Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NEWBRIDGE BANCORP | v390955_8k.htm |

| EX-2.1 - EXHIBIT 2.1 - NEWBRIDGE BANCORP | v390955_ex2-1.htm |

| EX-99.1 - EXHIBIT 99.1 - NEWBRIDGE BANCORP | v390955_ex99-1.htm |

Exhibit 99.2

NASDAQ: NBBC www.newbridgebank.com ACQUISITION OF PREMIER COMMERCIAL BANK October 9, 2014

FORWARD - LOOKING STATEMENTS This presentation contains forward-looking statements relating to the financial condition, results of operations and business of NewBridge Bancorp and its subsidiary NewBridge Bank . These forward looking statements involve risks and uncertainties and are based on the beliefs and assumptions of the management of NewBridge Bancorp, and the information available to management at the time that this presentation was prepared . Factors that could cause actual results to differ materially from those contemplated by such forward-looking statements include, among others, the following : (i) general economic or business conditions, either nationally or regionally, may be less favorable than expected, resulting in, among other things, a deterioration in credit quality and/or a reduced demand for credit or other services ; (ii) changes in the interest rate environment may reduce net margins and/or the volumes and values of loans made or held as well as the value of other financial assets held ; (iii) competitive pressures among depository and other financial institutions may increase significantly ; (iv) legislative or regulatory changes, including changes in accounting standards, may adversely affect the businesses in which NewBridge Bancorp is engaged ; (v) local, state or federal taxing authorities may take tax positions that are adverse to NewBridge Bancorp ; (vi) adverse changes may occur in the securities markets ; (vii) competitors of NewBridge Bancorp may have greater financial resources and develop products that enable them to compete more successfully than NewBridge Bancorp ; (viii) costs or difficulties related to the integration of Premier Commercial Bank may be greater than expected ; (ix) expected cost savings associated with our acquisition of Premier Commercial Bank may not be fully realized within the expected time frame ; and (x) deposit attrition, customer loss or revenue loss following our acquisition of Premier Commercial Bank may be greater than expected . Additional factors affecting NewBridge Bancorp and NewBridge Bank are discussed in NewBridge Bancorp’s filings with the Securities and Exchange Commission (the “SEC”), Annual Report on Form 10 -K, its Quarterly Reports on Form 10 -Q and its Current Reports on Form 8 -K . Please refer to the Securities and Exchange Commission's website at www . sec . gov to review such documents . NewBridge Bancorp does not undertake a duty to update any forward-looking statements made in this presentation 2

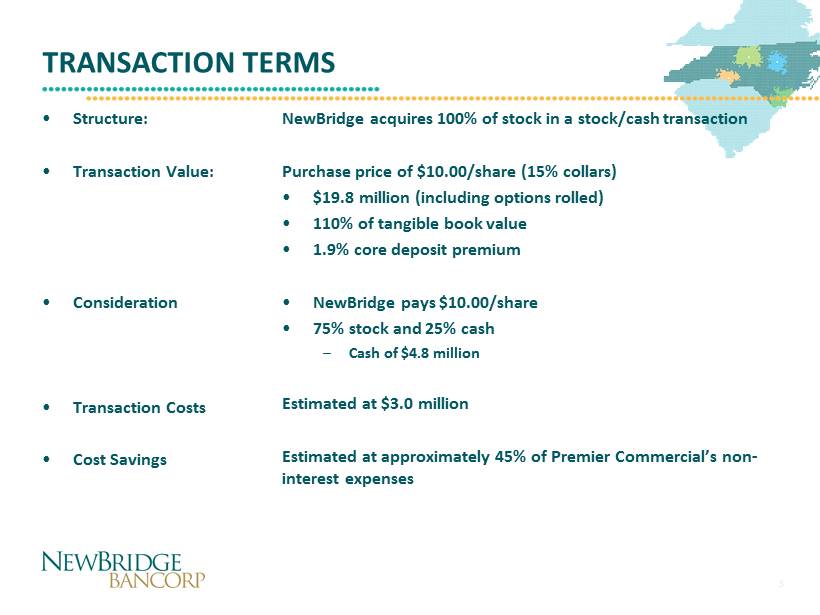

TRANSACTION TERMS • Structure: • Transaction Value: • Consideration • Transaction Costs • Cost Savings 3 NewBridge acquires 100% of stock in a stock/cash transaction Purchase price of $10.00/share (15% collars) • $19.8 million (including options rolled) • 110% of tangible book value • 1.9% core deposit premium • NewBridge pays $10.00/share • 75% stock and 25% cash – Cash of $4.8 million Estimated at $3.0 million Estimated at approximately 45% of Premier Commercial’s non - interest expenses

STRATEGIC RATIONALE • Adds key Greensboro branch location in attractive Green Valley / Friendly Center area • U pscale market not currently served by a full - service NewBridge office • Addition of three senior commercial bankers to Greensboro team • Adds $173 million of total assets, $96 million of loans held for investment, $116 million of core deposits 1 • Immediately accretive to EPS, increasing to an estimated 3.8% by FY17 • Anticipated TBV dilution is minimal (.4%) and expected payback period is less than one year • Adds mortgage producers in key growth markets • Premier’s mortgage loan production offices to be consolidated with existing NewBridge facilities • Ability to expand Premier’s existing commercial relationships through increased lending, treasury services, and wealth management Expanding Greensboro Footprint Strong Financial Impact Mortgage Banking and Relationship Expansion 1 Source: SNL Financial Core Deposits = Total Transaction Accts + Money Market Deposit Accts + Other Savings Deposits + Retail Time Deposits − Brokered Deposits = $115.78 million 4

OVERVIEW OF PREMIER COMMERCIAL BANK • Premier Commercial Bank: established in Greensboro in 2008 – 1 full - service banking office in Greensboro, NC • Financial Highlights: – Assets of $173 million – Loans (held for investment) of $96 million – Total deposits of $133 million – Core deposits of $116 million • NPAs of 0.85%; gross credit mark of 1.50% of portfolio • Mortgage offices in Greensboro, Charlotte (including operations), Raleigh, High Point, Kernersville and Burlington, NC 5

FINANCIAL IMPACT OF TRANSACTION • Attractive Pro Forma Balance Sheet 1 – Total assets of more than $2.6 billion – Total loans of $1.8 billion – Total deposits of $2.0 billion • Strong Pro Forma Capital Ratios (Bancorp) 2 – Leverage ratio ~ 8.1% – Tier 1 RBC ratio ~10.3% – Total RBC ratio ~12.3% • Financial Returns – TBV dilution is minimal and expected payback period is less than one year – 26% projected internal rate of return – Meaningful expected cost savings of approximately 45% – Addition of three senior commercial bankers – Consolidation of mortgage loan production/operations facilities – Clean balance sheet with no adverse effect on resulting credit metrics 6 1 Pro forma Bancorp assets, loans, and deposits based on June 30, 2014 data 2 Pro forma Bancorp capital ratios based on June 30, 2014 data

EXPANDED FOOTPRINT Source: SNL Financial as of June 30, 2014 7

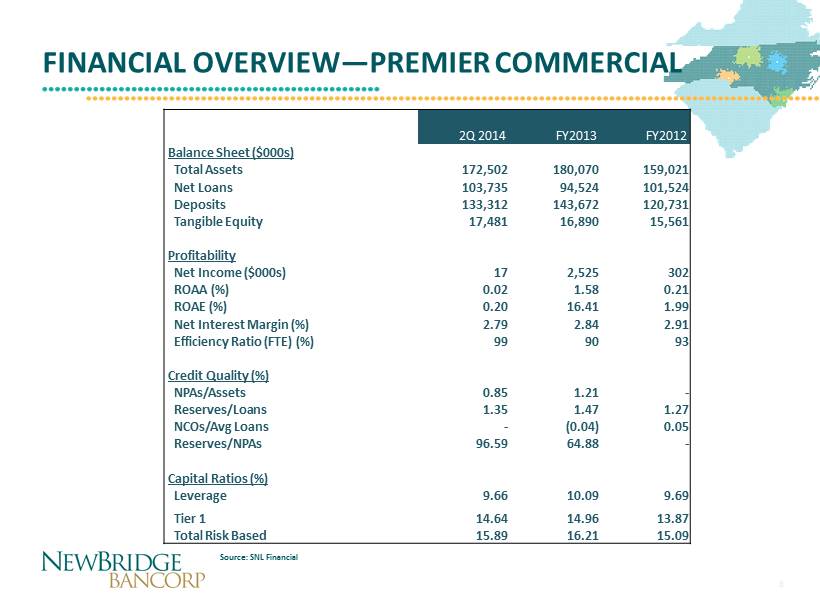

FINANCIAL OVERVIEW — PREMIER COMMERCIAL Source: SNL Financial 8 2Q 2014 FY2013 FY2012 Balance Sheet ($000s) Total Assets 172,502 180,070 159,021 Net Loans 103,735 94,524 101,524 Deposits 133,312 143,672 120,731 Tangible Equity 17,481 16,890 15,561 Profitability Net Income ($000s) 17 2,525 302 ROAA (%) 0.02 1.58 0.21 ROAE (%) 0.20 16.41 1.99 Net Interest Margin (%) 2.79 2.84 2.91 Efficiency Ratio (FTE) (%) 99 90 93 Credit Quality (%) NPAs/Assets 0.85 1.21 - Reserves/Loans 1.35 1.47 1.27 NCOs/ Avg Loans - (0.04) 0.05 Reserves/NPAs 96.59 64.88 - Capital Ratios (%) Leverage 9.66 10.09 9.69 Tier 1 14.64 14.96 13.87 Total Risk Based 15.89 16.21 15.09

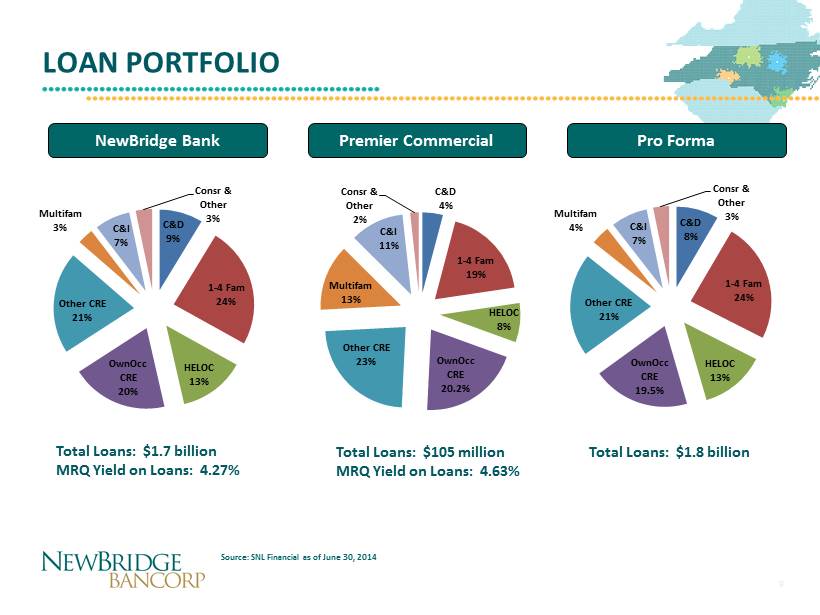

LOAN PORTFOLIO NewBridge Bank Premier Commercial Pro Forma Total Loans: $1.7 billion MRQ Yield on Loans: 4.27% Total Loans: $105 million MRQ Yield on Loans: 4.63% Total Loans: $1.8 billion 9 Source: SNL Financial as of June 30, 2014 C&D 9% 1 - 4 Fam 24% HELOC 13% OwnOcc CRE 20% Other CRE 21% Multifam 3% C&I 7% Consr & Other 3% C&D 4% 1 - 4 Fam 19% HELOC 8% OwnOcc CRE 20.2% Other CRE 23% Multifam 13% C&I 11% Consr & Other 2% C&D 8% 1 - 4 Fam 24% HELOC 13% OwnOcc CRE 19.5% Other CRE 21% Multifam 4% C&I 7% Consr & Other 3%

DEPOSIT MIX NewBridge Bank Premier Commercial Pro Forma Total Deposits: $1.9 billion MRQ Cost of Interest Bearing Deposits: 0.27% Total Deposits: $133 million MRQ Cost of Interest Bearing Deposits: 0.87% Total Deposits: $2.0 billion 10 Source: SNL Financial as of June 30, 2014 NOW, MMDA & Savings 51% Retail Time 30% Jumbo Time 3% Non Int. Bearing 16% NOW, MMDA & Savings 51% Retail Time 33% Jumbo Time 2% Non Int. Bearing 14% NOW, MMDA & Savings 51% Retail Time 30% Jumbo Time 3% Non Int. Bearing 16%

TRANSACTION SUMMARY • Adds earning assets, good location, and strong commercial team to the Greensboro, NC market • Estimated EPS accretion approaching 4% in FY17 with minimal TBV dilution • Adds mortgage teams in Triad, Raleigh, and Charlotte • Costs savings (45%) through consolidation of mortgage operations and mortgage production offices • Additional presence in High Point, NC (mortgage office) • Projected IRR exceeding 26% • Pricing protection through collars (+/ - 15% change in NBBC stock price) 11

ADDITIONAL INFORMATION Additional Information About the Merger and Where to Find It In connection with the proposed merger, NewBridge will file with the SEC a registration statement on Form S - 4 to register the shares of NewBridge common stock to be issued to the shareholders of Premier. The registration statement will include a proxy statement/prospectu s which will be sent to the shareholders of Premier seeking their approval of the merger and related matters. In addition, NewBridge may file other relevant documents concerning the proposed merger with the SEC. INVESTORS AND SHAREHOLDERS OF PREMIER ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S - 4 AND THE PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT NEWBRIDGE, PREMIER AND THE PROPOSED TRANSACTION. Investors and shareholders may obtain free copies of these documents, when filed, through the website maintained by the SEC a t www.sec.gov . Free copies of the proxy statement/prospectus also may be obtained, when available, by directing a request by telephone or ma il to NewBridge Bancorp, 1501 Highwoods Boulevard, Suite 400, Greensboro, N.C. 27410, Attention: Investor Relations (telephone: 336 - 369 - 0900), or Premier Commercial Bank, 701 Green Valley Road, Suite 102 Greensboro, NC 27408, Attention: Investor Relations (telephone: 336 - 398 - 2321), or by accessing NewBridge’s website at www.newbridgebank.com under "Investor Relations" or Premier's website at www.premierbanknc.com under "Investor Relations." The information on NewBridge’s and Premier's websites is not, and shall not be deemed to be, a part of this release or incorporated into other filings either company makes with the SEC. Premier and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Premier in connection with the merger. Information about the directors and executive officers of Premier is set forth in the proxy st ate ment for Premier's 2014 annual meeting of shareholders. Additional information regarding the interests of these participants and other persons w ho may be deemed participants in the proxy solicitation may be obtained by reading the proxy statement/prospectus when it becomes available. 12

INVESTOR CONTACTS 13 • Ramsey K. Hamadi, Chief Financial Officer ramsey.hamadi@newbridgebank.com 336.369.0975 • David P. Barksdale, Chief Strategy Officer david.barksdale@newbridgebank.com 336.369.0939 • Pressley A. Ridgill, Chief Executive Officer pressley.ridgill@newbridgebank.com 336.369.0903

NASDAQ: NBBC www.newbridgebank.com ACQUISITION OF PREMIER COMMERCIAL BANK October 9, 2014