UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(X) QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITES EXCHANGE ACT OF 1934

|

|

For the quarter period ended July 31, 2014

|

( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE EXCHANGE ACT OF 1934

|

|

For the transition period form to

|

|

|

|

|

|

Commission File number 333-172825

|

MONARCHY RESOURCES, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

46-0525633

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

Calle urque numero 5,

Colonia Fuentes de Bellavista, c.p. 33880

Hidalgo del Parral, Chihuahua, Mexico

|

|

(Address of principal executive offices)

|

|

|

|

(702) 722-1003

|

|

(Registrant’s telephone number)

|

|

|

|

N/A

|

|

(Former name, former address and former fiscal year, if changed since last report)

|

Indicate by check mark whether the registrant(1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See definition of “large accelerated filer”, “accelerated filer” and “small reporting company” Rule 12b-2 of the Exchange Act.

Large accelerated filer[ ] Accelerated filer [ ]

Non-accelerated filer[ ] (Do not check if a small reporting company) Small reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

Yes [] No [X]

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PROCEDING FIVE YEARS

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 after the distribution of securities subsequent to the distribution of securities undera plan confirmed by a court. Yes [ ] No [X]

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

September 18, 2014: 811,540 common shares

|

|

|

Page

Number

|

|

PART 1.

|

FINANCIAL INFORMATION

|

|

|

|

|

|

|

ITEM 1.

|

Financial Statements (unaudited)

|

3

|

|

|

|

|

|

|

Condensed Balance Sheet as atJuly 31, 2014 and October 31, 2013

|

4

|

|

|

|

|

|

|

Condensed Statement of Operations

For the threeand ninemonths ended July 31, 2014 and 2013

|

5

|

|

|

|

|

|

|

Condensed Statement of Cash Flows

For the ninemonths ended July 31, 2014 and 2013

|

6

|

|

|

|

|

|

|

Notes to the Condensed Financial Statements.

|

7

|

|

|

|

|

|

ITEM 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

13

|

|

|

|

|

|

ITEM 3.

|

Quantitative and Qualitative Disclosuresabout Market Risk

|

17

|

|

|

|

|

|

ITEM 4.

|

Controls and Procedures

|

17

|

|

|

|

|

|

PART 11.

|

OTHER INFORMATION

|

18

|

|

|

|

|

|

ITEM 1.

|

Legal Proceedings

|

18

|

|

|

|

|

|

ITEM 1A.

|

Risk Factors

|

18

|

|

|

|

|

|

ITEM 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

21

|

|

|

|

|

|

ITEM 3.

|

Defaults Upon Senior Securities

|

21

|

|

|

|

|

|

ITEM 4.

|

Submission of Matters to a Vote of Security Holders

|

21

|

|

|

|

|

|

ITEM 5.

|

Other Information

|

21

|

|

|

|

|

|

ITEM 6.

|

Exhibits

|

22

|

|

|

|

|

|

|

SIGNATURES.

|

29

|

|

|

|

|

PART 1 — FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

The accompanying condensed balance sheets of Monarchy Resources, Inc. (Exploration stage company) at July 31, 2014 (with comparative figures as at October 31, 2013 as re-stated) and the condensed statement of operations for the threeand ninemonths ended July 31, 2014 and 2013, and the condensed statement of cash flows for the nine months ended July 31, 2014 and 2013, have been prepared by the Company’s management in conformity with accounting principles generally accepted in the United States of America. In the opinion of management, all adjustments considered necessary for a fair presentation of the results of operations and financial position have been included and all such adjustments are of a normal recurring nature.

Operating results for the nine months ended July 31, 2014 are not necessarily indicative of the results that can be expected for the year ending October 31, 2014.

MONARCHY RESOURCES, INC.

CONDENSED BALANCE SHEETS

|

|

|

July 31, 2014

|

|

October 31,

2013

|

|

|

|

(Unaudited)

|

|

(Restated and Unaudited)

|

|

ASSETS

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

Cash

|

$

|

-

|

$

|

99,970

|

|

Prepaid expense

|

|

-

|

|

180,500

|

|

Total Current Assets

|

|

-

|

|

280,470

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

$

|

-

|

$

|

280,470

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIENCY

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

Accounts payable (including related party amounts of $40,104 and $0, respectively)

|

$

|

89,364

|

$

|

79,613

|

|

Accrued interest

|

|

27,310

|

|

-

|

|

Advances from related parties

|

|

40,326

|

|

40,326

|

|

Convertible promissory notes payable

|

|

496,804

|

|

175,000

|

|

Notes Payable

|

|

-

|

|

800,000

|

|

|

|

|

|

|

|

Total current liabilities

|

|

653,804

|

|

1,094,939

|

|

|

|

|

|

|

|

TOTAL LIABILITIES

|

|

653,804

|

|

1,094,939

|

|

|

|

|

|

|

|

STOCKHOLDERS’ DEFICIENCY

|

|

|

|

|

|

Common stock

|

|

|

|

|

|

300,000,000 shares authorized, at $0.001 parvalue;

|

|

|

|

|

|

811,540 shares issued and outstanding as at July 31, 2014 (461,400 as at October 31, 2013)

|

|

812

|

|

462

|

|

Additional Paid in Capital

|

|

6,460,943

|

|

4,804,438

|

|

Accumulated deficit

|

|

(7,115,559)

|

|

(5,619,369)

|

|

|

|

|

|

|

|

Total Stockholders’ Deficiency

|

|

(653,804)

|

|

(814,469)

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIENCY

|

$

|

-

|

$

|

280,470

|

The accompanying notes are an integral part of these condensed financial statements.

MONARCHY RESOURCES, INC.

CONDENSED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

Three months

ended

July 31, 2014

|

Threemonths

ended

July 31, 2013

|

Nine months

ended

July 31, 2014

|

Nine months

ended

July 31, 2013

|

|

|

|

|

|

|

|

REVENUES

|

$ -

|

$ -

|

$ -

|

$ -

|

|

|

|

|

|

|

|

EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

Impairment loss on investment

|

80,000

|

-

|

352,990

|

-

|

|

Loss on equity method investment

|

|

30,852

|

|

30,852

|

|

General and administrative

|

35,645

|

5,200

|

363,771

|

32,417

|

|

|

115,645

|

36,052

|

716,761

|

63,269

|

|

|

|

|

|

|

|

OTHER EXPENSE

|

|

|

|

|

|

Loss on debt extinguishment

|

-

|

-

|

346,000

|

-

|

|

Interest expense

|

137,028

|

-

|

433,429

|

-

|

|

|

|

|

|

|

|

TOTAL OTHER EXPENSE

|

137,028

|

-

|

779,429

|

-

|

|

|

|

|

|

|

|

NET LOSS FROM OPERATIONS

|

$ (252,673)

|

$ (36,052)

|

$ (1,496,190)

|

$ (63,269)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS PER COMMON

SHARE

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

$ (0.38)

|

$ (0.10)

|

$ (2.47)

|

$ (0.20)

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE

OUTSTANDING SHARES

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

661,540

|

362,500

|

605,130

|

318,230

|

The accompanying notes are an integral part of these condensed financial statements.

MONARCHY RESOURCES, INC.

CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

Nine months

ended

July 31, 2014

|

Nine months

ended

July 31, 2013

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

Net loss

|

$ (1,496,190)

|

$ (63,269)

|

|

|

|

|

|

Adjustments to reconcile net loss to net cash used

in operating activities:

|

|

|

|

Loss on debt extinguishment

|

346,000

|

-

|

|

Impairment loss on investment

|

352,990

|

-

|

|

Loss on equity method investment

|

-

|

30,852

|

|

Debt discount amortization

|

411,185

|

-

|

|

Purchase of property for shares

|

-

|

30,000

|

|

Changes in operating assets and liabilities:

|

|

|

|

Prepaid expense

|

180,500

|

2,250

|

|

Accrued interest

|

16,243

|

-

|

|

Accounts payable and accrued expenses

|

20,488

|

3,897

|

|

|

|

|

|

Net cash used in operating activities

|

(168,784)

|

3,730

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

Investment in New World Metals

|

(352,990)

|

(780,000)

|

|

Net cash used in investing activities

|

(352,990)

|

(780,000)

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

Advances from related parties

|

-

|

5,187

|

|

Payments on promissory notes

|

(50,000)

|

|

|

Proceeds from promissory notes

|

471,804

|

750,000

|

|

|

|

|

|

Net cash provided by financing activities

|

421,804

|

755,187

|

|

|

|

|

|

Net decrease in cash

|

(99,970)

|

(21,083)

|

|

|

|

|

|

Cash at beginning of period

|

99,970

|

21,083

|

|

|

|

|

|

CASHAT END OF PERIOD

|

$ -

|

$ -

|

SUPPLEMENTAL DISCLOSURE OF NONCASH INVESTING AND FINANCING ACTIVITIES:

|

Note payable issued for investment

|

$ 75,000

|

$ -

|

|

Common stock issued to extinguish debt

|

$ 1,096,000

|

$ -

|

The accompanying notes are an integral part of these condensed financial statements

MONARCHY RESOURCES, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

July 31, 2014

(Unaudited)

1. ORGANIZATION AND BASIS OF PRESENTATION

The Company, Monarchy Resources, Inc., was incorporated under the laws of the State of Nevada on June 16, 2010 with the authorized capital stock of 300,000,000 shares at $0.001 par value.

The Company was organized for the purpose of acquiring and developing mineral properties. At the report date mineral claims, with unknown reserves, had been acquired. The Company has not established the existence of a commercially minable ore deposit and therefore has not reached the exploration stage and is considered to be in the exploration stage.

The interim financial statements for the three and nine months ended July 31, 2014 and 2013are unaudited. These financial statements are prepared in accordance with requirements for unaudited interim periods, and consequently do not include all disclosures required to be in conformity with accounting principles generally accepted in the United States of America. The results of operations for the interim periods are not necessarily indicative of the results for the full year. In management's opinion all adjustments necessary for a fair presentation of the Company's financial statements are reflected in the interim periods included, and are of a normal recurring nature. These interim financial statements should be read in conjunction with the financial statements included in our Annual Report on Form 10-K, for the year ended October 31, 2013, as filed with the SEC.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Accounting Method

The Company recognizes income and expenses based on the accrual method of accounting.

Dividend Policy

The Company has not yet adopted a policy regarding payment of dividends.

Basic and Diluted Net Income (loss) Per Share

Basic net income (loss) per share amounts are computed based on the weighted average number of shares actually outstanding. Diluted net income (loss) per share amounts are computed using the weighted average number of common and common equivalent shares outstanding as if shares had been issued on the exercise of the common share rights unless the exercise becomes antidilutive and then the basic and diluted per share amounts are the same. As of July 31, 2014 and 2013, there were 49,680,400 (from convertible debt) and 0 potential common shares.

Income Taxes

The Company utilizes the liability method of accounting for income taxes. Under the liability method deferred tax assets and liabilities are determined based on differences between financial reporting and the tax bases of the assets and liabilities and are measured using the enacted tax rates and laws that will be in effect, when the differences are expected to be reversed. An allowance against deferred tax assets is recorded, when it is more likely than not, that such tax benefits will not be realized.

Impairment of Long-lived Assets

The Company reviews and evaluates long-lived assets for impairment when events or changes in circumstances indicate that the related carrying amounts may not be recoverable. The assets are subject to impairment consideration under ASC 360-10-35-17 if events or circumstances indicate that their carrying amounts might not be recoverable. When the Company determines that an impairment analysis should be done, the analysis will be performed using rules of ASC 930-360-35, Asset Impairment, and 360-10-15-3 through 15-5, Impairment or Disposal of Long-Lived Assets.

Foreign Currency Translations

The books of the Company are maintained in United States dollars and this is the Company’s functional and reporting currency. Transactions denominated in other than the United States dollar are translated as follows with the related transaction gains and losses being recorded in the Statement of Operations:

|

(i)

|

Monetary items are recorded at the rate of exchange prevailing as at the balance sheet date;

|

|

(ii)

|

Non-Monetary items including equity are recorded at the historical rate of exchange; and

|

|

(iii)

|

Revenues and expenses are recorded at the period average in which the transaction occurred.

|

Investments

Investments in companies that are not consolidated, but over which the Company exercises significant influence, are accounted for under the equity method of accounting. Whether or not the Company exercises significant influence with respect to an investee depends on an evaluation of several factors, including, among others, ownership level. Under the equity method of accounting, an investee company’s accounts are not reflected within the Company’s Balance Sheets and Statements of Operations; however, the Company’s share of the earnings or losses of the investee company is reflected in the Company’s Statements of Operations and the Company’s carrying value in an equity method investee company is reflected in the Company’s Balance Sheets. The Company evaluates these investments for other-than-temporary declines in value each quarterly period. Any impairment found to be other than temporary would be recorded through a charge to earnings. As of July 31, 2014 and 2013, the Company recorded impairment losses on the New World investment of $352,990 and $0, respectively. During the nine month period ended July 31, 2013, the Company recorded a loss on its equity method investment of $30,852.

Revenue Recognition

Revenue from the sale of minerals will be recognized when a contract is in place and minerals are delivered to the customer.

Mineral claim acquisition and exploration costs

The cost of acquiring mineral properties or claims is initially capitalized and then tested for recoverability whenever events or changes in circumstances indicate that its carrying amount may not be recoverable. Mineral exploration costs are expensed as incurred.

Advertising and Market Development

The company expenses advertising and market development costs as incurred.

Financial Instruments

The carrying amounts of financial instruments are considered by management to be their fair value due to their short term maturities.

Estimates and Assumptions

Management uses estimates and assumptions in preparing financial statements in accordance with generally accepted accounting principles. Those estimates and assumptions affect the reported amounts of the assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses. Actual results could vary from the estimates that were assumed in preparing these financial statements.

Statement of Cash Flows

For the purposes of the statement of cash flows, the Company considers all highly liquid investments with a maturity of three months or less to be cash equivalents.

Environmental Requirements

At the report date environmental requirements related to the mineral claim acquired are unknown and therefore any estimate of any future cost cannot be made.

Recent Accounting Pronouncements

In June 2014, the FASB issued ASU 2014-10, “Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements, Including an Amendment to Variable Interest Entities Guidance in Topic 810, Consolidation”. The guidance eliminates the definition of a development stage entity thereby removing the incremental financial reporting requirements from U.S. GAAP for development stage entities, primarily presentation of inception to date financial information. The provisions of the amendments are effective for annual reporting periods beginning after December 15, 2014, and the interim periods therein. However, early adoption is permitted. Accordingly, the Company has adopted this standard as of July 31, 2014.

The Company does not expect the adoption of any other recent accounting pronouncements to have a material impact on its financial statements.

3. ACQUISITION OF MINERAL CLAIM

On June 21, 2010, the Company acquired the La Carlota Gold Claim located in the Republic of Philippines from Rodelio Mining Ltd., an unrelated company, for the consideration of $5,000. The La Carlota Gold Claim is located 30 kilometres northwest of the city of La Carlota in the Philippines. Under Philippine’s law, the claim remains in

good standing as long as the Company has an interest in it. There are no annual maintenance fees or minimum exploration work required on the Claim.

The acquisition costs have been impaired and expensed because there has been limited exploration activity and there has been no reserve established and we cannot currently project any future cash flows or salvage value.

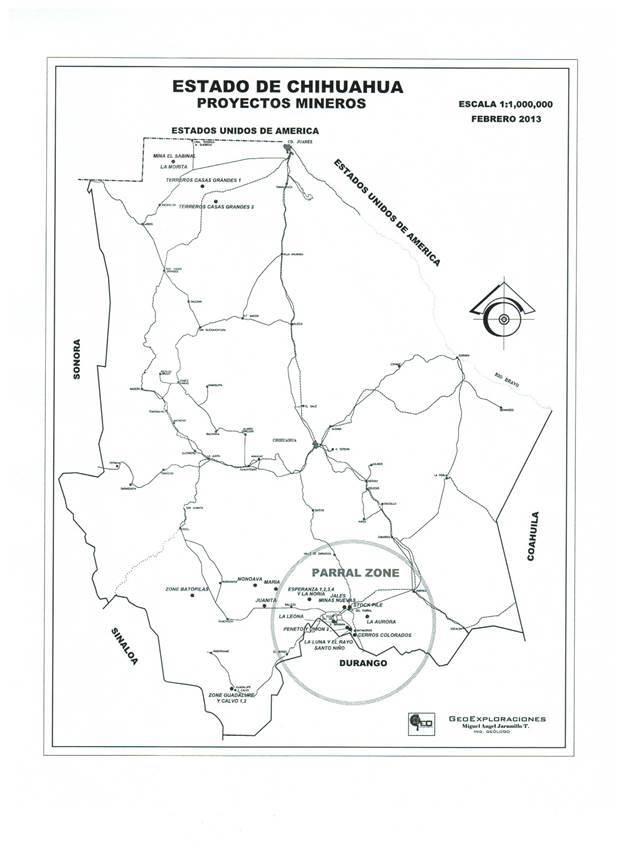

4. INVESTMENT IN NEW WORLD MINERALS S.A. de C.V.

On May 14, 2013, the Company entered into a Share Purchase Agreement (the “SPA”) with the owners of New World Metals S.A.P.I. de C.V. (“New World”) Under the terms of the SPA, the Company issued 100,000 shares (10,000,000 pre-reverse split) of the Company’s common stock to the owners of New World in exchange for 28% of the issued and outstanding shares of New World. New World is a mining operator in the Chihuahua region of Mexico which owns three working mines; Morelos, La Luna, and Peneto. The shares of the Company were valued at $.285, which was the price of the shares sold to a third party under a stock subscription agreement in May 2013. The Company is accounting for this investment using the equity method.

On July 4, 2013, the Company entered into an agreement to increase its ownership in New World by 17%, to 45%, by issuing 50,000 shares (5,000,000 pre-reverse split) and agreeing to pay $750,000 to three separate owners of New World. The shares of the Company were valued at $.285 per pre-rollback share, which was the price of the shares sold to a third party under a stock subscription agreement in May 2013. The Company is accounting for this investment using the equity method. The Company’s share of the losses of New World for the nine month period ended July 31, 2014 was $0 (for the year ended October 31, 2013 - $30,852).

On January 15, 2014, the Company converted the $750,000 commitment to New World into 200,000 shares (20,000,000 pre-reverse split) of the Company, and on January 17, 2014 these shares were issued. As the fair value of these shares was $1,096,000 (based on the quoted price of the Company’s stock on January 17, 2014), the Company recorded a loss on debt extinguishment of $346,000 in the statement of operations.

5. SIGNIFICANT TRANSACTIONS WITH RELATED PARTIES

The two previous Directors have acquired 12.5% of the common stock issued and have made advances to the Company of $40,326, as of July 31, 2014. The advances are non-interest bearing, unsecured and payable on demand.

6. PROMISSORY NOTES PAYABLE

The Company has entered into the following promissory note agreements:

|

Promissory Note

|

Rate

|

Date of Agreement

|

Repayment terms

|

Amount July 31, 2014

|

Amount October 31, 2013

|

|

|

1. Affiliated debt holder for services

|

5%

|

1-Aug-13

|

Demand, Convertible at $0.01 per share

|

$15,000

|

$75,000

|

|

|

2. Non related debt holder for property interest

|

12%

|

23-Aug-13

|

Monthly Payments of $15,000. Payout May 11, 2014

|

$ -

|

$ 50,000

|

|

|

3. Non related debt holder — for cash consideration

|

5%

|

1-Sep-13

|

Demand, Convertible at $0.01 per share

|

$ -

|

$100,000

|

|

|

4. Affiliated debt holder — for cash consideration

|

5%

|

23-Nov-13

|

Demand, Convertible at $0.01 per share

|

$75,000

|

$-

|

|

|

5. Affiliated debt holder — for cash consideration

|

5%

|

24-Apr-14

|

Demand, Convertible at $0.01 per share

|

$64,500

|

$-

|

|

|

6. Affiliated debt holder — for cash consideration

|

5%

|

1-May-14

|

Demand, Convertible at $0.01 per share

|

$65,705

|

$-

|

|

|

7. Affiliated debt holder — for cash consideration

|

5%

|

1-Jun-14

|

Demand, Convertible at $0.01 per share

|

$40,000

|

$-

|

|

|

8. Affiliated debt holder

|

5%

|

3-Jul-14

|

Demand, Convertible at $0.01 per share

|

$86,599

|

$-

|

|

|

|

|

|

|

$346,804

|

$225,000

|

|

7. CAPITAL STOCK

On June 19, 2013 the Company issued 100,000 (10,000,000 pre-reverse split shares) shares and on July 4, 2013, the Company issued 50,000 shares (5,000,000 pre-reverse split) to acquire 45% of the issued and outstanding shares of New World.

On August 23, 2013, the Company recorded prepaid expense of $286,000 for 10,000 shares (1,000,000 pre-reverse split) issued to its President (valued at $.285 per pre-rollback share), and the payment of $1,000 in cash, for a nine month service contract. $178,750 of this amount was amortized to general and administrative expenses for the nine months ended July 31, 2014 ($107,250 of this amount was amortized to general and administrative expense for the year ended October 31, 2013).

On October 24, 2013, the Company issued 1,400 shares (140,000 pre-reverse split) for cash of $39,900.

On January 15, 2014, the Company issued 200,000 shares (20,000,000 pre-reverse split) to settle the $750,000 Note Payable to New World (see Note 4).

On July 10, 2014, the Company issued 150,000 shares (15,000,000 pre-reverse split) in exchange for $150,000 of Notes Payable.

On August 20, 2014 the Company completed a reverse split of its issued shares of 1 share for every 100 shares issued as of August 20, 2014. The financial statements have been retroactively restated to reflect this reverse split.

8. COMMITMENTS

The Company has entered into an agreement with its president to pay him $5,000 per month commencing January 2014.

9. GOING CONCERN

The Company will need additional working capital to accomplish its intended purpose of exploring its mining claim, which raises substantial doubt about its ability to continue as a going concern. Management of the Company has developed a strategy, which it believes will accomplish this objective through Director Advances, additional equity funding, and long term financing, which will enable the Company to operate for the coming year.

10. RESTATEMENT

The Company has restated the financial statements for the year ended October 31, 2013, to account for a promissory note that was executed in the prior year, but not recorded. The effect on the financial statement line items is as follows:

|

a.

|

Promissory Notes have increased $50,000 to reflect the Diamondback Eden settlement dated July 23, 2013 (see Note 6 above).

|

|

b.

|

Deficit as at October 31, 2013 has increased from $5,567,725 to $5,619,369 to reflect the $50,000 increase in the Impairment Loss on Mineral Claim, plus an increase in accrued interest and interest expense of $1,644.

|

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with the information contained in the financial statements of MonarchyResources, Inc. (“Monarchy” or the “Company”) and the notes which form an integral part of the financial statements which are attached hereto.

The financial statements mentioned above have been prepared in conformity with accounting principles generally accepted in the United States of America and are stated in United States dollars.

Our Company was formed under the laws of the State of Nevada on June 16, 2010.

Our offices are located at Calleuriquenúmero 5,Colonia Fuentes de Bellavista, c.p. 33880, Hidalgodel Parral, Chihuahua, Mexicoand can be reached at (408) 879-2669.

We are an Emerging Growth Company as defined in the Jumpstart Business Startups Act.

We shall continue to be deemed an emerging growth company until the earliest of—

(A) the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more;

(B) the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under this title;

(C) the date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or

(D) the date on which such issuer is deemed to be a ‘large accelerated filer’, as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto.

As an emerging growth company we are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires Issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls and procedures.

Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company we are exempt from Section 14A and B of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Act.

From our inception June 16, 2010 through July 31, 2014, we raised $69,900 in capital as follows: (1) in private placements by issuing 300,000 shares of common stock (30,000,000 pre-reverse splitshares) at the price of $0.001 per pre-reverse split share to our two directors at the time, and (2) by issuing 1,400 shares (140,000 pre-reverse splitshares) in exchange for $39,900. Subsequent to July 31, 2014, we have raised no further funds other than the advances from our directors and affiliates.

On May 14, 2013, the Company entered into a Share Purchase Agreement (the “SPA”) with the owners of New World Metals S.A.P.I. de C.V. (“New World”) Under the terms of the SPA, the Company issued 100,000 (10,000,000 pre-reverse split) shares of the Company’s common stock to the owners of New World in exchange for 28% of the issued and outstanding shares of New World. New World is a mining

operator in the Chihuahua region of Mexico which owns three working mines; Morelos, La Luna, and Peneto. The shares of the Company were valued at $.285 per pre-reverse split share, which was the price of the shares sold to a third party under a stock subscription agreement in May 2013. The Company is accounting for this investment using the equity method.

On July 4, 2013, the Company entered into an agreement to increase its ownership in New World by 17%, to 45%, by issuing 50,000 shares (5,000,000 pre-reverse splitshares) and agreeing to pay $750,000 to three separate owners of New World. The shares of the Company were valued at $.285 per pre-reverse split share, which was the price of the shares sold to a third party under a stock subscription agreement in May 2013. The Company is accounting for this investment using the equity method. The Company’s share of the losses of New World for the nine month period ended July 31, 2014 was $174,213 (for the year ended October 31, 2013 the loss was $65,167).

On January 15, 2014, the Company converted the $750,000 commitment to 200,000 shares (20,000,000 pre-reverse split shares) of the Company, and on January 17, 2014 these shares were issued. As the fair value of these shares was $1,096,000 (based on the quoted price of the Company’s stock on January 17, 2014), the Company recorded a loss on debt extinguishment of $346,000 in the statement of operations.

On May 15, 2014, the Company converted $120,000 of its promissory notes to 120,000 shares (12,000,000 pre-reverse splitshares) of the Company.

On July 10, 2014, the Company converted $150,000 of its promissory notes to 150,000 shares (15,000,000 pre-reverse splitshares) of the Company

We have no full-time employees other than our management who devote time to our operations. For example, our President, Timothy Ferguson spends approximately 35 hours each month. As our Company develops he will both devote more time to our operations.

While our officer and director is not director or officer of any other company involved in the mining industry there can be no assurance such involvement will not occur in the future. Such involvement could create a conflict of interest.

Foreign Currency and Exchange Rates

Our mineral property is located in the Republic of Philippines.The cost expressed in the geological report on La Carlota is expressed in the local currency, Philippine Pesos (“PHP”).Our investment in New World Minerals S.A.P.I de C.V. is located in Mexico.

DESCRIPTION OF THE PROPERTY

La Carlota Mineral Claim

Our La Carlota mineral claim is a 97.3 hectare parcel located in the Republic of the Philippines.

La Carlota Gold Claim can be identified in the Philippines by the following information:

We are presently in the Explorationstage and there is no assurance that mineralized material with any commercial value exits on either of our properties.

We do not have any ore body and have not generated any revenues from our operations. We have placed our proposed exploration program on hold in order to concentrate fully on participating in the development of the three mineral properties held by New World Metals.

Investment in New World Minerals S.A. P.I de C.V.

New World owns three working mines; Morelos, La Luna, and Peneto located inChihuahua, Mexico. The Company is a 45% shareholder in New World.

In Mexico, we have a 45% interest in New World Metals SAPI (“New World”) which directly owns three working mines; Morelos, La Luna, and Peneto located in Chihuahua, Mexico. The Company is a 45% shareholder in New World. The Company, in addition to the issuance of shares,must make anadditional investment of $750,000 of which $402,990 has been invested as of July 31, 2014. Consequently, the Company, until it completes its investment of $750,000, is at risk of losing a prorated interest in New World.

All three interests are lode mining concessions granted by the State, with the right to explore and exploit. The expiration dates for all titles expire in 2052. The three concessions have been all obtained through the State Ministry of Mines. New World Metals has both the surface and mineral rights to the property. The Concessions are without known proven (measured) or probable (indicated) reserves, as defined under SEC Industry Guide 7, and the exploration program is exploratory in nature.

Authorization and Permits

The transfer of concessions in Mexico must be registered under Mexican law. We have been advised that the transfer of the concessions to New World Metals has been registered with the appropriate Mexican authorities. Under Mexican law, a mining concession gives the holder both exploration and exploitation rights for any minerals found in the property. To maintain the concession, the holder must pay appropriate taxes, perform assessment work, comply with environmental laws, and file a production report each year with the appropriate authorities. Foreign individuals and companies wanting to hold concessions must do so through ownership in a Mexican corporation or through a joint venture and they may not hold mining concessions directly. Because of those requirements, we rely on New World Metals, persons associated with New World Metals, and its employees and consultants in Mexico, to perform all acts necessary to comply with the legal requirements necessary to maintain the concessions.

The Company has been advised that consultants working with New World Metals have obtained all of the approvals required for exploration rights under the concessions.

Mineralization

The mineralization is believed to be a low sulphadation epithermal deposit in quartz and calcite vein structures. The gold and silver on the properties is found in these veins and the host rock is shale.

Morelos Mine:

We hold an indirect 45% interest in this mine through our investment in New World. New World owns a direct interest in this mine. In 2013, major repairs and upgrades have been carried out to the mining structure at the Morelos Mine. Current assays at this new level show 1 gram of Gold and 200 grams of Silver per ton. The Morelos mine is 21 hectares and has gold and silver as its main minerals with assays averaging 2 grams of gold and 600 grams of silver per ton. Currently there is a stockpile of 6,000 tons of ore ready to process. Production is currently 30 tons per day.

Additional Mine details:

|

Name of Property

|

Morelos, Title number: T172230

|

|

Location and access

|

7.4 km southeast of Inde, Durango; Mexico, 2 hour drive from Parral, accessible by highway and 6 km of well-traveled dirt road

|

|

Description / History

|

This mine was in full production in the 1950â?²s. During the 1970â?²s it produced high grade mineral (15 kgs. of Silver)

|

|

Acreage

|

21 Hectares

|

|

Minerals Types

|

Gold & Silver

|

|

Stock Pile Size

|

6,000 tons

|

|

How many Assays

|

Multiple

|

|

Avg. Assay Results

|

600 Gr Silver 2 Gr Gold per ton

|

|

Bulk Sampling rate

|

40 Tons per day.

|

|

Source of power and water

|

Diesel generator, power line approx. 100m from property, water pumped out of mine and stored on site

|

La Luna Mine

We hold an indirect 45% interest in this mine through our investment in New World. New World owns a direct interest in this mine. In 2013 the La Luna Mine has been pumped free of water to the lower levels, and the shaft has been lowered an additional 7 meters. Most recent assays at these levels show 1.5 grams of Gold and 600 grams of Silver. The La Luna mine is 30 hectares and has gold and silver as its main minerals with assays averaging 2.5 grams of gold and 600 grams of silver per ton. Currently there is a stockpile of 3000 tons of ore ready to process. Production is currently 25 tons per day.

Additional Mine details:

|

Name of Property

|

La Luna, Title number: T217204

|

|

Location and access

|

Matamoros, Chihuahua, 42 km south of Parral, 24 km of highway, and 18 km of well-traveled dirt road.

|

|

Description / History

|

This mine was in operation in the 1970â?²s, but only the north zone was mined and only to the third level.

|

|

Acreage

|

30 hectares

|

|

Minerals Types

|

Gold and Silver

|

|

Stock Pile Size

|

3,000 tons

|

|

How many Assays

|

Multiple

|

|

Avg. Assay Results

|

600 Grams Silver; 2.5 Grams Gold. The main vein shows 13 kilos Silver and 25 Grams Gold

|

|

Bulk Sampling rate

|

30 Tons per day

|

Source of power, water Access to electrical grid power on site, water pumped out of mine and stored on site

Peneto Mine

We hold an indirect 45% interest in this mine through our investment in New World. New World owns a direct interest in this mine. The Peneto mine has gold and silver as its main minerals with assays averaging 11 grams of gold and 170 grams of silver per ton. Currently there is a stockpile of 500 tons of ore ready to process. Production is currently at 15tons per day. In 2013, at the Peneto Mine, the shaft was deepened an additional 8 meters, and assays have been ordered on these recent samples.

Additional Mine details:

|

Name of Property

|

Peneto, Title number: T194641

|

|

Location and access

|

Santa Barbara, Chihuahua, access by 6km of well-traveled dirt road

|

|

Description / History

|

Mine in production since 1990, but only explored to the fourth level

|

|

Minerals Types

|

Gold & Silver

|

|

Stock Pile Size

|

500 Tons

|

|

Acreage

|

20 Hectares

|

|

Avg Assay Results

|

11 Grams Gold, 170 Grams Silver

|

|

Bulk Sampling Rate

|

15 Tons per day

|

During the 6 months ended October 31, 2013, New World has spent $141,641 on exploration activities. Our share of this loss was $54,989 which has been recorded in the records as an equity loss in the investment in New World.

Our total daily production or bulk sampling rate was a combined 85 tons per day for all three mines. Based on this daily total, and on a basis of 25 operating days per month, our bulk sampling rate is approximately 25,500 tons per year.

Balance Sheet as of July 31, 2014

Total cash as of July 31, 2014 was $nil

Our working capital was derived solely from capital stock and promissory notes.In addition, the previous directors have made advances to the Company of $40,326. No revenue was generated during these periods.

Total stockholders’ deficiencyas of July 31, 2014, was $653,804. Our issued and outstanding shares as of July 31, 2014, were 811,540 common shares.

The ninemonthsended July 31, 2014compared to the ninemonths endedJuly 31, 2013.

We have incurred an accumulated deficit of $7,115,559 as of July 31, 2014. An analysis of the changes in expenses for theninemonths ended July 31, 2014compared toJuly 31, 2013 is as follows:

|

|

Nine months ended 31-Jul-14

|

Nine months ended 31-Jul-13

|

Difference

|

Explanation

|

|

Impairment loss on Investment

|

352,990

|

30,852

|

322,138

|

Due to lack of forecasted cash flows, the Company has determined this investment is impaired.

|

|

Loss on Debt Extinguishment

|

346,000

|

-

|

346,000

|

A loss was generated when stock was issued to settle the note payable with New World.

|

|

Postage and delivery

|

4,740

|

186

|

4,554

|

Private placement costs

|

|

Printing and reproduction

|

3,200

|

-

|

3,200

|

Private placement costs

|

|

Bank Charges

|

489

|

-

|

489

|

|

|

Director Fees

|

120,595

|

-

|

120,595

|

Director fees paid and accrued.

|

|

Management fees

|

12,000

|

-

|

12,000

|

Fees paid to President

|

|

Rent

|

3,000

|

-

|

3,000

|

|

|

Audit and Accounting

|

25,500

|

9,660

|

15,840

|

Increased activity

|

|

Consulting Fees

|

135,259

|

-

|

135,259

|

Consultants’ expense related to mining activity.

|

|

Impairment on Receivable

|

-

|

-

|

-

|

|

|

Filing fees

|

5,674

|

22,570

|

(16,896)

|

Change of transfer agents in 2013

|

|

Transfer Agent

|

3,164

|

-

|

3,164

|

|

|

Legal

|

36,051

|

-

|

36,051

|

Increased activity with loans and promissory notes

|

|

Travel

|

14,099

|

-

|

14,099

|

Travel to Mexico

|

|

Interest Expense

|

433,429

|

-

|

433,429

|

Stated interest and debt discount amortization.

|

|

Total

|

$ 1,496,190

|

$ 63,268

|

$ 1,432,922

|

|

The three months ended July 31, 2014 compared to the three months endedJuly 31, 2013.

We incurred accumulated net losses since inception of $7,029,040. An analysis of the changes in expenses for the ninemonths ended July 31, 2014 compared to July 31, 2013 is as follows:

|

|

Three months ended

|

Three months ended

|

|

|

|

|

31-Jul-14

|

31-Jul-13

|

Difference

|

Explanation

|

|

Impairment loss on Investment

|

$ 80,000

|

30,852

|

$ 49,148

|

Due to lack of forecasted cash flows, the Company has determined this investment is impaired.

|

|

Management, Director and Consulting

|

$ 15,000

|

-

|

15,000

|

|

|

Audit and Accounting

|

$ 2,500

|

2,600

|

(100)

|

|

|

Bank Charges

|

$ 245

|

-

|

245

|

|

|

Filing fees

|

$ 424

|

2,600

|

(2,176)

|

Increased filing requirements

|

|

Legal

|

$ 9,176

|

-

|

9,176

|

Increased activity with loans and promissory notes

|

|

Postage and Delivery

|

$ 1,029

|

-

|

1,029

|

|

|

Rent

|

$ 1,500

|

-

|

1,500

|

|

|

Travel

|

$ 4,099

|

-

|

4,099

|

Travel to Mexico

|

|

Transfer Agent

|

$ 1,672

|

-

|

1,672

|

Issue of shares

|

|

Interest Expense

|

$ 137,028

|

-

|

137,028

|

Interest on convertible debt

|

|

Total

|

$ 252,673

|

$ 36,052

|

$ 216,621

|

|

As of July 31, 2014, we had cash of $0, accounts payable of $89,364, promissory notes and accrued interest of $524,114, representing a working capital deficit of $653,804. Management has estimated that the need for funds over the next twelve months is as follows:

|

Expense

|

Ref.

|

Estimated

Amount

|

|

|

|

|

|

Accounting and audit

|

(i)

|

$ 30,000

|

|

Edgarizing and XBRL filings

|

(ii)

|

5,000

|

|

Development costs — New World Metals

|

(iii)

|

347,000

|

|

Miscellaneous

|

(iv)

|

100,000

|

|

Promissory notes

|

(v)

|

497,000

|

|

Accounts payable and accrued expenses

|

(vi)

|

145,000

|

|

|

|

1,124,000

|

|

Less: cash on hand as at July 31, 2014

|

|

-

|

|

Estimate of additional cash requirements over the next twelve months

|

|

$1,124,000

|

(i) Accounting and audit

Relates to fees in connection with the preparation of quarterly and annual financial statements and filings on Forms 10-K and 10-Q

(ii) Edgarizing

With the requirement to do an XBRL filing both annually and quarterly the edgarizing cost are projected to increase over previous years.

(iii) Development Costs - Mexico

We were to have invested $750,000 in New World by July 3, 2014. To date we have only invested $403,000. The Company is currently at risk of losing its investment in New World.

(iv) Miscellaneous

We must have a minimum of $100,000 to pay for consultants, offices, travel and other related items.

(v) Promissory Notes

The notes are to third parties and are due on demand.

(vi) Accounts payable — unrelated parties

Our future operations are dependent upon our ability to obtain third party financing in the form of debt and equity and ultimately to generate future profitable operations. As of the date of this Form 10-Q, we have not generated revenues, and have experienced negative cash flow from operations. We may look to secure additional funds through future debt, equity financings or advances from our officers and directors. These sources of financing may not be available or may not be available on reasonable terms.

Trends

From our date of inception we have been aExplorationcompany which has produced no revenue and maybe will not be able to produce revenue. To the knowledge of management we are unaware of any trends or past and future events which will have a material effect upon our Company, its income and business, both in the long and short term. Please refer to our assessment of Risk Factors as noted on page 24.

Critical Accounting Policies and Estimates

In presenting our financial statements in conformity with U.S. generally accepting accounting principles, or GAAP, we are required to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, costs and expenses and related disclosures.

Some of the estimates and assumptions we are required to make relate to matters that are inherently uncertain as they pertain to future events. We base these estimates and assumptions on historical experience or on various other factors that we believe to be reasonable and appropriate under the circumstances. On an ongoing basis, we reconsider and evaluate our estimates and assumptions. Actual results may differ significantly from these estimates.

We believe that the critical accounting policies listed below involve our more significant judgments, assumptions and estimates and, therefore, could have the greatest potential impact on our financial statements. In addition, we believe that a discussion of these policies is necessary to understand and evaluate the financial statements contained in this prospectus.

Estimates and Assumptions

Management uses estimates and assumptions in preparing financial statements in accordance with generally accepted accounting principles. Those estimates and assumptions affect the reported amounts of the assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses. Actual results could vary from the estimates that were assumed in preparing these financial statements.

Mineral claim acquisition and exploration costs

The cost of acquiring mineral properties or claims is initially capitalized and then tested for recoverability whenever events or changes in circumstances indicate that its carrying amount may not be recoverable. Mineral exploration costs are expensed as incurred.

Income Taxes

The Company utilizes the liability method of accounting for income taxes. Under the liability method deferred tax assets and liabilities are determined based on differences between financial reporting and the tax bases of the assets and liabilities and are measured using the enacted tax rates and laws that will be in effect, when the differences are expected to be reversed. An allowance against deferred tax assets is recorded, when it is more likely than not, that such tax benefits will not be realized.

Recent Accounting Pronouncements

In June 2014, the FASB issued ASU 2014-10, “Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements, Including an Amendment to Variable Interest Entities Guidance in Topic 810, Consolidation”. The guidance eliminates the definition of a development stage entity thereby removing the incremental financial reporting requirements from U.S. GAAP for development stage entities, primarily presentation of inception to date financial information. The provisions of the amendments are effective for annual reporting periods beginning after December 15, 2014, and the interim periods therein. However, early adoption is permitted. Accordingly, the Company has adopted this standard as of July 31, 2014.

The Company does not expect the adoption of any other recent accounting pronouncements to have a material impact on its financial statements.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Not Applicable.

ITEM 4. CONTROLS AND PROCEDURES.

Disclosure Controls and Procedures

Under the supervision and with the participation of our management, including the Principal Executive Officer and Principal Accounting Officer, we have evaluated the effectiveness of our disclosure controls and procedures as required by Exchange Act Rule 13a-15(b) as of July 31, 2014(the “Evaluation Date”). Based on that evaluation, the Principal Executive Officer and Principal Accounting Officer have concluded that these disclosure controls and procedures were not effective as of the Evaluation Date as a result of the material weaknesses in internal control over financial reporting.

Disclosure controls and procedures are those controls and procedures that are designed to ensure that information required to be disclosed in our reports filed or submitted under the Exchange Act are recorded, processed, summarized and reported within the time periods specified in the SEC's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in our reports filed under the Exchange Act is accumulated and communicated to management, including our Principal Executive Officer and Principal Accounting Officer, to allow timely decisions regarding required disclosure.

Notwithstanding the assessment that our internal control over financial reporting was not effective and that there were material weaknesses, we believe that our financial statements contained in our Quarterly Report on Form 10-Q for the quarter ended July 31, 2014fairly present our financial condition, results of operations and cash flows in all material respects

Changes in Internal Controls

There were no changes in our internal control over financial reporting during the quarter ended July 31, 2014that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II — OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

There are no legal proceedings to which Monarchyis a party or to which the La CarlotaClaim or New World Metals S.A.P.I. de C.V. is subject, nor to the best of management’s knowledge are any material legal proceedings contemplated.

ITEM 1A. RISK FACTORS

Investing in our common stock involves a high degree of risk. Before you invest in our common stock, you should be aware that our business faces numerous financial and market risks, including those described below, as well as general economic and business risks. The following discussion provides information concerning the material risks and uncertainties that we have identified and believe may adversely affect our business, financial condition and results of operations. Before you decide whether to invest in our common stock, you should carefully consider these risks and uncertainties, together with all of the other information included in this Form 10-Q .

Risks Associated with our Company and our Industry

We are governed by only one person which may lead to faulty corporate governance.

We have one executive officer who makes all the decisions regarding corporate governance. This includes their (executive) compensation, accounting overview, related party transactions and so on. This may introduce conflicts of interest and prevent the segregation of executive duties from those that require Board of Directors’ approval. This may lead to ineffective disclosure and accounting controls. None compliance with laws and regulations may result in fines and penalties. They would have the ability to take any action as they themselves review them and approve them. They would exercise control over all matters requiring shareholder approval including significant corporate transactions. We have not implemented various corporate governance measures nor have we adopted any independent committees as we presently do not have any independent directors.

Our executive officers have other business interests which may limit the amount of time they can devote to our Company and create conflicts of interest.

Our executive officers have other business interests meaning they are unable to work full time for our Company. This might eventually led to business failure. Our President spends approximately 35 hours a month on the affairs of the Company.As our Company commences further exploration programs management will have to spend more time on the affairs of the Company. Unforeseen events may cause this amount of time to become even less. Our officers may also have conflicts of interest as a result of their relationships with the companies they currently are involved with.

We must attract and maintain key personnel or our business will fail.

Success depends on the acquisition of key personnel. We will have to compete with other companies both within and outside the mining industry to recruit and retain competent employees. If we cannot maintain qualified employees to meet the needs of our anticipated growth, this could have a material adverse effect on our business and financial condition.

We are recently incorporated, have a lack an operating history and have yet to make any revenues. If we cannot generate any profits, you may lose your entire investment.

We are a recently incorporated company and have yet to generate any revenues. No profits have been made to date and if we fail to make any then we may fail as a business and an investment in our common stock will be worth nothing. We have no operating history and thus no way for you to measure progress or potential future success. Success has yet to be proved. Currently, there are no operations in place to produce revenue. We are an Exploration Companyand have yet to find or produce sellable product. Financial losses should be expected to continue in the near future and at least until such time that we enter the production stage. As a new business we face all the risks of a ‘start-up’ venture including unforeseen costs, expenses, problems, and management limitations and difficulties. Since inception,

we have accumulated losses of $7,115,559. There is no guarantee, unfortunately, that we may ever be able to turn a profit or locate additional opportunities, hire additional management and other personnel.

We need to acquire additional financing or our company will fail.

We must obtain additional capital or our business will fail. In order to explore the claim and eventually establish operations, we must secure more funds. For instance we require $347,000 immediately to retain our ownership of New World. Should we not raise this $347,000, we risk losing our investment in New World. Currently, we have very limited resources and have already accumulated a net loss. Without operations, we will make no money which may result in complete loss of your investment. Financing is also needed to bring product to market. Financing may be subject to numerous factors including investor sentiment, acceptance of mining claims and so on. We currently have no arrangements for additional financing. We may also have to borrow large sums of money that require substantial capital and interest payments. We must perform mineral explorations on La Carlota Gold Claim to determine if any ore reserves are present.

The probability of a mineral claim having profitable reserves is very rare and our claim, even with large investments, may never generate a profit.

We are dependent upon our mining property for success. All anticipated future revenues would come directly from La Carlota. Should we fail to extract and sell gold from this property, our business will fail. Mineral deposit estimates are imprecise and subject to error, and resource calculations when made may prove unreliable. Assumptions made regarding the supporting data may prove inaccurate and unforeseen events may lead to further inaccuracies. Sample variability, mining and processing adjustments, environmental changes, metal price fluctuations, and law and regulation changes are all factors that could lead to deviances from the original estimations. No assurances can be given that any mineral deposit estimate will ever be reclassified as a reserve. We have no known ore reserves. Despite future investment in exploration activities, there is no guarantee we will locate a commercially viable ore reserve. Most exploration projects do no result in discovery of commercially mineable deposits. With little capital available, we will have to limit our exploration which decreases the chances of finding a commercially viable ore body. Even if gold is identified, La Carlota may not be put into production due to high extraction costs, low gold prices, or inadequate amount and reduced recovery rates. If the exploration activities do not suggest a commercially successful prospect then we may altogether abandon plans to develop the property.

The exploration and prospecting of minerals is speculative and extremely competitive which may make success difficult.

We face strong competition from other mining companies for the acquisition of new properties. New properties increase the probability of discovering a profitable reserve. Most companies have greater financial and managerial resources than we do and can acquire and explore attractive new mining properties. We will face similar difficulties raising new capital to expand operations against the larger, better capitalized competitors. Limited supply and unforeseen demand from larger, more competitive companies may make secure all necessary equipment and materials difficult and may result in periodic interruptions or even business failure. Success depends on a combination of many factors including but not limited to: the quality of management, technical (geological) expertise, quality of land available for exploration and the capital available for exploration.

International operations in the Philippines and Mexico are subject to inherent risks.

Political instability, uncertainty of the economic climate, currency fluctuations, exchange controls and taxation laws may be significant in our business dealing in the Philippines and Mexico. Access to all of the equipment, supplies and materials necessary to begin exploration may not be available and may delay our exploration activities in the Philippines. We have not yet attempted to locate or negotiate with any suppliers of products, equipment or materials but plan to do so when exploration begins. Exchange rate changes between the Philippine currency and the Mexican currency and the U.S. Dollar may also adversely affect our successful operations.

Our future operations may be adversely affected by future governmental and environmental regulations and permitting.

Environmental regulations may negatively affect the progression of operations and these regulations may become stricter in the future. Obtaining licenses and permits from these agencies as well as an environmental impact study for each mining property must be completed before starting mining activities. These are expensive and affect the timing of operations. Pollution can be anticipated with mining activities. If we are unable to comply with current or future regulations, this may expose us to fines, penalties and litigation that could cause our business to fail.

We are vulnerable to the change of the world gold supply, demand and prices.

Gold prices change on a world market beyond our control. A drop in price would adversely affect our ability to generate a profit. All our revenues would be derived from the sale of gold and possibly other precious metals. Changes in the price of gold thus may affect profitability and impede us from being able to afford to continue operations. Gold prices historically have fluctuated widely; price tends to be linked to a number of factors beyond our control such as: various macroeconomic factors (terrorism, political and regional events that may include such, confidence in the global monetary system, rate of inflation expectations, interest rates, US dollar and certain other currency strength); speculative or hedging activities; forward sales by producers, speculators and other holders; central bank lending; sales and purchases of gold; industrial and jewellery demand; and the current supply and demand. These things are impossible for us to predict. Per ounce, gold has been $384 (1995), $279 (2000), $420 (2005), $1,120 (2010), $1,834 (2011), $1,754 (2012), $1,450 (2013) London PM Fix Price for instance. This volatility may favour operations now but should the price drop unexpectedly some or all exploration activities may become economically unfeasible in the future.

We are subject to inherent mining hazards and risks that may result in future financial obligations.

Risks and hazards associated with the mining industry may adversely affect our operations such as, but not limited to political and country risks, industrial accidents, labor disputes, inability to retain necessary personnel or equipment, environmental hazards, unexpected geologic formations, cave-ins, landslides, flooding and monsoons, fires, explosions, power outages, processing problems. Personal injury and death could result as well as property damage, delays in mining, environmental damage, legal liability and monetary loss. We may not be able to obtain insurance to cover these risks at economically reasonable premiums. We do not carry any sort of insurance and may have difficulties obtaining such once operations start as insurance is generally sparse and cost prohibitive.

Risks related to our stock

We may not be able to raise additional capital through future offers of our shares but in doing so will dilute the shares presently issued and outstanding.

Raising additional capital through future offerings of common stock may be necessary for our company to continue going, but there is no guarantee that this will be possible. Doing so will, however, dilute percentage of our Company’s shares presently held by our shareholders. Financing may be achieved by issuing more shares which will increase the number of common shares outstanding. This will decrease the percentage interest held by each of our shareholders. As the total number of outstanding common shares increases, the equity attached to any individual share will decrease causing a dilution of shareholders’ ownership over the company. With little other access to funds currently, we may have to rely on this method substantially to raise additional capital.

Should a public market develop for our stock, future sales of shares may negatively affect their market price.

Even if a market develops, the shares may be sparsely traded and have wide share price fluctuations. If we succeed in receiving a quotation, the liquidity of the stock may be low despite there being a market making it difficult to get a return on the investment. In addition the price also depends on potential investor’s feelings regarding the results of our operations, the competition of other companies’ shares, mineral prices, our ability to generate future revenues, and market perception about future mineral exploration.

Because our stock is a “penny stock”, trading of it may be restricted and limit a shareholder’s ability to buy and sell shares.

As our stock is a penny stock, there are restrictions imposed by the United States Securities and Exchange Commission’s (“SEC”) penny stock regulations and the FINRA’s sales practice requirements. This might limit a shareholder’s ability to buy and sell their shares as broker-dealers may be less likely to engage in transactions of our common shares. A penny stock generally includes any non-NASDAQ equity security that has a market price of less than $5.00 per share. Our common stock is expected to trade well below that mark. Rules 15g-1 through 15g-9 under the Exchange Act impose sale practice and disclosure requirements on certain brokers-dealers who engage in certain transactions involving a “penny stock”

We have not paid nor anticipate paying cash dividends on our common stock.

Cash dividends are not currently paid on our common stock shares nor are they expected to be paid in the near future. We intend to retain our cash for the continued development of our business. Thus, you will not be able to derive any dividend income and your return on investment will solely be based on your ability to sell your shares in a secondary market.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

There has been no change in our securities since the fiscal year ended October 31,2013 except that on January 15, 2014, we issued 200,000 (20,000,000 pre-reverse split) shares to satisfy a debt of $750,000 and on May 15, 2014 $150,000 of convertible notes were converted into 150,000 (15,000,000 pre-reverse split) shares of the Company.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None

ITEM 4. MINE SAFETY DISCLOSURE

Not Applicable

ITEM 5. OTHER INFORMATION

On September 3, 2014, Mr. Jose Perez, appointed Mr. Timothy J. Ferguson and Mr. Ambrocio Lainez-Morales as directors to fill the vacancies on the Board of Directors of the Company. The Board of Directors of the Company now consists of Mr. Jose Perez, Mr. Timothy J. Ferguson, and Mr. Ambrocio Lainez-Morales. Mr. Timothy Fergusonwas appointed as the sole officer of the Company on September 18, 2014.

Mr. Timothy J. Ferguson, aged 51, has been the Owner and President of North By Northwest Ventures Inc., a private Canadian company that is an industry leader in commercial and residential landscape construction working throughout the Greater Vancouver Region and British Columbia for over 19 years. Mr. Ferguson has 25 years of experience in landscaping, land reclamation and environmental mitigation projects. Over this period, Mr. Ferguson has worked with major mining companies, governmental and private developers, and been closely involved in the design, estimating and operational aspects of these projects. Mr. Ferguson attended the British Columbia Institute of Technology where he became certified as a BioScience Technician. He is also a certified horticultural technician in Canada.

Mr. Ambrocio Lainez-Morales, aged 49, is a certified Journeyman Horticultural Landscaper. For the past 18 years, he has worked full-time for North By Northwest Ventures Inc. with Mr. Ferguson. Mr. Lainez-Morales has served in almost every capacity in the company, beginning as a labourer, through to a site superintendent. Currently, Mr. Lainez-Morales’ primary role in this company is Construction Superintendent, where he is responsible for ensuring projects are completed professionally and accurately. Mr. Lainez-Morales also speaks fluent Spanish.

ITEM 6. EXHIBITS

(a) (3) Exhibits

|

The following exhibits are included as part of this report by reference:

|

|

|

3

|

Corporate Charter (incorporated by reference from Monarchy’s Registration Statement on Form S-1 filed on March 15, 2011 Registration No. 333-172825)

|

|

3(i)

|

Articles of Incorporation (incorporated by reference from Monarchy’s Registration Statement on Form S-1 filed on March 15, 2011, Registration No.333-172825)

|

|

3(ii)

|

By-laws (incorporated by reference from Monarchy’s Registration Statement on Form S-1 filed on March 15, 2011, Registration No. 333-172825)

|

|

10.1

|

Transfer Agent and Registrar Agreement (incorporated by reference from Monarchy’s Registration Statement on Form S-1 filed on March 15, 2011 Registration No. 333-172825)

|

|

10.2

|

Share Exchange Agreement dated May 14, 2013 (incorporated by reference to the Form 8 filed on May 14, 2013.

|

|

10.3

|

Share Exchange Agreement dated July 9, 2013 (incorporated by reference to the Form 8 filed on July 9, 2013)

|

|

31.1

|

Certification of Principal Executive Officer filed pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (*)

|

|

31.2

|

Certification of Principal Financial Officer filed pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (*)

|

|

32.1

|

Certification of Principal Executive Officer pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (*)

|

|

32.2

|

Certification of Principal Executive Officer pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 906 of Sarbanes-Oxley Act of 2002 (*)

|

|

101

|

INS XBRL Instant Document (*)

|

|

101

|

SCH XBRL Taxonomy Extension Schema Document (*)

|

|

101

|

CAL XBRL Taxonomy Extension Calculation Linkbase Document (*)

|

|

101

|

LAB XBRL Taxonomy Extension Labels Linkbase Document (*)

|

|

101

|

PRE XBRL Taxonomy Extension Presentation Linkbase Document (*)

|

|

101

|

DEF XBRL Taxonomy Extension Definition Linkbase Document (*)

|

(*) Filed herewith

SIGNATURES