Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PROASSURANCE CORP | v390127_8k.htm |

Exhibit 99.1

September 30, 2014 Answering The Challenges We Face Edward L. Rand, Jr. Chief Financial Officer

Forward Looking Statements 2 This presentation contains Forward Looking Statements and other information designed to convey our projections and expectations regarding future results. There are a number of factors which could cause our actual results to vary materially from those projected in this presentation. The principal risk factors that may cause these differences are described in various documents we file with the Securities and Exchange Commission, such as our Current Reports on Form 8 - K, and our regular reports on Forms 10 - Q and 10 - K, particularly in “Item 1A, Risk Factors.” Please review this presentation in conjunction with a thorough reading and understanding of these risk factors. We especially identify statements concerning our acquisition of Eastern Insurance Holdings, Inc. and the establishment of Lloyd's Syndicate 1729 as Forward Looking Statements and direct your attention to our news releases issued on September 24, 2013, our Current Report on Form 8K, issued on September 24, 2013 and our subsequently filed Forms 10K and 10Q for discussion s of risk factors pertaining to these transactions and subsequent integration into ProAssurance. This presentation contains Non - GAAP measures, and we may reference Non - GAAP measures in our remarks and discussions. A reconciliation of these measures to GAAP measures is included in this presentation and is also available in our latest quarterly news release, which is available in the Investor Relations section of our website, www.ProAssurance.com, and in the related Current Report on Form 8K disclosing that release . N on - GAAP Measures

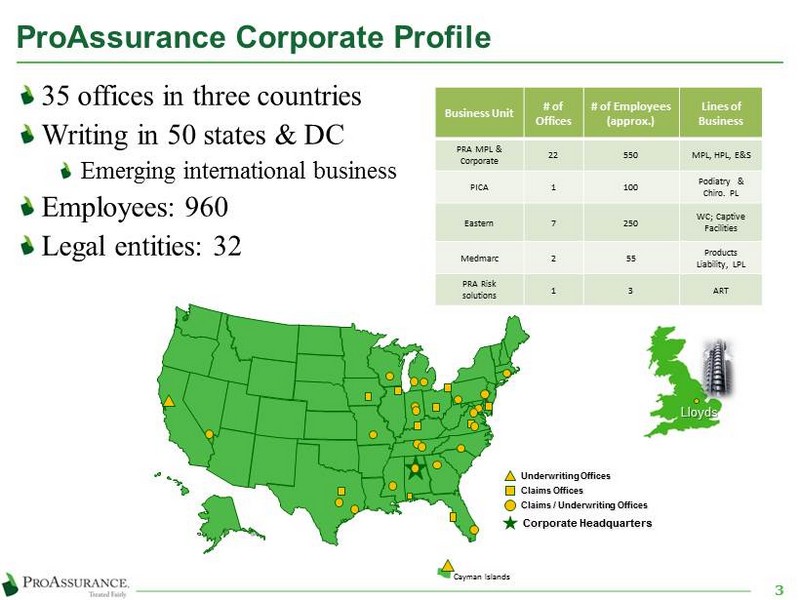

ProAssurance Corporate Profile 35 offices in three countries Writing in 50 states & DC Emerging international business Employees: 960 Legal entities: 32 Corporate Headquarters Claims Offices Claims / Underwriting Offices Underwriting Offices Lloyds Business Unit # of Offices # of Employees (approx.) Lines of Business PRA MPL & Corporate 22 550 MPL, HPL, E&S PICA 1 100 Podiatry & Chiro. PL Eastern 7 250 WC; Captive Facilities Medmarc 2 55 Products Liability, LPL PRA Risk solutions 1 3 ART Cayman Islands 3

Healthcare Realities American healthcare is wrestling with the question of cost vs. care — we can deliver far more care than we can afford Restructuring will produce profound changes in healthcare delivery Will affect almost every line of insurance we write Changes to reduce cost were underway before passage of the Affordable Care Act which is, in reality, more about availability than affordability 4

Healthcare Realities 5 The Affordable Care Act (ACA) is creating additional layers of complexity Healthcare delivery will be in continuous flux for years to come Will additional coverage under the ACA help or hurt Worker’s Compensation writers? Will the healthcare burden shift How will the addition of millions of insureds affect Medical P rofessional Liability? Patient frustration and unexpected outcomes

Insurance Industry Realities 6 Insurance companies are awash in capital Especially true in HCPL given industrywide reserve development and claims trends Pressure is mounting to “do something” with it M&A — the hunter vs. the hunted Chase market share with low prices but disastrous long - term consequences Appease investors with unwise capital - return strategies

The ProAssurance Realities 7 ProAssurance has always evolved ahead of the curve in our industry — we will continue that trend We have proven our ability to thrive across insurance cycles and safeguard those we insure The insurance cycle is a harsh mistress and will ultimately level the playing field Our long - term focus on financial strength is central to our overall strategy and success

Our Strategies We continue building a platform that will allow us to serve the broad spectrum of evolving risk Prudently leveraging our success and experience with the addition of specialized expertise Deliver broad capabilities to meet evolving demands Acquiring traditional HCPL companies will deepen our capabilities and broaden our reach Eastern, Medmarc, PICA & Mid - Continent allow us to cover new healthcare – centric risks Lloyd’s Syndicate 1729 Investment opportunity with the significant insurance benefits Provides access to international medical professional liability opportunities Direct benefit to Medmarc in reaching international medical technology and life sciences risks Increases flexibility for ProAssurance when working with complex risks 8

Our Strategies 9 Bring new capabilities to the market Alternative risks — we can meet any need, all the way to a full captive solution Enhanced with the expertise of Eastern ProAssurance Risk Solutions sm Newly hired industry veterans with proven expertise in complex risk financing Will capitalize on restructuring trends that are creating significant opportunities to write one - off policies in both healthcare professional liability and workers’ compensation ProAssurance Complex Medicine Excess insurance program to augment the capabilities of entities with self - insured retentions Working with Pro - Praxis, a new unit of Cooper Gay Swett & Crawford Proprietary analytics provides advanced underwriting & pricing capabilities