Attached files

| file | filename |

|---|---|

| 8-K - MAINBODY - Well Power, Inc. | mainbody.htm |

On - Site Processing of Natural Gas to Engineered Fuels and Power MICRO REFINERY UNIT MOBILE | MODULAR | FINANCIALLY VIABLE

DISCLAIMER This presentation is confidential and has been furnished to the intended recipient solely for such recipient’s information an d private use and may not be referred to, disclosed, reproduced or redistributed, in whole or in part, to any other person. Thi s presentation does not constitute a due diligence review and should not be construed as such. This presentation is highly confidential and contains sensitive commercial information in connection with a publically listed company. The purpose of the presentation is to describe development stage projects, which projects, by there nature, are inherently risky and have many uncertainties. This presentation has been prepared by a third party, and reflects their own research and views as to the prospects of the projects. Recipients of this presentation must not rely on the information con tai ned herein to make any investment decisions. The publically listed company accepts no responsibility or liability whatsoever in relation to this presentation (including f or any error contained in this presentation or in relation to the accuracy, completeness or correctness of this presentation or in r ela tion to any projections, analyses, assumptions and/or opinions contained herein nor for any loss of profit or damages or any liabi lit y to a third party whatsoever arising from the use of this presentation). The exclusion of liability provided herein shall protect th e public company in all circumstances. This presentation is not intended to form the basis of any investment decision and does not constitute or form part of any of fer to sell or an invitation to subscribe for, hold or purchase any securities or any other investment, and neither this presentatio n n or anything contained herein shall form the basis of or be relied on in connection with any contract or commitment whatsoever. Thi s presentation is not, and should not be treated or relied upon as investment research or a research recommendation under applicable regulatory rules. This presentation does not reflect the views of the publically listed company, Well Power Inc. (the “Company”) nor any of its management team, nor any of its directors or officers. Certain information contained in this presentation can also be found on the Company’s website but the interpretation of such information, as set out in this document, solely reflects the views of t he third party analysis. Well Power Inc. has no liability to any recipients of this presentation.

| 2 |

Overview » Licensed , Patented Technology » Targeting Oil & Gas producing industry » High demand market for technology » Experienced , Intelligent R&D team » Preparing for Commercialization

| 3 |

Licensed, Patented Technology » Well Power, Inc. announced license Jan 22/14 » Solutions to Flared, Shut - in and Stranded gases » Initial licensed state: Texas » Strategic states to follow » Exclusivity allows for strong business alliances » Patents filed by Licensor

| 4 |

Targeting Oil & Gas Industry » Optimization technology » Reduction of waste emissions » Niche market » Proprietary solutions: 1. Flexible 2. Scalable 3. Modular 4. Easy Integration 5. Cost Effective 6. Profitable

| 5 |

Niche Opportunity – New York Times

| 6 |

RRC Texas # Rigs » RRC Production Statistics and Allowable From August 2014. “AUSTIN –– The Texas average rig count as of July 18, was 886 , representing about 49 percent of all active land rigs in the United States. In the last 12 months, total Texas reported production was 786 million barrels of oil and 7.8 trillion cubic feet of natural gas . ” http ://www.rrc.state.tx.us/all - news/072914b /

| 7 |

RRC of Texas Flaring Regulations » 10 Day Maximum Flare Period » Extension by Permit only “The majority of flaring permit requests that the Commission receives are for flaring cashing head gas from oil wells. The Commission does not issue long - term permits for flaring from natural gas wells as natural gas is the main product of a gas well. Both oil and gas wells are allowed under Commission rules to flare during the drilling phase and for up to 10 days after a well’s completion for well potential testing. Rare exceptions for long - term flaring may be made in cases where the well or compressor are in need of repair.” http://www.rrc.state.tx.us/about - us/resource - center/faqs/oil - gas - faqs/faq - flaring - regulation /

| 8 |

Management/Directors and Advisory Panel » Cristian Neagoe CEO/Director: received his degree in physics at the University of Bucharest in Romania, a PH. D in Theoretical Chemistry from the Romanian Academy of Science in 2004 and a Chemical Engineering degree in 2012 from the Ecole Polytechnique Montgreal . » Dan Patience President/Director Mr. Patience currently serves as the President of Noble Investment Corp., a private company based in Calgary, Alberta that has been providing Investment Banking/Investor Relations Services to publicly listed Canadian and US Companies since 1994. » Brad Barton P. Eng, B Admin 20 years operational experience in the oil patch. Including acting as an officer and director of public and private companies. » Parminder Singh Project Lead with International Business; Corporate Management; and Technology and Manufacturing Industry Expertise. EXPERIENCE: President, Intellectual Ventures Canada, a $5.4 Billion Private Equity Fund investing in Early Stage Technologies and Intellectual Property; Managing Director, Microsoft Canada Development Center. » Professor Gregory Patience Ph.D. Chemical Engineering (Polytechnique Montreal), Specialist in Catalytic Reactors. At Ecole Polytechnique Dr. Patience established a laboratory on heterogeneous catalysis and fluidization. » Dr. Michael Raymont Expertise in R&D Financing through Public and Private Sectors. EXPERIENCE: Chairman and Principal, Borderline Asia, an Investment Funding and Financial Advisory Company; Chief Executive, EnergyNet, a think tank with Govt. Departments and Major Energy Companies.

| 9 |

Our Solution

| 10 |

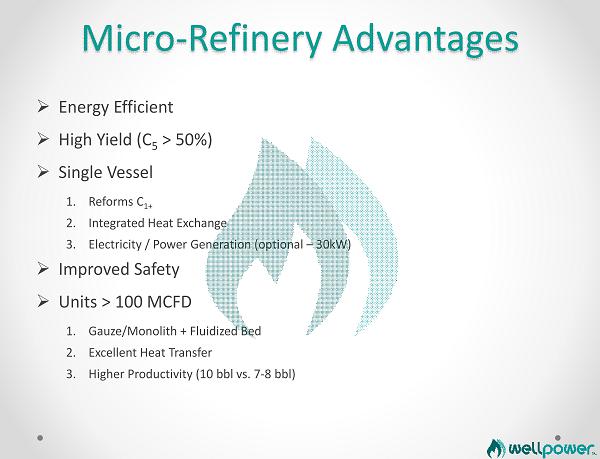

Micro - Refinery Advantages » Energy Efficient » High Yield (C 5 > 50%) » Single Vessel 1. Reforms C 1+ 2. Integrated Heat Exchange 3. Electricity / Power Generation (optional – 30kW) » Improved Safety » Units > 100 MCFD 1. Gauze/Monolith + Fluidized Bed 2. Excellent Heat Transfer 3. Higher Productivity (10 bbl vs. 7 - 8 bbl)

| 11 |

Process Flow Diagram ( B a f f l e ) Mist Extractor Vortex Breaker De-Sulferization Unit Lean Amine Solvent Top Tray Bottom Tray Mist Extractor P M PT LT GLYCOL L K 102 K 101 M T P T P T A L Rich Amine Solvent 1- Rich Amine TO Lean Amine Purification Process 2- Acid Gas product Acid Gases ??? P T L Slurry Sulfur ??? Lean Amine P T A L M M T P I n l e t D i v e r te r ( B a f f le ) Vortex Breaker L-OIL 3 Phases Separator (Oil, Water & Gases) Vortex Breaker Weir Product L-Water Two Phase Separator Desulfurization & Dehydration Air & Methane Compressors 1 2 3 5 6 Three Phase Separator 7 HOT GASES OUT T P 4 Reactor Mixed Gases Condensate Saturated Water Steam Glycol Supply Sweet Gas Dry Gas Air Water Gas Line Water Line Product Glycol Loop Air Oil&Water Liquid Engineered Fuel Production V 3.30 J-T THROTTLE VALVE COMPRESSOR CO-GEN ( Micro Turbine) LEASE GAS PUMP JACK Emulsion in Sour Gas 8 Steam & Power Generation Steam TurbineShaft Generator Water Cooler Closed Loop Glycol PI TI PI TI PI TI PI TI PI TI 100 KW of Available Power 30-40 KW of Generated Power Hot Mixed Gases

| 12 |

In the Oil Industry, There is no “SILVER BULLET” The Beauty Of This System Is The Flexibility And Modular Design That Can Be Adapted To A Variety Of Situations. » Able to tailor the components of the skid to match the site specific requirements A. Inlet separator already on site (2 or 3 phase) B. Sweetening/Dehydration C. Mixed OR Separated product stream D. Excess Energy, in the form of heat and pressure 1. Co - Gen Opportunities 2. Heating/Cooling E. Product Spec can be adjusted depending on requirements

| 13 |

Two Ways to View the Economics » Alternative to flaring when producing oil wells » Selling liquid hydrocarbon vs. natural gas

| 14 |

Alternative to Flaring - Considerations - » Flaring Regulations » Relative capital cost of MRU to: 1. Gas Facilities 2. Electricity Generation 3. Both a function of distance to existing infrastructure » Timing Considerations 1. Start wells without waiting for tie ins 2. Extend well tests for better information

| 15 |

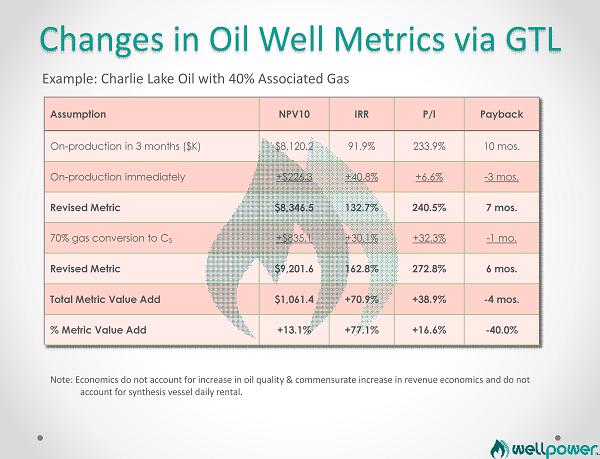

Changes in Oil Well Metrics via GTL Assumption NPV10 IRR P/I Payback On - production in 3 months ($K) $8,120.2 91.9% 233.9% 10 mos. On - production immediately +$226.3 +40.8% +6.6% - 3 mos. Revised Metric $8,346.5 132.7% 240.5% 7 mos. 70% gas conversion to C 5 +$835.1 +30.1% +32.3% - 1 mo. Revised Metric $9,201.6 162.8% 272.8% 6 mos. Total Metric Value Add $1,061.4 +70.9% +38.9% - 4 mos. % Metric Value Add +13.1% +77.1% +16.6% - 40.0% Example: Charlie Lake Oil with 40% Associated Gas Note: Economics do not account for increase in oil quality & commensurate increase in revenue economics and do not account for synthesis vessel daily rental.

| 16 |

Selling Liquid Hydrocarbon - Considerations - » Relative value of the two products; 1. 100mcf of Gas vs. 10bbls of Oil 2. $300.00 / day vs $1000.00 / day » Capital Costs; 1. Purchase unit 2. Lease unit 3. Joint Venture with Well Power » Operating Costs; 1. Fees to Market (Compression, handling and line usage) 2. Royalties 3. Unit operating costs

| 17 |

Case Study THE MICRO REFINERY UNIT; INNOVATION TO CREATE ENVIRONMENTAL AND ECONOMIC BENEFIT In order to Optimize the Value Proposition to End Users we need assistance in reviewing the local economics. Gas Composition and Flow Rates: Each resource will be slightly unique in its gas composition and flow rates as well as H2S content. Ideally we select sites with sweet gas but the cost of sulphur removal can be reviewed as well. Selection of Engineered Fuel: We need to establish commodity values and than develop a catalyst to produce those specific end products: Diesel High Quality Crude Diluents Heating and Cooling Remote Power Generation: Current power requirements and operator cost of close to wellhead including generator, fuel, and labour costs. Review of Opportunity SAMPLE CANADIAN CASE STUDY - Value Proposition Each Micro Refinery Unit will be able to provide the following benefits from 100 mcf/day: Reduction of Flaring: 1224 tonnes of CO 2 per 100MRU $30,000 Production of Engineered Fuels: D iluent to blend with Heavy Oil 10 bbls/day @ $125/bbl $450,000 Power Generation: 35 KWH @ .40/KWH $125,000 Water Production: 80 bbls/day @ .50/bbl $15,000 TOTAL ANNUAL ECONOMIC BENEFIT: $620,000 HOW CAN WE BENEFIT YOUR BOTTOM LINE?

| 18 |

Total US Potential » World Bank Data: Flare Volumes http://web.worldbank.org/WBSITE/EXTERNAL/TOPICS/EXTOGMC/EXTGGFR/0,, contentMDK:22137498~menuPK:3077311~pagePK:64168445~piPK:64168309~theSitePK:578069,00.html Volumes in BCM 2007 2008 2009 2010 2011 Change from 2010 to 2011 USA 2.2 2.4 3.3 4.6 7.1 2.5 Top 20 132 124 127 118 121 3.1 Rest of the World 22 22 20 20 19 (1.1) Global Flaring Level 154 146 147 138 140 1.9 Yearly USA flared number 7,100,000,000 m3/yr 35.31 ft3/m3 250,701,000,000 ft3 250,701,000 mcf 500 size of unit mcf 1,374 number of potential units 50 bbls/day/unit 68,685 bbls /day USA wasted

| 19 |

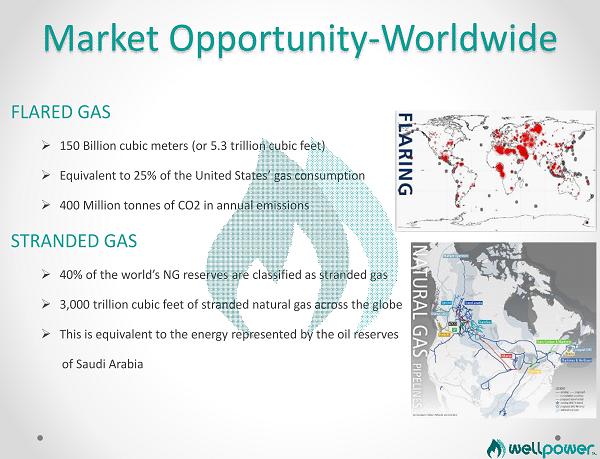

Market Opportunity - Worldwide FLARED GAS » 150 Billion cubic meters (or 5.3 trillion cubic feet) » Equivalent to 25% of the United States’ gas consumption » 400 Million tonnes of CO2 in annual emissions STRANDED GAS » 40% of the world’s NG reserves are classified as stranded gas » 3,000 trillion cubic feet of stranded natural gas across the globe » This is equivalent to the energy represented by the oil reserves of Saudi Arabia

| 20 |

Flaring Metrics - Worldwide Estimated flared volume from satellite data Volumes in bcm 2007 2008 2009 2010 2011 Change from 2010 to 2011 Russia 52.3 42 46.6 35.6 37.4 1.8 Nigeria 16.3 15.5 14.9 15 14.6 - 0.3 Iran 10.7 10.8 10.9 11.3 11.4 0 Iraq 6.7 7.1 8.1 9 9.4 0.3 USA 1 2.2 2.4 3.3 4.6 7.1 2.5 Algeria 5.6 6.2 4.9 5.3 5 - 0.3 Kazakhstan 2 5.5 5.4 5 3.8 4.7 0.9 Angola 3.5 3.5 3.4 4.1 4.1 0 Saudi Arabia 3 3.9 3.9 3.6 3.6 3.7 0.1 Venezuela 2.2 2.7 2.8 2.8 3.5 0.7 China 2.6 2.5 2.4 2.5 2.6 0.1 Canada 2 1.9 1.8 2.5 2.4 - 0.1 Libya 3.8 4 3.5 3.8 2.2 - 1.6 Indonesia 2.6 2.5 2.9 2.2 2.2 0 Mexico 4 2.7 3.6 3 2.8 2.1 - 0.7 Qatar 2.4 2.3 2.2 1.8 1.7 - 0.1 Uzbekistan 2.1 2.7 1.7 1.9 1.7 - 0.2 Malaysia 1.8 1.9 1.9 1.5 1.6 0.2 Oman 2 2 1.9 1.6 1.6 0 Egypt 1.5 1.6 1.8 1.6 1.6 0 Total top 20 132 124 127 118 121 3.1 Rest of the world 22 22 20 20 19 - 1.1 Global flaring level 154 146 147 138 140 1.9 Source: NOAA Satellite data

| 21 |

SUMMARY » Patented technology » Transportable and adaptable to the site conditions » Improves well economics » Texas license in place, opportunity for more regions » Working toward strategic alliances » Working capital efficient

| 22 |

Corporate Information R & D Team: E’cole Polytechnique, Montreal, QC Bank: Bank of Montreal Auditor: GBH CPA’s, Houston, TX Legal: Clark Corporate Law, Las Vegas, NV Transfer Agent: Nevada Agency & Transfer Company, Reno, NV Contact Information Dan Patience: President, Houston Office (713) 973 - 5738 Calgary Office (403) 668 - 5019 Investor Relations: Dream Team Network, (512) 758 - 8877 Website: www.wellpowerinc.com

| 23 |