Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Cooper-Standard Holdings Inc. | a8-kfordeutschebankleverag.htm |

1 Deutsche Bank Leveraged Finance Conference October 1, 2014

2 2 Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of U.S. federal securities laws, and we intend that such forward-looking statements be subject to the safe harbor created thereby. We make forward-looking statements in this presentation and may make such statements in future filings with the SEC. We may also make forward-looking statements in our press releases or other public or stockholder communications. These forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events, future revenue or performance, capital expenditures, financing needs, plans or intentions relating to acquisitions, business trends, and other information that is not historical information. When used in this presentation, the words “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “forecasts,” or future or conditional verbs, such as “will,” “should,” “could,” or “may,” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking statements, including, without limitation, management’s examination of historical operating trends and data are based upon our current expectations and various assumptions. Our expectations, beliefs, and projections are expressed in good faith and we believe there is a reasonable basis for them. However, no assurances can be made that these expectations, beliefs and projections will be achieved. Forward-looking statements are not guarantees of future performance and are subject to significant risks and uncertainties that may cause actual results or achievements to be materially different from the future results or achievements expressed or implied by the forward-looking statements. There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in this presentation. Important factors that could cause our actual results to differ materially from the forward-looking statements we make herein include, but are not limited to: cyclicality of the automotive industry with the possibility of further material contractions in automotive sales and production effecting the viability of our customers and financial condition of our customers; global economic uncertainty, particularly in Europe; loss of large customers or significant platforms; our ability to generate sufficient cash to service our indebtedness, and obtain future financing; operating and financial restrictions imposed on us by our credit agreements; our underfunded pension plans; supply shortages; escalating pricing pressures and decline of volume requirements from our customers; our ability to meet significant increases in demand; availability and increasing volatility in cost of raw materials or manufactured components; our ability to continue to compete successfully in the highly competitive automotive parts industry; risks associated with our non-U.S. operations; foreign currency exchange rate fluctuations; our ability to control the operations of joint ventures for our benefit; the effectiveness of our continuous improvement program and other cost savings plans; a disruption in our information technology systems; product liability and warranty and recall claims that may be brought against us; work stoppages or other labor conditions; natural disasters; our ability to meet our customers’ needs for new and improved products in a timely manner or cost-effective basis; the possibility that our acquisition strategy may not be successful; our legal rights to our intellectual property portfolio; environmental and other regulations; the possible volatility of our annual effective tax rate; significant changes in discount rates and the actual return on pension assets; the possibility of future impairment charges to our goodwill and long-lived assets; and the interests of our major stockholders may conflict with our interests. There may be other factors that may cause our actual results to differ materially from the forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf apply only as of the date of this presentation and are expressly qualified in their entirety by the cautionary statements included herein. We undertake no obligation to update or revise forward-looking statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events.

Cooper Standard Overview Allen Campbell Executive Vice President and Chief Financial Officer

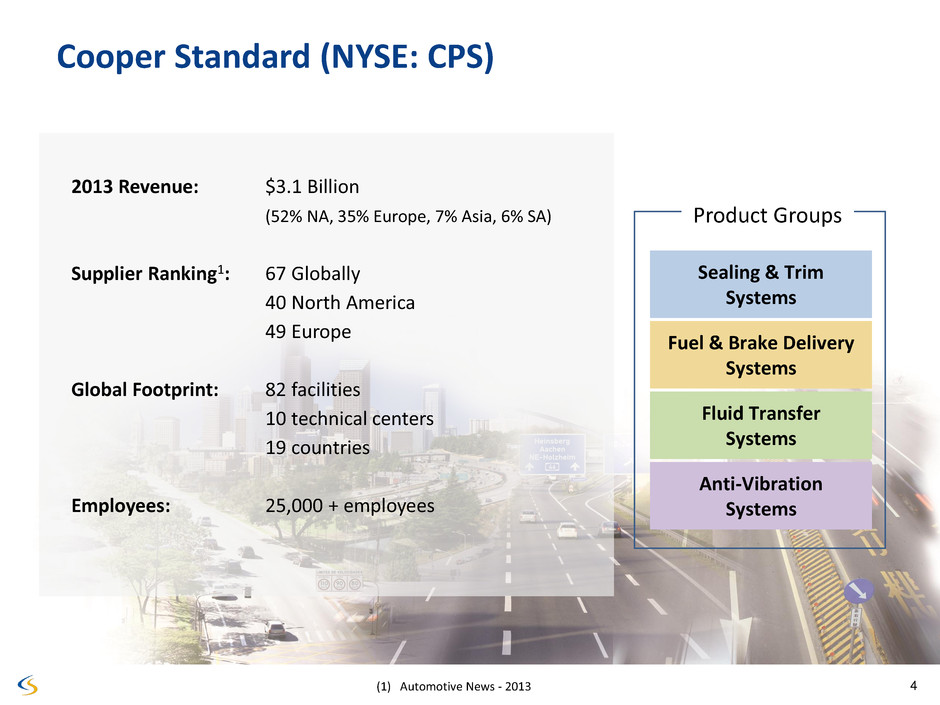

4 4 Cooper Standard (NYSE: CPS) 2013 Revenue: $3.1 Billion (52% NA, 35% Europe, 7% Asia, 6% SA) Supplier Ranking1: 67 Globally 40 North America 49 Europe Global Footprint: 82 facilities 10 technical centers 19 countries Employees: 25,000 + employees (1) Automotive News - 2013 Sealing & Trim Systems Fuel & Brake Delivery Systems Fluid Transfer Systems Anti-Vibration Systems Product Groups

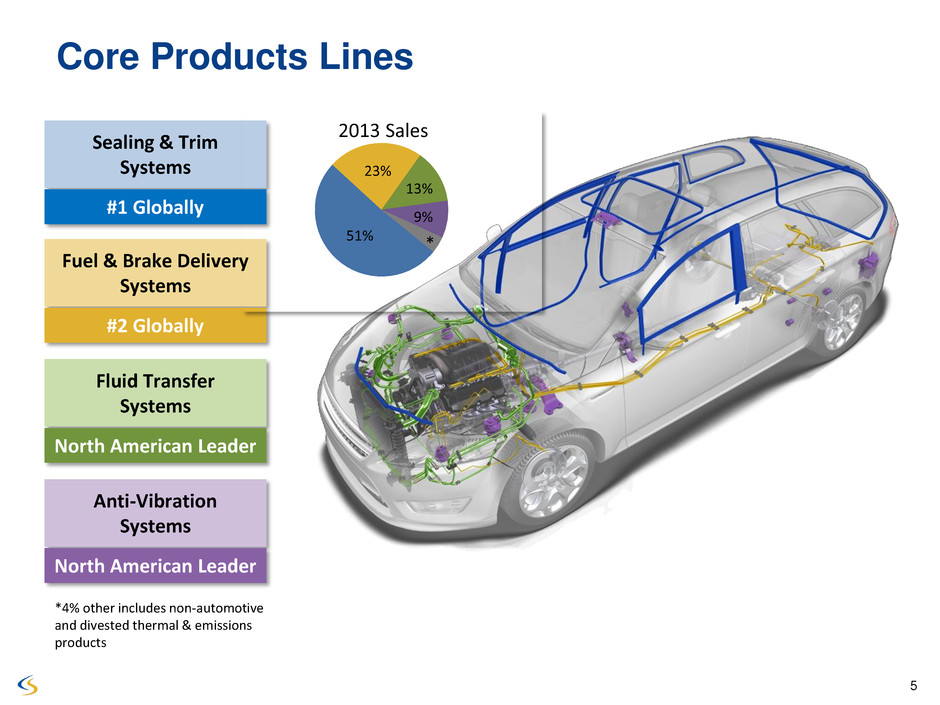

5 5 Static Systems • Glass Run Channels • Waist belts • Encapsulation • Day Light Systems Trim Systems • Appliqués • Bright trim • Exterior Aesthetics Dynamic Systems • On Body Seals • On Door Seals • Convertible • Occupant Detection Systems (ODS) • Fuel Lines • Brake Lines • Bundles Fuel Rails • Tank Lines Fluid Delivery • Hoses • Sensors • Connectors • Quick-Connects • Engine Tubes Power Management • Power Steering Lines • Convertible Lines • Cabin Tilt Lines • Transmission Oil Cooler (TOC) • TOC Lines • TOC Modules • AC Lines / Bundles Body Mounts • Conventional • Hydro Suspension • Strut mounts • Jounce bumpers • Bushing systems Powertrain Mounts • Conventional • Hydro • Multi-State • Torque struts Core Products Lines Sealing & Trim Systems #1 Globally Fuel & Brake Delivery Systems #2 Globally Fluid Transfer Systems North American Leader Anti-Vibration Systems North American Leader 51% 23% 13% 9% 2013 Sales *4% other includes non-automotive and divested thermal & emissions products *

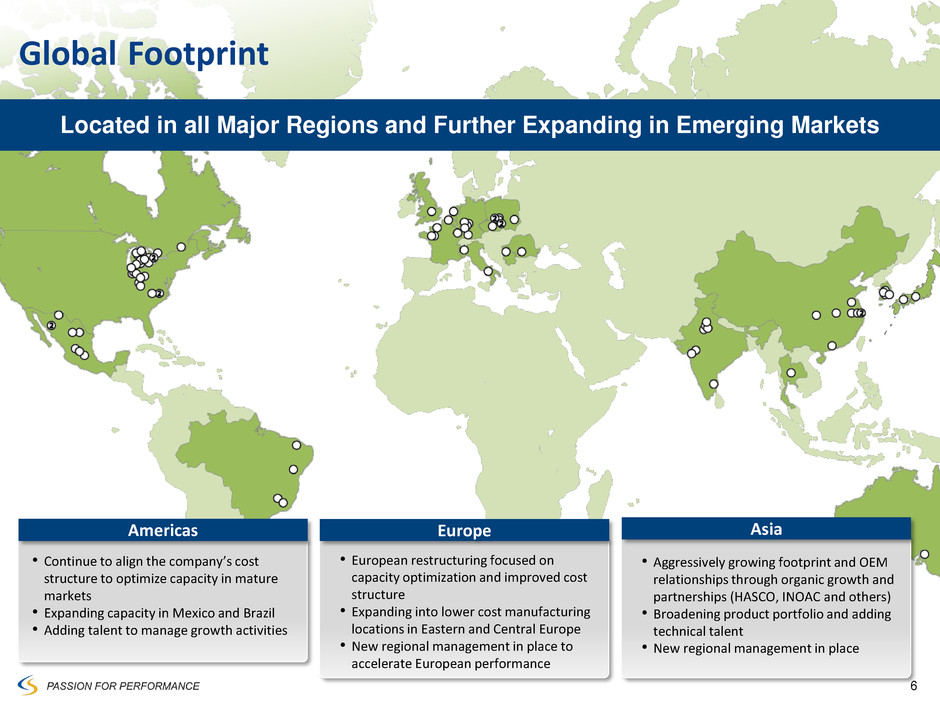

6 Global Footprint Located in all Major Regions and Further Expanding in Emerging Markets Americas Europe Asia • Aggressively growing footprint and OEM relationships through organic growth and partnerships (HASCO, INOAC and others) • Broadening product portfolio and adding technical talent • New regional management in place • Continue to align the company’s cost structure to optimize capacity in mature markets • Expanding capacity in Mexico and Brazil • Adding talent to manage growth activities • European restructuring focused on capacity optimization and improved cost structure • Expanding into lower cost manufacturing locations in Eastern and Central Europe • New regional management in place to accelerate European performance

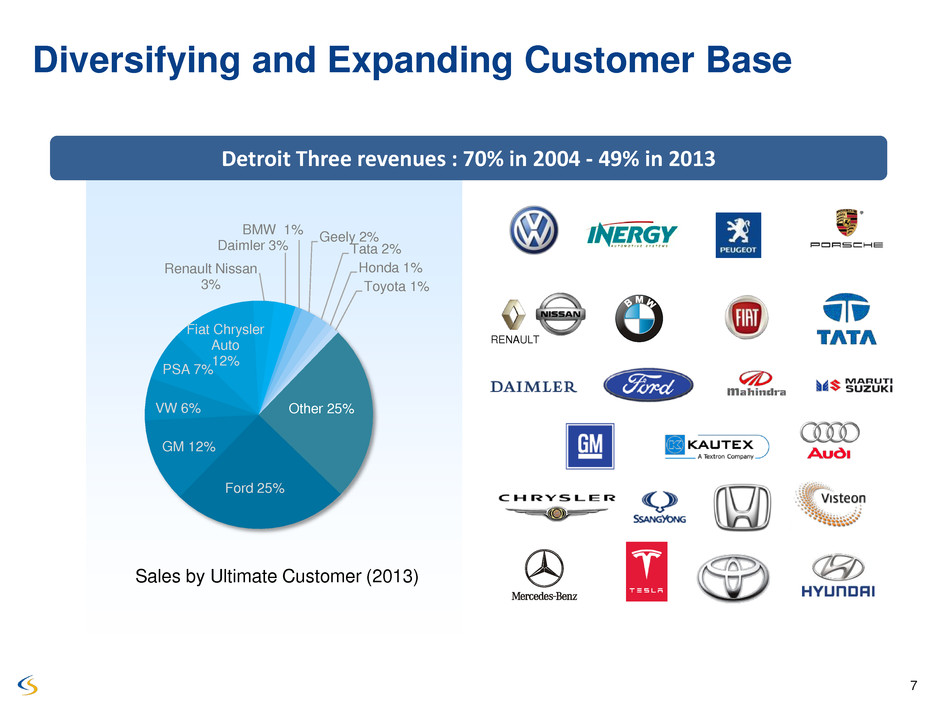

7 7 Diversifying and Expanding Customer Base Detroit Three revenues : 70% in 2004 - 49% in 2013 Ford 25% GM 12% VW 6% PSA 7% Fiat Chrysler Auto 12% Renault Nissan 3% Daimler 3% BMW 1% Geely 2% Tata 2% Honda 1% Toyota 1% Other 25% RENAULT Sales by Ultimate Customer (2013)

8 8 Products Well Represented on Global Platforms #12 Ford Fusion/Mondeo/MKZ #3 Ford Explorer / Taurus #16 Chrysler Dodge Challenger/Charger #9 PSA Picasso/C3 #11 GM Cruze/Volt/Astra #1 Ford F-150 #19 Chrysler Jeep Wrangler #18 VW Jetta #17 Chrysler Town &Country/ Dodge Caravan #8 Chrysler 200 Mid - Size CUV #15 Ford F-Series Super Duty Denotes Global Platform Cooper Standard Products are Consistently on the Top Selling Global Platforms #4 Ford Focus/Escape #13 Volvo* S60/V70 #5 Ford Fiesta / Ecosport #6 GM LaCrosse / Malibu #2 GM Silverado/Sierra/Tahoe/ Yukon/Escalade #7 Chrysler Ram #10 PSA 408 / C4 #14 Fiat Giulietta / Dart *This particular Volvo model is not global but the platform was designed as part of Ford’s global platform #20 Ford Expedition / Navigator

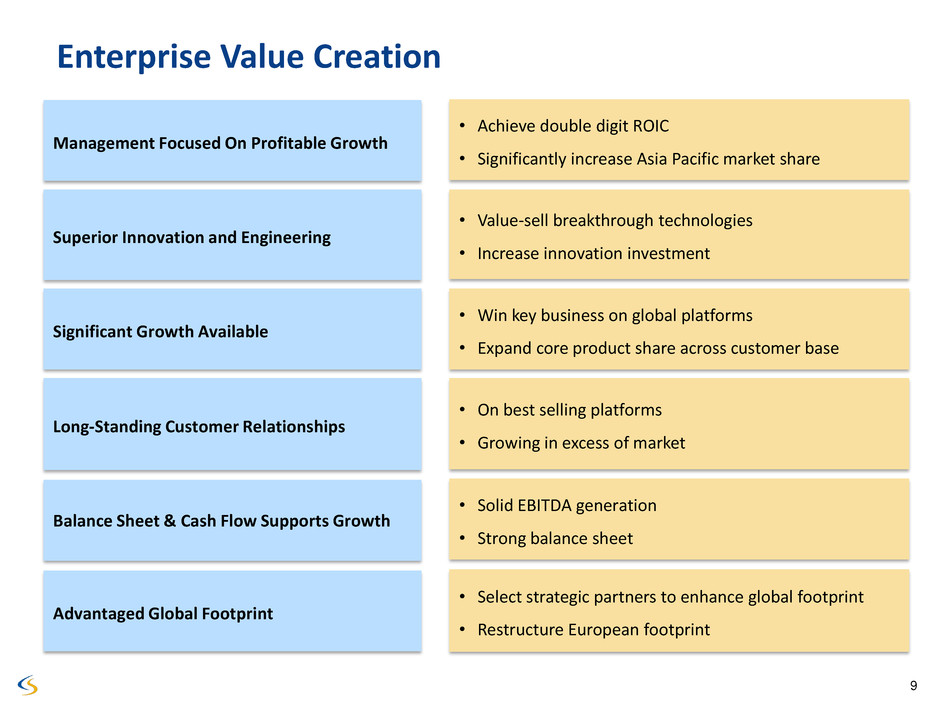

9 9 Enterprise Value Creation Management Focused On Profitable Growth • Achieve double digit ROIC • Significantly increase Asia Pacific market share Significant Growth Available • Win key business on global platforms • Expand core product share across customer base Superior Innovation and Engineering • Value-sell breakthrough technologies • Increase innovation investment Long-Standing Customer Relationships • On best selling platforms • Growing in excess of market Balance Sheet & Cash Flow Supports Growth • Solid EBITDA generation • Strong balance sheet Advantaged Global Footprint • Select strategic partners to enhance global footprint • Restructure European footprint

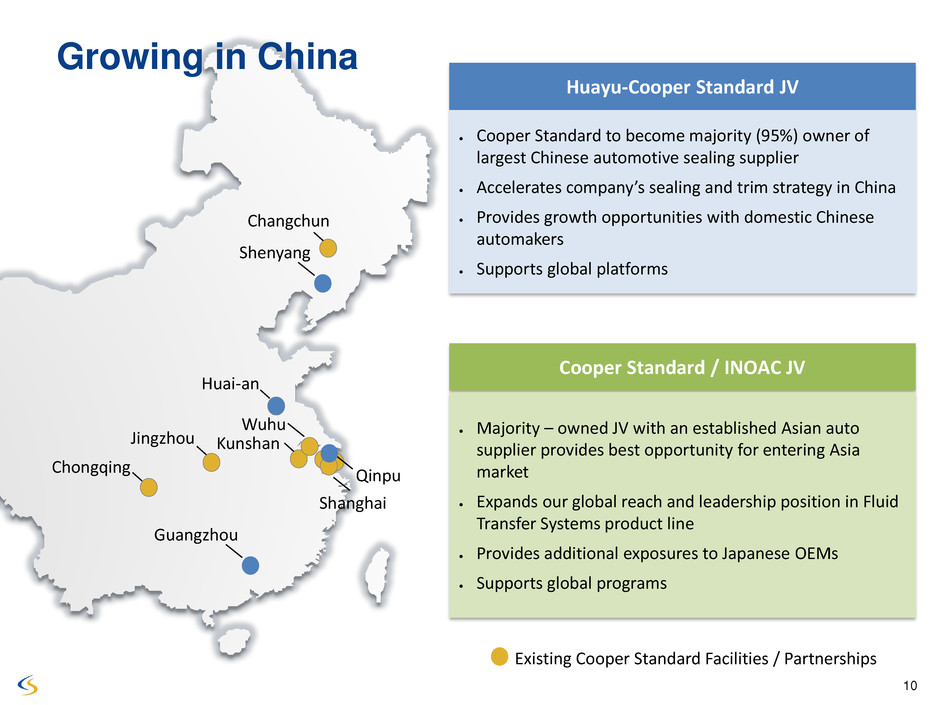

10 10 Growing in China Changchun Chongqing Huai-an Jingzhou Kunshan Shanghai Cooper Standard / INOAC JV Majority – owned JV with an established Asian auto supplier provides best opportunity for entering Asia market Expands our global reach and leadership position in Fluid Transfer Systems product line Provides additional exposures to Japanese OEMs Supports global programs Huayu-Cooper Standard JV • Cooper Standard to become majority (95%) owner of largest Chinese automotive sealing supplier Huayu-Cooper Standard JV Cooper Standard to become majority (95%) owner of largest Chinese automotive sealing supplier Accelerates company’s sealing and trim strategy in China Provides growth opportunities with domestic Chinese automakers Supports global platforms Existing Cooper Standard Facilities / Partnerships Wuhu Guangzhou Shenyang Qinpu

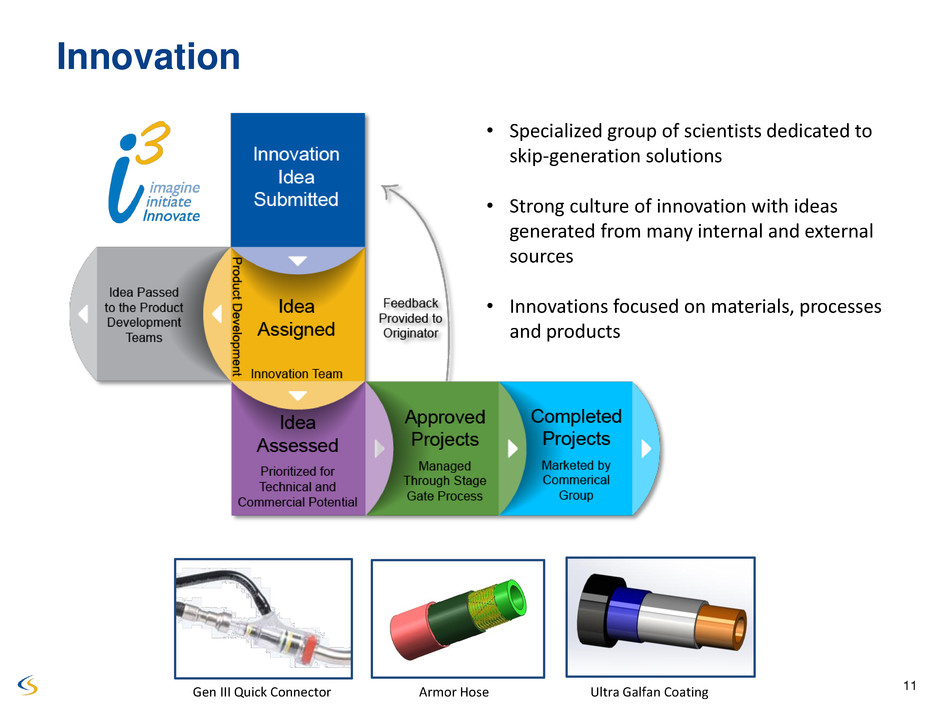

11 11 Photos Others? Innovation • Specialized group of scientists dedicated to skip-generation solutions • Strong culture of innovation with ideas generated from many internal and external sources • Innovations focused on materials, processes and products Ultra Galfan Coating Armor Hose Gen III Quick Connector

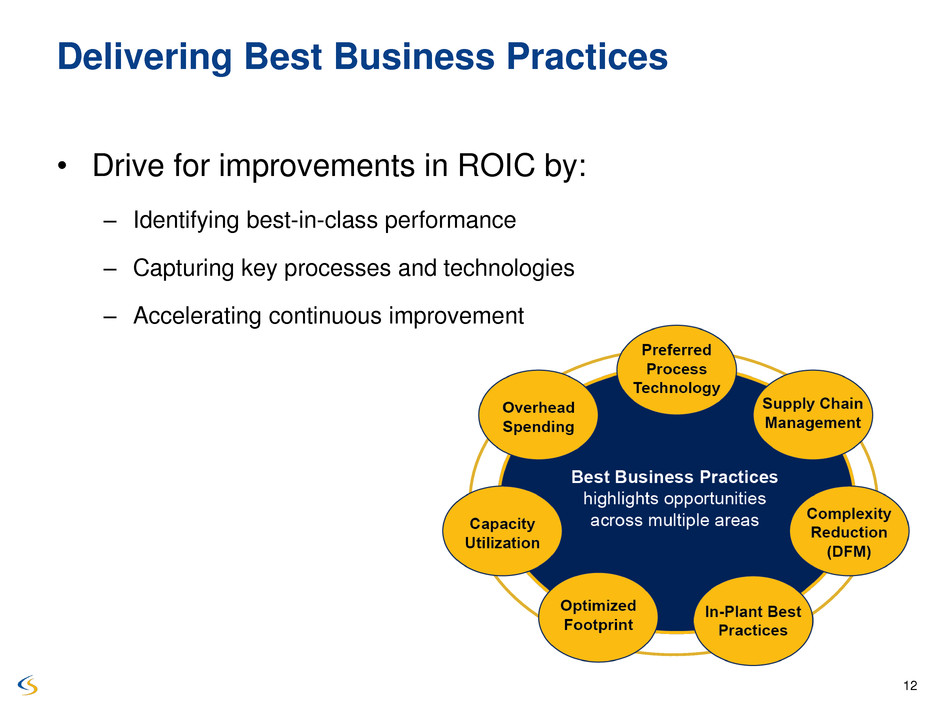

12 12 Delivering Best Business Practices • Drive for improvements in ROIC by: – Identifying best-in-class performance – Capturing key processes and technologies – Accelerating continuous improvement

13 13 Building a Great Place to Work

Glenn Dong Vice President and Treasurer Financial Overview

15 15 Strong Financial Attributes • Growing in excess of market • Improving margin performance • Investing for future growth • Flexible capital structure

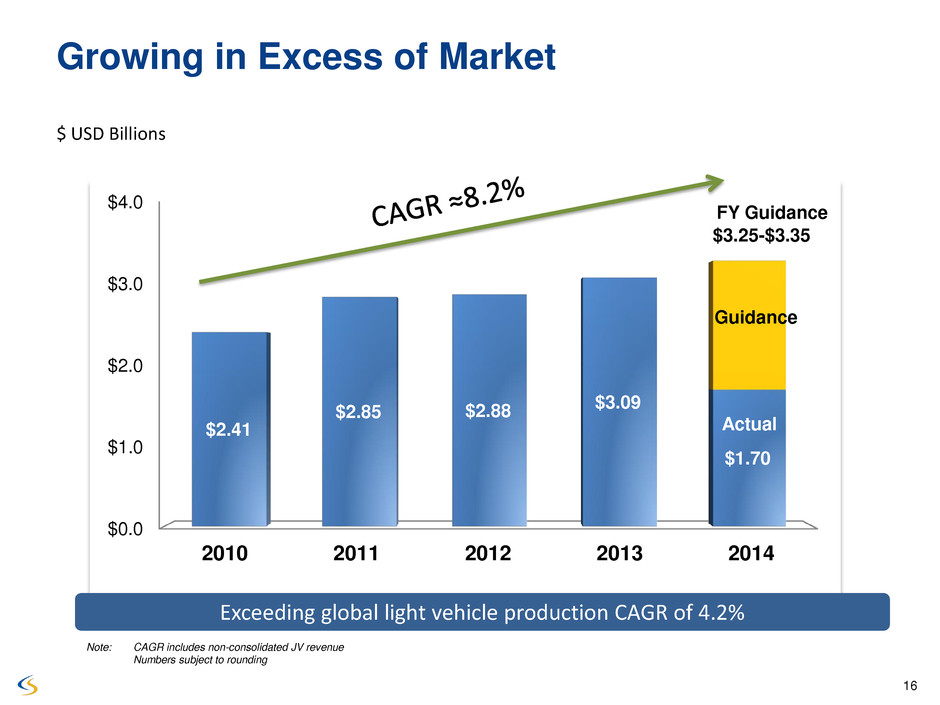

16 16 Growing in Excess of Market $ USD Billions Note: CAGR includes non-consolidated JV revenue Numbers subject to rounding $0.0 $1.0 $2.0 $3.0 $4.0 2010 2011 2012 2013 2014 $2.41 $2.85 $2.88 $3.09 $1.70 Exceeding global light vehicle production CAGR of 4.2% $3.25-$3.35 FY Guidance Actual Guidance

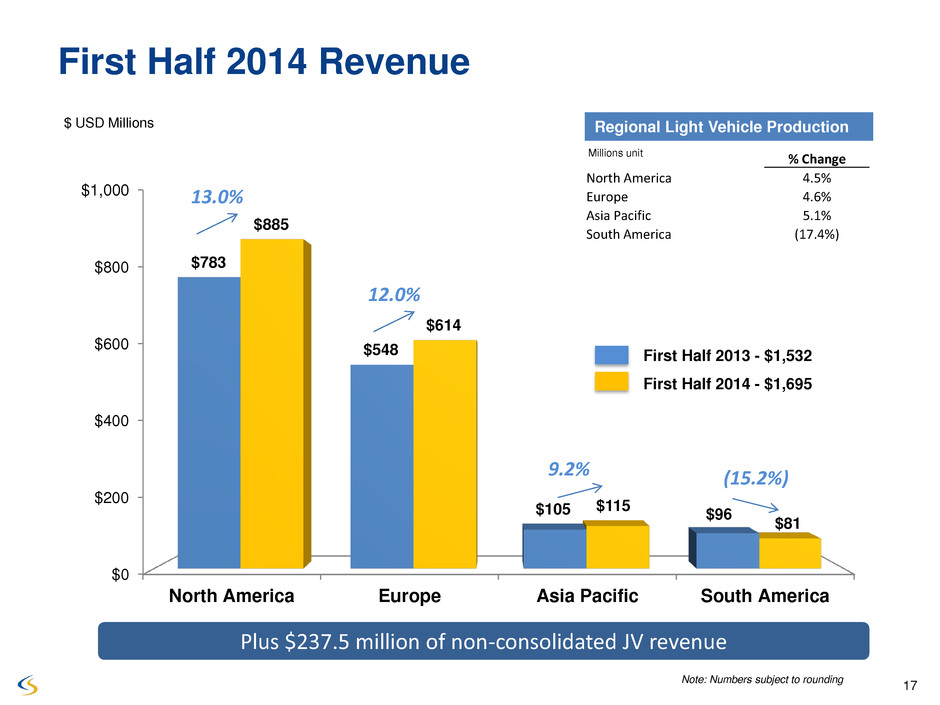

17 17 First Half 2014 Revenue Note: Numbers subject to rounding First Half 2013 - $1,532 First Half 2014 - $1,695 $ USD Millions $0 $200 $400 $600 $800 $1,000 North America Europe Asia Pacific South America $783 $548 $105 $96 $885 $614 $115 $81 13.0% 12.0% 9.2% (15.2%) Regional Light Vehicle Production % Change North America 4.5% Europe 4.6% Asia Pacific 5.1% South America (17.4%) Millions unit Plus $237.5 million of non-consolidated JV revenue

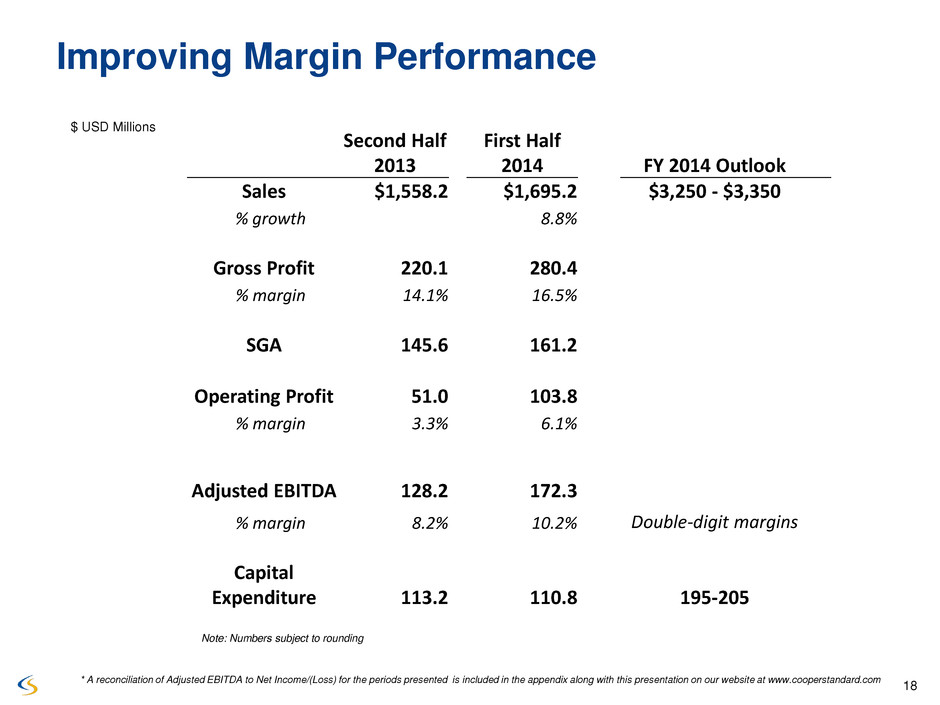

18 18 Improving Margin Performance Second Half 2013 First Half 2014 FY 2014 Outlook Sales $1,558.2 $1,695.2 $3,250 - $3,350 % growth 8.8% Gross Profit 220.1 280.4 % margin 14.1% 16.5% SGA 145.6 161.2 Operating Profit 51.0 103.8 % margin 3.3% 6.1% Adjusted EBITDA 128.2 172.3 % margin 8.2% 10.2% Double-digit margins Capital Expenditure 113.2 110.8 195-205 $ USD Millions Note: Numbers subject to rounding * A reconciliation of Adjusted EBITDA to Net Income/(Loss) for the periods presented is included in the appendix along with this presentation on our website at www.cooperstandard.com

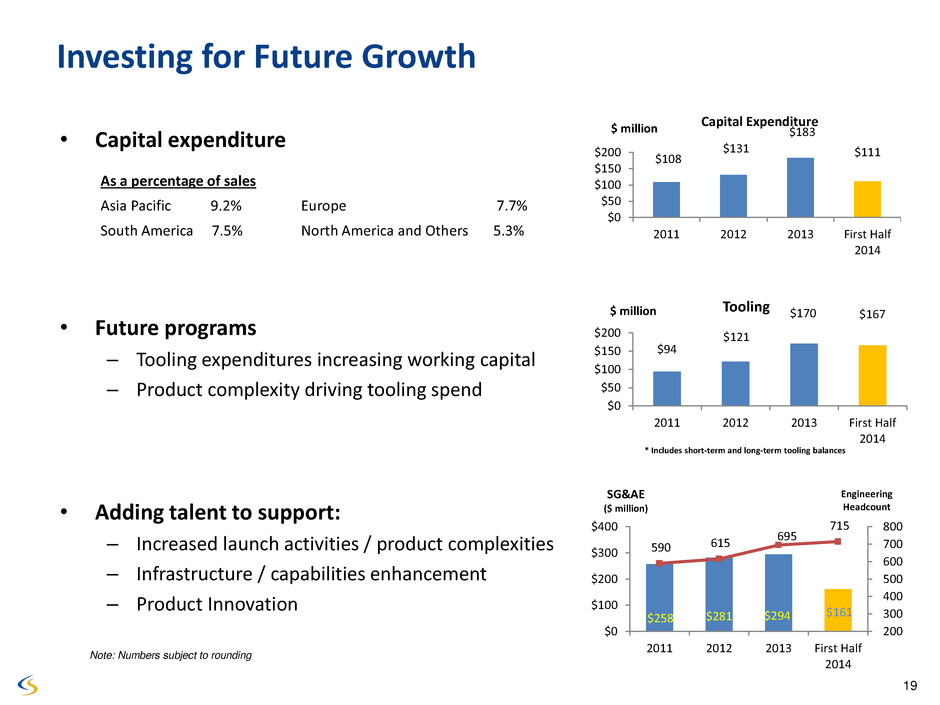

19 19 Investing for Future Growth • Capital expenditure • Future programs – Tooling expenditures increasing working capital – Product complexity driving tooling spend • Adding talent to support: – Increased launch activities / product complexities – Infrastructure / capabilities enhancement – Product Innovation * Includes short-term and long-term tooling balances $94 $121 $170 $167 $0 $50 $100 $150 $200 2011 2012 2013 First Half 2014 $ million Tooling $108 $131 $183 $111 $0 $50 $100 $150 $200 2011 2012 2013 First Half 2014 $ million Capital Expenditure $258 $281 $294 $161 590 615 695 715 200 300 400 500 600 700 800 $0 $100 $200 $300 $400 2011 2012 2013 First Half 2014 Engineering Headcount SG&AE ($ million) Note: Numbers subject to rounding As a percentage of sales Asia Pacific 9.2% Europe 7.7% South America 7.5% North America and Others 5.3%

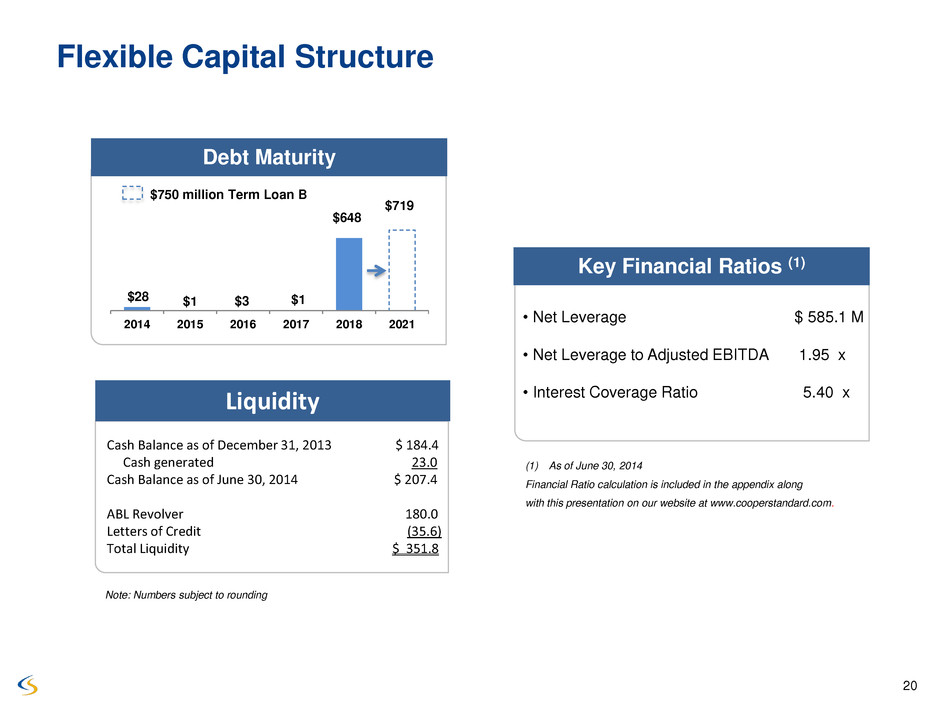

20 20 Flexible Capital Structure • Net Leverage $ 585.1 M • Net Leverage to Adjusted EBITDA 1.95 x • Interest Coverage Ratio 5.40 x Debt Maturity $28 $1 $3 $1 $648 $719 2014 2015 2016 2017 2018 2021 $750 million Term Loan B Key Financial Ratios (1) Note: Numbers subject to rounding Liquidity Cash Balance as of December 31, 2013 $ 184.4 Cash generated 23.0 Cash Balance as of June 30, 2014 $ 207.4 ABL Revolver 180.0 Letters of Credit (35.6) Total Liquidity $ 351.8 (1) As of June 30, 2014 Financial Ratio calculation is included in the appendix along with this presentation on our website at www.cooperstandard.com.

21 21 Management Focused On Profitable Growth Significant Growth Available Superior Innovation and Engineering Long-Standing Customer Relationships Balance Sheet & Cash Flow Supports Growth Advantaged Global Footprint Cooper Standard Value Proposition

Appendix

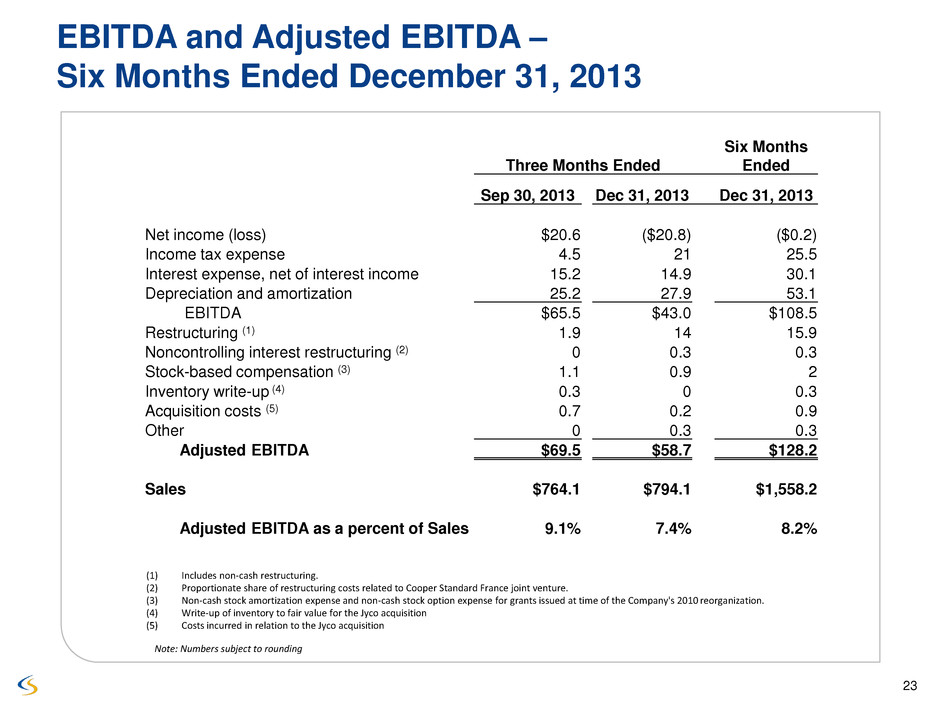

23 23 Note: Numbers subject to rounding EBITDA and Adjusted EBITDA – Six Months Ended December 31, 2013 Three Months Ended Six Months Ended Sep 30, 2013 Dec 31, 2013 Dec 31, 2013 Net income (loss) $20.6 ($20.8) ($0.2) Income tax expense 4.5 21 25.5 Interest expense, net of interest income 15.2 14.9 30.1 Depreciation and amortization 25.2 27.9 53.1 EBITDA $65.5 $43.0 $108.5 Restructuring (1) 1.9 14 15.9 Noncontrolling interest restructuring (2) 0 0.3 0.3 Stock-based compensation (3) 1.1 0.9 2 Inventory write-up (4) 0.3 0 0.3 Acquisition costs (5) 0.7 0.2 0.9 Other 0 0.3 0.3 Adjusted EBITDA $69.5 $58.7 $128.2 Sales $764.1 $794.1 $1,558.2 Adjusted EBITDA as a percent of Sales 9.1% 7.4% 8.2% (1) Includes non-cash restructuring. (2) Proportionate share of restructuring costs related to Cooper Standard France joint venture. (3) Non-cash stock amortization expense and non-cash stock option expense for grants issued at time of the Company's 2010 reorganization. (4) Write-up of inventory to fair value for the Jyco acquisition (5) Costs incurred in relation to the Jyco acquisition

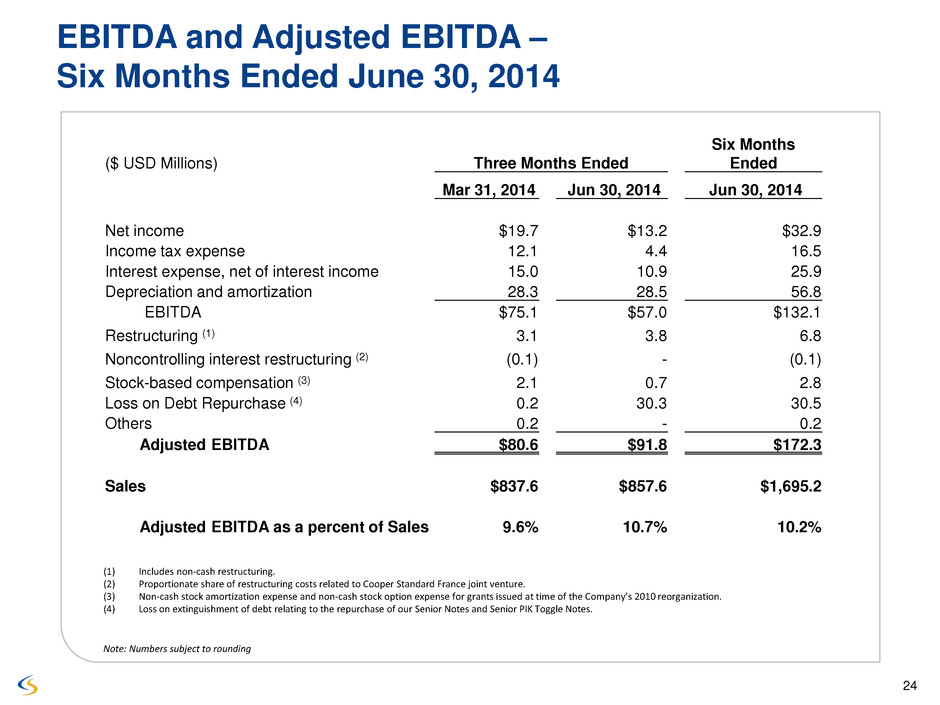

24 24 Note: Numbers subject to rounding (1) Includes non-cash restructuring. (2) Proportionate share of restructuring costs related to Cooper Standard France joint venture. (3) Non-cash stock amortization expense and non-cash stock option expense for grants issued at time of the Company’s 2010 reorganization. (4) Loss on extinguishment of debt relating to the repurchase of our Senior Notes and Senior PIK Toggle Notes. EBITDA and Adjusted EBITDA – Six Months Ended June 30, 2014 ($ USD Millions) Three Months Ended Six Months Ended Mar 31, 2014 Jun 30, 2014 Jun 30, 2014 Net income $19.7 $13.2 $32.9 Income tax expense 12.1 4.4 16.5 Interest expense, net of interest income 15.0 10.9 25.9 Depreciation and amortization 28.3 28.5 56.8 EBITDA $75.1 $57.0 $132.1 Restructuring (1) 3.1 3.8 6.8 Noncontrolling interest restructuring (2) (0.1) - (0.1) Stock-based compensation (3) 2.1 0.7 2.8 Loss on Debt Repurchase (4) 0.2 30.3 30.5 Others 0.2 - 0.2 Adjusted EBITDA $80.6 $91.8 $172.3 Sales $837.6 $857.6 $1,695.2 Adjusted EBITDA as a percent of Sales 9.6% 10.7% 10.2%

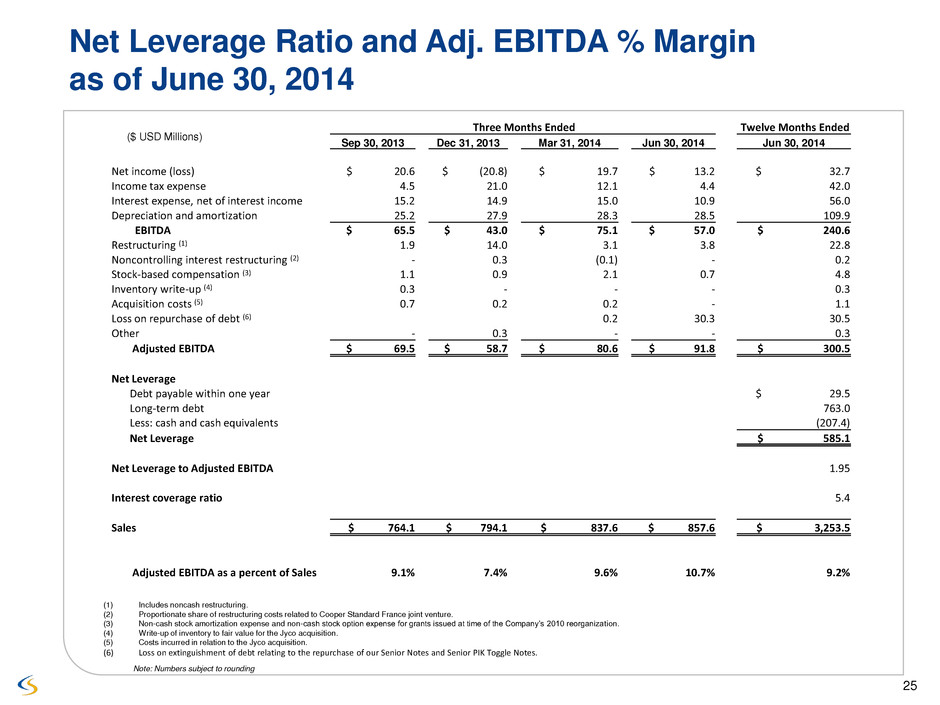

25 25 Net Leverage Ratio and Adj. EBITDA % Margin as of June 30, 2014 Note: Numbers subject to rounding ($ USD Millions) (1) Includes noncash restructuring. (2) Proportionate share of restructuring costs related to Cooper Standard France joint venture. (3) Non-cash stock amortization expense and non-cash stock option expense for grants issued at time of the Company’s 2010 reorganization. (4) Write-up of inventory to fair value for the Jyco acquisition. (5) Costs incurred in relation to the Jyco acquisition. (6) Loss on extinguishment of debt relating to the repurchase of our Senior Notes and Senior PIK Toggle Notes. Three Months Ended Twelve Months Ended Sep 30, 2013 Dec 31, 2013 Mar 31, 2014 Jun 30, 2014 Jun 30, 2014 Net income (loss) $ 20.6 $ (20.8) $ 19.7 $ 13.2 $ 32.7 Income tax expense 4.5 21.0 12.1 4.4 42.0 Interest expense, net of interest income 15.2 14.9 15.0 10.9 56.0 Depreciation and amortization 25.2 27.9 28.3 28.5 109.9 EBITDA $ 65.5 $ 43.0 $ 75.1 $ 57.0 $ 240.6 Restructuring (1) 1.9 14.0 3.1 3.8 22.8 Noncontrolling interest restructuring (2) - 0.3 (0.1) - 0.2 Stock-based compensation (3) 1.1 0.9 2.1 0.7 4.8 Inventory write-up (4) 0.3 - - - 0.3 Acquisition costs (5) 0.7 0.2 0.2 - 1.1 Loss on repurchase of debt (6) 0.2 30.3 30.5 Other - 0.3 - - 0.3 Adjusted EBITDA $ 69.5 $ 58.7 $ 80.6 $ 91.8 $ 300.5 Net Leverage Debt payable within one year $ 29.5 Long-term debt 763.0 Less: cash and cash equivalents (207.4) Net Leverage $ 585.1 Net Leverage to Adjusted EBITDA 1.95 Interest coverage ratio 5.4 Sales $ 764.1 $ 794.1 $ 837.6 $ 857.6 $ 3,253.5 Adjusted EBITDA as a percent of Sales 9.1% 7.4% 9.6% 10.7% 9.2%

26 26 Non-GAAP Financial Measures EBITDA and adjusted EBITDA are measures not recognized under Generally Accepted Accounting Principles (GAAP) which exclude certain non-cash and non-recurring items. When analyzing the company’s operating performance, investors should use EBITDA and adjusted EBITDA in addition to, and not as alternatives for, net income (loss), operating income, or any other performance measure derived in accordance with GAAP, or as an alternative to cash flow from operating activities as a measure of the company’s performance. EBITDA and adjusted EBITDA have limitations as analytical tools and should not be considered in isolation or as substitutes for analysis of the company’s results of operations as reported under GAAP. Other companies may report EBITDA and adjusted EBITDA differently and therefore Cooper Standard’s results may not be comparable to other similarly titled measures of other companies.