Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MOLINA HEALTHCARE, INC. | d791807d8k.htm |

Investor Day 2014B

September 18, 2014

New York, New York

Exhibit 99.1 |

2

©

2014 Molina Healthcare, Inc.

Cautionary Statement

Safe

Harbor

Statement

under

the

Private

Securities

Litigation

Reform

Act

of

1995:

This

slide

presentation and our accompanying oral remarks contain numerous

“forward-looking statements” regarding,

without

limitation

to:

our

2014

financial

guidance;

our

revenue,

revenue

mix,

and

membership

projections;

our

business strategy; duals demonstration projects and their expected implementation

start dates; the annual Health

Insurer

Fee

or

excise

tax

and

its

reimbursement

by

states

on

a

grossed-up

basis;

the

2014

rate

environment; the hepatitis C drug Sovaldi; our recent acquisitions in the

State of Florida; and various other matters.

All of our forward-looking statements are subject to numerous risks,

uncertainties, and other factors

that could

cause

our

actual

results

to

differ

materially.

Anyone

viewing

or

listening

to

this

presentation

is

urged

to read the risk factors and cautionary statements found under Item 1A in our

annual report on Form 10-K, as well as the risk factors and cautionary

statements in our quarterly reports and in our other reports and filings

with

the

Securities

and

Exchange

Commission

and

available

for

viewing

on

its

website

at

www.sec.gov.

Except to the extent otherwise required by federal securities laws, we do not

undertake to address or update forward-looking

statements

in

future

filings

or

communications

regarding

our

business

or

operating

results. |

©

2014 Molina Healthcare, Inc.

3

Approx. Time

Topic

Speaker

12:30pm-12:35pm

Opening Remarks

Juan José

Orellana, SVP Investor Relations

12:35pm-1:10pm

Business Overview

Dr. J. Mario Molina, Chief Executive Officer

1:10pm-1:45pm

Operations Discussion

Terry Bayer, Chief Operating Officer

1:45pm-2:00pm

Q&A

2:00pm-2:15pm

Break

2:15pm-2:45pm

Recent Financing

Transactions

Joseph White, Chief Accounting Officer

2:45pm-3:05pm

Q&A

3:05pm-3:50pm

Finance Discussion

John Molina, Chief Financial Officer

3:50pm-4:30pm

Q&A

4:30pm

End of Program

Today |

Business Overview

J. Mario Molina, M.D.

President & Chief Executive Officer

September 18, 2014

New York, New York |

©

2014 Molina Healthcare, Inc.

5

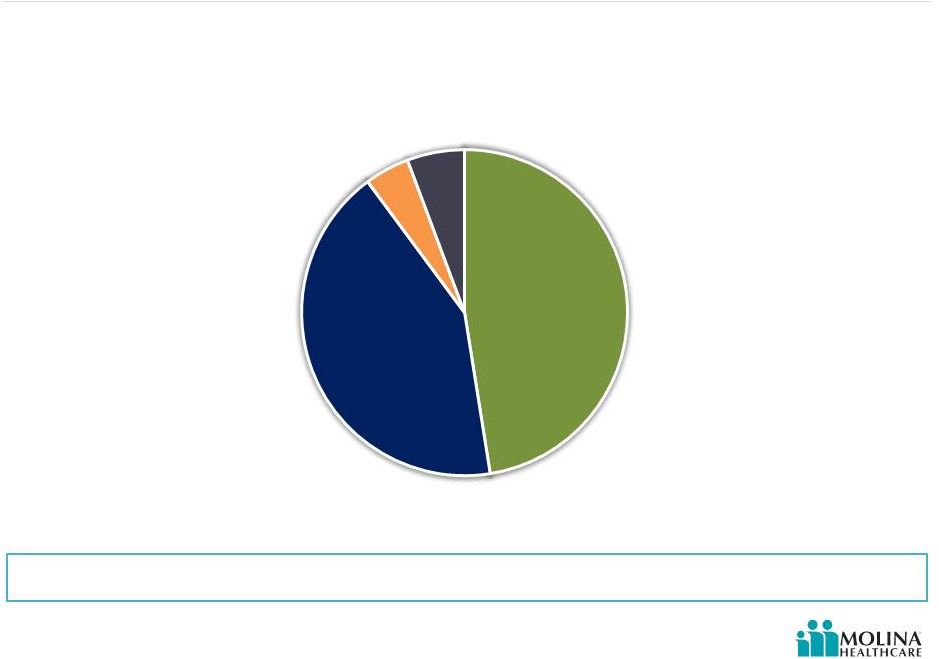

Presence in Key Medicaid Markets

2.3 million members

WA

461K

CA

455K

FL

58K

NM

195K

TX

247K

WI

85K

MI

244K

SC

119K

IL

6K

UT

83K

Health Plan Enrollment as of June 2014

Health Plan footprint includes 4 of 5 largest Medicaid Markets

Health Plan Enrollment

by Product

Medicare

2%

80%

TANF

14%

CHIP

3%

Aged, Blind

Marketplace

1%

ID

WV

ME

NJ

VA

Molina Health Plan

Molina Medicaid Solutions

Direct Delivery

USVI

OH

302K

or Disabled |

©

2014 Molina Healthcare, Inc.

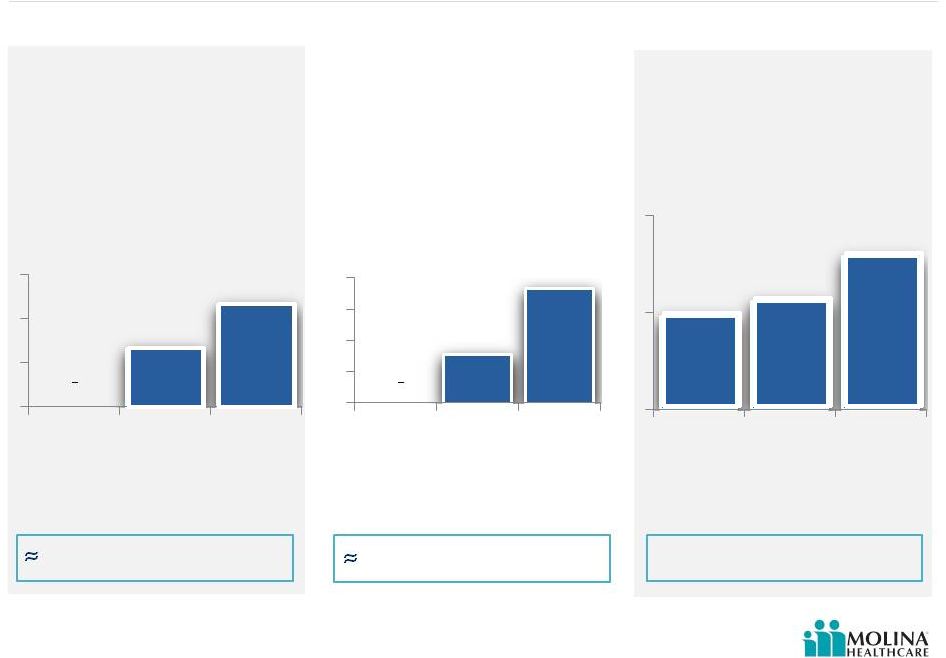

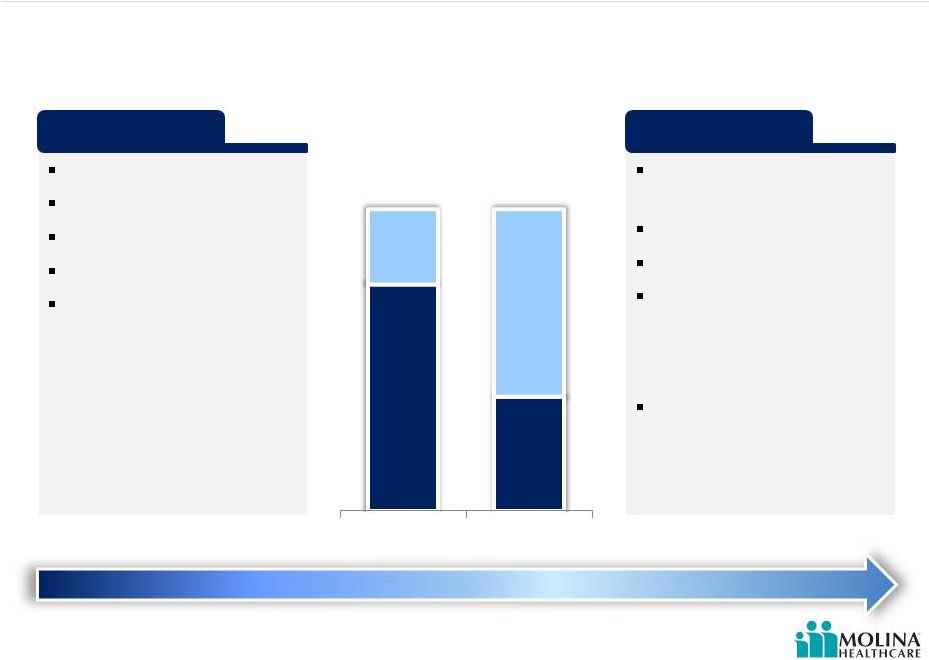

6

2014 Update –

Short Term

Medicare-Medicaid plan (MMP) program delay –

Michigan

TX Quality Revenue not yet recognized

Delays in recognition and collection of Health Insurer Fee

(HIF) reimbursement

Medicaid expansion enrollment higher than anticipated

Florida Medicaid Managed Medical Assistance (MMA)

program launch

Washington dispute settlements

Convertible Senior Note transactions in September 2014

MMP enrollment on track

Please refer to the Company’s cautionary statements. |

©

2014 Molina Healthcare, Inc.

7

Affordable

Care

Act

–

Effect

on

MOH

after

6

Months

Medicaid Expansion

Enrollment

Enrollment from Molina States

participating in Medicaid Expansion

TANF & Welcome Mat

Effect

Medicaid TANF Enrollment from Molina

States participating in Medicaid

Expansion

Marketplace Enrollment

Enrollment in California, Florida,

Michigan, New Mexico, Ohio, Texas,

Utah, Washington and Wisconsin

$20M 1

Half Revenue

Not Materialized

Charts presented with varying scales.

133K

232K

4Q2013

1Q2014

2Q2014

8K

18K

4Q2013

1Q2014

2Q2014

1,148K

1,156K

1,179K

4Q2013

1Q2014

2Q2014

$500M 1

Half Revenue

st

st |

©

2014 Molina Healthcare, Inc.

8

Medicaid Expansion

TANF

Enrollment 1.5 Million

Average age: 14

Seniors & Persons with

Disabilities

Enrollment: 227K

Average age: 42

Medicaid Expansion

Enrollment 241K

Average age: 40

age

age

age

Gender Mix

Female

Male

Gender Mix

Female

Male

Gender Mix

Female

Male

Enrollment Demographic Profile

1.

Molina internal analytics. Most recent data available.

78%

5%

9%

8%

1%

0%

0%

15%

25%

41%

19%

0%

17%

7%

12%

30%

24%

9%

45%

55%

46%

54%

50%

50%

1 |

©

2014 Molina Healthcare, Inc.

9

Medicaid Expansion

TANF

Enrollment 1.5 Million

Average age: 14

Seniors & Persons with

Disabilities

Enrollment: 227K

Average age: 42

Medicaid Expansion

Enrollment 241K

Average age: 40

Medical Spending Profile by Service Category

1.

Molina internal analytics. Most recent data available.

IP = Inpatient

OP = Outpatient

ER = Emergency Room

MAT = Maternity Related

BH = Behavioral Health

LTC = Long Term Care

RX = Pharmacy

PROF = Professional Services

19%

12%12%

11%

2%

1%

16%

28%

32%

14%

12%

4%

1%

0%

10%

26%

25%

10%

7%

1%

2%

12%

24%

18%

1 |

©

2014 Molina Healthcare, Inc.

10

Medicaid Expansion

TANF

Enrollment 1.5 Million

Average age: 14

Seniors & Persons with

Disabilities

Enrollment: 227K

Average age: 42

Medicaid Expansion

Enrollment 241K

Average age: 40

Pharmacy Spending Profile

Top 10 Drugs by Spend

1.

Molina internal analytics. Most recent data available.

1

Abilify

ProAir HFA

QVAR

Synagis

Vyvanse

Methylphenidate

Hydrochloride

Budesonide

Tamiflu

Lantus

Humira

7%

3%

2%

2%

2%

2%

2%

1%

1%

1%

Abilify

Lantus

Humalog

QVAR

Humira

ProAir HFA

Enbrel

Gabapentin

Novolog

Atripla

5%

3%

2%

2%

2%

2%

1%

1%

1%

1%

Lantus

Abilify

Invega Sustenna

Spiriva

Nexium

Truvada

Lantus Solostar

ProAir HFA

QVAR

Humira

3%

3%

2%

2%

2%

2%

2%

2%

2%

1% |

©

2014 Molina Healthcare, Inc.

11

ACA Medicaid Expansion Demographics vs. Actual

Experience

Seniors & Persons with

Disabilities

Molina actual enrollment of Seniors and

Persons with Disabilities adjusted

by

removing age bands 0-18 and 65+.

age

age

age

Gender Mix

Female

Male

Gender Mix

Female

Male

Gender Mix

Female

Male

Urban Institute

Demographic expectations prior to

implementation

1.

Urban

Institute.

August

2012.

http://www.urban.org/UploadedPDF/412630-opting-in-medicaid.pdf

2.

Molina internal analytics. Most recent data available

Medicaid Expansion

Actual enrollment experience

Enrollment 241K

Average age: 40

of the Affordable

1

2

2

0%

26%

26%

36%

13%

0%

0%

15%

25%

41%

19%

0%

0%

10%

16%

41%

33%

0%

47%

53%

46%

54%

47%

53%

Care Act |

©

2014 Molina Healthcare, Inc.

12

2014 Update –

Long Term

Molina is transforming from

an acute care company to a

chronic care company.

Business requirements are

changing as we take on more

complex patients.

Please refer to the Company’s cautionary statements. |

©

2014 Molina Healthcare, Inc.

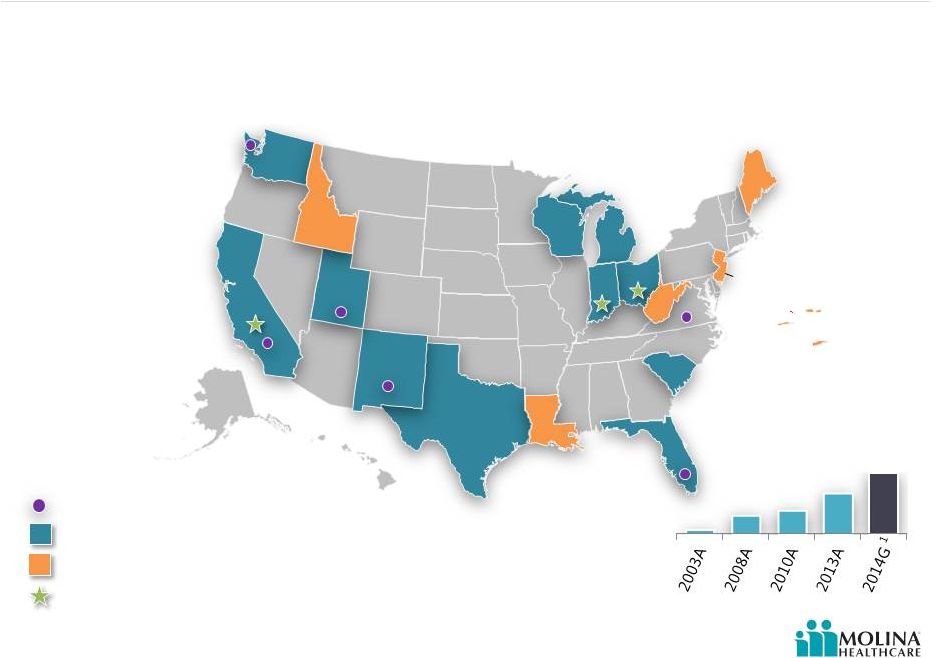

13

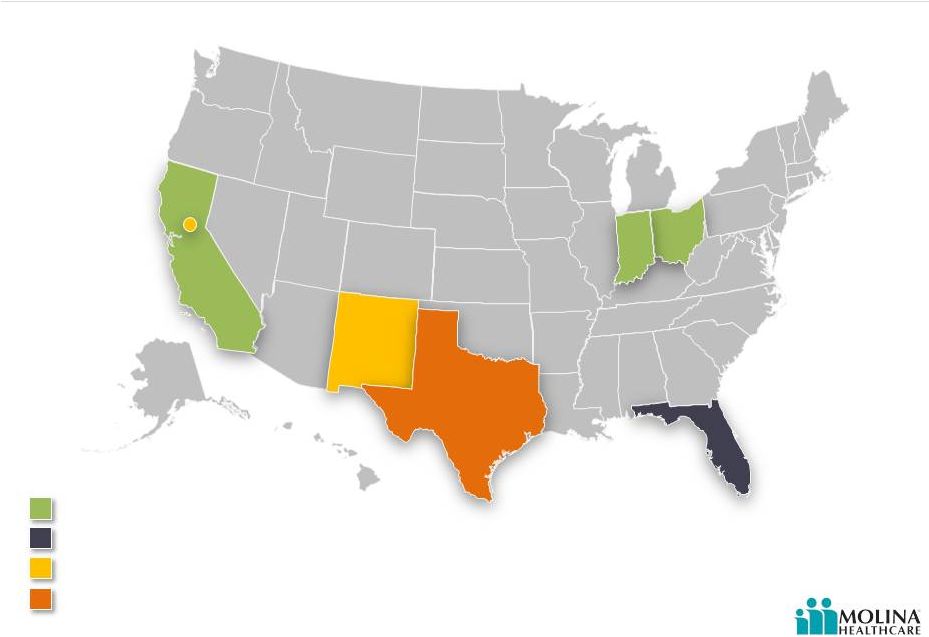

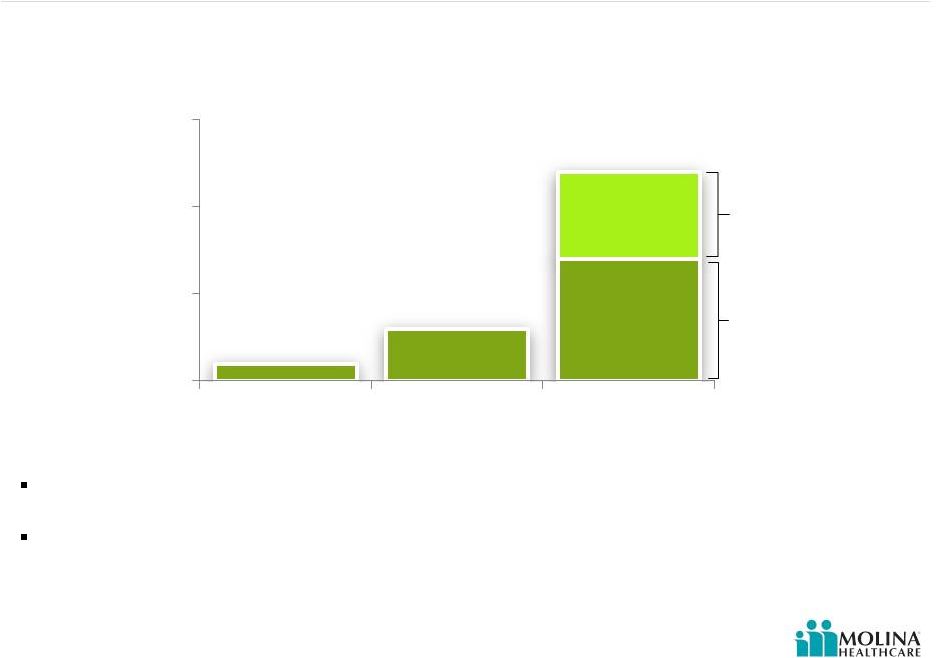

Molina Footprint

Please refer to the Company’s cautionary statements.

2014: Molina launches MMP Demos in three

states…

MMP Demonstrations

CA

NM

MI

WA

UT

TX

OH

FL

WI

ID

LA

WV

NJ

ME

SC

IL

Direct Delivery

Service Areas:

Molina Health Plan

Molina Medicaid Solutions

Total Revenue

$794M

1.2M

$3.1B

$3.9B

$6.6B

560K

Members

1.5M

1.9M

2010: Molina offers services through Molina Medicaid

Solutions…

$9.9B

2.6M

1

1.

Constitutes forward-looking guidance issued on February 2014. Amounts are

estimates and subject to change. Actual results may differ materially. See

our risk factors as discussed in our Form 10-K and other periodic filings.

USVI

VA

2008: Molina offers Medicare services…

2003: Molina becomes publicly traded on the

New York Stock Exchange…

1980: Molina Healthcare is born…

|

©

2014 Molina Healthcare, Inc.

14

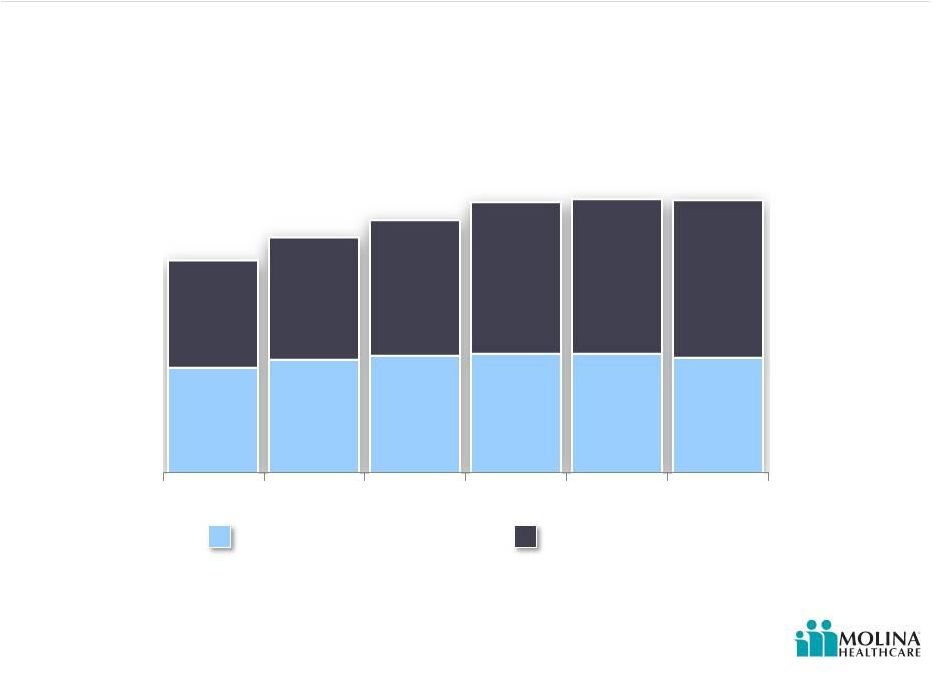

Medicaid Enrollment and Spending

While most Enrollees are in Managed Care, most Medicaid Spending

is still in Fee-for-Service

Medicaid Enrollment and Spending

FY 2011

1.

Managed care includes only risk based MCOs.

CMS-64 data for 2012, and: MACPAC, ‘Report to Congress on Medicaid and

CHIP’, June 2013. FFS

MCOs

$407B

57M

26%

74%

77%

23%

Managed Care Organizations (MCOs) and Fee-For-Service (FFS)

$92B

$315B

Medicaid Spend 2011

42M

15M

Medicaid Enrollment 2011 |

©

2014 Molina Healthcare, Inc.

15

Home & Community-Based Care

Institutional-Based Care

Growing Long-Term Care Needs

Medicaid Long-Term Services and Supports Expenditures

2007-2012

1

$113B

$123B

$131B

$139B

$140B

$140B

1.

Truven Health Analytics. ‘Medicaid Expenditures for Long-Term Services and

Supports in FFY 2012’, April 28, 2014. 59%

57%

55%

52%

52%

50%

41%

43%

45%

48%

48%

50%

2007

2008

2009

2010

2011

2012 |

©

2014 Molina Healthcare, Inc.

16

Medicaid Long-Term Services and Supports (LTSS)

Older People &

People with

Physical Disabilities

People with

Developmental

Disabilities

61%

30%

People with

Serious Mental Illness

6%

Other/Multiple Populations

3%

Full Medicaid LTSS spend in 2012: $140B

1.

Truven Health Analytics. ‘Medicaid Expenditures for Long-Term Services and

Supports in FFY 2012’, April 28, 2014. |

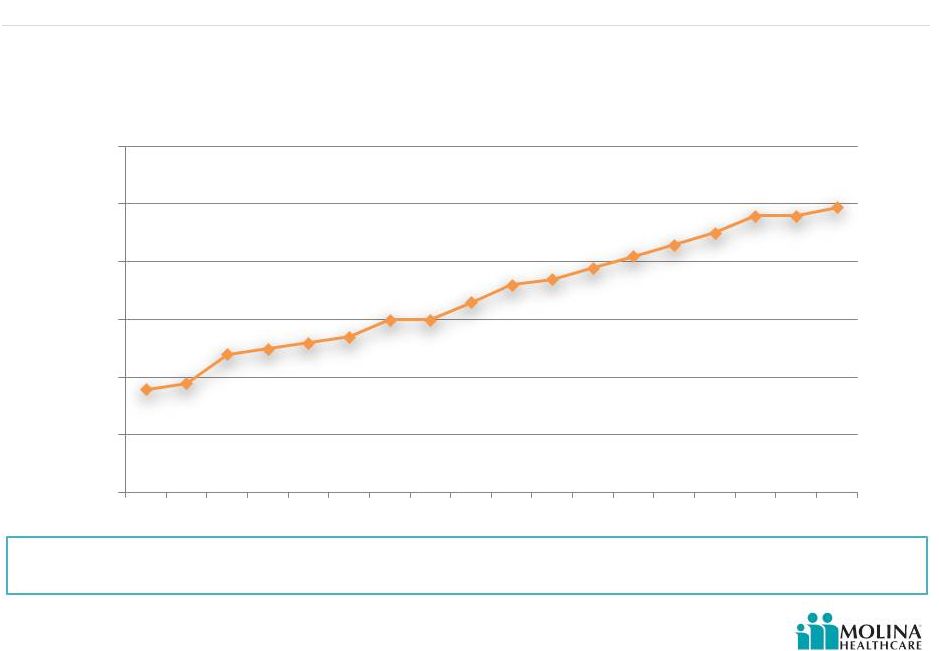

©

2014 Molina Healthcare, Inc.

17

Medicaid Home and Community-Based Services (HCBS) as

% of LTSS Spending

Medicaid HCBS as Percent of Total Medicaid

LTSS Expenditures

1

FY

1995

–

FY

2012

1.

Truven Health Analytics. ‘Medicaid Expenditures for Long-Term Services and

Supports in FFY 2012’, April 28, 2014. Medicaid spend on Long-Term

Care has been shifting toward Community-Based Care

18%

19%

24%

25%

26%

27%

30%

30%

33%

36%

37%

39%

41%

43%

45%

48%

48%

50%

0%

10%

20%

30%

40%

50%

60%

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012 |

©

2014 Molina Healthcare, Inc.

18

Medicaid Home and Community-Based Services (HCBS)

People with

Serious Mental Illness

4%

Other/Multiple Populations

6%

Medicaid HCBS total spend in 2012: $69B

1.

Truven Health Analytics. ‘Medicaid Expenditures for Long-Term Services and

Supports in FFY 2012’, April 28, 2014. Older People &

People with

Physical

Disabilities

People with

Developmental

Disabilities

48%

42% |

©

2014 Molina Healthcare, Inc.

19

Medicaid Home and Community-Based Services (HCBS)

Medicaid expenditures for long-term care services have gradually shifted from

institutional-based care to home and community-based care.

Medicaid HCBS total spend in 2012: $69B

Medicaid HCBS Expenditures

FY 2010

1

Mental Health

3%

Case Management

4%

Group living, mental health services: 34%

Round-the-clock services, unspecified: 28%

Group living, other: 11%

Shared living, other: 9%

In-home residential habilitation: 5%

In-home round-the-clock services, other: 5%

Group living, residential habilitation: 4%

Shared living, residential habilitation: 3%

In-home round-the-clock mental health

services: 1%

Home-based

habilitation

Home health aide

Personal care

Companion

Homemaker

Chore

Prevocational services

Day habilitation

Education services

Day treatment/partial

hospitalization

Adult day health

Adult day services

Community integration

Medical day care for

children

Round-the-Clock

46%

Home-Based

18%

Day Services

15%

Other

2

14%

1.

Mathematica Policy Research. ‘The HCBS Taxonomy: A New Language for Classifying Home- and

Community-Based Services’, August 2013.

2.

Other includes expenses related to goods and services, interpreters, housing consultation, and claims

where the procedure code could not be interpreted. |

©

2014 Molina Healthcare, Inc.

20

Molina Long Term Services & Support (LTSS) Footprint –

as of September 2014

Service Areas:

MMP Demonstrations

LTSS ”Stand Alone”

LTSS and Acute Care

Home and Community-Based

Services (HCBS)

CA

NM

OH

FL

IL

TX |

©

2014 Molina Healthcare, Inc.

21

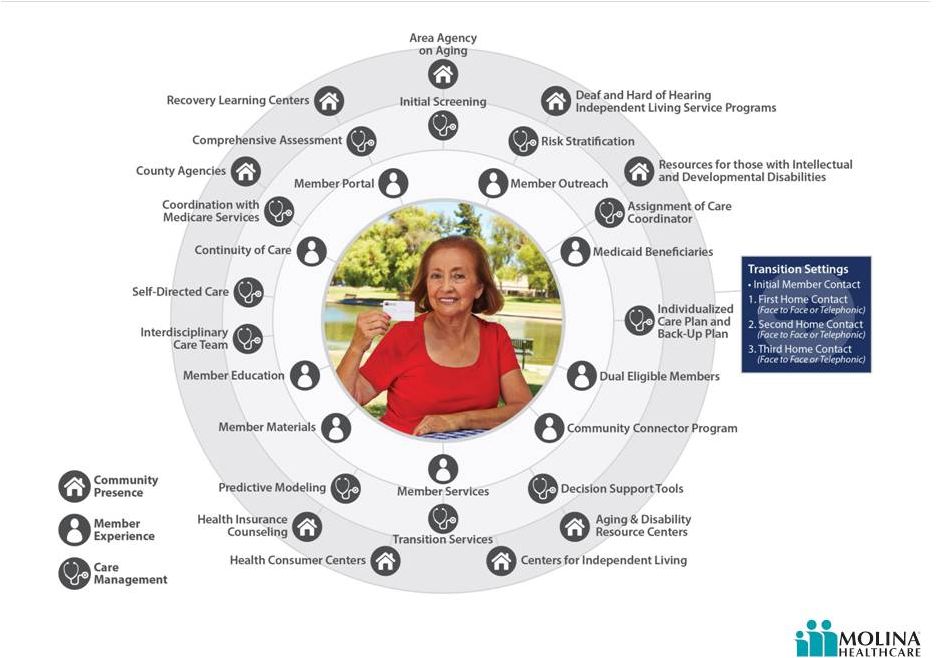

Long Term Services & Supports Continuum of Care

Management Model

LTSS

Medical

Health

Services

Behavioral

Health

Services |

©

2014 Molina Healthcare, Inc.

22

Molina Long Term Model of Care

Functional Elements |

©

2014 Molina Healthcare, Inc.

23

Manage our growth

Organic growth

Medicaid expansion

Dual eligible population

RFPs

Leverage our business portfolio

Health plan business

MMS

Direct delivery

Strive for operational excellence

Quality care

STAR ratings

Strategic Priorities

Our mission is to provide quality

health services to financially

vulnerable families and

individuals covered by

government programs.

Mission

Priorities |

24

©

2014 Molina Healthcare, Inc. |

Operations Discussion

Terry Bayer

Chief Operating Officer

September 18, 2014

New York, New York |

©

2014 Molina Healthcare, Inc.

26

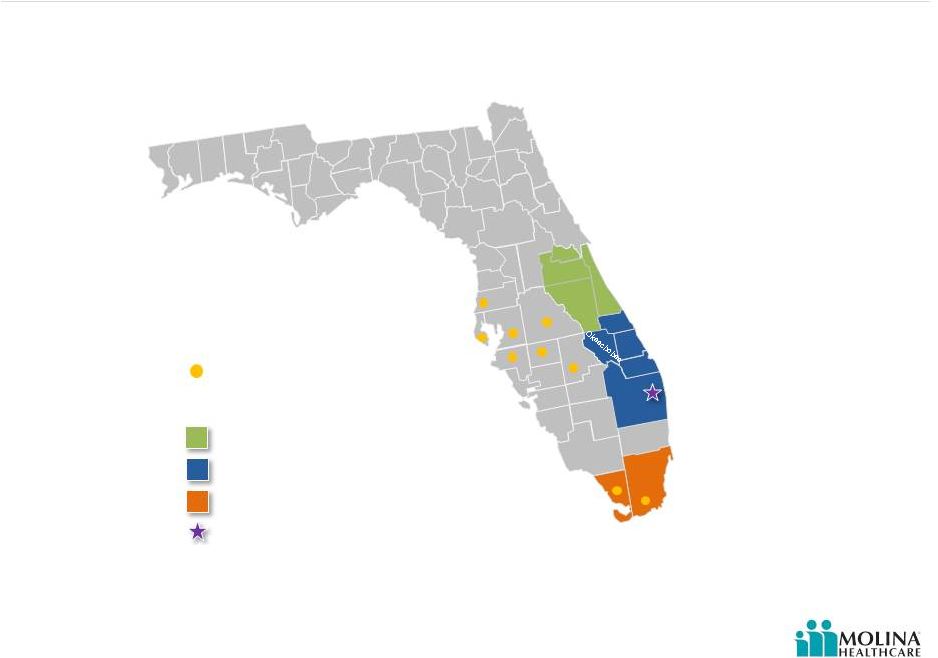

Molina Healthcare of Florida: Service Areas

Yesterday

Pre-Florida Medicaid Managed Care (MMA) and Long Term Care…

Pre-Florida

MMA

Long Term

Care

Service Areas:

Hillsborough

Polk

Osceola

Palm

Beach

Broward

Miami-

Dade

Highlands

Monroe

Seminole

Hardee

Manatee

Pasco

Pinellas |

©

2014 Molina Healthcare, Inc.

27

Molina Healthcare of Florida: Service Areas

Long Term Care

Today

Long Term Care, Florida MMA and Healthy Palm Beaches Acquisition…

Service Areas:

Pasco

Hillsborough

Polk

Osceola

Palm

Beach

Miami-

Dade

Pinellas

Manatee

Hardee

Highlands

Monroe

Seminole

Region 7

Region 9

Region 11

Healthy Palm Beaches Asset

Acquisition

1

Florida MMA –

Orange

Brevard

Indian

River

St.

Lucie

Martin

1.

Molina acquired Medicaid assets of Healthy Palm Beaches, with an effective date of August 1, 2014. |

©

2014 Molina Healthcare, Inc.

28

Molina Healthcare of Florida: Closed Acquisition

On August 1

st

, Molina acquired Medicaid business

assets of a Florida health plan, Healthy Palm

Beaches

Approximately 11,500 members in Palm Beach

County transferred over effective August 1, 2014

Members transitioned into Molina as part of the

Florida Managed Medical Assistance (MMA) program

implementation |

©

2014 Molina Healthcare, Inc.

29

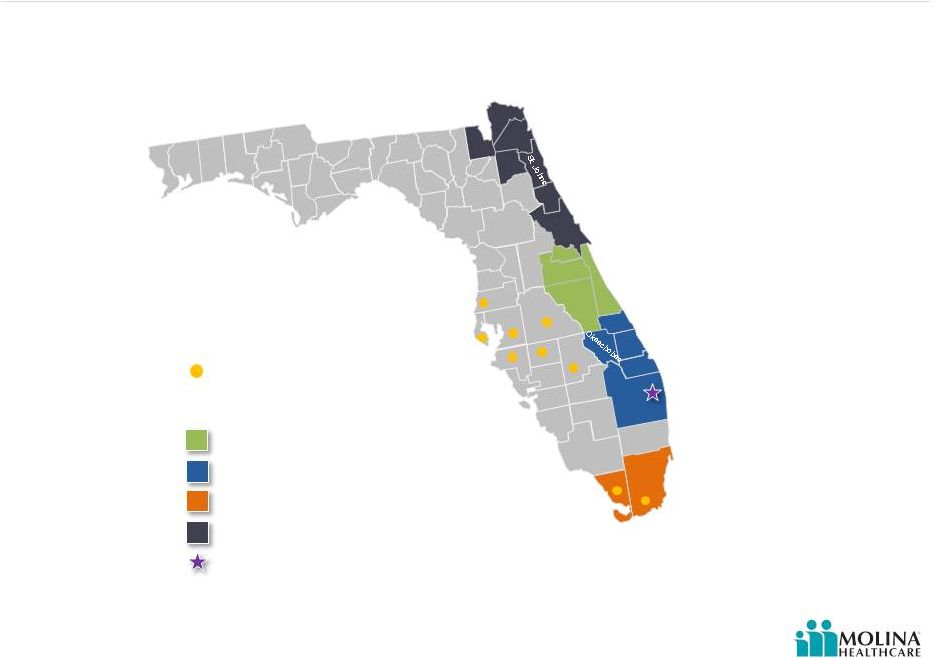

Molina Healthcare of Florida: Service Areas

Long Term Care

Tomorrow

Long Term Care, Florida MMA, and New Acquisitions

1,2

…

Service Areas:

Pasco

Hillsborough

Polk

Osceola

Palm

Beach

Miami-

Dade

Pinellas

Manatee

Hardee

Highlands

Monroe

Seminole

Region 7

Region 9

Region 11

Region 4 (through acquisition)

1

Healthy Palm Beaches Asset

Acquisition

2

Florida MMA –

Orange

Brevard

Nassau

Baker

Duval

Clay

Flage

r

Volusia

Indian

River

St.

Lucie

Martin

1.

New Florida MMA region added through the First Coast Advantage asset acquisition, with an effective

date of December 1, 2014 pending AHCA approval.

2.

Molina acquired Medicaid assets of Healthy Palm Beaches, with an effective date of August 1, 2014. |

©

2014 Molina Healthcare, Inc.

30

Molina Healthcare of Florida: Pending Acquisition

On August 8

th

, Molina agreed to acquire certain

assets of a Florida health plan, First Coast Advantage

Approximately 65,500 individuals eligible for transfer

to Molina

Anticipated effective date of December 1, 2014

1

Will assume First Coast Advantage’s Medicaid

contract and certain provider agreements for Region

4 of the Florida MMA program

Region 4 is in Northeast Florida and includes Baker,

Clay, Duval, Flagler, Nassau, St. Johns and Volusia

counties

1.

Pending state approvals and satisfaction or waiver of customary closing

conditions. |

©

2014 Molina Healthcare, Inc.

31

Molina Healthcare of Florida: Program Implementations

Region 4

Region 5

Region 6

Region 7

Region 9

Region 9

Region

11

Region 11

Program Type

Florida

MMA

(through

acquisition)

2

Long Term

Care

Long Term

Care

Florida

MMA

Florida

MMA

Florida

MMA

(through

acquisition)

3

Florida

MMA

4

Long Term

Care

4

Implementation

Date

12/1/14

2/1/14

2/1/14

8/1/14

8/1/14

8/1/14

7/1/14

12/1/13

Covered Lives

1

65K

1.6K

1.3K

11K

57K

11.5K

24K

3

3K

1.

Membership is based on August data and rounded to nearest hundred.

2.

New Florida MMA region added through the First Coast Advantage asset acquisition,

with an anticipated effective date of 12/1/14 (pending AHCA approval and satisfaction or waiver of customary closing conditions).

3.

Molina acquired assets of Healthy Palm Beaches in Palm Beach County, with an

effective date of 08/01/14. 4.

In Region 11 there are approximately 1,200 members that are included in both LTC and

MMA. Covered lives and implementation dates |

©

2014 Molina Healthcare, Inc.

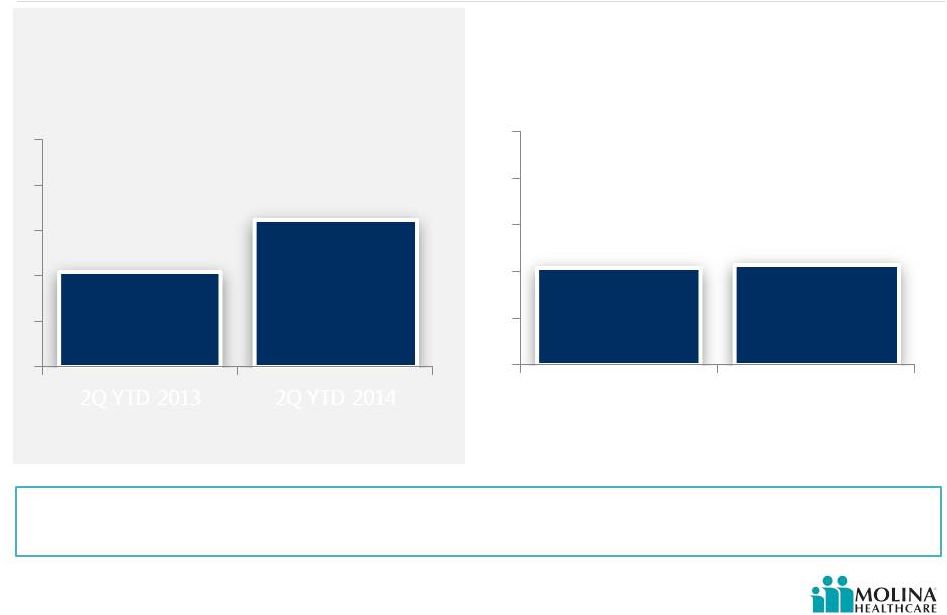

Molina Healthcare of Florida: Medical Care Ratio YoY

Comparison

Same Store MCR remains consistent through first half of 2014.

Higher MCR attributed to new Long Term Care enrollment.

Molina Healthcare of

Florida

Medical Care Ratio

_

Excluding Long Term

Care

Molina Healthcare of

Florida

Medical Care Ratio

_

All Products

84.4%

90.2%

2Q YTD 2013

2Q YTD 2014

84.4%

84.8%

2Q YTD 2013

2Q YTD 2014

32 |

©

2014 Molina Healthcare, Inc.

33

Molina Medicare-Medicaid Plan (MMP) Update

Enrollment in MMP demos

15K

1

California opt-out rate

50%

Enrollment tracking with

expectations

33

1.

Enrollment

figure

as

of

September

5

th

,

2014. |

©

2014 Molina Healthcare, Inc.

34

MMP Demonstrations –

National View as of June 2014

Over two dozen states submitted applications, with ten states participating in the

MMP demonstration Capitated model –

No

MOU

Capitated Demo –

Started

2014

Capitated Demo –

Starts in

2015

MFFS model –

Started

2014

Withdrawn

CA

NM

OH

IL

AZ

OK

CO

ID

OR

WA

MN

WI

IA

MO

MI

VA

NC

SC

VT

MA

RI

CT

TN

Hybrid Capitated and FFS

model

TX

MFFS model –

No MOU |

©

2014 Molina Healthcare, Inc.

35

Molina MMP Footprint

Contracts awarded to MOH

Demonstration is ‘Live’

CA

TX

SC

IL

OH

MI |

©

2014 Molina Healthcare, Inc.

36

The MMP Opaque Crystal Ball… |

©

2014 Molina Healthcare, Inc.

37

MMP –

Lessons Learned from “Go Live”

Enrollment Files

Lack of common data elements

Contact Centers

Call volume trending lower than expected

Provider and members call to clarify benefits

Average talk time 10 minutes

Contract Management Team (CMT)

Weekly or monthly and vary by state

Includes representatives from CMS and State

Effective way to mange early operational issues

Opportunity to Listen, Learn & Adjust |

©

2014 Molina Healthcare, Inc.

38

MMP –

Lessons Learned from “Go Live”

Health Risk Assessments & Initial Care Plans

Member Contact and Engagement

Reaching Members

Opportunity to Listen, Learn & Adjust

Mining claims data, prior auth/referral data

to identify places to find members

Working with providers and pharmacies

Leveraging Community Connectors

Passive enrollment limits opportunity to engage member

Difficult to schedule assessment

Bad phone numbers and addresses

Large numbers and compressed time frames

38 |

©

2014 Molina Healthcare, Inc.

39

What Else is New Beyond the 2

nd

Quarter?

Ohio Medicaid expansion

Michigan Medicaid expansion

Illinois new TANF members effective August 2014 |

©

2014 Molina Healthcare, Inc.

40

More continuous

eligibility

Chronic illnesses

Behavioral health

More likely to have

greater limitations in

activities of daily living

(ADL)

Require more focused

care including home

care

Caring for the Dual Eligible

Shift from Acute Care company to a Chronic Care company

Two Ends of the Continuum

Duals

TANF

Breaks in eligibility

Episodic care

Pregnancy

Greater ethnic diversity

Larger support system

at clinic visits

1. KFF.org

Under

Age 65

38%

Over

Age 65

62%

Under

Age 65

75%

Over

Age 65

25%

Demographics

1

TANF

ABDs

Duals

TANF

Duals |

©

2014 Molina Healthcare, Inc.

41

Shift of Care Model from Inpatient Care to Home-Based

Outpatient Care |

©

2014 Molina Healthcare, Inc.

42

Improving the Member Experience –

Case Study

54 year-old woman,

homeless with behavioral

health issues, unreachable

for health risk assessment.

Image for illustrative purposes only. Not actual patients.

|

©

2014 Molina Healthcare, Inc.

43

Improving the Member Experience –

Case Study

Image for illustrative purposes only. Not actual patients.

52 year-old woman, with

COPD, diabetes, high blood

pressure, stroke with

paralysis. |

©

2014 Molina Healthcare, Inc.

44

Long Term Services & Supports Continuum of Care

Management Model

LTSS

Medical

Health

Services

Behavioral

Health

Services |

©

2014 Molina Healthcare, Inc.

45

Q&A |

September 18, 2014

New York, New York

Recent Financing Transactions

Joseph White

Chief Accounting Officer |

©

2014 Molina Healthcare, Inc.

47

Please refer to the Company’s cautionary statements.

Convertible Note Exchange and Issuance

$301,551,000

September 2014

1.625% Convertible Senior Notes due 2044

Interest payable February 15 and August 15

$302M Convertible Debt ($177M+$125M)

Underlying shares 5.2 million

1.625% coupon

30% conversion premium ($58.09 per share)

No call spread

Net share settlement

Maturity 8/15/2044

Call / put at 8/19/2018

GAAP interest rate 5%

$0.12 diluted EPS (annualized);

$0.05 cash/ $0.07 non-cash diluted EPS |

©

2014 Molina Healthcare, Inc.

48

$176.6M of 2044 Notes

2044 Convertible Notes-

Summary of Execution

Please refer to the Company’s cautionary statements.

2014

Convertible

Investors

$187.0M of 2014

Notes

$10.4M Cash

1.8M Shares

1.

$176.6M of the 2014 notes exchanged, maturing in

2044

2.

2014 note holders exchanging their notes for 2044

notes received:

a.

Shares of MOH stock as if they had held the 2014

notes to maturity

b.

Interest payments on the 2014 notes as if they had

held those notes to maturity

3.

Remaining $10.4M of 3.75% convertible notes will

mature on October 1, 2014 as planned

Molina

Healthcare

New

Convertible

Investors

$125M Cash

$125M of 2044 Notes

Interest paid through

2014 note maturity

1.

An additional $125M of 2044 notes were issued to new

investors

Exchange

New Issuance

Molina

Healthcare |

©

2014 Molina Healthcare, Inc.

49

MOH Convertible Debt Exchange

2020 Notes

2044 Notes

Principal Amount

$550.0M

$301.6M

Coupon rate

1.125%

1.625%

GAAP Interest rate

6%

5%

Call spread

Yes

No

Contingent interest

No

Yes

Maturity date

1/15/2020

8/15/2044

Settlement

Cash

Net shares

Conversion ratio

24.5277

17.2157

Conversion price

$ 40.77

$ 58.09

High strike

$ 53.85

N/A

Put / call options

No

Yes

–

put

and

call

at

year 4

Conversion premium

32.5% / 75% (high strike)

30%

Basic

terms

summary

–

1.125%

2020

notes

vs.

1.625%

2044

notes

Please refer to the Company’s cautionary statements. |

©

2014 Molina Healthcare, Inc.

50

Cost of Capital Comparison

Molina CPDI convertible due 2044

After Tax Cost of Capital

1

1

Assumes a 40% tax rate, $44.68 stock price at issuance.

Convertible vs Straight Debt Break-even

Stock price: $70.60

CAGR: 11.8%

Please refer to the Company’s cautionary statements.

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

$44.68

$49.35

$54.44

$59.98

$66.02

$72.57

Stock Price

Straight Debt (6.00% coupon area, pre-tax)

CPDI Convertible (1.625% up 30%) |

©

2014 Molina Healthcare, Inc.

51

Cost of Capital Comparison

Molina Convertible & Call Spread Due 2020

After Tax Cost of Capital

1

Convertible vs Straight Debt Break-even

Stock price: $62.91

CAGR: 15.4%

1

Assumes a 40% tax rate, $30.77 stock price at issuance.

Please refer to the Company’s cautionary statements.

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

$30.77

$34.16

$37.54

$40.93

$44.31

$47.70

$51.08

$54.47

$57.86

$61.24

$64.63

Stock Price

1.125% Convertible + Call Spread + 75%

Straight Debt (6.00% coupon area, pre-tax) |

©

2014 Molina Healthcare, Inc.

Incremental Interest Impact of New Convert

Interest expense for the 2044 notes exchanged for 2014 notes began accruing

effective 9/5/2014

Interest expense for the additional 2044 notes issued began accruing effect

9/16/2014 Cash

Non-cash

EPS

Please refer to the Company’s cautionary statements.

$0.01

$0.03

3Q

4Q

Annualized

52

$0.1

$0.07

$0.05

Note:

(1) Approximately $1M that had previously been categorized as interest expense in the guidance issued

February, 2014 will be reported as “Other expense” in the Company’s Consolidated Statements of Income

for the quarter ended September 30, 2014. This amount represents interest paid and discount

amortized for the 2014 notes exchanged for the period September 5, 2014 through September 30, 2014. |

©

2014 Molina Healthcare, Inc.

53

Estimated Shares Outstanding –

2

nd

half 2014

Bridge from 12/31/2013 to 12/31/2014

(In thousands)

Year ended

12/31/2014

Shares outstanding at the beginning of the period

45,871

Shares issued:

3.75% Senior Notes

1,784

Employee equity incentives and other

945

Subtotal, estimated shares outstanding 12/31/2014

48,600

Adjustments for Weighted Shares Outstanding, Diluted:

Common stock equivalents - employee equity incentives

500

Weighting of shares issued - 3.75% Senior Notes

(160)

Weighting of shares issued - employee equity incentives and other

(440)

Weighted shares outstanding, Diluted (estimate)

48,500

Weighted shares outstanding, Diluted (estimate) - Guidance Issued Feb

2014

47,700

Estimated diluted shares for Q3 2014 EPS

48,700

Estimated diluted shares for Q4 2014 EPS

48,900

|

©

2014 Molina Healthcare, Inc.

54

Q&A |

Financial Discussion

John Molina

Chief Financial Officer

September 18, 2014

New York, New York |

©

2014 Molina Healthcare, Inc.

56

Base Rate Update

State

FINAL

Effective Date

Rate Change

Notes

California

Jul-14

+5.5%

Normalized for -3% benefit change

Excludes Medicaid Expansion

1

Florida

Jul-14

NA

MMA New Rates / Regions

Illinois

Jul-14

+2.5%

Michigan

Oct-14

-2.5% to +3.5%

Rate Ranges (Low / High)

New Mexico

Jul-14

+0.0%

Normalized for +6% fee schedule &

benefit changes

Ohio

Jan-14

+2.0%

Excludes new product and benefit

expansions and risk adjustment

South Carolina

Jul-14

+1.5%

Texas

Sep-14

+0.5%

Utah

Jul-14

+0.0%

Washington

Jan-14

+0.0%

Wisconsin

Jan-14

+1.0%

Excludes new product and benefit

expansions

1.

Medicaid Expansion rates will be adjusted retroactively back to 7/1/2014 (CA) and

1/1/2014 (WA). Excludes new product and benefit

expansions; net of fee schedule

adjustments; excludes risk adjustment

1 |

WA

Overpayment and Member Assignment Settlements September 2014

Item

1

-

Molina

agrees

to

pay

$19M

to

the

state

to

adjust premiums for two rate-related issues for the

period 7/1/2012 to 12/31/2013

Item 2 -

State agrees to pay Molina $8M to adjust

premiums for member assignment issues for the

period 7/1/2012 –

12/31/2013

Two separate one-time items to be

recorded in the 3

quarter of 2014;

reducing pre-tax income by

approximately $11M

Amounts are not included in guidance

issued February 2014

Both matters had been resolved

previously on a go-forward basis

effective January 1, 2014

No impact on premiums or

membership related to January 1,

2014 and later

57

©

2014 Molina Healthcare, Inc.

rd |

Total Health Insurer Fee (HIF) on Medicaid

revenue

approximately

$80M

due

September

30th,

2014

Lack of tax deductibility requires revenue of $130M

Contractual agreements in hand representing

approximately 50% of required revenue

Payment has not yet been received from any state

Health Insurer Fee (HIF) Reimbursement Update

Please refer to the Company’s cautionary statements.

58

©

2014 Molina Healthcare, Inc. |

©

2014 Molina Healthcare, Inc.

59

Texas Quality Revenue

$35M of 2014 revenue based on quality measures

Many quality measures are new this year

Calculation of performance is complex and subject

to interpretation

State has not released its calculation of 2013

performance

Molina will compare its 2013 calculations to those

released by state and adjust its 2014 calculations

accordingly

If Molina’s 2014 calculations support achievement

of the measurements, revenue will be recorded |

©

2014 Molina Healthcare, Inc.

60

What Admin Leverage May Do for MOH in Q3 and Q4 of 2014

G&A Expense

1

Note(s):

1.

G&A ratio computed as a percentage of total revenue.

2.

Constitutes forward-looking guidance. Amounts are estimates and subject to

change. Actual results may differ materially. See our risk factors as discussed in our Form 10-K and other periodic filings.

2014 Guidance G&A

Ratio

1H14

2H14

2

Total revenue

$4.4B

$5.5B

G&A expenses

$381M

$430M

G&A ratio

8.7%

7.7%

2

nd

half admin at 1

st

half G&A ratio

$480M

2

nd

half admin at projected G&A

ratio

$430M

2

nd

half benefit from lower ratio

$50M

Guidance

Actual

1Q14

8.9%

9.1%

2Q14

8.6%

8.4%

3Q14

7.9%

-

4Q14

7.5%

-

Please refer to the Company’s cautionary statements. |

61

©

2014 Molina Healthcare, Inc.

Delays in Revenue Recognition Distort Normal

Seasonality

Please refer to the Company’s cautionary statements.

Q2 YTD reported Adjusted EPS

$1.35

+ HIF revenue we haven’t recognized

$0.29

+ TX Quality Revenue we haven’t recognized

$0.12

Total YTD Adjusted EPS with HIF and TX

Quality Revenue add-backs

$1.76

Adjusted Net Income Per Diluted Share, Continuing

Operations, with Health Insurer Fee (HIF) and TX Quality

Revenue Reimbursement Add-Backs

Note(s):

1.

See Appendix for reconciliation of adjusted net income per diluted share, continuing

operations, to GAAP net income per diluted share, continuing operations.

1 |

©

2014 Molina Healthcare, Inc.

62

Delayed recognition of the Health Insurer

Fee (HIF) reimbursement may reduce

third quarter GAAP & Adjusted EPS by

(~$0.14)

Substantial uncertainty around Q3 results

Delays in recognition of Texas quality

revenue may reduce third quarter GAAP

& Adjusted EPS by (~$0.06)

Expected Financial Performance –

Q3 2014 vs. Q4 2014

Delays in revenue recognition may continue

$0.00

$0.00

($0.14)

($0.43)

Q3

Q3 YTD

($0.06)

($0.18)

Q3

Q3 YTD |

©

2014 Molina Healthcare, Inc.

63

Excludes

2014 Guidance –

What’s In and What’s Out

Includes

Full Reimbursement of ACA Health Insurer Fee (HIF)

Full Reimbursement of TX Quality Revenue

Increased dilution from convertible debt due to higher than anticipated share

price

Washington settlements and other agreements on contractual disputes

Higher interest expense due to the issuance of 2044 convertible notes

Sovaldi

Please refer to the Company’s cautionary statements. |

©

2014 Molina Healthcare, Inc.

64

Levers for Improved Profitability

Please refer to the Company’s cautionary statements.

Rate increases that reach the mid-point of actuarial ranges

Rates that adequately compensate health plans for new drugs/ new procedures /

new technologies

More cost effective delivery of medical care and other member services through

care coordination

Administrative cost leverage

Reimbursement of the Health Insurer Fee (HIF)

Ability

of

health

plans

to

share

in

the

savings

they

generate

–

fair

sharing

of

profits

AND losses through caps and floors on medical care costs

|

©

2014 Molina Healthcare, Inc.

65

Please refer to the Company’s cautionary statements.

Convertible Note Exchange and Issuance Update

$301,551,000

September 2014

1.625% Convertible Senior Notes due 2044

Interest payable February 15 and August 15

$302M Convertible Debt ($177M+$125M)

Underlying shares 5.2 million

1.625% coupon

30% conversion premium ($58.09 per share)

No call spread

Net share settlement

Maturity 8/15/2044

Call / put at 8/19/2018

GAAP interest rate 5%

$0.12 diluted EPS (annualized);

$0.05 cash/ $0.07 non-cash diluted EPS |

©

2014 Molina Healthcare, Inc.

66

Capital and Revenue Capacity

Estimated Net Worth Revenue Capacity

12/31/14

Parent Cash

$0.4B

Excess Net

Worth (Plans)

$0.2B

Required Net

Worth (Plans)

$0.6B

Expected

Revenue

$9.7B

Excess

Revenue

Capacity

(Plans) $3.3B

Excess

Revenue

Capacity

(Parent)

$5.0B

Caveats:

Regulators may require

maintenance of net worth in

excess of minimum

requirements

Capital demands on health plans

in the event of losses

Costs of acquisitions and other

expansions

Costs of MMS implementations

in new and existing states

Costs of infrastructure

$1.2B

$18.0B

12/31/14

1.

Based upon minimum required net worth. Regulators may require maintenance of net

worth in excess of minimum requirements. Please refer to the Company’s cautionary

statements. 1 |

©

2014 Molina Healthcare, Inc.

67

Q&A |

©

2014 Molina Healthcare, Inc.

68

Appendix |

©

2014 Molina Healthcare, Inc.

69

Glossary of Long Term Care Terminology

Long Term Care Services & Supports

(LTSS)

Refers to services and supports that assist

individuals with performing activities of daily living and

instrumental activities of daily living. These range from

providing assistance with eating, dressing, and toileting, to

assisting with managing a home and medication

management.

Home and Community-Based Services

(HCBS)

Refers to a range of services that help the individual to live

independently, outside of an institutional setting, including

adult day care and services, respite care, homemaker

services, training in activities of daily living skills,

transportation, provision of equipment, and group living.

Institutional-Based Care

Refers to care in institutional facilities, such as nursing

homes, licensed by the state that offer 24-hour room and

board, supervision, and nursing care. These serve not only

long-stay residents, but also short-stay residents who

receive rehabilitation or post-hospital recuperation.

|

©

2014 Molina Healthcare, Inc.

70

GAAP reconciliation to Adjusted EPS

Please refer to the Company’s cautionary statements.

The following table reconciles net income per diluted share, continuing operations,

to adjusted net income per diluted share, continuing operations, with Health

Insurer Fee (HIF) and Texas Quality Revenue add-backs for six months

ended June 30, 2014. Net income per diluted share, continuing operations

0.26

$

Adjustments, net of tax:

Depreciation, and amortization of capitalized software

0.58

Stock-based compensation

0.19

Amortization of convertible senior notes and

lease financing obligations

0.18

Amortization of intangible assets

0.14

Adjusted net income per diluted share,

continuing operations 1.35

$

Change in fair value of derivatives, net

—

HIF revenue not recognized

0.29

Texas Quality Revenue not recognized

0.12

Adjusted net income per diluted share,

continuing operations with HIF and Texas Quality add-backs

1.76

$

Ended June 30,

2014 |

©

2014 Molina Healthcare, Inc.

71

Status of Reimbursement –

ACA Health Insurer Fee

(HIF) in Molina States

Our guidance assumes the HIF and related tax effects will be fully reimbursed in all

states. Note: Constitutes forward-looking guidance. Amounts are estimates

and subject to change. Actual results may differ materially. See our risk factors as discussed in our Form 10-K and other periodic filings.

Numbers may not add up due to rounding

Please refer to the Company’s cautionary statements.

Comments

ACA Fee

Gross Up

Revenue

Revenue

Recognized

06/30/14

California

Health plan has received letter from state committing to reimbursement of fee

and tax impact upon CMS approval. State is collecting information needed

from health plans to process payment.

$7.3M

$4.4M

$11.6M

No

Florida

Contract amendment specifically calls for reimbursement of fee and tax

impact.

$3.6M

$2.2M

$5.8M

Yes

Illinois

Contract amendment specifically calls for reimbursement of fee and tax

impact.

$0.1M

$0.1M

$0.2M

Yes

Michigan

State legislature has appropriated funds for ACA fee and tax reimbursement.

Awaiting supplemental legislation approving reimbursement.

$10.7M

$6.8M

$17.5M

No

New Mexico

Health plan has received letter from state committing to reimbursement of fee

and tax impact upon CMS approval. Mercer is working on approach now.

Molina has shared information with the state.

$7.1M

$4.3M

$11.3M

No

Ohio

Contract specifically calls for reimbursement of fee and tax impact.

$18.2M

$12.2M

$30.4M

Yes

South Carolina

No revenue in 2013; We have contract amendment for reimbursement of fee

and tax impact

$0.0M

$0.0M

$0.0M

No

Texas

Informal support from state Medicaid agency. Molina has shared information as

requested by the state.

$11.8M

$6.7M

$18.5M

No

Utah

State has proposed rates effective July 1, 2014 that partially reimburses Molina

for financial impact of the ACA fee.

$3.3M

$2.0M

$5.3M

No

Washington

Contract specifically calls for reimbursement of fee and tax impact.

$16.1M

$9.2M

$25.2M

Yes

Wisconsin

Contract specifically calls for reimbursement of fee and tax impact. State has

committed to reimbursement by Sept. 26.

$2.9M

$1.9M

$4.8M

Yes

Medicare

Included in bid pricing

$7.7M

$4.5M

$12.2M

Yes

TOTAL FY 2014

$88.6M

$54.3M

$142.9M |