Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Vectrus, Inc. | d791887d8k.htm |

| EX-10.1 - EXHIBIT 10.1 - Vectrus, Inc. | d791887dex101.htm |

VECTRUS

INVESTOR PRESENTATION

SEPTEMBER 19, 2014 |

SAFE

HARBOR STATEMENT Page 2

SAFE

HARBOR

STATEMENT

UNDER

THE

PRIVATE

SECURITIES

LITIGATION

REFORM

ACT

OF

1995

(THE

“ACT”):

CERTAIN

MATERIAL

PRESENTED

HEREIN

INCLUDES

FORWARD-LOOKING

STATEMENTS

INTENDED

TO

QUALIFY

FOR

THE

SAFE

HARBOR

FROM

LIABILITY

ESTABLISHED

BY

THE

ACT.

THESE

FORWARD-LOOKING

STATEMENTS

INCLUDE,

BUT

ARE

NOT

LIMITED

TO,

STATEMENTS

ABOUT

THE

SEPARATION

OF

VECTRUS,

INC.

(THE

“COMPANY”) FROM EXELIS INC., THE TERMS AND THE EFFECT OF THE SEPARATION,

THE NATURE AND IMPACT OF SUCH A SEPARATION, CAPITALIZATION

OF

THE

COMPANY,

FUTURE

STRATEGIC

PLANS

AND

OTHER

STATEMENTS

THAT

DESCRIBE

THE

COMPANY'S

BUSINESS

STRATEGY,

OUTLOOK,

OBJECTIVES,

PLANS,

INTENTIONS

OR

GOALS,

AND

ANY

DISCUSSION

OF

FUTURE

OPERATING

OR

FINANCIAL

PERFORMANCE.

WHENEVER

USED,

WORDS

SUCH

AS

“MAY”,

“WILL”,

“LIKELY”,

"ANTICIPATE,"

"ESTIMATE,"

"EXPECT,"

"PROJECT,"

"INTEND,"

"PLAN,"

"BELIEVE,"

"TARGET"

AND

OTHER

TERMS

OF

SIMILAR

MEANING

ARE

INTENDED

TO

IDENTIFY

SUCH

FORWARD-LOOKING

STATEMENTS.

FORWARD-

LOOKING

STATEMENTS

ARE

UNCERTAIN

AND

TO

SOME

EXTENT

UNPREDICTABLE,

AND

INVOLVE

KNOWN

AND

UNKNOWN

RISKS,

UNCERTAINTIES

AND OTHER

IMPORTANT

FACTORS

THAT

COULD

CAUSE

ACTUAL

RESULTS

TO

DIFFER

MATERIALLY

FROM

THOSE

EXPRESSED

OR

IMPLIED

IN,

OR

REASONABLY INFERRED FROM, SUCH FORWARD-LOOKING STATEMENTS.

SUCH

FORWARD-LOOKING

STATEMENTS

INCLUDE

FACTORS

THAT

COULD

CAUSE

RESULTS

TO

DIFFER

MATERIALLY

FROM

THOSE

ANTICIPATED

INCLUDE, BUT ARE NOT LIMITED TO: ECONOMIC, POLITICAL AND SOCIAL CONDITIONS IN THE

COUNTRIES IN WHICH WE CONDUCT OUR BUSINESSES;

CHANGES

IN

U.S.

OR

INTERNATIONAL

GOVERNMENT

DEFENSE

BUDGETS;

GOVERNMENT

REGULATIONS

AND

COMPLIANCE

THEREWITH,

INCLUDING

CHANGES

TO

THE

DEPARTMENT

OF

DEFENSE

PROCUREMENT

PROCESS;

CHANGES

IN

TECHNOLOGY;

INTELLECTUAL

PROPERTY

MATTERS;

GOVERNMENTAL

INVESTIGATIONS,

REVIEWS,

AUDITS

AND

COST

ADJUSTMENTS;

DELAYS

IN

COMPLETION

OF

THE

U.S.

GOVERNMENT’S

BUDGET;

OUR

SUCCESS

IN

EXPANDING

OUR

GEOGRAPHIC

FOOTPRINT

OR

BROADENING

OUR

CUSTOMER

BASE;

OUR

ABILITY

TO REALIZE

THE

FULL

AMOUNTS

REFLECTED

IN

OUR

BACKLOG;

IMPAIRMENT

OF

GOODWILL;

MISCONDUCT

OF

OUR

EMPLOYEES,

SUBCONTRACTORS,

AGENTS

AND

BUSINESS

PARTNERS;

OUR

ABILITY

TO

CONTROL

COSTS;

OUR

LEVEL

OF

INDEBTEDNESS;

SUBCONTRACTOR

PERFORMANCE;

ECONOMIC

AND

CAPITAL

MARKETS

CONDITIONS;

ABILITY

TO

RETAIN

AND

RECRUIT

QUALIFIED

PERSONNEL;

SECURITY

BREACHES

AND

OTHER

DISRUPTIONS

TO

OUR

INFORMATION

TECHNOLOGY

AND

OPERATIONS;

CHANGES

IN

OUR

TAX

PROVISIONS

OR

EXPOSURE TO ADDITIONAL INCOME TAX LIABILITIES; CHANGES IN GENERALLY ACCEPTED

ACCOUNTING PRINCIPLES; AND OTHER FACTORS SET FORTH

IN

OUR

REGISTRATION

STATEMENT

ON

FORM

10

AND

OUR

OTHER

FILINGS

WITH

THE

SECURITIES

AND

EXCHANGE

COMMISSION.

IN

ADDITION, THERE ARE RISKS

AND

UNCERTAINTIES

RELATING

TO

THE

SEPARATION,

INCLUDING

WHETHER

THOSE

TRANSACTIONS

WILL

RESULT

IN ANY TAX

LIABILITY,

THE

OPERATIONAL

AND

FINANCIAL

PROFILE

OF

THE

COMPANY

OR

ANY

OF

ITS

BUSINESSES

AFTER

GIVING

EFFECT

TO

THE

SEPARATION, AND THE ABILITY

OF

THE

COMPANY

TO

OPERATE

AS

AN

INDEPENDENT

ENTITY.

THE COMPANY

UNDERTAKES

NO

OBLIGATION

TO

UPDATE

ANY

FORWARD-LOOKING

STATEMENTS,

WHETHER

AS

A

RESULT

OF

NEW

INFORMATION, FUTURE EVENTS OR OTHERWISE. |

TRANSACTION OVERVIEW

Page 3

DISTRIBUTING COMPANY

Exelis Inc.

(NYSE:XLS)

DISTRIBUTED COMPANY

Vectrus, Inc.

TICKER

VEC

EXCHANGE

NYSE

DISTRIBUTION RATIO

18 shares of Exelis : 1 share of Vectrus

EXPECTED VEC SHARES O/S

10.46M

CAPITAL STRUCTURE

$140M Term Loan A with a

$75M Revolving Credit facility

KEY DATES

•

When-Issued Trading

September 16, 2014

•

Record Date

September 18, 2014

•

Distribution Date

September 27, 2014

•

Regular-Way Trading Begins

September 29, 2014

Presentation

may

be

found

at

http://www.exelisinc.com/transformation |

AGENDA

Page 4

Opening Remarks – Cindy Frothingham, Vectrus Director of Investor Relations Introduction

– Dave Melcher, Exelis CEO and President

Corporate Overview – Ken Hunzeker, Vectrus CEO Business

Strategy – Ted Wright, Vectrus COO

Customers and Programs – Chuck Anderson, Vectrus SVP of Programs

Business Development – Janet Oliver, Vectrus SVP of Business

Development

Financial Overview – Matt Klein, Vectrus CFO

Summary – Ken Hunzeker, Vectrus CEO Q&A |

INTRODUCTION

DAVE MELCHER –

EXELIS CHIEF EXECUTIVE OFFICER AND PRESIDENT |

CORPORATE OVERVIEW

KEN HUNZEKER –

VECTRUS CHIEF EXECUTIVE OFFICER |

VECTRUS: TRUE TO YOUR MISSION

Page 7

Our

Mission

We deliver large-scale IT, logistics, and

Our

Vision

Be the customer’s first choice and most

trusted partner.

infrastructure services to enable customer

success. |

EXPERIENCED LEADERSHIP TEAM

Page 8

Ken Hunzeker

Chief Executive

Officer

•

Joined company in 2010

•

President, Mission Systems

•

Vice President for Government Relations,

ITT Defense and Information Solutions

•

Lieutenant General (Ret.), U.S. Army

•

Deputy Commander, United States

Forces —

Iraq

Ted Wright

Chief Operating Officer

•

Joined company in 1995 (9 years);

rejoined in 2013

•

President and CEO, Academi

•

President, KBR North American

Government and Defense

•

President of Technology Solutions and

Services Division, BAE Systems

Matt Klein

Chief Financial Officer

•

Joined company in 1996

•

Chief Financial Officer, Mission Systems

•

Assistant Controller, ITT Electronic

Systems, Communications Systems

•

Assistant Controller, ITT Electronic

Systems, Radar, Reconnaissance and

Acoustic Systems

•

CPA

Chuck Anderson

SVP, Programs

•

Joined company in 2011

•

Vice President & General Manager, Base

Operations & Logistics Programs

•

Major General (Ret.), U.S. Army

•

Commanding General of Training

Division West at Fort Hood, TX

Janet Oliver

SVP, Business Dev.

•

Joined company in 2009

•

Vice President & Director, U.S. & Europe

Programs

•

Vice President, Mission Support

Services, Shaw Group

•

Executive VP, Marketing & Business

Development, Fluor Government Group

subsidiary |

VECTRUS OVERVIEW

Page 9

Vectrus Today

(1) As of June 30, 2014. Total backlog represents firm orders and potential

options on multi-year contracts, excluding potential orders under indefinite delivery / indefinite quantity

(IDIQ) contracts.

Our Legacy

2014

1945

Founded as ITT

Federal

Electric, Inc.

Vectrus Spins

Out of Exelis

Proven 50+ year history of deploying resources

rapidly and with precision to support the mission

success of our customers

1990

Moved to Colorado

Springs; Renamed ITT

Federal Services Corp.

Renamed ITT

Corp., Systems

Division

2011

1997

Renamed Exelis

Systems

Corporation

•

Leading provider of:

–

Infrastructure asset management

–

Information technology and network

communication services

–

Logistics and supply chain management

services

•

Revenue $1.1B -

$1.2B 2014E

•

Deep, long-term customer relationships

•

Robust backlog of $2.4B

(1)

and healthy new

business pipeline

•

Global service solutions in 18 countries, with

approximately 5,600 current global employees

•

Headquartered in Colorado Springs, CO |

INVESTMENT HIGHLIGHTS

•

> $1B business supporting customers’

mission

•

Long-term foundational contracts with $2.4B in backlog

(1)

•

Accomplished management team

Page 10

Strong Core Business

Enduring Customer

Relationships

Significant Market

Opportunity

Large Pipeline and Proven

Growth Strategy

Solid Financial Position

•

More than 50-year legacy supporting customers’

key missions

•

Recent expansion into new customers

•

Proven ability to win and execute large-scale, mission critical

global programs involving complex logistics and supply chains

•

Opportunity to capture larger share of a ~$111B fragmented

market

•

~$10B 3-year pipeline of qualified contract opportunities

•

Won over $2B of new awards and seven new IDIQ contracts

in past 18 months

•

Free cash flow conversion

(2)

~100% of net income

•

Scalable cost structure

(1)

As of June 30, 2014. Total backlog represents firm orders and potential options on

multi-year contracts, excluding potential orders under indefinite

delivery / indefinite quantity (IDIQ) contracts.

(2)

Free Cash Flow Conversion is calculated by taking GAAP net cash from operating

activities, less capital expenditures divided by net income |

•

Relentless focus on controlling indirect costs

•

Deep customer and mission knowledge critical to delivering mission success

at competitive cost

Grow the top line

•

Successful program execution

•

Enables client mission success

True to customers’

missions

•

Integrity, respect, responsibility

•

Strong governance and compliance

Values and reputation

enable success

•

All business systems approved by the Government

•

Business disciplines, e.g. ISO, CMMI, Lean Six Sigma

Consistent delivery of

services

VECTRUS VALUE PROPOSITION

•

Historically have received high award fees

•

Current excellent assessment of performance by customers

Customer satisfaction

Page 11

Customer Focus – Deep understanding of customer needs Performance

Excellence – Vectrus performs on contracts

Operational Excellence – Culture of continuous improvement Honorable Values

– Vectrus lives its values

Cost Leadership

–

Know how to win in a competitive environment |

MARKET DYNAMICS

Page 12

•

Vectrus-provided services remain critical to government outsourcing

efforts •

Balance between performance, cost and schedule remains a priority for the

customer •

U.S. global reach requires extensive international experience

•

Expeditionary capability remains critical to support U.S. efforts around the

world •

DoD base O&M budget projected to increase |

AFGHANISTAN

•

Agility and positioning enabled Vectrus to

win significant amount of work related to

OCO funding in Afghanistan

•

Base business aligns with government

spending priorities

•

Revenue from existing Afghanistan

programs projected to decline with U.S.

combat troop levels

•

Cost, capital, management structure,

strategy and business development

aligned with post-Afghanistan

(1)

Source:

OMB

March

2014;

President’s

Budget

FY15;

OCO

forecast

represents

Vectrus’

estimates

based

on

CBO

Sequestration

allocation

methodology, with Vectrus’

estimates for OCO O&M allocation

(2)

Afghanistan revenue projection for full year 2014.

DoD Base O&M Budget

(1)

($B)

Vectrus’

Afghanistan Revenue

Adapting to the realities of a post-Afghanistan environment

($M)

Page 13

(2) |

EMPLOYEES

Page 14

•

Approximately 5,600 current global employees

•

110 locations in 18 countries with over 75% of employees stationed abroad

•

Over 60% of program managers and 30% of employees reporting a military

background Denotes Vectrus employee locations supporting customer

requirements |

BUSINESS STRATEGY

TED WRIGHT –

VECTRUS CHIEF OPERATING OFFICER |

CORE

CAPABILITIES Page 16

Infrastructure

Asset

Management

Logistics &

Supply Chain

Management

Services

Information

Technology &

Network

Communication

Services

Services

Key Contracts

Three Service Lines * Large Contracts * Challenging Environments

•

Infrastructure sustainment

services including base

maintenance, public works, civil

engineering and minor

construction/renovations

•

Base support including

transportation, emergency

services and life support services

•

Lifecycle management of IT

systems & components

•

Network systems management,

network defense, information

assurance

•

Military communications

operations & maintenance

•

Equipment maintenance and

repair

•

Warehouse management and

distribution

•

Ammunition

and

fuel

–

issue,

maintenance and storage

•

Kuwait Base Operations and

Security Support Services

•

Maxwell Air Force Base

Operations Support

•

Kaiserslautern Facilities

Engineering

•

Army Communications in Southwest

Asia and Central Asia

•

Navy Fleet Systems Engineering

Team

•

U.S. Army Corps of Engineers IT

Support Services

•

Army Pre-Positioned Stocks

Kuwait and Qatar

•

Fort Rucker Logistics Support

Services

•

Marine Corps Logistics Support

Services |

GLOBAL ADDRESSABLE MARKETS

•

Large fragmented market both

domestically and overseas

•

Significant opportunity to grow

and expand to new DoD

customers and new geographies

Page 17

Infrastructure

Asset

Management

Logistics &

Supply Chain

Management

Services

Information

Technology &

Network

Communication

Services

FY14 Estimated

Markets

Comments

$48B

$45B

$18B

•

Growing, attractive market as

U.S. continues to leverage

technological advantages

•

Recent major wins (two re-

competes, two new) set the stage

to address multiple customers

•

Current work primarily with Army

•

Opportunities with Marine Corps

and allied international

governments

Sources: Federal Procurement Data System (FPDS), TechAmerica

Army

Air Force

Navy

Other DoD

DOE

Other Civil U.S.G.

International

Army

Navy

Other DoD

Other Civil U.S.G.

International

Army

Air Force

Navy

Other DoD

DOS

Other Civil U.S.G.

International |

LONG-TERM STRATEGY

Balance the Portfolio

Expand the Diversity of

Revenue Streams in Core

Offerings through New

Customers and Geographies

Enhance Solid Foundation

Continued Focus on the

Competitiveness of our

Core Business

Provide More Value

Enhance and Extend

Offerings to Increase

Value

Page 18

Strengthen Base

Grow Top Line

Expand Margins

•

Add capabilities that allow

us to deliver higher value-

added and differentiated

service solutions

•

Evaluate and pursue

acquisitions on a strategic

basis

•

Continue to manage

internal costs

•

Broaden customer base

•

Expand geographic

footprint

•

Enterprise-wide focus on

Business Development

•

Continued excellent

performance on existing

contracts

•

Manage costs

•

Balance between

performance and cost

•

Enterprise-wide focus on re-

competes |

CUSTOMERS AND PROGRAMS

CHUCK ANDERSON –

VECTRUS SENIOR VICE PRESIDENT OF PROGRAMS |

CUSTOMER RELATIONSHIPS

Page 20

Customer

Relationship

Length

(Years)

Customer

Relationship

Length

(Years)

U.S. Army Network

Enterprise Technology

Command

38+

U.S. Air Force

Combat Command

32+

U.S. Army Materiel

Command

12+

U.S. Air Force –

Europe

32+

U.S. Army Europe

12+

U.S. Air Force Air

Education & Training

Command

12+

U.S. Army Central

Command

12+

U.S. Navy Space and

Naval Warfare

Systems Command

15+

U.S. Army Installation

Management Command

4+

Missile Defense

Agency

2+

U.S. Army Corps of

Engineers

4+

U.S. Marine Corps

Logistics Command

1+

Strong relationships with agencies critical to our Nation’s security

Denotes different funding source within U.S. Army |

Locations

Camps Arifjan, Virginia,

and Buehring; Ali Al

Salem; Camp Patriot;

Airport and Seaport

Customer

Operational: Area

Support Group

-

Kuwait

Contract Type

Cost Plus Award Fee

and Award Term

Contract Award /

Length

February 2011 /

5 years

Page 21

KUWAIT BASE OPERATIONS

AND SECURITY SUPPORT SERVICES

DESCRIPTION

•

K-BOSSS provides full-spectrum life support and

base operations services including transportation,

logistics, public works, information management,

medical support services, range operations, and

security, fire, and emergency services for all U.S.

Army facilities in the Kuwait Area of Responsibility

•

Awarded contract value: $1.3B

PROGRAM HIGHLIGHTS AND

SUCCESSES

•

All “Exceptional”

government ratings

•

97% and 98% Award Fee scores for most recent

2-year period

•

Growth in contract value from an initial $1.3B to

$2.3B today (increased scope due to retrograde

from Iraq) |

Locations

Afghanistan,

Bahrain, Kuwait and

Qatar

Customer

U.S. Army NETCOM

and 160 Signal

Brigade

Contract Type

Cost Plus Fixed Fee

w/Award Term

Contract Award /

Length

July 2013 / 5 years

OPERATIONS, MAINTENANCE, AND DEFENSE OF

ARMY COMMUNICATIONS

DESCRIPTION

•

OMDAC-SWACA provides network & systems

management, communications O&M, network

defense and information assurance services to

support U.S. Army, USARCENT, and USCENTCOM

requirements

•

Total contract value: $788M

PROGRAM HIGHLIGHTS AND

SUCCESSES

•

All “Exceptional”

government ratings

•

Operate the largest overseas Army Cyber Center

(Kuwait)

•

Successfully executed network transition optimization

plan in sync with military mission realignments

•

Earned first award term period in August 2014

•

Successor contract

Page 22

th |

Locations

Arifjan, Kuwait and

Camp As Sayliyah,

Qatar

Customer

Operational:

Army Field Support

Battalions –

Kuwait/Qatar

Contract Type

Cost Plus Award Fee

and Fixed Price

Contract Award /

Length

Kuwait & Qatar 2010 /

5 years

ARMY PREPOSITIONED STOCKS –

KUWAIT AND QATAR

Page 23

DESCRIPTION

•

APS5 KU and APS5 QT provides multifunctional

logistics -

sustainment level maintenance, retail and

wholesale

supply,

and

multimodal

transportation

-

in

support of Army units, theater retrograde operations,

and direct theater support to units operating in the

Middle East

•

Configure and prepare for issue to military units

equipment sets and supplies

•

Awarded contract value: $545M

PROGRAM HIGHLIGHTS AND

SUCCESSES

•

Key hubs for retrograde

•

Transferred equipment sets from outdoor locations to

inside climate-controlled buildings

•

Successfully executed numerous equipment draws

•

Facilitated worldwide equipment distribution |

Location

Maxwell Air Force

Base Montgomery,

AL

Customer

Air Education and

Training Command

Contract Type

Fixed Price, Firm

Target, Incentive

Contract Award

May 2009 / 5.5 years

(Base Period +

5 Option Years)

MAXWELL AIR FORCE BASE OPERATIONS

SUPPORT SERVICES

•

Services include facilities, communications and

information technology, custodial services,

emergency management, energy management,

engineering services, environmental, site

maintenance, survival equipment services, human

resources, community services, transportation,

supply, fuel services, airfield management, weather

•

Total contract value: $359M

Page 24

PROGRAM HIGHLIGHTS AND

SUCCESSES

DESCRIPTION

•

Earned 99% possible performance profit

•

Customer feedback: “Best base operations support

contract in Air Force Education and Training

Command”

•

The only contractor in the U.S. Air Force to achieve

a grade of “Outstanding”

on the Logistics

Compliance Assessment Program

•

All “Exceptional”

government ratings |

FLEET SYSTEMS ENGINEERING TEAM

Page 25

Locations

Worldwide Support with

Major Presence in

Japan, Bahrain, Italy,

Maryland, Virginia,

California, Florida,

Washington, Hawaii

Customer

SPAWAR Fleet

Readiness Division

Contract Type

Cost Plus Fixed Fee

w/Award Term

Contract Award /

Length

November 2013 /

5 years

DESCRIPTION

•

FSET provides ashore and afloat fleet systems

engineers in support of Navy networks and Complex

Command, Control, Communications, Computer,

Intelligence, Surveillance and Reconnaissance

(C4ISR) Systems Worldwide

•

Awarded contract value: $122M

PROGRAM HIGHLIGHTS AND

SUCCESSES

•

Onboard all large deck / command ships and their

associated carrier strike groups

•

Perform critical communications functions from 11

shore locations covering seven time zones

•

All “Exceptional”

government ratings for 15

consecutive years |

PERFORMANCE

•

“Senior leadership does not view Exelis as

simply a contractor, rather a mission partner

willing to do what it takes to get the mission

done.”

•

“The contractor continually provides

exceptional quality and customer service in all

logistical areas.”

•

“Extremely responsive to unexpected

missions and short notice requirements-all

requirements executed with 100%

accountability.”

•

“This Team makes my job look easy. They

are flexible, reliable, and knowledgeable.”

•

“Proficiently maintains cost and actively seeks

to contain cost without diminishing contract

performance.”

•

“Their open and honest communications

coupled with their top-down driven culture of

cooperation and “Can-Do”

attitude help

ensure mission success every day.”

Page 26

Exceptional

Very Good

Satisfactory Marginal

Unsatisfactory

Government Documented Comments

Performance drives base business

Government Ratings

(1)

93% Exceptional

or Very Good

(1)

Top seven programs from base business (excluding Afghanistan), encompassing 88%

of revenue

81%

12% |

BUSINESS DEVELOPMENT

JANET OLIVER – VECTRUS SENIOR VICE PRESIDENT OF BUSINESS DEVELOPMENT |

VECTRUS BUSINESS DEVELOPMENT

Page 28

•

Centralized Business Development organization creates efficiency,

consistency and alignment with strategic plan

•

Regional offices positioned to remain close to target customers and

support centralized strategy

•

$8.8B in contract wins in the last 5 years

•

Healthy pipeline to build future business |

LARGE OPPORTUNITY FOR GROWTH

Page 29

APPROX. $25B 3-YEAR NEW BUSINESS

IDENTIFIED PIPELINE

$1.5B currently under evaluation + 7 IDIQ

•

Approx. $25B 3-year new

business identified pipeline

–

$10B qualified

–

$1.5B currently under

evaluation (expect to award

in the next 6-12 months)

–

IDIQ prime contracts carry

no value in pipeline

–

11% of bid value related to

recompetes

•

Nearly half of opportunities

>$100M in value

•

Domestic and overseas

opportunities split evenly

•

40% of bids outside DoD

Identified

Submitted

Qualified

Capture |

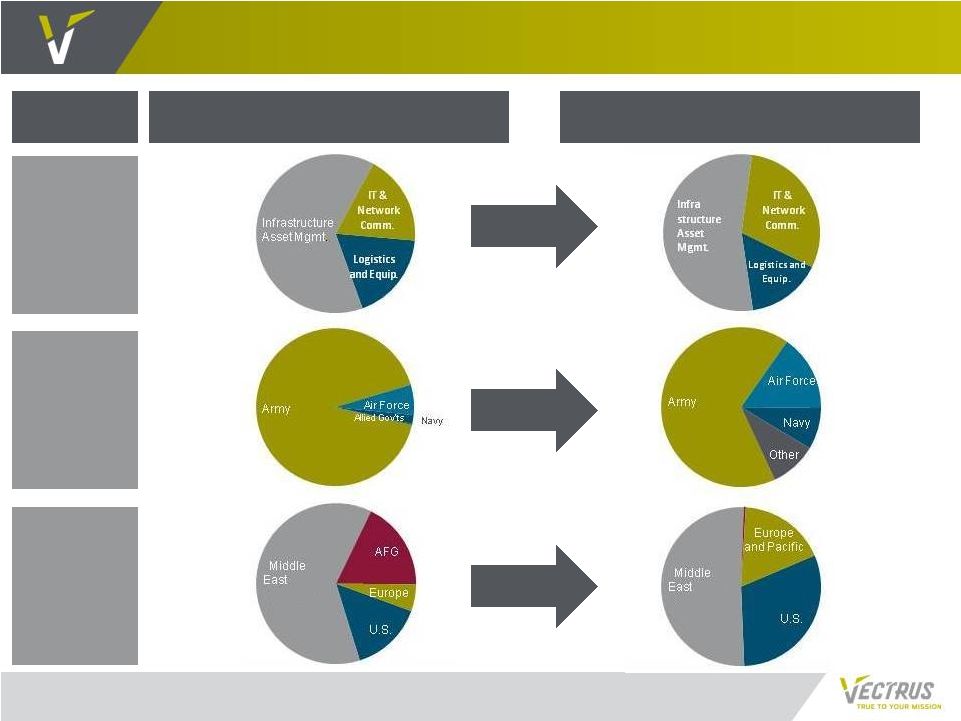

PORTFOLIO TRANSFORMATION

Page 30

2014E Revenue Mix

Future Revenue Mix

Balance

Service Lines

Strategic

Intent

Diversify

Client Base

Balance

Geographies |

MAJOR COMPETITORS

Page 31

IT and Network

Communication

Infrastructure Asset

Management

Logistics and Supply

Chain Management |

RECENT CONTRACT WINS

Page 32

Date

Awarded

Customer

Program

Period of

Performance

Value of

Award

September

2014

(1)

U.S. Air

Forces

Europe

Turkey/Spain Base Maintenance

Contract

7 years

$458M

August

2014

(2)

U.S. Army

Corps of

Engineers

U.S. Army Corps of Engineers

Enterprise Information

Management/Information

Technology

5 years

$517M

June 2014

U.S. Air

Forces

Europe

Kaiserslautern Military

Community Family Housing

Maintenance Services

June 2014 –

September

2019

$32M

September

2013

U.S. Navy,

Space and

Naval

Warfare

Systems

Command

Fleet Systems Engineering Team

Support Services for SPAWAR

FRD Fleet Support

September

2013 –

September

2018

$122M

May 2013

U.S. Army,

Network

Command

Operations Maintenance and

Defense of Army

Communications Southwest Asia

and Central Asia

May 2013 –

January 2018

$788M

June 2012

U.S. Army

Installation

Management

Command

Total Maintenance Contract

Kaiserslautern Military

Community Germany

June 2012 –

September

2020

$393M

(1)

The

Turkey/Spain

Base

Maintenance

contract

was

awarded

on

September

17,

2014.

Until

the

protest

period

ends,

this

contract

award

is

subject

to

the

ordinary

protest

procedures

and

stay

of

performance

under

the

Competition

in

Contracting

Act.

(2)

This

contract

was

awarded

on

August

15,

2014.

The

incumbent

contractor

filed

a

protest

with

the

GAO

on

September

2,

2014.

Under

the

Competition

in

Contracting

Act,

the

protest

operated

to

stay

the

transition

of

the

contract

pending

the

results

of

the

protest.

Generally,

a

GAO

decision

on

a

protest

is

due

within

100

days

of

the

protest’s

submission. |

FINANCIAL OVERVIEW

MATT KLEIN –

VECTRUS CHIEF FINANCIAL OFFICER |

FINANCIAL OVERVIEW

Page 34

•

> $1B business supporting customers’

mission critical programs

•

Substantial pipeline of new business opportunities aligned with

strategy

•

Backlog of $2.4B provides significant revenue visibility

(1)

•

Highly scalable and controllable cost structure

•

Strong cash flow generation for incremental growth

•

Capital allocation that provides strong return for our shareholders

(1) As of June 30, 2014. Total backlog represents firm orders and potential

options on multi-year contracts, excluding potential orders under indefinite delivery /

indefinite quantity (IDIQ) contracts |

FINANCIAL PERFORMANCE

Revenue

•

Historical revenues include Middle East and

Afghanistan contract wins

•

Key strategy to broaden customer base and

geographic footprint

•

Revenue

$1.1B

-

$1.2B

2014E

Income

•

Strong operating margin in 2012-2013 due to

operational efficiencies on fixed price

programs

•

Demand for expeditionary services drives

historical income

•

Margins

expected

to

normalize

in

the

4%

-

5%

range

Adjusted Revenue

(1)

Adjusted Operating Income and Margin

(1)

Page 35

(1)

Excludes Tethered Aerostat Radar System (TARS) historical revenue and cost

and the impact of separation costs to become a stand-alone public company. See Appendix for

reconciliation.

(2)

For six months ended June 30, 2014; extrapolation is not indicative of full year

forecast. (2)

(2) |

BACKLOG DRIVES PREDICTABILITY

(1)

•

Funded backlog four to six months in advance of work

•

2013 Book-to-Bill

(2)

= 1.2; 2014 YTD June = 0.8

•

Funded backlog excludes K-BOSSS funding of $445M received in Q3 2014

•

Backlog excludes ACE-IT

(3)

& Turkey/Spain contract wins of $975M in Q3 2014

Page 36

($B)

(1)

Total backlog represents firm orders and potential options on multi-year

contracts, excluding potential orders under indefinite delivery / indefinite quantity (IDIQ) contracts.

(2)

Book-to-Bill is the amount of funded orders divided by revenue for the

reporting period. (3)

This

contract

was

awarded

on

August

15,

2014.

The

incumbent

contractor

filed

a

protest

with

the

GAO

on

September

2,

2014.

Under

the

Competition

in

Contracting

Act,

the

protest

operated

to

stay

the

transition

of

the

contract

pending

the

results

of

the

protest.

Generally,

a

GAO

decision

on

a

protest

is

due

within

100

days

of

the

protest’s

submission. |

ORGANIZATIONAL COST TRENDS

(1)

Page 37

•

Leveraging technology to

centralize data centers

•

Centralizing transaction

services to HQ

•

Implementing lean,

repeatable solutions

•

Stand-alone costs tracking

at or below historical

allocations

Local G&A

Down 10%

Stand-Alone Costs

Down

Balancing Costs with Operational Excellence

Middle East Office

Consolidation

(1) Reductions based on a comparison of actual 2013 expenses to anticipated 2014

expenses. Centralized

Data Centers

•

Direct costs flex with

program & competitive

requirements

•

Low fixed costs to run

operations

•

Low CapEx

•

Future solutions focused on

government service

requirements only lowering

future costs

Scalable Cost Structure

Cost Trends |

CAPITAL STRUCTURE AND CASH FLOW

Page 38

Capital Summary

Cash Flow Commentary

•

Predictable cash flows

•

Low receivables and inventory risk

•

Continued focus on working capital

•

Minimal capital expenditures

•

Free cash flow conversion

(1)

~ 100%

of net income

•

Credit Facility

$140M 5-year Term Loan A

$75M revolving line of credit

•

Assumed $25M for letters of credit under

a $35M sublimit

•

Remaining amounts (estimated at $50M)

available for other business requirements

•

Balanced liquidity position

(1)

Free Cash Flow Conversion is calculated by taking GAAP net cash from operating

activities, less capital expenditures divided by Net Income |

SUMMARY

KEN HUNZEKER –

VECTRUS CHIEF EXECUTIVE OFFICER |

Q&A |

APPENDIX |

RECONCILIATION OF NON-GAAP MEASURES

42

The

primary

financial

performance

measures

Vectrus

uses

to

manage

its

business

and

monitor

results

of

operations

are

revenue

trends

and

operating

income

trends.

In

addition,

we

consider

adjusted

revenue

and

adjusted

operating

income

to

be

useful

to

management

and

investors

in

valuating

our

operating

performance

for

the

periods

presented,

and

to

provide

a

tool

for

evaluating

our

ongoing

operations.

This

information

can

assist

investors

in

assessing

our

financial

performance

and

measures

our

ability

to

generate

capital

for

deployment

among

competing

strategic

alternatives

and

initiatives.

Adjusted

revenue

and

adjusted

operating

income,

however,

is

not

a

measure

of

financial

performance

under

generally

accepted

accounting

principles

in

the

United

States

of

America

(GAAP)

and

should

not

be

considered

a

substitute

for

revenue,

operating

income,

income

from

continuing

operations,

or

net

cash

from

operating

activities

as

determined

in

accordance

with

GAAP.

A

reconciliation

of

adjusted

revenue

and

adjusted

operating

income

from

net

income

is

provided

below.

“Adjusted

revenue”

is

defined

as

revenue

adjusted

to

exclude

the

TARS

program

revenue

which

will

be

retained

by

Exelis.

“Adjusted

operating

income”

is

defined

as

net

income,

adjusted

to

exclude

income

taxes

TARS

operating

income

and

items

that

include,

but

are

not

limited

to,

significant

charges

or

credits

that

impact

current

results,

but

are

not

related

to

our

ongoing

operations,

unusual

and

infrequent

non-

operating

items

and

non-operating

tax

settlements

or

adjustments.

A

reconciliation

of

adjusted

revenue

and

adjusted

operating

income

is

provided

below.

Adjusted Revenue (Non-GAAP Measure)

2009

2010

2011

2012

2013

YTD 2014

Revenue

$1,078

$1,132

$1,806

$1,828

$1,512

$617

TARS revenue

(26)

(34)

(32)

(37)

(37)

(19)

Adjusted revenue

$1,052

$1,098

$1,774

$1,791

$1,475

$598

Adjusted Operating Income (Non-GAAP Measure)

2009

2010

2011

2012

2013

YTD 2014

Net income

$39

$22

$54

$75

$84

$17

Income taxes

23

13

33

35

47

10

Operating income

$62

$35

$87

$110

$131

$27

TARS operating income (pretax)

(2)

(6)

(4)

(4)

(3)

(1)

Separation costs ?¹? (pretax)

-

-

-

-

1

6

Adjusted operating income

$60

$29

$83

$106

$129

$32

(1) Costs incurred to become a stand-alone public company

(2) For six months ended June 30, 2014

(2)

(2)

(1) |

ACE-IT

Army Corps of Engineers Enterprise Information

Management / Information Technology

AFB

Air Force Base

ANSF (N&S)

Afghan National Security Forces (ANSF) Operations

and Maintenance

APS5 KU

Army Prepositioned Stocks -5 Kuwait

APS5 QT

Army Prepositioned Stocks -5 Qatar

BAE

British Aerospace

BD

Business Development

BOS

Base Operations Support

CAGR

Compounded Annual Growth Rate

CapEx

Capital Expenditure

CBO

Congressional Budget Office

CEO

Chief Executive Officer

CFO

Chief Financial Officer

CIM

Confidential Information Memorandum

CMMI

Capability Maturity Model Integration

COO

Chief Operating Officer

CTSS

Communication Technical Support Services

DoD

Department of Defense

DoE

Department of Energy

EBITDA

Earnings Before Interest, Taxes, Depreciation, and

Amortization

EPS

Earnings per Share

FRD

Fleet Readiness Directorate

FSET

Fleet Systems Engineering Team

GAAP

Generally Accepted Accounting Principles

G&A

General & Administrative Expense

GAO

Government Accountability Office

HQ

Headquarters

ISO

International Organization for Standardization

IDIQ

Indefinite Delivery/Indefinite Quantity

IRAD

Independent Research and Development

ISR

Intelligence, Surveillance, and Reconnaissance

IT

Information Technology

Kaiserslautern TMC

Kaiserslautern Total Maintenance Contract

K-BOSSS

Kuwait Base Operations Support and Security Services

KBR

Kellogg, Brown & Root

KMOD

Kuwait Ministry of Defense

MBA

Master of Business Administration

MCLOGSS

Marine Corps Logistics Support Services

NETCOM

U.S. Army Network Enterprise Technology Command

NTP

Notice to Proceed

NYSE

New York Stock Exchange

O&M

Operations & Maintenance

OCO

Overseas Contingency Operations

OMDAC-SWACA

Operations, Maintenance & Defense of Army

Communications-Southwest Asia and Central Asia

OMB

Office of Management and Budget

Op

Opportunities

OPMAS-E

Operations Maintenance and Supply –

Europe

Qatar BOSS

Qatar Base Operation Support Services

Q&A

Question & Answer

SG&A

Selling, General & Administrative Expense

SPAWAR

Space and Naval Warfare Systems Command

SVP

Senior Vice President

SWA

Southwest Asia

TARS

Tethered Aerostat Radar System

TBD

To Be Determined

TSBMC

Turkey Spain Base Maintenance Contract

USARCENT

U.S. Army Central

USCENTCOM

U.S. Central Command

USG

U.S. Government

VEC

Vectrus Stock Symbol

XLS

Exelis Stock Symbol

YE

Year End

YTD

Year-to-Date

ACRONYM CHART

Page 43 |

BOARD OF DIRECTORS

Page 44

Name

Background

Louis Giuliano

Chairman of the

Board

•

Director, Accudyne Industries

•

Chairman of the Board, Meadowkirk Retreat

Center

•

Former Chairman, U.S. Post Office Board of

Governors

•

Senior Advisor, The Carlyle Group

•

Former Chairman, CEO & President, ITT

Corporation

Stephen

Waechter

Director & Chair,

Audit

•

Chair, Audit Committee, Social & Scientific

Systems, Inc.

•

Chair, Audit Committee for CareFirst, Inc.

•

Member, Executive, Strategic Planning &

Nominating Committees, CareFirst, Inc.

•

Former Vice President, Business Operations &

Chief Financial Officer, ARINC Incorporated

•

Former Executive Vice President & Chief

Financial Officer, CACI

Bradford Boston

Director & Chair,

Comp & Personnel

•

Director, NetNumber, Inc

•

Chair, Comp. Committee & Audit Committee

Member, Aap3, Inc.

•

President & Chief Executive Officer,

NetNumber Inc.

•

Former Senior Vice President, Global

Government Solutions & Corporate Security

Programs Office, Cisco Systems, Inc.

Eric Pillmore

Director & Chair,

Nom & Gov

•

Director, Cardone Industries, Focus on the

Family, & the CEO Forum

•

Former Senior Advisor, Center for Corporate

Governance of Deloitte LLP

•

Former Senior Vice President, Corporate

Governance, Tyco International Corporation

•

Former SVP and CFO -

General Instrument

Corp.

Name

Background

William Murdy

Director

•

Chair, Comp. Committee & Audit Committee

Member, UIL Holdings

•

Chair, Comp. Committee & Nominating

Committee Member, Kaiser Aluminum

•

Comp. Committee & Strategic Committee,

LSB Industries, Inc.

•

Former Chairman & Chief Executive Officer,

Comfort Systems U.S.A.

Mel Parker

Director

•

President, North America, Brink’s Company

•

Director, Board of the National Black MBA

Association

•

Member, Executive Leadership Council

•

Former Vice President & General Manager,

North America Consumer & Small Business

Division, Dell, Inc.

Mary Howell

Director

•

Director, Esterline Corporation

•

Executive Committee, Atlantic Council

•

Chair, Development Committee, Philips

Collection

•

Chief Executive Officer, Howell Strategy Group

•

Former Executive Vice President, Textron Inc.

Phillip Widman

Director

•

Chair, Audit Committee & Risk Oversight

Committee Member, Sturm, Ruger & Co, Inc.

•

Audit Committee Member, Harsco Corporation

•

Former Senior Vice President & Chief

Financial Officer, Terex Corporation

•

Former Executive Vice President & Chief

Financial Officer, Philip Services Corporation |