Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - REGENERX BIOPHARMACEUTICALS INC | v389118_8k.htm |

Exhibit 99.1

Corporate Presentation Annual Shareholder’s Meeting September 2014

2 Forward - Looking Statements This presentation contains certain forward - looking statements that involve risks and uncertainties that could cause actual results to be materially different from historical results or from any future results expressed or implied by such forward - looking statements . Examples of such forward - looking statements include statements concerning the target dates for completing the company’s ongoing clinical trials for ophthalmic and orphan indications, the potential size of addressable markets, including the market for topical gels, sterile eye drops and parenteral delivery products, the company’s ability to enter into any collaborations with respect to the development or commercialization of its product candidates, and the therapeutic potential of Tβ 4 for dermal, ophthalmic, cardiovascular and neurovascular wounds . Factors that may cause actual results to differ materially from any future results expressed or implied by any forward - looking statements include the risk that although Tβ 4 has demonstrated potential therapeutic benefit for dermal, ophthalmic, cardiovascular and neurovascular disorders, the company’s product candidates may not demonstrate safety and/or efficacy in clinical trials, the risk that encouraging results from early research, preclinical studies, compassionate use or clinical trials may not be confirmed upon further analysis of the detailed results of such research, preclinical study , compassionate use or clinical trial, the risk that additional information relating to the safety, efficacy or tolerability of our product candidates may be discovered upon further analysis of preclinical or clinical trial data, the risk that the company or its licensees will not obtain approval to market the company’s product candidates in the U . S . or abroad, the risks associated with reliance on outside financing to meet capital requirements, the risks associated with reliance on licensees for the funding or conduct of further development and commercialization activities relating to the company’s product candidates, and such other risks described in the company’s latest Annual Report on Form 10 - K, and other filings the company makes with the SEC . Any forward - looking statements are made pursuant to Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended, and, as such, speak only as of the date made . The Company undertakes no obligation to publicly update any forward - looking statements, whether as a result of new information, future events or otherwise .

3 RegeneRx and Thymosin Beta 4 ▪ Thymosin beta 4 (T β 4) is a highly active molecule and a critical component of t issue protection, repair and regeneration ▪ T β 4 is the subject of numerous published studies in high impact journals showing its broad activity in ophthalmic, cardiac, dermal, CNS and PNS indications ▪ RGRX has developed a synthetic copy of T β4 for clinical use that has been shown to be safe and well - tolerated in over 350 patients ▪ RGRX has developed three distinct T β 4 formulations to optimize its clinical potential and has established a robust intellectual property portfolio ▪ RGRX is engaged in three strategic out - licensing agreements with pharma companies in the EU, China and Pan Asia (includes Korea, Japan, Australia) ▪ RGRX is focused on late - stage ophthalmic clinical indications, including its orphan product candidate for neurotrophic keratopathy. RGRX has products in late stage clinical development

4 Key Ophthalmic Clinical Objectives for 2014 - 2016 ▪ Conduct U.S. Phase 3 trial in patients with neurotrophic keratopathy (NK), an orphan disease − RGRX received orphan designation for NK in December 2013 − RGRX will meet with FDA in 3 rd quarter 2014 − Planning to initiate trial with data projected in 2015 ▪ Support U.S. Phase 2b physician - sponsored trial planned in patients with severe dry eye − 30 patient study to confirm and extend previous results from 2a − P atient data projected within 12 months from initiation − RGRX to provide RGN - 259, clinical monitoring, and regulatory assistance for study ▪ Support Chinese Phase 2 dry eye study estimated to initiate in 2015 − RGRX has provided API for clinical trial − RGRX has provided pre - clinical, clinical, CMC data to licensee for IND − RGRX will have access to data from study ▪ Support Korean Phase 3 dry eye study targeted to initiate in 2015 − RGRX provided API for clinical development − RGRX has provided pre - clinical, clinical, CMC data to licensee for IND − RGRX will have access to data from study Data from 4 clinical trials targeted in 2015 - 2016

5 Orphan Drug Opportunities ▪ RGRX currently has two drug candidates with orphan designations − RGN - 259 for ophthalmic wound healing in patients with neurotrophic keratopathy (NK ) received in December 2013. − RGN - 137 for dermal wound healing in patients with epidermolysis bullosa (EB) that has been out - licensed to Korean company in U.S. ▪ Animal studies have shown that RGN - 259 can regenerate nerve damage and we believe this may be a therapeutic pathway for patients with severe dry eye due to graft vs. host disease (GvHD), a possible third orphan product ▪ Orphan Drug approval benefits: − accelerated clinical development timeline. − 7 years of market exclusivity in the U.S. and 10 years in the E.U. − certain tax credits upon marketing approval. − Japan, China, and Korea either have or are adopting orphan regulations 3 orphan drugs possible in U.S.

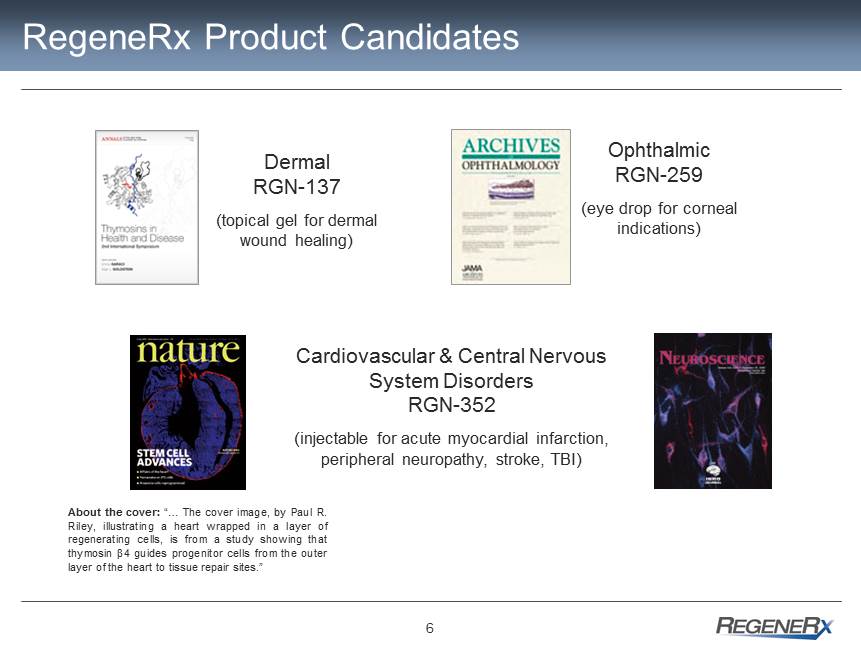

6 Dermal RGN - 137 (topical gel for dermal wound healing) RegeneRx Product Candidates Ophthalmic RGN - 259 (eye drop for corneal indications) Cardiovascular & Central Nervous System Disorders RGN - 352 (injectable for acute myocardial infarction, peripheral neuropathy, stroke, TBI) About the cover : “ … The cover image, by Paul R . Riley, illustrating a heart wrapped in a layer of regenerating cells, is from a study showing that thymosin β 4 guides progenitor cells from the outer layer of the heart to tissue repair sites . ”

7 Potential Clinical Applications T β 4 is a versatile molecule with numerous potential clinical applications Product Disease/application US treatable population/yr.* RGN - 137 Epidermolysis Bullosa (orphan) 12K (T β4 dermal gel) Pressure and Venous Stasis Ulcers >3M Scarring/burns TBD Trauma/surgical procedures TBD RGN - 259 Dry Eye Syndrome 20M (T β4 eye drop) Neurotrophic Keratopathy (orphan) ~10K** Recurrent Corneal Erosions 2.8M Corneal Surgeries 1.3M RGN - 352 Acute Myocardial Infarction 650K (T β4 Injectable solution) Peripheral Neuropathy 15M Stroke 700K Traumatic Brain Injury 500K Multiple Sclerosis 300K *Company estimates ** Stage 2 & 3, Based on EU prevalence data

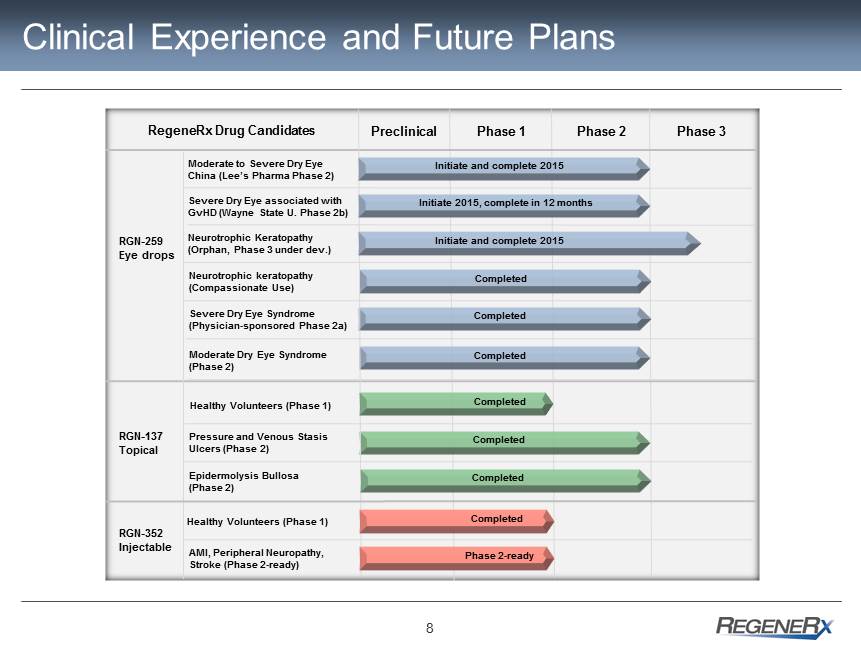

8 Clinical Experience and Future Plans Preclinical Phase 1 Phase 2 Phase 3 RegeneRx Drug Candidates Moderate to Severe Dry Eye China (Lee’s Pharma Phase 2) Severe Dry Eye associated with GvHD (Wayne State U. Phase 2b) Neurotrophic keratopathy (Compassionate Use) Severe Dry Eye Syndrome (Physician - sponsored Phase 2a) Moderate Dry Eye Syndrome (Phase 2) RGN - 259 Eye drops Completed Completed Pressure and Venous Stasis Ulcers (Phase 2) RGN - 137 Topical Epidermolysis Bullosa (Phase 2) Completed Completed Initiate 2015, complete in 12 months Initiate and complete 2015 Healthy Volunteers (Phase 1) Completed Completed RGN - 352 Injectable AMI, Peripheral Neuropathy, Stroke (Phase 2 - ready) Completed Phase 2 - ready Healthy Volunteers (Phase 1) Neurotrophic Keratopathy (Orphan, Phase 3 under dev.) Initiate and complete 2015

9 Summary of Neurotrophic Keratopathy (NK) Trial ▪ Significant findings in neurotrophic keratopathy study: − Drug well - tolerated, no adverse events − 6 neurotrophic keratopathy patients with corneal ulcers that had not healed for 6 weeks to several years either completely healed or demonstrated significant improvement by end of treatment − NK patients reported reduction of eye discomfort after using RGN - 259 − Conclusion : The positive results of this exploratory trial reflect RGN - 259’s reported mechanisms of action and was, in part, the basis for FDA’s decision to grant orphan status. We believe this provides us with the rationale to initiate Phase 3.

10 Development Plans for NK 2014 - 2015 ▪ Received orphan drug designation on December 31, 2013 ▪ Will meet with FDA to discuss plans for pivotal Phase 3 clinical trial in Q3 2014 ▪ Targeting initiation and completion of Phase 3 trial in 2015

11 RGN - 259 Targeted Ophthalmic Markets ▪ Current worldwide dry eye market of $1.9 billion per year → $2.8 billion by 2017* − Restasis™, only Rx product available in U.S. for dry eye • Sales of >$700 million per year, typically patients have burning & stinging, usually takes 6 months until efficacy is seen • Only 15% effective vs. 10% for placebo according to package insert − Clinical data for RGN - 259 shows effects are within days, no burning or stinging ▪ Dry Eye market growth exceeds 6% annually − Supported by aging population, increase in diabetes ▪ If approved, RGN - 259 could be the only product on the market targeted for alleviation of signs and symptoms of dry eye ********************* ▪ Estimated U.S. and EU prevalence of all stages of neurotrophic keratopathy <50,000 each, <10,000 with Stage 2 or 3 ▪ Orphan disease in both territories ▪ Currently no effective treatment for patients with non - healing NK * Market estimates from Global Data Addressing a significant unmet medical needs

12 Strategic Partnering Objectives

13 RGRX Strategic Partnering Objective ▪ Currently we have 3 strategic partnerships via out - licensing agreements that include double - digit royalties, regulatory and commercial milestone payments, and API supply agreements. − Sigma - Tau in - licensed RGRX product candidates for wound healing in the EU − Lee’s Pharmaceuticals in - licensed RGRX product candidates for China, HK, Taiwan and Macau and will initially develop RGN - 259 for dry eye − G - treeBNT in - licensed RGRX’s ophthalmic drug candidate, RGN - 259, for the Pan Asia territory (excluding countries licensed by Lee’s) and our dermal wound healing drug candidate, RGN - 137, in the U.S. ▪ RegeneRx is also seeking strategic partners to develop RGN - 352, our injectable T β 4 drug candidate, for large market opportunities requiring substantial substantial development costs − Preclinical data supports large market indications such as acute myocardial infarction and heart failure − Preclinical data also support CNS and PNS indications such as stroke, traumatic brain injury and peripheral neuropathy Leveraging our assets to effectively develop our product candidates internally and externally

14 Selected Financial Data at 9/9/2014 ▪ OTC symbol RGRX ▪ Cash @ 6/30 $675K E st Use (275K) $1M from G - treeBNT 1.0M Est Cash at 8/30 $1.4M ▪ Shares outstanding 101M ▪ S hare price $0.12 ▪ Market capitalization $12M

15 Summary of Key Value Drivers: ▪ RGN - 259 preservative - free eye drops are being studied in 4 critical clinical trials with patient data estimated in 2015/2016 − RegeneRx highest priority is developing and sponsoring a Phase 3 pivotal clinical trial in patients with neurotrophic keratopathy (NK) in the U.S. targeted to be initiated and completed in 2015 − RegeneRx’s physician collaborators intend to initiate a Phase 2b study with RGN - 259 in the U.S. to evaluate 3 doses of the drug candidate in patients with severe dry eye in 2015 − RegeneRx’s Chinese licensee is sponsoring a Phase 2 moderate to severe dry eye trial in China with RGN - 259 and filed its IND this past summer − RegeneRx’s Korean licensee is developing RGN - 259 for dry eye in Korea and other Pan Asian countries and is evaluating sponsoring a Phase 3 study in Korea ▪ RGN - 352 injectable solution is Phase 2 - ready and is the subject of strategic licensing discussions