Attached files

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

[X]

|

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For Fiscal Year Ended: June 30, 2014

OR

|

[ ]

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from __________________ to

|

Commission file number

|

000-54706

|

MV PORTFOLIOS, INC.

(Exact name of small business issuer as specified in its charter)

|

Nevada

|

83-0483725

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

10752 Deerwood Park Blvd.

|

||

|

S. Waterview II, Suite 100

|

||

|

Jacksonville, FL

|

32256

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number: (904) 586-8673

Securities registered under Section 12(b) of the Act: None

Securities registered under Section 12(g) of the Act: Common Stock

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes[ ] No[X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes[ ] No[X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a smaller reporting company. See the definitions of the “large accelerated filer,” “accelerate filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer [ ] Accelerated Filer [ ]

Non-Accelerated Filer [ ] Smaller reporting company [X]

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of the voting stock held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter: $10,977,626 based upon the closing sale price of our common stock of $0.10 on that date. Common stock held by each officer and director and by each person known to own in excess of 5% of outstanding shares of our common stock has been excluded in that such persons may be deemed to be affiliates. The determination of affiliate status in not necessarily a conclusive determination for other purposes.

TABLE OF CONTENTS

|

Forward Looking Information

|

|

1 | |

|

PART I

|

|||

|

Item 1.

|

Business

|

|

2 |

|

Item 1A.

|

Risk Factors

|

|

9 |

|

Item 1B.

|

Unresolved Staff Comments

|

|

19 |

|

Item 2.

|

Properties

|

|

19 |

|

Item 3.

|

Legal Proceedings

|

|

22 |

|

Item 4.

|

Mine Safety Disclosures

|

22 | |

|

PART II

|

|||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

23 |

|

Item 6.

|

Selected Financial Data

|

|

24 |

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operation

|

|

25 |

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

28 |

|

Item 8.

|

Financial Statements and Supplementary Data

|

|

28 |

|

Item 9.

|

Changes and Disagreements With Accountants on Accounting and Financial Disclosure

|

|

29 |

|

Item 9A.

|

Controls and Procedures

|

|

29 |

|

Item 9B.

|

Other Information

|

|

30 |

|

PART III

|

|||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

|

31 |

|

Item 11.

|

Executive Compensation

|

|

33 |

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

37 |

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

|

39 |

|

Item 14.

|

Principal Accountant Fees and Services

|

|

40 |

|

PART IV

|

|||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

|

41 |

|

SIGNATURES

|

|

||

FORWARD-LOOKING STATEMENTS

Certain statements contained in this Form 10-K, including without limitation, statements containing the words “believes,” “estimates,” “expects” and words of similar import, constitute “forward looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such words and expressions are intended to identify such forward looking statements, but are not intended to constitute the exclusive means of identifying such statements. Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of MV Portfolios, Inc. (the “Company”), or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. Given these uncertainties, prospective investors are cautioned not to place undue reliance on such forward looking statements.

PART I

ITEM 1. BUSINESS

Company History

We were incorporated on April 19, 2004, and for much of our history were engaged in the acquisition and exploration of mineral properties. We have shifted our focus during 2014 and are now an intellectual property company that owns patented and unpatented intellectual property. On August 28, 2014, we changed our name to MV Portfolios, Inc.

The MVP Acquisition

During 2014 we acquired 8 issued and 11 pending patents. The patents disclose systems and methods for providing video drive-by data to enable a street level view of a neighborhood surrounding a geographic location. The systems include, generally, a video and data server farm incorporating at least one video storage server that stores video image files containing video drive-by data corresponding to a geographic location, a data base server that processes a data query received from a user over the internet and an image processing server.

On February 7, 2014, we entered into a securities exchange agreement (the “Securities Exchange Agreement”) with MVP Portfolio, LLC (“MVP”), MV Patents, LLC (“MV PAT”), and the other members of MVP (MV PAT and such other members, the “Members”). Pursuant to the terms of the Securities Exchange Agreement, the Members sold all of their membership interests in MVP to us in exchange for 9,385,000 shares (the “MVP Exchange Shares”) of our post-Reverse Split (defined below) common stock to be issued following completion of the Reverse Split. As a result of the MVP Acquisition, we have acquired the business of MVP, that is, patent licensing and assertion of rights under patents against parties believed to be selling goods or services that rely upon MVP’s patented technology.

A summary of the MVP Acquisition and related transactions is discussed below. For a more detailed discussion of the MVP Acquisition and the related transactions, reference is made to the Company’s Current Report on Form 8-K filed with the SEC on February 10, 2014, as amended.

Pursuant to the Securities Exchange Agreement:

|

●

|

At the closing of the MVP Acquisition and pursuant to the terms of the Securities Exchange Agreement, all of the membership interests of MVP issued and outstanding immediately prior to the closing were exchanged (the “Securities Exchange”) for the right to receive 9,385,000 post-Reverse Split shares of our common stock, which shall be delivered to the members of MVP promptly following completion of the Reverse Split.

|

|

●

|

Additionally, at the closing of the MVP Acquisition, we paid MV Patents, LLC, the majority member of MVP, $625,000 in cash consideration, and we agreed to pay to the members of MVP ten (10%) percent of the net proceeds to be received from any Enforcement Activities or Sale Transactions (as such terms are defined in the Securities Exchange Agreement) related to the patents owned or applications pending as of the closing of the MVP Acquisition.

|

|

●

|

Upon the closing of the MVP Acquisition, William Meadow was appointed Chief Executive Officer and Chairman of the Board of Directors, Shea Ralph was appointed Chief Financial Officer, Treasurer, Secretary and director and David Rector was appointed Chief Operating Officer (and remains a director of the Company). James Davidson resigned as Chief Executive Officer and a director of the Company and Michael Baybak resigned as Interim Treasurer, Secretary and a director.

|

|

●

|

Following the closing of the MVP Acquisition, we expect to evaluate whether to terminate or split off our mining business (although we are not sure we will be able to complete such a split-off on acceptable terms to us), and pursuant to the terms of the Securities Exchange Agreement, we have acquired and will continue the business of MVP, that is, patent licensing and assertion of rights under patents against parties believed to be selling goods or services that rely upon MVP’s patented technology.

|

|

●

|

Concurrently with the closing of the MVP Acquisition, we sold to each of David Rector and William Meadow, ten thousand (10,000) shares, for an aggregate of twenty thousand (20,000) shares, of our to-be-authorized and designated Series D Convertible Preferred Stock (the “Series D Preferred Stock”) at a post-Reverse Split price of $0.10 per share. The Series D Preferred Stock will be equivalent in all respects to our common stock, except that each share of Series D Preferred Stock will be entitled to cast 1,000 votes per share and will have a liquidation preference equal to $0.10 per share. The sale of the Series D Preferred Stock is further discussed below.

|

The Securities Exchange Agreement contained customary representations and warranties and pre- and post-closing covenants of each party and customary closing conditions. Breaches of the representations and warranties will be subject to customary indemnification provisions, subject to specified aggregate limits of liability.

For financial reporting purposes, the MVP Acquisition is being accounted for as a “reverse merger” rather than a business combination, because the managing member of MV PAT, the majority member of MVP, effectively controlled the Company immediately following the closing of the MVP Acquisition. As such, MVP is deemed to be the accounting acquirer in the transaction and, consequently, the transaction is being treated as a reverse acquisition of the Company by MVP. Accordingly, the assets and liabilities and the historical operations that will be reflected in the Company’s ongoing financial statements will be those of MVP. For periods prior to the formation of MVP (July 26, 2013), MV PAT would be deemed the accounting acquirer.

The parties have taken all actions with respect to the Securities Exchange intending that it be treated as a tax-free exchange under Section 351 of the Internal Revenue Code of 1986, as amended. It is expected that the $625,000 in cash consideration paid to MV PAT will be treated as taxable income to MV PAT.

The issuance of shares of our common stock to the members of MVP in connection with the Securities Exchange was not, and will not be, registered under the Securities Act, in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act, which exempts transactions by an issuer not involving any public offering, and Regulation D promulgated by the SEC under that section. These securities may not be offered or sold absent registration or an applicable exemption from the registration requirement, and are subject to further contractual restrictions on transfer as described below.

2014 10% Convertible Notes Private Placement Offering

Also on February 7, 2014, we completed a first closing of a related private placement offering (the “2014 Notes Offering”) of $2,942,495 in principal amount of our 10% convertible promissory notes (the “2014 Notes”). The 2014 Notes sold in the first closing automatically converted on August 28, 2014 into 5,581,547 shares, including shares issued as converted interest, of the Company’s Series C Convertible Preferred Stock, par value $0.001 per share (the “Series C Preferred Stock”), at a post-Reverse Split conversion price of $0.50 per share, upon the Company’s filing of a Certificate of Designation of Series C Convertible Preferred Stock (the “Certificate of Series C Designation”) with the Secretary of State of the State of Nevada following completion of the proposed Authorized Capital Increase (defined below) and the related filing of the Articles Amendments (defined below).

On March 3, 2014, we completed a second closing of the 2014 Notes Offering for gross proceeds of $1,017,500 (before deducting placement agent fees and expenses of the offering) of which $25,000 represented the settlement of outstanding legal fees. The 2014 Notes sold in the March 3rd closing automatically converted on August 28, 2014 into 2,135,619 shares, including shares issued as converted interest, of the Company’s Series C Preferred Stock.

Prior to August 28, 2014, the Company twice extended the maturity dates of the 2014 Notes. On May 30, 2014, the Company exercised its unilateral right as set forth in Section 1.04 of the 2014 Notes to extend the maturity dates of the 2014 Notes by 90 days. The other terms and conditions of the Notes remained unchanged. On August 11, 2014, the balance of the February 2014 Notes was reduced to $2,642,500 and the Company, the holders of the February 2014 Notes and the holders of the March 2014 Notes amended the 2014 Notes to extend the maturity dates of the Notes to November 2, 2014. Except for the amended maturity dates the terms and conditions of the 2014 Notes remained unchanged.

Each share of Series C Preferred Stock is entitled to a liquidation preference equal to $0.001 per share. Otherwise, the Series C Preferred Stock is equivalent in all respects to the Company’s common stock, with each share of Series C Preferred stock entitled to one vote and the holders of the Series C Preferred Stock voting together with the holders of the Company’s common stock. The Series C Preferred Stock is convertible on a one-for-one basis into shares of our common stock at the option of the holders, subject to a 9.99% blocker.

In connection with the 2014 Notes Offering, we agreed to pay the placement agent, Cavu Securities, LLC (“Cavu”), a cash commission of between 4% and 10% of the gross funds raised from Investors in the 2014 Notes Offering introduced by the placement agent, for a total of $295,150, and to issue to Cavu 250,000 post-Reverse Split shares of our common stock as a retainer fee (the “Retainer Shares”) and warrants (the “Broker Warrants”) to purchase 590,300 shares of our post-Reverse Split common stock. The Broker Warrants have a post-Reverse Split exercise price of $0.50 per share and expire three years after the date of issuance.

The Company provided the net proceeds from the 2014 Notes Offering to MVP to finance MVP’s business relating to the enforcement of its intellectual property rights through litigation against, and/or licensing with, any companies that are believed to be infringing certain of the patents owned by MVP. MVP expects to use the net proceeds from the 2014 Notes Offering to pay legal fees and costs relating to these planned litigations and licensing arrangements.

The Series D Preferred Stock

Concurrently with the closing of the Securities Exchange, we sold to each of David Rector and William Meadow ten thousand (10,000) shares at a price of $0.10 per share (calculated on a post-Reverse Split basis) of our to be authorized and designated Series D Convertible Preferred Stock (the “Series D Preferred Stock”). The Series D Preferred Stock is equivalent in all respects to the Common Stock, other than each share of Series D Preferred Stock is entitled to cast 1,000 votes per share and has a liquidation preference equal to $0.10 per share. Each share of Series D Preferred Stock automatically converts into one (1) share of Common Stock on the earlier of: (i) the listing the Company’s securities on a national securities exchange and (ii) a change of control of the Company. William Meadow delivered an irrevocable voting proxy to David Rector covering the shares of Series D Preferred Stock held by Meadow.

The Reverse Stock Split and Related Matters

On August 28, 2014 the Company filed a certificate of amendment to its Amended and Restated Articles of Incorporation (the “Amendment”) with the Secretary of State of the State of Nevada in order to (i) effectuate a reverse stock split of its common stock with a reverse split ratio of one-for-one hundred (1:100) (the “Reverse Split”), (ii) increase its authorized capitalization from 300,000,000 shares of Common Stock and 22,000,000 shares of blank check preferred stock, to 300,000,000 shares of common stock and 50,000,000 shares of blank check preferred stock, par value $0.001 per share (the “Authorized Capital Increase”) and (iii) change its name to “MV Portfolios, Inc.” from “California Gold Corp.” (the “Name Change”).

The Name Change and the Reverse Split became effective for our principal market, the OTC Markets, Inc. QB Tier, upon approval by the Financial Industry Regulatory Authority (FINRA) at which time a new trading symbol, “MPVI” become effective.

Description of MVP’s Business

MVP is engaged in the business of patent acquisition, product development, patent licensing and when necessary assertion of rights under patents against parties believed to be selling goods or services that rely upon our patented technology. The Company owns a patent portfolio we refer to as “ Video Drive-b y ” and online mapping, which has previously been used by MVP’s predecessors and licensees commercially. We currently own (through MVP) a patent portfolio consisting of 8 issued and 11 pending patents. The patents disclose systems and methods for providing video drive-by data to enable a street level view of a neighborhood surrounding a geographic location. The systems include, generally, a video and data server farm incorporating at least one video storage server that stores video image files containing video drive-by data corresponding to a geographic location, a data base server that processes a data query received from a user over the internet and an image processing server. Now that the Transactions have closed, MVP expects to enforce its intellectual property rights through litigation against, and/or licensing with, any companies that are believed to be infringing certain of the patents owned by MVP. MVP expects to use net proceeds from the Private Placement to pay legal fees and costs relating to these planned litigations.

We intend to attempt to maximize the economic benefits of our intellectual property portfolio, add significant talent in technological innovation, and potentially enhance our opportunities for revenue generation through the monetization of our assets, including patents owned by MVP. Acquisitions typically involve the ongoing relationship of the original innovator(s) and owners to help in the continued development of the portfolio to maximize value.

We intend to expand our intellectual property portfolio through both internal development and acquisition. We believe that our experience and ability to offer shares of our stock to inventors and others will enable us to expand our intellectual property portfolio as well as create additional intellectually property internally.

We continue to actively seek to broaden our intellectual property portfolio. Our philosophy is to seek and acquire intellectual property and technology. We are reviewing portfolio opportunities with a view toward acquiring those which we believe have potential for monetization through licensing opportunities or enforcement which may be related or unrelated to the Video Drive-by and online mapping patents. We are actively engaged in due diligence with respect to a number of patent and intellectual property portfolios and are in discussions as to the acquisition of several such portfolios. On August 15th MVP signed an option agreement with Harvard University related to a dielectric elastomer innovation that has the potential to create digital smart phone images where all objects are in focus. We will likely need to raise additional capital to complete any such acquisition. There is no assurance that we will succeed in acquiring any such portfolios, as to the terms of any such acquisition or that we will successfully monetize any portfolio that we acquire.

Key Elements of Business Strategy

Our intellectual property acquisition, development and licensing business strategy will include the following key elements:

| ● |

Identify Emerging Growth Areas where Patented Technologies will Play a Vital Role

|

Certain technologies become core technologies in the way products and services are manufactured, sold and delivered by companies across a wide array of industries. In conjunction with our partners, patent attorneys, and other patent sourcing professionals, we will identify core, patented technologies that have been or are anticipated to be widely adopted by third parties in connection with the manufacture or sale of products and services.

| ● |

Contact and Form Alliances with Owners of Core, Patented Technologies

|

Often individual inventors and small companies have limited resources and/or expertise and are unable to effectively address the unauthorized use of their patented technologies. We will seek to enter into business agreements with owners of intellectual property that do not have experience or expertise in the areas of intellectual property licensing and enforcement, or that do not possess the in-house resources to devote to intellectual property licensing and enforcement activities, or that, for any number of strategic business reasons, desire to more efficiently and effectively outsource their intellectual property licensing and enforcement activities.

| ● |

Effectively and Efficiently Evaluate Patented Technologies for Acquisition, Licensing and Enforcement

|

Subtleties in the language of a patent, recorded interactions with the patent office, and the evaluation of prior art can make a significant difference in the potential licensing and enforcement revenue derived from a patent or patent portfolio. It is important to identify potential problem areas, if any, and determine whether potential problem areas can be overcome, prior to acquiring a patent portfolio or launching an effective licensing program.

| ● |

Purchase or Acquire the Rights to Patented Technologies

|

After evaluation, we may elect to purchase the patented technology, or acquire the exclusive right to license the patented technology in all or in specific fields of use. The original owner of the patent or patent rights will typically receive an upfront acquisition payment or shares of common stock in the Company or a subsidiary, or retain the right to a portion of the gross revenues generated from a patent portfolio’s licensing and enforcement program, or a combination of the two.

| ● |

Successfully License and Enforce Patents with Significant Royalty Potential

|

As part of the patent evaluation process, significant consideration is also given to the identification of potential licenses, customers, infringers, industries within which the potential infringers exist, longevity of the patented technology, and a variety of other factors that directly impact the magnitude and potential success of a licensing, development and enforcement program. We are seeking to hire individuals trained in commercialization and in evaluating potentially infringing technologies and in presenting the claims of our patents and demonstrating how they apply to companies we believe are using our technologies in their products or services. These presentations can take place in a non-adversarial business setting, but can also occur through the litigation process, if necessary. Ultimately, we will execute patent licensing arrangements with users of our patented technologies through licensing negotiations, without the filing of patent infringement litigation, or through the negotiation of license and settlement arrangements in connection with the filing of patent infringement litigation.

| ● |

Business Update

|

On March 17, 2014, Visual Real Estate, Inc., our wholly-owned subsidiary and successor to MVP as a result of a corporate reorganization, filed a patent infringement lawsuit against Google Inc. in the United States District Court for the Middle District of Florida. The lawsuit claims infringement of three of Visual Real Estate’s patents: U.S. Patent number 7,389,181, entitled “Apparatus and Method for Producing Video Drive-By Data Corresponding to a Geographic Location”; U.S. Patent number 7,929,800, entitled “Methods and Apparatus for Generating a Continuum of Image Data”; and U.S. Patent number 8,078,396, entitled “Methods for and Apparatus for Generating a Continuum of Three Dimensional Image Data.” Among other things, the complaint identifies Google Street View and Google Earth as infringing Visual Real Estate’s patents. The case number is 3:14-cv-00274-TJC-PDB. On August 20, 2014 Google, Inc. filed four petitions for InterParties Review against the three asserted patents. VRE, Inc. plans to respond to the petition before the end of the year.

Competition

We expect to encounter significant competition in our new line of business from others seeking to commercialize, acquire, license and develop their intellectual property assets. Most of our competitors have much longer operating histories, and significantly greater financial and human resources, than we do. Entities such as Document Security Systems, Inc. (NYSE:DSS), Vringo, Inc. (NYSE:VRNG), VirnetX Holding Corp. (NYSE:VHC), Acacia Research Corporation (NASDAQ:ACTG), Allied Security Trust, Altitude Capital Partners, Augme Technologies Inc. (OTC:AUGT) Intellectual Ventures, Ocean Tomo, RPX Corporation (NASDAQ:RPXC), Rembrandt IP Management and others presently market themselves as being in the business of creating, acquiring, licensing or leveraging the value of intellectual property assets. We expect others to enter the market. In addition, competitors may seek to acquire the same or similar patents and technologies that we may seek to acquire, making it more difficult for us to realize the value of our assets which may be the result of the inability or unwillingness of third parties to also grant licenses to parties without the cooperation of the owners of other infringed rights.

Research and Development Expenditures

We have incurred no research and development expenditures over the last fiscal year and do not anticipate significant future research and development expenditures.

Employees

We currently have five employees, including our Chief Executive Officer, William D. Meadow, our Chief Financial Officer, Shea Ralph, and an Executive Administrator and one consultant. Our Chief Operating Officer, David Rector, provides his services to us on an independent contractor basis.

Offices

Effective August 31, 2013, we terminated our services agreement with Incorporated Communications Services (“ICS”), to reduce our corporate overhead relating to certain administrative costs. Under this agreement, ICS had provided, among other things, our corporate headquarter offices at 4515 Ocean View Blvd, La Canada, CA. From that date until the closing of the MVP Acquisition, we utilized the offices of our former legal counsel, Gottbetter & Partners, LLP, 488 Madison Avenue, 12th Floor, New York, NY 10022, as our corporate headquarters address. Effective as of the date of the Securities Exchange, our principal offices are located at 10752 Deerwood Park Blvd., S. Waterview II, Suite 100, Jacksonville, FL 32256, phone (904)-586-8673. Our website address is www.mvportfolios.com.

Subsidiaries

We currently have two subsidiaries, CalGold de Mexico, S. de R.L. de C.V., and Visual Real Estate, Inc.

Intellectual Property and Patent Rights

Our intellectual property will primarily be comprised of trade secrets, patented know-how, issued and pending patents, copyrights and technological innovation.

As a result of closing the Securities Exchange, we own a portfolio comprised of approximately 8 patents in the United States and 16 pending patent applications.

We have included a list of our U.S. patents below. Each patent below is publicly accessible on the Internet website of the U.S. Patent and Trademark Office at www.uspto.gov.

|

Patent

Number

|

Application Number

|

Title

|

Issue Date

|

Filing Date

|

|

7,389,181

|

11/216,465

|

APPARATUS AND METHOD FOR PRODUCING VIDEO DRIVE-BY DATA CORRESPONDING TO A GEOGRAPHIC LOCATION

|

06/17/2008

|

08/31/2005

|

|

7,929,800

|

11/702,708

|

METHODS ANDAPPARATUS FOR

GENERATING A CONTINUUM OF IMAGE DATA

|

04/19/2011

|

02/06/2007

|

|

8,078,396

|

12/035,423

|

METHODS FOR AND APPARATUS FOR GENERATING A CONTINUUM OF THREE DIMENSIONAL IMAGE DATA

|

12/13/2011

|

02/21/2008

|

|

8,090,633

|

12/344,021

|

METHOD AND APPARATUS FOR IMAGE DATA BASED VALUATION

|

01/03/2012

|

12/24/2008

|

|

8,207,964

|

12/036,197

|

METHODS AND APPARATUS FOR GENERATING THREE-DIMENSIONAL IMAGE DATA MODELS

|

||

|

8,213,743

|

13/025,819

|

METHODS AND APPARATUS FOR GENERATING A CONTINUUM OF IMAGE DATA

|

07/03/2012

|

02/11/2011

|

|

8,558,848

|

13/791,961

|

WIRELESS INTERNET-ACCESSIBLE DRIVE-BY STREET VIEW SYSTEM AND METHOD

|

10/15/2013

|

03/09/2013

|

|

8,554,015

|

13/481,852

|

METHODS AND APPARATUS FOR GENERATING A CONTINUUM OF IMAGE DATA

|

10/08/2013

|

05/27/2012

|

ITEM 1A. RISK FACTORS

An investment in shares of our common stock is highly speculative and involves a high degree of risk. We face a variety of risks that may affect our operations or financial results and many of those risks are driven by factors that we cannot control or predict. Before investing in our common stock you should carefully consider the following risks, together with the financial and other information contained in this Report. If any of the following risks actually occurs, our business, prospects, financial condition and results of operations could be materially adversely affected. In that case, the trading price of our common stock would likely decline and our stockholders may lose all or a portion of their investments in us. Only those investors who can bear the risk of loss of their entire investment should consider investing in our common stock.

The risk factors set forth below relate to our new business focus following the closing of the MVP Acquisition.

RISKS RELATED TO OUR BUSINESS AND FINANCIAL CONDITION

The Company has changed the focus of its business to commercializing, developing and monetizing intellectual property, including through licensing and enforcement. The Company may not be able to successfully monetize the patents, which it acquires and thus it may fail to realize all of the anticipated benefits of such acquisition.

There is no assurance that the Company will be able to successfully commercialize, acquire, develop or monetize the patent portfolios that it acquired from MVP. The acquisition of the patents could fail to produce anticipated benefits, or could have other adverse effects that the Company does not currently foresee. Failure to successfully monetize these patent assets may have a material adverse effect on the Company’s business, financial condition and results of operations.

In addition, the acquisition of the patent portfolios is subject to a number of risks, including the fact that there is a significant time lag between acquiring a patent portfolio and recognizing revenue from those patent assets. During that time lag, material costs are likely to be incurred that would have a negative effect on the Company’s results of operations, cash flows and financial position.

Therefore, there is no assurance that the monetization of the patent portfolios acquired will generate enough revenue to recoup the Company’s investment or outlays.

The Company’s operating history makes it difficult to evaluate its current business and future prospects.

The Company has, prior to the acquisition of MVP, been involved in businesses primarily as a junior mining exploration company. The Company not only has no operating history in executing its additional new business which includes, among other things, creating, commercializing, prosecuting, licensing, litigating or otherwise monetizing patent assets, but the Company’s lack of operating history in this sector makes it difficult to evaluate its additional new business model and future prospects.

The Company will be initially reliant primarily on the patent assets it acquired from MVP. If the Company is unable to commercialize, license or otherwise monetize such assets and generate revenue and profit through those assets or by other means, there is a significant risk that the Company’s business would fail.

Upon closing of the Securities Exchange, the Company acquired a portfolio of patent assets from MVP that it plans to commercialize, license or otherwise monetize. If the Company’s efforts to generate revenue from such assets fail, the Company will have incurred significant losses and may be unable to acquire additional assets. If this occurs, the Company’s business would likely fail.

Upon closing of the Securities Exchange and commencement of its additional new line of business, the Company expects to commence legal proceedings against one or more defendants, and the Company expects such litigation to be time-consuming and costly, which may adversely affect its financial condition and its ability to operate its business.

As described above, we expect to institute patent litigation. The Company’s viability could be highly dependent on the outcome of this litigation, the willingness of defendants to engage in settlement discussions, changes in the law and regulatory environment and as a result there is a risk that the Company may be unable to achieve the results it desires from such litigation, which failure would harm the Company’s business to a great degree. In addition, the defendants in this litigation are likely to be much larger than the Company and have substantially more resources than the Company does, which could make the Company’s litigation efforts more difficult and costly. The Company anticipates that its legal proceedings may continue for several years and may require significant expenditures including the costs of experts and other expenses. Disputes regarding the assertion of patents and other intellectual property rights are highly complex and technical. Once initiated, the Company may be forced to litigate against others to enforce or defend its intellectual property rights or to determine the validity and scope of other parties’ proprietary rights. The defendants or other third parties involved in the lawsuits in which the Company is involved may allege defenses and/or file counterclaims in an effort to avoid or limit liability and damages for patent infringement. If such defenses or counterclaims are successful, they may preclude the Company’s ability to derive licensing revenue from the patents. Third parties may sue us for patent or other intellectual property infringement. A negative outcome of any such litigation, or one or more claims contained within any such litigation, could materially and adversely impact the Company’s business and the value of the patents. Additionally, the Company anticipates that its legal fees and other expenses could be material and could negatively impact the Company’s financial condition and results of operations and may result in its inability to continue its business.

The Company may seek to internally develop additional new inventions and intellectual property, which would take time and be costly. Moreover, the failure to obtain or maintain intellectual property rights for such inventions would lead to the loss of the Company’s investments in such activities.

Part of the Company’s new additional business focus may include the internal development of new inventions or intellectual property that the Company will seek to monetize. However, this aspect of the Company’s business would likely require significant capital and would take time to achieve. There is also the risk that the Company’s initiatives in this regard would not yield any viable new inventions or technology, which would lead to a loss of the Company’s investments in time and resources in such activities.

In addition, even if the Company is able to internally develop new inventions, in order for those inventions to be viable and to compete effectively, the Company would need to develop and maintain, and it would heavily rely on, a proprietary position with respect to such inventions and intellectual property. However, there are significant risks associated with any such intellectual property the Company may develop principally including the following:

|

●

|

patent applications the Company may file may not result in issued patents or may take longer than the Company expects to result in issued patents;

|

|

●

|

the Company may be subject to interference proceedings;

|

|

●

|

the Company may be subject to opposition proceedings in the U.S. or foreign countries;

|

|

●

|

any patents that are issued to the Company may not provide meaningful protection;

|

|

●

|

the Company may not be able to develop additional proprietary technologies that are patentable;

|

|

●

|

other companies may challenge patents issued to the Company;

|

|

●

|

other companies may have independently developed and/or patented (or may in the future independently develop and patent) similar or alternative technologies, or duplicate the Company’s technologies;

|

|

●

|

other companies may design around technologies the Company has developed; and

|

|

●

|

enforcement of the Company’s patents would be complex, uncertain and very expensive.

|

The Company cannot be certain that patents will be issued as a result of any future applications, or that any of the Company’s patents, once issued, will provide the Company with adequate protection from competing products. For example, issued patents may be circumvented or challenged, declared invalid or unenforceable, or narrowed in scope. In addition, since publication of discoveries in scientific or patent literature often lags behind actual discoveries, the Company cannot be certain that it will be the first to make its additional new inventions or to file patent applications covering those inventions. It is also possible that others may have or may obtain issued patents that could prevent the Company from commercializing the Company’s products or require the Company to obtain licenses requiring the payment of significant fees or royalties in order to enable the Company to conduct its business. As to those patents that the Company may license or otherwise monetize, the Company’s rights will depend on maintaining its obligations to the licensor under the applicable license agreement, and the Company may be unable to do so. The Company’s failure to obtain or maintain intellectual property rights for the Company’s inventions would lead to the loss the Company’s investments in such activities, which would have a material and adverse effect on the Company’s company.

Moreover, patent application delays could cause delays in recognizing revenue from the Company’s internally generated patents and could cause the Company to miss opportunities to license patents before other competing technologies are developed or introduced into the market.

New legislation, regulations or court rulings related to enforcing patents could harm the Company’s new line of business and operating results.

If Congress, the United States Patent and Trademark Office or courts implement new legislation, regulations or rulings that impact the patent enforcement process or the rights of patent holders, these changes could negatively affect the Company’s new business model. For example, limitations on the ability to bring patent enforcement claims, limitations on potential liability for patent infringement, lower evidentiary standards for invalidating patents, increases in the cost to resolve patent disputes and other similar developments could negatively affect the Company’s ability to assert its patent or other intellectual property rights.

In addition, on September 16, 2011, the Leahy-Smith America Invents Act (the “Leahy-Smith Act”), was signed into law. The Leahy-Smith Act includes a number of significant changes to United States patent law. These changes include provisions that affect the way patent applications will be prosecuted and may also affect patent litigation. The U.S. Patent Office is currently developing regulations and procedures to govern administration of the Leahy-Smith Act, and many of the substantive changes to patent law associated with the Leahy-Smith Act recently became effective. Accordingly, it is too early to tell what, if any, impact the Leahy-Smith Act will have on the operation of the Company’s business. However, the Leahy-Smith Act and its implementation could increase the uncertainties and costs surrounding the prosecution of patent applications and the enforcement or defense of the Company’s issued patents, all of which could have a material adverse effect on the Company’s business and financial condition.

On February 27, 2013, US Representatives DeFazio and Chaffetz introduced HR845. In general, the bill known as the SHIELD Act (“Saving High-tech Innovators from Egregious Legal Disputes”), seeks to assess legal fee liability to plaintiffs in patent infringement actions for defendants costs. In the event that the bill becomes law, the potential obligation to pay the legal fees of defendants in patent disputes could have a material adverse effect on the Company’s business or financial condition.

On June 4, 2013, the Obama Administration issued executive actions and legislative recommendations. The legislative measures recommended by the Obama Administration include requiring patentees and patent applicants to disclose the “Real Party-in-Interest”, giving district courts more discretion to award attorney’s fees to the prevailing party, requiring public filing of demand letters such that they are accessible to the public, and protecting consumers against liability for a product being used off -the shelf and solely for its intended use.

The executive actions includes ordering the USPTO to make rules to require the disclosure of the Real Party-in-Interest by requiring patent applicants and owners to regularly update ownership information when they are involved in proceedings before the USPTO (e.g. specifying the “ultimate parent entity”) and requiring the USPTO to train its examiners to better scrutinize functional claims to prevent allowing overly broad claims.

On October 23, 2013, Representative Bob Goodlatte with bipartisan support introduced a new set of proposed patent reforms titled the “Innovation Act.” The Innovation Act has a number of major proposed changes. Some of the proposed changes include a heightened pleading requirement for the filing of patent infringement claims. The proposed changes require a particularized statement with detailed specificity regarding how each asserted claim term corresponds to the functionality of each accused instrumentality. The Innovation Act also includes a provision that allows prevailing defendants to collect attorney fees from non-plaintiffs who have substantial interest in the asserted patent. Moreover, a patentee who gives a covenant not to sue to a defendant will be deemed a non-prevailing party, and therefore, subject to attorney fees.

The Innovation Act also calls for discovery to be limited until after claim construction. The patent infringement plaintiff must also disclose anyone with a financial interest in either the asserted patent or the patentee and must disclose the ultimate parent entity. When a manufacturer and its customers are sued at the same time, the suit against the customer would be stayed as long as the customer agrees to be bound by the results of the case.

It is impossible to determine the extent of the impact of any new laws, regulations or initiatives that may be proposed, or whether any of the proposals will become enacted as laws. Compliance with any new or existing laws or regulations could be difficult and expensive, affect the manner in which the Company conducts its business and negatively impact the Company’s business, prospects, financial condition and results of operations.

The Company’s acquisitions of patent assets may be time consuming, complex and costly, which could adversely affect the Company’s operating results.

Acquisitions of patent or other intellectual property assets, which are and will be critical to the Company’s business plan, are often time consuming, complex and costly to consummate. The Company may utilize many different transaction structures in its acquisitions and the terms of such acquisition agreements tend to be heavily negotiated. As a result, the Company expects to incur significant operating expenses and will likely be required to raise capital during the negotiations even if the acquisition is ultimately not consummated. Even if the Company is able to acquire particular patent assets, there is no guarantee that the Company will generate sufficient revenue related to those patent assets to offset the acquisition costs. While the Company will seek to conduct confirmatory due diligence on the patent assets the Company is considering for acquisition, the Company may acquire patent assets from a seller who does not have proper title to those assets. In those cases, the Company may be required to spend significant resources to defend the Company’s interest in the patent assets and, if the Company is not successful, its acquisition may be invalid, in which case the Company could lose part or all of its investment in the assets.

The Company may also identify patent or other intellectual property assets that cost more than the Company is prepared to spend with its own capital resources. The Company may incur significant costs to organize and negotiate a structured acquisition that does not ultimately result in an acquisition of any patent assets or, if consummated, proves to be unprofitable for the Company. These higher costs could adversely affect the Company’s operating results, and if the Company incurs losses, the value of its securities will decline.

In addition, the Company may acquire patents and technologies that are in the early stages of adoption in the commercial, industrial and consumer markets. Demand for some of these technologies will likely be untested and may be subject to fluctuation based upon the rate at which the Company’s licensees will adopt its patents and technologies in their products and services. As a result, there can be no assurance as to whether technologies the Company acquires or develops will have value that it can monetize.

In certain acquisitions of patent assets, the Company may seek to defer payment or finance a portion of the acquisition price. This approach may put the Company at a competitive disadvantage and could result in harm to the Company’s business.

The Company has limited capital and may seek to negotiate acquisitions of patent or other intellectual property assets where the Company can defer payments or finance a portion of the acquisition price. These types of debt financing or deferred payment arrangements may not be as attractive to sellers of patent assets as receiving the full purchase price for those assets in cash at the closing of the acquisition. As a result, the Company might not compete effectively against other companies in the market for acquiring patent assets, many of whom have greater cash resources than the Company has. In addition, any failure to satisfy the Company’s debt repayment obligations may result in adverse consequences to its operating results.

Any failure to maintain or protect the Company’s patent assets or other intellectual property rights could significantly impair its return on investment from such assets and harm the Company’s brand, its business and its operating results.

The Company’s ability to operate its new line of business and compete in the intellectual property market largely depends on the superiority, uniqueness and value of the Company’s acquired patent assets and other intellectual property. To protect the Company’s proprietary rights, the Company will rely on a combination of patent, trademark, copyright and trade secret laws, confidentiality agreements with its employees and third parties, and protective contractual provisions. No assurances can be given that any of the measures the Company undertakes to protect and maintain its assets will have any measure of success.

Following the acquisition of patent assets, the Company will likely be required to spend significant time and resources to maintain the effectiveness of those assets by paying maintenance fees and making filings with the United States Patent and Trademark Office. The Company may acquire patent assets, including patent applications, which require the Company to spend resources to prosecute the applications with the United States Patent and Trademark Office. Further, there is a material risk that patent related claims (such as, for example, infringement claims (and/or claims for indemnification resulting therefrom), unenforceability claims, or invalidity claims) will be asserted or prosecuted against the Company, and such assertions or prosecutions could materially and adversely affect the Company’s business. Regardless of whether any such claims are valid or can be successfully asserted, defending such claims could cause the Company to incur significant costs and could divert resources away from the Company’s other activities.

Despite the Company’s efforts to protect its intellectual property rights, any of the following or similar occurrences may reduce the value of the Company’s intellectual property:

|

●

|

the Company’s applications for patents, trademarks and copyrights may not be granted and, if granted, may be challenged or invalidated;

|

|

●

|

issued trademarks, copyrights, or patents may not provide the Company with any competitive advantages when compared to potentially infringing other properties;

|

|

●

|

the Company’s efforts to protect its intellectual property rights may not be effective in preventing misappropriation of the Company’s technology; or

|

|

●

|

the Company’s efforts may not prevent the development and design by others of products or technologies similar to or competitive with, or superior to those the Company acquires and/or prosecutes.

|

Moreover, the Company may not be able to effectively protect its intellectual property rights in certain foreign countries where the Company may do business in the future or from which competitors may operate. If the Company fails to maintain, defend or prosecute its patent assets properly, the value of those assets would be reduced or eliminated, and the Company’s business would be harmed.

Weak global economic conditions may cause infringing parties to delay entering into licensing agreements, which could prolong the Company’s litigation and adversely affect its financial condition and operating results.

The Company’s new additional business plan depends significantly on worldwide economic conditions, and the United States and world economies have recently experienced weak economic conditions. Uncertainty about global economic conditions poses a risk as businesses may postpone spending in response to tighter credit, negative financial news and declines in income or asset value s. This response could have a material negative effect on the willingness of parties infringing on the Company’s assets to enter into licensing or other revenue generating agreements voluntarily. Entering into such agreements is critical to the Company’s business plan, and the Company’s failure to do so could cause material harm to its business.

If the Company is unable to adequately protect its intellectual property, the Company may not be able to compete effectively.

The Company’s ability to compete depends in part upon the strength of the Company’s proprietary rights that it will own as a result of the Securities Exchange or may hereafter acquire in its technologies, brands and content. The Company intends to rely on a combination of U.S. and foreign patents, copyrights, trademark, trade secret laws and license agreements to establish and protect its intellectual property and proprietary rights. The efforts the Company takes to protect its intellectual property and proprietary rights may not be sufficient or effective at stopping unauthorized use of its intellectual property and proprietary rights. In addition, effective trademark, patent, copyright and trade secret protection may not be available or cost-effective in every country in which the Company’s services are made available. There may be instances where the Company is not able to fully protect or utilize its intellectual property in a manner that maximizes competitive advantage. If the Company is unable to protect its intellectual property and proprietary rights from unauthorized use, the value of the Company’s products may be reduced, which could negatively impact the Company’s new business. The Company’s inability to obtain appropriate protections for its intellectual property may also allow competitors to enter the Company’s markets and produce or sell the same or similar products. In addition, protecting the Company’s intellectual property and other proprietary rights is expensive and diverts critical managerial resources. If any of the foregoing were to occur, or if the Company is otherwise unable to protect its intellectual property and proprietary rights, the Company’s business and financial results could be adversely affected.

If the Company is forced to resort to legal proceedings to enforce its intellectual property rights, the proceedings could be burdensome and expensive. In addition, the Company’s proprietary rights could be at risk if the Company is unsuccessful in, or cannot afford to pursue, those proceedings. The Company will also rely on trade secrets and contract law to protect some of its proprietary technology. The Company will enter into confidentiality and invention agreements with its employees and consultants. Nevertheless, these agreements may not be honored and they may not effectively protect the Company’s right to its un-patented trade secrets and know-how. Moreover, others may independently develop substantially equivalent proprietary information and techniques or otherwise gain access to the Company’s trade secrets and know-how.

Being a public company has increased our expenses and administrative workload.

As a public company, we must comply with various laws and regulations, including the Sarbanes-Oxley Act of 2002 and related rules of the SEC. Complying with these laws and regulations requires the time and attention of our board of directors and management, and increases our expenses. Among other things, we must:

|

●

|

maintain and evaluate a system of internal controls over financial reporting in compliance with the requirements of Section 404 of the Sarbanes-Oxley Act and the related rules and regulations of the SEC and the Public Company Accounting Oversight Board;

|

|

●

|

maintain policies relating to disclosure controls and procedures;

|

|

●

|

prepare and distribute periodic reports in compliance with our obligations under federal securities laws;

|

|

●

|

institute a more comprehensive compliance function, including with respect to corporate governance; and

|

|

●

|

involve to a greater degree our outside legal counsel and accountants in the above activities.

|

In addition, being a public company has made it more expensive for us to obtain director and officer liability insurance. In the future, we may be required to accept reduced coverage or incur substantially higher costs to obtain this coverage. These factors could also make it more difficult for us to attract and retain qualified executives and members of our board of directors, particularly directors willing to serve on an audit committee which we expect to establish.

RISKS RELATED TO OUR COMMON STOCK

There is not now, and there may not ever be, an active market for our common stock.

There currently is a limited public market for our common stock. Further, although our common stock is currently quoted on the OTC Markets Inc., QB Tier, trading of our common stock may be extremely sporadic. For example, several days may pass before any shares may be traded. As a result, an investor may find it difficult to dispose of, or to obtain accurate quotations of the price of, our common stock. Accordingly, investors must assume they may have to bear the economic risk of an investment in our common stock for an indefinite period of time. There can be no assurance that a more active market for our common stock will develop, or if one should develop, there is no assurance that it will be sustained. This severely limits the liquidity of our common stock, and would likely have a material adverse effect on the market price of our common stock and on our ability to raise additional capital.

We cannot assure you that our common stock will become liquid or that it will be listed on a securities exchange.

Until our common stock is listed on a national securities exchange such as the New York Stock Exchange or the Nasdaq National Market, we expect our common stock to remain eligible for quotation on the OTC Markets, or on another over-the-counter quotation system. In those venues, however, an investor may find it difficult to obtain accurate quotations as to the market value of our common stock. In addition, if we fail to meet the criteria set forth in SEC regulations, various requirements would be imposed by law on broker-dealers who sell our securities to persons other than established customers and accredited investors. Consequently, such regulations may deter broker-dealers from recommending or selling our common stock, which may further affect the liquidity of our common stock. This would also make it more difficult for us to raise capital.

Our common stock is subject to the “penny stock” rules of the SEC and FINRA’s sales practice requirements, and the trading market in our common stock is limited, which makes transactions in our common stock cumbersome and may reduce the value of an investment in the stock.

The SEC has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

|

●

|

that a broker or dealer approve a person’s account for transactions in penny stocks; and

|

|

●

|

the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

|

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

|

●

|

obtain financial information and investment experience objectives of the person; and

|

|

●

|

make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

|

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form sets forth:

|

●

|

the basis on which the broker or dealer made the suitability determination; and

|

|

●

|

that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

|

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of common stock and cause a decline in the market value of stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

In addition to the “penny stock” rules promulgated by the SEC, the Financial Industry Regulatory Authority (FINRA) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. FINRA’s requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

The price of our common stock may become volatile, which could lead to losses by investors and costly securities litigation.

The trading price of our common stock is likely to be highly volatile and could fluctuate in response to factors such as:

|

●

|

actual or anticipated variations in our operating results;

|

|

●

|

announcements of developments by us, our strategic partners or our competitors;

|

|

●

|

announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments;

|

|

●

|

adoption of new accounting standards affecting our industry;

|

|

●

|

additions or departures of key personnel;

|

|

●

|

sales of our common stock or other securities in the open market; and

|

|

●

|

other events or factors, many of which are beyond our control.

|

The stock market is subject to significant price and volume fluctuations. In the past, following periods of volatility in the market price of a company’s securities, securities class action litigation has often been initiated against such company. Litigation initiated against us, whether or not successful, could result in substantial costs and diversion of our management’s attention and resources, which could harm our business and financial condition.

Compliance with U.S. securities laws, including the Sarbanes-Oxley Act, will be costly and time-consuming.

We are a reporting company under U.S. securities laws and are obliged to comply with the provisions of applicable U.S. laws and regulations, including the Securities Act of 1933, as amended (the “Securities Act”), the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Sarbanes-Oxley Act of 2002 and the related rules of the SEC, and the rules and regulations of the relevant U.S. market, in each case, as amended from time to time. Preparing and filing annual and quarterly reports and other information with the SEC, furnishing audited reports to shareholders and other compliance with these rules and regulations will involve a material increase in regulatory, legal and accounting expenses and the attention of management, and there can be no assurance that we will be able to comply with the applicable regulations in a timely manner, if at all.

We do not anticipate dividends to be paid on our common stock, and investors may lose the entire amount of their investment.

Cash dividends have never been declared or paid on our common stock, and we do not anticipate such a declaration or payment for the foreseeable future. We expect to use future earnings, if any, to fund business growth. Therefore, shareholders will not receive any funds absent a sale of their shares. We cannot assure shareholders of a positive return on their investment when they sell their shares, nor can we assure that shareholders will not lose the entire amount of their investment.

If securities analysts do not initiate coverage or continue to cover our common stock or publish unfavorable research or reports about our business, this may have a negative impact on the market price of our common stock.

The trading market for our common stock may be affected by, among other things, the research and reports that securities analysts publish about our business and the Company. We do not have any control over these analysts. There is no guarantee that securities analysts will cover our common stock. If securities analysts do not cover our common stock, the lack of research coverage may adversely affect its market price. If we are covered by securities analysts, and our stock is the subject of an unfavorable report, our stock price and trading volume would likely decline. If one or more of these analysts ceases to cover the Company or fails to publish regular reports on the Company, we could lose visibility in the financial markets, which could cause our stock price or trading volume to decline.

State Blue Sky registration – potential limitations on resale of the shares.

The holders of the shares of our common stock and persons, who desire to purchase the shares in any trading market that might develop in the future, should be aware that there may be significant state law restrictions upon the ability of investors to resell the securities. Accordingly, investors should consider the secondary market for our securities to be a limited one. It is the intention of our management to seek coverage and publication of information regarding the Company in an accepted publication which permits a “manuals exemption.” This manuals exemption permits a security to be sold by shareholders in a particular state without being registered if the company issuing the security has a listing for that security in a securities manual recognized by that state. The listing entry must contain (i) the names of issuers, officers, and directors, (ii) an issuer’s balance sheet, and (iii) a profit and loss statement for either the fiscal year preceding the balance sheet or for the most recent fiscal year of operations. The principal accepted manuals are those published by Standard and Poor’s, and Mergent, Inc. Many states expressly recognize these manuals. A smaller number of states declare that they recognize securities manuals, but do not specify the recognized manuals. Among others, the following states do not have any provisions and, therefore, do not expressly recognize the manuals exemption: Alabama, California, Georgia, Illinois, Kentucky, Louisiana, Montana, South Dakota, Tennessee, Vermont, and Wisconsin.

You may experience dilution of your ownership interests because of the future issuance of additional shares of our common stock.

In the future, we may issue our authorized but previously unissued equity securities, resulting in the dilution of the ownership interests of our present shareholders and the purchasers of our common stock offered hereby. We are currently authorized to issue an aggregate of 350,000,000 shares of capital stock, par value $0.001 per share, consisting of 300,000,000 shares of common stock and 50,000,000 shares of preferred stock, with the preferences and rights determined by our Board of Directors. As of September 29, 2014, there were 15,495,518 shares of our common stock and 11,409,405 shares of our preferred stock outstanding, consisting of 80,000 shares of Series A Preferred Stock, 3,592,238 shares of Series B Preferred Stock, 7,717,167 shares of Series C Preferred Stock and 20,000 shares of Series D Preferred Stock. As of September 29, we have issued and outstanding options to purchase 4,690,339 shares and warrants exercisable into 1,971,531 shares.

Any future issuance of our equity or equity-backed securities may dilute then-current shareholders’ ownership percentages and could also result in a decrease in the fair market value of our equity securities, because our assets would be owned by a larger pool of outstanding equity. As described above, we may need to raise additional capital through public or private offerings of our common or preferred stock or other securities that are convertible into or exercisable for our common or preferred stock. We may also issue such securities in connection with hiring or retaining employees and consultants (including stock options issued under our equity incentive plans), as payment to providers of goods and services, in connection with future acquisitions or for other business purposes. Our Board of Directors may at any time authorize the issuance of additional common or preferred stock without common shareholder approval, subject only to the total number of authorized common and preferred shares set forth in our certificate of incorporation. The terms of equity securities issued by us in future transactions may be more favorable to new investors, and may include dividend and/or liquidation preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect. Also, the future issuance of any such additional shares of common or preferred stock or other securities may create downward pressure on the trading price of the common stock. There can be no assurance that any such future issuances will not be at a price (or exercise prices) below the price at which shares of the common stock are then traded.

We may obtain additional capital through the issuance of preferred stock, which may limit your rights as a holder of our common stock.

As of September 29, 2014, we have a total of 50 million shares of preferred stock authorized for issuance, with 38,590,595 of such shares available for future issuances. Without any further shareholder vote or action, our Board of Directors may designate and approve for issuance additional shares of our preferred stock out of that number. The terms of any such preferred stock may include priority claims to assets and dividends and special voting rights which could limit the rights of the holders of our common stock. The designation and issuance of additional preferred stock favorable to current management or shareholders could make any possible takeover of the Company or the removal of our management more difficult.

Any failure to maintain effective internal control over our financial reporting could materially adversely affect us.

Section 404 of the Sarbanes-Oxley Act of 2002 will require us to include in our annual reports on Form 10-K, an assessment by management of the effectiveness of our internal control over financial reporting. While we intend to diligently and thoroughly document, review, test and improve our internal control over financial reporting in order to ensure compliance with Section 404, management may not be able to conclude that our internal control over financial reporting is effective. This could result in a loss of investor confidence in the reliability of our financial statements, which in turn could negatively impact the price of our common stock.

In particular, we must perform system and process evaluation and testing of our internal control over financial reporting to allow management and our independent registered public accounting firm to report on the effectiveness of our internal control over financial reporting, as required by Section 404. Our compliance with Section 404 will require that we incur substantial accounting expense and expend significant management efforts. We currently do not have an internal audit group, and we will need to retain the services of additional accounting and financial staff or consultants with appropriate public company experience and technical accounting knowledge to satisfy the ongoing requirements of Section 404. We intend to review the effectiveness of our internal controls and procedures and make any changes management determines appropriate, including to achieve compliance with Section 404 by the date on which we are required to so comply.

Any significant deficiencies in our control systems may affect our ability to comply with SEC reporting requirements and any applicable listing standards or cause our financial statements to contain material misstatements, which could negatively affect the market price and trading liquidity of our common stock and cause investors to lose confidence in our reported financial information, as well as subject us to civil or criminal investigations and penalties.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2. PROPERTIES

General

The information set forth below relates to the properties in Mexico where we hold rights under our legacy mining business. We do not hold any physical properties relating to our post-MVP Acquisition business.

The La Viuda Concessions

Property Mineral Rights

On February 11, 2011, we entered into the AuroTellurio Option Agreement with Mexivada to acquire up to an 80% interest in Mexivada’s La Viuda Concessions south of Moctezuma, Sonora, Mexico. The first 20% interest in the La Viuda Concessions vested in us as of August 28, 2012.

The La Viuda Concessions comprise two exploration concessions granted by the Mexican government to Compania Minera Mexivada, S.A. de C.V., a wholly owned subsidiary of Mexivada. The La Viuda Concessions, details of which are set forth below, cover approximately 7,624 hectares, or 18,839.31 acres.

|

Concession

|

Status

|

File No.

|

Legal Title #

|

Title Grant Date

|

Title Expiry Date

|

Surface Area (Ha.)

|

|

La Viuda

|

Granted

|

082/323550

|

232498

|

August 18, 2008

|

August 18, 2058

|

44

|

|

La Viuda 1

|

Granted

|

082/32407

|

232859

|

October 29, 2008

|

October 29, 2058

|

7,580.79

|

Property Location

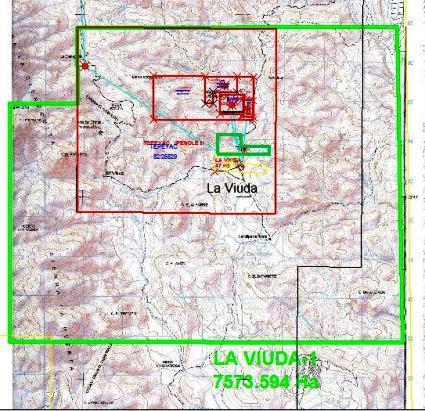

The La Viuda Concessions are located in the northeastern portion of the State of Sonora, Mexico, near the Chihuahua border and just south of the town of Moctezuma. The property is approximately 280 miles southeast of Tucson, Arizona. The following map shows the approximate location of the concessions:

Figure 1 – Location map of the La Viuda Concessions in Sonora, Mexico.