Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ENTERPRISE PRODUCTS PARTNERS L.P. | d798407d8k.htm |

| EX-2.1 - EX-2.1 - ENTERPRISE PRODUCTS PARTNERS L.P. | d798407dex21.htm |

| EX-10.2 - EX-10.2 - ENTERPRISE PRODUCTS PARTNERS L.P. | d798407dex102.htm |

| EX-10.1 - EX-10.1 - ENTERPRISE PRODUCTS PARTNERS L.P. | d798407dex101.htm |

| EX-99.1 - EX-99.1 - ENTERPRISE PRODUCTS PARTNERS L.P. | d798407dex991.htm |

| EX-4.1 - EX-4.1 - ENTERPRISE PRODUCTS PARTNERS L.P. | d798407dex41.htm |

| EX-10.3 - EX-10.3 - ENTERPRISE PRODUCTS PARTNERS L.P. | d798407dex103.htm |

Exhibit 99.2

ENTERPRISE PRODUCTS PARTNERS L.P.

EPD ACQUIRES GP & LP INTERESTS IN OILT; PROPOSES MERGER

October 1, 2014

© ALL RIGHTS RESERVED. ENTERPRISE PRODUCTS PARTNERS L.P.

EPD

LISTED

NYSE

enterpriseproducts.com

FORWARD-LOOKING STATEMENTS

This presentation includes “forward-looking statements” as defined by the U.S. Securities and Exchange Commission (the “SEC”). All statements,

other than statements of historical fact, included herein that address activities, events, developments or transactions that Enterprise Products Partners L.P. (“Enterprise”) expects, believes or anticipates will or may occur in the future,

including anticipated benefits and other aspects of such activities, events, developments or transactions, are forward-looking statements. These forward-looking statements are subject to risks and uncertainties that may cause actual results to

differ materially, including approval of the proposed merger by the conflicts committee and unitholders of Oiltanking Partners, L.P. (“Oiltanking”), any approvals by regulatory agencies, the possibility that the anticipated benefits from

such activities, events, developments or transactions cannot be fully realized, the possibility that costs or difficulties related thereto will be greater than expected, the impact of competition and other risk factors included in the reports filed

with the SEC by Enterprise. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. Except as required by law, Enterprise does not intend to update or revise its forward-looking

statements, whether as a result of new information, future events or otherwise.

© ALL RIGHTS RESERVED. ENTERPRISE PRODUCTS PARTNERS L.P.

2

ADDITIONAL INFORMATION

This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. This communication relates to a proposal which

Enterprise has made for a business combination transaction with Oiltanking. In furtherance of this proposal and subject to future developments, Enterprise (and, if a negotiated transaction is agreed, Oiltanking) may file one or more registration

statements, proxy statements or other documents with the SEC. This communication is not a substitute for any proxy statement, registration statement, prospectus or other document Enterprise and/or Oiltanking may file with the SEC in connection with

the proposed transaction. INVESTORS AND SECURITY HOLDERS OF ENTERPRISE AND OILTANKING ARE URGED TO READ THE PROXY STATEMENT, REGISTRATION STATEMENT, PROSPECTUS AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY IF AND WHEN THEY

BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any definitive proxy statement (if and when available) will be mailed to unitholders of Oiltanking. Investors and security holders will be able to obtain

free copies of these documents (if and when available) and other documents filed with the SEC by Enterprise and/or Oiltanking through the web site maintained by the SEC at http://www.sec.gov.

Enterprise, Oiltanking and their respective general partners, and the directors and certain of the executive officers of the respective general partners, may be deemed to be

participants in the solicitation of proxies from the unitholders of Oiltanking in connection with the proposed merger. Information about the directors and executive officers of the respective general partners of Enterprise and Oiltanking is set

forth in each company’s Annual Report on Form 10-K for the year ended December 31, 2013, filed with the SEC on March 3, 2014 and February 25, 2014, respectively. These documents can be obtained free of charge from the sources listed above.

Other information regarding the person who may be “participants” in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and

other relevant materials to be filed with the SEC when they become available.

© ALL RIGHTS RESERVED. ENTERPRISE PRODUCTS PARTNERS L.P.

3

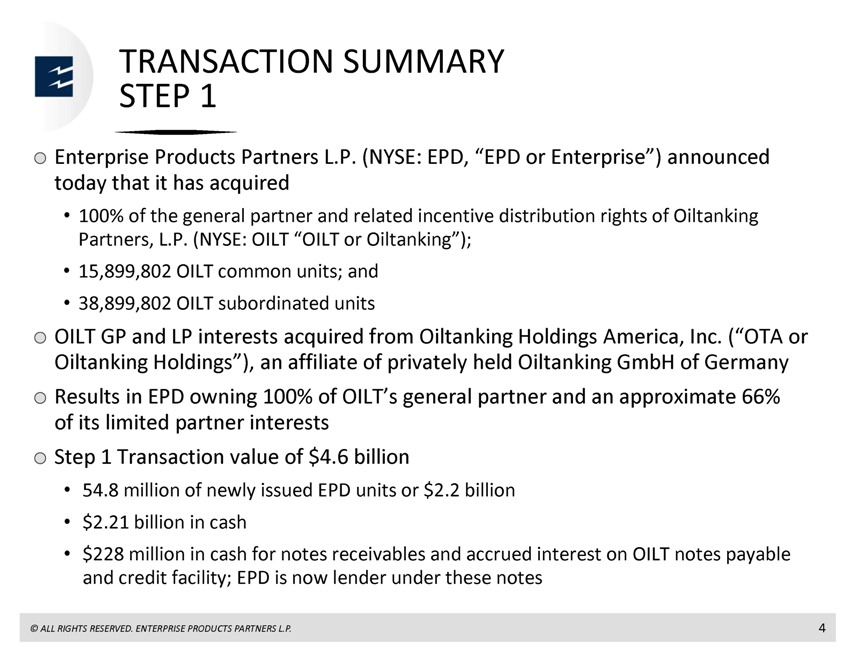

TRANSACTION SUMMARY STEP 1

Enterprise Products Partners L.P. (NYSE: EPD, “EPD or Enterprise”) announced today that it has acquired

100% of the general partner and related incentive distribution rights of Oiltanking Partners, L.P. (NYSE: OILT “OILT or Oiltanking”);

15,899,802 OILT common units; and

38,899,802 OILT subordinated units

OILT GP and LP interests acquired from Oiltanking Holdings America, Inc. (“OTA or Oiltanking Holdings”), an affiliate of privately held Oiltanking GmbH of Germany Results

in EPD owning 100% of OILT’s general partner and an approximate 66% of its limited partner interests Step 1 Transaction value of $4.6 billion

54.8 million of

newly issued EPD units or $2.2 billion

$2.21 billion in cash

$228 million in

cash for notes receivables and accrued interest on OILT notes payable and credit facility; EPD is now lender under these notes

© ALL RIGHTS RESERVED.

ENTERPRISE PRODUCTS PARTNERS L.P.

4

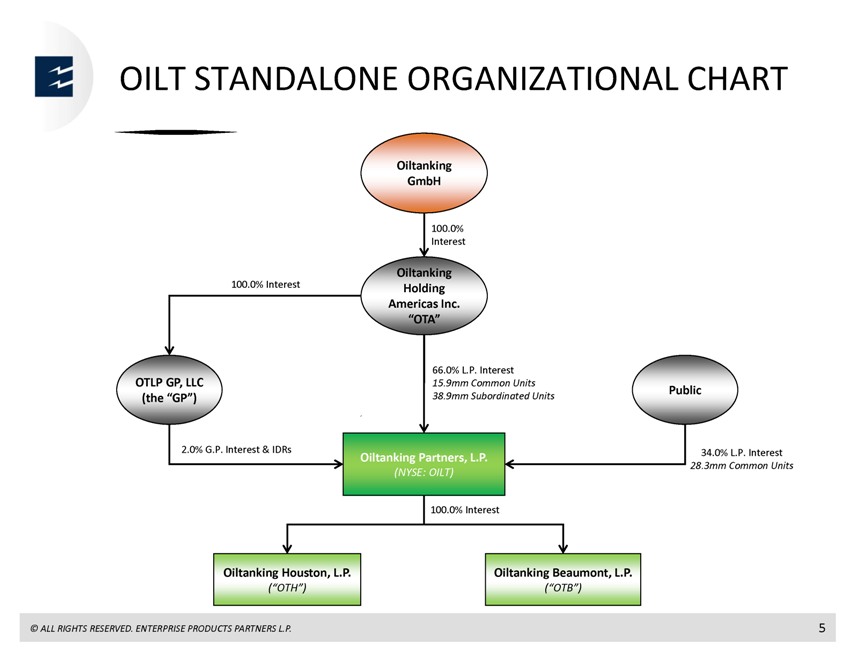

OILT STANDALONE ORGANIZATIONAL CHART

100.0% Interest

OTLP GP, LLC (the “GP”)

2.0% G.P. Interest & IDRs

Oiltanking Houston, L.P. (“OTH”)

Oiltanking GmbH

100.0% Interest

Oiltanking Holding Americas Inc. “OTA”

66.0% L.P. Interest 15.9mm Common Units

38.9mm Subordinated Units

Oiltanking Partners, L.P. (NYSE: OILT)

100.0%

Interest

Oiltanking Beaumont, L.P. (“OTB”)

Public

34.0% L.P. Interest 28.3mm Common Units

© ALL RIGHTS RESERVED. ENTERPRISE PRODUCTS

PARTNERS L.P.

5

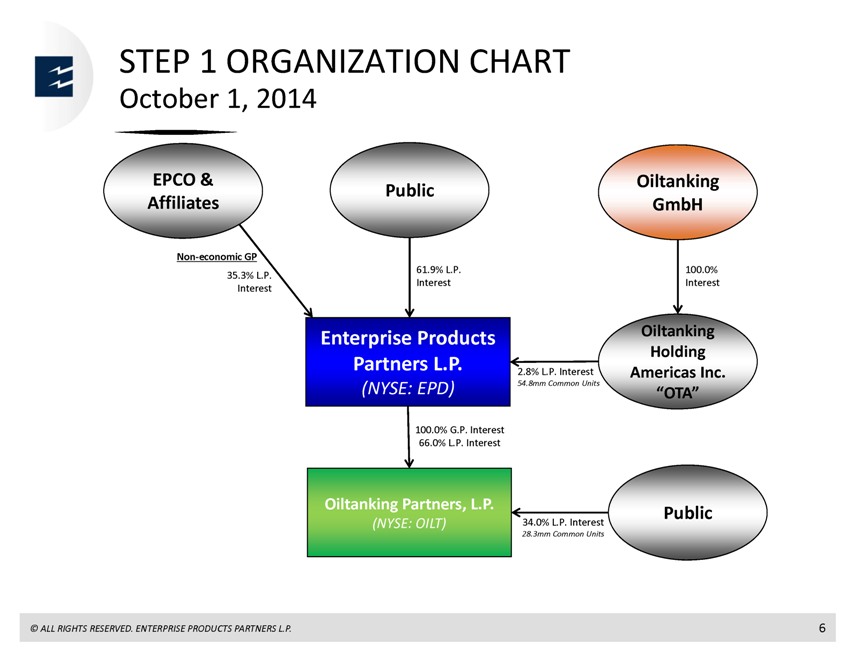

STEP 1 ORGANIZATION CHART

October 1, 2014

EPCO & Affiliates

Non-economic GP

35.3% L.P. Interest

Public

61.9% L.P. Interest

Enterprise Products Partners L.P. (NYSE: EPD)

100.0% G.P. Interest

66.0% L.P. Interest

Oiltanking Partners, L.P. (NYSE: OILT)

2.8% L.P. Interest 54.8mm Common Units

34.0% L.P. Interest

28.3mm Common Units

Oiltanking GmbH

100.0% Interest

Oiltanking Holding Americas Inc. “OTA”

Public

© ALL RIGHTS RESERVED. ENTERPRISE PRODUCTS PARTNERS L.P.

6

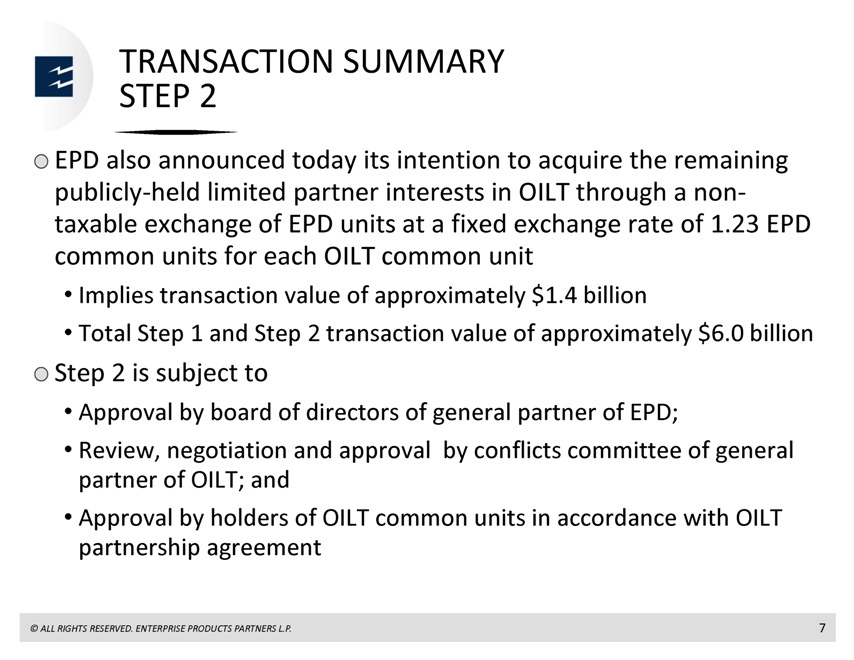

TRANSACTION SUMMARY STEP 2

EPD also announced today its intention to acquire the remaining publicly-held limited partner interests in OILT through a non-taxable exchange of EPD units at a

fixed exchange rate of 1.23 EPD common units for each OILT common unit

Implies transaction value of approximately $1.4 billion

Total Step 1 and Step 2 transaction value of approximately $6.0 billion

Step 2 is subject to

Approval by board of directors of general partner of EPD;

Review, negotiation

and approval by conflicts committee of general partner of OILT; and

Approval by holders of OILT common units in accordance with OILT partnership agreement

© ALL RIGHTS RESERVED. ENTERPRISE PRODUCTS PARTNERS L.P.

7

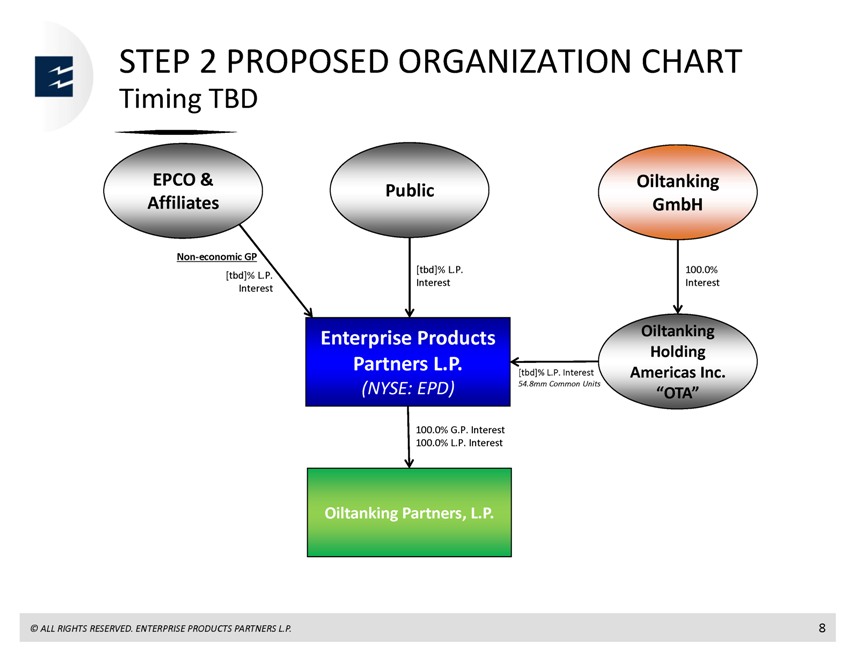

STEP 2 PROPOSED ORGANIZATION CHART

Timing TBD

EPCO & Affiliates

Non-economic GP [tbd]% L.P. Interest

Public

[tbd]% L.P. Interest

Enterprise Products Partners L.P. (NYSE: EPD)

100.0% G.P. Interest

100.0% L.P. Interest

Oiltanking Partners, L.P.

[tbd]% L.P. Interest 54.8mm Common Units

Oiltanking GmbH

100.0% Interest

Oiltanking Holding Americas Inc. “OTA”

© ALL RIGHTS RESERVED. ENTERPRISE

PRODUCTS PARTNERS L.P.

8

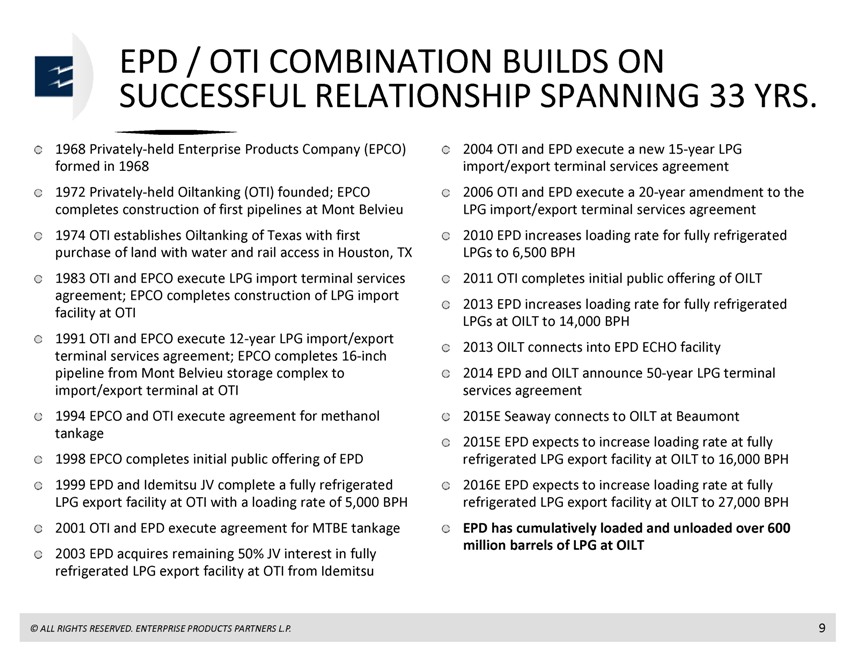

EPD / OTI COMBINATION BUILDS ON

SUCCESSFUL RELATIONSHIP SPANNING 33 YRS.

1968 Privately-held Enterprise Products Company

(EPCO) formed in 1968

1972 Privately-held Oiltanking (OTI) founded; EPCO completes construction of first pipelines at Mont Belvieu

1974 OTI establishes Oiltanking of Texas with first purchase of land with water and rail access in Houston, TX

1983 OTI and EPCO execute LPG import terminal services agreement; EPCO completes construction of LPG import facility at OTI

1991 OTI and EPCO execute 12-year LPG import/export terminal services agreement; EPCO completes 16-inch pipeline from Mont Belvieu storage complex to import/export terminal at OTI

1994 EPCO and OTI execute agreement for methanol tankage

1998 EPCO completes

initial public offering of EPD

1999 EPD and Idemitsu JV complete a fully refrigerated LPG export facility at OTI with a loading rate of 5,000 BPH

2001 OTI and EPD execute agreement for MTBE tankage

2003 EPD acquires remaining 50% JV

interest in fully refrigerated LPG export facility at OTI from Idemitsu

2004 OTI and EPD execute a new 15-year LPG import/export terminal services agreement

2006 OTI and EPD execute a 20-year amendment to the LPG import/export terminal services agreement

2010 EPD increases loading rate for fully refrigerated LPGs to 6,500 BPH

2011 OTI completes

initial public offering of OILT

2013 EPD increases loading rate for fully refrigerated LPGs at OILT to 14,000 BPH

2013 OILT connects into EPD ECHO facility

2014 EPD and OILT announce 50-year LPG terminal

services agreement

2015E Seaway connects to OILT at Beaumont

2015E EPD

expects to increase loading rate at fully refrigerated LPG export facility at OILT to 16,000 BPH

2016E EPD expects to increase loading rate at fully refrigerated

LPG export facility at OILT to 27,000 BPH

EPD has cumulatively loaded and unloaded over 600 million barrels of LPG at OILT

© ALL RIGHTS RESERVED. ENTERPRISE PRODUCTS PARTNERS L.P.

9

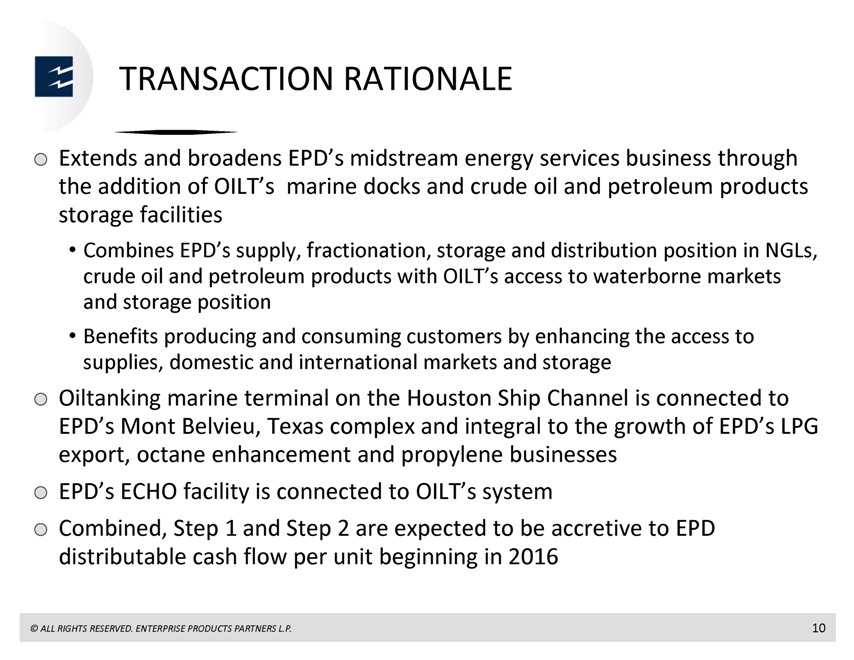

TRANSACTION RATIONALE

Extends and broadens EPD’s midstream energy services business through the addition of OILT’s marine docks and crude oil and petroleum products storage

facilities

Combines EPD’s supply, fractionation, storage and distribution position in NGLs, crude oil and petroleum products with OILT’s access to

waterborne markets and storage position

Benefits producing and consuming customers by enhancing the access to supplies, domestic and international markets and

storage

Oiltanking marine terminal on the Houston Ship Channel is connected to EPD’s Mont Belvieu, Texas complex and integral to the growth of EPD’s LPG

export, octane enhancement and propylene businesses

EPD’s ECHO facility is connected to OILT’s system Combined, Step 1 and Step 2 are expected to be

accretive to EPD distributable cash flow per unit beginning in 2016

© ALL RIGHTS RESERVED. ENTERPRISE PRODUCTS PARTNERS L.P.

10

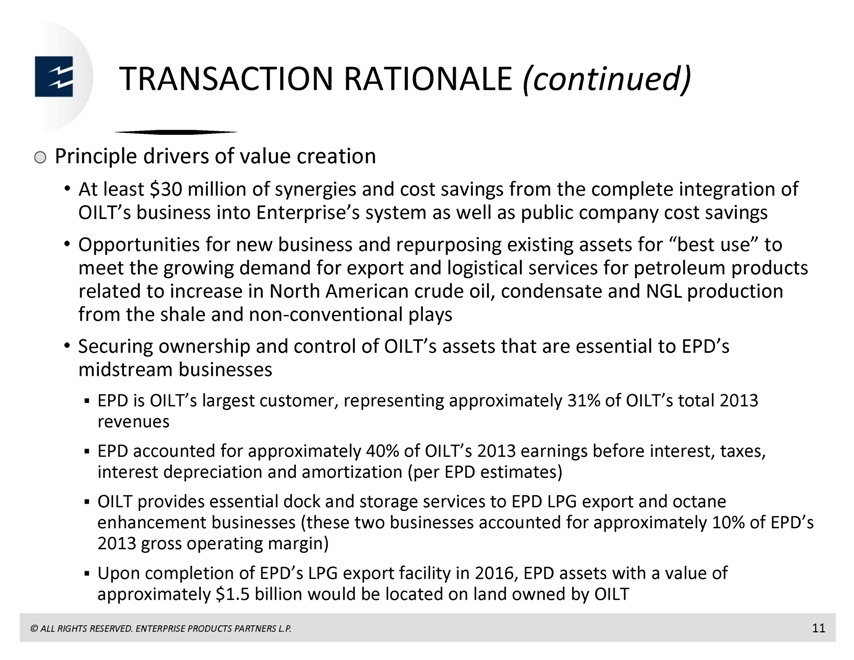

TRANSACTION RATIONALE (continued)

Principle drivers of value creation

At least $30 million of synergies and cost savings from

the complete integration of OILT’s business into Enterprise’s system as well as public company cost savings

Opportunities for new business and

repurposing existing assets for “best use” to meet the growing demand for export and logistical services for petroleum products related to increase in North American crude oil, condensate and NGL production from the shale and

non-conventional plays

Securing ownership and control of OILT’s assets that are essential to EPD’s midstream businesses

EPD is OILT’s largest customer, representing approximately 31% of OILT’s total 2013 revenues

EPD accounted for approximately 40% of OILT’s 2013 earnings before interest, taxes, interest depreciation and amortization (per EPD estimates)

OILT provides essential dock and storage services to EPD LPG export and octane enhancement businesses (these two businesses accounted for approximately 10% of EPD’s 2013 gross

operating margin)

Upon completion of EPD’s LPG export facility in 2016, EPD assets with a value of approximately $1.5 billion would be located on land owned

by OILT

© ALL RIGHTS RESERVED. ENTERPRISE PRODUCTS PARTNERS L.P.

11

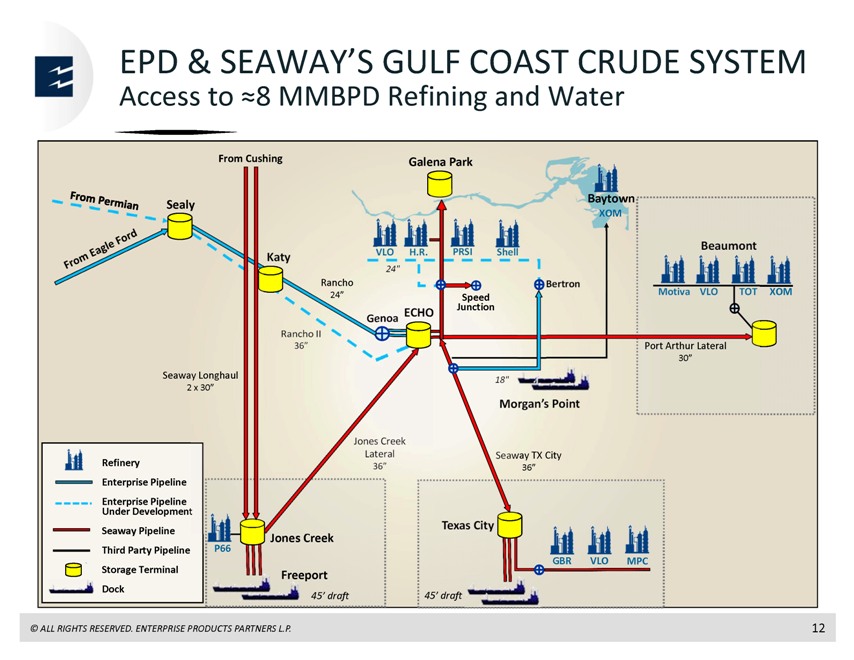

EPD & SEAWA’S GULF COAST CRUDE SYSTEMY

Access to 8 MMBPD Refining and Water

From Pemian

From Eagle Ford

Katy

Seaway Longhaul

2 x 30”

From Cushing

Sealy

Galena Park

VLO H.R PRSI Shell

24”

Rancho 24” Speed Junction

Rancho II 36”

Jones Creek Lateral 36”

Baytown

XOM

18”

Morgan’s Point

Seaway TX City

36”

Genoa ECHO

Bertron

Beaumont

Motiva VLO TOT XOM

Port Arthur Lateral 30”

P66

Jones Creek

Freeport

45’ draft

Texas City

45’ draft

GBR

VLO

MPC

Refinery

Enterprise Pipeline

Enterprise Pipeline

Under Development

Seaway Pipeline

Third Party Pipeline

Storage Terminal

Dock

© ALL RIGHTS RESERVED. ENTERPRISE PRODUCTS PARTNERS L.P.

12

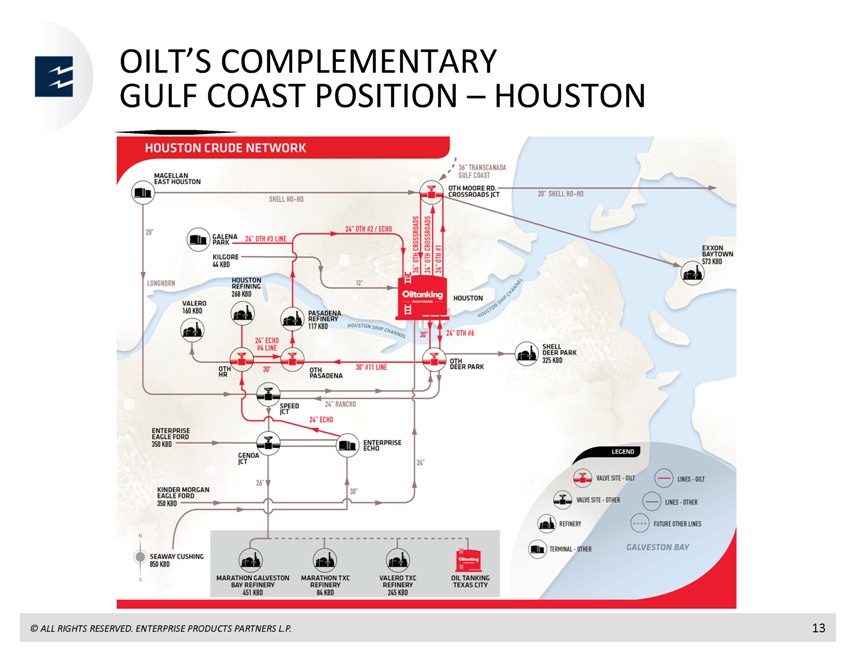

OILT’S COMPLEMENTARY

GULF COAST POSITION - HOUSTON

HOUSTON CRUDE NETWORK

MAGELLAN EAST HOUSTON

20”

LONGHORN

ENTERPRISE EAGLE FORD 350 KBD

KINDER MORGAN EAGLE FORD 350 KBD

N S

SEAWAY CUSHING 850 KBD

GALENA PARK

KILGORE 44 KBD

VALERO 160 KBD

SHELL HO-HO

24” OTH #3 LINE

HOUSTON REFINING 268 KBD

24” ECHO #4 LINE

OTH HR

30”

SPEED JCT

GENOA JCT

26”

MARATHON GALVESTON BAY REFINERY 451 KBD

PASADENA REFINERY 117 KBD

OTH PASADENA

24” RANCHO

24” ECHO

MARATHON TXC REFINERY 84 KBD

24” OTH #2 / ECHO

12”

HOUSTON SHIP CHANNEL

30” #11 LINE

ENTERPRISE ECHO

30”

VALERO REFINERY 245 KBD

36” OTH CROSSROADS

24” OTH CROSSROADS

Oiltanking PARTNERS

24” OTH #1

30” 24”

36” TRANSCANADA GULF COAST

OTH MOORE RD. CROSSROADS JCT

HOUSTON

HOUSTON SHIP CHANNEL

24” OTH #6

OTH DEER PARK

Oiltanking PARTNERS

OIL TANKING TEXAS CITY

20” SHELL HO-HO

SHELL DEER PARK 325 KBD

EXXON BAYTOWN 573 KBD

LEGEND

VALVE SITE - OILT

LINES - OILT

VALVE SITE - OTHER

LINES - OTHER

REFINERY

FUTURE OTHER LINES

TERMINAL - OTHER GALVESTON BAY

© ALL RIGHTS RESERVED. ENTERPRISE PRODUCTS PARTNERS L.P. 13

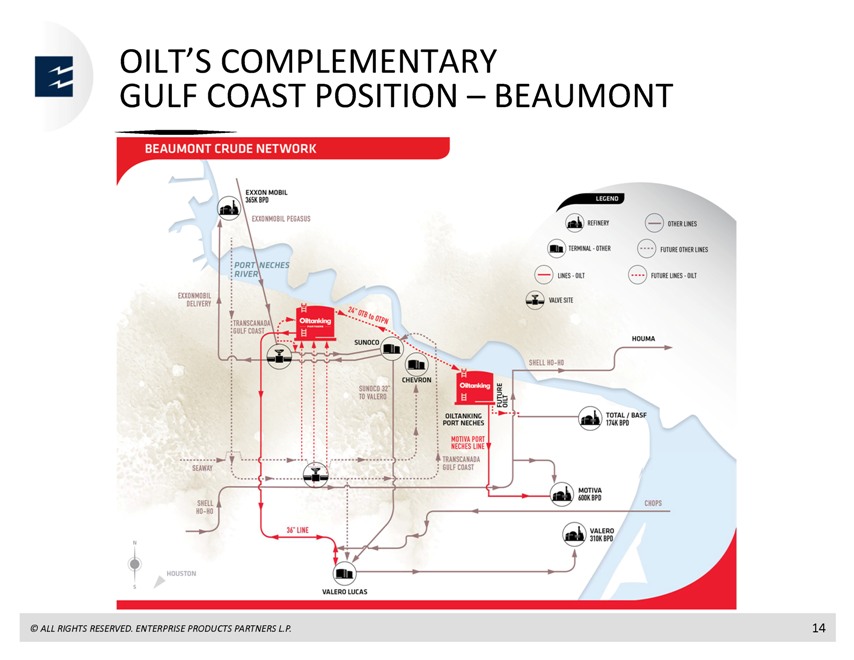

OIL’S COMPLEMENTARYT

GULF COAST POSITION – BEAUMONT

BEAUMONT CRUDE NETWORK

EXXON MOBIL 365k BPD

EXXONMOBIL PEGASUS

PORT NECHES

RIVER

EXXONMOBIL DELIVERY

TRANSCANADA

GULF COAST

Oiltanking PARTNERS

24” OTB to OTPN

SUNOCO

REFINERY OTHER LINES

TERMINAL - OTHER FUTURE OTHER LINES

LINES - OILT FUTURE LINES - OILT

VALVE SITE

HOUMA

SHELL HO-HO

CHEVRON

SUNOCO 32” TO VALERO

Oiltanking

FUTURE OILT

OILTANKING PORT NECHES

MOTIVA POST NECHES LINE

TRANSCANADA GULF COAST

TOTAL / BASF

174K BPD

SEAWAY

SHELL HO-HO

MOTIVA 600K BPD

CHOPS

36” LINE

VALERO 310K BPD

N S

HOUSTON

VALERO LUCAS

© ALL RIGHTS RESERVED. ENTERPRISE PRODUCTS PARTNERS L.P.

14

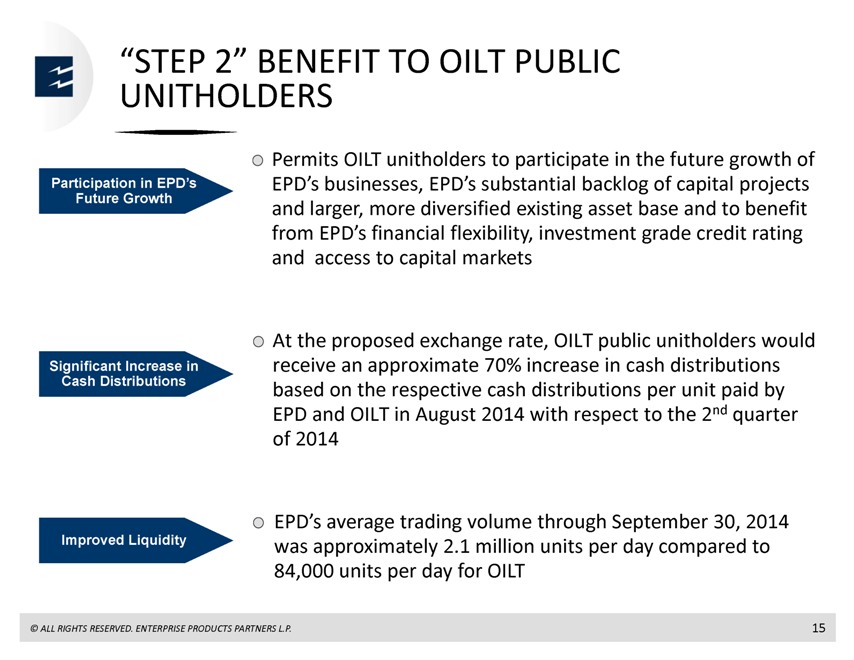

“STEP 2” BENEFIT TO OILT PUBLIC UNITHOLDERS

Participation in EPD’s Future Growth Permits OILT unitholders to participate in the future growth of EPD’s businesses, EPD’s substantial backlog of capital projects

and larger, more diversified existing asset base and to benefit from EPD’s financial flexibility, investment grade credit rating and access to capital markets

Significant Increase in Cash Distributions At the proposed exchange rate, OILT public unitholders would receive an approximate 70% increase in cash distributions

based on the respective cash distributions per unit paid by EPD and OILT in August 2014 with respect to the 2nd quarter of 2014

Improved Liquidity EPD’s

average trading volume through September 30, 2014 was approximately 2.1 million units per day compared to 84,000 units per day for OILT

© ALL RIGHTS RESERVED.

ENTERPRISE PRODUCTS PARTNERS L.P.

15

STRATEGIC TRANSACTION SUMMARY

© ALL RIGHTS RESERVED. ENTERPRISE PRODUCTS PARTNERS L.P.

enterpriseproducts.com

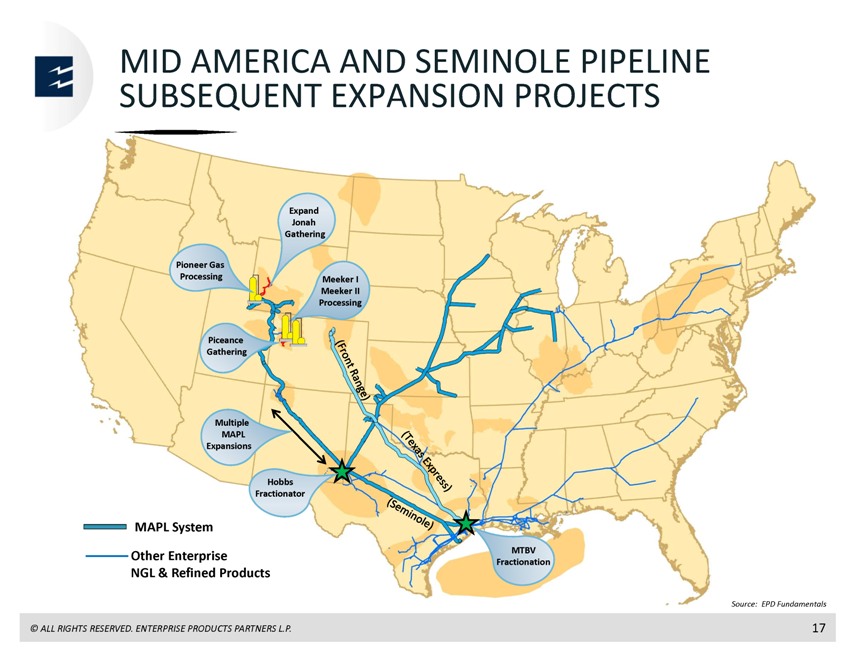

MID AMERICA AND SEMINOLE PIPELINE SUBSEQUENT EXPANSION PROJECTS

Pioneer Gas Processing

Piceance Gathering

Multiple MAPL Expansions

Expand Jonah Gathering

Meeker I Meeker II Processing

Hobbs Fractionator

(Front Range)

(Texas Express)

(Seminole)

MTBV Fractionation

MAPL System

Other Enterprise

NGL & Refined Products

Source: EPD Fundamentals

© ALL RIGHTS RESERVED. ENTERPRISE PRODUCTS PARTNERS L.P.

17

ENTERPRISE MONT BELVIEU: THE WORLD’S LARGEST NGL COMPLEX

Room to Grow

© ALL RIGHTS RESERVED. ENTERPRISE PRODUCTS PARTNERS L.P.

18

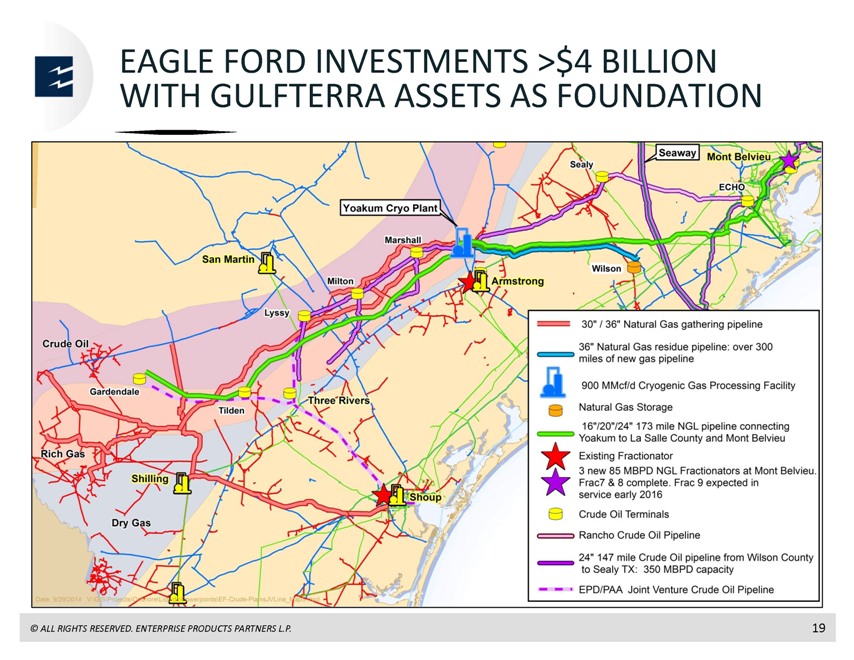

EAGLE FORD INVESTMENTS >$4 BILLION WITH GULFTERRA ASSETS AS FOUNDATION

Crude Oil

Gardendale

Rich Gas

Shilling

Dry Gas

San Martin

Three’Rivers

Milton

Lyssy

Tilden

Marshall

Yoakum Cryo Plant

Armstrong

Shoup

Wilson

Sealy

Mont Belvieu

ECHO

30” / 36” Natural Gas gathering pipeline

36” Natural Gas residue pipeline: over

300 5 miles of new gas pipeline

900 MMcf/d Cryogenic Gas Processing Facility Natural Gas Storage

16/20/24” 173 mile NGL pipeline connecting 5 Yoakum to La Salle County and Mont Belvieu

Existing Fractionator

3 new 85 MBPD NGL Fractionators at Mont Belvieu, Frac7

& 8 complete. Frac 9 expected in service early 2016

Crude Oil Terminals

Rancho Crude Oil Pipeline

24” 147 mile Crude Oil pipeline from Wilson

County to Sealy TX: 350 MBPD capacity

EPD/PAA Joint Venture Crude Oil Pipeline

© ALL RIGHTS RESERVED. ENTERPRISE PRODUCTS PARTNERS L.P.

19

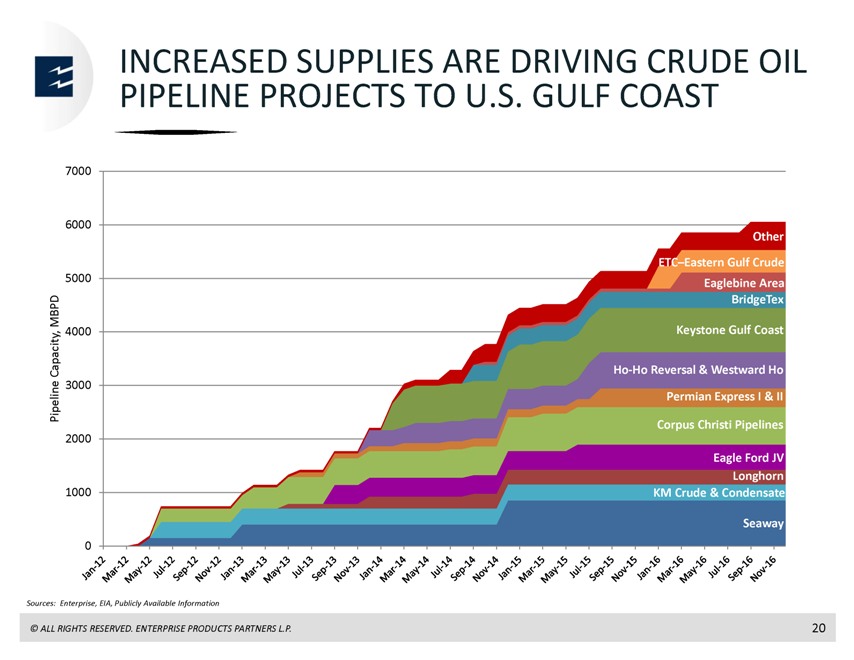

INCREASED SUPPLIES ARE DRIVING CRUDE OIL PIPELINE PROJECTS TO U.S. GULF COAST

Pipeline Capacity, MBPD

7000

6000

5000

4000

3000

2000

1000

0

Other

ETC–Eastern Gulf Crude

Eaglebine Area

BridgeTex

Keystone Gulf Coast

Ho-Ho Reversal & Westward Ho

Permian Express I & II

Corpus Christi Pipelines

Eagle Ford JV

Longhorn

KM Crude & Condensate

Seaway

Jan-12 Mar-12 May-12 Jul-12 Sep-12 Nov-12 Jan-13 Mar-13 May-13 Jul-13 Sep-13 Nov-13

Jan-14 Mar-14 May-14 Jul-14 Sep-14 Nov-14 Jan-15 Mar-15 May-15 Jul-15 Sep-15 Nov-15 Jan-16 Mar-16 May-16 Jul-16

Sep-16 Nov-16

Sources: Enterprise, EIA, Publicly Available Information

© ALL RIGHTS RESERVED.

ENTERPRISE PRODUCTS PARTNERS L.P.

20

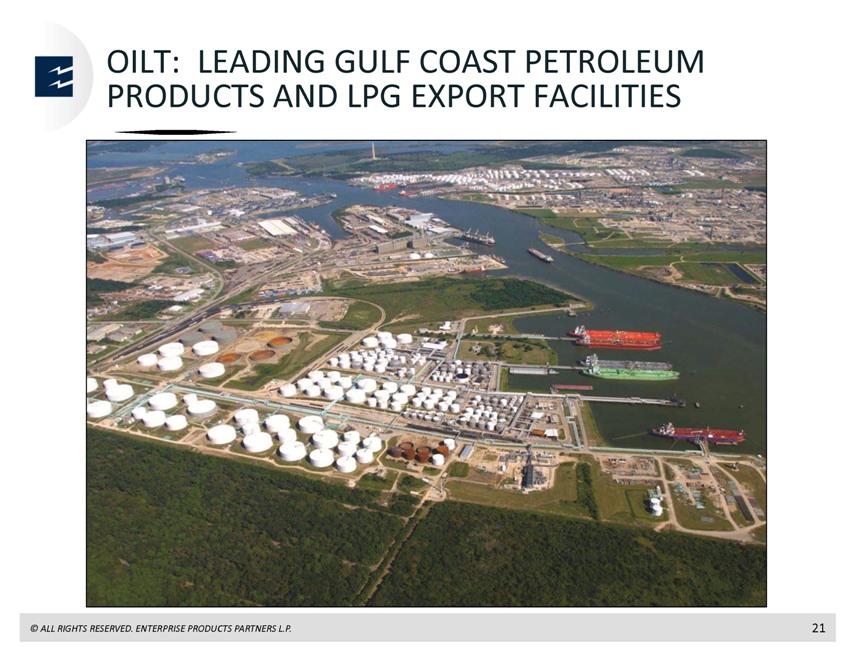

OILT: LEADING GULF COAST PETROLEUM PRODUCTS AND LPG EXPORT FACILITIES

© ALL RIGHTS RESERVED. ENTERPRISE PRODUCTS PARTNERS L.P. 21

QUESTIONS and ANSWERS

© ALL RIGHTS RESERVED. ENTERPRISE PRODUCTS PARTNERS L.P.

enterpriseproducts.com