Attached files

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON SEPTEMBER 18, 2014.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Lepota, Inc.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation)

5999

(Primary Standard Industrial Classification Code Number)

(IRS Employer Identification No. 47-1549749)

5348 Vegas Dr.

Las Vegas, NV 89108

+7918 553 90 95

(Address and telephone number of registrant's principal executive offices)

|

Frederick C. Bauman, Esq.

Bauman & Associates Law Firm

6440 Sky Pointe Dr., Ste 140-149

Las Vegas, NV 89131

(702) 533-8372

|

(Name, address and telephone number of agent for service)

Approximate date of commencement of proposed sale to the public: As soon as

practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. o

1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company.

|

Large accelerated filer o

|

Accelerated Filer o

|

|

Non-accelerated filer o

|

Smaller reporting company x

|

CALCULATION OF REGISTRATION FEE

|

Proposed

|

Proposed

|

|||

|

Title of

|

maximum

|

maximum

|

||

|

Securities

|

Amount

|

offering

|

aggregate

|

Amount

|

|

to be

|

to be

|

price

|

offering

|

|

|

registered

|

registered

|

per share(2)

|

price

|

fee(1)

|

|

Common Stock

|

10,050,000

|

$.01

|

$100,500

|

$12.94

|

|

(1)

|

This is an initial offering and no current trading market exists for our common stock.

|

|

(2)

|

Estimated solely for purposes of calculating the registration fee pursuant to Rule 457.

|

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such section 8(a), may determine.

2

Lepota, Inc.

10,050,000 SHARES OF COMMON STOCK

$.01 PER SHARE

NO MINIMUM

This is the initial offering of Common stock of Lepota, Inc. and no public market exists for the securities being offered. Lepota, Inc. is offering for sale a total of 10,000,000 shares of its Common Stock on a "self-underwritten", best effort basis. A selling shareholder is offering an additional 50,000 shares at the same price. The shares will be offered at a fixed price of $.01 per share for a period not to exceed 180 days from the date of this prospectus, unless extended by our Board of Directors for an additional 90 days.

There is no minimum number of shares required to be purchased. This offering is on a best effort, meaning, no minimum number of shares must be sold. See "Use of Proceeds" and "Plan of Distribution".

Lepota, Inc. is a development stage, start-up company. Any investment in the shares offered herein involves a high degree of risk. You should only purchase shares if you can afford a complete loss of your investment.

BEFORE INVESTING, YOU SHOULD CAREFULLY READ THIS PROSPECTUS AND, PARTICULARLY, RISK FACTORS SECTION, BEGINNING ON PAGE 7.

Lepota, Inc. qualifies as an “emerging growth company” as defined in the Jumpstart our Business Startups Act (the “JOBS Act”).

Neither the U.S. Securities and Exchange Commission nor any state securities division has approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

Offering

|

Total

|

||||||||

|

Price

|

Amount of

|

Underwriting

|

|||||||

|

Proceeds

|

|||||||||

|

Per Share

|

Offering

|

Commissions

|

To Us

|

||||||

|

Common Stock

|

$.01

|

$100,000

|

$0

|

$100,000

|

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

Subject to Completion, Dated __________, 2014

3

TABLE OF CONTENTS

|

Page No.

|

|

| 5 | |

| 5 | |

| 5 | |

| 7 | |

| 7 | |

| 10 | |

| 15 | |

| 15 | |

| 15 | |

| 17 | |

| 17 | |

| 18 | |

| 18 | |

| 18 | |

| 18 | |

| 19 | |

| 20 | |

| 20 | |

| 26 | |

| 26 | |

| 26 | |

| 28 | |

| 28 | |

| 30 | |

| 30 | |

| 34 | |

| 35 | |

| 36 | |

| 36 | |

| 37 |

4

Lepota, Inc.

5348 Vegas Dr., Las Vegas, NV 89108

You should read the following summary together with the more detailed business information, financial statements and related notes that appear elsewhere in this prospectus. In this prospectus, unless the context otherwise denotes, references to "we," "us," "our" and "Lepota" are to Lepota, Inc.

Lepota, Inc. was incorporated in the State of Nevada on December 9, 2013. Our primary business will be the import of cosmetics into the Russian Federation and distribution of the products through shops and drugstores.We have concluded an agreement with InterBeauty, LLC for distribution of the products.

We are a development stage company and have not yet generated any revenues. Our limited start-up operations have consisted of the formation of our business plan, identification of our target market and negotiation of supply and distribution contracts. We have procured our domain name, www.lepotainc.com, and the website is currently in development. Per our business plan we anticipate sales to begin in August 2015. Currently our President devotes approximately 20 hours a week to the company. We will require the funds from this offering in order to fully implement our business plan as discussed in the "Plan of Operation" section of this prospectus. We have been issued a "substantial doubt" going concern opinion from our auditors and our assets at July 31, 2014 consisted of $3,495.

Our administrative office of the company is currently located at the premises of our President, Iurii Iurtaev, which he provides to us on a rent free basis at 11 Leliushenko Street, Apt 65, Rostov-on-Don 344045 We plan to use these offices until we require larger space. Our fiscal year end is July 31.

Following is a brief summary of this offering. Please see the Plan of Distribution section for a more detailed description of the terms of the offering.

|

Securities Being Offered:

|

10,000,000 shares of common stock, par value $.001. A selling shareholder is selling an additional 50,000 shares in this offering.

|

|

Offering Price per Share:

|

$.01

|

|

Offering Period:

|

The shares are being offered for a period not to exceed 180 days, unless extended by our Board of Directors for an additional 90 days. There is no minimum offering of the shares before the expiration date of the offering.

|

|

Net Proceeds to Our Company:

|

$100,000

|

|

Use of Proceeds:

|

We intend to use the proceeds to start up and expand our business operations.

|

|

Number of Shares Outstanding

Before the Offering:

|

5,000,000

|

|

Number of Shares Outstanding

After the Offering:

|

15,000,000 if all shares are sold

|

5

Our officer, director, control person and/or affiliates do not intend to purchase any shares in this offering.

Selected Financial Data

The Following financial information summarises the more complete historical financial information at the end of this prospectus. The total Expenses are composed of incorporation and banking Costs.

|

As of July 31, 2014

|

||||

|

Balance Sheet

|

||||

|

Total Assets

|

$ | 3,495 | ||

|

Total Liabilities

|

$ | 3,845 | ||

|

Stockholders Deficit

|

$ | 349 | ||

|

Period from December 9, 2013

|

||||

|

(date of inception) to

|

||||

|

_______________, 2014

|

||||

|

Income Statement

|

||||

|

Revenue

|

$ | -0- | ||

|

Total Expenses

|

$ | 5,349 | ||

|

Net Loss

|

$ | (5,349 | ) | |

6

An investment in these securities involves an exceptionally high degree of risk and is extremely speculative in nature. Following are what we believe are all of the material risks involved if you decide to purchase shares in this offering.

OUR MARKET IS WITHIN THE RUSSIAN FEDERATION.

International sanctions on Russia could be imposed that could also affect our business. As our supplier is likely to be located in Poland we will work across the border, we may have issues with customs, brokers or transportation companies. This may delay the process of certification of products and their delivery time. Delays and the delivery condition of our products may cause the goods to expire and this could bring losses to our business. Fluctuations in Russian import taxes can arise and this will affect our profit margin. In addition, there is the risk posed by fluctuations in exchange rates.

OUR PRODUCTS MAY BE TOO EXPENSIVE FOR THE RUSSIAN CONSUMER

Our products may be too expensive for the Russian consumer. Most of the brands of Russian cosmetics companies are in the middle or lower price categories. A characteristic feature of the Russian cosmetics market is that monetary consumption of cosmetic products per capita in Russia is lower than Europe.

IURII IURTAEV, THE SOLE OFFICER AND DIRECTOR OF THE COMPANY, CURRENTLY DEVOTES APPROXIMATELY 20 HOURS PER WEEK TO COMPANY MATTERS. HE DOES NOT HAVE ANY PUBLIC COMPANY EXPERIENCE AND IS INVOLVED IN OTHER BUSINESS ACTIVITIES. THE COMPANY'S NEEDS COULD EXCEED THE AMOUNT OF TIME OR LEVEL OF EXPERIENCE HE MAY HAVE. THIS COULD RESULT IN HIS INABILITY TO PROPERLY MANAGE COMPANY AFFAIRS, RESULTING IN OUR REMAINING A START-UP COMPANY WITH NO REVENUES OR PROFITS.

Our business plan does not provide for the hiring of any additional employees until sales will support the expense, which is estimated to begin during second part of the year of 2015. Until that time the responsibility of developing the company's business, the offering and selling of the shares through this prospectus and fulfilling the reporting requirements of a public company all fall upon Mr. Iurtaev. While his business experience includes Director in sales, brand director in product promotion of “Kalina” and “Kalina Décor” concern, trade representative of “YuDiCom” Ltd, “Kalina” division, which were all within the cosmetics industry,he does not have experience in a public company setting, including serving as a principal accounting officer or principal financial officer. We have not formulated a plan to resolve any possible conflict of interest with his other business activities. In the event he is unable to fulfill any aspect of his duties to the company we may experience a shortfall or complete lack of sales resulting in little or no profits and eventual closure of the business.

7

SINCE WE ARE A DEVELOPMENT STAGE COMPANY, HAVE GENERATED NO REVENUES AND LACK AN OPERATING HISTORY, AN INVESTMENT IN THE SHARES OFFERED HEREIN IS HIGHLY RISKY AND COULD RESULT IN A COMPLETE LOSS OF YOUR INVESTMENT IF WE ARE UNSUCCESSFUL IN OUR BUSINESS PLANS.

Our company was incorporated on December 9, 2013 ; we have not yet commenced our business operations; and we have not yet realized any revenues. We have no operating history upon which an evaluation of our future prospects can be made. Based upon current plans, we expect to incur operating losses in future periods as we incur significant expenses associated with the initial startup of our business. Further, we cannot guarantee that we will be successful in realizing revenues or in achieving or sustaining positive cash flow at any time in the future. Any such failure could result in the possible closure of our business or force us to seek additional capital through loans or additional sales of our equity securities to continue business operations, which would dilute the value of any shares you purchase in this offering.

WE DO NOT YET HAVE ANY SUBSTANTIAL ASSETS AND ARE TOTALLY DEPENDENT UPON THE PROCEEDS OF THIS OFFERING TO FULLY FUND OUR BUSINESS. IF WE DO NOT SELL AT LEAST QUARTER OF THE SHARES IN THIS OFFERING AND RECEIVE AT LEAST QUARTER OF THE MAXIMUM PROCEEDS, WE WILL HAVE TO SEEK ALTERNATIVE FINANCING TO COMPLETE OUR BUSINESS PLANS OR ABANDON THEM.

The only cash currently available is the cash paid by our founder for the acquisition of his shares. In the event we do not sell all of the shares and raise the total offering proceeds, there can be no assurance that we would be able to raise the additional funding needed to implement our business plans or that unanticipated costs will not increase our projected expenses for the year following completion of this offering. Our auditors have expressed substantial doubt as to our ability to continue as a going concern.

WE CANNOT PREDICT WHEN OR IF WE WILL PRODUCE REVENUES, WHICH COULD RESULT IN A TOTAL LOSS OF YOUR INVESTMENT IF WE ARE UNSUCCESSFUL IN OUR BUSINESS PLANS.

We have not yet generated any revenues from operations. In order for us to continue with our plans and open our business, we must raise our initial capital to do so through this offering. The timing of the completion of the milestones needed to commence operations and generate revenues is contingent on the success of this offering. There can be no assurance that we will generate revenues or that revenues will be sufficient to maintain our business. As a result, you could lose all of your investment if you decide to purchase shares in this offering and we are not successful in our proposed business plans.

OUR CONTINUED OPERATIONS DEPEND ON THE PUBLIC'S ACCEPTANCE OF OUR COSMETICS IN RUSSIA. IF THE PUBLIC DOESN'T FIND OUR PRODUCTS DESIRABLE AND SUITABLE FOR PURCHASE AND WE CANNOT ESTABLISH A CUSTOMER BASE, WE MAY NOT BE ABLE TO GENERATE ANY REVENUES, WHICH WOULD RESULT IN A FAILURE OF OUR BUSINESS AND A LOSS OF ANY INVESTMENT YOU MAKE IN OUR SHARES.

The ability to market cosmetic products that the public finds desirable and willing to purchase is critically important to our success. We cannot be certain that the products that we will be offering will be appealing to the Russian public and as a result there may not be any demand for these products and our sales could be limited and we may never realize any revenues. In addition, there are no assurances that if we alter or change our products in the future that the public's demand for these new product offerings will develop and this could adversely affect our business and any possible revenues.

8

THE LOSS OF THE SERVICES OF IURII IURTAEV COULD SEVERELY IMPACT OUR BUSINESS OPERATIONS AND FUTURE DEVELOPMENT OF OUR PRODUCTS, WHICH COULD RESULT IN A LOSS OF REVENUES AND YOUR ABILITY TO EVER SELL ANY SHARES YOU PURCHASE IN THIS OFFERING.

Our performance is substantially dependent upon the professional expertise of our President,Iurii Iurtaev. Mr. Iurtaev has extensive expertise in conducting negotiations with producing company, determining the product positioning at a distribution market and its price model, and we are dependent on his abilities to sucecefuly conclude agreements. If he is unable to perform his duties, this could have an adverse effect on our business operations, financial condition and operating results if we are unable to replace him with another individual qualified to develop and market our products. The loss of his services could result in a loss of revenues, which could result in a reduction of the value of any shares you purchase in this offering.

THE RUSSIAN COSMETIC INDUSTRY IS HIGHLY COMPETITIVE. IF WE CAN NOT IMPORT AND DISTRIBUTE A DESIRABLE OFFERING OF PRODUCTS THAT THE RUSSIAN PUBLIC IS WILLING PURCHASE, WE WILL NOT BE ABLE TO COMPETE SUCCESSFULLY, OUR BUSINESS MAY BE ADVERSELY AFFECTED AND WE MAY NEVER BE ABLE TO GENERATE ANY REVENUES.

The Russian cosmetic industry is intensely competitive. We will compete against a number of large well-established companies with greater name recognition, a more comprehensive offering of products, and with substantially larger resources than ours; including financial and marketing. Many well-known leaders of the world of perfumes and cosmetics are already active in the Russian market, such as Procter & Gamble, Henkel, Avon, Unilever and Oriflame. In addition to these large competitors there are numerous smaller operations that have developed and are marketing custom products. There can be no assurance that we can compete successfully in this complex and changing market. If we cannot successfully compete in this highly competitive industry, we may never be able to generate revenues or become profitable. As a result, you may never be able to liquidate or sell any shares you purchase in this offering.

WE CURRENTLY HAVE ONLY ONE CUSTOMER.

At this time we have only one customer to sell our products to. Our cosmetics are new for Russian consumers and no demand may develop for our products. We have not identified any more customers for our cosmetics and we cannot guarantee that we will add more customers.

THERE ARE NO SUBSTANTIAL BARRIERS TO ENTRY INTO THE COSMETICS INDUSTRY AND BECAUSE WE DO NOT CURRENTLY HAVE ANY COPYRIGHT OR TRADEMARK PROTECTION FOR OUR PROPOSED PRODUCTS, THERE IS NO GUARANTEE SOMEONE ELSE WILL NOT DUPLICATE OUR IDEAS AND BRING THEM TO MARKET BEFORE WE DO, WHICH COULD SEVERELY LIMIT OUR PROPOSED SALES AND REVENUES.

9

We believe our ideas for our cosmetics are desirable; however, we currently have no copyright or trademark for our products or brand name. As business operations become established, we may seek such protection; however, we currently have no plans to do so. Since we have no copyright protection unauthorized persons may attempt to copy aspects of our business, including our web site design or functionality, products or marketing materials. Any encroachment upon our corporate information, including the unauthorized use of our brand name, the use of a similar name by a competing company or a lawsuit initiated against us for infringement upon another company's proprietary information or improper use of their copyright, may affect our ability to create brand name recognition, cause customer confusion and/or have a detrimental effect on our business. Litigation or proceedings may be necessary in the future to enforce our intellectual property rights, to protect our trade secrets and domain name and/or to determine the validity and scope of the proprietary rights of others. Any such infringement, litigation or adverse proceeding could result in substantial costs and diversion of resources and could seriously harm our business operations and/or results of operations.

THE SARBANES-OXLEY ACT IMPOSES SUBSTANTIAL BURDENS UPON THE COMPANY WITHOUT PROVIDING CORRESPONDING BENEFITS TO THE COMPANY.

The Sarbanes-Oxley Act of 2002 (the "Sarbanes-Oxley Act") was enacted in response to public concern regarding corporate accountability in the wake of a number of accounting scandals. The stated goals of the Sarbanes-Oxley Act are to increase corporate responsibility, provide enhanced penalties for accounting and auditing improprieties at publicly traded companies and protect investors by improving the accuracy and reliability of corporate disclosure pursuant to applicable securities laws. The Sarbanes-Oxley Act applies to all companies that file or are required to file periodic reports with the SEC under the Securities Exchange Act of 1934 (the "Exchange Act").

Upon becoming a public company, we will be required to comply with the

Sarbanes-Oxley Act. Since the enactment of the Sarbanes-Oxley Act has resulted in the imposition of a series of rules and regulations by the SEC that increase the responsibilities and liabilities of directors and executive officers, the perceived increased personal risk associated with these changes may deter qualified individuals from accepting such roles. Consequently, it may be more difficult for us to attract and retain qualified persons to serve as our directors or executive officers, and we may need to incur additional operating costs. This could prevent us from becoming profitable.

THE TRADING IN OUR SHARES WILL BE REGULATED BY SECURITIES AND EXCHANGE COMMISSION RULE 15G-9 WHICH ESTABLISHED THE DEFINITION OF A "PENNY STOCK." THE EFFECTIVE RESULT BEING FEWER PURCHASERS QUALIFIED BY THEIR BROKERS TO PURCHASE OUR SHARES, AND THEREFORE A LESS LIQUID MARKET FOR OUR INVESTORS TO SELL THEIR SHARES.

10

The shares being offered are defined as a penny stock under the Securities and Exchange Act of 1934, and rules of the Commission. The Exchange Act and such penny stock rules generally impose additional sales practice and disclosure requirements on broker-dealers who sell our securities to persons other than certain accredited investors who are, generally, institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000, or $300,000 jointly with spouse), or in transactions not recommended by the broker-dealer. For transactions covered by the penny stock rules, a broker-dealer must make a suitability determination for each purchaser and receive the purchaser's written agreement prior to the sale. In addition, the broker-dealer must make certain mandated disclosures in penny stock transactions, including the actual sale or purchase price and actual bid and offer quotations, the compensation to be received by the broker-dealer and certain associated persons, and deliver certain disclosures required by the Commission. Consequently, the penny stock rules may make it difficult for you to resell any shares you may purchase, if at all.

WE ARE SELLING THIS OFFERING WITHOUT AN UNDERWRITER AND MAY BE UNABLE TO SELL ANY SHARES. UNLESS WE ARE SUCCESSFUL IN SELLING AT LEAST 25% OF THE SHARES AND RECEIVING $25,000 IN THE PROCEEDS FROM THIS OFFERING, WE MAY HAVE TO SEEK ALTERNATIVE FINANCING TO IMPLEMENT OUR BUSINESS PLANS.

This offering is self-underwritten, that is, we are not going to engage the services of an underwriter to sell the shares; we intend to sell them through our officer and director, who will receive no commissions. He will offer the shares to friends, relatives, acquaintances and business associates, however, there is no guarantee that he will be able to sell any of the shares.

DUE TO THE LACK OF A TRADING MARKET FOR OUR SECURITIES, YOU MAY HAVE DIFFICULTY SELLING ANY SHARES YOU PURCHASE IN THIS OFFERING.

There is presently no demand for our common stock and no public market exists for the shares being offered in this prospectus. We plan to contact a market maker immediately following the effectiveness of this Registration Statement and apply to have the shares quoted on the OTC Electronic Bulletin Board (OTCBB). The OTCBB is a regulated quotation service that displays real-time quotes, last sale prices and volume information in over-the-counter (OTC) securities. The OTCBB is not an issuer listing service, market or exchange. Although the OTCBB does not have any listing requirements per se, to be eligible for quotation on the OTCBB, issuers must remain current in their filings with the SEC or applicable regulatory authority. Market Makers are not permitted to begin quotation of a security whose issuer does not meet this filing requirement. As of the date of this filing, there have been no discussions or understandings between Lepota or anyone acting on our behalf with any marketmaker regarding participation in a future trading market for our securities. If no market is ever developed for our common stock, it will be difficult for you to sell any shares you purchase in this offering. In such a case, you may find that you are unable to achieve any benefit from your investment or liquidate your shares without considerable delay, if at all. In addition, if we fail to have our common stock quoted on a public trading market, your common stock will not have a quantifiable value and it may be difficult, if not impossible, to ever resell your shares, resulting in an inability to realize any value from your investment.

YOU WILL INCUR IMMEDIATE AND SUBSTANTIAL DILUTION OF THE PRICE YOU PAY FOR YOUR SHARES.

11

Our existing stockholder acquired his shares at a cost of $0.001 per share, a cost per share substantially less than that which you will pay for the shares you purchase in this offering. Accordingly, any investment you make in these shares will result in the immediate and substantial dilution of the net tangible book value of those shares from the $0.01 you pay for them. Upon completion of the offering, the net tangible book value of your shares will be $0.0066per share, $0.0034_____ less than what you paid for them.

WE WILL BE HOLDING ALL PROCEEDS FROM THE OFFERING IN A STANDARD BANK CHECKING ACCOUNT AND THERE IS NO GUARANTEE ALL OF THE FUNDS WILL BE USED AS OUTLINED IN THIS PROSPECTUS.

All funds received from the sale of shares in this offering will be deposited into a standard bank checking account. We intend to use the proceeds raised in this offering for the uses set forth in the proceeds table. However, certain factors beyond our control, such as increases in certain costs, could result in the company being forced to reduce the proceeds allocated for other uses in order to accommodate these unforeseen changes. The failure of our management to use these funds effectively could result in unfavorable returns. This could have a significant adverse effect on our financial condition and could cause the price of our common stock to decline.

OUR DIRECTOR WILL CONTINUE TO EXERCISE SIGNIFICANT CONTROL OVER OUR OPERATIONS, WHICH MEANS AS A MINORITY SHAREHOLDER, YOU WOULD HAVE NO CONTROL OVER CERTAIN MATTERS REQUIRING STOCKHOLDER APPROVAL THAT COULD AFFECT YOUR ABILITY TO EVER RESELL ANY SHARES YOU PURCHASE IN THIS OFFERING.

After the completion of this offering, our management will own 33% of our common stock. It will have a significant influence in determining the outcome of all corporate transactions, including the election of directors, approval of significant corporate transactions, changes in control of the company or other matters that could affect your ability to ever resell your shares. Its interests may differ from the interests of the other stockholders and thus result in corporate decisions that are disadvantageous to other shareholders.

FINANCIAL INDUSTRY REGULATORY AUTHORITY ("FINRA") SALES PRACTICE REQUIREMENTS MAY ALSO LIMIT YOUR ABILITY TO BUY AND SELL OUR COMMON STOCK, WHICH COULD DEPRESS THE PRICE OF OUR SHARES.

FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

12

WE WILL INCUR ONGOING COSTS AND EXPENSES FOR SEC REPORTING AND COMPLIANCE; WITHOUT REVENUE WE MAY NOT BE ABLE TO REMAIN IN COMPLIANCE, MAKING IT DIFFICULT FOR INVESTORS TO SELL THEIR SHARES, IF AT ALL.

Our business plan allows for the estimated cost of this Registration Statement to be paid from our cash on hand. We plan to contact a market maker immediately following the effectiveness of this Registration Statement and apply to have the shares quoted on the OTC Electronic Bulletin Board. To be eligible for quotation on the OTCBB, issuers must remain current in their filings with the SEC. Market Makers are not permitted to begin quotation of a security whose issuer does not meet this filing requirement. Securities already quoted on the OTCBB that become delinquent in their required filings will be removed following a 30 or 60 day grace period if they do not make their required filing during that time. In order for us to remain in compliance we will require future revenues to cover the cost of these filings, which could comprise a substantial portion of our available cash resources. If we are unable to generate sufficient revenues to remain in compliance it may be difficult for you to resell any shares you may purchase, if at all.

This Prospectus contains projections and statements relating to the Company that constitute "forward-looking statements." These forward-looking statements may be identified by the use of predictive, future-tense or forward-looking terminology, such as "intends," "believes," "anticipates," "expects," "estimates," "may," "will," "might," "outlook," "could," "would," "pursue," "target," "project," "plan," "seek," "should," "assume," or similar terms or the negatives thereof. Such statements speak only as of the date of such statement, and the Company undertakes no ongoing obligation to update such statements. These statements appear in a number of places in this Prospectus and include statements regarding the intent, belief or current expectations of the Company, and its respective directors, officers or advisors with respect to, among other things:

|

*

|

trends affecting the Company's financial condition, results of operations or future prospects

|

|

*

|

the Company's business and growth strategies

|

|

*

|

the factors that we expect to contribute to our success and our ability to be successful in the future

|

|

*

|

our business model and strategy for realizing positive sales result

|

|

*

|

competition, including the impact of competition on our operations, our ability to respond to such competition and our expectations regarding continued competition in the markets in which we compete;

|

|

*

|

expenses

|

|

*

|

our expectations with respect to continued disruptions in the global capital markets and reduced levels of consumer spending and the impact of these trends on our financial results

|

|

*

|

the impact of new accounting pronouncements on our financial Statements

|

|

*

|

that our cash flows from operating activities will be sufficient to meet our projected operating and capital expenditures for the next twelve months

|

13

|

*

|

our market risk exposure and efforts to minimize risk

|

|

*

|

our overall outlook including all statements under MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

|

|

*

|

that estimates and assumptions made in the preparation of financial statements in conformity with US GAAP may differ from actual results and

|

|

*

|

expectations, plans, beliefs, hopes or intentions regarding the future.

|

Potential investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that, should conditions change or should any one or more of the risks or uncertainties materialize or should any of the underlying assumptions of the Company prove incorrect, actual results may differ materially from those projected in the forward-looking statements as a result of various factors, some of which are unknown. The factors that could adversely affect the actual results and performance of the Company include, without limitation:

|

*

|

the Company's inability to raise additional funds to support operations and capital expenditures

|

|

*

|

the Company's inability to effectively manage its growth

|

|

*

|

the Company's inability to achieve greater and broader market acceptance in existing and new market segments

|

|

*

|

the Company's inability to successfully compete against existing and future competitors

|

|

*

|

the effects of intense competition that exists in the Russian cosmetics industry

|

|

*

|

the economic downturn and its effect on consumer spending

|

|

*

|

the risk that negative industry or economic trends, including the market price of our common stock trading below its book value, reduced estimates of future cash flows, disruptions to our business, slower growth rates or lack of growth in our business, may result in significant write-downs or impairments in future period

|

|

*

|

the effects of events adversely impacting the economy or the regions from which we draw a significant percentage of our customers, including the effects of the current economic recession, war, terrorist or similar activity or disasters

|

|

*

|

the effects of energy price increases on our cost of operations and our revenues

|

|

*

|

financial community perceptions of our Company and the effect of economic, credit and capital market conditions on the economy and the software industry and

|

14

|

*

|

other factors described elsewhere in this Prospectus, or other reasons.

|

Potential investors are urged to carefully consider such factors. All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements and the "Risk Factors" described herein.

When all the shares are sold the gross proceeds from this offering will be $100,000. We expect to disburse the proceeds from this offering in the priority set forth below. The following table shows the intended use of proceeds assuming that 25%, 50%, 75% and 100%, respectively, of the Offering is sold.

|

$25,000

|

$50,000

|

$75,000

|

$100,000

|

|||||

|

Legal and professional fees & Public company reporting cost

|

$

|

10,000

|

$

|

10,000

|

$

|

10,000

|

$

|

10,000

|

|

Net proceeds

|

$

|

15,000

|

$

|

40,000

|

$

|

65,000

|

$

|

90,000

|

|

The net proceed will be used :

|

||||||||

|

Rent of a premise

|

$

|

2,400

|

$

|

6,000

|

$

|

12,000

|

$

|

18,000

|

|

Office equipment

|

$

|

2,000

|

$

|

8,000

|

$

|

10,000

|

$

|

17,000

|

|

Hiring personnel and Salaries

|

$

|

6,000

|

$

|

12,000

|

$

|

18,000

|

$

|

18,000

|

|

Communication

|

$

|

1,200

|

$

|

5,000

|

$

|

8,000

|

$

|

15,000

|

|

Marketing & advertising

|

$

|

3,400

|

$

|

9,000

|

$

|

17,000

|

$

|

22,000

|

The offering price of the shares has been determined arbitrarily by us. The price does not bear any relationship to our assets, book value, earnings, or other established criteria for valuing a privately held company. In determining the number of shares to be offered and the offering price we took into consideration our capital structure and the amount of money we would need to implement our business plans. Accordingly, the offering price should not be considered an indication of the actual value of our securities.

Dilution represents the difference between the offering price and the net tangible book value per share immediately after completion of this offering.

Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly as a result of our arbitrary determination of the offering price of the shares being offered. Dilution of the value of the shares you purchase is also a result of the lower book value of the shares held by our existing stockholders.

15

As of July 31,2014, the net tangible book value of our shares was $(349) or approximately $(0.0001) per share, based upon 5,000,000 shares outstanding.

Upon completion of this offering, but without taking into account any change in the net tangible book value after completion of this offering other than that resulting from the sale of the shares and receipt of the total proceeds of $100,000, the net tangible book value of the 15,000,000 shares to be outstanding will be $99,651, or approximately $0.0066 per Share. Accordingly, the net tangible book value of the shares held by our existing stockholders (5,000,000 shares) will be increased by $0.0066 per share without any additional investment on his part. The purchasers of shares in this offering will incur immediate dilution (a reduction in the net tangible book value per share from the offering price of $0.01 per Share) of $0.0034 per share. As a result, after completion of the offering, the net tangible book value of the shares held by purchasers in this offering would be $0.0066 per share, reflecting an immediate reduction in the $0.01 price per share they paid for their shares.

After completion of the offering, the existing shareholders will own 33.33% of the total number of shares then outstanding, for which he will have made a cash investment of $5,000, or $0.001 per Share. Upon completion of the offering, the purchasers of the shares offered hereby will own 50.00% of the total number of shares then outstanding, for which they will have made a cash investment of $100,000, or $0.01 per Share.

The following table illustrates the per share dilution to the new investors and does not give any effect to the results of any operations subsequent to March 31, 2013:

|

Price Paid per Share by Existing Shareholders

|

$ | .001 | ||

|

Public Offering Price per Share

|

$ | .01 | ||

|

Net Tangible Book Value Prior to this Offering

|

$ | (349 | ) | |

|

Net Tangible Book Value After this Offering

|

$ | 99,651 | ||

|

Increase in Net Tangible Book Value per Share Attributable

|

||||

|

to cash payments from purchasers of the shares offered

|

$ | .0066 | ||

|

Immediate Dilution per Share to New Investors

|

$ | .0034 |

The following table summarizes the number and percentage of shares purchased,

the amount and percentage of consideration paid and the average price per Share paid by our existing stockholder and by new investors in this offering:

|

Total

|

||||||||||||||||

|

Price

|

Number of

|

Percent of

|

Consideration

|

|||||||||||||

|

Per Share

|

Shares Held

|

Ownership

|

Paid

|

|||||||||||||

|

Existing

|

||||||||||||||||

|

Stockholder

|

$ | .001 | 5,000,000 | 33.33 | % | $ | 5,000 | |||||||||

|

Investors in

|

||||||||||||||||

|

This Offering

|

$ | .01 | 10,000,000 | 66.67 | % | $ | 100,000 | |||||||||

16

This is a self-underwritten offering. This Prospectus is part of a Prospectus that permits our officer and director to sell the Shares directly to the public, with no commission or other remuneration payable to him for any Shares he sells.

There are no plans or arrangements to enter into any contracts or agreements to sell the Shares with a broker or dealer. Iurii Iurtaev, our officer and director, will sell the shares and intends to offer them to friends, family members and business acquaintances. In offering the securities on our behalf, he will rely on the safe harbor from broker dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934.

He will not register as a broker-dealer pursuant to Section 15 of the Securities Exchange Act of 1934, in reliance upon Rule 3a4-1, which sets forth those conditions under which a person associated with an Issuer may participate in the offering of the Issuer's securities and not be deemed to be a broker-dealer.

|

a.

|

Our officer and director is not subject to a statutory disqualification, as that term is defined in Section 3(a)(39)of the Act, at the time of his participation; and

|

|

b.

|

Our officer and director will not be compensated in connection with his participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities; and

|

|

c.

|

Our officer and director is not, nor will he be at the time of her participation in the offering, an associated person of a broker-dealer; and

|

|

d.

|

Our officer and our director meets the conditions of paragraph (a)(4)(ii) of Rule 3a4-1 of the Exchange Act, in that he

|

(A) primarily performs, or is intended primarily to perform at the end of the offering, substantial duties for or on behalf of our company, other than in connection with transactions in securities; and

(B) is not a broker or dealer, or been associated person of a broker or dealer, within the preceding twelve months; and

(C) has not participated in selling and offering securities for any Issuer more than once every twelve months other than in reliance on Paragraphs (a)(4)(i) (a)(4)(iii).

Our officer, director, control person and affiliates of same do not intend to purchase any shares in this offering.

17

The shares will be sold at the fixed price of $.01 per share until the completion of this offering. The selling shareholder will also sell at a fixed price of $0.01. There is no minimum amount of subscription required per investor, and subscriptions, once received, are irrevocable.

This offering will commence on the date of this prospectus and continue for a period not to exceed 180 days (the "Expiration Date"), unless extended by our Board of Directors for an additional 90 days.

This is a "best effort" offering and, as such, there is no assurance that we will sell any or all of the shares.

If you decide to subscribe for any shares in this offering, you will be required to execute a Subscription Agreement and tender it, together with a check or certified funds to us. All checks for subscriptions should be made payable to Lepota, Inc.

COMMON STOCK

Our authorized capital stock consists of 75,000,000 shares of common stock, par value $.001 per share. The holders of our common stock

(i) have equal ratable rights to dividends from funds legally available therefore, when, as and if declared by our Board of Directors;

(ii) are entitled to share in all of our assets available for distribution to holders of common stock upon liquidation, dissolution or winding up of our affairs;

(iii) do not have preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights; and (iv) are entitled to one non-cumulative vote per share on all matters on which stockholders may vote.

NON-CUMULATIVE VOTING

Holders of shares of our common stock do not have cumulative voting rights, which means that the holders of more than 33% of the outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in such event, the holders of the remaining shares will not be able to elect any of our directors.

As of the date of this prospectus, we have not paid any cash dividends to stockholders. The declaration of any future cash dividend will be at the discretion of our Board of Directors and will depend upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

18

The selling shareholders named in this prospectus is offering 50,000 shares of common stock through this prospectus. All of the shares were acquired from us by the selling shareholders in offerings that was exempt from registration pursuant to Regulation S of the Securities Act of 1933. The selling shareholders purchased his shares from the company in private offering. The following table provides information regarding the beneficial ownership of our common stock held by each of the selling shareholders as of July 31, 2014, including:

1. The number of shares owned by him prior to this offering;

2. The total number of shares that are to be offered by him;

3. The total number of shares that will be owned by him upon completion of the offering;

4. The percentage owned by him upon completion of the offering; and

5. The identity of the control person(s) of any entity that owns the shares in parentheses.

The named party beneficially owns and has sole voting and investment power over all shares or rights to the shares, unless otherwise shown in the table. The numbers in this table assume that none of the selling shareholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold. The percentages are based on 5,000,000 shares of common stock outstanding on July 31, 2014.

|

Beneficial Ownership

Prior to

this Offering (1)

|

Beneficial Ownership

After

this Offering (2)

|

|||||||||||

|

Selling Stockholder

|

Number of

Shares

|

Percent

of Class

|

Shares That May

be

Offered and Sold

Hereby

|

Number

of

Shares

|

Percent

of Class

|

|||||||

|

Rene Lawrence

|

5,000,000

|

100.0%

|

50,000

|

%

|

4,950,000

|

33.0%

|

||||||

|

Totals

|

5,000,000

|

100.0%

|

50,000

|

1.0%

|

4,950,000

|

33.0%

|

||||||

19

None of the below described experts or counsel have been hired on a contingent basis and none of them will receive a direct or indirect interest in the Company.

Our audited financial statements for the period from inception to July 31, 2014 have been audited by Harris & Gillespie CPA's, PLLC.

We include the financial statements in reliance on their report, given upon

their authority as experts in accounting and auditing.

Frederick C. Bauman, Esq. of the Bauman & Associates Law Firm has passed upon the validity of the shares being offered and certain other legal matters and is representing us in connection with this offering.

GENERAL INFORMATION

Lepota, Inc. was incorporated in the State of Nevada on December 9, 2013. We were formed to import and distribute cosmetic products in Russia. The company was incorporated by our director.

We are still in the development stage and we have generated no revenues. Our independent registered public accounting firm has issued an audit opinion for our Company which includes an explanatory paragraph expressing substantial doubt as to our ability to continue as a going concern.

We have not been involved in a bankruptcy receivership or similar proceeding. Additionally, we have not been involved in a reclassification, merger, consolidation, or purchase or sale of a significant amount of assets not in the ordinary course of business.

We have never declared bankruptcy, have never been in receivership, and have never been involved in any legal action or proceedings. Since incorporation, we have not made any significant purchase or sale of assets. We do not own physical properties.

We are not a blank check registrant, as that term is defined in Rule 419(a)(2) of Regulation C of the Securities Act of 1933, since we have a specific business plan or purpose. We have not had preliminary contact or discussions with, nor do we have any present plans, proposals, arrangements or understandings with, any representatives of the owners of any business or company regarding the possibility of an acquisition or merger.

20

BUSINESS PLAN

We have identified number of Poland - based companies that produces high-quality innovative cosmetics that are not widely represented on the territory of Russia, this are Evelina, Okeanic,Dax Cosmetics, Joana. We haven’t yet established any contracts with this firms. We intend to distribute their products in Russia through shops and Drugstores. We presently have a contract with one purchaser, Interbeauty, which we believe has access to the intended market.

We have target companies that we aim to work with on intercontinental level. This companies are: Incoco, a U.S. based company and Rohto in Japan. Incoco in particular has nail accessories products that we find are not represented on the Russian market.

As of this date, we do not have any formal agreements with Incoco or Rohto.

We intend to search for marketable products through focus groups, which are in demand in the Russian markets nowadays. Searching of the firm that produces these products through out foreign markets. Conclusion of exclusive contract with it for supplying on the territory of Russia. Conclusion the contract for supplying with shops and local networks of drogerie format. Distribution of import products to selling points.

We believe that products for import should be: unique, innovative, high-quality, attracting new customers to the shops and local networks, because of such product absence within the federal networks.

Our pricing model is based on the premise that the price should be the same for all territory of Russia and allow our clients to have a trading margin of at least 50 % more than have the known multi-brand manufacturers of mass market format.

THE PRINCIPLE OF BUILDING RELATIONSHIPS WITH THE MANUFACTURER.

1 To begin, we determine the type of products that has the prospects for the development of sales. (range, design, product category, price, pricing model, packaging, uniqueness and company benefits.

2 Manufacturer’s selected products are determined through our search for new businesses on international trade exhibition taking place in Bologna, Moscow, Guangzhou and Istanbul.

3 From producers who have a product suitable for all specified criteria (item 1) we take their prospectus coordinates and samples.

4 Next, we conduct focus groups through which we select the most interesting position.

5. From the manufacturer we then request price lists for these positions. When the pricing of manufacturer and our price model for a particular product coincide - communications for an appointment begin in order to discuss all the terms of the contract for the products supply.

21

6 Following the meetings, subject to agreements on all issues – formal supply contract is produced, we continue mutual operations including delivery/receipment of the product itself.

MARKETING

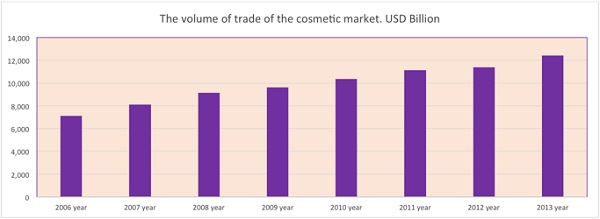

Our target market is retailers that sell to Russian women age 18 and up and distributors who supply these retailers. Sales of cosmetics have grown significantly in Russia over the past five years. According to data studied on www.euromonitor.com, Euromonitor International Ltd., a company that highlights worldwide markets of the future and publishes extensive reports on them, we’ve observed a dynamic uptrend on the cosmetics market in Russia.

Further industry date is available through the following link: http://www.euromonitor.com/beauty-and-personal-care-in-russia/report

|

The volume of trade of the cosmetic market in Russia in USD$ Billion

|

|

|

Data gathered from Euromonitor International Ltd.

|

We plan to initially sell our cosmetics in Russia through InterBeauty, our initial purchaser, and to try to secure additional channels of distribution.

We intend going to launch a public relations campaign to get our web site exposure which will direct buyers for retailers directly to the website.

Product information will be available at our proposed website www.lepotainc.com . We are currently Looking at several additional manufacturers of cosmetic products. Additionally, to increase awareness we will be attending major Cosmetic shows in Russia and Europe.

22

The depth of product offered is intended to be substantial. We would like every order to have a personal relationship attached to it - making it a truly pleasurable experience to do business with us. We will build on a referral program to retain and expand our customer database.

We are confident in the quality of our products and for any damaged goods while in transit we will refund.

DISTRIBUTION METHODS

We initially plan to sell the cosmetics through InterBeauty, LLC, a Russian cosmetics distributor with access to numerous shops, drugstores and other retail outlets. As our business grows, we may also sell direct to certain retailers or develop an online store through our website.

Our vision is become one of the leading importers and suppliers of cosmetics in Russia.

STATUS OF ANY PUBLICLY ANNOUNCED NEW PRODUCTS

We have not publicly announced any new products.

COMPETITION

The Russian cosmetic industry is intensely competitive. We will compete against a number of large well-established companies with greater name recognition, a more comprehensive offering of products, and with substantially larger resources than ours; including financial and marketing. Many well-known leaders of the world of perfumes and cosmetics are already active in the Russian market, such as Procter & Gamble, Henkel, Avon, Unilever and Oriflame. In addition to these large competitors there are numerous smaller operations that have developed and are marketing custom products.

We believe that our competitive strengths will lay in our managing director with his extensive experience and knowledge from within the industry, we rely on his ability to pin point a products for import that is unique, innovative, high-quality, able to attract new customers and be interesting for the shops and networks on the federal level.

SOURCES AND AVAILABILITY OF PRODUCTS

We will be contracting with manufacturers to provide their products to us, which will be selling to distributors or directly to retailers. We have identified several manufacturers that specialize in cosmetics. We will be negotiating agreements that will be suitable to all parties for our cosmetic products.

All completed product will be sent out from our offices or warehouse in Rostov – on Don to ensure quality and speed of service.

DEPENDENCE ON ONE OR A FEW MAJOR CUSTOMERS

We presently have only one customer. As our business is established and grows, we intend to add additional customers so that we will not continue to rely on one or few major customers.

23

PATENTS AND TRADEMARKS

We do not have any proprietary products. We currently have no patents or trademarks for our company name or brand name; however, as business is established and operations expand, we may seek such protection. Despite efforts to protect our proprietary rights, such as our brand and product line names, since we have no patent or trademark rights unauthorized persons may attempt to copy aspects of our business, including our web site design, products, product information and sales mechanics or to obtain and use information that we regard as proprietary, such as the technology used to operate our web site and content. Any encroachment upon our proprietary information, including the unauthorized use of our brand name, the use of a similar name by a competing company or a lawsuit initiated against us for infringement upon another company's proprietary information or improper use of their trademark, may affect our ability to create brand name recognition, cause customer confusion and/or have a detrimental effect on our business. Litigation or proceedings before the U.S. or International Patent and Trademark Offices may be necessary in the future to enforce our intellectual property rights, to protect our trade secrets and domain name and/or to determine the validity and scope of the proprietary rights of others. Any such litigation or adverse proceeding could result in substantial costs and diversion of resources and could seriously harm our business operations and/or results of operations.

NEED FOR ANY GOVERNMENT APPROVAL OF PRINCIPAL PRODUCTS

Our products will meet Russian regulations subject to our industry.

GOVERNMENT AND INDUSTRY REGULATION

We will be subject to federal laws and regulations that relate directly or indirectly to our operations including securities laws. We will also be subject to common business and tax rules and regulations pertaining to the operation of our business.

RESEARCH AND DEVELOPMENT ACTIVITIES

Other than time spent researching our proposed business we have not spent any funds on research and development activities to date. We do not currently plan to spend any funds on research and development activities in the future.

ENVIRONMENTAL LAWS

Our operations are not subject to any Environmental Laws.

EMPLOYEES AND EMPLOYMENT AGREEMENTS

We currently have one employee,of which acts as our executive officer, namely, Iurii Iurtaev. Iurii is devoted to our business and currently is responsible for sourcing suppliers of cosmetics, as well as identifying additional distributors and retailers that may be interested in becoming our customers.

24

Emerging Growth Company Status under the JOBS Act

Lepota, Inc. qualifies as an “emerging growth company” as defined in the Jumpstart our Business Startups Act (the “JOBS Act”).

The JOBS Act creates a new category of issuers known as "emerging growth companies." Emerging growth companies are those with annual gross revenues of less than $1 billion (as indexed for inflation) during their most recently completed fiscal year. The JOBS Act is intended to facilitate public offerings by emerging growth companies by exempting them from several provisions of the Securities Act of 1933 and its regulations. An emerging growth company will retain that status until the earliest of:

|

|

The first fiscal year after its annual revenues exceed $1 billion;

|

|

|

The first fiscal year after the fifth anniversary of its IPO;

|

|

|

The date on which the company has issued more than $1 billion in non-convertible debt during the previous three-year period; and

|

|

|

The first fiscal year in which the company has a public float of at least $700 million.

|

Financial and Audit Requirements

Under the JOBS Act, emerging growth companies are subject to scaled financial disclosure requirements. Pursuant to these scaled requirements, emerging growth companies may:

|

|

Provide only two rather than three years of audited financial statements in their IPO Registration Statement;

|

|

|

Provide selected financial data only for periods no earlier than those included in the IPO Registration Statement in all SEC filings, rather than the five years of selected financial data normally required;

|

|

|

Delay compliance with new or revised accounting standards until they are made applicable to private companies; and

|

|

|

Be exempted from compliance with Section 404(b) of the Sarbanes-Oxley Act, which requires companies to receive an outside auditor's attestation regarding the issuer's internal controls.

|

Offering Requirements

In addition, during the IPO offering process, emerging growth companies are exempt from:

|

|

Restrictions on analyst research prior to and immediately after the IPO, even from an investment bank that is underwriting the IPO;

|

|

|

Certain restrictions on communications to institutional investors before filing the IPO registration statement; and

|

25

|

|

The requirement initially to publicly file IPO Registration Statements. Emerging growth companies can confidentially file draft Registration Statements and any amendments with the SEC. Public filings of the draft documents must be made at least 21 days prior to commencement of the IPO "road show."

|

Other Public Company Requirements

Emerging growth companies are also exempt from other ongoing obligations of most public companies, such as:

|

|

The requirements under Section 14(i) of the Exchange Act and Section 953(b)(1) of the Dodd-Frank Act to disclose executive compensation information on pay-for-performance and the ratio of CEO to median employee compensation;

|

|

|

Certain other executive compensation disclosure requirements, such as the compensation discussion and analysis, under Item 402 of Regulation S-K; and

|

|

|

The requirements under Sections 14A(a) and (b) of the Exchange Act to hold advisory votes on executive compensation and golden parachute payments.

|

Election under Section 107(b) of the JOBS Act

As an emerging growth company we have made the irrevocable election to not adopt the extended transition period for complying with new or revised accounting standards under Section 107(b), as added by Section 102(b), of the JOBS Act. This election allows companies to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies.

Our operations are currently being conducted out of the premises at Lelushenko 11, Unit 65, Rostov on Don, Russian Federation 344000. We consider our current principal office space arrangement adequate and will reassess our needs based upon the future growth of the company.

We are not involved in any pending legal proceeding nor are we aware of any pending or threatened litigation against us.

No public market currently exists for shares of our common stock. Following completion of this offering, we intend to apply to have our common stock listed for quotation on the Over-the-Counter Bulletin Board.

26

PENNY STOCK RULES

The Securities and Exchange Commission has also adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

A purchaser is purchasing penny stock which limits the ability to sell the stock. The shares offered by this prospectus constitute penny stock under the Securities and Exchange Act. The shares will remain penny stocks for the foreseeable future. The classification of penny stock makes it more difficult for a broker-dealer to sell the stock into a secondary market, which makes it more difficult for a purchaser to liquidate his/her investment. Any broker-dealer engaged by the purchaser for the purpose of selling his or her shares in us will be subject to Rules 15g-1 through 15g-10 of the Securities and Exchange Act. Rather than creating a need to comply with those rules, some broker-dealers will refuse to attempt to sell penny stock.

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document, which:

contains a description of the nature and level of risk in the market for penny stock in both public offerings and secondary trading;

contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the Securities Act of 1934, as amended;

contains a brief, clear, narrative description of a dealer market, including "bid" and "ask" price for the penny stock and the

significance of the spread between the bid and ask price;

toll-free telephone number for inquiries on disciplinary actions;

defines significant terms in the disclosure document or in the conduct of trading penny stocks; and

contains such other information and is in such form (including language, type, size and format) as the Securities and Exchange Commission shall require by rule or regulation;

The broker-dealer also must provide, prior to effecting any transaction in a

penny stock, to the customer:

|

-

|

the bid and offer quotations for the penny stock;

|

|

-

|

the compensation of the broker-dealer and its salesperson in the transaction;

|

|

-

|

the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and

|

|

-

|

monthly account statements showing the market value of each penny stock held in the customer's account.

|

27

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary market for our stock because it will be subject to these penny stock rules. Therefore, stockholders may have difficulty selling their securities.

REGULATION M

Our officer and director, who will offer and sell the Shares, is aware that he is required to comply with the provisions of Regulation M promulgated under the Securities Exchange Act of 1934, as amended. With certain exceptions, Regulation M precludes the officers and directors, sales agents, any broker-dealer or other person who participate in the distribution of shares in this offering from bidding for or purchasing, or attempting to induce any person to bid for or purchase any security which is the subject of the distribution until the entire distribution is complete.

REPORTS

We are subject to certain reporting requirements and will furnish annual financial reports to our stockholders, certified by our independent accountants, and will furnish un-audited quarterly financial reports in our quarterly reports filed electronically with the SEC. All reports and information filed by us can be found at the SEC website, www.sec.gov.

STOCK TRANSFER AGENT

We do not have a stock transfer agent at this time. We intende to appoint a stock transfer agent following the completion of this offering.

Our fiscal year end is July 31. We intend to provide financial statements audited by an Independent Registered Public Accounting Firm to our shareholders in our annual reports. The audited financial statements for the period from inception, December 9, 2013, to July 31, 2014 can be found on page F-1.

We have generated no revenue since inception and have incurred $3,845 in miscellaneous expenses through July 31, 2014.

The following table provides selected financial data about our company for the period from the date of incorporation through July 31, 2014. For detailed financial information, see the financial statements included in this prospectus.

28

|

Balance Sheet Data:

|

July 31, 2014

|

|||

|

Cash

|

$ | 3,495 | ||

|

Total assets

|

$ | 3,495 | ||

|

Total liabilities

|

$ | 3,845 | ||

|

Shareholders' equity

|

$ | (349 | ) | |

Other than the shares offered by this prospectus, no other source of capital has been has been identified or sought. If we experience a shortfall in operating capital prior to funding from the proceeds of this offering, our director has verbally agreed to advance the company funds to complete the registration process.

PLAN OF OPERATION

Our plan for the next 12 months follows. In order to carry out this plan, we aim to sell 100% of the shares offered under this offering. If fewer shares are sold, we will reduce expenditures for these activities as set forth under “Use of Proceeds.”

1. Rent an office, execute a lease agreement, buy office furniture and office equipment, to include secretary and a bookkeeper.

2. Conclude a supplying contract with a store.

3. Invite focus groups to determine the need for updates on the market of cosmetic products with the help of an advertising agency.

4. Analysis of data, determining the criteria for marketable cosmetics products. Advance Internet search for products satisfying the criteria.

5. Visit international exhibitions which present products and companies producing cosmetics, household chemicals, perfumes and household goods with the secretary or interpreter if needed to collect contact information and product samples.

7. Hold additional focus groups to identify additional brands for import. Schedule dates for contract negotiations with potential additional suppliers.

8. Meetings with supplier company management. Topics for negotiation would include range of pricing models, certification stickers for Russian buyers, payment terms, delivery terms. The object of the meetings would be to negotiate and sign an exclusive supply agreement.

9. Research concerning customs broker identification documents required for certification of products selected for the first delivery.

10. Addition of company marketing staff with development of marketing activity, point of sale materials (POSM) and customer presentation packages.

29

11. Marketing research and questioning of consumers. Work out price lists, exhibition catalogs, brochures and plan for promotion. Advertising in the media and Internet.

12. Presentations on the new products with potential customers

13. Conclusion of contracts with a warehouse and transportation company.

GOING CONCERN

In our audited financial statements as of July 31, 2014 we were issued an opinion by our auditors that raised substantial doubt about our ability to continue as a going concern based on our current financial position.

AND FINANCIAL DISCLOSURE

None.

Directors of the corporation are elected by the stockholders to a term of one year and serve until a successor is elected and qualified. Officers of the corporation are appointed by the Board of Directors to a term of one year and serves until a successor is duly appointed and qualified, or until he or she is removed from office. The Board of Directors has no nominating, auditing or compensation committees.

The name, address, age and position of our officer and director is set forth below:

|

Name and Address

|

Age

|

Position(s)

|

||

|

Iurii Iurtaev

|

38

|

President,

|

||

|

Lelushenko 11, Unit 65

|

Chief Financial Officer,

|

|||

|

Rostov-on-Don

|

Chief Executive Officer,

|

|||

|

Russian Federation 344000

|

Sole Director

|

|||

|

Rene Lawrence

|

35

|

Secretary

|

||

|

80 Whitmore Gardens

|

||||

|

London NW105HJ

|

||||

|

England, United Kingdom

|

Our Director Iurii Iurtaev:

Held his offices/positions since the inception of our Company and is expected to hold said offices/positions until the next annual meeting of our stockholders. The officers listed are our only officers and control persons.

BACKGROUND INFORMATION ABOUT OUR OFFICER AND DIRECTOR

30

Iurii Iurtaev

Education:

Higher, Don State Technical University

1993-1999 Faculty – Automation and informatics

Specialty - programmer

Work

(listed in inverse chronology):

|

1.

|

2012 up to now “YuDiCom” Ltd.

|

Capacity: Director in sales

|

1.

|

Identification of needs of drogerie format networks.

|

|

2.

|

Finding of products meeting the specified conditions at foreign market. (Search of company producing necessary products is carried out by means of visit to exhibitions and by internet)

|

|

3.

|

Focus group realization. Determination of price model of selected products.

|

|

4.

|

conducting of negotiations with producing company. Determination of the product positioning at Russian market and its price model.

|

|

5.

|

Signing of contract at agreement of the price model and marketing from the both parties.

|

|

6.

|

Coordination of the first supply (name, stickering, certificates, custom clearance, delivery). Control over the next supplies.

|

|

7.

|

Position in Russia network. Control over brand manager work on the territory.

|

|

2.

|

2007-2012 “YuDiCom” LTD.

|

Capacity: Brand director in product promotion of “Kalina” and “Kalina Décor” concern

Since 2010 contracts of “Vesna” OJSC, Colgate Palmolive”, “Hygiene_ Kinetics (OLA)” were added.

Since 2011 contracts of “Arnest” and Dividik” were added.

Since 2012 contracts of “Nefis Cosmetics” OJSC were added.

Obligations:

|

1.

|

Interaction with supplier representative.

|

|

2.

|

Control of work of trade representatives.

|

|

3.

|

TT monitoring.

|

|

4.

|

Planning of annual budget.

|

|

5.

|

Development of new territories.

|

|

6.

|

Debit indebtedness.

|

|

7.

|

TT training.

|

31

|

3.

|

2004-2007 “Crocus” Ltd.

|

Capacity: Trade representative of “YuDiCom” Ltd, “Kalina” division

Obligations: Promotion of “Kalina” concern products on the basis of

“YuDiCom” Ltd. Distributor

|

·

|

Work at trade sites of retail and wholesale categories, control and making orders with customers, achievement of high-quality distribution, money collection, planning of working week schedule, making of plan of visiting, monitoring of territory, search of new customers.

|

|

·

|