Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Commercial Vehicle Group, Inc. | d790284d8k.htm |

Exhibit 99.1 |

| pg | 1

FORWARD LOOKING STATEMENT

This presentation contains forward-looking statements that are subject to risks and

uncertainties. These statements often include words such as "believe,"

"expect," "anticipate," "intend," "plan," "estimate," or similar expressions. In particular, this press release may contain forward-

looking statements about Company expectations for future periods with respect to its plans to

improve financial results and enhance the Company, the future of the Company’s end

markets, Class 8 North America build rates, performance of the global construction equipment

business, expected cost savings, enhanced shareholder value and other economic benefits of the

consulting services, the Company’s initiatives to address customer needs, organic

growth, the Company’s economic growth plans to focus on certain segments and markets and the

Company’s financial position or other financial information. These statements are

based on certain assumptions that the Company has made in light of its experience in

the industry as well as its perspective on historical trends, current conditions, expected future developments and other

factors it believes are appropriate under the circumstances. Actual results may differ

materially from the anticipated results because of certain risks and uncertainties,

including but not limited to: (i) general economic or business conditions affecting the markets in which the Company

serves; (ii) the Company's ability to develop or successfully introduce new products; (iii)

risks associated with conducting business in foreign countries and currencies; (iv)

increased competition in the medium and heavy-duty truck, construction, aftermarket, military, bus, agriculture

and other markets; (v) the Company’s failure to complete or successfully integrate

strategic acquisitions; (vi) the impact of changes in governmental regulations on the

Company's customers or on its business; (vii) the loss of business from a major customer or the discontinuation

of particular commercial vehicle platforms; (viii) the Company’s ability to obtain future

financing due to changes in the lending markets or its financial position; (ix) the

Company’s ability to comply with the financial covenants in its revolving credit facility; (x) the Company’s ability to

realize the benefits of its cost reduction and strategic initiatives; (xi) a material

weakness in our internal control over financial reporting which could, if not

remediated, result in material misstatements in our financial statements; (xii) volatility and cyclicality in the commercial vehicle

market adversely affecting us; and (xiii) various other risks as outlined under the heading

"Risk Factors" in the Company's Annual Report on Form 10-K for fiscal year

ending December 31, 2013. There can be no assurance that statements made in this presentation relating to future events

will be achieved. The Company undertakes no obligation to update or revise

forward-looking statements to reflect changed assumptions, the occurrence of

unanticipated events or changes to future operating results over time. All subsequent written and oral forward-looking

statements attributable to the Company or persons acting on behalf of the Company are

expressly qualified in their entirety by such cautionary statements.

|

AGENDA

pg | 2

Wednesday, September 17, 2014

8:00 to 9:00 AM

BREAKFAST

9:00 to 9:20 AM

STRATEGY

9:20 to 9:40 AM

FINANCIAL

9:40 to 9:50 AM

Q&A

9:50 to 10:05 AM

GLOBAL BUS & TRUCK

10:05 to 10:20 AM

GLOBAL CON | AG | MIL

10:20 to 10:30 AM

BREAK

10:30 to 10:40 AM

ASIA-PACIFIC

10:40 to 10:50 AM

EUROPE, MIDDLE EAST & AFRICA

10:50 to 11:00 AM

PRODUCT INNOVATION

11:00 to 11:15 AM

MARGIN ENHANCEMENT

11:15 to 11:20 AM

TALENT | CULTURE

11:20 to 11:25 AM

WRAP-UP

11:25 AM

Q&A

|

PRESENTERS

pg | 3 |

pg | 4

|

•

CVG was founded in 2000 as a privately-held company providing

trim, wiper, mirror, and seating for medium and heavy duty trucks

•

IPO in 2004

•

Over the past 14 years, CVG pursued growth largely through

acquisition of companies providing commercial vehicle

components, on and in the cab

STRATEGY

Our Background

pg | 5 |

Our

Executive Leadership Team STRATEGY

pg | 6 |

Our

Global Footprint pg | 7

STRATEGY |

2013

Sales Product

End-Market

Customers

Region

STRATEGY

pg | 8 |

CVG has about 5% share of the addressable market –

significant opportunity to

drive profitable organic growth across our end markets and penetrate our

addressable market with current products

$5M

$3.5B

$3.5B

$3.2B

$5.6B

$5.6B

Truck

$5.0B

$416M

Construction

$176M

$2.6B

$2.6B

$2.8B

Bus

$1.2B

$1.2B

$2.9B

Agriculture

2013 Sales

3

Addressable Market

White Space

$32M

•

Available Market

1

| $27B

•

Addressable Market

2

| $13B

Source:

Company data, LMC + Millmark research reports

1

Available market = Universe of applications / platforms available for product

portfolio 2

Addressable market = Subset of available market for which products are currently

available or product plans are in place 3

Does not include approximately $118M in sales of complementary products

$10.6B

$6.7B

$4.1B

$5.4B

STRATEGY

Our Opportunity is Significant

pg | 9 |

Our

Focus is to Drive Profitable Organic Growth •

We intend to achieve sales and earnings targets

commensurate with companies delivering top-quartile

total shareholder returns

•

We will invest in products and capabilities that will

strengthen our right-to-win with our core products in our

end markets

•

We will consider opportunistic acquisitions to address

gaps in our core product portfolio and to enhance

serving our end markets & customers

STRATEGY

pg | 10 |

Wire Harnesses

CVG

2020

|

Region

|

Product

|

End-Market

Diversification

Sales Breakdown

Region

Product

End-Market

2020

67%

67%

16%

16%

17%

17%

2013

72%

72%

16%

16%

12%

12%

NALA

EMEA

APAC

2020

2013

Seats

Trim

Structures

Wipers

7%

7%

10%

20%

20%

21%

21%

47%

47%

20%

20%

22%

22%

7%

4%

4%

42%

42%

STRATEGY

Agriculture

Truck

Other

Bus

Construction

55%

24%

24%

16%

1%

4%

pg | 11

2020

2013 |

REGIONS

REGIONS

END-

MARKETS

CORE

PRODUCTS

COMPLEMENTARY

PRODUCTS

NA

NA

Seats

Trim

Wire

Harnesses

Mirrors

Office Seats

Structures

Wipers

Truck

X

X

Construction

X

X

X

Agriculture

X

X

X

Bus

X

X

Aftermarket

X

X

EMEA

EMEA

Truck

X

Construction

X

X

Agriculture

X

X

Bus

X

Aftermarket

X

APAC

APAC

Truck

X

X

Construction

X

X

Agriculture

X

X

Bus

X

X

Aftermarket

X

•

Focus on core, value accretive

businesses

•

Prioritize investment in core products

•

Hire and develop difference-making

talent across the product lines

–

Product line management

–

Engineers

–

Sales

–

Manufacturing management

•

Build / enhance our right to win

–

Design and engineer innovative products

–

Next generation product plans

–

Global supply chain management

–

Operational excellence / Lean Six Sigma

•

CVG Sales Playbook

–

OEM coverage / participation / closure plans

at customer product family, product, and

program level

–

“Sell the House”

•

Better support our customers

globally

Prioritized Opportunities | Focused on Core

Products | Driving Disciplined Execution

CVG Business Portfolio

Regions, End-Markets and Products

Action Plan for Core Products

STRATEGY

pg | 12 |

STRATEGY

pg | 13 |

What

You’re Going To See •

A compilation of plans that we believe will deliver

top-quartile EBITDA performance

•

A pure organic growth strategy

Revenue and EBITDA growth driven by differentiated,

customer focused product designs

Sales capabilities that extend our reach and deepen our

penetration across OEMs

Operational excellence across the organization that drives

improved productivity and enables margin expansion

An engaged and empowered team, laser focused on

executing our plans and delivering our commitments

STRATEGY

pg | 14 |

pg | 15 |

Sales

and Operating Income Margin FINANCIAL

Q1

Q2

Q3

Q4

Q1

Q2

Sales

(millions)

OI

Margin

2014

2013

(0.2)%

1.1%

2.3%

(1.8)%

2.1%

4.4%

4.2%

5%

4%

3%

1%

2%

0%

(1)%

(2)%

(3)%

2.8%

3.3%

See

appendix

for

reconciliation

of

GAAP

to

non-GAAP

financial

measures

–

adjusted

OIM

pg | 16

Sales

OIM

Adjusted OIM |

An

operational

and

financial

roadmap

–

by

regions

|

end-markets

|

products

-

to

guide

resource

allocation

and other decision making to achieve our 2020 goals

•

A six month, bottom up process

•

Interviews of Directors, senior management and certain mid-

level management gave rise to Imperatives

An Imperative is a collection of opportunities we intend to

seize or risks that must be mitigated

•

Portfolio of twelve Imperatives

Four

enterprise

enablers

–

Product

Innovation

/

CVG Sales

Playbook / Culture & Talent / Financial Management

Eight Product Line Manager (“PLM”) Imperatives

CVG 2020 –

The Process

FINANCIAL

pg | 17 |

•

PLM Imperatives –

e.g., improve the core, grow share,

new / adjacent markets, new geographies

•

Collection of about 60 PLM initiatives and associated

financial modeling –

sales, costs and investments –

for

the years 2015 to 2020

•

Product portfolio map based on market opportunity

and right to win –

PLM initiatives distilled into a

collection of those associated with core products

FINANCIAL

An operational and financial roadmap –

by regions |

end-markets | products -

to guide resource allocation

and other decision making to achieve our 2020 goals

CVG 2020 –

The Process

pg | 18 |

Top

Quartile Total Shareholder Return Correlation to ~13% EBITDA CAGR

1

Stock Appreciation & Dividends

EBITDA Growth

Multiple

We intend to achieve sales and earnings targets

commensurate with companies delivering top-quartile

total shareholder returns

1

Sample

of

360

Fortune

500

companies

for

some

part

of

the

period

2004

–

2014

for

which

share

prices

are available

FINANCIAL

pg | 19 |

1

2014 to 2020

2

EBITDA as may be adjusted from time-to-time for special items (such as

asset impairments, restructuring, etc.)

CVG 2020 Financial Objectives

Sales

EBITDA

2

Compound

Annual

Growth

Rate

1

13% –

17%

6% –

8%

•

We serve cyclical industries

•

Many of our customers (the OEMs) have 2-3 year

program lead times for our products

•

2015 & 2016 will be building | investment years for us

FINANCIAL

pg | 20 |

OPACC

is our Measure Operating Profit After Capital Charge

•

Positive OPACC = Value Creation

•

Negative OPACC = Value Erosion

•

Higher profit without corresponding

asset growth

•

Reduce assets without

corresponding profit drop

•

Invest when project OPACC

exceeds the ROC hurdle rate

•

Positive OPACC = Value Creation

•

Negative OPACC = Value Erosion

•

Higher profit without corresponding

asset growth

•

Reduce assets without

corresponding profit drop

•

Invest when project OPACC

exceeds the ROC hurdle rate

Operating Profit

(EBIT)

Less: Capital Charge

Operating

Asset Base

Cost of

Capital

x

FINANCIAL

pg | 21 |

Managing Through the Cycle

•

Playbook for down and up cycles

•

Enhanced focus on shareholder value

•

Consistent execution lends to

credibility

•

Act strategically and opportunistically

What Does

That Mean

Objective

FINANCIAL

pg | 22 |

Senior Secured Notes

Principal Balance

$ 250

Interest

7.875%

Due

Apr 2019

Asset Based Credit Facility

Commitment

$ 40

Availability

$ 37

Letters of Credit

$ 3

Accordion Option

$ 35

Agency Rating / Outlook

Moodys

B2 | Stable

S&P

B | Negative

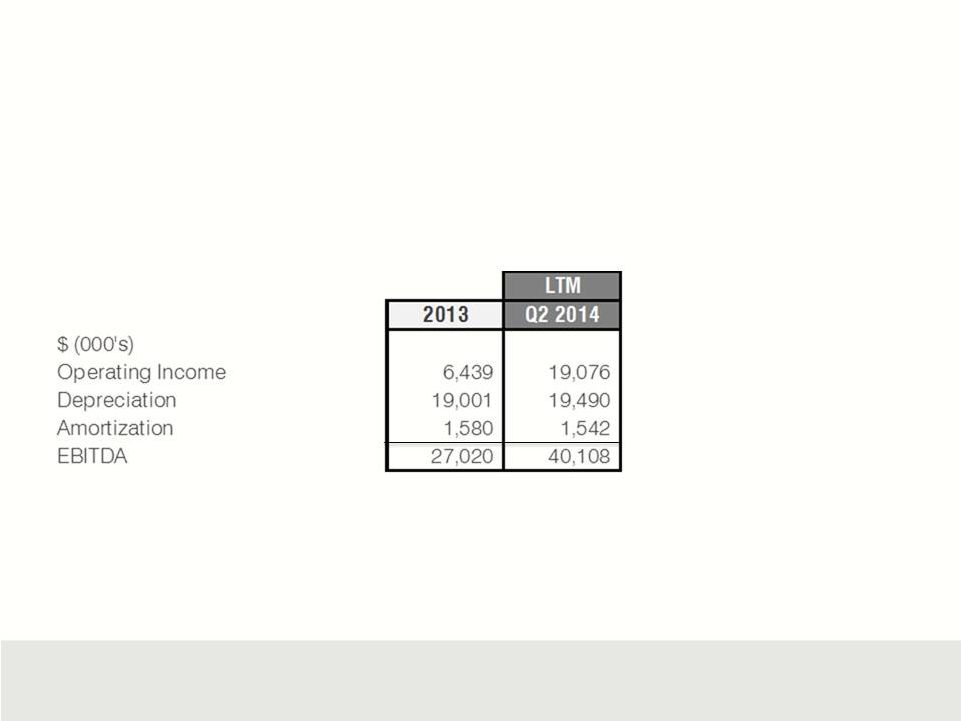

LTM

2013

Q2 2014

Cash

$ 73

$ 70

Debt

250

250

Net Debt

$ 177

$ 180

EBITDA

$ 27

$ 40

Leverage:

Debt / EBITDA

9.3x

6.2x

Net Debt / EBITDA

6.6x

4.5x

Capital Structure / Leverage

($ in millions)

FINANCIAL

pg | 23

See

appendix

for

reconciliation

of

GAAP

to

non-GAAP

financial

measures

–

EBITDA

reconciliation |

pg | 24 |

37%

37%

APAC

NALA

54%

19%

$ 1.2B

21%

27%

27%

42%

$ 5.6B

EMEA

Region

42%

45%

44%

38%

EMEA

NALA

Seats

30%

28%

28%

$0.8B

Trim

Structures

APAC

Wipers

$ 3.3B

20%

35%

35%

$2.4B

37%

37%

$0.3B

33%

29%

29%

19%

Product

Addressable Market

Truck

Bus

GLOBAL TRUCK & BUS

•

GTB addressable

market is

approximately

$6.8B

•

Structures is

generally OEM

captive

•

Focus is on

seating, trim, and

aftermarket growth

pg | 25 |

Product Strategy

Seats

Trim

Aftermarket

North America

•

Market shifting from soft to hard trim

•

Shape design and program management capabilities to shifting

market

•

Invest in new equipment in the right places to shift with market

•

Seize opportunity in North America and India

•

Top two seat brands | established distribution channels | attractive

margins

•

Derivative products to increase offering over same distribution

network

•

Leveraging OEM product design and infrastructure

•

Growing penetration in Canada, Mexico, and Latin America

•

Leverage strength in NA to grow w/ multi national OEMs

•

Best beach-head product to grow in emerging regions

•

Replicate knowledge and infrastructure in underserved segments to

grow

•

Product line refresh and customized by target segment or region

•

Product innovation

Growth and development resources will focus on core

products in targeted regions

GLOBAL TRUCK & BUS

pg | 26 |

•

High growth focus

•

Design to market

expectations

•

Leverage global

OEM relationships

•

Expand domestic

OEM participation

•

Euro seat line

expansion

•

Initial focus –

mid

size Truck OEMs

•

Develop bus and

aftermarket

business

Global Market Strategy

•

Improve our market

leading seat and trim

positions

•

Grow Mexico base

•

Enhance margins –

product, process, and

capacity

GLOBAL TRUCK & BUS

pg | 27 |

•

Investments | Margin enhancement

–

Next

Gen

seat

and

trim

programs

quoted

/

won

-

SOP

2017

/

2018

–

Proprietary headliner processing for current and next gen

platforms -

target launch 2015

–

India infrastructure –

Upgrade facilities, assembly cells, and seat

validation assets

•

Capabilities | Systems

–

System Upgrades –

CVG Operating System, ERP improvements

–

Expand hard trim design, tooling, and process capabilities

–

Upgrade aftermarket customer service tools, technical support,

new brand based web portals

•

Footprint actions underway

–

Reduce capacity in US plants

–

Re-align assets closer to customers for landed cost advantage

–

Expand Mexico and India operations

Operational Transformation

GLOBAL TRUCK & BUS

pg | 28 |

•

We are only 5% of the global addressable market

•

Focused growth efforts on Seating, Trim, and

Aftermarket

•

Leveraging strength in North America with Global

OEMs in emerging markets

•

Enhancing margins with new products and processes

In Summary

GLOBAL TRUCK & BUS

pg | 29 |

pg | 30 |

Addressable Market

•

Addressable market

is approximately

$6.1B

•

Agricultural market of

$3.5B

•

Two global product

lines

•

Three regional

product lines

GLOBAL CON | AG | MIL

APAC

NALA

EMEA

Region

Wire

Harnesses

$0.1B

Product

$2.1B

$1.0B

$1.5B

$1.4B

$2.6B

$3.5B

CON

AG

APAC

NALA

EMEA

Seats

Structures

Trim

Wipers

pg | 31 |

Seats

Seats

Wire

Wire

Harnesses

Harnesses

Trim

Trim

•

Apply construction equipment know-how to agriculture

equipment market

•

Replicate construction model for energy generation market

•

Expand into high-voltage cabling with new product offering

•

Expand into China

•

Apply North American truck know-how to construction and

agricultural applications

•

Leverage construction / agriculture seat and wire harness

OEM relationships

•

Seize

opportunity

in

earth-moving

equipment

–

leverage

medium / heavy excavation construction equipment position

•

Launch new product for compact construction equipment

•

Launch new agriculture seat line, featuring semi-active

Invictus for premium and 4-tier Sentinel line for value

Product Strategy

GLOBAL CON | AG | MIL

pg | 32 |

•

Enhance construction

equipment seat

offering and grow

market share

•

Penetrate the

agriculture market –

seating & wiring

•

Grow our construction

equipment seat market

share

•

Develop seats for

agriculture market

expectations

•

Establish a beach-

head –

wire harnesses

Global Market Strategy

•

Strengthen our wire

harness construction

equipment market

share

•

Grow our construction

equipment seat market

share

•

Penetrate the

agriculture market –

all

products

GLOBAL CON | AG | MIL

pg | 33 |

Operational Transformation

•

Investments / Margin enhancement

•

Standardized, smart production lines for built-in-quality

•

Capabilities / Systems

–

System upgrades –

CVG Operating System, ERP

improvements

–

Momentum in building out PLM organization

•

Footprint actions underway

–

Extended value stream mapping

–

Continued optimization of wire harness footprint

GLOBAL CON | AG | MIL

pg | 34 |

In

Summary •

An approximately $6.1B addressable market in which

we can credibly show right-to-win

•

A $3.6B agricultural playing field

–

With “familiar”

right-to-win prospects for CVG

–

As we fill out our seats product line, we address this

broader market

•

Logical opportunities exist for wire harnesses in

agricultural and energy generation space

•

Product and coverage plans aligned to succeed

GLOBAL CON | AG | MIL

pg | 35 |

pg | 36 |

Ag

Con

Wipers

Structures

Wire Harnesses

Trim

Seats

Bus

Truck

28%

28%

15%

15%

36%

36%

20%

20%

$ 2.4B

$ 1.2B

$ 0.7B

$ 1.3B

1%

3%

2%

3%

19%

19%

17%

17%

40%

40%

22%

22%

7%

7%

47%

47%

43%

43%

77%

77%

20%

20%

Addressable Market

APAC

•

Approximately a $5.6B

addressable market opportunity

•

As with any good strategy, it is

important we identify both

desired and undesirable

segments to participate in

•

Primary focus will be on seating,

and

wire

harness opportunities

pg | 37

ASIA-PACIFIC |

Product Strategy

Seats

Wire

Harnesses

•

Establish joint venture or acquire wire harness business to

accelerate growth and achieve economy of scale

•

Leverage OEM construction equipment seat relationships

to penetrate the market

•

Develop truck seat market share

•

Penetrate the driver and passenger seat bus market –

leverage India know-how

•

Leverage established OEM relationships in heavy

excavator seating across OEM product lines

•

Design seats for the Chinese agriculture market

•

Develop the local supply base in China

•

Vertically integrate core process –

weld and paint

Aftermarket

•

Develop Australia and establish in China

•

Product offerings that are market driven in price point

configuration

•

Develop appropriate channel leveraging OEM

relationships, trading houses and online capabilities

pg | 38

ASIA-PACIFIC |

CVG

Sales Playbook Participation

Closure

Retention

Recommendation

Address customer

key challenges

Increase the

closure rate

Develop Customer

Loyalty

Leverage existing

customer base

Online Lead

Generation

SMS Campaigns

Facility Visits

Customer Events

Product Launch

(awareness)

Customer Care Program

Referral Program

Build brand and

product awareness

Trade Shows

Social Media (iWOM)

Brand Promotion

(online, print)

Trade Associations

Product / Solutions

Seize Market Opportunity

Sense Of Urgency

Market Awareness

Game Plan

Execute

pg | 39 |

In

Summary •

We have a vast addressable market opportunity to take

advantage of

•

Designing product that is in tune to the varying

requirements on durability, valued features and price

•

Execution of a process driven CVG Sales Playbook will

expand our ability to both grow and capture addressable

market share

pg | 40

ASIA-PACIFIC |

pg | 41 |

Ag

Con

EMEA Region

Wipers

Structures

Wire Harnesses

Trim

Seating

Bus

Truck

Addressable Market

$0.2B

$0.7B

$1.2B

$1.3B

52%

71%

16%

15%

1%

16%

10%

5%

26%

14%

19%

26%

31%

14%

46%

35%

•

Total addressable “white space”

of $3.4B,

over $1.3B of that in seating and wire

harnesses

•

Grow seat business from strong position

in construction to truck / bus and

agriculture

•

Deepen wire harness business,

especially in construction and agriculture

•

Pursue other segments opportunistically

3%

EUROPE, MIDDLE EAST & AFRICA

pg | 42 |

Product Strategy

Seats

Wire

Harnesses

•

Build customer portfolio, especially with construction

equipment OEMs

•

Further strengthen design capabilities as a service offering

•

Truck / bus seat market size is attractive –

must meet

European standards and take on entrenched competitors

•

Expand range of truck / bus seat products to OEMs

•

Large Agriculture market –

now developing a full range of

agricultural seats to meet full range of customer needs

•

Further room to grow in construction equipment seat

market by extending product range and feature levels

Aftermarket

•

Room for further growth in European aftermarket

•

Further develop aftermarket sales force and distribution

channels across the region, building on existing footprint

EUROPE, MIDDLE EAST & AFRICA

pg | 43 |

Manufacturing Footprint

•

Global demand patterns

and our product and

customer mix are shifting

and will continue to do so

•

Ensuring we have the right

global manufacturing and

distribution footprint is

vital to our overall success

•

We continually evaluate

our footprint to ensure

that it best allows us to

meet our growth and

profitability objectives

pg | 44

We will assess our footprint

in the context of our strategy,

including:

•

How and where we produce, by

product line and region

•

Ways we can improve our global

supply chain to ensure it

supports our growth, allows us to

meet our commitments to

customers, and achieves our

cost requirements |

In

Summary •

EMEA holds a large amount of “white space”

for CVG, creating an

opportunity for a renewed phase of growth in the region

•

We will focus our resources on the most attractive growth

opportunities:

–

Seats for trucks / buses, agriculture and construction equipment

–

Wire harnesses for construction equipment and agriculture

•

Building on our solid foundation in the region, we will pursue further

initiatives including:

–

Broader range of products tailored to the region

–

More systematic sales processes

–

Continuous improvement in operations

EUROPE, MIDDLE EAST & AFRICA

pg | 45 |

pg | 46 |

PRODUCT INNOVATION

Strategy

Existing Customers

Existing Customers

Addressable Market

Available Market

Penetrate existing customers

Penetrate the addressable

market

Expand the addressable market

into available market

pg | 47 |

Product Innovation at Work | The Sentinel Seat |

Penetrate Existing Customers

Target: Light Construction & Agriculture

Markets

Value proposition

•

Customer branding for the cab

•

Upgraded seat / less weight and cost

•

New features

–

Operator position sensor

–

Split trim levels to cover price points

–

ISO Compliant

Result

•

Awarded two compact equipment models

•

Opportunity to participate on two other models

PRODUCT INNOVATION

pg | 48 |

Product Innovation at Work | The Sentinel Seat |

Expand the Addressable Market

Light Construction & Agriculture Available

Markets

PRODUCT INNOVATION

Traditional Suspension Seats –

Low Coverage

Currently in Market

Sentinel Seat Tier 1 | 2

Available 2014

Sentinel Seat Tier 3 | 4

Available Late 2015

pg | 49 |

pg | 50 |

MARGIN ENHANCEMENT

Global Engineering

Enhanced Processes and Discipline Through Centrally

Led Engineering

pg | 51 |

MARGIN ENHANCEMENT

Global Purchasing & Logistics

Transition from Tactical / Transactional to Strategic

pg | 52 |

•

Commercial Vehicle Group Operating System (CVGOS)

–

Team based activities focused on the elimination of waste

–

Increase plant-wide productivity in operations

–

Reduce work-in-process (WIP) inventory

•

Sample CVGOS model cell results :

–

Average productivity improvement of 30%

–

Floor space reduction of up to 25 to 50%

–

WIP inventory reductions of 35 to 90%

–

Delivery performance improvement of up to 10%

•

Process

–

Expand model cell focus incorporating CVGOS principles

–

Lean Six Sigma program, resources and training

•

Accelerate!

Accelerate Operational Excellence Program

MARGIN ENHANCEMENT

Operational Excellence

pg | 53 |

Margin Enhancement Programs

pg | 54

In Summary

MARGIN ENHANCEMENT

•

Design to value

•

Modularity & parts rationalization

•

Supplier consolidation & cost targets

•

Global logistics strategy & third party logistics consolidation

•

CVGOS expansion & Lean 6 Sigma |

pg | 55 |

•

Leadership behavior defines the characteristics and actions

that support our Core Values

–

Help guide our decisions and interactions

–

Make the core values more meaningful and actionable

•

Values Oriented Leaders Drive & Deliver Better Results!

–

Set the Tone from the Top

•

Involve Everyone

–

Incorporate into onboarding & performance management

processes

CVG 2020 Core Values

Integrity | Continuous Improvement |

Innovation | Teamwork | Sense of Urgency

TALENT | CULTURE

pg | 56 |

TALENT | CULTURE

•

Early focus on roles critical to the success of CVG 2020

–

Product line management, engineering, manufacturing

management

•

Build a sustainable talent pipeline

•

Provide training & development for current & future roles

•

Utilize best practice succession planning tools

–

Build bench strength

–

Competency gap analysis

–

Career development activities

•

Commitment to more robust CVG Human Resources

Information System

Effective Talent Management is Critical

to the Success of CVG 2020

pg | 57 |

WRAP-UP

pg | 58 |

APAC

NALA

EMEA

Seats

Trim

Structures

Wire Harnesses

Other

Wipers

$1.2 –

$1.3B

WRAP-UP

Revenue Roadmap by Region | Product |

End-Market

pg | 59 |

What

You Can Expect 61

•

Top-quartile total shareholder return

•

Trusted strategic supply partner with major OEMs in all key

industries and best in class competitor

•

World class product design and introduction capabilities

•

Manufacturing and assembly facilities that set the industry

standard for quality, productivity and efficiency

•

Preferred employer with a reputation for values-based

leadership and merit-based development and compensation

•

Highly engaged and empowered employees who have the

freedom and resources to perform at the highest level

WRAP-UP

pg | 60 |

QUESTIONS AND DISCUSSION

pg | 61 |

APPENDIX

pg | 62 |

Richard P. “Rich”

Lavin was appointed President and Chief Executive Officer of Commercial Vehicle

Group (CVG) effective May 28, 2013. He also serves as a member of

CVG’s board of directors. Rich comes to CVG with 28 years of global

experience with Caterpillar Inc., where he most recently served as Group

President of Construction Industries and Growth Markets. In this role, he was

responsible for Caterpillar’s Earthmoving, Excavation and Building

Construction Products Divisions and the development and deployment of

business strategies in China, India and elsewhere in the Asia-Pacific

region.

Rich began his career at Caterpillar as an attorney in the company’s Legal

Services Division. During his Caterpillar tenure, Lavin served in

numerous positions in the company’s Asian and Latin American

operations,

including

global

product

manager

in

the

company’s

Track-Type

Tractor

Division.

In

addition,

he

served

as

Director

of

Corporate

Labor

and

Human

Relations

and

Director

of

Compensation and Benefits. Before becoming a Group President, he was Vice

President of Manufacturing Operations for the Asia Pacific Division,

serving as Chairman of Shin Caterpillar Mitsubishi Ltd. (now Caterpillar

Japan Ltd.) and Chairman of Caterpillar (China) Investment Co., Ltd. Rich had

responsibility for manufacturing operations in the Asia-Pacific region,

including facilities in China, India, Thailand and Indonesia and for

developing and deploying Caterpillar’s emerging markets strategy.

Before joining Caterpillar, he served as an attorney at a subsidiary of W.R. Grace

& Co. Rich holds a Bachelor of Arts degree from Western Illinois

University, a Juris Doctor degree from Creighton

University

and

a

Master

of

Laws

degree

from

Georgetown

University.

In

addition

to

his role as

CEO of CVG, he serves as a Non-Executive Director for ITT Corporation (NYSE:

ITT) and USG Corporation (NYSE: USG).

He served as a member of the board of directors of the U.S. China Business

Council, the U.S. India Business Council and the U.S. Korea Business

Council. Lavin is currently a member of the Board of Trustees at Bradley

University. In 2010, he was appointed to serve on the APEC Business Advisory

Council (ABAC), which provides private sector input to the leaders of 21 economies

comprising the Asia- Pacific Economic Cooperation (APEC).

Richard P. Lavin

President & CEO

EXECUTIVE BIOGRAPHY

pg | 63 |

C. Timothy “Tim”

Trenary joined CVG in October 2013 as Executive Vice President and Chief

Financial Officer with responsibility for Finance, Accounting, Planning &

Analysis, Internal Audit and Shared Services.

Tim

brings

35

years

of

finance,

accounting

and

operations

experience

to

CVG.

Prior

to

joining CVG, Tim served as the Senior Vice President and Chief Financial Officer

of ProBuild Holdings LLC, a North American supplier of building

materials. His work experience includes assignments as the Senior Vice

President & Chief Financial Officer

of

EMCON

Technologies

Holdings

Limited,

a

privately

held

global

automotive

parts

supplier, and prior to that as the Vice President & Chief Financial Officer of

DURA Automotive Systems, Inc., a publicly held global automotive parts

supplier. Tim holds a Bachelor of Arts Degree in Accounting from Michigan

State University and a Masters

of

Business

Administration

Degree

from

the

University

of

Detroit

Mercy.

He

is

a

Certified Public Accountant (registered status).

Tim Trenary

Chief Financial

Officer

EXECUTIVE BIOGRAPHY

pg | 64 |

Patrick Miller

Division

President, Global

Truck and Bus

Patrick Miller joined CVG in October, 2005 and currently serves as the President

of Global Truck & Bus. Prior to that, he served as the Vice

President and General Manager of Structures, Vice President of Operations,

Senior Vice President of Sales, and Vice President and General Manager of

the Aftermarket division. Prior to joining CVG, he served as

the Sr. Vice President of Sales and Engineering for Hayes Lemmerz, Vice

President and General Manager of Automotive Extrusions with Alcoa, and held

various leadership positions in operations, sales, and product engineering for

ArvinMeritor, supplying component systems to the light vehicle and heavy

duty truck OEMs. Pat holds an Industrial Engineering degree from Purdue

University and earned a Masters of Business Administration from the Harvard

Business School. Pat participates in various industry related organizations

including the Heavy Duty Manufacturers Association (HDMA), National

Association of Manufacturing, and the Technology and Maintenance Council

(TMC). He is also a member of the US-India Business Council.

EXECUTIVE BIOGRAPHY

pg | 65 |

Kevin R.L. Frailey joined CVG in February, 2007 and currently serves as the

President of Global Construction, Agriculture & Military. Prior

to that, he served as President and General Manager of Global Electrical

Systems. His earlier leadership assignments with CVG included responsibility for

Business Development, Research & Development, Purchasing, and Mergers &

Acquisitions. Before joining CVG, Kevin served as Vice President and General

Manager for Joint Ventures & Business Strategy at ArvinMeritor’s

Emissions Technologies Group. He held several other key management

positions in engineering, sales and worldwide supplier development during his

tenure at ArvinMeritor. In addition, during that time he served

on the boards of various joint

ventures, most notably those of Arvin Sango, Inc. and AD Tech Co., Ltd.

Kevin holds a Bachelor of Arts Degree in Economics and Management from DePauw

University and a Masters of Business Administration from Harvard

University. Kevin is a member of the Heavy Duty Business Forum, the China

Business Council, the Innovation Executive Form, the OESA Sales and

Marketing Council and the National Association of Manufacturers.

Kevin Frailey

Division President,

Global

Construction,

Agriculture,

Military

EXECUTIVE BIOGRAPHY

pg | 66 |

Ulf

Lindqwister Chief

Administrative

Officer

Ulf Lindqwister joined CVG in August, 2014 in the capacity of Chief Administrative

Officer. His portfolio of responsibilities includes Global IT, Global

Engineering, Global Supply Chain Management, Operational Excellence,

Mergers & Acquisitions, Corporate Business Development, Strategic

Planning and Government Affairs. Prior to joining CVG, Ulf was the Manager

of Strategy, Growth and M & A at Cat Electronics, a division of

Caterpillar. His earlier assignments with Caterpillar included Country Director of

Korea and Director of Strategy for the Asia-Pacific Group of Divisions.

Before Caterpillar, Ulf served as Director of Valuation for Huron Consulting and

at Arthur Andersen. His prior experience includes executive

leadership positions with several smaller, high technology companies,

including President, Vice President and Board of Directors. Early in his

career, he spent more than a decade with NASA developing their GPS program.

Ulf

holds

a

Masters

of

Business

Administration

from

The

Anderson

School

of

Business

at

UCLA

and a PhD in Physics from Princeton University. He is a member of the US-Korea

Business Council and the Chicago Council for Global Affairs.

EXECUTIVE BIOGRAPHY

pg | 67 |

Laura Macias

Chief Human

Resource / Public

Affairs Officer

Laura

L.

Macias

joined

CVG

in

August,

2008

as

the

Vice

President

of

Corporate

Human

Resources. Her current responsibilities as Chief Human Resources Officer

include global human resources, corporate communications and public

affairs. Before joining CVG, Laura was with Dominion Homes, Inc. where she

served as the Senior Vice President of Human Resources & Administration

and Corporate Secretary, with responsibility for HR,

Marketing/Communication,

Corporate

Services

and

Governance.

She

also

has

prior

HR

and

communications leadership experience from assignments as the Vice President of

Human Resources

for

Broadband

Express

and

the

Assistant

Vice

President

of

Human

Resources

and

Marketing Communications for Banc One Leasing Corporation.

Laura is a graduate of Ohio University, where she earned a Bachelor of Science

Degree in Journalism with a Public Relations concentration.

She

is

a

member

of

the

Society

for

Human

Resource

Management

and

the

Human

Resources

Association of Central Ohio and holds an SPHR certification.

EXECUTIVE BIOGRAPHY

pg | 68 |

Kevin Lane

Managing

Director, EMEA

Kevin joined CVG in April, 2014 in the capacity of Managing Director, European,

Middle East and African markets . He is based in Zurich, with

responsibility for our manufacturing facilities in the UK, Czech Republic,

Belgium, and the Ukraine and our sales organization across the region. Prior

to joining CVG, Kevin was a partner with McKinsey & Company. Initially based in Beijing,

then in London, Shanghai, Singapore and Zurich, he advised senior executives of

leading multinational corporations on strategic and organizational

challenges in nearly 30 countries across Asia, Europe, the Middle East, and

North America. Spending the bulk of his time working with clients in

manufacturing industries, he also served at various times as a leader of

McKinsey’s Advanced Industries Practice, Consumer Goods Practice, Marketing

Practice and Organization Practice, and led a major initiative to build

McKinsey’s Leadership Development Practice.

Kevin

served

for

two

years

as

Executive

Vice

President

of

Overstock.com.

He

was

also

a university professor for several years in the US and Hong Kong.

Kevin holds a BA from Dartmouth College and an MA and PhD from Harvard

University. He has conducted research at Peking University, National

Taiwan University, and the Chinese University of Hong Kong. He is a

two-time Fulbright Scholar and has published a book and numerous

articles.

Kevin is a member of the Board of Trustees for Zurich International School and has

served on the board of the Concordia International School in

Shanghai. EXECUTIVE BIOGRAPHY

pg | 69 |

Geoff Perich

Managing

Director, Asia

Pacific

Geoff Perich joined CVG in August, 2013 in the capacity of Managing Director for

the Asia- Pacific markets. He is based in Shanghai with

responsibility for our manufacturing facilities and sales organization in

China, India, and Australia. Before

joining

CVG,

Geoff

held

a

number

of

leadership

positions

with

Caterpillar,

most

recently

as the Product Manager responsible for the hydraulic track type excavators in the

Asia Pacific theatre.

His earlier Caterpillar experience includes leadership positions

in service engineering and

commercial account management, and a US based assignment as the Product Manager

for mid-sized wheel loaders.

Geoff is a graduate of the West Australian Institute of Technology School of

Engineering and holds a degree in Mechanical Engineering.

EXECUTIVE BIOGRAPHY

pg | 70 |

Terry joined CVG in October, 2004 and currently serves in the capacity of Vice

President of Tax and Treasury, which includes responsibility for Investor

Relations. Prior to that, Mr. Hammett served as the Corporate

Director of Finance. Terry has 15 years of prior finance leadership

experience at various companies including Invensys Controls, Nationwide

Insurance, and Cardinal Health. He is a graduate of The Ohio State

University, holds a Master’s in Taxation from Capital University Law

School, and a Master’s in Business Administration from Otterbein University.

Terry is a Certified Public Accountant and Certified Treasury Professional, and is

a member of the Tax Executive Institute and the National Investor Relations

Institute. Terry Hammett

Vice President,

Tax & Treasury,

Investor Relations

EXECUTIVE BIOGRAPHY

pg | 71 |

John

Wehrenberg

Global

Product

Manager

John

Wehrenberg

joined

CVG

in

January,

2014

and

currently

serves

as

the

Vice

President

of

Seat Product Line Management for the Construction, Agriculture, and Military

business unit. Before joining CVG, John was a Vice President at

Nelson Global Products with responsibility for operations strategy.

Wehrenberg previously served as the Managing Director of the

Emissions

Business

in

Asia

Pacific

for

Arvin/ArvinMeritor,

where

he

established

seven

greenfield factories in the region and more than six joint venture

operations. At the same time he

served

for

many

years

on

the

Board

of

Directors

of

several

JV

companies

on

behalf

of

ArvinMeritor.

He

also

served

ArvinMeritor

as

the

Vice

President

of

Sales,

Asia

Pacific

and

Regional Director of Operations for the region. John has also held

leadership positions with Teleflex, where he managed five plants and

established a new joint venture operation in India and a greenfield entity

in China for their medical division. Wehrenberg is a graduate of DePauw

University with a Bachelor’s degree in Economics and received an MBA

from the Darden School of Business at the University of Virginia.

John serves on the board of directors of Contour Industries, a private

equity-backed glass tempering firm serving the appliance and building

products industries, the Chicago Sister Cities China

Committee,

and

the

DongFang

Chinese

Education

Institute

in

Chicago.

EXECUTIVE BIOGRAPHY

pg | 72 |

RECONCILIATION OF GAAP TO NON-GAAP

FINANCIAL MEASURES

Adjusted Operating Income Reconciliation

pg | 73

Q1 2013

Q2 2013

Q3 2013

Q4 2013

Q1 2014

Q2 2014

$ (000's)

Net Sales

177,822

198,909

187,942

183,045

198,071

215,996

Cost of Sales

159,737

176,035

169,852

162,364

173,767

187,811

Gross Profit

18,085

22,874

18,090

20,681

24,304

28,185

SGA

17,949

20,339

21,135

12,288

18,472

18,748

Amortization

409

404

383

384

384

390

Operating Income

(273)

2,131

(3,428)

8,009

5,448

9,047

Operating Income Margin

(0.2)%

1.1%

(1.8)%

4.4%

2.8%

4.2%

2013 Special Items

Employee Seperation Costs

(1,800)

McKinsey Consulting

(2,800)

Asset Impairment

(2,700)

CEO Change

(2,500)

2014 Special Items

Tigard / Dublin Closure

(500)

(100)

Loss on Sale of Building

(800)

Adjusted Operating Income

(273)

4,631

3,872

8,009

6,748

9,147

Adjusted Operating Income Margin

(0.2)%

2.3%

2.1%

4.4%

3.3%

4.2% |

pg | 74

EBITDA Reconciliation

RECONCILIATION OF GAAP TO NON-

GAAP FINANCIAL MEASURES |