Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CMS ENERGY CORP | a14-20523_48k.htm |

Exhibit 99.1

|

|

Wolfe Research Power & Gas Leaders September 17, 2014 Content How it Works Investment (New) Upsides (Updates) Partners |

|

|

This presentation is made as of the date hereof and contains “forward-looking statements” as defined in Rule 3b-6 of the Securities Exchange Act of 1934, Rule 175 of the Securities Act of 1933, and relevant legal decisions. The forward-looking statements are subject to risks and uncertainties. All forward-looking statements should be considered in the context of the risk and other factors detailed from time to time in CMS Energy’s and Consumers Energy’s Securities and Exchange Commission filings. Forward-looking statements should be read in conjunction with “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s Form 10-K for the year ended December 31, 2013 and as updated in subsequent 10-Qs. CMS Energy’s and Consumers Energy’s “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important factors that could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no obligation to update any of the information presented herein to reflect facts, events or circumstances after the date hereof. The presentation also includes non-GAAP measures when describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com. CMS Energy provides historical financial results on both a reported (Generally Accepted Accounting Principles) and adjusted (non-GAAP) basis and provides forward-looking guidance on an adjusted basis. Management views adjusted earnings as a key measure of the company’s present operating financial performance, unaffected by discontinued operations, asset sales, impairments, regulatory items from prior years, or other items. These items have the potential to impact, favorably or unfavorably, the company's reported earnings in future periods. Investors and others should note that CMS Energy and Consumers Energy post important financial information using the investor relations section of the CMS Energy website, www.cmsenergy.com and Securities and Exchange Commission filings. |

|

|

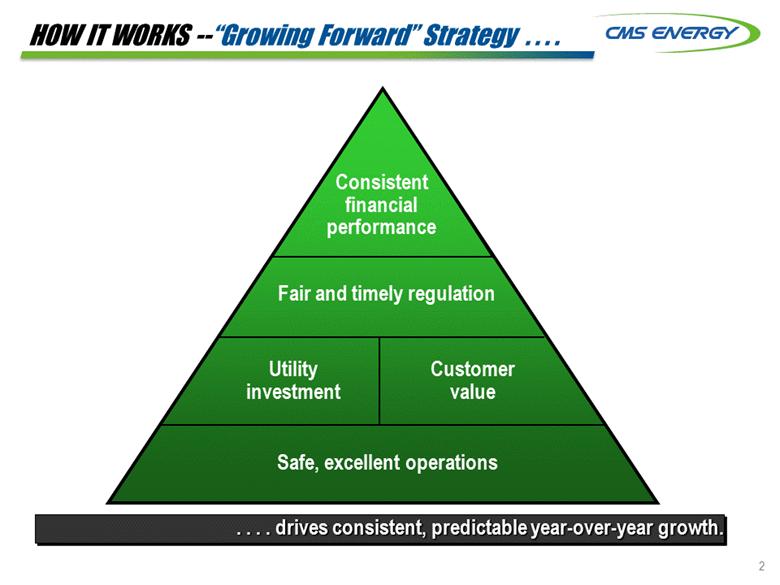

2 HOW IT WORKS --“Growing Forward” Strategy . . . . . . . . drives consistent, predictable year-over-year growth. Consistent financial performance Fair and timely regulation Utility investment Customer value Safe, excellent operations |

|

|

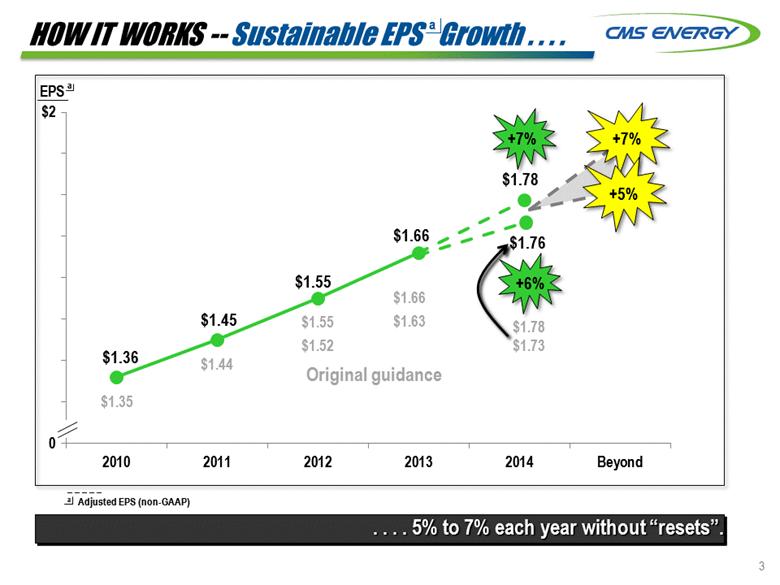

3 HOW IT WORKS -- Sustainable EPS Growth . . . . . . . . 5% to 7% each year without “resets”. _ _ _ _ _ a Adjusted EPS (non-GAAP) $2 $1.66 $1.35 $1.44 $1.55 $1.52 $1.66 $1.63 Original guidance $1.78 $1.73 EPS 0 a $1.78 $1.76 +7% +6% a +7% +5% |

|

|

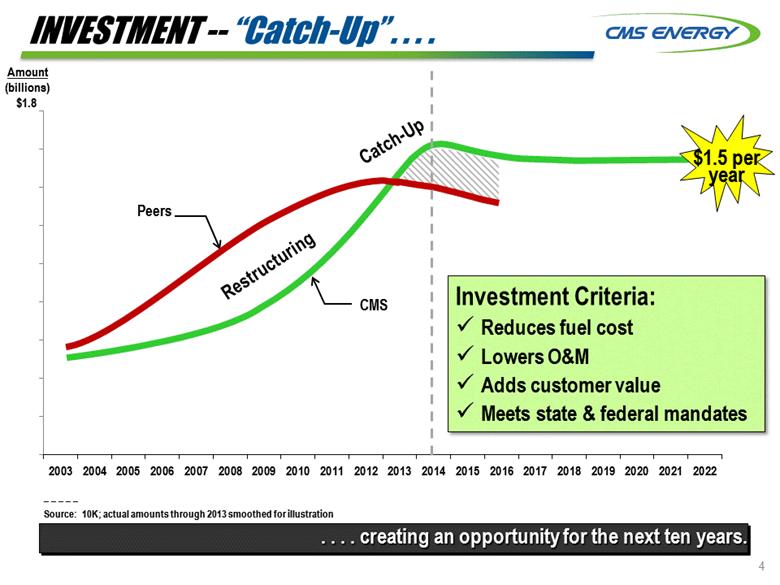

4 INVESTMENT -- “Catch-Up” . . . . . . . . creating an opportunity for the next ten years. Amount (billions) $1.8 CMS Peers _ _ _ _ _ Source: 10K; actual amounts through 2013 smoothed for illustration Restructuring Catch-Up $1.5 per year Investment Criteria: Reduces fuel cost Lowers O&M Adds customer value Meets state & federal mandates |

|

|

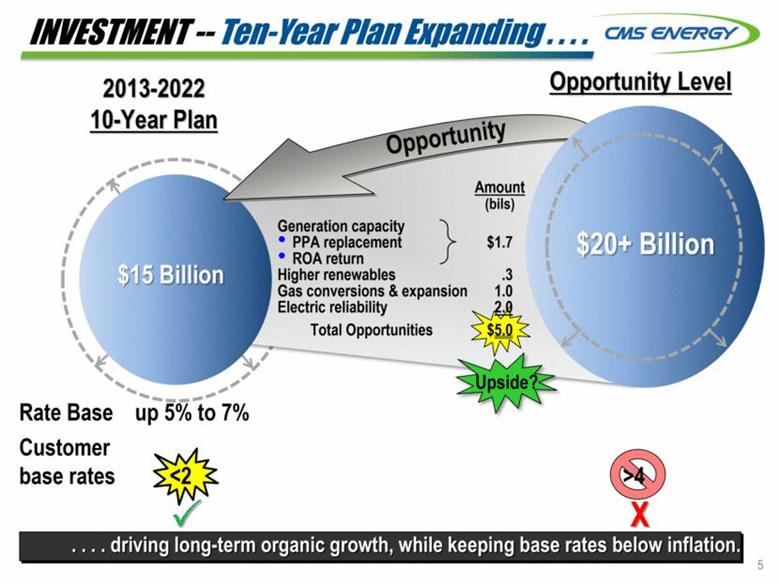

5 INVESTMENT -- Ten-Year Plan Expanding . . . . . . . . driving long-term organic growth, while keeping base rates below inflation. 2013-2022 10-Year Plan Opportunity Level $15 Billion $15 Billion $20+ Billion Opportunity Amount (bils) Generation capacity PPA replacement $1.7 ROA return Higher renewables .3 Gas conversions & expansion 1.0 Electric reliability 2.0 Total Opportunities $5.0 X Rate Base up 5% to 7% Customer base rates <2 >4 Upside? |

|

|

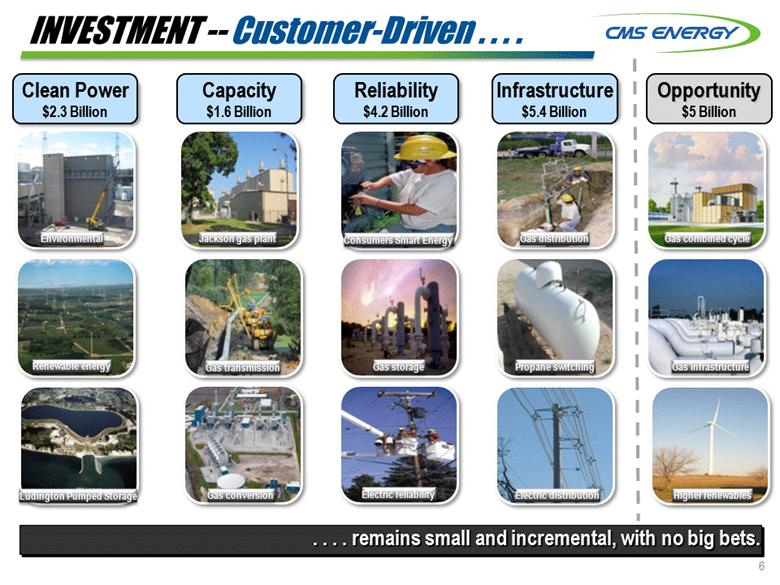

6 INVESTMENT -- Customer-Driven . . . . Clean Power $2.3 Billion Reliability $4.2 Billion . . . . remains small and incremental, with no big bets. Renewable energy Jackson gas plant Gas storage Propane switching Gas transmission Gas distribution Electric reliability Consumers Smart Energy Electric distribution Capacity $1.6 Billion Infrastructure $5.4 Billion Environmental Gas conversion Ludington Pumped Storage Opportunity $5 Billion Gas combined cycle Gas infrastructure Higher renewables |

|

|

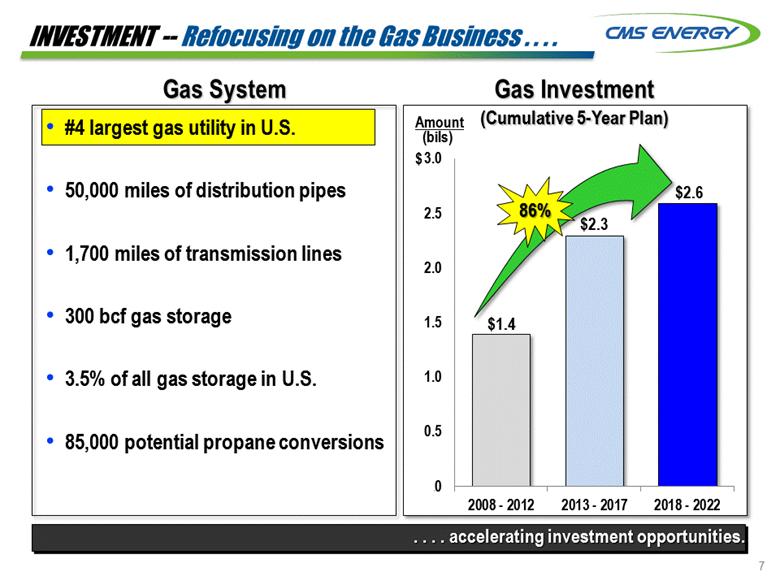

7 INVESTMENT -- Refocusing on the Gas Business . . . . . . . . accelerating investment opportunities. #4 largest gas utility in U.S. 50,000 miles of distribution pipes 1,700 miles of transmission lines 300 bcf gas storage 3.5% of all gas storage in U.S. 85,000 potential propane conversions Gas System Gas Investment Amount (bils) $ (Cumulative 5-Year Plan) 86% |

|

|

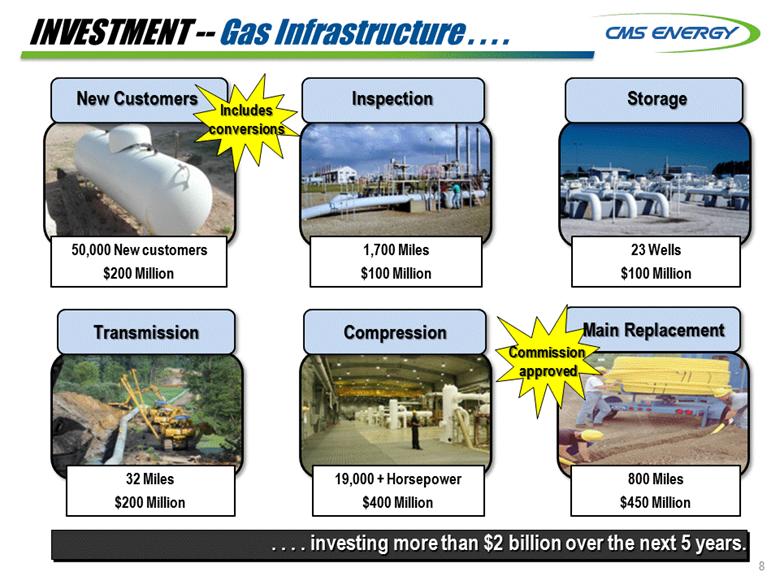

8 INVESTMENT -- Gas Infrastructure . . . . . . . . investing more than $2 billion over the next 5 years. New Customers Inspection Storage Compression Transmission 50,000 New customers $200 Million 1,700 Miles $100 Million 23 Wells $100 Million 800 Miles $450 Million 19,000 + Horsepower $400 Million 32 Miles $200 Million Includes conversions Commission approved Main Replacement |

|

|

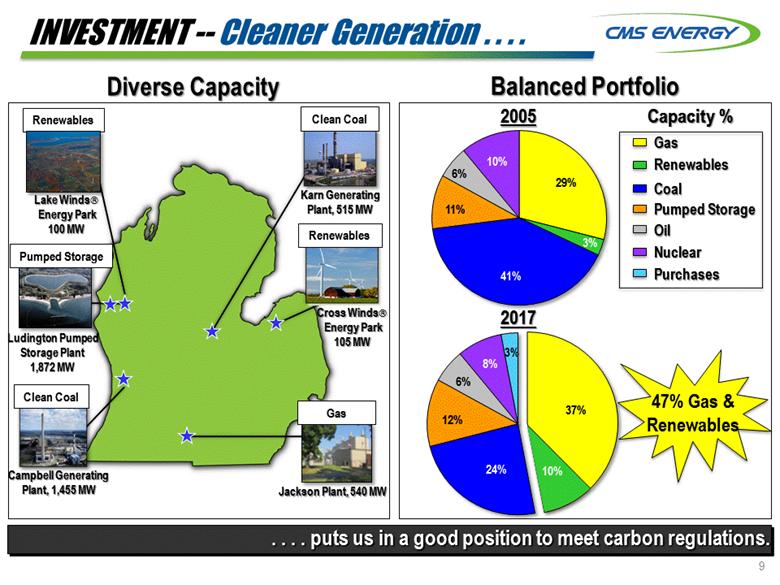

9 INVESTMENT -- Cleaner Generation . . . . . . . . puts us in a good position to meet carbon regulations. Cross Winds Energy Park 105 MW Jackson Plant, 540 MW Ludington Pumped Storage Plant 1,872 MW Campbell Generating Plant, 1,455 MW Karn Generating Plant, 515 MW Diverse Capacity Balanced Portfolio Renewables Lake Winds Energy Park 100 MW Capacity % Gas Clean Coal Clean Coal Renewables Pumped Storage 2005 Coal Gas Pumped Storage Renewables Oil Nuclear Purchases 10% 47% Gas & Renewables 2017 |

|

|

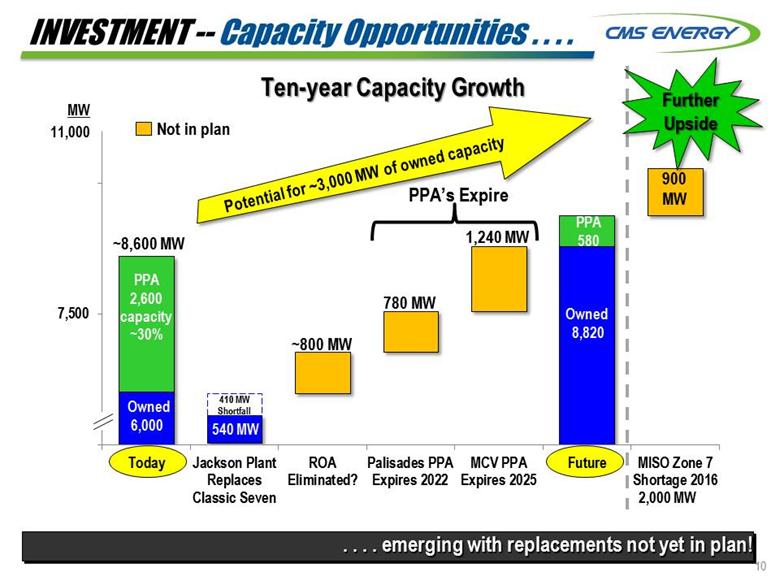

10 INVESTMENT -- Capacity Opportunities . . . . . . . . emerging with replacements not yet in plan! Ten-year Capacity Growth ~800 MW 1,240 MW MW PPA 2,600 capacity ~30% ~8,600 MW 540 MW 410 MW Shortfall Owned 6,000 780 MW 900 MW Potential for ~3,000 MW of owned capacity 2,000 MW 11,000 Further Upside PPA’s Expire Owned 8,820 PPA 580 Not in plan |

|

|

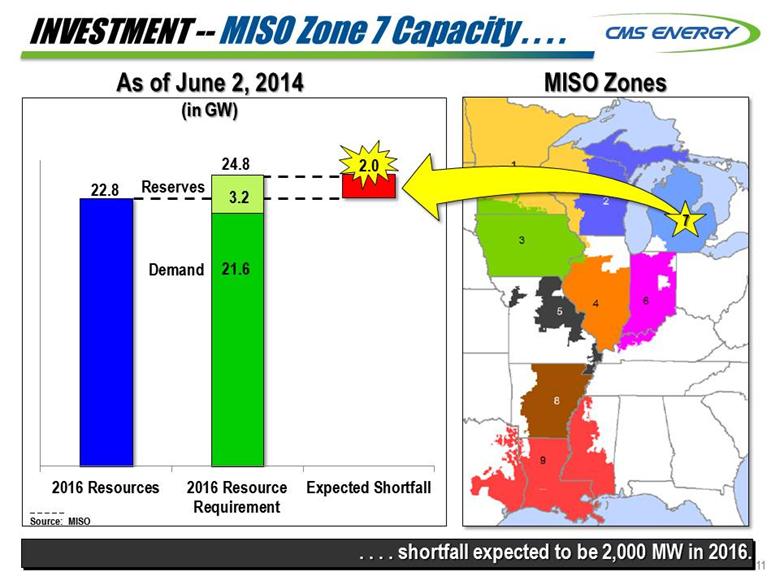

11 INVESTMENT -- MISO Zone 7 Capacity . . . . . . . . shortfall expected to be 2,000 MW in 2016. As of June 2, 2014 (in GW) 22.8 3.2 21.6 24.8 Reserves Demand 2.0 _ _ _ _ _ Source: MISO MISO Zones 7 |

|

|

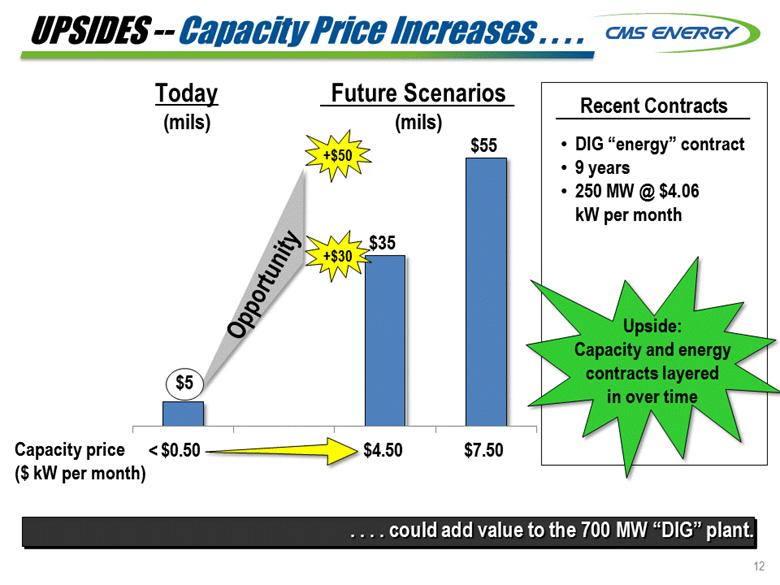

12 UPSIDES -- Capacity Price Increases . . . . . . . . could add value to the 700 MW “DIG” plant. Capacity price ($ kW per month) Today (mils) Future Scenarios (mils) $55 $35 +$50 Opportunity Recent Contracts DIG “energy” contract 9 years 250 MW @ $4.06 kW per month < +$30 $5 Upside: Capacity and energy contracts layered in over time |

|

|

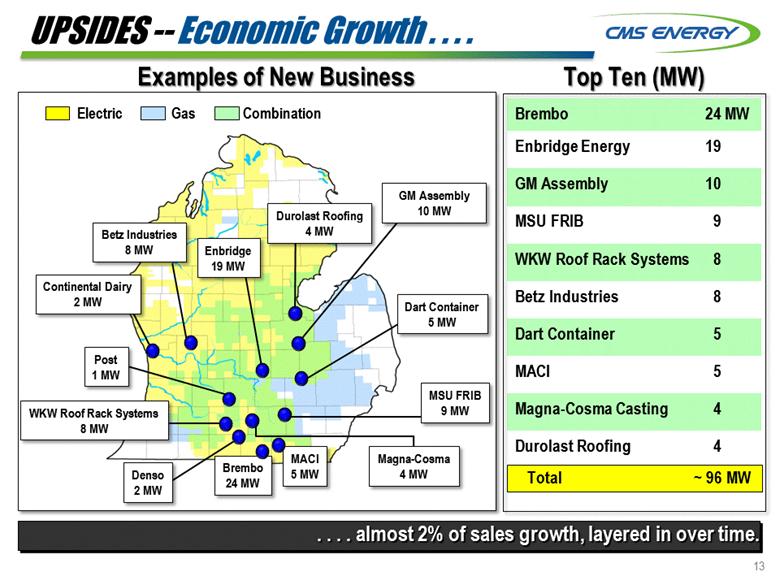

13 UPSIDES -- Economic Growth . . . . . . . . almost 2% of sales growth, layered in over time. Electric Gas Combination Brembo 24 MW Enbridge Energy 19 GM Assembly 10 MSU FRIB 9 WKW Roof Rack Systems 8 Betz Industries 8 Dart Container 5 MACI 5 Magna-Cosma Casting 4 Durolast Roofing 4 MACI 5 MW Betz Industries 8 MW Post 1 MW Brembo 24 MW Magna-Cosma 4 MW WKW Roof Rack Systems 8 MW MSU FRIB 9 MW Enbridge 19 MW Total 96 MW Dart Container 5 MW ~ Denso 2 MW Continental Dairy 2 MW Durolast Roofing 4 MW GM Assembly 10 MW Examples of New Business Top Ten (MW) |

|

|

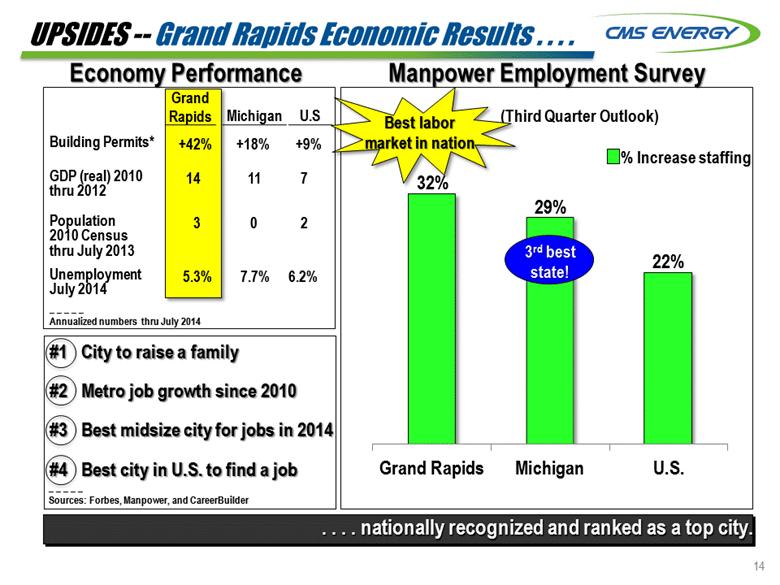

14 UPSIDES -- Grand Rapids Economic Results . . . . Economy Performance Manpower Employment Survey _ _ _ _ _ Sources: Forbes, Manpower, and CareerBuilder 29% 22% (Third Quarter Outlook) % Increase staffing 3rd best state! 32% #1 City to raise a family #2 Metro job growth since 2010 #3 Best midsize city for jobs in 2014 #4 Best city in U.S. to find a job Best labor market in nation . . . . nationally recognized and ranked as a top city. Grand Rapids Michigan U.S Building Permits* +42% +18% +9% GDP (real) 2010 thru 2012 14 11 7 Population 2010 Census thru July 2013 3 0 2 Unemployment July 2014 5.3% 7.7% 6.2% _ _ _ _ _ Annualized numbers thru July 2014 |

|

|

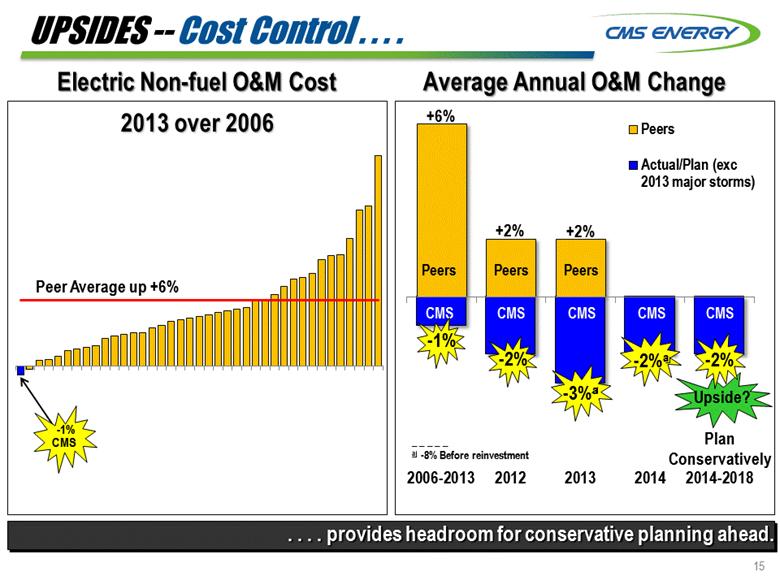

15 UPSIDES -- Cost Control . . . . Average Annual O&M Change +6% -2% -2% Plan Conservatively Upside? _ _ _ _ _ a -8% Before reinvestment +2% CMS CMS CMS CMS . . . . provides headroom for conservative planning ahead. CMS -1% Peer Average up +6% -1% CMS 2013 over 2006 Electric Non-fuel O&M Cost Peers Peers Peers |

|

|

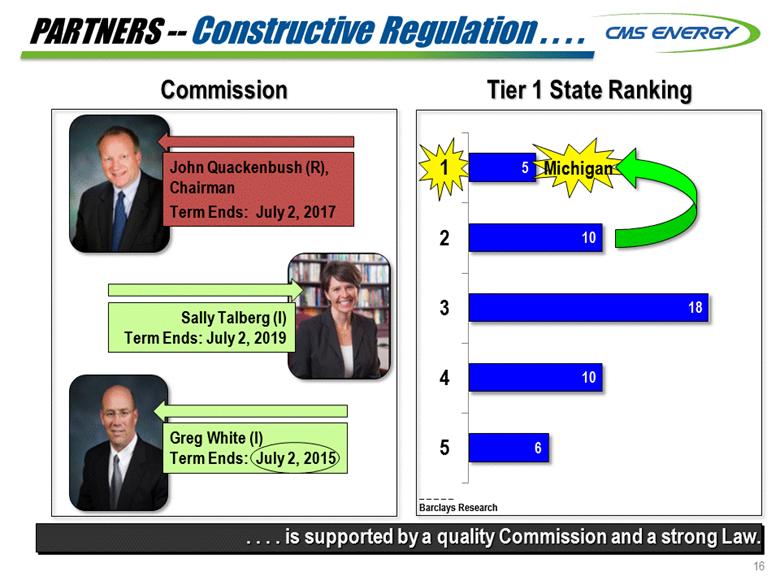

16 PARTNERS -- Constructive Regulation . . . . . . . . is supported by a quality Commission and a strong Law. Tier 1 State Ranking _ _ _ _ _ Barclays Research Michigan John Quackenbush (R), Chairman Term Ends: July 2, 2017 Greg White (I) Term Ends: July 2, 2015 Sally Talberg (I) Term Ends: July 2, 2019 Commission |

|

|

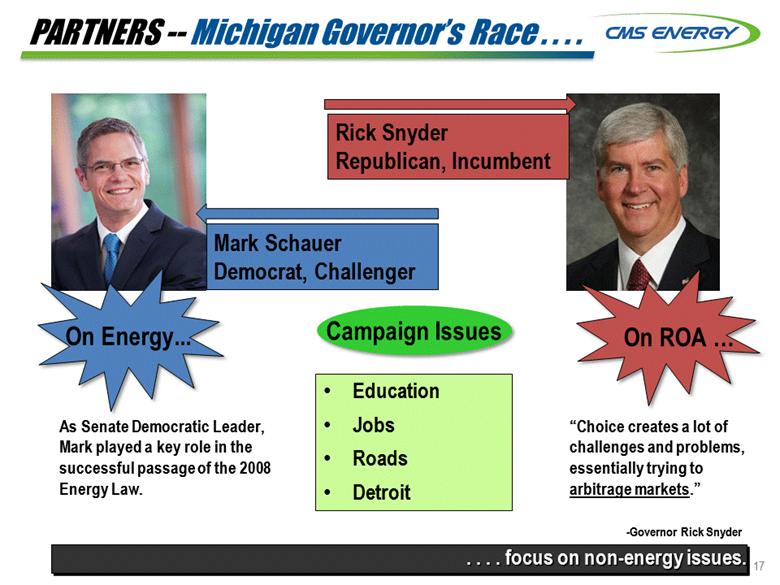

17 PARTNERS -- Michigan Governor’s Race . . . . . . . . focus on non-energy issues. Mark Schauer Democrat, Challenger Rick Snyder Republican, Incumbent Campaign Issues Education Jobs Roads Detroit On Energy On ROA As Senate Democratic Leader, Mark played a key role in the successful passage of the 2008 Energy Law. “Choice creates a lot of challenges and problems, essentially trying to arbitrage markets.” -Governor Rick Snyder |

|

|

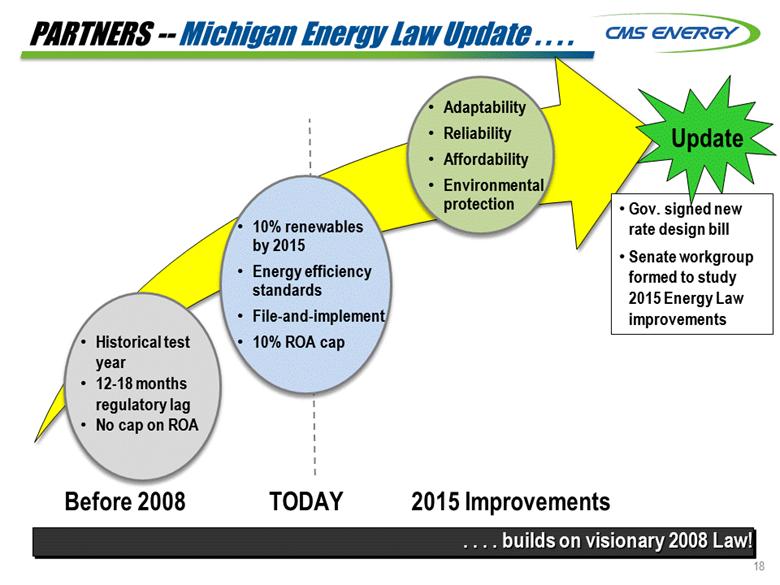

18 PARTNERS -- Michigan Energy Law Update . . . . Historical test year 12-18 months regulatory lag No cap on ROA 10% renewables by 2015 Energy efficiency standards File-and-implement 10% ROA cap Adaptability Reliability Affordability Environmental protection Before 2008 TODAY 2015 Improvements . . . . builds on visionary 2008 Law! Gov. signed new rate design bill Senate workgroup formed to study 2015 Energy Law improvements Update |

|

|

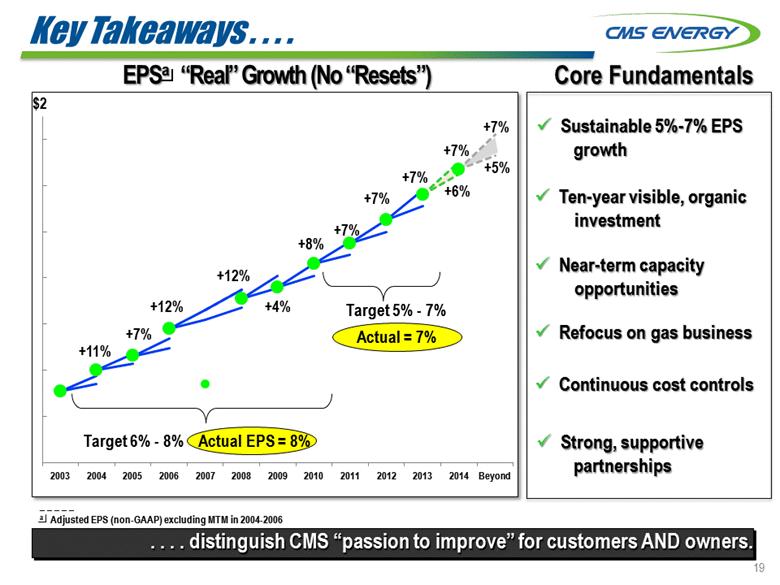

19 Key Takeaways . . . . . . . . distinguish CMS “passion to improve” for customers AND owners. _ _ _ _ _ a Adjusted EPS (non-GAAP) excluding MTM in 2004-2006 EPSa “Real” Growth (No “Resets”) $2 Target 5% - 7% Actual = 7% +11% Target 6% - 8% Actual EPS = 8% +7% +12% +12% +4% +7% +7% +7% +8% +7% +6% +7% +5% Ten-year visible, organic investment Continuous cost controls Refocus on gas business Sustainable 5%-7% EPS growth Core Fundamentals Near-term capacity opportunities Strong, supportive partnerships |

|

|

Appendix |

|

|

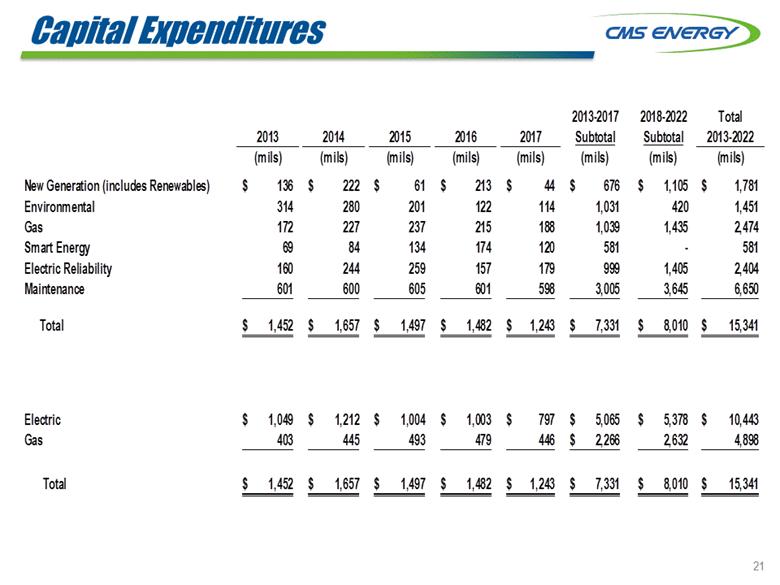

21 Capital Expenditures (mils) 2013-2017 2018-2022 Total 2013 2014 2015 2016 2017 Subtotal Subtotal 2013-2022 (mils) (mils) (mils) (mils) (mils) (mils) (mils) (mils) New Generation (includes Renewables) $136 $222 $61 $213 $44 $676 $1,105 $1,781 Environmental 314 280 201 122 114 1,031 420 1,451 Gas 172 227 237 215 188 1,039 1,435 2,474 Smart Energy 69 84 134 174 120 581 - 581 Electric Reliability 160 244 259 157 179 999 1,405 2,404 Maintenance 601 600 605 601 598 3,005 3,645 6,650 Total $1,452 $1,657 $1,497 $1,482 $1,243 $7,331 $8,010 $15,341 Electric $1,049 $1,212 $1,004 $1,003 $797 $5,065 $5,378 $10,443 Gas 403 445 493 479 446 $2,266 2,632 4,898 Total $- $1,452 $- $1,657 $- $1,497 $- $1,482 $- $1,243 $- $7,331 $- $- $8,010 $- $15,341 |

|

|

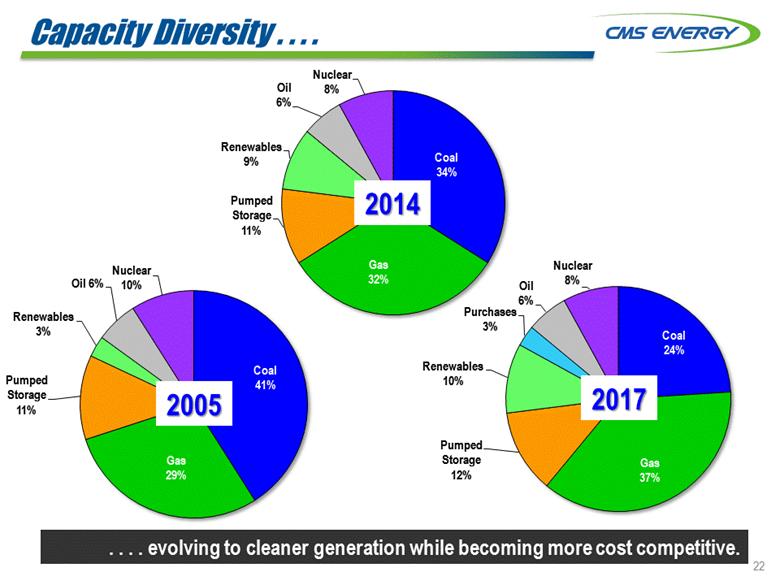

22 Capacity Diversity . . . . . . . . evolving to cleaner generation while becoming more cost competitive. 2005 2017 2014 |

|

|

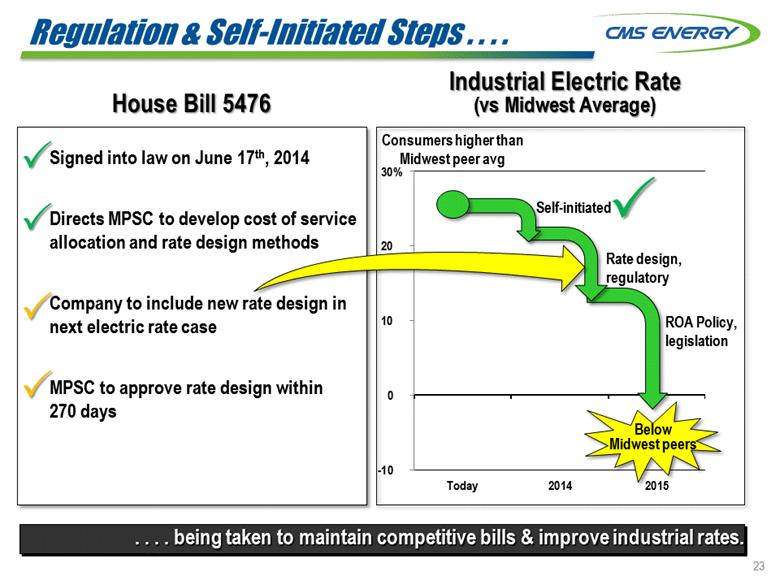

23 Regulation & Self-Initiated Steps . . . . Self-initiated Rate design, regulatory ROA Policy, legislation Consumers higher than Midwest peer avg Below Midwest peers . . . . being taken to maintain competitive bills & improve industrial rates. House Bill 5476 Industrial Electric Rate (vs Midwest Average) Signed into law on June 17th, 2014 Directs MPSC to develop cost of service allocation and rate design methods Company to include new rate design in next electric rate case MPSC to approve rate design within 270 days |

|

|

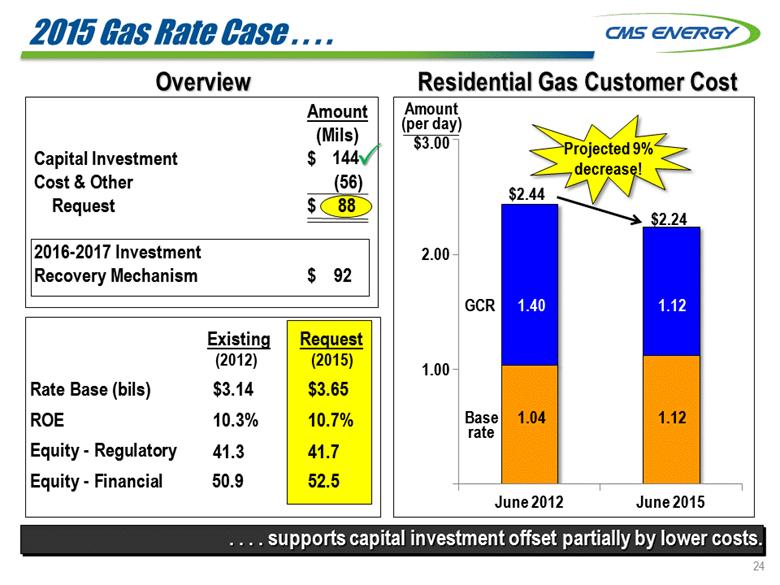

24 2015 Gas Rate Case . . . . Overview Rate Base (bils) XX ROE XX Equity - Regulatory XX Equity - Financial XX Residential Gas Customer Cost . . . . supports capital investment offset partially by lower costs. Amount (Mils) Capital Investment $ Cost & Other (56) Request $ 88 2016-2017 Investment Recovery Mechanism $ 92 Existing $3.14 10.3% 41.3 50.9 144 Request $3.65 10.7% 41.7 52.5 Amount $3.00 2.00 1.00 June 2012 June 2015 1.04 1.40 $2.44 1.12 1.12 $2.24 Projected 9% decrease! (per day) GCR Base rate (2012) (2015) |

|

|

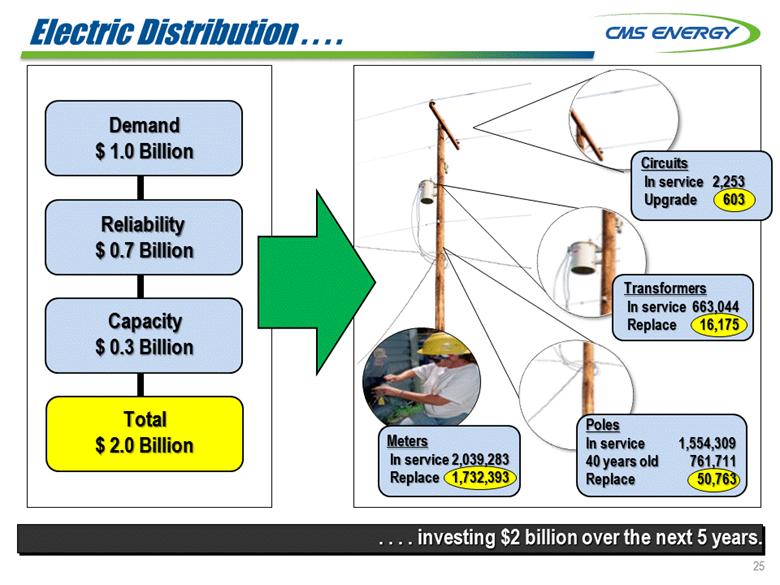

25 Electric Distribution . . . . Demand $ 1.0 Billion . . . . investing $2 billion over the next 5 years. Reliability $ 0.7 Billion Capacity $ 0.3 Billion Total $ 2.0 Billion Circuits In service 2,253 Upgrade 603 Transformers In service 663,044 Replace 16,175 Poles In service 1,554,309 40 years old 761,711 Replace 50,763 Meters In service 2,039,283 Replace 1,732,393 |

|

|

26 GAAP Reconciliation |

|

|

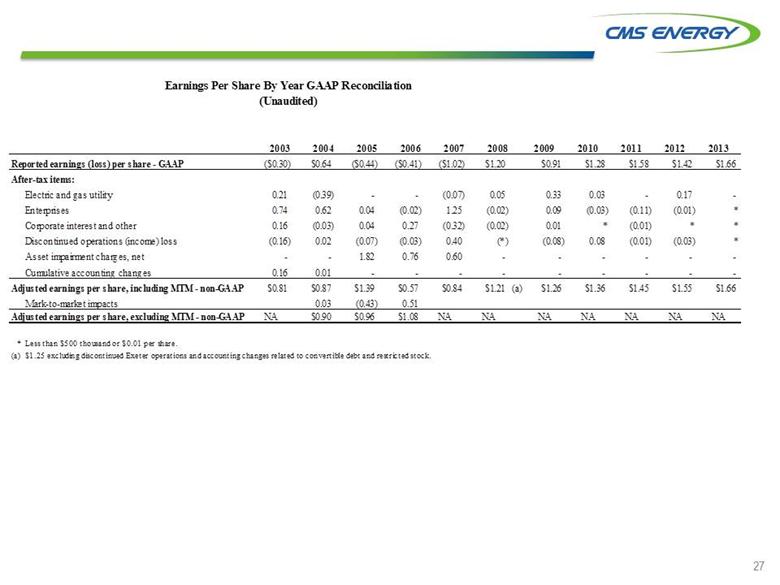

27 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Reported earnings (loss) per share - GAAP ($0.30) $0.64 ($0.44) ($0.41) ($1.02) $1.20 $0.91 $1.28 $1.58 $1.42 $1.66 After-tax items: Electric and gas utility 0.21 (0.39) - - (0.07) 0.05 0.33 0.03 - 0.17 - Enterprises 0.74 0.62 0.04 (0.02) 1.25 (0.02) 0.09 (0.03) (0.11) (0.01) * Corporate interest and other 0.16 (0.03) 0.04 0.27 (0.32) (0.02) 0.01 * (0.01) * * Discontinued operations (income) loss (0.16) 0.02 (0.07) (0.03) 0.40 (*) (0.08) 0.08 (0.01) (0.03) * Asset impairment charges, net - - 1.82 0.76 0.60 - - - - - - Cumulative accounting changes 0.16 0.01 - - - - - - - - - Adjusted earnings per share, including MTM - non-GAAP $0.81 $0.87 $1.39 $0.57 $0.84 $1.21 (a) $1.26 $1.36 $1.45 $1.55 $1.66 Mark-to-market impacts 0.03 (0.43) 0.51 Adjusted earnings per share, excluding MTM - non-GAAP NA $0.90 $0.96 $1.08 NA NA NA NA NA NA NA * Less than $500 thousand or $0.01 per share. (a) $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock. Earnings Per Share By Year GAAP Reconciliation (Unaudited) |