Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Horizon Therapeutics Public Ltd Co | d804018d8k.htm |

| EX-99.1 - EX-99.1 - Horizon Therapeutics Public Ltd Co | d804018dex991.htm |

Horizon Pharma

plc October 13, 2014

Friedreich's Ataxia Analyst Day Presentation

Exhibit 99.2

Non-Confidential Information – Horizon Pharma plc

|

Forward-Looking Statements

2

Non-Confidential Information – Horizon Pharma

plc This presentation contains

forward-looking statements, including, but not limited to, statements related to the consummated business

combination transaction between Horizon Pharma, Inc. and Vidara Therapeutics

International plc and the benefits thereof, the strategy, plans, objectives,

expectations (financial or otherwise) and intentions, future financial results and growth potential of the combined company –

Horizon Pharma plc, development programs and management structure, and other statements that

are not historical facts. This presentation also includes forward-looking statements regarding results of the Phase

2 clinical trial of ACTIMMUNE and management expectations and plans regarding further

study of ACTIMMUNE in Friedreich’s ataxia (FA) , related discussions with the FDA, the potential for

ACTIMMUNE as a treatment for FA patients, and potential sales opportunity for

ACTIMMUNE. The statements made by representatives of the Friedreich’s

Ataxia Research Alliance and the Collaborative Clinical Research Network in Friedreich’s Ataxia represent their independent

conclusions and recommendations.

These forward-looking statements are based on Horizon Pharma plc’s current

expectations and inherently involve significant risks and uncertainties.

Actual results and the timing of events could differ materially from those anticipated in such forward looking statements as a

result of these risks and uncertainties, which include, without limitation, risks related to

future opportunities and plans for Horizon Pharma plc, including uncertainty of the

expected financial performance and results; disruption from the transaction, making it more difficult to conduct

business as usual or maintain relationships with customers, employees or suppliers; and the

possibility that if Horizon Pharma plc does not achieve the perceived benefits of the

transaction as rapidly or to the extent anticipated by financial analysts or investors, the market price of its

shares could decline, as well as other risks related to Horizon Pharma plc’s business,

including whether results of subsequent studies will be consistent with results of the

Phase 2 clinical trial of ACTIMMUNE; risks regarding timing and outcome of regulatory review and approval of

product candidates; its dependence on sales of its existing products and its ability to

increase sales of its existing products; Horizon Pharma plc’s ability to

successfully execute its commercial strategy and achieve projected financial results in 2014 and 2015; the fact that past financial or

operating results are not a guarantee of future results; competition, including potential

generic competition; the ability of Horizon Pharma plc to protect its intellectual

property and defend its patents; regulatory obligations and oversight; and those risks detailed from time-to-time under

the caption “Risk Factors” and elsewhere in Horizon Pharma plc’s SEC

filings and reports, including in its Annual Report on Form 10-K for the year ended

December 31, 2013. Horizon Pharma plc undertakes no duty or obligation to update any forward-looking statements contained in

this presentation as a result of new information, future events or changes in its

expectations. For full prescribing information, please see product websites;

www.DUEXIS.com

www.ACTIMMUNE.com

www.RAYOSrx.com

www.VIMOVO.com

,

;

;

. |

Non-Confidential Information – Horizon Pharma

plc Forward-Looking Statements

– Friedreich’s Ataxia

Slides regarding the Friedreich’s ataxia population and market are from a report prepared

by L.E.K. Consulting LLC (“L.E.K.”) and are being provided for informational

purposes only. Recipients of such report and the information contained

therein are not permitted to rely on the report, and their access to the report is not

a substitute for the investigations and due diligence that any such recipient would

ordinarily undertake. L.E.K. is not and shall not be responsible for decisions made by any such recipient

of

the report. L.E.K. owes no obligations or duties to recipients

of this report in connection with the report, whether in contract,

tort (including negligence), breach of statutory duty or otherwise.

During the course of L.E.K.’s analysis, certain assumptions and forecasts may have been

developed. These assumptions are inherently subject to uncertainties, and

actual results may differ from those projected. While L.E.K. believes that the

assumptions and forecasts are reasonably based, L.E.K. does not provide any assurance that

these assumptions are correct, or that any forecasts will reflect actual

results. Therefore, no representation is made or intended to be made, nor should be

inferred, with respect to the likely occurrence of any particular future set of

facts. L.E.K.’s analysis is based on information available at the time

it prepared its analysis and on certain assumptions, including, but not limited to, assumptions regarding

future events, developments and uncertainties and contains “forward-looking

statements” (statements that may include, without

limitation, statements about projected revenues, earnings, market opportunities, strategies,

competition, expected activities and expenditures, and at times may be identified by

the use of words such as “may”, “could”, “should”,

“would”, “project”, “believe”, “anticipate”,

“expect”, “plan”, “estimate”, “forecast”, “potential”, “intend”, “continue”

and variations of these words or

comparable words). L.E.K. is not able to predict future events, developments and

uncertainties. Consequently, any of the forward-looking statements contained in

this report may prove to be incorrect or incomplete, and actual results could differ

materially from those projected or estimated in this report. L.E.K. undertakes no

obligation to update any forward-looking statements for revisions or changes after

the date of this report and L.E.K. makes no representation or warranty that any of the

projections or estimates in this report will be realized. Nothing contained herein is,

or should be relied upon as, a promise or representation as to the future.

3 |

Non-Confidential Information – Horizon Pharma

plc Note Regarding Use of Non-GAAP

Financial Measures 4

Horizon provides certain financial measures such as adjusted non-GAAP net income (loss),

adjusted non-GAAP net income (loss) per share, non- GAAP gross profit margins

and non-GAAP cash from operations that include adjustments to GAAP figures. These adjustments to GAAP exclude

acquisition transaction related expenses as well as non-cash items such as stock

compensation, depreciation and amortization, accretion, non- cash interest expense,

and other non-cash adjustments such as the increase or decrease in the fair value of the embedded derivative associated

with the Company’s convertible senior notes. Certain other special items or

substantive events may also be included in the non-GAAP adjustments periodically

when their magnitude is significant within the periods incurred. EBITDA, or earnings before interest, taxes,

depreciation and amortization, and adjusted EBITDA are also used and provided by Horizon as

non-GAAP financial measures. Horizon believes that these non-GAAP

financial measures, when considered together with the GAAP figures, can enhance an overall understanding of Horizon's

financial performance. The non-GAAP financial measures are included with the intent

of providing investors with a more complete understanding of the Company’s

operational results, trends and expectations. In addition, these non-GAAP financial measures are among the

indicators Horizon’s management uses for planning and forecasting purposes and measuring

the Company's performance. These non-GAAP financial measures should be

considered in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance

with GAAP. The non-GAAP financial measures used by the Company may be calculated

differently from, and therefore may not be comparable to, non-GAAP financial

measures used by other companies. The Company has not provided a reconciliation of full year 2014 or 2015 adjusted

EBITDA outlook to a net income (loss) outlook because certain items that are a component of

net income (loss) but not part of adjusted EBITDA, such as the gain (loss) on

derivative revaluation associated with the convertible senior notes, stock compensation, acquisition related expenses

and certain purchase accounting items such as intangibles and step-up inventory, cannot be

reasonably projected, either due to the significant impact of changes in Horizon’s

stock price on derivative revaluation and stock compensation, or the variability associated with acquisition

related expenses and purchase accounting items due to timing and other factors.

|

Friedreich’s

Ataxia Analyst Day Agenda 5

Non-Confidential Information – Horizon Pharma

plc Overview & Vision for

ACTIMMUNE ®

Timothy P. Walbert

Chairman, President and Chief Executive Officer

FA Overview & ACTIMMUNE Phase 2

Clinical Trial Results

Jennifer Farmer, MS

Certified Genetic Counselor

Executive Director, FARA and Coordinator,

Collaborative Clinical Research Network in FA

FARA’s Mission and Strategy

Ronald J. Bartek

Co-Founder & President of FARA

ACTIMMUNE Clinical & Regulatory Plan

Jeffrey W. Sherman, M.D., FACP

Executive

Vice President, Research and

Development,

Chief Medical Officer

FA Market Overview

Brian Andersen

Group Vice President and General Manager,

Orphan Business Unit

Business Development Strategy

Robert F. Carey

Executive Vice President, Chief Business Officer

Q&A

All |

6

HZNP Overview and Vision for ACTIMMUNE®

Timothy P. Walbert

Chairman, President and Chief Executive Officer

Non-Confidential Information – Horizon Pharma

plc |

Non-Confidential Information – Horizon Pharma

plc (1)

On a non-GAAP basis

(2)

RAYOS is known as LODOTRA outside the United States

•

Profitable

(1)

specialty biopharmaceutical

company with accelerating growth

•

Integrated commercial model with track

record of execution

•

Four products targeting unmet

therapeutic needs in orphan diseases,

primary care and specialty segments

•

Experienced, proven leadership team

•

Tax efficient corporate platform

facilitating an aggressive business

development strategy via

product/company acquisitions

Horizon Pharma plc Overview

7

(2) |

Non-Confidential Information – Horizon Pharma

plc Four U.S. Products in Three Market

Segments 8

•

7 clinical science associates

–

Academic medical centers

–

Infectious disease and

immunology

Orphan Diseases

Primary Care

•

250 sales reps

–

Primary care

–

Orthopedic surgeons

Specialty

•

42 sales reps

–

Rheumatology |

Non-Confidential Information – Horizon Pharma

plc 2012

2013

2014E

(1)

2Q 2013

2Q 2014

2015E

(1)

~495% Year-over-Year

Net Sales Growth

2Q13 vs. 2Q14

Accelerating Growth in Net Sales and EBITDA

9

$18.8

$74.0

$270 -

$280

$380 -

$405

$11.1

$66.1

$(73.3)

$(33.5)

$80 -

$90

$(12.5)

$23.8

$(150.0)

$(50.0)

$50.0

$150.0

$250.0

$350.0

$450.0

Net Sales

Adjusted EBITDA

$150 -

$170

(1)

Guidance provided on September 19, 2014 which included estimated ACTIMMUNE results and

excluded transaction related expenses. By this presentation, Horizon is not confirming

or updating September 19, 2014 financial guidance. |

Non-Confidential Information – Horizon Pharma

plc •

Adjusted 2Q 2014 non-GAAP net income was $20.7 million, or $0.28 non-GAAP

basic earnings per share and $0.21 non-GAAP diluted earnings per share

(1)

RAYOS is known as LODOTRA outside the United States

Consistently Improving Quarterly Growth

10

$9

$11

$24

$30

$52

$66

$0

$10

$20

$30

$40

$50

$60

$70

1Q 2013

2Q 2013

3Q 2013

4Q 2013

1Q 2014

2Q 2014

LODOTRA

(1)

RAYOS

(1)

DUEXIS

VIMOVO |

Non-Confidential Information – Horizon Pharma

plc 11

ACTIMMUNE

–

Making

a

Difference

in

Patients’

Lives

See full prescribing information at www.ACTIMMUNE.com |

ACTIMMUNE

- $500M Product Opportunity*

12

ACTIMMUNE in CGD/SMO

+

•

ACTIMMUNE (interferon gamma-1b)

•

Indications

–

Reduction of the frequency and

severity of serious infections

associated with Chronic

Granulomatous Disease (CGD)

–

Delaying time to disease

progression in patients with severe,

malignant osteopetrosis (SMO)

•

270 CGD/SMO patients on drug

ACTIMMUNE in FA

•

Friedreich's ataxia is a debilitating,

life-shortening, ultra-orphan

disorder

•

Prevalence of 1 in 50,000 people in

U.S. or ~3,700 U.S. patients

•

No FDA approved treatment for

patients

•

Strong efficacy signal in Phase 2

study

•

Plan to partner with FARA and

rapidly move into Phase 3

registration program

* Subject to approval in Friedreich’s ataxia

+

See full prescribing information at www.ACTIMMUNE.com

Non-Confidential Information – Horizon Pharma

plc |

Non-Confidential Information – Horizon Pharma

plc •

$73.6 million annual sales and $39.1 million operating income run-rate based on 2Q

2014 performance

•

Q2 2014 ACTIMMUNE sales of $18.4M, an increase of $4.9 million from 2Q 2013

ACTIMMUNE Financial Overview –

Q2 2014

13

($ in millions)

2014

2013

2014

2013

Product Sales, net

18.4

$

13.5

$

35.7

$

25.9

$

Cost of product sales

0.8

1.7

1.7

3.2

Gross Profit

17.6

11.8

34.1

22.7

Gross Margin

96%

87%

95%

88%

Operating Expenses

7.8

6.1

17.1

12.6

Income from Operations

9.8

5.7

17.0

10.1

Operating Margin

53%

42%

47%

39%

Other Expenses

0.2

0.6

0.5

1.6

Income Taxes

0.4

(0.8)

0.7

(1.5)

Net Income

9.2

$

5.9

$

15.7

$

10.1

$

Net Margin

50%

44%

44%

39%

(Unaudited)

(Unaudited)

Three Months Ended June 30,

Six Months Ended June 30, |

Non-Confidential Information – Horizon Pharma

plc Drive market penetration in

CGD (currently < 30%)

Meet with FDA and finalize Phase 3

program in Friedreich’s ataxia

Identify further potential

indications with proven science

Rapidly understand opportunity in

Cutaneous T-cell lymphoma and

Eczema Herpeticum

ACTIMMUNE Strategy

Drive CGD Penetration and Rapidly Expand Market Opportunity

14 |

Non-Confidential Information – Horizon Pharma

plc 15

FA & ACTIMMUNE Phase 2 Clinical Trial Results

Jennifer Farmer, MS, Certified Genetic Counselor

Executive Director, FARA

Coordinator, Collaborative Clinical Research

Network in FA |

Friedreich

Ataxia (FA) •

A rare, genetic condition that is a progressive

degenerative disease of children, adolescents and

adults

•

Affects 1 in 50,000

•

Estimated 4-5,000 individuals in US and 15,000

worldwide

•

Nicolaus Friedreich first described in 1860’s based on

6 patients from 2 families

•

Typically thought of as a neurodegenerative disease

as this is the most visible and common symptom;

however FA is a multi-system disease

•

Genotypic and phenotypic heterogeneity

16

–

Childhood onset is associated with more rapid progression.

•

Onset/symptoms appear between ages of 5-15 years

•

Late teens –

early twenties most individuals are wheelchair-bound

and require assistance with ADLs

–

Late onset (diagnosed after age 20) is associated with slower progression

and overall more mild phenotype |

FA –

Clinical Features

Clinical features: Neuro

•

Loss of large sensory neurons -

proprioception

–

Loss of balance and coordination

–

Loss of reflexes

•

Loss of spinocerebellar tracts

–

Loss of balance and coordination

•

Loss of motor tracts to a lesser degree

•

Loss of dentate nucleus of the cerebellum

–

Dysarthria (slurred speech), modest eye movement

abnormalities

•

Loss of a few other specific sites.

–

Vision, hearing loss

•

Sparing of cerebellar cortex, cerebral cortex

–

Normal cognition

•

Overall loss of relatively few neurons, modest number of

axonal tracts----MRI scans are normal or almost normal in

early disease

17 |

FA –

Not just Neuro but Multi-system condition

•

Heart: Cardiomyopathy and arrhythmia

–

Hypertrophic cardiomyopathy can be

progressive and severe and early

morbidity and mortality

–

Clinically significant arrhythmia

•

Endo: Diabetes –10-20%; >65% Insulin

resistance

•

ENT

–

Swallowing difficulty in later stage

patients

–

Hearing loss –

10-15% of patients

•

Ophthal

–

Optic atrophy –

present in 10% of pts

–

Fixation abnormalities common

(square wave jerks, ocular flutter)

•

Skeletal: Scoliosis

-Corrective surgery required in up to

50% of patients

-Pes cavus

•

Fatigue: Nearly all patients

experience significant fatigue that

impacts quality of life.

•

Cognition remains normal

18 |

Friedreich’s Ataxia: Management

•

No treatment to stop progression of disease

•

Most individuals take vitamins and antioxidants

•

Annual Echocardiogram and EKG

–

Treat cardiac symptoms as they appear

–

No clinical treatment guidelines

•

Annual glucose

•

Annual scoliosis screening (especially kids ages

7-18)

–

Spinal fusion –

as needed

•

Annual vision and hearing screening

•

Annual PT/OT/Speech

19 |

Diagnosis

- FXN

gene identified in 1996

Exon 1

2

3

4

5

4

GAA

FXN Gene

5

Transcription

Translation

Frataxin: highly conserved;

functions in mitochondria

20 |

Diagnosis

-

FXN gene identified in 1996

Exon 1

2

3

4

GAA

5

Exon 1

2

3

4

GAA

5

GAA repeats

3-33 –

normal

GAA repeats

66-1700

-

abnormal

Frataxin

21 |

Diagnosis

-

FXN gene identified in 1996

Exon 1

2

3

4

GAA

5

Exon 1

2

3

4

GAA

5

Mat

Pat

Low frataxin

22 |

Frataxin

Correlates with GAA repeat length Deutsch et al., Mol Genet Metab. 2010

Measured frataxin levels inversely correlates with GAA repeat

length, suggesting that the assay is useful for assessing severity of

disease in buccal cells.

23 |

p

<<< 0.0001 p <<< 0.0001

p <<< 0.0001

p <<< 0.0001

p <<< 0.0001

p <<< 0.0001

Two Encouraging Learnings: 1) Individuals with FA

make some Frataxin; 2) One does not need 100%

24 |

Low frataxin =

mitochondrial dysfunction and energy deprivation

Frataxin: highly conserved; functions in

mitochondria

25 |

Why Interferon

gamma for FA? 26 |

Why Interferon

gamma for FA? 27 |

Why Interferon

gamma for FA? •

FRDA mice improve both locomotor activity and

motor coordination, when treated with IFN

, and

that this is paralleled by both frataxin upregulation

and neuronal preservation in DRG.

28 |

Pilot Study of

IFN in Children with FA

•

Investigator-initiated study; IND waiver

–

Goals

•

Safety and tolerability of IFN

•

Effect on frataxin protein levels

•

Effect on neurologic function

•

Design: Small, open-label

pilot study

•

12 Individuals with genetic confirmation of FA, ages 5-17

•

Dose-escalation

(10mcg/m2,

25mcg/m2,

50mcg/m2

–

3xwk)

every

two

weeks

based

on

tolerability

•

Overall treatment phase was 12 weeks

•

Reevaluation 1 month post treatment

29 |

Study Outcome

Measures 30

•

Primary outcome measure

–

Effect

of

IFN-

on

frataxin

mRNA

and

protein

levels

in

whole

blood

(primary)

and buccal cells after 12 weeks of treatment.

•

Secondary outcome measures

•

Pharmacokinetic:

in

vivo

and

in

vitro

levels

of

IFN-

,

whole

blood

•

Neurologic:

Friedreich’s

Ataxia

Rating

Scale

(FARS),

Timed

25

Foot

Walk

Test (T25FW), 9-Hole Peg Test (9HPT), Low Contrast Sloan Letter Acuity

(LCSLA), Listening in Spatialized Noise –

Sentences (LiSN-S)

•

Overall

clinical

measures:

Global

Impression

of

Clinical

Severity,

Modified

Fatigue Impact Scale, Activities of Daily Living, Pediatrics Quality of Life

scales

•

Safety

and

Tolerability:

Clinical

safety

lab

testing,

electrocardiogram,

assessment of adverse events, flu-like symptoms (FLS), injection-site

reactions (ISR) |

Demographics

31

8-17 years old, mean age of 12

Mean GAA repeat length 835

Mean age of onset was 6

12 of 12 subjects screened met criteria

Two subjects did not follow dose escalation protocol

due to adverse events

Two subjects withdrawn from the study for inability

to complete study procedures |

No

drug-related serious adverse events (SAE) occurred

11 of 12 subjects experienced at least 1 AE

Low grade, not dose related

Largely known side-effects of IFN-

Two subjects were unable to continue with dose-

escalation of IFN-

due to moderate to severe flu-like

symptoms

Safety and tolerability

32 |

Frataxin

Measurements A rapid, noninvasive

immunoassay

for

frataxin: utility in assessment of Friedreich

ataxia,

Deutsch

EC

1

,

Santani

AB,

Perlman

SL,

Farmer

JM,

Stolle

CA,

Marusich

MF,

Lynch

DR.

Mol

Genet

Metab.

2010

Oct-Nov;101(2-3):238-45.

Usefulness of

frataxin

immunoassays for the diagnosis of Friedreich ataxia,

Deutsch

EC

1

,

Oglesbee

D

,

Greeley

NR

,

Lynch

DR,

J

Neurol

Neurosurg

Psychiatry.

2014 Sep;85(9):994-1002.

Validation in whole blood and buccal cells

Exploratory –

RBCs, platelets and WBCs

–

While

there

was

statistically

significant

change

it

was

not

at

a

level

or

magnitude

that

could

be

clinically meaningful

–

Unaffected tissue

33

2

3 |

34

|

Friedreich

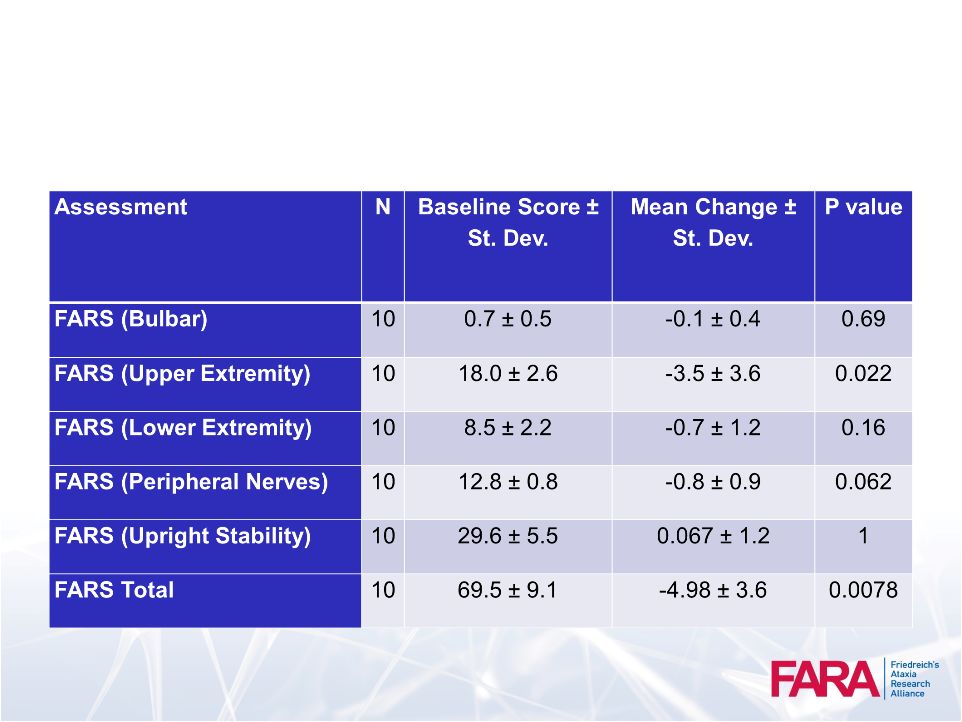

Ataxia Rating Scale (FARS)

35

Clinical neurological exam and ADL based scale developed by

S. Subramony

•

Good inter-rater reliability; correlates with duration, disability and ADL

•

Bulbar –

speech, facial strength, cough

•

Upper Extremity –

finger to nose, dysmetria, finger taps

•

Lower Extremity –

heel to shin –

slide and tap

•

Peripheral Nerves –

reflexes, proprioception, sensation

•

Upright Stability –

sitting, standing, walking

•

FARS, Functional Disability Rating Scale –

0-6

•

Clinician grading

•

FARS, Activities of Daily Living 0-36

•

Patient response

•

FARS Neuro, 5 separate subscores (0-125) |

36

|

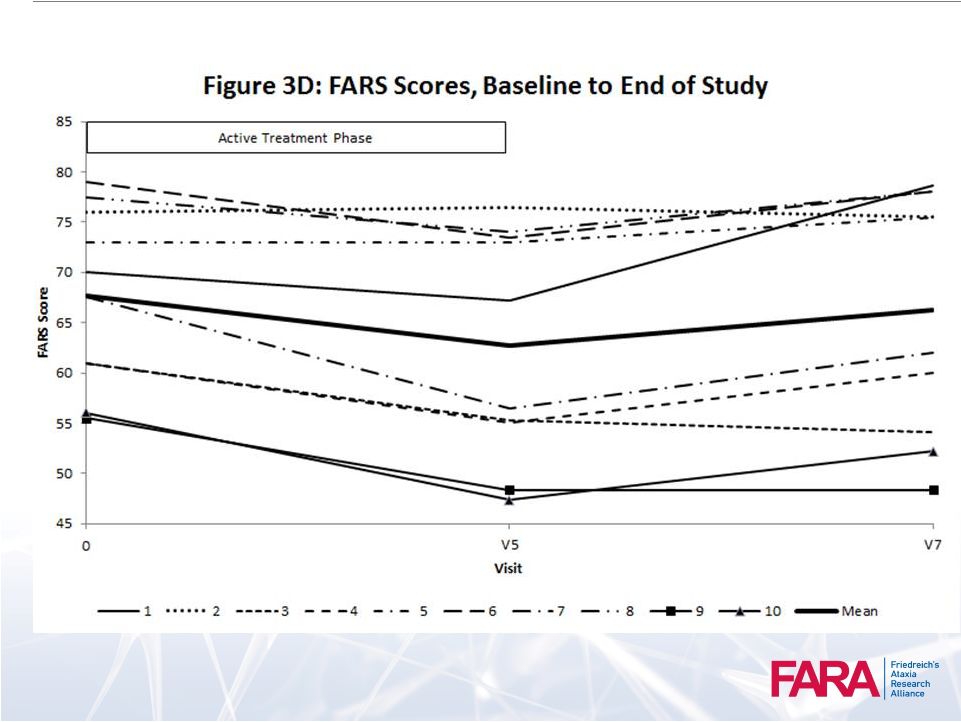

FARS:

Clinical Outcome Measure 37 |

38

|

Performance

Measures 39 |

Conclusions

IFN-

was safe and well-tolerated

No overt significant increase in frataxin levels

–

Presence of increased levels through treatment

–

Sampling limited to unaffected tissue

–

Timing

of

sampling

-

short

half

life

of

gamma

interferon

–

Limited to FDA approved dose for other diseases

Clinically significant neurologic improvement

magnitude

40 |

Limitations

•

The small size of the study

•

Absence of a placebo group

•

One site

41 |

Future

Directions •

Double-blind, placebo-controlled trial

•

Larger number of subjects

•

Frataxin measurements more consistently timed

with dosing

•

Frataxin measurement in affected tissue

–

Muscle

•

Explore higher-dose

42 |

43

Non-Confidential Information – Horizon Pharma

plc Ronald J. Bartek

Co-Founder & President of FARA

FARA’s Mission and Strategy

|

FARA Mission

& Strategy Mission

is to marshal and focus the resources and relationships

needed to cure FA

Guiding Principle

-

Collaboration and Partnership

•

As a rare disease we can not afford to seek progress in isolation

Strategy

•

Growing the scientific community

•

Diverse and Deep Pursuit of Treatments

•

Focus on Infrastructure needs

•

Public-Private Partnership

•

Advocacy

44 |

FARA Research

and Clinical Programs Grant

Program

Scientific

Conference

Program

Patient Registry &

Education

Program

Collaborative

Clinical

Research

Network

Advocacy

•24/7/365

•Peer-reviewed

•Basic,

Translational

and Clinical

Research

•

> $25 Million

in research

funding to

scientists in

both public and

private

organizations.

•Facilitating

rapid and open

sharing research

•Promoting

collaboration

•Nurturing young

investigators

•Patient

Recruitment

•2200 Registrants

•Athena Diagnostics

sends letter to

referring physicians

alerting them to the

FARA Patient

Registry when an

individual is

diagnosed.

•10 Network Sites

Worldwide

•>750 Individuals

seen on an annual

•Infrastructure for

clinical research,

including natural

history, outcome

measures,

biorepository,

biomarker studies

and trials.

•Trained physicians

and coordinators

•Promote

public-

private

partnership.

•Government

(NIH &FDA)

•Pharmaceutica

l Industry

•Other

advocacy

organizations

45 |

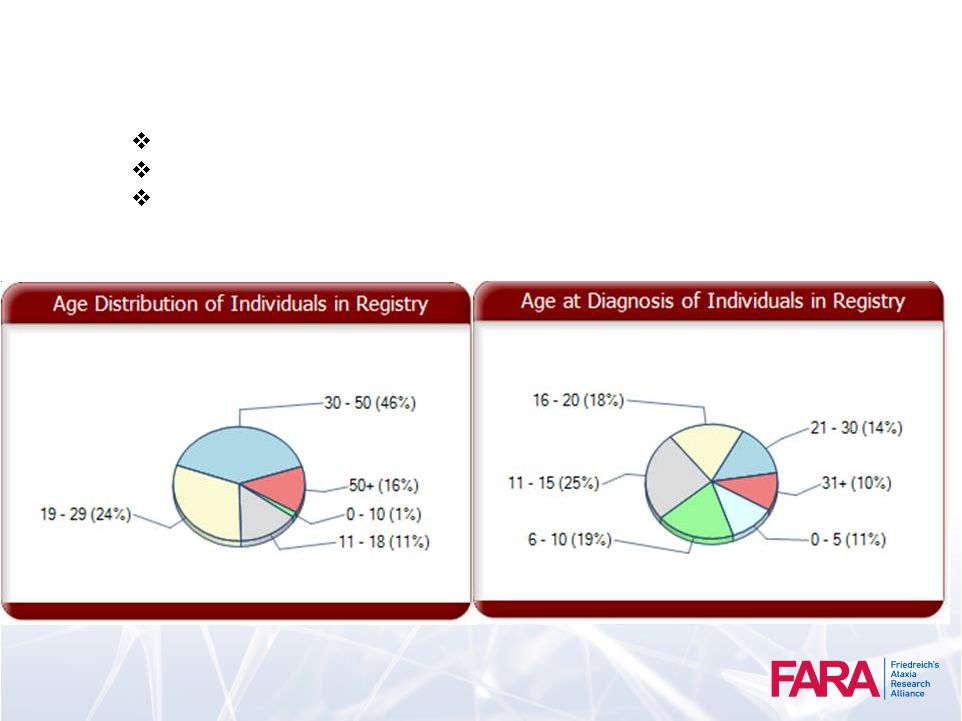

FARA Patient

Registry •

The

FARA

Patient

Registry

is

the

only

worldwide

registry

of

FA

patients

•

Web-based, patient entered demographic and basic clinical

data

•

Proven successful for clinical research and trial recruitment.

–

7 clinical trials; 9 clinical research studies

–

Recruiting subjects in hours and days not weeks and months

•

Providing good evidence for geographic distribution and

population data

46 |

FARA Patient

Registry Over 2000 Patients Active Enrollment

From 65 Countries

Top Five Countries –

United States (64%), Canada, United Kingdom,

Australia, Spain

47 |

FARA Patient

Registry Average 200 new registrants per year

48

0

500

1000

1500

2000

2500

2006

2008

2010

2012

2014

>2400 individuals with FA Enrolled

New Enrollment /YR

Existing |

Collaborative

Clinical Research Network in FA (CCRN in FA)

•

Established 10 years ago -

10 sites in U.S., Australia and

South America

•

Goals

•

Provide

quantitative

serial

clinical

data

on

patients

–

natural

history

•

Design

improved

clinical

measures

for

use

in

trials

•

Build

a

clinical

database

in

parallel

with

a

biorepository

for

use

in

translational research including modifier gene studies and biomarker studies

•

Create

a

mechanism

for

sharing

data

and

resources

•

Facilitate

the

implementation

and

conduct

of

clinical

trials

•

Define

best

practices

for

FA

and

provide

the

highest

level

of

clinical

care

for

patients

49 |

CCRN in FA

Cohort Assessment

N

Mean

SD

Age of Onset

746

13.7

10.03

Age at Baseline

746

26.2

15.17

Shorter GAA

repeat

746

632.7

241.14

50

Gender

Male

50%

Female

50% |

Advocacy

•

NIH –

Member NINDS Council, Steering Committee NINDS non-profit

forum, Rare Disease Patient Registry Advisors

–

1

NIH RAID grant for non-cancer condition

•

Partnership –

Industry, Academia, Advocacy

•

Raising awareness and knowledge at FDA

–

2013 & 2014 –

Invited speakers at FDA training

–

FA community members on FDA Advisory panels

•

Institute of Medicine

–

Accelerating Drug Development for Rare Diseases

–

Independent Review of the RAC

51

st |

Researchers

&

Physicians

Government

NIH, FDA

Pharma & Biotech

Patients and

Families

FARA

FARA

52 |

53

Clinical and Regulatory Plan

Clinical and Regulatory Plan

Jeffrey W. Sherman, M.D., FACP

Executive Vice President, Research and

Development, Chief Medical Officer

Non-Confidential Information – Horizon Pharma

plc |

Clinical/Regulatory Considerations for FA

Clinical/Regulatory Considerations for FA

•

FA is a debilitating, life-shortening, ultra orphan disorder

(prevalence of 1 in 50,000 people in U.S.)

•

No treatment for patients only monitored for symptoms

•

Increase in initiatives and incentives from FDA to expedite

treatments for conditions such as FA

–

Rare and orphan disease programs

–

Expedited programs for serious conditions

–

Best Pharmaceuticals for Children Act (BPCA)

•

ACTIMMUNE already FDA approved for two debilitating,

orphan diseases

•

Supplement approval pathway typically more straightforward

than new entity approval

54

Non-Confidential Information – Horizon Pharma

plc |

Non-Confidential Information – Horizon Pharma

plc Potential to Address an Unmet Medical

Need Potential to Address an Unmet Medical Need

Before Treatment

55

Source: Patient Blog

http://fafysio.wordpress.com/2014/08/21/amazing-ilva/#comments |

Potential to

Address an Unmet Medical Need Potential to Address an Unmet Medical Need

On Treatment

(200mcg 3x/week

[2x CGD Dose])

after 6 months

56

Non-Confidential Information – Horizon Pharma

plc Source: Patient Blog http://fafysio.wordpress.com/2014/08/21/amazing-ilva/#comments |

57

Anticipated ACTIMMUNE FA Clinical/Regulatory Timeline

Anticipated ACTIMMUNE FA Clinical/Regulatory Timeline

October

2014

November

2014

October

2014

Q1

2015

Received Orphan

Drug Designation

for ACTIMMUNE

to treat FA

Pre-IND meeting

with FDA

Planning ongoing in

collaboration with

CCRN in FA and FARA

for FDA Pre-IND

meeting and next-step

development activities

leading to clinical

study and

supplemental BLA

Phase 3 clinical trial

start

pending

FDA

Pre-IND meeting

feedback and IND

submission

IND Submission:

Also planning a

submission at the

same time to FDA

expedited programs

for serious

conditions (e.g., Fast

Track Designation)

pending Pre-IND

meeting feedback

Q2

2015

Non-Confidential Information – Horizon Pharma

plc |

Additional

Potential ACTIMMUNE Indications Additional Potential ACTIMMUNE Indications

58

•

Autosomal Dominant Osteopetrosis (ADO)

–

1 in 250,000 in the U.S.

(1)

•

Severe Atopic Dermatitis (AD) -

3.4 million

(2)

–

Methicillin Resistant Staphylococcus aureus

(MRSA)

infection -

colonization up to 11%

(3)

–

Eczema Herpeticum (EH)

-

< 3%; ~102,000

(4)

•

Cutaneous T-Cell Lymphoma (CTCL)

–

6 in 1 million in the U.S.

(5)

Non-Confidential Information – Horizon Pharma

plc (1)

Shaw, Tatyana E, Gabriel P Currie, Caroline W Koudelka, and Eric L Simpson. Eczema Prevalence

in the United States: Data from the 2003 National Survey of Children’s Health. The

Journal of Investigative Dermatology 131 (1): 67–73. doi:10.1038/jid.2010.251. (2) Hanifin, Jon M, Michael L Reed, and Eczema Prevalence and Impact

Working Group. 2007. “A Population-Based Survey of Eczema Prevalence in the United

States.” Dermatitis: Contact, Atopic, Occupational, Drug 18 (2): 82–91.

(3)

Huang, Jennifer T., Melissa Abrams, Brook Tlougan, Alfred Rademaker, Amy S. Paller.

Treatment of Staphylococcus aureus Colonization in Atopic Dermatitis Decreases Disease

Severity. Pediatrics Vol. 123 No 5 May1, 2009 pp. e808-e814 (dol:10,152/peds/2008-2217).

(4)

Leung, Donald Y M. 2013. “Why is Eczema Herpeticum Unexpectedly Rare? “

Antiviral Research 98 (2): 153-57 . Doi:10.1016/j.anitivral.2013.02.010. (5) Cutaneous T-Cell Lymphoma Facts. Leukemia & Lymphoma

Society. June 2014 .

|

59

ACTIMMUNE Market Overview

ACTIMMUNE Market Overview

Brian Andersen

Group Vice President and

General Manager, Orphan Business Unit

Non-Confidential Information – Horizon Pharma

plc |

60

ACTIMMUNE Impacts Patients’

ACTIMMUNE Impacts Patients’

Lives

Lives

Non-Confidential Information – Horizon Pharma

plc |

Chronic

Granulomatous Disease (CGD) Overview •

CGD was identified in the 1950’s

•

Survival has improved over time and

most patients are able to manage their

disease and can live well into adulthood

•

CGD is a disease of the immune system

and described as a primary

immunodeficiency disorder

•

CGD is the most common disorder of

phagocytes making up 6% of primary

immune deficiencies

•

~1 in every 200,000 babies are born

with CGD. There are estimated to be

~1,600 CGD patients in the U.S.

61

Non-Confidential Information – Horizon Pharma

plc |

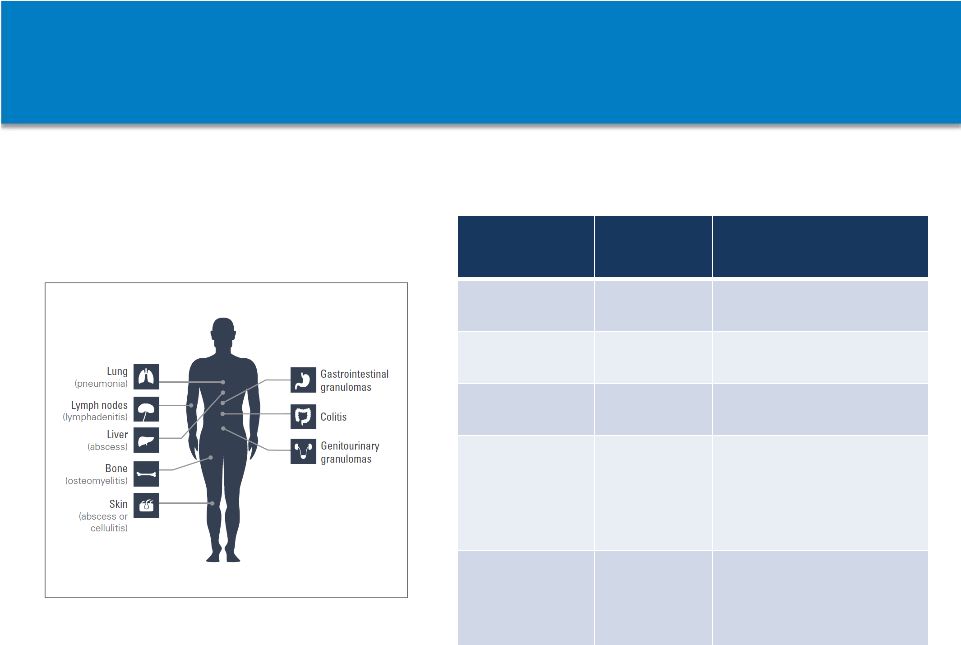

Non-Confidential

Information

–

Horizon

Pharma

plc

62

Common Presentation Indicating CGD

Common Presentation Indicating CGD

In the U.S., the majority of CGD-related

infections are caused by:

* This is not a complete list of pathogens. Infections may also be caused by other species of

bacteria, fungi, and yeast not listed here. Pathogen*

Type of

Infection

Common Presentation

Aspergillus

species

Fungal

Pneumonia, lymphadenitis,

osteomyelitis, brain abscess

Burkholderia

species

Bacterial

Pneumonia, sepsis

Nocardia

species

Bacterial

Pneumonia, osteomyelitis,

brain abscess

Serratia

marcescens

Bacterial

More common:

Osteomyelitis, soft tissue

infections

Less common: Pneumonia,

sepsis

Staphylococcus

aureus

Bacterial

Soft tissue infections,

lymphadenitis, liver abscess,

osteomyelitis, pneumonia,

sepsis

Most frequent sites of infection and

common inflammatory complications

resulting from CGD |

van den Berg JM, et al. (2009) Chronic Granulomatous Disease: The European

Experience. PLoS ONE 4(4): e5234. Typically Diagnosed Before the Age of Five

•

CGD may become apparent any time from infancy to late adulthood

•

>75% are diagnosed before the age of five years

•

CGD is under-diagnosed and can be misdiagnosed

•

Diagnostic testing is readily available

63

Non-Confidential Information – Horizon Pharma

plc |

64

ACTIMMUNE Clinical Benefit in CGD

ACTIMMUNE Clinical Benefit in CGD

Fewer Days of Hospitalization

Reduction in Relative Risk of Serious Infections

Non-Confidential Information – Horizon Pharma

plc * Serious infection was defined as

an infection requiring hospitalization and parenteral antibiotics **The

beneficial effect of ACTIMMUNE was demonstrated throughout a 12 month study •

67% reduction in relative risk of serious

infection* in patients receiving ACTIMMUNE

(p=0.0006)

•

64% reduction in total number of serious

infections* (p<0.0001)

•

Placebo patients required 3x as many inpatient

hospitalization days for treatment of clinical

events compared to patients receiving

ACTIMMUNE (p=0.02)

•

77% of patients receiving ACTIMMUNE were

free of serious infections vs. 30% receiving

placebo. ** (P= 0.0006).

The mean duration of

therapy for these patients was 8.9 months

•

A long-term observational follow-up study of

patients who received adjunctive prophylactic

therapy with ACTIMMUNE demonstrated an

incidence of 0.30 serious infections* per

patient-year |

Severe Malignant

Osteopetrosis (SMO) Overview •

SMO is a one form of osteopetrosis and is sometimes referred to as

marble bone disease or malignant infantile osteopetrosis (MIOP)

•

Often misdiagnosed as hematologic cancer

•

~1 in every 250,000 babies are born with SMO

•

There are estimated to be ~200 SMO patients in the U.S.

65

Non-Confidential Information – Horizon Pharma

plc |

Non-Confidential

Information

–

Horizon

Pharma

plc

66

•

Most severe form and diagnosis usually in first

months of life

•

Clinical Presentation

–

Failure to thrive

–

Impaired vision or blindness

–

Hearing loss

–

Fractures, frontal bossing, macrocephaly,

hydrocephalus, hypocalcaemia

–

Infections

–

Absence of the bone marrow cavity results in

severe anemia and thrombocytopenia

•

If left untreated, generally lethal < 10 years old

due to severe anaemia, bleeding or infections

associated with bone marrow failure

Severe Malignant Osteopetrosis

(SMO)

Severe Malignant Osteopetrosis

(SMO)

Clinical Presentation

Clinical Presentation

Sobacchi et al. Nature Rev Endocrinology. 2013 (9) 522-36 |

67

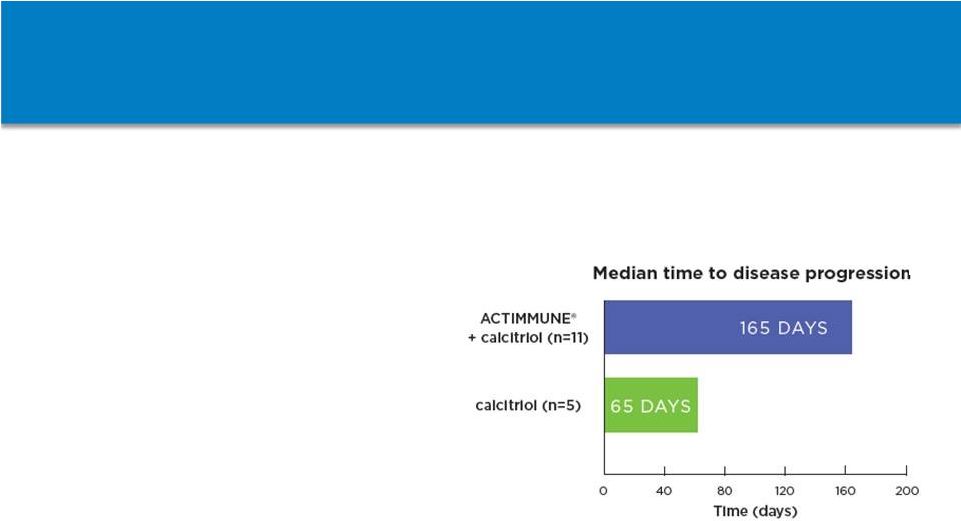

ACTIMMUNE Clinical Benefit in SMO

ACTIMMUNE Clinical Benefit in SMO

•

Median time to disease

progression was significantly

delayed in the ACTIMMUNE

plus calcitriol arm (165 days)

vs. calcitriol alone (65 days)

•

When combined with data

from a second study, 19 of 24

patients on ACTIMMUNE

therapy (+/-

calcitriol) for at

least 6 months had reduced

trabecular bone volume

compared to baseline

Delays the time to disease

progression

(1)

in patients with SMO

(1)

Disease progression is defined by death, significant reduction in hemoglobin or platelet

counts, a serious bacterial infection requiring antibiotics, a 50 dB decrease in

hearing, or progressive optic atrophy. Non-Confidential Information – Horizon

Pharma plc (1)

|

Non-Confidential

Information

–

Horizon

Pharma

plc

Weekly CGD/SMO SP Vials Dispensed up 73%

Weekly CGD/SMO SP Vials Dispensed up 73%

Likely impacted by lack of patient

support programs and promotion

+73%

Jun-12: Vidara acquires

ACTIMMUNE

®

Sep-12:

COMPASS

HUB launched

Apr-13: Launched

patient ed. brochure

& HCP detailer

Jan-13: New

brand launched

with COMPASS

brochure

Jan-14: Launched new

ACTIMMUNE.com

website

Note: 8-week moving average CGD/SMO vials dispensed per SP data. Excludes OptumRx,

CignaTel Drug, Aetna SP and FEP. ~200+

new CGD patients have initiated ACTIMMUNE therapy since July 2012

68 |

Non-Confidential

Information

–

Horizon

Pharma

plc

Our Commercial Effort is Focused Solely on CGD

Our Commercial Effort is Focused Solely on CGD

and SMO Patients

and SMO Patients

69

CGD / SMO

Other ICD-9

CGD / SMO

Other ICD-9

% of ACTIMMUNE®

Specialty Pharmacy Vials Dispensed

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

55%

60%

65%

70%

Note: 8-week moving average vials dispensed per specialty pharmacy data.

Excludes OptumRx, CignaTel Drug, Aetna SP and FEP. |

Non-Confidential

Information

–

Horizon

Pharma

plc

ACTIMMUNE CGD/SMO Patient Increase of 74%

ACTIMMUNE CGD/SMO Patient Increase of 74%

Note: Active Patient defined as a patient that has shipped in the last 120 days. Grossed up by

10% to account for restricted data from OptumRx, CignaTel, Aetna SP and FEP

patients. 70

0

25

50

75

100

125

150

175

200

225

250

275

300

Active CGD/SMO Specialty Pharmacy Patients

155 CGD/SMO Pts

270 CGD/SMO Pts |

Non-Confidential Information – Horizon Pharma

plc 71

ACTIMMUNE COMPASS Program

ACTIMMUNE COMPASS Program

COMPASS

Advocacy & Support Services)

*SP= Specialty Pharmacy, **SD= Specialty Distributor,

†

For FDA approved indications

•

Benefits Investigation

•

Prior Authorization Support

†

•

Appeals Support

†

•

Co-Pay Assistance (Private Insurance)

•

Patient Assistance Program (Uninsured)

•

Foundation Referral (Public Insurance)

•

StarterRX (Private insurance)

•

BridgeRX (Private insurance)

•

Sharps Container Program/Syringe Disposal

–

Improved Patient Safety

–

Environmentally-friendly

•

Clinical Support Program

–

Improve persistency

–

Improve compliance

SP*

SP*

SD**

SD**

Patient Support

Patient Support

(Comprehensive Personalized Patient Prescription |

FA Population

Overview: ~3,700 in the U.S. U.S.

Population

X

%

Caucasian*

X

Diagnosed FA

prevalence in

Caucasians

=

Diagnosed FA

prevalence in

Caucasians

~320M

X

78%

X

~1.5/100,000

=

~3,700

72

Total estimated diagnosed FA prevalence is ~3,700 in the U.S.

Methodology

Non-Confidential Information – Horizon Pharma

plc |

85% of Diagnosed

Patients are Early Onset Patients 73

Source: FARA, L.E.K. interviews and analysis

•

The vast majority (~85%) of

diagnosed patients are early onset

patients (i.e., exhibit symptoms

before age 25) and are typically

diagnosed by age 12

Age of FA onset and current age

among diagnosed prevalent FA

patients (2014)

Adult

(

25 years)

Percent of Patients)

Adolescent

(12-17

years)

Non-Confidential Information – Horizon Pharma

plc 0

10

20

30

40

50

60

70

80

90

100

Late onset

(>25 years)

Early onset

Age of onset

Current age of patient

(N=8)

(

25 years)

Pre-adolescent

(12-17

years)

) |

Non-Confidential

Information

–

Horizon

Pharma

plc

Neurological Examinations and Genetic Testing

Lead to Specialized Care Centers

74

•

Patients are typically referred by

their primary provider to

neurologists (including pediatric

neurologists) for evaluation and

diagnosis of FA

•

FA is typically suspected after a

neurological exam, though

genetic testing of frataxin is

needed for definitive diagnosis

•

KOLs estimate two thirds of FA

patients will eventually receive

care at a center that specializes in

muscular dystrophies, FA or

general ataxias

Source: L.E.K. interviews and analysis

FA patient journey

Pediatrician / PCP

Neurological (including

pediatric neurologist)

FA or ataxia

center

neurologist

MDA clinic

neurologist

Pediatric

Cardiologist

Clinical

geneticist

Specialized

care centers

33% of patients

are managed by

general

neurologists only

Return to

primary

neurologist

100%

20-40%

60-80%

33%

Return for

Regular

care

33%

FA or ataxia centers

are the primary care

center for ~50% of FA

patients

DIRECTIONAL

based on small N |

Significant

Growth Opportunities for ACTIMMUNE •

Significant expansion opportunity in CGD & SMO

–

CGD & SMO still under-diagnosed or misdiagnosed

–

Increasing focus on supporting patient and advocacy groups to

help the CGD and SMO communities

•

We will continue to enhance the COMPASS program to serve

patients

–

Scalable for new indications

–

Easily adapted for new orphan products

75

Non-Confidential Information – Horizon Pharma

plc |

76

Horizon Pharma plc Business Development Strategy

Robert F. Carey

Executive Vice President,

Chief Business Officer

Non-Confidential Information – Horizon Pharma

plc |

77

Business Development Strategy

April 2010

Nitec Pharma

acquisition

November 2013

Acquired from

AstraZeneca

September 2014

Vidara Therapeutics

acquisition

Established track record of deal execution

Non-Confidential Information – Horizon Pharma

plc |

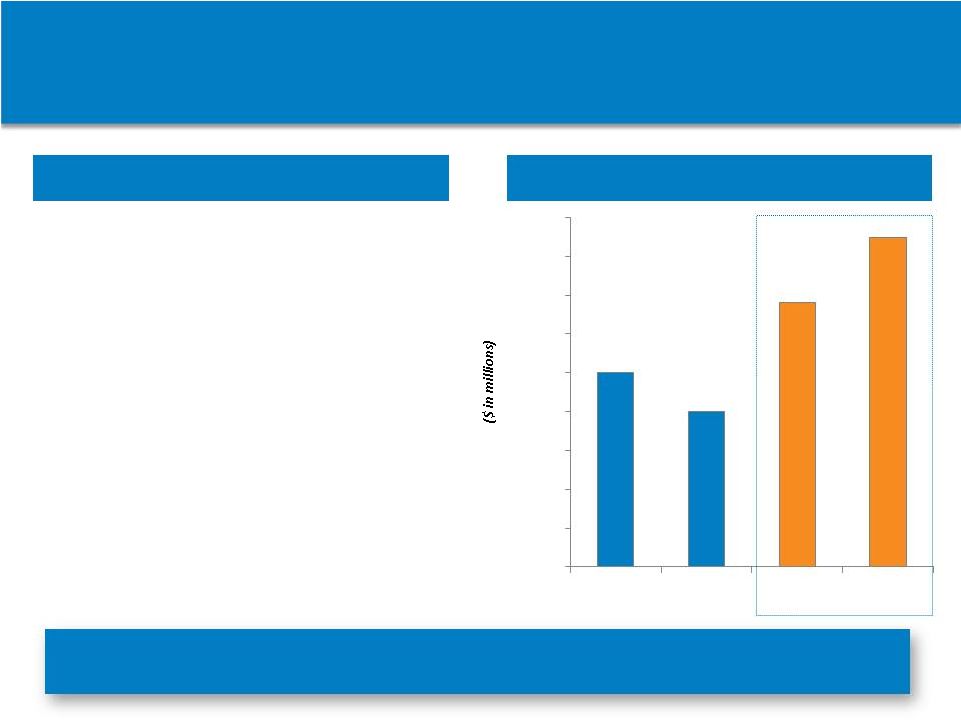

(1)

AstraZeneca Annual Reports

(1)

(1)

Rapidly Successful VIMOVO Acquisition

Perfect example of value arbitrage we intend to capture

through our BD strategy

Net Sales

Product Highlights

•

Acquired November 18, 2013

from AstraZeneca

•

$35 million one-time payment

•

Leverages existing commercial

infrastructure

•

Rapid growth in VIMOVO

prescriptions and revenues

•

Maximizing value through price

and lower patient co-pay

•

$76.4 million in 1H 2014

revenues

78

Non-Confidential Information – Horizon Pharma

plc $25.0

$20.0

$34.0

$42.4

$-

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

$40.0

$45.0

2012

2013

1Q:14

2Q:14 |

Plan to Execute

Aggressive Acquisition Strategy •

Executing on our aggressive business development strategy

via product/company acquisitions to maximize shareholder

value creation

79

Potential for

attractive financial

returns –

rapid

accretion, long-life

assets

Non-Confidential Information – Horizon Pharma

plc Near

term focus

on U.S. marketed

products/

companies to

leverage core

strengths

Pursuing

products with

differentiated

clinical benefits

Differentiated

and/or under

appreciated

assets

regardless of

therapeutic area

Targeting

products with

potential annual

revenues of $20

million to $200

million

-

- |

80

Q&A

Non-Confidential Information – Horizon Pharma

plc |

Non-Confidential

Information

–

Horizon

Pharma

plc

81

Appendix

Appendix |

Non-Confidential

Information

–

Horizon

Pharma

plc

2011

2012

2013

2014

2013

2014

2013

Adjusted Non-GAAP Net Income (Loss):

GAAP Net Loss

(113,265)

$

(87,794)

$

(149,005)

$

(27,769)

$

(18,441)

$

(234,019)

$

(40,612)

$

Non-GAAP Adjustments:

Change in estimate of VIMOVO royalties

-

-

-

13,033

-

13,033

-

Loss on derivative revaluation

-

-

69,300

10,965

-

214,995

-

Vidara acquisition costs

-

-

-

10,125

-

14,174

-

Intangible impairment charge

69,621

-

-

-

-

-

-

Amortization and accretion:

Intangible amortization expense (net of tax effect)

3,012

3,782

6,790

4,683

1,311

9,363

2,635

Amortization of debt discount and deferred financing costs

2,708

2,740

17,245

2,333

919

4,666

1,829

Accretion of royalty liability

-

-

-

2,953

-

2,953

-

Amortization of deferred revenue

(166)

(217)

(930)

(161)

(147)

(322)

(215)

Stock-based compensation

2,530

4,661

5,014

4,160

1,021

6,087

2,100

Depreciation expense

446

806

1,174

404

299

780

558

Total of non-GAAP adjustments

78,151

11,772

98,593

48,495

3,403

265,729

6,907

Adjusted Non-GAAP Net Income (Loss)

(35,114)

$

(76,022)

$

(50,412)

$

20,726

$

(15,038)

$

31,710

$

(33,705)

$

Weighted average shares - basic

9,014,968

38,871,422

63,657,924

73,384,801

62,872,173

70,164,267

62,339,285

Weighted average shares - diluted

9,014,968

38,871,422

63,657,924

98,073,812

62,872,173

93,119,769

62,339,285

Adjusted Non-GAAP net income (loss) per common share-basic

0.28

$

0.28

$

0.28

$

0.28

$

(0.24)

$

0.45

$

(0.54)

$

Adjusted Non-GAAP net income (loss) per common share-diluted

0.21

$

0.21

$

0.21

$

0.21

$

(0.24)

$

0.34

$

(0.54)

$

(Unaudited)

(Unaudited)

Three Months Ended June 30,

Six Months Ended June 30,

Fiscal Year Ended December 31,

GAAP to Non-GAAP Reconciliation

GAAP to Non-GAAP Reconciliation

82 |

Non-Confidential

Information

–

Horizon

Pharma

plc

GAAP to Non-GAAP Reconciliation (continued)

GAAP to Non-GAAP Reconciliation (continued)

83

2011

2012

2013

2014

2013

2014

2013

EBITDA and Adjusted EBITDA:

GAAP Net Loss

(113,265)

$

(87,794)

$

(149,005)

$

(27,769)

$

(18,441)

$

(234,019)

$

(40,612)

$

Depreciation

446

806

1,174

404

299

780

558

Amortization and accretion:

Intangible amortization expense

3,753

4,732

8,136

5,029

1,634

10,056

3,297

Accretion of royalty liability

-

-

-

2,953

-

2,953

-

Amortization of deferred revenue

(166)

(217)

(930)

(161)

(147)

(322)

(215)

Interest expense, net (including amortization of

debt discount and deferred financing costs)

6,284

14,525

39,178

4,207

3,442

8,414

7,045

Expense (benefit) for income taxes

(14,683)

(5,171)

(1,121)

880

(351)

(225)

(1,232)

EBITDA

(117,631)

$

(73,119)

$

(102,568)

$

(14,457)

$

(13,564)

$

(212,363)

$

(31,159)

$

Non-GAAP adjustments:

Change in estimate of VIMOVO reyalties

-

-

-

13,033

-

13,033

-

Intangible impairment charge

69,621

-

-

-

-

-

-

Loss on derivative revaluation

-

-

69,300

10,965

-

214,995

-

Vidara acquisition costs

-

-

1,252

10,125

-

14,174

-

Stock-based compensation

2,530

4,661

5,014

4,160

1,021

6,087

2,100

Total of Non-GAAP adjustments

72,151

$

4,661

$

75,566

$

38,283

$

1,021

$

248,289

$

2,100

$

Adjusted EBITDA

(45,480)

$

(68,458)

$

(27,002)

$

23,826

$

(12,543)

$

35,926

$

(29,059)

$

(Unaudited)

(Unaudited)

Three Months Ended June 30,

Six Months Ended June 30,

Fiscal Year Ended December 31, |

Horizon Pharma

plc October 13, 2014

Friedreich's Ataxia Analyst Day Presentation

Non-Confidential Information – Horizon Pharma plc

|