Attached files

Table of Contents

As filed with the Securities and Exchange Commission on September 11, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

MEVION MEDICAL SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

3845 (Primary Standard Industrial Classification Code Number) |

20-0794350 (I.R.S. Employer Identification Number) |

300 Foster St.

Littleton, MA 01460

(978) 540-1500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Joseph K. Jachinowski

Chief Executive Officer

Mevion Medical Systems, Inc.

300 Foster St.

Littleton, MA 01460

(978) 540-1500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Mitchell S. Bloom, Esq. John M. Mutkoski, Esq. Laurie A. Burlingame, Esq. Goodwin Procter LLP Exchange Place Boston, MA 02109 (617) 570-1000 |

Patrick O’Brien, Esq. Ropes & Gray LLP Prudential Tower 800 Boylston St. Boston, MA 02199 (617) 951-7000 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer ¨ |

Non-accelerated filer x |

Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price(1) |

Amount of registration fee(2) | ||

| Common stock, $0.001 par value |

$69,000,000 | $8,887.20 | ||

|

| ||||

| (1) | Includes offering price of shares that the underwriters have the option to purchase to cover over-allotments, if any. Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933, as amended. |

| (2) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated September 11, 2014

Prospectus

shares

Common Stock

This is an initial public offering of common stock by Mevion Medical Systems, Inc. We are selling shares of common stock. The estimated initial public offering price is between $ and $ per share.

Prior to this offering, there has been no public market for our common stock. We have applied for listing of our common stock on NASDAQ Global Market under the symbol “MEVI.”

We are an “emerging growth company” under applicable Securities and Exchange Commission rules and will be subject to reduced public company reporting requirements.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds to Mevion Medical Systems, Inc., before expenses |

$ | $ | ||||||

| (1) | The underwriters will receive compensation in addition to the underwriting discount. See “Underwriting” beginning on page 128. |

We have granted the underwriters an option for a period of 30 days to purchase up to additional shares of common stock.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 10.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to investors on or about , 2014.

| Jefferies | Leerink Partners | |

| Oppenheimer & Co.

BTIG | ||

, 2014

Table of Contents

Table of Contents

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission. Neither we nor any of the underwriters have authorized anyone to provide any information or make any representations other than those contained in this prospectus or in any free writing prospectus filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock. Our business, financial condition, results of operations and prospects may have changed since such date.

Through and including , 2014 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

For investors outside of the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus outside of the United States.

i

Table of Contents

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision. Unless the context otherwise requires, the terms “Mevion,” “the company,” “we,” “us,” and “our” in this prospectus refer to Mevion Medical Systems, Inc. and its consolidated subsidiaries.

MEVION MEDICAL SYSTEMS, INC.

We are a leading provider of proton therapy systems for use in radiation treatment for cancer patients. Our MEVION S250 Proton Therapy System, or MEVION S250, is the only modular, single room proton therapy system currently on the market. The MEVION S250 integrates with standard radiation therapy workflow and provides a proton therapy treatment environment at a fraction of the cost, footprint and operational complexity of conventional systems. We believe this enables the deployment of proton therapy into a broader variety of cancer care facilities, creating greater access for more patients. We have received 510(k) marketing clearance from the U.S. Food and Drug Administration, or FDA, for the MEVION S250, and the right to affix the Conformité Européene, or CE, mark to the MEVION S250 for its marketing and sale in the European Economic Area.

We market the MEVION S250 to a broad range of worldwide customers, including university research and teaching hospitals, community hospitals, private practices, government institutions and freestanding cancer centers. Although the length of our sales process varies based on the customer, it is typically lengthy lasting up to 36 months or more from initial customer contact to contract execution, nine to 12 months for the customization of a customer’s facility for the system and 18 to 24 months to install the system. As of the date of this prospectus, we have installed only one MEVION S250. In December 2013, the Siteman Cancer Center at Barnes-Jewish Hospital, or BJH, a National Cancer Institute Designated Comprehensive Cancer Center, became the first center to treat patients with a MEVION S250. During the three month period ended June 30, 2014, we recognized revenue of $7.6 million from our first installed MEVION S250. BJH is rapidly ramping up the use of the MEVION S250 in its clinical practice, recently treating 18 different patients per day with a total of approximately 50 treatment fields, or unique radiation beams delivered from different directions. This represents a utilization rate of 60% to 70%. On March 22, 2014, we delivered a recall notice to BJH regarding a defect we identified in an advanced software feature for the patient positioning system of the MEVION S250. On September 11, 2014, we announced the introduction of Intensity Modulated Proton Therapy, an alternative beam shaping technology, for the MEVION S250, which we named HYPERSCAN. We expect that HYPERSCAN will be available for delivery in fiscal 2016. We promptly updated our software to resolve this defect and the FDA closed the recall notice on April 3, 2014. As of June 30, 2014, we had 21 signed system purchase contracts that also cover service during the warranty period, of which 17 are included in our backlog at a total value of $257.6 million and one service contract for post-warranty services at a total value of $3.0 million. Included in our backlog are signed system purchase contracts from our distributors in Japan and South Korea of $65.8 million and $20.0 million, respectively, and we do not yet have regulatory approval to sell the MEVION S250 in either jurisdiction.

We have incurred net losses in each year since our inception in 2004. Our net losses were $38.9 million and $26.5 million during the years ended September 30, 2013 and September 30, 2012, respectively, and $29.0 million and $26.1 million during the nine months ended June 30, 2014 and June 30, 2013, respectively. We expect to continue to incur significant expenses and increasing operating losses through at least our fiscal year ending September 30, 2016 as a result of an ongoing expansion of our commercial operations, including increased manufacturing, sales and marketing costs.

Radiation therapy is a proven, effective and widely accepted form of treatment for many types of cancer. Physicians divide the prescribed treatment into a sequence of radiation doses, or fractions, which may consist of

1

Table of Contents

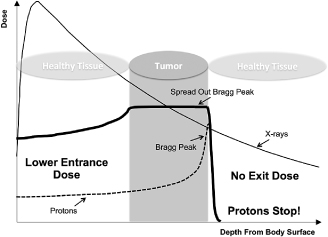

one or more treatment fields. Currently, the most common type of radiation therapy is external beam radiation therapy whereby patients are treated with high-energy X-ray radiation generated by a device external to the patient called a linear accelerator. Although over 85% of patients treated with radiation therapy in the United States receive this type of external beam radiation, it faces a number of significant challenges. While the goal of radiation therapy is to selectively deliver radiation solely to cancer cells, X-ray radiation therapy exposes healthy tissue outside of the intended treatment area to significant doses of radiation. Damage to healthy tissues caused by radiation therapy can have a range of adverse effects, including treatment-related side effects, the potential to develop secondary cancer, developmental problems in pediatric patients, and limits on future radiation treatment possibilities. Despite attempts to minimize these types of adverse effects, collateral damage from X-ray radiation therapy remains a leading concern and continues to limit the dose of X-ray radiation that can safely be used to treat cancer.

Similar to traditional X-ray therapy, proton therapy is an external beam radiation therapy technique. High-energy protons generated by a particle accelerator deposit radiation dose in a more targeted manner than X-rays. When protons enter the body, they only leave a small amount of radiation along their path as they pass through the tissue. Upon reaching a specific depth, protons deposit a large focused amount of radiation and then stop, leaving no radiation beyond that depth. This physical characteristic of protons makes them more effective for the delivery of radiation therapy to cancer patients than other current radiation delivery methods, such as X-rays. The use of protons to deliver radiation therapy allows physicians to maximize the radiation dose to the treatment target, while minimizing the adverse effects of radiation on the surrounding healthy tissue. The clinical premise of proton therapy has been widely published in studies based on treatment planning comparisons, showing that proton therapy can deliver equivalent or improved dose to the treatment target while reducing unnecessary dose to the healthy tissue by as much as a factor of three. In the United States, although Medicare has not adopted a national coverage determination, reimbursement rates for proton therapy treatments delivered in the outpatient hospital setting have been established for more than a decade for local coverage determinations by Medicare Administrative Contractors. The current Medicare unadjusted reimbursement rate for proton therapy delivered in the outpatient hospital setting is $872 per fraction for simple proton therapy procedures where only a single area of the patient is treated, and $1,205 per fraction for complex proton therapy procedures where one or more areas of the patient are treated.

Although proton therapy offers important clinical advantages in the treatment of certain cancers, its use has been greatly limited because the current model for conventional proton therapy centers has several key limitations. Conventional proton therapy centers utilize large particle accelerators weighing 90 to more than 200 tons, requiring complicated beam transport systems. As a result, conventional proton therapy systems are large, costly, operationally complex and result in inefficient workflow. To amortize the total project cost, which has exceeded $200 million for recently announced proton therapy centers, most conventional proton therapy centers in operation have three or more treatment rooms, resulting in facilities that span as much as 100,000 square feet. These centers are operationally complex, as extensive equipment is needed to transport, steer and safely cue the proton beam from the particle accelerator to the proper treatment room. There is also a significant loss of treatment time as the shared proton source must be reset each time it is transferred to a new treatment room, making treatment scheduling challenging. These centers are further hindered by high energy and personnel costs and frequent maintenance. Many of these key limitations also apply to the proton therapy systems currently marketed as compact by our competitors, as such systems continue to utilize large particle accelerators, requiring multi-room beam transport systems.

The MEVION S250 addresses the key limitations of conventional proton therapy centers. We utilize a proprietary miniaturized particle accelerator in the MEVION S250, which measures only three feet in radius. The substantial reduction in size and complexity of the accelerator allows the MEVION S250 to be integrated onto a high-precision frame structure, or gantry, that can fit within a single treatment room, with a footprint of approximately 2,000 square feet. Building size and cost are greatly reduced and expensive and complex beam transport systems are eliminated. Since each room has a dedicated proton source, the MEVION S250 also

2

Table of Contents

eliminates beam switching and associated waiting times, greatly simplifying the proton therapy equipment and reducing staffing requirements. In addition, as demand for proton therapy grows, the MEVION S250 provides customers with the modular flexibility to expand treatment capacity by adding additional treatment rooms. The list price of the MEVION S250 in the United States is $25 million, a fraction of the cost of conventional proton therapy centers.

We believe that a U.S. customer buying a MEVION S250 can recover its capital outlay for the MEVION S250 and associated installation costs within three to four years after initiating patient treatment. This belief is based on published data from conventional proton therapy centers, reporting that approximately 275 patients can be treated per treatment room per year, and on the assumption that each patient receives 35 fractions over the course of treatment. This assumes reimbursement for all procedures at the current Medicare rates for proton therapy delivered in the outpatient hospital setting and a mix of 40% simple and 60% complex proton therapy procedures. The foregoing is intended to be illustrative and the actual time needed for a customer to recover its capital outlay for the MEVION S250 and associated installation costs will depend on many factors including, among others, the extent to which the MEVION S250 can be operated at or near capacity, that adequate coverage and reimbursement are available, including in foreign countries, as well as a customer’s cost to construct, finance and operate its facility.

We believe that at least 15% of the U.S. radiation therapy patient population, or 170,000 patients per year, would benefit from proton therapy treatment. Assuming 275 patients can be treated per room per year, there is a need for more than 600 proton therapy treatment rooms in the United States. We believe there are approximately the same number of proton therapy centers built, under construction or under planning in the United States as there are internationally. Thus, the worldwide market can be estimated on the order of 1,200 treatment rooms. We estimate that currently there are 31 operational proton therapy centers worldwide and 39 centers, including those using the MEVION S250, in some stage of installation, construction or architectural planning worldwide, containing an aggregate of 168 treatment rooms. As a result, we believe that there is a large addressable market for the MEVION S250.

Our Strategy

Our objective is to become the leading provider of proton therapy systems and the technology of choice for proton therapy providers around the world. Key elements of our strategy include:

| • | Accessing a larger segment of the radiation therapy market by enhancing awareness of the MEVION S250’s benefits. |

| • | Adding advanced features to our proprietary platform. |

| • | Expanding our worldwide distribution chain. |

| • | Selling additional MEVION S250s to our existing customers. |

| • | Pursuing strategic partnerships and collaborations. |

Risks Related to Our Business and Industry

Our business, financial condition, results of operations and prospects are subject to numerous risks. These risks include:

| • | We may not be able to generate sufficient revenue from the commercialization of the MEVION S250 to achieve and maintain profitability. |

| • | The long sales cycle and high unit price of the MEVION S250, as well as other factors, may contribute to substantial fluctuations in our quarterly operating results and stock price and make it difficult to compare our results of operations to prior periods. |

3

Table of Contents

| • | Amounts included in our order backlog may not result in actual revenue and are an uncertain indicator of our future earnings. |

| • | We rely on a limited number of suppliers or, in some cases, sole suppliers, for some of our components, subassemblies and materials and may not be able to find replacements or immediately transition to alternative suppliers. |

| • | If we are unable to support demand for the MEVION S250 and our future products, including ensuring that we have adequate facilities and manufacturing capacity to meet increased demand, or we are unable to successfully manage the evolution of our proton technology, our business could suffer. |

| • | We depend on third-party distributors to market and distribute our products in international markets. If our distributors fail to successfully market and distribute our products, our business will be materially harmed. |

| • | The loss of our President and Chief Executive Officer or other key members of our senior management team or our inability to attract and retain highly skilled scientists and salespeople could adversely affect our business. |

| • | Servicing our debt and other payment obligations requires a significant amount of cash, and we may not have sufficient cash flow from our business to pay our substantial debt. |

| • | If we are unable to adequately protect our proprietary technology or maintain issued patents which are sufficient to protect the MEVION S250, others could compete against us more directly, which would have a material adverse impact on our business, results of operations, financial condition and prospects. |

| • | If we or our distributors do not obtain and maintain the necessary regulatory approvals in a specific country, we will not be able to market and sell the MEVION S250 in that country. |

Corporate Information

We were incorporated under the laws of the State of Delaware in 2004 under the name Still River Systems Incorporated and changed our name to Mevion Medical Systems, Inc. in 2011. Our principal executive offices are located at 300 Foster St., Littleton, MA 01460. Our telephone number is (978) 540-1500. We maintain a website at www.mevion.com. The reference to our website is intended to be an inactive textual reference only. The information contained on, or that can be accessed through, our website is not a part of this prospectus.

This prospectus contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including Mevion Medical Systems, Mevion S250 Proton Therapy System, Mevion TriNiobium Core, Verity Patient Positioning System, logos, artwork, and other visual displays, may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Except where the context requires otherwise, in this prospectus “Company,” Mevion,” “we,” “us” and “our” refer to Mevion Medical Systems, Inc. and its consolidated subsidiaries.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies, including:

| • | reduced disclosure about our executive compensation arrangements; |

| • | no non-binding advisory votes on executive compensation or golden parachute arrangements; and |

4

Table of Contents

| • | exemption from the auditor attestation requirement in the assessment of our internal controls over financial reporting. |

We may take advantage of these exemptions up until the last day of the fiscal year following the fifth anniversary of this offering or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if (i) we have more than $1 billion in annual revenue, (ii) we have more than $700 million in market value of our stock held by non-affiliates (and we have been a public company for at least 12 months and have filed one annual report on Form 10-K) or (iii) we issue more than $1 billion of non-convertible debt securities over a three-year period. We may choose to take advantage of some, but not all, of the available exemptions. We have taken advantage of certain reduced reporting obligations in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are electing not to take advantage of the extended transition period for complying with new or revised accounting standards as provided for emerging growth companies under the JOBS Act. As a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies.

5

Table of Contents

| Common Stock Offered by Us |

shares |

| Common Stock to be Outstanding After This Offering |

shares |

| Option to Purchase Additional Shares from Us |

We have granted the underwriters an option, exercisable for 30 days after the date of this prospectus, to purchase up to an additional shares from us. |

| Use of Proceeds |

We estimate that the net proceeds from the sale of shares of our common stock that we are selling in this offering will be approximately $ million (or approximately $ million if the underwriters’ option to purchase additional shares in this offering is exercised in full), based upon an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We currently intend to use the net proceeds of this offering for expansion of manufacturing and global distribution facilities, research and development of additional beam shaping options, continued research and development of key components for the MEVION S250, with the remainder for manufacturing, other research and development, sales and marketing, general and administrative and public company expenses, maintenance capital expenditures, and other general corporate purposes, including working capital. |

| Risk Factors |

See “Risk Factors” for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| Proposed NASDAQ Trading Symbol |

“MEVI” |

The number of shares of common stock to be outstanding after this offering is based on 9,376,781 shares of common stock outstanding as of June 30, 2014.

The number of shares of our common stock to be outstanding after this offering excludes the following:

| • | 1,193,376 shares of common stock issuable upon exercise of outstanding options as of June 30, 2014 at a weighted average exercise price of $4.17 per share; |

| • | 236,283 shares of common stock issuable upon exercise of outstanding warrants as of June 30, 2014 at a weighted average exercise price of $4.46 per share; |

| • | 92,807 shares of common stock reserved for future issuance under our Amended and Restated 2005 Stock Option Plan, or 2005 Stock Option Plan, as of June 30, 2014; |

| • | shares of our common stock reserved for future issuance under our 2014 Stock Option and Incentive Plan, or 2014 Stock Option, which will become effective upon the completion of this offering; and |

| • | shares of common stock issuable upon exercise of outstanding warrants to purchase shares of common stock at an exercise price equal to 80% of the assumed initial offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus. |

6

Table of Contents

Except as otherwise indicated, all information contained in this prospectus assumes or gives effect to:

| • | the automatic conversion of all outstanding shares of our redeemable convertible preferred stock into an aggregate of 8,903,506 shares of our common stock upon the completion of this offering; |

| • | no exercise of the outstanding options described above; |

| • | The issuance of shares of common stock issuable upon the conversion of all principal outstanding and accrued interest under our outstanding convertible notes at a conversion price equal to 80% of the assumed initial offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus; |

| • | no exercise of the outstanding warrants described above; |

| • | no exercise by the underwriters of their option to purchase up to an additional shares of our common stock in this offering; and |

| • | our amended and restated certificate of incorporation and our amended and restated bylaws, both of which we will file immediately prior to the completion of this offering. |

The number of shares of our common stock to be issued upon the automatic conversion of all outstanding principal and accrued interest on our convertible notes upon the closing of this offering depends in part on the initial public offering price of our common stock and the date on which this offering closes. As a result, the actual number of shares of common stock issued upon such conversion may differ from the number of shares set forth above. If the initial public offering price is equal to $ per share, which is the midpoint of the estimated price range set forth on the cover page of this prospectus, the outstanding principal and accrued interest on our convertible notes, which convert at 80% of the initial public offering price, would convert into an aggregate of shares of our common stock upon the closing of this offering, in each case assuming that the offering closes on , 2014. A $1.00 increase in the assumed initial public offering price of $ per share would decrease by shares the aggregate number of shares of our common stock issuable upon the automatic conversion of the outstanding principal and interest accrued on our convertible notes upon the closing of this offering. A $1.00 decrease in the assumed initial public offering price of $ per share would increase by shares the aggregate number of shares of our common stock issuable upon the automatic conversion of the outstanding principal and interest accrued on our convertible notes upon the closing of this offering.

7

Table of Contents

You should read the following summary consolidated financial data together with our consolidated financial statements and the related notes appearing at the end of this prospectus and the “Selected Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of this prospectus. We have derived the consolidated statements of operations data for the years ended September 30, 2013 and 2012 and the consolidated balance sheets data as of September 30, 2013 and 2012 from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the consolidated statements of operations data for the nine months ended June 30, 2014 and June 30, 2013 and the consolidated balance sheet data as of June 30, 2014 from our unaudited consolidated financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of results that should be expected in the future.

| Year Ended September 30, | Nine Months Ended June 30, | |||||||||||||||

| 2013 | 2012 | 2014 | 2013 | |||||||||||||

| (unaudited) | ||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||

| Statements of Operations Data: |

||||||||||||||||

| Revenue |

$ | — | $ | — | $ | 7,610 | $ | — | ||||||||

| Cost of revenue |

— | — | 11,904 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross loss |

— | — | (4,294 | ) | — | |||||||||||

| Operating expenses: |

||||||||||||||||

| Research and development |

26,155 | 18,921 | 11,504 | 17,135 | ||||||||||||

| Selling and marketing |

3,779 | 2,473 | 2,784 | |

2,674 |

| ||||||||||

| General and administrative |

7,804 | 7,276 | 7,070 | |

5,984 |

| ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

37,738 | 28,670 | 21,358 | 25,793 | ||||||||||||

| Gain on termination of contracts |

— | 750 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(37,738 | ) | (27,920 | ) | (25,652 | ) | (25,793 | ) | ||||||||

| Other income (expense): |

||||||||||||||||

| Interest expense |

(1,117 | ) | (144 | ) | (3,156 | ) | (295 | ) | ||||||||

| (Loss) gain on revaluation of warrants |

(44 | ) | 1,514 | (200 | ) | — | ||||||||||

| Other (expense) income, net |

(7 | ) | 14 | (4 | ) | 5 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other (expense) income, net |

(1,168 | ) | 1,384 | (3,360 | ) | (290 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

(38,906 | ) | (26,536 | ) | (29,012 | ) | (26,083 | ) | ||||||||

| Accretion of redeemable convertible preferred stock to redemption value |

(659 | ) | (572 | ) | (571 | ) | (462 | ) | ||||||||

| Gain on extinguishment of redeemable convertible preferred stock |

6,959 | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss attributable to common stockholders |

$ | (32,606 | ) | $ | (27,108 | ) | $ | (29,583 | ) | $ | (26,545 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per share attributable to common stockholders—basic and diluted(1) |

$ | (118.68 | ) | $ | (207.10 | ) | $ | (63.69 | ) | $ | (125.07 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted-average common shares used in computing net loss per share attributable to common stockholders—basic and diluted(1) |

275 | 131 | 465 | 212 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Pro forma net loss per share attributable to common stockholders—basic and diluted (unaudited)(2) |

$ | (4.60 | ) | $ | (3.10 | ) | ||||||||||

|

|

|

|

|

|||||||||||||

| Pro forma weighted-average number of common shares used in net loss per share applicable to common stockholders—basic and diluted (unaudited)(2) |

8,465 | 9,369 | ||||||||||||||

|

|

|

|

|

|||||||||||||

8

Table of Contents

| September

30, 2013 |

September

30, 2012 |

June 30, 2014 (unaudited) |

June 30, 2014 Pro Forma(4) (unaudited) |

June 30, 2014 Pro Forma(5)(6) (as adjusted) (unaudited) | ||||||||||||||

| (in thousands) | ||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||

| Cash and cash equivalents |

$ | 12,058 | $ | 19,084 | $ | 6,124 | $ | 6,124 | ||||||||||

| Working capital(3) |

8,797 | 4,060 | (9,569 | ) | (9,569 | ) | ||||||||||||

| Total assets |

61,410 | 55,159 | 62,983 | 62,983 | ||||||||||||||

| Long term debt, net |

19,817 | — | 30,158 | 30,158 | ||||||||||||||

| Redeemable convertible preferred stock |

155,533 | 138,263 | 156,104 | — | ||||||||||||||

| Common stock and additional paid-in capital |

1,147 | 492 | 775 | 158,866 | ||||||||||||||

| Total stockholders’ deficit |

(161,897 | ) | (130,605 | ) | (191,281 | ) | (33,190 | ) | ||||||||||

| (1) | See Note 11 to our consolidated financial statements for further details on the calculation of basic and diluted net loss per share attributable to common stockholders. |

| (2) | See Note 11 to our consolidated financial statements for further details on the calculation of pro forma net loss per share attributable to common stockholders. |

| (3) | We define working capital as current assets less current liabilities. |

| (4) | Pro forma to reflect the conversion of all outstanding shares of our redeemable convertible preferred stock into shares of common stock and the assumed exercise of all warrants outstanding upon the closing of this offering. |

| (5) | Pro forma as adjusted to further reflect the conversion of all principal outstanding and accrued interest under our outstanding convertible notes at a conversion price equal to 80% of the assumed initial offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, and (b) the sale of shares of our common stock offered in this offering, assuming an initial public offering price of $ per share, the midpoint of the price range set forth on the cover of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

| (6) | A $1.00 increase (decrease) in the assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover of this prospectus, would increase (decrease) the pro forma as adjusted amount of each of cash and cash equivalents and total stockholders’ deficit by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover of this prospectus, remains the same and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. A share increase in the number of shares offered by us together with a concomitant $1.00 increase in the assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover of this prospectus, would increase each of cash and cash equivalents and total stockholders’ deficit by approximately $ million after deducting underwriting discounts and commissions and any estimated offering expenses payable by us. Conversely, a share decrease in the number of shares offered by us together with a concomitant $1.00 decrease in the assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover of this prospectus, would decrease each of cash and cash equivalents and total stockholders’ deficit by approximately $ million after deducting underwriting discounts and commissions and any estimated offering expenses payable by us. |

9

Table of Contents

Investment in our common stock involves a number of risks. You should carefully consider the risks and uncertainties described below and the other information included in this prospectus before deciding to invest in shares of our common stock. If any of the following risks or uncertainties actually occurs, our business, prospects, financial condition and operating results would likely suffer, possibly materially. In that event, the market price of our common stock could decline and you could lose all or part of your investment. Additional risks and uncertainties presently unknown to us, or that we believe not to be material at this time, may also impair or have a material adverse effect on our operations.

Risks Relating to Our Business and Strategy

We may not be able to generate sufficient revenue from the commercialization of our MEVION S250 Proton Therapy System to achieve and maintain profitability.

Currently, we rely solely on the commercialization of our only product, the MEVION S250 Proton Therapy System, or MEVION S250, to generate revenue. As of the date of this prospectus, we have installed only one system which is currently treating patients. During the three month period ended June 30, 2014, we recognized revenue of $7.6 million from our first installed MEVION S250. We believe our commercial success is dependent upon our ability to successfully market and sell the MEVION S250, to continue to expand our marketing efforts and develop new relationships and expand existing relationships with customers, to receive clearance or approval for the MEVION S250 in additional countries, to achieve and maintain compliance with all applicable regulatory requirements, and to develop and commercialize new features for the MEVION S250. We expect to generate all of our revenue for the foreseeable future from sales of the MEVION S250 and post-warranty service contracts for the MEVION S250. Any factor materially adversely affecting our ability to market and sell the MEVION S250 or pricing and demand for the MEVION S250 would have a material adverse effect on our financial condition and results of operations.

Our customers may decide to cancel orders due to changes in treatment offerings, research and product development plans, changes in reimbursement rates for proton therapy treatment, the high costs associated with the MEVION S250, facility constraints, utilization of proton therapy or other cancer treatment methods developed by other parties, lack of financing or the inability to obtain a certificate of need from state regulatory agencies or zoning restrictions, all of which are circumstances outside of our control.

We are currently not profitable. In addition, demand for the MEVION S250 products may not increase as quickly as planned and we may be unable to increase our revenue levels as expected. Even if we succeed in increasing adoption of the MEVION S250 by cancer treatment facilities, maintaining and creating relationships with our existing and new customers and developing and commercializing new features for the MEVION S250, we may not be able to generate sufficient revenue to achieve profitability.

The MEVION S250 may never achieve significant commercial market acceptance.

The MEVION S250 may never gain significant acceptance in the marketplace and, therefore, may never generate substantial revenue or profits for us. Our ability to achieve commercial market acceptance for the MEVION S250 or any other products will depend on several factors, including:

| • | our ability to convince the medical community of the clinical utility of the MEVION S250 and its potential advantages over other cancer treatment methods, including future alternative treatments; |

| • | the strength of our sales, marketing and distribution organizations; |

| • | the willingness of physicians and patients to utilize the MEVION S250; and |

| • | the agreement by commercial third-party payors and government payors to reimburse for proton therapy treatment, the scope and amount of which will affect patients’ willingness or ability to pay for proton therapy treatment and likely heavily influence physicians’ decisions to treat with proton therapy and thereby utilize the MEVION S250. |

10

Table of Contents

We have a limited history of manufacturing, assembling and installing the MEVION S250 in commercial quantities and may encounter related problems or delays that could result in lost revenue.

We commenced manufacturing the MEVION S250 in 2011. The pre-installation manufacturing processes include sourcing components from various third-party suppliers, manufacturing certain components ourselves, sub-assembly, assembly, system integration and testing. We must manufacture and assemble the MEVION S250 in compliance with regulatory requirements and at an acceptable cost. We have only a limited history of manufacturing, assembling and installing the MEVION S250 and, as a result, we may have difficulty manufacturing, assembling and installing the MEVION S250 in sufficient quantities in a timely manner. To manage our manufacturing and operations with our suppliers, we forecast anticipated product orders and material requirements to predict our inventory needs up to two or three MEVION S250 shipments in advance and enter into purchase orders on the basis of these requirements. Our limited manufacturing history may not provide us with enough data to accurately predict future component demand. Further, we have experienced delays in obtaining components from suppliers and installing our systems at customer sites, which may delay our ability to manufacture, assemble and install the MEVION S250 on our expected timeline. Accordingly, we may encounter difficulties in scaling up production of the MEVION S250, including problems with quality control and assurance, component supply shortages, increased costs, shortages of qualified personnel and difficulties associated with compliance with local, state, federal and foreign regulatory requirements. In addition, if we are unable to maintain larger-scale manufacturing capabilities, our ability to generate revenue will also be limited and our reputation could be damaged. If we cannot achieve the required level and quality of production, we may need to outsource production or rely on licensing and other arrangements with third parties who possess sufficient manufacturing facilities and capabilities in compliance with regulatory requirements. Even if we could outsource needed production or enter into licensing or other third-party arrangements, the associated cost could reduce our gross margin.

The long sales cycle and high unit price of the MEVION S250, as well as other factors, may contribute to substantial fluctuations in our quarterly operating results and stock price and make it difficult to compare our results of operations to prior periods.

Because of the high price of the MEVION S250 and the relatively small number of systems we expect to install in any period, if any, each installation of a particular MEVION S250 will represent a significant percentage of our revenue for a particular period. Also, customer site construction and additional zoning and licensing permits are often required in connection with the sale of a MEVION S250 any of which may further delay installation. We recognize revenue from the sale of the MEVION S250 only after the system has been installed and accepted by the customer and we have performed any substantive post-acceptance performance conditions. Therefore, if we do not install a particular MEVION S250 when anticipated, our operating results will vary significantly from our expectations. This is of particular concern in the current volatile economic environment, where we have had experiences with customers cancelling or postponing orders for our MEVION S250 and delaying any required facility build-outs. In addition, if our customers delay or cancel purchases, we may be required to modify or cancel contractual arrangements with our suppliers which may result in the loss of deposits. Future fluctuations in revenue and costs as well as other potential fluctuations mean that you should not rely upon our operating results in any particular period as an indication of future performance. In particular, in addition to the other risk factors described above and below, factors which may contribute to these fluctuations include:

| • | timing of when we are able to recognize revenue associated with sales of the MEVION S250; |

| • | regulatory requirements in some states for a certificate of need prior to the installation of a radiation system; |

| • | delays in shipment due, for example, to unanticipated construction delays at customer locations where the MEVION S250 is to be installed, cancellations by customers, natural disasters or labor disturbances; |

| • | delays in our manufacturing processes or unexpected manufacturing difficulties; |

11

Table of Contents

| • | timing of the announcements of contract executions or other customer and commercial developments; |

| • | timing of the announcement, introduction and delivery of new products or product features by us and by our competitors; |

| • | timing and level of expenditures associated with expansion of sales and marketing activities and our overall operations; |

| • | fluctuations in our gross margins and the factors that contribute to such fluctuations, as described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” elsewhere in this prospectus; |

| • | how well we execute on our strategic and operating plans; |

| • | the extent to which the MEVION S250 gains market acceptance; |

| • | actions relating to regulatory matters; |

| • | demand for the MEVION S250; |

| • | our ability to protect our proprietary rights and defend against third-party challenges; |

| • | disruptions in the supply or changes in the costs of raw materials, labor, product components or transportation services; and |

| • | changes in third-party coverage and reimbursement, changes in government regulation or a change in a customer’s financial condition or ability to obtain financing. |

These factors are difficult to forecast and may contribute to substantial fluctuations in our quarterly revenue and substantial variation from our projections, particularly during the periods in which our sales volume is low. These fluctuations may cause volatility in our stock price.

The MEVION S250 is a major capital equipment item and has a lengthy sales cycle. Generally, the time from initial customer contact to execution of a contract can be up to 36 months or more. Following execution of a contract, it may take nine to 12 months for a customer to construct a new bunker or customize an existing facility. Upon the commencement of installation at a customer’s facility, it typically takes 18 to 24 months to complete the installation and on-site testing of the system, including the completion of acceptance test procedures with the customer. Because of the high price of the MEVION S250 and the relatively small number of systems installed in a given fiscal period, each installation will represent a significant component of our revenue for a particular period. If a small number of customers defer installation of a MEVION S250 for even a short period of time, recognition of a significant amount of revenue may be deferred to a subsequent period. Because our operating costs are relatively fixed, our inability to recognize revenue in a particular quarter may adversely affect our profitability in that quarter. As a result, the inability to recognize revenue in a particular quarter may make it difficult to compare our quarterly operating results with prior periods. Given the high cost of purchasing an MEVION S250, our customers often must obtain outside financing before committing to purchasing the product. Even though we have relationships with a third party provider to facilitate our customers financing the purchase of the MEVION S250, such financing may be difficult for our customers to obtain in any given period, if at all. The requirement of site-specific modifications or construction may also delay adoption or overall demand. In addition, while we believe that our backlog of orders provides a better measure at any particular point in time of the long-term performance prospects of our business than our quarterly operating results, investors may attribute significant weight to our quarterly operating results, which may result in substantial fluctuations in our stock price.

The progress payment structure we use in our customer arrangements may lead to fluctuations in operating cash flows in a given period.

All of our customer contracts use a progress payment structure; these progress payment milestones include such items as execution by a customer of a contract with us, shipment of the metal housing and support structure, which we refer to as gantry embeds, shipment of the accelerator module, customer acceptance and clinical

12

Table of Contents

commissioning. If we miss targeted shipment timelines or our customers do not actively work towards the completion of these progress payment milestones our receipt of progress payments and our operating cash flow will be adversely affected. These fluctuations in operating cash flow as well as other potential fluctuations mean that you should not rely upon our operating results in any particular period as an indication of future performance.

Amounts included in our order backlog may not result in actual revenue and are an uncertain indicator of our future earnings.

We define backlog as the revenue value in dollars resulting from customer contracts or purchase orders that meet certain criteria and that have not yet been recognized as revenue. The determination of our backlog includes, among other factors, our subjective judgment about whether an accelerator module will be shipped to a customer’s site within four years. In making this judgment we assess the likelihood that any one or more of the several contingencies to which our orders are subject may preclude such shipment within four years. Our judgments in this area have been, and may in the future be, incorrect and there is no assurance that, for any order included in backlog, we will ship the accelerator module to the customer within four years or that we will recognize revenue with respect to such order. In addition, orders can be delayed for a number of reasons, many of which are beyond our control, including, supplier delays which may cause delays in our manufacturing process, customer delays in commencing or completing construction of its facility, delays in obtaining zoning or other approvals and delays in obtaining financing. We may not be aware of these delays affecting our suppliers and customers and as a result may not take them into account when evaluating the contemporaneous effect on backlog. Moreover, orders generally do not have firm dates by which a customer must take delivery which could allow a customer to delay its order even without cancelling the contract. Further, our backlog could be reduced due to cancellation of orders by customers; for example, we have had four customers cancel orders in the past three years. Should a cancellation occur, our backlog and anticipated revenue would be reduced unless we were able to replace such order. Reported reductions in our backlog could have a material adverse effect on our future results of operations or our stock price.

We evaluate our backlog at least quarterly to determine if the order continues to meet our criteria for inclusion in backlog and we may adjust our reported backlog due to changes in our judgment about the timing of shipment of an accelerator module for particular projects. Projects we once categorized as included within our backlog may be removed for a number of reasons, including a reassessment of any contractual contingencies and the likelihood of shipment of the accelerator module within four years. In addition, one or more of our contracts have in the past and may in the future contribute to a material portion of our backlog in any one year. Because revenue will not be recognized until customer acceptance at the earliest, there may be a significant amount of time from signing a contract with a customer or shipping an accelerator module and revenue recognition. No assurance can be given that our backlog will result in revenue on timely basis or at all, or that any cancelled contracts will be replaced.

A large portion of our revenue will be derived from a small number of contracts in any fiscal period.

Given a significant portion of the purchase price for the MEVION S250 will generally be recognized as revenue in a single quarter upon installation and acceptance by a customer, we expect a small number of contracts in any given fiscal period to account for a substantial part of our revenue in any such period, and we expect this trend to continue. Any decrease in revenue from these contracts could harm our operating results. Accordingly, our revenue and results of operations may vary substantially from period to period. We are also subject to credit risk associated with the concentration of our accounts receivable from our customers. If one or more of our significant customers at any given time were to terminate their contracts with us, to otherwise cease doing business with us, or to fail to pay us on a timely basis, our business, financial condition and results of operations could be materially adversely affected.

13

Table of Contents

Our ability to increase our profitability depends in part on increasing our average selling prices and our gross margins on product sales, reducing our warranty and service costs, and improving our economies of scale in service operations which we may not be able to achieve.

Our overall operations currently are not profitable. The system purchase contracts we have entered into to date have been at a range of selling prices. Generally, earlier contracts have been at lower prices and more recent contracts have been at higher prices. Our earlier contracts may result in low or, in some cases, even negative gross margins. In order to become profitable we will need to be able to enter into contracts at increased prices. Our intention is to enter into system purchase contracts for the MEVION S250 with selling prices that are increasingly closer to our list price of our MEVION S250. Our ability to enter into contracts at higher selling prices depends on a number of factors including:

| • | the pricing of competitors’ proton therapy systems; |

| • | our ability to achieve commercial market acceptance for our system; |

| • | availability of adequate reimbursement by commercial and government payors for proton therapy treatments; and |

| • | our ability to manufacture and install our systems in a timely and efficient manner. |

Further, several of our existing customers have options to purchase additional systems at prices lower than the list price of the MEVION S250 in the United States, and in some instances substantially lower, which will impact our gross margins for several years.

The warranty for the MEVION S250 is typically provided on a repair or replace basis, and is not limited to products or parts manufactured by us. As a result, we bear the risk of warranty claims on all products we supply, including equipment and component parts manufactured by third parties. There can be no assurance that we will be successful in claiming recovery under any warranty or indemnity provided to us by our suppliers or vendors in the event of a successful warranty claim against us by a customer or that any recovery from such vendor or supplier would be adequate. In addition, warranty claims brought by our customers related to components supplied to us by third parties may arise after our ability to bring corresponding warranty claims against such suppliers has expired, resulting in additional costs to us. There is a risk that warranty claims made against us will exceed our warranty reserve and could have a material adverse effect on our financial condition, results of operations, business and/or prospects.

Because our customer contracts provide that our customers commit to purchase a MEVION S250 for a fixed price, and the MEVION S250 will not be delivered for many years, the cost of product supplies may increase significantly in the intervening time period. In addition, inflation may generally reduce the real value of the purchase price payable upon the achievement of future progress payment milestones. Either of these occurrences could cause our gross margins to decline or cause us to lose money on the sale of a MEVION S250.

Moreover, our gross margins may decline in a given period due in part to significant replacement rates for components, resulting in increased warranty expense, negative profit margins on service contracts and customer dissatisfaction. If we are unable to reduce our expenses and improve quality and reliability, our profitability may not improve or may be materially adversely affected. Additionally, we may face increased demands for compensation from customers who are not satisfied with the quality and reliability of our products, which could increase our service costs or require us to issue credits against future service payments and negatively affect future product sales. The first MEVION S250 we installed has experienced issues with satisfying contractual uptime requirements, which are requirements regarding the percentage of time such system must be operable. Even if we are able to implement these cost reduction and quality improvement efforts successfully, our service operations may remain unprofitable given the relatively small size and geographic dispersion of our installed base, which prevents us from achieving significant economies of scale for the provision of services. If we are unable to continue to sell our MEVION S250 at increasingly higher prices which result in higher gross margins, we may never become profitable.

14

Table of Contents

We face competition from numerous competitors, many of whom have greater resources than we do, which may make it more difficult for us to achieve significant market penetration.

The market for proton therapy equipment is characterized by intense competition and pricing pressure. In particular, we compete with a number of existing therapy equipment companies including Hitachi, Ltd., Ion Beam Applications S.A., Mitsubishi Electric Corporation, ProNova Solutions, LLC, Protom International, Inc., Sumitomo Heavy Industries, Ltd. and Varian Medical Systems, Inc. Most of our competitors are large, well-capitalized companies with significantly greater market share and resources than we have. As a result, these companies may be better positioned than we are to spend more aggressively on marketing, sales, intellectual property and other product initiatives and research and development activities.

Our current competitors or other companies may at any time develop new products for the treatment of cancer which may replace proton therapy. If we are unable to develop products that compete effectively against the products of existing or future competitors, our future revenue could be negatively impacted. Some of our competitors may compete by changing their pricing model or by lowering the price of their therapy systems. If these competitors’ pricing techniques are effective, it could result in downward pressure on the price of all therapy systems. If we are unable to maintain or increase our selling prices in the face of competition, we may not improve our gross margins.

In addition to the competition that we face from technologies performing similar functions to the MEVION S250, competition also exists for the limited capital expenditure budgets of our customers. A potential purchaser may be forced to choose between two items of capital equipment. Our ability to compete may also be adversely affected when purchase decisions are based largely upon price, since the MEVION S250 is a premium-priced system relative to other capital expenditures.

We have limited experience in marketing and selling our products, and if we are unable to adequately address our customers’ needs, it could negatively impact sales and market acceptance of the MEVION S250 and we may never generate sufficient revenue to achieve or sustain profitability.

We have limited experience in marketing and selling the MEVION S250. The only MEVION S250 to be installed to date was accepted and has been used for treating patients only since December 2013. In addition, the MEVION S250 is a new technology in the proton therapy systems sector. Our future sales will depend in large part on our ability to increase our marketing efforts and adequately address our customers’ needs. The cancer treatment industry is a large and diverse market. As a result, we believe it is necessary to maintain a sales force that includes sales representatives with specific technical backgrounds that can support our customers’ needs. We will also need to attract and develop sales and marketing personnel with industry expertise. Competition for such employees is intense. We may not be able to attract and retain sufficient personnel to maintain an effective sales and marketing force. If we are unable to adequately address our customers’ needs, it could negatively impact sales and market acceptance of our products and we may never generate sufficient revenue to achieve or sustain profitability.

We rely on a limited number of suppliers or, in some cases, sole suppliers, for some of our components, subassemblies and materials and may not be able to find replacements or immediately transition to alternative suppliers.

We rely on several sole suppliers, including Oxford Instruments Superconductor Wire LLC, Accuray Inc. and TechPrecision Corporation, or TechPrecision, for certain components for the MEVION S250. In addition, we rely on Storrington Industries Limited, a subsidiary of Tesla Engineering Ltd., or Tesla, as the sole supplier of the superconducting magnets that are a key component of the proton accelerator in the MEVION S250. We have supply agreements in place with each of these suppliers. However, these sole source suppliers may be unwilling or unable to supply components of the MEVION S250 to us reliably and at the levels we anticipate or are required by the market. Our former sole source supplier of integrated conductors failed to deliver such components in a timely fashion and also delivered components that did not meet our quality standards. We terminated our relationship with

15

Table of Contents

this sole source supplier and our new sole source supplier for this component has delivered quality components in a timely manner. An interruption in our commercial operations could occur if we encounter delays or difficulties in securing these components, and if we cannot then obtain an acceptable substitute. For example, TechPrecision recently entered into a forebearance and modification agreement with its lender pursuant to which the lender has agreed to forebear from exercising certain of its rights and remedies (but not waive such rights and remedies) arising as a result of TechPrecision’s non-compliance with certain financial covenants in TechPrecision’s loan agreement until September 30, 2014. As of the date of this prospectus, we have not encountered any performance issues with TechPrecision, but we will continue to monitor this situation and have identified alternative suppliers for the components obtained from TechPrecision, in case we experience any issues with TechPrecision. Any such interruption could significantly affect our business, financial condition, results of operations and reputation.

If we are required to transition to a new third-party supplier, we believe that there are only a few other manufacturers that are currently capable of supplying the components necessary for the MEVION S250. In addition, the use of components or materials furnished by these alternative suppliers would require us to alter our operations. Furthermore, if we are required to change the manufacturer of a critical component of the MEVION S250, we will be required to verify that the new manufacturer maintains facilities, procedures and operations that comply with our quality and applicable regulatory requirements, which could further impede our ability to manufacture the MEVION S250 in a timely manner. We typically do not carry inventory or have open purchase orders for components for more than two or three systems at any given time. Transitioning to a new supplier would be time consuming and expensive, may result in interruptions in our operations and product delivery, could affect the performance specifications of the MEVION S250 or could require that we modify the design of the MEVION S250. For example, Tesla may control intellectual property related to the cooling system used in our superconducting magnets, under our agreement with Tesla we may be required to pay up to $5.0 million in fees if we use another supplier to manufacture the superconducting magnets for the MEVION S250. If the change in manufacturer results in a significant change to the MEVION S250, a new 510(k) clearance from the U.S. Food and Drug Administration, or FDA, or similar international clearance may be necessary, which would likely cause substantial delays. The occurrence of any of these events could harm our ability to meet the demand for the MEVION S250 in a timely manner or within budget.

There can be no assurance that we will be able to secure alternative equipment and materials, and utilize such equipment and materials without experiencing interruptions in our workflow. In the case of an alternative supplier for Tesla, there can be no assurance that replacement superconducting magnets will be available or will meet our quality control and performance requirements for our operations. If we should encounter delays or difficulties in securing, reconfiguring or revalidating the equipment and components we require for our products, our business, financial condition, results of operations and reputation could be adversely affected.

Sales of the MEVION S250 may be adversely affected if clinicians do not widely adopt proton therapy.

Our success in marketing the MEVION S250 depends in part on persuading clinicians and patients of the benefits of proton therapy. While proton therapy has been around for a long period of time, its adoption and use has been limited due to the cost, size, and operational complexity of conventional proton therapy systems. Widespread adoption of proton therapy depends on many factors, including many which are outside of our control. These factors include acceptance by clinicians that proton therapy is clinically effective and cost-effective in treating a wide range of cancers, demand by patients for such treatment, successful education of clinicians on the various aspects of this technique and adequate reimbursement for procedures performed using proton therapy. If widespread market acceptance of proton therapy does not occur, or does not occur as rapidly as we anticipate, sales of the MEVION S250 may be adversely affected and our revenue may decline or fail to grow.

We may be delayed or prevented from implementing our long-term sales strategy if we fail to educate clinicians and patients about the benefits of the MEVION S250.

In order to increase revenue, we must raise awareness of the range of benefits that we believe the MEVION S250 offers to both existing and potential customers, namely cancer therapists and clinicians and their patients. An important part of our sales strategy involves educating and training clinicians to utilize the entire functionality

16

Table of Contents

of the MEVION S250. In addition, we must further educate clinicians about the ability of the MEVION S250 to treat a wide range of cancer types effectively and efficiently. If clinicians are not properly educated about the use of the MEVION S250 for proton therapy, they may be unwilling or unable to take advantage of the full range of functionality that we believe the MEVION S250 offers, which could have an adverse effect on our product sales. Customers or potential customers may decide that certain tumors can be adequately treated using traditional radiation therapy systems, such as X-rays, notwithstanding the benefits of the MEVION S250. We must also succeed in educating clinicians about the potential for cost-effective reimbursement for procedures performed using the MEVION S250. In addition, we must raise awareness of the MEVION S250 among potential patients, who are increasingly educated about cancer treatment options and therefore drive adoption of new technologies by clinicians. Our efforts to expand sales of the MEVION S250 in the long-term may be adversely affected if we fail in implementing these strategies.

If we are unable to support demand for the MEVION S250 and our future products, including ensuring that we have adequate facilities and manufacturing capacity to meet increased demand, or we are unable to successfully manage the evolution of our proton technology, our business could suffer.

As our commercial operations and sales volume grows, we will need to continue to increase our workflow capacity for manufacturing, customer service, billing and general process improvements and expand our internal quality assurance program, among other things. We will also need to purchase additional equipment, some of which can take several months or more to procure, set up, and validate, and increase our manufacturing, maintenance, software and computing capacity to meet increased demand. In addition, we do not currently have adequate space in our facilities to accommodate the expansion we expect to require. If we are unable to locate additional facility space to allow adequate expansion of our manufacturing capabilities, if the acquisition and commissioning of such additional space does not happen in a timely manner, or if we are unsuccessful in our facility ramp-up efforts, our results of operations will be adversely affected. There is no assurance that any of these increases in scale, expansion of personnel, equipment, increased manufacturing capacity or process enhancements will be successfully implemented.

The proton therapy system industry is subject to rapidly changing technology that could make our product, the MEVION S250, and other products we develop obsolete.

Our industry is characterized by rapid technological changes, new product introductions and enhancements and evolving industry standards, all of which could make our only commercial product, the MEVION S250, and the other products we may develop obsolete. Our future success will depend on our ability to keep pace with the evolving needs of our customers and the medical profession on a timely and cost-effective basis and to pursue new market opportunities that develop as a result of technological and scientific advances. In recent years, there have been numerous advances in technologies relating to the treatment of cancer. We must continuously enhance our product technology and develop new products to keep pace with evolving standards of care. If we do not update our product technology to reflect new scientific knowledge about cancer biology, information about relevant proton therapy in general, or to otherwise keep pace with demands from customers or potential customers, our products could become obsolete and sales of the MEVION S250 and any new products could decline, which would have a material adverse effect on our business, financial condition, and results of operations.

If the MEVION S250 does not perform as expected, or if we are unable to satisfy customers’ demands for additional product features, our operating results, reputation, and business will suffer.

Our success depends on the market’s confidence that we can provide reliable, high-quality proton therapy systems, namely the MEVION S250. There is only one MEVION S250 being used in commercial practice, and we therefore have very few statistics regarding efficacy or reliability of our system. We believe that our customers are likely to be particularly sensitive to product defects and errors, including functional downtime that limits that number of patients that can be treated using the system and if a failure results in additional capital

17

Table of Contents

expenditures to repair. This could also include the mistreatment of a patient with the MEVION S250 caused by human error on the part of the MEVION S250’s operators or prescribing physicians, or a machine malfunction. Any failure of the MEVION S250 to perform as expected would significantly impair our operating results, reputation and market position. We may be subject to legal claims arising from any defects or errors. In addition, our customers are technologically well informed and at times have specific demands or requests for additional functionality. If we are unable to meet those demands through the development of new features for the MEVION S250 or new products, or those new features or products are not functional, or we are unable to obtain regulatory clearance or approval of those new features or products where applicable, we would experience an adverse effect on our operating results and our reputation, and our business would suffer.

If third party payors do not provide adequate coverage and reimbursement for proton therapy to our customers, it could adversely affect sales of the MEVION S250.