Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NABORS INDUSTRIES LTD | a14-21670_18k.htm |

Exhibit 99.1

|

|

2014 Johnson Rice Energy Conference September 30, 2014 Presenters: Siggi Meissner President, Nabors International William Conroy Associate Director, Corporate Development |

|

|

Forward-Looking Statements We often discuss expectations regarding our markets, demand for our products and services, and our future performance in our annual and quarterly reports, press releases, and other written and oral statements. Such statements, including statements in this document incorporated by reference that relate to matters that are not historical facts are -looking within the meaning of the safe harbor provisions of Section 27A of the U.S. Securities Act of 1933 as amended (the Securities Act) and Section 21E of the Securities Exchange Act of 1934. These -looking are based on our analysis of currently available competitive, financial and economic data and our operating plans. They are inherently uncertain, and investors must recognize that events and actual results could turn out to be significantly different from our expectations. Factors to consider when evaluating these forward-looking statements include but are not limited to: fluctuations in worldwide prices and demand for natural gas, natural gas liquids and crude oil; fluctuations in levels of natural gas, natural gas liquids and crude oil exploration and development activities; fluctuations in the demand for our services; the existence of competitors, technological changes and developments in the oilfield services industry; the existence of operating risks inherent in the oilfield services industry; the existence of regulatory and legislative uncertainties; the possibility of changes in tax laws; the possibility of political instability, war or acts of terrorism in any of the countries in which we do business; and general economic conditions including the capital and credit markets. Our businesses depend, to a large degree, on the level of spending by oil and gas companies for exploration, development and production activities. Therefore, a sustained increase or decrease in the price of natural gas, natural gas liquids or crude oil, which could have a material impact on exploration and production activities, could also materially affect our financial position, results of operations and cash flows. The above description of risks and uncertainties is by no means all inclusive, but is designed to highlight what we believe are important factors to consider. 2 |

|

|

Embark in a New Direction Streamlining the Business > Actions Combine CS and PS segments into one organization Consolidate Alaska and U.S. Offshore into NDUSA Merge engineering groups into single centralized unit > Benefits Eliminate duplicate expenses Focus engineering and research efforts with cohesive strategy Accelerate rig technology development 3 |

|

|

Embark in a New Direction Streamlining the Business > Anticipated Merger of NCPS with C&J Energy Retain 53% equity interest in combined entity Create critical mass Capitalize on technology and increased scale Facilitate international expansion Realize more than $900M cash back to NBR 4 |

|

|

Embark in a New Direction Streamlining the Business > Nabors Post-transaction Benefits Refocus on Drilling business Reduce internal competition for capital Increase proportion of revenue contractually covered Strategy Target ultra-high and high-performance drilling markets Advance drilling state-of-the-art with innovative technology > -play Land Driller 5 |

|

|

6 Drilling Ahead - International |

|

|

7 We are market leaders in land drilling globally 1. We have a Global Footprint operating in about 24 countries around the world 2. Our crew is heavily skewed towards national crew in most regions 3. We invest substantially in training and safety of our people 4. We have Global 24-hour rig operations support center that helps us troubleshoot problems in real time 5. We have a Consolidated Engineering team that helps us develop and implement advanced drilling technologies 6. We have a Performance Drilling Group to ensure we: Monitor key metrics and performance Identify important trends Implement best practices 7 Key areas that set us apart Plan vs. Actual time depth curve Our aim is to consistently exceed client expectations |

|

|

countries outside United States 8 >Our workforce: Over 10,000 employees Over 70 nationalities >Our assets: 134 Land Rigs 24 Offshore Rigs Mexico Argentina Saudi Arabia Operating areas Priority markets with details in later slides >Land rig description: <1500 HP: 42 Rigs 1500-2000 HP: 42 Rigs >2000 HP: 50 Rigs As of June 30, 2014 |

|

|

9 Saudi Arabia is our largest International market > Rig renewals: 12 rigs renewed in 2013 and another 12 in 2014 Trend for early renewals expected to continue into 2015 > New rigs: 11 new rig awards for 2014 deployment Schedule: 1st rig started in 1Q and 2nd in 2Q 9 expected in 2H 2014 Capex: On-budget Returns expected to meet or exceed threshold Description of the market Marketable Rigs in Saudi Arabia 43 32 34 32 2011 2012 2014E 2013 1. Includes both 100% and 50% owned rigs |

|

|

Saudi Arabia: We have the largest share of land drilling rigs and are positioned to grow 10 Strong current market share Promising future opportunities Description > As of June 30, we estimate we are market leaders with ~21% share of land rig market and 8% share of offshore rig market > Saudi Arabia is also expected to see an increased demand for rigs: In high pressure gas are where we have significant experience In the Unconventional space and we are well positioned to take advantage of it due to: Our experience in high-pressure gas drilling in Saudi Arabia Our experience in unconventional shale areas of the U.S. Our relationship with the client Strong position to leverage > We have three key strengths that position us for growth: Trust of the client in delivering value Experience in operating in high pressure gas areas which requires a specialized skill-set Workforce comprised of increasingly Saudi crew (not only at the Floorhand level but also at the Driller and Rig Manager level) |

|

|

11 Argentina is increasingly becoming an important market > Renewals: Most contracts extend into 2015 > New Rigs: 6 new rigs deployed since 2013 Schedule 1st rig started August 2013 Project delivered on time and on budget 26 24 19 21 2013 2014E 2011 2012 Description of the market Marketable rigs in Argentina |

|

|

Argentina: We are increasing our presence in drilling rigs 12 Significant current market share Promising future opportunities Description > We currently have ~9% of land drilling rig and 8% workover rig market share > We have moved from primarily providing workover rigs to providing drilling rigs > Argentina is expected to see increasing activity: In the current areas of activity e.g. Neuquén and Mendoza where we have significant experience In the Unconventional space and we are well positioned to take advantage of it due to: Our experience in unconventional Shale areas of the U.S. Our relationship with the client In utilization of our directional and MWD services Strong position to leverage > We have three key strengths that position us for growth: Infrastructure (e.g. Neuquén base) to support current activity and projected future increase in activity Trust of the client in delivering value Workforce comprised of completely national crew |

|

|

13 Mexico offshore market has become one of our most important offshore markets > Renewals: Expect most offshore rigs to be renewed Land rig market is challenging in short term > New Rigs: Deploying two 3000 HP platform rigs in 2014/15 Schedule: 1st rig starting 4Q14 2nd rig starting 1Q15 Project on time and on budget Description of the market Marketable rigs in Mexico 14 13 13 12 2013 2012 2011 2014E |

|

|

Mexico-Offshore: We have pioneered the offshore market and have significant market share 14 Significant current market share Promising future opportunities Description > We currently have about 8% of offshore rig market share > We have pioneered the offshore technology (MASE rigs) in Mexico and PEMEX typically specifies the requirement for this rigs (which is a NABORS proprietary design) > Mexico is expected to see increasing activity: In the current areas of activity offshore due to Energy Reforms in Mexico In the Unconventional space (especially Eagle Ford outcrop across border) and we are well positioned to take advantage of it due to our experience across the border In utilization of our directional and MWD services Strong position to leverage > We have three key strengths that position us for growth: Experience in building and operating offshore rigs for our existing client Ability to provide high-end technology to solve complex offshore problems |

|

|

15 In summary, we are well positioned to take advantage of the increasing demand for land rigs 1. We have a Global Footprint 2. Our crew is heavily skewed towards national crew in most regions 3. We invest substantially in training and safety of our people 4. We have Global 24-hour rig operations support 5. We have a Consolidated Engineering team 6. We have a Performance Drilling Group 15 Key areas that set us apart Plan vs. Actual time depth curve Our aim is to consistently exceed client expectations |

|

|

16 Drilling Ahead |

|

|

Drilling Ahead > Unmatched Global Position and Opportunity Set Largest fleet of land drilling rigs in the industry Vertically-integrated drilling equipment and technology Global footprint with dominant position in attractive markets > Clear Path to Improving Performance Strong International backlog Ongoing upside in U.S. Land Visible growth in other segments > Ongoing Return-on-Capital Initiatives Improving margins Reducing newbuild construction cost Divesting non-core assets 17 |

|

|

Drilling Ahead Next 5 Years Market Survey Conducted by 3rd Party Firm > Interviews with 60 Oil & Gas Operators 40 North America based majors to mid- > International #1 in drilling performance and technical capabilities Clear market share leader > North America One of two top-tier drillers High ratings on customer priorities: Rig operating efficiency Rig technical specifications 18 |

|

|

Drilling Ahead Next 5 Years Global Market Study International Summary > Nabors holds prime slot in two markets with the highest expected five-year growth Nabors is a leader in the high value/high growth Saudi Arabia and Latin America markets Middle East, 160 total additional rigs expected Latin America, over 100 total additional rigs expected 19 |

|

|

Drilling Ahead Next 5 Years Global Market Study North America Summary 20 > 2-4% - projected NAM total rig demand CAGR > 5-7% - rig demand CAGR > 10-12% - Pad Drilling 2010A 2013A 2018E % of Wells Drilled on Pads 20% 50% 70% Avg. # of Wells per Pad 2.2 4.0 6+ Accelerating Trend Towards Higher-Density Pad Drilling |

|

|

Drilling Ahead Strong Contractual Backlog Clear Path to Improving Performance > International Rigs Under Contract Revenue backlog >$3,500M > U.S. Lower-48 Rigs Under Contract Revenue backlog >$800M > Other Segments Revenue backlog >$400M > More than $4.7 Billion of Revenue 21 |

|

|

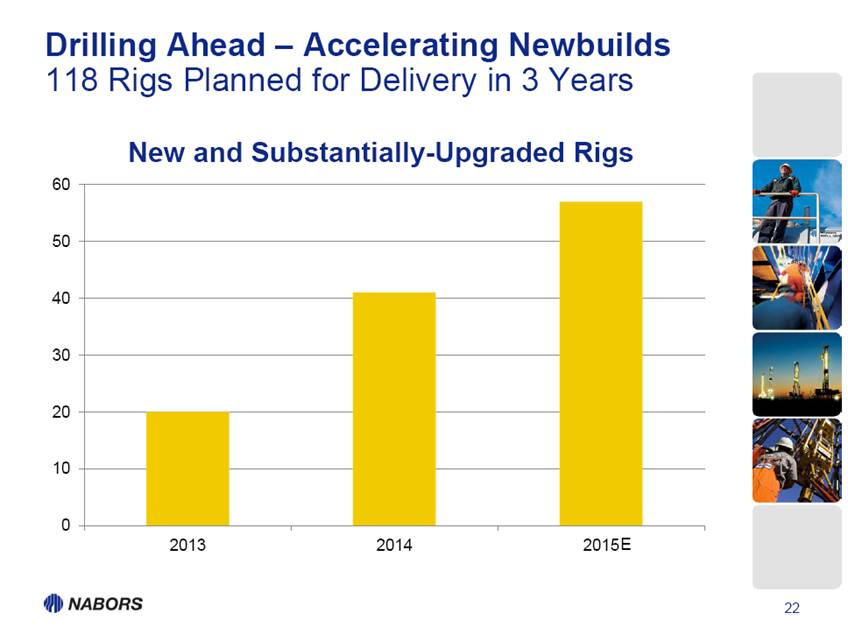

Drilling Ahead Accelerating Newbuilds 118 Rigs Planned for Delivery in 3 Years 22 0 10 20 30 40 50 60 2013 2014 2015 New and Substantially-Upgraded Rigs |

|

|

Drilling Ahead Enhancing ROCE Return-on-Capital Improvement Opportunities 23 > Near-term 7-Point Improvement in PACE®-X ROCE Growing the Numerator Value Pricing and Pricing Discipline Operating Expenses Improving the Denominator Capital Cost Reduction of 15% > Enhanced Value Proposition Processes to capture approximately 3 days/well > Repricing Approximately 60 Lower-48 term contracts rollover in 2H 2014 Material increases in International renewals > Impactful Global Newbuild Deployments |

|

|

0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x Legacy Other AC PACE®-X International Alaska + Offshore Drilling Ahead Leverage from New Rigs Growing Accretion through Mix Shift to High-spec Rigs 24 Average Daily Rig Margin by Rig Type as of 2Q 2014 118 planned newbuild rig deployments 2013-2015E |

|

|

Drilling Ahead Strong Pricing Gains Actual Lower-48 AC Rig Fleet (Excluding PACE®-X Rigs) 25 Revenue per Day Trend, Normalized for Mix 100% 102% 104% 106% 108% 110% 112% Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 May-14 Jun-14 Jul-14 |

|

|

Drilling Ahead Robust Outlook > Lower-48 Positive pricing momentum Strong AC newbuild demand > International Middle East Latin America Repricing renewals to current market > Canada Stronger year-round demand Evaluating potential newbuilds > Canrig Growing internal and third-party equipment Strong growth in drilling software 26 |

|

|

Summary Why Nabors? > Significant progress on streamlining the business, evidenced by the C&J transaction > Intensified focus on global drilling business with emphasis on return on capital > Strong global growth outlook > Optimized capital structure and financial flexibility 27 |