Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DiamondRock Hospitality Co | d787626d8k.htm |

| Exhibit 99.1

|

Exhibit 99.1

Investor Presentation

September 2014

|

|

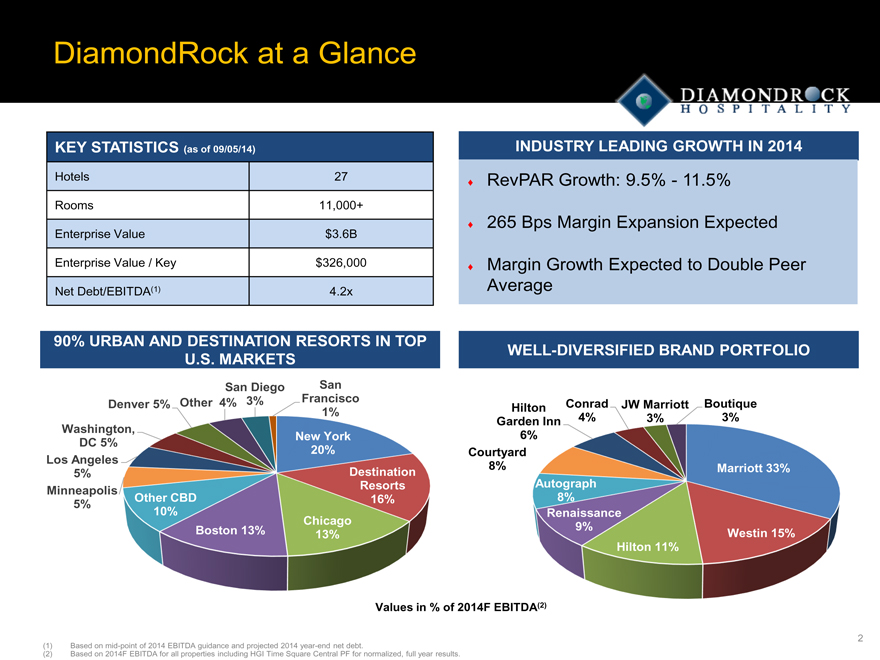

DiamondRock at a Glance

KEY STATISTICS (as of 09/05/14)

Hotels 27

Rooms 11,000+

Enterprise Value $3.6B

Enterprise Value / Key $326,000

Net Debt/EBITDA(1) 4.2x

INDUSTRY LEADING GROWTH IN 2014

RevPAR Growth: 9.5%-11.5%

265 Bps Margin Expansion Expected

Margin Growth Expected to Double Peer Average

90% URBAN AND DESTINATION RESORTS IN TOP U.S. MARKETS

San Diego San

Denver 5% Other 4% 3% Francisco

1%

Washington,

DC 5% New York

20%

Los Angeles

5% Destination

Minneapolis Resorts

5% Other CBD 16%

10%

Chicago

Boston 13% 13%

WELL-DIVERSIFIED BRAND PORTFOLIO

Hilton Conrad JW Marriott Boutique

Garden Inn 4% 3% 3%

6%

Courtyard

8% Marriott 33%

Autograph

8%

Renaissance

9% Westin 15%

Hilton 11%

Values in % of 2014F EBITDA(2)

(1) Based on mid-point of 2014 EBITDA guidance and projected 2014 year-end net debt.

(2) Based on 2014F EBITDA for all properties including HGI Time Square Central PF for normalized, full year results.

2

|

|

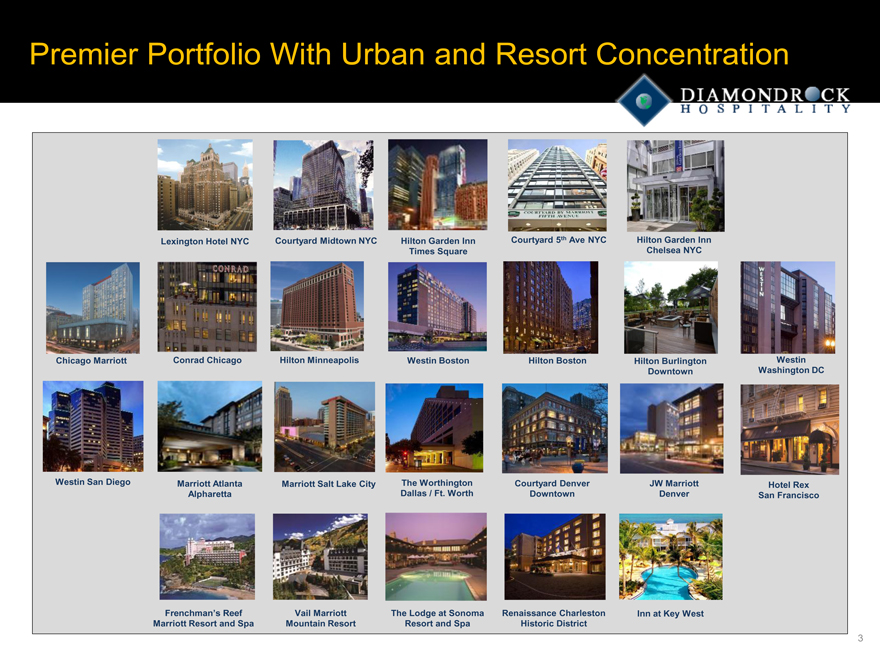

Premier Portfolio With Urban and Resort Concentration

Lexington Hotel NYC Courtyard Midtown NYC Hilton Garden Inn Courtyard 5th Ave NYC Hilton Garden Inn

Times Square Chelsea NYC

Chicago Marriott Conrad Chicago Hilton Minneapolis Westin Boston Hilton Boston Hilton Burlington Westin

Downtown Washington DC

Westin San Diego Marriott Atlanta Marriott Salt Lake City The Worthington Courtyard Denver JW Marriott Hotel Rex

Alpharetta Dallas / Ft. Worth Downtown Denver San Francisco

Frenchman’s Reef Vail Marriott The Lodge at Sonoma Renaissance Charleston Inn at Key West

Marriott Resort and Spa Mountain Resort Resort and Spa Historic District

3

|

|

Why DiamondRock? Top 5

High Quality Portfolio: Upgraded via Capital Recycling

2014F RevPAR of $157

$1.3B in deals this cycle

Sold hotels: RevPAR = $90

Bought hotels: RevPAR =$177

Outsized Internal Growth: Renovated and Repositioned Portfolio

Multi-year payoff from $140M capital renovations in 2013 / 2014

Profit Margin Expansion Momentum

Profit margin growth expected to double industry average in 2014

New asset management leadership driving outsized margin growth

360 basis points below prior peak at year-end provides further opportunity for growth

External Growth Opportunities

HGI TSC: 20% discount to current market value

Inn at Key West: Off-market, accretive

$150M excess cash at 2014 year-end for dry powder

Fortress Balance Sheet

3.0x net debt-to-EBITDA by 2016 from internal growth alone

Inn at Key West Acquired at

7.4% Cap Rate

Acquired Hilton Garden Inn Times Square at 20% Discount to Market Value

4

|

|

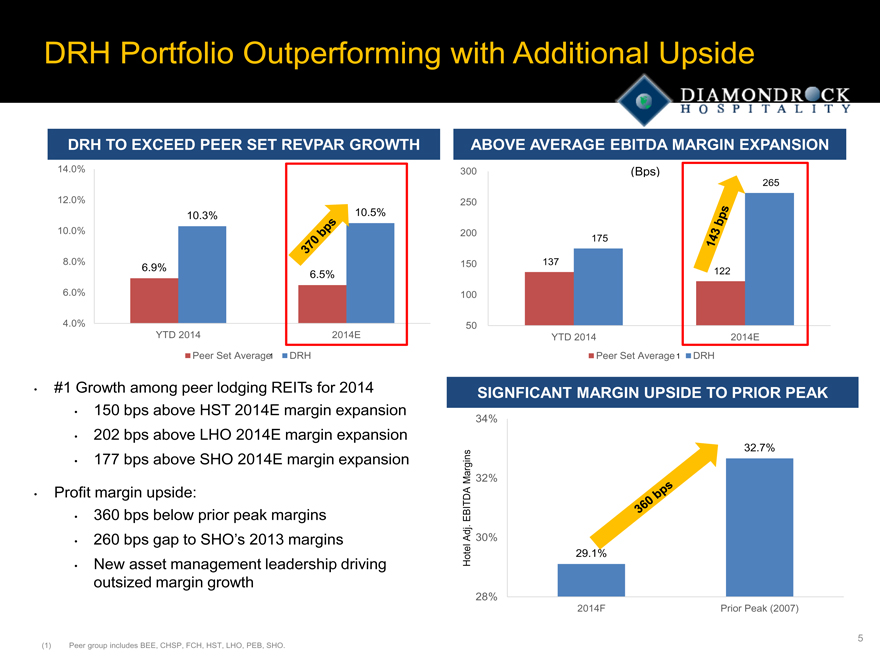

DRH Portfolio Outperforming with Additional Upside

DRH TO EXCEED PEER SET REVPAR GROWTH

14.0%

12.0%

10.3% 10.5%

10.0%

8.0% 6.9%

6.5%

6.0%

4.0%

370bps

YTD 2014 2014E

Peer Set Average1 DRH

ABOVE AVERAGE EBITDA MARGIN EXPANSION

300 (Bps)

265

250

200 175

150 137

122

100

50

YTD 2014 2014E

Peer Set Average 1 DRH

143bps

#1 Growth among peer lodging REITs for 2014

150 bps above HST 2014E margin expansion

202 bps above LHO 2014E margin expansion

177 bps above SHO 2014E margin expansion

Profit margin upside:

360 bps below prior peak margins

260 bps gap to SHO’s 2013 margins

New asset management leadership driving

outsized margin growth

SIGNFICANT MARGIN UPSIDE TO PRIOR PEAK

34%

32.7%

Margins 32%

EBITDA

.

Hotel Adj.

30%

29.1%

28%

2014F Prior Peak (2007)

(1) Peer group includes BEE, CHSP, FCH, HST, LHO, PEB, SHO.

5

|

|

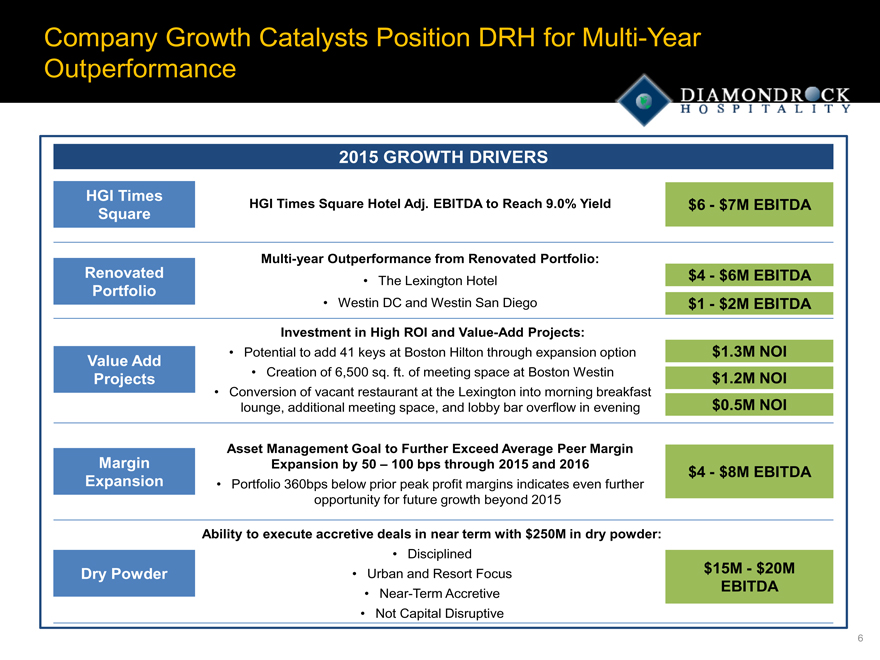

Company Growth Catalysts Position DRH for Multi-Year Outperformance

2015 GROWTH DRIVERS

HGI Times HGI Times Square Hotel Adj. EBITDA to Reach 9.0% Yield $6 -$7M EBITDA

Square

Multi-year Outperformance from Renovated Portfolio:

Renovated • The Lexington Hotel $4 -$6M EBITDA

Portfolio

• Westin DC and Westin San Diego $1 -$2M EBITDA

Investment in High ROI and Value-Add Projects:

Value Add • Potential to add 41 keys at Boston Hilton through expansion option $1.3M NOI

Projects • Creation of 6,500 sq. ft. of meeting space at Boston Westin $1.2M NOI

• Conversion of vacant restaurant at the Lexington into morning breakfast

lounge, additional meeting space, and lobby bar overflow in evening $0.5M NOI

Asset Management Goal to Further Exceed Average Peer Margin

Margin Expansion by 50 – 100 bps through 2015 and 2016 $4 -$8M EBITDA

Expansion • Portfolio 360bps below prior peak profit margins indicates even further

opportunity for future growth beyond 2015

Ability to execute accretive deals in near term with $250M in dry powder:

• Disciplined

Dry Powder • Urban and Resort Focus $15M-$20M

• Near-Term Accretive EBITDA

• Not Capital Disruptive

6

|

|

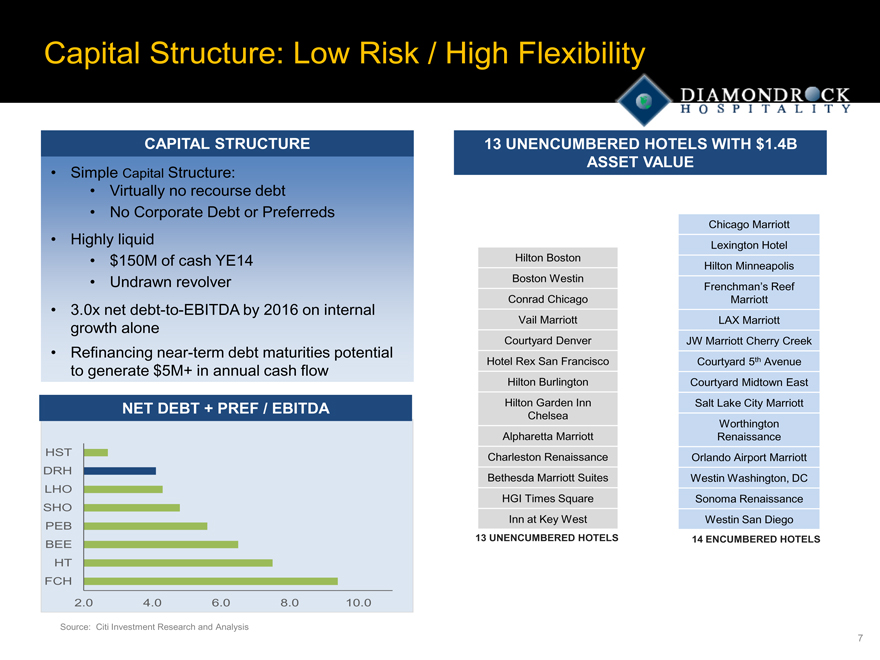

Capital Structure: Low Risk / High Flexibility

CAPITAL STRUCTURE

Simple Capital Structure:

Virtually no recourse debt

No Corporate Debt or Preferreds

Highly liquid

$150M of cash YE14

Undrawn revolver

3.0x net debt-to-EBITDA by 2016 on internal growth alone

Refinancing near-term debt maturities potential to generate $5M+ in annual cash flow

NET DEBT + PREF / EBITDA

HST

DRH

LHO

SHO

PEB

BEE

HT

FCH

2.0 4.0 6.0 8.0 10.0

Source: Citi Investment Research and Analysis

13 UNENCUMBERED HOTELS WITH $1.4B

ASSET VALUE

Chicago Marriott

Lexington Hotel

Hilton Boston

Hilton Minneapolis

Boston Westin

Frenchman’s Reef

Conrad Chicago Marriott

Vail Marriott LAX Marriott

Courtyard Denver JW Marriott Cherry Creek

Hotel Rex San Francisco Courtyard 5th Avenue

Hilton Burlington Courtyard Midtown East

Hilton Garden Inn Salt Lake City Marriott

Chelsea

Worthington

Alpharetta Marriott Renaissance

Charleston Renaissance Orlando Airport Marriott

Bethesda Marriott Suites Westin Washington, DC

HGI Times Square Sonoma Renaissance

Inn at Key West Westin San Diego

13 UNENCUMBERED HOTELS 14 ENCUMBERED HOTELS

7

|

|

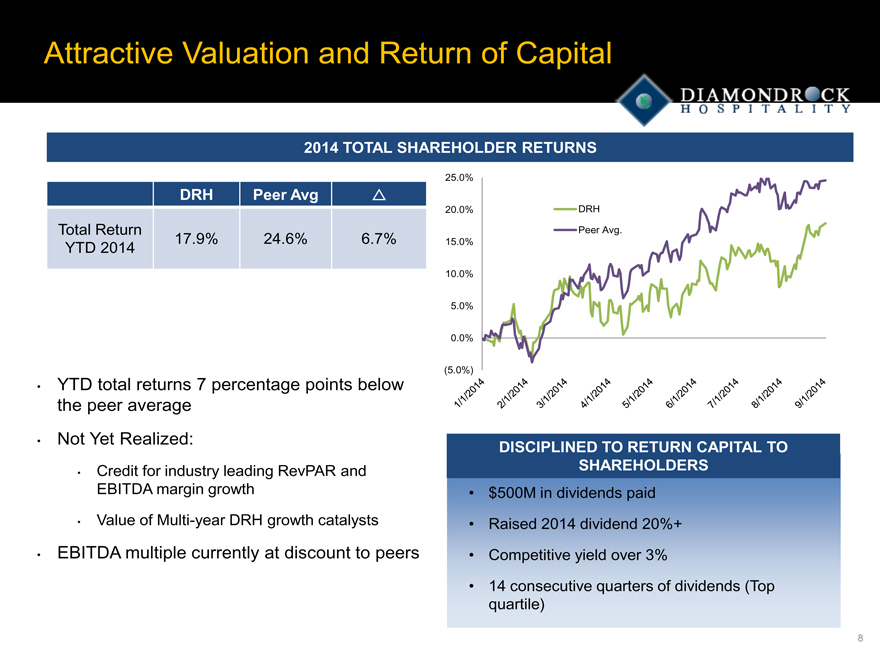

Attractive Valuation and Return of Capital

2014 TOTAL SHAREHOLDER RETURNS

DRH Peer Avg

Total Return

YTD 2014 17.9% 24.6% 6.7%

25.0%

20.0% DRH

Peer Avg.

15.0%

10.0%

5.0%

0.0%

(5.0%)

1/1/2014

2/1/2014

3/1/2014

4/1/2014

5/1/2014

6/1/2014

7/1/2014

8/1/2014

9/1/2014

YTD total returns 7 percentage points below

the peer average

Not Yet Realized:

Credit for industry leading RevPAR and

EBITDA margin growth

Value of Multi-year DRH growth catalysts

EBITDA multiple currently at discount to peers

DISCIPLINED TO RETURN CAPITAL TO SHAREHOLDERS

$500M in dividends paid

Raised 2014 dividend 20%+

Competitive yield over 3%

14 consecutive quarters of dividends (Top quartile)

8

|

|

Key Takeaways

Transformed Portfolio in Markets with Superior Growth Potential

Renovation Fueling Outperformance

360bps of Margin Expansion Opportunity

Fortress Balance Sheet with 3.0x Net Debt / EBITDA by 2016

$250M of Investment Capacity

Hotel Rex San Francisco

Hilton Garden Inn Times Square

The Lodge at Sonoma Resort and Spa

9

|

|

APPENDIX

|

|

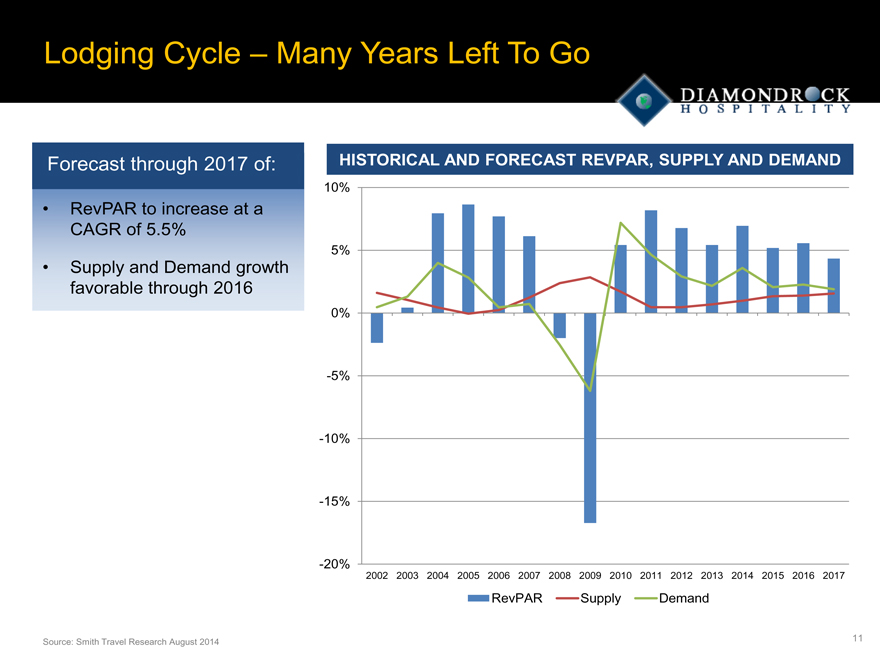

Lodging Cycle – Many Years Left To Go

Forecast through 2017 of:

RevPAR to increase at a

CAGR of 5.5%

Supply and Demand growth

favorable through 2016

HISTORICAL AND FORECAST REVPAR, SUPPLY AND DEMAND

10%

5%

0%

-5%

-10%

-15%

-20%

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

RevPAR Supply Demand

Source: Smith Travel Research August 2014 11

|

|

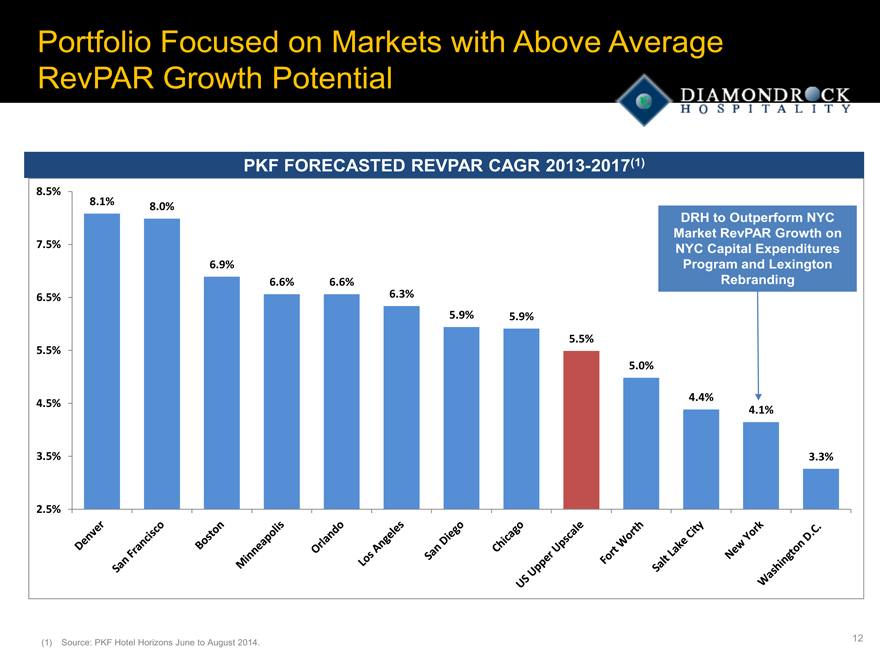

Portfolio Focused on Markets with Above Average RevPAR Growth Potential

PKF FORECASTED REVPAR CAGR 2013-2017(1)

8.5%

8.1% 8.0%

DRH to Outperform NYC

Market RevPAR Growth on

7.5% NYC Capital Expenditures

6.9% Program and Lexington

6.6% 6.6% Rebranding

6.5% 6.3%

5.9% 5.9%

5.5%

5.5%

5.0%

4.5% 4.4%

4.1%

3.5% 3.3%

2.5%

Denver

San Francisco

Boston

Minneapolis

Orlando

Los Angeles

San Diego

Chicago

US Upper Upscale

Fort Worth

Salt Lake City

New York

Washington D.C.

(1) Source: PKF Hotel Horizons June to August 2014.

12

|

|

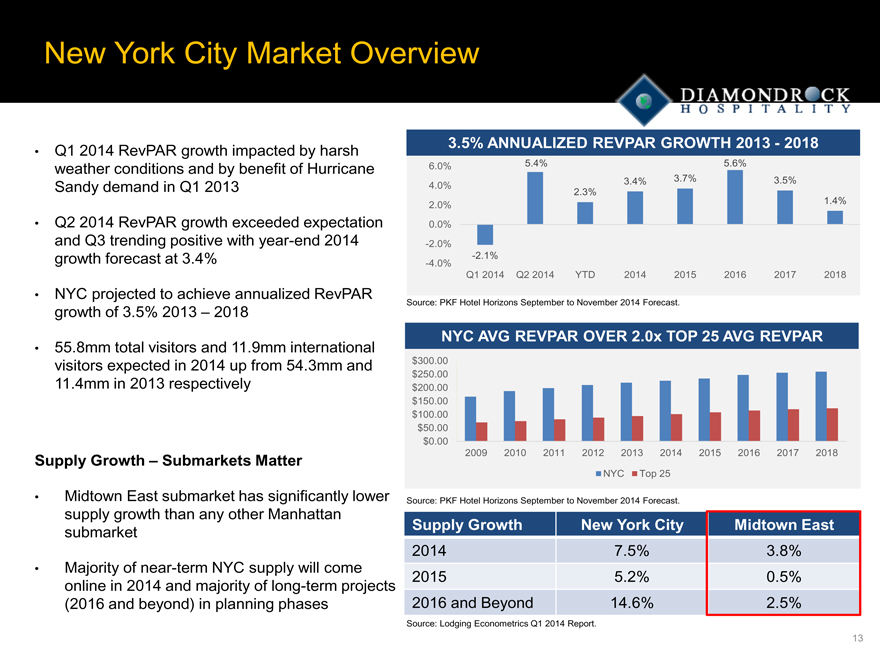

New York City Market Overview

Q1 2014 RevPAR growth impacted by harsh weather conditions and by benefit of Hurricane Sandy demand in Q1 2013

Q2 2014 RevPAR growth exceeded expectation and Q3 trending positive with year-end 2014 growth forecast at 3.4%

NYC projected to achieve annualized RevPAR growth of 3.5% 2013 – 2018

55.8mm total visitors and 11.9mm international visitors expected in 2014 up from 54.3mm and 11.4mm in 2013 respectively

Supply Growth – Submarkets Matter

Midtown East submarket has significantly lower supply growth than any other Manhattan submarket

Majority of near-term NYC supply will come online in 2014 and majority of long-term projects (2016 and beyond) in planning phases

3.5% ANNUALIZED REVPAR GROWTH 2013-2018

6.0% 5.4% 5.6%

4.0% 3.4% 3.7% 3.5%

2.3%

2.0% 1.4%

0.0%

-2.0%

-2.1%

-4.0%

Q1 2014 Q2 2014 YTD 2014 2015 2016 2017 2018

Source: PKF Hotel Horizons September to November 2014 Forecast.

NYC AVG REVPAR OVER 2.0x TOP 25 AVG REVPAR

$300.00

$250.00

$200.00

$150.00

$100.00

$50.00

$0.00

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

NYC Top 25

Source: PKF Hotel Horizons September to November 2014 Forecast.

Supply Growth New York City Midtown East

2014 7.5% 3.8%

2015 5.2% 0.5%

2016 and Beyond 14.6% 2.5%

Source: Lodging Econometrics Q1 2014 Report.

13

|

|

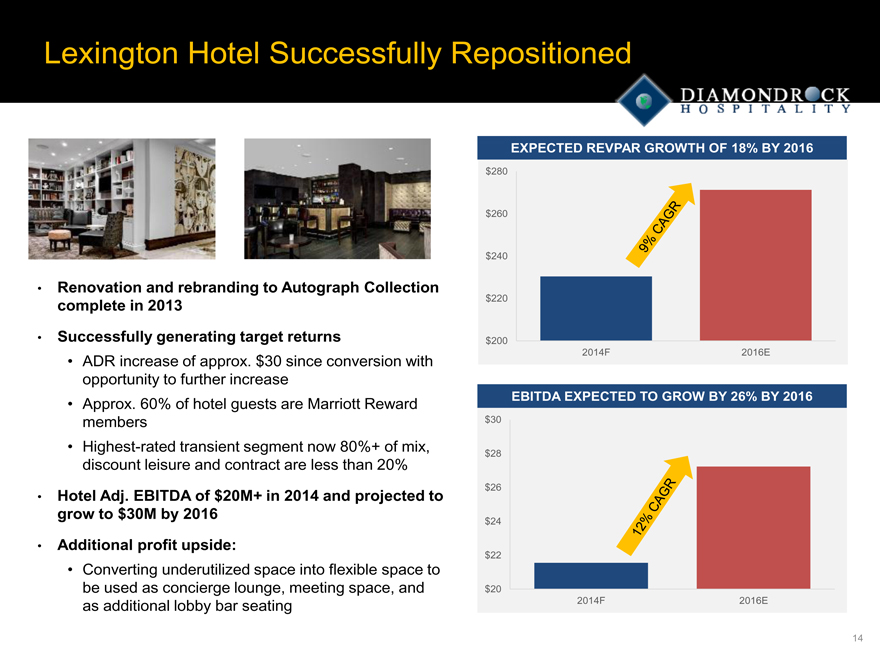

Lexington Hotel Successfully Repositioned

Renovation and rebranding to Autograph Collection complete in 2013

Successfully generating target returns

ADR increase of approx. $30 since conversion with opportunity to further increase

Approx. 60% of hotel guests are Marriott Reward members

Highest-rated transient segment now 80%+ of mix, discount leisure and contract are less than 20%

Hotel Adj. EBITDA of $20M+ in 2014 and projected to grow to $30M by 2016

Additional profit upside:

Converting underutilized space into flexible space to be used as concierge lounge, meeting space, and as additional lobby bar seating

EXPECTED REVPAR GROWTH OF 18% BY 2016

$280

$260

$240

$220

$200

2014F 2016E

9% CAGR

EBITDA EXPECTED TO GROW BY 26% BY 2016

$ 30

$ 28

$ 26

$ 24

$ 22

$ 20

2014F 2016E

12% CAGR

14

|

|

Hilton Garden Inn Times Square

PROJECTED EBITDA GROWTH

14

12

10

8

6

4

2

0

2014F 2015E 2016E

Value in Millions

Successfully locked in 2010 pricing ($450K/key) with

current values indicating $20M NAV gain

Hotel Adj. EBITDA of $5M in 2014 growing to 9.0% yield

($11M+) in 2015

Additional Profit Upside:

• Successfully leased F&B operations to save hotel

$0.5M in operations costs in addition to generating

incremental rental income

• Successfully combined management positions with

other DRH owned hotel to streamline labor costs

15

|

|

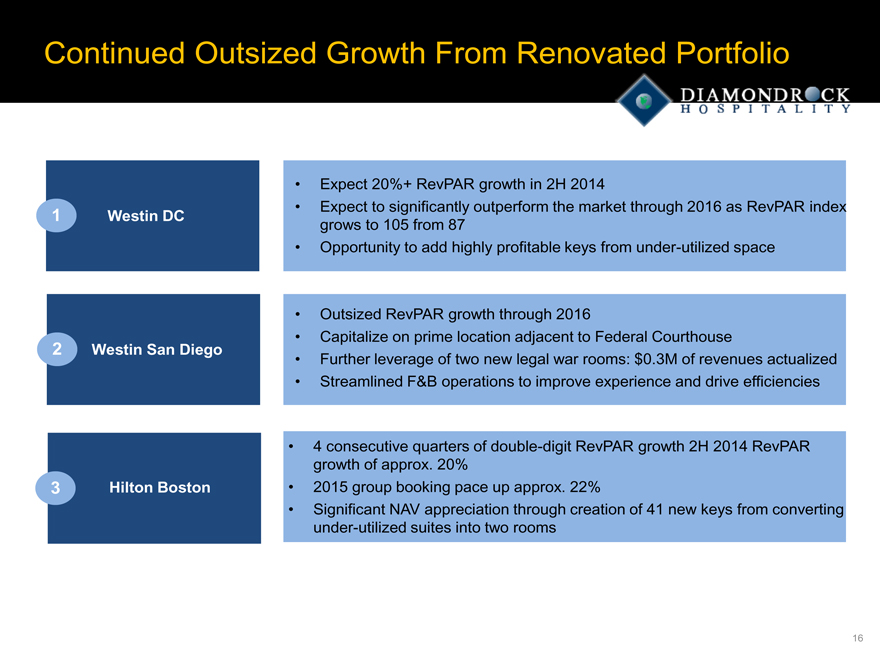

Continued Outsized Growth From Renovated Portfolio

1 Westin DC

2 Westin San Diego

3 Hilton Boston

Expect 20%+ RevPAR growth in 2H 2014

Expect to significantly outperform the market through 2016 as RevPAR index grows to 105 from 87

Opportunity to add highly profitable keys from under-utilized space

Outsized RevPAR growth through 2016

Capitalize on prime location adjacent to Federal Courthouse

Further leverage of two new legal war rooms: $0.3M of revenues actualized

Streamlined F&B operations to improve experience and drive efficiencies

4 consecutive quarters of double-digit RevPAR growth 2H 2014 RevPAR growth of approx. 20%

2015 group booking pace up approx. 22%

Significant NAV appreciation through creation of 41 new keys from converting under-utilized suites into two rooms 16

|

|

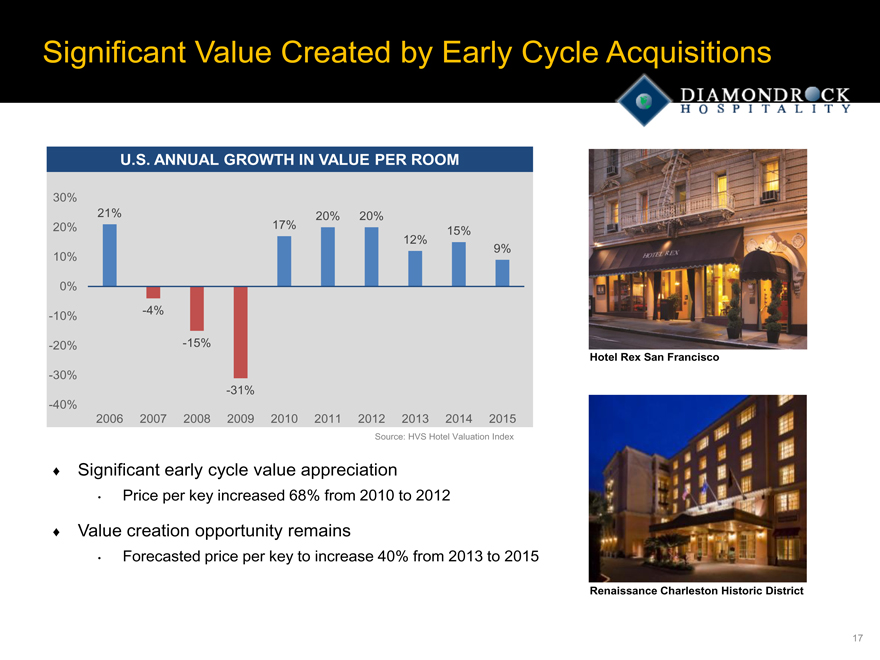

Significant Value Created by Early Cycle Acquisitions

U.S. ANNUAL GROWTH IN VALUE PER ROOM

30%

21% 20% 20%

20% 17% 15%

12%

9%

10%

0%

-10% -4%

-20% -15%

-30%

-31%

-40%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Source: HVS Hotel Valuation Index

Significant early cycle value appreciation

Price per key increased 68% from 2010 to 2012

Value creation opportunity remains

Forecasted price per key to increase 40% from 2013 to 2015

Hotel Rex San Francisco

Renaissance Charleston Historic District

17

|

|

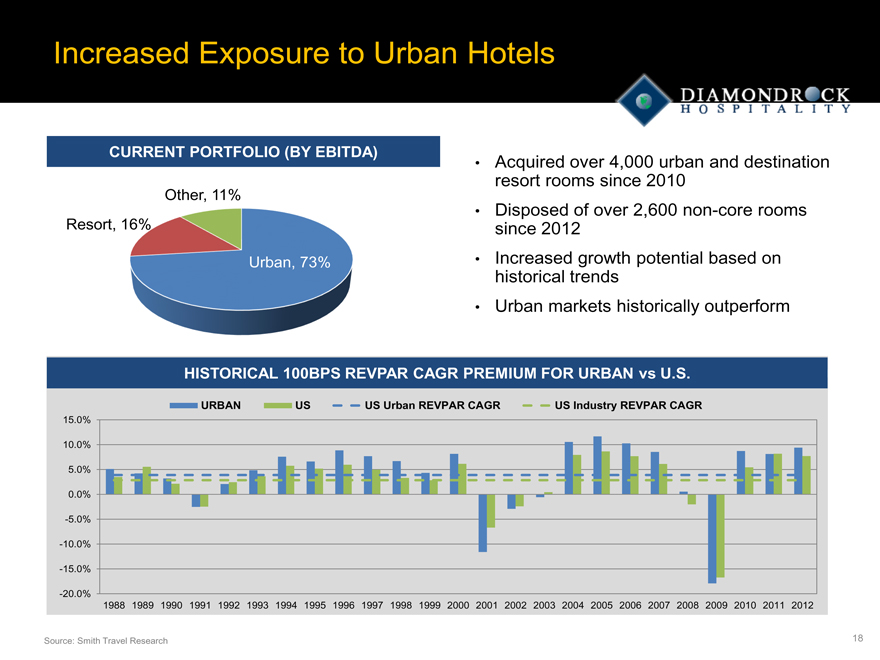

Increased Exposure to Urban Hotels

CURRENT PORTFOLIO (BY EBITDA)

Other, 11% Resort, 16%

Urban, 73%

Acquired over 4,000 urban and destination resort rooms since 2010

Disposed of over 2,600 non-core rooms since 2012

Increased growth potential based on historical trends

Urban markets historically outperform

HISTORICAL 100BPS REVPAR CAGR PREMIUM FOR URBAN vs U.S.

URBAN US US Urban REVPAR CAGR US Industry REVPAR CAGR

15.0%

10.0%

5.0%

0.0%

-5.0%

-10.0%

-15.0%

-20.0%

1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Source: Smith Travel Research 18

|

|

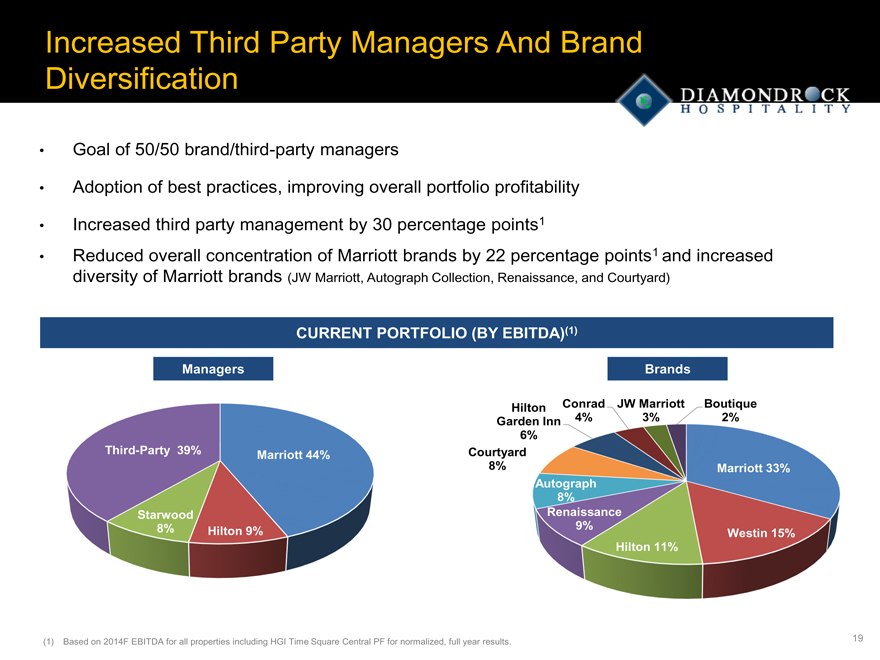

Increased Third Party Managers And Brand

Diversification

Goal of 50/50 brand/third-party managers

Adoption of best practices, improving overall portfolio profitability

Increased third party management by 30 percentage points1

Reduced overall concentration of Marriott brands by 22 percentage points1 and increased

diversity of Marriott brands (JW Marriott, Autograph Collection, Renaissance, and Courtyard)

CURRENT PORTFOLIO (BY EBITDA)(1)

Managers Brands

Third-Party 39% Marriott 44%

Starwood

8% Hilton 9%

Hilton Conrad JW Marriott Boutique

Garden Inn 4% 3% 2%

6%

Courtyard

8% Marriott 33%

Autograph

8%

Renaissance

9% Westin 15%

Hilton 11%

(1) Based on 2014F EBITDA for all properties including HGI Time Square Central PF for normalized, full year results. 19

|

|

Portfolio Transformation

BETTER MARKETS, HIGHER QUALITY ASSETS

$0.4B in Strategic Dispositions $1.3B in Strategic Acquisitions

Lexington, KY Suburban Austin, TX New York, NY Boston, MA San Diego, CA

Suburban Atlanta, GA Suburban Los Angeles, CA Minneapolis, MN Denver, CO Charleston, SC

Suburban Chicago, IL Washington, DC Burlington, VT San Francisco, CA

Key West, FL

Dispositions: 1 to 2 non-core assets marketed over next 24 months

Acquisitions: Disciplined, actively seeking core hotels with strong returns

20

|

|

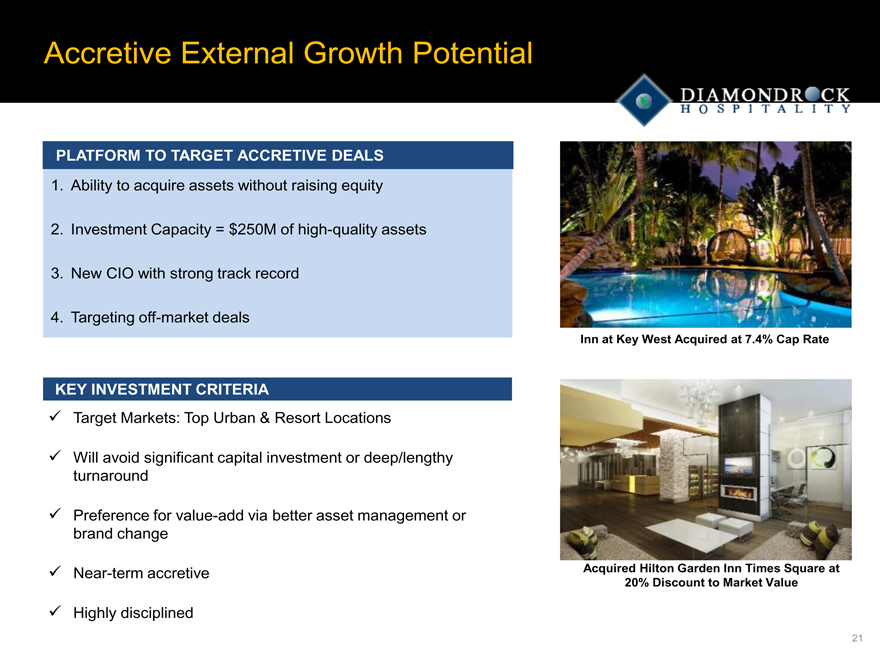

Accretive External Growth Potential

PLATFORM TO TARGET ACCRETIVE DEALS

1. Ability to acquire assets without raising equity

2. Investment Capacity = $250M of high-quality assets

3. New CIO with strong track record

4. Targeting off-market deals

KEY INVESTMENT CRITERIA

Target Markets: Top Urban & Resort Locations

Will avoid significant capital investment or deep/lengthy turnaround

Preference for value-add via better asset management or brand change

Near-term accretive

Highly disciplined

Inn at Key West Acquired at 7.4% Cap Rate

Acquired Hilton Garden Inn Times Square at

20% Discount to Market Value

21

|

|

Forward Looking Statements

Certain statements made during this presentation are forward-looking statements that are subject to risks and uncertainties. Forward-looking statements generally include the words “believe,” “expect,” “anticipate,” “plan,” “estimate,” “project,” “will,” “intend” or other similar expressions. Forward-looking statements include, without limitation, statements regarding, industry outlook, results of operations, cash flows, business strategies, growth and value opportunities, capital and other expenditures, financing plans, expense reduction initiatives and projected dispositions.

Factors that could cause actual results to materially differ from those contained in the forward-looking statements include, without limitation, those risks and uncertainties discussed in the Company’s most recent Annual Report on

Form 10-K, quarterly report on Form 10-Q and current reports on Form 8-K, which have been filed with the Securities and Exchange Commission, all of which you should carefully review. The forward-looking statements made are based on our beliefs, assumptions and expectations of future performance, taking into account all information currently available to us. Actual results could differ materially from the forward-looking statements made during this presentation. The forward-looking statements made during this presentation are subject to the safe harbor of the Private Securities Litigation Reform Act of 1995.

Any forward-looking statement speaks only as of the date on which it is made. Although the Company believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that the expectations will be attained or that any deviation will not be material. All information in this presentation is as of the date of this presentation, and the Company undertakes no obligation to update any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations.

This presentation contains statistics and other data that has been obtained or compiled from information made available by third-party service providers.

22