Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Tribune Publishing Co | investorpresentation-8xkdo.htm |

INVESTOR PRESENTATION UPDATE - SUPPLEMENTAL F INANCIAL SCHEDULES September 2014 Exhibit 99.1

99.158.200 49.93.124 124.49.108 210.124.57 113.125.52 150.59.88 98.101.109 13.107.124 Disclaimer Non-GAAP Financial Measures To provide investors with additional information regarding Tribune Publishing Company‘s (“Tribune Publishing” or “Company”) financial results, this presentation includes references to Adjusted EBITDA and Pro forma Adjusted EBITDA. These measures are not presented in accordance with generally accepted accounting principles in the United States (GAAP), and Tribune Publishing’s use of these terms may vary from that of others in the Company’s industry. These measures should not be considered as an alternative to net income (loss), operating profit, revenues or any other performance measures derived in accordance with GAAP as measures of operating performance or liquidity. Further information regarding the Company’s presentation of these measures, including a reconciliation to net income, the most directly comparable GAAP financial measure, is included in this presentation. Adjusted EBITDA Adjusted EBITDA is defined as net income before income taxes, interest income, interest expense, depreciation and amortization, income and losses from equity investments, corporate management fee from Tribune Media Company (“Tribune Media”), pension credits, stock-based compensation, certain unusual and non-recurring items (including spin-related costs) and reorganization items. The Company's management uses Adjusted EBITDA (a) as a measure of operating performance; (b) for planning and forecasting in future periods; and (c) in communications with the Company’s Board of Directors concerning the Company’s financial performance. Management believes the presentation of Adjusted EBITDA enhances investors’ overall understanding of the financial performance of the Company’s business as a stand-alone company. In addition, Adjusted EBITDA, or a similarly calculated measure, is used as the basis for certain financial maintenance covenants that the Company is subject to in connection with certain credit facilities. Since not all companies use identical calculations, the Company's presentation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies and should not be used by investors as a substitute or alternative to net income or any measure of financial performance calculated and presented in accordance with GAAP. Instead, management believes Adjusted EBITDA should be used to supplement the Company’s financial measures derived in accordance with GAAP to provide a more complete understanding of the trends affecting the business. Although Adjusted EBITDA is frequently used by investors and securities analysts in their evaluations of companies, Adjusted EBITDA has limitations as an analytical tool, and investors should not consider it in isolation or as a substitute for, or more meaningful than, amounts determined in accordance with GAAP. Some of the limitations to using non-GAAP measures as an analytical tool are: they do not reflect the Company’s interest income and expense, or the requirements necessary to service interest or principal payments on the Company’s debt; they do not reflect future requirements for capital expenditures or contractual commitments; and although depreciation and amortization charges are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and non-GAAP measures do not reflect any cash requirements for such replacements. Pro forma Adjusted EBITDA Pro forma Adjusted EBITDA is defined as Adjusted EBITDA after taking into consideration rental expenses and public company costs expected to be incurred post-spin, and reductions for partial economics on reasonable-case modified affiliate agreements for digital products, including CareerBuilder.com and Cars.com. Management believes the presentation of Pro forma Adjusted EBITDA enhances investors’ overall understanding of the financial performance of the Company’s business as a stand-alone company and includes elements used as the basis for forecasting going forward. Management believes this measure improves the understanding and comparability of future results by providing quantitative estimates for historical periods presented. 1

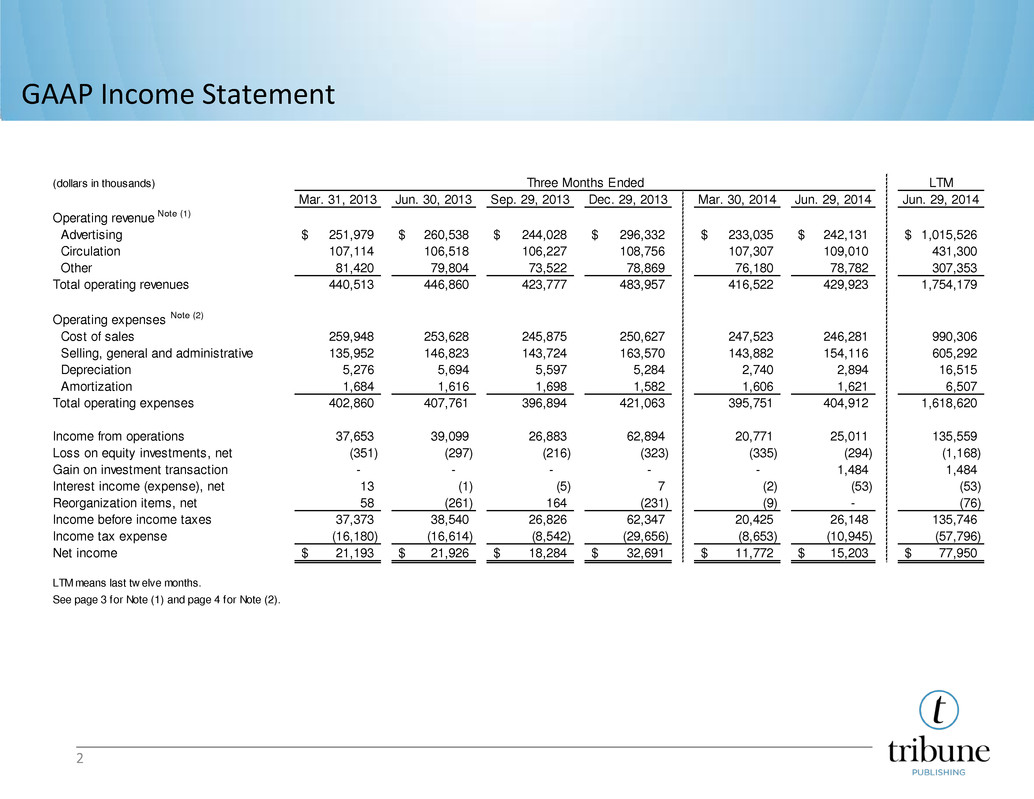

99.158.200 49.93.124 124.49.108 210.124.57 113.125.52 150.59.88 98.101.109 13.107.124 GAAP Income Statement 2 (dollars in thousands) LTM Mar. 31, 2013 Jun. 30, 2013 Sep. 29, 2013 Dec. 29, 2013 Mar. 30, 2014 Jun. 29, 2014 Jun. 29, 2014 Operating revenue Note (1) Advertising 251,979$ 260,538$ 244,028$ 296,332$ 233,035$ 242,131$ 1,015,526$ Circulation 107,114 106,518 106,227 108,756 107,307 109,010 431,300 Other 81,420 79,804 73,522 78,869 76,180 78,782 307,353 Total operating revenues 440,513 446,860 423,777 483,957 416,522 429,923 1,754,179 Operating expenses Note (2) Cost of sales 259,948 253,628 245,875 250,627 247,523 246,281 990,306 Selling, general and administrative 135,952 146,823 143,724 163,570 143,882 154,116 605,292 Depreciation 5,276 5,694 5,597 5,284 2,740 2,894 16,515 Amortization 1,684 1,616 1,698 1,582 1,606 1,621 6,507 Total operating expenses 402,860 407,761 396,894 421,063 395,751 404,912 1,618,620 Income from operations 37,653 39,099 26,883 62,894 20,771 25,011 135,559 Loss on equity investments, net (351) (297) (216) (323) (335) (294) (1,168) Gain on investment transaction - - - - - 1,484 1,484 Interest income (expense), net 13 (1) (5) 7 (2) (53) (53) Reorganization items, net 58 (261) 164 (231) (9) - (76) Income before income taxes 37,373 38,540 26,826 62,347 20,425 26,148 135,746 Income tax expense (16,180) (16,614) (8,542) (29,656) (8,653) (10,945) (57,796) Net income 21,193$ 21,926$ 18,284$ 32,691$ 11,772$ 15,203$ 77,950$ LTM means last tw elve months. Three Months Ended See page 3 for Note (1) and page 4 for Note (2).

99.158.200 49.93.124 124.49.108 210.124.57 113.125.52 150.59.88 98.101.109 13.107.124 3 Supplemental Revenue Information Note (1) - Quarterly Operating Revenues (dollars in thousands) LTM Mar. 31, 2013 Jun. 30, 2013 Sep. 29, 2013 Dec. 29, 2013 Mar. 30, 2014 Jun. 29, 2014 Jun. 29, 2014 Advertising Retail 129,493$ 136,470$ 126,458$ 165,934$ 113,341$ 125,895$ 531,628$ National 53,776 52,614 45,428 61,800 51,003 44,873 203,104 Classified 68,710 71,454 72,142 68,598 68,691 71,363 280,794 Total advertising (1a) 251,979 260,538 244,028 296,332 233,035 242,131 1,015,526 Circulation 107,114 106,518 106,227 108,756 107,307 109,010 431,300 Other revenue Commercial print and delivery 49,389 48,434 44,707 46,986 45,575 44,266 181,534 Direct mail and marketing 20,208 18,563 17,219 19,505 17,799 17,729 72,252 Other 11,823 12,807 11,596 12,378 12,806 16,787 53,567 Total other revenues 81,420 79,804 73,522 78,869 76,180 78,782 307,353 Total operating revenues 440,513$ 446,860$ 423,777$ 483,957$ 416,522$ 429,923$ 1,754,179$ Note (1a) LTM Mar. 31, 2013 Jun. 30, 2013 Sep. 29, 2013 Dec. 29, 2013 Mar. 30, 2014 Jun. 29, 2014 Jun. 29, 2014 Advertising ROP (Run of Press) 126,462$ 126,694$ 116,146$ 139,327$ 113,292$ 115,232$ 483,997$ Preprint 81,009 85,452 79,867 105,544 73,199 79,601 338,211 Digital 44,508 48,392 48,015 51,461 46,544 47,298 193,318 Total advertising 251,979$ 260,538$ 244,028$ 296,332$ 233,035$ 242,131$ 1,015,526$ Three Months Ended Three Months Ended

99.158.200 49.93.124 124.49.108 210.124.57 113.125.52 150.59.88 98.101.109 13.107.124 Supplemental Operating Expense Information 4 Note (2) - Quarterly Operating Expenses (dollars in thousands) LTM Mar. 31, 2013 Jun. 30, 2013 Sep. 29, 2013 Dec. 29, 2013 Mar. 30, 2014 Jun. 29, 2014 Jun. 29, 2014 Compensation 151,446$ 147,114$ 148,516$ 150,806$ 143,712$ 140,939$ 583,973$ Newsprint and ink 42,909 42,217 37,130 39,940 35,498 35,499 148,067 Circulation distribution 78,703 77,593 74,700 78,314 73,540 73,392 299,946 Promotion and marketing 11,409 13,649 13,703 13,246 10,063 14,503 51,515 Affiliate fees 7,292 7,752 8,322 8,445 9,305 9,170 35,242 Other (outside services, occupancy costs) 72,077 78,741 65,455 89,882 84,128 87,438 326,903 Corporate allocations (2a) 32,064 33,385 41,773 33,564 35,159 39,456 149,952 Depreciation and amortization 6,960 7,310 7,295 6,866 4,346 4,515 23,022 Total operating expenses 402,860$ 407,761$ 396,894$ 421,063$ 395,751$ 404,912$ 1,618,620$ Note (2a) LTM Mar. 31, 2013 Jun. 30, 2013 Sep. 29, 2013 Dec. 29, 2013 Mar. 30, 2014 Jun. 29, 2014 Jun. 29, 2014 Corporate management fee (2a-i) 5,727$ 6,656$ 8,239$ 8,828$ 9,060$ 8,960$ 35,087$ Allocated depreciation (2a-ii) 3,380 4,266 4,836 4,645 4,781 5,195 19,457 Shared service centers (2a-iii) 21,370 20,765 26,653 18,699 20,285 23,099 88,736 Other (2a-iii) 1,587 1,698 2,045 1,392 1,033 2,202 6,672 Total corporate allocations 32,064$ 33,385$ 41,773$ 33,564$ 35,159$ 39,456$ 149,952$ (2a-i) Corporate management fee replaced by public company costs post-spin. (2a-ii) Allocated depreciation becomes a part of Depreciation and Amortization post-spin. (2a-iii) Shared service center and Other corporate allocations become direct costs spread across Compensation (60%) and other general & administrative costs (40%) post-spin. Three Months Ended Three Months Ended

99.158.200 49.93.124 124.49.108 210.124.57 113.125.52 150.59.88 98.101.109 13.107.124 GAAP Net Income Reconciliation to Adjusted EBITDA and Pro forma Adjusted EBITDA 5 (dollars in thousands) LTM Mar. 31, 2013 Jun. 30, 2013 Sep. 29, 2013 Dec. 29, 2013 Mar. 30, 2014 Jun. 29, 2014 Jun. 29, 2014 Net income 21,193$ 21,926$ 18,284$ 32,691$ 11,772$ 15,203$ 77,950$ Income tax expense 16,180 16,614 8,542 29,656 8,653 10,945 57,796 Reorganization items, net (58) 261 (164) 231 335 294 696 Gain on investment fair value adjustments - - - - - (1,484) (1,484) Interest expense, (income), net (13) 1 5 (7) 2 53 53 Loss on equity investments, net 351 297 216 323 9 - 548 Income from operations 37,653 39,099 26,883 62,894 20,771 25,011 135,559 Depreciation and amortization 6,960 7,310 7,295 6,866 4,346 4,515 23,022 Allocated depreciation (1) 3,380 4,266 4,836 4,645 4,781 5,195 19,457 Allocated corporate management fee (2) 5,727 6,656 8,239 8,828 9,060 8,960 35,087 Spin-related and restructuring costs (3) 2,430 8,449 8,473 17,805 6,726 7,619 40,623 Litigation settlement (4) - - - - - (867) (867) Stock-based compensation (5) - 455 684 559 697 622 2,562 Pension credits (6) (5,894) (5,989) (5,941) (5,942) (5,472) (4,968) (22,323) Intercompany rent (7) - - - 7,543 8,396 8,394 24,333 Adjusted EBITDA 50,256 60,246 50,469 103,198 49,305 54,481 257,453 Est. modified affilitate agreement - CareerBuilder (8) (5,000) (5,000) (4,000) (3,000) (4,000) (3,000) (14,000) Est. modified affiliate agreement - Cars.com (9) (4,000) (4,000) (4,000) (3,000) (4,000) (4,000) (15,000) Est. incremental public company costs (10) (6,000) (6,000) (6,000) (7,000) (6,000) (4,000) (23,000) Est. incremental related party rent (11) (7,000) (7,000) (7,000) (7,000) (7,000) (7,000) (28,000) Pro forma Adjusted EBITDA 28,256$ 38,246$ 29,469$ 83,198$ 28,305$ 36,481$ 177,453$ See page 6 for footnotes. Three Months Ended Note: Pro forma Adjusted EBITDA does not include the full f iscal year impact of 2014 acquisitions, including the Landmark Media properties - The Capital and the Carroll County Times.

99.158.200 49.93.124 124.49.108 210.124.57 113.125.52 150.59.88 98.101.109 13.107.124 Footnotes to GAAP Net Income Reconciliation to Adjusted EBITDA and Pro forma Adjusted EBITDA 6 (1) Allocated depreciation represents depreciation for technology assets that were used by Tribune Publishing prior to the spin-off. As a result of the spin- off, these technology assets were assigned to Tribune Publishing and the related depreciation will be included in post-spin operating results as depreciation. (2) Allocated corporate management fee is added back to Adjusted EBITDA in order to reflect public company costs in the Pro forma Adjusted EBITDA that more closely approximates Tribune Media post-spin costs. (3) Spin-related and restructuring costs include costs related to the internal restructuring and the distribution and separation from Tribune Media. (4) Adjustment to litigation settlement. (5) Stock-based compensation is due to Tribune Media's equity compensation plan and is included for comparative purposes. (6) Pension credits are due to allocations from Tribune Media and as part of the spin-off, Tribune Media retained this single-employer plan. No pension allocations will be made subsequent to the spin-off. (7) Intercompany rent is added back to Adjusted EBITDA so that incremental rent expense estimated subsequent to spin off could be reflected in Pro forma Adjusted EBITDA. Intercompany rent represents rental expense recorded by Tribune Publishing for facilities owned by Tribune Media and its affiliates pursuant to lease agreements. No rent expense for these leases was recorded in the comparable periods in 2013 (except in fourth quarter of 2013) because although the properties subject to leases are legally owned by holding companies controlled by Tribune Media, Tribune Publishing determined that pursuant to the terms of the leases, it maintained forms of continuing involvement with the properties, which, pursuant to ASC Topic 840, “Leases,” precluded Tribune Publishing from derecognizing those properties from its combined financial statements. As a result, Tribune Publishing continued to account for and depreciate the carrying values of the transferred properties subject to leases until December 1, 2013 when, due to modifications to certain provisions of the leases, Tribune Publishing derecognized the properties from its financial statements and began accounting for these operating leases on December 1, 2013. Because of the difference in accounting for the periods presented, intercompany rent expense is added back to net income for the 2014 periods for better comparability between the periods presented. The Company began rent payments effective with the spin-off. (8) On September 1, 2014, Tribune Publishing began a 5-year modified agreement with CareerBuilder.com. (9) Upon completion of the sale of Classified Ventures to Gannett Co., estimated October 1, 2014, Tribune Publishing begins a 5-year modified agreement with Cars.com. (10) Subsequent to the spin-off, public company costs replace allocated corporate management fees and is estimated at $25 million annually. For the second quarter ended June 29, 2014, the Pro forma adjustment is $4 million as approximately $2 million of the public company costs were reflected in operating results. (11) Subsequent to the spin-off, Tribune Publishing begins rent payments to Tribune Media.