Attached files

| file | filename |

|---|---|

| EX-23.10 - EX-23.10 - Fortress Transportation & Infrastructure Investors LLC | d616610dex2310.htm |

| EX-23.3 - EX-23.3 - Fortress Transportation & Infrastructure Investors LLC | d616610dex233.htm |

| EX-23.11 - EX-23.11 - Fortress Transportation & Infrastructure Investors LLC | d616610dex2311.htm |

| EX-23.4 - EX-23.4 - Fortress Transportation & Infrastructure Investors LLC | d616610dex234.htm |

| EX-23.2 - EX-23.2 - Fortress Transportation & Infrastructure Investors LLC | d616610dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on October 8, 2014

Registration No. 333-193182

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Amendment No. 2

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Fortress Transportation and Infrastructure Investors LLC

(Exact name of registrant as specified in its charter)

| Delaware | 6141 | 32-0434238 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

1345 Avenue of the Americas, 46th Floor

New York, New York 10105

(212) 798-6100

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Cameron D. MacDougall

1345 Avenue of the Americas, 46th Floor

New York, New York 10105

(212) 798-6100

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| Richard B. Aftanas Joseph A. Coco Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, New York 10036-6522 (212) 735-3000 |

William M. Hartnett Helene R. Banks Cahill Gordon & Reindel LLP Eighty Pine Street New York, New York 10005-1702 (212) 701-3000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities To Be Registered |

Proposed Maximum Aggregate Offering Price (1) |

Amount Of Registration Fee | ||

| Common Shares, representing limited liability company interests |

$100,000,000 | (2) | ||

|

| ||||

| (1) | Estimated solely for the purpose of computing the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | The registration fee for the offering was previously paid in connection with the filing of the Registration Statement on Form S-1 with the SEC on January 3, 2014 (File No. 333-193182), to which this Registration Statement is Amendment No. 2. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 8, 2014

PRELIMINARY PROSPECTUS

Fortress Transportation and Infrastructure Investors LLC

Common Shares

Representing Limited Liability Company Interests

This is an initial public offering of common shares representing limited liability company interests of Fortress Transportation and Infrastructure Investors LLC. We are selling of our common shares. After this offering, we will be externally managed by FIG LLC, which is an affiliate of Fortress Investment Group LLC (“Fortress”). Pursuant to the terms of a Management Agreement we have entered into in connection with this offering, FIG LLC, as our Manager, will be responsible for the day-to-day management of our operations, including sourcing, analyzing and executing on asset acquisitions and sales in accordance with our board-approved criteria. See “Our Management Agreement and Other Compensation Arrangements.”

We expect the public offering price to be between $ and $ per share. Currently, no public market exists for the shares. We have been approved to list our common shares on the New York Stock Exchange (“NYSE”) under the symbol “FTAI.” We will be treated, for U.S. federal income tax purposes, as a partnership and not as an association or a publicly traded partnership taxable as a corporation. See “Certain United States Federal Tax Considerations—Taxation of FTAI.”

We are an “emerging growth company” as defined under applicable Federal securities laws and have elected to utilize reduced public company reporting requirements. See “Risk Factors—We are an emerging growth company within the meaning of the Securities Act, and due to our taking advantage of certain exemptions from various reporting requirements applicable to emerging growth companies, our common shares could be less attractive to investors.”

Investing in our common shares involves risks. See “Risk Factors” beginning on page 25 to read about certain factors you should consider before buying our common shares.

| Per Share |

Total | |||||||

| Public Offering Price |

$ | $ | ||||||

| Underwriting Discount(1) |

$ | $ | ||||||

| Proceeds Before Expenses to Us |

$ | $ | ||||||

| (1) | We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See “Underwriting.” |

We have granted the underwriters the right for up to 30 days following this offering to purchase up to additional common shares, at the public offering price, less the underwriting discount.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the common shares against payment on or about , 2014.

| Barclays | Deutsche Bank Securities |

The date of this prospectus is , 2014.

Table of Contents

| 1 | ||||

| 25 | ||||

| 50 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 56 | ||||

| 57 | ||||

| 59 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

75 | |||

| 103 | ||||

| 113 | ||||

| OUR MANAGER AND MANAGEMENT AGREEMENT AND OTHER COMPENSATION ARRANGEMENTS |

129 | |||

| 135 | ||||

| 140 | ||||

| 141 | ||||

| 142 | ||||

| CERTAIN PROVISIONS OF DELAWARE LAW AND OUR OPERATING AGREEMENT |

144 | |||

| 150 | ||||

| 152 | ||||

| 168 | ||||

| 173 | ||||

| 173 | ||||

| 173 | ||||

| 174 | ||||

| F-1 |

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by us or on our behalf that we have referred you to. We and the underwriters have not authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We are not making an offer of these securities in any state, country or other jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus or any free writing prospectus is accurate as of any date other than the date of the applicable document regardless of its time of delivery or the time of any sales of our common shares. Our business, financial condition, results of operations or cash flows may have changed since the date of the applicable document.

Until , 2014 (25 days after the date of this prospectus), all dealers that buy, sell or trade our common shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to each dealer’s obligation to deliver a prospectus when acting as underwriter and with respect to its unsold allotments or subscriptions.

Table of Contents

This summary highlights information contained elsewhere in this prospectus. It may not contain all the information that may be important to you. You should read this entire prospectus carefully, including the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes included elsewhere in this prospectus, before making a decision to purchase our common shares. Some information in this prospectus contains forward-looking statements. See “Forward-Looking Statements.”

Fortress Transportation and Infrastructure Investors LLC (the “Issuer”) is a Delaware limited liability company. Unless the context suggests otherwise, references in this prospectus to “FTAI,” the “Company,” “we,” “us,” and “our” refer to the Issuer and its consolidated subsidiaries, including Fortress Worldwide Transportation and Infrastructure General Partnership (“the Partnership”). References in this prospectus to the “General Partner” refer to Fortress Worldwide Transportation and Infrastructure Master GP LLC, the general partner of the Partnership. References in this prospectus to “Fortress” refer to Fortress Investment Group LLC. References in this prospectus to our “Manager” refer to FIG LLC, our Manager and an affiliate of Fortress. All amounts in this prospectus are expressed in U.S. dollars, except where noted, and the financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”).

Our Company

We own and acquire high quality infrastructure and equipment that is essential for the transportation of goods and people globally. We currently invest across four market sectors: rail, aviation, offshore energy and intermodal transport. We target assets that, on a combined basis, generate strong cash flows with the potential for earnings growth and asset appreciation. We believe that there are a large number of acquisition opportunities in our target sectors and that our Manager’s expertise and business and financing relationships, together with our access to capital, will allow us to take advantage of these opportunities. We are externally managed by FIG LLC, an affiliate of Fortress, which has a dedicated team of professionals who collectively have acquired over $16 billion in transportation-related assets since 2002. As of June 30, 2014, we had total consolidated assets of $457.1 million and total equity capital of $346.6 million. We intend to pay regular quarterly dividends from cash available for distribution.

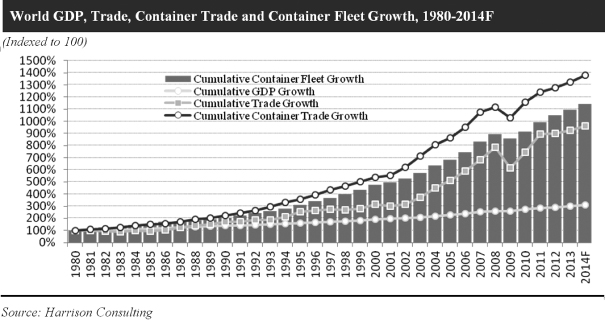

We believe that market developments around the world are generating significant opportunities for the acquisition of infrastructure and equipment essential to the transportation industry. Global trade growth has consistently outpaced global GDP growth over the last three decades and has fueled a large and growing demand for both cargo and passenger-related transportation infrastructure and equipment. At the same time, significant market dislocations, like the current transformation of the U.S. energy industry, are providing tremendous new investment opportunities. Traditional capital providers such as governments and European banks are not keeping pace with the need for long-term capital to support the industry, and we believe this shortage will continue for years to come. We believe that these factors will enable us to acquire attractive assets and continue to grow our business.

Our operations consist of two primary strategic business units—Infrastructure and Equipment Leasing. Our Infrastructure business acquires long-life assets or operating businesses that provide mission-critical services or functions to transportation networks and typically have high barriers to entry, strong margins, stable cash flows and upside from earnings growth and asset appreciation driven by increased use and inflation. Our Equipment Leasing business acquires assets that are designed to carry cargo or people or provide functionality to transportation infrastructure. Transportation equipment is typically long-lived, moveable and leased by us to companies that provide transportation services on either operating leases or finance leases. Our leases generally

1

Table of Contents

provide for long-term contractual cash flow at high cash-on-cash yields and may include structural protections to mitigate credit risk.

Our goal is to increase our earnings and cash flows by acquiring a diverse mix of transportation infrastructure and equipment that combine to deliver significant cash flow and upside potential from earnings growth and asset appreciation. We target sectors that we believe enjoy strong long-term growth potential and proactively seek investment opportunities within those sectors that we believe have the best risk-adjusted return potential. We take an opportunistic approach—targeting assets that are distressed or undervalued, or where we believe we can add value through active management, without heavy reliance on the use of financial leverage to generate returns. We also seek to develop incremental opportunities to deploy capital through follow-on investments in our existing assets. As of June 30, 2014, our leverage on a weighted basis across our existing portfolio is approximately 18% of our total capital. While leverage on any individual asset may vary, we target overall leverage for our assets on a consolidated basis of no greater than 50% of our total capital.

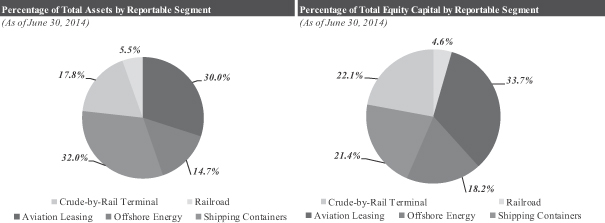

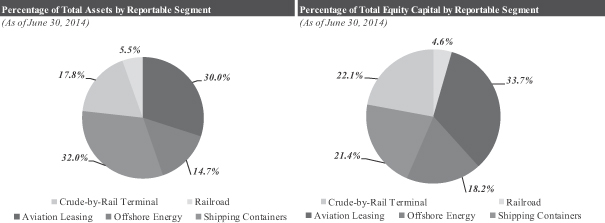

The charts below illustrate our existing assets, and our equity deployed in acquiring these assets separated by reporting segment as of June 30, 2014.

| (1) | Excludes $50.1 million of assets and $45.6 million of equity reflected in our corporate operating segment. |

2

Table of Contents

Market Opportunity

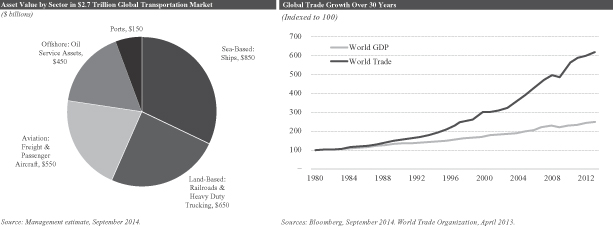

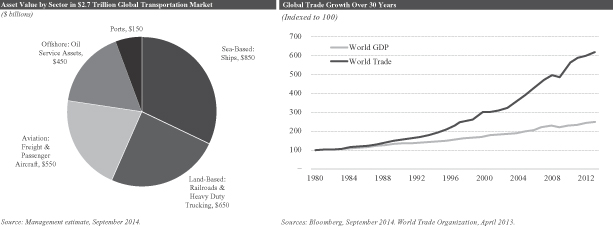

We believe that market developments around the world are generating significant opportunities for the acquisition of infrastructure and equipment essential to the transportation industry. We estimate the total market for transportation-related infrastructure and equipment to be approximately $2.7 trillion, and we believe that demand for such assets will continue to grow given their critical role in the movement of goods and people globally. According to a report by the McKinsey Global Institute, approximately $7.2 trillion of global infrastructure investment will be needed in our target sectors between now and 2030. We expect this capital investment need to be driven by a number of factors, including global trade growth—which has, on average, doubled the rate of GDP growth over the past 30 years—and an emerging middle class in major markets around the world. The charts below illustrate the value of transportation infrastructure and equipment by sector as well as historical global trade growth.

In North America, the need for significant new capital investment is also being driven by the dramatic growth in oil and gas production, often referred to as the “shale revolution.” According to the U.S. Energy Information Administration, the United States now tops Saudi Arabia and Russia as the largest oil producer in the world. Over the past four years, U.S. and Canadian oil production has grown by approximately 50%, from 8 million barrels per day (b/d) in 2010 to an estimated 12 million b/d in 2014. The United States is also the largest natural gas producer in the world—with record volumes driven by an approximate 800% increase in shale gas production over the last five years. To support the flow of oil and gas production from U.S. fields, industry experts estimate that $641 billion in new infrastructure will be needed over the next two decades, with much of that investment required during the next six years. We expect opportunities in this sector to include investments in terminals to handle the loading and unloading of crude-by-rail trains as well as new tank cars to safely handle the growth in volumes shipped. The Association of American Railroads (“AAR”) estimates that crude oil originated carloads on U.S. Class 1 railroads increased thirteen-fold from 29.6 thousand carloads in 2010 to 400.0 thousand in 2013. Currently, almost 11% of all U.S. domestic crude oil—or approximately 940,000 barrels per day—is transported by rail, and this trend is expected to continue, driving renewed investment in the U.S. rail and energy infrastructure networks and equipment.

As the demand for infrastructure and related equipment continues to grow, we believe that traditional providers of capital for transportation projects and equipment—including many governments and European banks—are failing to keep pace, particularly in the wake of the 2008-2009 financial crisis and changes to the banking regulatory landscape. European banks, for example, were the dominant financing providers in the world’s transportation markets, accounting for over 50% of total transportation lending in 2006; by 2013, they

3

Table of Contents

accounted for only 36%, according to Bloomberg. We believe that this funding gap has led operators to rely more heavily on third parties like us to finance and own transportation infrastructure and equipment on their behalf.

We believe that these funding shortages are likely to continue, and will be particularly acute for small and midsized projects as well as projects with unique characteristics that do not fit easily within pre-established financing criteria. We believe that the supply-demand imbalance for capital to fund essential infrastructure and equipment will lead to additional opportunities for us to acquire and operate assets on compelling terms, and that our access to capital and our Manager’s expertise and business and financing relationships position us well to take advantage of those opportunities. If we are able to continue to acquire assets on the basis that we have thus far, we believe that we will be well-positioned to grow our earnings and our cash flow available for dividends.

Our Strategy

We invest across a number of major sectors within the transportation industry, including rail, aviation, offshore energy, and intermodal transport, and we may pursue acquisitions in other areas as and when they arise in the future. In general, we seek to own high quality infrastructure and equipment within our target sectors that generate predictable cash flows, in markets that we believe provide the potential for strong long-term growth and attractive returns on deployed capital. We believe that by investing in a diverse mix of assets across sectors, we can select from among the best risk-adjusted investment opportunities, while avoiding overconcentration in any one segment. We target IRRs of 15% to 25% with the use of what we believe to be reasonable leverage. From our inception in June 2011 to June 30, 2014, the IRR for our assets (calculated before overhead expenses, transaction expenses of our rail-related investments and before any management fee or incentive allocation) was 19.7%.

We take a proactive investment approach—identifying key secular trends as they emerge within our target sectors and then pursuing what we believe are the most compelling opportunities within those sectors. We look for unique investments, including assets that are distressed or undervalued, or where we believe that we can add value through active management. We consider investments across the size spectrum, including smaller opportunities often overlooked by other investors, particularly where we believe we may be able to grow the investment over time. We believe one of our strengths is our ability to create attractive follow-on investment opportunities and deploy incremental capital within our existing portfolio.

Within each sector, we consider investments in operating infrastructure as well as in equipment that we lease to operators. Within the rail sector, for example, we target rail lines and rail terminals (which we classify as infrastructure) as well as railcars (which on a stand-alone basis we classify as leasing equipment). We believe that as owners of both infrastructure and equipment assets, we have access to more opportunities and can be a more attractive counterparty to the users of our assets. Our Manager has significant prior experience in all of our target sectors, as well as a network of industry relationships, that we believe positions us well to make successful acquisitions and to actively manage and improve operations and cash flow of our existing and newly-acquired assets. These relationships include senior executives at lessors and operators, end users of transportation and infrastructure assets, as well as banks, lenders and other asset owners.

Market Sectors

Rail

The North American economy relies on an extensive network of railroads to transport raw materials such as petroleum, coal, ores, aggregates, lumber and grain as well as finished goods such as food products, paper products, automobiles and machinery. Railroads represent the largest component of North America’s freight transportation industry, carrying more freight than any other mode of transportation on a ton-mile basis. With a network of over 140,000 miles of track (in the United States and Canada), railroads link businesses with each

4

Table of Contents

other domestically and with international markets through connections with ports and other international terminals. Unlike other modes of transportation, such as trucking (which uses highways, toll roads, etc.) and shipping companies (that utilize ports), railroad operators generally own or lease their infrastructure of track, land and rail yards. This rail infrastructure, most of which was originally established over 100 years ago, represents a limited supply of assets and a difficult-to-replicate network. According to the AAR, there were 574 freight railroads in the United States as of December 31, 2013.

The North American railroad industry has increased its share of freight ton-miles compared to other forms of freight transportation over the past quarter-century. Since de-regulation in 1980, the railroad industry has continually improved its overall productivity and cost structure compared to other forms of freight transportation as it consumes less fuel and has lower labor costs per ton transported than other forms of freight transportation. According to the AAR, railroads are estimated to be approximately four times more fuel efficient than truck transportation and a single train can haul the equivalent of up to approximately 280 trucks. In 1980, one gallon of diesel fuel moved one ton of freight by rail an average of 235 miles, versus 2012 where the equivalent gallon of fuel moved one ton of freight an average of 476 miles by rail—representing a 103% increase over 1980. As a result of these cost advantages as well as increased highway congestion, the railroad industry’s share of U.S. freight ton-miles has steadily increased from 30% in 1980 to 40% in 2009.

Recently, owners and operators of strategically-located rail assets have participated in the significant growth of the North American energy sector by transporting petroleum and natural gas products both for refining and export. Since 2009, volumes of “crude-by-rail” have increased by more than 40 times, from 22,000 barrels per day to approximately 940,000 barrels per day currently. This increase has been driven by dramatic growth in U.S. and Canadian crude oil production, which is expected to continue over the next ten to twenty years as hydraulic fracking technologies continue to be utilized and improved. The surge in production has put pressure on existing pipeline infrastructure, driving shippers to seek alternative forms of transportation. Crude-by-rail offers shippers purity of product and a cost-competitive, faster and more flexible route to market than traditional pipelines.

In addition to operating railroads and rail-related infrastructure such as terminals, the North American rail market includes rail equipment such as railcars and locomotives. According to publicly available sources, there are approximately 1.5 million railcars currently in operation in North America. Approximately 80% of these railcars are leased to railroads and shipping companies, most under multi-year contracts. Monthly rates for tank cars, which are used in the crude-by-rail market, have increased 300%-400% since early 2011.

We believe that demand for rail related infrastructure and equipment in North America will continue to grow due to the cost-efficient nature of rail. We believe that growing market demand, together with the capital intensive nature of the sector and our Manager’s expertise will enable us to make acquisitions and grow our exposure to the rail sector. As of , 2014, we own one short-line railroad, one crude-by-rail terminal in Beaumont, Texas, and 300 tank railcars.

Aviation

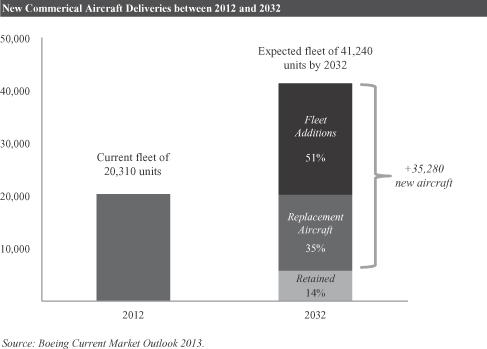

According to International Air Transport Association (the “IATA”), global demand for passenger traffic has grown at an average annual rate of 5.1% over the past two decades, outpacing global GDP of 3.7% in the same period. According to The Boeing Company’s (“Boeing”) 2013 Commercial Market Outlook, this growth is expected to continue, rising at an average annual rate of 5% per annum over next two decades. This projected increase in air travel presents an attractive opportunity for the private sector to invest in airports and aviation-related leasing equipment such as airplanes and engines. Airports are mission-critical infrastructure for global businesses and leisure travelers. There are over 42,000 airports globally, handling over 5.5 billion passengers and generating over $120 billion in revenue annually. Airports are long-lived assets with limited competition due to significant barriers to entry. Typically, private investments in airports are structured as a concession where the

5

Table of Contents

private investor receives the right to operate and collect income from the airport for a defined time period, with ownership being retained by governmental entities. Airports tend to generate significant cash flows with minimal maintenance capital expenditures.

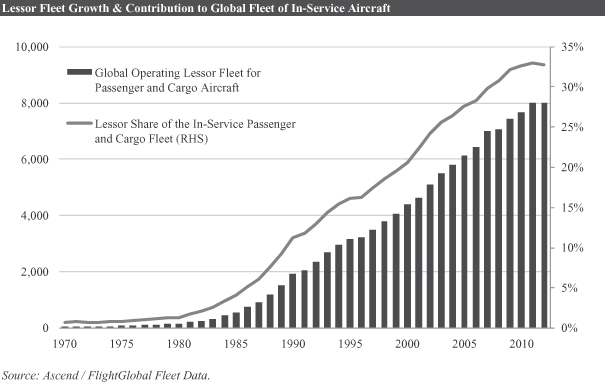

The market for aviation equipment, namely commercial aircraft and engines, is also large and growing. According to Boeing, the global commercial passenger and cargo fleet of aircraft is expected to grow from approximately 21,000 at the end of 2013 to over 42,000 by 2032. We estimate that the combined value of the existing commercial aircraft and engine fleet is approximately $550 billion. Furthermore, aircraft operating leases, and thus aircraft lessors, are becoming increasingly important to the aviation industry. According to the IATA, over 30% of the current passenger fleet is subject to operating leases, and many industry analysts expect this percentage to grow to over 50%.

Given the cost of such aviation assets, investors in this sector need access to capital as well as specialized technical knowledge in order to compete successfully. We believe that our Manager’s expertise and our access to financing positions us well for future acquisitions across the aviation sector. As of , 2014, our aviation portfolio includes three commercial aircraft and 28 commercial jet engines.

Offshore Energy

Oil and natural gas constitute the majority of global energy sources and are expected to remain so for the foreseeable future. According to the United States Energy Information Administration (the “EIA”), fossil fuels represented approximately 80% of energy consumption in 2012 and will continue to represent approximately 80% of energy consumption through 2040. Energy demand is expected to grow, driven by increasing global population and GDP growth. This growth in energy demand is expected to result from both a larger pool of energy users as well as higher energy use per capita.

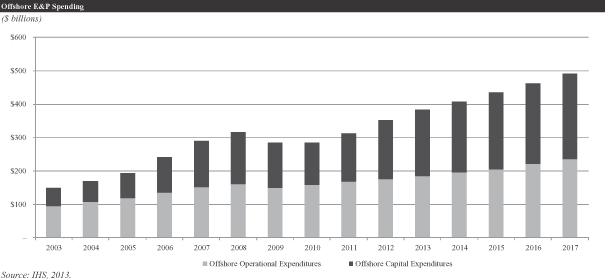

Offshore Energy refers to the production of oil and natural gas from offshore (subsea) reserves. The world’s largest offshore markets include the North Sea, the Gulf of Mexico, Brazil, West Africa, Asia and the Middle East. From 2001 to 2012, approximately two-thirds of all new oil and gas discoveries worldwide were located offshore, and we believe that offshore oil and gas exploration and production (“E&P”) spending will continue to increase in order to meet increased demand for energy. This higher level of E&P spending is expected to lead to a greater demand for offshore assets by operators in the offshore energy sector.

Based on publicly available sources, we believe offshore E&P spending will average $450 billion per year for the next four years, largely as a result of increased demand for oil and gas and increased activity in the deepwater offshore energy markets. We estimate that approximately $250 billion is required to finance the construction of new offshore assets over the next five years in order to supply the existing growth in demand as well as replace retiring assets. We believe that the underlying market demand, together with the need for additional assets such as support and supply vessels, presents us with significant opportunities for new investment in the sector, and that our Manager’s expertise in the sector will enable us to take advantage of these opportunities. As of , 2014, we own one support vessel and one supply vessel.

Intermodal Transport

The Intermodal Transport, or containerized, market includes the infrastructure and equipment that enables the efficient movement of goods via shipping containers throughout multiple modes of transportation, including trucking, shipping and rail. The containerized market volume has grown at over 8% per year over the last three decades, more than double the annualized rate of world GDP growth during that same period. While the rate of growth in containerized trade has slowed in the last few years due to general economic conditions, we expect future growth to benefit from an increasing global middle class, driving increased consumption of goods and services worldwide. The Intermodal market includes infrastructure such as container seaports and inland terminals as well as

6

Table of Contents

equipment such as containers, chassis or trailers, generators sets, containerships, cranes and other loading equipment.

Seaports are the gateway for the global trade network. There are over 3,000 seaports worldwide, handling 12 billion tons of cargo and generating over $55 billion in revenue annually. Of these, there are over 500 container seaports (handling the import and export of containerized goods) with an annual volume of 657 million twenty foot equivalent units (“TEUs”). Worldwide, seaport volumes are expected to increase 41% from 2012 to 2017. Ports are typically owned by government entities, and are overseen by local port authorities. Over the last two decades, governments have privatized port operations via long-term concession agreements with private parties. Seaports tend to generate strong cash flows via multiple revenue streams from infrastructure users with minimal routine maintenance capital expenditures.

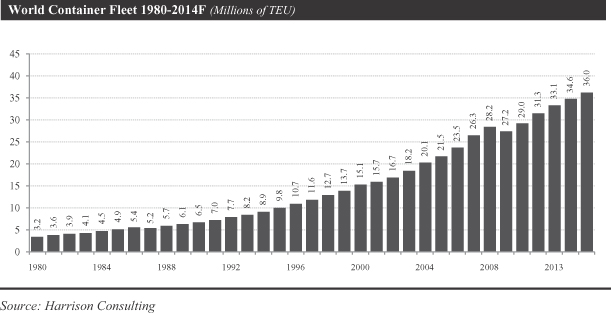

According to Harrison Consulting, the size of the world container fleet as of June 30, 2014 was 35.5 million TEUs. This equipment is owned or leased by the world’s shipping lines to move their cargo. Approximately 45% of the equipment is leased from container leasing companies and other third-party owners and the other 55% is owned directly. We believe that this market will continue to grow over the next few years and that our Manager’s expertise will enable us to take advantage of such future growth. To date, we have focused our investment activity on acquiring container boxes but we also consider other related opportunities across the sector, including in container seaports and terminals. As of June 30, 2014, our intermodal portfolio includes 165,000 shipping containers and related intermodal equipment.

Our Strengths

Strong Contracted Cash Flows Plus Growth Potential—We target a diverse mix of transportation infrastructure and equipment that delivers, on a combined basis, significant and predictable current cash flows plus the potential for earnings growth and asset appreciation. Our current portfolio includes assets in the rail, aviation, offshore energy and intermodal transport sectors. Many of our equipment assets are subject to ongoing leases providing stable operating cash flows equal to a significant percentage of the purchase price of our assets. Our holdings also include value-add infrastructure projects where we expect to be able to generate strong earnings growth through development and asset repositioning. We expect our future investments to continue to deliver a mix of current cash flow and earnings upside.

Opportunistic Investment Approach—We take an opportunistic approach to buying and managing assets—targeting assets that are distressed or undervalued, or where we believe we can add value through active management. We also try to develop incremental opportunities to deploy capital through follow-on investments. In these ways, we seek to deliver attractive returns on our portfolio without heavy reliance on financial leverage. As of June 30, 2014, our leverage on a weighted basis across our existing portfolio is approximately 18% of our total capital. While leverage on any individual asset may vary, we target overall leverage for our assets on a consolidated basis of no greater than 50% of our total capital.

Experienced Investment Team—Our Manager is an affiliate of Fortress, a leading, diversified global investment firm with approximately $63.8 billion under management as of June 30, 2014. Founded in 1998, Fortress manages assets on behalf of over 1,500 institutional clients and private investors worldwide across a range of private equity, credit, liquid hedge funds and traditional asset management strategies. Over the last ten years, Fortress has been one of the industry’s most active investors in transportation-related infrastructure and equipment globally. The Fortress team of investment professionals, currently led by Joseph Adams, has over fifty years of combined experience in acquiring, managing and marketing transportation and infrastructure assets. The team has been working directly together for over ten years and has collectively invested almost $3 billion in equity capital and purchased over $16 billion in transportation and infrastructure assets since 2002. Some of our Manager’s prior transactions include the creation of Aircastle Ltd., one of the world’s leading aircraft lessors;

7

Table of Contents

SeaCube Container Leasing Ltd., one of the world’s largest container lessors; RailAmerica Inc., a leading short-line rail operator; and Global Signal Inc., an owner operator and lessor of towers and other communication structures for wireless communications.

Extensive Relationships with Experienced Operators—Through our Manager, we have numerous relationships with operators across the transportation industry. We typically seek to partner and often co-invest with experienced operators and owners when making acquisitions, and our existing relationships enable us not only to source opportunities, but also to maximize the value of each asset post-closing. Our strategy is to actively manage our investments to improve operations, grow cash flows and develop incremental investment opportunities.

We Plan to Pay Dividends—Since inception through June 30, 2014, we have made a total of eleven regular quarterly distributions to our investors equal to approximately 8% on an annualized basis of our average invested capital during that period, not including distributions related to the sale of certain assets. We intend to continue paying regular quarterly dividends to our shareholders from cash available for distribution; however, our dividend policy will be based on a number of factors including the timing of our investments, and will not be determined solely by our net income or any other measure of performance. Our ability to pay dividends will also be subject to certain risks and limitations. There can be no assurance that dividends will be paid in amounts or on a basis consistent with prior distributions to our investors, if at all. See “Dividend Policy.”

Existing Portfolio

The following is a summary of our existing portfolio within our two business areas (Infrastructure and Equipment Leasing), with detail provided for each of our five reportable segments:

| • | Infrastructure (approximately 26.7% of equity within our reportable segments as of June 30, 2014)—We own transportation infrastructure in the rail sector, including a crude-by-rail terminal in Beaumont, Texas and a short line railroad that operates from Maine to Montreal. These operations are included within our Crude-by-Rail Terminal and Railroad reportable segments, respectively. |

| • | Crude-by-Rail Terminal (approximately 22.1% of equity within our reportable segments as of June 30, 2014)—On August 27, 2014, we acquired a 60% equity interest in Jefferson Gulf Coast Energy Partners LLC (“Jefferson”), an energy logistics company that is developing a large crude oil handling terminal at the Port of Beaumont, Texas and also owns several other key assets involved in the transportation and processing of crude oil and related products. Jefferson’s unique location close to Port Arthur enjoys direct rail service from three Class I railroads, and is adjacent to four major oil refineries with the capacity for over 1.5 million barrels of oil per day, the largest concentration of refineries in North America by capacity. Upon completion, Jefferson’s terminal is expected to include three tracks with the capacity to handle a total of 220,000 barrels per day of free-flowing crude oil and heavy bitumen, as well as barge docks and deep water ship loading capacity. Jefferson also owns 300 general purpose tank cars built in compliance with the latest safety standards that we can lease to crude shippers. As a result, we believe Jefferson is ideally positioned to take advantage of the rapidly growing crude-by-rail and crude export markets, which are being driven by a boom in U.S. and Canadian oil production. |

| • | Railroad (approximately 4.6% of equity within our reportable segments as of June 30, 2014)—We acquired certain assets and assumed certain liabilities of the Montreal, Maine & Atlantic Railroad, which we have renamed the Central Maine & Quebec Railroad (the “CMQR”, or the “Line”), out of bankruptcy in May and June 2014. The CMQR is a 480-mile Class II railroad that runs from Montreal to the east coast of Maine, primarily transporting pulp and paper, construction |

8

Table of Contents

| products and chemicals. The CMQR offers the most direct route from ports in Montreal and on the East Coast of the U.S. to manufacturers and other customers in Maine and Quebec. We believe that CMQR represents an investment in critical infrastructure with a captive customer base at an attractive valuation and significant growth potential. |

| • | Equipment Leasing (approximately 73.3% of equity within our reportable segments as of June 30, 2014)—We own transportation equipment that we lease out to customers in the following reportable segments: aviation leasing, offshore energy and shipping containers. |

| • | Aviation Leasing (approximately 33.7% of equity within our reportable segments as of June 30, 2014)—We own three Boeing commercial aircraft—one 757 and two 767 passenger aircraft—that are each on long-term leases. We also own 28 commercial jet engines that are compatible with Boeing 737, 747, 757 and 767 aircraft models. Our engines are primarily on short-term leases with various airlines located around the globe. Our aviation portfolio is currently unlevered. As of June 30, 2014, 17 of our commercial jet engines, and all of our commercial aircraft, were leased to operators or other third-parties. Aviation assets currently off lease are either undergoing repair and/or maintenance, or are currently held in short term storage awaiting a future lease. On an equity-weighted basis, our aviation equipment was approximately 70% utilized as of June 30, 2014. |

| • | Offshore Energy (approximately 18.2% of equity within our reportable segments as of June 30, 2014)—We own one Anchor Handling Towing Supply (“AHTS”) vessel and one Remote Operated Vehicle (“ROV”) support vessel. Our assets in our offshore energy segment are subject to long-term charters, whereby the operator assumes the operating expense and utilization risk for the vessels. The locally based operators with whom we partner operate our vessels for large energy companies, some of whom are national oil companies. Both of our offshore energy assets are leased to operators or other third-parties and are unlevered. |

| • | Shipping Containers (approximately 21.4% equity within our reportable segments as of June 30, 2014)—We own, either directly or through a joint venture, interests in approximately 165,000 maritime shipping containers and related equipment. All of our shipping containers are on long-term leases to various shipping companies located around the globe, primarily on a finance lease basis with required or bargain purchase obligations. As of June 30, 2014, our shipping container portfolio was approximately 70% levered on a weighted-average basis. |

Recent Developments

Acquisition Pipeline. In addition to our current investment portfolio, we have been and continue to be active in evaluating and pursuing various attractive acquisition opportunities. We are currently evaluating over $ of potential acquisitions, which are in varying stages of development from preliminary diligence, to submission of a nonbinding offer, and through delivery of a letter of intent and negotiation of key terms. We plan to use the net proceeds from this proposed offering to help fund this acquisition pipeline.

There can be no assurance that we will be successful in acquiring any such assets or, if acquired, that they will generate returns meeting our expectations, or at all.

Capital Availability. As of June 30, 2014, we had a total of $ million of capital availability remaining under our partnership agreements (including $45.0 million of prior distributions subject to recall pursuant to the terms of the Partnership Agreement). Prior to the consummation of this offering, we expect to cause our limited partners of the Offshore Partnership and Onshore Partnership to contribute $ of such remaining available capital. Following the consummation of this offering, we will no longer be entitled to any capital contributions from our partners. Including capital called from our limited partners prior to the consummation of this offering,

9

Table of Contents

we will have received approximately $ in capital from our limited partners since June 30, 2014. As a result, immediately following the consummation of this offering, we will have available cash of $ (or $ if the underwriters exercise their option to purchase in full). We expect to use these funds, together with a combination of revenues from our leasing activities (net of operating expenses), debt borrowings, distributions received from unconsolidated investees and proceeds from the sale of assets, to make new acquisitions, including those identified above.

Our Manager and Management Agreement and Other Compensation Arrangements

We have entered into a Management Agreement with our Manager, an affiliate of Fortress, effective upon completion of this offering, pursuant to which our Manager provides for the day-to-day management of our operations.

Pursuant to the terms of our Management Agreement, our Manager provides us with a management team and other professionals who are responsible for implementing our business strategy and performing certain services for us, subject to oversight by our board of directors. Our Manager’s duties include: (i) performing all of our day-to-day functions, (ii) determining investment criteria in accordance with the broad investment guidelines adopted by our board of directors, (iii) sourcing, analyzing and executing on acquisitions and sales, (iv) performing ongoing commercial management of the portfolio, and (v) providing financial and accounting management services.

Our Management Agreement has an initial ten-year term beginning at the consummation of this offering and is automatically renewed for one-year terms thereafter unless terminated by our Manager. Our Manager is entitled to receive a management fee from us that is based on the average value of our total equity (excluding non-controlling interests) determined on a consolidated basis in accordance with GAAP as of the last day of the two most recently completed calendar quarters multiplied by an annual rate of 1.50%, as further described below. In addition, we are obligated to reimburse certain expenses incurred by our Manager.

Under our Management Agreement, each of we, Holdco and the General Partner have agreed that our Manager will have the exclusive authority to manage our and Holdco’s assets as further provided in the Management Agreement. We will not conduct any operations other than our direct ownership of Holdco, which is responsible for acquiring assets on our behalf through one or more of its subsidiaries. Pursuant to the partnership agreement of Holdco (the “Partnership Agreement”), a copy of which has been filed as an exhibit to the registration statement of which this prospectus forms a part, the General Partner which, like our Manager, is an affiliate of Fortress, will be entitled to receive incentive distributions before any amounts are distributed to the Issuer based both on our consolidated net income and capital gains income in each fiscal quarter and for each fiscal year, respectively, subject to certain adjustments.

10

Table of Contents

The terms of our Management Agreement and our compensation arrangements with the General Partner are summarized below and described in more detail under “Our Manager and Management Agreement and Other Compensation Arrangements” in this prospectus.

| Type |

Description | |

| Management Fee |

The management fee is determined by taking the average value of our total equity (excluding non-controlling interests) determined on a consolidated basis in accordance with GAAP at the end of the two most recently completed calendar quarters multiplied by an annual rate of 1.50%, and is payable quarterly in arrears in cash. For illustrative purposes only, and as more fully described in “Unaudited Pro Forma Combined Financial Information,” the amount of the management fee payable to the Manager on a pro forma basis for the year ended December 31, 2013 and the six months ended June 30, 2014, had the Management Agreement been in effect would have been approximately $7.0 million and $3.4 million, respectively. | |

| Incentive Allocation to the General Partner | Income Incentive Allocation

Income Incentive Allocation is calculated and payable quarterly in arrears based on our pre-incentive allocation Net Income for the immediately preceding calendar quarter. For this purpose, pre-incentive allocation net income means, with respect to a calendar quarter, our consolidated net income during such quarter calculated in accordance with GAAP excluding gains and losses, realized or unrealized, and excluding any incentive allocation during the quarter.

We will pay the General Partner an Income Incentive Allocation with respect to our pre-incentive allocation net income in each calendar quarter as follows: (1) no Income Incentive Allocation in any calendar quarter in which our pre-incentive allocation net income, expressed as a rate of return on the average value of our net equity capital at the end of the two most recently completed calendar quarters, does not exceed 2.0% for such quarter (8.0% annualized); (2) 100% of our pre-incentive allocation net income with respect to that portion of such pre-incentive allocation net income, if any, that is equal to or exceeds 2.00% but does not exceed 2.2223% for such quarter; and (3) 10.0% of the amount of our pre-incentive allocation net income, if any, that exceeds 2.2223% for such quarter. These calculations are appropriately prorated for any period of less than three months. The effect of the allocation calculation described above is that if pre-incentive allocation net income, expressed as a rate of return on the average value of our net equity capital at the end of the two most recently completed calendar quarters, is equal to or exceeds 2.2223%, the General Partner will receive an Income Incentive Allocation of 10.0% of our pre-incentive allocation net income for the quarter. | |

11

Table of Contents

| Type |

Description | |

| Capital Gains Incentive Allocation

Capital Gains Incentive Allocation is calculated and payable in arrears as of the end of each calendar year and will equal 10% of our cumulative realized gains from the date of the consummation of this offering through the end of the applicable calendar year net of cumulative capital losses for such period, unrealized losses attributed to impairments and all realized gains upon which prior performance-based capital gains incentive allocation payments were previously made to the General Partner.

For illustrative purposes only, as more fully described in “Unaudited Pro Forma Combined Financial Information,” there would have been no Income Incentive Allocation or Capital Gains Income Allocation payable to the General Partner on a pro forma basis for the year ended December 31, 2013 and the six months ended June 30, 2014, respectively, had these compensation arrangements been in effect. | ||

| Reimbursement of Expenses |

We will pay or reimburse our Manager for performing certain legal, accounting, due diligence tasks and other services that outside professionals or outside consultants otherwise would perform, provided that such costs and reimbursements are no greater than those which would be paid to outside professionals or consultants on an arm’s-length basis. We will also pay all operating expenses, except those specifically required to be borne by our Manager under our Management Agreement.

Our Manager is responsible for all of its other costs incident to the performance of its duties under the Management Agreement, including compensation of our Manager’s employees, rent for facilities and other “overhead” expenses; we will not reimburse our Manager for these expenses. The expenses required to be paid by us include, but are not limited to, issuance and transaction costs incident to the acquisition, disposition and financing of our assets, legal and auditing fees and expenses, the compensation and expenses of our independent directors, the costs associated with the establishment and maintenance of any credit facilities and other indebtedness of ours (including commitment fees, legal fees, closing costs, etc.), expenses associated with other securities offerings of ours, the costs of printing and mailing proxies and reports to our shareholders, costs incurred by our Manager for travel on our behalf, costs associated with any computer software or hardware that is used solely for us, costs to obtain liability insurance to indemnify our directors and officers and the compensation and expenses of our transfer agent. | |

| Termination Fee |

If we terminate the Management Agreement, we will generally be required to pay the manager a termination | |

12

Table of Contents

| Type |

Description | |

| fee. The termination fee is equal to the amount of the management fee during the 12 months immediately preceding the date of the termination. | ||

| Incentive Allocation Fair Value Amount |

An Incentive Allocation Fair Value Amount will be payable to the General Partner if the General Partner is | |

| removed due to the termination of our Management Agreement in certain specified circumstances. The Incentive Allocation Fair Value Amount is an amount equal to the Income Incentive Allocation and the Capital Gains Incentive Allocation that would be paid to the General Partner if our assets were sold for cash at their then current fair market value (as determined by an appraisal, taking into account, among other things, the expected future value of the underlying investments). | ||

| Grant of Options to Our Manager |

Upon the successful completion of an offering of our common shares or any preferred shares, we will grant our Manager options to purchase common shares or preferred units, as applicable, in an amount equal to 10% of the number of shares being sold in the offering, with an exercise price equal to the offering price per share paid by the public or other ultimate purchaser, which may be an affiliate of Fortress. For the avoidance of doubt, this initial public offering of our common shares will not constitute an offering for purposes of this provision. | |

Summary Risk Factors

Our business is subject to risks, as discussed more fully in the section entitled “Risk Factors” beginning on page 22. You should carefully consider all of the risks discussed in the “Risk Factors” section before investing in our common shares. In particular, the following risks, among others, may have an adverse effect on our business, which could cause a decrease in the price of our common shares and result in a loss of all or a portion of your investment:

| • | We are reliant on FIG LLC, our Manager, and other key personnel at Fortress and there are conflicts of interest in our relationship with our Manager; |

| • | Our Manager is authorized to follow a broad asset acquisition strategy and changes to such strategy may increase our exposure to certain risks or otherwise adversely affect our business; |

| • | There can be no assurance that targeted returns or any other level of returns can be achieved and there can be no assurance that we will pay dividends in a manner consistent with prior distributions to our investors, or at all; |

| • | Economic uncertainty and political risks have historically negatively impacted the transportation industry and may reduce the demand for our assets, result in non-performance of contracts by our lessees or charterers, limit our ability to obtain additional capital to finance new acquisitions or have other unforeseen negative effects; |

| • | We could experience a period of oversupply in the markets that we operate, which could depress charter or lease rates for our assets, result in decreased utilization of our assets and materially adversely affect our results of operations and cash flows; |

13

Table of Contents

| • | Our cash flows are substantially impacted by our ability to collect compensation from customers and contractual defaults and our failure to renew or obtain new charters or leases may adversely affect our business and results of operations; |

| • | If our investments become concentrated in a particular type of asset or sector, our business and financial results could be adversely affected by changes in market demand or problems specific to that asset or sector; |

| • | The business of acquiring transportation and transportation-related infrastructure assets is highly competitive and market competition for such assets includes both traditional participants as well as a growing number of non-traditional participants seeking investment opportunities, including other affiliates of Fortress; |

| • | The values of the assets we purchase may fluctuate due to various factors; |

| • | Our railroad infrastructure may be damaged, including by flooding and railroad derailments; |

| • | We rely on select operators to perform certain day-to-day activities in managing our assets; and |

| • | Our inability to obtain sufficient capital would constrain our ability to grow our portfolio and to increase our revenues. |

Conflicts of Interest

Although we have established certain policies and procedures designed to mitigate conflicts of interest, there can be no assurance that these policies and procedures will be effective in doing so. It is possible that actual, potential or perceived conflicts of interest could give rise to investor dissatisfaction, litigation or regulatory enforcement actions.

One or more of our officers and directors have responsibilities and commitments to entities other than us. For example, we have some of the same directors and officers as other entities affiliated with Fortress. In addition, we do not have a policy that expressly prohibits our directors, officers, securityholders or affiliates from engaging for their own account in business activities of the types conducted by us. However, our code of business conduct and ethics prohibits, subject to the terms of our organizational documents, the directors, officers and employees of our Manager from engaging in any transaction that involves an actual conflict of interest with us. Our Manager and its members, managers, officers and employees may pursue acquisition opportunities in transportation and transportation-related infrastructure assets, and that we may acquire or dispose of transportation or transportation-related infrastructure assets in which such persons have a personal interest, subject to pre-approval by the independent members of our board of directors only in certain circumstances. In the event of a violation of this code of business of conduct and ethics that does not constitute bad faith, willful misconduct, gross negligence or reckless disregard of our Manager’s duties, neither our Manager nor its members, managers, officers or employees will be liable to us. See “Risk Factors—Risks Relating to our Manager—There are conflicts of interest in our relationship with our Manager.”

Our key agreements, including our Management Agreement, the Partnership Agreement and our operating agreement, were negotiated among related parties, and their respective terms, including fees and other amounts payable, may not be as favorable to us as terms negotiated on an arm’s-length basis with unaffiliated parties. Our independent directors may not vigorously enforce the provisions of our Management Agreement against our Manager. For example, our independent directors may refrain from terminating our Manager because doing so could result in the loss of key personnel.

The structure of our Manager’s and the General Partner’s compensation arrangements may have unintended consequences for us. We have agreed to pay our Manager a management fee and the General Partner is entitled to receive incentive allocations from Holdco that are each based on different measures of performance.

14

Table of Contents

Consequently, there may be conflicts in the incentives of our Manager to generate attractive risk-adjusted returns for us. In addition, because the General Partner and our Manager are both affiliates of Fortress, the incentive allocations to the General Partner may cause our Manager to place undue emphasis on the maximization of earnings, including through the use of leverage, at the expense of other objectives, such as preservation of capital, to achieve higher incentive allocations. Investments with higher yield potential are generally riskier or more speculative than investments with lower yield potential. This could result in increased risk to the value of our portfolio of assets and your investment in us.

We may compete with entities affiliated with our Manager or Fortress for certain target assets. From time to time, affiliates of Fortress may focus on investments in assets with a similar profile as our target assets that we may seek to acquire. These affiliates may have meaningful purchasing capacity, which may change over time depending upon a variety of factors, including, but not limited to, available equity capital and debt financing, market conditions and cash on hand. Fortress has multiple existing and planned funds focused on investing in one or more of the sectors in which we acquire assets, each with significant current or expected capital commitments. We may co-invest with these funds in certain target assets. Fortress funds generally have a fee structure similar to ours, but the fees actually paid will vary depending on the size, terms and performance of each fund. Fortress had approximately $63.8 billion of assets under management as of June 30, 2014.

Our Manager may determine, in its discretion, to make a particular acquisition through an investment vehicle other than us. Investment allocation decisions will reflect a variety of factors, such as a particular vehicle’s availability of capital (including financing), investment objectives and concentration limits, legal, regulatory, tax and other similar considerations, the source of the opportunity and other factors that the Manager, in its discretion, deems appropriate. Our Manager does not have an obligation to offer us the opportunity to participate in any particular investment, even if it meets our asset acquisition objectives. In addition, employees of Fortress or certain of its affiliates—including personnel providing services to or on behalf of our Manager—may perform services for Fortress affiliates that may acquire or seek to acquire transportation and infrastructure-related assets.

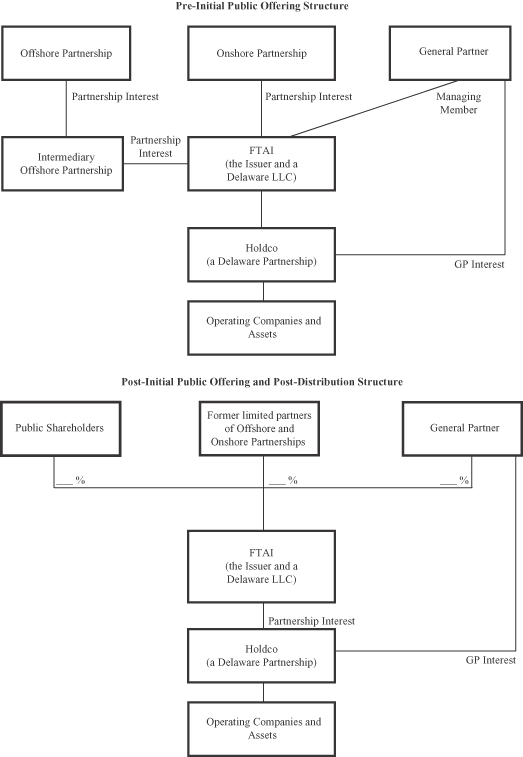

Our Organizational Structure

We are substantially owned by three entities: the General Partner, Fortress Worldwide Transportation and Infrastructure Investors LP (the “Onshore Partnership”) and Fortress Worldwide Transportation and Infrastructure Investors Offshore L.P. (the “Offshore Partnership”), which holds indirect ownership interests in us through FTAI Offshore Holdings, L.P. (the “Intermediary Offshore Partnership” and, together with the Onshore Partnership, the “Initial Shareholders”). The Onshore Partnership and the Offshore Partnership are limited partnerships controlled by affiliates of Fortress formed for the purpose of investing in us. Immediately prior to the consummation of this offering, we intend to effect a for one share split, which will result in the Onshore Partnership holding an aggregate of of our common shares and the Intermediary Offshore Partnership holding an aggregate of of our common shares. If applicable, immediately prior to the consummation of this offering, the General Partner will also contribute its rights to previously undistributed incentive allocations pursuant to the partnership agreement of the general partner to the Onshore Partnership and the Offshore Partnership, in exchange for limited partnership interests in each such partnership equal to the amount of any such undistributed incentive allocations.

Following the expiration of the lock-up agreements entered into between the underwriters and the Initial Shareholders, the Initial Shareholders and the Offshore Partnership will liquidate, which will result in the distribution (the “Distribution”) of all of the common shares of the Company owned by the Initial Shareholders and any other distributable proceeds to holders of the limited partnership interests of the Offshore Partnership and the Onshore Partnership, including the General Partner (collectively, the “Limited Partners”), in accordance with the distribution allocation formulas contained in the respective limited partnership agreements of the Initial Shareholders and the Offshore Partnership. For purposes of allocating the common shares in the Distribution, the shares will be valued at the initial public offering price per share. Immediately following the Distribution (assuming an offering price of $ per

15

Table of Contents

share, which is the midpoint of the price range set forth on the cover of this prospectus, and no additional issuances or repurchases of common shares following this offering), the General Partner will own approximately % of our outstanding shares and the other Limited Partners will own, in the aggregate, approximately % of our outstanding shares.

Prior to the consummation of this offering, we expect to cause the existing limited partners of the Offshore Partnership and the Onshore Partnership to contribute $ of the remaining capital under the respective partnership agreements. See “—Recent Developments—Capital Availability.”

We were formed for the purpose of effecting this offering. Our only business following this offering will be our ownership of partnership interests in Holdco and, as such, our only source of income will be distributions from Holdco, which are subject to the General Partner’s right to receive certain incentive payments before any distributions are made to us. In addition, we will be obligated to pay a management fee to FIG LLC, our Manager, which is an affiliate of Fortress. See “Our Manager and Management Agreement and Other Compensation Arrangements” for additional information on the management fee and potential incentive allocation payable to the General Partner.

16

Table of Contents

The graphic below illustrates our holding company structure both before and after giving effect to this offering and the Distribution (assuming no exercise of the underwriters’ option to purchase additional shares).

17

Table of Contents

Tax Considerations

Skadden, Arps, Slate, Meagher & Flom LLP has acted as our counsel in connection with this offering. At the closing of this offering, Skadden, Arps, Slate, Meagher & Flom LLP will deliver to us an opinion that, under current law, FTAI will be treated, for U.S. federal income tax purposes, as a partnership and not as an association or a publicly traded partnership taxable as a corporation. Accordingly, our shareholders will be required to report and pay tax currently on their allocable share of our income for U.S. federal income tax purposes, regardless of whether any cash or other dividends are paid to them. See “Certain United States Federal Income Tax Considerations—Taxation of FTAI.”

Emerging Growth Company Status

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act. As such, we have elected to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. Because we will take advantage of each of these exemptions, we do not know if some investors will find our common shares less attractive as a result. The result may be a less active trading market for our common shares, and our share price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 13(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have not elected to take advantage of this extended transition period.

We could remain an “emerging growth company” until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the last day of the fiscal year following the fifth anniversary of the date of this offering, (iii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iv) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

Our Corporate Information

We were formed as Fortress Transportation and Infrastructure Investors Ltd., an exempted company incorporated under the laws of Bermuda, on October 23, 2013. We were domesticated in Delaware as a limited liability company and changed our name to Fortress Transportation and Infrastructure Investors LLC on February 19, 2014. Holdco was formed on May 9, 2011 and commenced operations on June 23, 2011; from that time until the current date its operations have consisted of acquiring managing and disposing of transportation and transportation-related infrastructure and equipment assets as more fully described herein. Our principal executive offices are located at 1345 Avenue of the Americas c/o Fortress Transportation and Infrastructure Investors LLC, New York, New York 10105. Our telephone number is 212-798-6100. Our web address is www. . The information on or otherwise accessible through our web site does not constitute a part of this prospectus or any other report or document we file with or furnish to the SEC.

18

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The following tables summarize the consolidated financial information of the Company. The Company is a recently-formed limited liability company that has not, to date, conducted any activities other than those incident to its formation and its ownership of Holdco, which have been deemed immaterial and therefore are not presented in the summary historical consolidated financial data.

The summary consolidated statement of operations data for the years ended December 31, 2013 and 2012, and the period from June 23, 2011 (commencement of operations) to December 31, 2011, and the summary consolidated balance sheet data as of December 31, 2013, 2012, and 2011 have been derived from our audited financial statements. The summary financial data as of and for the six months ended June 30, 2014 and June 30, 2013 have been derived from the unaudited consolidated financial statements. The summary unaudited consolidated financial statements were prepared on the same basis as our audited financial statements. In the opinion of management, such financial statements include all adjustments, consisting only of normal recurring adjustments, that management considers necessary for a fair presentation of the financial information set forth in those statements. The financial data presented for the interim periods are not necessarily indicative of the results for the full fiscal year.

The summary financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements and related notes included elsewhere in this prospectus.

19

Table of Contents

| Year ended December 31, 2013 |

Year ended December 31, 2012 |

Six months ended June 30, 2014 (unaudited) |

Six months ended June 30, 2013 (unaudited) |

|||||||||||||

| (in thousands) |

||||||||||||||||

| Statement of Operations data: |

||||||||||||||||

| Lease income |

$ | 9,284 | $ | 126 | $ | 9,698 | $ | 2,156 | ||||||||

| Maintenance revenue |

2,242 | 2,255 | 2,604 | 296 | ||||||||||||

| Finance lease income |

7,781 | 94 | 5,095 | 3,315 | ||||||||||||

| Freight rail revenue |

— | — | 949 | — | ||||||||||||

| Other income, net |

246 | 1,014 | 46 | 51 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

19,553 | 3,489 | 18,392 | 5,818 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Repairs and maintenance |

712 | 1,275 | 164 | 470 | ||||||||||||

| Management fees |

2,211 | 520 | 1,837 | 947 | ||||||||||||

| Rail operating expenses |

— | — | 487 | — | ||||||||||||

| General and administrative |

3,510 | 1,745 | 14,155 | 1,050 | ||||||||||||

| Depreciation and amortization |

3,909 | 887 | 4,631 | 1,161 | ||||||||||||

| Interest expense |

2,816 | 30 | 1,572 | 1,255 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total expenses |

13,158 | 4,457 | 22,846 | 4,883 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Equity in earnings of unconsolidated entities, net of premium amortization of $95, $69, $0 (unaudited) and $53 (unaudited), respectively |

10,325 | 3,162 | 3,131 | 5,887 | ||||||||||||

| Gain on sale of equipment |

2,415 | — | 2,308 | 1,820 | ||||||||||||

| Gain on sale of unconsolidated entity |

6,144 | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other income |

18,884 | 3,162 | 5,439 | 7,707 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income before income taxes |

25,279 | 2,194 | 985 | 8,642 | ||||||||||||

| Provision for income taxes |

— | — | 558 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

25,279 | 2,194 | 427 | 8,642 | ||||||||||||

| Less: Net income attributable to non-controlling interest in consolidated subsidiaries |

458 | — | 341 | 92 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) attributable to members |

$ | 24,821 | $ | 2,194 | $ | 86 | $ | 8,550 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings (loss) per share, basic and diluted, as adjusted for the Reorganization |

||||||||||||||||

| Weighted average shares outstanding, basic and diluted, as adjusted for the Reorganization |

||||||||||||||||

| Core Net Income attributable to members (1) |

$ | 25,081 | $ | 2,265 | $ | 10,559 | $ | 8,580 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted EBITDA (2) |

$ | 70,397 | $ | 13,914 | $ | 37,122 | $ | 30,957 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance Sheet data: |

||||||||||||||||

| Total assets |

$ | 278,647 | $ | 170,574 | $ | 457,112 | $ | 215,899 | ||||||||

| Debt obligations |

73,388 | 55,991 | 68,627 | 56,149 | ||||||||||||

| Total liabilities |

82,763 | 58,559 | 110,485 | 59,817 | ||||||||||||

| Total members’ equity |

195,884 | 112,015 | 346,627 | 156,082 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Core Net Income attributable to members is a non-GAAP performance measure. Core Net Income attributable to members is defined as net income adjusted to exclude acquisition and transaction expenses and net income attributable to non-controlling interests. The Company believes that net income as defined |

20

Table of Contents

| by GAAP is the most appropriate earnings measurement, with which to reconcile Core Net Income attributable to members. Core Net Income attributable to members should not be considered as an alternative to net income as determined in accordance with GAAP. A reconciliation of Core Net Income attributable to members is below. |