Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - EnSync, Inc. | Financial_Report.xls |

| EX-32.1 - EXHIBIT 32.1 - EnSync, Inc. | exh32_1.htm |

| EX-21.1 - EXHIBIT 21 - EnSync, Inc. | exh21.htm |

| EX-3.1 - EXHIBIT 3.1 - EnSync, Inc. | exh3_1.htm |

| EX-32.2 - EXHIBIT 32.2 - EnSync, Inc. | exh32_2.htm |

| EX-31.1 - EXHIBIT 31.1 - EnSync, Inc. | exh31_1.htm |

| EX-10.31 - EXHIBIT 10.31 - EnSync, Inc. | exh10_31.htm |

| EX-10.24 - EXHIBIT 10.24 - EnSync, Inc. | exh10_24.htm |

| EX-10.33 - EXHIBIT 10.33 - EnSync, Inc. | exh10_33.htm |

| EX-10.32 - EXHIBIT 10.32 - EnSync, Inc. | exh10_32.htm |

| EX-23.1 - EXHIBIT 23 - EnSync, Inc. | exh23.htm |

| EX-31.2 - EXHIBIT 31.2 - EnSync, Inc. | exh31_2.htm |

| EX-10.34 - EXHIBIT 10.34 - EnSync, Inc. | exh10_34.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended June 30, 2014

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission File Number: 001-33540

|

(Exact name of registrant as specified in its charter)

|

Wisconsin

|

39-1987014

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

N93 W14475 Whittaker Way, Menomonee Falls, Wisconsin

|

53051

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s telephone number, including area code:

|

(262) 253-9800

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 Par Value

|

NYSE MKT

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

||

|

None

|

||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

Non-accelerated filer ¨

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates, computed by reference to the last sales price on December 31, 2013, which was the last business day of the registrant's most recently completed second fiscal quarter, was $14,843,314.

The number of shares of the registrant’s Common Stock outstanding as of September 29, 2014 was 39,022,174.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant intends to file a definitive proxy statement pursuant to Regulation 14A within 120 days after the end of the fiscal year ended June 30, 2014. Portions of such proxy statement are incorporated by reference into Part III of this Form 10-K.

1

ZBB ENERGY CORPORATION

2014 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

|

PAGE

|

|||||

|

PART I

|

3 | ||||

|

Item 1.

|

Business

|

3 | |||

|

Item 1A.

|

Risk Factors

|

10 | |||

|

Item 1B.

|

Unresolved Staff Comments

|

16 | |||

|

Item 2.

|

Properties

|

17 | |||

|

Item 3.

|

Legal Proceedings

|

17 | |||

|

Item 4.

|

Mine Safety Disclosures

|

17 | |||

|

PART II

|

18 | ||||

|

Item 5.

|

Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

|

18 | |||

|

Item 6.

|

Selected Financial Data

|

19 | |||

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

19 | |||

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

22 | |||

|

Item 8.

|

Financial Statements and Supplementary Data

|

23 | |||

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

49 | |||

|

Item 9A.

|

Controls and Procedures

|

49 | |||

|

Item 9B.

|

Other Information

|

49 | |||

|

PART III

|

51 | ||||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

51 | |||

|

Item 11.

|

Executive Compensation

|

51 | |||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

51 | |||

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

51 | |||

|

Item 14.

|

Principal Accounting Fees and Services

|

51 | |||

|

PART IV

|

52 | ||||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

52 | |||

|

Signatures

|

53 | ||||

2

PART I

Forward-Looking Statements

The following discussion should be read in conjunction with our accompanying Consolidated Financial Statements and Notes thereto included within this Annual Report on Form 10-K. In addition to historical information, this Annual Report on Form 10-K and the following discussion contain statements that are not historical facts and are considered forward-looking within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements contain projections of our future results of operations or of our financial position or state other forward-looking information. In some cases you can identify these statements by forward-looking words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “will” and “would” or similar words. We believe that it is important to communicate our future expectations to our investors. However, there may be events in the future that we are not able to accurately predict or control and that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. Investors are cautioned not to rely on forward-looking statements because they involve risks and uncertainties, and actual results may differ materially from those discussed as a result of various factors, including, but not limited to: the cost and timing of developing our products; our ability to raise the necessary capital to fund our operations; market acceptance of our ZBB EnerStore® and ZBB EnerSection® systems and other new products; our ability to grow rapidly while successfully managing our growth; our ability to establish and maintain relationships with third parties with respect to product development, manufacturing, distribution and servicing, and the supply of key product components; the cost and availability of components and parts for our products; our ability to develop commercially viable products; our ability to reduce product and manufacturing costs and improve our global supply chain; our ability to demonstrate system reliability for both our ZBB EnerStore and ZBB EnerSection products; our ability to successfully expand our product lines; competitive factors, such as price competition and competition from other traditional and alternative energy companies; our ability to manufacture products on a large-scale commercial basis; our ability to retain our managerial personnel and to attract additional personnel; the successful management of our international operations, including our international joint ventures; our ability to protect our intellectual property; the cost of complying with current and future federal, state and international governmental regulations; and other risks and uncertainties discussed under Item 1A—Risk Factors. Readers should not place undue reliance on our forward-looking statements. These forward-looking statements speak only as of the date on which the statements were made and are not guarantees of future performance. Except as may be required by applicable law, we do not undertake or intend to update any forward-looking statements after the date of this Annual Report on Form 10-K.

Item 1. BUSINESS

ZBB Energy Corporation (“ZBB,” “we,” “us,” “our,” or the “Company”) develops innovative energy storage and power control products and capabilities that serve the global need for reliable power in off-grid and grid-connected environments, critically integral to accelerating the expansion of renewable energy generation in utility and behind the meter applications. ZBB seeks to improve quality of life for an increasingly modernized and energy “hungry” population.

Incorporated in the United States in 1998, the Company focused on advancing proprietary zinc bromide rechargeable electrical energy storage technologies, ultimately leading to the current generation ZBB EnerStore flow battery utilizing the Company’s zinc bromide chemistry. In 2010, the Company accelerated its strategy to become a leading developer and manufacturer of modular, scalable and environmentally friendly power systems, leveraging its unique power electronics capabilities to provide the market with storage systems to serve a multitude of markets, applications and geographies. The ZBB EnerSection power and energy control center was the resultant product introduced as the enabling technology to augment that in off-grid and grid-connected environments, all conventional and renewable generating assets are effectively prioritized and optimized to validate that loads are served with cost effective and reliable power and energy. The Company’s capabilities target the growing global need for renewable energy, energy efficiency, power quality, and grid modernization. ZBB’s combined energy storage and power electronics capabilities are presently deployed in markets and applications throughout the world, enhancing power reliability, independence and security.

Headquartered in Menomonee Falls, Wisconsin, USA, the consolidated financial statements include the accounts of the Company and those of its wholly-owned subsidy ZBB Energy Pty Ltd. (formerly known as ZBB Technologies, Ltd.) which has an advanced engineering and development facility in Perth, Australia, and its sixty percent owned subsidiary ZBB PowerSav Holdings Limited located in Hong Kong which was formed in connection with the Company’s investment in a China joint venture.

Target Markets

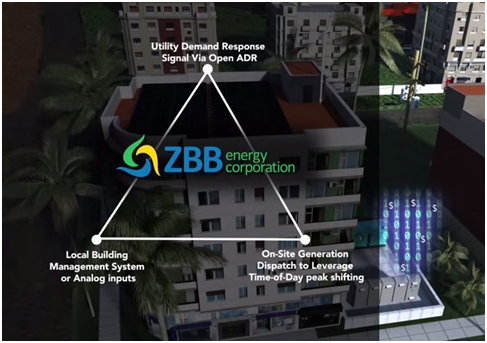

ZBB’s Power Control Systems, Energy Storage Technology and Power Quality products are used in a variety of applications in two primary markets, Utility Grid Power Distribution and Commercial & Industrial Buildings, Multi-Tenant Buildings and Communities. ZBB enables utilities to reduce construction of under-utilized “peak” power generating plants and incorporate more renewable energy generating assets into the grid. ZBB’s ability to provide modular and configurable power control and storage solutions can be tailored to meet virtually any need, whether it be shifting energy from low rate to high rate periods, or enabling complete grid independence.

3

Utility Grid Power Distribution

ZBB’s platforms for utility grid power distribution enable a significant increase in the incorporation of renewable energy generating assets to the grid, thereby providing for increased demand while precluding the need for massive spending on “peak power” generating plants only used for peak power demand that is often only a few hours at given periods. Due to the modular design and high energy density of ZBB energy storage, systems are quickly and efficiently deployed in sizes up to several megawatt hours (MWh). Unlike other technologies, ZBB storage does not require large, temperature regulated structures to deliver operating performance and maximize capital efficiency. The majority of the world’s industrial nations are working aggressively to increase renewable energy generation, and ZBB’s products are designed to allow this to be done in an effective and efficient manner.

Incorporation of large amounts of residential renewable energy, or heavy community usage of “plug-in” hybrid vehicles, also poses a challenge to grid power quality and reliability. The ZBB STATCOM product addresses this problem by adjusting, regulating and stabilizing voltage, as well as improving power quality for areas at the “edge of the grid”, such as remote cul-de-sacs, unstable areas and rural communities.

ZBB Addresses Numerous Grid Power Problems by Enabling:

|

|

·

|

Increased utility scale renewable energy generation to grid

|

|

|

·

|

“Shifting” of large amounts of energy from one time of day to another

|

|

|

·

|

Discharging stored energy for long periods of time

|

|

|

·

|

Limiting construction of new “peak power” assets

|

|

|

·

|

Increased utilization of existing “peak power” producing assets

|

|

|

·

|

Improved power quality and reliability in areas that are near the edge of the grid

|

|

|

·

|

Increased use of “plug-in” electric vehicles

|

|

|

·

|

Improved power quality and reliability in areas with high-density of rooftop solar

|

|

|

·

|

Firming of large renewable energy generating plants

|

|

|

·

|

Deployment of “dispatchable” and distributed generating assets

|

|

|

·

|

Tangible benefits of the “Smart Grid”, maximizing the efficiency and productivity of infrastructure

|

Power for Commercial & Industrial Buildings, Multi-Tenant Structures and Communities

ZBB products provide a wide range of power control and energy storage solutions for applications from off-grid island community power to implementation of solar power for buildings in dense commercial and industrial zones. ZBB power control systems work with the storage technology that is best suited to each individual application, be it a flow battery, lithium ion, lead acid, ultra-capacitor or flywheel, alone or in combination. ZBB brings solutions to the markets that are scalable and highly configurable, helping buildings or communities yield higher returns from their investments. ZBB systems are safe and by design offer a small footprint, making them ideally suited for installations within buildings.

Advantages to Communities, Building Owners, Developers and Occupants:

|

|

·

|

Reduce costly demand charges and peak rates

|

|

|

·

|

Enable “net-zero” energy from the grid

|

|

|

·

|

Forecast energy delivered from solar assets and regulate energy storage assets to meet demand with minimal grid supplied energy

|

|

|

·

|

Supplement solar generated electricity during cloud cover ramp-up and ramp-down to provide stable power

|

|

|

·

|

Protect building equipment and critical functions from damaging power surges and grid outages

|

|

|

·

|

Protect the grid from power in areas where building premise generated electricity cannot be sent back to the grid

|

|

|

·

|

Instant back-up power in combination with or in lieu of a diesel gen set for elevators and other critical building functions

|

|

|

·

|

Use normally ‘stranded generating assets’ during grid outages

|

|

|

·

|

Minimize peak loads

|

|

|

·

|

Participate in utility demand response programs without curtailing operations

|

|

|

·

|

Maintain critical systems, such as elevator power, during power outages or failures

|

|

|

·

|

Dampen the impact of electric vehicle fast charging stations

|

|

|

·

|

Gain greater efficiency and improve reliability using a DC distribution system

|

|

|

·

|

Participate in Federal and State tax credits and grants

|

|

|

·

|

For off-grid communities, greatly reduce or eliminate altogether the use of diesel generators, leverage renewables and eliminate the use of environmental damaging lead-acid batteries

|

4

Our Products

These are disruptive times for the power industry, and the industry must adapt to meet the challenges of a grid built on old technology and inefficient transmission and distribution. With an abundance of renewable energy generation being realized in various domestic and international locations, problems utilizing power from renewables persist because the grid network cannot effectively utilize the additional and inherently variable generation propensity of renewables. The grid today simply is not designed to accommodate such influxes and their intrinsic variability. Additionally, peak demand is often not realized during periods of maximum wind or sun, leading to a condition where overbuilding of heavily under-utilized generation capacity is required to meet the load during the highest usage periods of the day. Energy storage systems that are capable of long discharge can shift significant amounts of energy from relatively lower demand to higher demand periods, reducing the need for build-out of low utilization “peak power” generation.

ZBB products address the increasingly overtaxed grid networks throughout the world by enabling variable power generation from renewable sources to be introduced in large amounts in an economical, clean and reliable manner, improving the quality of life for an energy hungry population.

ZBB products have also been instrumental in enabling breakthroughs in distributed energy and micro-grid deployment in grid interactive or completely off-grid applications. From island power installations in the Pacific Ocean to remote off-grid power for military use and diesel displacement for back-up power for buildings in Hawaii, ZBB’s advanced energy storage and power control systems deliver highly effective solutions for a variety of needs.

Advanced Energy Storage Products

ZBB EnerStore flow batteries are efficient, safe and modular, enabling them to be easily scaled to installations of up to multiple MWh for a wide varied of utility, community or commercial and industrial building applications. The ZBB EnerStore captures multiple value streams including time shifting, firming of renewables, load management and system backup.

ZBB EnerStore zinc-bromide flow batteries provide:

|

·

|

Long discharge capability for shifting large amounts of energy from one time of day to another

|

|

·

|

The lowest cost of ownership over a 20-year design life in bulk energy storage applications

|

|

·

|

High energy density and excellent safety for small footprint applications, such as commercial or occupied buildings

|

|

·

|

Quick deployment, requiring minimal site preparation and no additional infrastructure

|

|

·

|

A patented, integrated DC bus design requiring no onsite wiring for DC power connections

|

|

·

|

A black-start capable system with no external auxiliary power input required

|

|

·

|

A modular and scalable architecture from 50 kWh to Multi MWh from a single point of system connection

|

|

·

|

Wide ambient operating temperature range with no external structures or climate controlled enclosures that significantly increase cost and reduce overall energy efficiency

|

|

·

|

A system requiring no additional ventilation, fire suppression or spill containment for indoor locations

|

ZBB’s energy storage system expertise enables us to design and deploy customized systems using whatever storage technology is most effective and economical for the specific needs of the customer and application, including applications where the optimum solution utilizes multiple storage technologies in a “hybrid” configuration.

Advanced Power Control Systems and Distribution Grid Control Solutions

The ZBB EnerSection power and energy control center provides a firm, dispatchable, renewable and back-up power plant for everyday energy management and emergency operations. Its configurable architecture integrates multiple AC and DC power generation sources together with one or many different types of energy storage units combined with any blend of utility grid-tie inverters, stand-alone inverters for off-grid AC power and/or DC outputs to provide DC power.

The ZBB EnerSection power and energy control center is:

|

·

|

The heart of the ZBB EnerSystem, requiring only a single point of connection to all connected power sources and storage

|

|

·

|

A universal, modular design integrating any power input and output with any storage device via discrete power electronic ‘buckets’

|

|

·

|

Easily and quickly expanded or modified in the field

|

|

·

|

Utilizes inverters that are certified by ETL to the UL1741 standard

|

|

·

|

Patented with a common DC bus seamlessly hybridizing multiple battery traits — providing a fast response with long discharge bulk storage as needed

|

|

·

|

Rated from 25kw to Multi MW

|

|

·

|

A system with a wide temperature range of -22°F to 104°F / -30°C to 40°C

|

|

·

|

Available with additional AC and/or DC output ‘buckets’ for continuous, grid independent power supply to critical loads onsite

|

5

|

·

|

Customizable with an optional ZBB Grid Isolation Disconnect (GID) which automatically provides both normal and backup power supply with controls to isolate power to and from the grid supply, while connecting customer loads with onsite generation and storage during outages, then seamlessly reconnects to the normal grid operation when grid service is restored

|

Integrated Power Management Platform and Energy Storage

The ZBB EnerSystem integrated energy management platform combines the power and energy controls of its ZBB EnerSection and advanced energy storage with its ZBB EnerStore battery, or a hybrid of various energy storage technologies, to optimize local, renewable energy resources and other power inputs from any source.

|

ZBB Integrated Power Management System and Energy Storage

ZBB Technology:

|

·

|

Optimizes and integrates multiple, often intermittent energy sources into power that is manageable, cost-effective, clean, safe and secure

|

|

·

|

Often utilizes the ZBB EnerSection, a hybrid power conversion system and intelligent energy management system

|

|

·

|

Is configurable, modular, flexible and scalable for on-grid, off-grid and/or grid-as-backup

|

|

·

|

Has an open architecture that integrates multiple, simultaneous renewable energy sources including the grid as an input, with AC and/or DC critical power outputs

|

|

·

|

Combines with energy storage, like the ZBB EnerStore or in a hybrid storage configuration that provides continuous power regardless of momentary ramps up and down in generation supply and load demand

|

|

·

|

Is factory-built and tested for each customer application

|

The ZBB system can be configured with a variety of storage technologies to create the optimal solution for a given application. Each unique platform configuration provides an intelligent management system to realize multiple value streams including demand charge avoidance, enabling a higher penetration of renewables, management of DC circuits, avoiding turning loads off due to “Demand Response” and saving money by peak shaving or time shifting to lower rates.

6

|

Distribution Grid Control

As a natural extension of the proven ZBB power electronics platform, ZBB has engineered products to improve power quality, integrate Conservation Voltage Reduction (CVR) and improve Volt/ Var Optimization (VVO) at “edge of the grid” distribution networks. With the ever-increasing deployment of smart meters, and penetration of distributed renewables, utilities require better control of their distribution system.

ZBB’s technology supplies the aforementioned benefits, and offers a smart meter function to provide the utility with real time feedback, insight and high resolution of local events. This capability can be integrated into the existing customer supervisory control and data acquisition (“SCADA”) telemetry, or as a stand-alone software solution such as VVO or CVR. The ZBB technology can be controlled by a central command in various operation modes and with a local autonomous control, allowing multiple systems to be deployed in a common area without issue.

Sales and Marketing

An important component of our marketing and sales strategy is to work with strategic partners in the United States and abroad who can help us achieve our business goals. ZBB has formalized and is executing on joint development and joint venture agreements in South Korea and China, and will continue to evolve strategic relationships in geographic markets that offer rapid and substantial growth opportunities. These strategic partners offer numerous benefits, such as market entry and penetration, low-cost manufacturing, financial consideration, technical complement, government relationships and integration as well as support services. A small but growing company, we continue to demonstrate the ability to accomplish global reach and create strong partnerships that allow us to rapidly advance market penetration and technology development.

Strategic Partners

We continue to utilize strategic partners to maximize our speed to market with solutions, augment our capabilities and expand our global presence. Our product licensing and development agreements with Lotte Chemical in South Korea have enabled ZBB to fund development programs and significantly reduce our development cycle time. Meineng Energy, our partner in China, has enabled us to expand our production in a low cost region, in addition to significantly increase our post-prototype test and characterization capability. Both partners have spread the ZBB brand to their respective regions in a robust manner.

Competition

As discussed elsewhere in this Business section of this Annual Report on Form 10-K, we believe our technologies and products provide us with certain competitive advantages in the markets we serve. However, even with these advantages, the market for renewable energy products and services is intensely competitive and continually impacted by evolving industry standards, rapid price changes and product obsolescence. Our competitors include many domestic and foreign companies, most of which have substantially greater financial, marketing, personnel and other resources than we do. Although we believe that the advantages described above and elsewhere in this Business section of this Annual Report on Form 10-K position us well to be competitive in our industry, as a small company, we are and will continue to be at a competitive disadvantage to most of our competitors, which include larger, established companies that have substantially greater financial, technical, manufacturing, marketing, distribution and other resources than we do.

7

Intellectual Property

Our market position, in part, depends on our Intellectual Property (IP) portfolio and our ability to obtain and maintain intellectual property (IP) protection for our products, processes, technology and know-how. In addition, we must operate without infringing on the proprietary rights of others while preventing others from infringing on our proprietary rights. We seek to protect our IP by, among other methods, filing United States and foreign patent applications related to our proprietary technology, inventions and improvements that are important to the development and conduct of our business. We also rely on trademarks, trade secrets, know-how and continuing technological innovation to evolve and secure our proprietary position.

We have been issued international patents in several strategic countries including South Korea, China, Australia, Canada, Mexico and South Africa for the ZBB EnerSection power and energy control technology with additional patents pending in several other countries and regions. In July 2012, we also filed for US and international patents on enhancements to the ZBB EnerSection which are presently pending. Additionally, we have filed for multiple patents in the areas of advanced energy storage components, products and process technologies; some of which have been filed as ZBB specific applications and others as co-applicants with our strategic energy storage technology development partner (Lotte). Our power and controls power electronic products and systems patent portfolio has also been advanced with multiple patents filed and pending domestically and internationally in the area of control concepts related to renewable energy optimization as well as other novel product enhancements and energy storage control. Beyond the actual patent filings, we continue to identify, prepare disclosures and file patent applications for power electronics and energy storage technologies. On an ongoing basis we review and evaluate the opportunity to expand our IP portfolio with an established roadmap of IP development as to the best means of protecting additional technologies related to each of the Company’s core product areas: power and control system power electronics, energy storage technologies, and system integration control. Research and Development continue in all areas and continue to generate IP opportunities.

In some circumstances we rely on trade secrets to protect our technology, and seek to protect our proprietary technology and processes, in part, by confidentiality agreements with our employees, customers, prospective customers, consultants, advisors and contractors.

We use trademarks on some of our products, and have registered our ZBB EnerStore, ZBB EnerSection, ZBB EnerSystem and ZBB EnerTower™ marks in the United States and internationally.

Advanced Engineering and Development

Our key advanced engineering initiatives are:

|

·

|

The advancement of our zinc bromide flow battery technology both internally and in cooperation with strategic partners

|

|

·

|

Development of additional versions and sizes of the ZBB EnerSection and ZBB EnerStore

|

|

·

|

Expansion of the existing ZBB EnerSection plug-and-play module portfolio

|

|

·

|

Advancement of our remote monitoring and control platforms

|

|

·

|

Development of additional power electronics and control technologies dedicated to support of the ZBB EnerSection as well as products designed for the renewable energy, alternative energy and power quality markets

|

|

·

|

Further advance and field test our Distribution Grid Control power electronics products

|

|

·

|

Continuous enhancement of the existing product lines

|

The goal of these initiatives is to address existing and emerging market needs in the modern electric power grid as well as micro grids that incorporate renewable and advanced energy generating sources, substantially reduce manufacturing costs, improve performance, reduce cost of ownership and expand the capabilities of our products. Our advanced engineering and development expense and cost of engineering and development revenues totaled approximately $5.5 million and $5.4 million in the years ended June 30, 2014 and June 30, 2013, respectively. We also had engineering and development revenues of approximately $1.3 million and $400,000 in the years ended June 30, 2014 and June 30, 2013, respectively.

8

Employees

ZBB currently has an aggregate of 58 full time employees, of which 57 are located at our U.S. manufacturing and corporate headquarters in Wisconsin, and one is employed at our Research and Development facility in Australia. We expect staffing numbers to increase as our business grows and new production equipment is deployed in accordance with our business expansion plans.

Available Information

Our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and any Current Reports on Form 8-K that we may file or furnish to the SEC pursuant to Sections 13(a) or 15(d) of the Securities Exchange Act of 1934 as well as any amendments to any of those reports are available free of charge on or through our website as soon as reasonably practicable after we file them with or furnish them to the SEC electronically. Our website is located at www.zbbenergy.com. In addition, you may receive a copy of any of our reports free of charge by contacting our Investor Relations department at our corporate headquarters.

Item 1A. RISK FACTORS

We operate in a rapidly changing environment that involves a number of risks, some of which are beyond our control. This discussion highlights some of the risks which may affect future operating results. These are the risks and uncertainties we believe are most important for you to consider. We cannot be certain that we will successfully address these risks. If we are unable to address these risks, our business may not grow, our stock price may suffer and we may be unable to stay in business. Additional risks and uncertainties not presently known to us, which we currently deem immaterial or which are similar to those faced by other companies in our industry or business in general, may also impair our business operations.

We have incurred losses since our inception in 1998 and anticipate incurring continuing losses.

For the fiscal year ended June 30, 2014, we had revenues of $7,851,607. During this period, we had a net loss of $8,855,418 after deducting the net loss attributable to the noncontrolling interest. For the year ended June 30, 2013, we had revenues of $7,723,699. During this period, we had a net loss of $11,878,915 after deducting the net loss attributable to the noncontrolling interest. There can be no assurance that we will have income from operations or net income in the future. As of June 30, 2014 we had an accumulated deficit of $89,788,242. As discussed in our financial statements our significant operating losses and operating cash flow deficits raise substantial doubt about our ability to continue as a going concern. We anticipate that we will continue to incur losses and operating cash flow deficits until we can produce and sell, if ever, a sufficient number of our systems to be profitable. However, we cannot predict when we will operate profitably, if ever. Even if we do achieve profitability, we may be unable to sustain or increase our profitability in the future.

We may require a substantial amount of additional funds to finance our capital requirements and the growth of our business, and we may not be able to raise a sufficient amount of funds, or be able to do so on terms favorable to us and our stockholders, or at all.

We have incurred losses since our inception in 1998 and expect to continue to incur losses until we are able to significantly grow our revenues. Accordingly we need additional financing to remain in operation and to maintain and expand our business, and such financing may not be available on favorable terms, if at all. In the event that we issue any additional equity securities, investors’ interests in the Company will be diluted and investors may suffer dilution in their net book value per share depending on the price at which such securities are sold. Further, any such issuance may result in a change in control.

If we are unable to obtain the necessary funds on acceptable terms, we may not be able to:

|

|

·

|

execute our growth plan;

|

|

|

·

|

take advantage of future opportunities;

|

|

|

·

|

respond to customers and competition; or

|

|

|

·

|

remain in operation.

|

We may issue debt and/or senior equity securities in the future which would be senior to our common stock upon liquidation. Upon liquidation, holders of our debt securities, senior equity securities and lenders with respect to other borrowings will receive distributions of our available assets prior to the holders of our common stock.

Our stock price could be volatile and our trading volume may fluctuate substantially.

The price of our common stock has been and may in the future continue to be extremely volatile, with the sale price fluctuating from a low of $0.40 to a high of $30.00 since June 18, 2007, the first day our stock was traded on the NYSE MKT (formerly NYSE Amex). Many factors could have a significant impact on the future price of our common stock, including:

|

|

·

|

the various risks and uncertainties discussed herein;

|

|

|

·

|

general domestic and international economic conditions and other external factors;

|

|

|

·

|

general market conditions; and

|

|

|

·

|

the degree of trading liquidity in our common stock.

|

9

In addition, the stock market has from time to time experienced extreme price and volume fluctuations. This volatility has had a significant effect on the market price of securities issued by many companies which may be unrelated to the operating performance of those particular companies. These broad market fluctuations may adversely affect our share price, notwithstanding our operating results.

For the three-month period ended June 30, 2014, the daily trading volume for shares of our common stock ranged from 146,600 to 3,511,800 shares traded per day, and the average daily trading volume during such three-month period was 717,768 shares traded per day. Accordingly, our investors who wish to dispose of their shares of common stock on any given trading day may not be able to do so or may be able to dispose of only a portion of their shares of common stock.

Our industry is highly competitive and we may be unable to successfully compete.

We compete in the market for renewable energy products and services which is intensely competitive. Evolving industry standards, rapid price changes and product obsolescence also impact the market. Our competitors include many domestic and foreign companies, most of which have substantially greater financial, marketing, personnel and other resources than we do. Our current competitors or new market entrants could introduce new or enhanced technologies, products or services with features that render our technologies, products or services obsolete or less marketable. Our success will be dependent upon our ability to develop products that are superior to existing products and products introduced in the future, and which are cost effective. In addition, we may be required to continually enhance any products that are developed as well as introduce new products that keep pace with technological change and address the increasingly sophisticated needs of the marketplace. Even if our current technologies prove to be commercially feasible, there is extensive research and development being conducted on alternative energy sources that may render our technologies and protocols obsolete or otherwise non-competitive.

There can be no assurance that we will be able to keep pace with the technological demands of the marketplace or successfully develop products that will succeed in the marketplace. As a small company, we will be at a competitive disadvantage to most of our competitors, which include larger, established companies that have substantially greater financial, technical, manufacturing, marketing, distribution and other resources than us. There can be no assurance that we will have the capital resources available to undertake the research which may be necessary to upgrade our equipment or develop new devices to meet the efficiencies of changing technologies. Our inability to adapt to technological change could have a materially adverse effect on our results of operations.

Our ability to achieve significant revenue growth will be dependent on the successful commercialization of our new products, including our third generation ZBB EnerStore zinc bromide flow battery and ZBB EnerSection power and energy control center.

We anticipate that a substantial majority of our revenue in fiscal year 2015 will come from new products, including our third generation ZBB EnerStore zinc bromide flow battery and ZBB EnerSection power and energy control center. If these new products do not meet with market acceptance, our business, financial condition and results of operations will be adversely affected. A number of factors may affect the market acceptance of our new products, including, among others:

|

|

·

|

the price of our products relative to other products either currently available or subsequently introduced;

|

|

|

·

|

the perception by potential customers and strategic partners of the effectiveness of our products for their intended purposes;

|

|

|

·

|

our ability to fund our manufacturing, sales and marketing efforts; and

|

|

|

·

|

the effectiveness of our sales and marketing efforts.

|

Our products are and will be sold in new and rapidly evolving markets. As such, we cannot accurately predict the extent to which demand for these products will increase, if at all. We do not know whether our targeted customers will accept our technology or will purchase our products in sufficient quantities to allow our business to grow. To succeed, demand for our products must increase significantly in existing markets, and there must be strong demand for products that we introduce in the future. The commercial success of our new products is also dependent on the design and development of an efficient and cost-effective means to integrate such products into existing electrical systems.

To achieve profitability, we will need to lower our costs and increase our margins, which we may not be able to do.

To achieve profitability we will need to lower our costs and increase our margins. A major focus for us for fiscal 2015 is to improve our global supply chain and reduce our costs. These efforts may fail due to unforeseen factors. Our failure to lower our costs could make our products less competitive and harm our ability to grow our revenues. Our inability to lower our costs and increase our margins could have a materially adverse effect on our results of operations.

10

If our products do not perform as planned, we could experience increased costs, lower margins and harm to our reputation.

The failure of our products to perform as planned could result in increased costs, lower margins and harm to our reputation which could have a material adverse effect on our business and financial results. A substantial majority of our revenue in recent periods came from new products, including our third generation ZBB EnerStore zinc bromide flow battery and ZBB EnerSection power and energy control center. We are continually improving these products. Subsequent to commercialization, installation and commissioning of units in the field we garnered meaningful insights that have resulted in system design modifications and other general upgrades that have improved performance, efficiency, and reliability. In the interest of enhancing customer satisfaction and market reputation, in the fourth quarter of fiscal 2014 we launched an initiative to implement these improvements at certain locations of our installed base over fiscal 2015. As a result of this initiative, results of operations for the quarter ended June 30, 2014 include a charge of $1.7 million.

We need to continue to improve the performance of our products to meet future requirements and competitive pressures.

We need to continue to improve various aspects of our technology as we move forward with larger scale production and new applications of our products. For example, through our collaboration with Lotte Chemical Corporation we are currently working to develop a 500kWh version of our EnerStore zinc bromide battery. Our products are complex and there can be no assurance our development efforts will be successful. Future developments and competition may reveal additional technical issues that are not currently recognized as obstacles. If we cannot continue to improve the performance of our products in a timely manner, we may be forced to redesign or delay large scale production or possibly abandon our product development efforts altogether.

We must build quality products to ensure acceptance of our products.

The market perception of our products and related acceptance of such products is highly dependent upon the quality and reliability of the products we build. Any quality problems attributable to our product lines may substantially impair our revenue and operating results. Moreover, quality problems for our product lines could cause us to delay or cease shipments of products or have to recall or field upgrade products, thus adversely affecting our ability to meet revenue or cost targets. In addition, while we seek to limit our liability as a result of product failure or defects through warranty and other limitations, if one of our products fails, a customer could suffer a significant loss and seek to hold us responsible for that loss and our reputation with other current or potential customers would likely suffer.

To succeed, we will need to rapidly grow and we may not be successful in managing this rapid growth.

In order to successfully grow our revenues and become profitable, we will need to grow rapidly but if we fail to effectively manage this growth; our business could be adversely affected. Rapid growth will place significant demands on our management, operational and financial infrastructure. If we do not effectively manage our growth, we may fail to timely deliver products to our customers in sufficient volume or the quality of our products could suffer, which could negatively affect our operating results. To effectively manage this growth, we will need to hire additional personnel, and we will need to continue to improve our operational, financial and management controls and our reporting systems and procedures. As we move forward in commercializing our new products, we will also need to effectively manage our manufacturing and marketing needs, which represent new areas of oversight for us. These additional employees, systems enhancements and improvements will require significant capital expenditures and management resources. Failure to successfully implement these improvements could hurt our ability to manage our growth and our financial position.

Our relationships with our strategic partners may not be successful, and we may not be successful in establishing additional partnerships, which could adversely affect our ability to commercialize our products and services.

An important element of our business strategy is to enter into strategic partnerships with partners who can assist us in achieving our business goals. We are currently a party to several strategic partnership arrangements and any disruption in these collaborations could be detrimental to our business. We expect to seek additional collaborators or strategic partners due the expense, effort and expertise required to develop market and commercialize our products and our limited resources, but we may not be successful in our efforts to establish additional strategic partnerships and arrangements. If we are unable to reach agreements with suitable strategic partners, we may fail to meet our business objectives for the commercialization of our products. The terms of any additional strategic partnerships or other arrangements that we establish may not be favorable to us. Our inability to successfully implement strategic partnerships and arrangements could adversely affect our business, financial condition and results of operations.

We depend on sole and limited source suppliers and outsource selected component manufacturing, and shortages or delay of supplies of component parts may adversely affect our operating results until alternate sources can be developed.

Our operations are dependent on the ability of suppliers to deliver quality components, devices and subassemblies in time to meet critical manufacturing and distribution schedules. If we experience any constrained supply of any such component parts, such constraints, if persistent, may adversely affect operating results until alternate sourcing can be developed. There may be an increased risk of supplier constraints in periods where we are increasing production volume to meet customer demands. Volatility in the prices of component parts, an inability to secure enough components at reasonable prices to build new products in a timely manner in the quantities and configurations demanded or, conversely, a temporary oversupply of these parts, could adversely affect our future operating results.

11

We purchase several component parts from sole source and limited source suppliers. As a result of our current production volumes, we lack significant leverage with these and other suppliers especially when compared to some of our larger competitors. If our suppliers receive excess demand for their products, we may receive a low priority for order fulfillment as large volume customers may receive priority that may result in delays in our acquiring components. If we are delayed in acquiring components for our products, the manufacture and shipment of our products could be delayed. Lead times for ordering materials and components vary significantly and depend on factors such as specific supplier requirements, contract terms, the extensive production time required and current market demand for such components. Some of these delays may be substantial. As a result, we sometimes purchase critical, long lead time or single sourced components in large quantities to help protect our ability to deliver finished products. If we overestimate our component requirements, we may have excess inventory, which will increase our costs. If we underestimate our component requirements, we will have inadequate inventory, which will delay our manufacturing and render us unable to deliver products to customers on scheduled delivery dates. Manufacturing delays could negatively impact our ability to sell our products and could damage our customer relationships.

To assure the availability of our products to our customers, we outsource the manufacturing of selected components prior to the receipt of purchase orders from customers. However, we do not recognize revenue for such products until we receive an order from a customer and the product is shipped. As a result, we incur inventory and manufacturing costs in advance of anticipated revenue. As demand for our products may not materialize, this product delivery method subjects us to increased risks of high inventory carrying costs, obsolescence and excess, and may increase our operating costs. In addition, we may from time to time make design changes to our products, which could lead to obsolescence of inventory.

We have no experience manufacturing our products on a large-scale basis and may be unable to do so at our manufacturing facilities.

To date, we have achieved only very limited production of our energy storage systems and have no experience manufacturing our products on a large-scale basis. We believe our current facilities in Menomonee Falls, Wisconsin, are sufficient to allow us to significantly increase production of our products. However, there can be no assurance that our current facilities, even if operating at full capacity, will be adequate to enable us to produce the energy storage systems in sufficient quantities to meet potential future orders. Our inability to manufacture a sufficient number of units on a timely basis would have a material adverse effect on our business prospects, financial condition and results of operations. In addition, even if we are able to meet production requirements, we may not be able to achieve margins that enable us to become profitable.

We are subject to risks relating to product concentration and lack of revenue diversification.

We derive a substantial portion of our revenue from a limited number of products. These products are also an integral component of many of our other products. We expect these products to continue to account for a large percentage of our revenues in the near term. Continued market acceptance of these products is therefore critical to our future success. Our future success will also depend on our ability to reduce our dependence on these few products by developing and introducing new products and product or feature enhancements in a timely manner. Specifically, our ability to capture significant market share depends on our ability to develop and market extensions to our existing product lines at higher and lower power range offerings and as containerized solutions. We are currently investing significant amounts in our products to broaden our product portfolio. Even if we are able to develop and commercially introduce new products and enhancements, they may not achieve market acceptance and the revenue generated from these new products and enhancements may not offset the costs, which would substantially impair our revenue, profitability and overall financial prospects. Successful product development and market acceptance of our existing and future products depend on a number of factors, including:

|

|

·

|

changing requirements of customers;

|

|

|

·

|

accurate prediction of market and technical requirements;

|

|

|

·

|

timely completion and introduction of new designs;

|

|

|

·

|

quality, price and performance of our products;

|

|

|

·

|

availability, quality, price and performance of competing products and technologies;

|

|

|

·

|

our customer service and support capabilities and responsiveness;

|

|

|

·

|

successful development of our relationships with existing and potential customers; and

|

|

|

·

|

changes in technology, industry standards or end-user preferences.

|

Our China joint venture could be adversely affected by the laws and regulations of the Chinese government, our lack of decision-making authority and disputes between us and the Joint Venture.

The China market has a large inherent need for advanced energy storage and power electronics and is likely to become the world’s largest market for energy storage. To take advantage of this opportunity, in November 2011, we established a joint venture to develop, produce, sell, distribute and service advanced storage batteries and power electronics in China (the “Joint Venture”).

However, achieving the anticipated benefits of the Joint Venture is subject to a number of risks and uncertainties.

12

The Joint Venture has (1) an exclusive royalty-free license to manufacture and distribute our third generation ZBB EnerStore zinc bromide flow battery and ZBB EnerSection power and energy control center (up to 250KW) (the “Products”) in mainland China in the power supply management industry and (2) a non-exclusive royalty-free license to manufacture and distribute the Products in Hong Kong and Taiwan in the power supply management industry. Although the Joint Venture partners are contractually restricted from using our intellectual property outside of the Joint Venture, there is always a general risk associated with sharing intellectual property with third parties and the possibility that such information may be used and shared without our consent. Moreover, China laws that protect intellectual property rights are not as developed and favorable to the owner of such rights as are U.S. laws. If any of our intellectual property rights are used or shared without our approval in China, we may have difficulty in prosecuting our claim in an expeditious and effective manner. Difficulties or delays in enforcing our intellectual property rights could have a material adverse effect on our business and prospects.

As a general matter, there are substantial uncertainties regarding the interpretation and application of China laws and regulations, including, but not limited to, the laws and regulations governing the anticipated business of the Joint Venture and the protection of intellectual property rights. These laws and regulations are sometimes vague and may be subject to future changes, and their official interpretation and enforcement may involve substantial uncertainty. The effectiveness of newly enacted laws, regulations or amendments may be delayed, resulting in detrimental reliance by foreign investors. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. The unpredictability of the interpretation and application of existing and new China laws and regulations will pose additional challenges for us as we seek to develop and grow the Joint Venture’s business in China. Our failure to understand these laws or an unforeseen change in a law or the application thereof could have an adverse effect on the Joint Venture.

The success of the Joint Venture will depend in part on continued support of “new energy” initiatives by the government of China that includes requirements for products like ours. Should the government change its policies in an unfavorable manner the anticipated demand for the Joint Venture’s products in China may fail to materialize.

The Joint Venture may have economic, tax or other business interests or goals which are inconsistent with our business interests or goals, and may be in a position to take actions contrary to our policies or objectives. Disputes between us and the Joint Venture partners may result in litigation or arbitration that could be costly and divert the attention of our management and key personnel from focusing their time and effort on our day to day business. In addition, we may, in certain circumstances, be liable for the actions of the Joint Venture.

The Joint Venture is a new business in China. As with any new business, there will be many challenges facing the Joint Venture, including establishing successful manufacturing capabilities, developing a market for the Joint Venture’s products, obtaining requisite governmental approvals and permits, implementation of an untested business plan, and securing adequate funding for working capital and growth. Failure to overcome any of these or any other challenges facing the Joint Venture could result in its failure.

Business practices in Asia may entail greater risk and dependence upon the personal relationships of senior management than is common in North America, and therefore some of our agreements with other parties in China and South Korea could be difficult or impossible to enforce.

We are increasing our business activities in Asia. The business culture in parts of Asia is, in some respects, different from the business cultures in Western countries. Personal relationships among business principals of companies and business entities in Asia are very significant in their business cultures. In some cases, because so much reliance is based upon personal relationships, written contracts among businesses in Asia may be less detailed and specific than is commonly accepted for similar written agreements in Western countries. In some cases, material terms of an understanding are not contained in the written agreement but exist only as oral agreements. In other cases, the terms of transactions which may involve material amounts of money are not documented at all. In addition, in contrast to the Western business environment where a written agreement specifically defines the terms, rights and obligations of the parties in a legally-binding and enforceable manner, the parties to a written agreement in Asia may view that agreement more as a starting point for an ongoing business relationship which will evolve and undergo ongoing modification over time. As a result, any contractual arrangements we enter into with a counterparty in Asia may be more difficult to review, understand and/or enforce.

Our success depends on our ability to retain our managerial personnel and to attract additional personnel.

Our success depends largely on our ability to attract and retain managerial personnel. Competition for desirable personnel is intense, and there can be no assurance that we will be able to attract and retain the necessary staff. The loss of members of managerial staff could have a material adverse effect on our future operations and on successful development of products for our target markets. The failure to maintain management and to attract additional key personnel could materially adversely affect our business, financial condition and results of operations.

13

We market and sell, and plan to market and sell, our products in numerous international markets. If we are unable to manage our international operations effectively, our business, financial condition and results of operations could be adversely affected.

We market and sell, and plan to market and sell, our products in a number of foreign countries, including China, Australia, South Africa, Canada, European Union countries, the United Kingdom, Italy, Chile, Brazil, India, Mexico as well as Puerto Rico, various Caribbean island nations and various southeast Asia countries, and we are therefore subject to risks associated with having international operations. Risks inherent in international operations include, but are not limited to, the following:

|

|

·

|

changes in general economic and political conditions in the countries in which we operate;

|

|

|

·

|

unexpected adverse changes in foreign laws or regulatory requirements, including those with respect to renewable energy, environmental protection, permitting, export duties and quotas;

|

|

|

·

|

trade barriers such as export requirements, tariffs, taxes and other restrictions and expenses, which could increase the prices of our products and make us less competitive in some countries;

|

|

|

·

|

fluctuations in exchange rates may affect demand for our products and may adversely affect our profitability;

|

|

|

·

|

difficulty of, and costs relating to compliance with, the different commercial and legal requirements of the overseas markets in which we offer and sell our products;

|

|

|

·

|

inability to obtain, maintain or enforce intellectual property rights; and

|

|

|

·

|

difficulty in enforcing agreements in foreign legal systems.

|

Our business in foreign markets requires us to respond to rapid changes in market conditions in these countries. Our overall success as a global business depends, in part, on our ability to succeed in differing legal, regulatory, economic, social and political conditions. We may not be able to develop and implement policies and strategies that will be effective in each location where we do business, which in turn could adversely affect our business, financial condition and results of operations.

Our sales cycle is lengthy and variable, which makes it difficult for us to forecast revenue and other operating results.

The sales cycle for our products is lengthy, which makes it difficult for us to accurately forecast revenue in a given period, and may cause revenue and operating results to vary significantly from period to period. Some potential customers for our products typically need to commit significant time and resources to evaluate the technology used in our products and their decision to purchase our products may be further limited by budgetary constraints and numerous layers of internal review and approval, which are beyond our control. We spend substantial time and effort assisting potential customers in evaluating our products, including providing demonstrations and validation. Even after initial approval by appropriate decision makers, the negotiation and documentation processes for the actual adoption of our products can be lengthy. As a result of these factors, based on our experience to date, our sales cycle, the time from initial contact with a prospective customer to routine commercial utilization of our products, has varied and can sometimes be several months or longer, which has made it difficult for us to accurately project revenues and other operating results. In addition, the revenue generated from sales of our products may fluctuate from time to time due to market and general economic conditions. As a result, our financial results may fluctuate on a quarterly basis which may adversely affect the price of our common stock.

Our increased emphasis on larger and more complex system solutions and customer concentration may adversely affect our ability to accurately predict the timing of revenues and to meet short-term expectations of operating results.

Our increased emphasis on larger and more complex system solutions has increased the effort and time required by us to complete sales to customers. Further, a larger portion of our quarterly revenue is derived from relatively few large transactions with relatively few customers. Any delay in completing these large sales transactions or any reduction in the number of customers or large transactions, may result in significant adverse fluctuations in our quarterly revenue. Further, we use anticipated revenues to establish our operating budgets and a large portion of our expenses, particularly rent and salaries are fixed in the short term. As a result, any shortfall or delay in revenue could result in increased losses and would likely cause our operating results to be below public expectations. The occurrence of any of these events would likely materially adversely affect our results of operations and likely cause the market price of our common stock to decline.

Businesses and consumers might not adopt alternative energy solutions as a means for obtaining their electricity and power needs, and therefore our revenues may not increase, and we may be unable to achieve and then sustain profitability.

On-site distributed power generation solutions, such as fuel cell, photovoltaic and wind turbine systems, which utilize our energy storage systems, provide an alternative means for obtaining electricity and are relatively new methods of obtaining electrical power that businesses may not adopt at levels sufficient to grow this part of our business. Traditional electricity distribution is based on the regulated industry model whereby businesses and consumers obtain their electricity from a government regulated utility. For alternative methods of distributed power to succeed, businesses and consumers must adopt new purchasing practices and must be willing to rely upon less traditional means of purchasing electricity. We cannot assure you that businesses and consumers will choose to utilize on-site distributed power at levels sufficient to sustain our business in this area. The development of a mass market for our products may be impacted by many factors which are out of our control, including:

|

|

·

|

market acceptance of fuel cell, photovoltaic and wind turbine systems that incorporate our products;

|

|

|

·

|

the cost competitiveness of these systems;

|

|

|

·

|

regulatory requirements; and

|

|

|

·

|

the emergence of newer, more competitive technologies and products.

|

14

If a mass market fails to develop or develops more slowly than we anticipate, our business, financial condition and results of operations could be materially adversely affected.

The success of our business depends on our ability to develop and protect our intellectual property rights, which could be expensive.

Our ability to compete effectively will depend, in part, on our ability to protect our proprietary technologies, systems designs and manufacturing processes. While we have attempted to safeguard and maintain our proprietary rights, there can be no assurance we have been or will be completely successful in doing so. We rely on patents, trademarks, and policies and procedures related to confidentiality to protect our intellectual property. However, most of our intellectual property is not covered by any patents or patent applications. Moreover, there can be no assurance that any of our pending patent applications will issue or, in the case of patents issued or to be issued, that the claims allowed are or will be sufficient to protect our technology or processes. Even if all of our patent applications are issued, our patents may be challenged or invalidated. Patent applications filed in foreign countries may be subject to laws, rules and procedures that are substantially different from those of the United States, and any resulting foreign patents may be difficult and expensive to enforce.

While we take steps to protect our proprietary rights to the extent possible, there can be no assurance that third parties will not know, discover or develop independently equivalent proprietary information or techniques, that they will not gain access to our trade secrets or disclose our trade secrets to the public. Therefore, we cannot guarantee that we can maintain and protect unpatented proprietary information and trade secrets. Misappropriation of our intellectual property could have an adverse effect on our competitive position and may cause us to incur substantial litigation costs.

We may be subject to claims that we infringe the intellectual property rights of others, and unfavorable outcomes could harm our business.

Our future operations may be subject to claims, and potential litigation, arising from our alleged infringement of patents, trade secrets or copyrights owned by other third parties. We intend to fully comply with the law in avoiding such infringements. However, we may become subject to claims of infringement, including such claims or litigation initiated by existing, better-funded competitors. We could also become involved in disputes regarding the ownership of intellectual property rights that relate to our technologies. These disputes could arise out of collaboration relationships, strategic partnerships or other relationships. Any such litigation could be expensive, take significant time, and could divert management’s attention from other business concerns. Our failure to prevail in any such legal proceedings, or even the mere occurrence of such legal proceedings, could substantially affect our ability to meet our expenses and continue operations.

If our shareholders’ equity falls below the minimum requirement or we otherwise fail to satisfy all required continued listing requirements, our common stock may be delisted from the NYSE MKT, which would cause our common stock to become less liquid.

Our shares have been listed on the NYSE MKT (formerly the NYSE Amex) since June 18, 2007. We are required to comply with all reporting and listing requirements on a timely manner and maintain our corporate governance and independent director standards. The NYSE MKT imposes, among other requirements, listing maintenance standards including minimum shareholders’ equity, minimum stock price and market capitalization requirements. On October 14, 2013, we received notice from the Exchange staff indicating that we were noncompliant with certain listing requirements concerning minimum stockholders’ equity and financial condition requirements. On December 31, 2013, the Exchange staff notified us that it had accepted our compliance plan and granted us an extension until April 15, 2015, to regain compliance with the minimum stockholders' equity continued listing standards. The Company will be able to continue its listing during the plan period and will be subject to periodic review by the Exchange Staff. Failure to make progress consistent with the plan or to regain compliance with the continued listing standards by the end of the applicable extension periods could result in the Company's shares being delisted from the Exchange.

If we are unable to remain in compliance with applicable listing requirements and our common stock is delisted by NYSE MKT, it could lead to a number of negative implications, including reduced liquidity in our common stock, greater volatility in the price of our common stock and greater difficulty in obtaining financing. There can be no assurance that our common stock will remain eligible for trading on the NYSE MKT.

15

We may engage in acquisitions that could disrupt our business, cause dilution to our stockholders and reduce our financial resources.

In the future, we may enter into transactions to acquire other businesses, products or technologies. If we do identify suitable candidates, we may not be able to make such acquisitions on favorable terms or at all. Any acquisitions we make may not strengthen our competitive position, and these transactions may be viewed negatively by customers or investors. We may decide to incur debt in connection with an acquisition or issue our common stock or other securities to the stockholders of the acquired company, which would reduce the percentage ownership of our existing stockholders. We could incur losses resulting from undiscovered liabilities of the acquired business that are not covered by the indemnification we may obtain from the seller. In addition, we may not be able to successfully integrate the acquired personnel, technologies and operations into our existing business in an effective, timely and non-disruptive manner. Acquisitions may also divert management from day-to-day responsibilities, increase our expenses and reduce our cash available for operations and other uses. We cannot predict the number, timing or size of future acquisitions or the effect that any such transactions might have on our operating results.

We have never paid cash dividends and do not intend to do so.

We have never declared or paid cash dividends on our common stock. We currently plan to retain any earnings to finance the growth of our business rather than to pay cash dividends. Payments of any cash dividends in the future will depend on our financial condition, results of operations and capital requirements, as well as other factors deemed relevant by our board of directors.

Item 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

Item 2. PROPERTIES

Wisconsin U.S.A. Properties

The Company’s primary manufacturing and administrative facility is located at N93 W14475 Whittaker Way, Menomonee Falls, Wisconsin. The Company owns this facility which has approximately 72,000 square feet of space. We believe this facility has manufacturing capacity for up to $45 million of annual product sales.

Bibra Lake, Western Australia (Leasehold)