Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ENDEAVOUR INTERNATIONAL CORP | d801703d8k.htm |

| EX-99.6 - EX-99.6 - ENDEAVOUR INTERNATIONAL CORP | d801703dex996.htm |

| EX-99.1 - EX-99.1 - ENDEAVOUR INTERNATIONAL CORP | d801703dex991.htm |

| EX-99.4 - EX-99.4 - ENDEAVOUR INTERNATIONAL CORP | d801703dex994.htm |

| EX-99.2 - EX-99.2 - ENDEAVOUR INTERNATIONAL CORP | d801703dex992.htm |

| EX-99.3 - EX-99.3 - ENDEAVOUR INTERNATIONAL CORP | d801703dex993.htm |

Project North

October 2, 2014

Reorganization Considerations

Exhibit 99.5

Confidential

Subject to FRE 408 |

| Confidential

Subject to FRE 408

Project North

Blackstone

Weil

1

Disclaimer

This presentation (the “Presentation”) regarding Endeavour International Corporation

and its subsidiaries (the “Company”) has been prepared by Blackstone Advisory

Partners L.P. (“Blackstone”) and Weil, Gotshal & Manges LLP (“Weil”) solely for informational purposes using certain

information provided by the Company and publicly available information (collectively, the

“Sources”). This presentation is illustrative, does not represent a proposal,

and is subject to FRE 408. Blackstone and Weil make no representation or warranty, express or implied, as to the accuracy

or completeness of the information obtained from the Sources, and nothing contained herein is,

or should be relied on as a promise or representation, whether as to the past or the

future. Blackstone and Weil have not independently verified information obtained from the Sources.

The Presentation is not a proposal or a solicitation and is non-binding on all parties.

The Presentation includes certain statements, estimates, and projections

prepared and provided by the Sources with respect to, among other things, the

anticipated operating performance of the Company. Such statements, estimates, and projections reflect various assumptions by the

Sources concerning anticipated results that are inherently subject to significant economic,

competitive, and other uncertainties and contingencies and have been included solely

for illustrative purposes. Blackstone and Weil have relied on the truth, accuracy and completeness of certain

representations of the Sources and disclaims any liability for any misrepresentations or

omissions that may be contained herein based on such statements or contained in the

information referenced above. No representations, express or implied, are made as to the accuracy or

completeness of such statements, estimates, or projections or with respect to any other

materials herein. Actual results may vary materially from the estimates and projected

results contained herein. By accepting the Presentation, each recipient agrees

that Blackstone and Weil shall have no liability on any basis (including, without limitation, in

contract, tort, under United States or other countries’ federal or state securities laws

or otherwise) for any representations, express or implied, contained in, or for any

omissions from, the Presentation or any other written or oral communications transmitted to the recipient by or on behalf

of Weil or Blackstone in the course of the recipient’s evaluation of the Presentation.

The information contained herein has been prepared to assist the recipients in making

their own evaluation and does not purport to be all-inclusive or to contain all of the information that may be material.

The information and data contained herein are confidential and may not be divulged to any

person or entity or reproduced, disseminated, or disclosed, in whole or in part, except

as required by applicable law or regulation, as requested by regulatory authorities, or with the consent of

Blackstone and Weil.

This Presentation is not intended to furnish regulatory, tax, accounting, investment or other

advice to any recipient. This Presentation should be reviewed by each recipient and its

regulatory, tax, accounting, investment and other advisors. Recipients should not regard it as a substitute for

the exercise of their own judgment. |

Confidential

Subject to FRE 408

Project North

Blackstone

Weil

2

Agenda

U.K. Opportunities and Business Strategy

Restructuring Goals

Debt Capacity Considerations

Potential Compromise Structure

1

2

3

4 |

Project North

Blackstone

Weil

3

U.K. Opportunity and Business Strategy

U.K. North Sea presents large remaining reserves with undeveloped and undiscovered volumes

across the region

•

Stable region with low geopolitical risk

•

Geologically

well

understood

with

decades

of

experience

drilling

in

the

region

•

Significant infrastructure in-place to support economics of development for new

production Governmental

and

regulatory

support

for

exploration,

development

and

production

•

Attractive fiscal terms by global standards and improving regulatory environment (Wood

Report) •

After-tax treatment of decommissioning

•

Access to infrastructure

Larger players seeking to re-shape or exit their North Sea positions

•

Increasing availability of personnel

•

Rig market softening

•

Assets on the market

Limited

competition

in

the

small/mid

cap

space

–

20k

boe/d

threshold

•

Private equity entering the market

1

The U.K. North Sea presents significant opportunity today for a full-cycle E&P business

properly capitalized, with adequate scale and core producing assets.

Confidential

Subject to FRE 408 |

Confidential

Subject to FRE 408

Project North

Blackstone

Weil

4

U.K. Opportunity and Business Strategy (Cont’d)

1.

Maximize production from existing North Sea assets and pursue realization of upsides

a)

Collaborate with JV partners

b)

Infill drilling opportunities at Alba

c)

Increase Scott platform capacity

d)

Utilize existing tax assets

2.

Explore, develop and monetize contingent resources

a)

Track record of successfully finding new oil and gas reserves more efficiently than any other

independent b)

Pursue new opportunities (Rossini, Mabry, other contingent resources)

c)

Partner through farm-ins to reduce capital need while receiving carry

d)

Share sub surface technical team with business development and operation teams

3.

Opportunistic acquisition of producing North Sea reserves

a)

Diversify portfolio and reduce well concentration

b)

Seek out producing assets with minimal development costs or decommissioning exposure and 3P

upside c)

Potential to buy assets at attractive prices

4.

Monetize selected assets and redeploy proceeds to core

a)

Consider sale of U.S. assets to reduce investment needs and capex costs

b)

Potential opportunities to sell selected U.K. assets

Endeavour is well positioned as a leading pure-play U.K. independent producer. The

Company’s proposed strategy is anchored in existing U.K. assets and aimed at

balancing production and lower- risk growth.

Confidential

Subject to FRE 408

Project North

Blackstone

Weil

4 |

Project North

Blackstone

Weil

5

Indicative

Capital to

Realize

Alba

Rochelle

Bacchus

Columbus

Bittern

Enoch

$30 -

$50

million

per year

(1)

________________________________________________

(1)

Based on analysis of the 6/30/14 reserve report.

Mature Low Risk

Assets

The opportunity in the North Sea related to the Endeavour platform presents significant value as

a going concern.

Accelerate drilling at Alba

Potentially debottleneck

Scott Platform

Accelerate drilling at

Rochelle

Indicative

Capital to

Realize

Rossini

Mabry

Rochelle

Jurassic

$10

-

$15

million

per year

Clear Upside with

Limited Risk

Indicative

Capital to

Realize

Centurion North

Centurion South

Ravel

Mostyn

Buffalo

Rogers

Others

$10

-

$15

million

per year

Other Contingent

Resources

Endeavour successfully

developed Rochelle, Cygnus,

and other prospects in the

North Sea

Rossini exploration /

appraisal well with partner

(2015)

Mabry exploration well (late

2015 or 2016)

Create value by derisking

existing portfolio of

prospects

Opportunity to farm down

to partially monetize once

derisked

Long term could create

significant value in the

portfolio

Indicative

Capital to

Realize

Various Assets

$30

-

$40

million

per year

M&A

Majors pulling back

H1 2014 activity implies a

low $/boe for already

producing assets

U.K. Opportunity and Business Strategy (Cont’d)

1

Confidential

Subject to FRE 408 |

| Project North

Blackstone

Weil

6

Restructuring Goals

1.

Protect Company assets during restructuring

2.

Minimize restructuring costs

3.

Design new capital structure to maximize business value

4.

Reduce debt service to permit capex to maintain and grow cash flows

5.

Maximize recovery to all creditors

2

Confidential

Subject to FRE 408 |

Confidential

Subject to FRE 408

Project North

Blackstone

Weil

7

________________________________________________

(1)

Reflects netting of LC cash collateral that is expected to increase to $105mm on

12/1/14. (2)

Assumes refinancing of existing UK debt facility in 12 months.

(3)

Cash change driven primarily by $12mm of UK interest, $26mm of capex/decommissioning, net of

operating cash flow. I) Pro Forma Capital Structure Summary

Illustrative

($ in millions)

Principal

Current Rate

PF Rate

Amort

UK Bank Debt

$440.0

11.0%

8.0%

(2)

10.0%

New Notes

200.0

12.0%

8.5%

NA

Total Debt

$640.0

Total Debt Excluding LC

(1)

$535.0

II) Bridge to Starting Cash

Amount

9/30/14 Aprox. Consolidated Cash

$60.0

New UK Facility Liquidity

36.0

Incremental Q4 L/C Need

(15.0)

Q4 Cash Use

(3)

(33.0)

Emergence Costs

(15.0)

Projected Cash at Emergence (Illustrative 12/31/14)

$33.0

Confidential

Subject to FRE 408

Project North

Blackstone

Weil

7

Debt Capacity Considerations – Compromise Scenario Assumptions |

Confidential

Subject to FRE 408

Project North

Blackstone

Weil

8

Debt

Capacity

Considerations

(Cont’d)

–

Compromise

Scenario

Illustrative

Forecast

3

($ in millions)

Business Plan

Illustrative Run Rate

2014E

2015E

2016E

2017E

2018E

UK EBITDA

$221.0

$281.6

$275.8

$250.0

$250.0

Less: PRT

11.5

(28.1)

(51.0)

(35.6)

(35.6)

Less: CT Taxes

-

-

-

-

-

Less: SCT Taxes

-

-

-

(21.2)

(40.5)

Less: Capex

(68.3)

(71.7)

(45.2)

(80.0)

(80.0)

Less: Abandonment

(59.8)

(56.4)

(37.9)

-

-

Less: Provision for LCs

(15.0)

(15.0)

(15.0)

(15.0)

(15.0)

Less: Contingency

-

-

-

-

-

UK Unlevered FCF

89.4

$110.4

$126.7

$98.2

$79.0

UK Bank Debt Interest

($48.4)

($33.4)

($29.9)

($26.4)

UK Bank Debt Amortization

-

(44.0)

(44.0)

(44.0)

Cash Flow to US

$62.0

$49.3

$24.3

$8.6

US Unlevered Cash Flow

($10.0)

$ –

$ –

$ –

New Note Interest

(17.0)

(17.0)

(17.0)

(17.0)

Total Free Cash Flow

$35.0

$32.3

$7.3

($8.4)

Beginning Cash

$33.0

$68.0

$100.3

$107.5

Total Cash Flow

35.0

32.3

7.3

(8.4)

Ending Cash

$33.0

$68.0

$100.3

$107.5

$99.1

Total Debt

$640.0

$640.0

$596.0

$552.0

$508.0

Total Debt/ UK EBITDA

2.9x

2.3x

2.2x

2.2x

2.0x

Total Debt Excl. LCs

535.0

535.0

491.0

447.0

403.0

Adj. Debt / UK EBITDA

2.4x

1.9x

1.8x

1.8x

1.6x

CT NOL Ending Balance

$629.5

$569.5

$478.2

$390.7

$299.7

SCT NOL Ending Balance

358.4

212.8

60.1

–

– |

Confidential

Subject to FRE 408

Project North

Blackstone

Weil

9

Debt

Capacity

Considerations

(Cont’d)

–

U.K.

2P

Reserve

Report

Metrics

________________________________________________

Source: Interim Reserve Report (Q2 2014 Roll-Forward).

3

Production (mboe)

Capital Expenditures ($ in millions)

Adequate capital spend is necessary to maintain and grow production, otherwise existing reserves

will deplete and future production will decline.

Confidential

Subject to FRE 408

Project North

Blackstone

Weil

9

$0

$25

$50

$75

$100

$125

$150

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

0

1,000

2,000

3,000

4,000

5,000

6,000

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025 |

Confidential

Subject to FRE 408

Project North

Blackstone

Weil

10

Debt

Capacity

Considerations

(Cont’d)

–

Rationale

For

Illustrated

Leverage

Provides

cash

flow

for

investment

to

replace

naturally

declining

asset

base

and

take

advantage

of

lower

risk growth opportunities

Positions

the

company

as

an

attractive

investment

opportunity

to

take

advantage

of

U.K.

North

Sea

dynamics

Without

investment,

a

simple

“blow

down”

of

the

existing

reserves

will

not

allow

the

company

to

amortize or retire debt

Without investment, any new equity unlikely to have long-term value

Without a cash cushion, business will be run sub-optimally and at significant risk of

unplanned downtime 3 |

Confidential

Subject to FRE 408

Project North

Blackstone

Weil

11

Debt

Capacity

Considerations

(Cont’d)

–

Comparable

Company

Credit

Metrics

($ in millions)

________________________________________________

Source: Company filings, Capital IQ, and Company estimates.

Note: Market data as of 9/30/14.

(1)

Endeavour LTM EBITDA as of Q1 2014.

3

Sample Peer Group

Illustrative Endeavour

EnQuest

Ithaca Energy

Iona Energy

Mean

$200mm US

$445mm US

Market Capitalization

$1,382

$619

$94

Debt

$942

$769

$265

$535

$780

Unrestricted Cash

(216)

(61)

(26)

TEV

$2,108

$1,309

$334

Metrics

LTM EBITDA

(1)

$631

$309

$77

$217

$217

2014E EBITDA

$511

$311

NM

$222

$222

2015E EBITDA

$673

$494

NM

$293

$293

Credit Metrics

Debt / LTM EBITDA

1.5x

2.5x

3.4x

2.5x

2.5x

3.6x

Debt / 2014E EBITDA

1.8x

2.5x

NM

2.2x

2.4x

3.5x

Debt / 2015E EBITDA

1.4x

1.6x

NM

1.5x

1.8x

2.7x

Debt / Market Capitalization

68%

124%

282%

158% |

Appendix |

Confidential

Subject to FRE 408

Project North

Blackstone

Weil

13

Existing Capital Structure

________________________________________________

Note: Debt balances as of 9/30/14.

(1)

Excludes $105mm LC Facility.

(2)

As of 9/30/14.

($ in mm)

Terms

Maturity

Interest Rate

Principal

Price

(2)

Market Value

Term Loan

(1)

Jan-17

L+1000

$ 440.0

100.0

$ 440.0

Total EEUK Debt and Claims

$ 440.0

$ 440.0

First Priority Notes

Mar-18

12.0%

404.0

72.0

290.9

Second Priority Notes

Jun-18

12.0%

150.0

21.0

31.5

Total Secured Debt

$ 994.0

$ 762.4

Convertible Unsecured Notes

Jul-16

5.5%

$ 135.0

6.0

8.1

Convertible Unsecured Bonds

Nov-17 (Oct-15)

6.5%

17.5

8.3

1.4

Convertible Unsecured Bonds

Jan-16

7.5%

82.9

NA

NA

Total Debt

$ 1,229.4

NA

Series C Preferred

4.5%

$ 37.0

NA

NA

Series B Preferred

4.5%

3.9

NA

NA

Common: $0.30 per share as of 09/30/14

15.1

15.1

Total Capitalization

$ 1,285.4 |

Confidential

Subject to FRE 408

Project North

Blackstone

Weil

14

(2)

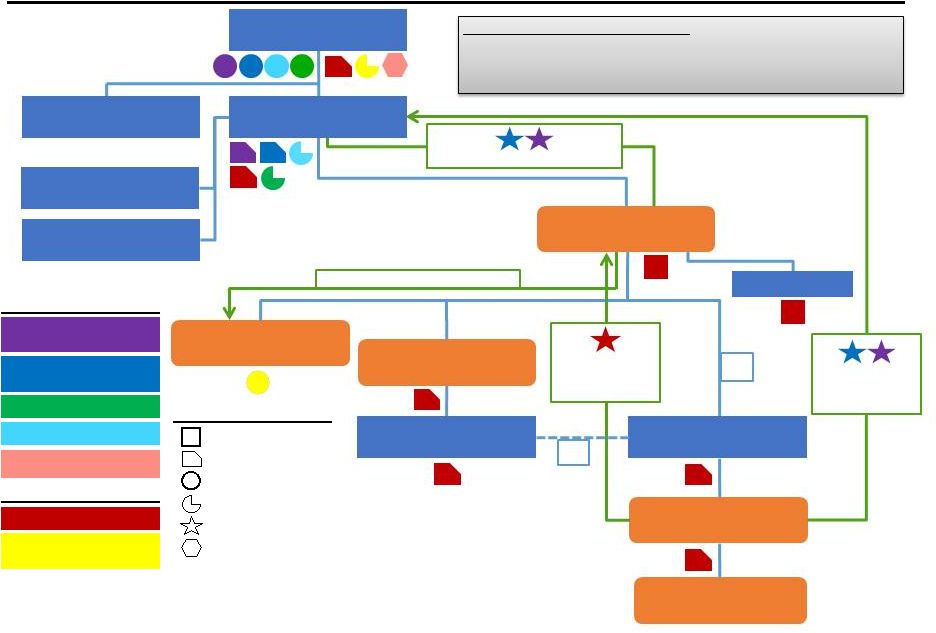

Corporate Structure

________________________________________________

$40.9mm Series B & C Preferred

Equity

U.S.-Based Debt

$404.0mm March 2018

12% Notes

$150.0mm June 2018

12% Notes

$135.0mm 5.5% 2016 Converts

$82.9mm 7.5% 2016

Convertible Notes

Endeavour Energy U.K. Limited

(English/Welsh Corp.)

Endeavour International

Corporation (NV)

Endeavour North Sea Limited

(English/Welsh Corp.)

Endeavour Energy

Luxembourg S.à

r.l. (Lux. Corp.)

$440.0mm EEUK Term Loan

Europe-Based Debt

Endeavour Energy North Sea,

L.P. (DE)

Intercompany

Note

($500.0mm)

(2)

Intercompany Note ($82.9mm)

Endeavour Operating

Corporation (DE)

(65% Pledge of Capital Stock)

Secured Issuer/Borrower

Unsecured Issuer/Borrower

Unsecured Guarantor

Lien

Claim Type

Equity

Secured Guarantor

Endeavour International

Holding B.V. (Netherlands)

Intercompany

Note

($440.0mm)

Endeavour Colorado Corp.

(DE)

$17.5mm 6.5% 2017 Converts

End Finco LLC (DE)

Endeavour Energy New

Ventures Inc. (DE)

END Management Company

(DE)

Endeavour Energy North Sea

LLC (DE)

Endeavour Energy Netherlands

B.V. (Netherlands)

99.9%

LP

0.1%

GP

(1)

This chart is for illustrative purposes only. Nothing in the chart is intended to

or shall be construed as an admission as to the validity of any claim against

Endeavour or a waiver of any of Endeavour’s or any party’s rights to dispute

the amount of, basis for, or validity of, any claim against Endeavour.

The guarantee from EOC on account of the EEUK Term Loan excludes the 65% Pledge of Capital

Stock of EIHBV, the $500.0mm intercompany note, and the cash, cash equivalents,

and bank accounts of EOC. The $500.0mm Intercompany Note is

subject to payment subordination in favor of the EEUK Term Loan.

Note: Dollar amounts represents face value as of 9/30/14 and excludes any accrued interest or

OID. (1)

|

Confidential

Subject to FRE 408

Project North

Blackstone

Weil

15

Structure

$440mm term loan to EIHBV

Refinances $365mm existing UK debt

Tenor

Matures January 1, 2017

Pricing

L+1,000; 1.0% floor (11.0%)

2% OID ($8.8mm)

Guarantors / Collateral

US & UK

Does not include US cash

Amortization

None

Pre-Payment

During

year

1

MWC

equal

to

interest

due

after

1

anniversary

until

maturity

plus

1%

After year 1 101%

Covenants / Other

2.75x leverage

1.0x 2P asset coverage ($16 / boe) (e.g. 38.1mboe x $16 = $610mm)

Transfer of $55mm and $19mm cash to US in years 1 and 2 permitted, restrictions on use of

cash in US

Min cash in UK of $10mm to transfer cash to the US

$440mm UK Term Loan Refinancing Summary

st |