Attached files

| file | filename |

|---|---|

| EX-10.2 - EX-10.2 - Bison Merger Sub I, LLC | d744403dex102.htm |

| EX-10.3 - EX-10.3 - Bison Merger Sub I, LLC | d744403dex103.htm |

| EX-10.4 - EX-10.4 - Bison Merger Sub I, LLC | d744403dex104.htm |

| EX-10.1 - EX-10.1 - Bison Merger Sub I, LLC | d744403dex101.htm |

| EX-23.1 - EX-23.1 - Bison Merger Sub I, LLC | d744403dex231.htm |

| EX-10.5 - EX-10.5 - Bison Merger Sub I, LLC | d744403dex105.htm |

Table of Contents

As filed with the Securities and Exchange Commission on September 15, 2014

Registration No. 333-198322

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

FMSA HOLDINGS INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 1400 | 34-1831554 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

8834 Mayfield Road

Chesterland, Ohio 44026

(800) 255-7263

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jenniffer D. Deckard

President and Chief Executive Officer

FMSA Holdings Inc.

8834 Mayfield Road

Chesterland, Ohio 44026

(800) 255-7263

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| David P. Oelman | J. Michael Chambers | |

| Alan Beck | Sean T. Wheeler | |

| Vinson & Elkins L.L.P. | Latham & Watkins LLP | |

| 1001 Fannin Street, Suite 2500 | 811 Main Street, Suite 3700 | |

| Houston, Texas 77002 | Houston, Texas 77002 | |

| (713) 758-2222 | (713) 546-5400 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer þ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

(Subject to Completion, dated September 15, 2014)

Shares

FMSA Holdings Inc.

COMMON STOCK

This is the initial public offering of the common stock of FMSA Holdings Inc., a Delaware corporation. We are not offering any shares of our common stock. The selling stockholders identified in this prospectus are offering shares of our common stock. We will not receive any proceeds from the sale of shares by the selling stockholders. No public market currently exists for our common stock. We are an “emerging growth company” and are eligible for reduced reporting requirements. Please see “Prospectus Summary—Emerging Growth Company Status.”

We have applied to list our common stock on the New York Stock Exchange under the symbol “FMSA.”

We anticipate that the initial public offering price will be between $ and $ per share.

Investing in our common stock involves risks. Please see “Risk Factors” beginning on page 13 of this prospectus.

| Per share |

Total |

|||||||

| Price to the public |

$ | $ | ||||||

| Underwriting discounts and commissions (1) |

$ | $ | ||||||

| Proceeds to the selling stockholders (before expenses) |

$ | $ | ||||||

| (1) | Please see “Underwriting” for a description of all underwriting compensation payable in connection with this offering. |

The selling stockholders have granted the underwriters the option to purchase up to additional shares of common stock on the same terms and conditions set forth above if the underwriters sell more than shares of common stock in this offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares on or about , 2014.

| Morgan Stanley | Wells Fargo Securities | Barclays | ||||||||

| Goldman, Sachs & Co. | Jefferies | J.P. Morgan | ||

| KeyBanc Capital Markets | RBC Capital Markets |

| Baird | Cowen and Company | |

| PNC Capital Markets LLC | Raymond James | |

| Scotiabank / Howard Weil | Simmons & Company International | |

| Tudor, Pickering, Holt & Co. | ||

Prospectus dated , 2014

Table of Contents

Table of Contents

| 1 | ||||

| 13 | ||||

| 34 | ||||

| 36 | ||||

| 37 | ||||

| 37 | ||||

| 38 | ||||

| SELECTED HISTORICAL CONSOLIDATED FINANCIAL AND OPERATING DATA |

39 | |||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

41 | |||

| 60 | ||||

| 68 | ||||

| 96 | ||||

| 100 | ||||

| 111 | ||||

| 116 | ||||

| 118 | ||||

| 123 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS FOR NON-U.S. HOLDERS |

125 | |||

| 129 | ||||

| 135 | ||||

| 135 | ||||

| 135 | ||||

| F-1 | ||||

| A-1 |

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by us or on behalf of us or to the information which we have referred you. Neither we, the selling stockholders nor the underwriters have authorized anyone to provide you with information different from that contained in this prospectus and any free writing prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We, the selling stockholders and the underwriters are offering to sell shares of common stock and seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. See “Risk Factors” and “Forward-Looking Statements.”

i

Table of Contents

INDUSTRY AND MARKET DATA

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, government publications and other published independent sources. The industry data sourced from The Freedonia Group is from their Industry Study #3160, “Well Stimulation Materials,” published in June 2014. The industry data sourced from PacWest Consulting Partners is from their “Proppant Market Analysis: 13Q4 Release,” published in March 2014. Investors are cautioned not to place undue reliance on the market related research statistics. The market data regarding supply and demand is difficult to quantify as the proppant industry continues to evolve and many market participants are privately held, making accurate estimates of supply capacity and market demand difficult to qualify. Some data is also based on our good faith estimates. Although these are third-party sources, we acknowledge our responsibility for all disclosures in this prospectus. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled “Risk Factors.” These and other factors could cause results to differ materially from those expressed in these publications.

TRADEMARKS AND TRADE NAMES

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and does not imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks, service marks and trade names.

ii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our common stock. For a more complete understanding of us and this offering, you should read and carefully consider the entire prospectus, including the more detailed information set forth under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes. Some of the statements in this prospectus are forward-looking statements. See “Forward-Looking Statements.” Unless we state otherwise or the context otherwise requires, the terms “we,” “us,” “our,” “Fairmount Santrol,” “our business” and “our company” refer to FMSA Holdings Inc. and its consolidated subsidiaries and predecessor companies. On August 15, 2014, FML Holdings, Inc. changed its name to “FMSA Holdings Inc.” We include a glossary of some of the terms used in this prospectus as Appendix A. Unless otherwise indicated, information in this prospectus is adjusted to reflect the for stock split to be effected prior to the effective date of the registration statement of which this prospectus forms a part.

Our Company

We are one of the world’s largest providers of sand-based proppant solutions and for over 30 years have been a pioneer in the development of high performance proppants used by oilfield service and exploration and production (“E&P”) companies to enhance the productivity of their oil and gas wells. Fairmount Santrol offers the broadest range of proppants available in the market today, including high quality sand and a spectrum of resin coated products, all of which exceed American Petroleum Institute (“API”) specifications. Additionally, for more than 120 years, we and our predecessor companies have provided high quality sand-based products, strong technical leadership and applications knowledge to end users in the foundry, glass, building products, and sports and recreation markets (collectively the Industrial and Recreational, or the “I&R” markets). We believe our two primary market segments are complementary. Our ability to sell to a wide range of customers across multiple end markets allows us to maximize the economic recovery of our reserve base.

As one of the nation’s longest continuously operating mining organizations, we have developed a strong commitment to environmental stewardship and to the three pillars of Sustainable Development: People, Planet and Prosperity. Our strong commitment to safety is reflected in the health and safety of our employees and is illustrated by having achieved a lost-time incident rate that is less than half the industry average. From 2011 through June 30, 2014, our employees have demonstrated our commitment to our communities by donating approximately 36,000 hours of company-paid volunteer time, as well as significant personal volunteer time, into the communities in which we live and operate. We are focused on environmental stewardship, and ten of our facilities now generate zero waste to landfills. Additionally, we have successfully executed annual initiatives to reduce our carbon emissions and have planted over 225,000 trees since 2011 in order to offset our Tier I and Tier II carbon emissions. We believe adhering to sustainable development principles is not only the right thing to do, but also results in a higher level of engagement and commitment from our employees, better relationships with our communities and, as a result, a stronger base from which to pursue profitable growth over the long-term. Abiding by these guiding principles, our corporate motto is “Do Good. Do Well.”

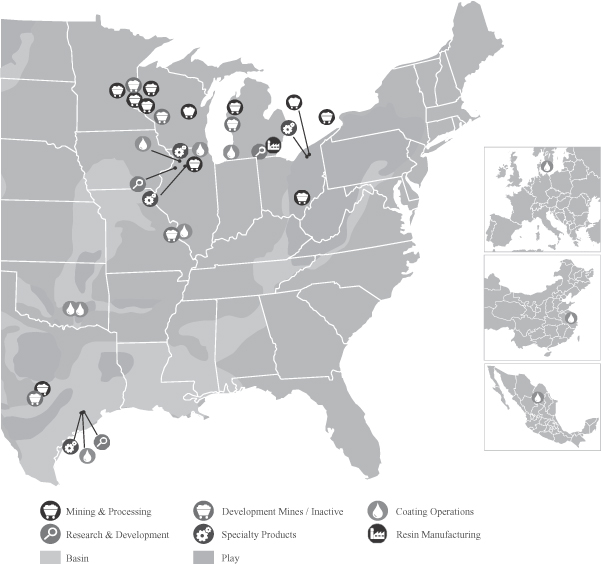

We began investing in large scale proppant production capacity in the early 1980s, leveraging our early industry relationships with Halliburton and a predecessor company to Baker Hughes. Since then, our business, and particularly our Proppant Solutions segment, has grown significantly. Today we have vertically integrated operations that combine mining, sand processing, and resin manufacturing and coating operations with a broad logistics network and state-of-the-art research and development capabilities. Our ability to leverage our integrated asset base to provide comprehensive proppant solutions has allowed us to become a long-term, trusted partner to our customers.

1

Table of Contents

Our primary attributes include:

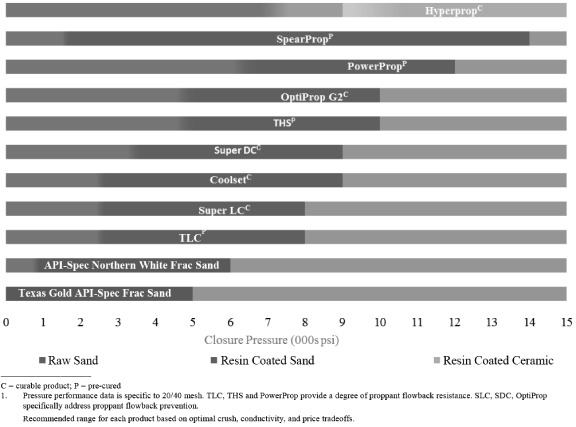

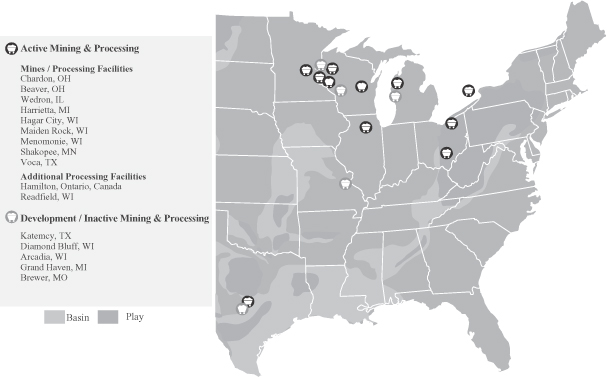

| • | Sand Reserves and Processing Assets. We have one of the largest sand reserves and processing asset bases in the industry, including, as of December 31, 2013, 798.2 million tons of proven mineral reserves, 11 active sand processing facilities with 12.3 million tons of annual sand processing capacity, a resin manufacturing facility and 11 coating facilities with 2.4 million tons of annual coating capacity. From 2009 to 2013, we expanded our annual raw frac sand and coating capacities by approximately 6.0 million and 1.5 million tons, respectively, through a combination of organic growth and acquisitions. Our coating facilities include operations in Mexico, Denmark and China, through which we serve international oil and gas markets. |

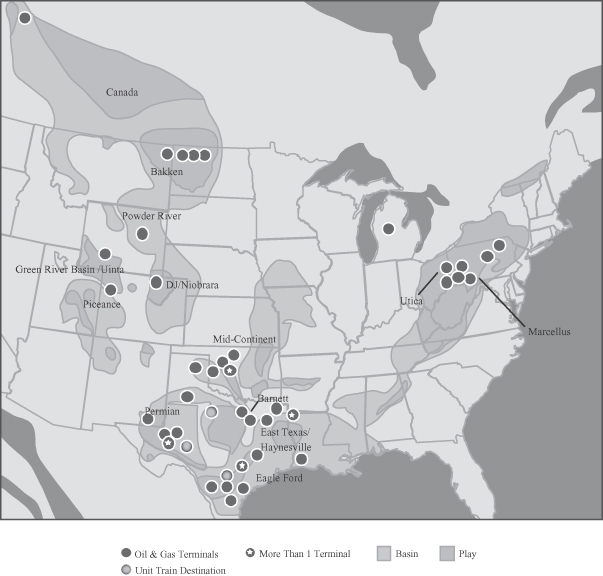

| • | Product Delivery. We are capable of Class I railroad deliveries to each of North America’s major oil and gas producing basins and we also have the flexibility to ship our product via barge and trucks to reach our customers in certain basins. We operate an integrated logistics platform consisting of 46 proppant distribution terminals with significant associated storage, 32 of which exclusively handle our products. Since 2011, we have developed or acquired 24 distribution terminals, providing significant additional annual transloading capacity. We also service I&R end markets through seven additional terminals. As of August 15, 2014, we had a fleet of over 8,500 railcars and expect this fleet to grow to over 13,000 through 2016. By the end of the third quarter of 2014, we also expect to have expanded our unit train capabilities to three production facilities and three in-basin terminals, which we expect to reduce freight costs and improve cycle times for our railcar fleet. |

| • | Customers. We currently have approximately 80 proppant customers, including the largest U.S. pressure pumping companies, and a total of nearly 850 customers across all end markets. Our goal is to create long-term, partnering relationships with our customers. We sell product on a purchase order basis and through supply agreements. The majority of our proppant supply agreements have market-based pricing and volumetric provisions based on our customer’s requirements, which we believe has strengthened our customer relationships over multiple market cycles. |

| • | Innovation. We have an established history of proppant innovation and we continue to make substantial investments in engineering, research and development and technical marketing. We pioneered the manufacturing and use of resin coated proppant and continue to introduce new and innovative products. For example PowerProp, our coated product with the greatest crush resistance, has characteristics competitive with lightweight ceramics. We are currently field testing a brand new technology, Propel SSP. This proppant transport technology is a new proppant category in which a polymer, wrapped around sand or ceramic, swells upon contact with water. The shear-stable polymer suspends the proppant in water, transporting each grain farther and higher into fractures. Polymer breaking occurs with conventional chemistry. This better transport expands the hydrocarbon drainage radius with a maximized propped fracture area to increase ultimate recovery. |

We are experiencing high demand for our products and our business is currently experiencing significant growth. Our revenues have grown at a compound annual growth rate of approximately 19% and 25% since 2004 and 2009, respectively. Since 2011, our revenues have grown at a rate of 4% as the market for resin-coated products softened. We have seen considerable strengthening in both the raw and resin-coated markets in 2014, and our revenues for the first six months of this year are up by 40% compared to the same period last year (please see “Results of Operations” beginning on page 47 for further discussion of factors impacting our revenue growth).

For the year ended December 31, 2013, we sold over 7.5 million tons, generated $988 million in revenues, $293 million of Adjusted EBITDA and $105 million of net income. We cannot provide any assurance that we will achieve these growth rates or margins in the future. For a definition of “Adjusted EBITDA” and a reconciliation of Adjusted EBITDA to its most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles (“GAAP”), please read “—Summary Historical Consolidated Financial and Operating Data—Non-GAAP Financial Measures” beginning on page 10.

2

Table of Contents

Our Competitive Strengths

We believe that we are well positioned to execute our strategy based on the following competitive strengths:

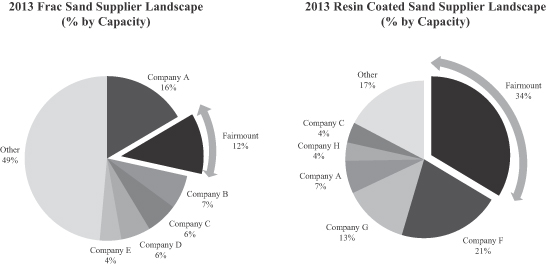

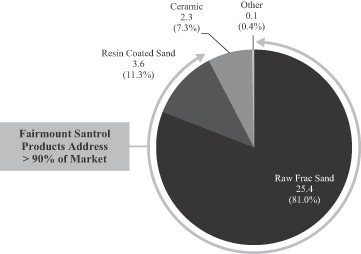

A Leading Proppant Producer; Broadest Product Suite. We have a broad suite of products that address more than 90% of the proppant market. According to PacWest Consulting Partners, we were the second largest supplier of raw frac sand and the largest supplier of resin coated sand in 2013, based on our production capacity and coating capacity, respectively. Our raw sand product suite includes all mesh sizes of high performing API-spec Northern White frac sand and our branded API-spec Texas Gold brown frac sand, which enjoys a delivered cost advantage to certain basins, including the Eagle Ford Shale and Permian Basin. Our portfolio of resin coated products provides a range of strength, flowback and conductivity characteristics. Our product breadth allows us to offer a comprehensive proppant solution across a broad range of well characteristics and our scale provides us with the flexibility to fill large individual orders, often on short notice. As proppant consumption per well has increased, and completion solutions are increasingly tailored, we believe that our scale and product breadth provide us with a competitive advantage.

Industry’s Largest Captive Terminal Footprint and Broadest Logistics Capabilities. In recent years, oilfield service companies have increasingly sought proppant suppliers with logistics capabilities to deliver product in-basin. We sell our proppants directly to customers in all of North America’s major oil and gas producing basins through our 46 proppant distribution terminals, the largest logistics network in the industry. In 2013, approximately 80% of our proppant volume was sold in-basin at one of our distribution terminals, compared to approximately 65% in 2012. We ship our products via North America’s Class I railroads in our fleet of more than 8,500 railcars as of August 15, 2014, which includes approximately 790 railcars made available to us by our customers. By the third quarter of 2014, we expect to have expanded our unit train capabilities to three of our processing facilities and three of our in-basin terminals. We expect these unit train capabilities will reduce our freight costs and improve cycle times for our railcar fleet. We also have the flexibility to ship our product via barge and truck to multiple basins. Importantly, over 70% of our terminal capacity exclusively handles our products. Taken together, we believe the significant scale our distribution network, its geographic scope, and our captive terminal strategy provide us with a competitive advantage.

Focus on Innovation and New Product Development. We have a history of collaborating with our customers to develop innovative solutions to enhance the effectiveness of well completions, from conventional wells to the most complex, multi-stage, horizontal wells. Our vertically integrated model allows us to participate in each phase of proppant development, manufacturing and delivery and provides us a unique perspective into the current and future needs of our customers. Our technical sales team works closely with market participants to demonstrate the value proposition of our performance proppants in order to stimulate market demand. In 1976, our predecessor pioneered the development of resin coated proppants and we have been issued numerous related patents. Our product developments include OptiProp, SLC, THS, PowerProp and CoolSet, each with uniquely tailored down-hole performance characteristics. After acquiring the technology that underlies Propel SSP in May 2013, our team worked to further refine the product’s technology and manufacturing technique. We have successfully produced and shipped Propel SSP in commercial quantities to several key customers who are currently testing the product in field trials.

Trusted Partner to Our Customers. We are a trusted partner and have significant long-term relationships with each of the four largest U.S. pressure pumping companies, who together represent approximately 65% of the market, as well as many small and mid-sized oilfield service companies. These customer relationships are driven by our ability to enhance our customers’ operations and profitability by delivering a full suite of high-quality proppant products, where, when and as-needed. These benefits also extend to the E&P companies serviced by our service company customers, who directly benefit from the enhanced well productivity that our products offer. We believe our customers value the ability of our substantial scale, product diversity and extensive logistics network to meet their evolving proppant needs.

3

Table of Contents

Efficient Operations and Economies of Scale Support Strong Cash Flow Generation. Our vertically integrated operations, low production costs and low maintenance capital expenditures have enabled us to be profitable and generate positive cash flows over an extended period. We own a substantial majority of our reserves, and our processing plants are located on or in close proximity to rail access, reducing the need for on-road transportation and minimizing product movement costs. Our integrated logistics management expertise and geographically advantaged facility network enables us to reliably ship products by the most cost-effective method available. We believe our significant and growing cash flow will enable us to continue to invest in additional sand production, processing, coating and terminal facilities as well as research and development for new products.

Experienced Management Team Aligned with Stockholders. We have an experienced leadership team with extensive industry knowledge and a proven track record of profitable growth. Our executive management team has developed new product offerings and process technologies, and has grown our business through greenfield mine development, capacity expansions, acquisitions and investments in logistics infrastructure. Most of our executive management team has been at Fairmount Santrol for 20 years or more, and as of December 31, 2013 our revenue had grown at a compound annual growth rate of approximately 14% and 25% since 1994 and 2009, respectively. Our founders remain active advisors to our management and are members of our board of directors. Pro forma for this offering, our management, employees and founders will own approximately % of our outstanding common stock. Accordingly, our executive management team and our employees are aligned with our investors and highly incentivized to pursue long-term, profitable growth and a high return on capital deployed.

Our Strategy

Our objective is to create long-term and sustainable value for our stakeholders. We intend to pursue this objective through the execution of the following strategies:

Increase Reserves and Processing Capacity. We have historically grown our reserves and mining and processing capacities by developing greenfield sites, expanding existing facilities and acquiring operating assets and reserves. From 2009 to 2013, we expanded our annual raw frac sand capacity by approximately 6.0 million tons and our annual coating capacity by 1.5 million tons. Currently, we believe our customers’ demand for our products exceeds our production capacity. Accordingly, we expect to continue to invest in production capacity and new reserves. In 2013, we acquired an idled 1.0 million ton per year frac sand processing facility in Brewer, Missouri from FTS International Services, LLC (“FTSI”) and expect to resume operations at this facility within the next six months. We also expect to increase annual frac sand production capacity at a current facility by 1.5 million tons by the end of the first quarter of 2016. In addition to these expansions, we control, or have an option to control, additional reserves on four properties (three with Northern White reserves, one with Texas Gold) and expect to develop one or two frac sand facilities on these greenfield sites by mid-2016. In order to ensure that we have adequate capacities and reserves to meet future demand, we have an active pipeline of expansion opportunities in varying stages of development. We currently have 2.4 million tons of annual coating capacity and are in the process of expanding these capacities by an additional 0.8 million tons per year by the fourth quarter of 2015. We will continue to evaluate the opportunity to expand coating capacity based on market demand for coated products.

Expand Logistics Capabilities. Since 2011, we have developed or acquired 24 distribution terminals, providing 13.1 million tons of additional annual transloading capacity. We will continue to invest in terminals, storage and rail infrastructure as our customers continue to demand more product delivered closer to producing basins. We will also continue to enhance our unit train capabilities to reduce freight costs and improve cycle times for our railcar fleet. Since 2009, we have increased our railcar fleet by approximately 140% and expect to increase the size of our railcar fleet by over 35% through the second half of 2015 to accommodate our growing customer demands.

4

Table of Contents

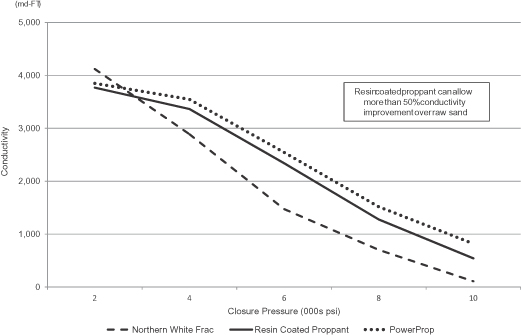

Increase Market Penetration of Our Resin Coated Proppants. We believe that resin coated proppants offer compelling performance advantages relative to other proppants. Our field data indicates that high quality resin coated proppants enhance oil and gas reservoir conductivity compared to raw sand and are a cost-effective alternative to lightweight ceramic proppants. Field data also indicate that resin coated proppants reduce proppant flowback. Our resin coating capacity is the largest in the industry, providing our customers enhanced assurance of supply. Due to superior performance and value added formulation and manufacturing processes, sales of our resin coated products generate a higher per ton profit as compared to our raw frac sand. We will continue to work with market participants by hosting technical sales meetings, obtaining field data, and producing scientific papers which highlight the value proposition of resin coated proppant. Through these efforts, we will seek to increase overall market penetration of our resin coated proppant.

Develop and Commercialize High Performance Proprietary Proppants. We pioneered the manufacturing and use of resin coated proppants and have a history of developing innovative technologies that increase the effectiveness of downhole completions, from conventional wells to the most complex, multi-stage horizontal wells. In 2012, we made a significant investment in a new state-of-the-art research and development facility and strengthened our team of scientists, material engineers and process engineers focused on developing innovative and proprietary proppants. As a result of our commitment, our new product development record is strong. For example, we successfully developed and commercialized PowerProp, a patented resin coated sand proppant with characteristics competitive with lightweight ceramic proppants, and CoolSet, a resin coated sand proppant that works at low temperatures with no chemical activators. Additionally, we are currently conducting field trials for Propel SSP after developing a commercialized processing capability and expect full commercial launch by early 2015. We are in constant dialogue with our customers regarding evolving product needs and have a number of new products in various stages of development.

Execute all of our Corporate Initiatives with a Commitment to Customers, Employees and Communities. Our corporate culture emphasizes People, Planet and Prosperity, and our sustainability strategy defines our approach to operations and community engagement. We work to minimize our environmental impact and continue to find ways to reduce waste while also reducing operating costs. We are honored to receive recognition from our communities for our focus on sustainable mining practices, reclamation and community investment. We believe that positive community engagement is both a privilege and a responsibility, and that it enhances our ability to recruit and retain employees, obtain mining and other operating permits and strengthen relationships with our customers. Our corporate motto is “Do Good. Do Well” and we intend to continue to execute our growth strategy with a focus on sustainable development.

Industry Trends

Over the past decade, E&P companies have increasingly focused on exploiting the vast hydrocarbon reserves contained in North America’s oil and gas reservoirs. Using advanced techniques, such as horizontal drilling and hydraulic fracturing, North American production of oil and gas has grown rapidly as the development of horizontal drilling technologies has evolved. More recently, E&P companies are increasing their focus on optimizing the use of proppant as a critical component of these efforts to improve well productivity and maximize their returns on invested capital.

This focus on efficiency and profitability has led to new development techniques, such as increased use of pad drilling which results in a greater number of wells drilled per rig, and incorporating longer lateral lengths and shorter intervals between frac stages, which results in more fracturing stages per well. In addition, the amount of proppant used per stage has increased dramatically, compounding the increase in total demand for proppant. In recent months, individual wells have been completed with more than 6,000 tons of proppant, which is the equivalent of 60 railcars or 240 truckloads. This represents a several fold increase in large scale completions from just a few years ago.

5

Table of Contents

Both E&P companies as well as oilfield service providers with whom they contract, are more precisely selecting the type and volume of proppants employed to optimize conductivity and improve well productivity. Specifications for proppant type and quantity can be made by the E&P companies, the oilfield service providers or collaboratively. These specifications are resulting in not only the use of increasing amounts of proppant per well, they are also incorporating a broader selection of proppant types, a wider range of mesh sizes, and a selection of high performance proppants to tailor the proppant solution to the specific geologic characteristics of the well. Furthermore, both E&P companies and oilfield service providers are investing in value-added proppants when the improvement in well production and efficiencies justifies the increased proppant investment. These recent trends are resulting in increased demand for resin coated proppants, which provides enhanced performance characteristics relative to raw sand but at a lower cost than ceramic proppants.

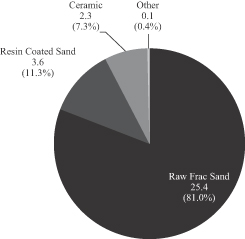

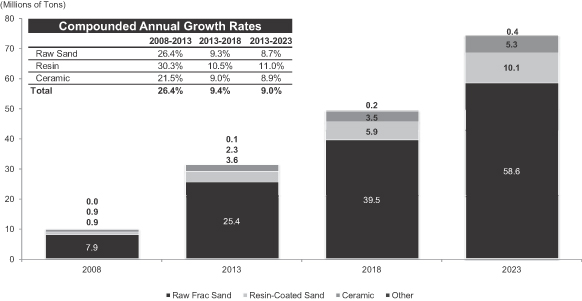

As a result of these trends, according to The Freedonia Group, an international business research company, U.S. demand for all proppants has increased rapidly, growing at an average annual rate of 26% from 2008 to 2013, when proppant sales reached more than 31 million tons. The Freedonia Group estimates that total annual proppant sales will exceed 49 million tons in 2018 and 74 million tons by 2023. They also estimate that resin coated sands and other value added products will comprise a growing share of the overall proppant market. The market for resin coated sand is expected to grow 10.5% annually through 2018 as compared to 9.3% for raw frac sand and 9.0% for ceramic proppants according to the Freedonia Group’s estimates.

As demand for sand-based proppants has increased dramatically in recent years, the supply of quality API-spec raw frac sand has struggled to keep pace, resulting, at times, in a supply-demand disparity. While a number of existing and new proppant vendors have announced supply expansions and greenfield projects, we do not expect the magnitude of these supply expansions to fully meet the expected growth in demand. There are numerous key constraints to increasing raw frac sand production on an industry-wide basis, including:

| • | the difficulty of finding frac sand deposits that meet API specifications; |

| • | the difficulty of securing contiguous frac sand reserves large enough to justify the capital investment required to develop a processing facility; |

| • | the challenges of identifying reserves with the above characteristics that are either located in close proximity to oil and gas reservoirs or have rail access needed for low-cost transportation to major shale basins; |

| • | the hurdles of securing mining, production, water, air, refuse and other federal, state and local operating permits from the proper authorities; |

| • | local opposition to the development of mining facilities, especially those that require the use of on-road transportation, including moratoria on raw frac sand facilities in multiple counties in Wisconsin and Minnesota which hold potential sand reserves; and |

| • | proximity to logistics infrastructure and the ability to develop comprehensive logistics capabilities. |

E&P companies’ and oilfield service providers’ preferences and expectations have also been evolving in recent years. A proppant vendor’s logistics capabilities have become an important differentiating factor when competing for business, on both a spot and contract basis. Proppant consumers have an increasing preference for convenient in-basin proppant delivery capability. We believe that, over time, the largest proppant customers will prefer to consolidate their purchases across a smaller group of suppliers with robust logistics capabilities and a broad offering of high performance proppants.

Risk Factors

Investing in our common stock involves risks that include the demand for sand-based proppants and other risks. For a discussion of these risks and other considerations that could negatively affect us, including risks related to this offering and our common stock, see “Risk Factors” and “Forward-Looking Statements.”

6

Table of Contents

Ownership

We have a long history of employee ownership as well as ownership by financial sponsors. Our current ownership is comprised of employees, including members of our management team and our employee stock bonus plan, our founders, other non-employee stockholders and ASP FML Holdings, LLC (“ASP FML”), an affiliate of American Securities LLC (“American Securities”). American Securities is a leading U.S. middle-market private equity firm that invests in market-leading North American companies. American Securities currently has over $10 billion of assets under management and is investing from its sixth fund. American Securities focuses its core investments in the industrial sector including general industrial, aerospace and defense, agriculture, environmental, recycling paper and packaging, power and energy, and specialty chemicals. American Securities has a proven track record of successfully working with management teams to develop and implement strategies for sustained profitability.

Emerging Growth Company Status

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or “JOBS Act.” For as long as we are an emerging growth company, unlike other public companies, we will not be required to:

| • | provide an auditor’s attestation report on management’s assessment of the effectiveness of our system of internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002; |

| • | comply with any new requirements adopted by the Public Company Accounting Oversight Board, or the PCAOB, requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; |

| • | comply with any new audit rules adopted by the PCAOB after April 5, 2012, unless the Securities and Exchange Commission determines otherwise; |

| • | provide certain disclosure regarding executive compensation required of larger public companies; or |

| • | obtain stockholder approval of any golden parachute payments not previously approved. |

We will cease to be an “emerging growth company” upon the earliest of:

| • | when we have $1.0 billion or more in annual revenues; |

| • | when we have at least $700 million in market value of our common stock held by non-affiliates; |

| • | when we issue more than $1.0 billion of non-convertible debt over a three-year period; or |

| • | the last day of the fiscal year following the fifth anniversary of our initial public offering. |

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to “opt out” of such extended transition period and, as a result, will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

Stock Split

On , 2014, we amended and restated our Second Amended and Restated Certificate of Incorporation to effect a for stock split of our issued and outstanding common stock. For additional information, see “Stock Split.”

7

Table of Contents

Corporate History Information

We were incorporated as a Delaware corporation in 1986. Our predecessor companies began operations over 120 years ago. In August 2010, we partnered with American Securities when affiliated funds managed by American Securities (collectively with American Securities, the “AS Group”) acquired indirect control over ASP FML, who acquired 51% of our stock (the “AS Group Acquisition”). Our corporate headquarters is located at 8834 Mayfield Road, Chesterland, Ohio 44026. Our telephone number is (800) 255-7263. Following the completion of this offering, our website will be located at www.fairmountsantrol.com. The information on our website is not deemed to be part of this prospectus.

8

Table of Contents

The Offering

| Common stock offered by the selling stockholders |

shares (or shares, if the underwriters exercise in full their option to purchase additional shares) |

| Common stock to be outstanding after the offering |

shares |

| Common stock owned by the selling stockholders after the offering |

shares (or shares, if the underwriters exercise in full their option to purchase additional shares) |

| Over-allotment option |

The selling stockholders have granted the underwriters a 30-day option to purchase up to an aggregate of additional shares of our common stock to cover over-allotments. |

| Use of proceeds |

We will not receive any of the proceeds from the sale of shares of our common stock by the selling stockholders. |

| Dividend policy |

We do not anticipate paying any cash dividends on our common stock. In addition, our revolving credit facility and term loans place certain restrictions on our ability to pay cash dividends. |

| Listing and trading symbol |

We have applied to list our common stock on the New York Stock Exchange (“NYSE”) under the symbol “FMSA.” |

The information above excludes 519,113 shares ( shares after giving effect to our proposed stock split) of common stock issuable upon the exercise of stock options outstanding as of June 30, 2014 under our existing equity incentive plan, as well as shares of common stock reserved for issuance under our new 2014 Long-Term Incentive Plan, or the LTIP, that we intend to adopt in connection with the completion of this offering.

Unless otherwise indicated, all information in this prospectus reflects and assumes the for stock split of our common stock to be effected prior to the effective date of the registration statement of which this prospectus forms a part.

9

Table of Contents

Summary Historical Consolidated Financial and Operating Data

The following table sets forth our summary historical consolidated financial and operating data as of the dates and for the periods indicated. We have derived the summary historical consolidated financial and operating data as of and for the years ended December 31, 2009, 2010 and 2011 from our unaudited consolidated financial statements, which are not included in this prospectus. We have derived the summary historical consolidated financial and operating data as of, and for the years ended December 31, 2012 and 2013 from our audited consolidated financial statements, which are included elsewhere in this prospectus. We have derived the summary historical consolidated financial and operating data for the six months ended June 30, 2013 and as of and for the six months ended June 30, 2014 from our unaudited condensed consolidated financial statements that are included elsewhere in this prospectus. We have derived the financial data as of June 30, 2013 from our unaudited condensed consolidated financial statements that are not included in this prospectus. Our unaudited condensed consolidated financial statements have been prepared on the same basis as our audited consolidated financial statements and, in our opinion, include all adjustments, consisting of normal recurring adjustments, that we consider necessary for a fair presentation of our financial position, results of operations and cash flows for such periods. Historical results are not necessarily indicative of future results.

The summary historical consolidated data presented below should be read in conjunction with “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes and other financial data included elsewhere in this prospectus.

| Year Ended December 31, | Six Months Ended June 30, |

|||||||||||||||||||||||||||

| 2009 | 2010 | 2011 | 2012 | 2013 | 2013 | 2014 | ||||||||||||||||||||||

| (In thousands) | ||||||||||||||||||||||||||||

| Statement of Income Data: |

||||||||||||||||||||||||||||

| Revenue |

$ | 398,660 | $ | 667,089 | $ | 909,742 | $ | 885,190 | $ | 988,386 | $ | 448,241 | $ | 629,223 | ||||||||||||||

| Income from operations |

78,711 | 173,034 | 296,903 | 278,426 | 227,956 | 125,621 | 146,246 | |||||||||||||||||||||

| Income before provision for income taxes |

69,526 | 146,602 | 217,855 | 219,842 | 149,876 | 98,510 | 111,227 | |||||||||||||||||||||

| Net income |

49,506 | 100,494 | 146,098 | 149,473 | 104,657 | 68,816 | 78,815 | |||||||||||||||||||||

| Net income attributable to FML Holdings, Inc. |

48,901 | 99,454 | 145,183 | 148,886 | 103,961 | 68,564 | 78,460 | |||||||||||||||||||||

| Earnings per share: |

||||||||||||||||||||||||||||

| Basic(1) |

n/a | n/a | $ | 32.28 | $ | 32.49 | $ | 22.66 | $ | 14.95 | $ | 17.04 | ||||||||||||||||

| Diluted(1) |

n/a | n/a | $ | 30.70 | $ | 30.80 | $ | 21.47 | $ | 14.17 | $ | 16.11 | ||||||||||||||||

| Statement of Cash Flows Data: |

||||||||||||||||||||||||||||

| Net cash provided by (used in): |

||||||||||||||||||||||||||||

| Operating activities |

$ | 96,566 | $ | 75,722 | $ | 167,861 | $ | 186,433 | $ | 174,635 | $ | 93,657 | $ | 49,982 | ||||||||||||||

| Investing activities |

(13,156 | ) | (45,165 | ) | (102,572 | ) | (107,366 | ) | (579,517 | ) | (161,575 | ) | (60,613 | ) | ||||||||||||||

| Financing activities |

(82,076 | ) | 3,783 | (49,202 | ) | (119,070 | ) | 410,515 | 70,901 | 5,347 | ||||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||||||||||

| Capital expenditures |

$ | 20,158 | $ | 41,928 | $ | 77,827 | $ | 109,016 | $ | 111,514 | $ | 41,276 | $ | 61,827 | ||||||||||||||

| EBITDA(2) |

96,522 | 192,820 | 303,227 | 303,659 | 248,877 | 140,352 | 172,872 | |||||||||||||||||||||

| Adjusted EBITDA(2) |

102,854 | 239,144 | 335,110 | 318,650 | 292,584 | 146,330 | 179,984 | |||||||||||||||||||||

| Operating Data: |

||||||||||||||||||||||||||||

| Proppant Solutions: |

||||||||||||||||||||||||||||

| Total tons sold |

1,730 | 2,609 | 3,402 | 3,765 | 5,117 | 2,134 | 3,352 | |||||||||||||||||||||

| Revenue |

$ | 325,542 | $ | 580,117 | $ | 807,849 | $ | 757,851 | $ | 856,212 | $ | 378,286 | $ | 567,185 | ||||||||||||||

| Average selling price (per ton) |

$ | 188 | $ | 222 | $ | 237 | $ | 201 | $ | 167 | $ | 177 | $ | 169 | ||||||||||||||

| Segment contribution margin(3) |

n/a | 248,187 | 339,050 | 316,251 | 296,320 | 150,267 | 192,928 | |||||||||||||||||||||

| Industrial & Recreational Products: |

||||||||||||||||||||||||||||

| Total tons sold |

1,918 | 2,228 | 2,296 | 2,375 | 2,462 | 1,261 | 1,193 | |||||||||||||||||||||

| Revenue |

$ | 73,118 | $ | 86,972 | $ | 101,893 | $ | 127,339 | $ | 132,174 | $ | 69,955 | $ | 62,038 | ||||||||||||||

| Average selling price (per ton) |

$ | 38 | $ | 39 | $ | 44 | $ | 53 | $ | 54 | $ | 55 | $ | 52 | ||||||||||||||

| Segment contribution margin(3) |

n/a | 20,904 | 29,142 | 37,837 | 34,765 | 17,002 | 16,835 | |||||||||||||||||||||

10

Table of Contents

| Year Ended December 31, | Six Months Ended June 30, |

|||||||||||||||||||||||||||

| 2009 | 2010 | 2011 | 2012 | 2013 | 2013 | 2014 | ||||||||||||||||||||||

| (In thousands) | ||||||||||||||||||||||||||||

| Balance Sheet Data (at period end): |

||||||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 3,841 | $ | 38,788 | $ | 51,765 | $ | 11,866 | $ | 17,815 | $ | 14,934 | $ | 12,514 | ||||||||||||||

| Total assets |

340,521 | 522,179 | 646,176 | 679,601 | 1,283,431 | 860,400 | 1,375,488 | |||||||||||||||||||||

| Long term debt (including current portion) |

235,409 | 709,925 | 947,447 | 831,195 | 1,262,146 | 906,010 | 1,264,972 | |||||||||||||||||||||

| Total liabilities |

314,458 | 857,475 | 1,094,168 | 965,529 | 1,448,789 | 1,073,788 | 1,457,461 | |||||||||||||||||||||

| Total equity (deficit)(4) |

26,063 | (335,296 | ) | (447,992 | ) | (285,928 | ) | (165,358 | ) | (213,388 | ) | (81,973 | ) | |||||||||||||||

| (1) | Basic and diluted earnings per share are not disclosed for 2009 and 2010 since they are not considered meaningful for the periods prior to the AS Group Acquisition. |

| (2) | EBITDA and Adjusted EBITDA are non-GAAP financial measures. For a definition of EBITDA and Adjusted EBITDA and a reconciliation to net income, see “—Non GAAP Financial Measures” below. |

| (3) | Segment contribution margin is not available for the year ended December 31, 2009. |

| (4) | The reduction in equity in 2010 resulted from our purchase of treasury stock in connection with the AS Group Acquisition. |

Non-GAAP Financial Measures

We define EBITDA as net income before interest expense, income tax expense, depreciation, depletion, and amortization. We define Adjusted EBITDA as EBITDA before non-cash stock-based compensation, management fees and reimbursement of expenses to sponsor, transaction expenses, impairment of assets, loss on extinguishment of debt, gain or loss on disposal of assets, and other non-cash income or expenses. Management believes EBITDA and Adjusted EBITDA are useful because they allow management to more effectively evaluate our operating performance and compare the results of our operations from period to period without regard to our financing methods or capital structure.

Disclosure in this prospectus of EBITDA and Adjusted EBITDA, which are “non-GAAP financial measures,” as defined under the rules of the SEC, are intended as supplemental measures of our performance that are not required by, or presented in accordance with, GAAP. EBITDA and Adjusted EBITDA should not be considered as alternatives to net income, cash flow provided by operating activities or any other performance measure derived in accordance with GAAP. Our presentation of EBITDA and Adjusted EBITDA should not be construed to imply that our future results will be unaffected by unusual or non-recurring items. EBITDA and Adjusted EBITDA are included in this prospectus because they are key metrics used by management to assess our operating performance. Adjusted EBITDA is also used by our lenders to evaluate our compliance with covenants. Additionally, performance targets associated with our annual incentive plans and stock-based compensation vesting targets are tied to our Adjusted EBITDA.

We believe these measures are meaningful to our investors to enhance their understanding of our financial performance. Although EBITDA and Adjusted EBITDA are not necessarily measures of our ability to fund our cash needs, we understand that they are frequently used by securities analysts, investors and other interested parties as measures of financial performance. Our calculation of Adjusted EBITDA may not be comparable to the similarly titled measure reported by other companies.

11

Table of Contents

The following tables set forth a reconciliation of net income, the most directly comparable GAAP financial measure, to EBITDA and Adjusted EBITDA.

| Year Ended December 31, | Six Months Ended June 30, |

|||||||||||||||||||||||||||

| 2009 | 2010 | 2011 | 2012 | 2013 | 2013 | 2014 | ||||||||||||||||||||||

| (In thousands) | ||||||||||||||||||||||||||||

| Net income attributable to FML Holdings, Inc. |

$ | 48,901 | $ | 99,454 | $ | 145,183 | $ | 148,886 | $ | 103,961 | $ | 68,564 | $ | 78,460 | ||||||||||||||

| Interest expense, net |

8,539 | 22,927 | 64,665 | 56,714 | 61,926 | 26,541 | 34,478 | |||||||||||||||||||||

| Income taxes |

20,020 | 46,108 | 71,757 | 70,369 | 45,219 | 29,694 | 32,412 | |||||||||||||||||||||

| Depreciation, depletion, and amortization |

19,062 | 24,331 | 21,622 | 27,690 | 37,771 | 15,553 | 27,522 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| EBITDA |

96,522 | 192,820 | 303,227 | 303,659 | 248,877 | 140,352 | 172,872 | |||||||||||||||||||||

| Non-cash stock based compensation(1) |

3,906 | 23,278 | 17,539 | 11,434 | 10,133 | 3,709 | 4,313 | |||||||||||||||||||||

| Management fees and reimbursement of expenses paid to sponsor(2) |

— | 503 | 1,119 | 1,274 | 2,928 | 570 | 541 | |||||||||||||||||||||

| Transaction expenses(3) |

580 | 17,536 | — | 1,414 | 12,462 | 1,699 | 637 | |||||||||||||||||||||

| Impairment of long-lived assets(4) |

1,846 | 2,100 | — | 273 | — | — | — | |||||||||||||||||||||

| Loss on extinguishment of debt(5) |

— | — | 12,682 | — | 11,760 | — | — | |||||||||||||||||||||

| (Gain) / Loss on disposal of assets(6) |

— | |

— |

|

|

— |

|

596 | 6,424 | — | — | |||||||||||||||||

| IPO-related fees |

— | — | — | — | — | — | 1,621 | |||||||||||||||||||||

| Non-recurring payments relating to sponsor buyout(7) |

— | 2,907 | 543 | — | — | — | — | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Adjusted EBITDA |

$ | 102,854 | $ | 239,144 | $ | 335,110 | $ | 318,650 | $ | 292,584 | $ | 146,330 | $ | 179,984 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | Represents cost of stock-based awards issued to our employees attributable to each year presented. |

| (2) | Includes fees and expenses paid to American Securities for ongoing consulting and management services provided pursuant to a management consulting agreement. In connection with the completion of this offering, the management consulting agreement will be terminated. See “Certain Relationships and Related Party Transactions—American Securities.” |

| (3) | These expenses are associated with the evaluation of potential acquisitions of assets or businesses, some of which were completed. Expenses in 2010 are associated with the AS Group Acquisition. |

| (4) | Represents the impairment charges related to certain closed facilities. |

| (5) | Upon entering into new credit facilities, we were required to write-off a portion of the remaining unamortized deferred financing fees related to the previous credit facilities. |

| (6) | Includes the non-cash loss related to the sale and disposal of certain assets, including property, plant and equipment, discontinued inventory and an investment in foreign operations. |

| (7) | Represents the employer portion of income taxes on options that were exercised in connection with the AS Group Acquisition. |

12

Table of Contents

This offering and an investment in our common stock involve a high degree of risk. You should carefully consider the risks described below, together with the financial and other information contained in this prospectus, before you decide to purchase shares of our common stock. If any of the following risks actually occurs, our business, financial condition, results of operations, cash flows and prospects could be materially and adversely affected. As a result, the trading price of our common stock could decline and you could lose all or part of your investment in our common stock.

Risks Related to Our Business

Our business and financial performance depend on the level of activity in the oil and gas industries.

Approximately 87% of our revenues for the year ended December 31, 2013 were derived from sales to companies in the oil and gas industry. As a result, our operations are materially dependent on the levels of activity in oil and gas exploration, development and production. More specifically, the demand for the proppants we produce is closely related to the number of oil and gas wells completed in geological formations where sand-based proppants are used in fracturing activities. These activity levels are affected by both short- and long-term trends in oil and gas prices, among other factors.

In recent years, oil and gas prices and, therefore, the level of exploration, development and production activity, have experienced significant fluctuations. Worldwide economic, political and military events, including war, terrorist activity, events in the Middle East and initiatives by the Organization of the Petroleum Exporting Countries (“OPEC”), have contributed, and are likely to continue to contribute, to price and volume volatility. Furthermore, the availability of key resources that impact drilling activity have experienced significant fluctuations and could impact product demand.

A prolonged reduction in oil and gas prices would generally depress the level of oil and gas exploration, development, production and well completion activity and result in a corresponding decline in the demand for the proppants we produce. Such a decline would likely have a material adverse effect on our business, results of operations and financial condition. In addition, certain U.S. federal income tax deductions currently available with respect to oil and gas exploration and development, including the repeal of the percentage depletion allowance for oil and gas properties, may be eliminated as a result of proposed legislation. Any future decreases in the rate at which oil and gas reserves are discovered or developed, whether due to the passage of legislation, increased governmental regulation leading to limitations or prohibitions on exploration and drilling activity, including hydraulic fracturing, or other factors, could have a material adverse effect on our business, even in a stronger oil natural gas price environment.

Increasing logistics costs, a lack of dependability or availability of transportation services or infrastructure and geographic shifts in demand could have a material adverse effect on our business.

Transportation and handling costs are a significant component of the total delivered cost of our products. In many instances, transportation costs can represent 70 to 80% of the delivered cost of frac sand. The high relative cost of transportation could favor suppliers located in close proximity to the customer. In addition, as we continue to expand our sand-based proppant production, we will need increased investment in transportation infrastructure, including terminals and railcars. We contract with truck, rail, ship and barge services to move sand-based proppants from our production facilities to distribution terminals. Labor disputes, derailments, adverse weather conditions or other environmental events, an increasingly tight railcar leasing market, increased railcar congestion and other changes to rail freight systems could interrupt or limit available transportation services or result in a significant increase in transportation service rates. Increased costs resulting from these types of events that we are not able to pass on to our customers could impair our ability to deliver our products economically to our customers or to expand our markets. Accordingly, because we are so dependent on rail

13

Table of Contents

infrastructure, if there are disruptions of the rail transportation services utilized by us or our customers, and we or our customers are unable to find alternative transportation providers to transport our products, our business and results of operations could be adversely affected.

A significant portion of our distribution infrastructure is located in or near oil and gas producing areas. A shift in demand away from areas where we have significant distribution infrastructure or relocation of our customers’ businesses to areas farther from our plants or distribution infrastructure could have a material adverse effect on our business, financial condition and results of operations.

Our operations are dependent on timely securing and maintaining various permits and approvals from governmental authorities and other third parties.

We hold numerous governmental, environmental, mining and other permits, water rights and approvals authorizing operations at each of our facilities. A decision by a governmental agency or other third party to deny or delay issuing a new or renewed permit or approval, or to revoke or substantially modify an existing permit or approval, could have a material adverse effect on our ability to continue operations at the affected facility. Furthermore, state and local governments could impose a moratorium on mining operations in certain areas. Expansion of our existing operations is also predicated on securing the necessary environmental or other permits, including air permits for our resin coated manufacturing, and water rights or approvals, which we may not receive in a timely manner or at all. In addition, our facilities are located near existing and proposed third-party industrial operations that could affect our ability to fully extract, or the manner in which we extract, the mineral reserves to which we have mining rights.

We may be adversely affected by decreased or shifted demand for sand-based proppants or the development of either effective alternative proppants or new processes to replace hydraulic fracturing.

Frac sand and resin coated sand are proppants used in the completion and re-completion of oil and gas wells through the process of hydraulic fracturing. A significant shift in demand from sand-based proppants to other proppants, or a shift in demand from higher-margin sand-based proppants to lower-margin sand-based proppants, could have a material adverse effect on our business, financial condition and results of operations. The development and use of new technology for effective alternative proppants, or the development of new processes to replace hydraulic fracturing altogether, could also cause a decline in demand for the sand-based proppants we produce and could have a material adverse effect on our business, financial condition and results of operations.

Our proppant sales are subject to fluctuations in market pricing.

Substantially all of our supply agreements involving the sale of sand-based proppants have market-based pricing mechanisms. Accordingly, in periods with decreasing prices, our results of operations may be lower than if our agreements had fixed prices. In periods with increasing prices, our agreements permit us to increase prices; however, our customers may elect to cease purchasing our sand-based proppants if they do not agree with our price increases or are able to find alternative, cheaper sources of supply. Furthermore, certain of our supply agreements contain most favored nation clauses that may prevent us from capturing current market prices in an increasing price environment. These pricing provisions may result in significant variability in our results of operations and cash flows from period to period.

Changes in supply and demand dynamics could also impact market pricing for proppants. A number of existing frac sand providers and new market entrants have recently announced reserve acquisitions, processing capacity expansions and greenfield projects. In periods where sources of supply of raw frac sand exceed market demand, market prices for frac sand may decline and our results of operations and cash flows may decline or be volatile or otherwise be adversely affected.

14

Table of Contents

We may not be able to complete greenfield development or expansion projects or, if we do, we may not realize the expected benefits.

Any greenfield development or expansion project requires us to raise substantial capital and obtain numerous state and local permits. A decision by any governmental agency not to issue a required permit or substantial delays in the permitting process could prevent us from pursuing the development or expansion project. In addition, if the demand for our products declines during the period we experience delays in raising capital or completing the permitting process, we may not realize the expected benefits from our greenfield facility or expansion project. Furthermore, our new or modified facilities may not operate at designed capacity or may cost more to operate than we expect. The inability to complete greenfield development or expansion projects or to complete them on a timely basis and in turn grow our business could adversely affect our business and results of operations.

We rely upon trade secrets, contractual restrictions and patents to protect our proprietary rights. Failure to protect our intellectual property rights may undermine our competitive position, and protecting our rights or defending against third-party allegations of infringement may be costly.

Our commercial success depends on our proprietary information and technologies, know-how and other intellectual property. Because of the technical nature of our business, we rely on patents, trade secrets, trademarks and contractual restrictions to protect our intellectual property rights, particularly with respect to our resin coated products. The measures we take to protect our trade secrets and other intellectual property rights may be insufficient. Failure to protect, monitor and control the use of our existing intellectual property rights could cause us to lose our competitive advantage and incur significant expenses. It is possible that our competitors or others could independently develop the same or similar technologies or otherwise obtain access to our unpatented technologies. In such case, our trade secrets would not prevent third parties from competing with us. As a result, our results of operations may be adversely affected. Furthermore, third parties or our employees may infringe or misappropriate our proprietary technologies or other intellectual property rights, which could also harm our business and results of operations. Policing unauthorized use of intellectual property rights can be difficult and expensive, and adequate remedies may not be available.

In addition, third parties may claim that our products infringe or otherwise violate their patents or other proprietary rights and seek corresponding damages or injunctive relief. Defending ourselves against such claims, with or without merit, could be time-consuming and result in costly litigation. An adverse outcome in any such litigation could subject us to significant liability to third parties (potentially including treble damages) or temporary or permanent injunctions prohibiting the manufacture or sale of our products, the use of our technologies or the conduct of our business. Any adverse outcome could also require us to seek licenses from third parties (which may not be available on acceptable terms, or at all) or to make substantial one-time or ongoing royalty payments. Protracted litigation could also result in our customers or potential customers deferring or limiting their purchase or use of our products until resolution of such litigation. In addition, we may not have insurance coverage in connection with such litigation and may have to bear all costs arising from any such litigation to the extent we are unable to recover them from other parties. Any of these outcomes could have a material adverse effect on our business, financial condition and results of operations.

The development and marketing of Propel SSP may prove to be unsuccessful.

In April 2013, we acquired intellectual property rights to self-suspending proppant technology which led to the development of Propel SSP. We are currently conducting field trials on Propel SSP and are attempting to secure a patent for this technology. The technology supporting Propel SSP is still unproven. Although the results of initial field trials have been encouraging, additional testing ultimately may demonstrate that the product is ineffective or not commercially viable. A failure to successfully develop Propel SSP for commercial application would result in a significant unrecouped investment and the failure to realize certain anticipated benefits from this product launch, each of which could have a material adverse effect on our business, financial condition and results of operations. For more information on Propel SSP, please read “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Acquisitions.”

15

Table of Contents

Our future performance will depend on our ability to succeed in competitive markets, and on our ability to appropriately react to potential fluctuations in demand for and supply of sand-based proppants.

We operate in a highly competitive market that is characterized by several large, national producers and a larger number of small, regional or local producers. Competition in the industry is based on price, consistency and quality of product, site location, distribution capability, customer service, reliability of supply, breadth of product offering and technical support. In the proppant business, we compete with producers such as Badger Mining Corporation, CARBO Ceramics Inc., Emerge Energy Services LP, Hi-Crush Partners, LP, Momentive Performance Materials Inc., Preferred Sands LLC, Unimin Corporation and U.S. Silica Holdings, Inc. Certain of our large competitors may have greater financial and other resources than we do, may develop technology superior to ours or may have production facilities that are located closer to key customers than ours.

We also compete with smaller, regional or local producers. In recent years there has been an increase in the number of small producers servicing the sand-based proppants market which could result in increased competition and pricing pressure in certain market conditions. In addition, oil and gas exploration and production companies and other providers of hydraulic fracturing services could acquire their own sand reserves, expand their existing sand-based proppant production capacity or otherwise fulfill their own proppant requirements and existing or new sand-based proppant producers could add to or expand their sand-based proppants production capacity, which could increase competition in the proppant industry. We may not be able to compete successfully against either our larger or smaller competitors in the future, and competition could have a material adverse effect on our business, financial condition and results of operations.

A large portion of our sales is generated by a limited number of customers, and the loss of, or a significant reduction in purchases by, our largest customers could adversely affect our operations.

For the year ended December 31, 2013 and the six months ended June 30, 2014, our top two proppant customers, Halliburton and FTSI, collectively accounted for approximately 30% and 36% of our sales, respectively. These customers may not continue to purchase the same levels of our sand-based proppants in the future due to a variety of reasons. Over the course of our relationships, we have sold proppant to Halliburton and FTSI on a purchase order basis and pursuant to supply agreements. We currently have supply agreements with both customers that contain customary termination provisions for bankruptcy related events and uncured breaches of the applicable agreement. The Halliburton supply agreement may also be terminated for unresolved pricing disputes. If any of our major customers substantially reduces or altogether ceases purchasing our sand-based proppants and we are not able to generate replacement sales of sand-based proppants into the market, our business, financial condition and results of operations could be adversely affected for a short-term period until such time as we generate replacement sales in the market.

We are exposed to the credit risk of our customers, and any material nonpayment or nonperformance by our customers could adversely affect our financial results.

We are subject to the risk of loss resulting from nonpayment or nonperformance by our customers, many of whose operations are concentrated in a single industry, the global oilfield services industry. Our credit procedures and policies may not be adequate to fully reduce customer credit risk. If we fail to adequately assess the creditworthiness of existing or future customers or unanticipated deterioration in their creditworthiness, any resulting increase in nonpayment or nonperformance by them and our inability to re-market or otherwise use the production could have a material adverse effect on our business, financial condition and results of operations.

The demand for industrial and recreational sand fluctuates, which could adversely affect our results of operations.

A portion of our sales are to customers in industries that have historically been cyclical, such as glassmaking, building products and foundry. During periods of economic slowdown, our customers often reduce their production rates and also reduce capital expenditures and defer or cancel pending projects. Such developments occur even among customers that are not experiencing financial difficulties.

16

Table of Contents

Demand in many of the end markets for industrial and recreational sand is driven by the construction and automotive industries. For example, the flat glass market depends on the automotive and commercial and residential construction and remodeling markets. The market for industrial and recreational sand used to manufacture building products is driven primarily by demand in the construction markets. The demand for foundry silica substantially depends on the rate of automobile, light truck and heavy equipment production. Other factors influencing the demand for industrial and recreational sand include (i) the substitution of plastic or other materials for glass, (ii) competition from offshore producers of glass products, (iii) changes in demand for our products due to technological innovations and (iv) prices, availability and other factors relating to our products.

We cannot predict or control the factors that affect demand for our products. Negative developments in the above factors, among others, could cause the demand for industrial and recreational sand to decline, which could adversely affect our business, financial condition, results of operations, cash flows and prospects.

Our operations are subject to operating risks that are often beyond our control and could adversely affect production levels and costs, and such risks may not be covered by insurance.

Our mining, processing and production facilities are subject to risks normally encountered in the proppant and industrial and recreational sand industries. These risks include:

| • | changes in the price and availability of transportation; |

| • | changes in the price and availability of natural gas or electricity; |

| • | unusual or unexpected geological formations or pressures; |

| • | cave-ins, pit wall failures or rock falls, particularly in underground mines; |

| • | unanticipated ground, grade or water conditions; |

| • | extreme seasonal weather conditions; |

| • | hazardous or catastrophic weather conditions or events, including flooding, tornadoes and hurricanes, and the physical impacts of climate change; |

| • | environmental hazards; |

| • | industrial accidents; |

| • | changes in laws and regulations (or the interpretation thereof) or increased public scrutiny related to the mining and the drilling and well completion industries, silica dust exposure or the environment; |

| • | inability to acquire or maintain necessary permits or mining or water rights; |

| • | restrictions on blasting and mining operations, including potential moratoriums on mining as result of local activism or complaints; |

| • | inability to obtain necessary production equipment or replacement parts; |

| • | reduction in the amount of water available for processing; |

| • | labor disputes; |

| • | late delivery of supplies; |

| • | fires, explosions or other accidents; and |

| • | facility shutdowns in response to environmental regulatory actions. |