Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - MEDIFAST INC | v389257_8k.htm |

Exhibit 99.1

Imperial Capital Global Opportunities Conference September 18 , 2014

2 2 Certain information included in this presentation may constitute forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, Section 21 E of the Securities Exchange Act of 1934 , as amended, and the Private Securities Litigation Reform Act of 1995 . These forward - looking statements generally can be identified by use of phrases or terminology such as "intend" or other similar words or the negative of such terminology . Similarly, descriptions of Medifast's objectives, strategies, plans, goals or targets contained herein are also considered forward - looking statements . Medifast believes this presentation should be read in conjunction with all of its filings with the United States Securities and Exchange Commission and cautions its readers that these forward - looking statements are subject to certain events, risks, uncertainties, and other factors . Some of these factors include, among others, Medifast's inability to attract and retain independent Health Coaches and Members, stability in the pricing of print, TV and Direct Mail marketing initiatives affecting the cost to acquire customers, increases in competition, litigation, regulatory changes, and its planned growth into new domestic and international markets and new channels of distribution . Although Medifast believes that the expectations, statements, and assumptions reflected in these forward - looking statements are reasonable, it cautions readers to always consider all of the risk factors and any other cautionary statements carefully in evaluating each forward - looking statement in this presentation, as well as those set forth in its latest Annual Report on Form 10 - K and Quarterly Report on Form 10 - Q, and other filings filed with the United States Securities and Exchange Commission, including its current reports on Form 8 - K . Safe Harbor Statement

Our Company 3

Since 1980… 4 FAST SAFE SIMPLE LONG TERM PORTABLE Over 20,000 Over Customers 1,000,000 Doctors have recommended Medifast products & programs

Medifast Today Enriching lives through innovative choices for lasting health 5 • Weight Management and Healthy Living products company • Founded in 1980 • $357M Revenue in 2013 • Industry - leading margins • Strong Balance Sheet • 10,000+ health coach channel • Direct - to - consumer E - commerce platform • Company - owned and franchise Weight Loss Centers • Physician channel & heritage • Recent expansion into Canada • Latin America partnership with Medix

Recent Accomplishments 6 • Canada Launch • 12 U.S. centers sold to Medix • 12 U.S. centers sold to TransformU • Medix buys Slim Centers • Stop.Challenge.Choose. • E - commerce Promotions • New Products • Jimmy V Foundation • Share Repurchase

In 2014 7 1 2 3 DELIVER ON PROFIT GOALS EXECUTE STRATEGIC PLAN HEALTHY LIVING Full - year 2014 earnings at our guidance represents 3 consecutive years of profit growth Health Coach expansion, Weight Control Center conversion, Technology integration and other efforts under way New product launches will address consumer demand and growth opportunities 7

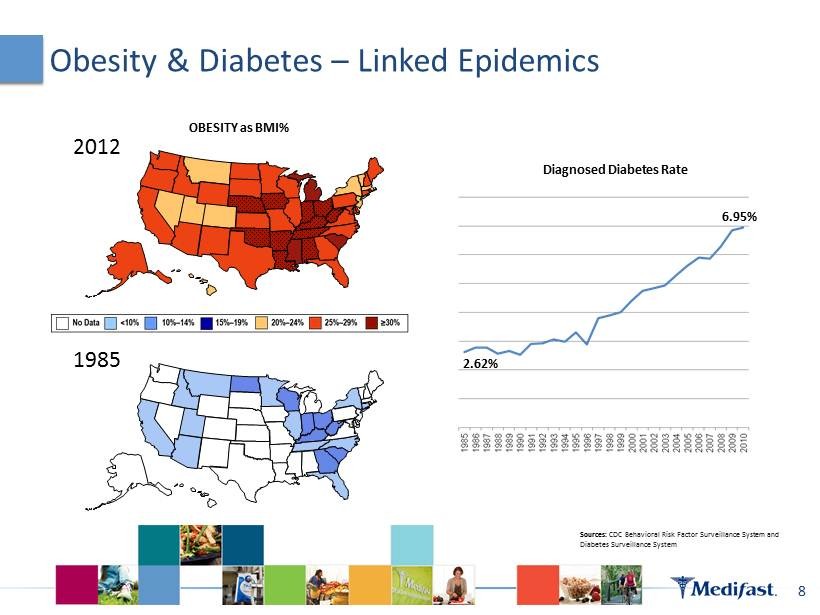

Obesity & Diabetes – Linked Epidemics 8 2.62% 6.95% 2012 OBESITY as BMI% Diagnosed Diabetes Rate 1985 Sources: CDC Behavioral Risk Factor Surveillance System and Diabetes Surveillance System

Diet Industry Market Size 9 Total Market Served Market 2% Medifast share of served market $65 Bn $18 Bn $47 Bn Served Market ‣ Diet Foods/Meals ‣ Weight Loss Centers ‣ Low Calories Programs ‣ Medical Plans & Surgery ‣ Books & Videos Unserved Market: ‣ Diet Soft Drinks ‣ Artificial Sweeteners ‣ Health Club Revenues Sources: U.S. Census Data, CDC Data, IBIS World, MarketData

Over 90 Choices! 10

Proven Business Model to Deliver Shareholder Value 11 1 1

Key Strategies 12 ‣ DELIVER profitability and enhance shareholder value long term ‣ INNOVATE in products, programs & technology ‣ BUILD the network and reach of TSFL health coaches ‣ LEVERAGE our medical provider heritage & relationships ‣ GROW our online business thru best - in - class platform ‣ EXPAND business development: I nternational & Corporate Wellness ‣ LAUNCH extensions into Healthy Living ‣ EXPLORE Value Enhancing Opportunities 12

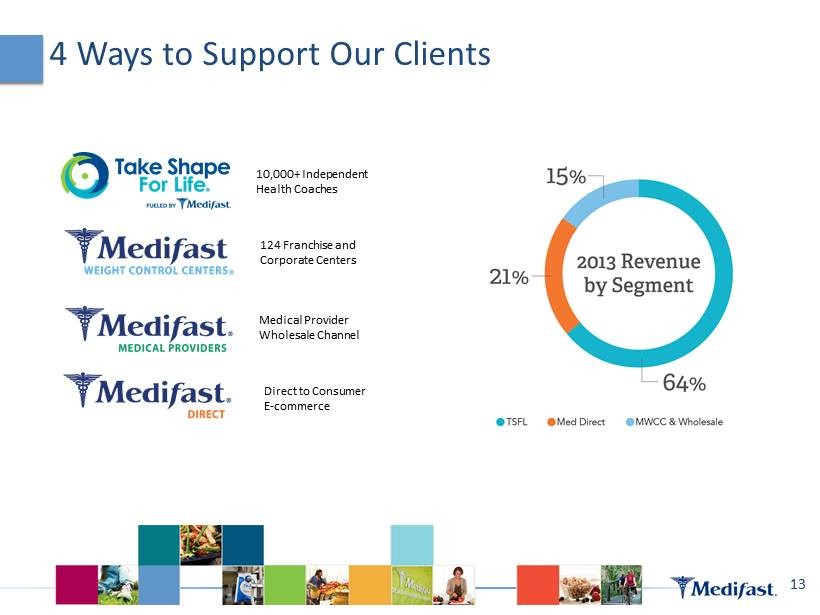

4 Ways to Support Our Clients 13 1 3 10,000+ Independent Health Coaches 124 Franchise and Corporate Centers Medical Provider Wholesale Channel Direct to Consumer E - commerce

TSFL: A Unique Model Our coaches are our success stories • Most coaches joined to achieve a healthy weight …and stayed for the business opportunity • Emphasize long term “Optimal Health” • Certification exams* Our processes are clear and transparent • 94% of orders go directly to clients, and 6% for coaches’ own use • Coaches do not hold inventory • All commissions are based on product sales 14 *Center for Obesity Prevention and Education(COPE) at Villanova University Dr. Wayne Andersen NY Times Bestselling Author

TSFL Strategy 15 1 5 1 2 3 EXPAND COACH NETWORK IMPROVED COMMISSION PLAN NEW PRODUCTS 10,000+ Health Coaches • New BeSlim Program • New Video Messaging • Stop.Challenge.Choose • 5 Super - regionals in 1Q14 • National Convention July 2014 in Anaheim – 3,000 attendees Integrated Plan Focuses on Growth • Rewards development of coach and coaches’ business • Reduces expense allowing for future investment in growth Extend Optimal Health Opportunity • New Lean & Green ™ and Healthy Living products launching in 2014 • Long term innovation strategy to attract more coaches and clients

Complete e - Commerce Business & Experience 16 ‣ Full Product Line & Programs ‣ Quick Start Guides & Video How - to’s ‣ Dashboard for Tracking the Weight Loss Journey ‣ The Science Behind Medifast ‣ Programs for Diabetes, Seniors, Teens, Gluten - free, more ‣ Success Stories & “Happy Afters” ‣ MyMedifast Community & Blog ‣ Links to Medifast Social Sites & Support Channels ‣ And options for getting 1 - on - 1 support ‣ Medifast provides information, tools & support for successful self - guided weight management

Medifast Direct Strategy 17 1 2 3 ENHANCE WEB PLATFORM ADDRESS DIY TREND OPTIMIZE AD & PROMO SPEND Best in class capabilities to drive orders • Streamlined ordering experience to increase conversion • Flexibility to rapidly change and target promotions Innovate for rewarding online experience • Launch new mobile app, new online community • Integrate with Activity Trackers consumers are already using Execute the best mix of media & promotion • Use Analytics to deploy funds to the right media and the right discounts and promotions • New Medifast Advantage program targets improved conversion and loyalty • New Advertising Agency in Q3 17

Local, Personal, Accountable • 51 Corporate Centers • 73 Franchise Centers • Supervised Programs • Dietitian Support • Body Composition Technology • Onsite Product Purchasing • Weekly Weigh - ins • Constant Contact “Care Calls” 18

MWCC Strategy 19 1 2 3 CONVERT TO FRANCHISES GROW FOOTPRINT PROGRESS TO DATE Highly Accretive Shift to Wholesale • Food revenues will decline to wholesale price • Operating Profit will improve with SG&A reductions Responsibly Expand Franchise Footprint • Entrepreneurial management will invest to grow profitably • Expansion by current and new franchisees Successfully Transitioning Centers • 24 Corporate centers converting to Franchise centers on June 30, 2014 • 8 New franchise centers opened in 1Q14 • 5 New franchise centers opened in 4Q13 19

Leveraging Our Medical Heritage • Obese patients spend 50% more on healthcare costs — over $7,100 more per year • Obesity screening and nutritional counseling now an “essential benefit” under Affordable Care Act • Providers seeking new revenue streams to offset increasing financial pressures • Sales of consumer products through providers up 20% in 2013 and 23% YTD 2014. 20 Market of 350K+ Primary care physicians, Chiropractors, Independent Nutritionists in U.S. Sources: Bureau of Labor Statistics; Issue Brief, Center for Healthcare Research & Transformation, January 2014

Medical Providers Strategy 21 1 2 3 EXPAND COVERAGE & TERRITORY CURRENT CLIENT REVENUE GROWTH BUSINESS MODEL ENHANCEMENTS Expand US & Establish business in Canada • Drive account acquisition with multi - touch campaigns and trade events • Streamline on - boarding process and enhance client support Drive shared growth with providers • New strategic account management practices to expand relationships • New sales & marketing tools support program expansion and growth New E - commerce technology platform • Enables direct - to - consumer ordering for each practice , reducing need for inventory • Co - branded, with ability to reach new patients and extend lifecycle 21

CORPORATE WELLNESS Weight management a key element in growing industry Obesity epidemic is costing employers in premiums and lost productivity Affordable Care Act promotes proactive steps and insurance coverage for weight management Medifast exploring partnership models to enter market this year Strategic Growth Initiatives 22 CANADIAN EXPANSION Medifast launched in Canada 1Q14 Initial launch of Medifast Direct & Medical Provider Wholesale channels MEXICO & LATIN AMERICA Medix investment to expand partnership Acquisition of 13 Slim Centers in prime locations across Mexico City Progressing multiple new revenue opportunities to drive business expansion Executing in Colombia and planning expansion in further LatAm countries

Medix - Medifast Partnership • Launched June 2012 • Medifast enables Medix to offer robust preventative products & programs in addition to existing nutraceutical & pharmaceutical options • Multi - channel market strategy: – Leveraging 6,000+ physician network – Medifast - branded clinics: 3 in Mexico, 1 in Colombia – 13 Slim Center acquisition to scale clinic business – Corporate Wellness, VIP Program, Nutritionists 23

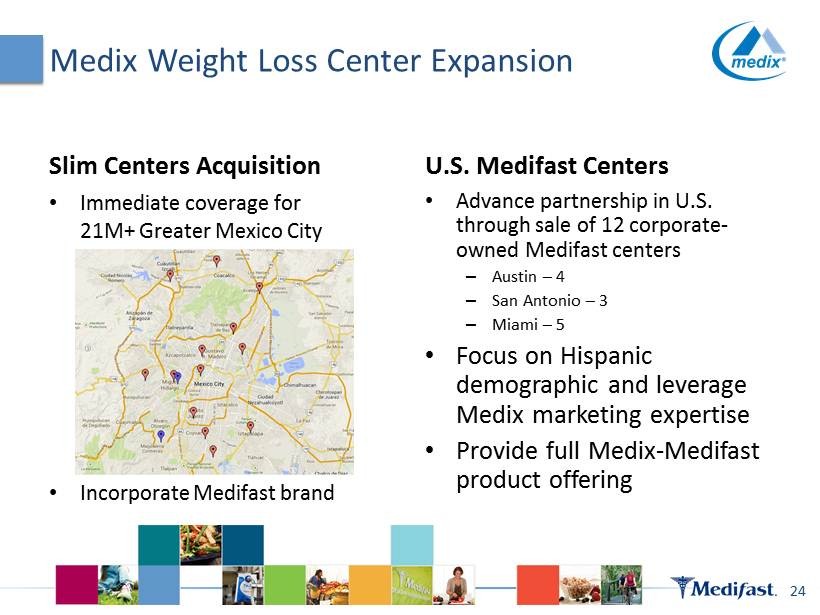

Medix Weight Loss Center Expansion Slim Centers Acquisition • Immediate coverage for 21M+ Greater Mexico City • Incorporate Medifast brand U.S. Medifast Centers • Advance partnership in U.S. through sale of 12 corporate - owned Medifast centers – Austin – 4 – San Antonio – 3 – Miami – 5 • Focus on Hispanic demographic and leverage Medix marketing expertise • Provide full Medix - Medifast product offering 24

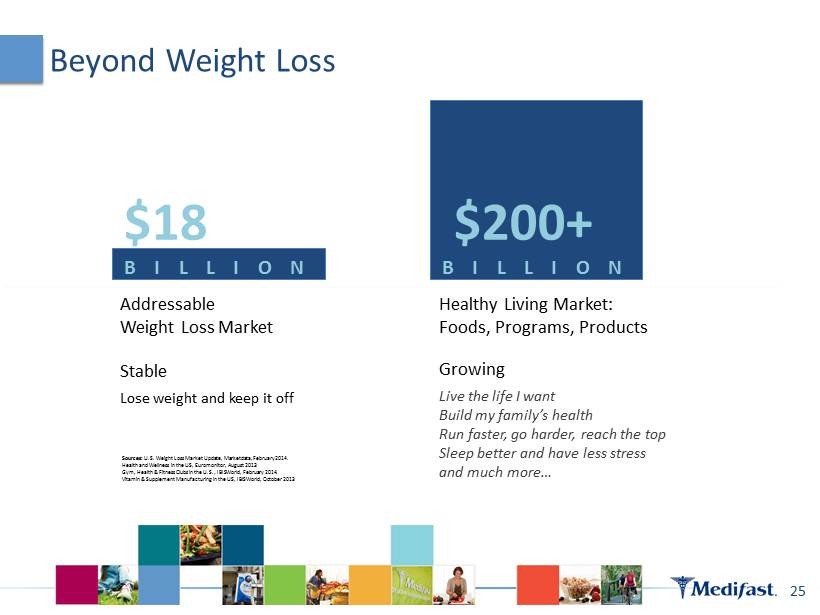

Beyond Weight Loss 25 2 5 Addressable Weight Loss Market Healthy Living Market: Foods, Programs, Products Sources: U.S. Weight Loss Market Update, Marketdata, February 2014. Health and Wellness in the US, Euromonitor, August 2013 Gym, Health & Fitness Clubs in the U.S., IBISWorld, February 2014. Vitamin & Supplement Manufacturing in the US, IBISWorld, October 2013 Lose weight and keep it off Live the life I want Build my family’s health Run faster, go harder, reach the top Sleep better and have less stress and much more… Stable Growing $18 B I L L I O N $200+ B I L L I O N

2014 Product Launches 26 Meal Replacements • Garlic Mashed Potatoes (1Q) • Sour Cream & Chive Mashed Potatoes (1Q) • Gingerbread Soft Bake (4Q) Lean & Green ™ Meals • Turkey Meatball Marinara* (1Q) • Chicken Cacciatore* (1Q) • Chicken with Rice & Vegetables* (1Q) • Beef Stew* (2Q) • Cheddar & Sour Cream Popcorn (3Q) • Sea Salt Popcorn (3Q) • Spicy Black Bean Veggie Chips (3Q) • Sea Salt & Olive Oil Veggie Chips (3Q) Snacks • Peanut Butter Chocolate Shake (4Q) • Strawberry Banana Smoothie (4Q) • Pina Colada Smoothie (4Q) • Salted Caramel Nut Bar (4Q) • Dark Chocolate Dream Bar (4Q) • Strawberry Yogurt Bar (4Q) • Cookies & Cream Shake (4Q) Maintenance Sleep & Stress • Habits of Health Sleep Set (3Q) • Melatonin (3Q) • Chill Time Gum (3Q) • Restful Mind Herbal Sleep Tea (3Q) • Far Infrared Blanket (3Q) Fitness & Tracking • Activity Trackers & Integration (3Q) • Bathroom Scale & Integration (3Q) • Lemon Energy Infuser (4Q) • Mandarin Orange Infuser (4Q) • Lemonade Energy Drops (4Q) • Wild Strawberry Energy Drops (4Q) • Pineapple Mango Energy Drops (4Q) Energy Each Flavors of HomeTM meal counts as one Lean & Green Meal on the Medifast Program. Not a lean food as per 9 CFR 317.362 for fat content.

Technology that Drives Change • Engage and motivate the client • Support Healthy Living beyond Weight Loss • Interface with the Apps and Trackers consumers are using • New desktop and mobile platform launching in 2014 27

Our Newest Campaign 28

Growing Brand Awareness 29 Source: Medifast Brand Awareness based from proprietary research based on statistically representative samples of over 1,000 consumers

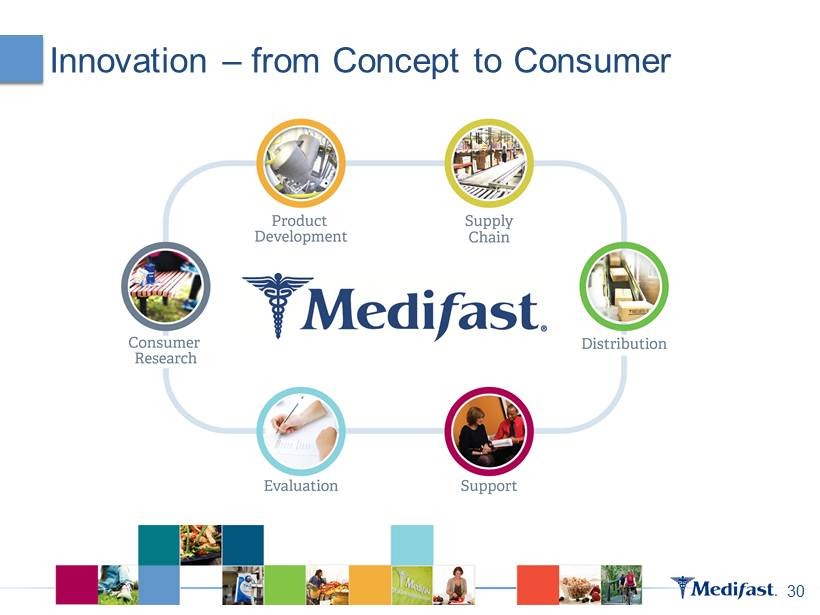

Innovation – from Concept to Consumer 30 30

Leading Manufacturing & Distribution Infrastructure 31 • Company - owned state - of - the - art facilities • Supports industry - leading gross margins • Capacity to drive aggressive growth • Partnerships with leading suppliers

Financial Overview

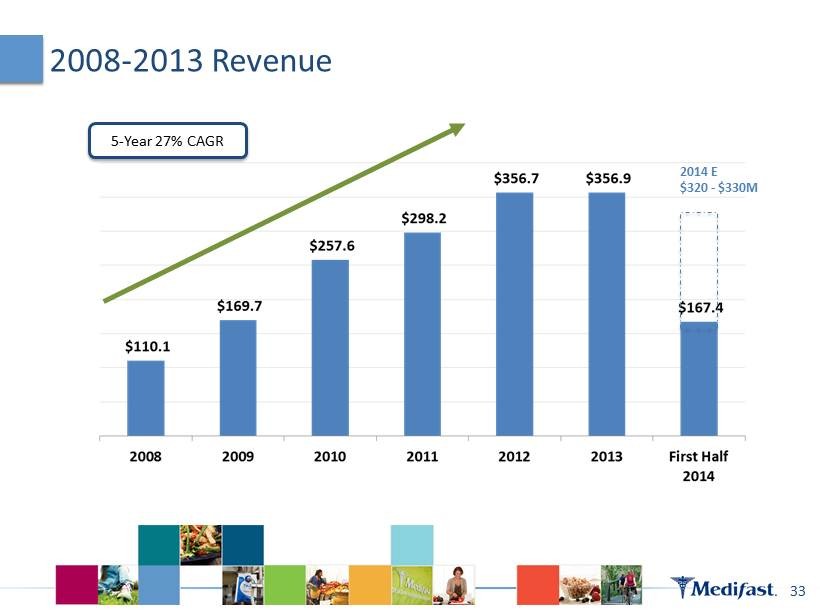

2008 - 2013 Revenue 33 5 - Year 27% CAGR 2014 E $320 - $330M

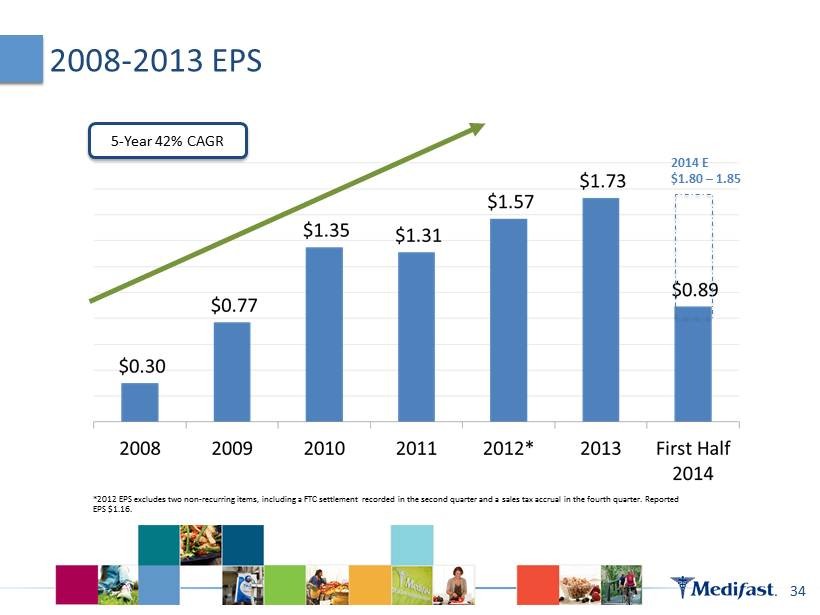

2008 - 2013 EPS 34 *2012 EPS excludes two non - recurring items, including a FTC settlement recorded in the second quarter and a sales tax accrual in the fourth quarter. Reported EPS $1.16. 5 - Year 42% CAGR 2014 E $1.80 – 1.85

Strong Cash & Balance Sheet 35 • $69M Cash & Investments • No Long Term Debt • Low Working Capital Levels • Minimal CapEx Requirements • Strong Free Cash Flows Note: As of June 30, 2014 • Purchased 451,000 thousand shares through our share repurchase plan through 6/30. • Management team and Board of Directors remain focused on increasing shareholder value long - term

Why Medifast? TRUSTED HEALTH BRAND 4 CHANNELS TO REACH CONSUMERS PRODUCT & PROGRAM EXPERTISE “The people who know how to lose weight and keep it off, know how to keep you healthy in the first place” Each channel has strengths for reaching current and new clients with products that address needs for the whole journey of health Our food and program science supports expansion to adjacent markets Organically or via Acquisition 36

Q & A