Attached files

| file | filename |

|---|---|

| EX-21.1 - EX-21.1 - CHC Group Ltd. | exhibit211-subsidiaries.htm |

| EX-12.1 - EX-12.1 - CHC Group Ltd. | exhibit121-fixedchargesrat.htm |

| EX-10.22 - EX-10.22 - CHC Group Ltd. | exhibit1022-chcformofindem.htm |

| EX-23.4 - EX-23.4 - CHC Group Ltd. | exhibit234-ascendconsent.htm |

| EX-23.5 - EX-23.5 - CHC Group Ltd. | exhibit235-helivaluesconse.htm |

| EX-10.24 - EX-10.24 - CHC Group Ltd. | exhibit1024-chcnonxemploye.htm |

| EX-23.1 - EX-23.1 - CHC Group Ltd. | exhibit231-consentofernsty.htm |

As filed with the Securities and Exchange Commission on September 22, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CHC Group Ltd.

(Exact name of Registrant as specified in its charter)

Cayman Islands | 4522 | 98-0587405 |

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

CHC Group Ltd. 190 Elgin Avenue George Town Grand Cayman, KY1-9005 Cayman Islands (604) 276-7500 | CT Corporation System 111 Eighth Avenue New York, New York 10011 (212) 590-9070 |

(Address, including zip code, and telephone number, of registrants’ principal executive offices) | (Name, address, including zip code and telephone number, including area code, of agent for service) |

Please send copies of all communications to:

Louis Lehot Michael Tenta Cooley LLP 3175 Hanover Street Palo Alto, California 94304-1130 (650) 843-5949 (650) 843-5636 | William E. Curbow Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, NY 10017 (212) 455-3160 Christopher R. May Simpson Thacher & Bartlett LLP 2 Houston Center – Suite 1475 909 Fannin Street Houston, TX 77010 (713) 821-5666 | Kevin A. Rinker Debevoise & Plimpton LLP 919 Third Avenue New York, New York 10022 (212) 521-7569 | Michael J. O’Neill SVP, Chief Legal Officer Russ Hill VP, Deputy General Counsel, Corporate Secretary and Chief Compliance Officer c/o Heli-One Canada, Inc. 4740 Agar Drive Richmond, BC V7B 1A3, Canada (604) 276-7500 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered (1) | Amount to be Registered(2) | Proposed Maximum Offering Price Per Share | Proposed Maximum Aggregate Offering Price (2) | Amount of Registration Fee |

Convertible preferred shares, $0.0001 par value per share | 100,000 | $1,000 | $100,000,000(3) | $12,880 |

Ordinary shares, $0.0001 par value per share | (4) | (4) | (4) | (4) |

Non-transferable convertible preferred share subscription rights | — | — | N/A | (5) |

Non-transferable non-voting ordinary shares, $0.0001 par value per share | (4) | (4) | (4) | (4) |

Total | $100,000,000 | $12,880 | ||

(1) | This Registration Statement relates to (a) the non-transferable subscription rights to purchase convertible preferred shares of the Registrant, which |

subscription rights are to be issued to holders of the Registrant’s ordinary shares, (b) the shares of convertible preferred shares deliverable upon the exercise of non-transferable subscription rights to be issued in connection with the rights offering described in this Registration Statement, and (c) the ordinary shares issuable upon the conversion of such convertible preferred shares. This Registration Statement also covers any additional convertible preferred shares, ordinary shares and non-voting ordinary shares of the Registrant that may become issuable due to adjustments for changes resulting from stock dividends, stock splits, recapitalizations, mergers, reorganizations, combinations or exchanges or other similar events.

(2) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

(3) | Represents the gross proceeds from the assumed exercise of all non-transferable subscription rights to be issued. |

(4) | There are also registered an indeterminate number of ordinary shares or non-transferable non-voting ordinary shares into which the convertible preferred shares may be converted. Pursuant to Rule 457(i), no separate registration fee is payable where securities and securities into which conversion is offered are registered at the same time and no additional consideration is payable upon conversion. |

(5) | The non-transferable subscription rights are being issued without consideration. Pursuant to Rule 457(g), no separate registration fee is payable with respect to the rights being offered hereby since the rights are being registered in the same registration statement as the securities to be offered pursuant thereto. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement of which this prospectus is a part and which is filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities nor does it solicit an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated September 22, 2014

PROSPECTUS

CHC Group Ltd.

Up to 100,000 Convertible Preferred Shares

Issuable upon the Exercise of Non-Transferable Subscription Rights at $1,000 Per Share

We are distributing, at no charge, to holders of our ordinary shares, par value $0.0001 per share, as of , 2014, who we refer to as our “Legacy Shareholders,” non-transferable subscription rights to purchase up to 100,000 shares of our newly created convertible preferred shares, which we refer to as the “preferred shares,” at a price of $1,000 per share in this rights offering. You will receive one right for each one of our ordinary shares held by you of record as of , 2014. We refer to this date as the “Record Date.” Each right will entitle you to purchase 0.001229 preferred shares at a subscription price of $1,000 per share, provided, that in no event will fractional preferred shares be issued in this rights offering. We refer to this as the “basic subscription right.” If you timely and fully exercise your basic subscription right and 6922767 Holding (Cayman) Inc. (who we refer to as “CHC Cayman”), an entity controlled by affiliates of First Reserve Management, L.P. (“First Reserve”), does not exercise its basic subscription right (as it has notified us that it does not intend to do), you will have an over-subscription privilege to subscribe for up to an additional 0.0016423 preferred shares at a subscription price of $1,000 per share. We refer to this as the “over-subscription privilege.” This rights offering will expire at 5:00 p.m., New York City time, , 2014, which we refer to as the “Expiration Date.” Any right not exercised at or before the Expiration Date will expire without any payment. We currently do not intend to extend the Expiration Date. All exercises of rights are irrevocable.

On August 21, 2014, we entered into an investment agreement with funds managed by Clayton, Dubilier & Rice (who we refer to as “CD&R” or the “Investor”) which contemplates CD&R making an investment of up to $600.0 million in us by means of a purchase of preferred shares in a private placement at a purchase price of $1,000 per share, or the “Private Placement.” The preferred shares to be purchased under the investment agreement consist of (i) upon the first closing, a number of preferred shares, which, if converted to ordinary shares immediately, would constitute 19.9% of our total ordinary shares issued and outstanding immediately prior to the issuance of the preferred shares, less preferred shares issuable in lieu of preferred dividends in cash on the first two preferred dividend payment dates, (ii) upon the second closing, 500,000 preferred shares, less the preferred shares sold upon the first closing, and (iii) upon the third closing, 100,000 preferred shares, less the preferred shares sold in this rights offering. CD&R will hold shares representing approximately 45.0% of our ordinary shares on an as-converted basis immediately after the second closing and shares representing up to approximately 49.6% of our ordinary shares on an as-converted basis immediately after the third closing if there is no participation by our existing holders in this rights offering (in both cases, without taking into account any preferred shares issued or to be issued in respect of amounts accrued as preferred dividends).

We are conducting this rights offering pursuant to the terms of the investment agreement. Subject to the terms of the investment agreement, CD&R is required to purchase in the Private Placement, preferred shares in an amount equal to the shares not purchased pursuant to this rights offering. This rights offering is being made directly by us. We are not using an underwriter or selling agent. We have engaged Computershare Trust Company, N.A., or Computershare, to serve as our subscription agent for this rights offering, and Georgeson Inc., or Georgeson, is acting as information agent. The subscription agent will hold in escrow the funds we receive from subscribers until we complete or cancel the rights offering.

Ordinary shares underlying our preferred shares are quoted on the New York Stock Exchange, or NYSE, under the symbol “HELI.” On September 19, 2014, the closing price of our ordinary shares was $6.24 per share. The rights are not transferable and will not be quoted on the NYSE or any other stock exchange or trading market. There is no minimum subscription amount for each individual holder of our ordinary shares required for such shareholder to participate in this rights offering. Consummation of this rights offering is conditioned upon receiving at least $50.0 million of aggregate demand from Legacy Shareholders.

We cannot give you any assurance that a market for the preferred shares will develop or, if a market does develop, whether it will be sustainable throughout the period when the preferred shares are transferable or at what price the preferred shared shares will trade. In addition, the preferred shares issued in this rights offering will not be transferable for 8.5 years after the first closing of the private placement with CD&R.

Investing in our preferred shares and ordinary shares involves risks. See “Risk Factors” beginning on page 33.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Per Share | Total(1) | |

Subscription Price | $1,000 | $100,000,000 |

Proceeds, before estimated expenses, to us | $1,000 | $100,000,000 |

(1) | Assumes the exercise of rights to purchase all 100,000 preferred shares in this rights offering. |

It is anticipated that delivery of the preferred shares purchased in this rights offering will be made on or about , 2014.

TABLE OF CONTENTS

Cover Photo:Anthony Pecchi

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the U.S. Securities and Exchange Commission, or the SEC. We have not authorized anyone to provide additional information or information different from those contained in this prospectus or in any free writing prospectuses filed with the SEC. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any exercise of the subscription rights. Our business, financial condition, results of operations, and prospects may have changed since that date.

For investors outside the United States: We have not done anything that would permit this rights offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our preferred shares and the distribution of this prospectus outside of the United States.

MARKET, INDUSTRY AND OTHER DATA

The market data and other statistical information (such as the size of certain markets and our position and the position of our competitors within these markets, oil and gas production and market information) used throughout this prospectus and in the documents incorporated by reference into this prospectus are based on independent industry publications, government publications, reports by market research firms or other published independent sources. Some market data and statistical information are also based on our good faith estimates, which are derived from our review of internal surveys, as well as the independent sources listed above. This information may prove to be inaccurate because of the method by which we obtain some of the data for our estimates or because this information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. As a result, although we believe these sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness.

TRADEMARKS

CHC Helicopter and the CHC Helicopter logo are trademarks of CHC Helicopters (Barbados) Ltd., a wholly owned subsidiary of CHC Group Ltd. All other trademarks and service marks appearing in this prospectus are the property of their respective holders. All rights reserved. The absence of a trademark or service mark or logo from this prospectus does not constitute a waiver of trademark or other intellectual property rights of CHC Group Ltd., its subsidiaries, affiliates, licensors or any other persons.

1

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference” the information that we file with it, which means that we can disclose important information to you by referring you to other documents. The information incorporated by reference is an important part of this prospectus. We incorporate by reference the following documents (other than information deemed “furnished” rather than filed in accordance with SEC rules):

• | our Annual Report on Form 10-K for the fiscal year ended April 30, 2014 as filed with the SEC on July 10, 2014; |

• | our Annual Report on Form 10-K/A for the fiscal year ended April 30, 2014 as filed with the SEC on September 15, 2014; |

• | our Quarterly Report on Form 10-Q for the quarter ended July 31, 2014 as filed with the SEC on September 10, 2014; |

• | our Definitive Proxy Statement related to our 2014 annual general meeting of shareholders, as filed with the SEC on July 30, 2014; |

• | our Preliminary Proxy Statement related to our extraordinary general meeting of shareholders, as filed with the SEC on September 16, 2014; and |

• | our Current Reports on Form 8-K filed with the SEC on July 3, 2014 and August 27, 2014. |

We will provide without charge, upon written or oral request, a copy of any or all of the documents that are incorporated by reference into this prospectus and a copy of any or all other contracts or documents which are referred to in this prospectus. Requests should be directed to: Lynn Antipas Tyson, VP, Investor Relations, 4740 Agar Drive, Richmond, BC V7B 1A3, Canada, by telephone at (914) 485-1150 or by email at lynn.tyson@chc.ca. Our SEC filings, including the registration statement of which this prospectus forms a part and the documents incorporated by reference that are listed above, are also available from the SEC’s website at http://www.sec.gov or on our website at http://www.chc.ca. Except with respect to the documents expressly incorporated by reference above which are accessible at our website, the information contained on our website is not a part of, and should not be construed as being incorporated by reference into, this prospectus.

2

PROSPECTUS SUMMARY

This summary highlights some of the information contained in this prospectus and in the documents incorporated by reference in this prospectus and does not contain all of the information you will need in making your investment decision. You should read this entire prospectus and the documents incorporated by reference in this prospectus before making an investment decision. You should also carefully consider the information set forth under “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” included elsewhere in this prospectus.

Unless the context otherwise requires, references in this prospectus to “Company,” “CHC,” “we,” “us” and “our” refer to CHC Group Ltd., a Cayman Islands exempted company, and its subsidiaries. CHC is the parent company of the CHC Helicopter business. Our fiscal year ends on April 30, and we refer to fiscal years based on the end of such period (the fiscal year ended April 30, 2014 is referred to as “fiscal 2014”). Certain operational terms used in this prospectus are defined under the heading “Glossary.”

CHC HELICOPTER

Overview

We are the world’s largest commercial operator of helicopters based on revenue of $1.8 billion in fiscal 2014. We are also the world’s largest commercial operator of heavy and medium helicopters based on our fleet of 233 heavy and medium helicopters as of July 31, 2014. With bases on six continents, we are one of only two global commercial helicopter service providers to the offshore oil and gas industry. Our mission is to provide the highest level of service in the industry, which we believe will enable our customers to go further, do more and come home safely. With over 60 years of experience providing helicopter services, we believe our brand and reputation have become associated with safe and reliable transportation and mission-critical logistics solutions. Our fleet of heavy and medium helicopters, global capabilities and reputation for safety position us to capitalize on anticipated increases in ultra-deepwater and deepwater drilling and production spending by our major, national and independent oil and gas company customers.

Our helicopters are primarily used to facilitate large, long-distance crew changes on offshore production facilities and drilling rigs. We also provide search and rescue services, or SAR, and emergency medical services, or EMS, to government agencies. We maintain a presence in most major offshore oil and gas markets through a network of approximately 70 bases with operations in approximately 30 countries. We cover this expansive and diverse geography with a technologically advanced fleet of 233 helicopters and the expertise to serve customers in ultra-deepwater and deepwater locations. To secure and maintain operating certificates in the many jurisdictions in which we provide helicopter services, we must meet stringent and diverse regulatory standards across multiple jurisdictions, and have an established track record in obtaining and maintaining certificates as well as working with regulators and local partners.

We generate the majority of our oil and gas customer Helicopter Services revenue from contracts tied to our customers’ offshore production operations, which have long-term transportation requirements. A substantial portion of our remaining oil and gas customer Helicopter Services revenue comes from transporting personnel to and from offshore drilling rigs, and we believe this capability allows us to take advantage of expansion in the global ultra-deepwater rig fleet. Approximately 73% to 78% of the flying revenue in our Helicopter Services segment was attributable to fixed monthly charges for the fiscal years ended April 30, 2012, 2013 and 2014.

We also provide maintenance, repair and overhaul, or MRO, services through our Heli-One business to both our own Helicopter Services segment and to third-party customers. Our MRO capabilities enable us to perform heavy structural repairs, and maintain, overhaul and test helicopters and helicopter components globally across various helicopter types. We believe our in-house MRO operations through our Heli-One business enable us to manage our supply chain and maintain our fleet more efficiently, thereby increasing the availability of our helicopters and reducing our overall cost of maintenance. In addition, we are the largest provider of these services (excluding original equipment manufacturers, or OEMs), which allows us to provide our Heli-One customers with comprehensive MRO services across multiple helicopter types and families. Our MRO services include complete maintenance outsourcing solutions, parts sales and distribution, engineering services, design services and logistics support.

3

We report under two operating segments and have a Corporate segment comprised primarily of general and administration costs. Subsequent to April 30, 2014, we changed our internal reporting structure to heighten accountability for and efficiency of maintenance costs and asset utilization. As a result, certain direct maintenance and supply chain costs previously allocated to and reported in the Heli-One segment are now allocated to and reported in the Helicopter Services segment. Under the previous reporting, Heli-One provided maintenance services to the Helicopter Services segment under the terms of a Power by Hour, or PBH, contract. Costs incurred by Heli-One to provide services under the PBH contract were reported in the Heli-One segment, whether they related to maintenance costs performed internally by Heli-One or to services contracted from external third parties. Under the new reporting, all third-party maintenance costs are reflected in the Helicopter Services segment. Maintenance services provided by Heli-One to Helicopter Services are separately reflected for each repair or overhaul of engines and components completed as opposed to a PBH contract basis. Information on segment assets is not reviewed by our chief operating decision maker in making operating decisions and assessing performance.

The following charts show our revenue generated by segment, our HE Rate, our Adjusted EBITDAR excluding special items, our Adjusted EBITDAR margin excluding special items, operating income and operating margin for the fiscal years ended April 30, 2012, 2013 and 2014:

(1) | HE Rate is the third-party operating revenue from our Helicopter Services segment excluding reimbursable revenue divided by a weighted average factor corresponding to the number of heavy and medium helicopters in our fleet. Our heavy and medium helicopters, including owned and leased, are weighted at 100% and 50%, respectively, to arrive at a single HE count, excluding helicopters expected to be retired from our fleet. |

(2) | Adjusted EBITDAR margin excluding special items is calculated as Adjusted EBITDAR excluding special items divided by total revenue less reimbursable revenue. Cost reimbursements from customers are recorded as reimbursable revenue with the related reimbursement expense in direct costs. |

(3) | Operating margin is calculated as operating income divided by total revenue. |

Adjusted EBITDAR, Adjusted EBITDAR excluding special items, Adjusted EBITDAR margin, Adjusted EBITDAR margin excluding special items, Adjusted net loss and HE Rate are non-GAAP financial measures. We have chosen to include Adjusted EBITDAR, and Adjusted EBITDAR excluding special items, as we consider these measures to be significant indicators of our financial performance and we use these measures to assist us in allocating available capital resources. Adjusted EBITDAR is defined as earnings before interest, taxes, depreciation, amortization, helicopter lease and associated

4

costs, asset impairments, gain (loss) on disposal of assets, foreign exchange gain (loss) and other financing income (charges) or total revenue plus earnings from equity accounted investees, less direct costs excluding helicopter lease and associated costs, and general and administration costs. Adjusted EBITDAR excluding special items excludes stock-based compensation triggered by our initial public offering and expenses related to the initial public offering, including costs related to restructuring our compensation plan. For additional information about our segment revenue and Adjusted EBITDAR, including a reconciliation of these measures to our consolidated financial statements, see Note 25 of the annual audited consolidated financial statements for the fiscal years ended April 30, 2012, 2013 and 2014 included in our Annual Report on Form 10-K/A for the fiscal year ended April 30, 2014 incorporated by reference into this prospectus.

We have chosen to include Adjusted net loss as it provides us with an understanding of the results from the primary activities of our business by excluding items such as stock-based compensation triggered by the initial public offering and expenses related to the initial public offering, including costs related to restructuring our compensation plans, asset dispositions, asset impairments, loss on debt extinguishment, the revaluation of our derivatives and foreign exchange gain (loss), which is primarily driven by the translation of U.S. dollar balances in entities with a non-U.S. dollar functional currency. This measure excludes the net earnings or loss attributable to non-controlling interests. We believe that this measure is a useful supplemental measure as net loss includes these items, and the inclusion of these items is not meaningful indicators of our ongoing performance. For additional information about our Adjusted net loss, including reconciliation to our consolidated financial statements included under “Summary of Results of Operations” in our Annual Report on Form 10-K/A for the fiscal year ended April 30, 2014 incorporated by reference into this prospectus. We have chosen to include the HE Rate, which is the third-party operating revenue from the Helicopter Services segment excluding reimbursable revenue divided by a weighted average factor corresponding to the number of heavy and medium helicopters in our fleet. Our heavy and medium helicopters, including owned and leased, are weighted at 100% and 50%, respectively, to arrive at a single HE count, excluding helicopters expected to be retired from the fleet. We believe this measure is useful as it provides a standardized measure of our operating revenue per helicopter taking into account the different revenue productivity and related costs of operating our fleet mix of heavy and medium helicopters.

Our Market Opportunity

We believe trends in the offshore oil and gas industry will positively affect the market and demand for our helicopter services. As the major, national and independent oil and gas companies seek to replace reserves and grow production, we believe they will continue to explore for, develop and produce oil and gas from deeper waters and at locations that are further offshore, which requires more complex transportation and logistics services. Oil and gas companies are also adopting increasingly complex offshore oilfield services and solutions that require more personnel to operate. Additionally, regulatory bodies are increasing their own oversight functions, and crews are being rotated on and off at periodic intervals. We believe these factors will drive an increase in the number of personnel needing to be transported to and from offshore facilities. Helicopter service is the most efficient and often the only viable or permitted form of transportation in many of these jurisdictions due to the distance from shore of the platforms and environmental conditions offshore, particularly in the North Sea, where a sea-faring vessel may take a substantially longer time to cover the same distance and in significantly less comfortable conditions, with greater logistical risks of transporting workers from vessel to platform.

We believe that the adoption of more complex services on ultra-deepwater and deepwater installations, increased regulatory oversight of these installations and more frequent rotation of increasingly larger crews at regular intervals will further drive customer demand for heavy and medium helicopters, which comprise all of our fleet. Based on our experience, heavy and medium helicopters are favored by customers with ultra-deepwater and deepwater transportation needs due to their greater range, passenger capacity, comfort, enhanced passenger safety systems and ability to fly under a variety of conditions. In recent years, in our experience, the demand for new commercial medium and heavy helicopters has outpaced their supply, a trend we believe will continue. As a result, we expect the market dynamics for our helicopter services to remain strong. Furthermore, we believe that our size and scale afford us greater operational and commercial flexibility when purchasing new helicopters and helicopter parts, allowing us to continue to grow our business in response to market opportunities.

Based on our experience operating in the industry, the market for MRO services is highly fragmented. We believe we are the only independent non-OEM provider of MRO services with a global footprint. Moreover, we believe our status as the largest commercial operator that purchases heavy and medium helicopters has positioned us to obtain licenses from all of the major manufacturers to conduct a full range of MRO services across a wide array of models of helicopters used in our industry. We believe that our geographic reach, combined with the related licenses, offers us a significant opportunity to grow our Heli-One business with our third-party customers. As demand for helicopter services grows in conjunction with growth in ultra-deepwater and deepwater drilling and production, we expect that a corresponding increase in flying hours should lead to greater demand for MRO services.

5

Our Operations

We conduct operations in approximately 30 countries through a network of approximately 70 bases on six continents, including a global operations center located in Irving, Texas. We believe our global operations center is the first of its kind in our industry, allowing us to centrally coordinate flight schedules, pilot rostering, training, fleet management and maintenance from a single location. Representatives from helicopter manufacturers work on-site at our global operations center alongside our own employees to resolve maintenance issues and return helicopters to service. Our global operations center leverages new information technology systems to promulgate best-in-class practices and procedures throughout our company.

We assist our customers with logistics solutions to manage rotation of their crews, as many of our offshore oil and gas customers are required by law and collective labor agreements to change crews every seven to 14 days. For the fiscal year ended April 30, 2014, we operated approximately 86,000 flights worldwide, carrying in excess of one million passengers. As offshore operators have moved further from shore and become more remote, crews have grown larger and taken on functions that previously relied on shore based support. To accommodate the change out of larger crews, a helicopter would have to make multiple trips or several helicopters would have to be used. Computerized logistics systems in our global operations center help us provide seamless coordination between our regional bases and our customers, matching customer needs with helicopters, engineer and pilot availability which enables efficient crew changes, while maintaining compliance with relevant regulations. We continue to enhance our logistical systems and are implementing a roll-out of our long-term crew planning and scheduling program, our Airline Information Management System to further improve customer service levels. This system improves crew scheduling, the integration of crew rosters, allows integrated training planning and enhances key performance indicator reporting to improve crew and helicopter productivity. In addition, we have advanced systems in place to monitor and maintain equipment. In the event a helicopter requires unforeseen repairs or replacement of parts, we have the ability to provide immediate support to ground personnel to make a repair as well as a dedicated team available to identify the most efficient manner to source any replacement parts. We believe that our global operations center, combined with our expertise in crew logistics and equipment availability as well as our robust compliance programs, allow us to offer superior and differentiated service to our customers.

Our MRO operations are conducted through our Heli-One business, which provides quality and cost control for maintenance, repair, and overhaul of our own fleet as well as comprehensive outsourced MRO services to third-party customers. We maintain four principal Heli-One centers for our global MRO operations, including Delta, British Columbia (Canada), Fort Collins, Colorado (USA), Rzeszow (Poland) and Stavanger (Norway). We maintain a strategic inventory of spare parts, providing us the ability to respond quickly and efficiently to unplanned maintenance events. We believe our focus on speed and efficiency allows us to provide better service at lower cost. Approximately 28%, 34% and 38% of our third-party Heli-One revenue in the 2012, 2013 and 2014 fiscal years, respectively, was derived from PBH contracts, where the customer pays a ratable monthly charge, typically based on the number of hours flown, for all scheduled and un-scheduled maintenance.

Safety and Regulatory Compliance

We strive to exceed the stringent safety and performance audit standards set by aviation regulatory bodies and our customers. We have established an in-house flight safety group that is responsible for our compliance with safety standards within our organization, standardizing base operating procedures, compliance with government regulations and customer requirements, and educating and training our flight crews. Over the five year period ended July 31, 2014, according to our safety records, we had a rolling average of 0.38 accidents per 100,000 flight hours, a much lower than average rate reported for civilian twin engine helicopters and an even smaller fraction of the rate reported for offshore helicopter operations generally, per industry reports. We also host a highly regarded annual international safety summit, attended by our customers, manufacturers, competitors and regulators, which is a manifestation of our commitment to safe operations.

A key to maintaining our strong safety record is having a highly qualified and experienced workforce. Our pilots average in excess of 3,000 flight hours of experience, and many of them carry endorsements to operate more than one type of helicopter. Our mechanics are highly experienced and receive ongoing training from helicopter manufacturers.

In addition to safety regulations, most of the countries in which we conduct flying operations have laws, with typically complex requirements, that require commercial operators to hold either or both an operating license and an air operator certificate, or AOC. We believe our track record of safety and experience working with regulators will enhance our ability to obtain needed licenses/certificates as we continue to grow.

6

Our Fleet

Helicopters are generally classified as light (3 to 7 passengers), medium (8 to 15 passengers) and heavy (16 to 26 passengers). We believe heavy and medium helicopters are favored by our customers and are best suited for crew change transportation services on oil and gas production facilities and drilling rigs due to their greater range, higher passenger capacity, enhanced passenger safety systems and ability to fly under a broader variety of conditions than light helicopters. In addition, heavy and medium helicopters have twin engines and typically two pilots, making them safer for longer flights. As a result, larger helicopters generally command higher pricing and earn higher margins compared to smaller helicopters.

We operate the largest fleet of heavy and medium commercial helicopters serving the offshore oil and gas industry, with 233 helicopters as of July 31, 2014. Our fleet is comprised purely of heavy and medium helicopters, which we believe optimally positions us to respond to opportunities in the high growth ultra-deepwater and deepwater market. Over the last nine years, we have modernized and expanded our fleet significantly, and we continue to invest to meet customer demand for newer heavy and medium helicopters. We have strong longstanding operating relationships with the four major OEMs, Airbus Helicopters, Sikorsky, AgustaWestland and Bell, and have helicopters manufactured by each of them in our fleet. This diversity ensures that we are not overly reliant on any one model or manufacturer, while still giving our fleet critical mass across various helicopter types, resulting in fleet management, maintenance and training efficiencies.

The model life cycle for helicopters spans multiple decades. Individual components, which represent a large majority of a helicopter’s value, are frequently replaced to meet regulatory requirements or safety standards. In addition, there is an active secondary market for helicopters supported by independent appraisers and valuation experts.

As of April 30, 2014, our fleet was valued at approximately $3.0 billion based on the average of 2014 third-party appraisals of fair market value by Ascend, a Flightglobal Advisory Service, part of Reed Business Information Ltd., and HeliValue$, Inc., consisting of approximately $2.1 billion of value attributable to heavy helicopters and approximately $898 million of value attributable to medium helicopters. As of April 30, 2014, the average age of our fleet was 11 years. The Airbus EC225, Sikorsky S92A, AgustaWestland AW139 and Sikorsky S76C++, which have been the core part of our capital investment program in recent years, represent approximately 79% of our total fleet value as of April 30, 2014.

As of July 31, 2014, our fleet was comprised of the following helicopters:

Helicopter Type | Total | Cruise Speed (kts) | Approximate Range (nmi) | Passenger Capacity | Maximum Weight (lbs) | ||||

Helicopter Type | |||||||||

Heavy: | |||||||||

Sikorsky S92A | 42 | 145 | 400 | 19 | 26,500 | ||||

Airbus Helicopters EC225 | 37 | 145 | 400 | 19 | 24,250 | ||||

Airbus Helicopters (AS332 L, L1, and L2) | 37 | 130-140 | 250-350 | 17-19 | 18,000-20,500 | ||||

Total Heavy | 116 | ||||||||

Medium: | |||||||||

AgustaWestland AW139 | 39 | 145 | 280 | 12-15 | 15,000 | ||||

Sikorsky S76C++ | 23 | 145 | 220 | 12 | 11,700 | ||||

Sikorsky S76C+ | 20 | 145 | 175 | 12 | 11,700 | ||||

Sikorsky S76A++ | 15 | 135 | 110-130 | 12 | 10,800-11,700 | ||||

Bell 412 | 8 | 125 | 135 | 13 | 11,900 | ||||

Airbus Helicopters AS365 Series | 7 | 120-145 | 80 | 11 | 9,500 | ||||

Airbus Helicopters EC135/145/155 | 5 | N/A(1) | N/A(1) | N/A(1) | N/A(1) | ||||

Total Medium | 117 | ||||||||

Total Helicopters | 233 | ||||||||

(1) | EMS only |

As of July 31, 2014, we have committed to purchase 25 new helicopters and the total required additional expenditure for these helicopters is approximately $615.2 million. These helicopters are expected to be delivered in fiscal 2015 ($270.5 million), 2016 ($229.0 million) and 2017 ($115.7 million) and will be deployed in our Helicopter Services segment. We

7

intend to enter into leases for these helicopters or purchase them outright upon delivery from the manufacturer. Additionally, we have committed to purchase $53.2 million of helicopter parts by October 31, 2015 and $100.0 million of heavy helicopters from Airbus Helicopters by December 31, 2016.

The following table shows the expected delivery dates of the helicopter purchase commitments referred above:

Number of helicopters purchase commitments (i) | ||

2015 | 12 | |

2016 | 9 | |

2017 | 4 | |

25 | ||

(i) Does not include helicopters related to our commitment to purchase $100.0 million of heavy helicopters from Airbus Helicopters or our intention to lease helicopters from an independent lessor with two planned deliveries in fiscal 2015.

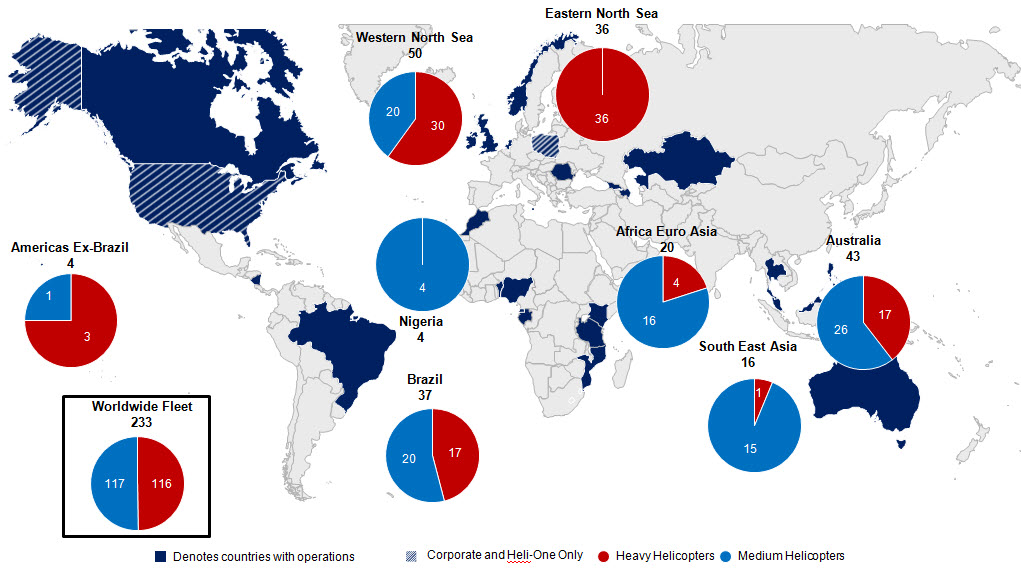

The following map illustrates the geographic distribution of our helicopters as of July 31, 2014 and countries in which we operated over the prior 12 months:

Note: Fleet count as of July 31, 2014. Worldwide fleet includes 23 helicopters held for retirement, dry lease or post-delivery modification.

Customers and Contracts

Our current oil and gas customer base is comprised of major, national and independent oil and gas companies. These customers generally enter into multi-year contracts for our services. The majority of our customer contracts provide for revenues based on fixed-monthly charges and hourly flight rates. In addition, our contracts generally require the customer to either provide or to be charged for fuel, which significantly limits our operational exposure to volatility in fuel costs.

Our contracts with offshore oil and gas customers are typically for periods of four to five years, and normally carry extension options of one to five years. Our contracts with government agencies for SAR and EMS services are typically for periods of eight to ten years, and we believe government agencies will increasingly look to outsource this function. Based on our experience, we believe that contracts are awarded based on a number of factors, including technical capability, operational effectiveness, price, strength of relationships, availability of fleet types and other technical mission requirements, quality of customer service and the safety record of the helicopter service provider. We believe that maintaining a strong safety record is

8

imperative for our customers, and that our safety record and safety culture at all levels of our organization are key to maintaining and growing our business.

Longer-term contracts are ordinarily awarded through competitive bidding processes. An incumbent operator commonly has a competitive advantage when pursuing future business with that customer because of its relationship with the customer, knowledge of operating site characteristics, pre-existing investment in support infrastructure and demonstrated ability to meet defined service-level requirements. Also, customers often prefer to avoid start-up costs associated with switching to another operator. In the fiscal year ended April 30, 2014, we have retained approximately 94% of offshore oil and gas customer

contracts that were up for renewal or extension.

Our key customers include many leading oil and gas companies around the world. The following table sets out our top ten oil and gas customers based on revenue for our fiscal year ended April 30, 2014 and geographic regions served. Our top two customers for the year ended April 30, 2014 were Statoil and Petrobras, accounting for 14% and 13% of our revenues respectively. No other single customer accounted for more than 10% of our revenues during this period.

Geographic regions served by CHC | |||||||||||

Company | Credit rating (Moody’s / S&P) | North Sea | Brazil | Australia | SE Asia | Africa-Euro Asia | |||||

| A2 / A | l | l | l | |||||||

| Aa1 / AA | l | l | ||||||||

| A1 / A | l | l | l | |||||||

| A3 / A | l | l | ||||||||

| Baa1/BBB- | l | l | ||||||||

| Aa1 / AA | l | l | l | l | ||||||

| Aa2 / AA- | l | l | ||||||||

| Aa1 / AA- | l | l | l | l | ||||||

| Baa1/BBB+ | l | |||||||||

| A3/A- | l | |||||||||

For our fiscal year ended April 30, 2014, the customers in the table above constituted approximately 67% of our total revenues.

The largest customer of our Heli-One segment is our Helicopter Services segment. Our Heli-One contracts with third parties include military, coast guard, parapublic and other governmental organizations, and other helicopter operators. Revenues can be earned for services provided individually or, in many cases, as part of multi-year, complete maintenance outsourcing agreements.

Competitive Strengths

We believe that we possess the following competitive strengths, which will enable us to continue to grow our business globally:

• | The world’s largest new generation fleet of heavy and medium helicopters. We are the world’s largest commercial operator of helicopters based on revenue of $1.8 billion in fiscal 2014. We are also the world’s largest commercial operator of heavy and medium helicopters based on our fleet of 233 heavy and medium helicopters as of July 31, 2014. Our premium fleet has enabled us to establish a prominent position as a helicopter services provider to the fast-growing ultra-deepwater and deepwater markets. Our fleet includes some of the newest and most advanced civilian helicopters, including the Airbus Helicopters EC225, Sikorsky S92A, AgustaWestland AW139 and Sikorsky S76C++, which together represent approximately 79% of our total fleet value as at April 30, 2014 and which we believe helps us attract and retain highly experienced pilots and maintenance engineers. We have modernized and expanded our |

9

fleet significantly over the last nine years, and we continue to invest to meet customer demand. As of July 31, 2014, we have plans to acquire 25 new heavy and medium helicopters from multiple OEMs, and $100.0 million of heavy helicopters from Airbus Helicopters, with delivery dates between fiscal 2015 and 2017. The size of our fleet and diversity across multiple helicopter types enables us to meet the varied operational requirements of our customers.

• | Largest global footprint servicing the offshore oil and gas market. We believe we are the most globally diverse participant in our industry, with operations in approximately 30 countries. Our broad geographic coverage and experience entering new markets enables us to respond quickly and efficiently to new business opportunities, by leveraging our knowledge of, and experience with, international safety standards, local market regulations and customs. Additionally, our multi-national footprint and scale allow us to secure contracts and global framework agreements where our largest customers are seeking helicopter operators that can provide one standard of service in many locations around the world. |

• | Strong long-term relationships with leading oil and gas producers. We believe we have strong relationships with our top ten customers, which include Statoil, Petrobras, BP, Shell, ConocoPhillips, Total, ENI and other oil and gas producers, many of which we have continuously served for over a decade. We establish relationships with our customers at both the regional and global level, which positions us to grow our business as our customers grow. We believe this enables us to better understand our customers’ growth objectives and positions us to participate in contract tenders. Our strong customer relationships and track record of performance have allowed us to achieve a 94% retention rate on contract renewals and extensions and a 77% win rate on all contract tenders by count over the 12 month period through April 30, 2014. |

• | Safety record and reputation. We have implemented a single safety management system worldwide and continue to meet or exceed the stringent safety and performance audits conducted by our customers. Over the five year period ended July 31, 2014, according to our safety records, we had a rolling average of 0.38 accidents per 100,000 flight hours, a much lower than average rate reported for civilian twin engine helicopters and an even smaller fraction of the rate reported for offshore helicopter operations generally, per industry reports. Our pilots average in excess of 3,000 hours of flight experience, and many of them carry endorsements to operate more than one type of helicopter. Our mechanics are highly experienced and receive ongoing training from helicopter manufacturers. We also host a highly regarded annual CHC Safety & Quality Summit, with international attendance from our customers, manufacturers, competitors and regulators, which is a manifestation of our commitment to safe operations. |

• | Our innovative transformation initiatives are driving standardization, efficiencies and cost savings. For the past four years, we have implemented a comprehensive review of our operations and organizational structure through our transformation initiatives, with the goal of consolidating, strengthening and standardizing our capabilities, tools, processes and systems globally, while lowering overhead costs. We recently designed and launched our global operations center and implemented new IT systems across our operations to drive highly integrated processes, including fleet management, flight scheduling, maintenance and supply chain, which we believe allow us to offer superior and differentiated services to our customers and our personnel in the field. |

• | Only global commercial helicopter operator with in-house MRO operations through Heli-One. Our Heli-One division is the market leader in helicopter MRO services by a non-OEM. Our Heli-One segment enhances the quality control and cost competitiveness of our maintenance processes, and improves the flight availability of our fleet. We have the capability to service and support multiple models from all the major OEMs including Airbus Helicopters, Sikorsky, AgustaWestland and Bell, which allows us to offer a comprehensive outsourced maintenance solution to other helicopter operators, and to diversify our revenue stream. |

• | Experienced management team. Our chief executive officer and senior executives have extensive experience at CHC managing our helicopter services business and Heli-One business and with managing major, international public corporations focused on technology, IT services and operational excellence. We believe our management’s breadth of experience, equity ownership and incentive plans align their objectives with those of our shareholders. |

Our Business Strategy

Our goal is to enhance our leadership position and create value for our shareholders by consistently and efficiently providing safe, reliable value-added services to our customers while maximizing our return on assets, earnings and cash flow. To achieve this goal, we intend to focus on the following key strategies:

• | Achieve the highest levels of safety and performance. Our overall strategy is deeply rooted in a foundation of safety. We will continue to build on our highly safety-conscious culture where the safety of our passengers and employees is |

10

embedded in everything we do. We will invest in technology, processes, training and talent to continuously improve our capabilities to enable us to achieve the highest level of safety performance and standards.

• | Continue to apply a disciplined, returns-based approach to evaluating growth opportunities. We have implemented a rigorous, financial returns-based approach throughout our organization that is fundamental to how we evaluate growth opportunities. Our centralized decision-making framework is critical to ensuring that our clearly defined return thresholds are applied in all key investment-making decisions, such as setting contract terms, pursuing expansion into new regions and acquiring new helicopters. This disciplined and coordinated methodology of pursuing the highest risk-adjusted growth opportunities will continue to drive our expansion strategy and enable us to make rational capital investment decisions and maximize our returns as we continue to grow. |

• | Continue to invest in our fleet of heavy and medium helicopters to meet customer demand and maximize our long-term financial returns. We will continue to upgrade our fleet and improve our fleet size and mix to reflect the latest technologies and larger helicopters demanded by our customers, while selectively divesting older helicopters. We will continue to manage our fleet to provide optimum service to the growing ultra-deepwater and deepwater markets, where larger helicopters are preferred by our customers for their reliability, comfort and efficiency. The demand for helicopter services combined with continued constraints on new helicopter supply will allow us to focus our investments in our fleet on opportunities with the highest strategic and financial value. We believe our global fleet management strategy allows us to deploy our assets to our most attractive opportunities worldwide. |

• | Expand our operations in high growth markets. We have existing operations in what we believe are some of the highest growth markets for helicopter services, such as Brazil and Nigeria. We intend to continue to grow in these regions as we believe the demand for our services continues to grow. We will also continuously evaluate entry into new markets with high projected growth rates which are often characterized by isolated locations and greater operating distances from shore. We have a track record of successfully entering new markets, which requires experienced pilots and expertise in assessing risks, obtaining permits, partnering with local businesses, working with regulators and establishing new flight bases. We believe our customers recognize the importance of our track record as well as our standardized and globally-integrated operational support, maintenance and IT systems, and our ability to realize operational efficiencies across numerous and often remote jurisdictions. We believe that owning the world’s largest fleet of heavy and medium helicopters positions us to continue to grow our business in high growth ultra-deepwater and deepwater markets. |

• | Leverage the differentiated attributes of our Heli-One segment to expand the depth and global reach of our Heli-One platform. We believe we are the largest non-OEM MRO vendor servicing the industry today and we believe that our Heli-One segment provides us with a competitive and differentiating advantage. The breadth of services we provide and our operational scale has enabled us to establish unique supply chain management expertise that we will leverage to provide superior service levels to our customers. We will capitalize upon our access to key OEM licenses to bolster our strategic inventories and to improve the level of integration with our own internal operations, as well as to expand our third-party revenues. We will seek to grow our third-party Heli-One business, as we believe it offers an opportunity to generate attractive returns on limited incremental capital investment. Given the fragmented nature of the global MRO market, we will also pursue targeted strategic acquisitions to enhance our position in key regions or markets and to capture new, unique service offerings for our customers. |

• | Utilize knowledge and enterprise management systems to hone our customer service. We seek to build a customer-centric culture responsive to our customers’ unique requirements. As part of our operational transformation efforts and investment in IT systems, we have expanded our capabilities to measure and report key performance metrics that are most critical to our customers. Our commercial and customer support teams maintain a regular dialogue across multiple disciplines within our customers’ organizations to share these performance metrics as well as to discuss our customers’ future plans. This enables us to better understand our customers’ needs and how well we are addressing them. We believe that developing and maintaining such a deep understanding of our customers’ requirements enables us to provide superior customer-centric services and ideally positions us to grow with our customers as they expand their operations. |

• | Continue to implement innovative transformation initiatives to pursue industry leading operating efficiency and superior returns. We believe innovation is core to our culture. We believe we are the first in the industry to establish a global, in-house MRO capability through Heli-One and a global operations center, and to implement innovative IT platforms to standardize global processes. We have established leadership in innovative transformation as a firmwide mindset with the goal of continuously improving operating efficiency, identifying cost savings and enhancing returns. |

11

Recent Developments

Following an incident in October 2012 that led to the widespread suspension of all over-water Airbus Helicopters EC225 helicopters, extensive investigation by the manufacturer, independent analysis and Authority-approved modifications to the helicopters were completed and we commenced in July 2013 the phased re-introduction of our EC225 fleet to full service. Full regular service on the Airbus Helicopters EC225 fleet was completed during the fourth-quarter of the 2013 calendar year in conjunction with robust interim safety measures.

On June 11, 2014, the UK Air Accident Investigation Branch, or UK AAIB, issued its final report into this and a related May 2012 incident by another operator. A full copy of the final report is available at http://www.aaib.gov.uk/publications/formal_reports/2_2014_g_redw_g_chcn.cfm. Neither the foregoing website nor the information contained on the website nor the report accessible through such website shall be deemed incorporated into, and neither shall be a part of, this prospectus or the registration statement of which it forms a part. The root cause of the incident was attributed to the bevel gear vertical shaft design. In April 2014, Airbus Helicopters announced that a redesigned vertical gear shaft had been approved by the European Aviation Safety Agency, or EASA. The retrofitting of the redesigned gear shaft has begun, with the expectation that this retrofit program will be completed within twelve months.

On August 23, 2013, one of our Airbus Helicopters AS332L2 heavy helicopters was involved in an accident near Sumburgh in the Shetland Isles, United Kingdom. Authorities subsequently confirmed four fatalities and multiple injuries among the 16 passengers and two crew members on board. The cause of the accident is not yet known and full investigations are being carried out in conjunction with the UK AAIB, and Police Scotland.

Despite engineering and operating differences between the AS332L2, AS332L, AS332L1 and EC225 helicopters, for a limited period, we voluntarily canceled all our flights worldwide on those helicopter types (except for those involved in life-saving missions), out of respect for our work force and those of our customers, and to evaluate any implications associated with the accident.

Within a week of the accident, after consultation with our principal regulators, the manufacturer, customers, union representatives and industry groups, and based on findings that there was no evidence to support a continuation of our temporary voluntary suspension and, on recommendations to return to active service all variants of these helicopter types, we resumed commercial passenger flights with all of these helicopter types to and from offshore oil and gas installations worldwide, excluding those in the UK with AS332L2 helicopters. We resumed AS332L2 commercial flights in the UK in mid-September 2013. All of these helicopter types have now been returned to commercial operations worldwide.

On October 18, 2013, the UK AAIB issued a special bulletin about its investigation on the causes of the AS332L2 accident. A full copy of the special bulletin is available at http://www.aaib.gov.uk/publications/special_bulletins/s1_2014___as332_l2_super_puma__g_wnsb.cfm. Neither the foregoing website nor the information contained on the website nor the report accessible through such website shall be deemed incorporated into, and neither shall be a part of, this prospectus or the registration statement of which it forms a part. In the special bulletin, the UK AAIB confirmed that, to date, the wreckage examination and analysis of recorded data as well as information from interviews of people involved in the accident have not found any evidence of a technical fault that could have been causal to the accident. The investigations by the UK AAIB and Police Scotland are ongoing. On January 23, 2014, the UK AAIB issued a further special bulletin (S1/2014) on the accident which contained enhanced pre-flight safety briefing recommendations relating to the use of the passenger re-breather; these recommendations were implemented in all regions where this equipment was in use. It is too early to determine the extent of the impact of the accident on our results of operations or financial condition based on information currently available.

On February 20, 2014, the UK Civil Aviation Authority (CAA) published its safety review of offshore oil and gas public transport helicopter operations (CAP 1145). A full copy of the review is available at http://www.caa.co.uk/application.aspx?catid=33&pagetype=65&appid=11&mode=detail&id=6088. Neither the foregoing website nor the information contained on the website nor the report accessible through such website shall be deemed incorporated into, and neither shall be a part of, this prospectus or the registration statement of which it forms a part. The report's prescribed actions and recommendations were the result of a comprehensive review of offshore helicopter operations, undertaken in conjunction with the Norwegian Civil Aviation Authority and the EASA. The UK CAA identified several actions intended to minimize the risk of further accidents and to improve the survivability in the event of an accident; those actions/recommendations included prohibiting helicopter flights in certain sea conditions, except in response to an emergency, relative to the sea conditions for which the helicopter has been certificated, and only allowing passengers to be seated next to push-out window exits unless all passengers are equipped with enhanced emergency breathing systems, or EBS, or the helicopter is fitted with side floats. The review also identified several other areas of activity to further enhance the levels of safety in the offshore helicopter industry. In May 2014, the UK CAA announced certain changes to the timing of the implementation of the measures within this report, which

12

included the delay of seating restrictions until September 1, 2014 to allow for the phased introduction of EBS; this introduction has now been completed as planned.

On July 3, 2014, one of our helicopters conducted a medivac flight of a reportedly ill oil worker from the Troll A platform in the North Sea. During the flight, the patient freed himself from his safety belts and exited the helicopter through an emergency window at 600 meters above the sea. His remains were subsequently recovered from the sea. We are fully cooperating with the police and aviation authorities in their investigation.

Financing Transactions

On August 21, 2014, we announced the entry into definitive agreements with funds managed by CD&R for aggregate investment of up to $600.0 million in us through the Private Placement issuance of our preferred shares.

The Private Placement will involve three closings: (a) upon the first closing, CD&R will purchase a number of preferred shares, which, if converted to ordinary shares immediately, would constitute 19.9% of the total ordinary shares issued and outstanding immediately prior to the issuance of the preferred shares, less preferred shares issuable in lieu of preferred dividends in cash on the first two preferred dividend payment dates, (b) upon the second closing, CD&R will purchase 500,000 preferred shares less the preferred shares purchased upon the first closing, and (c) upon the third closing, CD&R will purchase 100,000 preferred shares, less the preferred shares sold in this rights offering. If no preferred shares are purchased in this rights offering, CD&R’s total investment will amount to an aggregate of $600.0 million. Consummation of the transactions contemplated by such agreements is subject to the satisfaction of closing conditions, including (i) with respect to the second and third closings, the approval of the issuance of the preferred shares by the holders of a majority of the issued and outstanding ordinary shares voted in person or by proxy at an extraordinary general meeting of shareholders, (ii) expiration or termination of required waiting periods of applicable competition laws, (iii) obtaining certain required third-party consents, (iv) execution of certain shareholder agreements with CD&R and CHC Cayman, (v) authorizing for listing ordinary shares issuable upon conversion of the preferred shares on the NYSE, (vi) resignation of one of the directors designated by CHC Cayman and taking of all necessary actions by our board of directors for the election of two directors designated by CD&R at or prior to the first closing and taking of all board actions necessary for the election of two additional directors designated by CD&R at or prior to the second closing, and (vii) absence of a Company Material Adverse Effect (as defined in the investment agreement). No assurance can be given that we will complete the pending financing transactions on the currently contemplated timetable or at all, or that we will be able to derive the benefits contemplated.

The preferred shares offered to CD&R in the Private Placement will not be or have not been registered under the United States Securities Act of 1933, as amended, or the Securities Act, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. We will complete the sale of our preferred shares in this rights offering in accordance with applicable law and the terms stated in the registration statement thereby.

Summary Risk Factors

An investment in our preferred shares involves a number of risks, including changes in economic and oil and gas industry conditions, competition and other material factors, that could materially affect our business, financial condition and results of operations, and cause the trading price of our ordinary shares to decline. Some of the significant challenges and risks include the following:

• | the preferred shares issued in the rights offering will not be transferable until 8.5 years after the first closing of the Private Placement with CD&R; |

• | the market price of our ordinary shares underlying the preferred shares is less than the initial conversion price of the preferred shares; |

• | we have a history of net losses; |

• | our level of indebtedness could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in our business and place us at a competitive disadvantage; |

• | many of the markets in which we operate are highly competitive, which may result in a loss of market share or a decrease in revenue or profit margins; |

• | we rely on a limited number of large offshore helicopter support contracts with a limited number of customers, and if any of these are terminated early or not renewed, our revenues could decline; |

13

• | operating helicopters involves a degree of inherent risk and we are exposed to the risk of losses from safety incidents; |

• | failure to mitigate potential losses through a robust safety management and insurance coverage program, would jeopardize our financial condition in the event of a safety or other hazardous incident; |

• | failure to maintain standards of acceptable safety performance could have an adverse impact on our ability to attract and retain customers and could adversely impact our reputation, operations and financial performance; |

• | our operations are subject to extensive regulations, which could increase our costs and adversely affect us; |

• | we derive significant revenue from non-wholly owned entities, which, if we develop problems with the other owners of such non-wholly owned entities, could adversely affect our financial condition and results of operations; |

• | our operations may suffer due to political and economic uncertainty; and |

• | we are controlled by First Reserve, and following the Private Placement, CD&R and First Reserve, each of which might have interests that conflict with ours and the interests of our other shareholders. |

After the completion of this rights offering and the first closing of the Private Placement, funds affiliated with CD&R and First Reserve will own a majority of the voting power of ordinary shares eligible to vote in the election of our directors. CD&R and First Reserve will be considered a “group” under Rule 13d-5 of the Exchange Act because they will have entered into a voting agreement whereby they each agree to vote the shares each beneficially owns in favor of the director nominees designated by the other. As a result, we will continue to be a “controlled company” within the meaning of the corporate governance standards of NYSE. For more information, see “Principal Shareholders.”

Founded in 1978, Clayton, Dubilier & Rice is a private equity firm with an investment strategy predicated on producing financial returns through building stronger, more profitable businesses. CD&R manages approximately $21 billion on behalf of its investors and since inception has acquired 62 businesses with an aggregate transaction value of more than $90 billion. For more information, please visit www.cdr-inc.com. The CD&R website address is provided as an inactive textual reference only. The information provided on the CD&R website is not part of this prospectus, and therefore is not incorporated herein by reference.

Founded in 1983, First Reserve is an investment firm with over $23 billion of capital raised since inception. First Reserve makes both private equity and infrastructure investments throughout the energy value chain. For 30 years, it has invested solely in the global energy industry, utilizing its broad base of specialized energy industry knowledge as a competitive advantage. First Reserve invests strategically across a wide range of industry sectors, developing a portfolio that is diversified across the energy value chain, backing talented management teams and creating value by building companies.

14

Our Organizational Structure

The following chart shows a summary of our organizational structure, as adjusted for this rights offering and the Private Placement.

(1) | On October 4, 2010, our subsidiary CHC Helicopter S.A. issued $1.1 billion aggregate principal amount of 9.250% Senior Secured Notes due 2020, or the senior secured notes, at an issue price of 98.399%. On October 5, 2012, CHC Helicopter S.A. issued an additional $200.0 million aggregate principal amount of senior secured notes at an issue price of 101%. On May 13, 2013, CHC Helicopter S.A. issued $300.0 million aggregate principal amount of 9.375% Senior Notes due 2021, or the senior unsecured notes, and, together with the senior secured notes, the senior notes, at par. On February 7, 2014, CHC Helicopter S.A. redeemed $130.0 million of the senior secured notes at a price of 103% of the principal amount and during May 2014, CHC Helicopter S.A purchased $65.0 million of the senior secured notes on the open market at premiums ranging from 8.00% to 9.13%. |

(2) | On January 23, 2014, we entered into a new revolving credit facility for $375.0 million held by a syndicate of financial institutions for a term of five years and bearing interest at the Alternate Base Rate, LIBOR, Canadian Prime Rate, CDOR or EURIBOR, plus an applicable margin that ranges from 3.50% to 4.50%, subject to a leverage-based step-down of 0.75%. As of July 31, 2014, we had no borrowings outstanding under our existing senior secured revolving credit facility and $51.3 million of letters of credit were issued and outstanding thereunder. See “Description of Indebtedness.” |

15

Corporate Information

CHC Group Ltd., formerly known as FR Horizon Holding (Cayman) Inc., was incorporated in the Cayman Islands on July 3, 2008 and changed its name by way of special shareholder resolution dated September 12, 2013 to CHC Group Ltd. CHC Group Ltd.’s registered office is located at c/o Intertrust Corporate Services (Cayman) Ltd., 190 Elgin Avenue, George Town, Grand Cayman, KY1-9005, Cayman Islands.

We have entered into agreements with Heli-One Canada Inc. and Heli-One American Support, LLC to provide certain management services, subject to authority limits as determined by our board of directors and set out in such agreements. The corporate headquarters of Heli-One Canada Inc.’s offices is located at 4740 Agar Drive, Richmond, British Columbia, V7B 1A3 Canada and its telephone number is (604) 276-7500.

Our website is located at http://www.chc.ca. Information contained on, or that can be accessed through, our website shall not be deemed incorporated into and is not a part of this prospectus or the registration statement of which it forms a part.

16

The Rights Offering

Securities offered by us | We are distributing at no charge to holders of our ordinary shares one non-transferable right for each one of our ordinary shares held of record as of 5:00 p.m., New York City time, on the Record Date of , 2014. |

Subscription Price | $1,000 per preferred share. The subscription price is the same as the price paid by the Investor in the Private Placement. See “Questions and Answers Relating to this Rights Offering—How was the subscription price determined?” |

Right | Each right consists of a basic subscription right and an over-subscription privilege. |

Basic subscription right | The basic subscription right gives you the right to purchase 0.001229 preferred shares at the Subscription Price. You may exercise your basic subscription right for some or all of your rights, or you may choose not to exercise any of your basic subscription right, provided, that in no event will fractional preferred shares be issued in this rights offering. Accordingly, you will need to exercise 814 rights in order to purchase one whole preferred share. |