Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HERITAGE COMMERCE CORP | a14-22048_18k.htm |

| EX-99.1 - EX-99.1 - HERITAGE COMMERCE CORP | a14-22048_1ex99d1.htm |

| EX-10.1 - EX-10.1 - HERITAGE COMMERCE CORP | a14-22048_1ex10d1.htm |

Exhibit 99.2

|

|

Acquisition Summary of Bay View Funding (“BVF”) October 9, 2014 |

|

|

2 Forward Looking Statement Disclaimer Forward-looking statements are based on management’s knowledge and belief as of today and include information concerning the Company’s possible or assumed future financial condition, and its results of operations, business and earnings outlook. These forward-looking statements are subject to risks and uncertainties. For a discussion of factors which could cause results to differ, please see the Company’s reports on Forms 10-K and 10-Q as filed with the Securities and Exchange Commission and the Company’s press releases. Readers should not place undue reliance on the forward-looking statements, which reflect management's view only as of the date hereof. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect subsequent events or circumstances. |

|

|

3 Complementary to Commercial Banking platform Expands market depth of commercial enterprises that can be served, both within footprint and outside Provides compatible and complementary commercial products to the core banking franchise, just in different economic segments Consistent with the asset sensitivity of core bank portfolio Factored Accounts Receivables revolve rapidly, demonstrating similar asset / liability behavior to a Prime Rate based C&I loan Expands Risk Management capabilities Provides ability to internally migrate eroding / improving risk rated clients between varying levels of portfolio risk management practices Enhanced Specialty Lending Expertise Factoring Corporate finance / asset-based lending SBA lending Non-profit organizations, education, and churches Construction lending Strategic Rationale |

|

|

4 Experienced Management Business Unit will report to Keith Wilton, EVP & COO From 2002-2007, Keith Wilton was President of Greater Bay Bank’s highly successful Specialty Finance Group which included a large factoring / asset-based lending operation Existing Management to continue to operate business Glen Shu, CEO has 23 years with BVF and will remain under a 3-year employment and non-compete agreement. Other key management average 18 years with BVF Operational Leverage for both entities Liquidity Margin Efficiency Capital Infrastructure (Credit, Risk Management, and Compliance) Strategic Rationale (continued) |

|

|

5 Low Execution Risk Understand the business and customer base Expect to retain all BVF employees Consistent risk / credit cultures Minimal system / operational integration Thorough due diligence (credit, operational, and regulatory) BVF headquartered in HTBK footprint Expedited closing Additive to long-term shareholder value Profitable company purchasing just under $500 million per year in accounts receivables Strategic Rationale (continued) |

|

|

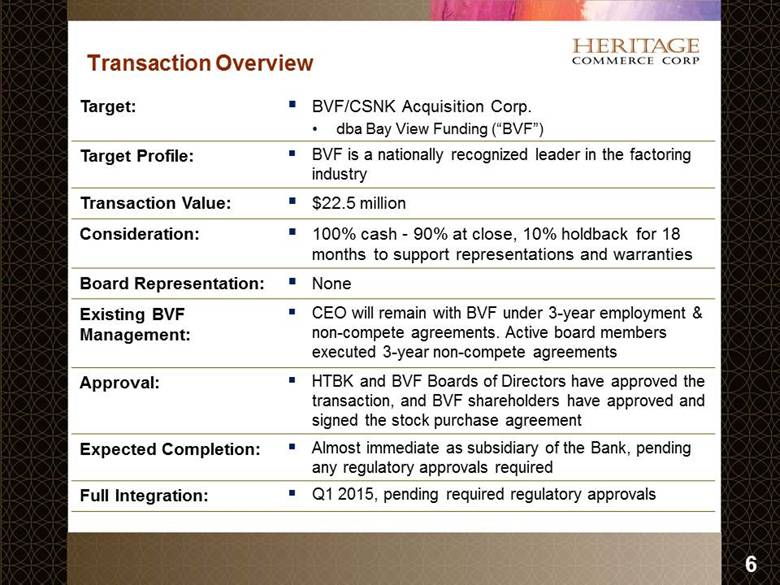

6 Transaction Overview Target: BVF/CSNK Acquisition Corp. dba Bay View Funding (“BVF”) Target Profile: BVF is a nationally recognized leader in the factoring industry Transaction Value: $22.5 million Consideration: 100% cash - 90% at close, 10% holdback for 18 months to support representations and warranties Board Representation: None Existing BVF Management: CEO will remain with BVF under 3-year employment & non-compete agreements. Active board members executed 3-year non-compete agreements Approval: HTBK and BVF Boards of Directors have approved the transaction, and BVF shareholders have approved and signed the stock purchase agreement Expected Completion: Almost immediate as subsidiary of the Bank, pending any regulatory approvals required Full Integration: Q1 2015, pending required regulatory approvals |

|

|

7 Pro-forma Full Integration Financial Impact & Assumptions Acquisition Impact EPS Accretion: > 20% of 2015e Consensus EPS TBV Earnback: < 4.5 years IRR: > 25% Risk Based Capital: ~13.0% Transaction Assumptions One-time Costs: $1.0 to $1.3 million pre-tax Cost Savings: Minimal expected cost savings (Other than Funding Costs and Directors’ expense) Full Integration: Q1, 2015 |

|

|

8 Contact Information Walter T. Kaczmarek President and Chief Executive Officer 408.494.4500 Keith A. Wilton Executive Vice President Chief Operating Officer 408.494.4534 Michael E. Benito Executive Vice President Business Banking Division 408.792.4085 Lawrence D. McGovern Executive Vice President Chief Financial Officer 408.494.4562 Corporate Headquarters 150 Almaden Boulevard San Jose, CA 95113 NASDAQ: HTBK David E. Porter Executive Vice President Chief Credit Officer 408.792.4029 Debbie K. Reuter Executive Vice President Chief Risk Officer 408.494.4542 |