Attached files

| file | filename |

|---|---|

| EX-5.1 - EX-5.1 - Wayfair Inc. | a2221390zex-5_1.htm |

| EX-3.5 - EX-3.5 - Wayfair Inc. | a2221390zex-3_5.htm |

| EX-1.1 - EX-1.1 - Wayfair Inc. | a2221390zex-1_1.htm |

| EX-3.4 - EX-3.4 - Wayfair Inc. | a2221390zex-3_4.htm |

| EX-4.1 - EX-4.1 - Wayfair Inc. | a2221390zex-4_1.htm |

| EX-3.2 - EX-3.2 - Wayfair Inc. | a2221390zex-3_2.htm |

| EX-3.6 - EX-3.6 - Wayfair Inc. | a2221390zex-3_6.htm |

| EX-10.6 - EX-10.6 - Wayfair Inc. | a2221390zex-10_6.htm |

| EX-10.4 - EX-10.4 - Wayfair Inc. | a2221390zex-10_4.htm |

| EX-23.1 - EX-23.1 - Wayfair Inc. | a2221390zex-23_1.htm |

| EX-10.3 - EX-10.3 - Wayfair Inc. | a2221390zex-10_3.htm |

| EX-10.5 - EX-10.5 - Wayfair Inc. | a2221390zex-10_5.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS 2

As filed with the Securities and Exchange Commission on September 19, 2014.

Registration No. 333-198171

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WAYFAIR INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

5961 (Primary Standard Industrial Classification Code Number) |

36-4791999 (I.R.S. Employer Identification No.) |

4 Copley Place, 7th Floor

Boston, MA 02116

(617) 532-6100

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Niraj Shah

Chief Executive Officer

Wayfair Inc.

4 Copley Place, 7th Floor

Boston, MA 02116

(617) 532-6100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||||

John H. Chory, Esq. Susan L. Mazur, Esq. Latham & Watkins LLP 1000 Winter Street, Suite 3700 Waltham, MA 02451 Telephone: (781) 434-6700 Facsimile: (781) 434-6601 |

Michael Fleisher Chief Financial Officer Wayfair Inc. 4 Copley Place, 7th Floor Boston, MA 02116 Telephone: (617) 532-6100 Facsimile: (617) 532-6148 |

Julie H. Jones, Esq. Thomas Holden, Esq. Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, MA 02199 Telephone: (617) 951-7000 Facsimile: (617) 951-7050 |

||

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer þ (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Class A Title of Each Class of Securities To Be Registered |

Amount To Be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price(2) |

Amount of Registration Fee(3) |

||||

|---|---|---|---|---|---|---|---|---|

Class A Common Stock, $0.001 par value per share |

12,650,000 | $28.00 | $354,200,000 | $45,621 | ||||

|

||||||||

- (1)

- Includes

additional shares that the underwriters have the option to purchase.

- (2)

- Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended.

- (3)

- Registration fee of $45,080 was previously paid in connection with the initial filing of this Registration Statement. The amount due in connection with this filing for the aggregate registration fee of $45,621 is partially offset by the $45,080 previously paid.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated September 19, 2014.

Preliminary Prospectus

11,000,000 Shares

Class A Common Stock

This is an initial public offering of shares of Class A common stock of Wayfair Inc.

Wayfair is offering 10,500,000 shares of Class A common stock to be sold in the offering. The selling stockholders identified in this prospectus are offering an additional 500,000 shares of Class A common stock. Wayfair will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders.

Wayfair has two classes of authorized common stock, Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting and conversion rights. Each share of Class A common stock is entitled to one vote per share. Each share of Class B common stock is entitled to ten votes per share and is convertible into one share of Class A common stock. Outstanding shares of Class B common stock will represent approximately 98.5% of the voting power of our outstanding capital stock immediately following the completion of this offering.

Prior to this offering, there has been no public market for the Class A common stock. It is currently estimated that the initial public offering price will be between $25.00 and $28.00 per share. We have applied to list our Class A common stock on the New York Stock Exchange under the symbol "W."

We are an "emerging growth company" as that term is used in the Jumpstart Our Business Startups Act of 2012, and, as such, have elected to comply with certain reduced public company reporting requirements. Investing in our common stock involves risks.

See "Risk Factors" beginning on page 14 to read about factors you should consider before buying shares of the Class A common stock.

|

Per Share

|

Total

|

|||||

Initial public offering price |

$ | $ | |||||

Underwriting discount |

$ | $ | |||||

Proceeds, before expenses, to Wayfair |

$ | $ | |||||

Proceeds, before expenses, to the selling stockholders |

$ | $ |

To the extent that the underwriters sell more than 11,000,000 shares of Class A common stock, the underwriters have the option to purchase up to an additional 1,650,000 shares from the selling stockholders at the initial public offering price less the underwriting discount.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares against payment in New York, New York on , 2014.

| Goldman, Sachs & Co. | BofA Merrill Lynch | Citigroup | ||

Allen & Company LLC |

||||

Pacific Crest Securities |

Piper Jaffray |

Wells Fargo Securities |

||

| Canaccord Genuity | Cowen and Company | Raymond James |

Prospectus dated , 2014.

Through and including , 2014 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

We, the selling stockholders and the underwriters, have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

Trademarks, Trade Names and Design Marks

We use various trademarks, trade names and design marks in our business, including without limitation Wayfair®, Joss & Main®, AllModern®, DwellStudio® and Birch Lane™. This prospectus also contains trademarks and trade names of other businesses that are the property of their respective holders.

Market, Industry and Other Data

We obtained the industry, market and competitive position data in this prospectus from our own internal estimates and research as well as from industry publications and research, surveys

i

and studies conducted by third parties and other publicly available information. Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe our internal company research is reliable and the market definitions are appropriate, neither such research nor these definitions have been verified by any independent source.

Research by Euromonitor International should not be considered as the opinion of Euromonitor International as to the value of any security or the advisability of investing in Wayfair and accordingly, such information should not be relied upon for making any investment decision in respect of Wayfair.

ii

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider in making your investment decision. Before deciding to invest in shares of our Class A common stock, you should read this summary together with the more detailed information elsewhere in this prospectus, including our consolidated financial statements and the related notes. You should carefully consider, among other things, the matters discussed in "Risk Factors," "Special Note Regarding Forward-Looking Statements," our consolidated financial statements and related notes, and "Management's Discussion and Analysis of Financial Condition and Results of Operations," in each case included elsewhere in this prospectus.

Unless the context otherwise requires, references in this prospectus to "Wayfair," "the company," "we," "us," and "our" refer, prior to the Corporate Reorganization discussed below, to Wayfair LLC, and, after the Corporate Reorganization discussed below, to Wayfair Inc., in each case together with its consolidated subsidiaries as a combined entity.

Overview

Wayfair is transforming the way people shop for their homes. Our homes are the center of our lives, where we raise families, create our fondest memories and spend most of our time. Our homes are very personal expressions of self and identity, which is why many of us seek uniqueness, crave originality and enjoy the feeling created by home design, furniture and décor. We built Wayfair to meet this emotional need for mass market consumers.

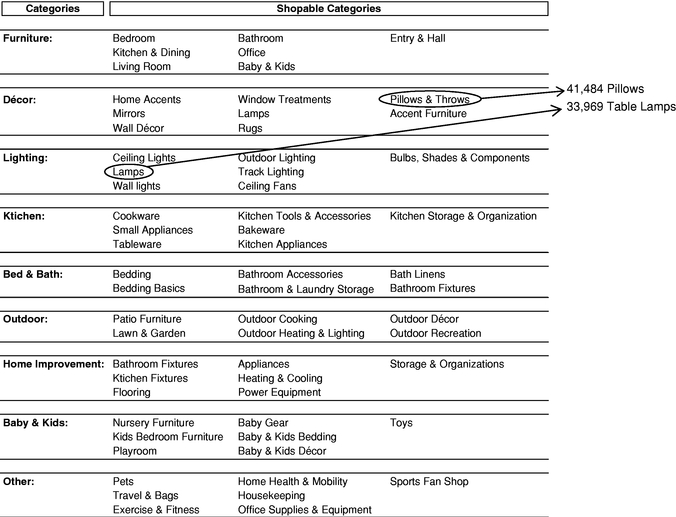

We have created one of the world's largest online destinations for the home. Through our e-commerce business model, we offer visually inspiring browsing, compelling merchandising, easy product discovery and attractive prices for over seven million products from over 7,000 suppliers across five distinct brands:

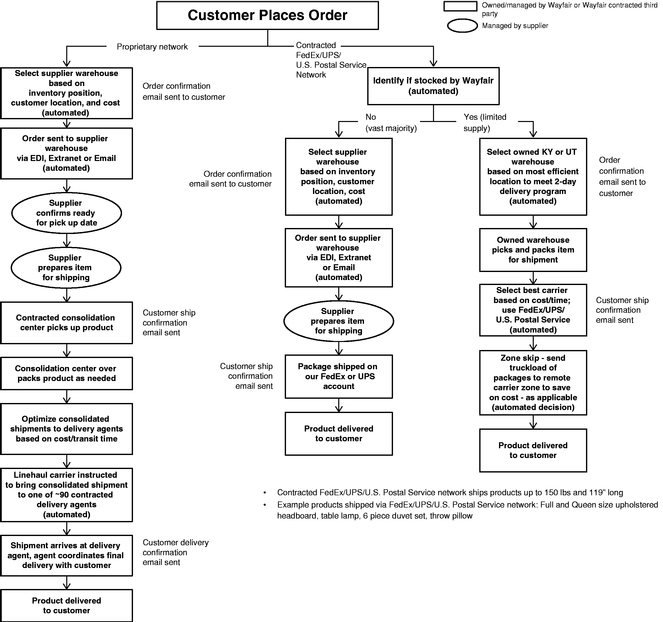

1

Our typical Wayfair customer is a 35 to 65 year old woman with an annual household income of $60,000 to $175,000, who we consider to be a mass market consumer and who we believe is underserved by traditional brick and mortar and other online retailers of home goods. Because each of our customers has a different taste, style, purchasing goal and budget when shopping for her home, we have built one of the largest online selections of furniture, home furnishings, décor and goods. We are able to offer this vast selection of products while holding minimal inventory because we typically ship products directly from our suppliers to our customers. This supplier direct fulfillment network is a key component of our custom-built and seamlessly integrated technology and operational platform, which also includes extensive supplier integrations, a proprietary transportation delivery network and superior customer service.

We founded our company in May 2002 and have since delivered nearly 13 million orders. From 2002 through 2011, the company was bootstrapped by our co-founders and operated as hundreds of niche websites, such as bedroomfurniture.com and allbarstools.com. In 2006, we launched AllModern. From 2003 to 2011, we grew our net revenue organically from $7.7 million to $517.3 million, representing a 69.2% compound annual growth rate, or CAGR. In late 2011, we made the strategic decision to close and permanently redirect over 240 of our niche websites into Wayfair.com to create a one-stop shop for furniture, home furnishings, décor and goods and to build brand awareness, drive customer loyalty and increase repeat purchasing. We also changed our name from CSN Stores LLC to Wayfair LLC.

Our co-founders are lifetime tech innovators who have worked together in the consumer internet sector since 1995 and have created a company culture deeply rooted in technology. Our technology and data focus facilitates critical e-commerce capabilities such as tailored shopping experiences across our five brands, consumer targeting and personalization, and "anytime, anywhere" shopping across our websites, mobile-optimized websites and mobile applications, which we collectively refer to as our sites.

Our strong customer loyalty and deep supplier relationships have helped us grow our Direct Retail sales, which we define as sales generated primarily through the sites of our five brands. In 2013 and the six months ended June 30, 2014, we generated Direct Retail net revenue of $673.4 million and $469.5 million, respectively, an increase of 73.0% and 75.0%, respectively, over our Direct Retail net revenue of $389.3 million and $268.4 million in 2012 and the six months ended June 30, 2013, respectively. In 2013, we delivered 3.3 million orders for 2.1 million Direct Retail active customers, representing increases of 85.2% and 61.0%, respectively, over 2012. In the six months ended June 30, 2014, we delivered 2.2 million orders, representing an increase of 76.6%, over the six months ended June 30, 2013. In the six months ended June 30, 2014, we had 2.6 million Direct Retail active customers, representing an increase of 75.0% over the six months ended June 30, 2013. In 2013 and the six months ended June 30, 2014, LTM net revenue per active customer was $322 and $332, respectively, an increase of 7.3% and 6.1% over 2012 and the six months ended June 30, 2013, respectively. In 2013 and the six months ended June 30, 2014, 47.2% and 51.2%, respectively, of orders delivered were from repeat customers, up from 37.4% and 47.7% in 2012 and the six months ended June 30, 2013, respectively. In addition, our mobile platform drives growth by engaging customers where and when they want to shop; in the first six months of 2014, 27.9% of all Direct Retail orders delivered were placed from a mobile device, up from 21.3% in the first six months of 2013. See the section titled "Management's Discussion and Analysis of Financial Condition and Results of Operations — Key Financial and Operating Metrics" on page 55 for further detail.

In 2013 and the six months ended June 30, 2014, we generated net revenue of $915.8 million and $574.1 million, respectively, up 52.4% and 49.8% over 2012 and the six months ended June 30, 2013, respectively. Our 2013 and six months ended June 30, 2014 net revenue included $673.4 million and $469.5 million, respectively, from Direct Retail and $242.4 million and $104.6 million, respectively,

2

from Other, which we define as net revenue generated primarily online through third parties, which we refer to as our retail partners. In 2013, we generated a net loss of $15.5 million and Adjusted EBITDA of $(2.9) million, improvements of $5.5 million and $9.1 million, respectively, over 2012. In the six months ended June 30, 2014, we generated a net loss of $51.4 million and Adjusted EBITDA of $(37.0) million, increases of $43.1 million and $34.9 million, respectively, over the six months ended June 30, 2013. Our net loss and Adjusted EBITDA results were driven primarily by our increased investment in advertising in 2012, 2013 and the six months ended June 30, 2014. Because we hold minimal inventory and a majority of our customers pay us before we pay our suppliers, we have an attractive net working capital dynamic which typically allows us to generate more cash than our Adjusted EBITDA on an annual basis. See the section titled "Management's Discussion and Analysis of Financial Condition and Results of Operations — Non-GAAP Financial Measures" on page 55 for more information and for a reconciliation of Adjusted EBITDA.

Our Industry

The home goods market is large and characterized by specific consumer trends, structural challenges and market dynamics that are shaping the future of our industry.

Addressable Market Size and Growth

Large and Growing Home Goods Market with Significant Online Potential: The home goods market is large, global and growing. Our addressable home goods market, which we define as the U.S. furniture and home décor markets, was $233 billion in 2013, according to Euromonitor International, Ltd., a market research firm. It also expects the U.S. home goods market to grow at a 2.5% CAGR in real terms from 2013 to 2023, reaching $297 billion in 2023. We believe the online penetration of the U.S. home goods market in 2013 was approximately 7%, significantly lower than other retail markets.

Mass Market for Home Goods is Large and Underserved: We believe the mass market for home goods represents the largest addressable opportunity within the home goods sector and that the mass market consumer is underserved due to structural limitations of brick and mortar and other online retailers.

Women Control an Outsized Share of Spending within the Household: In 2013, women represented 70% of our customers. According to a report released by the U.S. Census Bureau in 2013, there are 158 million women in the United States, of which 63 million are between the ages of 35 and 65. We believe these women control an outsized share of spending, particularly spending related to furniture, home furnishings, décor and goods.

Beneficial Effects of the Millennial Generation Aging and Maturing into the Home Category: We believe there are approximately 73 million millennials (which we define as individuals currently between the ages of 18 to 31) in the United States, many of whom are accustomed to purchasing goods online. As millennials age, start new families and move into new homes, we expect online sales of home goods to increase. In addition, we believe the online home goods market will further grow as older generations of consumers become increasingly comfortable purchasing online.

Mobile Commerce is Growing Rapidly and Only Just Beginning in Home Goods: The proliferation of smartphones and tablets has made mobile commerce one of the fastest growing online channels. Since consumers have access to their mobile devices virtually anytime and anywhere, they have the opportunity to browse, discover and shop throughout the day. From 2013 to 2018, mobile e-commerce as a percentage of overall e-commerce is projected to increase from 15% to 30%, according to eMarketer Inc., a market research firm.

3

Why Home is Different

Home is Shopped Differently than Other Retail Verticals: Homes are very personal expressions of self and identity, which is why many consumers seek uniqueness, crave originality and enjoy the feeling created by home design, furniture and décor. Consumers shopping for home goods often cannot articulate what they are looking for other than to describe a feeling or visual image that they want to capture in their home. In addition, while consumers typically know the names of big box and specialty retailers that offer various home products, we believe they rarely know the names of the product brands or suppliers. We believe traditional search-based sites that rely on directed product search (e.g., "running sneakers") or brand name search (e.g., "Samsung 32-inch LCD television") have difficulty serving customers shopping for home products in this more emotional, visual and inspirational manner.

Home Shoppers Desire Uniqueness, which Requires Vast Selection: In the mass market for home goods, consumers with different tastes, styles, purchasing goals and budgets require a broad selection of products and choices. This need for selection applies across many home categories, including furniture, décor, lighting, kitchen, bed & bath, outdoor, home improvement and baby & kids, each of which has dozens of sub-categories with hundreds to tens of thousands of products. Brick and mortar home goods retailers must balance a consumer's desire for uniqueness, which requires massive selection, with the challenges of high inventory carrying costs and limited showroom and storage space.

Time Consuming and Inconvenient for Consumers to Shop across Brick and Mortar Home Retailers: To browse a vast selection of products across highly-fragmented brick and mortar retailers, consumers must shop multiple stores. For example, if a nearby furniture retailer has 20 bedroom sets on its showroom floor, a consumer may feel she must visit multiple stores to see a wide enough selection to make an informed purchase decision that satisfies her style and budget needs. We believe the lack of an easy-to-browse, one-stop shopping experience with massive selection has led to dissatisfaction with brick and mortar home goods shopping. In contrast, Wayfair.com offers over 900 bedroom sets across many styles and prices, which mitigates the need for a consumer to visit multiple stores to find the perfect item at a price she can afford.

Difficult to Browse, Value Shop and Price Compare: Mass market home goods shoppers frequently seek a wide variety of information from disparate online and offline sources to research home goods products. Because this information is not easily comparable, it is difficult for consumers to make informed home décor and design-related decisions. In addition, consumers may struggle to mix and match different home goods items they are considering buying from multiple traditional brick and mortar retailers.

Challenging Logistics for Consumers and Retailers: Logistics, fulfillment and customer service for home goods products are challenging given the various categories, shapes, sizes, weights and price points in the home market. Given the personal nature and high touch physical characteristics of home goods products, many consumers seek first-rate customer service so they are not burdened with managing delivery, shipping and return logistics on their own. However, we believe big box retailers that serve the mass market for home goods are often unable or unwilling to provide this level of service. In addition, many regional retailers do not ship nationally, which we believe is because they lack the required scalable technology, operations and distribution infrastructure.

4

Our Solution

Key Benefits for Our Customers

We offer our consumers vast selection, easy access and value, inspirational content, personalized and mobile shopping experiences and superior customer service to help them find the perfect item at a price they can afford.

Broad Selection and Choice: We offer one of the largest online selections of furniture, home furnishings, décor and goods with over seven million products from over 7,000 suppliers.

Easy Access and Value: We offer consumers a one-stop shop with home goods pricing designed to be on par with big box retailers and a merchandising experience designed to be on par with specialty retailers.

Inspirational Photography and Editorial Content: To inspire customers, we produce beautiful imagery and highly-tailored editorial content both in house and through third parties.

Personalized and Mobile Shopping Experiences: We use personalization, based on past browsing, shopping patterns and personal preferences, to create a more engaging consumer experience. Our investment in mobile allows us to deliver value, convenience and inspiration to consumers anytime and anywhere.

Superior Customer Service: Our customer service organization has over 440 representatives who help consumers navigate our sites, answer questions and help complete orders. This team helps us build trust with consumers, build our brand awareness, enhance our reputation and drive sales.

Key Benefits for Our Suppliers

Through our technology platform, we offer our suppliers a cost-effective channel, the ability to leverage our technological expertise, a real-time view of our demand and proven logistics capabilities to help sell their products.

Cost-Effective Access to Our Large Customer Base: We sell products from over 7,000 suppliers, many of which are small, family-run operations without well-known product brands and without easy retail access to a large customer base. We provide our suppliers with access to our customer base of 2.6 million active customers, enabling them to increase their sales and access the growing e-commerce market.

Ability to Leverage Our Technological Expertise to Drive Sales: Our technology platform is designed to allow suppliers to easily provide us with their full product selection. Through our technology platform, we believe many of our suppliers have increased their sales, which has strengthened their loyalty to us.

Real-Time View of Demand and Inventory Needs via Data and Analytics: We offer our suppliers a real-time view of our demand and inventory needs via powerful data and analytics.

Proven Logistics Capabilities: Our logistics infrastructure allows us to ship directly from our suppliers to our customers. This supplier direct fulfillment network is a key component of our custom-built and seamlessly integrated technology and operational platform.

5

Our Strengths

We believe we have achieved our market leading position through the following key strengths:

- •

- our large scale drives powerful network effects;

- •

- superior logistics infrastructure and supplier direct fulfillment network require minimal inventory and capital

expenditures;

- •

- trusted brand with rapidly growing awareness;

- •

- personalized shopping experiences and differentiated use of data, analytics and technology drive high customer repeat

rates;

- •

- powerful and custom-built technology platform;

- •

- well-positioned to benefit from platform shift to mobile; and

- •

- proven and operationally disciplined management team.

Our Growth Strategy

Our goal is to further improve our leadership in the home goods market by pursuing the following key strategies:

- •

- continue building leading retail home brands;

- •

- acquire more customers;

- •

- continue to invest in the consumer experience;

- •

- increase repeat purchasing through merchandising, data, analytics and technology;

- •

- add new suppliers and deepen relationships with our existing suppliers;

- •

- continue to invest in our technology and operational platform, including our mobile platform;

- •

- expand internationally; and

- •

- opportunistically pursue strategic acquisitions.

Risk Factors

Our business is subject to numerous risks and uncertainties. Please carefully read "Risk Factors" beginning on page 14 and "Special Note Regarding Forward-Looking Statements" on page 42 for a more detailed explanation of the risks and uncertainties before investing in our Class A common stock. For example, any of the following risks may negatively affect our competitiveness or growth strategy, which could cause the price of our Class A common stock to decline and result in a loss of a part or all of your investment:

- •

- Our recent growth rates may not be sustainable or indicative of our future growth.

- •

- If we fail to manage our growth effectively, our business, financial condition and operating results could be harmed.

- •

- If we fail to acquire new customers, or fail to do so in a cost-effective manner, we may not be able to increase net

revenue per active customer or achieve profitability.

- •

- Our success depends in part on our ability to increase our net revenue per active customer. If our efforts to increase customer loyalty and repeat purchasing as well as maintain high levels of customer engagement and average order values of our customers are not successful, our growth prospects and revenue will be materially adversely affected.

6

- •

- Our business depends on our ability to build and maintain strong brands. We may not be able to maintain and enhance our

existing brands if we receive unfavorable customer complaints, negative publicity or otherwise fail to live up to consumers' expectations, which could materially adversely affect our business, results

of operations and growth prospects.

- •

- Our efforts to launch new brands and expand our existing brand portfolio internationally may not be successful.

- •

- Expansion of our international operations will require management attention and resources, involves additional risks, and

may be unsuccessful, which could harm our future business development and existing domestic operations.

- •

- We have a history of losses, and we have accumulated $277.1 million in common members' deficit as of

June 30, 2014. We expect to have increasing operating losses and negative cash flow as we continue to expand our business.

- •

- System interruptions that impair customer access to our sites or other performance failures in our technology

infrastructure could damage our business, reputation and brand and substantially harm our business and results of operations.

- •

- Our business is highly competitive. Competition presents an ongoing threat to the success of our

business.

- •

- The dual class structure of our common stock and the existing ownership of capital stock by our executive officers, directors and their affiliates have the effect of concentrating voting control with our executive officers, directors and their affiliates for the foreseeable future, which will limit your ability to influence corporate matters. Following this offering, our co-founders will own shares representing approximately 49.8% of the economic interest and 56.6% of the voting power of our outstanding capital stock, and, together with our other executive officers, directors and their affiliates, will own shares representing approximately 76.3% of the economic interest and 86.7% of the voting power of our outstanding capital stock.

Company Information and Reorganization

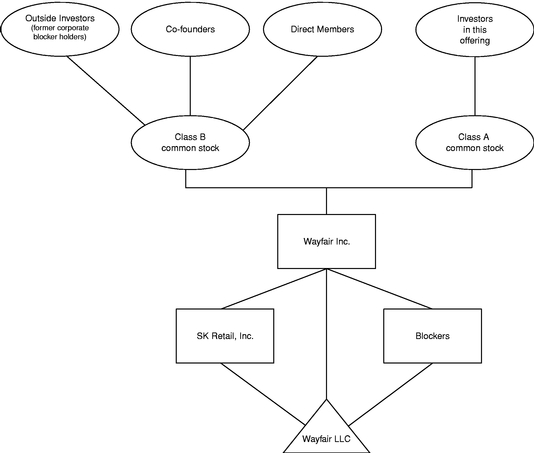

We began operating as Smart Tech Toys, Inc., a Massachusetts corporation, in May 2002 and changed our name to CSN Stores, Inc. in February 2003. In March 2008, we formed, and contributed all of the assets and liabilities of CSN Stores, Inc. to, a subsidiary, CSN Stores LLC, and we continued operating our business through this Delaware limited liability company. In late 2011, we changed the name of CSN Stores, Inc. to SK Retail, Inc. and changed our name from CSN Stores LLC to Wayfair LLC. Prior to the completion of this offering, we intend to complete an internal restructuring, which we refer to in this prospectus as the Corporate Reorganization. The proposed structure of the Corporate Reorganization is described in the section titled "Organizational Structure." Following the Corporate Reorganization, (i) Wayfair Inc. would be a holding company with no material assets other than 100% of the equity interests in Wayfair LLC and (ii) the holders of equity interests in Wayfair LLC would become stockholders of Wayfair Inc. Prior to the Corporate Reorganization, Wayfair Inc. will not have conducted any activities other than in connection with its formation and in preparation for this offering. Accordingly, our consolidated financial statements and other financial information included in this prospectus as of dates and for periods prior to the date of the Corporate Reorganization reflect the results of operations and financial position of Wayfair LLC. Our consolidated financial information, if any, as of dates and for periods from and after the date of the Corporate Reorganization reflect the results of operations and financial condition of Wayfair Inc. and its wholly-owned subsidiary, Wayfair LLC, unless otherwise expressly stated.

7

While our outstanding equity as a limited liability company prior to the Corporate Reorganization is called "common units," "incentive units" and "preferred units," we refer to such common units and incentive units as common stock and to the preferred units as preferred stock for the periods prior to the Corporate Reorganization for ease of comparison, except in the sections titled "Prospectus Summary — Summary Consolidated Financial Data," "Organizational Structure," "Selected Consolidated Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations," the audited financial statements included elsewhere in this prospectus and where otherwise indicated in this prospectus. For the same reason, we also refer to our "restricted unit bonus awards" and "restricted unit purchase right awards" under our Wayfair LLC second amended and restated 2010 incentive plan, or 2010 Plan, as restricted common stock and to our "deferred units" under our 2010 Plan as our restricted stock units.

Our executive offices are located at 4 Copley Place, 7th Floor, Boston, MA 02116, and our telephone number is (617) 532-6100. Our corporate website address is Wayfair.com. The information contained in, or accessible through, our website does not constitute part of this prospectus, and investors should not rely on any such information in deciding whether to purchase our Class A common stock.

We are an "emerging growth company," as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenue of at least $1.0 billion, or (c) in which we become a large accelerated filer, which means that we have been public for at least 12 months, have filed at least one annual report and the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last day of our then most recently completed second fiscal quarter, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. We refer to the Jumpstart Our Business Startups Act of 2012 herein as the "JOBS Act," and references herein to "emerging growth company" shall have the meaning associated with such term in the JOBS Act.

8

Issuer |

Wayfair Inc. | |

Class A common stock we are offering |

10,500,000 shares |

|

Class A common stock the selling stockholders are offering |

500,000 shares |

|

Class A common stock to be outstanding after the offering |

11,000,000 shares |

|

Class B common stock to be outstanding after the offering |

71,756,943 shares |

|

Total Class A common stock and Class B common stock to be outstanding after the offering |

82,756,943 shares |

|

Option to purchase additional shares of Class A common stock |

1,650,000 shares being offered by the selling stockholders |

|

Voting Rights |

We have two classes of authorized common stock: Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting and conversion rights. Each share of Class A common stock is entitled to one vote per share, and each share of Class B common stock is entitled to ten votes per share. The Class B common stock also has approval rights over certain corporate actions. Following the completion of this offering, each share of Class B common stock may be converted into one share of Class A common stock at the option of its holder and will be automatically converted into one share of Class A common stock upon transfer thereof, subject to certain exceptions. In addition, upon the date on which the outstanding shares of Class B common stock represent less than 10% of the aggregate number of shares of the then outstanding Class A common stock and Class B common stock, or in the event of the affirmative vote or written consent of holders of at least 662/3% of the outstanding shares of Class B common stock, all outstanding shares of Class B common stock shall convert automatically into Class A common stock. Please read the section titled "Description of Capital Stock" for additional information. |

9

Use of Proceeds |

We expect to distribute a portion of the net proceeds to our existing Series A preferred stockholders upon conversion to common stock in connection with the completion of this offering to satisfy the remaining portion of an accrued cash dividend, which amount was approximately $20.9 million as of June 30, 2014, or approximately 8.1% of the net proceeds, based on the midpoint of the range set forth on the cover page of this prospectus. Our co-founders and certain of our directors, executive officers and holders of more than 5% of our voting securities hold 85% of our outstanding shares of Series A preferred stock and, as a result of their ownership, will receive 85% of the dividend payment, or approximately $17.8 million as of June 30, 2014. We also expect to distribute a portion of the net proceeds to satisfy minimum statutory tax withholding and remittance obligations related to the settlement of outstanding restricted stock units upon the completion of this offering, which amount was approximately $14.0 million as of June 30, 2014. We intend to use the remaining net proceeds to us from this offering for working capital and other general corporate purposes. We may also use a portion of the net proceeds for the acquisition of, or investment in, technologies, solutions or businesses that complement our business. We will not receive any proceeds from the sale of shares by the selling stockholders. Please read the section titled "Use of Proceeds" for additional information. |

|

Risk Factors |

Please read the section titled "Risk Factors" beginning on page 14 and other information included in this prospectus for a discussion of factors you should consider before deciding to invest in our Class A common stock. |

|

Proposed New York Stock Exchange symbol |

"W" |

Unless otherwise indicated, this prospectus reflects and assumes the following:

- •

- the consummation of the Corporate Reorganization described in the section titled "Organizational Structure" prior to the

completion of this offering;

- •

- the reclassification of our common stock and the conversion of all outstanding shares of our preferred stock held by the selling stockholders into shares of our Class B common stock, which will occur prior to the completion of this offering;

10

- •

- the automatic conversion of all other outstanding shares of our preferred stock into shares of our Class B common

stock, which will occur immediately upon the completion of this offering;

- •

- the net issuance of 925,949 shares of Class B common stock upon the vesting of outstanding restricted stock units

in connection with this offering;

- •

- the filing and effectiveness of our restated certificate of incorporation and the adoption of our amended and restated

bylaws, each of which will occur immediately prior to the completion of this offering; and

- •

- no exercise by the underwriters of their option to purchase additional shares of Class A common stock.

The number of shares of our Class A common stock and Class B common stock to be outstanding after this offering is based on no shares of Class A common stock and shares of Class B common stock outstanding as of June 30, 2014 and excludes:

- •

- 646,413 shares of Class B common stock issuable upon exercise of options to purchase common stock

outstanding as of June 30, 2014 under our 2010 Plan at a weighted-average exercise price of $2.98 per share;

- •

- 4,630,834 shares of Class B common stock issuable from restricted stock units outstanding as of

June 30, 2014 under our 2010 Plan; and

- •

- 8,603,066 shares of Class A common stock, subject to increase on an annual basis, reserved for future issuance under our 2014 Incentive Award Plan, or our 2014 Plan, which will become effective prior to the completion of this offering.

11

Summary Consolidated Financial Data

The following tables set forth a summary of our historical financial data as of, and for the period ended on, the dates indicated. The statement of operations data for the years ended December 31, 2012 and 2013 are derived from the audited financial statements of Wayfair LLC included elsewhere in this prospectus. The statement of operations data for the six months ended June 30, 2013 and 2014 are derived from the unaudited financial statements of Wayfair LLC included elsewhere in this prospectus. The statement of operations data for the year ended December 31, 2011 are derived from the unaudited financial statements of Wayfair LLC not included elsewhere in this prospectus. You should read this data together with the audited financial statements and related notes appearing elsewhere in this prospectus and the information in the sections titled "Selected Financial Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations." The historical results are not necessarily indicative of our future results.

| |

Years ended December 31, | Six months ended June 30, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2011

|

2012

|

2013

|

2013

|

2014

|

|||||||||||

| |

(in thousands, except share and per share data) |

|||||||||||||||

Consolidated Statements of Operations: |

||||||||||||||||

Net revenue |

$ | 517,336 | $ | 601,028 | $ | 915,843 | $ | 383,208 | $ | 574,144 | ||||||

Cost of goods sold |

385,824 | 455,879 | 691,602 | 288,337 | 440,483 | |||||||||||

| | | | | | | | | | | | | | | | | |

Gross profit |

131,512 | 145,149 | 224,241 | 94,871 | 133,661 | |||||||||||

Operating expenses: |

||||||||||||||||

Sales and marketing |

106,794 | 113,370 | 177,475 | 72,714 | 138,228 | |||||||||||

General and administrative |

36,772 | 52,961 | 62,246 | 30,014 | 46,355 | |||||||||||

Amortization of acquired intangible assets |

— | 212 | 539 | 106 | 499 | |||||||||||

| | | | | | | | | | | | | | | | | |

Total operating expenses |

143,566 | 166,543 | 240,260 | 102,834 | 185,082 | |||||||||||

| | | | | | | | | | | | | | | | | |

Loss from operations |

(12,054 | ) | (21,394 | ) | (16,019 | ) | (7,963 | ) | (51,421 | ) | ||||||

Interest income, net |

157 | 234 | 245 | 124 | 133 | |||||||||||

Gain on joint venture acquisition |

1,425 | — | — | — | — | |||||||||||

Other (expense) income, net |

(675 | ) | 155 | 294 | (504 | ) | (96 | ) | ||||||||

| | | | | | | | | | | | | | | | | |

Loss before income taxes |

(11,147 | ) | (21,005 | ) | (15,480 | ) | (8,343 | ) | (51,384 | ) | ||||||

Provision for income taxes |

(22 | ) | (50 | ) | (46 | ) | 5 | (17 | ) | |||||||

| | | | | | | | | | | | | | | | | |

Net loss |

$ | (11,169 | ) | $ | (21,055 | ) | $ | (15,526 | ) | $ | (8,338 | ) | $ | (51,401 | ) | |

Accretion of convertible redeemable preferred units |

(9,337 | ) | (12,154 | ) | (25,388 | ) | (15,948 | ) | (11,755 | ) | ||||||

| | | | | | | | | | | | | | | | | |

Net loss attributable to common unit holders |

(20,506 | ) | (33,209 | ) | (40,914 | ) | (24,286 | ) | (63,156 | ) | ||||||

Net loss attributable to common unit holders per unit — basic and diluted(1) |

$ |

(0.50 |

) |

$ |

(0.80 |

) |

$ |

(0.99 |

) |

$ |

(0.59 |

) |

$ |

(1.55 |

) |

|

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Weighted average number of common units outstanding used in computing per unit amounts — basic and diluted(1) |

41,271,992 | 41,271,992 | 41,331,546 | 41,271,992 | 40,828,976 | |||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Pro forma net loss per share — basic and diluted (unaudited)(1) |

$ | (0.87 | ) | $ | (0.89 | ) | ||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Pro forma weighted average number of common shares outstanding (unaudited)(1) |

66,399,733 | 70,416,261 | ||||||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

- (1)

- See Note 15 to our consolidated financial statements for an explanation of the calculations of our basic and diluted net loss per share of common stock, and pro forma net loss per share of common stock.

12

| |

June 30, 2014 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Actual

|

Pro Forma(1)

|

Pro Forma as Adjusted(2)

|

|||||||

| |

(in thousands) |

|||||||||

Consolidated Balance Sheet Data: |

||||||||||

Cash and cash equivalents and short-term investments |

$ | 152,798 | $ | 117,902 | $ | 376,207 | ||||

Working capital |

68,706 | 33,810 | 292,115 | |||||||

Total assets |

277,018 | 242,122 | 500,427 | |||||||

Deferred revenue |

18,033 | 18,033 | 18,033 | |||||||

Convertible redeemable preferred units |

392,715 | — | — | |||||||

Total member's (deficit)/stockholders' equity |

$ | (277,455 | ) | $ | 80,058 | $ | 338,363 | |||

- (1)

- The

pro forma column reflects (i) the consummation of the proposed Corporate Reorganization described in the section titled "Organizational

Structure," including a net adjustment of $0.3 million to accumulated (deficit)/retained earnings in connection with deferred income tax liabilities assumed to be recognized in connection with

the Corporate Reorganization, all presented as if these events had occurred as of June 30, 2014, (ii) the reclassification of all outstanding shares of common stock and the conversion of

all outstanding shares of preferred stock held by selling stockholders into shares of Class B common stock prior to the completion of this offering, (iii) the automatic conversion of all

other outstanding shares of our preferred stock into shares of our Class B common stock, which will occur immediately upon the completion of this offering, (iv) an adjustment of

$13.3 million to reduce the carrying value of the convertible redeemable preferred units to reflect conversion value assuming the security was converted on the balance sheet date,

(v) the distribution of accrued dividend amounts payable to certain holders of our Series A convertible redeemable preferred units upon conversion to shares of Class B common

stock equal to the members' distribution payable balance on our consolidated financial statements as of the completion of this offering, which amount was $20.9 million as of June 30,

2014, (vi) the equity compensation expense of $40.3 million associated with the common option units, deferred units and restricted common units that have satisfied the service condition

as of June 30, 2014, (vii) the reclassification of $1.5 million from due to related party to accrued expenses to reflect the effect of consolidation of SK Retail and

(viii) the net issuance of 925,949 shares of Class B common stock issuable upon the vesting of outstanding deferred units in connection with this offering, net of minimum tax withholding

obligations and the associated payment of cash, which amount was approximately $14.0 million as of June 30, 2014.

- (2)

- The pro forma as adjusted column gives effect to the pro forma adjustments set forth above and the receipt of $258.3 million in proceeds from the sale and issuance by us of 10,500,000 shares of Class A common stock in this offering, based on the initial public offering price of $26.50 per share, the midpoint of the range listed on the cover page of this prospectus, after deducting the estimated underwriting discount and estimated offering expenses payable by us.

13

Investing in our Class A common stock involves a high degree of risk. Before you invest, you should carefully consider the following risks, as well as general economic and business risks and all of the other information contained in this prospectus. Any of the following risks could have a material adverse effect on our business, operating results and financial condition and cause the trading price of our Class A common stock to decline, which could cause you to lose all or part of your investment. When determining whether to invest, you should also refer to the other information contained in this prospectus, including the section titled "Special Note Regarding Forward-Looking Statements" and our financial statements and the related notes thereto.

Risks Related to Our Business and Industry

Our recent growth rates may not be sustainable or indicative of our future growth.

In late 2011, we closed and permanently redirected over 240 of our niche websites into Wayfair.com. Additionally, we launched Joss & Main. In 2013, we acquired DwellStudio, and in 2014, we launched Birch Lane. Because we launched most of our brands recently, we have a limited amount of information regarding the purchasing patterns of our customers on these websites. We depend heavily on this information to plan and forecast our business, including anticipated customer acquisition costs, net revenue per active customer and other key performance metrics. If our assumptions prove to be wrong, we may spend more than we anticipate to acquire and retain customers or may generate less net revenue per active customer than anticipated, any of which could have a negative impact on our business and results of operations. In addition, our historical growth rates may not be sustainable or indicative of future growth.

We believe that our continued revenue growth will depend upon, among other factors, our ability to:

- •

- build our brands and launch new brands;

- •

- acquire more customers;

- •

- develop new features to enhance the consumer experience on our websites, mobile-optimized websites and mobile

applications, which we collectively refer to as our sites;

- •

- increase the frequency with which new and repeat customers purchase products on our sites through merchandising, data,

analytics and technology;

- •

- add new suppliers and deepen our relationships with our existing suppliers;

- •

- enhance the systems our consumers use to interact with our sites and invest in our infrastructure platform;

- •

- expand internationally; and

- •

- pursue strategic acquisitions.

We cannot assure you we will be able to achieve any of the foregoing. Our customer base may not continue to grow or may decline as a result of increased competition and the maturation of our business. Failure to continue our revenue growth rates could have a material adverse effect on our financial condition and results of operations. You should not rely on our historical rate of revenue growth as an indication of our future performance.

14

If we fail to manage our growth effectively, our business, financial condition and operating results could be harmed.

To manage our growth effectively, we must continue to implement our operational plans and strategies, improve and expand our infrastructure of people and information systems and expand, train and manage our employee base. We have rapidly increased employee headcount since our inception to support the growth in our business, and we intend for this growth to continue for the foreseeable future. The number of our employees increased from 1,169 full-time equivalents as of December 31, 2012 to 1,558 full-time equivalents as of December 31, 2013, and we expect to add a significant number of employees in 2014. To support continued growth, we must effectively integrate, develop and motivate a large number of new employees. We face significant competition for personnel, particularly in the Boston, Massachusetts area where our headquarters are located. Failure to manage our hiring needs effectively or successfully integrate our new hires may have a material adverse effect on our business, financial condition and operating results.

Additionally, the growth of our business places significant demands on our management and other employees. For example in 2013, we launched hundreds of promotional events across thousands of products each month on Wayfair.com, in addition to hundreds of promotional events — or "Daily Events" — on Joss & Main in which we promote thousands of products via emails, "push" notifications and personalized displays. These events require us to produce updates of our sites and emails to our customers on a daily basis with different products, photos and text. The growth of our business may require significant additional resources to meet these daily requirements, which may not scale in a cost-effective manner or may negatively affect the quality of our sites and customer experience. We are also required to manage relationships with a growing number of suppliers, customers and other third parties. For example, in 2013, we added over 800 new suppliers. Our information technology systems and our internal controls and procedures may not be adequate to support future growth of our supplier base. If we are unable to manage the growth of our organization effectively, our business, financial condition and operating results may be materially adversely affected.

If we fail to acquire new customers, or fail to do so in a cost-effective manner, we may not be able to increase net revenue per active customer or achieve profitability.

Our success depends on our ability to acquire customers in a cost-effective manner. In order to expand our customer base, we must appeal to and acquire customers who have historically used other means of commerce to purchase home goods and may prefer alternatives to our offerings, such as traditional brick and mortar retailers, the websites of our competitors or a supplier's own website. We have made significant investments related to customer acquisition and expect to continue to spend significant amounts to acquire additional customers. For example, we have recently expanded our national U.S. television branding and advertising campaigns. Such campaigns are expensive and may not result in the cost-effective acquisition of customers. We cannot assure you that the net profit from new customers we acquire will ultimately exceed the cost of acquiring those customers. If we fail to deliver a quality shopping experience, or if consumers do not perceive the products we offer to be of high value and quality, we may not be able to acquire new customers. If we are unable to acquire new customers who purchase products in numbers sufficient to grow our business, we may not be able to generate the scale necessary to drive beneficial network effects with our suppliers, our net revenue may decrease, and our business, financial condition and operating results may be materially adversely affected.

We believe that many of our new customers originate from word-of-mouth and other non-paid referrals from existing customers. Therefore we must ensure that our existing customers remain loyal to us in order to continue receiving those referrals. If our efforts to satisfy our existing customers are not successful, we may not be able to acquire new customers in sufficient numbers

15

to continue to grow our business, or we may be required to incur significantly higher marketing expenses in order to acquire new customers.

We also utilize paid and non-paid advertising. Our paid advertising includes search engine marketing, display advertising, paid social media and television advertisements. Our non-paid advertising efforts include search engine optimization, non-paid social media, mobile "push" notifications and email. We obtain a significant amount of traffic via search engines and, therefore, rely on search engines such as Google, Bing and Yahoo!. Search engines frequently update and change the logic that determines the placement and display of results of a user's search, such that the purchased or algorithmic placement of links to our sites can be negatively affected. Moreover, a search engine could, for competitive or other purposes, alter its search algorithms or results, causing our sites to place lower in search query results. A major search engine could change its algorithms in a manner that negatively affects our paid or non-paid search ranking, and competitive dynamics could impact the effectiveness of search engine marketing or search engine optimization. We also obtain a significant amount of traffic via social networking websites or other channels used by our current and prospective customers. As e-commerce and social networking continue to rapidly evolve, we must continue to establish relationships with these channels and may be unable to develop or maintain these relationships on acceptable terms. If we are unable to cost-effectively drive traffic to our sites, our ability to acquire new customers and our financial condition would suffer.

Our success depends in part on our ability to increase our net revenue per active customer. If our efforts to increase customer loyalty and repeat purchasing as well as maintain high levels of customer engagement and average order values of our customers are not successful, our growth prospects and revenue will be materially adversely affected.

Our ability to grow our business depends on our ability to retain our existing customer base and generate increased revenue and repeat purchases from this customer base, and maintain high levels of customer engagement. To do this, we must continue to provide our customers and potential customers with a unified, convenient, efficient and differentiated shopping experience by:

- •

- providing imagery, tools and technology that attract customers who historically would have bought elsewhere;

- •

- maintaining a high-quality and diverse portfolio of products;

- •

- managing over 7,000 suppliers to deliver products on time and without damage; and

- •

- continuing to invest in our mobile platforms.

If we fail to increase net revenue per active customer, generate repeat purchases or maintain high levels of customer engagement and average order value, our growth prospects, operating results and financial condition could be materially adversely affected.

Our business depends on our ability to build and maintain strong brands. We may not be able to maintain and enhance our existing brands if we receive unfavorable customer complaints, negative publicity or otherwise fail to live up to consumers' expectations, which could materially adversely affect our business, results of operations and growth prospects.

We currently offer five distinct brands to our customers, but we have a limited operating history with most of these brands. Maintaining and enhancing these brands are critical to expanding our base of customers and suppliers. However, a significant portion of our customers' brand experience depends on third parties outside of our control, including suppliers and logistics providers such as FedEx, UPS and the U.S. Postal Service. If these third parties do not meet our or our customers' expectations, our brand may suffer irreparable damage. In addition, maintaining and

16

enhancing these brands may require us to make substantial investments, and these investments may not be successful. If we fail to promote and maintain our brands, or if we incur excessive expenses in this effort, our business, operating results and financial condition may be materially adversely affected. We anticipate that, as our market becomes increasingly competitive, maintaining and enhancing our brands may become increasingly difficult and expensive. Maintaining and enhancing our brands will depend largely on our ability to provide high quality products to our customers and a reliable, trustworthy and profitable sales channel to our suppliers, which we may not do successfully.

Customer complaints or negative publicity about our sites, products, product delivery times, customer data handling and security practices or customer support, especially on blogs, social media websites and our sites, could rapidly and severely diminish consumer use of our sites and consumer and supplier confidence in us and result in harm to our brands.

Our efforts to launch new brands and expand our existing brand portfolio internationally may not be successful.

Our business success depends to some extent on our ability to expand our customer offerings by launching new brands and expanding our existing brand portfolio into new geographies. For example, we recently launched Birch Lane in the United States and Canada and we recently launched our Joss & Main brand in the United Kingdom, France and Germany. Launching new brands or expanding our existing brand portfolio internationally requires significant upfront investments, including investments in marketing, information technology and additional personnel. Expanding our brands internationally is particularly challenging because it requires us to gain country-specific knowledge about consumers and regional competitors, construct home goods catalogs specific to the country, build local logistics capabilities and customize portions of our technology for local markets. We may not be able to generate satisfactory revenue from these efforts to offset these upfront costs. Any lack of market acceptance of our efforts to launch new brands or expand our existing brand portfolio could have a material adverse effect on our business, prospects, financial condition and results of operations.

Expansion of our international operations will require management attention and resources, involves additional risks, and may be unsuccessful, which could harm our future business development and existing domestic operations.

We believe international expansion represents a significant growth opportunity for us. Today, we deliver products to customers in a number of countries, including the United States, the United Kingdom, Canada, Australia, Germany, France, Austria, Ireland and New Zealand. We plan to expand into other international markets in order to grow our business, which will require significant management attention and resources. For example, we have made and will continue to make significant investments in information technology, logistics, supplier relationships, merchandising and marketing in the foreign jurisdictions in which we operate or plan to operate. We have limited experience in selling our products to conform to different local cultures, standards and regulations, and the products we offer may not appeal to customers in the same manner, if at all, in other geographies. We may have to compete with local companies which understand the local market better than we do and/or may have greater brand recognition than we do. In addition, to deliver satisfactory performance for customers in international locations, it may be necessary to locate physical facilities, such as consolidation centers, in foreign markets, and we may have to invest in these facilities before we can determine whether or not our foreign operations are successful. We have limited experience establishing such facilities internationally. We may not be successful in expanding into additional international markets or in generating net revenue from foreign operations. Furthermore, different privacy, censorship, liability, intellectual property and other laws

17

and regulations in foreign countries may cause our business, financial condition and operating results to be materially adversely affected.

Our future results could be materially adversely affected by a number of factors inherent in international operations, including:

- •

- localization of our product offerings, including translation into foreign languages and adaptation for local practices;

- •

- the need to vary our practices in ways with which we have limited or no experience or which are less profitable or carry

more risk to us;

- •

- unexpected changes in regulatory requirements, taxes, trade laws, tariffs, export quotas, custom duties or other trade

restrictions;

- •

- differing labor regulations where labor laws may be more advantageous to employees as compared to the United States;

- •

- more stringent regulations relating to data privacy and security, including the use of commercial and personal

information, particularly in the European Union;

- •

- changes in a specific country's or region's political or economic conditions;

- •

- the rising cost of labor in the foreign countries in which our suppliers operate, resulting in increases in our costs of

doing business internationally;

- •

- challenges inherent in efficiently managing an increased number of employees over large geographic distances, including

the need to implement appropriate systems, policies, benefits and compliance programs and maintain our corporate culture across geographies;

- •

- risks resulting from changes in currency exchange rates;

- •

- limitations on our ability to reinvest earnings from operations in one country to fund the capital needs of our operations

in other countries;

- •

- different or lesser intellectual property protection;

- •

- exposure to liabilities under anti-corruption and anti-money laundering laws, including the U.S. Foreign Corrupt Practices

Act and similar laws and regulations in other jurisdictions;

- •

- import/export controls; and

- •

- logistics and sourcing.

Operating internationally requires significant management attention and financial resources. We cannot be certain that the investment and additional resources required to establish and expand our international operations will produce desired levels of net revenue or profitability. If we invest substantial time and resources to establish and expand our international operations and are unable to do so successfully and in a timely manner, our business, financial condition and operating results may be materially adversely affected.

We have a history of losses and expect to have increasing operating losses and negative cash flow as we continue to expand our business.

We have a history of losses, and we have accumulated $277.1 million in common members' deficit as of June 30, 2014. We expect our operating losses and negative cash flow to increase significantly in the near-term as we increase investment in our business. Because the market for purchasing home goods online is rapidly evolving and has not yet reached widespread adoption, it is difficult for us to predict our future operating results. As a result, our losses may be larger than

18

anticipated, and we may never achieve profitability. We expect our operating expenses to increase over the next several years as we increase our advertising budget, hire additional personnel and continue to develop features on our sites. In particular, we intend to continue to invest substantial resources in marketing to acquire new customers. In addition, as we grow as a newly public company, we have and will continue to incur additional significant legal, accounting and other expenses that we did not incur as a private company. Furthermore, if our future growth and operating performance fail to meet investor or analyst expectations, or if we have future negative cash flow or losses resulting from our investment in acquiring new customers, our financial condition and stock price could be materially adversely affected.

System interruptions that impair customer access to our sites or other performance failures in our technology infrastructure could damage our business, reputation and brand and substantially harm our business and results of operations.

The satisfactory performance, reliability and availability of our sites, transaction processing systems and technology infrastructure are critical to our reputation and our ability to acquire and retain customers, as well as maintain adequate customer service levels.

We currently utilize two third-party data center hosting facilities. If the main facility where substantially all of our computer and communications hardware is located fails, or if we suffer an interruption or degradation of services at our main facility, we could lose customer data and miss order fulfillment deadlines, which could harm our business. Our systems and operations are vulnerable to damage or interruption from fire, flood, power loss, telecommunications failure, terrorist attacks, cyber-attacks, data loss, acts of war, break-ins, earthquake and similar events. In the event of a failure of our main facility, the failover to our back-up facility could take substantial time, during which time our sites could be completely shut down. Our back-up facility is designed to support transaction volume at a level slightly above our average daily sales, but is not adequate to support spikes in demand. The back-up facility may not process effectively during time of higher traffic to our sites and may process transactions more slowly and may not support all of our sites' functionality.

We use complex proprietary software in our technology infrastructure, which we seek to continually update and improve. We may not always be successful in executing these upgrades and improvements, and the operation of our systems may be subject to failure. In particular, we have in the past and may in the future experience slowdowns or interruptions in some or all of our sites when we are updating them, and new technologies or infrastructures may not be fully integrated with existing systems on a timely basis, or at all. Additionally, if we expand our use of third-party services, including cloud-based services, our technology infrastructure may be subject to increased risk of slowdown or interruption as a result of integration with such services and/or failures by such third-parties, which are out of our control. Our net revenue depends on the number of visitors who shop on our sites and the volume of orders we can handle. Unavailability of our sites or reduced order fulfillment performance would reduce the volume of goods sold and could also materially adversely affect consumer perception of our brand. We may experience periodic system interruptions from time to time. In addition, continued growth in our transaction volume, as well as surges in online traffic and orders associated with promotional activities or seasonal trends in our business, place additional demands on our technology platform and could cause or exacerbate slowdowns or interruptions. If there is a substantial increase in the volume of traffic on our sites or the number of orders placed by customers, we will be required to further expand and upgrade our technology, transaction processing systems and network infrastructure. There can be no assurance that we will be able to accurately project the rate or timing of increases, if any, in the use of our sites or expand and upgrade our systems and infrastructure to accommodate such increases on a timely basis. In order to remain competitive, we must continue to enhance and

19

improve the responsiveness, functionality and features of our sites, which is particularly challenging given the rapid rate at which new technologies, customer preferences and expectations and industry standards and practices are evolving in the e-commerce industry. Accordingly, we redesign and enhance various functions on our sites on a regular basis, and we may experience instability and performance issues as a result of these changes.

Any slowdown or failure of our sites and the underlying technology infrastructure could harm our business, reputation and our ability to acquire, retain and serve our customers, which could materially adversely affect our results of operations. Our disaster recovery plan may be inadequate, and our business interruption insurance may not be sufficient to compensate us for the losses that could occur.

Our business is highly competitive. Competition presents an ongoing threat to the success of our business.

Our business is rapidly evolving and intensely competitive, and we have many competitors in different industries. Our competition includes: furniture stores, big box retailers, department stores, specialty retailers, and online home goods retailers and marketplaces, including:

- •

- Furniture Stores: Ashley Furniture, Bob's Discount

Furniture, Havertys, Raymour & Flanagan and Rooms To Go;

- •

- Big Box Retailers: Bed, Bath & Beyond, Home Depot,

IKEA, Lowe's, Target and Walmart;

- •

- Department Stores: JCPenney and Macy's;

- •

- Specialty Retailers: Crate and Barrel, Ethan Allen,

HomeGoods, Pottery Barn and Restoration Hardware; and

- •

- Online Home Goods Retailers and Online Marketplaces: Amazon, eBay and One Kings Lane.

We expect competition in e-commerce generally to continue to increase. We believe that our ability to compete successfully depends upon many factors both within and beyond our control, including:

- •

- the size and composition of our customer base;

- •

- the number of suppliers and products we feature on our sites;

- •

- our selling and marketing efforts;

- •

- the quality, price and reliability of products offered either by us;

- •

- the convenience of the shopping experience that we provide;

- •

- our ability to distribute our products and manage our operations; and

- •

- our reputation and brand strength.

Many of our current competitors have, and potential competitors may have, longer operating histories, greater brand recognition, larger fulfillment infrastructures, greater technical capabilities, faster and less costly shipping, significantly greater financial, marketing and other resources and larger customer bases than we do. These factors may allow our competitors to derive greater net revenue and profits from their existing customer base, acquire customers at lower costs or respond more quickly than we can to new or emerging technologies and changes in consumer habits. These competitors may engage in more extensive research and development efforts, undertake more far-reaching marketing campaigns and adopt more aggressive pricing policies, which may

20

allow them to build larger customer bases or generate net revenue from their customer bases more effectively than we do.

Purchasers of home goods may not choose to shop online, which would prevent us from growing our business.