Attached files

| file | filename |

|---|---|

| S-1/A - S-1/A - TransFirst Inc. | d758948ds1a.htm |

Exhibit 10.14

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

CLEARING AND SETTLEMENT SERVICES AGREEMENT

THIS CLEARING AND SETTLEMENT SERVICES AGREEMENT (this “Agreement”) is made as of the 23rd day of July, 2004, by and between TransFirst Holdings, Inc., a Delaware corporation (“Company”) and Columbus Bank and Trust Company, a Georgia state banking corporation (“Bank”).

WHEREAS, Bank is a principal member of the VISA U.S.A., Inc. and MasterCard International Incorporated credit card associations (collectively, the “Card Associations”);

WHEREAS, Company is engaged in providing credit card and debit card (“Transaction Card”) processing services for merchants; and is or will become a registered Merchant Service Provider (“MSP”) or Independent Sales Organization (“ISO”) for Bank as those terms are defined under Card Associations’ by-laws, operating regulations and rules (collectively, the “Rules”); and

WHEREAS, Company wishes to utilize the clearing and settlement services of Bank with respect to agreements with merchants for the processing of Transaction Card transactions (the “Merchant Agreements”) and to provide certain other services as are more fully described herein, for those merchants (“Merchants”) who enter into Merchant Agreements as a part of Company’s Merchant Program (as defined below);

NOW THEREFORE, in consideration of the mutual covenants contained in this Agreement Company and Bank hereby agree as follows:

ARTICLE I

Section 1.1. Definitions. For purposes of this Agreement, the following terms shall have the following meanings:

(a) “ACH” means the Automated Clearing House Network.

(b) “ACH Rules” means, collectively, the NACHA Operating Rules and NACHA Operating Guidelines, as the same are amended from time to time.

(c) “Affiliate” means, (i) with respect to Bank, any other person that controls, is under common control with, or is controlled by, Bank, and (ii) with respect to Company, any subsidiary that Company owns or controls directly or indirectly.

(d) “Agent Bank” or “Agent” shall have the meaning set forth in Section 3.2.

(e) “Agreement” shall have the meaning set forth in the recitals, and includes the Exhibits and Schedules hereto.

(f) “Applicable Law” shall have the meaning set forth in Section 2.1(f).

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

(g) “Bank” shall have the meaning set forth in the recitals.

(h) “Bank Indemnified Parties” shall have the meaning set forth in Section 12.1.

(i) “BIN” means a unique Bank Identification Number assigned by Visa to identify a Member or Processor for authorization, clearing or settlement processing. “ICA” is the corresponding number assigned by MasterCard for the same purpose.

(j) “Business Day” shall mean any day on which Bank is open for business, other than Saturdays, Sundays or State or Federal holidays.

(k) “CISP” shall have the meaning set forth in Section 9.2(b).

(l) “Company” shall have the meaning set forth in the recitals.

(m) “Company Account” shall have the meaning set forth in Section 5.1(a).

(n) “Company Indemnified Parties” shall have the meaning set forth in Section 12.2.

(o) “Company Reserve Account” shall mean the account at Bank to be established by Company as set forth in Section 5.3 to insure payment of Merchant Losses, chargebacks, fees and other amounts due to Bank.

(p) “Confidential Information” shall have the meaning set forth in Section 10.1.

(q) “Effective Date” shall have the meaning set forth in Section 11.1.

(r) “ePayment Merchant List” is defined in Section 2.1(i)(ii).

(s) “ePayment Merchants” means Merchants which are under Merchant Agreements with ePayment.

(t) “ePayment Portfolio” means the portfolio of ePayment Merchants which are provided clearing and settlement services by J.P. Morgan Chase Bank.

(u) “Event of Default” shall have the meaning set forth in Section 11.4.

(v) “Existing Merchants” shall have the meaning set forth in Section 2.1(c)(i).

(w) “Existing Portfolio” shall have the meaning set forth in Section 2.1(c)(i).

(x) “Independent Contractors” and “ISAs” shall have the meanings given those terms in the Rules.

| -2- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

(y) “ISO” shall have the meaning set forth in the recitals.

(z) “LIBOR Rate” means the one month LIBOR Rate quoted in the Money Rates section of The Wall Street Journal on the third Tuesday of the month for the following month, plus [* * *]%

(aa) “Losses” shall have the meanings, respectively, set forth in Section 12.1 and Section 12.2.

(bb) “Marks” shall have the meaning set forth in Section 9.5(d).

(cc) “Material” (and “Materially”) when used with reference to information, a fact or circumstance, a course of action, a decision-making process or other matter, shall be limited to information, facts and circumstances, courses of action, decision-making processes or other matters as to which there is a substantial likelihood that a reasonable person would attach importance.

(dd) “Merchant” shall have the meaning set forth in the recitals, and also include the Existing Merchants.

(ee) “Merchant Agreement” shall have the meaning set forth in the recitals, and shall include the Merchant Agreements accepted by Bank in connection with the transfer of the Existing Portfolio in accordance with Section 2.1(c).

(ff) “Merchant Criteria” shall have the meaning set forth in Section 2.1(b).

(gg) “Merchant Program” shall have the meaning set forth in Section 2.1(a).

(hh) “Merchant Reserve Accounts” shall have the meaning set forth in Section 2.2(f).

(ii) “Merchant Settlement Accounts” shall have the meaning set forth in Section 5.1(a).

(jj) “MSP” shall have the meaning set forth in the recitals.

(kk) “Processing Agreement” shall have the meaning set forth in Section 2.1(e).

(ll) “Rules” shall have the meaning set forth in the recitals.

(mm) “SDP” shall have the meaning set forth in Section 9.2(b).

(nn) “Third Panty Provider” shall have the meaning set forth in Section 2.1(e).

(oo) “Transaction Card” shall have the meaning set forth in the recitals.

| -3- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

(pp) “V/MC Confidential Information” shall have foe meaning set forth in Section 9.5(h)(i).

(qq) “V/MC Systems” shall have the meaning set forth in Section 9.5(h)(i).

ARTICLE II

SERVICES

Section 2.1. Company Services. During the term of this Agreement,

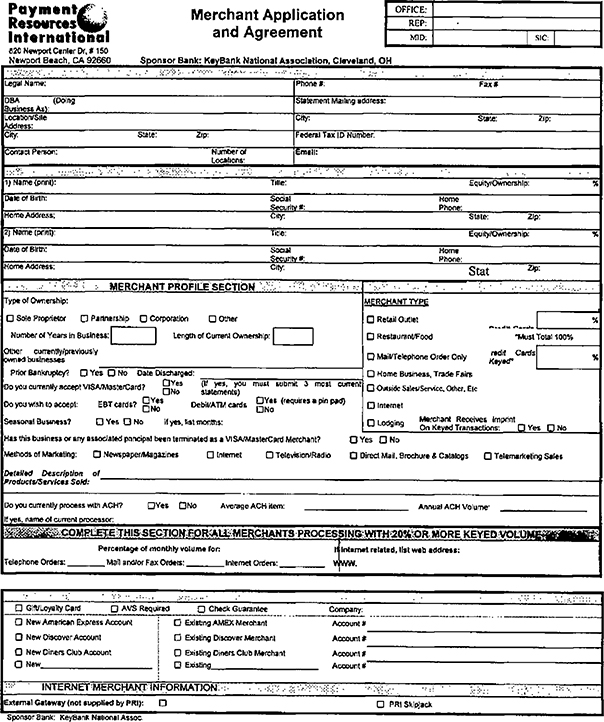

(a) Company, at its own expense, will conduct a merchant Transaction Card acquiring and ACH services business and will solicit merchants for participation in Company’s Transaction Card processing and ACH services program (the “Merchant Program”), using a Merchant Agreement approved by Bank, and under which the actual rates or fees applicable to Merchants may be selected by Company from a schedule of rates and fees approved by Bank. Any other application materials used by Company in soliciting Merchants also must be approved by Bank. Bank may require Company to change such Merchant Agreement, application materials, and rates and fees, at any time for the purpose of conforming to requirements under the Rules, the ACH Rules, or otherwise imposed by the Card Associations or NACHA, or to conform to requirements of Applicable Law or directions or guidance issued by governmental authorities with supervisory authority over Bank, and Company shall implement such changes within a reasonable time following written notice, but in no event later than the time period required by a Card Association or NACHA, the Rules, the ACH Rules, Applicable Law, or such directions or guidance issued by governmental authorities with supervisory authority over Bank.

(b) Company has developed criteria to be used for selection of merchants to participate in the Merchant Program (the “Merchant Criteria”). This Merchant Criteria is agreed upon by Company and Bank, and is attached hereto as Exhibit A. Company and Bank agree, except as provided below, to enter into Merchant Agreements in connection with the Merchant Program only with merchants meeting the Merchant Criteria. Company has the right to propose changes in the Merchant Criteria from time to time, and shall provide any proposed changes in Merchant Criteria to Bank for approval prior to implementation. Changes, if any, to the Merchant Criteria proposed by Company must be preapproved in writing by Bank. Bank shall make reasonable efforts to provide Company with notice of approval or disapproval of such changes to Merchant Criteria within five (5) business days of requested change. Bank may require Company to change the Merchant Criteria at any time, for the purpose of conforming to requirements under the Rules, the ACH Rules, or otherwise imposed by the Card Associations or NACHA, or to conform to requirements of Applicable Law or directions or guidance issued by governmental authorities with supervisory authority over Bank, and Company shall implement such changes within a reasonable time following written notice, but in no event later than the time period required by a Card Association, NACHA, the Rules, the

| -4- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

ACH Rules, Applicable Law, or such directions or guidance issued by governmental authorities with supervisory authority over Bank. For each Merchant Agreement that does not meet the Merchant Criteria (as amended from time to time in the manner described above), Company may submit each such Merchant Agreement to Bank for approval and Bank shall make reasonable efforts to provide Company with notice of approval or disapproval of such Merchant Agreement within three (3) business days; provided, however, Bank shall not be required to consider such exception requests for more than ten (10) proposed merchants per month. For purposes of changes or exceptions to the Merchant Criteria and/or approval or disapproval of a Merchant who does not comply with the Merchant Criteria, electronic mail notices will be permitted. Company will provide an electronic copy (or if unavailable in such electronic form, then in paper form) of any executed Merchant Agreement (including all related applications relating to processing by the Card Associations).

(c) Existing Merchants.

(i) Company represents and warrants: (1) that a Materially complete, true and correct list of Merchants (“Existing Merchants”) in the existing merchant portfolio of Company (“Existing Portfolio”) as of June 23, 2004 is attached hereto and made a part hereof as Exhibit 2.1(c)-l, and (2) that except as set forth in Exhibit 2.1(c)-2, none of the Merchants in the Existing Portfolio operate in the unacceptable industries outlined in the Merchant Criteria; and (3) that, subject to execution of acceptable transfer documents with J.P. Morgan Chase Bank and the Card Associations, it has the authority and light to assign and transfer the merchant agreements, merchant accounts and merchant reserves for the Existing Merchants in the Existing Portfolio to Bank. At Bank’s request, Company shall obtain a signed Merchant Agreement, in a form approved by Bank, from such of its Existing Merchants as Bank shall specify and Company shall provide a signed copy thereof to Bank. In the event Bank determines, in its reasonable discretion, that a form of Merchant Agreement is not in compliance with the Rules, the ACH Rules, or Applicable Law, or is otherwise inconsistent with Bank’s rights under this Agreement, and that the only reasonable remedy is to replace such agreement with one that is in compliance with the Rules, the ACH Rules, Applicable Law and this Agreement, or to the extent permitted by such Merchant Agreement, amended such that it is brought into compliance with the Rules, the ACH Rules, Applicable Law and this Agreement, Company will, at Bank’s request obtain a substitute agreement from such Existing Merchant or amend the existing Merchant Agreement with such Existing Merchant. Bank acknowledges that it has received forms of merchant agreements from Company for the Existing Portfolio as outlined on Exhibit 2.1(c)-3, which are acceptable to Bank.

| -5- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

(ii) Bank agrees that each Merchant in the Existing Portfolio is approved by Bank to participate in the Merchant Program pursuant to the terms of this Agreement, subject to Bank’s continued credit review. Should Bank determine that an Existing Merchant within the Existing Portfolio does not meet the Merchant Criteria and is not listed in Exhibit 2.1(c)-2, following the Effective Date, Bank may decline such Merchant and cease providing clearing and settlement services and ACH services under this Agreement, in Bank’s sole discretion. Bank will provide written notice of its desire to terminate a Merchant Agreement to Company prior to terminating a Merchant and to work with Company to identify approaches to mitigate risk factors (such as initiating or increasing Merchant Reserves or transfer of the Merchant to another acquirer) prior to terminating such Merchant if Bank concludes that it can do so without increased risk to Bank or violation of the Rules, the ACH Rules, other Card Association or NACHA requirements, Applicable Law or directions or guidance of a governmental authority with supervisory authority over Bank.

(iii) Company represents and warrants that, except as set forth herein, its merchant processing and ACH services business has been operated, and that the Existing Portfolio has been acquired and maintained, in compliance in all Material respects with Applicable Law and the Rules and the ACH Rules. In February 2003, an Affiliate of Company, TransFirst ePayment Services, Inc., formerly known as Data Processors International, Inc. (“ePayment”), suffered a hacking incident to its data processing systems, with the potential exposure of cardholder and merchant data. The Card Associations asserted that ePayment was not in compliance with applicable cardholder data security requirements. To the best of knowledge of Company, ePayment has resolved these claims with the Card Associations and ePayment is currently certified under the existing Card Association data security programs.

(iv) Following the Effective Date, Company shall assist Bank in performing such credit reviews on all or any of the Existing Merchants as Bank may from time to time request, and agrees to provide Bank at a minimum with the following documentation:

(A) An electronic report of the annual Transaction Card sales volume for each Existing Merchant account, including account numbers, d.b.a. names, legal names, addresses, start dates, MCC codes, annual sales and transactions, annual returns and annual Chargebacks.

(B) Upon request by Bank, a copy of the Existing Merchant’s application, data sheets, DDA account balances, and any other information Bank deems necessary to perform a credit review.

(C) A list of all Existing Merchants on Card Association compliance programs, internal watch list or classified accounts or any collateralized accounts.

| -6- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

(D) Upon request by Bank, a financial statement (including a balance sheet and an income statement) on all Existing Merchants with $[* * *] or more in high risk annual Bank Card sales volume, or those Existing Merchants where Bank finds such financial statements necessary addition, Company shall promptly provide any additional documentation as may be reasonably requested by Bank.

(v) If under Section 2.1(c)(iv) Bank determines, in its sole discretion, that Company has insufficient data upon which Bank can perform an adequate and proper credit review on an Existing Merchant, Company will obtain a fully completed Merchant Application from each such Existing Merchant. If Company is unable to obtain a fully completed Application from an Existing Merchant, Bank may decline such Merchant and cease providing clearing and settlement services and ACH services for such Merchant under this Agreement.

(vi) The reserve accounts and merchant accounts for all Existing Merchants, including any which are inactive, shall be transferred to Bank upon the Effective Date to fund Merchant Reserve Accounts with respect to such Existing Merchants.

(vii) [* * *] costs, including but not limited to [* * *], shall be borne by [* * *].

(viii) The obligations of the parties under this Agreement are conditioned upon Bank and J.P. Morgan Chase Bank entering into mutually acceptable documents pursuant to which there is consummated a transfer of the Existing Portfolio to Bank on or before June 30, 2005. In the event that the foregoing transfer is not accomplished by such date, then either party may, on notice to the other, terminate this Agreement without liability.

(d) Company shall be responsible for [* * *]. Company will direct, manage, conduct and administer the Merchant Program and the Merchant Agreements; provided, however, that nothing herein shall be construed to authorize Company to modify the Merchant Agreements, or to waive any of Bank’s rights thereunder, without Bank’s prior written consent. Any functions the Card Associations require to be performed by persons registered with or certified by the Card Associations or otherwise as provided in the Rules, and which are not directly performed by Company or its Party Provider shall be conducted with qualified industry vendors who are competent and who are, as defined below, either certified processors, registered ISOs/MSPs or ISAs as allowed by and provided under the Rules, and in each case shall be pre-approved by Bank.

(e) The responsibility to conduct the Merchant Program, including obtaining processing services for the Merchant Program, shall be the responsibility of Company. Company (or its Affiliate) has entered or is entering into an agreement directly with Vital Processing Services, L.L.C. (the “Third Party Provider”) to provide processing services on the Third Party Provider’s system (the “Processing Agreement”). Bank shall have no responsibility or liability for any costs due to this processing arrangement of Company

| -7- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

(or its Affiliate) and Third Party Provider or any claims of Merchants or others related to the processing services provided by Third Party Provider for the Merchant Program; additionally, Bank shall have no responsibility or liability for any other third party vendor of Company providing services to Company, Merchants or the Merchant Program. Company agrees to indemnify Bank pursuant to the terms of this Agreement for all Losses with respect to the foregoing, which indemnification shall include, without limitation, all fines, penalties, audit charges, fees and other amounts imposed by the Card Associations or NACHA in connection with the Merchant Program.

(f) Company shall have the sole responsibility for ensuring that the Merchant Program, including without limitation the Merchant Agreement, application materials, any promotional materials and all services performed hereunder, comply, and remain in compliance, with all applicable federal, state and local laws, rules and regulations (“Applicable Law”) and with the Rules and the ACH Rules. This will include, without limitation, the responsibility for obtaining and maintaining all information and documents relating to Merchants, Agents and others involved in the Merchant Program, making all filings, and taking all other actions, as needed in order for Bank to be in compliance with all Customer Identification Program and other requirements of the Bank Secrecy Act and all requirements of the Office of Foreign Assets Control regulations, applicable to the Merchant Program. Company agrees to provide all documents related to the Merchant Program to Bank for approval prior to Company’s use; Bank will approve or disapprove such documents within a reasonable time, such approval not to be reasonably withheld. Bank’s approval shall not in any way relieve Company from its responsibility for assuring that all such documents comply with Applicable Law and the Rules and the ACH Rules. Company will designate a liaison to interface with Bank and will provide reasonable cooperation and assistance to Bank to carry out and accomplish the transactions contemplated by this Agreement.

(g) From time to time in its sole discretion, Bank may also perform certain risk management services, such as periodic credit reviews, fraud reviews and monitoring and collections, with respect to Merchants. Bank’s participation in any such activity shall not in any way relieve Company its responsibility for credit and fraud Losses which may result from or be related to Merchants’ transactions.

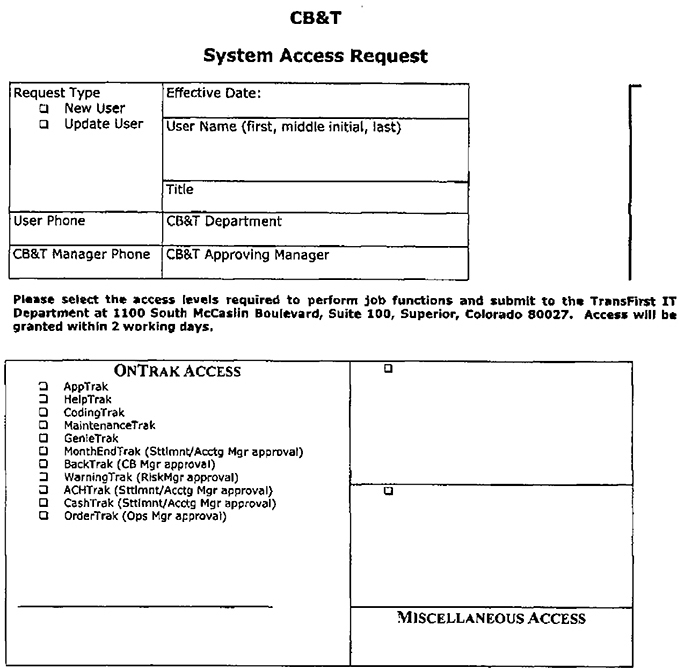

(h) In accordance with the terms and conditions set forth in Exhibit 2.1(H), Company will provide Bank with access to Company’s merchant accounting system and other systems to enable Bank to appropriately monitor risk associated with the Merchant Program.

(i) ePayment Merchants.

(i) During the term of this Agreement, upon sixty (60) days notice to Bank, and subject to compliance with the following terms and conditions, the Company may elect to transfer the ePayment Portfolio to Bank and to have Bank provide the clearing and settlement services set forth in this Agreement on behalf of the ePayment Merchants.

| -8- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

(ii) Company covenants and agrees: (1) that a Materially complete, true and correct list of ePayment Merchants in the ePayment Portfolio shall be supplied by the Company to Bank within thirty (30) days following the delivery of the election described in Section 2.1(i) (the “ePayment Merchant List”); (2) that except as set forth in the ePayment Merchant List, none of the ePayment Merchants operate in the unacceptable industries outlined in the Merchant Criteria; and (3) that, subject to execution of acceptable transfer documents with J.P. Morgan Chase Bank and the Card Associations, it shall have the authority and right to assign and transfer the merchant agreements, merchant accounts and merchant reserves for the ePayment Merchants in the ePayment Portfolio to Bank. At Bank’s request, Company shall obtain a signed Merchant Agreement from such of the ePayment Merchants as Bank shall specify and Company shall provide a signed copy thereof to Bank. In the event Bank determines, in its reasonable discretion, that a form of Merchant Agreement is not in compliance with the Rules, the ACH Rules, or Applicable Law, or is otherwise inconsistent with Bank’s rights under this Agreement, and that the only reasonable remedy is to replace such agreement with one that is in compliance with the Rules, the ACH Rules, Applicable Law and this Agreement, or to the extent permitted by such Merchant Agreement, amended such that it is brought into compliance with the Rules, the ACH Rules, Applicable Law and this Agreement, Company will, at Bank’s request obtain a substitute agreement from such ePayment Merchant or amend the existing Merchant Agreement with such ePayment Merchant.

(iii) Bank agrees that each ePayment Merchant in the ePayment Portfolio shall be approved by Bank to participate in the Merchant Program pursuant to the terms of this Agreement, subject to Bank’s continued credit review. Should Bank determine that an ePayment Merchant within the ePayment Portfolio does not meet the Merchant Criteria and is not listed in an ePayment Merchant Exception List approved by Bank, Bank may decline such ePayment Merchant and cease providing clearing and settlement services under this Agreement, in Bank’s sole discretion. Bank will provide written notice of its desire to terminate a Merchant Agreement to Company prior to terminating an ePayment Merchant and to work with Company to identify approaches to mitigate risk factors (such as initiating or increasing Merchant Reserves or transfer of the ePayment Merchant to another acquirer) prior to terminating such Merchant if Bank concludes that it can do so without increased risk to Bank or violation of the Rules, the ACH Rules, other Card Association or NACHA requirements, Applicable Law or directions or guidance of a governmental authority with supervisory authority over Bank.

| -9- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

(iv) Following the Effective Date, Company shall assist Bank in performing such credit reviews on all or any of the ePayment Merchants as Bank may from time to time request, and agrees to provide Bank at a minimum with the following documentation:

(A) An electronic report of the annual Transaction Card sales volume for each ePayment Merchant account, including account numbers, d.b.a. names, legal names, addresses, start dates, MCC codes, annual sales and transactions, annual returns and annual Chargebacks.

(B) Upon request by Bank, a copy of the ePayment Merchant’s application, data sheets, DDA account balances, and any other information Bank deems necessary to perform a credit review.

(C) A list of all ePayment Merchants on Card Association compliance programs, internal watch list or classified accounts or any collateralized accounts.

(D) Upon request by Bank, a financial statement (including a balance sheet and an income statement) on all ePayment Merchants with $[* * *] or more in high risk annual Bank Card sales volume, or those ePayment Merchants where Bank funds such financial statements necessary. In addition, Company shall promptly provide any additional documentation as may be reasonably requested by Bank.

(v) If under Section 2.1(i)(iv) Bank determines, in its sole discretion, that Company has insufficient data upon which Bank can perform an adequate and proper credit review on an ePayment Merchant, Company will obtain a fully completed Merchant Application from each such ePayment Merchant. If Company is unable to obtain a fully completed Application from an ePayment Merchant, Bank may decline such Merchant and cease providing clearing and settlement services for such ePayment Merchant under this Agreement.

(vi) The reserve accounts and merchant accounts for all ePayment Merchants, including any which are inactive, shall be transferred to Bank upon the effective date of the assignment of the ePayment Merchant agreements to Bank, to fund Merchant Reserve Accounts with respect to such ePayment Merchants.

(vii) All reasonable out-of-pocket costs, including but not limited to taxes and counsel costs, related to the transfer of ePayment Merchants’ merchant agreements, merchant accounts and merchant reserves to Bank, shall be borne by Company.

| -10- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

(viii) The obligations of the parties under this Section 2.1(i) are conditioned upon Bank and J.P. Morgan Chase Bank entering into mutually acceptable documents with respect to the transfer of the ePayment Portfolio. Bank agrees to act in a commercially reasonable fashion and to not unreasonably withhold consent to the form of such transfer documents.

(ix) In the event of the transfer of the ePayment Merchants to Bank as provided in this Section 2.1(i): (i) the ePayment Merchants shall be considered Merchants under this Agreement; (ii) the Bank fees with respect to the ePayment Merchants shall be established as set forth in Exhibit B; and (iii) the amount held in the Company Reserve Account shall be adjusted as provided in Exhibit 5.3A.

(x) Following the transfer of the ePayment Portfolio to Bank as set forth in this subsection, if Bank continues to provide the clearing and settlement and ACH services for the ePayment Portfolio for a period in excess of [* * *] months from and after the date of transfer: (i) the BIN Sponsorship Fee for the ePayment Merchants set forth in Exhibit B shall be adjusted to $[* * *] per settled Transaction, and (ii) the Company shall increase the amount held in the Company Reserve Account by the sum of $[* * *], by depositing cash in such amount into the Company Reserve Account, which amount shall be held by Bank in accordance with the provisions of this Agreement.

Section 2.2. Bank Services. During the term of this Agreement

(a) The Bank will remain a member of the Card Associations and serve as the Acquiring Bank or Acquiring Member (as those terms are defined in the Rules) for those Merchants who enter into Merchant Agreements including obtaining and providing the BINs and ICAs necessary for clearing and settlement of Merchant credit and debit card and related transactions for the Merchant Program. As provided in Section 8.2 hereof, Company shall be responsible for and pay [* * *]. Bank shall not otherwise utilize BINs and ICAs used for the Merchant Program for any of its other merchant acquiring programs, including Bank’s own programs or programs Bank provides for any other third party, without the prior written consent of Company.

(b) Provided Company meets and performs its representations, warranties and agreements hereunder, Bank will clear and settle transactions through the Card Associations as provided in Article V hereof. Company agrees that all clearing and settlement using Bank’s BINs and ICAs for the Merchant Program shall be performed by the Third Party Provider, and that the Third Party Provider will, in accordance with the terms of the Processing Agreement, be the preferred provider for authorization services using Bank’s BINs and ICAs for the Merchant Program to the extent the Third Party Provider offers such authorization services; provided, however, that the foregoing shall not apply to Company’s use of providers other than the Third Party Provider in connection with acquired merchants which may be added to the Merchant Program as provided in Section 3.3, so long as such use does not constitute a breach by Company under the Processing Agreement.

| -11- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

(c) Bank agrees to allow Company to use the name, logo and specified trademarks of Bank as set forth in Exhibit 2.2C solely in connection with the Merchant Program as required under the Rules, such as on Merchant Agreements, provided that any such other use shall require the prior written approval of Bank, such approval not to be unreasonably withheld or delayed and consistent with any Bank usage guidelines. If such approval is granted, Company may utilize such names, logos or marks subject to Bank’s prior approval of such materials. This use terminates upon termination of this Agreement; provided, however, following termination of this Agreement, in no event will Company be required to re-execute Merchant Agreements with Merchants in order to delete the use of Bank’s name on the existing Merchant Agreements.

(d) Bank will designate a liaison to interface with Company and provide reasonable cooperation and assistance to Company to accomplish the transactions contemplated by this Agreement.

(e) Bank, at Company’s expense, will reasonably cooperate with Company in chargeback and retrieval proceedings and other Card Association actions involving Company, the Merchant Program or merchants solicited by Company, including but not limited to the initiation and prosecution of appeal, dispute resolution and/or arbitration proceedings in accordance with the Rules.

(f) Bank shall have the right to terminate the Merchant Agreement with respect to any Merchant at any time in accordance with the terms of the Merchant Agreement with such Merchant or the Rules, in the event the Merchant violates the Rules, Applicable Law, or the Merchant Agreement, or at the request of a Card Association, or in the event the Merchant ceases to satisfy the Merchant Criteria, or the operations of the Merchant otherwise change Materially from that considered at the time of underwriting the specific Merchant (whether in terms of volume differences, product differences, type of business or otherwise, from those which were extant when the Merchant was approved) and Bank in good faith deems it reasonably necessary to avoid loss, damage or adverse exposure to Bank. Bank will provide written notice of its desire to terminate a Merchant Agreement to Company prior to terminating a Merchant and to work with Company to identify approaches to mitigate risk factors (such as initiating or increasing Merchant Reserves or the transfer of the Merchant to another acquirer) prior to terminating such Merchant if Bank concludes that it can do so without increased risk to Bank or violation of the Rules, the ACH Rules, other Card Association or NACHA requirements, Applicable Law or directions or guidance of a governmental authority with supervisory authority over Bank. Nothing contained in this Section will be interpreted to restrict or modify Bank’s obligations to the Card Association. Bank shall retain on deposit any security or reserves of Merchants (“Merchant Reserve Accounts”) held as security for the performance of Merchant obligations by Merchants relating to the Merchant Agreements, as may be required by Bank, or the Merchant Criteria. Bank in its discretion may place holds on, or offset against, such Merchant Reserve Accounts and any other monies belonging to or payable to Merchants. Company will assist in

| -12- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

providing information to Bank pertaining to the holding of, or offsetting against, Merchant funds. Bank will provide written notice to Company prior to holding of or offsetting against such funds if Bank concludes that it can do so without increased risk to Bank, but Bank shall have no liability for failure to provide such prior notice. For purposes of this Section 2.2(f) notice may be provided via electronic mail or fax.

(g) With respect to the performance of the above services or other services as specified in Exhibit B, Bank shall be paid the amounts as specified on Exhibit B hereto.

(h) Provided Company meets and performs its representations, warranties and agreements hereunder, Bank shall provide ACH services, as an Originating Depository Financial Institution under the ACH Rules, to Company and Merchants as provided in Exhibit 2.2(H) and, in consideration of the performance of the ACH services, Bank will be paid the fees specified on Exhibit B.

Section 2.3. Both Parties. Company will be responsible for all costs, obligations, expenses or liabilities of the Merchant Program, except to the extent any such costs and expenses directly result from the Material breach by Bank of its obligations hereunder involving no Material failure by Company to perform its obligations hereunder and no Material failure by any of the third parties referred to in Section 2.1, Article III or Exhibit 2.2(H) to perform their obligations under the applicable agreements or the Rules, the ACH Rules or Applicable Law. Except as otherwise expressly set forth herein, Bank is not liable or responsible for any cost, obligation, expense or liability of the Merchant Program.

ARTICLE III

OTHER MERCHANT SERVICE PROVIDERS AND INDEPENDENT SALES ORGANIZATIONS

Section 3.1. Other Merchant Service Providers and Independent Sales Organizations. Company may recommend to Bank other ISOs/MSPs to, among other things, assist Company in soliciting Merchants for the Merchant Program, provide customer and accounting services, and sell and service electronic terminals. Such entities must be approved in writing by Bank, such approval not to be unreasonably withheld or delayed. Company will provide such financial and other information regarding such entities as Bank may request in connection with Bank’s determination whether to approve such entities. If approved by Bank, such ISOs/MSPs must then be registered with the Card Associations in accordance with the Rules and enter into contractual agreements with Bank as reasonably required by Bank. Company shall be responsible for monitoring the activities of all such ISOs/MSPs to ensure, and shall ensure, compliance with the Rules governing these entities. (Based on Company’s representation and warranty that information previously furnished by Company to Bank regarding the existing ISOs/MSPs identified on Exhibit 3.1 (“Existing ISOs/MSPs”) is true and accurate in all Material respects, and that such Existing ISOs/MSPs are each registered and in good standing with the Card Associations, Bank hereby approves such Existing ISOs/MSPs.) Company will direct, manage, conduct, administer and enforce the ISO/MSP Agreements of Bank and Company as to

| -13- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

such ISOs/MSPs; provided, however, that nothing herein shall be construed to authorize Company to modify any such ISO/MSP Agreement to which Bank is a party or to waive any of Bank’s rights thereunder without Bank’s prior written consent. Company shall be responsible and liable for the acts and omissions of all such ISOs/MSPs and merchants of such ISOs/MSPs, except to the extent any such claims directly result from the Material breach by Bank of its obligations hereunder involving no Material failure by Company to perform its obligations hereunder and no Material failure by any of the parties referred to in Section 2.1, Article III or Exhibit 2.2(H) to perform their obligations under the applicable agreements or the Rules, the ACH Rules or Applicable Law. Nothing in this Section shall be interpreted to alter the responsibilities of the parties under this Agreement with regard to Merchants established via such ISOs/MSPs (including without limitation, Bank’s right to prior approval of Merchants, of the form of Merchant Agreements and application materials, of the schedule from which fees and charges are selected for use in Merchant Agreements, regarding Bank’s rights to terminate Merchants and to change or make exceptions to, or to decline to change or make exceptions to, the Merchant Criteria).

Section 3.2. Agent Bank Sponsorship. In addition to ISOs/MSPs, Bank agrees to register any Agent Bank with the Card Associations in accordance with the Rules. For purposes of this Agreement, “Agent Bank” or “Agent” means a financial institution that has entered into an agreement with Company to perform certain duties with respect to merchant agreements, provided such entities must be approved in writing by Bank, such approval not to be reasonably withheld or delayed, and must be acceptable to the Card Associations. Company will provide such financial and other information regarding such entities as Bank may request in connection with Bank’s determination whether to approve such entities. (Based on Company’s representation and warranty that information previously furnished by Company to Bank regarding the existing Agent Banks identified on Exhibit 3.2 (“Existing Agent Banks”) is true and accurate in all Material respects, and that such Existing Agent Banks are each registered and in good standing with the Card Associations, Bank hereby approves such Existing Agent Banks.) If approved by Bank, such Agent must then be registered with the Card Associations in accordance with the Rules. Bank may terminate any such Agent Bank in accordance with the Rules, or as otherwise required by the Card Associations or by directions or guidance of a governmental authority with supervisory authority over Bank. Company shall be responsible for monitoring the activities of all such Agents to ensure, and for ensuring, compliance with the Rules governing these entities, with the applicable contractual agreements, with this Agreement, and with Applicable Law. Company will direct, manage, conduct, administer and enforce the Agent agreements of Company as to such Agents and, as to Bank, shall be responsible and liable for the acts and omissions of all such Agents and merchants of such Agents, and for all Losses relating to any of the same, except the extent any such claims or Losses directly result from the Material breach by Bank of its obligations hereunder involving no Material failure by Company to perform its obligations hereunder and no Material failure by any of the third parties referred to in Section 2.1, Article III or Exhibit 2.2(H) to perform their obligations under the applicable agreements or the Rules, the ACH Rules or Applicable Law. However, nothing in this Agreement shall be construed as authorizing Company to modify any such agreements with any such Agents, or the Merchant Agreements with any such Merchants, or to waive any of Bank’s

| -14- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

rights under any such Merchant Agreements with any such Merchants. Nothing in this Section shall be interpreted to alter the responsibilities of the parties under this Agreement with regard to Merchants established via Company’s Agent Bank relationships (including without limitation, Bank’s right to prior approval of Merchants, of the form of Merchant Agreements and application materials, of the schedule from which fees and charges are selected for use in Merchant Agreements, and regarding Bank’s rights to terminate Merchants and to change or make exceptions to, or to decline to change or make exceptions to, the Merchant Criteria).

Section 3.3. Acquisitions. Bank acknowledges that Company may, from time to time, acquire the stock or assets of other entities that provide processing services for merchants. In addition, it is acknowledged by Bank and Company that, if requested by Company and approved by Bank in its reasonable discretion, Bank will provide the services contemplated under this Agreement to such of the acquired merchants as (1) satisfy the Merchant Criteria and (2) either (i) agree to enter into a Merchant Agreement in the form, and providing for the charges and fees, approved by Bank as provided in Section 2.1 or (ii) have existing merchant agreements which are in form and substance, and provide for charges and fees, as shall be satisfactory to Bank, and (3) with respect to which the Company increases the Company Reserve Account by an amount satisfactory to the Bank and (4) do not, by virtue of such acquisition, Materially change the business or risk profile of Company. Bank’s approval of its providing services under this agreement for such acquisitions will be completed through the Bank’s signing of an assignment and assumption agreement for the acquired merchants’ business, in form and substance reasonably satisfactory to the Bank. This agreement contemplates that Bank will provide services that are the subject of this Agreement for acquisitions made by Company. However, the parties acknowledge that Bank is under no obligation to provide services under this Agreement for acquisitions made by the Company after the date of this Agreement. Upon such approval the acquired merchant program shall be subject to this Agreement, including without limitation, Bank’s right to indemnification from Company for any trailing chargeback liability and any other liabilities arising from the acquired merchants’ business.

ARTICLE IV

BANK FEES

Section 4.1. Bank Fees. Company agrees to pay all fees as specified in the Exhibit B with respect to services provided by Bank under this agreement.

ARTICLE V

SETTLEMENT

Section 5.1. Settlement.

(a) Bank will establish one or more special agency accounts for merchant settlement (the “Merchant Settlement Accounts”), which will be owned by Bank, to receive settlement from Card Associations, through Company’s designated Third Party

| -15- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

Provider, with respect to the Merchant Program, to settle ACH debit and credit entries transmitted pursuant to Exhibit 2.2(H), and to receive discount rates/fees, processing fees, transaction fees and other fees and charges owing by Merchants under their Merchant Agreements for the Merchant Program (collectively, “discount fees”). Company agrees it has no right, title or interest in the Merchant Settlement Accounts. At no expense to Bank, Bank will cooperate with Company’s Third Party Provider to settle transactions through the interchange process of the Card Associations and to settle ACH debit and credit entries transmitted pursuant to Exhibit 2.2(H). Bank will provide fund transfers for the payment and transfer of funds to Merchants. Company shall be responsible for the cost of making fund transfers to Merchants as set forth on Exhibit B. Company will maintain an account (the “Company Account”) for the purpose of receiving amounts transferred from the Merchant Settlement Accounts after payment of amounts due to Merchants, Bank, and the Company Reserve Account. Company will provide Bank with routing instructions to effect transfers to and from the Company Account. Company authorizes Bank to initiate and make transfer to and from the Company Account to effect the transactions contemplated by this Agreement. Subject to Section 5.4, any amounts in the Merchant Settlement Accounts with respect to the Merchant Program net of those funds paid to Merchants, Bank or the Company Reserve Account shall be paid to the Company Account on each Bank business day. Any deficit in the Company Account balance shall be resolved within (3) business days by Company’s payment of immediately available funds into the Company Account or directly to Bank to cover any deficit. The parties acknowledge that there may be rare occasions when Bank must pay the daily settlement funds but does not receive funding for the daily settlement funds on that day from the applicable clearing Company agrees to reimburse Bank, on demand, at the [* * *] the amount of “float cost” Bank incurs as a result of fronting the settlement amount, together with such settlement amount as well as any other cost, fees, or Losses associated with Bank’s payment of the settlement amount. Nothing herein shall be construed as obligating Bank to front the settlement amount (i) for more than one (1) business day, or (ii) when there shall have occurred and be continuing any other Event of Default by Company or any event affecting Company referred to in Section 11.5(a) or (b). If the reason for the failure to receive funding for daily settlement amount arises due to any act or omission of the Party Provider, and such failure may require the fronting of settlement for more than one (1) business day, Bank and Company shall work in good faith to resolve the issue(s) which resulted in such failure and to provide the payment of settlement to Merchants as soon as is practicable.

(b) Company will maintain a positive balance in the Company Account at all times sufficient to accommodate all funding required by this Agreement. If at any time the Company Account balance is negative, Bank shall give Company written notice of such deficit and Company shall have three (3) business days to cure such deficit. Any fees or interest expenses with respect to funding such deficit shall be reimbursed by Company, on demand by Bank, at the [* * *]. Such notice may be provided by electronic mail or fax.

| -16- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

(c) Bank agrees to [* * *], provided (i) that there shall not have occurred and be continuing any Event of Default by Company or any event affecting Company referred to in Section 11.5(a) or (b), and (ii) that Company [* * *], in the manner specified in subsection (d) below.

(d) Each month, on or about the tenth (10th) calendar day of such month, Company will prepare an ACH file of the aggregate discount fees for the prior month, debiting each Merchant’s settlement account or reserve account, as the case may be, and crediting such discount fees to the Merchant Settlement Accounts referred to in (a) above. In the event Company fails to prepare such ACH file, Bank may do so, based on information provided directly to Bank by the Third Party Provider (or any successor thereto), and, notwithstanding any provision to the contrary in the Processing Agreement (or comparable agreement with any successor to the Third Party Provider), Company hereby authorizes and directs Third Party Provider (and any successor thereto) to provide such information directly to Bank for such purpose. Upon receipt of the funds generated by such file, Bank will remit such funds to the Company Account, less an amount equal to [* * *], and (ii) [* * *], (iii) [* * *], and (iv) [* * *].

Section 5.2. Company Account Funds. As between Bank and Company, Company shall be responsible for [* * *]. Subject to Section 5.4, Company shall be entitled to all funds remaining in the Company Account after payment of said sums. To the extent Company owes Bank for obligations arising under this Agreement, Bank shall satisfy such obligations first from the Merchant Settlement Accounts or the Company Account, prior to satisfying any such obligations from funds in the Company Reserve Account. Company remains responsible for any amounts owing Bank if such Accounts are not sufficient to satisfy such obligations.

Section 5.3. Company Reserve Account.

(a) Funding. Company will establish a Company Reserve Account (“Company Reserve Account”) to fund the payment of [* * *] and other amounts due to Bank, and, subject to Section 5.3(d), will fund the Company Reserve Account either by transferring funds from existing reserve accounts currently held at J.P. Morgan Chase Bank or by depositing funds with Bank, in an amount sufficient to satisfy the reserve requirements specified in Exhibit 5.3(A). The timing of such transfer will be determined by mutual agreement of Bank, Company and, if the funds are transferred from the existing reserve at J.P. Morgan Chase Bank, J.P. Morgan Chase Bank. Bank will notify Company of any deductions from the Company Reserve Account. In the event the Merchant Settlement Accounts and Company Account are insufficient or unavailable for reimbursement of [* * *], Bank may eliminate any [* * *] without notice to Company. The Company Reserve Account will earn funds credit at the Earnings Credit Rate specified in Exhibit B.

| -17- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

(b) Mechanics. Unless otherwise agreed in writing, when the Company Reserve Account is fully funded pursuant to Section 5.3(a) above, no further funding of the Company Reserve Account shall be required unless to replenish the Company Reserve Account, as described in Exhibit 5.3(A). It is expressly agreed and understood by the parties hereto that the level of reserves and reserve policy currently existing in Company, as required by Company’s current criteria and related underwriting are sufficient to fully fund any reserves required by Bank per Section 5.3(a) and will continue to be sufficient as long as the business and/or risk profile of Company (taking into consideration factors such as type of Merchant or Merchant volume) does not Materially change.

(c) Company Reserve Account Upon Termination.

(1) The Company Reserve Account shall remain deposited at Bank throughout the term of this Agreement, including any extensions and renewals thereof, and through the end of any period of continued servicing as described in Section 11.7. In the event that there are any unresolved obligations or liabilities of Company at the expiration or termination of this Agreement and the conclusion of any period of continued servicing as described in Section 11.7, Bank may retain in the Company Reserve Account a sum equal to [* * *] times the aggregate of such unresolved obligations or liabilities and may retain such sums until satisfactory resolution of the obligations or claims. Sums so retained shall be in addition to any sums retained pursuant to subsections (2) or (3) below. Bank will permit the entire amount held in the Company Reserve Account, except for sums, if any, retained pursuant to the foregoing provisions of this subsection (1), to be withdrawn by Company, upon the execution and delivery of an agreement, in form and substance satisfactory to Bank, by Bank and by the member in good standing of the Associations which has been recognized by the Card Associations as the assignee of the BINs and ICAs relating to the Merchant Program, and which has capitalization which is acceptable to Bank, in its reasonable discretion, whereby such member, having been designated by Company pursuant to Section 10.4, receives the assignments referred to therein and, concurrently therewith, assumes all liabilities associated with the assigned BINs/ICAs, including without limitation all trailing chargeback liabilities.

(2) In the event that one or more BINs/ICAs which are used for the Merchant Program are not transferred by Bank to another acquiring financial institution as contemplated by this Agreement, upon expiration or termination of this Agreement and the conclusion of any period of continued servicing as described in Section 11.7, Bank may retain in the Company Reserve Account a sum equal to the average monthly [* * *] utilizing the nontransferred BINs/ICAs during the [* * *] month period on or prior to the effective date of such expiration or termination or, if later, prior to the conclusion of any period of continued servicing as described in Section 11.7, multiplied by [* * *], and may hold such funds for a period of [* * *] months following the effective date of such expiration or termination or, if later, following the conclusion of any period of continued servicing as described in Section 11.7. Sums so retained shall be in addition to any sums retained pursuant to subsection (1) above or subsection (3) below.

| -18- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

(3) Upon expiration or termination of this Agreement and the conclusion of any period of continued servicing as described in Section 11.7, Bank may retain in the Company Reserve Account a equal to the average monthly [* * *], whether for Merchants or Company, during the [* * *] month period occurring prior to the effective date of such expiration or termination or, if later, prior to the conclusion of any period of continued servicing as described in Section 11.7, multiplied by [* * *], and may hold such funds for a period of [* * *] months following the effective date of such expiration or termination or, if later, following the conclusion of any period of continued servicing as described in Section 11.7. Sums so retained shall be in addition to any sums retained pursuant to subsection (1) or subsection (2) above.

(d) Letter of Credit

(1) In lieu of funding the Company Reserve Account, Company may procure an irrevocable letter of credit (the “Letter of Credit”), which Letter of Credit shall: (i) be a stand-by, at-sight, irrevocable letter of credit; (ii) be in the initial amount required to fund the Company Reserve Account under Exhibit 5.3(A): (iii) be drawn on an FDIC insured financial institution with an “A” credit rating or above and is reasonably satisfactory to the Bank; (iv) be payable to Bank; (v) require that any draw on the Letter of Credit shall be made only upon receipt by the issuer of a letter signed by a purported authorized representative of Bank certifying that Bank is entitled to draw on the Letter of Credit pursuant to this Agreement; (vi) allow partial draws; and (viii) provide that it is governed by the Uniform Customs and Practice for Documentary Credits (1993 revisions) or the International Standby Practices (ISP 98). The Letter of Credit (and any renewals or replacements thereof) shall be for a term of not less than one (1) year.

(2) Bank may present its written demand for payment of a portion of the amount of the Letter of Credit as is required to compensate Bank for Losses, Transaction Card chargebacks, Losses on ACH transactions for Merchants or Company, fees and other amounts due to Bank under the Agreement.

(3) Company agrees that it shall from time to time, as necessary, whether as a result of a draw on the Letter of Credit by Bank pursuant to the terms hereof, or any increase in the amount required as a deposit in the Company Reserve Account, or as a result of the expiration of the Letter of Credit then in effect, renew or replace the original and any subsequent Letter of Credit so that a Letter of Credit, in the amount required hereunder, is in effect until a date which is at least one hundred eighty (180) days after the expiration or termination of this Agreement or, if later, the date on which any period of continued servicing pursuant to Section 11.7 shall have concluded or, if later, the date on which there

| -19- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

shall remain no further Company Reserve Account requirement pursuant to any of Section 5.3(c)(1) or (2) or (3). If Company fails to furnish such renewal or replacement at least thirty (30) days prior to the stated expiration date of the Letter of Credit then held by Bank and, in the case of a replenishment of or increase in the amount required as a deposit in the Company Reserve Account, within three (3) business days after request therefor by Bank, then Bank, in addition to any other rights and remedies it may have under this Agreement, at its option may draw upon the full amount of such Letter of Credit and hold the proceeds thereof (and such proceeds need not be segregated) as a security deposit, and such sum shall be deposited into the Company Reserve Account, and/or may fund all or part of the required balance to be maintained in the Company Reserve Account by any of the means referred to in Exhibit 5.3(A). Any renewal or replacement of the original or any subsequent Letter of Credit shall meet the requirements for the original Letter of Credit as set forth above, except that such replacement or renewal shall be issued by a national bank with an “A” credit rating or above and reasonably satisfactory to Bank at the time of the issuance thereof.

(4) If Bank draws on the Letter of Credit as permitted in this Agreement, then, upon demand of Bank, Company shall restore the amount available under the Letter of Credit to its original amount by providing Bank with an amendment to the Letter of Credit evidencing that the amount available under the Letter of Credit has been restored to its original amount. In the alternative, Company may provide Bank with cash, to be held by Bank in the Company Reserve Account in accordance with Section 5.3(a) of the Agreement, equal to the restoration amount required under the Letter of Credit.

(5) The parties agree that the Company Reserve Account will in any event be established and maintained at Bank as provided herein, but will not be funded in the manner provided herein if a Letter of Credit meeting the requirements set out above shall be duly issued by the Effective Date and shall remain in effect thereafter with an available balance corresponding to the amount required from time to time, determined in accordance with the provisions hereof applicable to the Company Reserve Account. If at any time, before or after termination of this Agreement, there ceases to remain in effect such a Letter of Credit, in such amount and meeting such requirements set out above, Bank, at its option, may fund the Company Reserve Account using funds drawn under any such Letter of Credit and/or by any of the means referred to in Exhibit 5.3(A).

Section 5.4. Security; Set-off. Company hereby grants Bank a continuing security interest in and to the Company Account, the Merchant Settlement Accounts and the Company Reserve Account, all funds belonging or payable to Company, or in which Company may have an interest, now or hereafter in any such Account, and all other funds belonging or payable to Company, or in which Company may have an interest, now or hereafter in the possession of

| -20- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

Bank, to secure all of Company’s obligations to Bank under this Agreement and under any other agreement executed in connection with this Agreement to which Bank and Company may now or hereafter be parties. The Company Account, Merchant Settlement Accounts and Company Reserve Account shall each be maintained at Bank, and each such Account, all funds now or hereafter contained therein, and any other monies belonging or payable to Company or in which Company may have an interest which are now or hereafter in Bank’s possession, shall be subject to Bank’s immediate and unencumbered right to set-off any claims Bank has against Company, whether absolute or contingent, for services, indemnification, or otherwise.

ARTICLE VI

REPORTS AND RECORDS

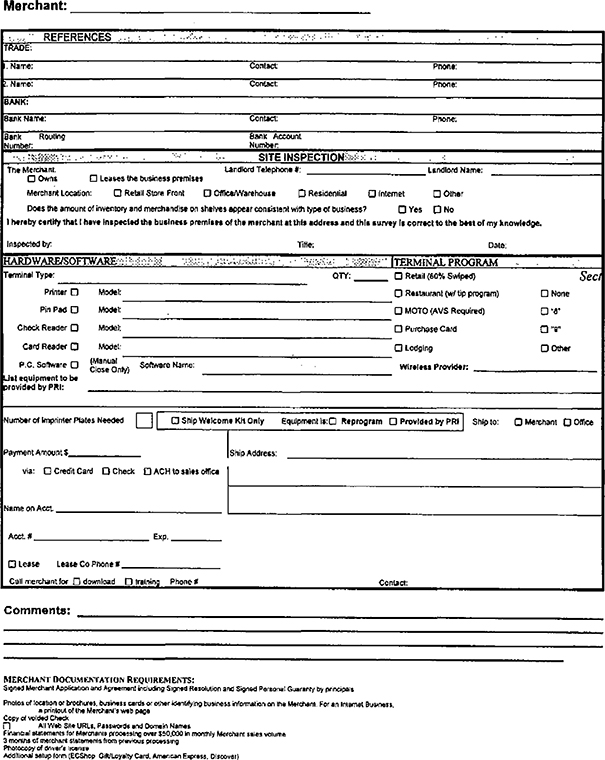

Section 6.1. Reports. To the extent Bank receives any Material reports including from Card Associations or Company’s Third Party Provider for the Merchant Program not otherwise received by or accessible to Company, Bank will promptly provide Company with reporting for the Merchant Program. The form and format of any other routine report utilized as periodic communication between Bank and Company will be as mutually agreed by Company and Bank. However, such reporting from Company to Bank will at a minimum include the information described in Exhibit 6.1.

Section 6.2. Records. At all times Company will maintain accurate business records relating to the Merchant Program. Company will maintain a disaster recovery and contingency plan that meets or exceeds applicable bank regulatory and Card Association requirements (as communicated by Bank). Company will deliver a copy of such plans to Bank prior to execution of this Agreement, and thereafter whenever any change is made to any such plans. If the plan does not meet such requirements or if a bank regulatory agency requires changes to such plans, Company agrees to promptly make such changes or meet such requirements upon written notice to Company of such changes or requirements by Bank.

ARTICLE VII

AUDIT

Section 7.1. Audits. Company shall provide Bank, its employees, and its auditors, and regulatory agencies having supervisory authority over Bank, with reasonable access to records and facilities to review records and conduct audits and inspections of the performance of services and assessment of fees and charges under this Agreement. Such access shall be requested upon at least 7 days’ advance notice, shall be during normal business hours and shall not Materially interfere with the conduct of the Company’s business (unless shorter notice or different hours or different conditions for such access shall be imposed by a Card Association, the Rules, the ACH Rules or such regulatory agency). Bank’s audits and inspections shall be no more frequent than quarterly unless otherwise required by the Card Associations, the Rules, the ACH Rules, Applicable Law or directions or guidance of governmental authorities with supervisory authority over the Bank.

| -21- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

Section 7.2. Audit Expense. Bank shall bear the sole cost and expense of audits and inspections conducted by it under this Agreement, except as specified on Exhibit B. However, Company shall bear the sole cost and expense of audits and inspections conducted or required by any regulatory authority or Card Association, including without limitation the annual inspections Bank is required to perform under the Rules.

Section 7.3. Financial Statements. Company will provide annual audited and quarterly unaudited financial statements to Bank, copies of SAS 70 audit reports on the Company annually, and such other financial information as Bank may reasonably request.

ARTICLE VIII

FEES AND EXPENSES

Section 8.1. Other Service Fees. Company shall pay to Bank fees for services, and other items, as stated on and at the time specified in Exhibit B. Bank may charge the Company Account for these amounts. In the event additional services are requested, the parties shall negotiate in good faith for the additional service and payment therefor.

Section 8.2. Card Association Fees. [* * *] used in this Merchant Program. As to Bank, Company is solely liable for [* * *]. Company shall pay [* * *]; provided that (i) Company shall not be liable for [* * *] arising out of claims which directly result from the Material breach by Bank of its obligations hereunder involving no Material failure by Company to perform its obligations hereunder and no Material failure by any of the third parties referred to in Section 2.1, Article III or Exhibit 2.2(H) to perform their obligations under the applicable agreements or the Rules, the ACH Rules or Applicable Law, and (ii) Bank shall retain any benefits, including without limitation any benefits in the form of discounts or waivers of charges or fees otherwise due in connection with the Program, which accrue by reason of Bank’s being part of the [* * *] program, it being understood that Company’s obligations hereunder shall be determined without reference to such discounts, waivers or other benefits, all of which shall be for the sole benefit of Bank.

Section 8.3. Company Account. As between Company and the Bank, [* * *]. To the extent there are insufficient funds in the Company Account to pay such expenses, Bank shall notify Company in writing of the deficiency and Company shall promptly deposit funds in the Company Account sufficient to pay those Losses, or Bank may utilize funds in the Company Reserve Account for this purpose. Bank may setoff Losses from amounts otherwise due Company hereunder; provided that, Company shall not be liable for Losses arising out of claims which directly result from Material breach by Bank of its obligations hereunder involving no Material failure by Company to perform its obligations hereunder and no Material failure by any of the third parties referred to in Section 2.1, Article III or Exhibit 2.2(H) to perform their obligations under the applicable agreements or the Rules, the ACH Rules or Applicable Law.

| -22- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

Section 8.4. Conversion Costs. Company is responsible for [* * *]. Notwithstanding the foregoing, Bank shall be responsible for [* * *] in the event (1) Bank’s membership in either Card Association is terminated, or (2) this Agreement is terminated by Company by virtue of an uncured Event of Default by Bank.

Section 8.5. Other Costs and Expenses. Except as otherwise specified herein, each party shall be responsible for its own costs and fees in the preparation of this Agreement and carrying out of its obligations under this Agreement.

ARTICLE IX

REPRESENTATIONS AND WARRANTIES

Section 9.1. Bank—General Representations and Warranties. Bank hereby represents and warrants to Company as follows:

(a) Bank is duly chartered and validly existing as a Georgia state banking corporation with full power and authority to carry on its banking business as now conducted.

(b) Bank has all requisite corporate power and authority to enter into and perform all its obligations under this Agreement. The execution and delivery of this Agreement and the consummation of the transactions contemplated hereby have been duly and validly authorized by all necessary corporate action in respect thereof on the part of Bank. This Agreement constitutes the legal, valid and binding obligation of Bank enforceable against it in accordance with its terms, subject only as to enforceability of bankruptcy, insolvency and other laws of general applicability relating to or affecting creditors’ rights and to general principles of equity.

(c) To the knowledge of Bank, no consent, approval or authorization of, or declaration, notice, filing or registration with, any government entity or any other person is required to be made or obtained by Bank in connection with the execution, delivery and performance of this Agreement except for the assignment of Company’s BIN and ICA and the registration and approval of Company, ISOs/MSPs, and Agent with the Card Associations as required by the Rules.

(d) To the knowledge of Bank, there is no litigation, proceeding or governmental investigation pending or threatened, and there is no proceeding, pending dispute, or ongoing investigation with any Card Association or any order, injunction or decree outstanding which does or might Materially affect Bank’s ability to enter into this Agreement or carry out Bank’s obligations thereunder.

(e) To the knowledge of Bank, this Agreement docs not conflict with any other agreement or obligation of Bank and neither the execution and delivery nor the performance of this Agreement will violate, conflict with, result in a breach of or default under, or constitute a violation of Bank’s bylaws, any agreement, or any law, regulation, judicial decree or order by which Bank is bound.

| -23- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

(f) Bank is a principal member in good standing of the Card Associations.

Section 9.2. Bank—General Covenants. Bank covenants with the Company as follows:

(a) Bank will continue to maintain its membership in the Card Associations throughout the term of this Agreement.

(b) Bank shall comply with the requirements of the VISA Cardholder Information Security Program (“CISP”) and MasterCard Site Data Protection (“SDP”) Program, as well as any other security guidelines or requirements established by the Card Associations, unless Bank obtains or is granted a waiver from such requirements.

Section 9.3. Company—General Representations and Warranties. Company hereby represents and warrants to Bank as follows:

(a) Company is a corporation duly organized and validly existing under the laws of the State of Delaware with full power and authority to carry on its business as now conducted.

(b) Company has all requisite power and authority to enter into and perform all its obligations under this Agreement. The execution and delivery of this Agreement and the consummation of the transactions contemplated hereby have been duly and validly authorized by all necessary action in respect thereof on the part of Company. This Agreement constitutes the legal, valid and binding obligation of Company enforceable against it in accordance with its terms, subject only as to enforceability of bankruptcy, insolvency and other laws of general applicability relating to or affecting creditors’ rights and to general principles of equity.

(c) No consent, approval or authorization of (other than the approval of Company’s lenders, which Company represents and warrants has been obtained), or declaration, notice, filing or registration with, any government entity or any other person is required to be made or obtained by Company in connection with the execution, delivery and performance of this Agreement except for the assignment of Company’s BIN and ICA and the registration of Company, ISOs/MSPs, and Agent Banks with the Card Associations as required by the Rules.

(d) There is no litigation, proceeding or governmental investigation pending or, to the knowledge of Company, threatened, and there is no proceeding, pending dispute, or ongoing investigation with any Card Association or any order, injunction or decree outstanding which does or might Materially affect Company’s ability to enter into this Agreement or carry out Company’s obligations thereunder.

(e) This Agreement does not conflict with any other agreement or obligation of Company and neither the execution and delivery nor the performance of this Agreement will violate, conflict with, result in a breach of or default under, or constitute a violation of Company’s charter documents or membership and operating agreement, any agreement, or any law, regulator or judicial decree or order by which Company is bound.

| -24- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

(f) Except as otherwise disclosed in this Agreement, the Existing Portfolio was solicited, and all services, operations and activities heretofore performed or conducted in relation thereto have complied, and the transactions contemplated herein with respect thereto shall comply, in all Material respects with the Rules, the ACH Rules and with Applicable Law.

Section 9.4. Company—General Covenants. Company covenants with Bank as follows:

(a) Company will be a registered Merchant Service Provider and Independent Sales Organization of Bank under applicable Rules in good standing and will continue to maintain those registrations throughout the term of this Agreement.

(b) During the term of this Agreement, Company will have sufficient experienced employees, facilities and systems to perform its merchant processing business and servicing and other obligations of its business. Company will conduct the Merchant Program in a professional and workmanlike manner, in a manner that will not bring discredit to Bank or its Affiliates and Company will respond and attempt to resolve Merchant inquiries promptly.

Section 9.5. Company—Card Association Representations, Warranties, and Covenants. Company hereby represents and warrants to Bank and covenants with Bank as follows:

(a) Company has received, understands, and agrees to comply with all Rules.

(b) On an ongoing basis, Company will regularly provide Bank with the current addresses for all its offices.

(c) In the event of any inconsistency between any provision of this Agreement and the Rules, the Rules in each instance shall be afforded precedence and shall apply.

(d) Company acknowledges and agrees that VISA and/or MasterCard are the sole and exclusive owner of VISA and/or MasterCard trademarks and service marks (“Marks”). Company agrees to never contest the ownership of these Marks and VISA and/or MasterCard may at any time immediately and without advance notice prohibit Company from using their respective Marks.

| -25- |

THIS EXHIBIT HAS BEEN REDACTED AND IS THE SUBJECT OF A

CONFIDENTIAL TREATMENT REQUEST. REDACTED MATERIAL IS MARKED

WITH [* * *] AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND

EXCHANGE COMMISSION.

(e) Company acknowledges and agrees that VISA and/or MasterCard shall have the right, either in law or in equity, to enforce any provision of the Rules and to prohibit Company’s conduct that creates a risk of injury to VISA and/or MasterCard or that may adversely affect the integrity of VISA’s and/or MasterCard’s systems, information or both. Company agrees to refrain from taking any action that would have the effect of interfering with or preventing an exercise of these rights by VISA and/or MasterCard.