Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ARGAN INC | d801979d8k.htm |

Exhibit 99.1

| AGAN, INC. June 2010 June 2011 October 2014 |

| Disclaimer All statements in this presentation that are not historical are forward- looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements may be identified by words such as "believe," "intend," "expect," "may," "could," "would," "will," "should," "plan," "project," "contemplate," "anticipate," or similar statements. Because these statements reflect the current views of Argan, Inc. ("Argan" or the "Company") concerning future events, these forward-looking statements are subject to risks and uncertainties. Argan's actual results could differ materially from those anticipated in these forward- looking statements as a result of many factors, which are described under the caption "Risk Factors" in Argan's most recent Forms 10-K and 10-Q filed with the Securities and Exchange Commission. Argan undertakes no obligation to update publicly any forward-looking statements contained in this presentation. |

| Investment Highlights Demonstrated track record of performance Substantial industry growth prospects Strong backlog and bidding pipeline Compelling financial characteristics Experienced management team |

| Company Overview Year founded - 1961 Headquarters - Rockville, MD Ticker - NYSE:AGX Market cap (10/02/14) - $524.97 million FY 2014 Revenue - $227.5 million FY 2014 EBITDA - $66.3 million YTD (07/31/14) Revenue - $153.2 million YTD (07/31/14) EBITDA - $19.4 million Employees - 619 [as of 9-22-14] Backlog at 07/31/14 - $643 million |

| Senior Management Team Rainer Bosselmann - Chairman and CEO Arthur Trudel - Chief Financial Officer Richard Deily - Corporate Controller Management has an established track record of creating value for the shareholders of Jupiter National, Inc. (AMEX:JPI), Arguss Communications, Inc. (NYSE:ACX) and Argan, Inc. (NYSE:AGX) |

| Senior Gemma Management Team William F. Griffin, Jr. - Co-Founder & Chief Executive Officer Daniel L. Martin - President Bill and Dan have more than 60 years combined experience in all facets of engineering, detailed design, procurement, construction management and other support services in the building of power plants and renewable energy facilities. |

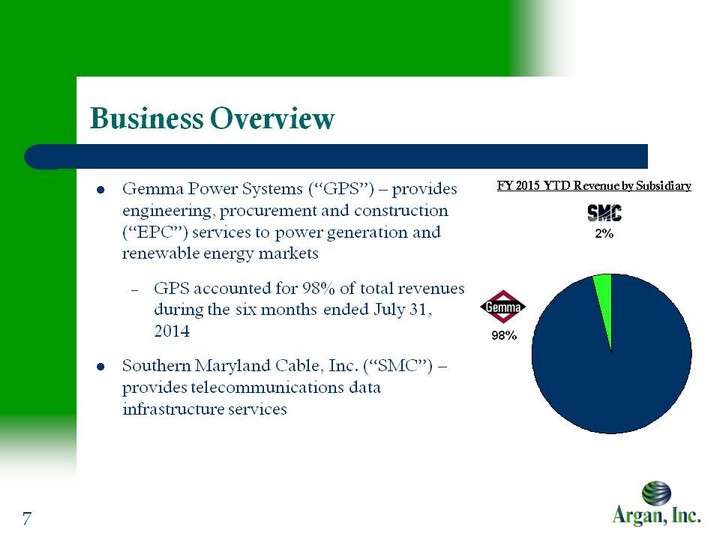

| Business Overview Gemma Power Systems ("GPS") - provides engineering, procurement and construction ("EPC") services to power generation and renewable energy markets GPS accounted for 98% of total revenues during the six months ended July 31, 2014 Southern Maryland Cable, Inc. ("SMC") - provides telecommunications data infrastructure services FY 2015 YTD Revenue by Subsidiary 98% 2% |

| Industry Growth Drivers Substantial capacity additions will be required to meet rising electricity demand as the US economy continues to recover The retirement of older and inefficient plants and coal- fired generation facilities will further drive investment in new gas fired generation capacity |

| Overview of GPS Acquired by Argan - December 2006 Purchase price - $33.1 million $12.9 million in cash $20.2 million from issuance of 3.7 million shares Funded in part by $8.0 million secured four year amortizing term loan, which has been paid-in-full. Cumulative EBITDA since acquisition - $241 million Services - engineering, procurement and construction of natural gas fired and alternative power energy facilities Customers - utilities and independent power producers FY 2014 revenue: $227.5 million FY 2014 EBITDA: $66.3 million YTD (07/31/14) Revenue - $153.2 million YTD (07/31/14) EBITDA - $19.4 million Backlog at 7/31/14: $643 million |

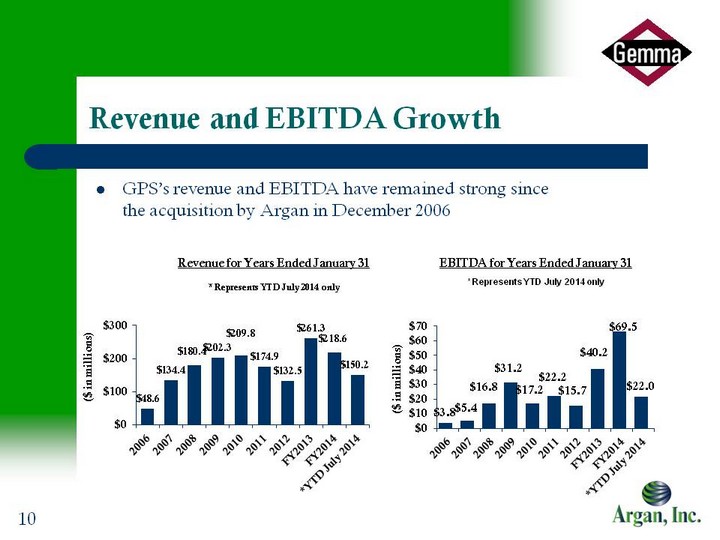

| Revenue and EBITDA Growth GPS's revenue and EBITDA have remained strong since the acquisition by Argan in December 2006 Revenue for Years Ended January 31 * Represents YTD July 2014 only (CHART) EBITDA for Years Ended January 31 * Represents YTD July 2014 only (CHART) |

| GPS Track Record More than 10,000 megawatts of generating capacity installed and under contract on an EPC basis More than 435 megawatts of wind power facility development More than 370 million gallons per year of installed renewable fuels capacity 36 major turnkey engineering, procurement and construction projects Power experience includes combined cycle, combustion turbines, coal/wood fueled projects, wind plants, solar facilities and waste recovery facilities Renewable fuels experience includes bio-diesel, biomass and ethanol facilities Project development support of 1,600 megawatts of gas fired generating capacity Project development support of 240 megawatts of biomass-fired power plants |

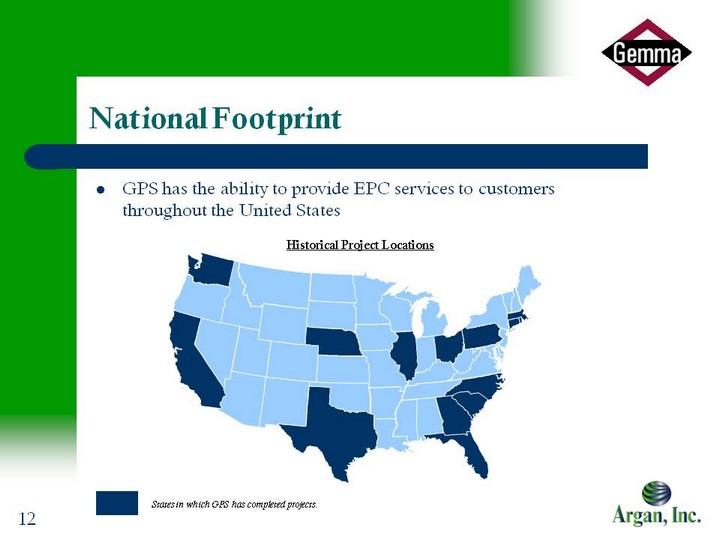

| National Footprint GPS has the ability to provide EPC services to customers throughout the United States Historical Project Locations States in which GPS has completed projects. |

| Extensive Project Portfolio Power facilities - simple cycle solution CPV Sentinel Energy Project A.L. Pierce Re-powering Project Vandolah Power Project DeSoto County Power Project Indigo Energy Facility Larkspur Energy Facility Richmond County Phase I Power Monroe Power Project Richland Peaking Project Rocky Road Unit 4 Project Broad River Energy Center Middletown, CT Project Pollution solution Brayton Point Power Station La Rosita SCR Project Biomass Power Facility - Woodville, Texas Solar Facility - Canton, MA - Carver, MA - Beaumont Solar Power facilities - combined cycle solution Panda Liberty Energy Project Panda Patriot Energy Project Colusa Generating Station Roseville Energy Park Hines PB-2 Power Project Rowan County Power Project Effingham County Power Project Richmond County Phase II Power Project Dighton Power Project Process facilities - biodiesel Renewable BioFuels Port Neches Galena Park Green Earth Fuels Houston LLC Process facilities - ethanol Carleton Ethanol Facility Wind Facilities - LaSalle County, Illinois - Vantage, Washington - Henry County, Illinois - Ebensburg, Pennsylvania |

| Current Projects Panda Liberty Energy Project - Panda Liberty, LLC (previously named Moxie Liberty) - design and construction of natural gas-fired power plant in Bradford County, PA 825 MW natural gas-fired combined cycle electrical generating facility Joint venture with Lane Construction. Gemma's share at 75% Contract value: $385 million Commenced project: Summer 2013 Expected completion: Spring 2016 |

| Current Projects Panda Patriot Energy Project - Panda Patriot, LLC (previously named Moxie Patriot) - design and construction of natural gas-fired power plant in Lycoming County, PA 829 MW natural gas-fired combined cycle electrical generating facility Joint venture with Lane Construction. Gemma's share at 75% Contract value: $385 million Commenced project: Late 2013 Expected completion: Mid-2016 |

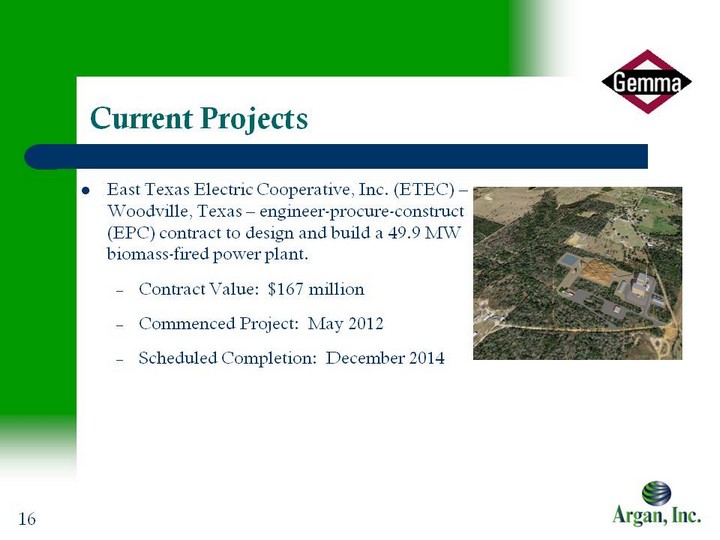

| Current Projects East Texas Electric Cooperative, Inc. (ETEC) - Woodville, Texas - engineer-procure-construct (EPC) contract to design and build a 49.9 MW biomass-fired power plant. Contract Value: $167 million Commenced Project: May 2012 Scheduled Completion: December 2014 |

| U.S. Natural Gas Development Argan is participating in Marcellus Shale Region development activities with the object of developing large- scale power plants. The approach is to take principal positions in the initial stages of development, secure the rights for an EPC contract for the large scale power plant to be built on the development site. Argan then sells its interests in the site to the ultimate developer of the power plant. Argan has consummated the Panda Liberty Project and the Panda Patriot Project with the acquisition of both projects by Panda Power Funds. Argan recently disclosed that it was partnering with Moxie to develop a third power plant in the Marcellus Shale Region which is named Moxie Freedom. |

| Renewable Energy - Alternative Fuels Gemma Power Systems (GPS) has accepted the assignment to design and build facilities to produce alternative fuels. To date, GPS has performed the process design, detail engineering, procurement and construction of more than 370 million gallons per year of installed alternative fuels capacity. |

| Renewable Energy - Wind and Solar Gemma Renewable Power (GRP) is well positioned to respond to our clients' needs for the installation of wind and solar projects throughout North America. GRP's integrated team of experienced professionals provides all the following elements of a turnkey installation. GRP has the unique capability to self-perform the construction work associated with our projects. This approach ensures direct control of labor, safety, quality and schedule for each project. GRP provides state-of-the- art technology coupled with advanced project management tools to ensure every job is completed on- time, in budget, and to the highest standards of excellence. GRP has constructed more than 435MW of wind power facility capacity. GRP has successfully completed the design coordination, procurement and installation of ground mounted photovoltaic panels supporting 12MW of solar power facilities. |

| Competitive Landscape Larger Projects / Traditional Fuels Smaller Projects / Alternative Fuels |

| Growth Strategy Establish additional strategic alliances in the EPC space Make additional strategic acquisitions that complement our unique market position Exploit long-term relationships throughout the industry to aggressively build backlog of traditional and renewable energy projects Make strategic investments in power plant development projects as a means to create greater opportunities to build backlog of large scale EPC contracts. |

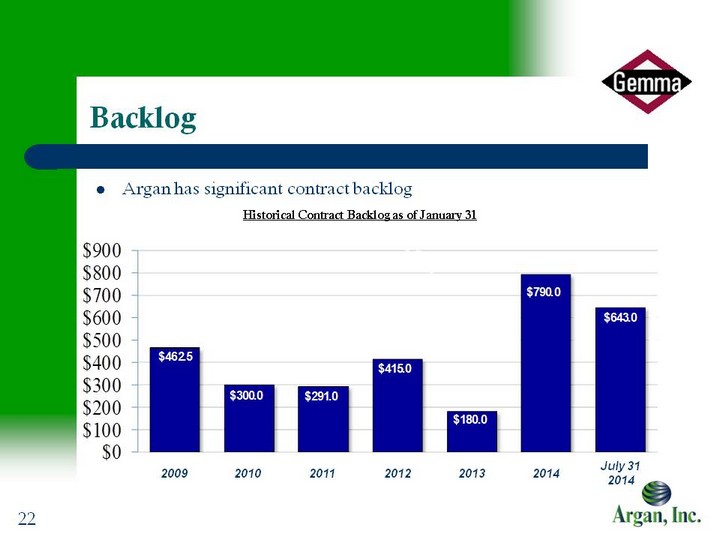

| Backlog Argan has significant contract backlog Historical Contract Backlog as of January 31 * * * 2009 2010 2011 2012 2013 July 31 2014 2014 |

| Investment Summary Demonstrated track record of performance Substantial industry growth prospects Strong backlog and bidding pipeline Compelling financial characteristics Experienced management team |

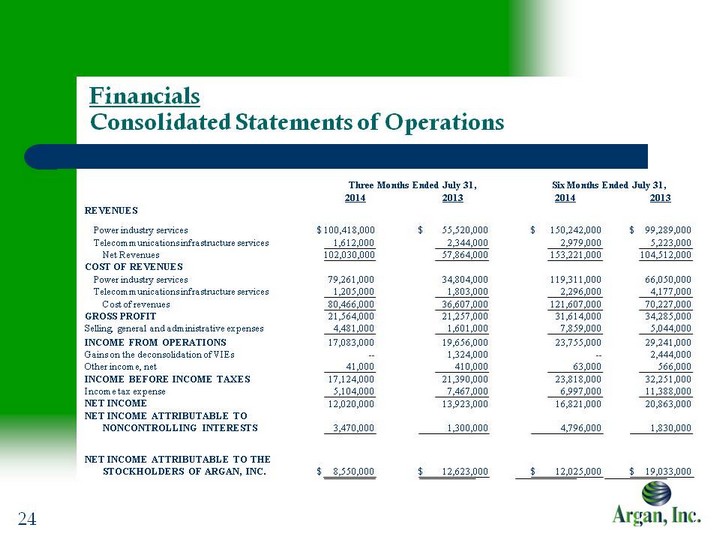

| Financials Consolidated Statements of Operations Three Months Ended July 31, Three Months Ended July 31, Three Months Ended July 31, Three Months Ended July 31, Three Months Ended July 31, Three Months Ended July 31, Three Months Ended July 31, Six Months Ended July 31, Six Months Ended July 31, Six Months Ended July 31, Six Months Ended July 31, Six Months Ended July 31, 2014 2014 2013 2013 2013 2014 2014 2013 2013 REVENUES Power industry services $ 100,418,000 $ 55,520,000 55,520,000 $ 150,242,000 $ 99,289,000 Telecommunications infrastructure services 1,612,000 2,344,000 2,344,000 2,979,000 5,223,000 Net Revenues 102,030,000 57,864,000 57,864,000 153,221,000 104,512,000 COST OF REVENUES Power industry services 79,261,000 34,804,000 34,804,000 119,311,000 66,050,000 Telecommunications infrastructure services 1,205,000 1,803,000 1,803,000 2,296,000 4,177,000 Cost of revenues 80,466,000 36,607,000 36,607,000 121,607,000 70,227,000 GROSS PROFIT 21,564,000 21,257,000 21,257,000 31,614,000 34,285,000 Selling, general and administrative expenses 4,481,000 1,601,000 1,601,000 7,859,000 5,044,000 INCOME FROM OPERATIONS 17,083,000 19,656,000 19,656,000 23,755,000 29,241,000 Gains on the deconsolidation of VIEs -- 1,324,000 1,324,000 -- 2,444,000 Other income, net 41,000 410,000 410,000 63,000 566,000 INCOME BEFORE INCOME TAXES 17,124,000 21,390,000 21,390,000 23,818,000 32,251,000 Income tax expense 5,104,000 7,467,000 7,467,000 6,997,000 11,388,000 NET INCOME 12,020,000 13,923,000 13,923,000 16,821,000 20,863,000 NET INCOME ATTRIBUTABLE TO NONCONTROLLING INTERESTS 3,470,000 1,300,000 1,300,000 4,796,000 1,830,000 NET INCOME ATTRIBUTABLE TO THE STOCKHOLDERS OF ARGAN, INC. $ 8,550,000 $ 12,623,000 12,623,000 $ 12,025,000 $ 19,033,000 |

| Financials Consolidated Statements of Operations, continued Earnings (loss) per share attributable to the stockholders of Argan: Basic $ 0.59 $ 0.90 $ 0.84 $ 1.36 Diluted $ 0.58 $ 0.89 $ 0.82 $ 1.35 Weighted Average of Shares Outstanding Basic 14,399,000 13,997,000 14,350,000 13,986,000 Diluted 14,655,000 14,129,000 14,641,000 14,132,000 Three Months Ended July 31, Three Months Ended July 31, Three Months Ended July 31, Three Months Ended July 31, Three Months Ended July 31, Three Months Ended July 31, Three Months Ended July 31, Six Months Ended January 31, Six Months Ended January 31, Six Months Ended January 31, Six Months Ended January 31, Six Months Ended January 31, 2014 2014 2013 2013 2013 2014 2014 2013 2013 |

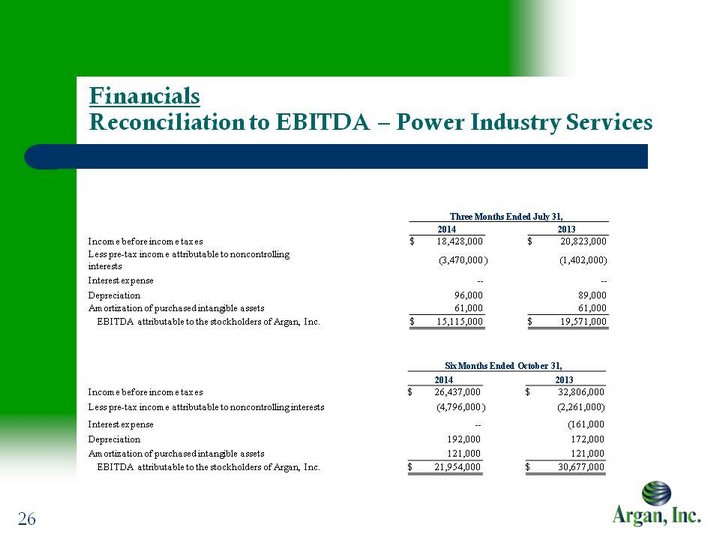

| Financials Reconciliation to EBITDA - Power Industry Services Reconciliation to EBITDA - Power Industry Services Reconciliation to EBITDA - Power Industry Services Six Months Ended October 31, Six Months Ended October 31, Six Months Ended October 31, Six Months Ended October 31, Six Months Ended October 31, 2014 2014 2013 2013 Income before income taxes $ 26,437,000 $ 32,806,000 Less pre-tax income attributable to noncontrolling interests (4,796,000 ) (2,261,000) Interest expense -- (161,000 Depreciation 192,000 172,000 Amortization of purchased intangible assets 121,000 121,000 EBITDA attributable to the stockholders of Argan, Inc. $ 21,954,000 $ 30,677,000 |

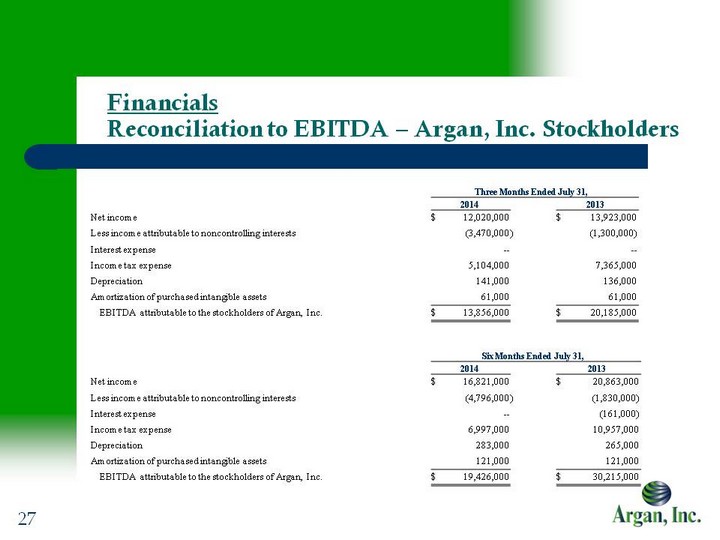

| Financials Reconciliation to EBITDA - Argan, Inc. Stockholders Reconciliation to EBITDA - Argan, Inc. Stockholders Reconciliation to EBITDA - Argan, Inc. Stockholders |

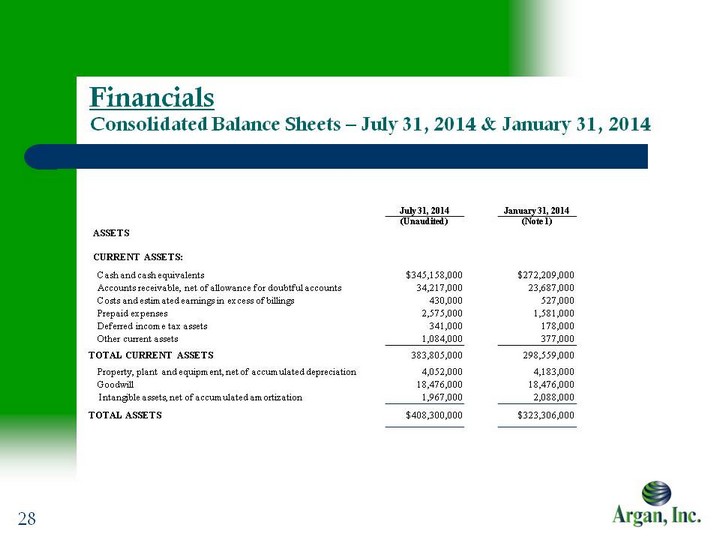

| Financials Consolidated Balance Sheets - July 31, 2014 & January 31, 2014 Consolidated Balance Sheets - July 31, 2014 & January 31, 2014 Consolidated Balance Sheets - July 31, 2014 & January 31, 2014 |

| Financials Consolidated Balance Sheets, continued - July 31, 2014 & January 31, 2014 Consolidated Balance Sheets, continued - July 31, 2014 & January 31, 2014 Consolidated Balance Sheets, continued - July 31, 2014 & January 31, 2014 July 31, 2014 January 31, 2014 (Unaudited) (Note 1) |

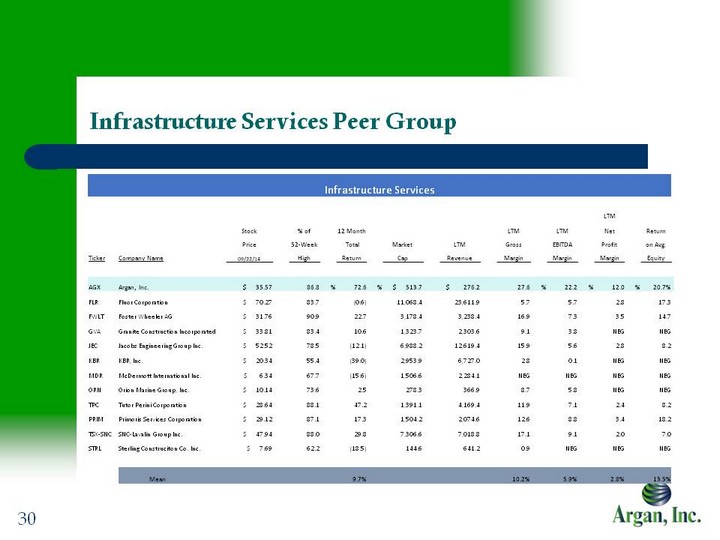

| Infrastructure Services Peer Group Infrastructure Services Peer Group |