Attached files

| file | filename |

|---|---|

| EX-21.1 - EX-21.1 - Xcerra Corp | d791690dex211.htm |

| EX-31.1 - EX-31.1 - Xcerra Corp | d791690dex311.htm |

| EX-31.2 - EX-31.2 - Xcerra Corp | d791690dex312.htm |

| EX-23.1 - EX-23.1 - Xcerra Corp | d791690dex231.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Xcerra Corp | Financial_Report.xls |

| EX-32.1 - EX-32.1 - Xcerra Corp | d791690dex321.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended July 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 000-10761

Xcerra Corporation

(Exact name of registrant as specified in its charter)

| MASSACHUSETTS | 04-2594045 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 825 University Ave Norwood, Massachusetts |

02062 | |

| (Address of principal executive offices) | (Zip code) | |

Registrant’s telephone number, including area code: (781) 461-1000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, par value $0.05 per share | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ¨ Accelerated Filer x Non-Accelerated Filer ¨

Smaller Reporting Company Filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes ¨ No x

The aggregate market value of the Common Stock held by non-affiliates of the registrant on January 31, 2014, the last business day of the registrant’s most recently completed second fiscal quarter was $399,748,991

Number of outstanding shares of Common Stock as of October 7, 2014: 54,072,673

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement in connection with its 2014 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

Table of Contents

TABLE OF CONTENTS

Table of Contents

PART I

Business Introduction

Xcerra Corporation (Xcerra or the Company), formerly known as LTX-Credence Corporation, is a global provider of test and handling capital equipment, interface products, test fixtures and related services to the semiconductor and electronics manufacturing industries. We design, manufacture and market products and services that address the broad, divergent requirements of the mobility, industrial, medical, automotive and consumer end markets, offering a comprehensive portfolio of solutions and technologies, and a global network of strategically deployed applications and support resources. We operate in the semiconductor and electronics manufacturing test markets through our atg-Luther & Maelzer, Everett Charles Technologies (ECT), LTX-Credence and Multitest businesses. We have a broad spectrum of semiconductor and printed circuit board (PCB) test expertise that drives innovative new products and services and our ability to deliver fully integrated semiconductor test solutions.

On December 1, 2013, we acquired the Multitest and ECT businesses from Dover Printing & Identification, Inc. (Dover Corporation or Dover) for $93.5 million, of which $73.5 million was paid in cash through a combination of existing cash-on-hand and bank debt, and $20.0 million was paid by the issuance of promissory notes. Pursuant to the Master Sale and Purchase Agreement entered into with Dover Corporation on September 6, 2013, the cash purchase price was increased by $12.5 million to reflect, among other required adjustments, specified cash balances held by the acquired businesses, acquired indebtedness, certain transaction costs, employee-related liabilities, working capital adjustments and reductions in the principal amount of the promissory notes payable to Dover Corporation in connection with the satisfaction of certain conditions.

Our Multitest business designs and manufactures products used in the testing of integrated circuits, including test handlers, test contactors and semiconductor load boards. Our ECT business designs and manufactures equipment and consumables that are used in the testing of bare and loaded printed circuit boards. ECT, which operates under the brand names atg-Luther & Maelzer and Everett Charles Technologies, offers a complete line of PCB testing solutions, including flying probe and universal grid testers, test fixtures and probes.

The acquisition of Multitest and ECT has enabled us to address a greater portion of the semiconductor test industry and has provided access to the broader electronics manufacturing industry. We believe this acquisition has several strategic benefits, including: (i) broadening our semiconductor test product portfolio and uniquely positioning us as a total test cell solutions provider, (ii) enabling us to cross-sell across multiple product lines, (iii) doubling our total addressable market from our estimate of approximately $2.3 billion to more than $5.1 billion, (iv) adding additional consumable-based, recurring revenue components to our business and (v) broadening our customer base to include companies such as Broadcom, Cisco, HP, IBM, Microsoft, SanDisk and TTM Technologies, among others.

Semiconductor designers and manufacturers worldwide use our test and handling equipment and interface products (load boards, test contactors and probe pins) to test their devices during the manufacturing process. The devices our products test are incorporated into a wide range of products, including personal computers; mobile internet equipment such as wireless access points and interfaces; broadband access products such as cable modems and set top boxes; personal communication and entertainment products such as mobile phones and tablets; consumer products such as televisions, videogame systems and digital cameras; automobile electronics; and power management devices used in portable and automotive electronics.

Our PCB test systems are used to verify the quality of the pre-assembled PCB before individual components, including integrated circuits, are installed onto the PCB. Our test fixture products are consumable components used by PCB test systems to test assembled PCBs. The types of PCBs that are tested using our systems are incorporated into a diverse set of electronic products including network servers, personal computers, tablets and mobile phones.

1

Table of Contents

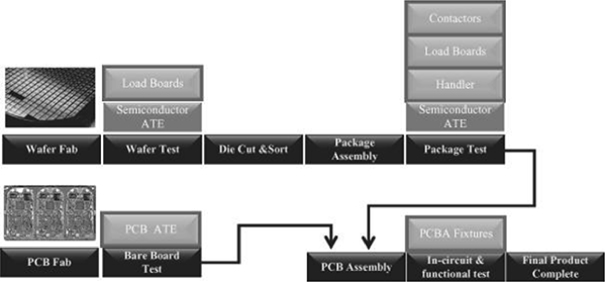

The chart below displays the semiconductor and PCB manufacturing processes and identifies the product and service offerings at the various steps where our systems or products are used.

Image of semiconductor wafer courtesy of Taiwan Semiconductor Manufacturing Co., Ltd.

For our semiconductor test-related businesses we focus our marketing and sales efforts on integrated device manufacturers (IDMs); outsourced semiconductor assembly and test providers (OSATs), which perform assembly and testing services for the semiconductor industry; and fabless semiconductor companies, which design integrated circuits but have no manufacturing capability. We offer our customers a comprehensive portfolio of semiconductor test systems, test handlers and interface products and provide a global network of strategically deployed applications and support resources. Representative customers include Bosch, HiSilicon, MediaTek, Microchip Technology, NXP, Skyworks, ST Microelectronics, Texas Instruments and Toshiba. For our PCB test systems and PCB assembly test fixtures and design services, we focus our marketing and sales efforts on the manufacturers of PCBs, as well as the companies into whose products the PCBs are incorporated. Representative customers for these businesses include AT&S, Continental, Microsoft, Samsung, TTM Technologies and Wurth.

Our objective is to be the leading supplier of market-focused, cost-optimized test solutions for the semiconductor and electronics manufacturing test markets. Key elements of our growth strategy include:

| • | Continue to introduce new, innovative products. We intend to continue to invest in the development of new test solutions designed to meet evolving customer demands such as achieving the lowest cost of test and reducing the time to high volume production on new products. We intend to leverage our existing technical expertise and continue to invest significant resources both in our current solutions and in developing solutions that address new markets as well as new segments of existing markets. |

| • | Leverage total test cell capabilities. We believe we are the only supplier capable of providing a total test cell solution and will continue to leverage this unique capability with our customers. Our customers historically have had to source disparate test products from multiple third-party providers to create their own solutions, which can lead to inefficiencies and increased costs. By offering a total test cell solution, we are able to help customers better fulfill their testing requirements and improve their overall manufacturing and testing process. |

| • | Generate cross-selling opportunities between our leading brands. Our acquisition of Multitest and ECT offers significant cross-selling opportunities across our brands and product portfolio. We will |

2

Table of Contents

| continue to build and strengthen our relationships with existing customers, as we believe there are significant opportunities to cross-sell load boards, test contactors and test handlers to our existing semiconductor ATE customers. |

| • | Increase additional sales of test handlers and consumables through our existing distribution relationships. We have expanded our relationship with our largest distributor to include test handlers and consumables, which will enable us to better serve customers in fast-growing geographies, including China and Taiwan. |

| • | Opportunistically pursue strategic acquisitions. We may pursue acquisitions that complement our strengths and help us execute our strategies. Our acquisition strategy is designed to accelerate our revenue growth, expand our technology portfolio and grow our addressable market. |

| • | Continue to improve operational efficiency. In order to focus our resources, improve our responsiveness to customer needs, reduce fixed costs and working capital requirements and manage the cyclicality of our industry more effectively, we have implemented a lean, flexible business model. We intend to continue to identify and implement programs which enhance our ability to meet customers’ needs while reducing fixed costs. |

We are headquartered and have a development facility in Norwood, Massachusetts. We also have manufacturing and other development facilities located in Milpitas, Santa Clara and Fontana, California; Rosenheim, Germany; Wertheim, Germany; Shenzhen, China; Singapore; Yerevan, Armenia and Penang, Malaysia and sales and service facilities located across the world to support our customer base.

We were incorporated in Massachusetts in 1976 as LTX Corporation. In connection with our August 2008 merger with Credence Systems Corporation, we changed our name to LTX-Credence Corporation and, following the acquisition of our Multitest and ECT businesses, we changed our name to Xcerra Corporation in May 2014. Our principal executive offices and global headquarters are located at 825 University Avenue Norwood, Massachusetts 02062, and our telephone number is 781-461-1000. Our common stock trades on the NASDAQ Global Market under the symbol “XCRA.” The terms “Xcerra,” the “Company,” “we,” “our,” and “us” refer to Xcerra Corporation and its wholly-owned subsidiaries unless the context otherwise indicates. We make available our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports, free of charge, in the “Investors” section of our website at www.xcerra.com as soon as reasonably practicable after such material is electronically filed with, or furnished to, the U.S. Securities and Exchange Commission. We are not, however, including the information contained on our website, or information that may be accessed through links on our website, as part of, or incorporating such information by reference into, this Annual Report on Form 10-K.

Industry Overview

We provide test solutions to the large and growing electronics manufacturing industry, of which semiconductors and PCBs are key components.

Sales of capital equipment products are driven by the expansion of manufacturing and test capacity, or when customers replace existing equipment with new equipment. Sales of consumable products, which include service, are driven by the level of manufacturing and test activity, and need to be replaced based on usage levels or to accommodate new designs or test techniques. Therefore, overall demand for our capital equipment and consumable products and services is generally dependent on growth in the semiconductor and electronics industry.

In particular, three primary characteristics of the industry in which we operate drive the demand for our products and services:

| i) | Increases in unit production of semiconductor devices and PCBs. The proliferation of sophisticated electronic devices including tablets, consumer electronics, the growth of the telecommunications industry and mobile devices capable of accessing the internet, the increased use of digital signal |

3

Table of Contents

| processing (DSP) devices, and the expansion of semiconductor devices in automotive and power management applications are driving a corresponding need for semiconductor and PCB test solutions. |

| ii) | Increases in the complexity of semiconductor devices and PCBs used in electronic products. Increasing demand continues worldwide for smaller, more highly integrated electronic products. This has led to higher performance and increasing complexity of the semiconductor devices that operate and power these electronic products. To the extent a customer’s existing test equipment is not able to meet the requirements of these new devices, there is a corresponding increase in demand for equally sophisticated semiconductor and PCB test solutions. |

| iii) | Emergence of next generation electronic products requiring new semiconductor and PCB technologies. The introduction of new generations of end-user electronics products requires the development of new semiconductor device and PCB technologies. The increase in complexity of leading edge end-user devices, and, ultimately, the emergence of new semiconductor device and PCB technologies have mandated changes in the design, architecture and complexity of semiconductor and PCB test solutions. Semiconductor and PCB manufacturers must be able to test the increasing volume and complexity of their devices in a reliable, cost-effective, efficient and flexible manner. |

We offer a wide range of products and services to the semiconductor and electronics manufacturing industries, including semiconductor automated test equipment (ATE), test handlers, bare board PCB test equipment, semiconductor load boards, test contactors, probe pins and loaded PCB test fixtures. In accordance with the provisions of Topic 280, Segment Reporting to the FASB ASC (ASC 280), for fiscal 2014, we determined that we have seven operating segments (Semiconductor Test, Semiconductor Handlers, Contactors, Interface Boards, PCB Test, Probes / Pins, and Fixtures). Based on the aggregation criteria of ASC 280, we determined that several of the operating segments can be aggregated due to these segments having similar economic characteristics and meeting all of the other aggregation criteria in ASC 280. Consequently, we have two reportable segments: the Semiconductor Test Solutions (STS) reportable segment, which is comprised of the Semiconductor Test, Semiconductor Handlers, Contactors and Interface Boards operating segments, and the Electronic Manufacturing Solutions (EMS) reportable segment, which is comprised of the PCB Test, Probes / Pins, and Fixtures operating segments. This financial reporting structure was implemented effective as of December 1, 2013, the acquisition date of Multitest and ECT. Refer to Note 9, Segment, Industry and Geographic and Significant Customer Segment Information, contained in the Notes to Consolidated Financial Statements included in Part II, Item 8 of this Annual Report on Form 10-K, for more information on our reportable segments.

Our revenue from our capital equipment products is driven by the capital expenditure budgets and spending patterns of our customers, who often delay or accelerate purchases in reaction to variations in their business. The level of capital expenditures by these companies depends on the current and anticipated market demand for semiconductor devices and PCBs and the products that incorporate them.

Our consumable products are driven by an increase in the number of printed circuit boards and semiconductor devices that are tested. As a result, our consumable products provide a more stable recurring source of revenue and do not have the same degree of cyclicality as our capital equipment products.

Listed below is a summary of our various product offerings:

Semiconductor ATE Solutions. Semiconductor automated test equipment is used to test a device after it has been fabricated but before it has been packaged to eliminate non-functioning parts. Our semiconductor ATE solutions consist of three scalable platforms focused primarily on the SoC market. Our Diamond series platform offers high-density packaging for low-cost testing of microcontrollers and cost sensitive consumer and digital-based ASSP and ASIC devices. Our X-Series platform offers configurations for optimal testing of analog-based ASSP and ASIC, power, automotive, mixed signal and RF applications. Our ASL platform is a market leader for testing linear, low-end mixed signal, precision analog and power management devices.

4

Table of Contents

Test Handlers. Test handlers are used in conjunction with automated test equipment and are used to automate the testing of packaged semiconductor devices. Our test handlers support a variety of package sizes and device types, including automotive, mobile, power, microelectromechanical systems (MEMS) and microcontrollers, among others. We offer a broad range of test handlers, including pick-and-place, gravity, strip and MEMS.

Bare Board PCB Test Systems. Bare board PCB test systems are used to test pre-assembled printed circuit boards. Our PCB test systems include flying probe testers, which are used to test low-volume, highly complex circuit boards and do not require the use of a separate test fixture, as well as universal grid testers, which require the use of a separate test fixture and are well-suited to test circuit boards that are produced in high volumes.

Semiconductor Load Boards. Semiconductor load boards are circuit boards that are specifically designed to serve as an interface between the tester and the semiconductor device, or the semiconductor wafer, that is being tested. We are focused on the high-end segment of the market and design and manufacture high pin count, high aspect ratio and fine pitch products. Typically, each new semiconductor device design requires the use of a specific semiconductor load board.

Test Contactors. Test contactors are used in the final test of semiconductor devices and serve as the interface between the test handler and the semiconductor device under test. Test contactors are specific to individual semiconductor device designs, need to be replaced frequently and grow with the number of units produced. We offer a wide range of test contactors for standard, power and RF markets.

Probe Pins. Probe pins are physical devices that are used to connect electronic test equipment to the device under test. We offer probes that are incorporated into bare board test systems, loaded PCB test fixtures and semiconductor test contactors. We address a wide range of applications with our spring probes, voltage probes, current probes, near-field probes, temperature probes, demodulator probes and logic probes.

Loaded PCB Test Fixtures. Test fixtures enable the transmission of test signals from the loaded PCB to the tester. We offer a wide range of in-circuit and functional test fixtures that can be optimized based on the complexity of the loaded PCB and production volume requirements. Our solutions address highly complex and low-to-medium technology applications.

Services. Our worldwide service organization is capable of performing installations and necessary maintenance of test and handling systems sold by us, including routine servicing of spare parts manufactured by third parties. We provide various parts and labor warranties on test and handling systems and instruments designed and manufactured by us and warranties on certain components that have been purchased from other manufacturers and incorporated into our test and handling systems. We also provide training on the maintenance and operation of test and handling systems we sell. Service revenues from our LTX-Credence maintenance and service contracts were $33.3 million, or 10% of net sales, in fiscal 2014; $34.0 million, or 22.4% of net sales, in the fiscal year ended July 31, 2013; and $36.8 million, or 27.8% of net sales, in the fiscal year ended July 31, 2012.

Engineering and Product Development

The markets in which we compete are characterized by rapid technological change and new product introductions, as well as advancing industry standards. Our competitive position depends upon our ability to successfully enhance our products, develop new instrumentation, and introduce these new products on a timely and cost-effective basis. We seek to maintain close relationships with our customers to better enable us to be responsive to their product development and production needs.

Our engineering strategy is to continue to develop new and innovative products in the markets in which we compete, as well as leveraging those technologies into providing an efficient and effective total test cell solution.

Our engineering strategy for our test products includes continued development of our Diamond, X-Series and ASL platforms. Consolidation of platform technologies, both hardware and software, is a key objective moving forward as we leverage our knowledge and expertise into cost-effective solutions. The development and release of the Diamondx, ASLx and PAx products are examples of our technology leveraged focus on the tester

5

Table of Contents

side. For our handler products, we are focused on continued development of our MT2168 and InCarrier solutions. For our fixture and probe groups, our development efforts are focused on wireless technology and Titan technology, respectively.

Engineering and product development expenses were $60.7 million, $52.3 million, and $49.9 million during fiscal 2014, 2013, and 2012, respectively.

We sell our products through a combination of a worldwide internal direct sales organization and external distributors for each of our reportable segments. Our direct sales organization is structured around key accounts, with a sales force of 165 people as of July 31, 2014. We also use third party distributors to sell our products in certain markets such as in Taiwan, China, Japan, South Korea, and other countries in Southeast Asia.

Our sales to customers outside the United States are primarily denominated in United States dollars. Our sales outside the United States composed 76%, 83%, and 77% of total net sales in fiscal 2014, 2013, and 2012, respectively. See Note 9 to our Consolidated Financial Statements for additional information relating to revenues derived from sales to customers outside the United States.

| For the fiscal years ended July 31, |

||||||||||||

| 2014 | 2013 | 2012 | ||||||||||

| The following customers had net sales in excess of 10% of our total net sales for the periods indicated: |

||||||||||||

| Spirox (1) |

15 | % | 27 | % | 22 | % | ||||||

| Texas Instruments |

<10 | % | 12 | % | 21 | % | ||||||

Net sales to the top ten customers were 50%, 70%, and 68% of net sales in fiscal 2014, 2013, and 2012, respectively.

| (1) | Spirox is our third-party sales distributor for Taiwan and China. There are no end customers sold through Spriox that represent greater than 10% of our net sales for any period presented. |

A representative list of our customers includes:

| Amkor |

Intel | RichTek | ||

| Anadigics |

KCE | Samsung | ||

| Analog Devices |

KYEC | Sigurd | ||

| AT&S |

LTC | Skyworks Solutions | ||

| Atmel |

Maxim Integrated Products | Spirox | ||

| Austriamicrosystems (AMS) |

Mediatek | STATSChipPac | ||

| ASE |

Melexis | STMicroelectronics | ||

| Bosch |

Microchip Technology | Texas Instruments | ||

| Carsem |

Microsoft | Triquint Semiconductor | ||

| Continental |

Murata | Toshiba | ||

| Elmos |

Nordic Semiconductor | TTM Technologies | ||

| Giga Solution |

Novatek | Unisem | ||

| HiSilicon |

NXP | UTAC | ||

| Infineon Technologies |

Renesas | Wurth |

We have concentrated our sales and support efforts on those semiconductor companies from which we believe we will receive the most return for our efforts. We believe that sales to a limited number of customers will continue to account for a high percentage of our net sales for the foreseeable future.

6

Table of Contents

We manufacture our products using a combination of internal and outsourced manufacturing solutions. We use Jabil Circuit as our outsourced partner for the manufacturing of our X-Series, ASL and Diamond products, and internal resources for the majority of our other products.

We outsource certain components and subassemblies for our test equipment to contract manufacturers other than Jabil Circuit. Our products incorporate standard components and prefabricated parts manufactured to our specifications. These components and subassemblies are used to produce testers in configurations specified by our customers. Some of the standard components for our products are available from a number of different suppliers; however, many such standard components are purchased from a single supplier or a limited group of suppliers. Although we believe that all single sourced components currently are available in adequate amounts, shortages or delivery delays may develop in the future. We are dependent on certain semiconductor device manufacturers, who are sole source suppliers of custom components for our products. We have no written supply agreements with these sole source suppliers and purchase our custom components through individual purchase orders. We continuously evaluate alternative sources for the manufacture of our custom components and the supply of our standard components; however, such alternative sources may not meet our required qualifications or have capacity that is available to us.

There are other domestic and foreign companies that participate in the markets for each of our products and the industry for each of our reportable segments is highly competitive. We compete principally on the basis of product performance, cost of test, reliability, customer service, applications support, price and ability to deliver products and service on a timely basis. In addition, to increase our market share, we will also need to demonstrate an ability to overcome customer risks and costs associated with switching vendors, including training on unfamiliar hardware and software.

Our primary competitors in the market for test systems include Advantest Corporation and Teradyne Inc. These companies have a substantially larger share of the ATE market, greater financial and other resources, and have a larger installed base of equipment than we do. Our primary competitor in the handler and contactor markets is Cohu, Inc.We expect our competitors to enhance their current products, introduce new products which may have comparable or better price and performance than ours, diligently defend their existing customer accounts, and attempt to grow their market share. In addition, new competitors, including semiconductor manufacturers themselves, may offer new testing technologies, which may compete with or otherwise reduce the value of our product lines.

We believe our key competitive strengths include:

| • | Technologically advanced products well suited for industry’s most challenging applications. Our breadth of capital equipment, including semiconductor ATE, test handlers and PCB testers, and consumables, including electronic interconnect and interface products, enable us to design solutions that lower the cost of testing, improve operating effectiveness of the test cell and reduce time to high volume production for our customers. |

| • | Uniquely positioned as total test cell solutions provider. The combination of our semiconductor ATE, test handlers, load boards and test contactors products enables us to provide customers with a complete solution that optimizes performance for selected test cell configurations. |

| • | Focused on fast growing segments within the semiconductor and PCB markets. We believe, based on management estimates, that we have more than doubled our addressable market to over $5 billion through the acquisition of Multitest and ECT and through strategic internal product development. We believe that our core end-markets, which include analog/mixed-signal, microcontroller, RF, power management and automotive, should grow in excess of broader semiconductor and electronics test markets. |

7

Table of Contents

| • | Long-standing customer relationships with limited concentration. Our acquisition of Multitest and ECT has further diversified our blue chip customer base beyond semiconductor device suppliers to leading mobile, industrial, medical, automotive and printed circuit board companies. Our close customer relationships with leading innovators in the electronics industry have been built based on years of collaborative product development, which provides us with deep system-level knowledge and key insights into our customers’ needs. |

| • | Highly leveraged operating model drives significant earnings growth in up cycle. We have a history of reducing costs and driving increased profitability. Our capital equipment products and fixed cost structure enable us to generate significant profitability during cycle upturns. |

| • | Strong recurring revenue model enables through-cycle profitability. Our acquisition of Multitest and ECT more than doubled our recurring revenue base, which now comprises approximately 50% of our total revenue. Our consumables products are unit driven, recurring in nature, and offer stability during cycle downturns. |

| • | Experienced management and engineering team with demonstrated ability to integrate accretive acquisitions. Our chief executive officer and chief financial officer/chief operating officer have over 35 years of combined experience with us and have successfully identified, executed, and integrated multiple accretive acquisitions. The acquisition of Credence Systems Corporation in 2008 broadened our semiconductor test capabilities and offered substantial cost savings opportunities. The acquisition of Multitest and ECT in 2013 has enabled us to become a diversified electronics test solutions provider with a larger base of recurring revenue. |

At July 31, 2014, our backlog of unfilled orders for all products and services was $97.3 million, compared with $35.3 million at July 31, 2013. The significant year over year increase was primarily due to backlog associated with our ECT, Multitest and atg-Luther & Maelzer businesses which were acquired during fiscal 2014 and therefore not reflected in our fiscal 2013 Consolidated Financial Statements. Backlog associated with our LTX-Credence business, which was reflected in our fiscal 2013 Consolidated Financial Statements, was $49.9 million at July 31, 2014, compared with $35.3 million at July 31, 2013. The $14.6 million or 41% increase, was primarily due to higher bookings during the relative periods, in line with an increase in product revenue for the same periods. Historically, our test systems generally ship within twelve weeks of receipt of a customer’s purchase order. Our probes and contactors generally ship within one to three weeks of a customer’s purchase order. While backlog is calculated on the basis of firm orders, orders may be subject to cancellation or delay by the customer with limited or no penalty. Our backlog at any particular date, therefore, is not necessarily indicative of actual sales which may be generated for any succeeding period.

The backlog as of July 31, 2014 for the reportable segments is as follows:

| Semiconductor Test Solutions |

$ | 80.3 | ||

| Electronic Manufacturing Solutions |

$ | 17.0 | ||

|

|

|

|||

| Total |

$ | 97.3 |

The development of our products is largely based on proprietary information. We rely upon a combination of contract provisions, intellectual property registration and copyright, trademark and trade secret laws to protect our proprietary rights in products. We also have a policy of seeking patents on technology considered to be of particular strategic importance. Our patents cover various technologies, including technology relating to proprietary instrumentation and pin electronics. Although we believe that the copyrights, trademarks and patents we own are of value, we also believe that they alone have not and will not determine our success. We believe that our overall success depends principally upon our management, engineering, applications, manufacturing,

8

Table of Contents

marketing and service skills. Regardless, we intend to protect our rights when, in our view, these rights are infringed upon.

We have at times been notified of claims that we may be infringing patents issued to others. Although there are no pending actions against us regarding any patents, claims of infringement by third parties could negatively impact our business and results of operations. As to any claims asserted against us, we may seek or be required to obtain a license under the third party’s intellectual property rights. However, a license may not be available under reasonable terms or at all. In addition, we could decide to engage in litigation to challenge such claims or a third party could engage in litigation to enforce such claims. Such litigation could be expensive and time consuming and could negatively impact our business and results of operations.

At July 31, 2014, we had 2,059 employees and temporary workers. None of our employees is represented by a labor union, and we have experienced no work stoppages during our history. Many of our employees are highly skilled, and we believe our future success will depend in large part on our ability to retain these employees and attract new, highly-skilled employees. We consider relations with our employees to be good.

Our facilities are subject to numerous laws and regulations designed to protect the environment. We do not anticipate that compliance with these laws and regulations will have a material effect on our capital expenditures, results of operations, or financial condition.

| Item 1A. | Risk Factors |

This Annual Report includes or incorporates forward-looking statements that involve substantial risks and uncertainties and fall within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. You can identify these forward-looking statements by our use of the words “believes,” “anticipates,” “plans,” “expects,” “may,” “will,” “would,” “should,” “intends,” “estimates,” “seeks” or similar expressions, whether in the negative or affirmative. We cannot guarantee that we actually will achieve these plans, intentions or expectations. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included below important factors that we believe could cause our actual results to differ materially from the forward-looking statements that we make. If any of these risks were to occur, our business, financial condition, results of operations or prospects, could be materially and adversely affected. These risks and uncertainties may be interrelated or co-related, and as a result, the occurrence of one risk might directly affect other risks described below, make them more likely to occur or magnify their impact. Moreover, the risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business. We do not assume any obligation to update any forward-looking statements we make.

Our mergers and acquisitions may be costly, be difficult to integrate, disrupt our business, dilute stockholder value, and divert management attention, which may limit our ability to realize the anticipated benefits of such transactions.

On December 1, 2013, we acquired the Multitest and ECT businesses of Dover Printing & Identification, Inc. (Dover) and its specified affiliates pursuant to a Master Sale and Purchase Agreement.

This acquisition was substantial in size, scope, and complexity, and entails many changes, including the integration of the Multitest and ECT businesses, Dover personnel and Dover systems with our operations. These transition activities are complex and we have incurred and will continue to incur significant costs related to the

9

Table of Contents

acquisition. The commercial and financial success of the acquisition is subject to many risks including those set forth below:

| • | We might not be successful in integrating employees, products and technology with our existing business, and such integration may divert significant management attention from our existing business; |

| • | We may realize greater expenses than we anticipated from the transaction; |

| • | We may fail to realize synergies that we anticipated from the transaction; |

| • | We may fail to retain key executives and employees, which could reduce the likelihood of success of the acquisition; |

| • | We may encounter difficulties in the assimilation of employees and corporate cultures; |

| • | The combination of the companies may not deliver to our customers the benefits that we have anticipated, which may result in customers reducing their aggregate spending with the ECT Business, the MT Business and/or with our existing businesses; |

| • | We may have difficulty in developing, manufacturing and marketing the products of newly acquired companies in a manner that enhances the performance of our combined businesses or product lines and allows us to realize value from expected synergies; |

| • | We may assume unforeseen legal, regulatory, intellectual property or other liabilities; |

| • | We will have less cash available for other purposes, including acquisitions of technologies or businesses. |

If any of these or other factors impair our ability to integrate our operations successfully or on a timely basis, we may not be able to realize the anticipated synergies, business opportunities, revenue, net income, and growth prospects from combining the businesses. In addition, we may be required to spend additional time or money on integration that otherwise would be spent on the development and expansion of our business.

In addition, the market price of our common stock may decline if the integration of the Multitest and ECT businesses are unsuccessful, take longer than expected or fails to achieve financial benefits to the extent anticipated by financial analysts or investors, or the effect of the business combination on the financial results of the combined company is otherwise not consistent with the expectations of financial analysts or investors.

We have in the past, and may in the future, seek to acquire or invest in additional businesses, products, technologies or engineers which could put a strain on our resources, result in one-time charges (such as acquisition-related expenses, write-offs or restructuring charges) or in the future, impairment of goodwill, cause ownership dilution to our stockholders and adversely affect our financial results. Additionally, we may fund future acquisitions by utilizing our cash, raising debt, issuing shares of our common stock, or by other means, which could subject us to the risks described below in “We may need financing, which could be difficult to obtain.” We have also incurred and may continue to incur certain liabilities or other expenses in connection with acquisitions, which could materially adversely affect our business, financial condition and results of operations.

Mergers and acquisitions of high-technology companies are inherently risky, and future mergers or acquisitions may not be successful and could materially adversely affect our business, operating results or financial condition. Integrating newly acquired businesses, products or technologies into our company could put a strain on our resources, could be expensive and time consuming, may cause delays in product delivery and might not be successful. Future acquisitions and investments could divert management’s attention from other business concerns and expose our business to unforeseen liabilities (including liabilities related to acquired intellectual property and other assets), unanticipated costs associated with transactions, and risks associated with entering new markets. In addition, we might lose key employees while integrating new organizations. We might not be successful in integrating any acquired businesses, products and product development projects, technologies, personnel, operations, or systems, and might not achieve anticipated revenues and cost benefits. Investments that we make may not result in a return consistent with our projections upon which such investments

10

Table of Contents

are made, or may require additional investment that we did not originally anticipate. In addition, future acquisitions could result in customer dissatisfaction, performance problems with an acquired company, potentially dilutive issuances of equity securities or the incurrence of debt, contingent liabilities, possible impairment charges related to goodwill or other intangible assets or other unanticipated events or circumstances, any of which could harm our business, financial condition, results of operations, and could cause the price of our common stock to decline.

One of our markets is the highly cyclical semiconductor industry, which causes a cyclical impact on our financial results.

We sell capital equipment and peripheral connectivity products to companies that design, manufacture, assemble, and test semiconductor devices. The semiconductor industry is highly cyclical, causing a cyclical impact on our financial results. Although industry conditions began to improve during the second half of fiscal 2014, industry conditions were weak in the fiscal year ended July 31, 2012 (fiscal 2012), fiscal 2013 and the first half of fiscal 2014. Industry conditions may not continue to improve, and if they do improve, a sustained industry recovery may not occur. The ability to forecast the business outlook for our industry is typically limited to three months. Regardless of our outlook and forecasts, any failure to expand in cycle upturns to meet customer demand and delivery requirements or contract in cycle downturns at a pace consistent with the industry could have an adverse effect on our business.

Any significant downturn in the markets for our customers’ semiconductor devices or in general economic conditions would likely result in a reduction in demand for our products and would negatively impact our business. Downturns in the semiconductor test equipment and electronics manufacturing industries have been characterized by diminished product demand, excess production capacity, accelerated erosion of selling prices and excessive inventory levels. We believe the markets for newer generations of semiconductor devices and electronic products will also have similar characteristics. Our market is also characterized by rapid technological change and changes in customer demand. In the past, we have experienced delays in purchase commitments, delays in collecting accounts receivable and significant declines in demand for our products during these downturns, and we may not be able to maintain or exceed our current level of sales.

Additionally, as a capital equipment provider, our revenue is driven by the capital expenditure budgets and spending patterns of our customers who often delay or accelerate purchases in reaction to variations in their businesses. Because a high portion of our costs are fixed, we are limited in our ability to reduce expenses and inventory purchases quickly in response to decreases in orders and revenues. In an economic contraction, we may not be able to reduce our significant fixed costs, such as continued investment in research and development, capital equipment requirements and materials purchased from our suppliers.

The market for capital equipment is highly concentrated, and we have limited opportunities to sell our products.

The semiconductor and electronics manufacturing industries are highly concentrated, and a small number of semiconductor device manufacturers, contract assemblers, and electronics manufacturers account for a substantial portion of the purchases of capital equipment generally, including our equipment. Our top customer in fiscal 2014 was Spirox, which accounted for 15% of our net sales. In fiscal 2013, our top customers were Spirox and Texas Instruments, which accounted for 27% and 12% of our net sales, respectively. In fiscal 2012, our top customers were Spirox and Texas Instruments, which accounted for 22%, and 21% of our net sales, respectively. Sales to the top ten customers were 50%, 70%, and 68%, of net sales in fiscal 2014, 2013, and 2012, respectively. Our customers may cancel orders with few or no penalties. If a major customer reduces orders for any reason, our revenues, operating results, and financial condition may be negatively affected.

Our ability to increase our sales will depend, in part, on our ability to obtain orders from new customers. Semiconductor and electronics manufacturers typically select a particular vendor’s product for testing and handling its new generations of a device and make substantial investments to develop related test program

11

Table of Contents

applications and interfaces. Once a manufacturer has selected a test and/or handling system vendor for a new generation of a device, that manufacturer is more likely to purchase systems from that vendor for that generation of the device, and, possibly, subsequent generations of that device as well. Therefore, the opportunities to obtain orders from new customers may be limited, which may impair our ability to grow our revenue.

Our substantial debt and financial obligations could adversely affect our financial condition and ability to operate our business, we may not be able to pay our debt and other obligations, and we may incur additional debt.

As of July 31, 2014, our outstanding indebtedness was approximately $69 million. On September 19, 2014, we repaid $20 million of this amount using a portion of the proceeds that we received from our follow-on public offering in September 2014. Although we repaid a portion of our outstanding indebtedness, we may incur additional indebtedness in the future. Our existing indebtedness and any additional indebtedness that we may incur in the future could have important consequences, including:

| • | making it more difficult for us to satisfy our obligations under our debt agreements, including financial and operational restrictions; |

| • | making it difficult for us to obtain any necessary future financing for working capital, capital expenditures, debt service requirements or other purposes; |

| • | limiting our future ability to refinance our indebtedness on terms acceptable to us or at all; |

| • | requiring us to dedicate a substantial portion of any cash flow from operations to pay principal and interest on our indebtedness, thereby reducing the amount of cash flow available for other purposes, including capital expenditures; |

| • | limiting our flexibility in planning for, or reacting to changes in, our business and the industries in which we compete; |

| • | placing us at a possible competitive disadvantage with respect to less leveraged competitors and competitors that have better access to capital resource; and |

| • | making us more vulnerable in the event of a downturn in our business. |

Our debt level and the terms of our financing arrangements could adversely affect our financial condition and limit our ability to successfully implement our growth strategy.

We may not be able to meet our debt service obligations, including our obligations under the Credit Agreement with SVB. If we are unable to maintain certain financial covenants, we would be in default under the Senior Secured Credit Facility (the Facility), which could permit the Lenders to accelerate the maturity of the Facility. Any such default could have material adverse effect on our business, prospects, financial position and operating results, and could force us to refinance all or part of our existing debt, sell our assets, borrow more money or raise equity. There is no guarantee that we would be able to take any of these actions on a timely basis, on terms satisfactory to us, or at all. In addition, we may not be able to repay amounts due in respect of our obligations, if payment of those obligations were to be accelerated following the occurrence of any other event of default as defined in the instruments creating those obligations.

We may need additional financing, which could be difficult to obtain or limit our operational flexibility.

We believe our cash, cash equivalents, and marketable securities balance of $98.9 million as of July 31, 2014, and the additional net proceeds of approximately $52.4 million that we received from the follow-on public offering that we closed in September 2014, will be sufficient to fund our ongoing operations for at least the next twelve months. However, we may need to raise additional funds in the future and, in such event, we may not be able to obtain such financing on favorable terms, if at all. Further, if we issue additional equity or equity-linked securities to obtain financing, stockholders may experience dilution. If we incur substantial additional

12

Table of Contents

indebtedness in the future, the risks described above under “Our substantial debt and financial obligations could adversely affect our financial condition and ability to operate our business, we may not be able to pay our debt and other obligations, and we may incur additional debt” would intensify.

Our sales and operating results have fluctuated significantly from period to period, including from one quarter to another, and they may continue to do so.

Our quarterly and annual operating results are affected by a wide variety of factors that have had and could continue to have material and adverse effects on our financial condition and stock price or lead to significant variability in our operating results or our stock price, including the following:

| • | the fact that sales of a limited number of test systems may account for a substantial portion of our net sales in any particular fiscal quarter; |

| • | order cancellations by customers; |

| • | lower gross margins in any particular period due to changes in: |

| • | our product mix; |

| • | the configurations of test systems sold; |

| • | the customers to whom we sell our test systems; or |

| • | volume; |

| • | a long sales cycle due to the significant investment made by our customers in installing our test systems and the time required to incorporate our systems into our customers’ design or manufacturing process; and |

| • | changes in the timing of product orders due to: |

| • | unexpected delays in the introduction of products by our customers, |

| • | excess production capacity by our customers, |

| • | shorter than expected lifecycles of our customers’ semiconductor devices, |

| • | uncertain market acceptance of products developed by our customers, or |

| • | our own research and development. |

We cannot predict the impact of these and other factors on our sales and operating results in any future period. Results of operations in any period, therefore, should not be considered indicative of the results to be expected for any future period. Because of this difficulty in predicting future performance, our operating results may fall below expectations of securities analysts or investors in some future quarter or quarters. Our failure to meet these expectations would likely adversely affect the market price of our common stock.

A substantial amount of the shipments of our systems for a particular quarter may occur late in the quarter. Our shipment pattern may expose us to significant risks of not meeting our expected financial results for each quarter in the event of problems during the complex process of final, test and acceptance prior to revenue recognition. If we were to experience problems of this type late in our quarter, shipments could be delayed and our operating results could fall below expectations.

Our dependence on subcontractors and sole source suppliers may prevent us from delivering an acceptable product on a timely basis.

We rely on one subcontractor to manufacture our test systems and multiple other subcontractors for the manufacture of the components and subassemblies used to produce our test systems. Certain of the suppliers for certain components and subassemblies are sole source suppliers. We have no long term supply agreements with

13

Table of Contents

our test system contract manufacturers and purchase products through individual purchase orders. For all of our products, we may be required to qualify new or additional subcontractors and suppliers due to capacity constraints, competitive or quality concerns or other risks that may arise, including as a result of a change in control of, or deterioration in the financial condition of, a supplier or subcontractor. The process of qualifying subcontractors and suppliers is lengthy. Our reliance on subcontractors gives us less control over the manufacturing process and exposes us to significant risks, especially inadequate capacity, late delivery, substandard quality, and high costs. In addition, the manufacture of certain of these components and subassemblies is an extremely complex process. If a supplier became unable to provide parts in the volumes needed, at the required standards of quality or at an acceptable price, we would have to identify and qualify acceptable replacement parts from alternative sources of supply or manufacture such components or subassemblies internally. The failure to qualify acceptable replacement subcontractors or suppliers quickly would delay the manufacturing and delivery of our products, which could cause us to lose revenues and customers.

We also may be unable to engage alternative sources for the production of our products on a timely basis or upon terms favorable to us, if at all. If we are required for any reason to seek a new manufacturer of our products, an alternate manufacturer may not be available and, in any event, transitioning to a new manufacturer would require a significant lead time of nine months or more and would involve substantial expense and disruption of our business. Our test systems are highly sophisticated and complex capital equipment, with many custom components, and final assembly requires specific technical know-how and expertise. These factors could make it more difficult for us to find a new manufacturer of our systems if our relationship with our outsource suppliers is terminated for any reason, which would cause us to lose revenues and customers.

We are dependent on certain semiconductor device manufacturers as sole source suppliers of certain sub-assemblies and components used in our test systems which are manufactured in accordance with our proprietary design and specifications. We have no written supply agreement with these sole source suppliers and purchase our custom components through individual purchase orders. If one of our sole source suppliers were to fail to produce or provide the parts they agreed to build for us at the specifications, price or volume required, we would face a significant delay in the final production of our products because we do not have redundant capacity available, and our revenue and results of operations would be materially and adversely affected.

Compliance with current and future environmental regulations may be costly and disruptive to our operations.

We may be subject to environmental and other regulations due to our production and marketing of products in certain states and countries that limit or restrict the amount of hazardous material in certain electronic components such as PCBs. One such regulation is Directive 2002/95/EC of the European Parliament and of the Council of 27 January 2003 that restricts the use of certain hazardous substances in electrical and electronic equipment. “RoHS” is short for restriction of hazardous substances. The RoHS Directive banned the placing on the EU market of new electrical and electronic equipment containing more than agreed levels of lead, cadmium, mercury, hexavalent chromium, polybrominated biphenyl (PBB) and polybrominated diphenyl ether (PBDE), except where exemptions apply, from July 1, 2006. Manufacturers are required to ensure that their products, including their constituent materials and components, do not contain more than the minimum levels of the nine restricted materials in order to be allowed to export goods into the Single Market (i.e. of the European Community’s 28 Member States). Any interruption in supply due to the unavailability of restriction free products could have a significant impact on the manufacturing and delivery of our products. If a supplier became unable to provide parts in the volumes needed or at an acceptable price, we would have to identify and qualify acceptable replacements from alternative sources of supply or manufacture such components internally. As previously discussed, the failure to qualify acceptable replacements quickly would delay the manufacturing and delivery of our products, which could cause us to lose revenues and customers.

14

Table of Contents

New regulations related to conflict minerals may adversely affect us.

The SEC recently adopted disclosure rules for companies that use conflict minerals in their products, with substantial supply chain verification requirements in the event that the materials come from, or could have come from, the Democratic Republic of the Congo or adjoining countries. These new rules and verification requirements, which applied to our activities in calendar 2013 and will apply to our activities going forward, will impose additional costs on us and on our suppliers, and may limit the sources or increase the prices of materials used in our products. Further, if we are unable to certify that our products are conflict free, we may face challenges with our customers, which could place us at a competitive disadvantage, and our reputation may be harmed.

We may not be able to deliver custom hardware options and related applications to satisfy specific customer needs in a timely manner.

The success of our business relies in substantial part on our ability to develop and deliver customized hardware and applications to meet our customers’ specific requirements. Our equipment may fail to meet our customers’ technical or cost requirements and may be replaced by competitive equipment or an alternative technology solution. Our inability to provide a test system that meets requested performance criteria when required by a device manufacturer would severely damage our reputation with that customer. This loss of reputation together with the risks discussed above under, “The market for capital equipment is highly concentrated, and we have limited opportunities to sell our products” may make it substantially more difficult for us to sell systems to that manufacturer for a number of years. We have, in the past, experienced delays in introducing some of our products and enhancements.

Our dependence on international sales and non-U.S. suppliers involves significant risk.

International sales have constituted a significant portion of our revenues in recent years, and we expect that to continue. International sales accounted for 76% of our revenues for fiscal 2014, 83% of our revenues for fiscal 2013 and 77% of our revenues for fiscal 2012. In addition, we rely on non-U.S. suppliers for several components of the equipment we sell. As a result, a major part of our revenues and the ability to manufacture our products are subject to the risks associated with international commerce. These international relationships make us particularly sensitive to economic, political, regulatory and environmental changes in the countries from which we derive sales and obtain supplies. Our sole source final assembly manufacturing supplier for our test systems in Malaysia increases our exposure to these types of international risks. International sales and our relationships with suppliers may be hurt by many factors, including:

| • | changes in law or policy resulting in burdensome government controls, tariffs, restrictions, embargoes or export license requirements; |

| • | political and economic instability in our target international markets; |

| • | longer payment cycles common in foreign markets; |

| • | difficulties of staffing and managing our international operations; |

| • | less favorable foreign intellectual property laws making it harder to protect our technology from appropriation by competitors; |

| • | difficulties collecting our accounts receivable; |

| • | the impact of the Foreign Corrupt Practices Act of 1977 and similar laws; and |

| • | adverse weather and climate events. |

In the past, we have incurred expenses to meet new regulatory requirements in Europe, experienced periodic difficulties in obtaining timely payment from non-U.S. customers, and been affected by economic conditions in several Asian countries. Our foreign sales are typically invoiced and collected in U.S. dollars. A strengthening in the U.S. dollar relative to the currencies of those countries where we do business would increase the prices of our

15

Table of Contents

products as stated in those currencies and could hurt our sales in those countries. Significant fluctuations in the exchange rates between the U.S. dollar and foreign currencies could cause us to lower our prices and thus reduce our profitability. These fluctuations could also cause prospective customers to push out or delay orders because of the increased relative cost of our products. In the past, there have been significant fluctuations in the exchange rates between the U.S. dollar and the currencies of countries in which we do business. From time to time we may enter into foreign currency hedging arrangements.

Our market is highly competitive, and we have limited resources to compete.

The semiconductor equipment and electronics manufacturing industries are highly competitive in all areas of the world. There are other domestic and foreign companies that participate in the markets for each of our products. Our competitors include Advantest Corporation and Teradyne Inc., Johnstech, MicroCraft, Cohu, Inc., SPEA, Shenzhen Mason Electronics Co., Ltd., Bojay, OXO, Sanmina, IDI, QA Technology, and Ingun. Some of these competitors have substantially greater financial resources and more extensive engineering, manufacturing, marketing, and customer support capabilities than we have.

We expect our competitors to enhance their current products and to introduce new products that may have comparable or better price and performance. The introduction of competing products could hurt sales of our current and future products. In addition, new competitors, including semiconductor and electronics manufacturers themselves, may offer new technologies, which may in turn reduce the value of our products. Increased competition could lead to intensified price-based competition, which would hurt our business and results of operations. Unless we are able to invest significant financial resources in developing products and maintaining customer support centers worldwide, we may not be able to compete effectively.

We are exposed to the risks associated with the volatility of the U.S. and global economies.

Slow or negative growth in the domestic or global economies may continue to materially and adversely affect our business, financial condition and results of operations for the foreseeable future. The strength of the domestic and global economies impact business capital spending and the sale of electronic goods and information technology equipment, which impacts our sales, revenues, and profits. The lack of visibility regarding whether there will be sustained growth in domestic and global economies creates uncertainty regarding the amount of our sales, and underscores the need for caution in predicting growth in the semiconductor test equipment industry in general and in our revenues and profits specifically. Our results of operations would be further adversely affected if we were to experience lower than anticipated order levels, cancellations of orders in backlog, extended customer delivery requirements or pricing pressure as a result of a slowdown. At lower levels of revenue, there is a higher likelihood that these types of changes in our customers’ requirements would adversely affect our results of operations because in any particular quarter a limited number of transactions accounts for an even greater portion of sales for the quarter.

Development of our products requires significant lead-time and expenditures, and we may fail to correctly anticipate the technical needs of our customers.

Our systems are used by our customers to develop, test and manufacture their new semiconductor and electronics devices. We therefore must anticipate industry trends and develop products in advance of the commercialization of our customers’ semiconductor and electronics devices, requiring us to make significant capital investments to develop new equipment for our customers well before their devices are introduced. If our customers fail to introduce their devices in a timely manner or the market does not accept their devices, we may not recover our capital investment, in whole or in part. In addition, even if we are able to successfully develop enhancements or new generations of our products, these enhancements or new generations of products may not generate revenue in excess of the costs of development, and they may be quickly rendered obsolete by changing customer preferences or the introduction of products embodying new technologies or features by our competitors. Furthermore, if we were to make announcements of product delays, or if our competitors were to

16

Table of Contents

make announcements of new systems, these announcements could cause our customers to defer or forego purchases of our systems, which would also hurt our business.

We may not be able to recover capital expenditures.

We continue to make capital expenditures in the ordinary course of our business. We may not be able to recover the expenditures for capital projects within the assumed timeframe, or at all, which may have an adverse impact on our profitability.

We have significant guarantees, indemnification and customer confidentiality obligations.

From time to time, we make guarantees to customers regarding the delivery and performance of our products and guarantee certain indebtedness, performance obligations or lease commitments of our subsidiary and affiliate companies. We also have agreed to provide indemnification to our officers, directors, employees and agents, to the extent permitted by law, arising from certain events or occurrences while the officer, director, employee or agent, is or was serving at our request in such capacity. Additionally, we have confidentiality obligations to certain customers. If we become liable under any of these obligations, it could materially and adversely affect our business, financial condition or operating results.

Our success depends on attracting and retaining key personnel.

Our success depends substantially upon the continued service of our executive officers and key personnel, none of whom is bound by an employment or non-competition agreement. Our success also depends on our ability to attract and retain highly qualified managers and technical, engineering, marketing, sales and support personnel. Competition for such specialized personnel is intense, and it may become more difficult for us to hire or retain them. Our volatile business cycles only aggravate this problem. If we implement layoffs during an industry downturn, our ability to hire or retain qualified personnel may be diminished. Our business, financial condition and results of operations could be materially adversely affected by the loss of any of our key employees, by the failure of any key employee to perform in his or her current position, or by our inability to attract additional skilled employees.

We may not be able to protect our intellectual property rights.

Our success depends in part on our ability to obtain intellectual property rights and licenses and to preserve other intellectual property rights covering our products and development and testing tools. To that end, we have obtained certain domestic and international patents and may continue to seek patents on our inventions when appropriate. We have also obtained certain trademark registrations. The process of seeking intellectual property protection can be time consuming and expensive. We cannot ensure that:

| • | patents will issue from currently pending or future applications; |

| • | our existing patents or any new patents will be sufficient in scope or strength to provide meaningful protection or any commercial advantage to us; |

| • | foreign intellectual property laws will protect our intellectual property rights; or |

| • | others will not independently develop similar products, duplicate our products or design around our technology. |

If we do not successfully enforce our intellectual property rights, our competitive position could suffer, which could harm our operating results. We also rely on trade secrets, proprietary know-how and confidentiality provisions in agreements with employees and consultants to protect our intellectual property. Other parties may not comply with the terms of their agreements with us, and we may not be able to adequately enforce our rights against these parties.

17

Table of Contents

Third parties may claim we are infringing their intellectual property, and we could incur significant litigation costs and licensing expenses or be prevented from selling our products.

Intellectual property rights are uncertain and involve complex legal and factual questions. We may be unknowingly infringing on the intellectual property rights of others and may be liable for that infringement, which could result in a significant liability for us. If we do infringe the intellectual property rights of others, we could be forced to either seek a license to intellectual property rights of others or alter our products so that they no longer infringe the intellectual property rights of others. A license could be very expensive to obtain or may not be available at all. Similarly, changing our products or processes to avoid infringing the rights of others may be costly or impractical.

If we were to become involved in a dispute regarding intellectual property, whether ours or that of another company, we may have to participate in legal proceedings. These types of proceedings may be costly and time consuming for us, even if we eventually prevail. If we do not prevail, we might be forced to pay significant damages, obtain licenses, modify our products or processes, stop making products or stop using processes.

In the future we may be subject to litigation that could have an adverse effect on our business.

From time to time, we may be subject to litigation or other administrative and governmental proceedings that could require significant management time and resources and cause us to incur expenses and, in the event of an adverse decision, pay damages in an amount that could have a material adverse effect on our financial position or results of operations.

Product defects and any damages stemming from product liability could harm our reputation among existing and potential customers and could have a material adverse effect upon our business results and financial condition

We cannot guarantee that there are no defects in the products we manufacture or that our product liability insurance will sufficiently cover the ultimate amount of any damages caused by such defects. Large scale accidents due to product defects or any discovery of defects in our products could harm our reputation, result in claims for damages, and have a material adverse effect upon our business results and financial condition.

Our operations and the operations of our customers and suppliers are subject to risks of natural catastrophic events, widespread health epidemics, acts of war, and the threat of domestic and international terrorist attacks, any one of which could result in cancellation of orders, delays in deliveries or other business activities, or loss of customers and could negatively affect our business and results of operations.

Our operations and those of our customers and suppliers are subject to disruption for a variety of reasons, including work stoppages, acts of war, terrorism, health epidemics, fires, earthquakes, hurricanes, volcanic eruptions, energy shortages, telecommunication failures, tsunamis, flooding or other natural disasters. Such disruption could materially increase our costs and expenses as well as cause delays in, among other things, shipments of products to our customers, our ability to perform services requested by our customers, or the installation and acceptance of our products at customer sites. Any of these conditions could have a material adverse effect on our business, financial conditions or results of operations.

Damage, interference or interruption to our information technology networks and systems could hinder business continuity and lead to substantial costs or harm to our reputation

We rely on various information technology networks and systems, some of which are managed by third parties, to process, transmit and store electronic information, including confidential data, and to carry out and support a variety of business activities, including manufacturing, research and development, supply chain management, sales and accounting. Attacks by hackers or computer viruses, wrongful use of the information security system, careless use, accidents or disasters could undermine the defenses we have established for these systems and disrupt business continuity, which could not only risk leakage or tampering of information but could

18

Table of Contents

also result in a legal claim, litigation, damages liability or an obligation to pay fines. If this were to occur, our reputation could be harmed, we could incur substantial costs, and it may have a material adverse effect upon our financial condition and results of operation.

Our stock price is volatile.

In the fiscal year ended July 31, 2014, our stock price ranged from a low of $4.05 to a high of $10.95. The price of our common stock has been and likely will continue to be subject to wide fluctuations in response to a number of events and factors, such as:

| • | quarterly variations in operating results; |

| • | variances of our quarterly results of operations from securities analysts’ estimates; |