Attached files

| file | filename |

|---|---|

| 10-K/A - OSAGE EXPLORATION & DEVELOPMENT, INC. | form10ka.htm |

| EX-32.1 - OSAGE EXPLORATION & DEVELOPMENT, INC. | ex32-1.htm |

| EX-31.1 - OSAGE EXPLORATION & DEVELOPMENT, INC. | ex31-1.htm |

| EX-32.2 - OSAGE EXPLORATION & DEVELOPMENT, INC. | ex32-2.htm |

| EX-31.2 - OSAGE EXPLORATION & DEVELOPMENT, INC. | ex31-2.htm |

| EXCEL - IDEA: XBRL DOCUMENT - OSAGE EXPLORATION & DEVELOPMENT, INC. | Financial_Report.xls |

Exhibit 10.32

PARTICIPATION AGREEMENT

NEMAHA RIDGE PROJECT

LOGAN COUNTY, OKLAHOMA

THIS PARTICIPATION AGREEMENT (this “Agreement”), entered into this 21st day of April, 2011, is by and between Osage Exploration & Development, Inc. whose address is 2445 Fifth Avenue Suite 310 San Diego, CA 92101 (hereafter “Osage”) and Slawson Exploration Company, Inc., a Kansas corporation, whose principal place of business is 727 North Waco, Suite 400, Wichita, Kansas, 67203 (hereafter “SEG”J and U.S. Energy Development Corporation, whose address is 2350 North Forest Road, Getzville, New York 14068, (hereafter “USE”). SEC! and USE shall sometimes be referred to herein as a “Participant”. Osage and Participant shall sometimes be referred to herein individually as a “Party” and collectively as the “Parties.”

WHEREAS, Osage has developed oil and gas leads and acquired certain leasehold interests covering lands within the Nemaha Ridge Project Area (“Project Area”), located in Logan County, Oklahoma, and described on Exhibit A; and,

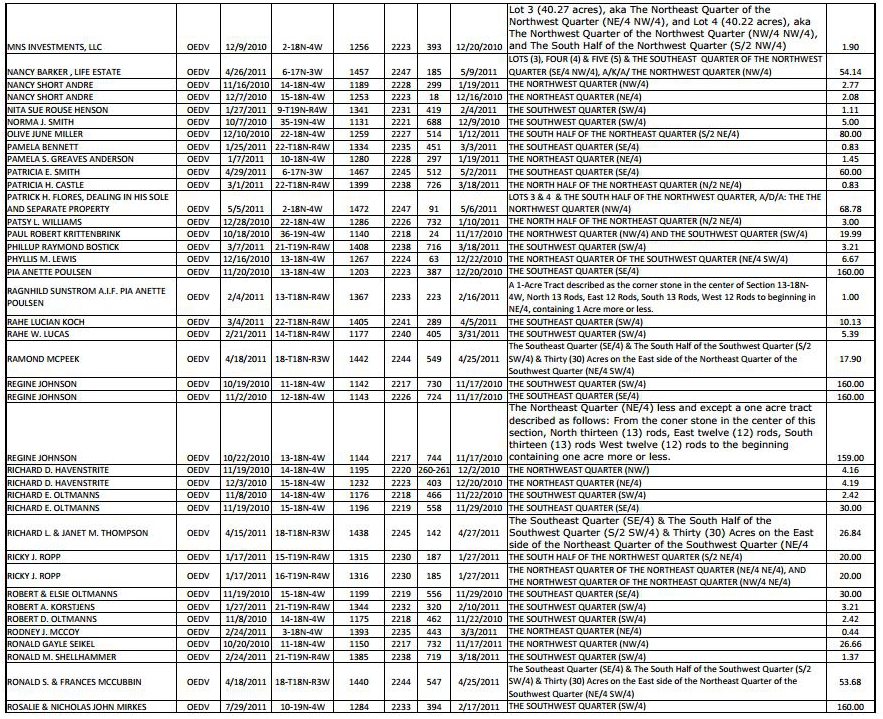

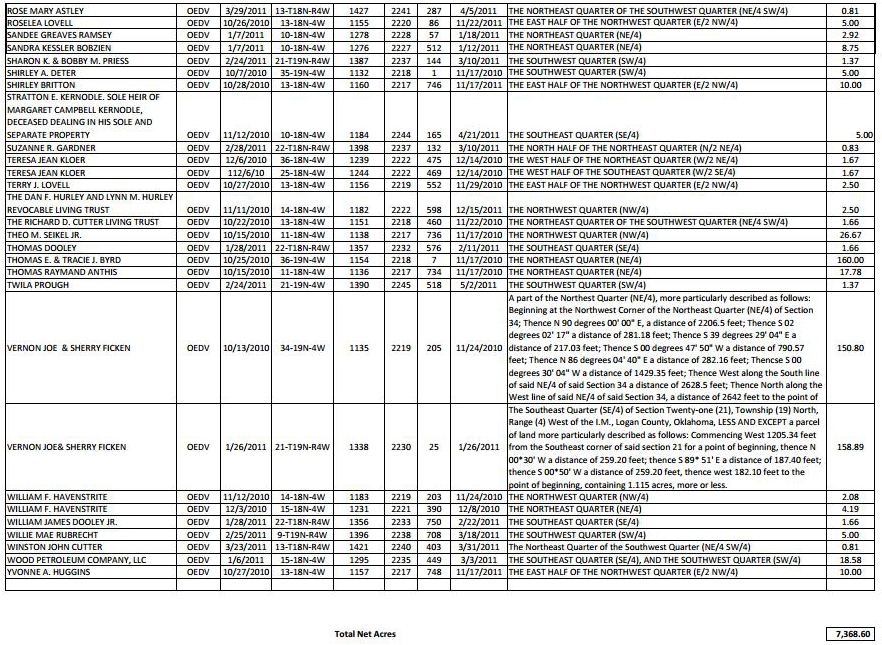

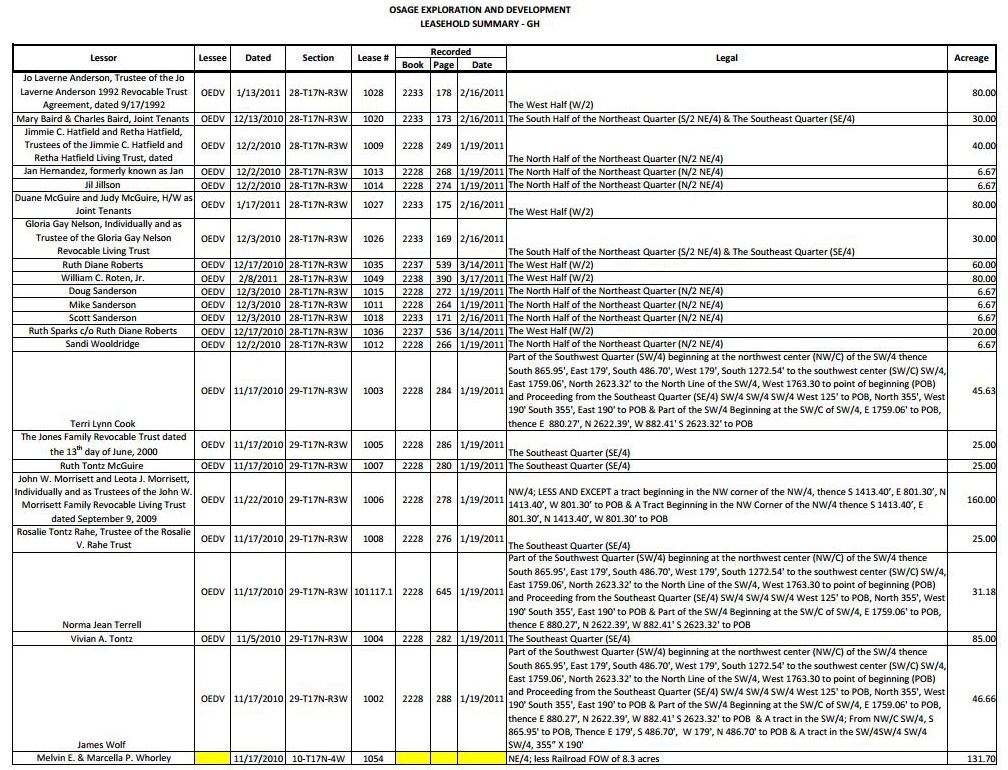

WHEREAS, the leasehold interest leased by Osage is listed on Exhibit B; and,

WHEREAS, Participants wish to participate with Osage in the leasing, drilling and development of the Project Area pursuant to the provisions of this Agreement and the agreements through which Osage acquires leasehold rights within the Project Area.

NOW THEREFORE, the Parties, for the mutual promises contained herein and other good and valuable consideration, the sufficiency of which is hereby acknowledged, do hereby contract and agree as follows:

| 1. | Participation Interest: By execution of this Agreement, SECI and USE acquire the right to participate in and ownership of the following percentage working interest: |

| SECI forty five percent (45%) | |

| USE thirty percent (30%) | |

| (the “Participation Interest”) in the exploration and development of the Project Area, subject to adjustment for non- consent and non-participation elections made by the Parties and other joint interest owners pursuant to the terms of this Agreement and similar agreements between Osage and other participants. Participants agree that the interest Participants acquire from Osage within the Project Area shall be specifically subject to the terms of the leases, options, and other agreements by which the leasehold interests were acquired in the Project Area by Osage, all of which shall be provided to Participants. |

| 1 |

| 2. | SECI shall be the “Operator” of all wells in the Project area. |

| 3. | Participants shall have a 60-day period to conduct due diligence and to confirm title to the acreage to be assigned. The amount payable to Osage shall be adjusted to account for defects in title to any of the acreage to be acquired at $650 per net acre affected by a title defect in the reasonable judgment of Participants, or Osage may, within 30 days from notice of a defective lease, substitute additional leases to account for the 10,000 acres being delivered. |

| 4. | Initial Payment: Within 30 days of execution of this Agreement, each Participant shall pay Osage each Participant’s Participation Interest share of the leasehold acquisition costs incurred and paid by Osage through the closing of this Participation Agreement, at $650.00 per net mineral acre, so long as the total acquired acreage does not exceed 10,000 net acres. |

| Upon payment of the sums provided in this paragraph less any allowances for title defects, Osage shall execute and record an assignment conveying to Participants the Participation Interests in and to the oil and gas leases in the Project Area, including but not limited to those described on Exhibit “B” hereto. The assignment will be in the form of assignment attached hereto as Exhibit “D”. Osage shall assign its interest free of any retained override, production payment or net profits interests or any other burden created by Osage or any affiliate of Osage except as otherwise expressly provided for herein. THE ASSIGNMENT SHALL BE WITHOUT WARRANTY OF TITLE EITHER EXPRESS OR IMPLIED EXCEPT THAT OSAGE WILL WARRANT TITLE AGAINST ALL CLAIMS BY, THROUGH OR UNDER OSAGE, and except as otherwise expressly provided for herein. | |

| 5. | Participation Terms: As to the initial three (3) net horizontal Mississippian wells drilled in the Project Area, (the “Initial Wells”), Participants shall pay Participants’ proportionate share plus ten percent (10%) of expenses chargeable under the relevant “Operating Agreement,” as that term is hereinafter defined, through the tanks or plugging and abandonment. Thereafter in each Initial Well and as to all subsequent wells, Participants shall pay their Participation Interest share of all costs incurred, (without said additional 10%) subject to the additional terms of this Agreement and the applicable Operating Agreement within the Project Area as to operations in which Participants elect to participate. |

| 6. | Invoicing: Operator will invoice the Parties monthly for its projected share of the costs incurred or to be incurred in the Project Area in the succeeding thirty (30) days, and the Parties agree to remit the amount invoiced within thirty (30) days of receipt. A reconciliation of amounts invoiced on a pre-bill basis per this paragraph and actual costs incurred shall be completed on a quarterly basis. Any adjustments due by either Party following reconciliation shall be paid within thirty (30) days of the completion of the reconciliation and notice thereof. |

| 2 |

| 7. | Drilling Proposals: Operator shall make a good faith effort to spud the initial well no later than August 1, 2011 and shall prosecute the drilling of the initial well with reasonable diligence, to the depth (the “Target Depth”) sufficient to test the Mississippian formation and then commence to drill the lateral as proposed to the Parties. |

| All well proposals in the Project Area shall be in writing and identify the location and projected lateral of the well to be drilled, the objective (or objectives) to be tested, the geological and/or geophysical basis for the proposed well, and an Authority for Expenditure (“AFE”). The Parties hereto agree to participate in the initial Mississippian test well. Parties receiving proposals for wells other than the initial Mississippian well will have thirty (30,) days from the date the proposal is made to either (1) elect to participate as to their working interest in the proposed well, or (2) elect not to participate in the proposed well. Elections shall be made in writing to the Party proposing the well. Failure to timely elect shall be deemed to constitute an election not to participate in the proposed well. Any Party electing not to participate in any of the initial three Mississippian test wells in any areas outlined on Exhibit A shall forfeit all rights within the section including the drill site plus the 8 sections cornering or adjoining the drill site section and shall reassign to the participating Party, all such leasehold working interest which it owns in the drill site section plus the 8 sections cornering or adjoining the drill site section at no cost to the participating Party. Notwithstanding the foregoing, if a Party elects not to participate in one of the 3 initial wells but has agreed to participate in a previous spacing unit which includes any of the acreage of the drill site or the 8 sections cornering or adjoining said initial wells, said party shall retain its interest on said previous spacing unit. | |

| After the three initial horizontal Mississippian wells have been drilled, or as to any other well that may be proposed other than a horizontal Mississippian well, should a Party elect not to participate in a well proposed under this paragraph, the forfeiture shall be a wellbore forfeiture of the drill site wellbore plus one offset location wellbore cornering or adjoining the drill site (as to acreage located either inside or outside the boundary of an existing spacing unit on which a producing or drilling well is located, or on which a well has been proposed hereunder, and in which Participant(s) has elected to participate) to be selected by the participating Party. Notwithstanding the foregoing, however, in order for any such forfeiture to occur and be binding on the non-participating Party, the participating Parties must proceed to commence and prosecute to conclusion the operations set out in the AFE and notice within a period of ninety (90) days after the date of the non-consent election of the notified Parties. The provisions of this paragraph supersede the penalty provisions of the Operating Agreement for failure to participate in a proposed well. |

| 3 |

| During the first year of this Agreement, and only during the first year of this Agreement, and after the two initial test wells are proposed, no Party may propose more than one well under this Agreement in any 90-day period, without the consent of 60% of the working interest owners, unless (1) the additional well proposed is to test a separate geological objective from that currently being tested (i.e. not the same source of supply) or (2) such additional well is proposed within six (6) months of the expiration of the lease or (3) the Parties have agreed to an increase in the number of proposals that may be made. Thereafter, proposals may be made under the terms of the Operating Agreement by the Parties. | |

| 8. | Funding Obligation - Well Costs: At least fifteen (15) days prior to the projected spud date of a well, each Party agrees to fund its proportionate share of estimated dry hole costs, as reflected in any applicable approved AFE, to Operator or into a segregated Operator account where such an account has been established, to assure payment to the drilling contractor. Failure to fund within twenty (20) days following receipt of written notice of a funding deficiency shall constitute, at Operator’s election, an election by Participant(s) not to participate in the well, and result in the penalties stated herein. |

| A Party shall likewise be obligated to advance payment for its share of estimated completion costs within forty eight (48) hours of commencement of completion work on any well. Failure to fund within fifteen (15) days following receipt of written notice of a funding deficiency for completion costs in which Participant(s) has elected to participate may, at Operator’s election, be deemed to constitute a modification of the non-funding Party’s election, and such non- funding Party shall be deemed to have elected non-consent with respect to the completion operation in the applicable well and the penalties of the Operating Agreement shall apply. | |

| The above funding provision shall apply to any wells drilled in the Project Area. | |

| The drilling of each well in the Project Area shall be governed by the applicable operating agreement in the form attached hereto as Exhibit C (the “Operating Agreement”). Where there is a conflict between the Operating Agreement and this Agreement, this Agreement will control. | |

| 9. | Net Revenue Interest: Participant(s) shall acquire from Osage a delivered 78% net revenue interest in the leasehold interest leased by Osage listed on Exhibit B. As to any leases acquired after the acquisition of 10,000 net acres, or closing of this Agreement, which ever comes first, Participant(s) shall be delivered a net revenue of 78% unless the delivered net revenue received by Osage is less than 78%, in which case the leasehold will be assigned to Participant at the same delivered net revenue received by Osage. |

| 4 |

| 10. | Leasehold: At no administrative cost to Participant, Osage shall be responsible for acquiring the leases and shall be responsible for assignment of Participant’s working interest to Participant(s) in said leases. Osage shall be responsible for maintenance of lease records within the Project Area and shall timely remit rentals when due and comply with the other obligations of the lease agreements on behalf of Participant(s). Participant(s) agrees to bear its proportionate share of any rental obligations incurred by Osage in its behalf that accrue after closing. |

| As to any top leases included in the 10,000 net initial acres acquired, Osage shall bear all costs for exercising the purchase option of said top leases, at the time they vest, and shall be responsible to pay the Participant(s) $650 per net acre for any top leases that fail to vest. | |

| 11. | Billings: Except as otherwise provided herein, billings attributable to Participant’s interest in leases and operated wells shall be billed and payable pursuant to the accounting provisions of the Operating Agreement. |

| 12. | AMI: An Area of Mutual Interest (“AMI”) shall be established within the boundaries of the Project Area. “Leases” means oil and gas leases, mineral interests, royalty interests, net profits interests, options or agreements to acquire or earn the foregoing such as farmins, farmouts, participation agreements and similar agreements. The provisions of this paragraph shall apply for a period of thirty (36) months from the date of this Agreement. Subject only to the specific terms of this Agreement to the contrary, should a Party or any “Affiliate,” as that term is hereinafter defined, acquire an interest in any Leases in the AMI, the acquiring Party shall offer the interest at a cost of leasehold bonus or purchase price and directly attributable broker charges to other Parties in the Project Area proportionate to their Participation Interest in the Project Area. Any Leases acquired hereunder, shall become subject to the terms of this Agreement. Should an acquired interest lie both within and outside the AMI, for the purposes of the acquisition, the interest shall be deemed lying wholly within the AMI. “Affiliate” means, with respect to either Party, any other person or entity directly or indirectly controlling, controlled by, or under common control with, such Party. For purposes of this definition, the term “control” (including the terms “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of any person or entity, whether through the ownership of voting securities or by contract or otherwise. |

| 5 |

| 13. | Term: Except as otherwise provided herein, the term of this Agreement shall begin on the date hereof and continue f a period of three (3) years, or as to a spacing or producing unit for a well, so long as the Operating Agreement remaii in effect. Notwithstanding the foregoing, this agreement may be extended beyond the original term of 3 years working interest owners holding at least 75% of said working interest elect to extend the agreement which extensio shall be for a period of 1 year and for subsequent periods of 1 year if so elected. |

| 14. | Notices: All notices required hereunder shall be considered given when delivered personally or when sent by e-ma facsimile, or U.S. Mail properly addressed as follows: |

| Slawson Exploration Company, Inc. | |

| 727 North Waco, Suite 400 | |

| Wichita, KS 67203 | |

| Attn: Coni Stokes | |

| Phone: (316) 263-3201 Fax: (316) 268-0702 | |

| E-mail: cstokes @ slawsoncompanies.com | |

| Osage Exploration and Development, Inc. 2445 5th Avenue, Suite 300 | |

| San Diego, CA 92131 Attn: Kim Bradford | |

| Phone: (619) 677-3956 | |

| Fax: (619) 677-3964 | |

| E-mail: kbradford@osageexploration.com | |

| U.S. Energy Development Corporation | |

| 2350 North Forest Road | |

| Getzville, New York 14068 | |

| Attn: Douglas K. Walch | |

| Phone: 716-636-0401 | |

| Fax: 716-636-0418 | |

| E-mail: dwalch@usenergydevcorp.com |

Notwithstanding the foregoing, notices or deliveries by U. S. Mail shall be deemed given or made only upon receipt by the addressee. Any Party to this Agreement may change its mailing address, telephone number, facsimile number, or email address for notice hereunder effective the thirtieth (30th) day after the giving of notice of such change in accordance with the provisions of this paragraph.

| 6 |

| 15. | Nature of Agreement: The liabilities of the Parties shall be several and not joint or collective, and each Party shall be responsible only for its share of the costs and liabilities incurred as provided hereunder. It is not the purpose or intention of this Agreement to create any partnership, mining partnership, joint venture, or any other association or entity, and neither this Agreement nor the activities or operations hereunder shall be construed or considered as creating any such legal relationship. Operator shall be responsible for marketing production from the wells drilled pursuant to this Agreement and shall account to each participant for their proportionate share thereof. Each Party, however, shall have the right to market its production in kind, but in doing so shall also assume the obligations of disbursing revenue to royalty and any other burden to its interest. |

| 16. | Miscellaneous Provisions: |

| Subject to the other provisions of this Agreement, this Agreement and all provisions hereof shall inure to the benefit of and be binding upon not only the Parties, but their respective heirs, successors, and assigns. The Parties may assign their rights, duties, and obligations hereunder, so long as any assignment by a Party hereto is expressly made subject to the terms and conditions herein contained. |

| i. | Operator shall have the right to require any Party who becomes an assignor to be the authorized agent for any of its assignees. | |

| ii. | The paragraph headings of this Agreement are inserted for convenience only and should not be considered a part of this Agreement or used in its interpretation. | |

| iii. | This Agreement shall be governed by and construed in accordance with the laws of the State of Oklahoma. | |

| iv. | The provisions of this Agreement are intended to be severable. If any term or provision hereof is illegal or invalid for any reason whatsoever, such illegality or invalidity shall not affect the legality or validity of the remainder of this Agreement. | |

| v. | This Agreement constitutes the entire understanding of the Parties in respect to the subject matter hereof, in lieu of any prior agreement, and no amendment, modification, or alteration of the terms hereof shall be binding unless the same be in writing and signed by the Party(ies) against whom/which it is sought to be enforced. | |

| vi. | This Agreement may be signed in counterparts, which, when taken together, shall have the effect of a single instrument. This Agreement, however, shall not be binding on any Party unless and until a single original or counterparts, of this Agreement have been signed by all Parties named therein. A printed faxed copy of a signature or a scanned and printed copy of a signature shall be deemed to be the equivalent of an original. |

| 7 |

| 8 |

EXHIBIT A to PARTICIPATION AGREEMENT

Summary of Net Acres at Closing

| Sail | 7,368.60 | |||

| Lowry | 689.71 | |||

| GH | 1,941.71 | |||

| Totals | 10,000.02 |