Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 19, 2014

Bone Biologics, Corp.

(Exact name of registrant as specified in its charter)

| Delaware | 000-53078 | 42-1743430 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 175 May Street, Suite 400, Edison, NJ | 08837 | |

| (Address of principal executive offices) | (Zip Code) |

(732) 661-2224

(Registrant’s telephone number, including area code)

AFH Acquisition X, Inc.

269 S. Beverly Drive, Suite 1600

Beverly Hills, CA 90212

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report contains forward-looking statements. These statements are based on the Company’s (as hereinafter defined) current beliefs, expectations and assumptions about future events, conditions and results and on information currently available to them. All statements, other than statements of historical fact, included herein regarding the Company’s strategy, future operations, financial position, future revenues, projected costs, plans, prospects and objectives are forward-looking statements. Words such as “expect,” “may,” “anticipate,” “intend,” “would,” “plan,” “believe,” “estimate,” “should,” and similar words and expressions are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements. Forward-looking statements in the Current Report include express or implied statements concerning the Company’s future revenues, expenditures, capital or other funding requirements, the adequacy of the Company’s current cash and working capital to fund present and planned operations and financing needs, expansion of and demand for product offerings, and the growth of the Company’s business and operations through acquisitions or otherwise, as well as future economic and other conditions both generally and in the Company’s specific geographic and product markets. These statements are based on currently available operating, financial and competitive information and are subject to various risks, uncertainties and assumptions that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements due to a number of factors including, but not limited to, those set forth below in the section entitled “Risk Factors and Special Considerations” in this Current Report. Given those risks, uncertainties and other factors, many of which are beyond the Company’s control, you should not place undue reliance on these forward-looking statements.

Before purchasing the Shares, you should carefully read and consider the risks described under the section entitled “Risk Factors and Special Considerations.” You should be prepared to accept any and all of the risks associated with purchasing the securities, including a loss of all of your investment.

The forward-looking statements relate only to events as of the date on which the statements are made. Neither the Company nor Bone (as hereinafter defined) undertakes any obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, even if experience or future changes make it clear that any projected results or events expressed or implied therein will not be realized. You are advised, however, to consult any further disclosures the Company makes in future public filings, statements and press releases.

| i |

On September 19, 2014, AFH Acquisition X, Inc. (the “Company”) and its wholly-owned subsidiary, Bone Biologics Acquisition Corp., a Delaware corporation (“Merger Sub”), entered into an Agreement and Plan of Merger, dated September 19, 2014 (the “Merger Agreement”), by and among (i) the Company, (ii) Bone Biologics, Inc. (“Bone” or “Bone Biologics”), and (iii) Merger Sub. Pursuant to the terms of the Merger Agreement, Bone merged with Merger Sub on September 19, 2014, with Bone as the surviving entity, in exchange for the issuance of 19,897,587 shares of the Company’s common stock, par value $0.001 per share (“Common Stock”) (including 2,151,926 shares of Common Stock issuable upon the exercise of outstanding warrants and 5,648,658 shares issuable upon the conversion of debt) to the stockholders of Bone as set forth in the Merger Agreement (the “Merger”). After the Merger, the Company ceased to be a shell company, as defined in the rules of the SEC, and the Company officially changed its name to “Bone Biologics, Corp.” The 5,000,000 outstanding shares of Common Stock of the Company prior to the Merger were consolidated into 3,853,600 shares of Common Stock and the remaining shares were cancelled.

As used in this Current Report, the terms the “we,” “us,” and “our” refer to the Company, after giving effect to the Merger, unless otherwise stated or the context clearly indicates otherwise. The term “AFH Acquisition X” refers to the Company, as it was named “AFH Acquisition X, Inc.” before giving effect to the Merger.

This Current Report contains summaries of the material terms of various agreements executed in connection with the transactions described herein. The summaries of these agreements are subject to, and are qualified in their entirety by, reference to these agreements, all of which are incorporated herein by reference.

This Current Report is being filed in connection with a series of transactions consummated by the Company and certain related events and actions taken by the Company.

This Current Report responds to the following items on Form 8-K:

| Item 1.01 | Entry into a Material Definitive Agreement |

| Item 2.01 | Completion of Acquisition or Disposition of Assets |

| Item 3.02 | Unregistered Sales of Equity Securities |

| Item 5.01 | Changes in Control of Registrant |

| Item 5.02 | Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers |

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year |

| Item 5.06 | Change in Shell Company Status |

| Item 9.01 | Financial Statements and Exhibits |

| ii |

TABLE OF CONTENTS

| iii |

Item 1.01. Entry into a Material Definitive Agreement.

The Merger Agreement

On September 19, 2014, we entered into the Merger Agreement, and on September 19, 2014 we completed the Merger. For a description of the Merger and the material agreements entered into in connection with the Merger, please see the disclosures set forth in Item 2.01 to this Current Report, which disclosures are incorporated into this item by reference.

Indemnification Agreements

Effective September 19, 2014, our Board of Directors approved a form of indemnification agreement (the “Indemnification Agreement”) to be entered into between us and our current directors and certain executive officers. The Indemnification Agreement requires that we, under the circumstances and to the extent provided for therein, indemnify such persons to the fullest extent permitted by applicable law against certain expenses and other amounts incurred by any such person as a result of such person being made a party to certain actions, suits and proceedings by reason of the fact that such person is or was a director, officer, employee or agent of the Company, any entity that was a predecessor corporation of the Company or any of the Company’s affiliates. The rights of each person who is a party to an Indemnification Agreement are in addition to any other rights such person may have under applicable law, our Articles of Incorporation, our Bylaws, any other agreement, a vote of our stockholders, a resolution adopted by our Board of Directors or otherwise. Immediately following the closing of the Merger, we entered into indemnification agreements in the form of the Indemnification Agreement with each of our newly appointed executive officers and directors. The foregoing is only a brief description of the Indemnification Agreement, does not purport to be a complete description of the rights and obligations of the parties thereunder and is qualified in its entirety by reference to the form of Indemnification Agreement filed as Exhibit 10.17 to this Current Report on Form 8-K and incorporated herein by reference.

Effective as of September 19, 2014, our Board of Directors also approved a form of indemnification agreement (the “Former D&O Indemnification Agreement”) to be entered into between us, Don Hankey and Amir Heshmatpour. The Former D&O Indemnification Agreement requires that for a period of four (4) years from and after September 19, 2014, we will indemnify (including advancement of expenses) and hold harmless persons who were officers and directors of the Company (i) by reason of being an officer or director of the Company prior to the Merger, including through all transactions relating to the Merger, or (ii) is related to acts in connection with the Merger taken by the Former D&O Indemnified Persons, provided however, that the foregoing indemnity shall be excess of all any insurance coverage available to the Former D&O Indemnified Parties for any such loss. The accuracy of the affidavits executed by Mr. Hankey (the “Hankey Affidavit”) and Mr. Heshmatpour (the “Heshmatpour Affidavit”) in connection with the Former D&O Indemnification is a condition precedent to the foregoing indemnity (including advancement of expenses). The Company has no insurance coverage that would cover any claim asserted against the Company by any Former D&O Indemnified Person pursuant to this Former D&O Indemnification Agreement. This description is qualified in its entirety by the Former D&O Indemnification Agreement filed as Exhibit 10.18 to this Current Report on Form 8-K and incorporated herein by reference.

Item 2.01. Completion of Acquisition or Disposition of Assets.

THE MERGER AND RELATED TRANSACTIONS

The Merger

On September 19, 2014, the Company and its wholly-owned subsidiary, Merger Sub, entered into the Merger Agreement, dated September 19, 2014, by and among the Company, Merger Sub, and Bone Biologics. Pursuant to the Merger Agreement, Merger Sub merged with and into Bone Biologics, with Bone Biologics remaining as the surviving corporation in the Merger. Upon the consummation of the Merger, the separate existence of Merger Sub ceased, on September 22, 2014 the Company officially changed its name to “Bone Biologics, Corp.” to more accurately reflect the nature of its business, and Bone Biologics became a wholly-owned subsidiary of the Company. A copy of the Merger Agreement is attached as Exhibit 2.1 to this Current Report and is incorporated herein by reference.

| 1 |

In connection with the Merger, the 5,000,000 outstanding shares of Common Stock of the Company prior to the Merger were consolidated into 3,853,600 shares of Common Stock and the remaining shares were cancelled.

Additionally, at the Effective Time (as defined below), all of the issued and outstanding shares of Bone Biologics Inc.’s $0.0001 par value common stock (“Bone Biologics Common Stock”) converted into a combined total of 19,897,587 shares of the Company’s Common Stock (including 2,151,926 shares issuable upon the exercise of outstanding warrants and 5,648,658 shares issuable upon the conversion of debt) (the “Company Merger Consideration”). In exchange, Bone Biologics agreed to pay AFH Holding & Advisory, LLC (“AFH Advisory”) the principal sum of $590,000. On July 3, 2014, Bone Biologics paid AFH Advisory $250,000 of such amount and on July 31, 2014, Bone Biologics issued that certain Promissory Note, dated July 31, 2014 (the “Note”), pursuant to which the Bone Biologics promised to pay AFH Advisory the principal sum of $340,000. MTF has granted AFH Advisory a standby letter of credit in the amount of $340,000 for the remaining amount due under the Note. On September 19, 2014, the Note was assigned to the Company.

In addition, MTF converted all amounts due, $1,533,356, pursuant to a convertible promissory note dated January 18, 2008 in the original face amount of $1,107,000 entered into by and between the Bone Biologics and MTF prior to consummation of the Merger to shares of Series B Preferred Stock of Bone Biologics at $ 1.00 per share, then to shares of Common Stock of Bone Biologics at a 1:1 basis. MTF agreed to execute any additional agreements reasonably necessary to give effect to that provision. Prior to the Merger, MTF converted all of the outstanding shares of Series A preferred stock and Series B preferred stock of Bone Biologics that MTF held into shares of Bone Biologics Common Stock.

Prior to consummation of the Merger, the 2013 Bridge Note holders converted outstanding principal and accrued interest of $455,974 into Common Stock at a conversion price of $1.00 per share. The $50,000 that Bone Biologics borrowed from AFH Advisory pursuant to the sale and issuance of Notes and Warrants to AFH Advisory was contingent upon liquidation of the securities transferred to the Company by AFH Advisory, as describe in that certain Letter Agreement, dated September 26, 2013, by and between Amir F. Heshmatpour, an individual residing in the State of California, and the Company.

Each share of capital stock of Merger Sub that was issued and outstanding immediately prior to the effective time of the Merger (the “Effective Time”), by virtue of the Merger and without further action on the part of Bone Biologics, Merger Sub, or the Company, was converted into and became 100 shares of Bone Biologics Common Stock, which shares were the sole issued and outstanding shares of Bone Biologics Common Stock immediately after the Effective Time. After the Merger, each certificate evidencing ownership of shares of Merger Sub common stock evidenced ownership of such shares of Bone Biologics Common Stock.

At the Effective Time, there were no shares of Bone Biologics Common Stock that were owned by Bone Biologics as treasury stock or reserved for issuance by Bone Biologics.

Also at the Effective Time, all of the issued and outstanding options and warrants to purchase shares of Bone Biologics Common Stock converted, respectively, into options (the “New Options”) and warrants (the “New Warrants”) to purchase shares of Common Stock. The New Options and the New Warrants were re-issued on a 1 for 1 basis.

The Merger Agreement contains customary representations, warranties, and covenants of the Company, Bone Biologics, and Merger Sub for a reverse triangular merger (and accompanying transactions). Breaches of representations and warranties are secured by customary indemnification provisions.

The Merger will be treated as a “reverse merger,” and although the Company is the legal acquirer, Bone Biologics is deemed to be the acquirer for accounting purposes in the reverse merger. Consequently, the assets and liabilities and the historical operations that will be reflected in the financial statements prior to the Merger will be those of Bone Biologics, and the consolidated financial statement after completion of the Merger will include the assets and liabilities of Bone Biologics, historical operations of Bone Biologics and operations of Bone Biologics from the Closing Date of the Merger and in all future filings with the Securities and Exchange Commission (the “SEC”).

| 2 |

Following the Effective Time, our Board of Directors will be as identified in this Current Report under the heading “Directors and Executive Officers.”

Bridge Financing

Bone Biologics borrowed $400,000 pursuant to the sale and issuance of convertible promissory notes (the “Bridge Notes,” or singularly each a “Bridge Note”) and warrants to purchase Common Stock (as defined below) of the Company, as the successor to Bone Biologics. Prior to consummation of the Merger, the 2013 Bridge Note holders converted outstanding principal and accrued interest of $455,974 into Common Stock at a conversion price of $1.00 per share. MTF has purchased $100,000 of the Notes and Warrants. Orthofix Holdings Inc. (“Orthofix”) has purchased $250,000 of the Notes and Warrants. AFH Advisory purchased $50,000 of the Bridge Notes and Bridge Warrants which was contingent upon liquidation of the securities transferred to the Company by AFH Advisory, as described in that certain Letter Agreement, dated September 26, 2013, by and between Amir F. Heshmatpour and the Company. The Bridge Warrants and the amendment thereto are filed as Exhibits 4.1, 4.2, 4.3 and 4.4, respectively, to this Current Report and are incorporated herein by reference. The issuance of the Bridge Notes and Bridge Warrants are collectively referred to in this Current Report as the “Bridge Financing.”

Bone entered into a Security Agreement, dated March 17, 2009, wherein it pledged certain of its assets as collateral to the Bridge Note holders. Additionally, Bone and MTF entered into a Subordination Agreement, dated April 2013, wherein the parties agreed that the security interest granted to MTF pursuant to the March 17, 2009 Security Agreement between the parties wherein MTF agreed to subordinate any rights to any payment and any security interest it may have in Bone’s assets to the holders of the Bridge Notes. In addition, Benjamin Wu, Kang Ting, and Chia Soo executed a Pledge and Guarantee Agreement, dated April 18, 2013, in favor of the Bridge Note purchasers wherein Benjamin Wu, Kang Ting, and Chia Soo pledged their shares of Bone Biologics Common Stock to secure the full and punctual payment of Bone’s obligations to the Bridge Note holders and unconditionally and irrevocably guaranteed such payment. Upon consummation of the Merger, the notes converted into notes of the Company.

On September 26, 2013, Bone and AFH Advisory entered into a letter agreement wherein Bone agreed to accept shares of common stock of Targeted Medical Pharma, Inc. (the “TMP Shares”) with a market value of $50,000 on the date of transfer as consideration for the aforementioned purchase of the Bridge Note and the Bridge Warrant for AFH Advisory. Bone agreed to use its commercially reasonable best efforts to sell the TMP Shares on the Over-the-Counter Market within 90 days of such transfer. Because the gross proceeds from the sale of the TMP Shares during such 90-day period (the “Initial Gross Proceeds”) were less than $50,000 (the “Deficiency Amount”), AFH Advisory agreed to provide the Company with a cash infusion equal to the Deficiency Amount following the Merger.

In addition to and subsequent to the Bridge Notes and Bridge Warrants discussed in the preceding paragraph, Orthofix, on July 1, 2014, also (A) purchased $500,000 worth of Bone Biologics Common Stock (the “Subsequent Orthofix Shares”); (B) was issued two convertible promissory notes (the “Subsequent Orthofix Convertible Promissory Notes”), each in the principal amount of $250,000 and exercisable for $333,333 worth of Bone Biologics Common Stock; and (C) was issued two warrants (the “Subsequent Orthofix Warrants”), each exercisable for 166,667 shares of Bone Biologics Common Stock at an exercise price per share of $1.50. Upon subscribing for the Subsequent Orthofix Shares, the Subsequent Orthofix Convertible Promissory Notes converted by its terms into a combined total of $666,666 worth of shares of Bone Biologics Common Stock in accordance with the terms of the Subsequent Orthofix Convertible Promissory Notes. The Subsequent Orthofix Warrants converted into warrants of the Company with substantially identical terms upon consummation of the Merger. Amounts received by Bone Biologics in connection with the Subsequent Orthofix Convertible Promissory Notes and the Subsequent Orthofix Shares will be aggregated towards the $5 million amount to be raised in the Private Placement for purposes of determining when various parties will be paid their fees in connection with the Merger and the Private Placement.

| 3 |

Subsequent Closings

Upon filing this Current Report, the Company will commence a private placement of securities, whether debt or equity, of up to a maximum of $10.0 million that will include an over-allotment option of 15% at AFH Advisory’s discretion or at the discretion of any investment bank engaged for such offering (the “Private Placement”). Private Placement proceeds in excess of $1.0 million will be used upon receipt for: (i) payment of the expenses payable to AFH Advisory for providing a publicly-reporting company for the Merger and capped at $250,000 to reduce the Note and (ii) $750,000 to the working capital of the Company to be utilized for general corporate purposes. All proceeds received between $1.0 million and $1.5 million in the Private Placement shall be used to further retire the Note by reimbursement of an additional $250,000 of the Note and to provide an additional $250,000 for general corporate purposes of the Company, split evenly on a dollar for dollar basis up to $500,000. The proceeds received over $1.5 million will initially be paid on a pro rata basis, with 50% of such proceeds being directed to the Company for working capital purposes and 50% being used to pay off other fees incurred in connection with the Merger and the Private Placement, including the final $90,000 owed under the Note. Once all such fees in connection with the Merger and the Private Placement have been paid by the Company, the Company will use any additional proceeds received in the Private Placement to first pay all outstanding principal, interest and penalties then outstanding with respect to the MTF Short Term 2014 Loan (as such term is defined herein) and second for working capital purposes. The Private Placement will be structured such that any debt issued may either be convertible into Common Stock at a fixed conversion price or repayable from the proceeds of the Initial Public Offering (as defined below), if not due sooner pursuant to the terms thereof. The Company and MTF each agree that none of the proceeds from the Private Placement will be used for the repayment of the Bridge Financing or any outstanding long-term debt of the Company. The shares offered in the Private Placement will be offered pursuant to exemptions provided by Section 4(a)(2) and/or Section 4(6) of the Securities Act of 1933 (the “Securities Act”) and Rule 506 of Regulation D as promulgated by the SEC. No general solicitation will be made by us or any person acting on our behalf in the Private Placement. The $1 million investment received from Orthofix on July 1, 2014 will be counted towards the amounts received in the Private Placement for purposes of determining when the Private Placement will be deemed closed and for purposes of determining when and how proceeds from the Private Placement will be allocated.

After the Private Placement, the Company intends to procure an investment bank to handle a private investment in public entity offering in an amount between $8.0 million and $10.0 million at a valuation of not less than the post-money valuation of the Company at the closing of the Private Placement through the sale of securities of the Company (the “PIPE”). The PIPE will include a 15% over allotment option at AFH Advisory’s discretion or at the discretion of any investment bank engaged for such offering. Commencement of the PIPE offering is contingent upon (i) the appointment and continued support of an investment bank, and (ii) the filing of Financial Industry Regulatory Authority, Inc. (“FINRA”) Form 211.

Following to the PIPE offering, and at such time as it is deemed appropriate by AFH Advisory and the Company, the Company intends to procure an investment bank to act as underwriter for an initial public offering in an amount up to $40 million (the “Initial Public Offering”) at a valuation not less than the post-money valuation of the Company at the closing of the PIPE offering. The Initial Public Offering shall include a 15% over allotment option at AFH Advisory’s discretion or at the discretion of any investment bank engaged for such offering. Both parties recognize that the Initial Public Offering is contingent upon the appointment and continued support of an investment bank.

The Private Placement, the PIPE, and the IPO are collectively referred to in this Current Report as the “Subsequent Closings.” The Merger, the Subsequent Closings, the Bridge Financing and the related transactions are collectively referred to in this Current Report as the “Transactions.”

Registration Rights

All of the securities issued in connection with the Transactions, except the IPO, are “restricted securities,” and as such are subject to all applicable restrictions specified by federal and state securities laws.

Effective as of September 19, 2014, the Company entered into a Registration Rights Agreement with MTF, AFH Advisory and Hanky Investment Company, L.P. (“HIC”), each of which have certain demand registration rights and unlimited piggyback registration rights for the Company’s shares under the Registration Rights Agreement and subject to an agreed lock up period. Pursuant to the Registration Rights Agreement, within thirty (30) days hereof, the Company will seek registration under the Securities Act of all or part of the registrable shares of MTF, AFH Advisory and HIC. Within five (5) days hereof, the Company will provide written notice of such request to all other holders of registrable securities and will include in such registration all registrable shares with respect to which the Company has received written requests for inclusion within twenty-five (25) days after delivery of the Company’s notice. The Company has agreed to pay all registration expenses relating to up to two long-form registrations or short-form registrations for each of MTF, AFH Advisory and HIC.

| 4 |

Whenever the Company proposes to register any of its securities under the Securities Act (other than pursuant to a demand registration under the Registration Rights Agreement) and the registration form to be used may be used for the registration of any registrable shares, the Company will give prompt written notice to all holders of the registrable shares of its intention to effect such a registration and will include in such registration all registrable shares (in accordance with the priorities set forth in the Registration Rights Agreement) with respect to which the Company has received written requests for inclusion within fifteen (15) days after the delivery of the Company’s notice. Pursuant to Registration Rights Agreement, holders of registrable shares and the Company agree not to effect any public sale or distribution of equity securities of the Company, or any securities convertible into or exchangeable or exercisable for such securities, during the six (6) months following, the effective date of the Merger Agreement.

Restriction on Resale

None of the securities offered in the Transactions, other than the IPO, will be registered under the Securities Act and the certificates representing our securities will contain a legend restricting the distribution, resale, transfer, pledge, hypothecation or other disposition of the securities unless and until such securities are registered under the Securities Act or an opinion of counsel reasonably satisfactory to us is received that registration is not required under the Securities Act.

Current Ownership

The following table sets forth information with respect to the post-merger beneficial ownership of the Company’s common stock as of September 19, 2014, by each person or group of affiliated persons known to the Company to beneficially own 5% or more of its common stock, each director, each named executive officer, and all of its directors and named executive officers as a group.

| Name of Beneficial Owner or Identity of Group | Title of Class | Shares(1) | Percentage | |||||||

| 5% or greater stockholders: | ||||||||||

| The Musculoskeletal Transplant Foundation, Inc. 125 May Street Edison, NJ 08837 | Common Stock | 11,932,807 | 49.3 | % | ||||||

| AFH Holding & Advisory, LLC 10830 Massachusetts Ave., Penthouse Los Angeles, CA 90024 | Common Stock | 2,609,602 | 10.8 | % | ||||||

| Amir Heshmatpour 269 Beverly Drive, Ste. 1600 Beverly Hills, CA 90212 | Common Stock | 3,609,602 | (2) | 14.9 | % | |||||

| Dr. Kang Ting 115 North Doheny Drive Beverly Hills, CA 90211 | Common Stock | 2,000,000 | 8.3 | % | ||||||

| Orthofix Holdings Inc. 3451 Plana Parkway Lewisville, TX 75056 | Common Stock | 1,909,908 | 7.9 | % | ||||||

| 5 |

| Executive Officers and Directors: | ||||||||||

| Michael Schuler 175 May Street Edison, NJ 08837 | Common Stock | - | - | |||||||

| William J. Treat 175 May Street, Suite 400 Edison, NJ 08837 | Common Stock | 198,202 | 0.8 | % | ||||||

| Catherine Doll 175 May Street, Suite 400 Edison, NJ 08837 | Common Stock | 12,625 | 0.1 | % | ||||||

| Bruce Stroever 175 May Street, Suite 400 Edison, NJ 08837 | - | - | ||||||||

| Dr. Chia Soo 175 May Street, Suite 400 Edison, NJ 08837 | Common Stock | 1,119,318 | 4.6 | % | ||||||

| William Coffin 175 May Street, Suite 400 Edison, NJ 08837 | - | - | ||||||||

| John Booth 175 May Street, Suite 400 Edison, NJ 08837 | - | - | ||||||||

| Jimmy Delshad 175 May Street, Suite 400 Edison, NJ 08837 | - | - | ||||||||

| Steve Warnecke 1026 Anaconda Drive Castle Rock, CO 80108 | - | - | ||||||||

| Total Officers and Directors as a Group | Common Stock | 1,330,145 | 5.5 | % | ||||||

| Reserve for Future Issuance: | ||||||||||

| Option Plan | 2,444,696 | |||||||||

(1) The number of shares of Common Stock issued and outstanding that was used to calculate the percentage ownership of each listed person includes the shares of Common Stock underlying convertible debt, stock options and warrants that are exercisable 60 days after the close of the Merger.

(2) These shares of Common Stock are owned by AFH Holding & Advisory, LLC (“AFH Holding”), H&H (Hong Kong) Holdings Co., Limited (“H&H”) and Mr. Heshmatpour’s spouse and children. Mr. Heshmatpour is sole member of AFH Holding and has sole voting and investment control over the 2,609,602 shares of Common Stock owned of record by AFH Holding. Mr. Heshmatpour is the sole member of H&H and has sole voting and investment control over the 200,000 shares of Common Stock owned of record by H&H. Mr. Heshmatpour has voting and investment control over the 800,000 shares of Common Stock owned by his spouse and children. Accordingly, he may be deemed a beneficial owner with respect to these 3,609,602 shares of Common Stock.

| 6 |

Accounting Treatment; Change of Control

The Merger will be treated as a “reverse merger,” and although the Company is the legal acquirer, Bone Biologics is deemed to be the acquirer for accounting purposes in the reverse merger. Consequently, the assets and liabilities and the historical operations that will be reflected in the financial statements prior to the Merger will be those of Bone Biologics, and the consolidated financial statement after completion of the Merger will include the assets and liabilities of Bone Biologics, historical operations of Bone Biologics and operations of Bone Biologics from the Closing Date of the Merger.

Pursuant the Merger Agreement AFH Advisory and MTF have the right to appoint one individual with non-voting “observer status” to receive all board of director communications and attend all meetings of the board of directors for a period of 2 years from the Effective Time, including attending meetings of the board of directors related to engaging professional service providers and the right to review any credentials provided by such service providers.

Except as described in the previous paragraphs, no arrangements or understandings exist among present or former controlling stockholders with respect to the election of members of our Board of Directors and, to our knowledge, no other arrangements exist that might result in a change of control of the Company. Further, as a result of the issuance of the shares of Common Stock pursuant to the Merger, a change in control of the Company occurred as of the date of consummation of the Merger.

| 7 |

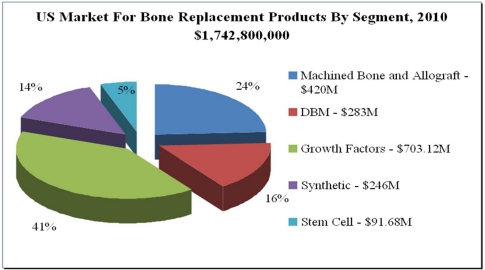

Immediately following the Merger, the business of Bone Biologics became our business. Bone Biologics was founded by University of California professors in collaboration with an Osaka University professor and a University of Southern California surgeon in 2004 as a privately-held company with proprietary, patented technology that has been clinically proven in non-human primate models to facilitate bone growth. Bone’s platform technology has application in delivering improved outcomes in the surgical specialties of spinal, orthopedic, general orthopedic, plastic reconstruction, neurosurgery, interventional radiology, and sports medicine. Lead product development and clinical studies are targeted on spinal fusion surgery, a growing market space. The following chart provides a segment overview of bone replacement products in the U.S.:

(See O’Reilly, Sharon. Beyond INFUSE: Spine Community Searches For Answers. INVIVO. November 2011, Vol. 29, No. 10.)

Products

Bone Biologics has developed stand-alone platform technologies through exhaustive lab and small animal research over the past seven years to generate the current applications across broad fields of use. The platform technologies are UCB-1TM, a proprietary skeletal specific growth factor in use with DBX™, a proprietary demineralized bone matrix, and UCS-1TM, a biomaterial that potentates and regulates growth factor in use with DBX, a proprietary demineralized bone matrix, activity in bone regeneration. Together, with DBX, or in isolation, Nell-1TM and UCS-1TM allow regulation over skeletal tissue formation and stem cell differentiation.

Bone Biologics is currently focused on bone regeneration in spinal fusion using its recombinant human protein, known as Nell-1. Nell-1 is an osteoinductive orthobiologic: a recombinant protein that provides control over bone regeneration. This patent protected technology has been exclusively licensed to Bone Biologics from the University of California, Los Angeles (“UCLA”). Leveraging the resources of investors and strategic partners, Bone Biologics has successfully surpassed two critical milestones:

| ● | Demonstrating a successful small laboratory scale pilot run for the recombinant manufacturing of the human Nell-1 protein in Chinese Hamster Ovary cells, which is a commercially established mammalian cell line for other recombinant proteins, which is well-defined and accepted by international regulatory agencies; and | |

| ● | Validation of protein dosing and efficacy in established large animal models and Rhesus Monkey primate models. |

| 8 |

Bone Biologics is targeting spinal fusion as the first clinical indication and is currently in the pre-investigational device exemption (“IDE”) phase. The lead product, purified Nell-1 recombinant protein, is expected to be dried onto ß-tricalcium phosphate (“TCP”) bone void filler to produce a medical device, known as Nell-1/TCP (“Nell/TCP Fusion Device”). This device will be mixed with 510(k) cleared DBX® Demineralized Bone Putty recommended for use in conjunction with a cleared intervertebral body fusion device. The Nell-1/TCP Fusion Device is intended for use in lumbar spinal fusion and may have a variety of other applications such as cervical spinal fusion.

While the product is initially targeted at the spine fusion market, Bone believes Nell-1’s unique set of characteristics, target specific mechanism of action, efficacy, safety, and affordability, position the product well for application in a variety of procedures, including:

Spine Implants. This is the largest market for bone substitute product, representing approximately 80% of the total 2009 U.S. market. While use of the patient’s own bone, also referred to as autograft, to enhance fusion of vertebral segments remains the gold standard for this type of treatment, complications associated with use of autograft bone including pain, increased surgical time and infection limit its use.

Non-Union Trauma Cases. While the majority of fractures heal without the need for osteosynthetic products, bone substitutes are used in complicated breaks where the bone does not mend naturally. Nell-1 is expected to perform as well as high-priced growth factors in this market.

Hip & Knee Revisions. The use of bone substitutes in reconstruction surgery is generally limited to revision cases where the products are used to account for the significant bone loss that accompanies these cases. The treatment of osteoporotic patients also represents a substantial opportunity for Nell-1 use in hip and knee reconstruction.

Implant Coating. The use of Nell-1 as a direct coating on hip and knee implants could have a very significant impact on the market. A Nell-1 coating may prolong the life of primary implants and allow for differentiation in a commodity market.

UCLA’s initial research was funded with approximately $18 million in resources from UCLA and government grants. After licensing the exclusive worldwide intellectual property rights from UCLA, development was funded with additional grant funding and $6.5 million in strategic investment from MTF. Bone anticipates that it will require an additional $2 million for preclinical studies, $4 million for completion of the filing of an IDE application completion, and $4 million for initiation of human studies. An estimated $50-60 million will be required to achieve product launch.

Nell-1’s powerful specific bone and cartilage forming properties derive from the ability of Nell-1 to only target cells that exhibit an activated “master switch” to develop into bone or cartilage. Nell-1 is a function specific recombinant human protein that has been proven in lab bench models to recapitulate normal human growth and development to provide control over bone and cartilage regeneration through research and development work at UCLA and written in publications.

The search for a target specific molecule to promote normal bone formation started in 1994. Nell-1 was isolated in 1996, and the first Nell-1 patent on bone regeneration was filed in 1999. Subsequent patents and continuations in part describing Nell-1 manufacturing, delivery, and cartilage regeneration were filed in 2002, 2003, 2006, 2007, 2008, and 2009 to further strengthen the patent portfolio.

The Nell-1/TCP Fusion Device will be comprised of a single dose vial of NELL-1 recombinant protein freeze dried onto TCP. A vial of Nell-1/TCP will be sold in a convenience kit with a diluent and a syringe of 510(k) cleared demineralized bone (“DBX® Putty”), produced by MTF. An elegant delivery device will allow the surgeon to mix the reconstituted Nell 1/TCP with the appropriate quantity of DBX® Putty just prior to implantation.

Research & Publications

Bone’s leading scientists have been published in notable scientific journals and publications in its field. These publications have served to highlight the work and achievements of its members.

| 9 |

Proposed Clinical Application

The Nell-1/TCP Fusion Device will be indicated for spinal fusion procedures in skeletally mature patients with degenerative disc disease (“DDD”) at one level from L4-S1. These DDD patients may also have up to Grade I spondylolisthesis at the involved level. The Nell-1/TCP Fusion Device is to be implanted via an anterior open or an anterior laparoscopic approach in conjunction with a cleared intervertebral body fusion device. Patients receiving the device should have had at least six months of non-operative treatment prior to treatment with the device. A cervical indication is currently under consideration. This indication for use would fill a current clinical gap, created by potentially dangerous inflammatory response caused by Infuse Bone Graft, the subject of a Public Health Notification from the United States Food and Drug Administration (the “FDA”) on July 1, 2008 about life threatening complications associated with rhBMP in cervical spine fusion. Bone would not expect to see the same adverse events with Nell-1/TCP as have been observed with BMP and OP-1. Bone has performed a rat femoral onlay model to compare proinflammatory response of BMP2 (Infuse Bone Graft) and Nell-1 within Helistate collagen sponges. While Nell-1 induced normal healing, BMP2 (Infuse Bone Graft) induced significant amounts of swelling and histological evidence of intense inflammatory response.

Description of the DBX® Putty to be used with Nell-1/TCP

The DBX® Demineralized Bone Putty provided in the convenience kit with Nell-1/TCP is a Class II device. The common name is “Bone Void Filler Containing Human Demineralized Bone Matrix.” The product is regulated under 21 C.F.R. §888.3045 Resorbable calcium salt bone void filler device, Product Codes MQV, GXP, and MBP. MTF is the manufacturer of the DBX® Putty. This product was cleared by the FDA under 510(k) number K053218 for spine indication in December 2006.

DBX® Putty is a matrix composed of processed human cortical bone. Demineralized bone granules are mixed with sodium hyaluronate to form the DBX® Putty. Every lot of final DBX® Putty product is tested in an athymic mouse model or in an alkaline phosphatase assay, which has been shown to have a positive correlation with the athymic mouse model, to ensure the osteoinductive potential of the final product.

The Bone Biologics instructions for use will recommend use of the Nell-1/TCP Fusion Device with a lumbar (or cervical) indication. The surgeon can therefore choose to use the intervertebral fusion device that he or she is most experienced with and in their judgment is the best option for successful treatment. Bone has three precedent products, which are also osteoinductive, with intended uses similar or the same as Nell-1, that have been cleared by the FDA as medical devices. These are as follow:

| ● | Infuse Bone Graft/LT-Cage Lumbar Tapered Fusion Device (PMA)-rhBMP-2 dissolved in water and applied to a collagen (bovine type I) sponge and placed in a cage; | |

| ● | GEM 21S (PMA)-rhPDGF-BB and -tricalcium phosphate (growth factor enhanced matrix); and | |

| ● | DBX® (510k)-human cortical bone (ground and demineralized) and mixed with sodium hyaluronate to form a putty. |

Based upon extensive discussions with regulatory experts and a specific communication from the FDA in response to a submission of our plan under the Exclusive License between UCLA and Bone Biologics we believe the Nell-1 TCP Fusion Device will be regulated as a Class III medical device and will therefore require submission and approval of a pre-market approval, (“PMA”). The FDA response to the submission of our plan is, “We have determined that the product is a combination product, that will be regulated under Device authorities, with CDRH (Center for Devices and Radiological Health) as the lead center.”

Bone’s Business Strategy

Bone’s business strategy has been to develop its target specific platform technology to meet a current established market with improvement in patient outcomes and reduction in costs to the healthcare delivery system. This narrowing of its focus from the research to the development stage is to allow for the approval for use of our target specific protein exhibiting efficacy and safety by matching or exceeding current market approved products. Identifying the best future strategic partners to facilitate the development through pre IDE, clinical, and ultimate commercialization is critical as Bone funds the pre-IDE work and continues achieving milestones. Bone believes that the licensing of the distribution of the Nell-1 product in the fields of use focused upon will generate sufficient funding to provide for the ongoing development of the Platform Technology across other surgical and therapeutic fields.

| 10 |

Material Agreements

UCLA Exclusive License Agreement

On March 15, 2006, Bone entered into an exclusive license agreement (the “Regents’ License”) with the Regents of the University of California (the “Regents”). The Regents’ License provides Bone with an exclusive license to several of the Regents’ patents covering, among other things, enhanced Nell-1 bone mineralization. The grant of the Regents’ License is subject to any license obligations to the U.S. government, and the term of the license lasts until the last-to-expire Regent patent licensed under the agreement expires. Under the Regents’ License, Bone is permitted to make, have made, use, sell, offer for sale and import any products covered by the Regents’ licensed patents in a certain field of use. By a subsequent Seventh Amendment entered into on August 7, 2012, the parties modified the applicable field of use that Bone is permitted to use the Regents’ patents in, which generally comprises musculoskeletal repair and regeneration, plus some related methods of manufacture. Bone has agreed to pay an annual maintenance fee to the Regents of $10,000 as well as to pay certain royalties to the Regents under the Regents’ License at the rate of 3% of net sales of licensed products. Bone must pay the royalties to the Regents on a quarterly basis, and Bone also must pay a minimum annual royalty of $25,000 to the Regents once earned royalties commence. If Bone is required to pay any third party any royalties as a result of Bone making use of the Regents’ patents, then Bone may reduce the royalty owed to the Regents by 0.333% for every percentage point paid to a third party. If Bone grants sublicensing rights to a third party to use the Regent’s patent, then Bone shall pay to the Regents 8% to 10% of the sublicensing income Bone receives from such sublicense.

By a subsequent Eighth Amendment entered into on October 22, 2013, the parties agreed that Bone is obligated to pay a milestone fee of 2% of the amount raised from this Private Placement. Additionally, if the Private Placement does not close or is less than $2.5 million, then a fee of $100,000 will be due and paid to the Regents by June 1, 2014. Furthermore, the Agreement was modified in that Bone shall pay the Regents $25,000 for dosing of Phase 1 clinical trial and $50,000 for dosing of Phase 3 clinical trial.

Bone is obligated to diligently proceed with developing and commercializing licensed products under the Regents’ patents set forth in the Regents’ License. The Regents have the right to either terminate the license or reduce the license to a non-exclusive license if Bone does not meet certain diligence milestone deadlines set forth in the Regents’ License.

Under a Fourth Amendment to the Regents’ License, entered into on August 19, 2009, Bone must reimburse or pre-pay the Regents for patent prosecution and maintenance costs incurred during the term of the Regents’ License. Bone has the right to bring infringement actions against third party infringers of the Regents’ License, the Regents may join voluntarily, at its own expense, or, at Bone’s expenses, be joined involuntarily to the action. Bone is required to indemnify the Regents against any third party claims arising out of Bone’s exercise of the rights under the Regents’ License or any sublicense.

Milestone Side Letter Agreement

Pursuant to a letter agreement, dated September 7, 2014, by and among AFH Advisory, Bone Biologics, and MTF (the “Milestone Side Letter Agreement”), Bone Biologics has agreed to use its commercially reasonable efforts to achieve the following milestones (the “Milestone Targets”) by the specified times following the closing of the Private Placement:

| (i) | Complete media screening studies of cell line within two (2) to three (3) months: | |

| (ii) | Initiate manufacturing of master cell bank within three (3) to four (4) months; | |

| (iii) | Initiate formulation studies for the cGMP manufacturing process once sufficient Nell-1 material is available within approximately eight (8) to ten (10) months; |

| 11 |

| (iv) | Initiate a pre-clinical bioreactor production run for toxicology material within nine (9) to twelve (12) months; | |

| (v) | Initiate pre-clinical toxicology studies to include carcinogenicity and reproductive within approximately eleven (11) to thirteen (13) months; | |

| (vi) | Finalize refinement of the manufacturing process within approximately twelve (12) to fourteen (14) months; | |

| (vii) | Initiate cGMP bioreactor run within twelve (12) to fourteen (14) months or after completion of (v), and | |

| (viii) | Request an IDE meeting to review the clinical safety plan within eighteen (18) to twenty (20) months; |

AFH Advisory and MTF will each receive restricted shares pursuant to the Milestone Targets equal to and not to exceed 2.5% of the fully diluted shares of the Company at the time of the completion of all Milestone Targets.

Placement Agent Agreement

On December 12, 2013, the Company and Bone Biologics entered into an engagement letter, which engagement letter was amended on September 22, 2014, with Forefront Capital Markets, LLC (“Forefront”) a registered FINRA broker-dealer, to act as placement agent for the Private Placement and the PIPE. Forefront shall be entitled to receive (i) a cash fee of 8% of the gross proceeds of the Private Placement, (ii) a warrant to purchase shares of the Company’s common stock (the “Agent Warrant”) equal to 8.0% of the Company’s common stock underlying the securities issued in the Private Placement, (iii) a cash fee of 3% of the gross proceeds received by the Company from any financing of non-convertible debt securities, and (iv) a warrant to purchase shares of the Company’s common stock (the “Advisory Warrant”) equal to 2.0% of the Company’s post-merger and financing fully diluted shares outstanding upon the closing of $2.5 million of investors on which Forefront is eligible to receive compensation. Forefront shall only be entitled to receive a management fee of 4% and a 4% Agent Warrant on the gross proceeds received from the sale of securities to investors introduced to the Company by AFH Advisory, Bone Biologics or their respective officers and directors at closing. The Agent Warrant will be issued at each closing and shall provide, among other things, that the Agent Warrant shall: (i) be exercisable at the price of the securities (or the exercise price of the securities) issued to the investors in the offering, (ii) expire five (5) years from the date of issuance, (iii) include customary registration rights, including the registration rights provided to the Investors, (iv) contain provisions for cashless exercise and (v) include such other terms that are normal and customary for warrants of this type. Forefront will serve as the Company’s exclusive placement agent in connection with the Private Placement through December 31, 2014, which exclusive period may be extended to 12 months at the discretion of the Company.

MTF Credit Agreement & Promissory Note

Bone and MTF entered into a loan agreement in 2008 and a credit agreement in 2009 (collectively, the “MTF Credit Agreements”), and accompanying promissory and convertible promissory notes in January 2008, November 2008, March 2009 and August 2009 to fund the development of Bone. On March 31, 2014, Bone and MTF entered into the Tenth Amendment to the MTF Credit Agreements and accompanying promisssory notes wherein MTF and Bone agreed that the aggregate principal amount of all advances would remain the same, but the maturity date of the notes would be extended to March 31, 2015. As of September 19, 2014, $5,192,684 in principal and interest was outstanding under the MTF Credit Agreements and $117,302 in principal and interst was outstanding under the 2013 Bridge Notes. On September 19, 2014, $1,533,356 of the amounts due under the MTF Credit Agreements were converted to shares of the Company. The remaining amounts due under the MTF Credit Agreements were cancelled and, as described in this Currert Report 8K under Recent Sales of Unregistered Securities, the New MTF Convertible Note (as defined herein) was issued by the Company.

| 12 |

In 2013, Bone and MTF also entered into a bridge note in the principal amount of $100,000. On June 6, 2014, the maturity date of the 2013 Bridge Note was extended to October 14, 2014.

MTF Short Term 2014 Loan

On September 15, 2014, Bone and MTF entered into a loan agreement and accompanying promissory note (the “MTF Short Term 2014 Loan”) to fund the continued operations of Bone prior to the Merger. Pursuant to the MTF Short Term 2014 Loan, MTF has agreed to advance an initial $250,000 to Bone and, at Bone’s request and subject to the terms and conditions of the MTF Short Term 2014 Loan, to advance up to an additional $250,000 to Bone. The MTF Short Term 2014 Loan has an interest rate of eight and one-half percent (8.5%) accruing annually. The MTF Short Term 2014 Loan matures on the earlier to occur of (i) the date on which at least $1 million is loaned to or invested in the Company and (ii) December 31, 2014. In further consideration of the MTF 2014 Loan, Bone granted to MTF 625,000 warrants at a strike price of $1.62. The MTF 2014 Loan was assigned to the Company on September 19, 2014.

Competition

Our most significant competitor is Infuse™ Bone Graft or BMP-2 (bone morphogenic protein 2) from Medtronics. BMP-2, despite dominant market position, is suffering from bad press related to negative off label cervical fusion outcomes due to inflammatory response. Bone believes that BMP2 also suffers from disadvantageous margins due to an unfavorable revenue sharing agreement with Wyeth. We believe that our product will not suffer from these same negative factors as to date, our products have not had inflammatory response issues and we are not burdened by an unfavorable revenue sharing agreement. A second potential competitor was OP-1 or BMP-7 from Stryker and sold to Olympus, which has had significant regulatory setbacks long delaying time to market beyond humanitarian use.

Customers

The customers for the product being developed by Bone are the acute care hospitals performing spinal fusion and long bone non-union fracture repair and regeneration. This universe of customers has been identified by Medtronic, with their bone growth product Infuse Bone Graft which is a bone morphogenic protein, and has grown over the past 10 years to a greater than $800 million market share dollar volume. FDA approval pathways, reimbursement pathways, and procedure acceptance by surgeons has been established by the Medtronic product. This does not provide any assurance that the Company will be approved by the FDA on the same pathway, reimbursed by payors comparably, and accepted by hospitals and surgeons as an alternative to Medtronic or any of the less efficacious modalities of therapy. Medrontic has experienced difficulties in this market from FDA questions relative to off label use, payors on reimbursement rates, and hospitals on procedural cost which create an environment that could be unfavorable to the Company achieving current forecasts for approval, commercialization, and revenue.

Intellectual Property

Bone Biologics has an intellectual property portfolio that includes exclusive, worldwide licenses from UCLA which Bone believes constitutes a formidable barrier to entry.

| 13 |

Additional patent applications are currently in preparation. The intellectual property is unique and comprehensively covers Nell-1 manufacture, Nell-1 compositions and Nell-1 use in wide ranging clinical and diagnostic applications. Bone Biologics protects its proprietary technology through all mechanisms including U.S. and foreign patent filings, trade secret protections, and collaboration agreements with domestic and international corporations, universities and research institutions. Bone is the exclusive licensee for the following twelve (12) UCLA issued patents:

| U.S Patent No. | Summary | Date Issued | ||

| 7052856 | NELL-1 Enhanced Bone Mineralization | 5/20/2006 | ||

| 7544486 | NELL-1 Peptide Expression Systems | 6/9/2009 | ||

| 7687462 | Composition for promoting Cartilage | 3/30/2010 | ||

| 7691607 | Expression system of NELL peptide | 4/6/2010 | ||

| 7776361 | NELL-1 Enhanced Bone Mineralization | 8/17/2010 | ||

| 7807787 | NELL-1 Peptide | 10/5/2010 | ||

| 7833968 | Pharmaceutical compositions for treating or preventing bone conditions | 11/16/2010 | ||

| 7844066 | Nell-1 Enhanced Bone Minerilization | 2/8/2011 | ||

| 8044026 | Composition for promoting cartilage | 10/25/2011 | ||

| 8048646 | NELL-1 peptide expression systems | 11/1/2011 | ||

| 8053412 | NELL-1 Peptides | 11/8/2011 | ||

| 8207120 | Nell-1 Enhanced Bone Mineralization | 6/26/2012 |

Government Regulation

The manufacturing and marketing of any product which Bone may formulate with its technologies as well as its related research and development activities are subject to regulation for safety, efficacy and quality by governmental authorities in the U.S. and other countries. Bone anticipates that these regulations will apply separately to each biotechnology product. Bone believes that complying with these regulations will involve a considerable level of time, expense and uncertainty.

In the U.S., drugs are subject to rigorous federal regulation and, to a lesser extent, state regulation. The Federal Food, Drug and Cosmetic Act, as amended, and the regulations promulgated thereunder, and other federal and state statutes and regulations govern, among other things, the testing, manufacture, safety, efficacy, labeling, storage, record keeping, approval, advertising and promotion of Bone’s products. Drug development and approval within this regulatory framework is difficult to predict, requires a number of years and involves the expenditure of substantial resources. Moreover, ongoing legislation by U.S. Congress and rule making by the FDA presents an ever-changing landscape where Bone could be required to undertake additional activities before any governmental approval is granted allowing us to market Bone’s products. The steps required before a pharmaceutical agent may be marketed in the U.S. include:

| ● | Laboratory and non-clinical tests for safety and small scale manufacturing of the agent; | |

| ● | The submission to the FDA of an IDE which must become effective before human clinical trials can commence; | |

| ● | Clinical trials to characterize the efficacy and safety of the product in the intended patient population; | |

| ● | The submission of a New Drug Application (“NDA”) or PMA to the FDA; and | |

| ● | FDA approval of the NDA or PMA prior to any commercial sale or shipment of the product. |

In addition to obtaining FDA approval for each product, each manufacturing establishment must be registered with, and approved by, the FDA. Moreover, manufacturing establishments are subject to biennial inspections by the FDA and must comply with the FDA’s Good Manufacturing Practices for products, drugs and devices.

| 14 |

Non-clinical Trials

Non-clinical testing includes laboratory evaluation of chemistry and formulation as well as tissue culture and animal studies to assess the safety and potential efficacy of the product. Non-clinical safety tests must be conducted by laboratories that comply with FDA regulations regarding good laboratory practices. Non-clinical testing is inherently risky and the results can be unpredictable or difficult to interpret. The results of non-clinical testing are submitted to the FDA as part of an IDE and are reviewed by the FDA prior to the commencement of clinical trials. Unless the FDA objects to an IDE, clinical studies may begin 30 days after the IDE is submitted. Bone has relied and intends to continue to rely on third-party contractors to perform non-clinical trials.

Clinical Trials

Clinical trials involve the administration of the investigational product to healthy volunteers or to patients under the supervision of a qualified investigator. Clinical trials must be conducted in accordance with good clinical practices under protocols that detail the objectives of the study, the parameters to be used to monitor safety and the efficacy criteria to be evaluated. Each protocol must be submitted to the FDA prior to its conduct. Further, each clinical study must be conducted under the auspices of an independent institutional review board. The institutional review board will consider, among other things, ethical factors, the safety of human subjects and the possible liability of the institution. The drug product used in clinical trials must be manufactured according to the FDA’s Good Manufacturing Practices.

Clinical trials under IDE regulations are typically conducted in two sequential trials. In the Pilot trial, the initial introduction of the product into healthy human subjects, the drug is tested for safety (adverse side effects), absorption, metabolism, bio-distribution, excretion, food and drug interactions, abuse as well as limited measures of pharmacologic effect and proof of principle that involves studies in a limited patient population in order to:

| ● | assess the potential efficacy of the product for specific, targeted indications; | |

| ● | demonstrate efficacy in a limited patient population; | |

| ● | identify the range of doses likely to be effective for the indication; and | |

| ● | identify possible adverse events and safety risks. |

When there is evidence that the product may be effective and has an acceptable safety profile in Pilot evaluations, Pivotal trials are undertaken to establish and confirm the clinical efficacy and establish the safety profile of the product within a larger population at geographically dispersed clinical study sites. Pivotal trials frequently involve randomized controlled trials and, whenever possible, studies are conducted in a manner so that neither the patient nor the investigator knows what treatment is being administered. Bone, or the FDA, may suspend clinical trials at any time if it is believed that the individuals participating in such trials are being exposed to unacceptable health risks. Bone intends to rely upon third-party contractors to advise and assist us in the preparation of Bone’s IDEs and the conduct of clinical trials that will be conducted under the IDEs.

Premarket Approval and FDA Approval Process

The results of the manufacturing process, development work, non-clinical studies and clinical studies are submitted to the FDA in the form of a PMA prior to marketing and selling the product. The testing and approval process is likely to require substantial time and effort. In addition to the results of non-clinical and clinical testing, the PMA applicant must submit detailed information about chemistry, manufacturing and controls that will describe how the product is made and tested through the manufacturing process.

The PMA review process involves FDA investigation into the details of the manufacturing process, as well as the design and analysis of each of the non-clinical and clinical studies. This review includes inspection of the manufacturing facility, the data recording process for the clinical studies, the record keeping at a sample of clinical trial sites and a thorough review of the data collected and analyzed for each non-clinical and clinical study. Through this investigation, the FDA reaches a decision about the risk-benefit profile of a product candidate. If the benefit is worth the risk, the FDA begins negotiating with the company about the content of an acceptable package insert and associated Risk Evaluation and Mitigation Strategies (“REMS”), if required.

| 15 |

The approval process is affected by a number of factors, including the severity of the disease, the availability of alternative treatments and the risks and benefits demonstrated in clinical trials. Consequently, there is a risk that approval may not be granted on a timely basis, if at all. The FDA may deny a PMA if applicable regulatory criteria are not satisfied, require additional testing or information or require post-marketing testing (Phase 4) and surveillance to monitor the safety of a company’s product if it does not believe the PMA contains adequate evidence of the safety and efficacy of the product. Moreover, if regulatory approval of a product is granted, such approval may entail limitations on the indicated uses for which it may be marketed. Finally, product approvals may be withdrawn if compliance with regulatory standards is not maintained or health problems are identified that would alter the risk-benefit analysis for the product. Post-approval studies may be conducted to explore the use of the product for new indications or populations such as pediatrics.

Among the conditions for PMA approval is the requirement that any prospective manufacturer’s quality control and manufacturing procedures conform to the FDA’s Good Manufacturing Practices and the specifications approved in the PMA. In complying with standards set forth in these regulations, manufacturers must continue to expend time, money and effort in the area of product and quality control to ensure full technical compliance. Manufacturing establishments, both foreign and domestic, also are subject to inspections by or under the authority of the FDA and by other federal, state or local agencies. Additionally, in the event of non-compliance, FDA may issue warning letters and/or seek criminal and civil penalties, enjoin manufacture, seize product or revoke approval.

International Approval

Whether or not FDA approval has been obtained, approval of a product by regulatory authorities in foreign countries must be obtained prior to the commencement of commercial sales of the drug in such countries. The requirements governing the conduct of clinical trials and drug approvals vary widely from country to country, and the time required for approval may be longer or shorter than that required for FDA approval. Although there are some procedures for unified filings for certain European countries, in general, each country at this time has its own procedures and requirements.

Other Regulation

In addition to regulations enforced by the FDA, Bone is also subject to U.S. regulation under the Controlled Substances Act, the Occupational Safety and Health Act, the Environmental Protection Act, the Toxic Substances Control Act, the Resource Conservation and Recovery Act and other present and potential future federal, state, local or similar foreign regulations. Bone’s research and development may involve the controlled use of hazardous materials, chemicals and radioactive compounds. Although Bone believes that its safety procedures for handling and disposing of such materials comply with the standards prescribed by state and federal regulations, the risk of accidental contamination or injury from these materials cannot be completely eliminated. In the event of any accident, Bone could be held liable for any damages that result and any such liability could exceed Bone’s resources.

Employees

As of the date hereof, Bone has one part-time employee working for Bone as Bone’s President and Chief Technology Officer (“CTO”).

Strategic Partners

Musculoskeletal Transplant Foundation

Bone Biologics has formed a formal strategic alliance with MTF on the collaborative development of osteoinductive products that incorporate MTF’s current product line of natural bone graft substitutes with Nell-1™. MTF is the exclusive allograft supplier for the BIOBONE-X™. MTF has become one of the major investors of Bone Biologics. MTF is the world’s largest allograft bone supplier. It is also the country’s largest full service tissue organization dedicated to providing quality tissue through a commitment to excellence in education, research, recovery and care for recipients, donors and their families. A not-for-profit organization, MTF is a consortium of academic medical institutions and organ and tissue recovery organizations across the country. Bone anticipates that MTF, with its proven ISO 9001 manufacturing and packaging of FDA approved osteogenic carriers, will significantly accelerate the clinical development cycle of Nell-1TM related products.

| 16 |

Katayama Chemical Industries Co., Ltd

Katayama Chemical Industries Co., Ltd (“KCI”), based in Osaka, Japan, was founded in 1918. KCI focuses on the production of OEM laboratory products for many distributors such as Amersham Biosciences, Millipore, and Sigma-Aldrich Japan, the exclusive Japanese distributor for laboratory products manufactured by KCI. Under a strategic partnership with Bone Biologics, KCI is seeking to develop clinical diagnostic reagents related to bone metabolism and regeneration. KCI produced the Nell-1 protein in an insect cell line that was utilized in development work and for proof of concept validation in rodent models and large animal (sheep) spinal fusion trials.

Available Information

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We are not required to deliver an annual report to our security holders, but will provide one voluntarily if a written request is sent to us at our principal executive office at 175 May Street, Suite 400, Edison, New Jersey. Reports filed with the SEC pursuant to the Exchange Act, including our annual and quarterly reports, and other reports we file, can be inspected and copied on official business days during the hours of 10 a.m. to 3 p.m. prevailing eastern time at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. Investors may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. Investors can request copies of these documents upon payment of a duplicating fee by writing to the SEC. The reports we file with the SEC are also available on the SEC’s website (http://www.sec.gov).

| 17 |

RISK FACTORS AND SPECIAL CONSIDERATIONS

This Report contains forward-looking statements.

Information provided in this Current Report may contain forward-looking statements which reflect management’s current view with respect to future events, the viability or efficacy of our products and our future performance. Such forward-looking statements may include projections with respect to market size and acceptance, revenues and earnings, marketing and sales strategies and business operations, as well as efficacy of our products.

We operate in a highly competitive and highly regulated business environment. Our business can be expected to be affected by government regulation, economic, political and social conditions, business’ response to new and existing products and services, technological developments and the ability to obtain and maintain patent and/or other intellectual property protection for our products and intellectual property. Our actual results could differ materially from management’s expectations because of changes both within and outside of our control. Due to such uncertainties and the risk factors set forth in this Current Report, prospective investors are cautioned not to place undue reliance upon such forward-looking statements.

Risks Related to Our Business

Our ability to grow and compete in the future will be adversely affected if adequate capital is not available to us or not available on terms favorable to us.

The ability of our business to grow and compete depends on the availability of adequate capital. Bone currently has no cash flow. We cannot assure you that we will be able to obtain equity or debt financing on acceptable terms or at all to implement our growth strategy. As a result, we cannot assure you that adequate capital will be available to finance our current growth plans, take advantage of business opportunities or respond to competitive pressures, any of which could harm our business.

Our recurring operating losses have raised substantial doubt regarding our ability to continue as a going concern.

Our recurring operating losses raise substantial doubt about our ability to continue as a going concern. As a result, our independent registered public accounting firms included an explanatory paragraph in their reports on our financial statements as and for the years ended December 31, 2013 and December 31, 2012 with respect to this uncertainty. The perception of our ability to continue as a going concern may make it more difficult for us to obtain financing for the continuation of our operations and could result in the loss of confidence by investors, suppliers and employees.

We have incurred losses for calendar year 2013 and we expect our operating expenses to increase in the foreseeable future, which may make it more difficult for us to achieve and maintain profitability.

We have no significant operating history and have never been profitable. From our inception on March 9, 2004 through June 30, 2014, we have generated a net loss of approximately $8.4 million. We have negative cash flow from operations, working capital deficiencies and have not established the commercial viability of our products. These conditions raise doubts as to the Company’s ability to continue as a going concern. The Company’s December 31, 2013 audited financial statements contained a notation by our auditors regarding the Company’s ability to continue as a going concern. Although we intend to raise additional capital or financing, we will continue to incur significant expenses for development activities for our lead product Nell-1. In addition, as a public company, we will incur additional accounting, legal and other expenses that we did not incur as a private company. These expenditures will make it harder for us to achieve profitability. As a result, we can provide no assurance as to whether or if we will ever be profitability. If we are not able to achieve and maintain profitability, the value of our company and our common stock could decline significantly.

There may be conflicts of interest between our management and our non-management stockholders and other affiliates.

Conflicts of interest create the risk that management may have an incentive to act adversely to the interests of the Company. A conflict of interest may arise between our management’s personal pecuniary interest and its fiduciary duty to our stockholders.

| 18 |

We face a number of risks associated with the completed Reverse Merger, including our incurrence of substantial debt which could adversely affect our financial condition.

On September 19, 2014, we completed the Merger. Completing the Merger increased our expenses, and we incurred substantial debt in completing the business combination, which could adversely affect our financial condition. In connection with the Merger, we incurred debt that includes, but is not limited to, a promissory note issued by the Company to AFH Advisory pursuant to which the Company agrees to pay AFH Advisory the amount of $340,000 out of the proceeds of the Private Placement for the remainder of the $590,000 owed to AFH Advisory in connection with the Merger. MTF has granted AFH Advisory a standby letter of credit in the amount of $340,000 for the remaining amount due under the Note. Principal and interest under the Note is due October 24, 2014.

Incurring a substantial amount of debt may require us to use a significant portion of any cash flow to pay principal and interest on the debt, which will reduce the amount available to fund working capital, capital expenditures, and other general purposes. Our indebtedness may negatively impact our ability to operate our business and limit our ability to borrow additional funds by increasing our borrowing costs, and impact the terms, conditions, and restrictions contained in possible future debt agreements, including the addition of more restrictive covenants; impact our flexibility in planning for and reacting to changes in our business as covenants and restrictions contained in possible future debt arrangements may require that we meet certain financial tests and place restrictions on the incurrence of additional indebtedness and place us at a disadvantage compared to similar companies in our industry that have less debt.

The business combination was completed through a “reverse merger.” As a result, we may not be able to attract the attention of major brokerage firms.

Securities analysts of major brokerage firms may not provide coverage of our Company since there is no incentive to brokerage firms to recommend the purchase of our Common Stock. No assurance can be given that brokerage firms will want to conduct any secondary offerings on behalf of our post-merger company.

We operate in a highly competitive environment.

The biotechnology industry is characterized by rapidly evolving technology and intense competition. Our competitors include major multi-national biotechnology companies developing both generic and proprietary therapies to treat serious diseases. Many of these companies are well-established and possess technical, human, research and development, financial and sales and marketing resources significantly greater than ours. In addition, many of our potential competitors have formed strategic collaborations, partnerships and other types of joint ventures with larger, well established industry competitors that afford these companies potential research and development and commercialization advantages in the therapeutic areas we are currently pursuing.