Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SPARTON CORP | d802677d8k.htm |

Investor

Day October 8, 2014

Exhibit 99.1 |

Welcome

Mike Osborne

Senior

Vice

President

–

Corporate

Development |

Safe Harbor

Statement 3

Certain statements herein constitute forward-looking statements within the meaning of the

Securities Act of 1933, as amended and the Securities

Exchange

Act

of

1934,

as

amended.

When

used

herein,

words

such

as

“believe,”

“expect,”

“anticipate,”

“project,”

“plan,”

“estimate,”

“will”

or “intend”

and similar words or expressions as they relate to the Company or its management constitute

forward- looking statements. These forward-looking statements reflect our

current views with respect to future events and are based on currently available

financial, economic and competitive data and our current business plans. The Company is under no obligation to, and expressly

disclaims any obligation to, update or alter its forward-looking statements whether as a

result of such changes, new information, subsequent events or otherwise. Actual results

could vary materially depending on risks and uncertainties that may affect our

operations,

markets,

prices

and

other

factors.

Important

factors

that

could

cause

actual

results

to

differ

materially

from

those

forward-

looking statements include those contained under the heading of risk factors and in the

management’s discussion and analysis contained from time-to-time in the

Company’s filings with the Securities and Exchange Commission. Adjusted EBITDA and

related reconciliation presented here represents earnings before interest, taxes, depreciation and amortization as

adjusted for restructuring/impairment charges, gross profit effects of capitalized profit in

inventory from acquisition and acquisition contingency settlement, and gain on sale of

investment. The Company believes Adjusted EBITDA is commonly used by financial analysts

and

others

in

the

industries

in

which

the

Company

operates

and,

thus,

provides

useful

information

to

investors.

The

Company

does

not

intend, nor should the reader consider, Adjusted EBITDA an alternative to net income, net cash

provided by operating activities or any other items calculated in accordance with GAAP.

The Company's definition of Adjusted EBITDA may not be comparable with Adjusted EBITDA

as defined by other companies. Accordingly, the measurement has limitations depending on its use. |

Agenda

4

11:00 am

Welcome

Business Overview

Performance Highlights

2020 Vision

Strategies & Imperatives

Closing Remarks

12:30 pm

Q&A Session

1:00 pm

Lunch / Transportation to Facility

2:00 pm

Facility Tour

4:00 pm

Transportation from Facility

6:00 pm

Cocktail Reception & Dinner |

Presenters

Cary Wood

President and CEO

5

Don Pearson

Chief Financial Officer

Mike Osborne

Senior Vice President, Corporate Development |

Business

Overview Cary Wood

President & CEO |

Key

Messages 7

Established,

Longstanding

Customer

Relationships

Attractive Platform

for Growth

Proven &

Experienced

Management Team

Diversified

Revenue

Mix

Strong Free Cash

Flow Generation &

Financial Condition

Highly Skilled &

Industry Leading

Manufacturing

Capabilities |

The Simple Choice

for Complex Needs Sparton is the simple choice for complex, contract design &

manufacturing needs 8

$336 million

Fiscal 2014

Revenue

9 + 4

Manufacturing &

Design Facilities

1500+

Employees

Worldwide

1900 A.D.

Founded in

Michigan

Total focus on our customers’

vision

Service for every step of a product’s lifecycle, from design and manufacturing

to logistics and service

Decades of experience

Our unique expertise and capabilities make Sparton a premier partner for the

contract design and manufacture of low-to-medium volume highly complex

electromechanical devices |

Investment

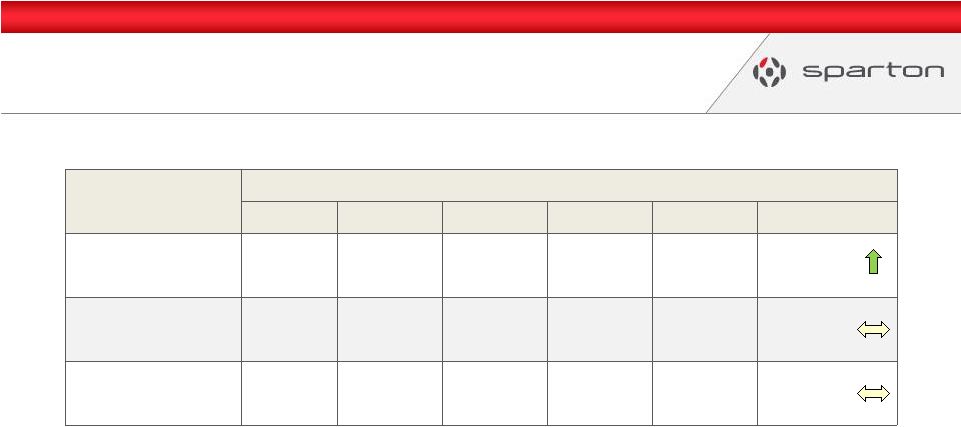

Considerations 9

Continued EPS

Growth

Established & Growing

Business

Expanded

EBITDA Margins

Solid

Balance Sheet

Repositioned the

Company for Growth

114 year old business with market leadership in defense and medical sectors;

27% sales increase in fiscal 2014; 52% year-over-year adjusted EBITDA increase

in fiscal 2014

As of June 30, 2014, Debt-to-EBITDA coverage of 1.2x with $8 million of cash and $41

million borrowed, $59 million unused on the line of credit. On September 11,

2014, the line of credit was increased to $200 million with a $100 million accordion

feature. Fiscal 2014:

9.9%

Fiscal 2011:

7.4%

Fiscal 2013:

8.1%

Fiscal 2010:

4.5%

Fiscal 2012:

7.6%

Fiscal 2009:

-4.5%

Fiscal 2014:

$ 1.58

Fiscal 2011:

$ (0.64)

Fiscal 2013:

$ 1.17

Fiscal 2010:

$ (0.40)

Fiscal 2012:

$ 0.91

Fiscal 2009:

$ (1.61)

FY11

FY12

FY13

FY14

New Programs

26

40

71

89

New Customers

11

20

12

26

Potential Annualized Revenue

$17.7

$23.8

$39.4

$38.8 |

Sparton is in

one single line of business called Electromechanical Devices Sparton

is

currently

segmented

into

three

financial

reporting

business

units

Current Business Model

10

Sparton

currently

serves

three

electronics

markets

Military & Aerospace

Medical

Industrial & Instrumentation

Commonly referred to within legacy Sparton as EMS, but

currently consists of circuit card assembly and box build

(contract manufacturing and assembly) outside of the

medical and defense markets

Complex Systems

Medical Device

Contract Design, Manufacturing, and Assembly

Defense & Security

Design and Manufacturing (both as a contractor and OEM) |

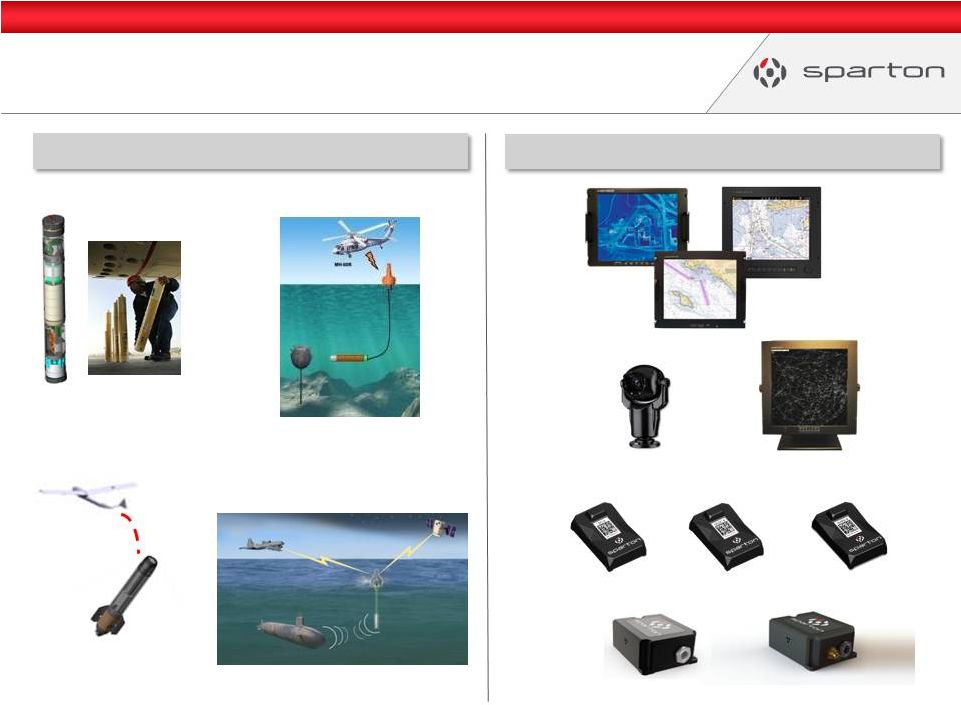

Defense &

Security Systems (DSS) •

Develop, design, and manufacture security products,

primarily anti-submarine warfare detection devices for the

U.S. and other free-world governments

•

Develop and manufacture ruggedized flat-panel monitors

and systems

•

Commercially develop spin-off technology for existing and

alternate markets (Navigation & Exploration)

•

FY2014 Sales: $109 million, consistently profitable business

•

Visible Backlog: $32 million as of 6/30/14

•

Key Customers:

Sonobuoys

Navigation

Sensors

Ruggedized Flat

Panel Displays

11 |

DSS Market

Outlook 12

•

Anti-Submarine Warfare budget line item < $250 mil

•

Budget is a small fraction of the cost of a single ship

•

Continued military actions by North Korea & China should

impact the use of sonobuoys in that region

•

Increased territorial disputes in the Pacific Rim and tensions

in the Middle East continue to drive strong demand from our

foreign customers

•

U.S. Navy plans to buy 117 P-8A aircraft to replace existing

P-3 fleet: operational capability started 2014

•

Indian navy signed a contract for eight P-8I aircraft in

January 2009; full delivery expected by the end of 2015

Limited risk of a negative impact of sonobuoy sales to the

U.S. Navy if sequestration occurs

Foreign sales are still somewhat unpredictable

The Boeing P-8 Poseidon aircraft to become the new

launch vehicle for sonobuoys

Won new 5-year Indefinite Delivery Indefinite Quantity

(ID/IQ) contract in July 2014 valued at $810 million; year 1

total spend to be $166 million

•

ERAPSCO joint venture will split revenue 50/50 over the

course of the contract

•

Year 1 split: $91 million to Sparton, $75 million to USSI

$53.7

$40.9

$42.3

$49.3

$53.0

$91.0

0

20

40

60

80

100

120

140

160

180

200

GFY 2008

GFY 2009

GFY 2010

GFY 2011

GFY 2012

GFY 2013

GFY 2014

GFY

2015E

GFY

2016E

GFY

2017E

GFY

2018E

GFY

2019E

GFY

2020E

DoD Estimated ASW Budgets / SPA Historical Spend

Source: Navy Budget (Actual/Estimate)

Navy Spend on Buoys (Actual)

Navy Spend on Buoys (Estimate)

Sparton Awards (Actual)

$5

$6

$10

$11

$11

$8

$10

$11

$11

$12

$12

$13

$13

$-

$2

$4

$6

$8

$10

$12

$14

$16

0

20

40

60

80

100

120

140

FY2008

FY2009

FY2010

FY2011

FY2012

FY2013

FY2014

FY2015E

FY2016E

FY2017E

FY2018E

FY2019E

FY2020E

DSS Engineering Activity

Engineers (FTE)

Engineering

Project

Spend

-

Gov't

&

IR&D

($in

mil)

$31.1 |

Medical

Device •

Design and manufacture medical devices and instruments

for the In Vitro Diagnostics and Therapeutics Device markets

•

Work with OEMs and biomedical companies to interface

their core technology into a complex medical laboratory

instrument or point of care device

•

Manufacturer

of

The

NeuroStar®

TMS

Therapy

System,

the

first and only Transcranial Magnetic Stimulation (TMS)

device cleared by the FDA for the treatment of depression

•

Recurring revenue due to highly regulated medical industry

•

FY2014 Sales: $163 million of consistently profitable

business

•

Visible Backlog: $80 million as of 6/30/14

•

Key Customers:

Analyzers

Neurology

Blood Separation

13 |

Complex

Systems •

Manufacturer of circuit card assemblies and electronic

based box build products primarily for the military and

commercial aerospace markets

•

New prototyping capabilities to shorten development and

introduction lead times for customers

•

Consolidated business from old and inefficient sites to state-

of-the-art and technologically advanced facilities in Florida

and Viet Nam for improved efficiencies and capacity

utilization

•

FY2014 External Sales: $64 million

•

Visible Backlog: $34 million as of 6/30/14

•

Key Customers:

14

Circuit Board Assembly

Sub Assembly

Complete System

Box Build |

Primary Market

Dynamics 15

X

X

X

X

Medical

Industrial &

Instrumentation

Military &

Aerospace

Computer

Automotive

Consumer

Communication

Total Electronics Market from 2013 to 2016 = $1.3 trillion to $1.5 trillion

Total 2013 EMS/ODM Outsourced Market:

$293 billion

2012 –

2016 Projected Outsourcing Growth:

7.9% CAGR

Defense & Security

Navigation & Exploration

Medical

Highly regulated

market (FDA)

High growth

Blue chip customers

New to outsourcing

Contract design, mfg,

and assembly roll-up

opportunity

Highly regulated

market (ITAR,

COMSEC)

Moderate growth

Blue chip customers

Preferred supplier

status

Contract design, mfg,

and assembly roll-up

opportunity

Moderate growth

Blue chip customers

Preferred supplier

status

New to outsourcing

Contract design, mfg,

and assembly roll-up

opportunity

Highest growth sector

No current customers

Volume & commodity

pricing resulting in low

margins

OEMs are experts at

outsourcing

High growth

High volume

production drives

lower margins

Outsourcing mostly in

low cost country

regions

Complexity is general

low

Moderate growth

High volume

production drives

lower margins

Outsourcing mostly in

low cost country

regions

OEMs are experts at

outsourcing

Moderate growth

High volume

production drives

lower margins

Outsourcing mostly in

low cost country

regions

OEMs are experts at

outsourcing

Source:

New Venture Research 2014 Worldwide Report

Growth based on 2012-2013 results.

Market: $16B

Growth:

6.3%

Market: $6B

Growth:

7.8%

Market: $21B

Growth:

4.7%

Market: $11B

Growth:

12.9%

Market: $47B

Growth:

3.8%

Market: $90B

Growth:

6.8%

Market: $101B

Growth:

2.0%

Complex Systems |

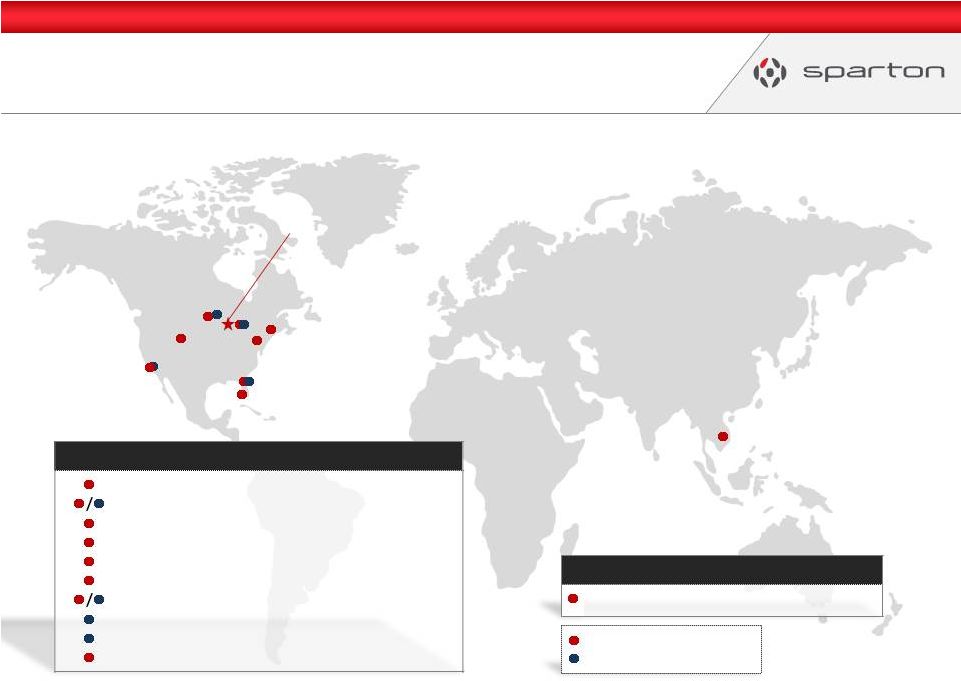

16

World-Class Facilities

Headquarters

Chicago, IL

Frederick, CO –

65,000 sq. ft.

Strongsville, OH –

60,000 sq. ft.

Watertown,

SD –

130,000 sq. ft.

Brooksville, FL -

80,000 sq. ft.

Birdsboro, PA –

42,000 sq. ft.

Plaistow, NH –

20,000 sq. ft.

De Leon Springs, FL –

120,000 ft.²

Plymouth, MN –

10,000 sq. ft.

Irvine, CA (Design Center) -

31,500 sq. ft.

Irvine, CA (Mfg

Center) –

29,000 sq. ft.

Ho Chi Minh City, Viet Nam –

60,000 ft.

2

Manufacturing Facility

Sales & Design

Center

North America

North America

Asia

Asia |

Chris

Ratliff Vice President –

Information Technology

Jake Rost

Vice President –

Business

Development

Senior Management Team

17

Responsible for developing

and implementing the

Company’s strategies,

managing the overall

operations and resources of a

company, and liaison to the

Board of Directors.

Cary Wood

President &

Chief Executive Officer

Don Pearson

Chief Financial Officer

Gordon Madlock

Senior Vice President –

Operations

Mike Osborne

Senior Vice President –

Corporate Development

Steve Korwin

Senior Vice President –

Quality &

Engineering

Larry Brand

Vice President –

Corporate

Human Resources

Drives corporate and business

unit strategic planning and

development, M&A activity,

business development &

customer retention, and

investor relations.

Management of the financial

risks of the corporation

including financial planning

and record-keeping, as well as

financial reporting to higher

management.

Responsible for executing the

strategic plan and overseeing

the day-to-day operations as

well as driving improved

manufacturing quality and

productivity using

contemporary, lean tools.

Leads enterprise-wide quality

and engineering initiatives to

improve business processes

that increase profitability and

sales.

Provides strategic direction

and leadership of the

company’s Information

Technology organization.

Successfully led numerous

enterprise wide

implementations.

Responsible for the business

development and marketing

efforts ensuring best practices

are being standardized and

optimized while continuing to

strengthen our brand image in

the various markets we serve.

Provides strategic leadership

and tactical direction for the

overall Human Resources

function to senior

management and company

leadership teams |

Improved

Corporate Governance 18

Reduced

Board Size

Board size reduced from 11 to 7 members

(6 independent, 1 non-independent)

De-staggered

Board

All directors required a majority vote threshold in order to be elected at

each annual meeting

Implemented

Annual Say-on-Pay

Implemented “say-on-pay”

vote on executive compensation ahead of

requirement

Aligned

Incentive Plans

Established Short Term Incentive Plan based on annual performance

objectives and Long Term Incentive Plan based on long term financial

metrics aligned with shareholder interests

Updated

Governing Documents

Update the Articles of Incorporation, Code of Regulations and

Committee Charters to reflect today’s business environment and

streamlined proxy statement to make it easier to read for investors

|

Performance

Highlights Don Pearson

Chief Financial Officer |

20

32.50

30.00

27.50

25.00

22.50

20.00

17.50

15.00

12.50

10.00

7.50

5.00

2.50

0.00

27%

Net Sales

52%

Adjusted EBITDA

36%

Adjusted EPS

89

89

New Business Programs

3

3

Strategic Acquisitions

2014

2009

Fiscal 2014 Highlights

Year-Over-Year

Increases of: |

Fiscal 2014

Highlights 21

•

Annual revenue growth of 27% to $336 million

•

Annual adjusted EBITDA of $33.3 million or an increase of 52% from the

prior year

•

Organic growth, net of acquisition impacts, was 5%

•

89 new business programs were awarded with potential annualized

sales of $38.8 million

•

Completed three acquisitions

–

Aydin Displays

–

Beckwood Services

–

Aubrey Group |

2014

Consolidated Financial Results 22

2014

2013

2014

2013

Net Sales

$ 336,139

$ 264,627

$ 336,139

$ 264,627

$ 71,512

27%

Gross Profit

64,453

45,435

64,790

46,001

18,789

41%

19.2%

17.2%

19.3%

17.4%

Selling and Administrative Expense

35,698

26,451

35,698

26,451

(9,247)

10.6%

10.0%

10.6%

10.0%

Internal R&D Expense

1,169

1,300

1,169

1,300

131

Amortization of intangible assets

3,287

1,575

3,287

1,575

(1,712)

EPA related - net environmental remediation

4,238

-

-

-

-

Restructuring/impairment charges

188

55

-

-

-

Other operating expense, net

(16)

13

(16)

13

29

Operating Income

19,889

16,041

24,652

16,662

7,990

48%

5.9%

6.1%

7.3%

6.3%

Income Before Provision For Income Tax

19,602

16,172

24,365

16,793

7,572

Provision For Income Taxes

6,615

2,702

8,352

4,976

(3,376)

Net Income

$ 12,987

$ 13,470

$ 16,013

$ 11,817

$ 4,196

36%

3.9%

5.1%

4.8%

4.5%

Income per Share (Basic)

$ 1.28

$ 1.32

$ 1.58

$ 1.16

$ 0.42

36%

Income per Share (Diluted)

$ 1.28

$ 1.32

$ 1.58

$ 1.16

$ 0.42

36%

($ in 000’s, except per share)

(adjusted removes certain gains and charges)

(Reported)

(Adjusted)

Year ended June 30,

Year ended June 30,

Total YoY

Variance ($)

Total YoY

Variance (%)

(Adjusted) |

Adjusted

EBITDA 23

2014

2013

2014

2013

Variance

Net Income

$ 2,971

$ 5,636

$ 12,987

$ 13,470

$ (483)

Interest expense

291

128

838

518

320

Interest income

(7)

(3)

(9)

(102)

93

Provision for income taxes

1,758

1,871

6,615

2,702

3,913

Depreciation and amortization

2,213

1,725

8,123

4,761

3,362

Restructuring/impairment charges

-

55

188

55

133

EPA

related -

net

environmental

remediation

4,238

-

4,238

-

4,238

Capitalized profit in inventory from acquisition

81

-

337

566

(229)

Adjusted EBITDA

$ 11,545

$ 9,412

$ 33,317

$ 21,970

$ 11,347

12.4%

11.6%

9.9%

8.3%

3 months ended June 30,

Year ended June 30, |

Liquidity &

Capital Resources ($ in '000)

Jun-13

Sep-13

Dec-13

Mar-14

Jun-14

Cash and equivalents

6,085

2,719

1,009

7,502

8,028

LOC Availability

55,000

36,000

40,000

30,000

59,000

Total

61,085

38,719

41,009

37,502

67,028

($ in '000)

Jun-13

Sep-13

Dec-13

Mar-14

Jun-14

Credit Revolver

10,000

28,500

25,000

35,000

41,000

IRB (Ohio)

1,539

1,506

1,472

1,437

-

Total

11,539

30,006

26,472

36,437

41,000

($ in '000)

Jun-13

Sep-13

Dec-13

Mar-14

Jun-14

Net Inventory

46,334

55,658

52,393

51,466

53,372

Cash Availability

Debt

Inventory

24 |

Shifting Sales

Mix To Higher Margin Business 25

FY2014

(Revenue of $336 million)

FY2009

(Revenue of $221 million)

FY2014

(Revenue of $336 million)

Medical

29%

DSS

19%

EMS

52%

Reporting Segments

Markets

Medical

48%

DSS

32%

Complex

Systems

19%

Industrial

11%

Medical

46%

MilAero

43% |

Target Gross

Margin by Segment by Year FY 2010

FY 2011

FY 2012

FY 2013

FY 2014

FY 2015

DSS

15%-18%

20%-25%

20%-25%

20%-25%

20%-25%

25%-30%

Medical

13%-16%

13%-16%

13%-16%

13%-16%

13%-16%

13%-16%

Complex Systems

3%-6%

5%-8%

7%-10%

7%-10%

9%-12%

9%-12%

Improving Gross Margin Performance

26

Target Gross Margins:

•

•

•

DSS guided upward to 25%-30% for FY 2015

Medical has been maintained at 13-16%

Complex Systems improved steadily from 3%-6% in FY 2010 to 9%-12% FY

2014-15 |

Backlog

27

Backlog is defined as firm purchase orders with product not yet shipped. Customer

forecasts are not taken into consideration.

Estimated increase in FY2015 Q1 is a result of Sparton’s $91 million portion of the $166

million ERAPSCO year 1 sonobuoy order.

0

50

100

150

200

250

300

* Estimate |

2015 Strategy

Summary 28

Fiscal 2014 Results:

27% revenue growth, including 5% organic growth in the legacy business

52% adjusted EBITDA growth

36% adjusted earnings per share growth

Supported by market research

& go-to-market programs

New Programs

New Customers

Potential Annualized Revenue

17.7

$

23.8

$

39.4

$

38.8

$

Aubrey Group

GEDC-6

Fiscal 2012

AHRS-8

Temperature compensated attitude heading reference system

Fiscal 2014

Aydin

Various new ruggedized displays

IMU-10

Harsh environment inertial sensing system

26

40

71

89

11

PHOD-1

Aydin Displays

Beckwood Services

Fiscal 2013

Onyx EMS

Creonix

Internal Research & Development

Fiscal 2011

Gyro-enhanced digital compass

Hydrophone

Fiscal 2015

eMT

Fiscal 2014

FY11

FY12

FY13

FY14

20

12

26

Acquisitions

New Business Awards

Delphi Medical

Byers Peak

Fiscal 2011 |

2015 Vision

Update Cary Wood

President & CEO |

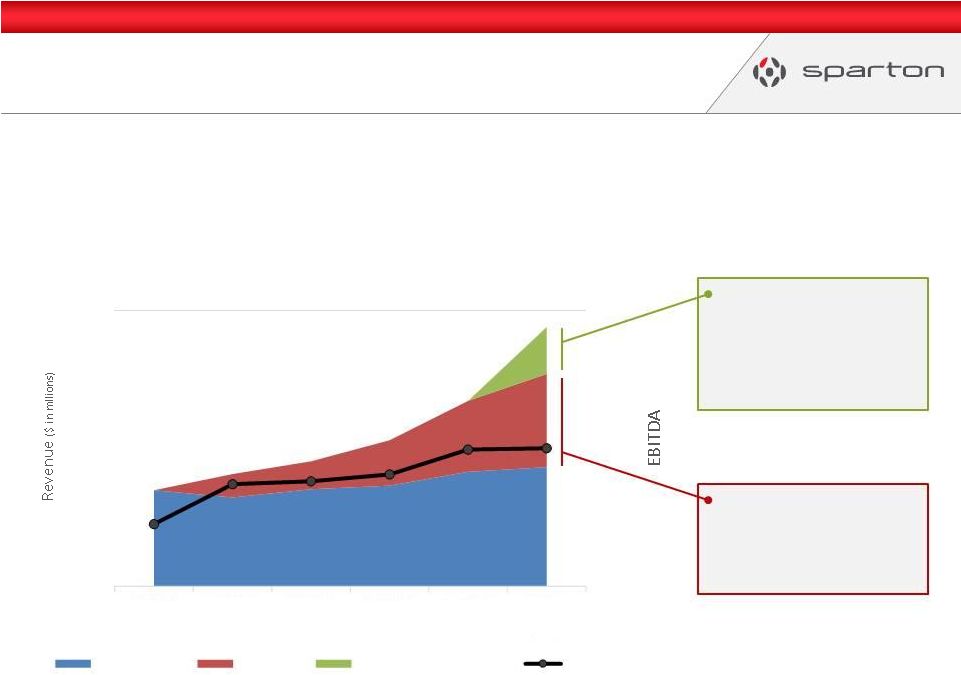

2015 Vision

Update 30

$380-400 million; full

effect of completed

acquisitions + organic

growth

$460-480 million run

rate with full effect of

completed acquisitions +

organic growth + 2015

potential acquisitions

0%

10%

20%

500

FY2010

FY2011

FY2012

FY2013

FY2014

FY2015

(est.)

Legacy Revenue

Acquisitions

2015 Potential Acquisitions

EBITDA (as %)

2015 Vision:

Sparton will become a $500 million revenue entity by attaining key market

positions in our primary lines of business and through complementary and

compatible acquisitions and will consistently rank in the top half of our peer

group in return on shareholder equity and return on net assets.

- |

2020

Vision |

Today

•

Sparton has a strong foundation in engineered

products and is a trusted contract manufacturing

partner

•

We have achieved success in the medical and

mil/aero segments by meeting technical

requirements and clearing compliance hurdles

•

We are very good at managing and improving the

performance of manufacturing operations with a

track record to prove it

•

But…we currently control a limited amount of IP

and other differentiated content

32 |

Landscape of

Business Models 33

Engineered Components & Products

Manufacturing & Design Services

Small, Regional Design Engineering

& Contract Manufacturing Firms

“Area of Margin Expansion”

OEMs

OEMs

IDEX

IDEX

Flextronics

Flextronics

Sanmina

Sanmina

Benchmark

Benchmark

Plexus

Plexus

Barco

Barco

Ultra

Ultra

[USSI]

[USSI] |

Going

Forward… By 2020 Sparton will achieve significant growth (revenue in excess of $1

billion) and increased profitability (EBITDA at or above 12%)

Three strategies will be executed to achieve the Vision:

34

Assess

Assess

SBS

Optimize

Optimize

Standardize

Standardize

Track

Track

I.

Maintain focus on regulated and demanding environments

II.

Pivot our business model to include a higher concentration of differentiated offerings

III.

Apply the Sparton Business System (SBS) to unlock value |

Expanding Our

Offerings: 2020 Vision 35

Engineered Components & Products

Manufacturing & Design Services

Plexus

Plexus

Benchmark

Benchmark

Sanmina

Sanmina

Small, Regional Design Engineering

& Contract Manufacturing Firms

OEMs

Ultra

Ultra

[USSI]

[USSI]

“Area of Margin Expansion”

Barco

Barco

OEMs

Flextronics

Flextronics

IDEX

IDEX |

36

“Reach $1 billion by 2020,

expanding our manufacturing and

design services while providing

more engineered components and

products to meet the needs of our

customers and markets” |

Mission &

2020 Vision 37

Mission:

Sparton provides engineered products and related

services to businesses, governments, and institutions

serving regulated and demanding environments.

2020 Vision:

Sparton will exceed $1 billion of revenue by fiscal year

2020 and deliver above average shareholder returns by

significantly expanding our differentiated product and

service offerings and applying our business systems,

resources, and talents to address the unique needs of

our customers and markets. |

38

Our Values |

$200

$400

$600

$800

$1,000

$1,200

Revenue Bridge: Fiscals 2014 to 2020

39

FY 2014

$336 mil

Manufacturing & Design

Services Expansion

Acquisitions

Organic

Growth

Engineered Components

& Products Expansion

Acquisitions

Organic

Growth

2020

Vision

$1 billion

Based on our analysis, growth to $1 billion will not

require a debt or equity offering: Net Debt to

EBITDA leverage peaks at 2.6x in 2019

FY 2015

$380-$400 |

Organizational

Alignment Our goals as we evolve our structure

1.

Provide a flexible and evolutionary structure to enable scalability given

the organization’s projected future growth

2.

Leverage operational and administrative strength in the M&A process to

enhance due diligence and integration

3.

Address the leadership required to create and implement the Sparton

Business System

4.

Evolve into two operating groups with the ability to flex the

organizational design based upon pace and focus of Vision

2020 strategy

•

Manufacturing & Design Services

•

Engineered Components & Products

40 |

Operating Group

Vice Presidents Jamie Shaddix

Group Vice President

Manufacturing & Design Services

Mike Gaul

Group Vice President

Manufacturing & Design Services

Jim Lackemacher

Group Vice President

Engineered Components & Products

Oversight of a significant portion

of the Company’s manufacturing

& design service locations

including operations,

engineering, quality and supply

chain strategies and activities.

Oversight of a significant portion

of the Company’s manufacturing

& design service locations

including operations,

engineering, quality and supply

chain strategies and activities.

Oversight of the Company’s

engineered products segment

providing multiple products into

the defense and commercial

channels.

Group Vice President positions were created in January 2014, staffed with internal

resources 41 |

Evolving Our

Financial Reporting A.

As our strategy evolves, we will reconfigure our reporting internally and

manage the businesses along two lines:

•

Manufacturing & Design Services

•

Engineered Components & Products

B.

Therefore, the SEC segment reporting requirements will necessitate a

reporting change as reporting must align with how we manage the

business

C.

Proposed structure is detailed on the following slide

42 |

Revenue

Reporting: Fiscals 2012 to 2014 •

Revenue figures above are net sales

•

Manufacturing & Design Services consists of Medical and Complex

Systems

•

Engineered Components & Products consists of DSS and Aydin

Legacy

Beginning

Q1 FY 2015

Reporting Segments

FY2012

FY2013

FY2014

Medical

110,894

146,873

162,648

Complex Systems

38,581

42,324

64,357

DSS

76,980

75,430

109,134

Totals

226,455

264,627

336,139

Manufacturing & Design Services

149,475

189,197

227,005

Engineered Components & Products

76,980

75,430

109,134

Totals

226,455

264,627

336,139

Revenue (Net Sales)

43 |

Shifting Revenue

Mix 44

FY

2014

2020 Vision |

Shifting

End-Market Mix 45

FY 2014

2020 Vision |

Strategies

& Key Imperatives Mike Osborne

Senior Vice President –

Corporate Development

46 |

Our

Strategies Differentiated

Products &

Services

Sparton

Business

System

Regulated &

Demanding

Environments

Vision

2020

47 |

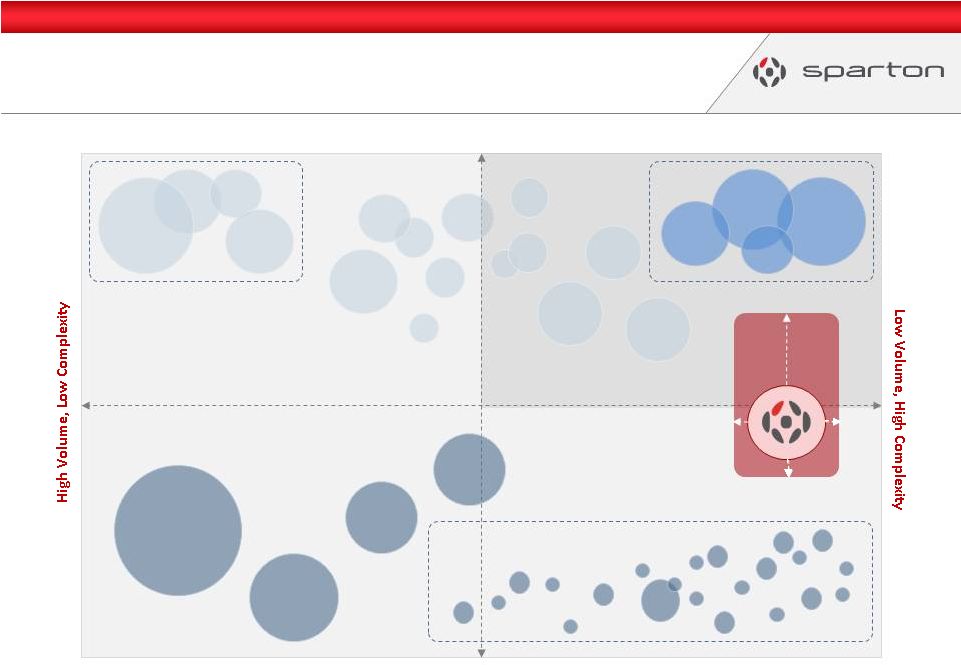

Regulated &

Demanding Environments Strategy I:

Maintain focus on regulated and demanding environments

A.

Continue to scale in medical & mil/aero

B.

Target low-volume, high-mix needs in demanding segments of the

commercial and industrial markets

C.

Grow contract manufacturing services at acceptable margins

48 |

“Regulated

and Demanding” A.

Regulated and demanding environments require specialized solutions that comply

with standards or that deliver one or more performance attributes that cannot be

found in traditional commercial off-the-shelf products

B.

Offerings for these environments may be fully custom solutions or highly modified

versions of standard offerings; in either case, they are inherently differentiated from

existing, mainstream alternatives

49

Regulated Environments

Monitored by a government-appointed body

•

Aerospace & Commercial Aviation

•

Defense

•

Healthcare / Biotechnology

•

Utilities & Energy

•

Telecommunications Infrastructure

Demanding Environments

Governed by industry standards or specific,

market-driven requirements

•

Automation & Precision Motion Control

•

Food Processing

•

Mining & Drilling

•

Security & Fire Control

•

Unmanned Vehicles |

50

Geographic Expansion

Facilities Strategy

•

Rationalize and optimize utilization of manufacturing facilities

•

Establish a network of strategically-located sales & design centers

Manufacturing Facility

Sales & Design Center

= Priority regions |

Pivot the

Business Model Strategy II:

Pivot the business model to include a higher concentration of

differentiated offerings

A.

Acquire and grow engineered component & product companies

B.

Expand the breadth and depth of design & engineering services;

promote & grow offerings

C.

Expand U.S. footprint to cover major product development corridors

51 |

“Differentiated Offerings”

52

Differentiated (or Engineered) Components and

Products are “sticky”

due to one or more of:

Differentiated Services require specialized

skills and/or intimate knowledge of markets

or applications and may include:

Differentiated products and services as those generally available from a limited number of

suppliers and not easily substituted.

Engineered components and products may

include raw materials, components, sub-

assemblies, and finished goods.

•

Proprietary design

•

Proprietary materials

•

Form factor

•

Build quality

•

Performance & reliability

•

Energy consumption

•

Life span

•

Sales, marketing, & distribution support

Sparton’s breadth of service offerings and

depth of experience with regulated and

demanding environments are differentiators.

•

Product design and engineering

•

Software and application design

•

Rapid prototyping

•

Contract manufacturing

•

Testing, regulatory, & compliance

•

Field service |

Value Chain

Expansion 53

Engineered

Components

Wiring Harness

& Cables

Circuit Card

Assembly

Sub-Assemblies

Box Build

Complete

Systems

Expanding internal engineering capability (product development, design,

and systems integration) enhances and supports the entire value stream.

|

Value Chain

Expansion – Medical Example

54

Microfluidic

Valves

Displays

Pumps

Wiring

Harnesses

Electronic

Circuit Cards

Acquire engineered component & product companies, optimize and scale

|

Value Chain

Expansion – Mil/Aero Example

55

RF Receivers

Ruggedized

Displays

Sensors

Electronic

Circuit Cards

Acquire engineered component & product companies, optimize and scale

|

Value Chain

Expansion – R&D

56

Government Funded R&D

Sonobuoys

Payload Delivery

Undersea Communication

Remote Mine-hunting

DC-4E

GEDC-6E

AHRS-8

IMU-10

GAINS-10

Displays

& Cameras

Civil Marine

Rugged

Cameras

Military

Industrial

Air Traffic

Control

Inertial Sensors

Internally Funded R&D |

Sparton Business

System Strategy III:

Apply the Sparton Business System (SBS) to unlock value

A.

Expand the Sparton Production System to more comprehensive business

system, including acquired tools, practices, and resources

B.

Deploy best practice processes & analytical tools

C.

Provide access to financial resources & human capital

57 |

Sparton Business

System (SBS) Overview SBS is Sparton’s proprietary engine for

value creation, with applications that:

•

Reduce cost

•

Improve efficiency

•

Ensure quality

•

Foster innovation

•

Support growth

•

Enable a predictable performance path

The Sparton Business System (SBS) is a proprietary set of practices, tools and

principles which are strategically applied to core business processes to drive

performance excellence across the enterprise.

58

Assess

SBS

Optimize

Standardize

Track |

FY 2015 Key

Imperatives 59

A.

Deliver sustainable, profitable growth

Evaluate, prioritize and pursue attractive opportunities for acquisitions, new business

development, program expansion and internal R&D to deliver 15-20% annual

growth. B.

Advance an engaged, performance-driven culture

Attract, retain, and develop resources at all levels in the organization; motivate and

empower our people and teams to continuously expand capabilities & improve

performance. C.

Enrich our innovation capabilities

Establish clear innovation objectives, foster applied creativity, develop, and acquire talent

in a full range of design, engineering, product development, and commercialization

disciplines. D.

Maximize our customer relationships

Engage customers to understand business / program goals, identify needs, and pursue

mutually-beneficial opportunities to deepen the relationship.

E.

Deploy the Sparton Business System

Develop and optimize a comprehensive set of best practices, deploy processes and tools, and

provide accesses to resources to unlock value across the enterprise.

|

Closing

Remarks Cary Wood, President & CEO |

Key

Messages 61

Proven &

Experienced

Management Team

Diversified

Revenue

Mix

Strong Free Cash

Flow Generation &

Financial Condition

Highly Skilled &

Industry Leading

Manufacturing

Capabilities

Established,

Longstanding

Customer

Relationships

Attractive Platform

for Growth |

Mission, Vision

& Strategies 62

“Reach

$1

billion

by

2020,

expanding

our

manufacturing

and

design

services

while

providing

more

engineered components and products to meet the needs of our customers and markets”

Mission:

Sparton provides engineered products and related services

to businesses, governments, and institutions

serving regulated and demanding environments.

Vision:

Sparton will exceed $1 billion of revenue by fiscal year 2020 and deliver above average

shareholder returns by significantly expanding our differentiated product and service

offerings and applying our business systems, resources, and talents to address

the unique needs of our customers and markets.

Strategy I:

Maintain focus on regulated

& demanding environments

Strategy II:

Pivot the business model to

include a higher

concentration of

differentiated offerings

Strategy III:

Apply the Sparton Business

System (SBS) to unlock value |

Why is this the

right direction? We have a strong foundation in engineered products and are a trusted

contract manufacturing partner

We are very good at fixing manufacturing operations; most of our

improvement

efforts flow through as cost savings for our customers

We have a track record of success in the medical and mil/aero segments; we can

leverage those strengths to capture more of the value chain via product

companies serving regulated and demanding environments

We have a strong foundation of design and engineering resources;

expanding

those offerings will help us capture more of the value chain

Expanding our proprietary Sparton Production System to a more comprehensive

Business System will allow us to build out a wider set of best practices, tools,

and resources

63 |

64

“Reach $1 billion by 2020,

expanding our manufacturing and

design services while providing

more engineered components and

products to meet the needs of our

customers and markets” |

Question

& Answer 65 |