Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BREEZE-EASTERN CORP | d789212d8k.htm |

Breeze-Eastern Shareholders Meeting

Brad Pedersen, President & CEO

September 16, 2014

Whippany, NJ

Exhibit 99.1

1

CONFIDENTIAL INFORMATION: Any and all information, specifications, manufacturing information,

schedules, marketing plans, prices or other data provided in this email to you is

proprietary information belonging to Breeze-Eastern Corporation, and is not to be used, revealed, copied, transmitted or discussed with any third party without the

prior written consent of Breeze-Eastern Corporation. This restriction does not limit your

right to use the above information if it is properly obtained from another source

without restriction. If you have received this E-mail in error, please delete it and

all its contents from your message systems and notify the sender of the erroneous receipt

EXPORT CONTROLLED - WARNING: This document may contain information that is subject to the

International Traffic in Arms Regulation (ITAR) or the Export Administration

Regulations (EAR), and may not be exported, released, or disclosed to foreign nationals,

either in the United States or overseas, without first complying with the export

requirements/regulations of the ITAR and/or the EAR. The recipient is responsible for

complying with all such export requirements/regulations. Include this notice with any

reproduced portions of this document

|

INFORMATION

ABOUT FORWARD-LOOKING STATEMENTS This

presentation

contains

forward-looking

statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933

as

amended,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended,

regarding

our

future

operating

performance,

financial

results,

events,

trends

and

plans.

All

statements

in

this

presentation

other

than

statements

of

historical

facts

are

forward-looking

statements.

Forward-looking

statements

involve

numerous

risks

and

uncertainties.

We

have

attempted

to

identify

any

forward-looking

statements

by

using

words

such

as

“anticipates,”

“believes,”

“could,”

“expects,”

“intends,”

“may,”

“should”

and

other

similar

expressions.

Although

we

believe

that

the

expectations

reflected

in

all

of

our

forward-looking

statements

are

reasonable,

we

can

give

no

assurance

that

such

expectations

will

prove

to

be

correct.

Such

statements

are

not

guarantees

of

future

performance

or

events

and

are

subject

to

known

and

unknown

risks

and

uncertainties

that

could

cause

our

actual

results,

events

or

financial

positions

to

differ

materially

from

those

included

within

the

forward-looking

statements.

Such

factors

include,

but

are

not

limited

to

competition

from

other

companies;

changes

in

applicable

laws,

rules,

and

regulations

affecting

the

Company

in

the

locations

in

which

it

conducts

its

business;

interest

rate

trends;

a

decline

or

redirection

of

the

United

States

government

defense

budget,

the

failure

of

Congress

to

approve

a

budget

or

continuing

resolution,

changes

in

spending

allocation

or

the

termination,

postponement,

or

failure

to

fund

one

or

more

significant

contracts

by

the

United

States

government

or

other

customers;

changes

in

our

sales

strategy

and

product

development

plans;

changes

in

the

executive

management

team;

status

of

labor

relations;

competitive

pricing

pressures;

market

acceptance

of

our

products

under

development;

delays

in

the

development

of

products;

determination

by

us

to

dispose

of

or

acquire

additional

assets;

general

industry

and

economic

conditions;

events

impacting

the

U.S.

and

world

financial

markets

and

economies;

and

those

specific

risks

disclosed

in

our

Annual

Report

on

Form

10-K

for

the

fiscal

year

ended

March

31,

2014,

Quarterly

Reports

on

Form

10-Q,

and

other

filings

with

the

Securities

and

Exchange

Commission.

We

undertake

no

obligation

to

update

publicly

any

forward-looking

statements,

whether

as

a

result

of

new

information

or

future

events.

2 |

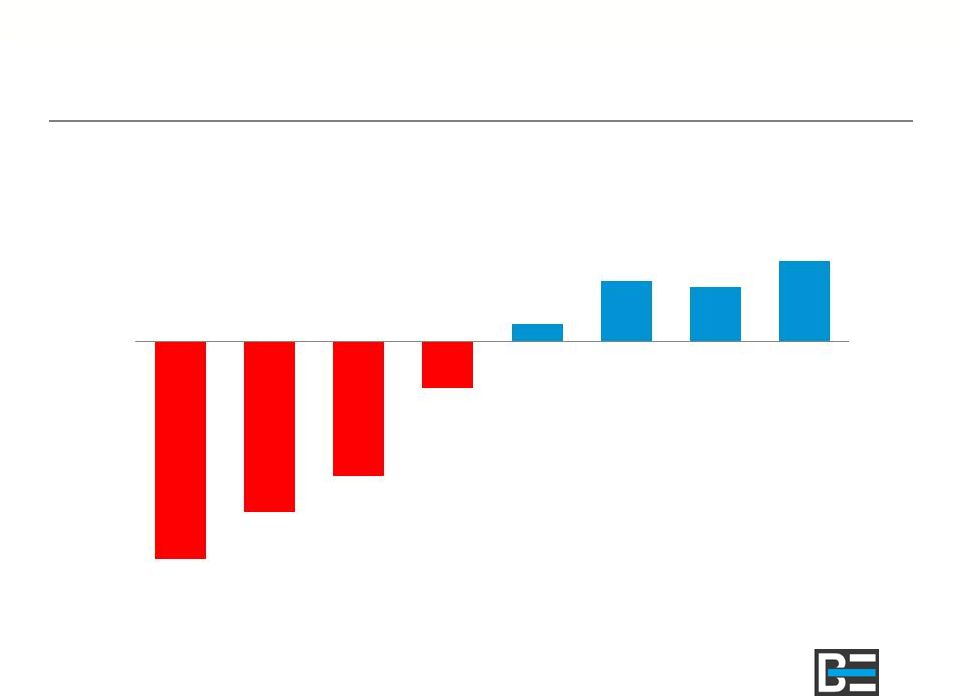

Use or disclosure of data contained on this sheet or subsequent sheets

is subject to the restriction on the title page. Sales and Operating Income

($ in Millions)

3

(a)

FY10 operating loss includes non-recurring adjustments of $13.7m ($12.2m adjustment to

estimated reserves and $1.5m for un-absorbed overhead due to Company relocation).

(b)

FY12 operating income includes non-recurring adjustments of $5.3m mainly for

engineering product development discontinuance and qualification unit obsolescence accruals.

(c)

FY14 operating income includes non-recurring adjustments of $0.2m ($1.2m

environmental benefit offset by a net $1.0m charge for a spare parts distribution change).

69.0

78.2

84.9

80.0

85.9

(6.7)

9.5

7.0

8.2

9.1

FY10 (a)

FY11

FY12 (b)

FY13

FY14 (c)

Sales

Operating Income |

Use or disclosure of data contained on this sheet or subsequent sheets

is subject to the restriction on the title page. 4

(a)

FY10 Adjusted EBITDA includes non-recurring adjustments of $13.7m, or 19.9% of

sales , ($12.2m adjustment to estimated reserves and $1.5m for un-absorbed overhead due to Company relocation).

(b)

FY12 Adjusted EBITDA includes non-recurring adjustments of $5.3m, or 6.2% of

sales, mainly for engineering product development discontinuance and qualification unit obsolescence accruals.

(c)

FY14 Adjusted EBITDA includes non-recurring adjustments of $0.2m, or 0.2% of

sales, ($1.2m environmental benefit offset by a net $1.0m charge for a spare parts distribution change).

-4.3

11.9

8.7

9.7

10.8

FY10 (a)

FY11

FY12 (b)

FY13

FY14 (c)

Adjusted EBITDA $

-6.3%

15.3%

10.3%

12.1%

12.6%

FY10

FY11

FY12

FY13

FY14

Adjusted EBITDA %

Adjusted EBITDA* $ and % of Sales

($ in Millions)

*Adjusted EBITDA is a non-GAAP financial measure and we refer you to the appendix to

this presentation for reconciliations to the most directly comparable GAAP financial

measures and related information.

|

Use or disclosure of data contained on this sheet or subsequent sheets

is subject to the restriction on the title page. Net Debt

($ in Millions)

FY08

FY09

FY10

FY11

FY12

FY13

FY14

5

FY15 1Q

(23.9)

(18.7)

(14.7)

(5.1)

2.0

6.7

6.0

8.9 |

Use or disclosure of data contained on this sheet or subsequent sheets

is subject to the restriction on the title page. FY2014: Key Accomplishments

•

Achieved Record Sales of $85.9 million

•

Began Full Rate Production to Airbus for the 400M

program

•

Initiated Development of Unique and Innovative

Products to Expand our Product Lines

•

Implemented an Improved Spare Parts Distribution

Strategy to Improve Customer Service

•

Closed 3 Environmental Sites

6 |

Use or disclosure of data contained on this sheet or subsequent sheets

is subject to the restriction on the title page. Breeze-Eastern Products and

Services •

“Heroes use our equipment to save lives every day”

•

Military and commercial helicopters:

•

Rescue hoists, cargo hooks, cargo winches

•

Military cargo aircraft:

•

Cargo winches and parachute line retrieval winches

•

Full-service supplier including:

•

Overhaul and repair

•

Spare parts

•

Training

7 |

Use or disclosure of data contained on this sheet or subsequent sheets

is subject to the restriction on the title page. Breeze-Eastern Customers

•

Global Original Equipment Manufacturers (OEM) and Helicopter

Operators

•

Mission critical operations

•

Search and rescue

•

Shipboard operators

•

Global Manufacturers and Operators of Military Cargo Aircraft

•

U.S. Government and Military:

•

Army, Navy, Air Force, USMC, USCG, National Guard, Border Patrol

•

International military organizations

•

State/county police, fire, and rescue departments

•

Other global aerospace/defense companies

8 |

Use or disclosure of data contained on this sheet or subsequent sheets

is subject to the restriction on the title page. Current Market Conditions

•

U.S. Department of Defense Budget Uncertainty

•

Future impact not predictable

•

Less vulnerable are mature programs with high-value rescue and

special ops missions

•

Our platform diversity and aftermarket service and parts should help

mitigate any impact

•

European and International Market Demand Forecasted to be

Stable and Consistent

9

–

Offshore oil exploration and commercial search and rescue operations

•

OEM’s continue to develop new aircraft platforms |

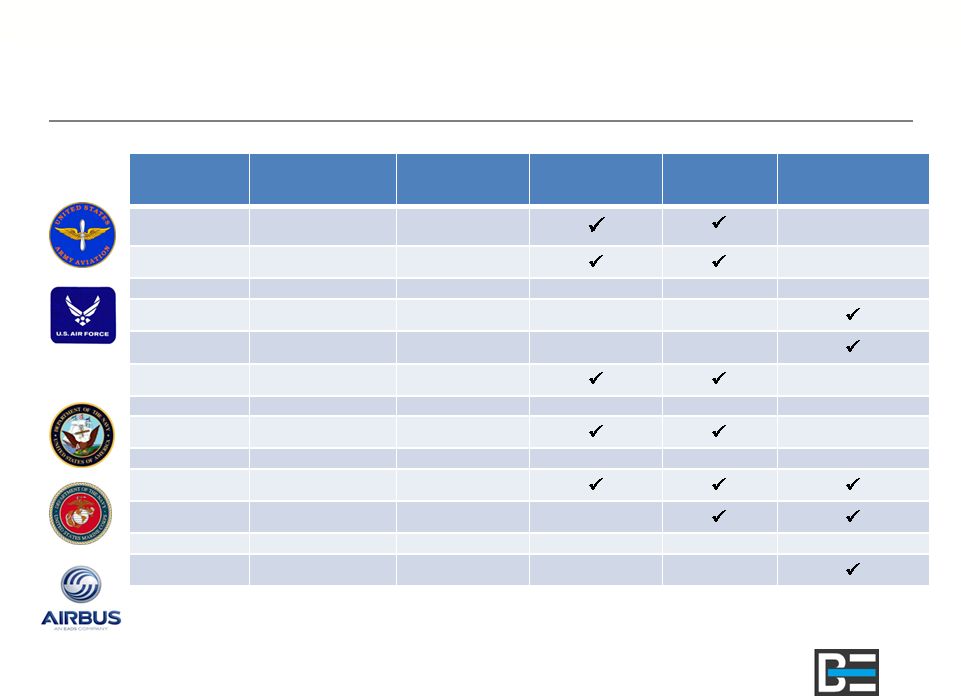

Use or disclosure of data contained on this sheet or subsequent sheets

is subject to the restriction on the title page. Major Military Platforms

Service

OEM

Platform

Rescue Hoist

Cargo Hook

Cargo/Retrieval

Winch

US Army

Sikorsky

UH-60M

Boeing

CH/MH-47

US Air Force

Alenia

C-27J

Boeing

C-17

Sikorsky

HH-60

US Navy

Sikorsky

MH-60R/S

USMC

Sikorsky

CH-53E/K

Bell/Boeing

V-22

Airbus Military

A400M

10 |

Product

Development Cargo Winch

Retrieval Winch

Cargo Hook & Rescue Hoist

Advanced Products

•

Sensors and safety improvement

•

Next generation hoist

•

Weight reduction and reliability improvements |

Use or disclosure of data contained on this sheet or subsequent sheets

is subject to the restriction on the title page. Environmental Site Status

•

Number of Sites at the end of FY10:

14

•

Number of sites closed between FY11 and FY13:

(3)

•

Achieved closures during FY14:

(3)

•

Closed in Q1 FY15:

(1)

•

Current number of sites left to close:

7

12 |

Use or disclosure of data contained on this sheet or subsequent sheets

is subject to the restriction on the title page. Environmental Liability Overview

•

Breeze-Eastern is performing environmental

assessments and remediation work at seven locations,

this is down from eleven locations as of March 31,

2013.

•

In FY 2015, we expect to spend approximately $1.67

million on environmental assessments and

remediation work at the remaining seven locations.

•

The current environmental reserve at June 30, 2014 of

$9.73

million is appropriate for our estimated

environmental liability.

•

Since March 2013, our environmental reserve has been

reduced by approximately $2.95 million, due to the

progress we have made.

13 |

Use or disclosure of data contained on this sheet or subsequent sheets

is subject to the restriction on the title page. Breeze-Eastern Strengths

•

Respected Global Leader in Hoists, Winches, Cargo

Hooks, and Weapons Handling

•

Highly-reliable Products

•

Full-service Provider –

Design, Build, Repair, and

Maintain

•

Established and Growing Product Base for

Aftermarket Spare Parts and Overhaul & Repair

•

Strong Cash Flow and Healthy Balance Sheet

14 |

Use or disclosure of data contained on this sheet or subsequent sheets

is subject to the restriction on the title page. Strategic Focus

•

New Product Development Through the New Virginia

Innovation Center

•

Improvement of Legacy Products

•

Continuous Improvement in Global Customer Service &

Support

•

Speed and Responsiveness to Customer Needs

•

Global Support Network

•

Continue to Leverage Balance Sheet Strength

15 |

Questions

? 16

CONFIDENTIAL INFORMATION: Any and all information, specifications, manufacturing information,

schedules, marketing plans, prices or other data provided in this email to you is

proprietary information belonging to Breeze-Eastern Corporation, and is not to be used, revealed, copied, transmitted or discussed with any third party without the

prior written consent of Breeze-Eastern Corporation. This restriction does not limit your

right to use the above information if it is properly obtained from another source

without restriction. If you have received this E-mail in error, please delete it and

all its contents from your message systems and notify the sender of the erroneous receipt

EXPORT CONTROLLED - WARNING: This document may contain information that is subject to the

International Traffic in Arms Regulation (ITAR) or the Export Administration

Regulations (EAR), and may not be exported, released, or disclosed to foreign nationals,

either in the United States or overseas, without first complying with the export

requirements/regulations of the ITAR and/or the EAR. The recipient is responsible for

complying with all such export requirements/regulations. Include this notice with any

reproduced portions of this document

|

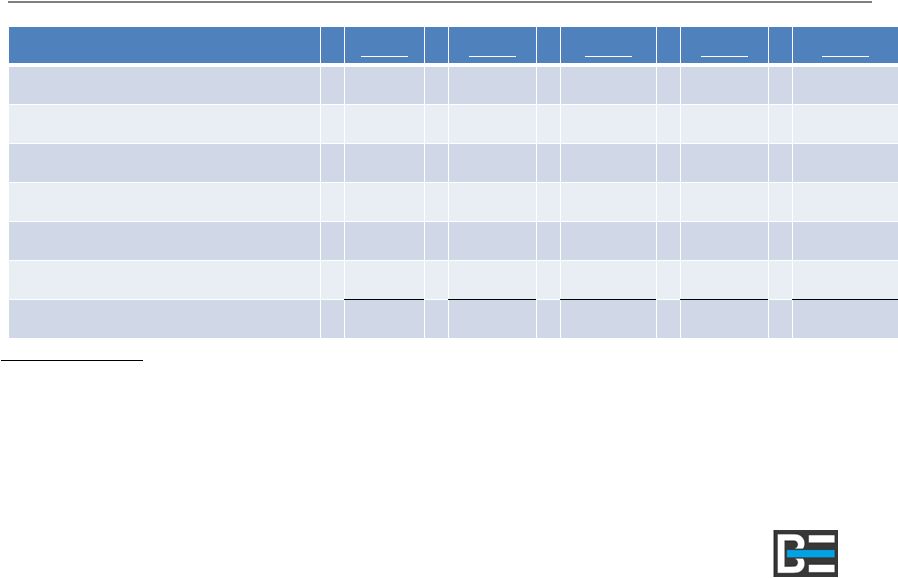

Use or disclosure of data contained on this sheet or subsequent sheets

is subject to the restriction on the title page. Appendix: Adjusted EBITDA

Reconciliation ($ in Thousands)

Adjusted EBITDA*

FY10

FY11

FY12

FY13

FY14

Net income (loss)

$

(6,043)

$

5,026

$

3,776

$

4,076

$

5,641

Provision (benefit) for income taxes

(2,029)

3,524

2,741

3,794

3,310

Depreciation and amortization

1,587

2,271

1,709

1,475

1,699

Relocation expense

817

211

-

-

-

Interest expense

891

694

396

227

49

Other expense-net

458

213

109

93

89

Adjusted EBITDA

$

(4,319)

$

11,939

$

8,731

$

9,665

$

10,788

17

Non–GAAP

Financial

Measures

In addition to disclosing financial results that are determined in accordance with Generally

Accepted Accounting Principles generally accepted in the United States of America (“GAAP”), the Company also

discloses Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization,

other income/expense, loss on debt extinguishment, and relocation expense). The Company presents Adjusted

EBITDA because it considers it an important supplemental measure of performance.

Measures similar to Adjusted EBITDA are widely used by the Company and by others in the Company's industry to

evaluate performance and valuation. The Company believes Adjusted EBITDA facilitates

operating performance comparisons from period to period and company to company by backing out potential

differences caused by variations in capital structure (affecting relative interest expense),

tax positions (such as the impact on periods or companies of changes in effective tax rates or net operating losses)

and the age and book depreciation of facilities and equipment (affecting relative depreciation

expense). The Company also presents Adjusted EBITDA because it believes it is frequently used by investors and

other interested parties as a basis for evaluating performance.

Adjusted EBITDA has limitations as an analytical tool, and should not be considered in

isolation or as a substitute for analysis of the Company's results as reported under GAAP. Some of the limitations of

Adjusted EBITDA are that (i) it does not reflect the Company's cash expenditures for capital

assets, (ii) it does not reflect the significant interest expense or cash requirements necessary to service interest or

principal payments on the Company's debt, and (iii) it does not reflect changes in, or cash

requirements for, the Company's working capital. Furthermore, other companies in the aerospace and defense

industry may calculate these measures differently than the manner presented above.

Accordingly, the Company focuses primarily on its GAAP results and uses Adjusted EBITDA only supplementally.

|