Attached files

| file | filename |

|---|---|

| EX-5 - OPINION - EFLO ENERGY, INC. | eflo_ex5.htm |

| EX-23.1 - CONSENT OF ATTORNEYS - EFLO ENERGY, INC. | eflo_ex231.htm |

| EX-10.4 - JOINT OPERATING AGREEMENT - EFLO ENERGY, INC. | eflo_ex104.htm |

| EX-23.2 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - EFLO ENERGY, INC. | eflo_ex232.htm |

| EX-10.5 - OWNERSHIP AND OPERATING AGREEMENT - EFLO ENERGY, INC. | eflo_ex105.htm |

| EXCEL - IDEA: XBRL DOCUMENT - EFLO ENERGY, INC. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

AMENDMENT NO. 1

EFLO ENERGY, INC.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation or organization)

8200

(Primary Standard Industrial Classification Code Number)

26-3062721

(I.R.S. Employer Identification Number)

333 N. Sam Houston Parkway East, Suite 600

Houston, TX 77060

(281) 260-1034

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

Keith Macdonald

333 N. Sam Houston Parkway East, Suite 600

Houston, Texas 77060

(281) 260-1034

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

|

William T. Hart

Hart & Hart, LLC

1624 Washington Street

Denver, CO 80203

(303) 839-0061

|

Walter Van Dorn

Denton US, LLP

1221 Avenue of the Americas

New York, NY 10020

(212) 768-6985

|

As soon as practicable after the effective date of this Registration Statement

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

| Non-accelerated filer o |

Smaller reporting company þ

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be

Registered

|

Amount to be

Registered

|

Proposed

Maximum

Offering

Price Per

Share

|

Proposed

Maximum

Aggregate

Offering

Price (1)

|

Amount of

Registration Fee

|

|||||||||

|

Common stock (2)

|

$ | 18,700,000 | $ | ||||||||||

|

Placement Agent Warrants

|

100 | ||||||||||||

| Common stock (3) | $ | 1,309,000 | $ | ||||||||||

|

Warrants issuable to Clarion Finance Ltd. PTE

|

100 | ||||||||||||

|

Common stock (4)

|

261,800 | ||||||||||||

|

TOTAL

|

20,271,000 | $ | 2,611 | ||||||||||

|

(1)

|

Computed in accordance with Rule 457(o). Based an offering by the Company of $20,000,000 in Canadian dollars, converted into U.S. dollars using the exchange rate for U.S./Canadian dollars on September 10, 2014.

|

|

(2)

|

Shares of common stock offered by the Company.

|

|

(3)

|

Shares issuable upon exercise of Placement Agent Warrants.

|

(4) Shares issuable upon exercise of warrants issuable to Clarion Finance PTE Ltd.

Pursuant to rule 416, this registration statement includes such indeterminate number of additional securities as may be required for issuance as a result of any stock dividends, stock splits or similar transactions.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of l933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

PRELIMINARY PROSPECTUS

The information in this preliminary prospectus is not complete and may be changed. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion dated September __, 2014

EFLO Energy, Inc.

Minimum Offering: Cdn$10,000,000 (● Shares)

Maximum Offering: Cdn$20,000,000 (● Shares)

Cdn$___ per Share

Common Stock

By means of this prospectus, EFLO Energy, Inc. (we, us, our company or EFLO) is offering a minimum of ● shares of common stock and a maximum of ● shares of our common stock at a price of Cdn$● per share for gross proceeds of a minimum of Cdn$10,000,000 and a maximum of Cdn$20,000,000. We have engaged Canaccord Genuity Corp. (the agent) to act as our agent in connection with the sale of shares of our common stock on a "reasonable commercial- best efforts" basis.

Until the Minimum Offering is raised, all funds received will be deposited at _______. If the Minimum Offering is not sold within 90 days after the date of this prospectus, or the issuance of a final receipt for this prospectus by the Canadian securities regulators, whichever is earlier, an amendment to this prospectus is filed and the Canadian securities regulators have issued a receipt for the amendment, in which case this offering may be continued for an additional 90 days from the date of the receipt of the amendment, all funds received by the agent will be promptly refunded, without interest or deduction for any expenses. If the Minimum Offering is raised within the time frame specified above (including the allowable __ day extension), the offering will continue until either the first to occur of the following: (i) all shares offered are sold; or (ii) the offering is terminated by the mutual consent of the Company and the agent.

Our common stock is traded on the OTCQB under the symbol "EFLO". On September __, 2014, the closing price (last sale of the day) for one share of our common stock on the OTCQB was $______.

|

Price to Public

|

Agent's Commission (1)

|

Net Proceeds to Our Company (2)

|

|

|

Per Share

|

Cdn$●

|

Cdn$●

|

Cdn$●

|

|

Minimum Offering

|

Cdn$10,000,000

|

Cdn$700,000

|

Cdn$9,300,000

|

|

Maximum Offering

|

Cdn$20,000,000

|

Cdn$1,400,000

|

Cdn$18,600,000

|

An investment in the shares of our common stock is speculative and involves a high degree of risk. See "Risk Factors" beginning on page 18 of this Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

CANACORD GENUITY CORP.

The date of this Prospectus is September __, 2014

Notes:

|

(1)

|

Pursuant to the terms and conditions of an agency agreement dated ●, 2014 between us and Canacord Genuity Corp., we have agreed to pay the agent a cash commission of Cdn$● per share, representing 7.0% of the gross proceeds of this offering and issue to the agent a number of broker warrants (the broker warrants) equal to 7.0% of the total number of shares of common stock issued pursuant to this offering. Each broker warrant shall be exercisable for one share of common stock at the offering price per share of common stock under this offering for a period of 24 months from the closing of this offering. We will not pay any cash commission or issue any broker warrants to the agent in respect of any shares of common stock sold to any of our officers, directors or affiliates, identified to the agent prior to closing of this offering. Pacific World Energy Corp., one of our significant stockholders has indicated its intent to purchase a sufficient number of shares of common stock, after giving effect to any conversion of 2014 Convertible Notes (as defined herein) held by it, to maintain its current percentage ownership in our company. We have agreed to pay Clarion Finance PTE Ltd., an affiliate of Pacific World Energy Corp. a cash financing fee of Cdn$● per share, representing 7.0% of the gross proceeds they remit in connection with this offering and issue to them a number of non-transferable stock purchase warrants equal to 7.0% of the total number of shares of common stock to which they subscribe in this offering. Each such warrant shall be exercisable for one share of common stock at the offering price per share of common stock pursuant to this offering for a period of 24 months from the closing of this offering.

|

By means of a registration statement, of which this prospectus is a part, we are registering the warrants issuable to Canacord Genuity Corp. and Clarion Finance PTE Ltd., as well as the shares of common stock issuable upon the exercise of these warrants.

|

(2)

|

Before deduction of the expenses of this offering, estimated to be approximately Cdn$500,000.

|

TABLE OF CONTENTS

|

ABOUT THIS PROSPECTUS

|

6 |

|

SELLING JURISDICTIONS

|

6 |

|

INDUSTRY AND MARKET DATA

|

6 |

|

MONETARY AMOUNTS

|

6 |

|

EXCHANGE RATE INFORMATION

|

6 |

|

FINANCIAL STATEMENTS

|

7 |

|

GLOSSARY OF OIL AND GAS TERMS

|

7 |

|

CAUTION REGARDING UNITS OF EQUIVALENCY

|

8 |

|

CONVERSION RATIOS

|

9 |

|

PROSPECTUS SUMMARY

|

10 |

|

THE OFFERING

|

10 |

|

FORWARD-LOOKING STATEMENTS

|

16 |

|

RISK FACTORS

|

18 |

|

CORPORATE STRUCTURE

|

26 |

|

DESCRIPTION OF THE BUSINESS

|

28 |

|

OTHER OIL AND GAS INFORMATION

|

51 |

|

OTHER BUSINESS INFORMATION

|

54 |

|

INDUSTRY CONDITIONS

|

55 |

|

USE OF PROCEEDS

|

59 |

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

61 |

|

DESCRIPTION OF SECURITIES

|

71 |

|

CONSOLIDATED CAPITALIZATION

|

72 |

|

OPTIONS AND OTHER RIGHTS TO PURCHASE SECURITIES

|

74 |

|

PRIOR SALES

|

75 |

|

TRADING PRICE AND VOLUME

|

76 |

|

ESCROWED SECURITIES

|

75 |

|

PRINCIPAL SECURITYHOLDERS

|

77 |

|

SELECTED HISTORICAL CONSOLIDATED FINANCIAL AND OTHER DATA

|

79 |

|

PLAN OF DISTRIBUTION

|

79 |

|

DIRECTORS AND OFFICERS

|

82 |

|

EXECUTIVE COMPENSATION

|

85 |

|

INDEBTEDNESS OF DIRECTORS AND OFFICERS

|

95 |

|

AUDIT COMMITTEE

|

95 |

|

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

|

96 |

|

WHERE YOU CAN FIND MORE INFORMATION

|

99 |

|

LEGAL PROCEEDINGS AND REGULATORY ACTIONS

|

100 |

|

INTERESTS OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS

|

100 |

|

RELATIONSHIP BETWEEN THE COMPANY AND THE AGENT

|

100 |

|

AUDITORS, TRANSFER AGENT AND REGISTRAR

|

100 |

| LEGAL MATTERS | 101 |

|

APPENDIX "A" — FINANCIAL STATEMENTS

|

A-1

|

|

APPENDIX "B" — AUDIT COMMITTEE CHARTER

|

B-1

|

5

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus and are not entitled to rely on parts of the information contained in this prospectus to the exclusion of others. We have not and the agent has not authorized anyone to provide you with information that is different. If anyone provides you with different or inconsistent information, you should not rely on it. This document may only be used where it is legal to sell these securities.

The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the common stock offered hereunder. Our business, financial condition, results of operations, and prospects may have changed since the date of this prospectus.

SELLING JURISDICTIONS

Neither we nor the agent are offering to sell common stock in any jurisdictions where the offer or sale is not permitted. For investors outside of Canada or the United States, neither we nor the agent have done anything that would permit the offering of our common stock or the use or distribution of this prospectus in any jurisdiction where our securities cannot legally be sold or in which action on our part is required for that purpose.

INDUSTRY AND MARKET DATA

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, government publications, or other published independent sources. Some data is also based on our good faith estimates. Although we believe these third-party sources are reliable and that the information is accurate and complete, we have not independently verified the information.

MONETARY AMOUNTS

In this prospectus, unless otherwise specified, all monetary amounts are in United States dollars. Reference to " dollars ," or "$", are to United States dollars and reference to “Cdn$”' are to Canadian dollars.

EXCHANGE RATE INFORMATION

We measure and report our financial results in United States dollars. The following table sets forth, for the periods indicated, the high, low, average, and period-end noon spot rates of exchange for the U.S. dollar, expressed in Canadian dollars per U.S. dollar, based on data published by the Bank of Canada. Although obtained from sources believed to be reliable, the data is only for informational purposes, and the Bank of Canada does not guarantee that the data is accurate or complete. No representation is made that the U.S. dollar amounts have been, could have been or could be converted into Canadian dollars at the noon buying rates on such dates or any other dates.

|

Nine months ended

May 31

|

Year ended August 31

|

|||||||||||||||||||

|

2014

|

2013

|

2013

|

2012

|

2011

|

||||||||||||||||

|

Cdn$

|

Cdn$

|

Cdn$

|

Cdn$

|

Cdn$

|

||||||||||||||||

|

Highest rate during the period

|

1.1251

|

1.0371

|

1.0576

|

1.0604

|

1.0520

|

|||||||||||||||

|

Lowest rate during the period

|

1.0237

|

0.9710

|

0.9710

|

0.9752

|

0.9449

|

|||||||||||||||

|

Average noon spot rate during the period(1)

|

1.0758

|

1.0022

|

1.0112

|

1.0092

|

0.9892

|

|||||||||||||||

|

Rate at the end of the period

|

1.0867

|

1.0339

|

1.0553

|

0.9863

|

0.9784

|

|||||||||||||||

Note:

|

(1)

|

Determined by averaging the noon rates on each business day during the respective period.

|

On August __, 2014, the noon spot rate of exchange published by the Bank of Canada for conversion of United States dollars into Canadian dollars was $1.00 = Cdn$______.

6

FINANCIAL STATEMENTS

The financial statements included in this prospectus have been prepared in accordance with U.S. generally accepted accounting principles (U.S. GAAP) and are reported in U.S. dollars.

GLOSSARY OF OIL AND GAS TERMS

The following are definitions of certain terms commonly used in our industry and this prospectus.

AECO. The Alberta natural gas trading price.

AOF. Absolute open flow potential.

bbl. One stock tank barrel, or 42 U.S. gallons liquid volume, of crude oil or liquid hydrocarbons.

Bcf. Billion cubic feet of natural gas.

Bcf/d. Bcf per day.

boe. Barrel of oil equivalent determined using the ratio of one bbl of crude oil, condensate, or natural gas liquids to six Mcf of natural gas.

boe/d. Barrels of oil equivalent per day.

Btu. A British Thermal Unit, or the amount of heat necessary to raise the temperature of one pound of water one degree Fahrenheit.

COGEH. The Canadian Oil and Gas Evaluation Handbook.

Condensate. Liquid hydrocarbons associated with the production of a primarily natural gas reserve.

Developed acreage. The number of acres which are allocated or held by producing wells or wells capable of production.

Development well. A well drilled within the proved area of an oil or gas reservoir to the depth of a stratigraphic horizon known to be productive.

Dry hole; dry well. A well found to be incapable of producing either oil or gas in sufficient or commercial quantities to justify completion as an oil or gas well.

Exploitation. Ordinarily considered to be a form of development within a known reservoir.

Exploratory well. A well drilled to find a new field or to find a new reservoir in a field previously found to be productive of oil or gas in another reservoir. Generally, an exploratory well is any well that is not a development well or a service well.

Field. A defined geographical area consisting of one or more pools.

First Nations. The aboriginal or native residents of Canada.

GJ. Gigajoules.

Gross acres or gross wells. The total acres or wells, as the case may be, in which a working interest is owned.

Hydraulic fracturing. A process used to stimulate production of hydrocarbons. The process involves the injection of water, sand, and chemicals under pressure into the formation to fracture the surrounding rock and stimulate production.

7

Lease operating expenses. The expenses of lifting oil or gas from a producing formation to the surface, constituting part of the current operating expenses of a working interest, and also including labor, superintendence, supplies, repairs, short-lived assets, maintenance, allocated overhead costs, and other expenses incidental to production, but not including lease acquisition or drilling or completion expenses.

Liquids. Describes oil, condensate, and natural gas liquids.

LNG. Liquified natural gas.

Mbbls. Thousand barrels of crude oil or other liquid hydrocarbons.

Mboe. Thousand barrels of oil equivalent determined using the ratio of one bbl of crude oil, condensate, or natural gas liquids to six Mcf of natural gas.

Mcf. Thousand cubic feet of natural gas.

Mcfe. Thousand cubic feet equivalent determined using the ratio of six Mcf of natural gas to one bbl of crude oil, condensate, or natural gas liquids.

MMboe. One million barrels of oil equivalent determined using the ratio of one bbl of crude oil, condensate, or natural gas liquids to six Mcf of natural gas.

MMBtu. One million British Thermal Units, a common energy measurement.

MMcf. Million cubic feet of natural gas.

Mstb. Thousands of stock tank barrels.

Net acres or net wells. The sum of the fractional working interest owned in gross acres or gross wells expressed in whole numbers and fractions of whole numbers.

Net production. The working interest production less the amount of production attributable to royalty burdens.

NGL. Natural gas liquids.

NI 51-101. National Instrument 51-101 – Standards of Disclosure for Oil and Gas Activities of the Canadian Securities Administrators.

Productive wells. Producing wells and wells that are capable of production, including injection wells, salt water disposal wells, service wells, and wells that are shut-in.

Reservoir. A porous and permeable underground formation containing a natural accumulation of producible oil and/or gas that is confined by impermeable rock or water barriers and is individual and separate from other reservoirs.

Undeveloped acreage. Acreage on which wells have not been drilled or completed to a point that would permit the production of economic quantities of oil or natural gas, regardless of whether such acreage contains proved reserves.

Working interest. An operating interest which gives the owner the right to drill, produce, and conduct operating activities on the property, and to receive a share of production.

Working interest production. The working interest share of production before the impact of royalty burdens.

CAUTION REGARDING UNITS OF EQUIVALENCY

Units of equivalency such as boe (barrel of oil equivalent) or Mcfe (thousand cubic feet of gas equivalent) may be misleading, particularly if used in isolation. Equivalent volumes are computed with oil and NGL quantities converted to Mcf at a ratio of one bbl to six Mcf, and natural gas converted to barrels at a ratio of six Mcf to one bbl.

8

A boe conversion ratio of six Mcf of natural gas to one bbl, and a Mcfe conversion ratio of one bbl of crude oil or NGLs to six Mcf of natural gas, is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

Although these conversion factors are industry accepted norms, they are not reflective of price or market value differentials between product types. On June 30, 2014, the AECO gas price was $____ per Mcf and the Edmonton Par oil price was $_____ per bbl. If a price equivalent conversion ratio was applied based on these prices, the conversion factor would be approximately 1 bbl of oil for every _____ Mcf of natural gas.

CONVERSION RATIOS

The following table sets forth certain standard conversions between Standard Imperial Units and the International System of Units (or metric units).

|

To convert from

|

To

|

Multiply by

|

||

|

Mcf

|

cubic metres

|

28.174

|

||

|

bbl

|

cubic metres (''m3'')

|

0.159

|

||

|

cubic metres

|

bbls

|

6.293

|

||

|

feet

|

metres

|

0.305

|

||

|

metres

|

feet

|

3.281

|

||

|

miles

|

kilometers

|

1.609

|

||

|

kilometres

|

miles

|

0.621

|

9

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. Because it is a summary, it is not complete and does not contain all of the information that you should consider before deciding whether or not to invest in our common stock. You should carefully read the entire prospectus. In particular, you should read the sections entitled “'Risk Factors”', “'Forward-looking Statements”, “'Management's Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the notes thereto included elsewhere in this prospectus. Unless the context otherwise requires, information presented in this prospectus assumes that the agent's over-allotment option to purchase additional shares of our common stock is not exercised.

Unless the context otherwise requires, references in this prospectus to ''we,'' ''us,'' ''our,'' ''our company,'' when used in the present tense or prospectively, those terms refer to EFLO Energy, Inc. and its consolidated subsidiaries.

Unless otherwise indicated or the context otherwise requires, all operating data in this prospectus presented on a per unit basis is calculated based on working interest production volumes. Certain oil and gas industry terms used in this prospectus are defined in the ''Glossary of Oil and Gas Terms'' section of this prospectus.

THE OFFERING

We have engaged the agent to conduct this offering on a "reasonable commercial efforts" basis. This offering is being made without a firm commitment by the agent, who has no obligation or commitment to purchase any of the shares of our common stock. See "Plan of Distribution".

|

Minimum shares offered:

|

● shares of our common stock

|

|

Maximum shares offered:

|

● shares of our common stock

|

|

Common stock to be outstanding, if minimum offering is sold:(1)

|

● shares of our common stock

|

|

Common stock to be outstanding, if maximum offering is sold:(1)

|

● shares of our common stock

|

|

Offering price per common stock:

|

Cdn$●

|

|

Expected net proceeds, if minimum offering is sold: (2)

|

Cdn$9,300,000

|

|

Expected net proceeds, if maximum offering is sold:(2)

|

Cdn$18,600,000

|

|

Use of proceeds:

|

We expect to use the proceeds primarily to recomplete and/or rework existing wells on our Kotaneelee, Yukon properties and for general working capital purposes. See "Use of Proceeds".

|

|

Termination of offering

|

The offering is for a minimum of Cdn$10,000,000 (the “Minimum Offering”) and a maximum of Cdn$20,000,000. Until the Minimum Offering is raised, all funds received will be deposited at _______. If the Minimum Offering is not sold within 90 days after the date of this prospectus, or the issuance of a final receipt for this prospectus by the Canadian securities regulators, whichever is earlier, an amendment to this prospectus is filed and the Canadian securities regulators have issued a receipt for the amendment, in which case this offering may be continued for an additional 90 days from the date of the receipt of the amendment, all funds received by the agent will be promptly refunded, without interest or deduction for any expenses. If the Minimum Offering is raised within the time frame specified above (including the allowable __ day extension), the offering will continue until either the first to occur of the following: (i) all shares offered are sold; or (ii) the offering is terminated by the mutual consent of the Company and the agent

|

10

Notes:

|

(1)

|

On an undiluted basis and prior to giving effect to any shares of common stock issued under the over-allotment option. See "Consolidated Capitalization".

|

|

(2)

|

Before deducting expenses of this offering, estimated to be approximately Cdn$500,000.

|

Our Business

We are a development stage company incorporated in the State of Nevada on July 22, 2008, and we are engaged in the acquisition, exploration and development of oil and gas properties primarily in the Yukon Territory, Canada.

During the period from July 18, 2012 through October 17, 2012, we acquired working interests totaling 53.65% (including a 100% working interest in one shut in gas well) in the Kotaneelee Gas Project (KGP) located in the Yukon Territory in Canada. We believe the KGP has significant conventional and shale gas potential and is supported by an environment of growing investment in gas processing and export in the Pacific Northwest.

Our acquisition of an initial working interest of 22.989% (including a 69.337% working interest in one shut in gas well) in the KGP, was completed on July 18, 2012, with an effective date of July 1, 2012. Since that date, we have been responsible for the operations of the KGP and have recognized our portion of its related net revenues and costs as an increase to the unamortized cost pool related to our unproven interests while economic viability is being evaluated.

During March 2011, we initiated oil and gas operations by entry into the Eagleford Agreement which provided for our acquisition of a net working interest, ranging from 21.25% to 42.5%, in a 2,629 acre oil and gas lease, insofar as that lease covers from the surface to the base of the San Miguel formation (the San Miguel Lease). The San Miguel Lease is located in Zavala County, Texas, and has no current production or reserves.

Prior to our initial working interest acquisition in the KGP, we had generated no revenues and had no reserves. Following our acquisition of the KGP we have generated limited revenue which reduced the unamortized cost pool related to our unproven interests while economic viability is being evaluated.

See "Description of the Business" for more information.

Business Strategy

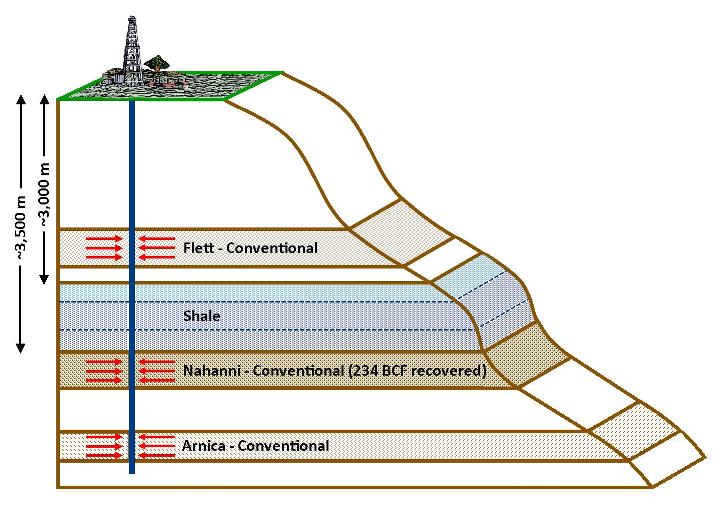

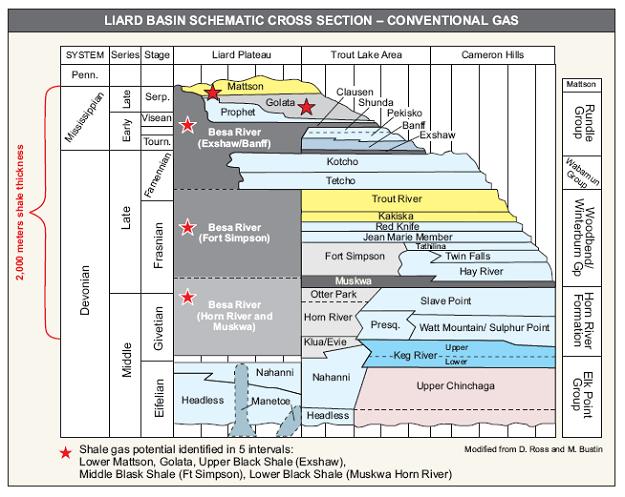

We are a Yukon-focused natural gas and energy company engaged in the exploration for, and the acquisition, development and production of, natural gas reserves in the Liard Basin and the development of energy alternatives for the Yukon and Northwest Canada. With the completion of two recent acquisitions at Kotaneelee, we have positioned ourself in a significant natural gas resource play with significant gas in place, contiguous undeveloped land, an underutilized plant infrastructure, pipeline connection to the North American markets, operatorship and a solid drilling inventory. Our business plan is to recommence gas production on our properties and leverage the cost advantage provided by existing infrastructure. We plan to use our proven expertise and experience to increase shareholder value by monetizing our primary exploration and development acreage.

Our long-term exploration plan for Kotaneelee involves the exploitation of conventional and shale gas reserves and resources and increasing our undeveloped land position around our Liard basin foothold. We will seek to maximize our working interest ownership in the project and will attempt to manage our risk profile by seeking a strategic partner to assist in funding and developing the Kotaneelee asset. We intend to evaluate gas market sales alternatives including the development of a modular LNG project to supply LNG to the Yukon and other areas of Northwest Canada. We also intend to investigate options to sell gas to Asian markets by moving gas through proposed west coast LNG facilities.

11

Corporate Information

Our principal executive offices are located at 333 North Sam Houston Parkway East, Suite 410, Houston Texas, and our telephone number is (281) 260-1034. Our website is www.efloenergy.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider such information to be part of this prospectus.

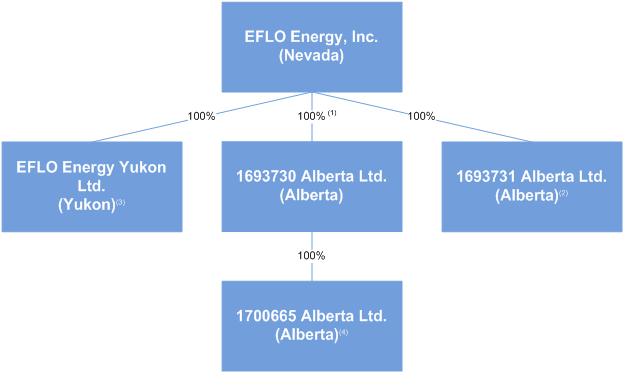

The following chart reflects our organizational structure as of the date of this prospectus:

Notes:

|

(1)

|

In connection with our acquisition of the entire right and interest (generally a working interest of 30.664%) in the KGP from Nahanni Energy Inc., we issued to Canada Southern Petroleum #1 L.P., a subsidiary of Nahanni Energy Inc., an aggregate of 1,614,767 exchangeable shares of 1693730 Alberta Ltd. The exchangeable shares are exchangeable for shares of our common stock on a one for one basis, and are non-voting. See "Description of Securities - Exchangeable Shares".

|

|

(2)

|

Our subsidiary 1693731 Alberta Ltd. has no assets and exists solely to facilitate the exchange of exchangeable shares of our subsidiary 1693730 Alberta Ltd. for shares of our common stock.

|

|

(3)

|

Title to our initial 22.989% working interest in the KGP, acquired on July 18, 2012, is held in the name of our wholly-owned Canadian subsidiary EFLO Energy Yukon Ltd.

|

|

(4)

|

Title to the additional 30.664% working interest in the KGP, acquired on October 17, 2012, is held in the name of our indirect wholly-owned Canadian subsidiary 1700665 Alberta Ltd.

|

12

Directors and Executive Officers

Our directors and executive officers are as follows:

|

Name

|

Position Held with our Company

|

|

|

Henry Aldorf

|

Chairman of the Board of Directors

|

|

|

Keith Macdonald

|

Chief Executive Officer, Secretary and Director

|

|

|

Robert Wesolek

|

Chief Financial Officer and Director

|

|

|

H. Wayne Hamal

|

Chief Operating Officer

|

|

|

James Hutton

|

Director

|

|

|

Eric Prim

|

Director

|

|

|

James Ebeling

|

Director

|

See "Directors and Officers".

Share Capital

We are authorized to issue 150,000,000 shares of common stock with a par value of $0.001 per share and 10,000,000 shares of preferred stock with a par value of $0.001 per share. Each share of common stock entitles the holder to one vote on all matters submitted to a vote of the stockholders including the election of directors. See "Description of Securities".

Selected Financial Information

The following table sets out selected financial information as at and for the periods indicated. Investors should read the selected financial information in conjunction with our management's discussion and analysis under ''Management's Discussion and Analysis of Financial Condition and Results of Operations and our audited and unaudited financial statements and the accompanying notes included in this prospectus.

|

As at and for the nine months ended

May 31,

2014

|

As at and for the year ended

August 31,

2013

|

|||||||

|

Statements of Operations

|

||||||||

|

Operating Expenses

|

(2,757,062 | ) | (5,212,548 | ) | ||||

|

Other Income (Expense)

|

(341,585 | ) | 11,794,774 | |||||

|

Net Income (Loss), after taxes

|

(3,098,647 | ) | 3,802,377 | |||||

|

Balance Sheets

|

||||||||

|

Oil and Gas Properties, unproven

|

49,833,036 | 48,897,972 | ||||||

|

Total Assets

|

52,782,657 | 51,542,311 | ||||||

|

Current Liabilities

|

6,033,465 | 3,197,627 | ||||||

|

Noncurrent Liabilities

|

20,363,738 | 19,846,599 | ||||||

|

Total Liabilities

|

26,397,194 | 23,044,226 | ||||||

|

Total Stockholders’ Equity

|

26,385,463 | 28,498,085 | ||||||

13

Risk Factors

An investment in our common stock involves a number of very significant risks. You should carefully consider the information set out under "Risk Factors" and other information in this prospectus before purchasing shares of our common stock. The risks we face include the following:

|

●

|

there may be ongoing doubt about our ability to continue as a going concern. We require substantial capital to develop our properties, conduct operations, engage in acquisition activities, and commence production. If we are unable to obtain, on satisfactory terms, financiing necessary to execute our operating strategy , you could lose your entire investment in our common stock ;

|

|

●

|

our pursuit of natural resource properties may fail and/or exploration activities may not be commercially successful, which could lead us to abandon our plans to develop properties;

|

|

●

|

we have negative cash flow from operating activities;

|

|

●

|

prices and markets for natural gas, NGL, LNG and oil are unpredictable and tend to fluctuate significantly, which could reduce profitability, growth and the value of our business;

|

|

●

|

the oil and natural gas industry is highly competitive, and there is no assurance that we will be successful in acquiring leases, equipment and personnel;

|

|

●

|

oil and gas exploration is not an exact science and involves a high degree of risk;

|

|

●

|

First Nations have claimed aboriginal title and rights in portions of Canada which, if found to be applicable to our land, could complicate, or delay our operations;

|

|

●

|

the marketability of our production is dependent upon transportation and processing facilities over which we may have no control;

|

|

●

|

our business will suffer if we cannot obtain or maintain necessary licenses or if there is a defect in the chain of title;

|

|

●

|

our reserves are estimates and depend on many assumptions. Any material inaccuracies in these assumptions could cause the quantity and/or value of our actual oil and natural gas reserves, and our revenue, profitability, and cash flow, to be materially different from our estimates;

|

|

●

|

one of our strategies for the sale of our natural gas production is dependent upon the development of west coast LNG projects;

|

|

●

|

we may not realize the anticipated benefits of acquisitions and dispositions;

|

|

●

|

we may not effectively manage the growth necessary to execute our business plan;

|

|

●

|

lower oil, natural gas, and NGL prices and other factors in the future may result in write-downs and other impairments of our asset carrying values;

|

|

●

|

environmental risks may result in delays, claims or additional costs which could adversely affect our business;

|

|

●

|

losses and liabilities arising from uninsured or under-insured hazards could have a material adverse effect on our business;

|

|

●

|

amendments to current laws and regulations governing our proposed operations could have a material adverse impact on our proposed business;

|

|

●

|

penalties we may incur could impair our business;

|

|

●

|

strategic relationships upon which we may rely are subject to change, which may diminish our ability to conduct our operations;

|

|

●

|

our failure to replace any oil and gas reserves could result in a material decline in our reserves, which could have a material adverse effect on our business, financial condition, cash flows, and results of operations;

|

|

●

|

fluctuations in currency exchange rates could have a material adverse impact on our operations;

|

14

|

●

|

Our articles of incorporation limit the liabilities of our officers and directors to us and our stockholders;

|

|

●

|

the loss of certain key management employees could have a material adverse effect on our business;

|

|

●

|

there are potential conflicts of interest between our company and some of our directors and officers;

|

|

●

|

the price of our common stock may become volatile, which could lead to losses by investors and costly securities litigation;

|

|

●

|

if we obtain additional financing through the sale of additional equity in our company, the issuance of additional shares of common stock will result in dilution to our existing stockholders;

|

|

●

|

substantial sales or other issuances of our common stock, or the perception that such sales might occur, could depress the market price of our common stock;

|

|

●

|

our directors and officers own or control a significant percentage of our outstanding voting shares, which may adversely affect the voting influence of other shareholders; and

|

|

●

|

we do not expect to pay dividends in the foreseeable future.

|

Please read this prospectus carefully. You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. You should not assume that the information set forth in the prospectus is accurate as of any date other than the date on the front of this prospectus.

15

FORWARD-LOOKING STATEMENTS

Certain statements contained in this prospectus constitute forward-looking statements. These statements relate to future events or our future performance. All statements other than statements of historical fact are forward-looking statements. The use of any of the words "anticipate", "plan", "contemplate", "continue", "estimate", "expect", "intend", "propose", "might", "may", "will", "shall", "project", "should", "could", "would", "believe", "predict", "forecast", "pursue", "potential" and "capable" and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this prospectus should not be unduly relied upon. These statements speak only as of the date of this prospectus. In addition, this prospectus may contain forward-looking statements and forward-looking information attributed to third party industry sources.

In particular, this prospectus contains forward-looking statements pertaining to the following:

|

●

|

the offering price and the completion, size and timing of this offering;

|

|

●

|

the potential exercise of the over-allotment option;

|

|

●

|

the net proceeds of this offering and the use of the net proceeds of this offering;

|

|

●

|

our growth strategy, including our intent to acquire additional interests in the KGP;

|

|

●

|

supply and demand fundamentals for crude oil and natural gas;

|

|

●

|

our expectations regarding commodity prices and costs;

|

|

●

|

expectations with respect to future opportunities;

|

|

●

|

expectations with respect to future cash flow from operations, net debt and other financial results;

|

|

●

|

our capital expenditure programs and future capital requirements;

|

|

●

|

the estimated quantity and value of our proved, probable and possible reserves;

|

|

●

|

our belief that analogous information with respect to the potential resources of the Liard Basin obtained from third party sources such as Apache Corporation, Lone Pine Resources Inc. and Paramount Resources Ltd. may be indicative of the resources associated with our properties;

|

|

●

|

our estimates of future interest and foreign exchange rates;

|

|

●

|

the cash available for the funding of capital expenditures;

|

|

●

|

the timing of commencement of certain of our operations on the KGP;

|

|

●

|

expectations regarding the timeframe at which we may begin paying income taxes;

|

|

●

|

our access to adequate pipeline capacity;

|

|

●

|

our access to third-party infrastructure;

|

|

●

|

our 2014 expected capital expenditures;

|

|

●

|

industry conditions pertaining to the oil and gas industry;

|

|

●

|

our plans for, and results of, exploration and development activities;

|

|

●

|

our plans to investigate gas market sales alternatives, including modular LNG in the Yukon and Northwest Canada;

|

|

●

|

our treatment under governmental regulatory regimes and tax laws;

|

|

●

|

our future general and administrative expenses;

|

|

●

|

our access to capital and overall strategy, development and drilling plans for the KGP;

|

|

●

|

expectations on how we will manage exploration, production and marketing risks;

|

|

●

|

our plans to seek a strategic partner to assist in developing and funding the KGP; and

|

|

●

|

the compensation which we expect to pay to our executive officers and directors in 2014 and thereafter.

|

16

With respect to forward-looking statements and forward-looking information contained in this prospectus, assumptions have been made regarding, among other things:

|

●

|

future crude oil, NGL and natural gas prices;

|

|

●

|

our ability to obtain qualified staff and equipment in a timely and cost–efficient manner;

|

|

●

|

the regulatory framework governing royalties, taxes and environmental matters in the jurisdictions in which we conduct our business and any other jurisdictions in which we may conduct our business in the future;

|

|

●

|

our ability to market production of oil, natural gas and LNG successfully to customers;

|

|

●

|

our future production levels;

|

|

●

|

the applicability of technologies for recovery and production of our reserves;

|

|

●

|

the recoverability of our reserves;

|

|

●

|

future capital expenditures;

|

|

●

|

future cash flows from production meeting the expectations stated in this prospectus;

|

|

●

|

future sources of funding for our capital program;

|

|

●

|

future debt levels;

|

|

●

|

geological and engineering estimates in respect of our reserves;

|

|

●

|

the geography of the areas in which we are conducting exploration and development activities;

|

|

●

|

the intentions of the board of directors with respect to the executive compensation plans and corporate governance programs described herein;

|

|

●

|

the impact of competition on us; and

|

|

●

|

our ability to obtain financing on acceptable terms.

|

Actual results could differ materially from those anticipated in these forward-looking statements as a result of the risk factors set forth below and included elsewhere in this prospectus, including:

|

●

|

operating and capital costs;

|

|

●

|

our status and stage of development;

|

|

●

|

general economic, market and business conditions;

|

|

●

|

volatility in market prices for crude oil and natural gas and hedging activities related thereto;

|

|

●

|

risks related to the exploration, development and production of oil and natural gas reserves and resources;

|

|

●

|

current global financial conditions, including fluctuations in interest rates, foreign exchange rates and stock;

|

|

●

|

risks related to the timing of completion of our projects;

|

|

●

|

competition for, among other things, capital, the acquisition of reserves and resources and skilled personnel;

|

|

●

|

operational hazards;

|

|

●

|

actions by governmental authorities, including changes in government regulation and taxation, including permanent prohibitions relating to hydraulic fracturing;

|

|

●

|

environmental risks and hazards;

|

|

●

|

risks inherent in the exploration, development and production of oil and natural gas which may create

|

liabilities to our company in excess of our insurance coverage;

|

●

|

failure to accurately estimate abandonment and reclamation costs;

|

|

●

|

failure of third parties' reviews, reports and projections to be accurate;

|

|

●

|

the availability of capital on acceptable terms;

|

|

●

|

political risks;

|

|

●

|

changes to royalty or tax regimes;

|

|

●

|

our failure or the failure of the holders of certain licenses or leases to meet specific requirements of such licenses or leases;

|

|

●

|

claims made in respect of our properties or assets; and

|

|

●

|

aboriginal claims;

|

17

|

●

|

unforeseen title defects;

|

|

●

|

risks arising from future acquisition activities;

|

|

●

|

hedging strategies;

|

|

●

|

potential conflicts of interest;

|

|

●

|

the potential for management estimates and assumptions to be inaccurate;

|

|

●

|

risks associated with establishing and maintaining systems of internal controls;

|

|

●

|

risks related to the reliance on historical financial information;

|

|

●

|

additional indebtedness;

|

|

●

|

volatility in the market price of the shares of our common stock;

|

|

●

|

the absence of an existing Canadian public market for our shares of common stock;

|

|

●

|

the effect that the issuance of additional securities by our company could have on the market price of our shares of common stock;

|

|

●

|

failure to engage or retain key personnel;

|

|

●

|

potential losses which would stem from any disruptions in production, including work stoppages or other labor difficulties, or disruptions in the transportation network on which we are reliant;

|

|

●

|

uncertainties inherent in estimating quantities of oil and natural gas reserves;

|

|

●

|

failure to acquire or develop replacement reserves;

|

|

●

|

geological, technical, drilling and processing problems, including the availability of equipment and access to properties;

|

|

●

|

failure by counterparties to make payments or perform their operational or other obligations to our company in compliance with the terms of contractual arrangements between us and such counterparties;

|

|

●

|

discretion in the use of proceeds of this offering; and

|

|

●

|

the other factors discussed under "Risk Factors".

|

In addition, information and statements in this prospectus relating to "reserves" are deemed to be forward-looking information and statements, as they involve the implied assessment, based on certain estimates and assumptions, that the reserves described exist in the quantities predicted or estimated, and that the reserves described can be profitably produced in the future. Readers are cautioned that the foregoing list of risk factors should not be construed as exhaustive.

The forward-looking statements included in this prospectus are expressly qualified by this cautionary statement and are made as of the date of this prospectus. We do not undertake any obligation to publicly update or revise any forward-looking statements except as required by applicable securities laws.

RISK FACTORS

An investment in our common stock involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in this prospectus in evaluating our company and our business before purchasing shares of our common stock. Our business, operating results and financial condition could be seriously harmed as a result of the occurrence of any of the following risks. You could lose all or part of your investment due to any of these risks. You should invest in our common stock only if you can afford to lose your entire investment.

Risks Associated With Our Business

There may be ongoing doubt about our ability to continue as a going concern. We require substantial capital to develop our properties, conduct operations, engage in acquisition activities, and commence production. If we are unable to obtain, on satisfactory terms, financing necessary to execute our operating strategy, you could lose your entire investment in our company.

We require substantial capital to develop our properties, conduct exploration, development, and production operations, engage in acquisition activities, and commence production.

Under the Joint Operating Agreement (JOA) and the Construction, Ownership & Operating Agreement (CO&O) governing our Kotaneelee properties, in the event any one or more of the interest owners elect not to participate in our planned exploration and development activities at Kotaneelee, we may be required to fund or seek funding for the entire costs of such activities rather than solely our proportionate interest. See "Description of the Business - The Kotaneelee Gas Project - KGP Governing Agreements".

We may need to access the private or public equity or debt capital markets or complete asset sales to fund such activities. If we are unable to obtain additional equity or debt financing in the private or public capital markets or access alternative sources of funds, we may be required to reduce the level of our planned capital expenditures and may lack the capital necessary to replace our reserves or commence production.

18

Our future revenues, cash flows, and spending levels are subject to a number of factors, including commodity prices, the level of production from existing and future wells, and our success in developing and or recompleting existing wells and successfully drilling new wells.

Our ability to access the private and public equity and debt markets and complete future asset realization transactions is also dependent upon primarily natural gas and NGL prices, and to a lesser extent oil prices in addition to a number of other factors, some of which are outside our control. These factors include, among others:

|

●

|

the value and performance of our equity securities;

|

|

●

|

domestic and global economic conditions; and

|

|

●

|

conditions in the domestic and global financial markets.

|

Due to these factors, we cannot be certain that funding, if needed, will be available to the extent required, or on acceptable terms. If we are unable to access funding when needed on acceptable terms, we may not be able to implement our business plans fully, take advantage of business opportunities, respond to competitive pressures, or refinance our debt obligations as they come due, any of which could have a material adverse effect on our business, financial condition, cash flows, and results of operations.

Our pursuit of natural resource properties may fail, and/or our exploration activities may not be commercially successful, which could lead us to abandon our plans to develop properties.

Our long-term success depends on our ability to discover commercially recoverable quantities of resources on our properties and develop them into commercially viable operations. Resource exploration and development is highly speculative in nature, involves many risks and is frequently non-productive. These risks include unusual or unexpected geologic formations, and the inability to obtain suitable or adequate machinery, equipment or labor. The success of exploration and development is determined in part by the following factors: (i) the identification of potential resources; (ii) availability of government-granted exploration permits and well licenses; (iii) the quality of management and geological and technical expertise; and (iv) the capital available for exploration.

We have negative cash flow from operating activities

We had negative operating cash flow from operating activities for the year ended August 31, 2013 and for the nine months ended May 31, 2014. Lack of cash flow from our operating activities could impede our ability to raise capital through debt or equity financing to the extent required to fund our business operations. If we do not generate sufficient cash flow from our operating activities we will remain dependent upon external financing sources. If we raise additional funds by issuing equity securities, dilution to the holders of shares of our common stock may result. There can be no assurance that such sources of financing will be available on acceptable terms or at all.

Prices and markets for natural gas, NGL, LNG and oil are unpredictable and tend to fluctuate significantly, which could reduce profitability, growth and the value of our business.

Our revenues and earnings, if any, will be highly sensitive to the price of natural gas and LNG in the longer term and, to a lesser extent, oil and NGLs. Prices for natural gas, LNG, NGL and oil are subject to large fluctuations in response to relatively minor changes in the supply of and demand for oil and gas, market uncertainty and a variety of additional factors beyond our control. These factors include, without limitation, governmental fixing, pegging, controls or any combination of these and other factors, changes in domestic, international, political, social and economic environments, worldwide economic uncertainty, the availability and cost of funds for exploration and production, the actions of the Organization of Petroleum Exporting Countries, governmental regulations, political stability in the Middle East and elsewhere, war, or the threat of war, in oil producing regions, the foreign supply of oil, the price of foreign imports and the availability of alternate fuel sources. Significant changes in long-term price outlooks for these commodities could have a material adverse effect on any future revenues as well as the value of our licenses or other assets.

The oil and natural gas industry is highly competitive, and there is no assurance that we will be successful in acquiring leases, equipment and personnel.

The oil and natural gas industry is intensely competitive. Although we do not compete with other oil and gas companies for the sale of any oil and gas that we may produce, as there is sufficient demand in the world market for these products, we compete with numerous individuals and companies for desirable oil and natural gas leases, suitable properties for drilling operations and necessary drilling equipment, access to pipelines and other transportation infrastructure, qualified personnel and access to capital. Many of these individuals and companies with whom we compete have substantially greater technical, financial and operational resources and staff than we have. If we cannot compete for personnel, equipment and oil and gas properties, our business could be harmed.

19

Oil and gas exploration is not an exact science and involves a high degree of risk.

Our primary exploration risk lies in the drilling of dry holes, failing to successfully recomplete existing wells, or drilling and completing wells which, though productive, do not produce gas and/or oil in sufficient amounts to return the amounts expended and produce a profit. Hazards, such as unusual or unexpected formation pressures, down hole fires, blowouts, loss of circulation of drilling fluids and other conditions are involved in drilling and completing oil and gas wells and, if such hazards are encountered, completion of any well may be substantially delayed or prevented. In addition, adverse weather conditions can hinder or delay operations, as can shortages of equipment and materials or unavailability of drilling, completion, and/or work-over rigs. Even though a well is completed and is found to be productive, water and/or other substances may be encountered in the well, which may impair or prevent production or marketing of oil or gas from the well. Exploratory drilling involves substantially greater economic risks than development drilling because the percentage of wells completed as producing wells is usually less than in development drilling. Exploratory drilling itself can be of varying degrees of risk and can generally be divided into higher risk attempts to discover a reservoir in a completely unproven area or relatively lower risk efforts in areas not too distant from existing reservoirs. While exploration adjacent to or near existing reservoirs may be more likely to result in the discovery of oil and gas than in completely unproven areas, exploratory efforts are nevertheless high risk activities.

Although the completion of oil and gas wells is, to a certain extent, less risky than drilling for oil and gas, the process of completing an oil or gas well is nevertheless associated with considerable risk. In addition, even if a well is completed as a producer, the well for a variety of reasons may not produce sufficient oil or gas in order to repay our investment in the well.

First Nations have claimed aboriginal title and rights in portions of Canada, which if found to be applicable to our land, could complicate, or delay our operations.

First Nations peoples have claimed aboriginal title and rights in portions of Canada. We are not aware that any claims have been made against us with respect to our properties and assets; however, if a claim arose and was successful, it could prevent or delay exploration, increase costs and/or cause us to forego exploration opportunities and therefore such claim may have a material adverse effect on our business, financial condition, cash flows, and results of operations. Our operations may be delayed or interrupted to the extent that they are deemed to encroach on the traditional rights of aboriginal people to hunt, trap, or otherwise have access to natural resources or lands.

The marketability of our production is dependent upon transportation and processing facilities over which we may have no control.

The marketability of our production depends in part upon the availability, proximity, and capacity of pipelines, natural gas gathering systems, and processing facilities. Any significant change in market factors affecting these infrastructure facilities, as well as delays in the construction of new infrastructure facilities, could harm our business. Any oil, natural gas or NGLs that we may produce will be delivered through gathering facilities that we do not own or operate. As a result, we are subject to the risk that these facilities may be temporarily unavailable due to mechanical reasons or market conditions, or may not be available to us in the future. If we experience interruptions or loss of pipelines or access to gathering systems that impact a substantial amount of our production, it could have a material adverse effect on our business, financial condition, cash flows, and results of operations.

Our business will suffer if we cannot obtain or maintain necessary licenses or if there is a defect in the chain of title.

Our operations require that we obtain and maintain licenses and permits from various governmental authorities. Our ability to obtain, maintain or renew such licenses and permits on acceptable terms is subject to extensive regulation and to changes, from time-to-time, in those regulations. Also, the decision to grant or renew a license or permit is frequently subject to the discretion of the applicable government. If we cannot obtain, maintain, extend or renew these licenses or permits our business could be harmed.

Also, although internal title reviews have been conducted on our existing properties, we have not engaged third party or legal title reviews. As a result, such reviews do not guarantee or certify that an unforeseen defect in the chain of title will not arise to defeat our claim which could result from the loss of title and a reduction of the revenue received, if any. Also, adverse claims of third parties, if successful, may result in the recognition of net profit interests or working interest with respect to all or a portion of our interest in the KGP. The recognition of any such claims could also result in a reduction in the potential revenue derived from our operation of the KGP.

20

Our reserves are estimates and depend on many assumptions. Any material inaccuracies in these assumptions could cause the quantity and/or value of our actual oil and natural gas reserves, and our revenue, profitability, and cash flow, to be materially different from our estimates.

There are numerous uncertainties inherent in estimating crude oil and natural gas reserves and their values. The reserves, if any, we report in our filings with the SEC or in Canada are estimates, and such estimates may prove to be inaccurate. Reservoir engineering is a subjective and inexact process of estimating underground accumulations of crude oil and natural gas that cannot be measured in an exact manner. Estimates of economically recoverable crude oil and natural gas reserves depend upon a number of variable factors, such as historical production from the area compared with production from other producing areas and assumptions concerning effects of regulations by governmental agencies, future crude oil and natural gas prices, future operating costs, severance and excise taxes, development costs and work-over and remedial costs. Some or all of these assumptions may in fact vary considerably from actual results. For these reasons, estimates of the economically recoverable quantities of crude oil and natural gas attributable to any particular group of properties, classifications of such reserves based on risk of recovery, and estimates of the future net cash flows prepared by different engineers or by the same engineers but at different times may vary substantially. Accordingly, reserve estimates may be subject to downward or upward adjustment. Actual production, revenue and expenditures with respect to our reserves will likely vary from estimates, and such variances may be material.

The oil and gas reserve information and the related future net revenues information contained in this prospectus represent only estimates, which were evaluated by Deloitte LLP, an independent qualified reserves evaluator. Estimating quantities of oil and gas reserves is a subjective, complex process and depends on a number of variable factors and assumptions. To prepare estimates of economically recoverable oil and gas reserves and future net cash flows, we:

|

●

|

analyze historical production from the area and compare it to production rates from other producing areas;

|

|

●

|

analyze available technical data, including geological, geophysical, production, and engineering data, the extent, quality, and reliability of which can vary; and

|

|

●

|

make various economic assumptions, including assumptions about oil, natural gas, and NGL prices, drilling, operating, and production costs, severance and excise taxes, capital expenditures, work over and remedial costs, and the availability of funds.

|

As a result, these estimates are inherently imprecise. Ultimately, actual production, revenues, taxes, expenses, and expenditures relating to our reserves will vary from our estimates. Any significant inaccuracies in our assumptions or changes in operating conditions could cause the estimated quantities and net present value of the reserves contained in this prospectus to be significantly different from the actual quantities and net present value of our reserves. In addition, we may adjust our estimates of proved reserves to reflect production history, actual results, prevailing commodity prices, and other factors, many of which are beyond our control.

Further, you should not assume that any present value of future net cash flows from our estimated proved and probable reserves contained in this prospectus represents the market value of our estimated proved and probable reserves. At August 31, 2014, all of our estimated reserves (by volume) were undeveloped. Recovery of undeveloped reserves generally requires significant capital expenditures and successful drilling operations. Our reserve estimates include the assumption that we will make significant capital expenditures to develop these undeveloped reserves, and the actual costs, development schedule, and results associated with these properties may not be as estimated.

21

One of our strategies for the sale of our natural gas production is dependent upon the development of westcoast LNG projects.

One of our potential gas market sales strategies is dependent upon the development of westcoast LNG facilities. Although various westcoast LNG projects have been proposed and are in various stages of approval and/or development, these projects are capital intensive and are subject to a number of risks and uncertainties including but not limited to: the approval, development and construction of supply pipelines to deliver natural gas to these facilities; the negotiation of definitive supply contracts with LNG customers; the availability of capital to construct the LNG facilities; the supply and demand for LNG in Asian and other markets; the inability to secure required governmental approvals, including but not limited to environmental approvals; First Nations claims; risks of third party injunction to delay or prevent such developments; the availability of skilled labour; and the effect of currency fluctuations on the economic viability of such projects.

Should the development or construction of proposed LNG projects and their associated supply pipelines be delayed or prevented, we will be required to pursue other strategies for natural gas sales, which may constrain the potential prices we may receive for our production, and which may have a material adverse effect on our financial results.

We may not realize the anticipated benefits of acquisitions and dispositions.

We will consider acquisitions and dispositions of certain petroleum or natural gas assets in the ordinary course of business, including the acquisition of additional interests in the KGP. We may not be successful in completing such acquisitions or dispositions, including any acquisition of additional interests in the KGP.

Achieving the benefits of acquisitions depends on successfully consolidating functions and integrating operations and procedures in a timely and efficient manner and our ability to realize the anticipated growth opportunities and synergies from combining the acquired businesses and operations with our operations. The integration of acquired businesses may require substantial management effort, time and resources diverting our focus from other strategic opportunities and operational matters. We may also enter into other industry related activities or new geographical areas or acquire different energy-related assets that may result in unexpected or significantly increased risk to us, which could materially adversely affect our business and financial condition. Additionally, we will continually assess the value and contribution of the various properties and assets which we own. In this regard, certain assets may be periodically disposed of so we can focus our efforts and resources more efficiently. Depending on the state of the market for such assets, certain of our assets, if disposed of, may realize less than what the market may expect for such disposition or their carrying value on our financial statements.

We may not effectively manage the growth necessary to execute our business plan.

The growth anticipated by our business plan will place significant strain on our current personnel, systems and resources. We expect that we will be required to hire more qualified employees to help us manage any growth effectively. We believe that we will also be required to improve our management, technical, information and accounting systems, controls and procedures. We may not be able to maintain the quality of our operations, control our costs, continue complying with all applicable regulations and expand our internal management, technical information and accounting systems to support our desired growth. If we fail to manage our anticipated growth effectively, our business could be adversely affected.

Lower oil, natural gas, and NGL prices and other factors have resulted, and in the future may result in write-downs and other impairments of our asset carrying values.

We use the full cost method of accounting under U.S. GAAP to report our oil and gas operations. Under this method, we capitalize the cost to acquire, explore for, and develop oil and gas properties. Under full cost accounting rules, the net capitalized costs of proved oil and gas properties may not exceed a "ceiling limit," which is based upon the present value of estimated future net cash flows from proved reserves (calculated in accordance with SEC rules and regulations and corresponding U.S. accounting standards), discounted at 10%. If net capitalized costs of proved oil and gas properties exceed the ceiling limit, we must charge the amount of the excess to earnings. This is called a "ceiling test write-down." Under the accounting rules, once we begin reclassifying our oil and gas assets from unproved to proved, we will be required to perform a ceiling test each quarter. A ceiling test write-down would not impact cash flow from operating activities, but it would reduce our stockholders’ equity.

22

We also assess investments in unproved properties, including capitalized interest costs, periodically to ascertain whether impairment has occurred. The cost of unproved properties, which costs are individually significant are assessed individually by considering the primary lease terms of the properties, the holding period of the properties, and geographic and geologic data obtained relating to the properties. The amount of impairment assessed, if any, is added to the costs to be amortized. If an impairment of unproved properties results in a reclassification to proved oil and gas properties, the amount by which the ceiling limit exceeds the capitalized costs of proved oil and gas properties would be reduced.

The risk that we will be required to write-down the carrying value of our oil and gas properties, our unproved properties, or goodwill increases when oil, natural gas, and NGL prices are low. In addition, write-downs may occur if we experience substantial downward adjustments to our estimated proved reserves or our unproved property values, or if estimated future development costs increase.

Environmental risks may result in delays, claims or additional costs which could adversely affect our business.

All phases of the oil and gas business present environmental risks and hazards and are subject to environmental regulation pursuant to a variety of laws and regulations. Environmental legislation provides for, among other things, restrictions and prohibitions on spills, releases or emissions of various substances produced in association with oil and gas operations. The legislation also requires that wells and facility sites be operated, maintained, abandoned and reclaimed to the satisfaction of applicable regulatory authorities. Compliance with such legislation can require significant expenditures and a breach may result in the imposition of fines and penalties, some of which may be material. The application of environmental laws to our business may cause us to curtail our production or increase the costs of any production, development or exploration activities.

Future environmental regulation may also encompass a prohibition or moratorium on the use of certain exploration techniques, including hydraulic fracturing. The implementation of any such prohibition or moratorium would have a material adverse effect on our business, financial condition and results.

Losses and liabilities arising from uninsured or under-insured hazards could have a material adverse effect on our business.