Attached files

Table of Contents

As filed with the Securities and Exchange Commission on September 12, 2014

Registration No.333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

FRESHPET, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2047 | 20-1884894 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

400 Plaza Drive, 1st Floor

Secaucus, New Jersey 07094

(201) 520-4000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Richard Kassar

Chief Financial Officer

400 Plaza Drive, 1st Floor

Secaucus, New Jersey 07094

(201) 520-4000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| Christian O. Nagler, Esq. Andrew M. Herman, Esq. Kirkland & Ellis LLP 601 Lexington Avenue New York, New York 10022 (212) 446-4800 |

Marc D. Jaffe, Esq. Senet S. Bischoff, Esq. Latham & Watkins LLP 885 Third Avenue New York, New York 10022 (212) 906-1200 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ |

Accelerated filer ¨ | Non-accelerated filer x (Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||

| Common Stock, $0.001 par value per share |

$100,000,000 | $12,880 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes the offering price of any additional shares of common stock that the underwriters have the option to purchase. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Table of Contents

Table of Contents

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated September 12, 2014.

Shares

Freshpet, Inc.

Common Stock

This is an initial public offering of shares of common stock of Freshpet, Inc.

Freshpet is offering of the shares to be sold in the offering. The selling stockholders identified in this prospectus are offering an additional shares. Freshpet will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $ and $ . Freshpet intends to list the common stock on the under the symbol “ .”

We are an “emerging growth company” as defined under the federal securities laws and, as such, will be subject to reduced public company reporting requirements. See “Prospectus Summary—Implications of Being an Emerging Growth Company.”

See “Risk Factors” on page 13 to read about factors you should consider before buying shares of the common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds, before expenses, to Freshpet |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholders |

$ | $ | ||||||

To the extent that the underwriters sell more than shares of common stock, the underwriters have the option to purchase up to an additional shares from Freshpet and the selling stockholders at the initial price to public less the underwriting discount.

The underwriters expect to deliver the shares against payment in New York, New York on , 2014.

| Goldman, Sachs & Co. | Credit Suisse |

| Baird | Stifel | SunTrust Robinson Humphrey | Canaccord Genuity | |||

Prospectus dated , 2014.

Table of Contents

| Page | ||||

| 1 | ||||

| 13 | ||||

| 32 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 38 | ||||

| 40 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

44 | |||

| 64 | ||||

| 76 | ||||

| 82 | ||||

| 92 | ||||

| 94 | ||||

| 97 | ||||

| 101 | ||||

| MATERIAL U.S. FEDERAL INCOME AND ESTATE TAX CONSIDERATIONS FOR NON-U.S. HOLDERS |

104 | |||

| 108 | ||||

| 112 | ||||

| 112 | ||||

| 112 | ||||

| F-1 | ||||

We have not and the underwriters have not authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where such offers and sales are permitted. The information in this prospectus or any free writing prospectus is accurate only as of its date, regardless of its time of delivery or the time of any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

i

Table of Contents

MARKET, RANKING AND OTHER INDUSTRY DATA

This prospectus contains industry and market data, forecasts and projections that are based on internal data and estimates, independent industry publications, reports by market research firms or other published independent sources. In particular, we have obtained information regarding the pet food industry from Euromonitor International (“Euromonitor”), the American Pet Products Association (“APPA”), and Packaged Facts, a division of Market Research Group LLC (“Packaged Facts”). Other industry and market data included in this prospectus are from internal analyses based upon data available from known sources or other proprietary research and analysis.

We believe these data to be reliable as of the date of this prospectus, but there can be no assurance as to the accuracy or completeness of such information. We have not independently verified the market and industry data obtained from these third-party sources. Our internal data and estimates are based upon information obtained from trade and business organizations, other contacts in the markets in which we operate and our management’s understanding of industry conditions. Though we believe this information to be true and accurate, such information has not been verified by any independent sources. You should carefully consider the inherent risks and uncertainties associated with the market and other industry data contained in this prospectus.

NON-GAAP FINANCIAL MEASURES

We believe that our financial statements and the other financial data included in this prospectus have been prepared in a manner that complies, in all material respects, with generally accepted accounting principles in the United States, or GAAP, and are consistent with current practice with the exception of the presentation of certain non-GAAP financial measures, EBITDA and Adjusted EBITDA (each as defined below).

As used herein, EBITDA represents net loss plus depreciation and amortization, interest expense (including fees on debt guarantee, which we believe are a cost of our financing arrangement and are akin to interest expense), and income tax expense. As used herein, Adjusted EBITDA represents EBITDA plus loss on disposal of equipment, new plant startup expenses and processing, share based compensation and launch expenses. EBITDA and Adjusted EBITDA do not represent, and should not be considered as alternatives to net loss, as determined under GAAP.

We present EBITDA and Adjusted EBITDA because we believe each of these measures provides an additional metric to evaluate our operations and, when considered with both our GAAP results and the reconciliation to net loss, provides a more complete understanding of our business than could be obtained absent this disclosure. We use EBITDA and Adjusted EBITDA, together with financial measures prepared in accordance with GAAP, such as sales, gross profit percentage, and cash flow from operations, to assess our historical and prospective operating performance, to provide meaningful comparisons of operating performance across periods, to enhance our understanding of our operating performance and to compare our performance to that of our peers and competitors. Adjusted EBITDA is further utilized for our covenant requirements under our credit agreement, and additionally an important component of internal budgeting and setting management compensation. We believe EBITDA and Adjusted EBITDA are useful to investors in assessing the operating performance of our business without the effect of non-cash items and other items.

EBITDA and Adjusted EBITDA should not be considered in isolation or as alternatives to net loss, income from operations or any other measure of financial performance calculated and prescribed in accordance with GAAP. Neither EBITDA nor Adjusted EBITDA should be considered a measure of discretionary cash available to us to invest in the growth of our business. Our Adjusted EBITDA may not be comparable to similar titled measures in other organizations because other organizations may

ii

Table of Contents

not calculate Adjusted EBITDA in the same manner as we do. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by the expenses that are excluded from that term or by unusual or non-recurring items. We recognize that both EBITDA and Adjusted EBITDA have limitations as analytical financial measures. For example, neither EBITDA nor Adjusted EBITDA reflects:

| • | our capital expenditures or future requirements for capital expenditures; |

| • | the interest expense (including fees on debt guarantee, which we believe are a cost of our financing arrangement and are akin to interest expense), or the cash requirements necessary to service interest expense or principal payments, associated with indebtedness; |

| • | depreciation and amortization, which are non-cash charges, although the assets being depreciated and amortized will likely have to be replaced in the future, nor does EBITDA or Adjusted EBITDA reflect any cash requirements for such replacements; and |

| • | changes in or cash requirements for our working capital needs. |

Additionally, Adjusted EBITDA excludes (i) non-cash stock based compensation expense, which is and will remain a key element of our overall long term incentive compensation package, and (ii) certain costs essential to our sales growth and strategy, including an allowance for marketing expenses for each new store added to our network and uncapitalizable freight costs associated with Freshpet Fridge replacements. Adjusted EBITDA also excludes certain cash charges resulting from matters we consider not to be indicative of our ongoing operations. Other companies in our industry may calculate EBITDA and Adjusted EBITDA differently than we do, limiting their usefulness as comparative measures.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

We own the trademarks, service marks and trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. This prospectus may also contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this prospectus are listed without the TM, SM, © and ® symbols, but we will assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors, if any, to these trademarks, service marks, trade names and copyrights.

iii

Table of Contents

The following summary highlights information appearing elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully. In particular, you should read the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the notes relating to those statements included elsewhere in this prospectus. Some of the statements in this prospectus constitute forward-looking statements. See “Forward-Looking Statements.”

In this prospectus, unless the context requires otherwise, references to “Freshpet” the “Company,” “we,” “our,” or “us” refer to Freshpet, Inc., the issuer of the common stock offered hereby, and its consolidated subsidiary.

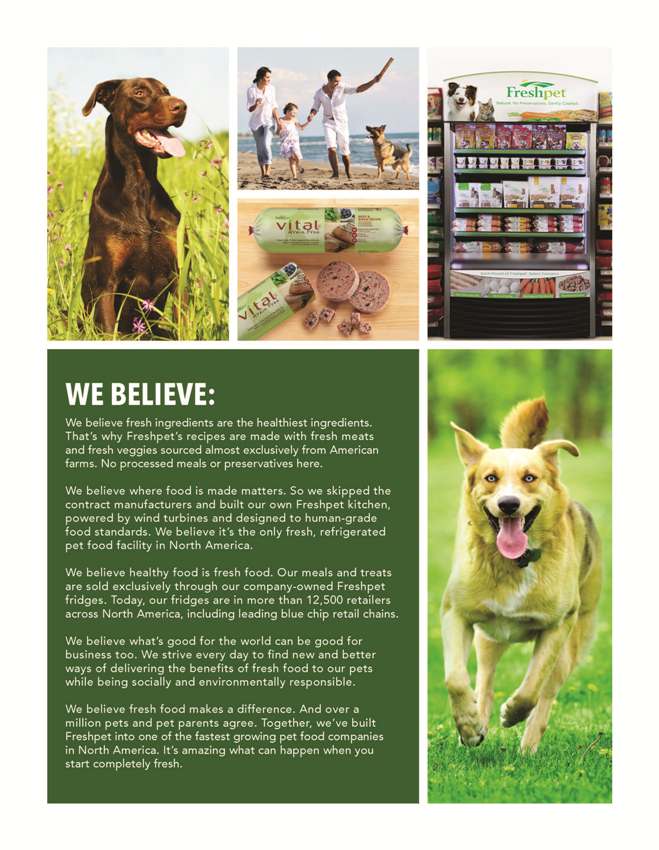

Overview

We started Freshpet with a single-minded mission—to bring the power of real, fresh food to our dogs and cats. We were inspired by the rapidly growing view among pet owners that their dogs and cats are a part of their family, leading them to demand healthier pet food choices. Over the last eight years, we have created a comprehensive business model to deliver wholesome pet food that “pet parents” can trust, and in the process we believe we have become one of the fastest growing pet food companies in North America. Our business model is difficult for others to replicate and we see significant opportunity for future growth by leveraging the unique elements of our business:

| Our Brand |

We founded the fresh, refrigerated pet food category in North America and our brand transparently communicates our passion and dedication. | |

| Our Product Know-How |

Our fresh, refrigerated products are differentiated inside and out from conventional pet food as a result of our proprietary recipes, cooking techniques and packaging developed over the last eight years. | |

| Our Freshpet Kitchens |

All of our food is made in the United States, and we own and operate what we believe is North America’s only fresh, refrigerated pet food manufacturing facility, which we call the Freshpet Kitchens, located in Bethlehem, Pennsylvania. | |

| Our Refrigerated Distribution |

We are the only pet food company with an established refrigerated supply chain connecting our Freshpet Kitchens to retail stores across North America. | |

| Our Freshpet Fridge |

We sell our products through a fast-growing network of company-owned branded refrigerators, known as Freshpet Fridges, installed in over 12,500 retail stores across North America. | |

| Our Culture |

We foster a culture of innovation, and we strive to be open, honest and socially responsible in everything we do. | |

1

Table of Contents

Freshpet is disrupting the $22.5 billion North American pet food industry by driving consumers to reassess conventional dog and cat food offerings that have remained essentially unchanged for decades. We position our brand to benefit from mainstream trends of growing pet humanization and consumer focus on health and wellness. We price our products to be accessible to the average consumer, providing us with broad demographic appeal and allowing us to penetrate multiple classes of retail including grocery, mass, club, pet specialty and natural. We have successfully expanded our network of Freshpet Fridges within leading blue-chip retail chains including Albertsons, BJ’s, Kroger, Petco, PetSmart, Publix, Safeway, Target, Wal-Mart and Whole Foods. The strength of our business model extends to our customers, who we believe find that Freshpet grows their pet category sales, drives higher traffic, increases shopper frequency and delivers category leading margins. As of June 30, 2014, Freshpet Fridges were located in over 12,500 stores, and we believe there is an opportunity to install a Freshpet Fridge in at least 35,000 stores across North America.

Freshpet’s differentiated pet food empowers pet parents to provide positive nutrition and well-being to their pets. Our success is reflected in the growth we have delivered:

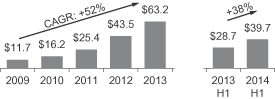

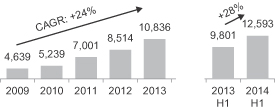

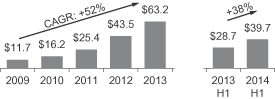

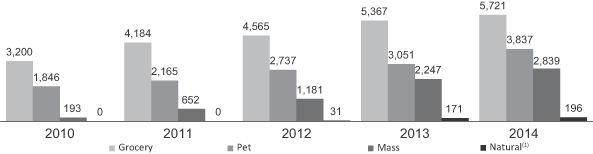

| • | Our Freshpet Fridge store locations increased from 7,001 in 2011 to 10,836 in 2013, representing a compounded annual growth rate of 24%; and, as of June 30, 2014, we had 12,593 installed Freshpet Fridges, representing 28% growth over the number as of June 30, 2013. |

| • | Our net sales increased from $25.4 million in 2011 to $63.2 million in 2013, representing a compounded annual growth rate of 58%; and for the six months ended June 30, 2014, we reported net sales of $39.7 million representing growth of 38% over the six months ended June 30, 2013. |

| Freshpet Fridge Store Locations |

Net Sales ($ millions) | |

|

|

|

| • | Our gross profit margin as a percent of net sales improved 610 basis points from 42.6% in the year ended December 31, 2011 to 48.7% in the six months ended June 30, 2014. |

| • | Our net loss from operations decreased from $23.4 million in 2011 to $12.4 million in 2013; and for the six months ended June 30, 2014, we reported net loss of $5.6 million compared with a net loss of $6.4 million in the six months ended June 30, 2013. |

| • | Our net loss decreased from $24.2 million in 2011 to $21.7 million in 2013; and for the six months ended June 30, 2014, we reported a net loss of $11.4 million compared with a net loss of $10.0 million in the six months ended June 30, 2013. |

Our Industry

We compete in the North American dog and cat food market, which had 2013 retail sales of $22.5 billion and has grown at an average compounded annual growth rate of 3.6% from 2008 to 2013, according to Euromonitor. The pet food market has historically been resilient as consumers continue to spend on their pets even during economic downturns. Within the pet food market, premium and/or natural brands are gaining market share, according to Packaged Facts. We believe pet food industry

2

Table of Contents

growth is being driven by increasing pet ownership in U.S. households, a growing trend of pet humanization as pet owners view their pets as family members, and a greater consumer focus on health and wellness.

The pet food purchasing decision is underpinned by higher brand loyalty than many other consumer packaged goods categories. A consumer selecting a pet food brand resists frequent switching in order to avoid disrupting the pet’s diet, resulting in high repeat purchasing behavior. As a result, we believe that as consumers try fresh, refrigerated pet food, they are likely to become repeat users of the product.

Our Competitive Strengths

We believe that the following strengths differentiate Freshpet and position us to become a leading brand in pet food:

The category defining brand in fresh, refrigerated pet food. Freshpet is the first and only fresh, refrigerated pet food brand distributed across North America. Our products represent a significant innovation in pet food, and we have developed a brand proposition that pet parents can intuitively trust.

All of our meats and vegetables are sourced in North America, and all of our products are made in the United States. We use simple, fresh ingredients that are gently cooked without preservatives. Pet parents can easily recognize ingredients in our products as being similar to fresh food they buy for their families. In palatability tests commissioned by us and conducted by third party kennels, dogs chose Freshpet over other leading pet food brands by a wide margin. In addition, according to a study commissioned by us and conducted by a third party researcher, pet parents perceived that Freshpet provides their pets with greater enthusiasm for eating and visible health improvements. By satisfying pet nutritional needs and strong pet parent motivations, we have built a growing base of loyal consumers who we believe have a deep emotional connection to the Freshpet brand.

Proven, scalable and defensible point-of-sale retail model. We sell our products through a fast-growing network of company-owned branded refrigerators, or Freshpet Fridges, which replace standard shelving in the pet aisle or an end-cap of a retail store. We are the only company to have a branded refrigeration fixture, in-aisle electric power and significant exclusive shelf space in the pet department of leading national retail chains. We believe our Freshpet Fridges generate compelling economics with an average cash-on-cash payback period of less than 15 months, calculated by comparing our total current costs for a refrigerator (including installation and maintenance) to our current margin on net revenues. We have installed Freshpet Fridges across all major classes of pet retail including grocery, mass, club, pet specialty and natural. Our track record of consistently growing the number of store locations with key customers underscores the success of our point-of-sale model.

| Selected Customers |

Year Entered | Freshpet Fridge Locations at Launch |

Freshpet Fridge Locations as of August 1, 2014 |

|||||||

| Wal-Mart |

2007 | 51 | 1,578 | |||||||

| Petco |

2007 | 97 | 1,337 | |||||||

| PetSmart |

2006 | 29 | 1,294 | |||||||

| Target |

2012 | 50 | 1,152 | |||||||

| Kroger |

2007 | 185 | 970 | |||||||

| Whole Foods |

2012 | 29 | 206 | |||||||

We believe our customers find that Freshpet grows sales of their overall pet category, drives higher traffic, increases shopper frequency and delivers category leading margins. We believe our attractive business proposition to customers will allow us to continue penetrating store locations of existing and new customers.

3

Table of Contents

Difficult to replicate know-how, manufacturing facilities and supply chain. We built and currently operate what we believe is the only fresh, refrigerated pet food manufacturing facility in North America, which was designed by us to operate at human-grade food quality and safety standards. Over the last eight years, we have developed proprietary know-how in the areas of recipes, ingredients sourcing, cooking techniques and product packaging, and have established the only refrigerated pet food supply chain in North America. We have built a team of professionals with unique skills in production and delivery of fresh refrigerated pet food. As a result, our facilities, processes and people represent advantages that would be difficult for others to replicate.

Experienced, committed management team and company culture focused on core values. We have a deep bench of management talent with a tremendous amount of pet industry experience and significant ownership in Freshpet. The majority of our senior executive team previously worked together to revitalize the Meow Mix brand, and successfully sold it in 2006. Our CEO, Richard Thompson, served as CEO of The Meow Mix Company from 2002 to 2006 and previously founded the American Italian Pasta Company. We believe our culture and core values, spanning Pets, People and Planet, allow us to attract a passionate employee base while also helping pet parents connect with the Freshpet brand.

Our Growth Strategies

We intend to continue growing net sales and profitability through the following growth strategies:

Continue to grow awareness, trial and adoption to increase Freshpet’s North American market share. Our market share is currently less than 1% of the overall $22.5 billion North American pet food market. As of March 2014, less than 20% of U.S. pet food consumers had aided awareness of the Freshpet brand, which provides us a significant opportunity to grow over time. As a result of our marketing investments, consumer trial of Freshpet products tripled from 2010 to 2013, and repeat purchase rates also increased significantly. In many retail accounts where Freshpet has been available for five years or more, we have achieved between 6%-10% market share of dry and wet dog food sales. We believe that with growing awareness and availability of Freshpet, we have expansive runway to grow trial, adoption and market share.

Continue to grow points of distribution by installing new Freshpet Fridges. We believe there is a significant opportunity to continue to grow our network of Freshpet Fridges by expanding within the store base of existing and new customers. We grew the number of Freshpet Fridge store locations at a compounded annual rate of 24% between 2011 and 2013. We operate Freshpet Fridges in more than 12,500 stores, and we estimate that there is an opportunity to install a Freshpet Fridge in at least 35,000 retail locations across North America. Over the next three years, we plan to install over Freshpet Fridges in new retail locations. We expect continued demand for our Freshpet Fridges driven by the strong business proposition and attractive margins that we deliver to customers.

Continue to deliver innovation in pet food and expand our product offerings. We are continually working to develop new products that are aligned with consumer trends and preferences. Our new products remain true to our founding mission—simple, fresh, good food—while expanding our base of consumers and usage occasions. New product introductions since 2011 represented 31% of our net sales in 2013. We currently have a strong innovation pipeline, including entirely new product platforms that expand the breadth of our fresh product offerings. We also see significant opportunity in the future to expand into pet categories such as cat food and pet treats where we are underpenetrated today. We expect that new product introductions will continue to meaningfully drive growth going forward.

4

Table of Contents

Continue to enhance our operating margins. We intend to enhance our operating margins through efficiencies of scale as we grow our net sales ahead of costs. We have made significant investments in management, manufacturing capacity, information systems and other infrastructure to enable us to pursue our growth. From 2011 through the second quarter of 2014, we expanded our gross margins by approximately 610 basis points from 42.6% to 48.7%. We expect that gross margin improvement and operating leverage from SG&A costs will be a significant driver of earnings growth going forward.

RISK FACTORS

An investment in our common stock involves a high degree of risk. Any of the factors set forth under “Risk Factors” may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth under “Risk Factors” in deciding whether to invest in our common stock. Below is a summary of some of the principal risks we face:

| • | we may not be able to successfully implement our growth on a timely basis or at all; |

| • | we may not be able to to generate sufficient cash flow or raise capital on acceptable terms to meet our needs; |

| • | we may lose key members of our senior management team; |

| • | our products may be alleged to cause injury or illness or fail to comply with government regulation; |

| • | we may lose a significant customer; and |

| • | our marketing and trade spending programs may prove insufficient or ineffective. |

OUR CORPORATE INFORMATION

We were incorporated in Delaware in November 2004 and currently exist as a Delaware corporation. In December 2010, MidOcean Partners and certain of its affiliated entities (collectively, “MidOcean”) became our largest stockholder.

Our principal executive offices are located at 400 Plaza Drive, 1st Floor, Secaucus, New Jersey 07094. Our telephone number is (201) 520-4000. The address of our corporate website is www.freshpet.com. The information contained in or that can be accessed through our website does not constitute a part of, and is not incorporated by reference into, this prospectus.

EQUITY SPONSOR

MidOcean is a private equity firm focused on investing in middle market companies in North America. MidOcean’s targeted sectors include consumer, business & media services and industrial services. Immediately following the consummation of this offering, MidOcean will own approximately % of our common stock, or % if the underwriters’ option to purchase additional shares of our common stock is exercised in full.

5

Table of Contents

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

We qualify as an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

| • | a requirement to have only two years of audited financial statements and only two years of related selected financial data and management’s discussion and analysis of financial condition and results of operations disclosure; |

| • | an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”); |

| • | an exemption from new or revised financial accounting standards until they would apply to private companies and from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation; |

| • | reduced disclosure about the emerging growth company’s executive compensation arrangements; and |

| • | no requirement to seek non-binding advisory votes on executive compensation or golden parachute arrangements. |

The JOBS Act permits emerging growth companies to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We are choosing to “opt out” of this provision, and as a result, we plan to comply with new or revised accounting standards as required when they are adopted. This decision to opt out of the extended transition period is irrevocable.

We have elected to adopt certain of the reduced disclosure requirements available to emerging growth companies. As a result of these elections, the information that we provide in this prospectus may be different than the information you may receive from other public companies in which you hold equity interests. In addition, it is possible that some investors will find our common stock less attractive as a result of our elections, which may result in a less active trading market for our common stock and more volatility in our stock price.

We will remain an emerging growth company until the earliest of (i) the end of the fiscal year following the fifth anniversary of the completion of this offering, (ii) the first fiscal year after our annual gross revenue are $1.0 billion or more, (iii) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities or (iv) the end of any fiscal year in which the market value of our common stock held by non-affiliates exceeded $700 million as of the end of the second quarter of that fiscal year.

6

Table of Contents

THE OFFERING

| Issuer |

Freshpet, Inc. |

| Common stock offered by us |

shares ( shares if the underwriters exercise their option to purchase additional shares of our common stock in full). |

| Common stock offered by the selling stockholders |

shares ( shares if the underwriters exercise their option to purchase additional shares of our common stock in full). |

| Underwriters’ option to purchase additional shares |

We and the selling stockholders have granted the underwriters a 30-day option to purchase up to an additional shares of our common stock. |

| Common stock to be outstanding immediately after completion of this offering |

Immediately following the consummation of this offering, we will have shares of common stock outstanding ( shares if the underwriters exercise their option to purchase additional shares of our common stock in full). |

| Use of proceeds |

We estimate that the net proceeds to us from this offering, after deducting the underwriting discount and estimated offering expenses payable by us, will be approximately $ million, or $ million if the underwriters’ option to purchase additional shares of our common stock is exercised in full. |

| We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders. |

| We intend to use the net proceeds from the sale of common stock by us in this offering (i) to repay our Indebtedness and to effect the Preferred Stock Redemption (each as defined herein), (ii) to support our growth, primarily through installing new Freshpet Fridges and adding manufacturing capacity, and (iii) for working capital and general corporate purposes. For additional information, see “Use of Proceeds.” |

| Dividend policy |

We currently intend to retain all available funds and any future earnings to fund the development and growth of our business and to repay |

7

Table of Contents

| indebtedness, and therefore, we do not anticipate paying any cash dividends in the foreseeable future. Any future determination to declare and pay cash dividends will be at the discretion of our Board of Directors and will depend on, among other things, our financial condition, results of operations, cash requirements, contractual restrictions and such other factors as our Board of Directors deems relevant. In addition, covenants in our credit agreement restrict our ability to pay dividends. For additional information, see “Dividend Policy.” |

| Listing |

We intend to apply to list our common stock on the under the symbol “ .” |

| Risk factors |

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 13 of this prospectus for a discussion of factors you should carefully consider before investing in our common stock. |

Unless otherwise indicated, all information in this prospectus assumes or gives effect to:

| • | the filing and effectiveness of our amended and restated certificate of incorporation (our “Certificate of Incorporation”) and amended and restated bylaws (our “Bylaws”), which we will adopt immediately prior to the completion of this offering; |

| • | the completion of a -for- stock split of our common stock (the “Stock Split”), which will be effected immediately prior to the completion of this offering; |

| • | the conversion of all outstanding shares of our Series C Preferred Stock, par value $0.001 (our “Series C Preferred Stock”), into an aggregate of shares of common stock (the “Preferred Stock Conversion”), which will occur immediately prior to the completion of this offering; |

| • | the redemption of all outstanding shares of our Series B Preferred Stock, par value $0.001 (our “Series B Preferred Stock”), for cash (the “Preferred Stock Redemption”), which will occur immediately following this offering; |

| • | no exercise by the underwriters of their option to purchase additional shares of our common stock; and |

| • | an initial public offering price of $ per share, the midpoint of the estimated offering price range set forth on the cover of this prospectus. |

8

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table presents a summary of our consolidated financial data as of, and for the periods ended on, the dates indicated. The summary consolidated financial data for each of the years ended December 31, 2013 and 2012 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated statement of operations data for each of the six months ended June 30, 2014 and 2013 and the summary consolidated balance sheet data as of June 30, 2014 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The unaudited consolidated financial statements were prepared on the same basis as our audited consolidated financial statements and, in the opinion of management, reflect all adjustments we consider necessary for a fair statement of financial information. You should read the following financial information together with the information under “Capitalization” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements included elsewhere in this prospectus. Historical results are not necessarily indicative of results to be expected for any future period.

| Year ended December 31, | Six months ended June 30, | |||||||||||||||

| 2013 | 2012 | 2014 | 2013 | |||||||||||||

| (Dollars in thousands, except per share data) | ||||||||||||||||

| Consolidated Statement of Operations Data |

||||||||||||||||

| Net sales |

$ | 63,151 | $ | 43,519 | $ | 39,736 | $ | 28,732 | ||||||||

| Cost of goods sold |

35,958 | 22,881 | 20,370 | 15,234 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

27,193 | 20,638 | 19,366 | 13,497 | ||||||||||||

| Selling, general and administrative expenses |

39,574 | 35,385 | 24,996 | 19,851 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(12,381 | ) | (14,747 | ) | (5,630 | ) | (6,353 | ) | ||||||||

| Other expenses |

(538 | ) | (344 | ) | (85 | ) | (29 | ) | ||||||||

| Fees on debt guarantee(1) |

(5,245 | ) | (1,895 | ) | (3,645 | ) | (2,034 | ) | ||||||||

| Interest expense |

(3,492 | ) | (1,638 | ) | (2,033 | ) | (1,540 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss before income taxes |

(21,656 | ) | (18,624 | ) | (11,393 | ) | (9,956 | ) | ||||||||

| Income tax expense |

(31 | ) | (32 | ) | (16 | ) | (16 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

(21,687 | ) | (18,656 | ) | (11,409 | ) | (9,972 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Preferred stock dividend accretion |

(8,596 | ) | (7,954 | ) | (6,904 | ) | (4,143 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss attributable to common stockholders |

$ | (30,283 | ) | $ | (26,610 | ) | $ | (18,256 | ) | $ | (14,115 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per share: |

||||||||||||||||

| Basic |

$ | (2.16 | ) | $ | (1.90 | ) | $ | (1.30 | ) | $ | (1.01 | ) | ||||

| Diluted |

$ | (2.16 | ) | $ | (1.90 | ) | $ | (1.30 | ) | $ | (1.01 | ) | ||||

| Weighted average shares of common stock outstanding: |

||||||||||||||||

| Basic |

14,026,999 | 14,024,908 | 14,035,660 | 14,024,908 | ||||||||||||

| Diluted |

14,026,999 | 14,024,908 | 14,035,660 | 14,024,908 | ||||||||||||

9

Table of Contents

| Six months ended June 30, 2014 | ||||||

| Actual | Pro Forma(4) | |||||

| Pro Forma Earnings per Share Data(2) |

||||||

| Net loss per share (unaudited): |

||||||

| Basic |

$ | (1.30 | ) | |||

| Diluted |

$ | (1.30 | ) | |||

| Weighted average shares of common stock outstanding used in computing pro forma net income per share (unaudited): |

||||||

| Basic |

14,035,660 | |||||

| Diluted |

14,035,660 | |||||

| Year ended December 31, |

Six months ended June 30, |

|||||||||||||||

| 2013 | 2012 | 2014 | 2013 | |||||||||||||

| (Dollars in thousands) | ||||||||||||||||

| Other Operating and Financial Data |

||||||||||||||||

| Freshpet Fridge store locations at period end |

10,836 | 8,514 | 12,593 | 9,801 | ||||||||||||

| EBITDA(3) |

$ | (6,974 | ) | $ | (10,363 | ) | $ | (2,591 | ) | $ | (4,470 | ) | ||||

| Adjusted EBITDA(3) |

(192 | ) | (6,096 | ) | 413 | (1,842 | ) | |||||||||

| Capital expenditures: |

||||||||||||||||

| Freshpet Kitchens and other plant capital expenditures |

12,987 | 13,298 | 2,548 | 11,043 | ||||||||||||

| Freshpet Fridge and other capital expenditures |

11,656 | 13,097 | 7,813 | 6,660 | ||||||||||||

| Total cash outflows of capital expenditures |

24,643 | 26,395 | 10,361 | 17,703 | ||||||||||||

| As of June 30, 2014 | ||||||||||||

| Actual | Pro Forma(4) | Pro Forma As Adjusted(5) |

||||||||||

| (Dollars in thousands) | ||||||||||||

| Consolidated Balance Sheet Data |

||||||||||||

| Cash and cash equivalents |

$ | 1,924 | $ | $ | ||||||||

| Working capital(6) |

1,179 | |||||||||||

| Property, plant and equipment, net |

55,419 | |||||||||||

| Total assets |

74,489 | |||||||||||

| Total debt |

83,640 | |||||||||||

| Redeemable preferred stock: |

||||||||||||

| Series B |

33,081 | |||||||||||

| Series C |

81,510 | |||||||||||

| Total stockholders’ (deficit) |

$ | (148,829 | ) | $ | $ | |||||||

| (1) | Represents fees paid to certain stockholders for acting as guarantors for a portion of our payment obligations under the $62.5 Million Revolver (as defined herein). Pursuant to a Fee and Reimbursement Agreement, the Company is obligated to pay each guarantor a contingent fee equal to 10% per annum of the amount each guarantor committed to guarantee. Payments will be made in the form of newly issued shares of Series C Preferred Stock. We plan to use a portion of the proceeds from this offering to repay the borrowings under the $62.5 Million Revolver, relieving us of future fees on the debt guarantee. See our consolidated financial statements and the notes thereto included elsewhere in this prospectus for additional information. |

| (2) | For the calculation of basic and diluted net loss per share and pro forma basic and diluted net loss per share, see notes and to our unaudited consolidated financial statements included elsewhere in this prospectus. |

| (3) | EBITDA and Adjusted EBITDA are not financial measures prepared in accordance with U.S. generally accepted accounting principles, or GAAP. As used herein, EBITDA represents net loss |

10

Table of Contents

| plus depreciation and amortization, interest expense (including fees on debt guarantee, which we believe are a cost of our financing arrangement and are akin to interest expense), and income tax expense. As used herein, Adjusted EBITDA represents EBITDA plus loss on disposal of equipment, new plant startup expenses and processing, share based compensation and launch expenses. |

We present EBITDA and Adjusted EBITDA because we believe each of these measures provides an additional metric to evaluate our operations and, when considered with both our GAAP results and the reconciliation to net loss set forth below, provides a more complete understanding of our business than could be obtained absent this disclosure. We use EBITDA and Adjusted EBITDA, together with financial measures prepared in accordance with GAAP, such as sales, gross profit percentage, and cash flow from operations, to assess our historical and prospective operating performance, to provide meaningful comparisons of operating performance across periods, to enhance our understanding of our operating performance and to compare our performance to that of our peers and competitors.

Adjusted EBITDA is further utilized for covenant compliance under our credit agreement, and additionally, as an important component of internal budgeting and setting management compensation.

EBITDA and Adjusted EBITDA are presented here because we believe they are useful to investors in assessing the operating performance of our business without the effect of non-cash items, and other items as detailed below.

EBITDA and Adjusted EBITDA should not be considered in isolation or as alternatives to net loss, income from operations or any other measure of financial performance calculated and prescribed in accordance with GAAP. Neither EBITDA nor Adjusted EBITDA should be considered a measure of discretionary cash available to us to invest in the growth of our business. Our Adjusted EBITDA may not be comparable to similarly titled measures in other organizations because other organizations may not calculate Adjusted EBITDA in the same manner as we do. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by the expenses that are excluded from that term or by unusual or non-recurring items. We recognize that both EBITDA and Adjusted EBITDA have limitations as analytical financial measures. For example, neither EBITDA nor Adjusted EBITDA reflects:

| • | our capital expenditures or future requirements for capital expenditures; |

| • | the interest expense (including fees on debt guarantee, which we believe are a cost of our financing arrangement and are akin to interest expense), or the cash requirements necessary to service interest expense or principal payments, associated with indebtedness; |

| • | depreciation and amortization, which are non-cash charges, although the assets being depreciated and amortized will likely have to be replaced in the future, nor does EBITDA or Adjusted EBITDA reflect any cash requirements for such replacements; and |

| • | changes in cash requirements for our working capital needs. |

Additionally, Adjusted EBITDA excludes (i) non-cash stock based compensation expense, which is and will remain a key element of our overall long term incentive compensation package, and (ii) certain costs essential to our sales growth and strategy, including an allowance for marketing expenses for each new store added to our network and uncapitalizable freight costs associated with Freshpet Fridge replacements. Adjusted EBITDA also excludes certain cash charges resulting from matters we consider not to be indicative of our ongoing operations. Other companies in our industry may calculate EBITDA and Adjusted EBITDA differently than we do, limiting their usefulness as comparative measures.

11

Table of Contents

The following table provides a reconciliation of EBITDA and Adjusted EBITDA to net loss which is the most directly comparable financial measure presented in accordance with GAAP:

| Year ended December 31, |

Six months ended June 30, |

|||||||||||||||

| 2013 | 2012 | 2014 | 2013 | |||||||||||||

| (Dollars in thousands) | ||||||||||||||||

| Net loss |

$ | (21,687 | ) | $ | (18,656 | ) | $ | (11,409 | ) | $ | (9,972 | ) | ||||

| Fees on debt guarantee(a) |

5,245 | 1,895 | 3,645 | 2,034 | ||||||||||||

| Depreciation & amortization |

5,945 | 4,728 | 3,124 | 1,912 | ||||||||||||

| Interest expense |

3,492 | 1,638 | 2,033 | 1,540 | ||||||||||||

| Income tax expense |

31 | 32 | 16 | 16 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| EBITDA |

(6,974 | ) | (10,363 | ) | (2,591 | ) | (4,470 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss on disposal of equipment |

503 | 333 | 71 | 24 | ||||||||||||

| Launch expense(b) |

3,305 | 2,815 | 2,334 | 1,678 | ||||||||||||

| New plant start up expenses and processing(c) |

1,996 | — | 113 | 436 | ||||||||||||

| Share based compensation(d) |

978 | 1,119 | 486 | 490 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted EBITDA |

$ | (192 | ) | $ | (6,096 | ) | $ | 413 | $ | (1,842 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Represents fees paid to certain stockholders for acting as guarantors for a portion of our payment obligations under the $62.5 Million Revolver. Pursuant to a Fee and Reimbursement Agreement, the Company is obligated to pay each guarantor a contingent fee equal to 10% per annum of the amount each guarantor committed to guarantee. Payments will be made in the form of newly issued shares of Series C Preferred Stock. We plan to use a portion of the proceeds from this offering to repay the borrowings under the $62.5 Million Revolver, relieving us of future fees on the debt guarantee except for changes in fair market value. See our consolidated financial statements and the notes thereto included elsewhere in this prospectus for additional information. |

| (b) | Represents new store marketing allowance of $1,000 for each store added to our distribution network as well as the uncapitalized freight costs associated with Freshpet Fridge replacements. The expense enhances the launch marketing spend to support our growing distribution network. |

| (c) | Represents additional operating costs incurred in 2013 and in the first quarter of 2014 in connection with the opening of our new primary manufacturing facility in Bethlehem, Pennsylvania, which was completed in the fourth quarter of 2013. |

| (d) | Represents non-cash stock based compensation expense. |

| (4) | The pro forma balance sheet data gives effect to the Stock Split, the Preferred Stock Conversion and the Preferred Stock Redemption. |

| (5) | The pro forma as adjusted balance sheet data gives effect to the pro forma adjustments set forth above and the sale of shares of common stock by us in this offering at an assumed initial public offering price of $ per share (the midpoint of the estimated price range set forth on the cover of this prospectus), after deducting the underwriting discount and estimated offering expenses payable by us. |

| (6) | Represents our currents assets minus current liabilities. |

12

Table of Contents

Investing in our common stock involves a high degree of risk. Before you purchase our common stock, you should carefully consider the risks described below and the other information contained in this prospectus, including our consolidated financial statements and accompanying notes. If any of the following risks actually occurs, our business, financial condition, results of operations or cash flows could be materially adversely affected. In any such case, the trading price of our common stock could decline, and you could lose all or part of your investment.

Risks Related to Our Business and Industry

We may not be able to successfully implement our growth strategy on a timely basis or at all.

Our future success depends, in large part, on our ability to implement our growth strategy of expanding distribution by installing new Freshpet Fridges, attracting new consumers to our brand and launching new products. Our ability to increase awareness, consumer trial and adoption of our products, and to implement this growth strategy depends, among other things, on our ability to:

| • | partner with customers to secure space for our Freshpet Fridges; |

| • | implement our marketing strategy; |

| • | develop new product lines and extensions; |

| • | partner with distributors to deliver our products to customers; |

| • | continue to compete effectively in multiple classes of retail, including grocery, mass, club, pet specialty and natural; and |

| • | expand and maintain brand loyalty. |

We may not be able to successfully implement our growth strategy or to grow consistently from period to period. Our business, financial condition and results of operations will be adversely affected if we fail to implement our growth strategy or if we invest resources in a growth strategy that ultimately proves unsuccessful.

We expect to need capital in the future, and we may not be able to generate sufficient cash flow or raise capital on acceptable terms to meet our needs.

Developing our business will require significant capital in the future. To meet our capital needs, we expect to rely on our cash flow from operations, the proceeds from this offering and other third-party financing. Third-party financing in the future may not, however, be available on terms favorable to us, or at all. Our ability to obtain additional funding will be subject to various factors, including general market conditions, our operating performance, the market’s perception of our growth potential, lender sentiment and our ability to incur additional debt in compliance with other contractual restrictions, such as financial covenants under our debt documents.

Additionally, our ability to make payments on and to refinance our indebtedness and to fund planned expenditures for our growth plans will depend on our ability to generate cash in the future. If our business does not achieve the levels of profitability or generate the amount of cash that we anticipate or if we expand faster than anticipated, we may need to seek additional debt or equity financing to operate and expand our business.

We believe that cash and cash equivalents, expected cash flow from operations and planned borrowing capacity are adequate to fund debt service requirements, operating lease obligations, capital

13

Table of Contents

expenditures and working capital obligations for the next quarters. However, our ability to continue to meet these requirements and obligations will depend on, among other things, our ability to achieve anticipated levels of revenue and cash flow from operations and our ability to manage costs and working capital successfully. Additionally, our cash flow generation ability is subject to general economic, financial, competitive, legislative and regulatory factors and other factors that are beyond our control. We cannot assure you that our business will generate cash flow from operations in an amount sufficient to enable us to fund our liquidity needs. Further, our capital requirements may vary materially from those currently planned if, for example, our revenues do not reach expected levels or we have to incur unforeseen capital expenditures and make investments to maintain our competitive position. If this is the case, we may seek alternative financing, such as selling additional debt or equity securities, and we cannot assure you that we will be able to do so on favorable terms, if at all. Moreover, if we issue new debt securities, the debt holders would have rights senior to common stockholders to make claims on our assets, and the terms of any debt could restrict our operations, including our ability to pay dividends on our common stock. If we issue additional equity or convertible debt securities, existing stockholders may experience dilution, and such new securities could have rights senior to those of our common stock. These factors may make the timing, amount, terms and conditions of additional financings unattractive. Our inability to raise capital could impede our growth or otherwise require us to forego growth opportunities and could materially adversely affect our business, financial condition and results of operations.

Failure to retain our senior management may adversely affect our operations.

Our success is substantially dependent on the continued service of certain members of our senior management, including Richard Thompson, our Chief Executive Officer. These members of senior management have been primarily responsible for determining the strategic direction of our business and for executing our growth strategy and are integral to our brand and culture, and the reputation we enjoy with suppliers, contract manufacturers, distributors, customers and consumers. The loss of the services of any of these employees could have a material adverse effect on our business and prospects, as we may not be able to find suitable individuals to replace them on a timely basis, if at all. In addition, any such departure could be viewed in a negative light by investors and analysts, which may cause the price of our common stock to decline.

If our products are alleged to cause injury or illness or fail to comply with governmental regulations, we may suffer adverse public relations, need to recall our products and experience product liability claims.

We may be exposed to product recalls, including voluntary recalls or withdrawals, and adverse public relations if our products are alleged to cause injury or illness or if we are alleged to have mislabeled or misbranded our products or otherwise violated governmental regulations. We may also voluntarily recall or withdraw products that we consider below our standards, whether for taste, appearance or otherwise, in order to protect our brand reputation. Consumer or customer concerns (whether justified or not) regarding the safety of our products could adversely affect our business. A product recall or withdrawal could result in substantial and unexpected expenditures, destruction of product inventory, and lost sales due to the unavailability of the product for a period of time, which could reduce profitability and cash flow. In addition, a product recall or withdrawal may require significant management attention. Product recalls, product liability claims (even if unmerited or unsuccessful), or any other events that cause consumers to no longer associate our brands with high quality and safe products may also result in adverse publicity, hurt the value of our brands, lead to a decline in consumer confidence in and demand for our products, and lead to increased scrutiny by federal and state regulatory agencies of our operations, which could have a material adverse effect on our business, financial condition and results of operations.

14

Table of Contents

We also may be subject to product liability claims and adverse public relations if consumption or use of our products is alleged to cause injury or illness. While we carry product liability insurance, our insurance may not be adequate to cover all liabilities we may incur in connection with product liability claims. For example, punitive damages are generally not covered by insurance. In addition, we may not be able to continue to maintain our existing insurance, obtain comparable insurance at a reasonable cost, if at all, or secure additional coverage (which may result in future product liability claims being uninsured). A product liability judgment against us or our agreement to settle a product liability claim could also result in substantial and unexpected expenditures, which would reduce profitability and cash flow. In addition, even if product liability claims against us are not successful or are not fully pursued, these claims could be costly and time-consuming and may require management to spend time defending the claims rather than operating our business.

The loss of a significant customer, certain actions by a significant customer or financial difficulties of a significant customer could adversely affect our results of operations.

A relatively limited number of customers account for a large percentage of our net sales. During 2013, ten customers, who purchase either directly from us or through third party distributors, collectively accounted for more than 67% of our net sales. Wal-Mart (which purchases through a distributor) and Kroger (which purchases directly from us) each accounted for more than 10% of our net sales during 2013. These percentages may increase if there is consolidation among retailers or if mass merchandisers grow disproportionately to their competition. We expect that a significant portion of our revenues will continue to be derived from a small number of customers; however, these customers may not continue to purchase our products in the same quantities as they have in the past. Our customers are generally not contractually obligated to purchase from us. Changes in our customers’ strategies, including a reduction in the number of brands they carry, shipping strategies, a shift of shelf space to or increased emphasis on private label products (including “store brands”), a reduction in shelf space for pet food items or a reduction in the space allocated for our Freshpet Fridges may adversely affect our sales. Requirements that may be imposed on us by our customers, such as sustainability, inventory management or product specification requirements, may have an adverse effect on our results of operations. Additionally, especially during economic downturns, our customers may face financial difficulties, bankruptcy or other business disruptions that may impact their operations and their purchases from us and may affect their ability to pay us for products purchased from us. Customers may grow their inventory in anticipation of a price increase, or in anticipation of, or during, our promotional events, which typically provide for reduced prices during a specified time or other customer or consumer incentives. To the extent customers seek to reduce their usual or customary inventory levels or change their practices regarding purchases in excess of consumer consumption, our sales and results of operations could be adversely impacted in that period. If our sales of products to one or more of our significant customers are reduced, this reduction could have a material adverse effect on our business, financial condition and results of operations.

Our operating results depend, in part, on the sufficiency and effectiveness of our marketing and trade spending programs.

In general, due to the highly competitive nature of the businesses in which we compete, we must execute effective and efficient marketing investments and trade spending programs with respect to our businesses overall to sustain our competitive position in our markets. Marketing investments may be costly. Additionally, we may, from time to time, change our marketing and trade spending strategies, including the timing, amount or nature of television advertising and related promotional programs. The sufficiency and effectiveness of our marketing and trade spending practices is important to our ability to retain or improve our market share or margins. If our marketing and trade spending programs are not successful or if we fail to implement sufficient and effective marketing and trade spending programs, our business, financial condition and results of operations may be adversely affected.

15

Table of Contents

The growth of our business depends on our ability to introduce new products and improve existing products in anticipation of changes in consumer preferences and demographics.

Our business is focused on the development, manufacture, marketing and distribution of pet food products. If consumer demand for our products decreased, our business would suffer. Sales of pet food products are subject to evolving consumer preferences and changing demographics. A significant shift in consumer demand away from our products or a decline in pet ownership could reduce our sales or the prestige of our brand, which would harm our business, financial condition and results of operations.

A key element of our growth strategy depends on our ability to develop and market new products and improvements to our existing products that meet our standards for quality and appeal to consumer preferences. The success of our innovation and product development efforts is affected by our ability to anticipate changes in consumer preferences and demographics, the technical capability of our product development staff in developing and testing product prototypes, including complying with governmental regulations, and the success of our management and sales team in introducing and marketing new products. Failure to develop and market new products that appeal to consumers could negatively impact our business, financial condition and results of operations.

Additionally, the development and introduction of new products requires substantial research, development and marketing expenditures, which we may be unable to recoup if the new products do not gain widespread market acceptance. Efforts to accelerate our innovation may exacerbate risks associated with innovation. If we are unsuccessful in meeting our objectives with respect to new or improved products, our business, financial condition and results of operations could be harmed.

Limited manufacturing capacity could have a material adverse effect on our business, financial condition, and results of operations.

All of the products we manufacture in-house are processed through our Freshpet Kitchens in Bethlehem, Pennsylvania, which we believe is North America’s only fresh, refrigerated pet food manufacturing facility. Accordingly, we have limited available manufacturing capacity to meet our quality standards. An unforeseen event, such as a natural disaster or work stoppage, at our Freshpet Kitchens could significantly limit our manufacturing capacity.

Accurate forecasting of sales demand is critical to ensuring available capacity. Our forecasts are based on multiple assumptions, which may cause our estimates to be inaccurate, affecting our ability to obtain adequate manufacturing capacity. Our current plans to meet expected production needs rely in large part on the successful expansion of our Freshpet Kitchens. Any substantial delay may hinder our ability to produce all of the product needed to meet orders and achieve financial performance.

If our growth exceeds our expectations, we may not be able to increase our own manufacturing capacity to, or obtain contract manufacturing capacity at, a level that meets demand for our products, which could prevent us from meeting increased customer demand and harm our business. However, if we overestimate our demand and overbuild our capacity, we may have significantly underutilized assets, and we may experience reduced margins. If we do not accurately align our manufacturing capabilities with demand, it could have a material adverse effect on our business, financial condition and results of operations.

Government regulation, scrutiny, warnings and public perception could increase our costs of production and increase legal and regulatory expenses.

Manufacturing, processing, labeling, packaging, storing and distributing pet products are activities subject to extensive federal, state and local regulation, as well as foreign regulation. In the United States, these aspects of our operations are regulated by the U.S. Food and Drug Administration

16

Table of Contents

(“FDA”), and various state and local public health and agricultural agencies. The FDA Food Safety Modernization Act provides direct recall authority to the FDA and includes a number of other provisions designed to enhance food safety, including increased inspections by the FDA of domestic and foreign food facilities and increased review of food products imported into the United States. In addition, many states have adopted the Association of American Feed Control Officials’ model pet food regulations or variations thereof, which generally regulate the information manufacturers provide about pet food. Complying with government regulation can be costly or may otherwise adversely affect our business. Failure to comply with applicable laws and regulations could subject us to civil remedies, including fines, injunctions, recalls or seizures, as well as potential criminal sanctions, which could have a material adverse effect on our business, financial condition and results of operations.

Our business is also affected by import and export controls and similar laws and regulations, both in the United States and elsewhere. Issues such as national security or health and safety, which slow or otherwise restrict imports or exports, could adversely affect our business. In addition, the modification of existing laws or regulations or the introduction of new laws or regulations could require us to make material expenditures or otherwise adversely affect the way that we have historically operated our business.

Our business may be subject to false marketing claims.

From time to time we may be subject to claims from competitors or consumers, including consumer class actions, alleging that our product claims are deceptive. Regardless of their merit, these claims can require significant time and expense to investigate and defend. Whether or not a false marketing claim is successful, such assertions could have an adverse effect on our business, financial condition and results of operations, and the negative publicity surrounding them could harm our reputation and brand image.

Adverse weather conditions, natural disasters, pestilences and other natural conditions can disrupt our operations, which can adversely affect our business, financial condition and results of operations.

The ingredients that we use in the production of our products (including, among others, meat, vegetables, fruits, carrageenans, whole grains, vitamins and minerals) are vulnerable to adverse weather conditions and natural disasters, such as floods, droughts, frosts, fires, earthquakes, tornadoes and pestilences. Adverse weather conditions may be impacted by climate change and other factors. Adverse weather conditions and natural disasters can reduce crop size and crop quality, which in turn could reduce our supply of ingredients, lower recoveries of usable ingredients, increase the prices of our ingredients, increase our transportation costs or increase our cost of storing ingredients if harvests are accelerated and processing capacity is unavailable. Additionally, the growth of crops, as well as the manufacture and processing of our products, requires significant amounts of water. Drought or other causes of a reduction of water in aquifers may affect availability of water, which in turn may adversely affect our results of operations. Competing manufacturers may be affected differently by weather conditions and natural disasters depending on the location of their supplies or operations. If our supply of ingredients is reduced, we may not be able to find enough supplemental supply sources on favorable terms, if at all, which could impact our ability to supply product to our customers and adversely affect our business, financial condition and results of operations. Increased costs for ingredients or other inputs could also adversely affect our business, financial condition and results of operations as described in “—The inputs, commodities, and ingredients that we require are subject to price increases and shortages that could adversely affect our results of operations.”

17

Table of Contents

Additionally, adverse weather conditions, natural disasters or other natural conditions affecting our operating activities or major facilities could cause an interruption or delay in our production or delivery schedules and loss of inventory and/or data or render us unable to accept and fulfill customer orders in a timely manner, or at all. If our operations are damaged by a fire, flood or other disaster, for example, we may be subject to supply or delivery interruptions, destruction of our facilities and products or other business disruptions, which could adversely affect our business, financial condition and results of operations.

If we fail to develop and maintain our brand, our business could suffer.

We believe that developing and maintaining our brand is critical to our success. The importance of our brand recognition may become even greater as competitors offer more products similar to ours. Our financial success is directly dependent on consumer perception of our brand. Our brand-building activities involve providing high-quality products, increasing awareness of our brand, creating and maintaining brand loyalty and increasing the availability of our products.

The success of our brand may suffer if our marketing plans or product initiatives do not have the desired impact on our brand’s image or its ability to attract customers. Further, our brand value could diminish significantly due to a number of factors, including consumer perception that we have acted in an irresponsible manner, adverse publicity about our products (whether or not valid), our failure to maintain the quality of our products, product contamination, the failure of our products to deliver consistently positive consumer experiences, or the products becoming unavailable to consumers. The growing use of social and digital media by consumers increases the speed and extent that information and opinions can be shared. Negative posts or comments about us or our brands or products on social or digital media could damage our brands and reputation. If we fail to maintain the favorable perception of our brands, our business, financial condition and results of operations could be negatively impacted.

The pet food product category in which we participate is highly competitive. If we are unable to compete effectively, our results of operations could be adversely affected.

The pet food product category in which we participate is highly competitive. There are numerous brands and products that compete for shelf space and sales, with competition based primarily upon brand recognition and loyalty, product packaging, quality and innovation, taste, nutrition, breadth of product line, price and convenience. We compete with a significant number of companies of varying sizes, including divisions or subsidiaries of larger companies. We face strong competition from competitors’ products that are sometimes sold at lower prices. Price gaps between our products and our competitors’ products may result in market share erosion and harm our business. A number of our competitors have broader product lines, substantially greater financial and other resources and/or lower fixed costs than we have. Our competitors may succeed in developing new or enhanced products, including fresh, refrigerated pet food, that are more attractive to customers or consumers than our products. These competitors may also prove to be more successful in marketing and selling their products or may be better able to increase prices to reflect cost pressures. We may not compete successfully with these other companies or maintain or grow the distribution of our products. We cannot predict the pricing or promotional activities of our competitors or whether they will have a negative effect on us. Many of our competitors engage in aggressive pricing and promotional activities. There are competitive pressures and other factors which could cause our products to lose market share or decline in sales or result in significant price or margin erosion, which would have a material adverse effect on our business, financial condition and results of operations.

18

Table of Contents

If the operating capacity or reputation of our Freshpet Fridges is harmed, our business, financial condition and results of operations may suffer.