Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PRUDENTIAL FINANCIAL INC | d787423d8k.htm |

Exhibit

99.1 PRUDENTIAL FINANCIAL, INC. INVESTOR

DAY SEPTEMBER 18,

2014 |

PRUDENTIAL FINANCIAL, INC.

INVESTOR DAY

ERIC DURANT

SENIOR VICE

PRESIDENT INVESTOR RELATIONS |

Tokyo

Investor Day 9.18.2014 Tokyo Investor Day 9.18.2014

3

Certain

of

the

statements

included

in

this

presentation

constitute

forward-looking

statements

within

the

meaning

of

the

U.

S.

Private

Securities

Litigation

Reform

Act

of

1995.

Words

such

as

“expects,”

“believes,”

“anticipates,”

“includes,”

“plans,”

“assumes,”

“estimates,”

“projects,”

“intends,”

“should,”

“will,”

“shall”

or

variations

of

such

words

are

generally

part

of

forward-looking

statements.

Forward-looking

statements

are

made

based

on

management’s

current

expectations

and

beliefs

concerning

future

developments

and

their

potential

effects

upon

Prudential

Financial,

Inc.

and

its

subsidiaries.

There

can

be

no

assurance

that

future

developments

affecting

Prudential

Financial,

Inc.

and

its

subsidiaries

will

be

those

anticipated

by

management.

These

forward-looking

statements

are

not

a

guarantee

of

future

performance

and

involve

risks

and

uncertainties,

and

there

are

certain

important

factors

that

could

cause

actual

results

to

differ,

possibly

materially,

from

expectations

or

estimates

reflected

in

such

forward-looking

statements,

including,

among

others:

(1)

general

economic,

market

and

political

conditions,

including

the

performance

and

fluctuations

of

fixed

income,

equity,

real

estate

and

other

financial

markets;

(2)

the

availability

and

cost

of

additional

debt

or

equity

capital

or

external

financing

for

our

operations;

(3)

interest

rate

fluctuations

or

prolonged

periods

of

low

interest

rates;

(4)

the

degree

to

which

we

choose

not

to

hedge

risks,

or

the

potential

ineffectiveness

or

insufficiency

of

hedging

or

risk

management

strategies

we

do

implement,

with

regard

to

variable

annuity

or

other

product

guarantees;

(5)

any

inability

to

access

our

credit

facilities;

(6)

reestimates

of

our

reserves

for

future

policy

benefits

and

claims;

(7)

differences

between

actual

experience

regarding

mortality,

longevity,

morbidity,

persistency,

surrender

experience,

interest

rates

or

market

returns

and

the

assumptions

we

use

in

pricing

our

products,

establishing

liabilities

and

reserves

or

for

other

purposes;

(8)

changes

in

our

assumptions

related

to

deferred

policy

acquisition

costs,

value

of

business

acquired

or

goodwill;

(9)

changes

in

assumptions

for

retirement

expense;

(10)

changes

in

our

financial

strength

or

credit

ratings;

(11)

statutory

reserve

requirements

associated

with

term

and

universal

life

insurance

policies

under

Regulation

XXX

and

Guideline

AXXX;

(12)

investment

losses,

defaults

and

counterparty

non-performance;

(13)

competition

in

our

product

lines

and

for

personnel;

(14)

difficulties

in

marketing

and

distributing

products

through

current

or

future

distribution

channels;

(15)

changes

in

tax

law;

(16)

economic,

political,

currency

and

other

risks

relating

to

our

international

operations;

(17)

fluctuations

in

foreign

currency

exchange

rates

and

foreign

securities

markets;

(18)

regulatory

or

legislative

changes,

including

the

Dodd-Frank

Wall

Street

Reform

and

Consumer

Protection

Act;

(19)

inability

to

protect

our

intellectual

property

rights

or

claims

of

infringement

of

the

intellectual

property

rights

of

others;

(20)

adverse

determinations

in

litigation

or

regulatory

matters

and

our

exposure

to

contingent

liabilities,

including

in

connection

with

our

divestiture

or

winding

down

of

businesses;

(21)

domestic

or

international

military

actions,

natural

or

man-made

disasters

including

terrorist

activities

or

pandemic

disease,

or

other

events

resulting

in

catastrophic

loss

of

life;

(22)

ineffectiveness

of

risk

management

policies

and

procedures

in

identifying,

monitoring

and

managing

risks;

(23)

effects

of

acquisitions,

divestitures

and

restructurings,

including

possible

difficulties

in

integrating

and

realizing

projected

results

of

acquisitions;

(24)

interruption

in

telecommunication,

information

technology

or

other

operational

systems

or

failure

to

maintain

the

security,

confidentiality

or

privacy

of

sensitive

data

on

such

systems;

(25)

changes

in

statutory

or

U.S.

GAAP

accounting

principles,

practices

or

policies;

(26)

Prudential

Financial,

Inc.’s

primary

reliance,

as

a

holding

company,

on

dividends

or

distributions

from

its

subsidiaries

to

meet

debt

payment

obligations

and

the

ability

of

the

subsidiaries

to

pay

such

dividends

or

distributions

in

light

of

our

ratings

objectives

and/or

applicable

regulatory

restrictions;

and

(27)

risks

due

to

the

lack

of

legal

separation

between

our

Financial

Services

Businesses

and

our

Closed

Block

Business.

Prudential

Financial,

Inc.

does

not

intend,

and

is

under

no

obligation,

to

update

any

particular

forward-looking

statement

included

in

this

presentation.

See

“Risk

Factors”

included

in

Prudential

Financial,

Inc.’s

Annual

Report

on

Form

10-K

for

discussion

of

certain

risks

relating

to

our

businesses

and

investment

in

our

securities.

_______________________________________________________________________________

Prudential

Financial,

Inc.

of

the

United

States

is

not

affiliated

with

Prudential

PLC

which

is

headquartered

in

the

United

Kingdom.

FORWARD-LOOKING

STATEMENTS |

Tokyo

Investor Day 9.18.2014 4

This

presentation

includes

references

to

“adjusted

operating

income.”

Adjusted

operating

income

is

a

non-GAAP

measure

of

performance

of

our

Financial

Services

Businesses.

Adjusted

operating

income

excludes

“Realized

investment

gains

(losses),

net,”

as

adjusted,

and

related

charges

and

adjustments.

A

significant

element

of

realized

investment

gains

and

losses

are

impairments

and

credit-related

and

interest

rate-related

gains

and

losses.

Impairments

and

losses

from

sales

of

credit-impaired

securities,

the

timing

of

which

depends

largely

on

market

credit

cycles,

can

vary

considerably

across

periods.

The

timing

of

other

sales

that

would

result

in

gains

or

losses,

such

as

interest

rate-related

gains

or

losses,

is

largely

subject

to

our

discretion

and

influenced

by

market

opportunities

as

well

as

our

tax

and

capital

profile.

Realized

investment

gains

(losses)

within

certain

of

our

businesses

for

which

such

gains

(losses)

are

a

principal

source

of

earnings,

and

those

associated

with

terminating

hedges

of

foreign

currency

earnings

and

current

period

yield

adjustments

are

included

in

adjusted

operating

income.

Adjusted

operating

income

excludes

realized

investment

gains

and

losses

from

products

that

contain

embedded

derivatives,

and

from

associated

derivative

portfolios

that

are

part

of

a

hedging

program

related

to

the

risk

of

those

products.

Adjusted

operating

income

also

excludes

gains

and

losses

from

changes

in

value

of

certain

assets

and

liabilities

relating

to

foreign

currency

exchange

movements

that

have

been

economically

hedged

or

considered

part

of

our

capital

funding

strategies

for

our

international

subsidiaries,

as

well

as

gains

and

losses

on

certain

investments

that

are

classified

as

other

trading

account

assets.

Adjusted

operating

income

also

excludes

investment

gains

and

losses

on

trading

account

assets

supporting

insurance

liabilities

and

changes

in

experience-rated

contractholder

liabilities

due

to

asset

value

changes,

because

these

recorded

changes

in

asset

and

liability

values

are

expected

to

ultimately

accrue

to

contractholders.

Trends

in

the

underlying

profitability

of

our

businesses

can

be

more

clearly

identified

without

the

fluctuating

effects

of

these

transactions.

In

addition,

adjusted

operating

income

excludes

the

results

of

divested

businesses,

which

are

not

relevant

to

our

ongoing

operations.

Discontinued

operations,

which

is

presented

as

a

separate

component

of

net

income

under

GAAP,

is

also

excluded

from

adjusted

operating

income.

We

believe

that

the

presentation

of

adjusted

operating

income

as

we

measure

it

for

management

purposes

enhances

understanding

of

the

results

of

operations

of

the

Financial

Services

Businesses

by

highlighting

the

results

from

ongoing

operations

and

the

underlying

profitability

of

our

businesses.

However,

adjusted

operating

income

is

not

a

substitute

for

income

determined

in

accordance

with

GAAP,

and

the

adjustments

made

to

derive

adjusted

operating

income

are

important

to

an

understanding

of

our

overall

results

of

operations.

The

schedules

on

the

following

pages

provide

a

reconciliation

of

adjusted

operating

income

for

the

Financial

Services

Businesses

to

income

from

continuing

operations

in

accordance

with

GAAP.

The

information

referred

to

above,

as

well

as

the

risks

of

our

businesses

described

in

our

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2013,

and

subsequent

Quarterly

Reports

on

Form

10-Q

should

be

considered

by

readers

when

reviewing

forward-looking

statements

contained

in

this

presentation.

Additional

historical

information

relating

to

our

financial

performance

is

located

on

our

Web

site

at

www.investor.prudential.com. NON–GAAP MEASURES |

Tokyo

Investor Day 9.18.2014 RECONCILIATION FOR INTERNATIONAL INSURANCE PRE-TAX ADJUSTED

1)

As disclosed in company earnings releases.

2)

Includes refinements of reserves and amortization of deferred policy acquisition

and other costs. 3)

Represents

one

time

gains

on

a

joint

venture

investment

(2007),

gain

on

sale

of

a

branch

office

(2008)

and

initial

surrenders

of

policies

following

the

restructuring

of

the

acquired

Yamato

Life

business

(2009).

5

OPERATING INCOME EXCLUDING MARKET DRIVEN AND DISCRETE ITEMS

(1) |

CHARLES LOWREY

EXECUTIVE VICE

PRESIDENT AND CHIEF OPERATING OFFICER

INTERNATIONAL BUSINESSES

2014 TOKYO INVESTOR

DAY PRUDENTIAL INTERNATIONAL INSURANCE |

•

Captive distribution provides sustainable competitive advantage

•

Emphasis on needs-based sales of protection products

•

Expansion through diversification and agent growth

•

Successful track record of acquisitions and business integrations

•

Solid risk management

•

Strong regulatory ratios and conservatively managed balance sheet

•

Sustained capital generation and deployment

2

Tokyo Investor Day 9.18.2014

Proven, superior business model drives

Proven, superior business model drives

sustainable strong results and returns

sustainable strong results and returns

High ROE

High ROE

(1)

(1)

and low volatility earnings primarily driven

and low volatility earnings primarily driven

by stable mortality and expense margins

by stable mortality and expense margins

1)

Return on Equity (ROE).

PRUDENTIAL INTERNATIONAL INSURANCE |

•

Leading position in highly attractive Japanese insurance market

•

Captive distribution serving lifetime financial security needs:

excellent fit for Japan’s demographic trend

•

Supplemental third party channels

•

Optimistic about Prudential’s opportunities in Japanese life

insurance market

•

Profitability and returns are sustainable

3

Tokyo Investor Day 9.18.2014

Solid prospects driven by strategy and positioning

Solid prospects driven by strategy and positioning

PRUDENTIAL INTERNATIONAL INSURANCE |

4

•

Began in 1988

•

Differentiated approach for the Japanese life insurance market

•

Proprietary distribution through selective, high-quality sales force

•

Emphasize protection products requiring analysis of client needs

•

Target the affluent and mass affluent consumer; serve small business

and professional markets

Tokyo Investor Day 9.18.2014

THE LIFE PLANNER

MODEL FOUNDATION OF OUR SUCCESS |

5

•

Life Consultants

(1)

expand proprietary distribution coverage

to middle-market customers, and have strong affinity

group relationships

•

Supplemental distribution through banks and independent agents

expands access to investable wealth, business market and

demographic cohorts

•

Product diversification to meet clients’

financial security needs

over a lifetime

•

Pursue opportunities in limited number of attractive countries

outside Japan

Maintain Discipline, Quality, Solid Execution;

Guided by Life Planner Business Model Concepts

1)

The formal name for Life Consultant is Life Plan Consultant.

Tokyo Investor Day 9.18.2014

EXPANSION THROUGH

DIVERSIFICATION |

6

Timeline

Timeline

Acquisitions

Acquisitions

2001

•

Kyoei Life, Japan –

acquired in bankruptcy

•

Predecessor of today’s Gibraltar Life

2004

•

Aoba Life, Japan

•

Integrated into Prudential of Japan

2009

•

Yamato Life, Japan

•

Integrated into Gibraltar Life

2011

•

AIG Star Life & AIG Edison Life, Japan

•

Merged into Gibraltar Life in 2012

1)

Japan only.

2)

Foreign

denominated

activity

translated

to

U.S.

dollars

at

uniform

exchange

rates

for

all

periods

presented;

Japanese

yen

82

per

U.S.

dollar.

U.S.

dollar

denominated

activity

is

included

based

on

the

amounts

as

transacted

in

U.S.

dollars.

Tokyo Investor Day 9.18.2014

SUCCESSFUL TRACK RECORD

OF ACQUISITIONS AND BUSINESS

INTEGRATIONS Number of In Force

Policies

(1)

Annualized New

Business Premiums

(1),(2) |

21

30

39

48

51

55

1980

1990

2000

2010

2020

2030

Japanese

Population

55

and

Over

(1)

JAPAN DEMOGRAPHIC CHANGE

DRIVES GROWTH

OPPORTUNITIES FOR PRUDENTIAL

7

1)

In millions; population data for 1980, 1990, 2000 and 2010 from Japan Statistics

Bureau; estimated population in 2020 and 2030 from National Institute of

Population and Social Security Research.

Tokyo Investor Day 9.18.2014

•

Retirement income needs

•

Healthcare needs

•

Inheritance needs

We have an experienced agent force

poised for steady growth that can help

customers meet their evolving needs |

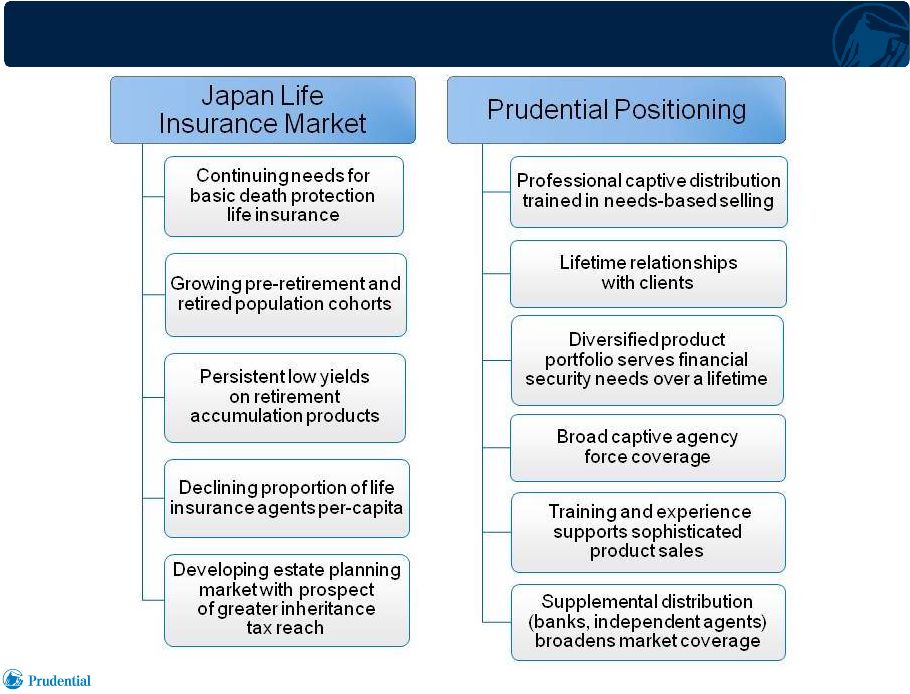

OPPORTUNITIES AND CHALLENGES

8

Opportunities Suited to

Prudential Strengths

•

Continued robust death protection

market

•

Japanese demographic trends lead

to growing retirement needs

•

Potentially significant Japanese

estate planning market

•

Persistent low yields on investments

available to Japanese retirement-

minded consumers contribute to

attraction of life insurance based

solutions

•

Product purchases with significant

wealth commitment require

sophisticated sales capabilities,

strong brand and reputation

Challenges

•

Changing currency translation rates,

managed by hedging programs

•

Expected gradual attrition of large

acquired blocks of business partly

offsets business growth

•

Potentially moderating pace of

policy size increases

•

Selectivity limits growth of Life

Planner force

Tokyo Investor Day 9.18.2014 |

JAPANESE INSURANCE OPERATIONS

MITSUO

KURASHIGE

CHIEF EXECUTIVE

OFFICER JAPAN LIFE INSURANCE OPERATIONS |

JAPANESE INSURANCE

MARKET

REMAINS

HIGHLY

ATTRACTIVE

FOR

PRUDENTIAL

2

Tokyo Investor Day 9.18.2014

Market Context

Market Context

Market Size

•

World’s second largest life insurance market:

Life premiums $423 billion

(1)

Household

Wealth

•

Household sector wealth ¥1,630 trillion ($15.8 trillion)

(2)

Investable

Asset Pool

•

¥864 trillion ($8.3 trillion) household pool of currency and deposits is

among the world’s largest

(2)

Retirement

Market

•

Expanding retirement market driven by aging population, increased

emphasis on individual responsibility for financial security

Product

Trend

•

Customers prefer insurance products to equities for savings

and investments

Distribution

Trend

•

Growing distribution opportunities include banks and independent

distributors

1)

Source: Swiss Re -

World Insurance in 2013, based on 2013 life insurance premiums.

2)

Based on March 31, 2014 data; Sources: Bank of Japan, Oanda. Japanese yen

translated to U.S. dollars at spot currency exchange rate as of March 31, 2014

(103 yen per USD). |

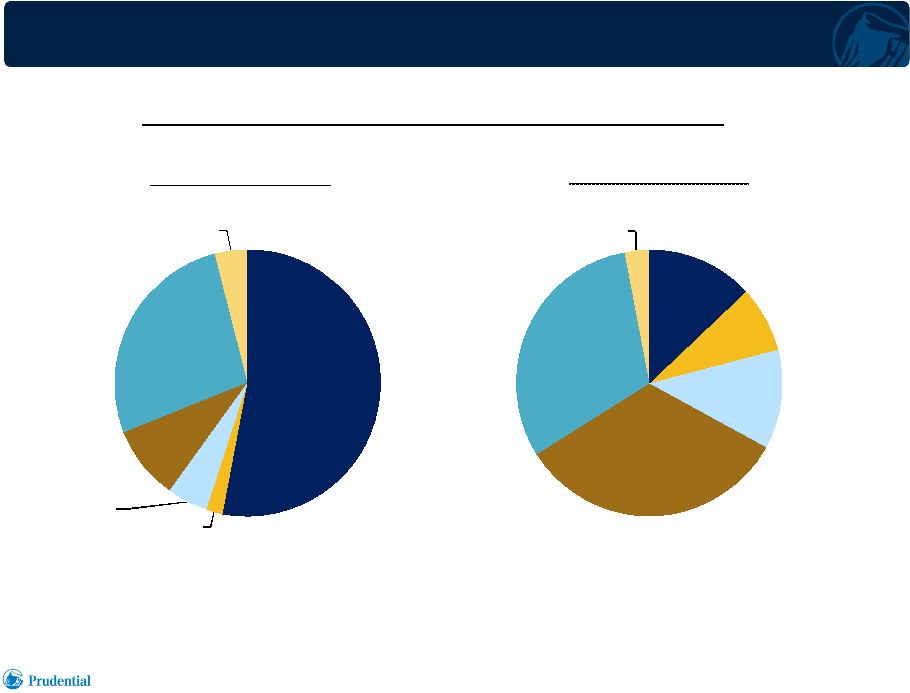

HOUSEHOLD SECTOR FINANCIAL ASSETS –

JAPAN AND THE UNITED

STATES Financial Assets of Japanese and U.S.

Households (1)

Japan

$15.8 Trillion

(2)

United States

$67.2 Trillion

1)

Sources: Japan: Bank of Japan (data as of March 31, 2014). U.S.:

Federal Reserve Statistical Release, Financial Accounts of the United States,

First Quarter 2014.

2)

Translated to U.S. dollars at spot currency exchange rate as of March 31, 2014

(Japanese yen 103 per U.S. dollar). 3

Tokyo Investor Day 9.18.2014

Currency and

deposits

53%

Bonds

2%

Investments

Trusts

5%

Equities

9%

Insurance and

Pension

Reserves

27%

Other

4%

Currency

and

deposits

13%

Bonds

8%

Investments

Trusts

12%

Equities

33%

Insurance

and Pension

Reserves

31%

Other

3% |

4

Tokyo Investor Day 9.18.2014

•

Japan is the second largest market in the world

•

Southeast Asia is growing fast, but the market size is still small (< 2% of

world) 2013 Life Insurance Premiums

(1)

($ billions)

1)

Source: Swiss Re. Based on 2013 life insurance premium volume, foreign denominated

activity translated to U.S. dollars at average exchange rates for

2013. World total life insurance premiums are $2,608 billion. This chart is

not inclusive of the remainder of Europe, Africa, Oceania and Canada. $533

$423

$80

$223

$160

$118

United States

Japan

Asia ex-

Japan

Latin

America

United

Kingdom

France

Italy

China

Korea

Taiwan

India

SE Asia

Other

$476

ATTRACTIVE MARKET FOR

PRUDENTIAL |

5

1)

Source: Company data published on individual company websites. Industry /

market share data excludes Japan Post Insurance. Twelve months ended March

31, 2014. 2)

Prudential’s premium income amount was adjusted down for internal reinsurance

transactions. •

New business face amount

•

Annualized new business premiums

•

In force face amount

•

Premium income

(2)

•

Total assets

Ranking Category

Rank

(1)

Prudential is a leading life insurer in Japan

10.3%

7.8%

7.5%

6.9%

5.3%

#3

#5

#5

#5

#5

Market Share

(1)

Tokyo Investor Day 9.18.2014

LEADING POSITION IN

ATTRACTIVE MARKET |

6

Tokyo Investor Day 9.18.2014

WELL POSITIONED TO

GROW IN EVOLVING JAPANESE MARKET |

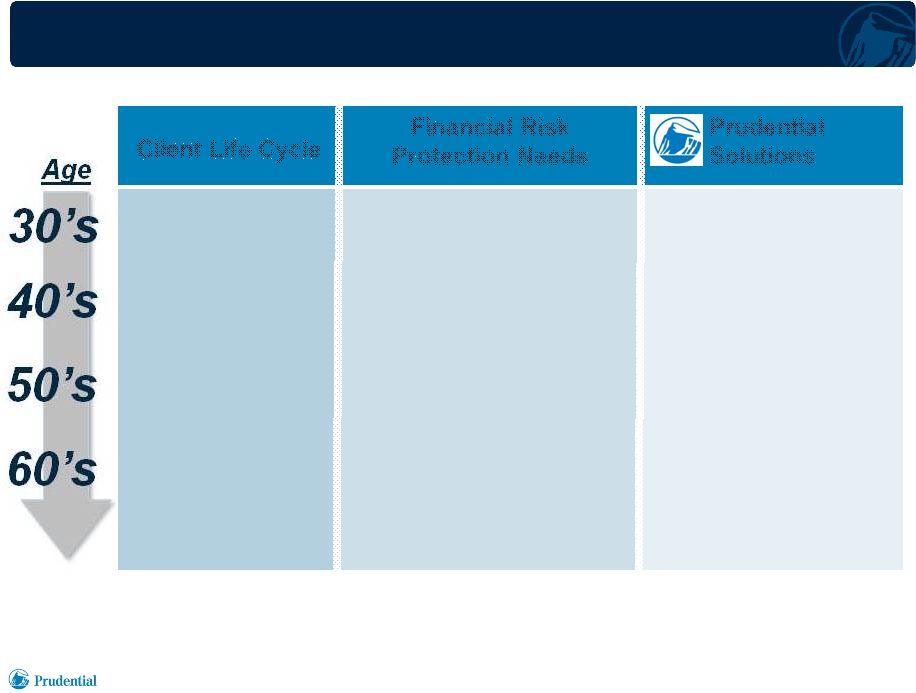

NEEDS-BASED SELLING OVER CUSTOMER’S LIFE CYCLE 7

Note: Specific needs and solutions will vary by customer.

Client

Life Cycle

Financial Risk

Protection Needs

Prudential

Solutions

Young household,

early professional

career

Mid career,

pre-retirement

Retirement

•

Premature death

income replacement

•

Income loss and expenses

due to accident or sickness

•

Accumulation of funds

for retirement

•

Lifetime retirement

income

•

Term insurance

•

Accident and health

policies and riders

•

Whole life insurance

•

Life insurance based

retirement income

products

Tokyo Investor Day 9.18.2014 |

8

Tokyo Investor Day 9.18.2014

Client Need

Client Need

Product Class

Product Class

Key Features

Key Features

Lower premium

premature death

protection

Term Insurance

•

Death protection for stated period

with level premiums

•

Optional third-sector protection riders

•

“Family Income”: protection declines as

income earning years elapse

Death protection

with savings feature

Whole Life

•

Death protection

•

Embedded savings fund

•

Guaranteed crediting rate

•

Optional third-sector protection riders

Retirement

accumulation

and income

Retirement

•

Death protection in working years

•

Retirement accumulation fund

•

Policy paid-up at retirement age

•

Annuitization options

•

Optional third-sector protection riders

PRODUCT PORTFOLIO: HOW

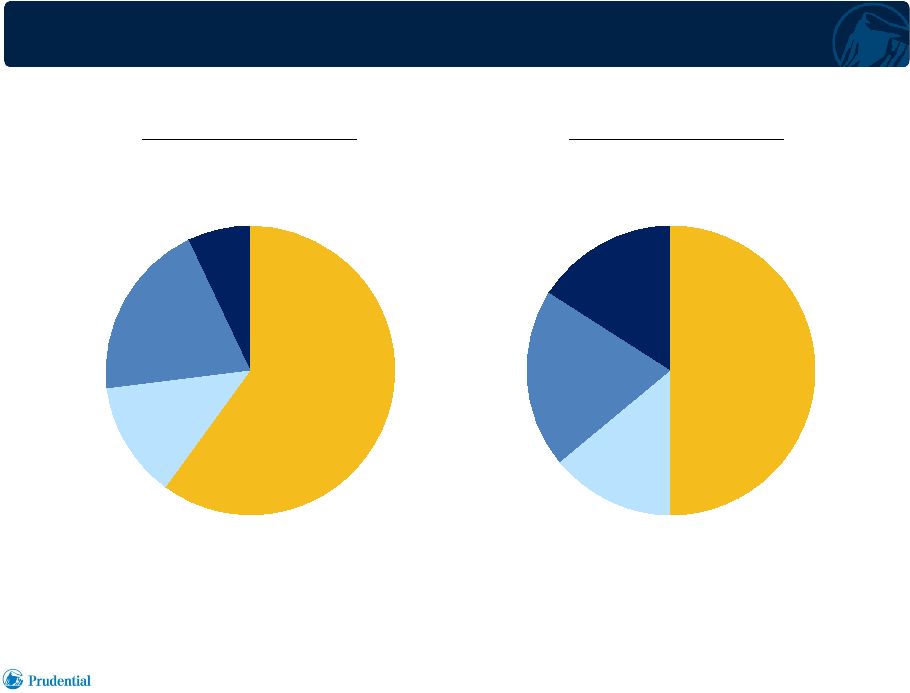

CUSTOMER NEEDS ARE MET |

Death

Protection

46%

Accident &

Health

14%

Retirement

27%

Savings

13%

Death

Protection

52%

Accident &

Health

Retirement

22%

Savings

19%

9

1)

In millions; for years ended December 31; Japan only.

2)

Foreign

denominated

activity

translated

to

U.S.

dollars

at

uniform

exchange

rates

for

all

periods

presented;

Japanese

yen

82

per

U.S.

dollar.

3)

Includes annuities and yen based bank channel single premium whole life

(SPWL). 2013 Annualized

New

Business

Premiums

$2,773

Tokyo Investor Day 9.18.2014

2009 Annualized

New

Business

Premiums

$1,252

(3)

(3)

Bank

SPWL

7%

(1),(2)

(1),(2)

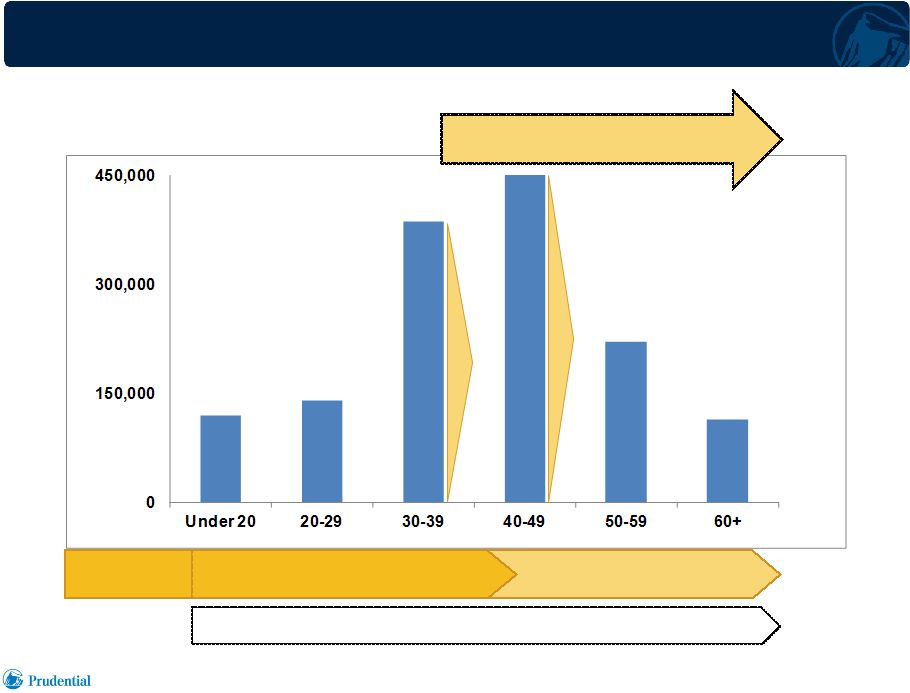

EMPHASIS ON PROTECTION

PRODUCTS |

Death

Protection

50%

Accident

& Health

14%

Retirement

20%

Savings

16%

10

1)

In millions; as of December 31. Annualized premiums in force, including

paid-up policies and 10% of single premium. Japan only. 2)

Foreign

denominated

activity

translated

to

U.S.

dollars

at

uniform

exchange

rates

for

all

periods

presented;

Japanese

yen

82

per

U.S.

dollar.

3)

Includes annuities and yen based bank channel single premium whole life.

2009

Premiums

In

Force

$9,902

Tokyo Investor Day 9.18.2014

2013

Premiums

In

Force

$15,911

Death

Protection

60%

Accident &

Health

13%

Retirement

20%

Savings

7%

(3)

(3)

(1),(2)

(1),(2)

EMPHASIS ON PROTECTION

PRODUCTS |

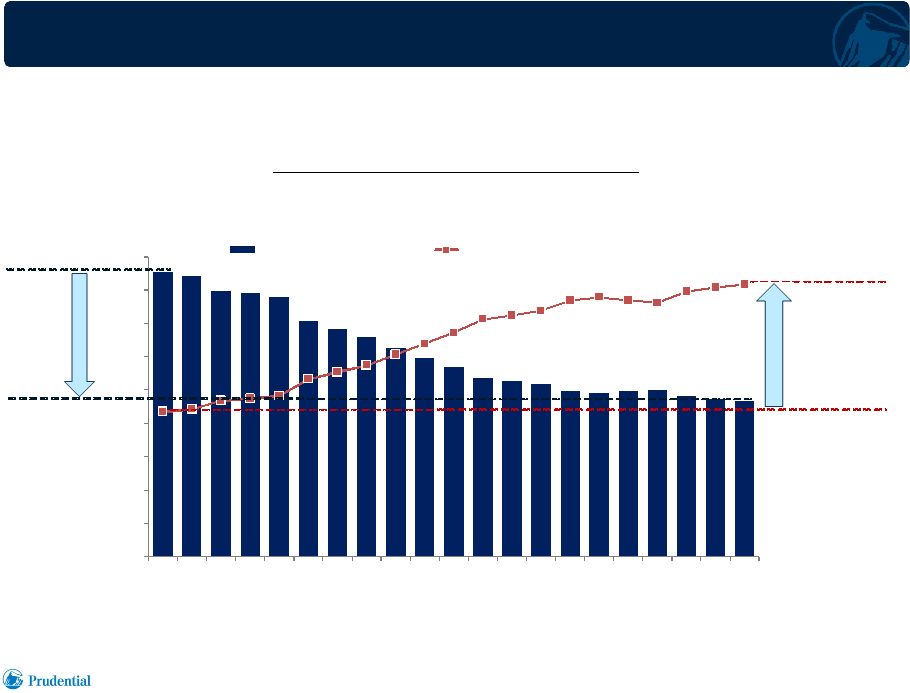

1980

1990

2000

2010

2020

2030

117

124

127

128

124

117

Japanese Population 55 and over

17.7%

11

Tokyo Investor Day 9.18.2014

1)

Population

data

for

1980,

1990,

2000,

and

2010

from

Japan

Statistics

Bureau;

estimated

population

in

2020

and

2030

from

National

Institute

of

Population

and

Social Security Research.

Total Population

Total Population

(in millions)

(in millions)

23.8%

30.4%

37.4%

41.3%

46.7%

(1)

GROWING RETIREMENT

OPPORTUNITY COMPLEMENTS DEATH PROTECTION MARKET |

45%

50%

55%

30%

35%

40%

45%

50%

55%

60%

¥200m -

¥300m

¥300m -

¥600m

Over ¥600m

12

Tokyo Investor Day 9.18.2014

Reduced Basic Exemptions

Higher Inheritance Tax Rates

January

January

2015

2015

inheritance

inheritance

tax

tax

change

change

expected

expected

to

to

expand

expand

tax

tax

reach

reach

to

to

approximately

approximately

20%

20%

of

of

urban

urban

population,

population,

from

from

current

current

national

national

average

average

of

of

about

about

5%

5%

•

Death protection coverage to fund inheritance tax

payment, with benefit amount targeted to expected tax

•

Lifetime gifting through recurring premiums can reduce

estate subject to tax

•

Beneficiary designations can facilitate estate division

•

Needs-based selling opportunity

Prudential Solution:

Recurring Premium

Whole Life

DEVELOPING ESTATE PLANNING

MARKET IN JAPAN |

13

Tokyo Investor Day 9.18.2014

•

Affluent and mass

affluent consumers

•

Business and

professional market

•

Mass middle-market

•

Affinity group relationships

•

Bank clients with investable

wealth, under-served

protection needs

•

Business and

professional market

Life Planners

Life Planners

Life

Life

Consultants

Consultants

Bank

Bank

Channel

Channel

Independent

Independent

Agency

Agency

Channel

Channel

TARGETED

DISTRIBUTION

SERVING

THE

JAPANESE

MARKET |

Industry

agent

count

declined

45%

Number

of

Life

Insurance

Captive

Agents

14

1)

Source: Japan Institute of Life Insurance. Data as of March 31 for each indicated

year. Some former captive agents continue their career in the life insurance

industry as independent sales agents.

•

Fewer captive agents to meet customer needs

Tokyo Investor Day 9.18.2014

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

450,000

1993

1995

1997

1999

2001

2003

2005

2007

2009

2011

2013

Number of captive agents

Population per captive agent

Captive agents

546

291

(1)

Population

per agent

increased

88%

JAPAN INDUSTRY

– NUMBER OF CAPTIVE AGENTS |

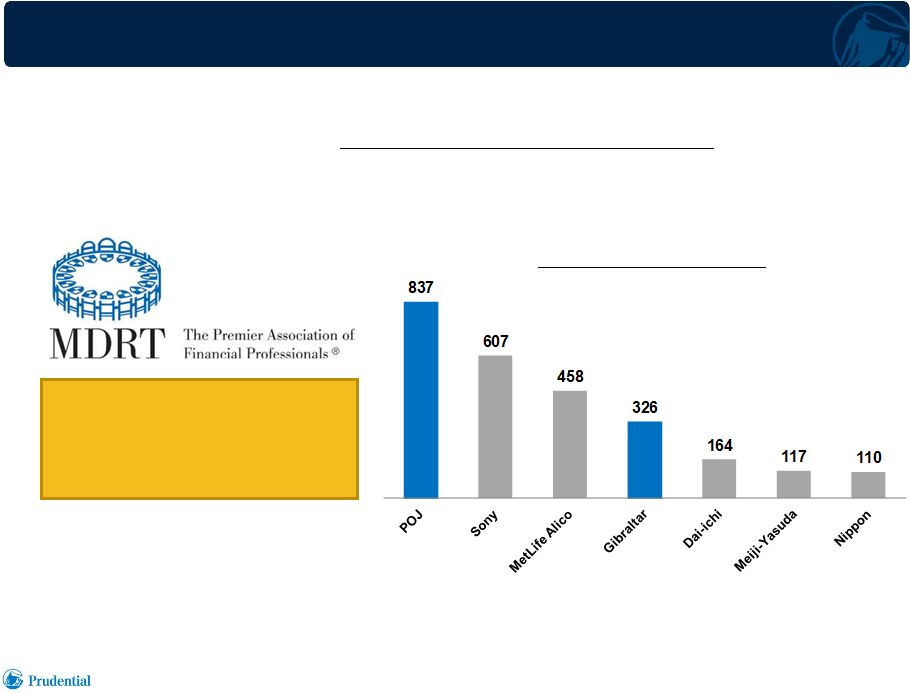

15

1)

Source:

Million

Dollar

Round

Table

Association,

Japan

-

membership

data

as

of

April

14,

2014.

Total

membership

3,680.

MDRT

Japan

Membership

~ One Third of all

MDRT members in Japan

are from

POJ and Gibraltar

(1)

•

Industry leading Million Dollar Round Table memberships

•

Prudential of Japan has the highest number of MDRT members

in the Japanese

industry for 17 consecutive years

(1)

Tokyo Investor Day 9.18.2014

(1)

QUALITY PEOPLE

|

•

Supplement core production by captive distribution

•

Opportunistic

generation

of

profitable

business

by

meeting

needs

of

market segments not fully penetrated by captive distribution

•

Continue emphasis on protection products, adapting to

specialized markets

16

Tokyo Investor Day 9.18.2014

OUR APPROACH TO THIRD

PARTY DISTRIBUTION

Independent

Agency

Banks

Commenced

fixed annuity

distribution, 2006

Commenced

insurance

product

distribution, 2008

Commenced

distribution, 2010

Added

Star/Edison

relationships,

2011 |

•

Sales can be volatile due to

changes in interest rates and

competitor actions

•

Less influence over distribution

•

Profitability can vary with

changes in product mix

•

Manage to bottom line, not

top line

•

Balance profitability and

business mix

17

•

Enhances access to expanded

customer base and investable

wealth

•

Growth potential through

development of distribution

relationships

•

Competitive product portfolio

meets customer needs

•

Strong brand name attracts

security focused customers

•

Leverages infrastructure costs

Advantages

Challenges

Tokyo Investor Day 9.18.2014

THIRD PARTY DISTRIBUTION

CHANNELS |

THIRD PARTY DISTRIBUTION CHANNELS

COMPLEMENT CORE

CAPTIVE AGENT PRODUCTION

18

1)

Foreign

denominated

activity

translated

to

U.S.

dollars

at

uniform

exchange

rates

for

all

periods

presented,

Japanese

yen

82

per

U.S.

dollar.

Japan Annualized New Business Premiums

(1)

Tokyo Investor Day 9.18.2014

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

2009

2010

2011

2012

2013

Life Planner (POJ)

Life Consultant

Bank

Independent Agency

($ millions)

1,252

1,633

2,776

3,612

2,773 |

PRUDENTIAL OF JAPAN SHOICHIRO ICHITANI

PRESIDENT AND

CHIEF EXECUTIVE

OFFICER PRUDENTIAL OF

JAPAN |

2

(¥

in billions)

1)

Prudential

of

Japan

(POJ).

As

of

March

31;

year

represents

a

fiscal

year

beginning

on

April

1

of

the

year

and

ending

on

March

31

of

the

following

year.

2)

In

force

face

amount

in

U.S.

dollars

is

translated

at

spot

rate

at

the

end

of

each

fiscal

year.

Tokyo Investor Day 9.18.2014

(1),(2)

HISTORY OF POJ IN FORCE FACE AMOUNT |

KEY DRIVERS

2009

2009

2010

2010

2011

2011

2012

2012

2013

2013

Annualized Premium Productivity

(1)

$17,441

$19,494

$21,638

$26,314

$22,636

Policy Count Productivity

(2)

7.0

6.9

6.9

7.4

7.3

Life Planner Retention

(3)

-

Initial Year

78.7%

79.7%

80.7%

82.1%

85.2%

Policy Persistency

(4)

95%

95%

95%

95%

95%

3

1)

Annualized

new

business

premiums

per

month

for

each

Prudential

of

Japan

Life

Planner;

foreign

denominated

activity

translated

to

U.S.

dollars

at

uniform

exchange

rates

for

all

periods

presented,

Japanese

yen

82

per

U.S.

dollar.

2)

Number

of

policies

sold

per

Prudential

of

Japan

Life

Planner,

per

month;

includes

medical

and

cancer

policies.

3)

Percentage

of

Prudential

of

Japan

Life

Planners

remaining

at

end

of

period

hired

12

months

earlier,

based

on

rolling

average

for

indicated

years.

4)

Prudential

of

Japan

13

month

policy

persistency

based

on

face

amount;

12

month

rolling

average

data

through

December

31.

Tokyo Investor Day 9.18.2014 |

PRUDENTIAL OF JAPAN

SALES TRACK

RECORD 4

Annualized New Business Premiums

(1)

Tokyo Investor Day 9.18.2014

1)

Foreign

denominated

activity

translated

to

U.S.

dollars

at

uniform

exchange

rates

for

all

periods

presented,

Japanese

yen

82

per

U.S.

dollar.

($ millions)

800 |

5

Tokyo Investor Day 9.18.2014

CORE

VALUES |

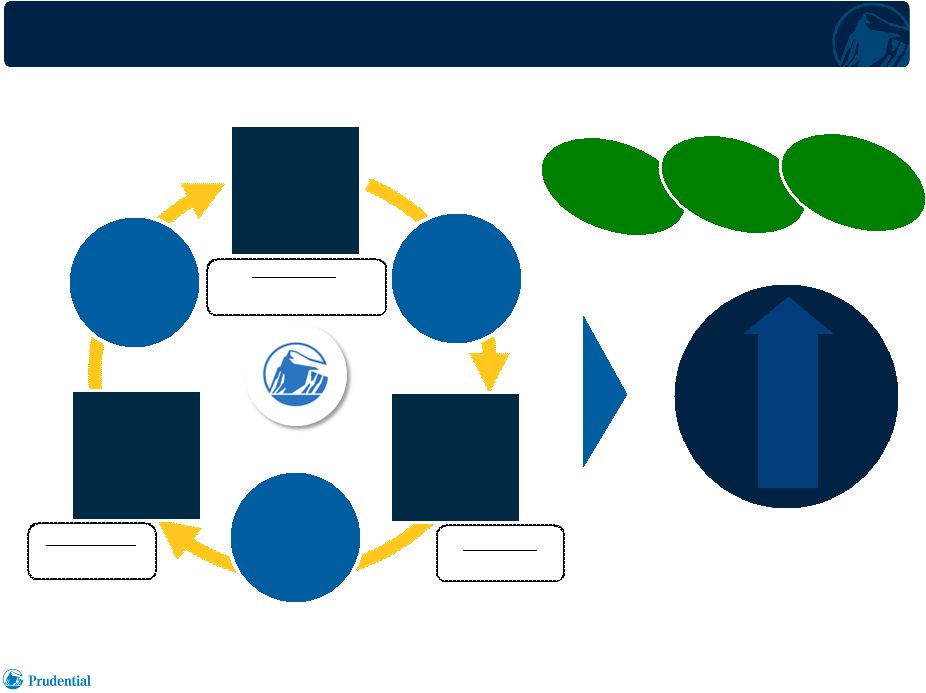

BENEFICIAL CYCLE OF LIFE PLANNER MODEL

6

Tokyo Investor Day 9.18.2014

1)

Data based on 2013 POJ. Annualized new business premiums (AP) produced by

each Life Planner (LP) in a month; foreign denominated activity translated to

U.S. dollars at uniform exchange rate, Japanese yen 82 per U.S. dollar. Number of

new policies sold per LP per month, including medical policies. Total retention

for agents in all service years. 13 month policy persistency measured based

on face amount, 12 month rolling average data for 2013. Superior

Returns &

Steady

Growth

High Income

High Income

for Life

for Life

Planner

Planner

Quality

Quality

Referrals

Referrals

Productivity

$22,636 AP per LP month

7.3 policies per LP month

High Life

High Life

Planner

Planner

Retention

Retention

High Life

High Life

Planner

Planner

Productivity

Productivity

High Policy

High Policy

Persistency

Persistency

Quality

Quality

People

People

Quality

Quality

Products

Products

Quality

Quality

Service

Service

High

High

Customer

Customer

Satisfaction

Satisfaction

Retention

89.6%

(1)

Persistency

95.2%

(1)

(1) |

QUALITY PEOPLE –

•

Life

Planner’s

Commitment

as

Entrepreneur

•

Life

Planner’s

Business

Vision

&

Mission

•

Life

Planner’s

Development

7

Tokyo Investor Day 9.18.2014

RECRUITING AND DEVELOPMENT

|

QUALITY SERVICE 8

1)

Life

Support

Insurance

segment

of

J.D.

Power

Asia

Pacific

2011

-

2014

Japan

Life

Insurance

Contract

Customer

Satisfaction

Studies

SM

.

Contract

Customer

Satisfaction

Study

based

on

a

total

of

4,647

life

insurance

policyholders

who

purchased

or

renewed

coverage

during

the

past

year.

japan.jdpower.com

2)

13

month

policy

persistency

measured

based

on

face

amount.

Rolling

average

of

12

months

experience

ending

at

December

31,

2011,

2012,

2013

and

June

30,

2014.

•

According to J.D. Power Asia Pacific, Prudential of Japan is the

highest in

customer satisfaction

(1)

for four years in a row

•

Satisfied customers drive high policy persistency

#1

#1

#1

#1

2011

2012

2013

2014

Tokyo Investor Day 9.18.2014

Customer

Satisfaction

(1)

POJ Policy

Persistency

(2)

95%

95%

95%

95% |

QUALITY PRODUCTS

MEETING FINANCIAL

SECURITY NEEDS OVER A LIFETIME

Age

High Net Worth Market

Business Insurance Market

Individual Insurance Market

20’s –

40’s

50’s –

60’s+

Tokyo Investor Day 9.18.2014

9

Death

Protection

Owner

Planning for

Post-Retirement

Employee Benefit

Program Funding

Sophisticated

Estate Planning

Business

Succession

Family

Distribution of

Inheritances

Nursing,

Medical Care |

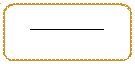

Future

Retirement Sales Opportunity Insured

Clients

(1)

Death Protection

Primary

Client Focus

Retirement Income Security

LIFETIME CLIENT

RELATIONSHIPS PROVIDE SIGNIFICANT OPPORTUNITY FOR RETIREMENT ORIENTED SALES

Age Group

1)

As of August 2014.

Tokyo Investor Day 9.18.2014

10

Inheritance Opportunity |

11

1)

Data

based

on

Prudential

of

Japan

sales

to

individual

market;

foreign

denominated

activity

translated

to

U.S.

dollars

at

uniform

exchange

rates;

Japanese

yen

82

per

U.S.

dollar.

LIFETIME CLIENT

RELATIONSHIPS DRIVE SUBSEQUENT SALES OPPORTUNITIES

Annualized New Business Premiums

(1)

POJ Second Sales to Existing Customers

($ millions)

117

121

145

191

152

Tokyo Investor Day 9.18.2014 |

SUMMARY 12

•

High Productivity

•

High Retention

•

High Persistency

Tokyo Investor Day 9.18.2014

Superior Returns

and

Steady Growth |

GIBRALTAR LIFE KEI

SATO PRESIDENT AND CHIEF EXECUTIVE OFFICER

GIBRALTAR LIFE

|

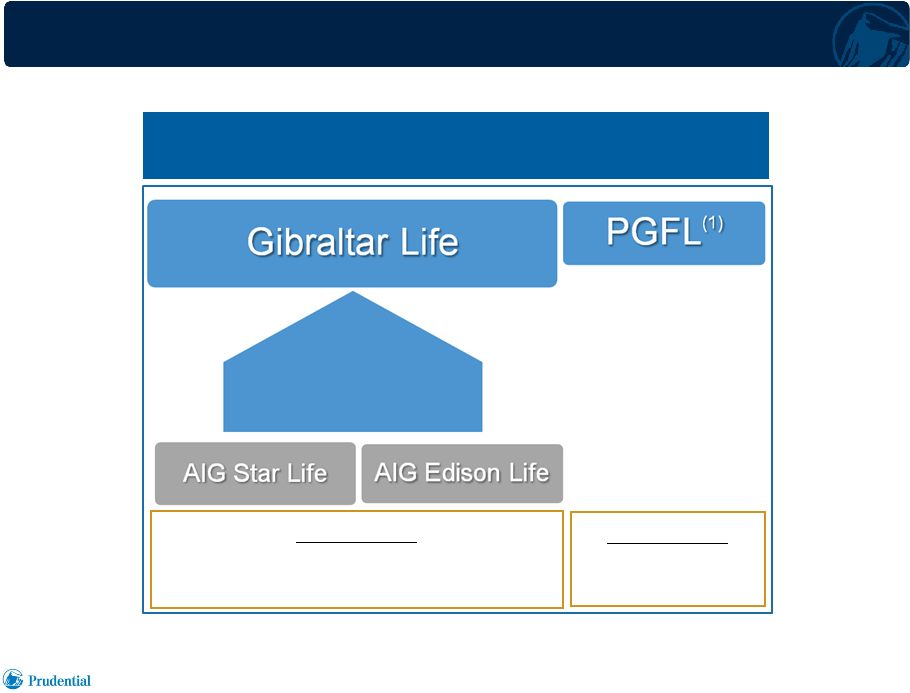

Tokyo

Investor Day 9.18.2014 Consolidated

Consolidated

Gibraltar Life

Gibraltar Life

Distribution

•

Life Consultants

•

Independent Agencies

Legal Entity Merger,

January 2012

GIBRALTAR LIFE

OVERVIEW 2

Distribution

•

Bank Channel

1)

Prudential Gibraltar Financial Life. |

LIFE CONSULTANT DISTRIBUTION

COMPLEMENTED BY THIRD PARTY

CHANNELS 2013 Sales

(1),(2)

$1.9 billion

2013 Number of Policies In Force

(3)

7.3 million

1)

Annualized new business premiums.

2)

Foreign denominated activity translated to U.S. dollars at uniform exchange rate;

Japanese yen 82 per U.S. dollar. 3)

As of end of period.

Tokyo Investor Day 9.18.2014

Life Consultants

Banks Independent Agencies

3

45%

43%

12%

88%

6%

6% |

PRODUCT PORTFOLIO HOW

CUSTOMER NEEDS ARE MET

Customer

Segment

Primary

Customer

Needs

Product

Solution

Distribution

Tokyo Investor Day 9.18.2014

4

Middle-market

Affinity groups

Life Consultant

Life Consultant

Channel

Channel

Death protection

Retirement

Whole life & Term

Retirement income

USD products

Accident & Health

Multi-currency fixed

annuities

Third Party Channels

Third Party Channels

Independent Agency

Independent Agency

Upper middle-market

Business and

professional market

Death protection

Retirement

Business planning

Savings

Whole life & Term

Retirement income

USD products

Accident & Health

Multi-currency fixed

annuities

Bank

Bank

High net worth

Business and

professional market

Death protection

Retirement

Business planning

Savings

Whole life & Term

Retirement income

USD products

Multi-currency fixed

annuities |

GIBRALTAR KEY BUSINESS PHILOSOPHIES

5

Tokyo Investor Day 9.18.2014

•

Stay focused on death protection products for customers with needs-

based approach

•

Differentiate based on “Three Qualities”

–

Quality People

–

Quality

Products

–

Quality Services

•

Maintain “C = C”

principle

–

“Contribution = Compensation” |

MAJOR BUSINESS INTEGRATION INITIATIVES

6

Tokyo Investor Day 9.18.2014

•

Active management of the sales force, by introducing proven training

and compensation approaches

•

Integration of systems

•

Integration of product lineups

•

Integration of investment portfolios

•

Strengthening of risk management and internal controls

|

7,400

6,700

6,400

7,400

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

2010

2011

2012

2013

Life Consultant Count

Life Consultant AP Productivity

LIFE CONSULTANT

DISTRIBUTION NUMBER AND PRODUCTIVITY 7

Tokyo Investor Day 9.18.2014

1)

Foreign

denominated

activity

translated

to

U.S.

dollars

at

uniform

exchange

rates

for

all

periods

presented;

Japanese

yen

82

per

U.S.

dollar.

Annualized

new

business

premium

(AP)

per

Life

Consultant

per

month.

2)

At

end

of

period.

Life

Consultant

Count

&

AP

Productivity

(1)

Life Consultant Count

(2)

Life Consultant productivity has returned to

Life Consultant productivity has returned to

pre-Star/Edison acquisition levels

pre-Star/Edison acquisition levels

AP Productivity |

4,300

4,700

$3,800

$4,000

$4,200

$4,400

$4,600

$4,800

$5,000

$5,200

2012

2013

LIFE CONSULTANT

DISTRIBUTION PRODUCTIVITY OF

NEW LIFE CONSULTANTS

8

Tokyo Investor Day 9.18.2014

1)

Foreign

denominated

activity

translated

to

U.S.

dollars

at

uniform

exchange

rates

for

all

periods

presented;

Japanese

yen

82

per

U.S.

dollar.

Annualized

new

business

premium

per

Life

Consultant

per

month.

2)

Life

Consultants

working

for

Gibraltar

Life

less

than

two

years.

AP Productivity

(1)

of New Life Consultants

(2)

New Life Consultants: Productivity has also Increased

New Life Consultants: Productivity has also Increased |

PROFILE OF A SUCCESSFUL LIFE CONSULTANT

•

Proven training and compensation approaches

•

Steady and continuous activity in our major affinity group markets

•

Networking among customers/community

9

Tokyo Investor Day 9.18.2014

Recruiting based on our experiences –

Recruiting based on our experiences –

High-educational background, Sales experience, etc.

High-educational background, Sales experience, etc.

|

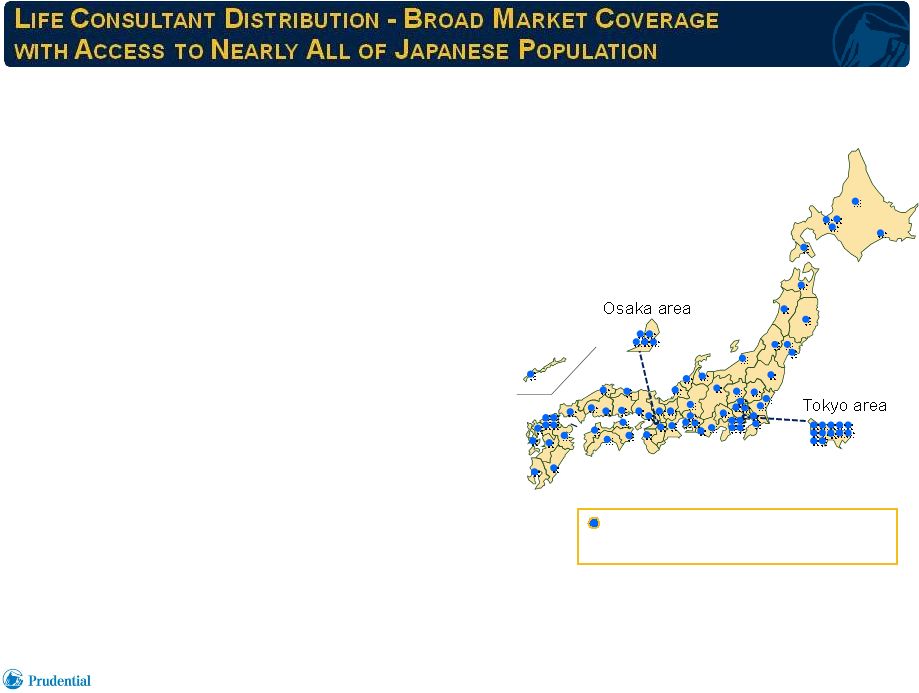

10

83 branch offices

supporting

Life

Consultants

(1)

•

Branch offices established in substantially

all prefectures

•

Prudential training supports emphasis on

death protection products and needs-based

selling

•

Serving expanding need for retirement

income security products

•

Teachers Association and other affinity

group relationships provide recurring

sources of new business

1)

As of April 1, 2014.

Tokyo Investor Day 9.18.2014 |

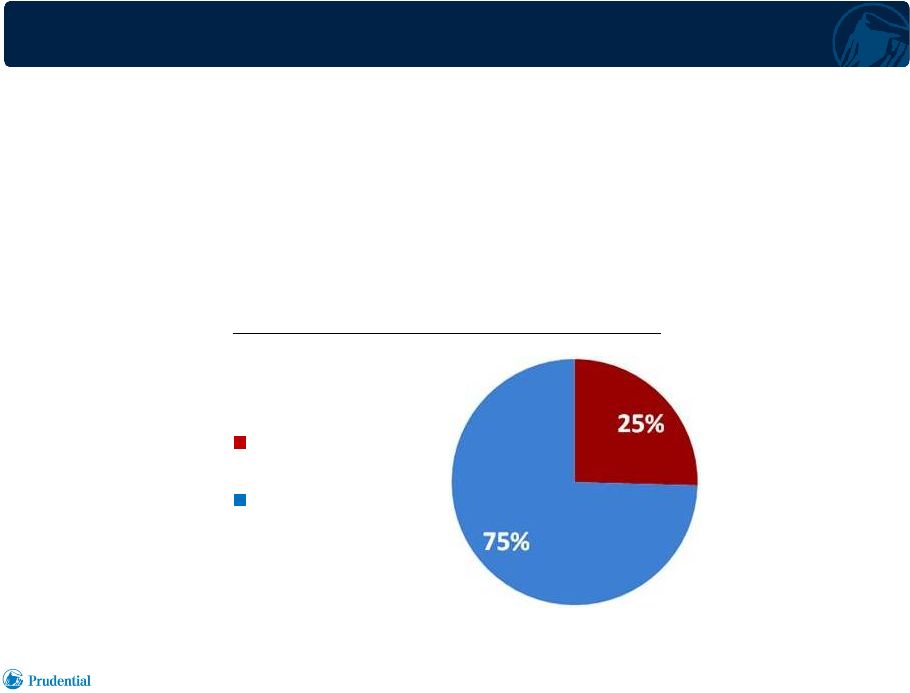

•

Teachers market remains a primary and stable source of business for Gibraltar

•

Approximately one-quarter of Life Consultant channel new business is

derived from this market

•

Perennial source of sales through teacher career spans

–

Protection products to entering and active teachers

–

Retirement products for lump-sum recipients

LIFE CONSULTANT

CHANNEL KEY

DRIVER –

TEACHERS MARKET

2013 Annualized New Business Premiums

(1)

Tokyo Investor Day 9.18.2014

11

1)

Foreign

denominated

activity

translated

to

U.S.

dollars

at

uniform

exchange

rates;

Japanese

yen

82

per

U.S.

dollar.

Teachers

Market

Other Life

Consultant

Sales |

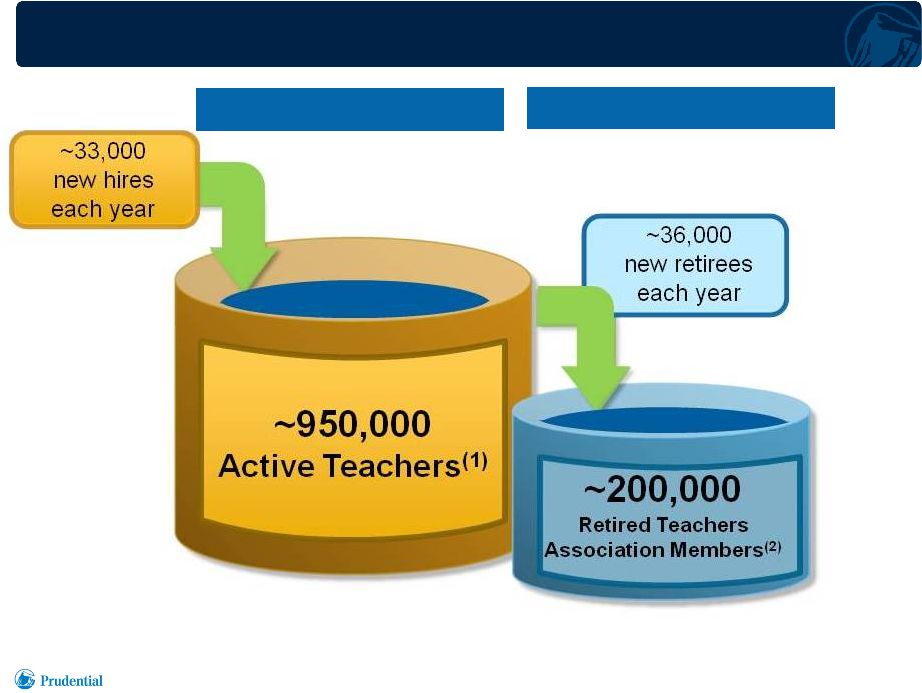

BROAD COVERAGE OF TEACHERS MARKET

12

Tokyo Investor Day 9.18.2014

Approximately

Life Consultants

(1)

Approximately

Public schools nationwide

(2)

1)

As of May 1, 2014.

2)

As

of

May

1,

2013,

Source:

Japan

Ministry

of

Education,

Culture,

Sports,

Science

and

Technology,

and

Japanese

Educational

Mutual

Aid

Association

of

Welfare

Foundation.

Includes

support

employees

of

public

schools.

Approximately

Public school

teachers nationwide

(2)

Japanese Educational Mutual Aid

Japanese Educational Mutual Aid

Association of Welfare Foundation

Association of Welfare Foundation

5,000

35,000

950,000 |

TEACHERS ASSOCIATION:

PERENNIAL SALES

OPPORTUNITIES 1)

As

of

May

1,

2013,

Source:

Japan

Ministry

of

Education,

Culture,

Sports,

Science

and

Technology,

and

Japanese

Educational

Mutual

Aid

Association

of

Welfare

Foundation.

Includes

support

employees

of

public

schools.

2)

As of May 1, 2014.

Active Market

Retiree Market

13

Tokyo Investor Day 9.18.2014 |

INDEPENDENT AGENCY CHANNEL

A DIFFERENTIATED STRATEGY

Key strategies

•

Focus on “Quality”

not just top-line growth

•

Price competition is not our key to winning sales

•

Strong partnership with high performing agencies

Key success factors

•

Develop highly-motivated agencies and producers who subscribe to

our business approach

•

Develop and train qualified marketing representatives to work

with agencies

Tokyo Investor Day 9.18.2014

14 |

3,419

3,393

3,352

3,248

2,882

2,646

2,685

2,687

37

52

47

76

55

60

67

80

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

3Q 2012

4Q 2012

1Q 2013

2Q 2013

3Q 2013

4Q 2013

1Q 2014

2Q 2014

Number of Agency Relationships

Annualized New Business Premiums

INDEPENDENT AGENCY CHANNEL

GROWING PRODUCTIVITY

15

Number of Agency Relationships and

Annualized New Business Premiums

Tokyo Investor Day 9.18.2014

1)

Foreign

denominated

activity

translated

to

U.S.

dollars

at

uniform

exchange

rates

for

all

periods

presented;

Japanese

yen

82

per

U.S.

dollar.

Number

of

agency

relationships

is

as

of

the

end

of

each

quarter.

Annualized New

Business Premiums

($ millions)

Number of Agency

Relationships

(1) |

BANCASSURANCE IN JAPAN TAKESHI TANIGAWA

PRESIDENT AND CHIEF

EXECUTIVE OFFICER PRUDENTIAL GIBRALTAR FINANCIAL LIFE |

•

Japanese household wealth is concentrated among older households

with substantial bank balances

•

Continuing flow of funds through proceeds of investments (e.g.

Japanese government bonds) and maturing annuities

•

Bancassurance has expanded Japan’s life insurance market

2

Tokyo Investor Day 9.18.2014

BANCASSURANCE MARKET IN JAPAN Demographic Structure of Japan

Demographic Structure of Japan

(1)

(1)

(Total population: 127 million)

(Total population: 127 million)

Household Wealth

Household Wealth

(2)

(2)

($15.8 trillion)

($15.8 trillion)

Aged 50 years

old and over

57 million

(45%)

$13.3 trillion

(84%)

Aged less than

50 years old

70 million

(55%)

$2.5 trillion

(16%)

1)

Source:

Final

figures

as

of

February

1,

2014,

released

by

the

National

Institute

of

Population

and

Social

Security

Research.

2)

Compiled

by

Prudential

based

on

Bank

of

Japan’s

“Flow

of

Funds

Accounts”

(as

of

the

end

of

March

2014)

and

Statistics

Bureau,

Ministry

of

Internal

Affairs

and

Communications’

“Family

Income

and

Expenditure

Survey”.

Japanese

yen

translated

to

U.S.

dollars

at

spot

currency

exchange

rate

as

of

March

31,

2014

(103

yen

per

U.S.

dollar).

Bank’s main

customers |

EMERGING OPPORTUNITY FOR THE BANCASSURANCE MARKET •

Tax system revision effective January 1, 2015

–

More people will be subject to inheritance tax payment

•

People place high confidence in banks for estate planning consultation

–

Highly promising for life insurance sales as inheritance solutions

3

Tokyo Investor Day 9.18.2014

As of 2012

As of 2012

(1)

(1)

After tax law revision

After tax law revision

(2)

(2)

(January, 2015)

(January, 2015)

National

Average

4.1%

~ 6%

Tokyo

7.0%

~ 20%

Percentage of People Subject to Inheritance Tax Payment

1)

Tokyo Regional Taxation Bureau “State of inheritance tax return”.

2)

Ratio of taxable persons after tax system revision:

Survey by Legacy, tax accounting firm, published in 2013.

|

PRUDENTIAL’S BANK CHANNEL BUSINESS STRATEGY

Product Class

Product Class

(Customer needs)

(Customer needs)

Market

Market

Characteristics

Characteristics

Prudential Bank

Prudential Bank

Channel Strategies

Channel Strategies

Protection Products

(Survivor benefits, wealth

transfer by inheritance)

•

Bank channel sales of

insurance products are

challenging absent solid

support and expertise

•

Provide full sales support

through skilled personnel

•

Quality products suited

to bank channel clients

Savings Products

(Investment goals)

•

Similarity to mutual funds and

other financial products allows

relatively simple sales

•

Sales are largely driven by

price competition

•

Expect sales to reflect

market growth and

competitive landscape

•

Ensure appropriate pricing

4

Tokyo Investor Day 9.18.2014

Emphasis on protection products with differentiated approach

Emphasis on protection products with differentiated approach

supports high quality sales at attractive margins

supports high quality sales at attractive margins |

BUSINESS BASE OF BANK CHANNEL RELATIONSHIPS

•

Partner

relationships

with

all

of

the

Mega

Banks

and

Major

Trust

Banks

(7

banks

in

total)

5

1)

As of August 1, 2014.

2)

Number of banks/institutions in which Prudential

products are offered.

3)

Japanese yen translated to U.S. dollars at spot

currency exchange rate as of March 31, 2014

(yen 103 per U.S. dollar).

4)

Includes Resona Bank.

Prudential Distribution

Partners

(1),(2)

Deposits, etc

(3)

(Trillion

USD) Mega Bank

(4)

4/4

$3.0

Major Trust Bank

3/3

$1.3

Regional bank, etc.

53

$1.6

Brokerage firm

1

$0.9

Total

61

$6.8

Tokyo Investor Day 9.18.2014 |

BUSINESS BASE OF BANK CHANNEL

PRODUCT LINE-UP (1)

•

Offering a comprehensive product line-up in Bancassurance with

emphasis on protection products

6

Tokyo Investor Day 9.18.2014

Annuity

Single pay

annuities

USD, EUR,

AUD, Yen

Variable

individual

annuities

(2)

USD

Whole Life

Single pay

whole life

insurance

USD, EUR,

AUD, Yen

Whole life

insurance

Yen, USD

Retirement

Retirement

income

insurance

USD

Term

Family

income

insurance

Yen

Level term

insurance

Yen

Increasing

term

insurance

Yen

Cancer

Whole life

cancer

insurance

Yen

Increasing

whole life

insurance

Yen

1)

As of June 30, 2014.

2)

Products available in portfolio; sales not significant.

|

BANK CHANNEL SALES SUPPORT

PRUDENTIAL’S DIFFERENTIATED APPROACH 7

With more than 7 years since Japan’s full deregulation of

With more than 7 years since Japan’s full deregulation of

Bancassurance in 2007, Prudential

Bancassurance in 2007, Prudential

has developed substantial marketing expertise and

has developed substantial marketing expertise and

skilled employees to serve the Bank Channel

skilled employees to serve the Bank Channel

Sales personnel

Sales personnel

Role

Role

Headcount

Headcount

(1)

(1)

Wholesaler

•

Provide sales support to bank

employees

~120

Insurance

Consultant

(secondment)

•

Sell insurance products at banks where

“seconded”

•

Provide training to bank employees

~210

(2)

Training

Specialist

•

Provide customized training

~10

1)

As of June 30, 2014.

2)

At certain banks.

Tokyo Investor Day 9.18.2014 |

PRUDENTIAL’S INSURANCE CONSULTANT

“SECONDMENT”

MODEL

•

Experienced Life Planners “seconded”

as Insurance Consultants to

partner with banks, directly bringing strength of Prudential’s distribution

model to bank channel

(1)

–

Insurance Consultants bring accumulated expertise in insurance sales

to the table

–

Sell insurance policies directly to bank customers

–

Train bank employees so that they can conduct sales on their own

8

Growth of Insurance Consultant –

Secondment Model

People

1)

At certain banks; at end of period.

Tokyo Investor Day 9.18.2014

0

50

100

150

200

250

2007

2008

2009

2010

2011

2012

2013

Jun

2014 |

BANK CHANNEL SALES TRACK RECORD

9

1)

Foreign

denominated

activity

translated

to

U.S.

dollars

at

uniform

exchange

rates

for

all

periods

presented;

Japanese

yen

82

per

U.S.

dollar.

Annualized New Business Premiums

(1)

($ millions)

Tokyo Investor Day 9.18.2014

Yen-based bank channel single premium whole life (limited death benefit)

product All Other Products

22

56

138

339

587

1,386

817

$0

$500

$1,000

$1,500

2007

2008

2009

2010

2011

2012

2013 |

IN CONCLUSION…

10

Our goal is to realize the full potential for bancassurance

distribution of life insurance protection products in Japan

Bancassurance

Bancassurance

= Investment

= Investment

(Savings Products)

(Savings Products)

Bancassurance

Bancassurance

= Insurance

= Insurance

(Protection Products)

(Protection Products)

Tokyo Investor Day 9.18.2014

We created a unique business model for the bank channel,

We created a unique business model for the bank channel,

taking advantage of our differentiated capabilities

taking advantage of our differentiated capabilities |

JOHN HANRAHAN SENIOR

VICE PRESIDENT AND CHIEF FINANCIAL OFFICER

INTERNATIONAL

PRUDENTIAL INTERNATIONAL INSURANCE FINANCIAL

OVERVIEW |

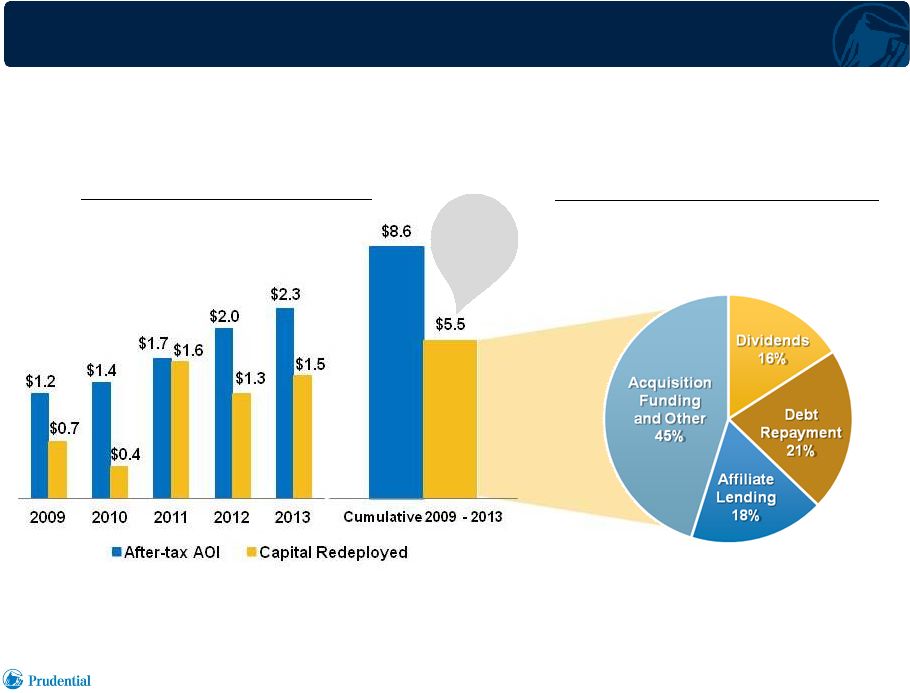

DRIVERS OF SUSTAINABLE FINANCIAL PERFORMANCE

2

Tokyo Investor Day 9.18.2014

•

Core captive agent and supplemental third party

•

High productivity and persistency

•

Scale

•

Needs-based sales

•

High margin death protection product focus

•

Growing retirement needs

•

Asset-liability management discipline

•

High credit quality fixed income portfolio

•

Low allocation to risk assets

•

Well capitalized insurance companies

•

Strong ROE and cash flows

•

Strong track record of capital deployment

through various means

Quality Focused

Quality Focused

Distribution

Distribution

Sound Capital

Sound Capital

Management

Management

Well Managed

Well Managed

Investment Portfolio

Investment Portfolio

Risks

Risks

Servicing Client’s

Servicing Client’s

Protection and

Protection and

Retirement Needs

Retirement Needs |

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

2010

2011

2012

2013

HIGH RETURN ON EQUITY

DRIVEN BY FUNDAMENTALS

3

1)

Based

on

after-tax

Adjusted

Operating

Income

(AOI)

of

our

International

Insurance

operations,

excluding

market

driven

and

discrete

items

as

disclosed

in

company

earnings

releases,

using

overall

effective

tax

rate

for

the

Financial

Services

Businesses,

and

associated

attributed

equity

excluding

accumulated

other

comprehensive

income

and

the

impact

of

foreign

currency

exchange

rate

remeasurement.

•

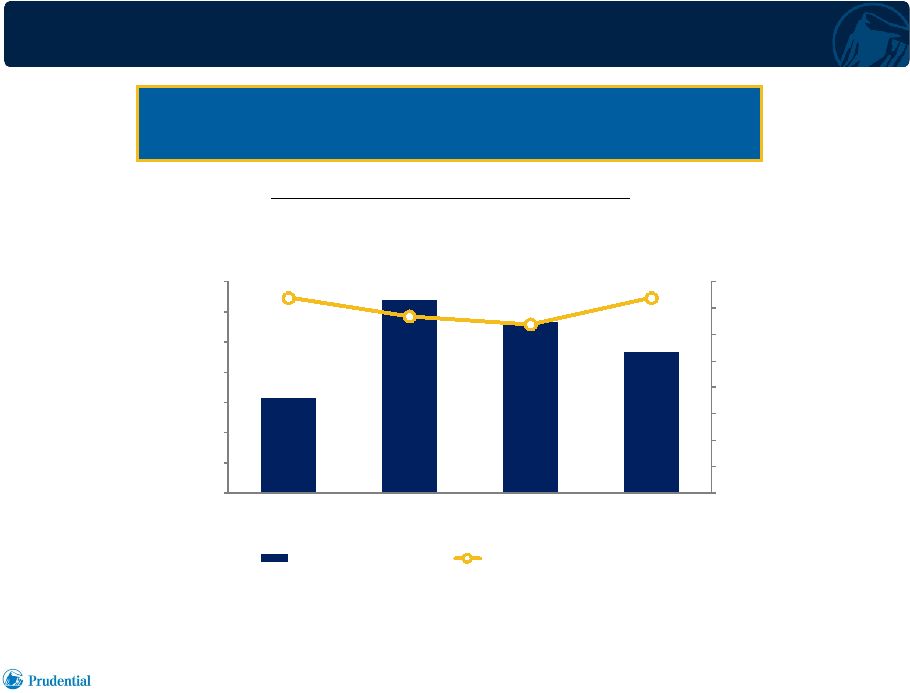

ROE has returned to pre-Star/Edison acquisition levels driven by strong

performance, expense synergies and “tailwinds”

Return on Equity

(1)

22.0%

17.4%

18.3%

21.2%

February 2011

Star/Edison

Acquisition

Tokyo Investor Day 9.18.2014 |

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

2007

2008

2009

2010

2011

2012

2013

Gibraltar Life and Other

Operations

Life Planner Operations

4

1)

Pre-tax AOI excludes market driven and discrete items as disclosed in company

earnings releases. 2)

Hedged foreign currency exchange rate for Japanese yen per U.S. dollar.

SUSTAINED EARNINGS

GROWTH Pre-Tax

Adjusted

Operating

Income

(1)

($ millions)

1,622

1,821

2,308

2,762

3,304

•

Organic growth

•

Star/Edison acquisition

•

Favorable hedged currency trend through 2013

•

Other “tailwinds”

in 2013

106

AOI FX Rate

(2)

99

92

85

80

Tokyo Investor Day 9.18.2014

106

102

1,572

1,381 |

INTERNATIONAL INSURANCE AOI

5

Tokyo Investor Day 9.18.2014

1)

Excludes

market

driven

and

discrete

items

as

disclosed

in

company

earnings

releases.

2)

Star/Edison

results

included

from

date

of

acquisition,

February,

2011.

3)

Reflects

yen

translation

at

hedged

foreign

currency

exchange

rates

of

106,

99,

92,

85,

80

for

2009,

2010,

2011,

2012,

and

2013

respectively.

($ millions)

Pro forma AOI:

All yen earnings translated at constant rate of ¥82

1,622

1,821

2,308

2,762

3,304

Reported AOI

(3)

1,829

1,996

2,474

2,812

3,265

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

2009

2010

2011

2012

2013

(1),(2) |

PRODUCT PROFITABILITY CHARACTERISTICS

6

Tokyo Investor Day 9.18.2014

1)

Conceptual

illustration

based

on

typical

products.

Mortality,

Expense &

Other Margin

Investment

Margin

Retirement / Savings Oriented

Term Life

Accident &

Health

Recurring Pay

Whole Life

Retirement

Income

Fixed

Annuity

Single Pay

Whole Life

Source of Earnings

(1)

Protection Oriented |

INTEREST RATE ENVIRONMENT

10 Year Government Bond Yield

•

Interest rates have been low in Japan for more than fifteen years

–

Majority of POJ’s in force business was written in a low rate

environment –

Rehabilitation measures lowered crediting rates for most of the legacy business of

Gibraltar, Star and Edison

–

High quality long duration investment portfolio

•

Repriced products to maintain profitability

•

Protection products provide stable

earnings from mortality and expense

margins

•

Fixed annuity products designed to

mitigate interest rate risk

–

Pricing updates bi-weekly

–

Early surrenders subject to market

value adjustments (MVA)

7

0%

1%

2%

3%

4%

5%

6%

7%

8%

1997

1999

2001

2003

2005

2007

2009

2011

2013

JGB

UST

Tokyo Investor Day 9.18.2014 |

1)

Pre-tax

AOI

excludes

market

driven

and

discrete

items

as

disclosed

in

company

earnings

releases.

The

analysis

represents

assumed

investment

of

renewal

premiums

and

reinvestment

of

investment

income

and

proceeds

from

maturing

investments

at

market

interest

rates

25

bps

higher

or

lower

than

actual

rates

during

the

year.

($ millions)

•

In the near-term, earnings are not materially impacted by modest changes in

interest rates •

In a scenario of 25 bps reduction in 2013, the cumulative pro forma negative impact

on pre- tax AOI would be $15 million in 2013, $45 million in 2014, $75

million in 2015 and $105 million in 2016

IMPACT OF CHANGING

INTEREST RATE ENVIRONMENT

8

Tokyo Investor Day 9.18.2014

Pre-Tax Adjusted Operating Income

(1)

+/-

25 bps =

~$15 million

in near-term

3,304

3,289

3,319

2013

If Interest rates

-25 bps

If interest rates

+25bps

Investment Margin

Mortality, Expense &

Other Margin |

FOREIGN CURRENCY RISK MANAGEMENT

9

Potential Exposure

Risk Management

Asset-Liability

Management

Well Matched FX

Shareholder Value in US$

Comprehensive

Hedging Strategy

•

Income and Cash Flow

•

Equity Value

Accounting

Remeasurement

Non-Economic Noise

Tokyo Investor Day 9.18.2014 |

COMPREHENSIVE HEDGING STRATEGY

10

Tokyo Investor Day 9.18.2014

Income

Income

Hedges

Hedges

•

We hedge local foreign currency income from Japan

and Korea on a 3-year rolling basis

•

Notional

amount

of

yen

income

hedges

is

~$3

billion

(1)

Equity

Equity

Protection

Protection

•

$10 billion USD

(1)

equivalent of yen equity protected

against currency movement exposure; largely achieved

by holding substantial portion of investment in our

Japanese businesses in USD

1)

As of December 31, 2013.

Benefits

•

More predictable AOI; mitigate income volatility over a 3-year period

•

Hedge income that we expect to repatriate

•

Equity value protected from foreign exchange movements

Considerations

•

Solvency margin volatility

•

AOI, ROE and book value volatility

•

Tax volatility and constraints

•

Leverage volatility |

JAPANESE YEN EARNINGS HEDGE

11

Tokyo Investor Day 9.18.2014

Historical Yen Spot Rates vs. Hedging Rates

2010

2011

2012

2013

2014

(¥)

¥99

¥92

¥85

¥80

¥82

•

Expected yen-based AOI is hedged over a 36 month rolling period using a

series of FX forwards with laddered maturities –

2014 expected yen

earnings were first hedged in 1Q11, and entirely hedged by 4Q13.

•

Each quarter’s expected yen earnings are hedged over the preceding 9

quarters. The hedged rate is an average of these transactions.

~50% of

Japan’s

2013 AOI

was

Yen-based |

EARNINGS AND ROE PROTECTION STRATEGY

12

Tokyo Investor Day 9.18.2014

Percentage

of

Expected

Yen

Earnings

Hedged

(1)

100%

93%

54%

2016

2015

2014

•

Yen depreciation lowers the USD value of yen earnings; causes earnings

and ROE dilution

•

Hedging of expected yen earnings protects USD value of near-term

earnings, ROE and potential capital repatriation

1)

As of June 30, 2014. |

FOREIGN CURRENCY MATCHING –

JAPANESE INSURANCE

OPERATIONS 13

Tokyo Investor Day 9.18.2014

1)