Attached files

| file | filename |

|---|---|

| 8-K - GENERAL EMPLOYMENT ENTERPRISES, INC 8-K 9-10-2014 - GEE Group Inc. | form8k.htm |

| EX-99.2 - EXHIBIT 99.2 - GEE Group Inc. | ex99_2.htm |

| EX-99.3 - EXHIBIT 99.3 - GEE Group Inc. | ex99_3.htm |

Exhibit 99.1

INVESTOR PRESENTATIONSEPTEMBER 2014NYSE: JOB Employing America since 1893

Forward Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements regarding the business of the Company and its industry generally, business strategy and prospects. These statements are based on the Company’s estimates, projections, beliefs and assumptions and are not guarantees of future performance. These forward-looking statements are subject to various risks and uncertainties, which may cause actual results to differ materially from the forward-looking statements. The Company disclaims any obligation to update these forward-looking statements except as required by law.

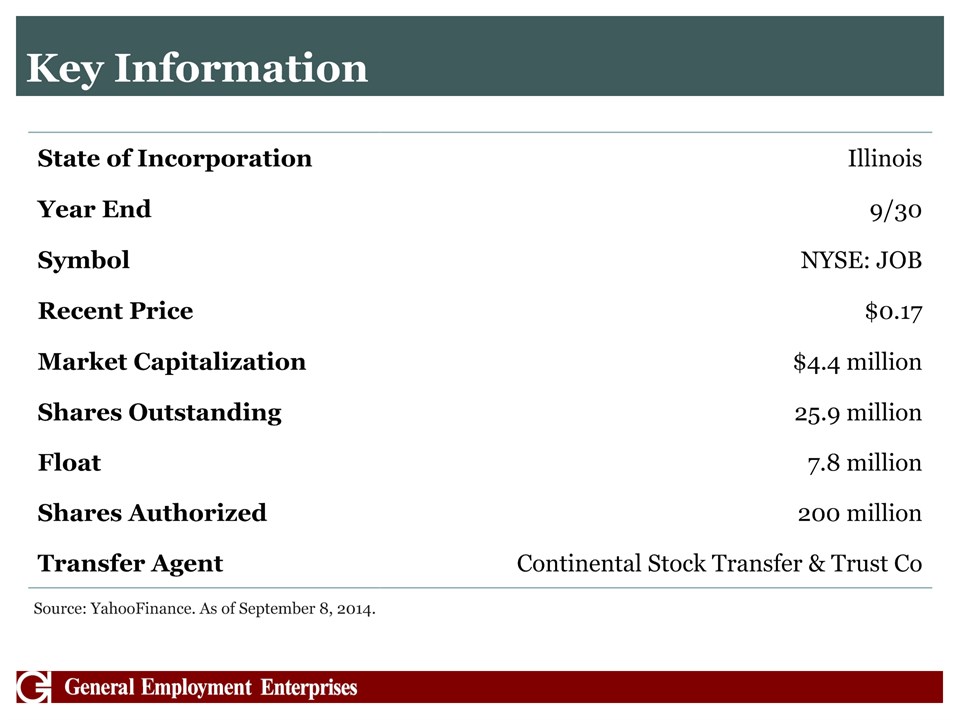

State of Incorporation Illinois Year End 9/30 Symbol NYSE: JOB Recent Price $0.17 Market Capitalization $4.4 million Shares Outstanding 25.9 million Float 7.8 million Shares Authorized 200 million Transfer Agent Continental Stock Transfer & Trust Co Source: YahooFinance. As of September 8, 2014. Key Information

Investment Thesis – Why Invest in GEE? Rich History: In business for over 120 years.Experienced Management Team: Newly appointed Management Team, Board of Directors, and Advisory Board with experience in public company management and compliance, staffing industry experience, acquisitions, and restructuring for profitability. Favorable Market Trends: Staffing industry is inelastic as a growing economy results in increase in demand for professional services while the tightening of the economy results in increased need for temporary employment placement services. Furthermore, the Affordable Care Act has resulted in a shift in staffing strategies as it relates to the overall benefits requirements for Companies around the United States.Expanded Product and Service Set: With the acquisition of Pivot, GEE is now poised to offer a complete suite of products and services for corporate clients and staffing companies alike. Furthermore, the scale of the combined entities has enabled GEE to begin rolling out the JOB Insurance product, reducing the Worker Compensation expense and creating a scalable platform for both organic growth and strategic acquisitions.NYSE Listing: The NYSE continues to work with GEE to ensure the Company remains listed on the NYSE exchange. Valuation: At the current market capitalization, the Company is trading at a Price/Sales (ttm) of 0.10x versus an industry average of 0.87x.

Executive Summary General Employment Enterprises, Inc. (NYSE MKT: JOB) has been providing staffing services for over 120 years through its network of branch offices located in major metropolitan areas throughout the United States. GEE currently offers both Professional Staffing Services and Industrial Staffing Services in 45 states through over 35 offices, strategically located throughout the United States.In 2014, GEE acquired Pivot Employment Platforms which has enabled GEE to augment their traditional staffing products with other non-traditional staffing services offerings such as PEO/HRO platforms, Workforce Strategy platforms, Employer of Record and Administrative only platforms for use by other staffing companies, and the ability to roll out JOB Insurance.

Experienced Core Management Andrew J. Norstrud, CEO – Mr. Norstrud started with GEE in March of 2013 and brings significant experience with public companies in the areas of financial reporting, restructuring for profitability and growth, acquisitions, and technology. Cary Daniel – Mr. Daniel has 18 years of industry experience and 3 years of acquisition finance experience having participated or consulted in over 20 personal and/or 3rd party acquisitions. Mr. Daniel is also a serial entrepreneur having been designated as an Ernst & Young Entrepreneur of the Year – Finalist and having successfully built and exited ventures that have made the Inc. 100, Inc. 500 (3x), and Ingrams 100 (5x) lists.Frank Elenio, CFO – Mr. Elenio has a long history of SEC financial reporting compliance as well as working with rapidly growing entities to develop internal reporting metrics and budget, and implementing strong financial controls. Frank has been involved with several financing and has been the CFO of several other public companies.

Experienced Core Management Deborah Santora-Tuohy, President of Staffing –Mrs. Santora-Tuohy has been with the Light Industrial Division for over 23 years, and was recently promoted to President of the Staffing Division to focus on internal expansion outside of Ohio and increasing profitability.James Windmiller, – An 18 year veteran in the employment services industry, Mr. Windmiller has spent the past 10 years with Nextaff. Prior to forming Nextaff, Mr. Windmiller was COO and Co-Founder of Human Resource, LLC, a temporary staffing and recruiting firm based in Kansas City, MO that operated 6 locations in MO, KS and CO prior to a liquidity event in 2003. Branch Level Managers – Our offices are operated by long tenured managers that have spent more than 10 years with General Employment, with our longest tenured manager at 45 years and continues to operate a profitable location in Columbus, Ohio.

Market Overview Employing America since 1893

US Staffing Industry Metrics Domestic staffing is a $215 billion industry.Over 32,000 US-based staffing companies.15,000 companies generating less than $20 million in revenue, representing significant industry fragmentation and excellent opportunity to employ a roll-up strategy.90% of US businesses use staffing services.US staffing industry will grow faster and add more jobs than any other industry over the next decade.In the 5 years following the recession, US staffing firms created more new jobs than any other industry.US staffing companies employ an average of 2.96 million temporary and contract workers per day.Utilization of staffing companies is quickly becoming part of normal business, and industry experts expect the industry to significantly grow over the next five years.

Favorable Demand-Side Trends Efficiency Factor: Employers seeking to maximize efficiency and reduce cost are leveraging contingent workforces supplied by staffing companies to achieve the competitive advantage a variable cost structure can provide.Shift in Attitude: A fundamental change in attitudes regarding temporary employees in the workforce fosters growing demand within the staffing industry. More companies are likely to use a mix of permanent staff, temporary workers and labor-hire employment services, along with other value-added out-sourced services, such as outsourced human resource services.‘Made in America’ Renaissance: Growth due to the renaissance in US manufacturing sector requires highly skilled temporary labor.Liability Concerns: Employers are increasingly looking to reduce their financial liability as it relates to their workforce.

Favorable Supply-Side Trends Shift in Attitude: Fundamental change in attitudes regarding flexible working hours and arrangements offered by temporary contracts.Necessity: Significant increase in the unemployment rate in the US, particularly as it relates to full-time employment has led to a larger pool of professionals seeking work and income.Attractiveness: Increased hourly demands of salaried employees have increased the attractiveness of temporary or project-based work. In some cases, they are better paid jobs.Technology: New technology innovation and mobility makes it easy for employees to “port” their skills to a new employer.Competition Factor: Keeping pace with competition is driving a growing number of employees to prefer project-based work where they are more likely to learn or use new skills.

Industry Prime for Consolidation Insurance: Insurance and especially Workers Compensation is a fundamental problem for smaller staffing companies and with certain class codes there are few choices, other than specialized PEO’s, which significantly reduce margins.Regulations: Employment regulations have continued to grow and smaller staffing companies continue to find it difficult to comply with these regulations and continue to be profitable. Lack of Viable Exit Strategy: Staffing Companies with less than $100 million in revenue without a specialized niche market have few options.Competition and Turnover of Businesses: Numerous staffing business go out of business to reset workers compensation rates, SUTA, FUTA rates, etc. and open three doors down with the same business to be able to compete in the market. Finance: Since 2009, obtaining lines of credit that can keep pace with growth, has been difficult for the majority of smaller staffing companies.

Public Staffing Company Summary Company Name (TCKR) Revenues (ttm) ($000’s) Market Cap($000’s) Price /Sales (ttm) Trailing P/E(ttm) EPS (ttm) Manpower (MAN) 20,250,000 6,410,000 0.32 22.26 3.62 Kelly Services (KELYA) 5,410,000 799,870 0.15 13.85 1.54 Robert Half (RHI) 4,310,000 5,850,000 1.36 23.03 1.88 TrueBlue (TBI) 1,670,000 1,060,000 0.63 24.07 1.11 Korn Ferry (KFY) 936,490 1,430,000 1.53 21.89 1.31 Huron Consulting (HURN) 720,520 1,340,000 1.86 21.41 2.92 Resources Connection (RECN) 555,580 503,010 0.91 28.20 0.46 RCM Technologies (RCMT) 170,780 83,180 0.49 41.75 0.16 Staffing 360 Solutions (STAF) 3,940 54,520 13.84 N/A -0.46 Corporate Resource Services (CRRS) 923,830 480,650 0.52 27.98 0.11 Kforce (KFRC) 1,150,000 704,750 0.61 66.91 0.32 On Assignment (ASGN) 1,630,000 1,870,000 1.15 22.25 1.55 General Employment Enterprises (JOB) 44,290 4,580 0.10 N/A -0.10 Source: Yahoo Finance as of April 25, 2014

Corporate Profile Employing America since 1893

GEE: Then and Now (1893 – 2014) Historical (1893 to 2012)Rich history in the staffing industry dating back to 1893.Publicly traded (Ticker: JOB) on the AMEX (now part of the NYSE) for the last 50 years.Historically thrived under strong leadership, despite the number of recessions throughout 1900’s. Business was adversely affected following the death of long-time CEO in 2001. The takeover of an unprepared management team led to an overall decline in business performance and loss of resiliency to survive the 2008 recession. Current (2013 to 2014)Newly appointed and highly experienced management team that is committed to growing & maximizing shareholder value.Initiatives including consolidation in spending, elimination of unnecessary payroll and other expenses, and roll out of new technology foundation are in the process of being implemented which will allow for greater efficiency and easier integration of future acquisitions.Acquired Pivot Employment Platforms in August 2014, creating a platform for other strategic acquisitions and organic growth via PEO/HRO, Employer of Record and Administrative Only platforms and JOB Insurance.

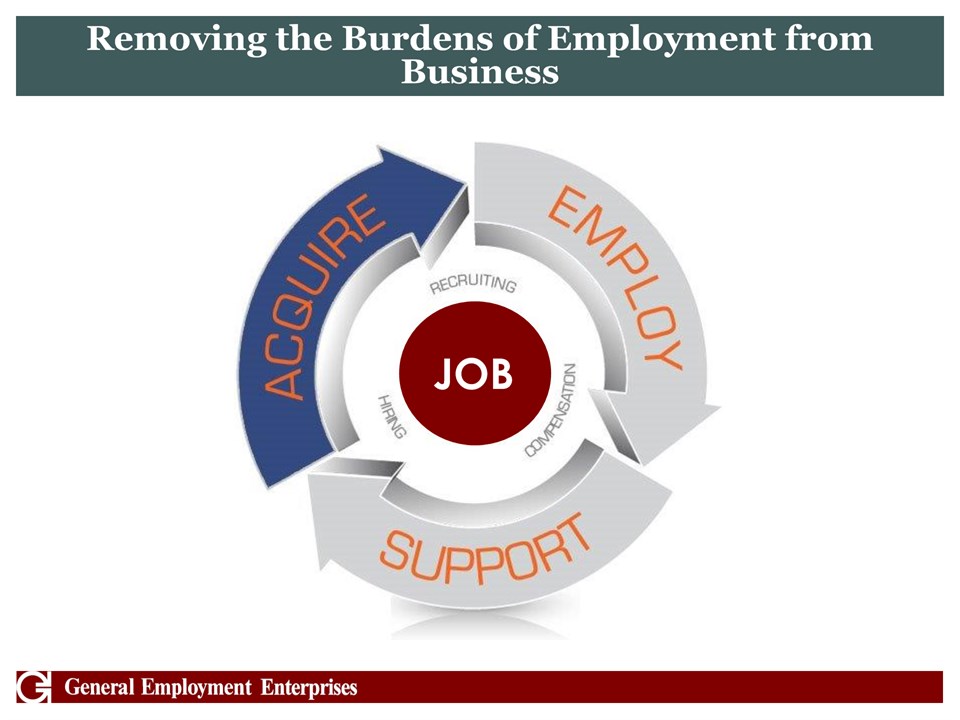

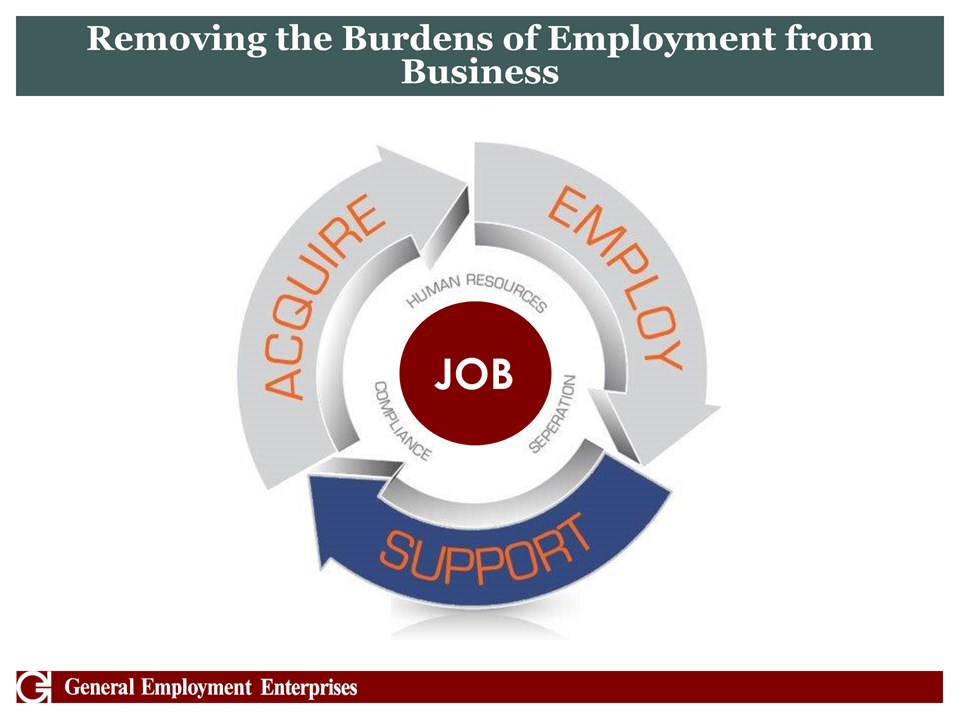

JOB Removing the Burdens of Employment from Business

JOB Removing the Burdens of Employment from Business

JOB Removing the Burdens of Employment from Business

Removing the Burdens of Employment from Business We are the experts to help grow their business

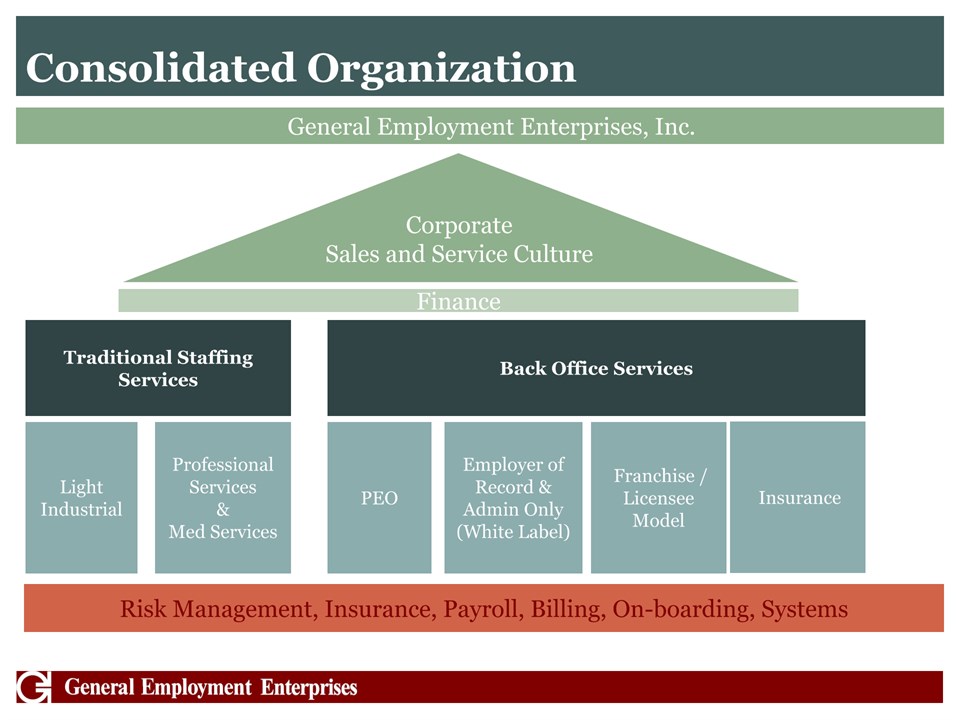

Consolidated Organization Risk Management, Insurance, Payroll, Billing, On-boarding, Systems Employer of Record & Admin Only (White Label) Franchise / Licensee Model CorporateSales and Service Culture General Employment Enterprises, Inc. Finance Traditional Staffing Services Back Office Services PEO LightIndustrial Professional Services &Med Services Insurance

Service We Provide Professional Staffing Services, offered on either a full-time direct hire basis or a temporary contract basis, are available to clients in the following high-growth sectors:Information TechnologyEngineeringAccountingSkilled TradesIndustrial Staffing Services, offered temporarily on a daily or weekly basis, are provided for its light industrial clients primarily in Ohio and Pennsylvania.JOB Insurance is a newly organized, Delaware corporation that will initially focus on workers compensation and then expand its insurance offerings to other business related insurance coverage.

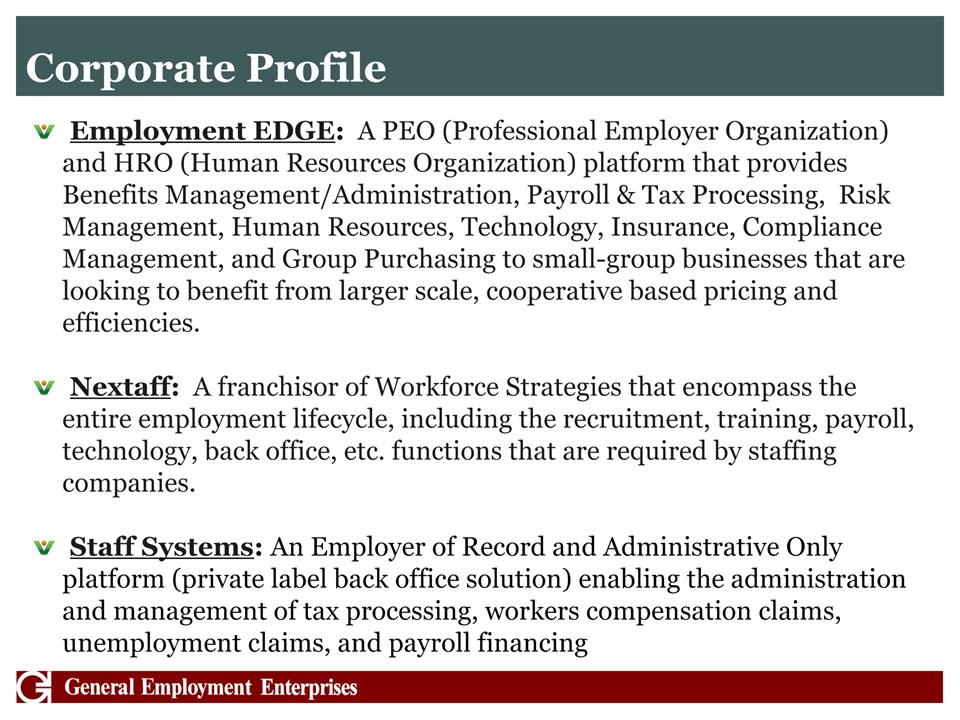

Corporate Profile Employment EDGE: A PEO (Professional Employer Organization) and HRO (Human Resources Organization) platform that provides Benefits Management/Administration, Payroll & Tax Processing, Risk Management, Human Resources, Technology, Insurance, Compliance Management, and Group Purchasing to small-group businesses that are looking to benefit from larger scale, cooperative based pricing and efficiencies.Nextaff: A franchisor of Workforce Strategies that encompass the entire employment lifecycle, including the recruitment, training, payroll, technology, back office, etc. functions that are required by staffing companies. Staff Systems: An Employer of Record and Administrative Only platform (private label back office solution) enabling the administration and management of tax processing, workers compensation claims, unemployment claims, and payroll financing

Elevates GEE and the combined entity to an “All Encompassing Employment Platform” status - facilitating current and future expansion via diversified product, customer (to include staffing companies as well as companies looking for traditional staffing service), and revenue streams:PEO/HRO, Employer of Record and Admin Only platforms expand GEE services beyond traditional staffing placement services;PEO platform will allow GEE to upsell clients “Temp to PEO” services, while continuing to provide the current “Temp to Perm” service offering, thus expanding GEE’s legacy business;The centralized cloud-based software (Staff Systems) will create a new revenue stream via back office service fees, while simultaneously creating a pipeline of “sales only” staffing company acquisition targets. *This creates a “win-win” scenario where GEE increases service revenues while providing a three to five year exit strategy to staffing companies that do not meet initial qualifications for acquisition; andUltimately, the scale of the combined business will allow GEE to launch an insurance product (Captive Insurance) and write workers compensation policies, resulting in another product offering the can be sold to staffing companies that do not meet initial qualifications for a potential acquisition. What has changed?

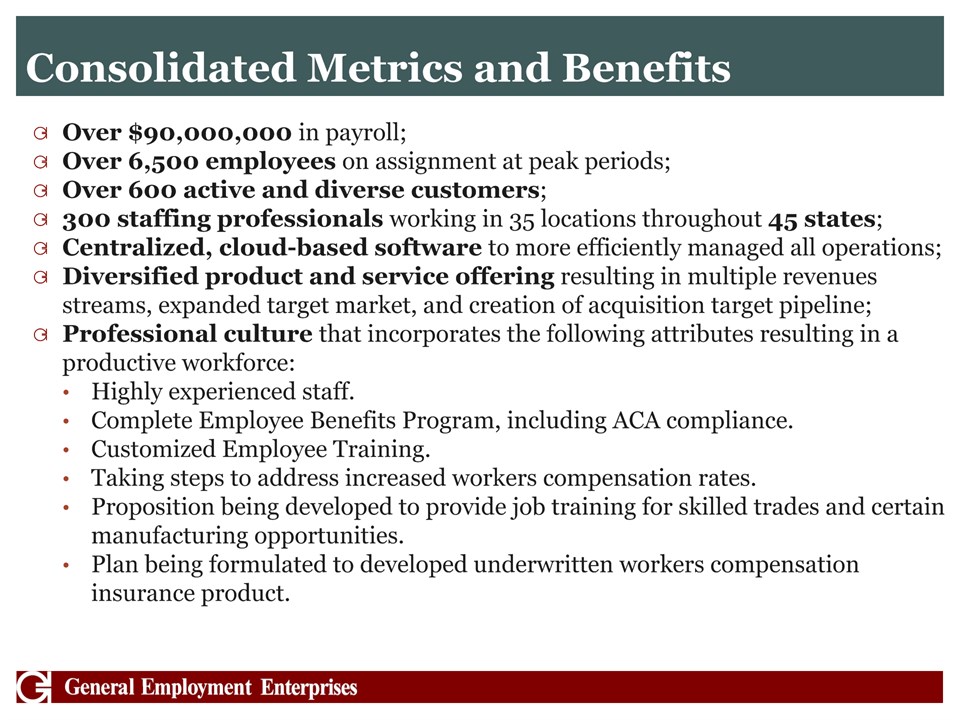

Consolidated Metrics and Benefits Over $90,000,000 in payroll;Over 6,500 employees on assignment at peak periods;Over 600 active and diverse customers;300 staffing professionals working in 35 locations throughout 45 states;Centralized, cloud-based software to more efficiently managed all operations; Diversified product and service offering resulting in multiple revenues streams, expanded target market, and creation of acquisition target pipeline;Professional culture that incorporates the following attributes resulting in a productive workforce:Highly experienced staff.Complete Employee Benefits Program, including ACA compliance.Customized Employee Training.Taking steps to address increased workers compensation rates.Proposition being developed to provide job training for skilled trades and certain manufacturing opportunities.Plan being formulated to developed underwritten workers compensation insurance product.

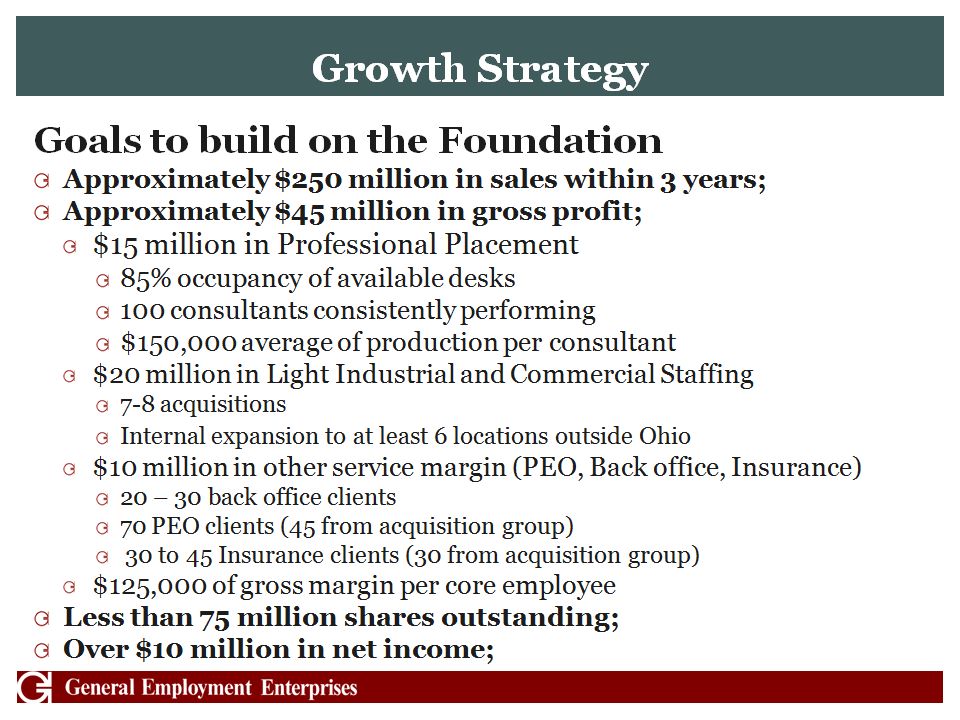

Growth Strategy Goals to build on the FoundationApproximately $250 million in sales within 3 years;Approximately $45 million in gross profit;$15 million in Professional Placement85% occupancy of available desks100 consultants consistently performing$150,000 average of production per consultant$20 million in Light Industrial and Commercial Staffing7-8 acquisitionsInternal expansion to at least 6 locations outside Ohio $10 million in other service margin (PEO, Back office, Insurance)20 – 30 back office clients70 PEO clients (45 from acquisition group) 30 to 45 Insurance clients (30 from acquisition group)$125,000 of gross margin per core employee Less than 75 million shares outstanding;Over $10 million in net income;

Acquisition Growth Strategy Lack of solid exit strategy in the marketThere is some source of pain for each candidate and why they are looking for an exit strategy.InsuranceRegulationBack officeExpansion capabilitiesTechnologyFinance

Acquisition Growth Strategy 300 Companies to review over a 3 year period300 – 2% to 3% to be acquired (6 to 9 companies) Acquired300 – 10% to sell back office (30 companies and future acquisition candidates)300 – 15% to sell PEO services (45 companies)300 – 10% to sell workers compensation insurance (30 new insurance customers)

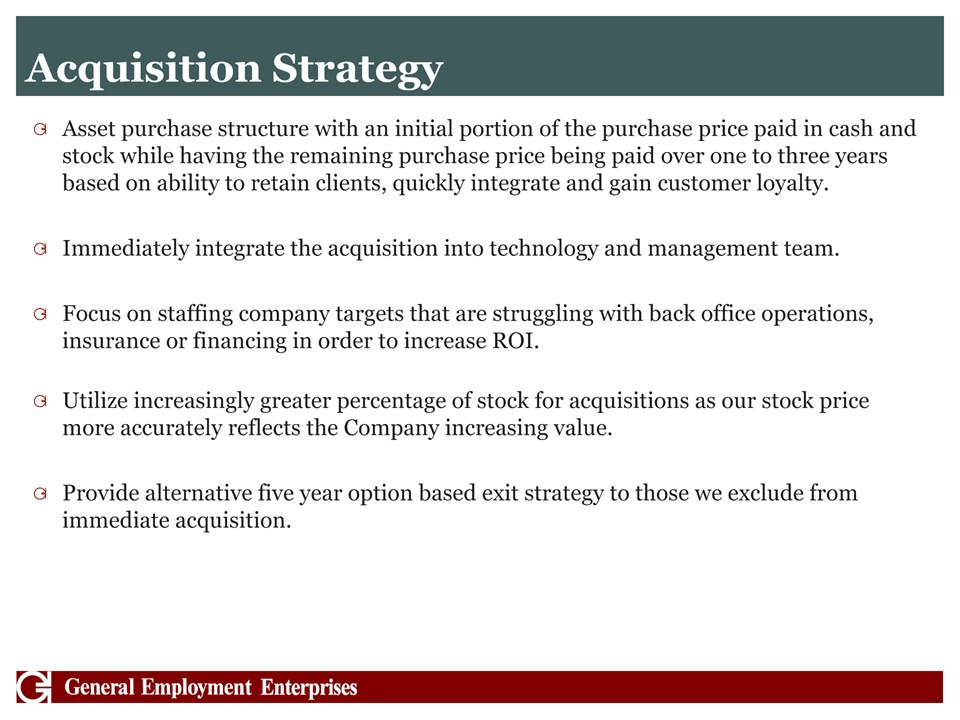

Acquisition Strategy Asset purchase structure with an initial portion of the purchase price paid in cash and stock while having the remaining purchase price being paid over one to three years based on ability to retain clients, quickly integrate and gain customer loyalty. Immediately integrate the acquisition into technology and management team.Focus on staffing company targets that are struggling with back office operations, insurance or financing in order to increase ROI.Utilize increasingly greater percentage of stock for acquisitions as our stock price more accurately reflects the Company increasing value.Provide alternative five year option based exit strategy to those we exclude from immediate acquisition.

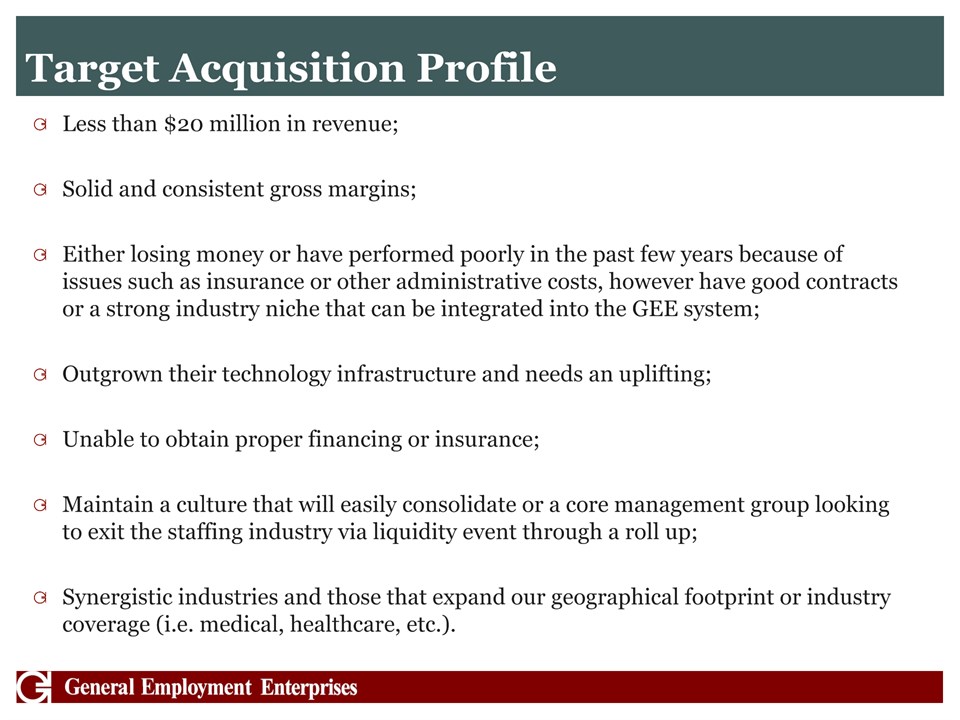

Target Acquisition Profile Less than $20 million in revenue;Solid and consistent gross margins;Either losing money or have performed poorly in the past few years because of issues such as insurance or other administrative costs, however have good contracts or a strong industry niche that can be integrated into the GEE system;Outgrown their technology infrastructure and needs an uplifting;Unable to obtain proper financing or insurance;Maintain a culture that will easily consolidate or a core management group looking to exit the staffing industry via liquidity event through a roll up;Synergistic industries and those that expand our geographical footprint or industry coverage (i.e. medical, healthcare, etc.).

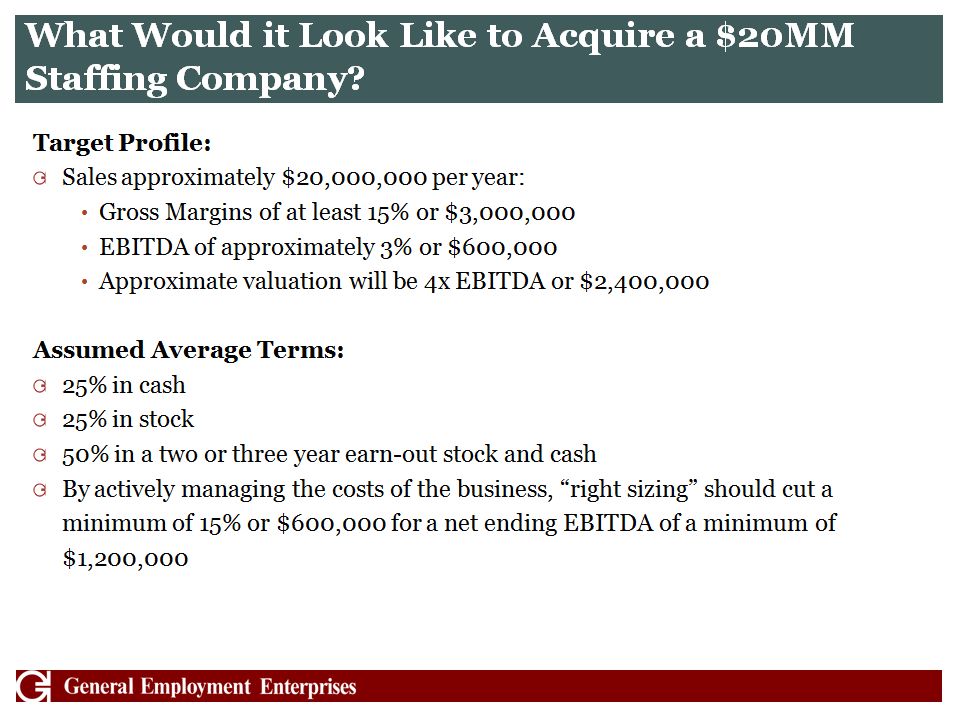

What Would it Look Like to Acquire a $20MM Staffing Company? Target Profile:Sales approximately $20,000,000 per year: Gross Margins of at least 15% or $3,000,000 EBITDA of approximately 3% or $600,000 Approximate valuation will be 4x EBITDA or $2,400,000Assumed Average Terms:25% in cash25% in stock50% in a two or three year earn-out stock and cashBy actively managing the costs of the business, “right sizing” should cut a minimum of 15% or $600,000 for a net ending EBITDA of a minimum of $1,200,000

Questions

Contacts Corporate Headquarters184 Shuman BoulevardSuite 420Naperville, IL 60563P: 630.954.0400F: 630.954.0447Company ContactAndrew J. Norstrud CEOWoodland Corporate Center8270 Woodland Center Blvd.Tampa, FL 33614P: 813.769.3580E: andrew.norstrud@genp.com Business DevelopmentWellfleet Partners, Inc.Mark I. Lev, Esq. – Chairman/CEOP: 212.714.0400E: mil@wellfleetpartners.comLegal CounselClint Gage - PartnerRoetzel & AndressP: 954.759.2760E: cgage@ralaw.com For more information, please visit http://www.generalemployment.com/