UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 3, 2014 (October 1, 2014)

SOLERA HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

Delaware | 001-33461 | 26-1103816 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

7 Village Circle, Suite 100

Westlake, TX 76262

(Address of principal executive offices, including Zip Code)

(817) 961-2100

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

Election of New Directors

On October 1, 2014, the Board of Directors (the “Board”) of Solera Holdings, Inc. (“Solera” or the “Company”) elected Patrick D. Campbell and Michael Lehman to the Board. Assuming Messrs. Campbell and Lehman are elected to the Board during Solera’s 2014 annual meeting of stockholders to be held in November 2014, Mr. Campbell will serve as a member of the Compensation Committee of the Board and Mr. Lehman will serve as a member of the Audit Committee of the Board effective immediately following the 2014 annual meeting.

Patrick D. Campbell, age 62, is the retired Senior Vice President and Chief Financial Officer of 3M Company, a global innovation company, a position he held from 2002 to 2011. Prior to his tenure with 3M, Mr. Campbell was Vice President of International and Europe for General Motors Corporation, a global vehicle manufacturer, where he served in various finance functions during his 25 years with the company. Mr. Campbell is also a director of Stanley Black & Decker and SPX Corporation.

Michael E. Lehman, age 64, has been an independent consultant to various companies since February 2014. He was the interim Chief Financial Officer at Ciber Inc., a global information technology company, from September 2013 until February 2014. He was Chief Financial Officer of Arista Networks, a cloud networking firm, from September 2012 through July 2013, and Chief Financial Officer of Palo Alto Networks, a network security firm, from April 2010 until February 2012. Prior to that, he was the Executive Vice President and Chief Financial Officer of Sun Microsystems, Inc., a provider of computer systems and professional support services, from February 2006 to January 2010, when Sun Microsystems, Inc. was acquired by Oracle Corporation. From July 2000 until his initial retirement in September 2002, he was Executive Vice President of Sun Microsystems, as well as its Chief Financial Officer from February 1994 to July 2002, and held senior executive positions with Sun Microsystems for more than five years before then. Mr. Lehman is also a director of MGIC Investment Corp. and also serves as the chairman of its audit committee. Mr. Lehman has a B.A. in business administration, with a minor in accounting, from the University of Wisconsin-Madison.

Amendment to Performance-Based Awards

On March 29, 2013, the Compensation Committee of the Board (the “Committee”) approved the grant of non-qualified stock options (the “Mission 2020 Awards”) to the Company’s named executive officers (the “NEOs”) in support of Mission 2020 - the Company’s initiative to achieve $2 billion in revenue and $800 million in Adjusted EBITDA by fiscal year 2020.

The Mission 2020 Awards were granted to all of the NEOs, including the below individuals (the “Continuing NEOs”):

• | Tony Aquila: Chairman of the Board, Chief Executive Officer and President |

• | Renato Giger: Chief Financial Officer, Treasurer and Assistant Secretary |

• | Jason Brady: Senior Vice President, General Counsel and Secretary |

The Mission 2020 Awards have two key pieces:

• | Time-Based Awards: 30% of the Mission 2020 Awards vest pursuant to a time-based vesting schedule. In keeping with the long-term nature of the Mission 2020 Awards, these options vest in three equal installments beginning at fiscal year-end 2015, more than two years from the date of grant. |

• | Performance-Based Awards: Vesting and exercisability for 70% of the Mission 2020 Awards is dependent upon achievement of two specific financial hurdles during the period from fiscal year 2014 through fiscal year 2017: Adjusted EBITDA and relative TSR. |

As set forth Solera’s November 5, 2013 letter to investors, the Committee agreed to consider the incorporation of return on invested capital (“ROIC”) as either an additional or alternative vesting hurdle for the Performance-Based Awards. On October 1, 2014, the Committee approved the incorporation of a ROIC metric as an additional vesting hurdle for the Performance-Based Awards granted to the Continuing NEOs. This metric is in addition to, rather than in lieu of, the existing Adjusted EBITDA vesting hurdle and relative TSR vesting hurdle, resulting in more rigorous performance standards overall.

The ROIC vesting hurdle will be applicable to the second, third and fourth tranches of the Performance-Based Awards, which represent 75% of the entire Performance-Based Awards. The ROIC vesting hurdle requires that Solera achieve ROIC in excess of the Company’s weighted average cost of capital plus a one percent premium. For purposes of this calculation, ROIC is defined as net operating profit after tax (“NOPAT”) divided by Solera’s average Invested Capital. NOPAT is defined as Adjusted EBITDA multiplied by one less an assumed tax rate of 26%. Invested Capital is equal to the four-quarter average of total assets less accounts payable less cash less one half of capital expenditures. Contributions from acquired businesses will be phased into Invested Capital during a four-year period following the completion of the acquisition at a rate of 1/16 per calendar quarter.

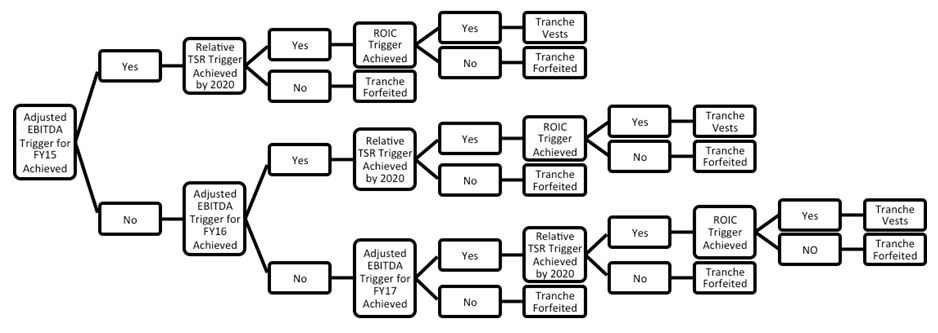

The performance measurement periods and performance hurdles for the second, third and fourth tranches of the Performance-Based Awards are now as follows:

• | The second tranche of 25% of the Performance-Based Awards will vest if we achieve the (i) Adjusted EBITDA Vesting Trigger for fiscal 2015, or the progressively higher Adjusted EBITDA Vesting Trigger for fiscal 2016 or fiscal 2017, (ii) TSR Vesting Trigger during any consecutive 20 trading day period ending July 1, 2015 or any day thereafter through March 29, 2020 and (iii) ROIC Vesting Trigger when either the Adjusted EBITDA Vesting Trigger or the TSR Vesting Trigger is achieved. |

• | The third tranche of 25% of the Performance-Based Awards will vest if we achieve the (i) Adjusted EBITDA Vesting Trigger for fiscal 2016 or the progressively higher Adjusted EBITDA Vesting Trigger for fiscal 2017, (ii) TSR Vesting Trigger during any consecutive 20 trading day period ending July 1, 2016 or any day thereafter through March 29, 2020 and (iii) ROIC Vesting Trigger when either the Adjusted EBITDA Vesting Trigger or the TSR Vesting Trigger is achieved. |

• | The final tranche of 25% of the Performance-Based Awards will vest if we achieve the (i) Adjusted EBITDA Vesting Trigger for fiscal 2017, (ii) TSR Vesting Trigger during any consecutive 20 trading day period ending July 1, 2017 or any day thereafter through March 29, 2020 and (iii) ROIC Vesting Trigger when either the Adjusted EBITDA Vesting Trigger or the TSR Vesting Trigger is achieved. |

By way of further illustration, the following graphic contains a flow chart summarizing the vesting criteria for the second tranche of Performance-Based Awards (which illustration would be similar for the third and fourth tranches):

Departure of NEO

On October 1, 2014, Abilio Gonzalez was terminated from his role as Senior Vice President of Global Human Resources of Solera. Mr. Gonzalez is entitled to receive certain cash severance, medical insurance reimbursement and equity acceleration benefits for termination without cause as provided by the terms of his executive employment agreement. By way of clarification, 100% of the Performance-Based Awards granted to Mr. Gonzalez have been forfeited.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

SOLERA HOLDINGS, INC. | ||||||

/s/ JASON M. BRADY | ||||||

Date: October 3, 2014 | Name: Jason M. Brady | |||||

Title: Senior Vice President, General Counsel and Secretary | ||||||