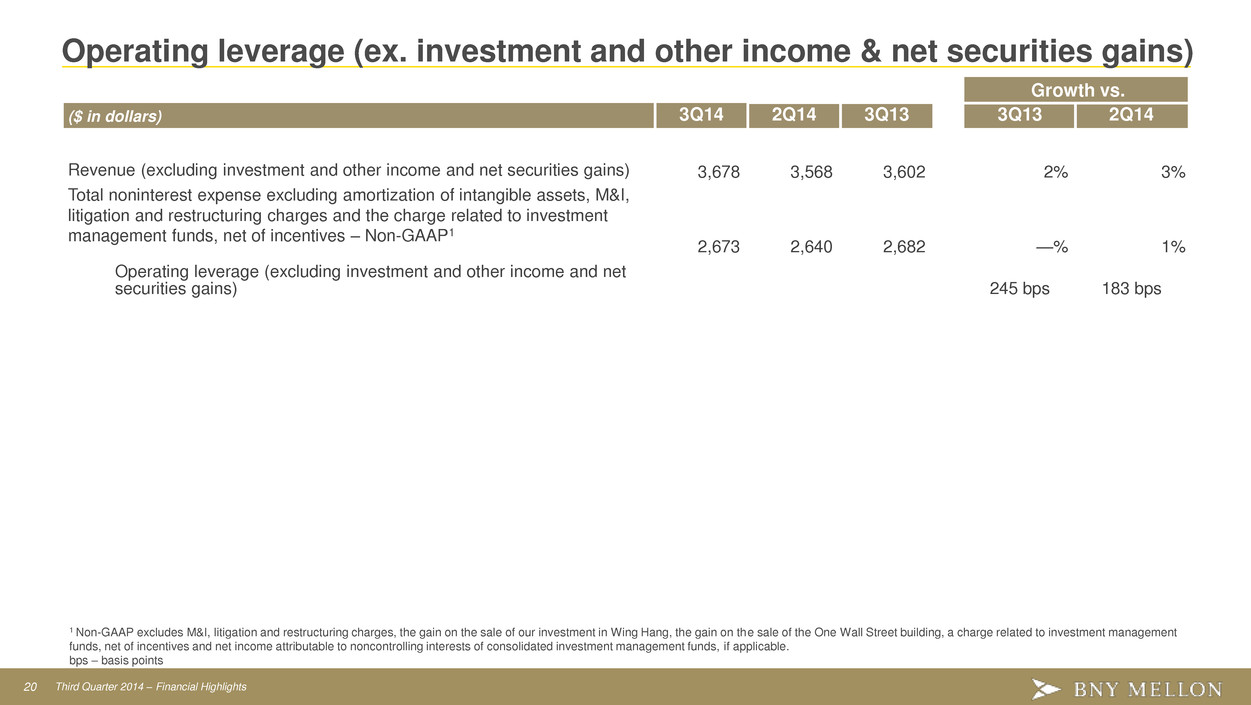

20 Third Quarter 2014 – Financial Highlights Operating leverage (ex. investment and other income & net securities gains) 1 Non-GAAP excludes M&I, litigation and restructuring charges, the gain on the sale of our investment in Wing Hang, the gain on the sale of the One Wall Street building, a charge related to investment management funds, net of incentives and net income attributable to noncontrolling interests of consolidated investment management funds, if applicable. bps – basis points Growth vs. ($ in dollars) 3Q14 2Q14 3Q13 3Q13 2Q14 Revenue (excluding investment and other income and net securities gains) 3,678 3,568 3,602 2 % 3 % Total noninterest expense excluding amortization of intangible assets, M&I, litigation and restructuring charges and the charge related to investment management funds, net of incentives – Non-GAAP1 2,673 2,640 2,682 — % 1 % Operating leverage (excluding investment and other income and net securities gains) 245 bps 183 bps

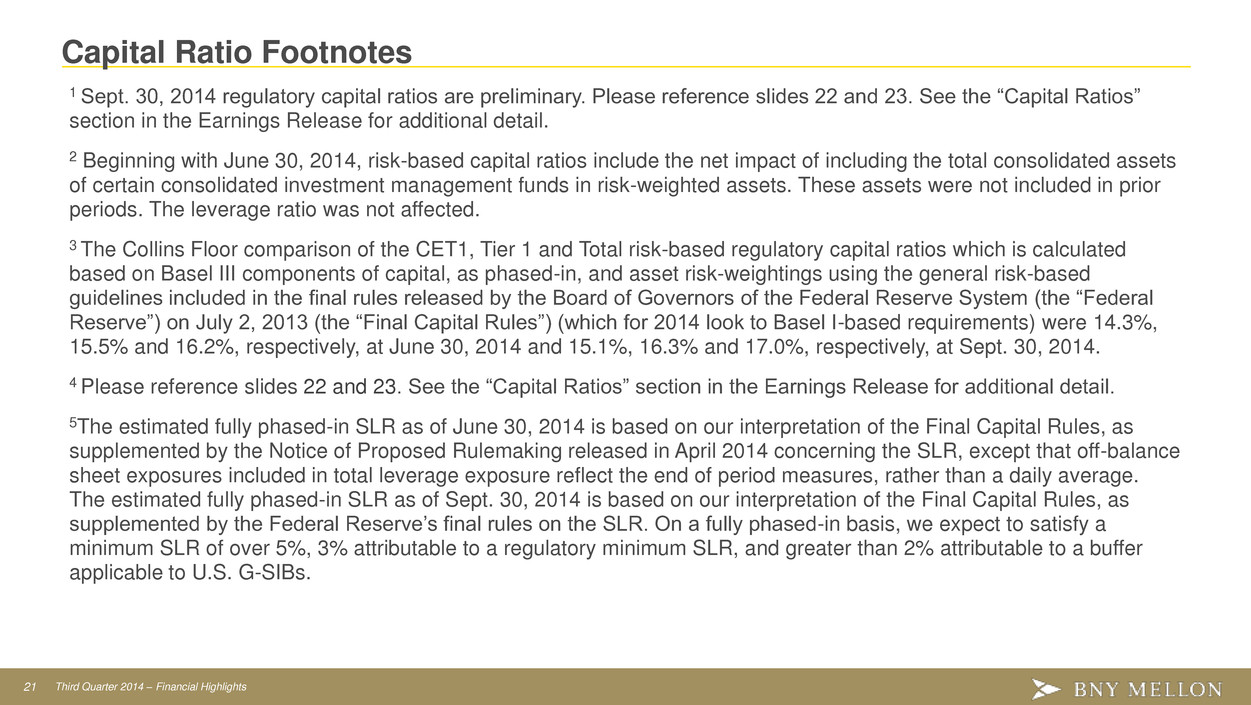

21 Third Quarter 2014 – Financial Highlights Capital Ratio Footnotes 1 Sept. 30, 2014 regulatory capital ratios are preliminary. Please reference slides 22 and 23. See the “Capital Ratios” section in the Earnings Release for additional detail. 2 Beginning with June 30, 2014, risk-based capital ratios include the net impact of including the total consolidated assets of certain consolidated investment management funds in risk-weighted assets. These assets were not included in prior periods. The leverage ratio was not affected. 3 The Collins Floor comparison of the CET1, Tier 1 and Total risk-based regulatory capital ratios which is calculated based on Basel III components of capital, as phased-in, and asset risk-weightings using the general risk-based guidelines included in the final rules released by the Board of Governors of the Federal Reserve System (the “Federal Reserve”) on July 2, 2013 (the “Final Capital Rules”) (which for 2014 look to Basel I-based requirements) were 14.3%, 15.5% and 16.2%, respectively, at June 30, 2014 and 15.1%, 16.3% and 17.0%, respectively, at Sept. 30, 2014. 4 Please reference slides 22 and 23. See the “Capital Ratios” section in the Earnings Release for additional detail. 5The estimated fully phased-in SLR as of June 30, 2014 is based on our interpretation of the Final Capital Rules, as supplemented by the Notice of Proposed Rulemaking released in April 2014 concerning the SLR, except that off-balance sheet exposures included in total leverage exposure reflect the end of period measures, rather than a daily average. The estimated fully phased-in SLR as of Sept. 30, 2014 is based on our interpretation of the Final Capital Rules, as supplemented by the Federal Reserve’s final rules on the SLR. On a fully phased-in basis, we expect to satisfy a minimum SLR of over 5%, 3% attributable to a regulatory minimum SLR, and greater than 2% attributable to a buffer applicable to U.S. G-SIBs. t

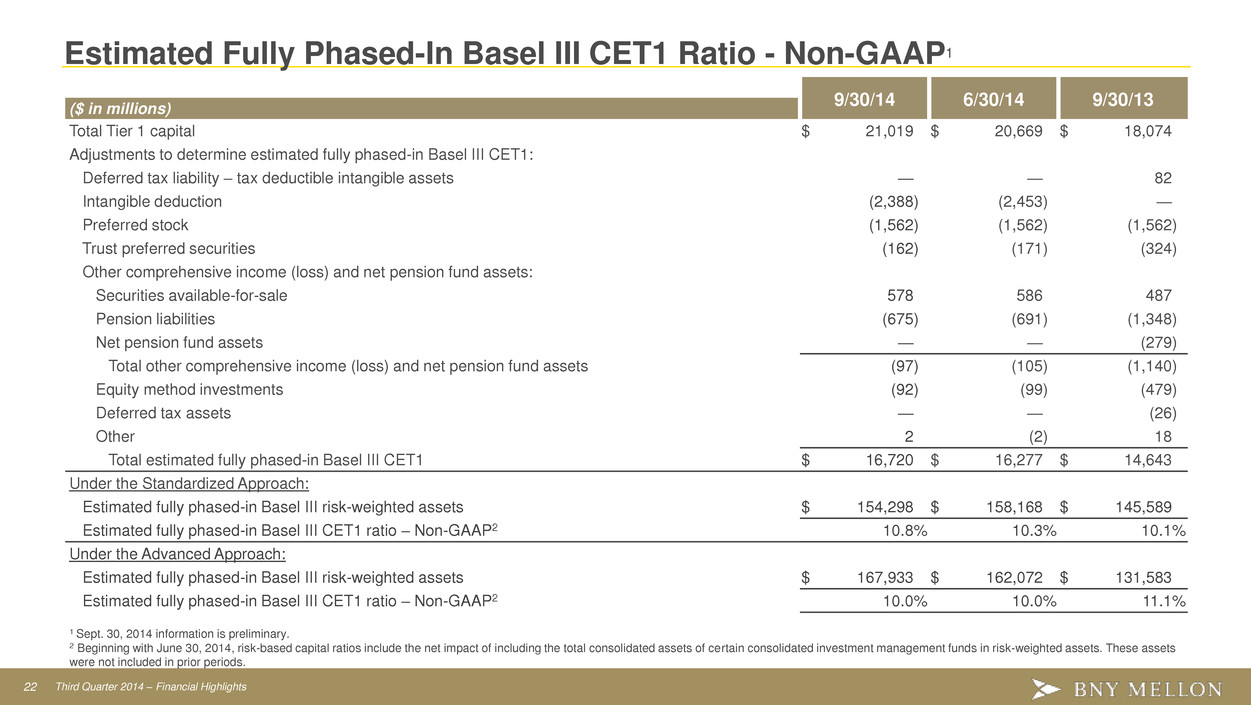

22 Third Quarter 2014 – Financial Highlights Estimated Fully Phased-In Basel III CET1 Ratio - Non-GAAP1 9/30/14 6/30/14 9/30/13 ($ in millions) Total Tier 1 capital $ 21,019 $ 20,669 $ 18,074 Adjustments to determine estimated fully phased-in Basel III CET1: Deferred tax liability – tax deductible intangible assets — — 82 Intangible deduction (2,388 ) (2,453 ) — Preferred stock (1,562 ) (1,562 ) (1,562 ) Trust preferred securities (162 ) (171 ) (324 ) Other comprehensive income (loss) and net pension fund assets: Securities available-for-sale 578 586 487 Pension liabilities (675 ) (691 ) (1,348 ) Net pension fund assets — — (279 ) Total other comprehensive income (loss) and net pension fund assets (97 ) (105 ) (1,140 ) Equity method investments (92 ) (99 ) (479 ) Deferred tax assets — — (26 ) Other 2 (2 ) 18 Total estimated fully phased-in Basel III CET1 $ 16,720 $ 16,277 $ 14,643 Under the Standardized Approach: Estimated fully phased-in Basel III risk-weighted assets $ 154,298 $ 158,168 $ 145,589 Estimated fully phased-in Basel III CET1 ratio – Non-GAAP2 10.8 % 10.3 % 10.1 % Under the Advanced Approach: Estimated fully phased-in Basel III risk-weighted assets $ 167,933 $ 162,072 $ 131,583 Estimated fully phased-in Basel III CET1 ratio – Non-GAAP2 10.0 % 10.0 % 11.1 % 1 Sept. 30, 2014 information is preliminary. 2 Beginning with June 30, 2014, risk-based capital ratios include the net impact of including the total consolidated assets of certain consolidated investment management funds in risk-weighted assets. These assets were not included in prior periods.

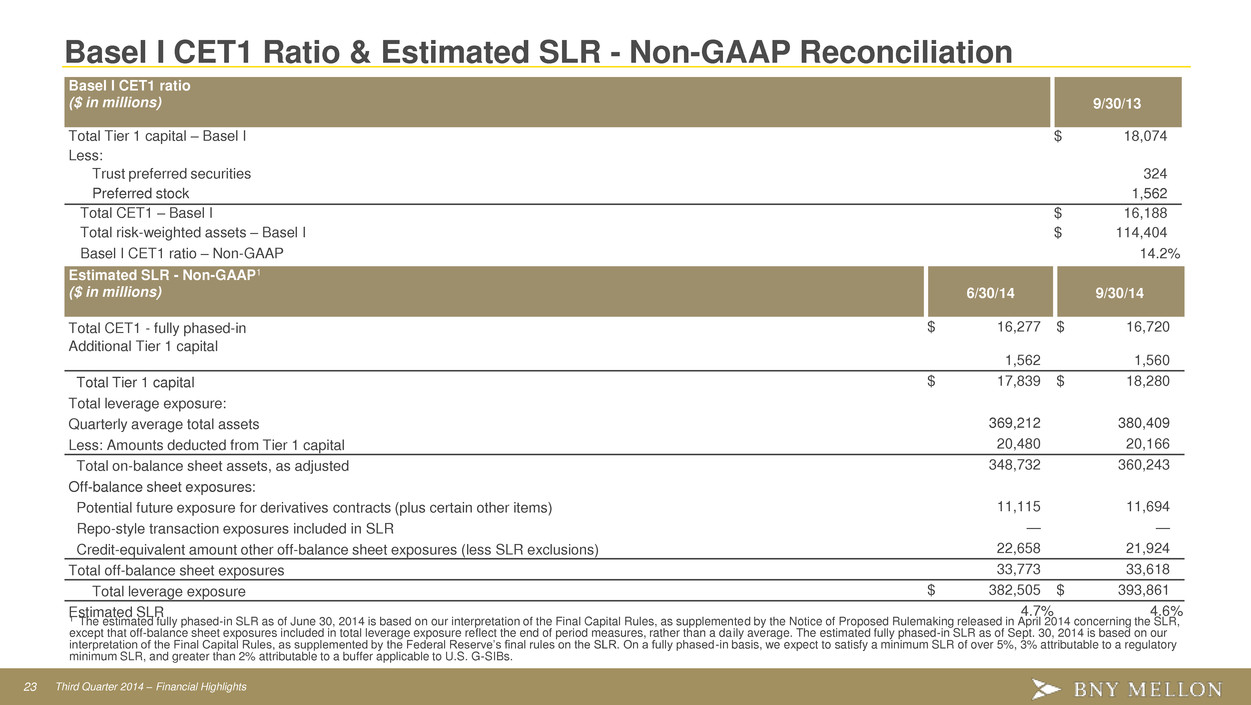

23 Third Quarter 2014 – Financial Highlights Basel I CET1 Ratio & Estimated SLR - Non-GAAP Reconciliation Basel I CET1 ratio ($ in millions) 9/30/13 Total Tier 1 capital – Basel I $ 18,074 Less: Trust preferred securities 324 Preferred stock 1,562 Total CET1 – Basel I $ 16,188 Total risk-weighted assets – Basel I $ 114,404 Basel I CET1 ratio – Non-GAAP 14.2 % Estimated SLR - Non-GAAP1 ($ in millions) 6/30/14 9/30/14 Total CET1 - fully phased-in $ 16,277 $ 16,720 Additional Tier 1 capital 1,562 1,560 Total Tier 1 capital $ 17,839 $ 18,280 Total leverage exposure: Quarterly average total assets 369,212 380,409 Less: Amounts deducted from Tier 1 capital 20,480 20,166 Total on-balance sheet assets, as adjusted 348,732 360,243 Off-balance sheet exposures: Potential future exposure for derivatives contracts (plus certain other items) 11,115 11,694 Repo-style transaction exposures included in SLR — — Credit-equivalent amount other off-balance sheet exposures (less SLR exclusions) 22,658 21,924 Total off-balance sheet exposures 33,773 33,618 Total leverage exposure $ 382,505 $ 393,861 Estimated SLR 4.7 % 4.6 % 1 The estimated fully phased-in SLR as of June 30, 2014 is based on our interpretation of the Final Capital Rules, as supplemented by the Notice of Proposed Rulemaking released in April 2014 concerning the SLR, except that off-balance sheet exposures included in total leverage exposure reflect the end of period measures, rather than a daily average. The estimated fully phased-in SLR as of Sept. 30, 2014 is based on our interpretation of the Final Capital Rules, as supplemented by the Federal Reserve’s final rules on the SLR. On a fully phased-in basis, we expect to satisfy a minimum SLR of over 5%, 3% attributable to a regulatory minimum SLR, and greater than 2% attributable to a buffer applicable to U.S. G-SIBs.

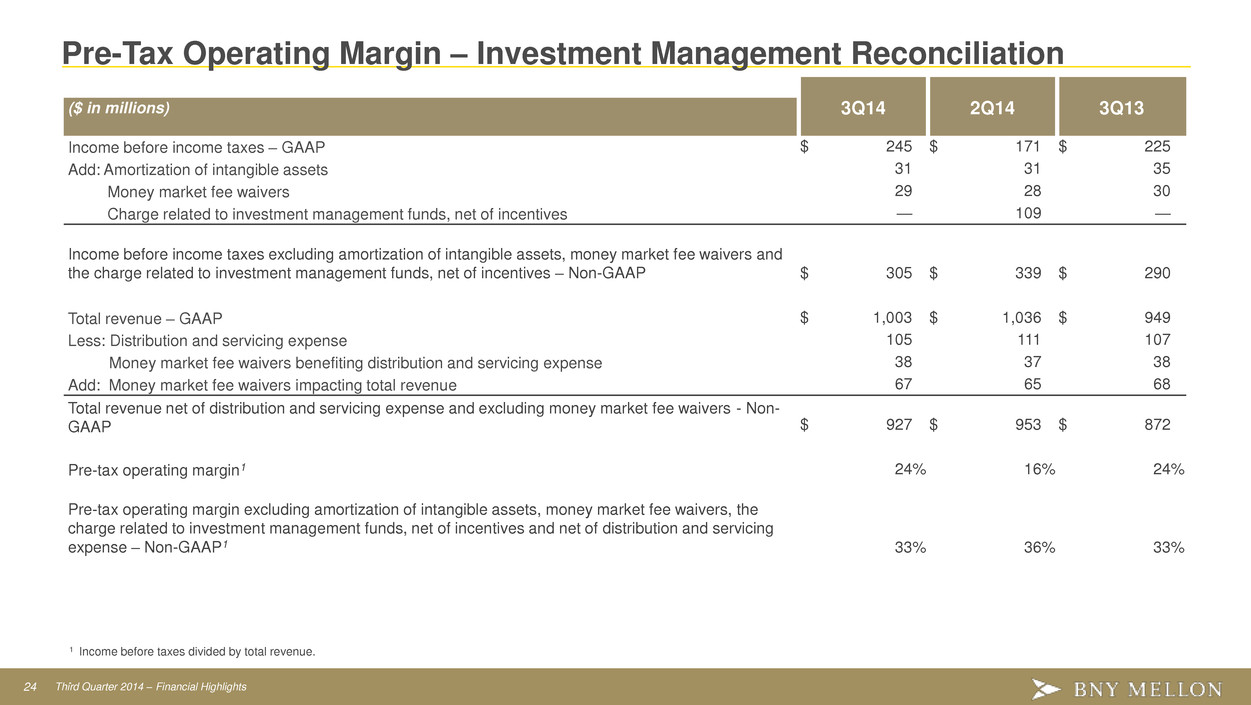

24 Third Quarter 2014 – Financial Highlights Pre-Tax Operating Margin – Investment Management Reconciliation 3Q14 2Q14 3Q13 ($ in millions) Income before income taxes – GAAP $ 245 $ 171 $ 225 Add: Amortization of intangible assets 31 31 35 Money market fee waivers 29 28 30 Charge related to investment management funds, net of incentives — 109 — Income before income taxes excluding amortization of intangible assets, money market fee waivers and the charge related to investment management funds, net of incentives – Non-GAAP $ 305 $ 339 $ 290 Total revenue – GAAP $ 1,003 $ 1,036 $ 949 Less: Distribution and servicing expense 105 111 107 Money market fee waivers benefiting distribution and servicing expense 38 37 38 Add: Money market fee waivers impacting total revenue 67 65 68 Total revenue net of distribution and servicing expense and excluding money market fee waivers - Non- GAAP $ 927 $ 953 $ 872 Pre-tax operating margin1 24 % 16 % 24 % Pre-tax operating margin excluding amortization of intangible assets, money market fee waivers, the charge related to investment management funds, net of incentives and net of distribution and servicing expense – Non-GAAP1 33 % 36 % 33 % 1 Income before taxes divided by total revenue. .