Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GREER BANCSHARES INC | d31677.htm |

Exhibit 10.1

GREER BANCSHARES INCORPORATED

_________________

EMPLOYMENT AGREEMENT

This Employment Agreement (the "Agreement") dated as of September 5, 2014, is made by and between of Greer Bancshares Incorporated, a South Carolina corporation (the "Company"), which is the holding company for Greer State Bank, a South Carolina state bank (the "Bank"), and George W. Burdette, an individual resident of South Carolina (the "Executive").

All references to the term "Employer" as used herein shall refer to the Company and the Bank.

WHEREAS, the Employer presently employs Executive as President and Chief Executive Officer of the Bank and the Company; and

WHEREAS, the Employer recognizes that the Executive’s contribution to the growth and success of the Employer is essential, and the Employer desires to provide for the continued employment of the Executive and to make certain changes in the Executive’s employment arrangements which the Employer has deteunined will reinforce and encourage the continued dedication of the Executive to the Employer and will promote the best interests of the Employer and its shareholders; and

WHEREAS, unless otherwise specified hereafter, any services performed by the Executive shall be for the benefit of the Bank and therefore any payments or benefits paid to the Executive pursuant to this Agreement shall be the sole responsibility of the Bank; provided however, the Bank’s obligation to make any payments owed to the Executive under this Agreement shall be discharged to the extent compensation payments are made by the Company.

NOW, THEREFORE, in consideration of the foregoing, the mutual covenants contained herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto, intending to be legally bound, hereby agree as follows

1.

Employment. The Employer shall continue to employ the Executive, and the Executive shall continue to serve the Employer, as the President and Chief Executive Officer of the Company and the Bank upon the terms and conditions set forth herein. The Executive shall have such authority and responsibilities consistent with his position as are set forth in the Company’s or the Bank’s Bylaws or assigned by the Company’s or the Bank’s Board of Directors (collectively, the "Board") from time to time. The Executive shall devote his full business time, attention, skill and efforts to the perfolinance of his duties hereunder, except during periods of illness or periods of vacation and leaves of absence consistent with Bank policy. The Executive may devote reasonable periods to service as a director or advisor to other organizations, to charitable and community activities, and to managing his personal investments, provided that such activities do not materially interfere with the performance of his duties hereunder and are not in conflict or competitive with, or adverse to, the interests of the Company or the Bank, and provided Executive has notified the Board of such activities in writing.

1

2.

Term. Unless earlier terminated as provided herein, the Executive’s employment under this Agreement shall commence on the date hereof and be for a term of one year (the "Initial Term"). The employment shall be extended for additional terms of one year each ("Renewal Term") unless either the Employer or the Executive provides written notice of non-renewal not less than ninety (90) days prior to the end of the Initial Term or the Additional Term, if applicable.

3.

Compensation and Benefits.

(a)

Base Salary. The Employer shall pay the Executive a base salary at an annual rate of $225,000, which shall be paid in accordance with the Employer’s Standard Payroll Procedures, which shall be no less frequently than monthly. The Board (or an appropriate committee of the Board) shall review the Executive’s performance and salary at least annually and may increase the Executive’s base salary if it determines in its sole discretion that an additional increase is appropriate.

(b)

Incentive Compensation. The Executive shall be entitled to annual bonus compensation, if any, as determined by the Board pursuant to any incentive compensation program as may be adopted from time to time by the Company or the Bank. Any bonus payment made pursuant to this Section 3(b) shall be made the earlier of (i) seventy (70) calendar days after the previous year end for which the bonus was earned by the Executive or (ii) the first pay period following the Employer’s press release announcing its previous year’s financial performance.

(c)

Expense Reimbursement. The Employer shall reimburse Executive for ordinary and necessary business expenses incurred by Executive in the performance of Executive’s duties hereunder in accordance with the Bank’s customary practices applicable to employees, provided that such expenses are incurred and accounted for in accordance with Bank policy. The Employer shall reimburse the Executive for such expenses as described in Section 21 hereof.

(d)

Cell Phone Allowance. The Employer shall pay the Executive $100 per month for expenses relating to a cellular phone to be used by the Executive for business purposes, which shall be paid in accordance with the Employer’s standard payroll procedures.

(e)

Benefit Plans. The Executive shall be eligible to participate in all equity, retirement, medical, dental welfare and other benefit plans or programs of the Employer now or hereafter applicable generally to employees of the Employer or to a class of employees that includes senior executives of the Employer. The Employer shall pay such premiums in accordance with the Employer’s standard payroll procedures.

(f)

Holidays. Executive shall be entitled to paid holidays subject to the terms and conditions of the Employer’s holiday pay policies, procedures, and practices.

(g)

Vacation and Sick Leave. The Employer shall provide the Executive with four (4) weeks’ paid vacation and eight (8) sick days per year, which shall be taken in accordance with any banking rules or regulations governing vacation or sick leave.

2

4.

Termination of Employment.

(a)

Death. Executive’s employment hereunder shall terminate upon Executive’s death.

(b)

Total Disability. The Employer may terminate the Executive’s employment in the event that the Executive becomes Disabled.

(c)

Termination by the Employer for Cause. The Employer may terminate Executive’s employment hereunder for "Cause" immediately upon delivery of a Notice of Termination by the Employer to Executive.

(d)

Voluntary Termination by Executive. Executive may terminate employment hereunder at any time after providing sixty (60) days written notice to the Employer.

(e)

Termination by the Employer Without Cause. The Employer may terminate Executive’s employment hereunder without Cause at any time by providing thirty (30) days written Notice of Termination to Executive.

(f)

Resignation as Director upon Termination of Employment. In the event that the Executive’s employment is terminated for any reason, whether by Executive or the Employer, as a condition to the Employer’s obligation to pay any severance or other post-termination compensation hereunder, the Executive shall tender his resignation as a director of the Company and Bank effective as of the date of termination.

5.

Compensation Following Termination of Employment or Non-Renewal. In the event that Executive’s employment hereunder is terminated, Executive shall be entitled to the following compensation and benefits upon such termination:

(a)

Termination by Reason of Death. In the event that Executive’s employment is terminated by reasons of Executive’s death, the Employer shall pay the following amounts to Executive’s beneficiary or estate:

(i)

Any accrued but unpaid base salary for services rendered to the date of death and any accrued but unpaid expenses required to be reimbursed under this Agreement.

(ii)

Any benefits to which Executive may be entitled pursuant to the plans, policies and arrangements referred to in Section 3 hereof as determined and paid in accordance with the terms of such plans, policies and arrangements.

(iii)

Any bonus earned under any applicable incentive compensation plan adopted by the Board, payable as set forth in Section 3(b) and pro rated to the date of termination.

(iv)

All compensation due to the Executive’s estate pursuant to this Section 5(a) shall be paid pursuant to the Employer’s Standard Payroll Procedures.

3

(b)

Termination by Reason of Total Disability. In the event that Executive’s employment is terminated by reasons of Executive’s Total Disability as determined in accordance with Section 4(b), the Employer shall pay the following amounts to Executive:

(i)

Any accrued but unpaid base salary for services rendered to the date of termination, any accrued but unpaid expenses required to be reimbursed under this Agreement, and any vacation accrued to the date of termination.

(ii)

Any benefits to which Executive may be entitled pursuant to the plans, policies and arrangements referred to in Section 3 hereof as determined and paid in accordance with the terms of such plans, policies and arrangements.

(iii)

Any bonus earned under any applicable incentive compensation plan adopted by the Board, payable as set forth in Section 3(b) and pro rated to the date of termination.

(iv)

All compensation due to the Executive pursuant to this Section 5(b) shall be paid pursuant to the Employer’s Standard Payroll Procedures.

(c)

Termination for Cause. In the event that Executive’s employment is terminated by the Employer for Cause pursuant to Section 4(c), the Employer shall pay the following amounts to Executive:

(i)

Any accrued but unpaid base salary for services rendered to the date of termination and any accrued but unpaid expenses required to be reimbursed under this Agreement. Any accrued but unused vacation pay shall be forfeited.

(ii)

Any benefits to which Executive may be entitled pursuant to the plans, policies and arrangements referred to in Section 3 hereof as determined and paid in accordance with the terms of such plans, policies and arrangements.

(iii)

All compensation due to the Executive pursuant to this Section 5(c) shall be paid pursuant to the Employer’s Standard Payroll Procedures.

(d)

Voluntary Termination by Executive or Notice of Non-Renewal by Either Party. In the event Executive voluntarily terminates employment pursuant to Section 4(d), or either Executive or the Employer provides timely notice of non-renewal of this Agreement as set forth in Section 2 and the Employee’s employment terminates after the end of such Initial or Renewal Term, as applicable, the Employer shall pay the following amounts to Executive:

(i)

Any accrued but unpaid base salary for services rendered to the date of termination, any accrued but unpaid expenses required to be reimbursed under this Agreement, and any vacation accrued to the date of termination.

(ii)

Any benefits to which Executive may be entitled pursuant to the plans, policies and arrangements referred to in Section 3 hereof as determined and paid in accordance with the terms of such plans, policies and arrangements.

4

(iii)

Any bonus earned under any applicable incentive compensation plan adopted by the Board, payable as set forth in Section 3(b) and pro rated to the date of termination.

(iv)

All compensation due to the Executive pursuant to this Section 5(d) shall be paid pursuant to the Employer’s Standard Payroll Procedures.

(e)

Termination by the Employer Without Cause. In the event that Executive’s employment is terminated by the Employer pursuant to Section 4(e) for reasons other than death, Total Disability or Cause, the Employer shall pay the following amounts to Executive:

(i)

Any accrued but unpaid base salary for services rendered to the date of termination, any accrued but unpaid expenses required to be reimbursed under this Agreement, and any vacation accrued to the date of termination.

(ii)

Any benefits to which Executive may be entitled pursuant to the plans, policies and arrangements referred to in Section 3 hereof as determined and paid in accordance with the terms of such plans, policies and arrangements.

(iii)

Any bonus earned under any applicable incentive compensation plan adopted by the Board, payable as set forth in Section 3(b) and pro rated to the date of termination.

(iv)

If the termination occurs during the Initial Term, severance pay in an amount equal to Executive’s then current monthly base salary for a period of six (6) months (the "Severance Payment"). If the termination occurs during any Renewal Term, the Severance Payment will be reduced to an amount equal to Executive’s average monthly Compensation for a period of three (3) months. In either event, the Severance Payment will be made in six (6) or three (3) equal monthly installments, as the case may be, less applicable state and federal withholdings, commencing on the forty-fifth (45th) day after the effective date of the Executive’s termination, provided the Executive has executed the full release of claims referenced below and has otherwise complied with all obligations set forth in this Agreement. The Severance Payment may not be accelerated or deferred in any regard.

(v)

Executive acknowledges and agrees that his entitlement to the payments and benefits set forth in this Section 5(d) is expressly conditioned upon his execution of a full release of claims to be drafted by the Employer.

(f)

No Other Benefits or Compensation Upon Termination. Except as may be provided under this Agreement, under the terms of any incentive compensation, employee benefit, or fringe benefit plan applicable to Executive at the time of Executive’s termination or resignation of employment, Executive shall have no right to receive any other compensation, or to participate in any other plan, arrangement or benefit, with respect to future periods after such termination or resignation.

6.

Ownership of Work Product. The Employer shall own all Work Product arising during the course of the Executive’s employment (prior, present or future). For purposes hereof, "Work Product" shall mean all intellectual property rights, including all Trade Secrets, U.S. and

5

international copyrights, patentable inventions, and other intellectual property rights in any programming, documentation, technology or other work product that relates to the Employer, its business or its customers and that the Executive conceives, develops, or delivers to the Employer at any time during his employment, during or outside normal working hours, in or away from the facilities of the Employer, and whether or not requested by the Employer. If the Work Product contains any materials, programming or intellectual property rights that the Executive conceived or developed prior to, and independent of the Executive’s work for the Employer, the Executive agrees to point out the pre-existing items to the Employer and the Executive grants the Employer a worldwide, unrestricted, royalty-free right, including the right to sublicense such items. The Executive agrees to take such actions and execute such further acknowledgments and assignments as the Employer may reasonably request to give effect to this provision.

7.

Protection of Trade Secrets. The Executive agrees to maintain in strict confidence and, except as necessary to perfolin his duties for the Employer, the Executive agrees not to use or disclose any Trade Secrets of the Employer during or after his employment. "Trade Secret" means information, including a formula, pattern, compilation, program, device, method, technique, process, drawing, cost data or customer list, that: (i) derives economic value, actual or potential, from not being generally known to, and not being readily ascertainable by proper means by, other persons who can obtain economic value from its disclosure or use; and (ii) is the subject of efforts that are reasonable under the circumstances to maintain its secrecy.

8.

Protection of Other Confidential Information. In addition, the Executive agrees to maintain in strict confidence and, except as necessary to perform his duties for the Employer, not to use or disclose any Confidential Business Information of the Employer during his employment and for a period of 24 months following termination of the Executive’s employment (regardless of whether this Agreement terminates or expires). "Confidential Business Information" shall mean any internal, non-public information (other than Trade Secrets already addressed above) concerning the Employer’s financial position and results of operations (including revenues, assets, net income, etc.); annual and long-range business plans; product or service plans; marketing plans and methods; training, educational and administrative manuals; customer and supplier information and purchase histories; and employee lists. The provisions of Sections 7 and 8 shall also apply to protect Trade Secrets and Confidential Business Information of third parties provided to the Employer under an obligation of secrecy.

9.

Return of Materials. The Executive shall surrender to the Employer, promptly upon its request and in any event upon termination of the Executive’s employment (regardless of whether this Agreement terminates or expires), all media, documents, notebooks, computer programs, handbooks, data files, models, samples, price lists, drawings, customer lists, prospect data, or other material of any nature whatsoever (in tangible or electronic form) in the Executive’s possession or control, including all copies thereof, relating to the Employer, its business, or its customers. Upon the request of the Employer, the Executive shall certify in writing compliance with the foregoing requirement.

6

10.

Restrictive Covenants.

(a)

No Solicitation of Customers. During the Executive’s employment with the Employer and for a period of 12 months thereafter (regardless of whether this Agreement terminates or expires), the Executive shall not (except on behalf of or with the prior written consent of the Employer), either directly or indirectly, on the Executive’s own behalf or in the service or on behalf of others, (A) solicit, divert, or appropriate to or for a Competing Business, or (B) attempt to solicit, divert, or appropriate to or for a Competing Business, any person or entity that is or was a customer of the Employer or any of its Affiliates at any time during the 12 months prior to the date of termination and with whom the Executive has had material contact. The parties agree that solicitation of such a customer to acquire stock in a Competing Business during this time period would be a violation of this Section 10(a).

(b)

No Recruitment of Personnel. During the Executive’s employment with the Employer and for a period of 12 months thereafter (regardless of whether this Agreement terminates or expires), the Executive shall not, either directly or indirectly, on the Executive’s own behalf or in the service or on behalf of others, (A) solicit, divert, or hire away, or (B) attempt to solicit, divert, or hire away, to any Competing Business located in the Territory, any employee of or consultant to the Employer or any of its Affiliates, regardless of whether the employee or consultant is full-time or temporary, the employment or engagement is pursuant to written agreement, or the employment is for a determined period or is at will. For purposes of this Section, "employee of or consultant to the Employer" shall mean (A) any individual employed by the Employer at the time of the actual or attempted solicitation, diversion or hiring, or (B) any individual employed by the Employer at the time of Executive’s termination of employment with the Employer.

(c)

Non-Competition Agreement. During the Executive’s employment with the Employer and for a period of 12 months following any termination (as opposed to expiration) of this Agreement, the Executive shall not (without the prior written consent of the Employer) compete with the Employer or any of its Affiliates by, directly or indirectly, forming, serving as an organizer or officer of, or consultant to, or acquiring or maintaining more than a 1% passive investment in, a depository financial institution or holding company therefor if such depository institution or holding company has, or upon formation will have, one or more offices or branches located in the Territory. Notwithstanding the foregoing, the Executive may serve as an officer of or consultant to a depository institution or holding company therefor even though such institution operates one or more offices or branches in the Territory, if the Executive’s employment does not directly involve, in whole or in part, the depository financial institution’s or holding company’s operations in the Territory.

(d)

Bank Receivership. Notwithstanding Sections 9(a-c) above, if Executive’s employment with the Employer shall terminate due to the Bank being taken into receivership by the FDIC, then the restrictive covenants of this Section 10 shall not apply to the Executive beginning as of the date of such receivership.

11.

Independent Provisions. The provisions in each of the above Sections 6, 7, 8, 9, 10(a), 10(b), and 10(c) are independent, and the unenforceability of any one provision shall not affect the enforceability of any other provision.

7

12.

Successors; Binding Agreement. The rights and obligations of this Agreement shall bind and inure to the benefit of the surviving corporation in any merger or consolidation in which the Employer is a party, or any assignee of all or substantially all of the Employer’s business and properties. The Executive’s rights and obligations under this Agreement may not be assigned by him, except that his right to receive accrued but unpaid compensation, unreimbursed expenses and other rights, if any, provided under this Agreement which survive termination of this Agreement shall pass after death to the personal representatives of his estate.

13.

Notice. For the purposes of this Agreement, notices and all other communications provided for in the Agreement shall be in writing and shall be deemed to have been duly given when personally delivered or sent by certified mail, return receipt requested, postage prepaid, addressed to the respective addresses last given by each party to the other; provided, however, that all notices to the Employer shall be directed to the attention of the Employer with a copy to the Secretary of the Employer. All notices and communications shall be deemed to have been received on the date of delivery thereof.

14.

Governing Law. This Agreement shall be governed by and construed and enforced in accordance with the laws of the State of South Carolina without giving effect to the conflict of laws principles thereof. Any action brought by any party to this Agreement shall be brought and maintained in a court of competent jurisdiction in the State of South Carolina.

15.

Non-Waiver. Failure of the Employer to enforce any of the provisions of this Agreement or any rights with respect thereto shall in no way be considered to be a waiver of such provisions or rights, or in any way affect the validity of this Agreement.

16.

Enforcement. The Executive agrees that in the event of any breach or threatened breach by the Executive of any covenant contained in Sections 6, 7, 8, 9, 10(a),10(b), or 10(c) hereof, the resulting injuries to the Employer would be difficult or impossible to estimate accurately, even though irreparable injury or damages would certainly result. Accordingly, an award of legal damages, if without other relief, would be inadequate to protect the Employer. The Executive, therefore, agrees that in the event of any such breach, the Employer shall be entitled to obtain from a court of competent jurisdiction an injunction to restrain the breach or anticipated breach of any such covenant, and to obtain any other available legal, equitable, statutory, or contractual relief. Should the Employer have cause to seek such relief, no bond shall be required from the Employer, and the Executive shall pay all attorney’s fees and court costs which the Employer may incur to the extent the Employer prevails in its enforcement action.

17.

Saving Clause. The provisions of this Agreement shall be deemed severable and the invalidity or unenforceability of any provision shall not affect the validity or enforceability of the other provisions hereof. If any provision or clause of this Agreement, or portion thereof, shall be held by any court or other tribunal of competent jurisdiction to be illegal, void, or unenforceable in such jurisdiction, the remainder of such provision shall not be thereby affected and shall be given full effect, without regard to the invalid portion. It is the intention of the parties that, if any court construes any provision or clause of this Agreement, or any portion thereof, to be illegal, void, or unenforceable because of the duration of such provision or the area or matter covered thereby, such court shall reduce the duration, area, or matter of such provision, and, in its reduced form, such provision shall then be enforceable and shall be enforced. The Executive and the

8

Employer hereby agree that they will negotiate in good faith to amend this Agreement from time to time to modify the terms of Sections 10(a), 10(b) or 10(c), the definition of the term "Territory," and the definition of the term "Business," to reflect changes in the Employer’s business and affairs so that the scope of the limitations placed on the Executive’s activities by Section 10 accomplishes the parties’ intent in relation to the then current facts and circumstances. Any such amendment shall be effective only when completed in writing and signed by the Executive and the Employer.

18.

Certain Definitions.

(a)

"Affiliate" shall mean any business entity controlled by, controlling or under common control with the Employer.

(b)

"Business" shall mean the operation of a depository financial institution, including, without limitation, the solicitation and acceptance of deposits of money and commercial paper, the solicitation and funding of loans and the provision of other banking services, and any other related business engaged in by the Employer or any of its Affiliates as of the date of termination.

(c)

"Cause" shall consist of any of (A) the commission by the Executive of a willful act (including, without limitation, a dishonest or fraudulent act) or a grossly negligent act, or the willful or grossly negligent omission to act by the Executive, which is intended to cause, causes or is reasonably likely to cause material harm to the Employer (including harm to its business reputation), (B) the indictment of the Executive for the commission or perpetration by the Executive of any felony or any crime involving dishonesty, moral turpitude or fraud, (C) the material breach by the Executive of this Agreement that, if susceptible of cure, remains uncured 10 days following written notice to the Executive of such breach, (D) the receipt of any form of notice, written or otherwise, that any regulatory agency having jurisdiction over the Employer intends to institute any form of formal or informal (e.g., a memorandum of understanding which relates to the Executive’s performance) regulatory action against the Executive or the Employer (provided that the Board determines in good faith, with the Executive abstaining from participating in the consideration of and vote on the matter, that the subject matter of such action involves acts or omissions by or under the supervision of the Executive or that termination of the Executive would materially advance the Employer’s compliance with the purpose of the action or would materially assist the Employer in avoiding or reducing the restrictions or adverse effects to the Employer related to the regulatory action); (E) the exhibition by the Executive of a standard of behavior within the scope of his employment that is materially disruptive to the orderly conduct of the Employer’s business operations (including, without limitation, substance abuse, sexual misconduct or disrespect toward any Bank employee) to a level which, in the Board’s good faith and reasonable judgment, with the Executive abstaining from participating in the consideration of and vote on the matter, is materially detrimental to the Employer’s best interest, that, if susceptible of cure remains uncured 10 days following written notice to the Executive of such specific inappropriate behavior; (F) the failure of the Executive to devote his full business time and attention to his employment as provided under this Agreement that, if susceptible of cure, remains uncured 30 days following written notice to the Executive of such failure; or (G) the failure of the Executive to comply with or adhere to the directives of the Board. In order for the Board to make a determination that termination shall be for Cause, the Board must provide the Executive with an opportunity to meet with the Board in person.

9

(d)

"Competing Business" shall mean any business that, in whole or in part, is the same or substantially the same as the Business.

(e)

"Disability" or "Disabled" shall mean as defined by Treasury Regulation § 1.409A-3(i)(4).

(f)

"Notice of Termination" shall mean a written notice of termination from one party to the other which specifies an effective date of termination, indicates the specific termination provision in this Agreement relied upon, and, in the case of a termination for Cause, sets forth in reasonable detail the facts and circumstances claimed to provide a basis for termination of Executive’s employment under the provision so indicated.

(g)

"Territory" shall mean a radius of 15 miles from (i) the main office of the Employer or (ii) any branch office of the Employer.

(h)

"Terminate," "terminated," "termination," or "Termination of Employment" shall mean separation from service as defined by Regulation 1.409A-1(h).

19.

Compliance with Regulatory Restrictions. Notwithstanding anything to the contrary herein, and in addition to any restrictions stated in Section 3 hereof, any compensation or other benefits paid to the Executive shall be limited to the extent required by any federal or state regulatory agency having authority over the Employer. The Executive agrees that compliance by the Employer with such regulatory restrictions, even to the extent that compensation or other benefits paid to the Executive are limited, shall not be a breach of this Agreement by the Employer.

20.

Clawback. Notwithstanding anything to the contrary herein, the Executive agrees that any compensation and benefits provided to him under this Agreement that are subject to recovery or recoupment under any applicable law, regulation or securities exchange rule, shall be recouped by the Employer as necessary to satisfy such law, regulation, or rules. These laws, regulations, and rules include, but are not limited to, where such compensation constitutes "excessive compensation" within the meaning of 12 C.F.R. Part 30, Appendix A, where the Executive has committed, is substantially responsible for, or has violated, the respective acts, omissions, conditions, or offenses outlined under 12 C.F.R. § 359.4(a)(4), and if the Bank becomes, and for so long as it remains, subject to the provisions of 12 U.S.C. § 1831o(f), where such compensation exceeds the restrictions imposed on the senior executive officers of such an institution. In addition, the Executive agrees that any incentive compensation provided to him under this Agreement that is subject to recovery or recoupment under any internal policy of the Employer shall be shall be recouped by the Employer as necessary to satisfy such internal policy. Executive agrees to promptly return or repay any such compensation, and authorizes the Employer to deduct such compensation from any other payments owed to the Executive by the Employer if he fails to do so.

21.

Compliance with Internal Revenue Code Section 409A. All payments that may be made and benefits that may be provided pursuant to this Agreement are intended to qualify for an exclusion from Section 409A of the Code and any related regulations or other pronouncements thereunder and, to the extent not excluded, to meet the requirements of Section 409A of the Code. Any payments made under Sections 3 and 4 of this Agreement which are paid on or before the last

10

day of the applicable period for the short-term deferral exclusion under Treasury Regulation § 1.409A-1(b)(4) are intended to be excluded under such short-term deferral exclusion. Any remaining payments under Sections 3 and 4 are intended to qualify for the exclusion for separation pay plans under Treasury Regulation § 1.409A-1(b)(9). Each payment made under Sections 3 and 4 shall be treated as a "separate payment", as defined in Treasury Regulation § 1.409A-2(b)(2), for purposes of Code Section 409A. Further, notwithstanding anything to the contrary, all severance payments payable under the provisions of Section 4 shall be paid to the Executive no later than the last day of the second calendar year following the calendar year in which occurs the date of Executive’s termination of employment. None of the payments under this Agreement are intended to result in the inclusion in Executive’s federal gross income on account of a failure under Section 409A(a)(1) of the Code. The parties intend to administer and interpret this Agreement to carry out such intentions. However, the Employer does not represent, warrant or guarantee that any payments that may be made pursuant to this Agreement will not result in inclusion in the Executive’s gross income, or any penalty, pursuant to Section 409A(a)(1) of the Code or any similar state statute or regulation. Notwithstanding any other provision of this Agreement, to the extent that the right to any payment (including the provision of benefits) hereunder provides for the "deferral of compensation" within the meaning of Section 409A(d)(1) of the Code, the payment shall be paid (or provided) in accordance with the following:

(a)

If the Executive is a "Specified Employee" within the meaning of Section 409A(a)(2)(B)(i) of the Code on the date of the Executive’s termination (the "Separation Date"), and if an exemption from the six month delay requirement of Code Section 409A(a)(2)(B)(i) is not available, then no such payment shall be made or commence during the period beginning on the Separation Date and ending on the date that is six months following the Separation Date or, if earlier, on the date of the Executive’s death. The amount of any payment that would otherwise be paid to the Executive during this period shall instead be paid to the Executive on the first day of the first calendar month following the end of the period.

(b)

Payments with respect to reimbursements of expenses or benefits or provision of fringe or other in-kind benefits shall be made on or before the last day of the calendar year following the calendar year in which the relevant expense or benefit is incurred. The amount of expenses or benefits eligible for reimbursement, payment or provision during a calendar year shall not affect the expenses or benefits eligible for reimbursement, payment or provision in any other calendar year.

22.

Entire Agreement. This Agreement constitutes the entire agreement between the parties hereto and supersedes all prior agreements, if any, understandings and arrangements, oral or written, between the parties hereto with respect to the subject matter hereof.

23.

Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original but all of which together shall constitute one and the same instrument.

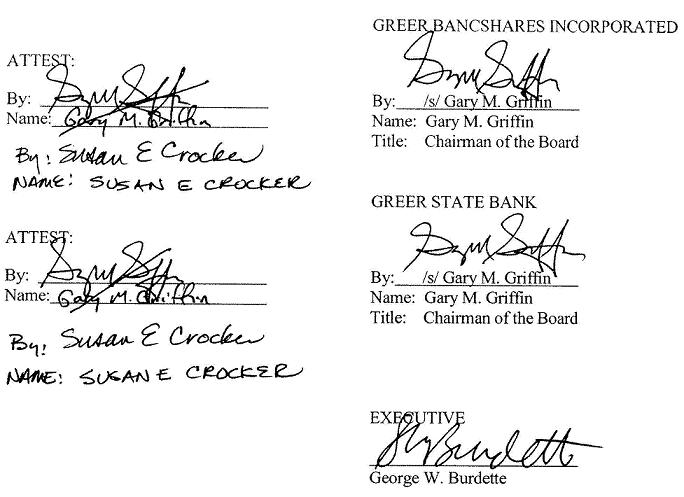

IN WITNESS WHEREOF, the Employer has caused this Agreement to be executed and its seal to be affixed hereunto by its officers thereunto duly authorized, and the Executive has signed and sealed this Agreement, effective as of the date first above written.

11