Attached files

| file | filename |

|---|---|

| 8-K - OKS ANNOUNCES BEAR CREEK AND BRONCO - ONEOK Partners LP | oksannouncesbearcreekbronco.htm |

Exhibit 99.1

September 22, 2014 | Analyst Contact: | T.D. Eureste 918-588-7167 |

Media Contact: | Stephanie Higgins 918-591-5026 | |

ONEOK Partners to Invest $480 Million to $680 Million to

Construct New Natural Gas Processing Facilities

and Related Infrastructure in North Dakota and Wyoming

Capital-growth Program Increased to $7.5 Billion to $8.2 Billion Through 2016;

Unannounced Backlog Remains $3.0 Billion to $4.0 Billion

Williston Basin Natural Gas Processing Capacity to Approach

1.2 Bcf/d With the Completion of the New Bear Creek Natural Gas Processing

Facility and Related Infrastructure

Completion of the New Bronco Natural Gas Processing Facility in Wyoming Will

Expand Operations in the Natural Gas Liquids (NGL)-rich Powder River Basin

TULSA, Okla. – Sept. 22, 2014 – ONEOK Partners, L.P. (NYSE: OKS) today announced plans to invest approximately $480 million to $680 million between now and the end of the third quarter 2016 to:

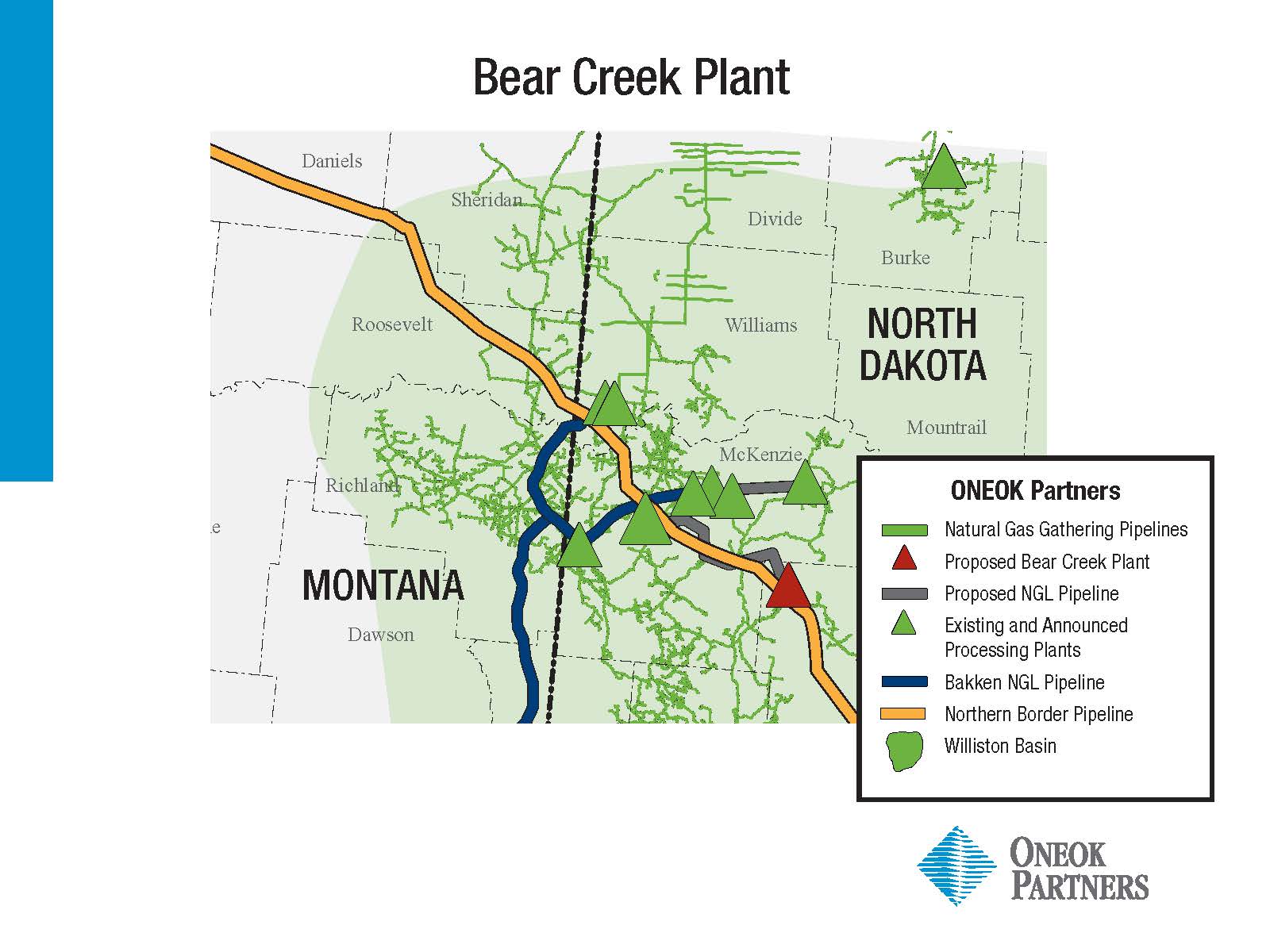

• | Build a new 80-million cubic feet per day (MMcf/d) natural gas processing facility – the Bear Creek plant – and related infrastructure in northwest Dunn County, North Dakota, which will process natural gas produced from the Bakken Shale in the Williston Basin; and |

• | Construct a new 100-MMcf/d natural gas processing facility – the Bronco plant – and related infrastructure in southern Campbell County, Wyoming, which will process natural gas produced from the NGL-rich Turner, Frontier, Sussex and Niobrara Shale formations in the Powder River Basin. |

“In 2014, the partnership has announced $1.5 billion to $1.9 billion in capital-growth projects – a continuation of our $7.5 billion to $8.2 billion capital-growth program planned through 2016,” said Terry K. Spencer, president and chief executive officer of ONEOK Partners. “The Bear Creek and Bronco plants will increase our natural gas processing capacity across our operating footprint by 180 MMcf/d and add additional natural gas and natural gas liquids volumes on our systems. These projects further demonstrate the value of the partnership’s integrated operations that allows us to better serve area producers.”

-more-

ONEOK Partners to Invest $480 Million to $680 Million

to Construct New Natural Gas Processing Facilities and

Related Infrastructure in North Dakota and Wyoming

September 22, 2014

Page 2

The partnership has strategically positioned capital-growth projects in multiple high-growth NGL-rich areas, including the Williston Basin, the Powder River Basin, and the Cana-Woodford and SCOOP plays in Oklahoma resulting in increased natural gas processing capacity across the partnership’s operating footprint.

Since 2010, ONEOK Partners has constructed, or is constructing, 11 new natural gas processing plants and related natural gas gathering infrastructure across its operating footprint – including eight in the Williston Basin, where the partnership’s natural gas processing capacity in the region is expected to increase by more than 11 times by the end of 2016, compared with 2010.

Construct Bear Creek natural gas processing facility and related infrastructure:

The Bear Creek natural gas processing plant, an 80-MMcf/d facility, and related infrastructure are expected to cost approximately $265 million to $375 million and be completed during the second quarter 2016, and include:

• | $130 million to $190 million for the construction of the Bear Creek natural gas processing plant; and |

• | $135 million to $185 million for the construction of related natural gas and natural gas liquids infrastructure. |

“The Bear Creek plant will be built near existing ONEOK Partners natural gas gathering, compression and residue takeaway infrastructure in Dunn County and will alleviate pipeline inefficiencies in an area challenged by geographical constraints and severe terrain,” said Spencer. “The 80-MMcf/d Bear Creek plant allows us to respond more quickly to accommodate our customers’ growing crude-oil and natural gas production on acreage dedicated to us in the area. The construction of this facility, along with previously announced capital-growth projects, shows our continued commitment to building critical natural gas infrastructure in North Dakota in an effort to meet the industry goal of reducing natural gas flaring to 5 to 10 percent of total production by the fourth quarter 2020.”

The partnership’s Williston Basin natural gas processing capacity is expected to increase to approximately 1.2 billion cubic feet per day (Bcf/d) in the third quarter 2016 following the completion of the Bear Creek plant and the completion of previously announced projects in the region, including:

• | The Garden Creek III plant, a 100-MMcf/d natural gas processing facility in McKenzie County, North Dakota, which is expected to be completed in the fourth quarter 2014; |

• | The Lonesome Creek plant, a 200-MMcf/d natural gas processing facility in the McKenzie County, North Dakota, which is expected to be completed in the fourth quarter 2015; |

-more-

ONEOK Partners to Invest $480 Million to $680 Million

to Construct New Natural Gas Processing Facilities and

Related Infrastructure in North Dakota and Wyoming

September 22, 2014

Page 3

• | The Demicks Lake plant, a 200-MMcf/d natural gas processing facility in McKenzie County, North Dakota, which is expected to be completed in the third quarter 2016; and |

• | The construction of additional natural gas compression to take advantage of additional natural gas processing capacity as a result of better than expected plant performance at the partnership’s existing and planned Garden Creek and Stateline natural gas processing plants in the Williston Basin by a total of 100 MMcf/d, which is expected to be completed in the fourth quarter 2015. |

EDITOR’S NOTE:

View a map showing the location of the Bear Creek natural gas processing plant.

Construct Bronco natural gas processing facility and related infrastructure:

The Bronco natural gas processing plant, a 100-MMcf/d facility, and related infrastructure are expected to cost approximately $215 million to $305 million and be completed during the third quarter 2016, and include:

• | $130 million to $190 million for the construction of the Bronco natural gas processing plant; |

• | $45 million to $60 million for construction of a 65-mile, 10-inch NGL pipeline to connect the Bronco Plant to ONEOK Partners’ Bakken NGL Pipeline lateral, currently under construction; and |

• | $40 million to $55 million for the construction of related natural gas infrastructure. |

“The Bronco plant will expand the partnership’s natural gas gathering and processing and NGL gathering infrastructure in Campbell and Converse Counties, Wyoming, and is supported by long-term dedications of more than 130,000 net acres.” said Spencer. “Last year, the partnership acquired the 50-MMcf/d Sage Creek plant, and the Bronco plant will provide ONEOK Partners with additional natural gas processing capacity in a region poised for significant growth in natural gas and NGL production volumes.”

EDITOR’S NOTE:

View a map showing the location of the Bronco natural gas processing plant.

Capital Projects:

The partnership has announced total investments exceeding $7.5 billion to $8.2 billion through 2016 for acquisitions and infrastructure growth projects related to natural gas gathering and processing and NGLs, which includes the projects described above.

-more-

ONEOK Partners to Invest $480 Million to $680 Million

to Construct New Natural Gas Processing Facilities and

Related Infrastructure in North Dakota and Wyoming

September 22, 2014

Page 4

These investments consist of $4.2 billion to $4.8 billion for natural gas gathering and processing projects, and $3.3 billion to $3.4 billion for NGL projects.

In aggregate, these projects are expected to generate adjusted EBITDA multiples of five to seven times. The incremental earnings from these projects are expected to increase distributable cash flow and value to unitholders in the form of higher distributions.

After this announcement and the recent announcements of the Demicks Lake and Knox natural gas processing plants and related infrastructure in North Dakota and Oklahoma, the partnership continues to have a $3 billion to $4 billion backlog of unannounced growth projects. Additional projects included in this backlog will be announced when sufficient supply commitments are obtained.

NON-GAAP (GENERALLY ACCEPTED ACCOUNTING PRINCIPLES) FINANCIAL MEASURES:

ONEOK Partners has disclosed in this news release anticipated adjusted EBITDA and distributable cash flow (DCF) levels that are non-GAAP financial measures. Adjusted EBITDA and DCF are used as a measure of the partnership’s financial performance. Adjusted EBITDA is defined as net income adjusted for interest expense, depreciation and amortization, income taxes and allowance equity funds used during construction. DCF is defined as adjusted EBITDA, computed as described above, less interest expense, maintenance capital expenditures and equity earnings from investments, adjusted for cash distributions received and certain other items.

The partnership believes the non-GAAP financial measures described above are useful to investors because these measurements are used by many companies in its industry as a measurement of financial performance and are commonly employed by financial analysts and others to evaluate the financial performance of the partnership and to compare the financial performance of the partnership with the performance of other publicly traded partnerships within its industry.

Adjusted EBITDA and DCF should not be considered an alternative to net income, earnings per unit or any other measure of financial performance presented in accordance with GAAP.

These non-GAAP financial measures exclude some, but not all, items that affect net income. Additionally, these calculations may not be comparable with similarly titled measures of other companies. Furthermore, these non-GAAP measures should not be viewed as indicative of the actual amount of cash that is available for distributions or that is planned to be distributed for a given period nor do they equate to available cash as defined in the partnership agreement.

-more-

ONEOK Partners to Invest $480 Million to $680 Million

to Construct New Natural Gas Processing Facilities and

Related Infrastructure in North Dakota and Wyoming

September 22, 2014

Page 5

ONEOK Partners, L.P. (pronounced ONE-OAK) (NYSE: OKS) is one of the largest publicly traded master limited partnerships in the United States and is a leader in the gathering, processing, storage and transportation of natural gas in the U.S. and owns one of the nation’s premier natural gas liquids (NGL) systems, connecting NGL supply in the Mid-Continent and Rocky Mountain regions with key market centers. Its general partner is a wholly owned subsidiary of ONEOK, Inc. (NYSE: OKE), a pure-play, publicly traded general partner, which owns 38.5 percent of the overall partnership interest as of June 30, 2014.

For more information, visit the website at www.oneokpartners.com.

For the latest news about ONEOK Partners, follow us on Twitter @ONEOKPartners.

Some of the statements contained and incorporated in this news release are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act, as amended. The forward-looking statements relate to the proposed construction of the new Bear Creek and Bronco natural gas processing facilities, and the other referenced infrastructure growth projects related to natural gas gathering and processing and natural gas liquids, the schedule and costs to complete the proposed projects and related infrastructure, and expected generation of EBITDA and distributable cash flow from the proposed projects. These forward-looking statements are made in reliance on the safe-harbor protections provided under the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include the items identified in the preceding paragraph, the information concerning possible or assumed future results of our operations and other statements contained or incorporated in this news release identified by words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “should,” “goal,” “forecast,” “guidance,” “could,” “may,” “potential,” “scheduled,” and other words and terms of similar meaning.

You should not place undue reliance on forward-looking statements. Known and unknown risks, uncertainties and other factors may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by forward-looking statements. Those factors may affect our operations, markets, products, services and prices. These and other risks are described in greater detail in Item 1A, Risk Factors, in our Annual Report on Form 10-K. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. Other than as required under securities laws, we undertake no obligation to update publicly any forward-looking statement whether as a result of new information, subsequent events or change in circumstances, expectations or otherwise.

###